e863675c73daeb3b2b93ea3c80dd26ce.ppt

- Количество слайдов: 22

Investing 101 Presented by &

Sponsored by

Today’s Topics n Investment Industry Overview – Types of Investing – Career Paths – Sample Investments n Basics of Investing

Industry Overview n Venture Capital – Oak, Sequoia, Kleiner Perkins n Equity/Debt (stocks/bonds) – Citadel, Cerberus (hedge funds); Fidelity, Vanguard (mutual funds) n Private Equity – KKR, Blackstone, TPG

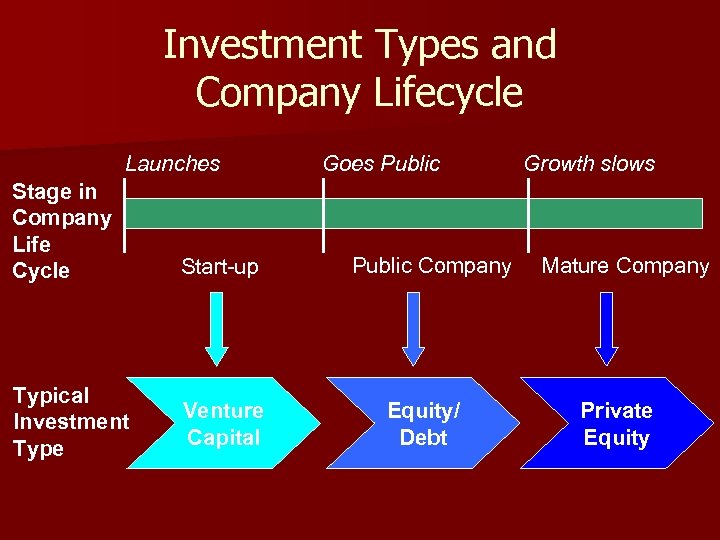

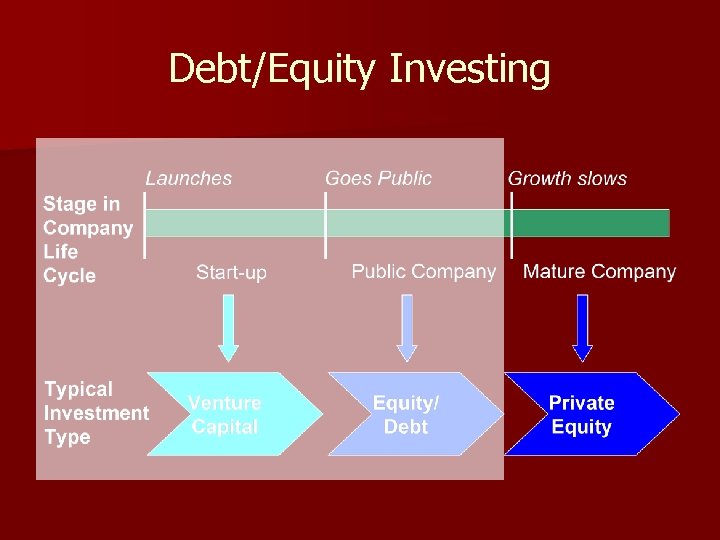

Investment Types and Company Lifecycle Launches Stage in Company Life Cycle Typical Investment Type Start-up Venture Capital Goes Public Company Equity/ Debt Growth slows Mature Company Private Equity

Venture Capital

Venture Capital n Typical Entry strategy n Value added n Typical Exit strategy n Example – Acquire stake in young, start-up firm – VCs provide funding, networking, and advice to the companies they invest in – Take portfolio companies public or sell them to other companies – Bessemer Venture Partners invested $1 -2 million in Skype, and when Skype was acquired by e. Bay, Bessemer made a 100 -fold return on its investment

Top Venture Capital Firms Sand Hill Road, Menlo Park, CA n Accel Partners n Crosspoint n Kleiner Perkins Caulfield & Byers n Oak Investment Partners n Sequoia n Softbank

Debt/Equity Investing

Debt/Equity Investing n Typical Entry strategy – Acquire position in stock or bonds of company n Value added – Investors can lobby companies to take measures to raise stock prices, such as share repurchases or divestitures n Typical Exit strategy – Unwind position in stock or bonds of company n Example – After doing comprehensive research on Auto. Zone, ESL, a hedge fund, concludes Auto. Zone is undervalued and buys shares in the company. In time the market comes to realize that the company is indeed undervalued and ESL sells its Auto. Zone shares after earning a 30% return.

Top Debt/Equity Investors Hedge Funds n n n Cerberus Citadel ESL SAC Capital Silverpoint (debt investing) Mutual Funds n n Fidelity Vanguard

Debt/Equity Investing

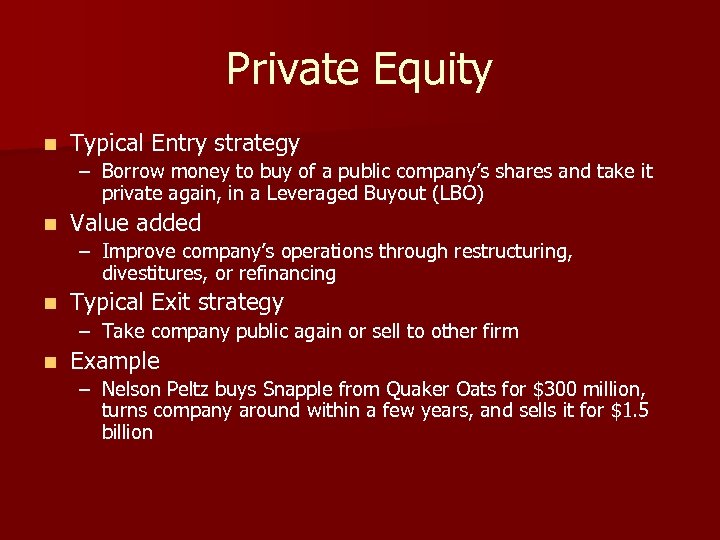

Private Equity n Typical Entry strategy – Borrow money to buy of a public company’s shares and take it private again, in a Leveraged Buyout (LBO) n Value added – Improve company’s operations through restructuring, divestitures, or refinancing n Typical Exit strategy – Take company public again or sell to other firm n Example – Nelson Peltz buys Snapple from Quaker Oats for $300 million, turns company around within a few years, and sells it for $1. 5 billion

Top Private Equity Firms n Bain Capital n Carlyle Group n Kohlberg, Kravis, & Roberts (KKR) n Texas Pacific Group (TPG) n Thomas H Lee Partners n Warburg Pincus

Investing Basics Sponsored By Bank of America Presented by WIC & WUFC

What’s the Investment Universe? n Stocks n Bonds n Derivatives n Real Estate n Commodities n Currency

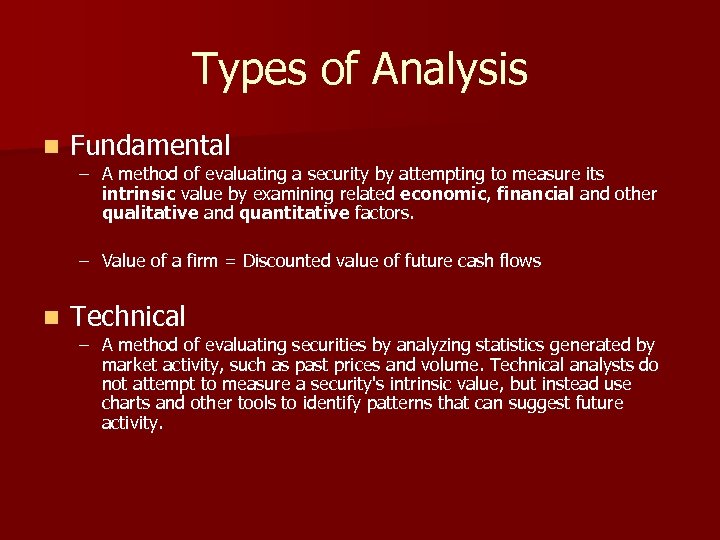

Types of Analysis n Fundamental – A method of evaluating a security by attempting to measure its intrinsic value by examining related economic, financial and other qualitative and quantitative factors. – Value of a firm = Discounted value of future cash flows n Technical – A method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to measure a security's intrinsic value, but instead use charts and other tools to identify patterns that can suggest future activity.

Where to Begin? n Develop a differentiated view n Top Down – View on the economy or a sector – Drill down into individual stocks, or trade a basket of companies n Bottom Up – Start with a company specific story – Investigate the firm’s prospects based upon micro factors

How to Evaluate a Business n Sustainable competitive advantages – – – n Barriers to entry, Substitutes Buyer and Supplier Leverage Technology, Infrastructure, Human Capital Cost structure – Fixed vs. variable – Margin Analysis Management n Opportunities for growth n

Valuation Methodolgy n Discounted Cash Flows – – – n Determine cost of firm’s capital Estimate the firm’s future cash flows Add back value of non-operational assets Multiples – – – P/E = (EPS/(r-g)) EBITDA/EV (EBITDA-Capex)/EV ROA, ROIC Net Debt/EBITDA

Derivatives n n Contract that “Derives” its value from another security Future - Obligation to exchange cash at some specified date for the underlying Option - Right but not the obligation to buy/sell (call/put) underlying at specified price Derivatives often allow for enhanced leverage

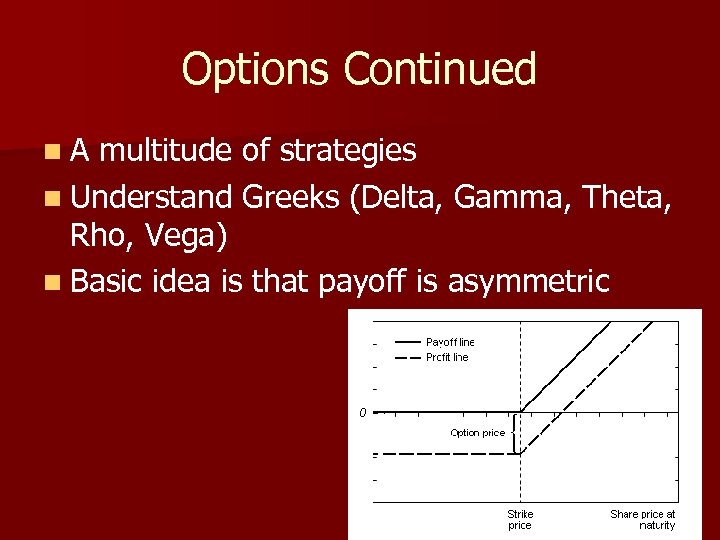

Options Continued n A multitude of strategies n Understand Greeks (Delta, Gamma, Theta, Rho, Vega) n Basic idea is that payoff is asymmetric

e863675c73daeb3b2b93ea3c80dd26ce.ppt