7418072956fa201e27bb2275265049ce.ppt

- Количество слайдов: 33

INVESTIGATION OF THE CRUISE LINER INDUSTRY SUMMARY of STUDY RESULTS | 7. 16. 08 MITCHELL DUPLESSIS PROJECTS (PTY) LTD | LANDDESIGN

INVESTIGATION OF THE CRUISE LINER INDUSTRY SUMMARY of STUDY RESULTS | 7. 16. 08 MITCHELL DUPLESSIS PROJECTS (PTY) LTD | LANDDESIGN

CRITICAL TOPICS COVERED § The modern cruise industry and the overall prospects for continued growth at a global and regional level § Infrastructure and services required by homeports and ports-of-call § Insights on other cruise regions business success—notably, Australia / New Zealand South America § Recommendations as to how Cape Town should consider moving forward and to become a greater participant within the industry

CRITICAL TOPICS COVERED § The modern cruise industry and the overall prospects for continued growth at a global and regional level § Infrastructure and services required by homeports and ports-of-call § Insights on other cruise regions business success—notably, Australia / New Zealand South America § Recommendations as to how Cape Town should consider moving forward and to become a greater participant within the industry

SEC 1 GLOBAL CRUISE CHARTERISTICS

SEC 1 GLOBAL CRUISE CHARTERISTICS

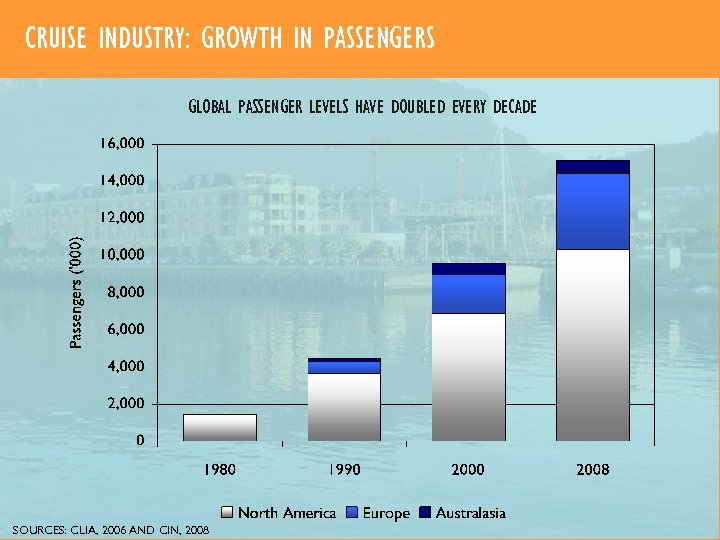

CRUISE INDUSTRY: GROWTH IN PASSENGERS GLOBAL PASSENGER LEVELS HAVE DOUBLED EVERY DECADE SOURCES: CLIA, 2006 AND CIN, 2008

CRUISE INDUSTRY: GROWTH IN PASSENGERS GLOBAL PASSENGER LEVELS HAVE DOUBLED EVERY DECADE SOURCES: CLIA, 2006 AND CIN, 2008

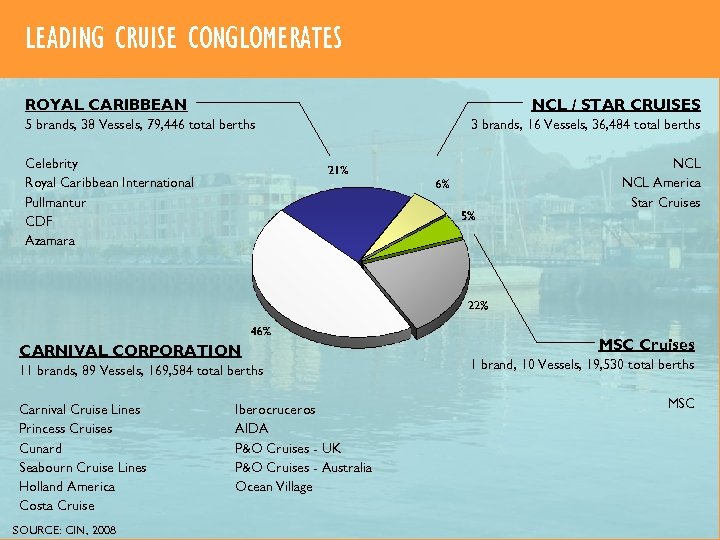

LEADING CRUISE CONGLOMERATES NCL / STAR CRUISES ROYAL CARIBBEAN 5 brands, 38 Vessels, 79, 446 total berths NCL America Star Cruises Celebrity Royal Caribbean International Pullmantur CDF Azamara CARNIVAL CORPORATION 11 brands, 89 Vessels, 169, 584 total berths Carnival Cruise Lines Princess Cruises Cunard Seabourn Cruise Lines Holland America Costa Cruise SOURCE: CIN, 2008 3 brands, 16 Vessels, 36, 484 total berths Iberocruceros AIDA P&O Cruises - UK P&O Cruises - Australia Ocean Village MSC Cruises 1 brand, 10 Vessels, 19, 530 total berths MSC

LEADING CRUISE CONGLOMERATES NCL / STAR CRUISES ROYAL CARIBBEAN 5 brands, 38 Vessels, 79, 446 total berths NCL America Star Cruises Celebrity Royal Caribbean International Pullmantur CDF Azamara CARNIVAL CORPORATION 11 brands, 89 Vessels, 169, 584 total berths Carnival Cruise Lines Princess Cruises Cunard Seabourn Cruise Lines Holland America Costa Cruise SOURCE: CIN, 2008 3 brands, 16 Vessels, 36, 484 total berths Iberocruceros AIDA P&O Cruises - UK P&O Cruises - Australia Ocean Village MSC Cruises 1 brand, 10 Vessels, 19, 530 total berths MSC

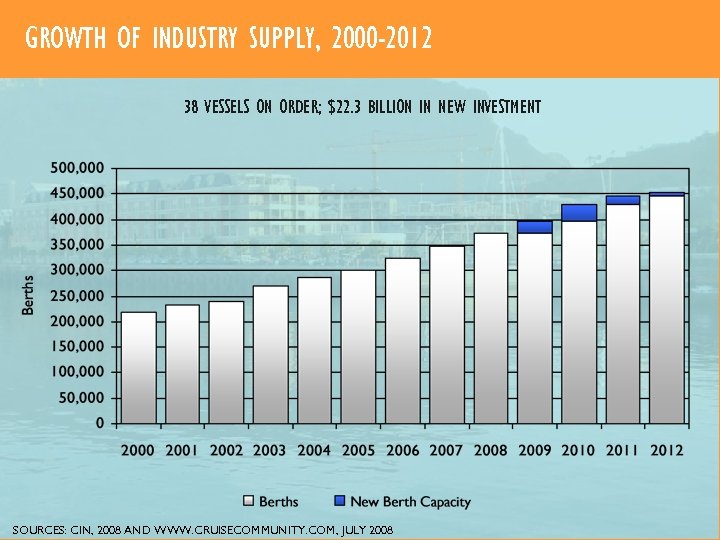

GROWTH OF INDUSTRY SUPPLY, 2000 -2012 38 VESSELS ON ORDER; $22. 3 BILLION IN NEW INVESTMENT SOURCES: CIN, 2008 AND WWW. CRUISECOMMUNITY. COM, JULY 2008

GROWTH OF INDUSTRY SUPPLY, 2000 -2012 38 VESSELS ON ORDER; $22. 3 BILLION IN NEW INVESTMENT SOURCES: CIN, 2008 AND WWW. CRUISECOMMUNITY. COM, JULY 2008

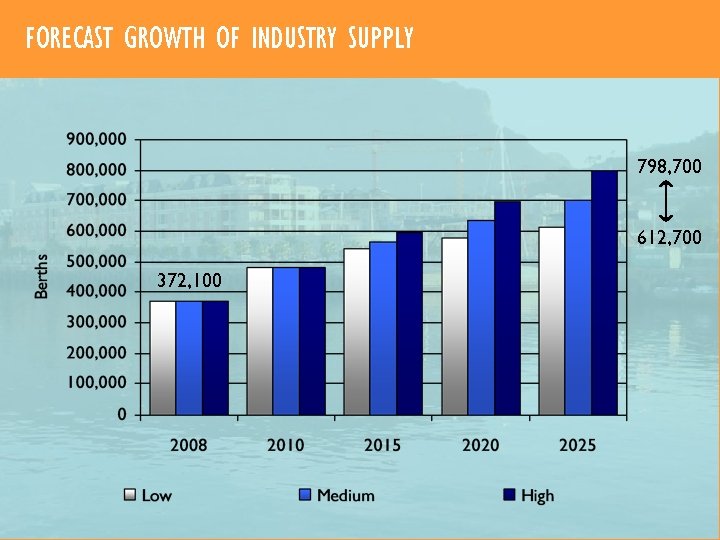

FORECAST GROWTH OF INDUSTRY SUPPLY 798, 700 612, 700 372, 100

FORECAST GROWTH OF INDUSTRY SUPPLY 798, 700 612, 700 372, 100

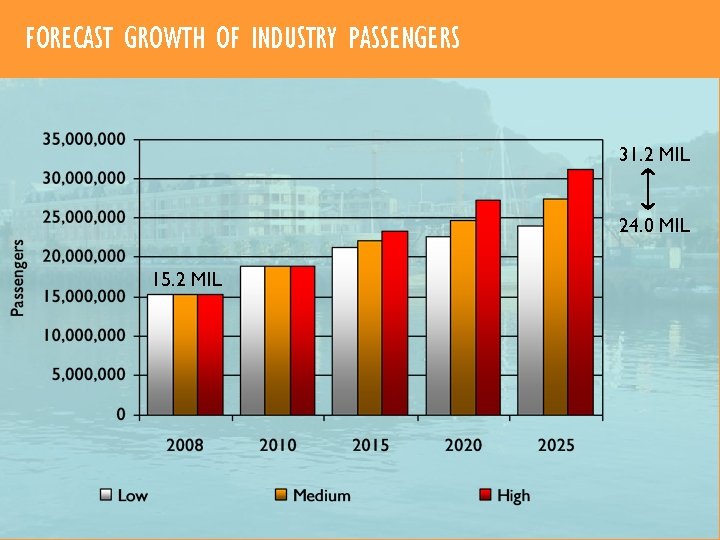

FORECAST GROWTH OF INDUSTRY PASSENGERS 31. 2 MIL 24. 0 MIL 15. 2 MIL

FORECAST GROWTH OF INDUSTRY PASSENGERS 31. 2 MIL 24. 0 MIL 15. 2 MIL

SEC 2 SOUTHERN AFRICA CRUISE CHARTERISTICS

SEC 2 SOUTHERN AFRICA CRUISE CHARTERISTICS

SOUTHERN AFRICA CRUSING REGION

SOUTHERN AFRICA CRUSING REGION

SOUTHERN AFRICA CRUSING REGION § Southern Africa, which includes pan-Southern Africa offerings and often island destinations § Seychelles and related cruises to the islands of Reunion, Mauritius and others § Specialty cruises to St. Helena § Repositioning cruises § World cruises

SOUTHERN AFRICA CRUSING REGION § Southern Africa, which includes pan-Southern Africa offerings and often island destinations § Seychelles and related cruises to the islands of Reunion, Mauritius and others § Specialty cruises to St. Helena § Repositioning cruises § World cruises

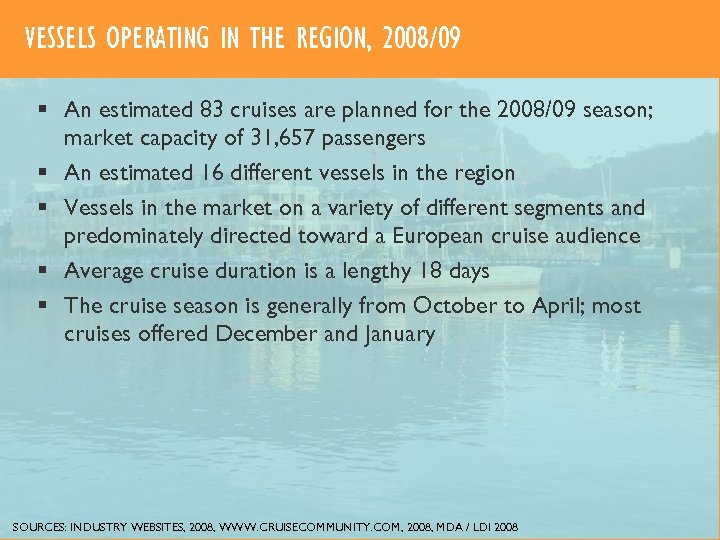

VESSELS OPERATING IN THE REGION, 2008/09 § An estimated 83 cruises are planned for the 2008/09 season; market capacity of 31, 657 passengers § An estimated 16 different vessels in the region § Vessels in the market on a variety of different segments and predominately directed toward a European cruise audience § Average cruise duration is a lengthy 18 days § The cruise season is generally from October to April; most cruises offered December and January SOURCES: INDUSTRY WEBSITES, 2008, WWW. CRUISECOMMUNITY. COM, 2008, MDA / LDI 2008

VESSELS OPERATING IN THE REGION, 2008/09 § An estimated 83 cruises are planned for the 2008/09 season; market capacity of 31, 657 passengers § An estimated 16 different vessels in the region § Vessels in the market on a variety of different segments and predominately directed toward a European cruise audience § Average cruise duration is a lengthy 18 days § The cruise season is generally from October to April; most cruises offered December and January SOURCES: INDUSTRY WEBSITES, 2008, WWW. CRUISECOMMUNITY. COM, 2008, MDA / LDI 2008

VESSELS OPERATING IN THE REGION, 2008/09 § Itineraries contribute 102 vessels calls to South African ports, with an estimated 45 of these arriving to Cape Town (44%) § Of the leading four cruise industry conglomerates, Royal Caribbean is absent from the list of lines offering cruises in the region § Primary regional homeports identified include Cape Town, Durban, Mombasa, and Mahe SOURCES: INDUSTRY WEBSITES, 2008, WWW. CRUISECOMMUNITY. COM, 2008, MDA / LDI 2008

VESSELS OPERATING IN THE REGION, 2008/09 § Itineraries contribute 102 vessels calls to South African ports, with an estimated 45 of these arriving to Cape Town (44%) § Of the leading four cruise industry conglomerates, Royal Caribbean is absent from the list of lines offering cruises in the region § Primary regional homeports identified include Cape Town, Durban, Mombasa, and Mahe SOURCES: INDUSTRY WEBSITES, 2008, WWW. CRUISECOMMUNITY. COM, 2008, MDA / LDI 2008

CURRENT REGIONAL CHALLENGES § Region is one of the smallest amongst other global deployment areas § Generally not on the radar of primary cruise operators other than an occasional call / operation as part of a repositioning or world cruise § Flight and vessel repositioning costs also limit some lines in their thinking about deployment to the region § Concerns on regional safety and stability § Uncertain size of regional consumer base

CURRENT REGIONAL CHALLENGES § Region is one of the smallest amongst other global deployment areas § Generally not on the radar of primary cruise operators other than an occasional call / operation as part of a repositioning or world cruise § Flight and vessel repositioning costs also limit some lines in their thinking about deployment to the region § Concerns on regional safety and stability § Uncertain size of regional consumer base

CURRENT REGIONAL OPPORTUNITIES § Key industry growth fundamentals § Diverse region with similar characteristics and itinerary diversity as other successful areas § Marquee ports-of-call and homeports § The region has shown consistency in preserving its share of the growing global industry § 2010 FIFA World Cup event – Successfully delivered by South Africa, this event could serve as an important catalyst—much like Olympics in Barcelona and Australia—to move the regional cruise market forward

CURRENT REGIONAL OPPORTUNITIES § Key industry growth fundamentals § Diverse region with similar characteristics and itinerary diversity as other successful areas § Marquee ports-of-call and homeports § The region has shown consistency in preserving its share of the growing global industry § 2010 FIFA World Cup event – Successfully delivered by South Africa, this event could serve as an important catalyst—much like Olympics in Barcelona and Australia—to move the regional cruise market forward

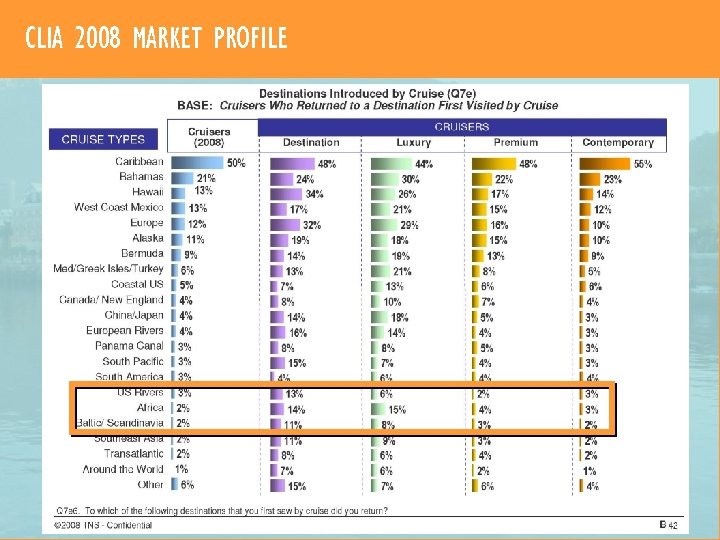

CLIA 2008 MARKET PROFILE

CLIA 2008 MARKET PROFILE

REGIONAL FORECAST GROWTH IMPLICATIONS § Business as usual will likely yield limited results; low to medium trend line § Activity in marketing and organizational components key to regional viability § Assuming Cape Town continues to see 44% of capacity, passenger throughput could be 126, 000 by 2020 under the high scenario – With cruise homeporting primary element of Cape Town’s business, revenue passengers could approach 250, 000

REGIONAL FORECAST GROWTH IMPLICATIONS § Business as usual will likely yield limited results; low to medium trend line § Activity in marketing and organizational components key to regional viability § Assuming Cape Town continues to see 44% of capacity, passenger throughput could be 126, 000 by 2020 under the high scenario – With cruise homeporting primary element of Cape Town’s business, revenue passengers could approach 250, 000

SEC 3 CRUISE INDUSTRY NEEDS FOR OPERATIONS

SEC 3 CRUISE INDUSTRY NEEDS FOR OPERATIONS

CRUISE LINE DESTINATION SELECTION CRITERIA § Appeal as a travel and leisure destination § Type and quality of cruise tourism infrastructure needed to support vessel operations and movement of passengers § A market basis and strategic fit within a greater cruise ship deployment scheme

CRUISE LINE DESTINATION SELECTION CRITERIA § Appeal as a travel and leisure destination § Type and quality of cruise tourism infrastructure needed to support vessel operations and movement of passengers § A market basis and strategic fit within a greater cruise ship deployment scheme

SEC 6 RECOMMENDATIONS MOVING FORWARD

SEC 6 RECOMMENDATIONS MOVING FORWARD

RECOMMENDATIONS MOVING FORWARD § Software. Programs and marketing efforts developed to ensure product quality, brand recognition, communication efforts and others. § Operations. Functional enhancements that allow for improved cruise operations. § Hardware. Strategies and action items to ensure that appropriate capital improvements are planned and developed to meet anticipated cruise industry throughput and facilities needs.

RECOMMENDATIONS MOVING FORWARD § Software. Programs and marketing efforts developed to ensure product quality, brand recognition, communication efforts and others. § Operations. Functional enhancements that allow for improved cruise operations. § Hardware. Strategies and action items to ensure that appropriate capital improvements are planned and developed to meet anticipated cruise industry throughput and facilities needs.

SOFTWARE: OVERARCHING OBJECTIVES § A large portion of the ultimate success to be achieved by Cape Town and South Africa is reliant on moving forward with marketing efforts – Establish a strong case for Southern Africa cruising with cruise lines – Work to build a foundation of seasonal business with international consumers; and, – Foster a local consumer base for cruise products. § Emphasis should be placed on organizing the messages and messengers first § Resources beyond those presently committed by Cape Town and elsewhere are going to be required

SOFTWARE: OVERARCHING OBJECTIVES § A large portion of the ultimate success to be achieved by Cape Town and South Africa is reliant on moving forward with marketing efforts – Establish a strong case for Southern Africa cruising with cruise lines – Work to build a foundation of seasonal business with international consumers; and, – Foster a local consumer base for cruise products. § Emphasis should be placed on organizing the messages and messengers first § Resources beyond those presently committed by Cape Town and elsewhere are going to be required

SOFTWARE: RECOMMENDATIONS § Cruise marketing plan – It is critical that Cape Town refine and implement a specific cruise marketing plan for the City and region. – Hold a marketing goals workshop – Identify the marketing audience – Message development and refinement – Messenger identification § Formulation of a Cruise Cape Town Committee (CCTC) § In-house education program § Incentives packaging for cruise lines

SOFTWARE: RECOMMENDATIONS § Cruise marketing plan – It is critical that Cape Town refine and implement a specific cruise marketing plan for the City and region. – Hold a marketing goals workshop – Identify the marketing audience – Message development and refinement – Messenger identification § Formulation of a Cruise Cape Town Committee (CCTC) § In-house education program § Incentives packaging for cruise lines

SOFTWARE: RECOMMENDATIONS § § § Market to the Cape Town community Development a cruise passenger visitor's kit Lead in development of Southern Africa Cruise Association Establish a methodology for port costs benchmarking Hold cruise tourism provider education sessions Establish strategic relationships with key ports in the region

SOFTWARE: RECOMMENDATIONS § § § Market to the Cape Town community Development a cruise passenger visitor's kit Lead in development of Southern Africa Cruise Association Establish a methodology for port costs benchmarking Hold cruise tourism provider education sessions Establish strategic relationships with key ports in the region

SOFTWARE: RECOMMENDATIONS Conduction travel agent education sessions International Cruise Trade Show Participation Hold North American and European cruise operator visits Hold North American and European cruise operator familiarization trips – Possibly linked with FIFA 2010 § Work with tour providers to design new offerings suitable for cruise passengers § Establish targeted provider program offerings – Luxury, adventure, destination § §

SOFTWARE: RECOMMENDATIONS Conduction travel agent education sessions International Cruise Trade Show Participation Hold North American and European cruise operator visits Hold North American and European cruise operator familiarization trips – Possibly linked with FIFA 2010 § Work with tour providers to design new offerings suitable for cruise passengers § Establish targeted provider program offerings – Luxury, adventure, destination § §

OPERATIONS: OVERARCHING OBJECTIVES § The smoothness of operations is as important as the quality of the facilities; think destination delivery – Operational planning and coordination – Benchmarking – Guest security and safety assessments and programs – Organization and communication

OPERATIONS: OVERARCHING OBJECTIVES § The smoothness of operations is as important as the quality of the facilities; think destination delivery – Operational planning and coordination – Benchmarking – Guest security and safety assessments and programs – Organization and communication

OPERATIONS: RECOMMENDATIONS § Become deeply involved with the FIFA 2010 floating hotel destination delivery – Sportscom (communication and sports marketing) § Meet with Port / V&A regularly on threat assessment and security issues – Conduct assessments for cruise passengers and generate a specific plan to share with the lines – Hold public safety education sessions § Become involved in homeport and port-of-call operations planning, especially for peak days

OPERATIONS: RECOMMENDATIONS § Become deeply involved with the FIFA 2010 floating hotel destination delivery – Sportscom (communication and sports marketing) § Meet with Port / V&A regularly on threat assessment and security issues – Conduct assessments for cruise passengers and generate a specific plan to share with the lines – Hold public safety education sessions § Become involved in homeport and port-of-call operations planning, especially for peak days

OPERATIONS: RECOMMENDATIONS § Develop and implement a cruise benchmarking strategy § Develop a scheduling plan for the committee § Establish an operations audit and enhancements program based on benchmarking feedback § Establish Cape Town primary and secondary venues and tour provider assessments § Establish a smart-pass program

OPERATIONS: RECOMMENDATIONS § Develop and implement a cruise benchmarking strategy § Develop a scheduling plan for the committee § Establish an operations audit and enhancements program based on benchmarking feedback § Establish Cape Town primary and secondary venues and tour provider assessments § Establish a smart-pass program

HARDWARE: OVERARCHING OBJECTIVES § Additional cruise berthing and related terminal spaces are needed over the medium- to long-term § Options need to be explored associated with the future role of V&A Waterfront, the Port of Cape Town (NPA) and City to create a win-win scenario that will be conducive to meeting future cruise industry opportunities § To reduce risk as well as meet other needs observed in the maritime and commercial environment, multi- and mixed-use cruise development approaches should be pursued.

HARDWARE: OVERARCHING OBJECTIVES § Additional cruise berthing and related terminal spaces are needed over the medium- to long-term § Options need to be explored associated with the future role of V&A Waterfront, the Port of Cape Town (NPA) and City to create a win-win scenario that will be conducive to meeting future cruise industry opportunities § To reduce risk as well as meet other needs observed in the maritime and commercial environment, multi- and mixed-use cruise development approaches should be pursued.

HARDWARE: RECOMMENDATIONS § Establish a cruise facilities improvement plan – Engage the cruise lines for assistance – Financial component § Prepare a MOU between V&A Waterfront, the Port and City on plan implementation § Ensure a working, interim capital improvements plan for delivery of homeport and port-of-call needs § Prepare a detailed plan, with emphasis on development of a mixed -use facility with supporting revenue inputs § Implement the detailed plan timed to market conductions (cruise or mixed-use components)

HARDWARE: RECOMMENDATIONS § Establish a cruise facilities improvement plan – Engage the cruise lines for assistance – Financial component § Prepare a MOU between V&A Waterfront, the Port and City on plan implementation § Ensure a working, interim capital improvements plan for delivery of homeport and port-of-call needs § Prepare a detailed plan, with emphasis on development of a mixed -use facility with supporting revenue inputs § Implement the detailed plan timed to market conductions (cruise or mixed-use components)

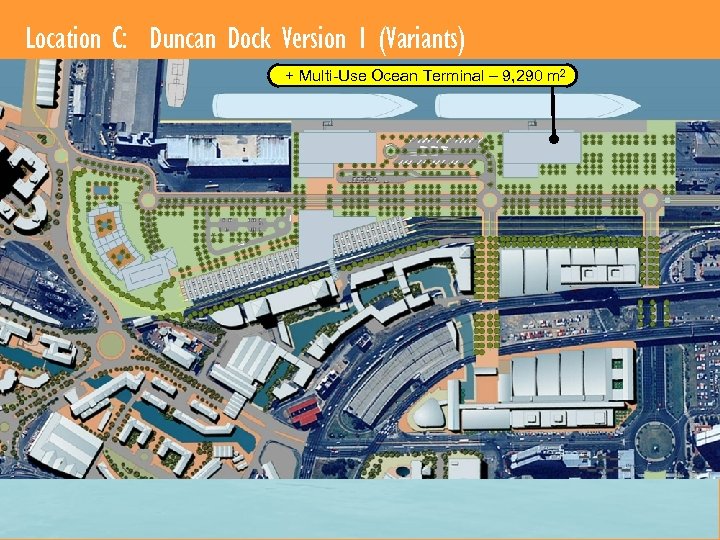

Location C: Duncan Dock Version 1 (Variants) + Multi-Use Ocean Terminal – 9, 290 m 2

Location C: Duncan Dock Version 1 (Variants) + Multi-Use Ocean Terminal – 9, 290 m 2

INVESTIGATION OF THE CRUISE LINER INDUSTRY DRAFT STUDY RESULTS | 7. 16. 08 MITCHELL DUPLESSIS PROJECTS (PTY) LTD | LANDDESIGN

INVESTIGATION OF THE CRUISE LINER INDUSTRY DRAFT STUDY RESULTS | 7. 16. 08 MITCHELL DUPLESSIS PROJECTS (PTY) LTD | LANDDESIGN