234157e691bfed2fd5fd5575f73b959f.ppt

- Количество слайдов: 18

INVESTIGATING RED FLAGS in Section 2 A of the SSG Education Segment Cincinnati Investment Model Club

INVESTIGATING RED FLAGS in Section 2 A of the SSG Education Segment Cincinnati Investment Model Club

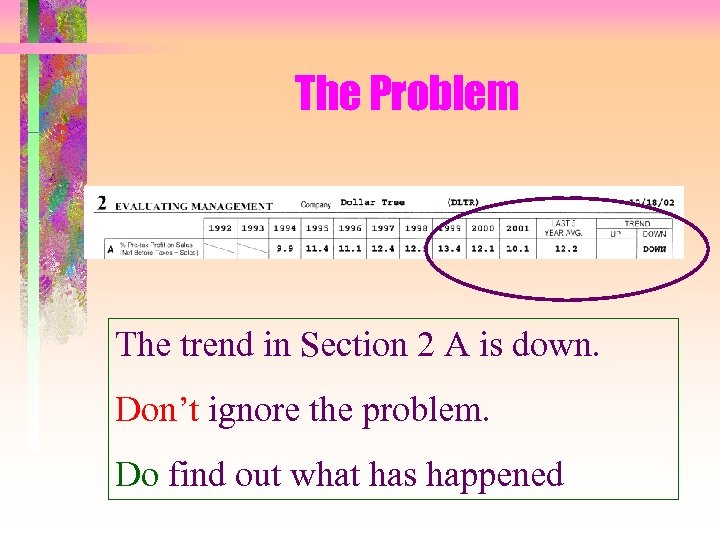

The Problem The trend in Section 2 A is down. Don’t ignore the problem. Do find out what has happened

The Problem The trend in Section 2 A is down. Don’t ignore the problem. Do find out what has happened

Section 2 A • Section 2 A tells us how good management is at making money.

Section 2 A • Section 2 A tells us how good management is at making money.

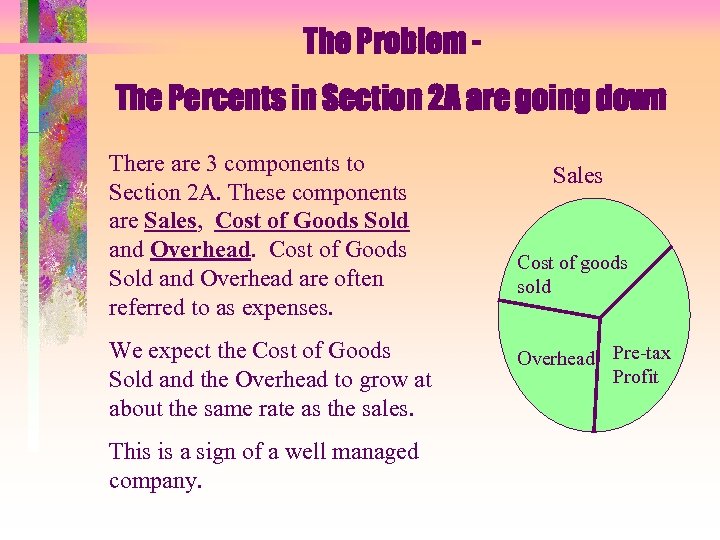

The Problem The Percents in Section 2 A are going down There are 3 components to Section 2 A. These components are Sales, Cost of Goods Sold and Overhead are often referred to as expenses. We expect the Cost of Goods Sold and the Overhead to grow at about the same rate as the sales. This is a sign of a well managed company. Sales Cost of goods sold Overhead Pre-tax Profit

The Problem The Percents in Section 2 A are going down There are 3 components to Section 2 A. These components are Sales, Cost of Goods Sold and Overhead are often referred to as expenses. We expect the Cost of Goods Sold and the Overhead to grow at about the same rate as the sales. This is a sign of a well managed company. Sales Cost of goods sold Overhead Pre-tax Profit

Reasons the numbers in Section 2 A could go down 1. Sales are decreasing and the company has not reduced expenses. 2 Cost of Goods Sold is growing faster than the sales 3. Overhead is growing faster than the sales You must look at each of these to determine what is the problem and then decide if it is a short term problem or a long term problem. If it is a long term problem, then you do not want to buy the company. If you already own the company consider selling if it is a long term problem.

Reasons the numbers in Section 2 A could go down 1. Sales are decreasing and the company has not reduced expenses. 2 Cost of Goods Sold is growing faster than the sales 3. Overhead is growing faster than the sales You must look at each of these to determine what is the problem and then decide if it is a short term problem or a long term problem. If it is a long term problem, then you do not want to buy the company. If you already own the company consider selling if it is a long term problem.

Reason 1 The sales are decreasing • This is easy to check out. Look at the graph on Side one of the SSG. • in the case of Dollar Tree this is not the problem.

Reason 1 The sales are decreasing • This is easy to check out. Look at the graph on Side one of the SSG. • in the case of Dollar Tree this is not the problem.

Comparing the Sales to the Cost of Goods Sold and Overhead • In order to compare the Sales with the Cost of Goods Sold and the Overhead we will have to convert the numbers into percentages. • The numbers we need are found on the Income Statements for Dollar Tree.

Comparing the Sales to the Cost of Goods Sold and Overhead • In order to compare the Sales with the Cost of Goods Sold and the Overhead we will have to convert the numbers into percentages. • The numbers we need are found on the Income Statements for Dollar Tree.

To convert the numbers to a percentage we will use this formula • Take this years amount and subtract last years amount from it. Then divide that answer by last years amount.

To convert the numbers to a percentage we will use this formula • Take this years amount and subtract last years amount from it. Then divide that answer by last years amount.

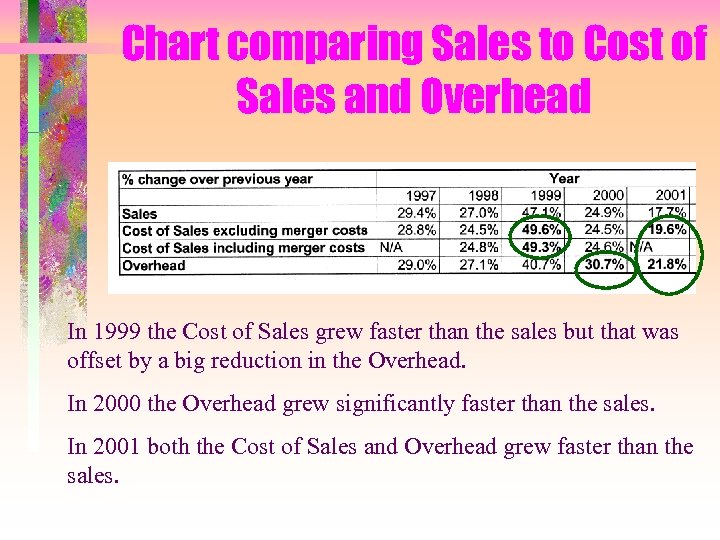

Chart comparing Sales to Cost of Sales and Overhead In 1999 the Cost of Sales grew faster than the sales but that was offset by a big reduction in the Overhead. In 2000 the Overhead grew significantly faster than the sales. In 2001 both the Cost of Sales and Overhead grew faster than the sales.

Chart comparing Sales to Cost of Sales and Overhead In 1999 the Cost of Sales grew faster than the sales but that was offset by a big reduction in the Overhead. In 2000 the Overhead grew significantly faster than the sales. In 2001 both the Cost of Sales and Overhead grew faster than the sales.

Now we know the problem. In the past two years the Cost of Goods Sold and/or the Overhead have been growing faster than then sales. We turn to the Management Discussion and Analysis in the 10 K or Annual Report to find out why.

Now we know the problem. In the past two years the Cost of Goods Sold and/or the Overhead have been growing faster than then sales. We turn to the Management Discussion and Analysis in the 10 K or Annual Report to find out why.

What we learn in the MD & A Section • Dollar Tree is opening more of the larger stores. These stores have lower sales per square foot than the smaller stores, but customers shop longer and buy more. • Dollar Tree is adding a “higher proportion of consumable merchandise, which typically carries a lower gross profit margin. ”

What we learn in the MD & A Section • Dollar Tree is opening more of the larger stores. These stores have lower sales per square foot than the smaller stores, but customers shop longer and buy more. • Dollar Tree is adding a “higher proportion of consumable merchandise, which typically carries a lower gross profit margin. ”

Their Expectations for the Future From the M D & A Regarding Cost of Goods Sold “We will continue to experience pressure on our gross profit margins in future years as we refine our merchandise mix to include a higher proportion of consumable merchandise, which typically carries a lower gross profit margin, open larger stores and continue to absorb higher costs. ” The goal is to maintain a gross profit margin between 36 and 37%. (Gross Profit is the amount after Cost of Goods Sold is subtracted from sales but before Overhead is subtracted)

Their Expectations for the Future From the M D & A Regarding Cost of Goods Sold “We will continue to experience pressure on our gross profit margins in future years as we refine our merchandise mix to include a higher proportion of consumable merchandise, which typically carries a lower gross profit margin, open larger stores and continue to absorb higher costs. ” The goal is to maintain a gross profit margin between 36 and 37%. (Gross Profit is the amount after Cost of Goods Sold is subtracted from sales but before Overhead is subtracted)

What they plan to do From the M D & A section 1. They built two new distribution centers in 2001 to partially offset the above factors with improved domestic freight costs. 2. Vary the mix among the consumable merchandise and variety categories to impact the gross margin. Consumable merchandise sells more quickly than their other merchandise resulting in increased sales 3. Installed a new scanner register and inventory management system to better track the inventory and move it to where it sells. They tailor the merchandise to the demographics of the store.

What they plan to do From the M D & A section 1. They built two new distribution centers in 2001 to partially offset the above factors with improved domestic freight costs. 2. Vary the mix among the consumable merchandise and variety categories to impact the gross margin. Consumable merchandise sells more quickly than their other merchandise resulting in increased sales 3. Installed a new scanner register and inventory management system to better track the inventory and move it to where it sells. They tailor the merchandise to the demographics of the store.

Additional Cost of Goods Sold Problems Listed in the M D & A • A “troubled distribution facility in Philadelphia. ” That has been closed and a new one opened but there were added expenses.

Additional Cost of Goods Sold Problems Listed in the M D & A • A “troubled distribution facility in Philadelphia. ” That has been closed and a new one opened but there were added expenses.

Overhead (or Operating)Expenses The Problem • There was a loss of leverage in payrollrelated costs and store operating expenses. • Operating leverage is the extent to which a company’s costs of operating are fixed (rent, insurance, management salaries) as opposed to variable (salaries of sales people, utilities)

Overhead (or Operating)Expenses The Problem • There was a loss of leverage in payrollrelated costs and store operating expenses. • Operating leverage is the extent to which a company’s costs of operating are fixed (rent, insurance, management salaries) as opposed to variable (salaries of sales people, utilities)

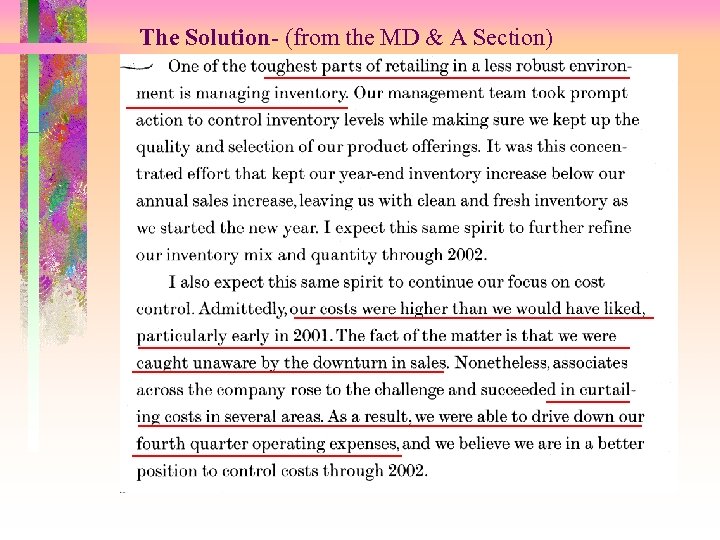

The Solution- (from the MD & A Section)

The Solution- (from the MD & A Section)

Quote from the M D & A • “We must control our merchandise costs, inventory levels and our general and administrative expenses. Increases in expenses could negatively impact our operating results because we cannot pass on increased expenses to our customers by increasing our merchandise price above the $1. 00 price point”

Quote from the M D & A • “We must control our merchandise costs, inventory levels and our general and administrative expenses. Increases in expenses could negatively impact our operating results because we cannot pass on increased expenses to our customers by increasing our merchandise price above the $1. 00 price point”

What we must decide? • 1. Are the problems short term or long term? • 2. Will the solutions fix the problems? THE ANSWERS ARE JUDGMENT

What we must decide? • 1. Are the problems short term or long term? • 2. Will the solutions fix the problems? THE ANSWERS ARE JUDGMENT