2fff131ea70aa71a6202584a44ae4bbf.ppt

- Количество слайдов: 36

Introduction to XBRL

Contents What Is XBRL? Why XBRL? Benefits of XBRL. A dive into XBRL How XBRL Works? Myths about XBRL Governance XBRL Progress in India Role of Chartered Accountants

What is XBRL X-e. Xtensible B-Business R-Reporting L-Language XBRL is a XML(extensible mark up language) base computer language which is a new way of communication of business information in which business reports are converted from paper format to machine readable format.

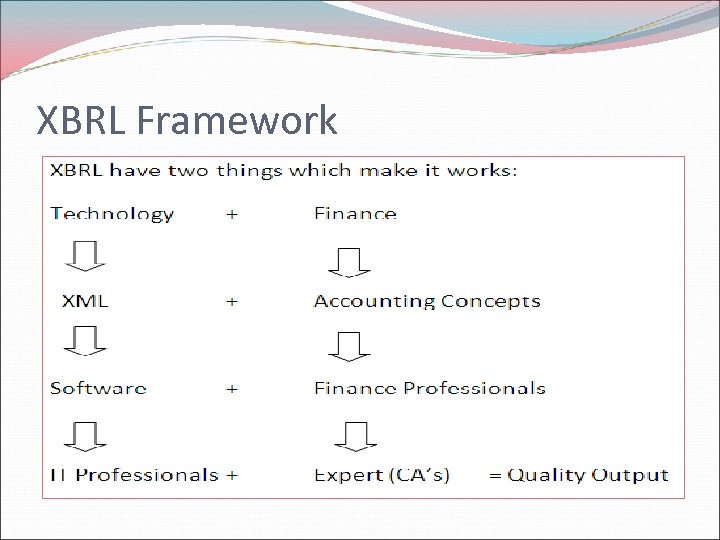

XBRL Framework

Why XBRL q In the century of computerization and with introduction of International Financial Reporting Standards, reporting of entities financial information has acquired new importance. q Reporting of financials is like a sharp edged sword in which balance has to be maintained between confidentiality and transparency. q In the past efforts has been made by various regulators to develop a mechanism of transparent reporting system with least resource wastage. q Still reporting process in most of the cases remains complex, companies are required to collate, check, validate and reconcile the volume of data to arrive at reporting package. q XBRL has emerged as an answer to all the queries. It is a complete package which satisfies all the needs and can be a revolution in the field of financial Reporting.

HISTORY OF XBRL o Begin in 1998 by Charles Hoffman in USA. o August 1999 Steering Committee was formed with Big 4’s as its member along with others o October 1999 First Meeting took place in New York. o In 2001 first XBRL International conference was held in London and since then number of countries have adopted XBRL o October 2001 XBRL jurisdictions were formed in US, Australia, Canada, Germany, Japan , UK, Netherland. o Till date there are major countries worldwide who have adopted XBRL.

Benefits of XBRL Transparency Accessibility Regulated Reporting Automation Data Analysis Unique Database

What does XBRL have to offer? Adopted worldwide Designed to be compatible with other applications Once entered, data does not have to be re-entered Uses standardized descriptions which reduces the possibility of error o The technology is ideal for web-enabled applications and those who gather financial information over internet. o Generate various outputs and reports based on a single set of data o Cost savings to be gained from input efficiency, preserving accuracy and integrity o o

Potential Uses of XBRL (Source: www. xbrl. org): XBRL can be applied to a very wide range of business and financial data. Among other things, it can handle: Company internal and external financial reporting. Business reporting to all types of regulators, including tax and financial authorities, central banks and governments. Filing of loan reports and applications; credit risk assessments. Exchange of information between government departments or between other institutions, such as central banks. Authoritative accounting literature - providing a standard way of describing accounting documents provided by authoritative bodies. A wide range of other financial and statistical data which needs to be stored, exchanged analyzed.

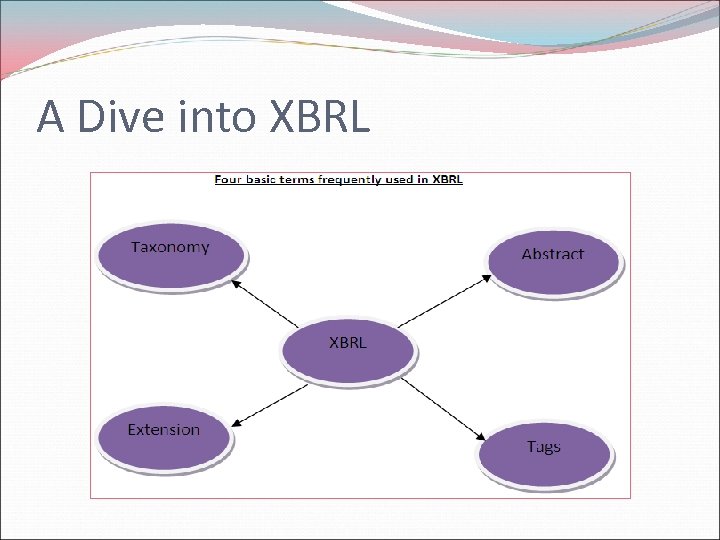

A Dive into XBRL

Fundamentals In XBRL data is so tagged that it can be easily understood by computers. Example <Cash>500</Cash> Between tags is value

Taxonomy is a hierarchal structure of financial definitions. It is like a dictionary from which definition of business concepts can be extracted. It also depicts the relationship between the total item and the sub items.

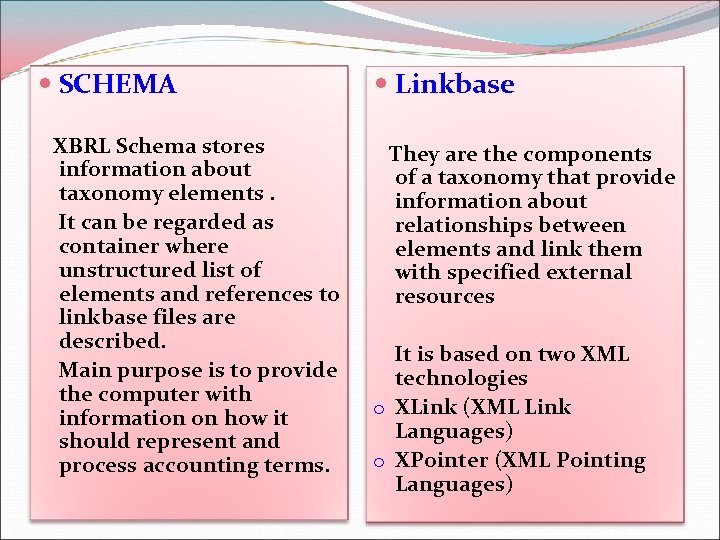

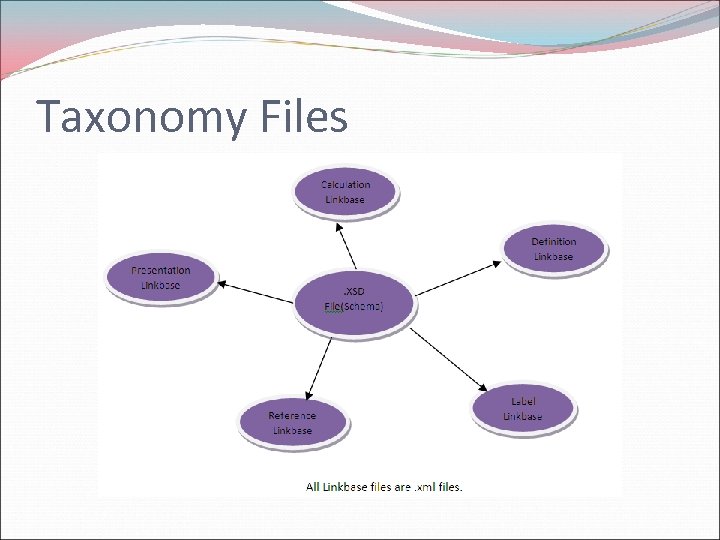

SCHEMA Linkbase XBRL Schema stores information about taxonomy elements. It can be regarded as container where unstructured list of elements and references to linkbase files are described. Main purpose is to provide the computer with information on how it should represent and process accounting terms. They are the components of a taxonomy that provide information about relationships between elements and link them with specified external resources It is based on two XML technologies o XLink (XML Link Languages) o XPointer (XML Pointing Languages)

Taxonomy Files

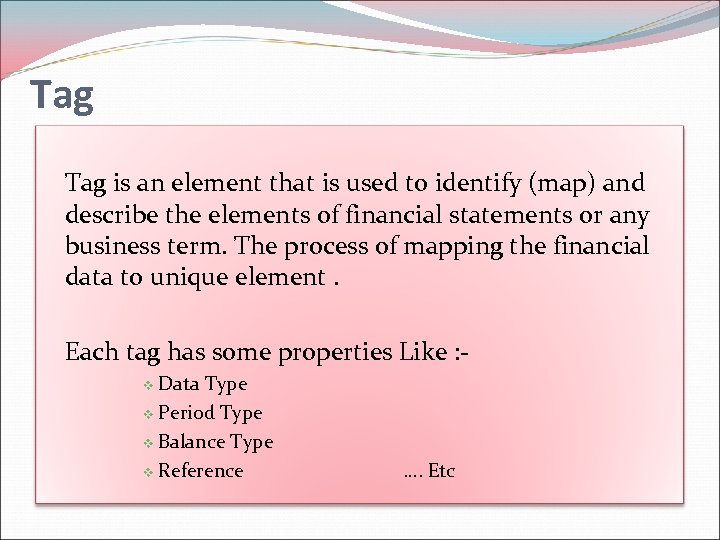

Tag is an element that is used to identify (map) and describe the elements of financial statements or any business term. The process of mapping the financial data to unique element. Each tag has some properties Like : Data Type v Period Type v Balance Type v Reference v …. Etc

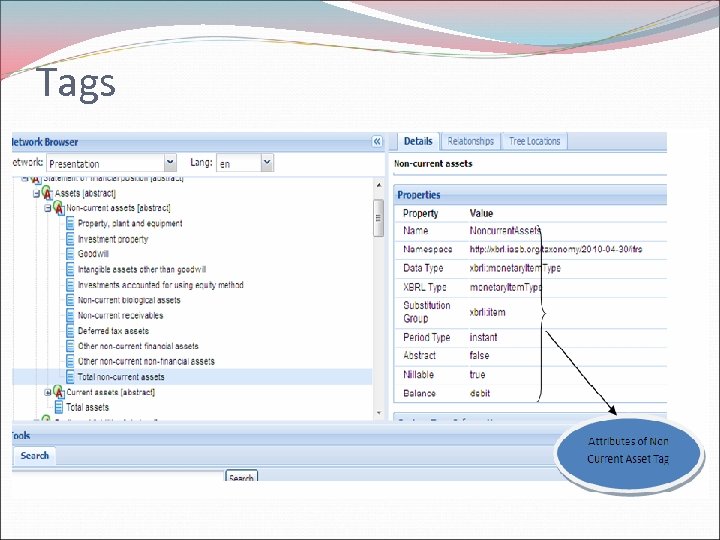

Tags

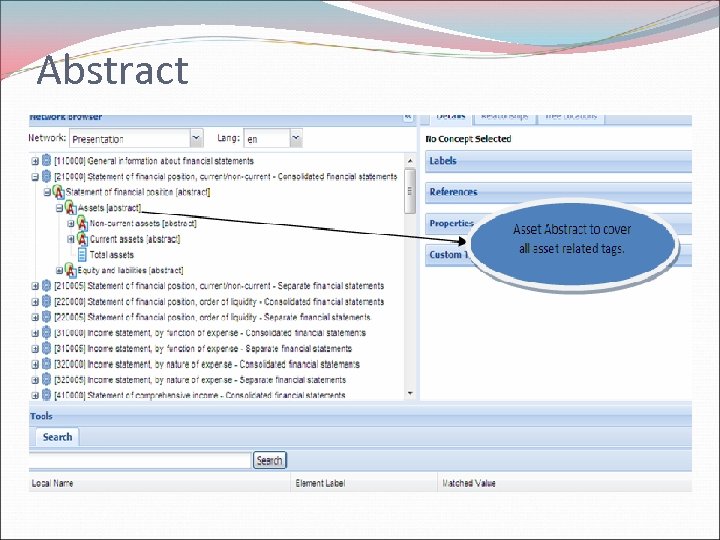

Abstract is used to cover all the tags of same group under one heading (roof), in such a way that hierarchy between the elements can be depicted in a systematic and logical manner.

Abstract

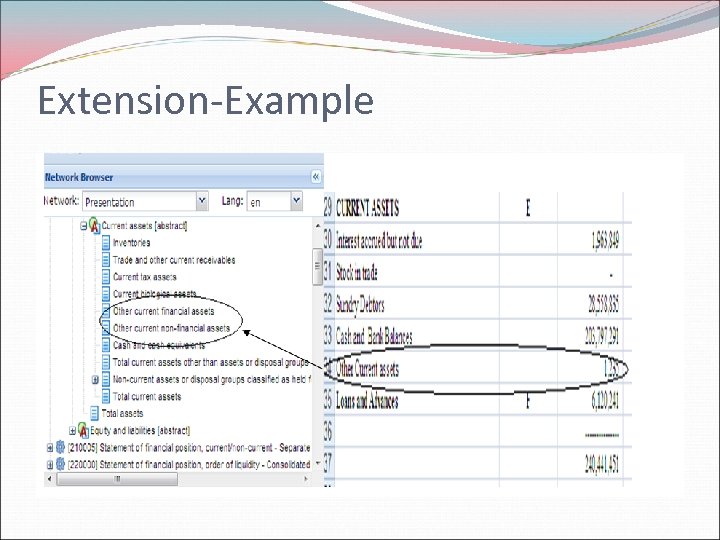

Extension Extensibility is one of the important aspects of XBRL. When there is no tag available in public taxonomy to identify an element of financial statements of Reporting Entity, Extension tag is used to identify (Map) the same element. Add Element that was not described in the base taxonomy. Modify relationship between elements in terms of reference or order

Extension-Example

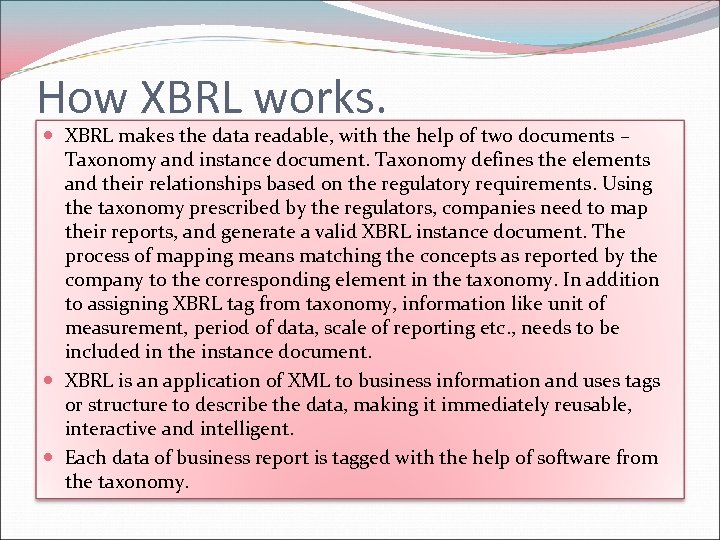

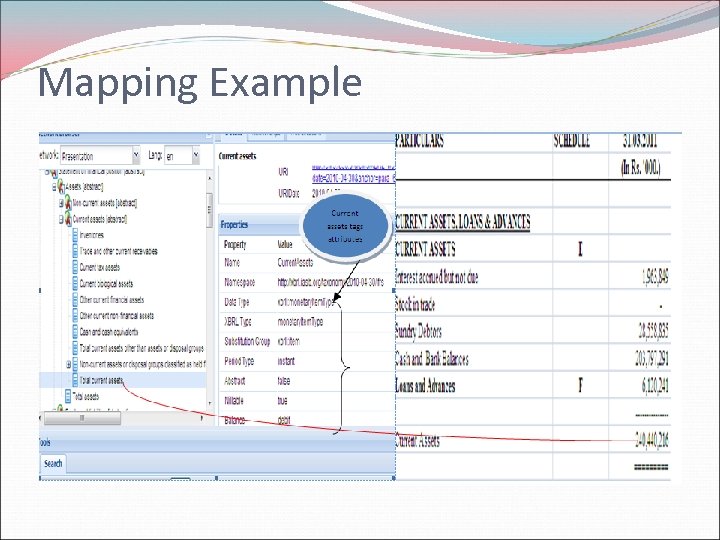

How XBRL works. XBRL makes the data readable, with the help of two documents – Taxonomy and instance document. Taxonomy defines the elements and their relationships based on the regulatory requirements. Using the taxonomy prescribed by the regulators, companies need to map their reports, and generate a valid XBRL instance document. The process of mapping means matching the concepts as reported by the company to the corresponding element in the taxonomy. In addition to assigning XBRL tag from taxonomy, information like unit of measurement, period of data, scale of reporting etc. , needs to be included in the instance document. XBRL is an application of XML to business information and uses tags or structure to describe the data, making it immediately reusable, interactive and intelligent. Each data of business report is tagged with the help of software from the taxonomy.

Mapping Example

Myths About XBRL Is it an accounting standard? Whether it’s a software program? XBRL is full proof?

XBRL International is a not-for-profit consortium of approximately 650 companies and agencies worldwide working together to build the XBRL language and promote and support its adoption. The consortium members meet periodically in international conferences, conduct committee work regularly via conference calls, and communicate in email and phone calls throughout the week. XBRL International is comprised of Jurisdictions which represent countries, region or international bodies and focus of XBRL in their area.

XBRL International Ø It consists of ØSterring Committee ØStandards Board ØBest Practice Board ØWorking Groups Ø Web address for XBRL International : www. xbrl. org Ø Dr. Avinash Chander of ICAI is one of the member of Steering Committee.

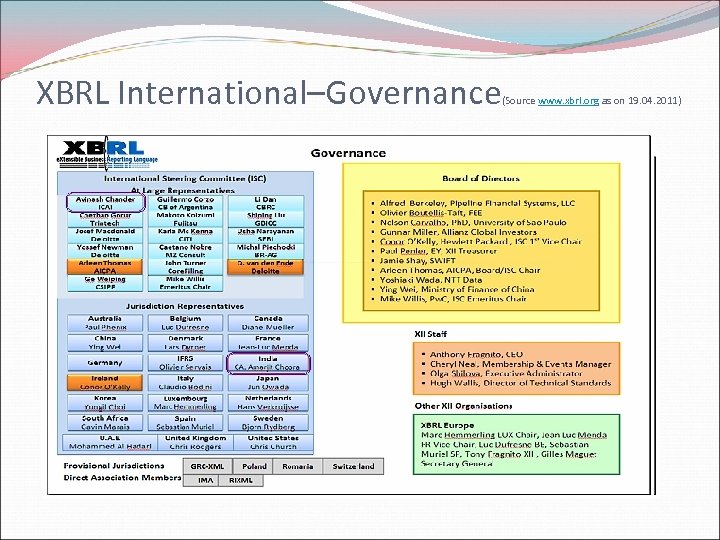

XBRL International–Governance (Source www. xbrl. org as on 19. 04. 2011)

XBRL India XBRL Indian Jurisdiction is an established Jurisdiction of XBRL International. XBRL India is a Company registered under Section 25 of Companies Act, 1956, incorporated for managing the affairs of Indian Jurisdiction of XBRL International. Web address for XBRL India: http: //www. xbrl. org/in/

XBRL India Objectives (Source: www. xbrl. org/in) o To promote and encourage the adoption of XBRL in India as a standard for electronic business reporting in India. o To facilitate education and marketing of XBRL. o To develop and manage XBRL taxonomies. o To keep developing XBRL taxonomies as per International Standards. o To represent India’s Interests within XBRL International. o To contribute to the International development of XBRL.

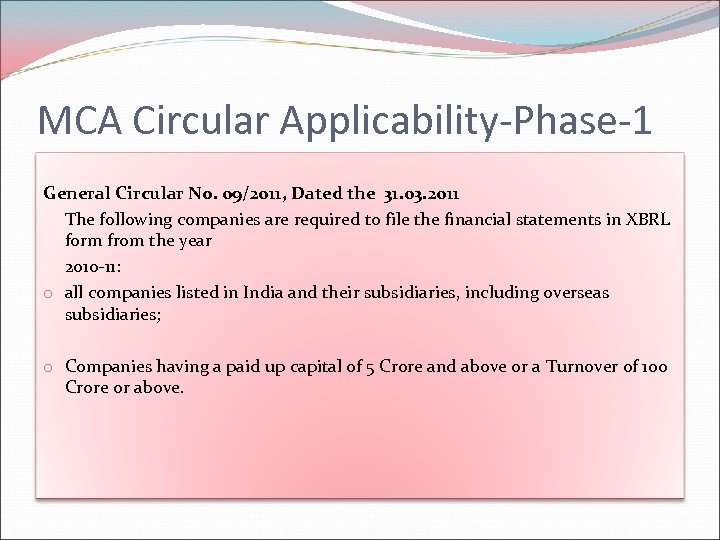

MCA Circular Applicability-Phase-1 General Circular No. 09/2011, Dated the 31. 03. 2011 The following companies are required to file the financial statements in XBRL form from the year 2010 -11: o all companies listed in India and their subsidiaries, including overseas subsidiaries; o Companies having a paid up capital of 5 Crore and above or a Turnover of 100 Crore or above.

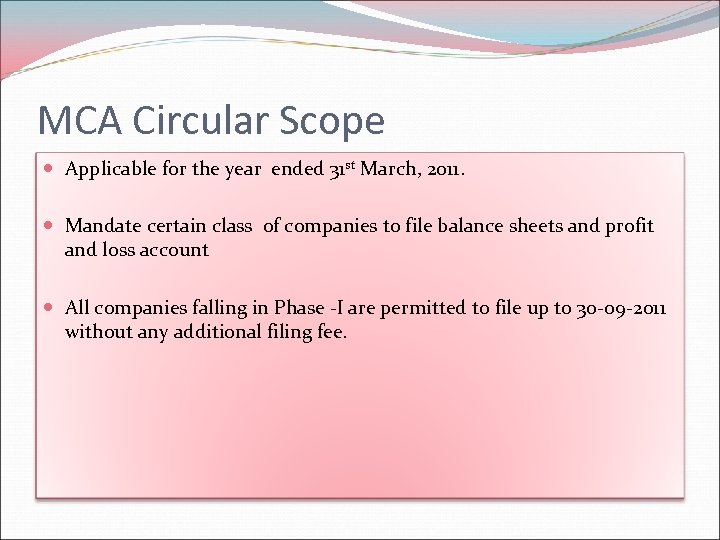

MCA Circular Scope Applicable for the year ended 31 st March, 2011. Mandate certain class of companies to file balance sheets and profit and loss account All companies falling in Phase -I are permitted to file up to 30 -09 -2011 without any additional filing fee.

Challenges for Indian Corporate Lack of XBRL Expert Shorter Time Period Software's Feasibility Uncertainty(Gateway and taxonomy etc)

How compliance can be done? Integrated In-House Outsource

Role of Chartered Accountants Regulatory Requirement. Taxonomy Development. Tool Evaluation. Examine the different option available suitable to company. Training Outsourcing Business.

Road Ahead Applicability will be extended to 9, 000 companies. Scope will be enhanced to full report including notes. Unified Reporting to all the regulators(Mumbai Conf. ) Assurance Services of XBRL filing.

Thank You

s at nd u n fi om u ca ail. c Yo @gm l. com xbrl p mai grou 5@g 211 n l. com mai avee n 6@g garg l. com ma 2 mai ar h 4@g lavis ay 8 h laks rwa aga g Gar en ave 15 N 1 CA 332 0 991 a arm Sh avi L 66 CA 720 1 al 560 9 arw Ag ay h Aks 102 CA 70 107 98

2fff131ea70aa71a6202584a44ae4bbf.ppt