f2e69689c3367032ca12b2098c8f4163.ppt

- Количество слайдов: 18

Introduction to Workshop on Risk Mitigation for African Financings June 22, 2005 Mahesh Kotecha, President Structured Credit International Corp. (SCIC) 1

Introduction to Workshop on Risk Mitigation for African Financings June 22, 2005 Mahesh Kotecha, President Structured Credit International Corp. (SCIC) 1

Objectives – Message 2

Objectives – Message 2

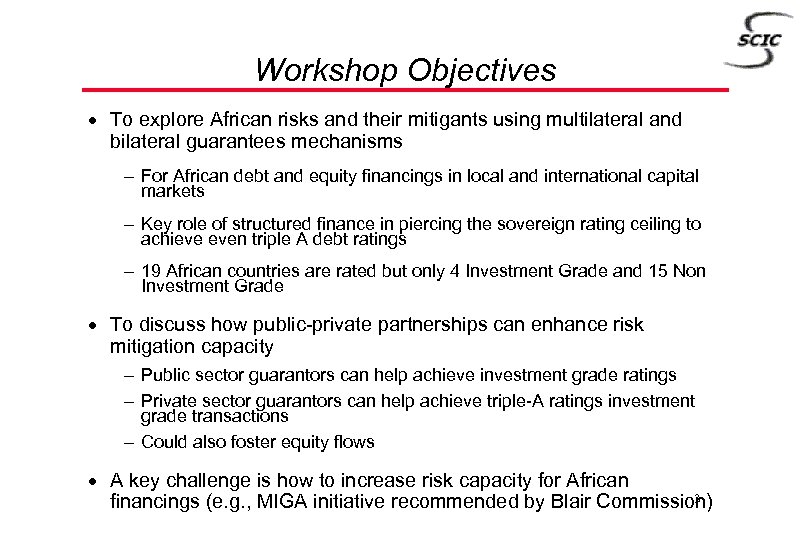

Workshop Objectives · To explore African risks and their mitigants using multilateral and bilateral guarantees mechanisms - For African debt and equity financings in local and international capital markets - Key role of structured finance in piercing the sovereign rating ceiling to achieve even triple A debt ratings - 19 African countries are rated but only 4 Investment Grade and 15 Non Investment Grade · To discuss how public-private partnerships can enhance risk mitigation capacity - Public sector guarantors can help achieve investment grade ratings - Private sector guarantors can help achieve triple-A ratings investment grade transactions - Could also foster equity flows · A key challenge is how to increase risk capacity for African 3 financings (e. g. , MIGA initiative recommended by Blair Commission)

Workshop Objectives · To explore African risks and their mitigants using multilateral and bilateral guarantees mechanisms - For African debt and equity financings in local and international capital markets - Key role of structured finance in piercing the sovereign rating ceiling to achieve even triple A debt ratings - 19 African countries are rated but only 4 Investment Grade and 15 Non Investment Grade · To discuss how public-private partnerships can enhance risk mitigation capacity - Public sector guarantors can help achieve investment grade ratings - Private sector guarantors can help achieve triple-A ratings investment grade transactions - Could also foster equity flows · A key challenge is how to increase risk capacity for African 3 financings (e. g. , MIGA initiative recommended by Blair Commission)

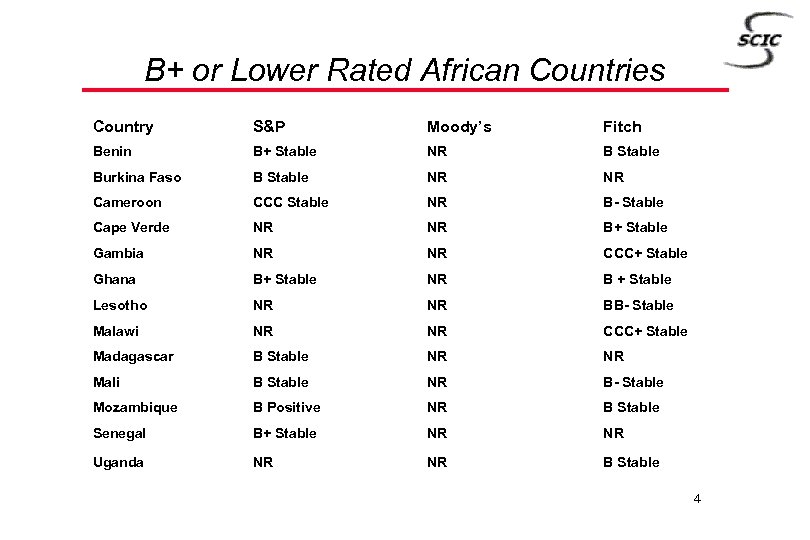

B+ or Lower Rated African Countries Country S&P Moody’s Fitch Benin B+ Stable NR B Stable Burkina Faso B Stable NR Cameroon CCC Stable NR B- Stable Cape Verde NR B+ Stable Gambia NR NR CCC+ Stable Ghana B+ Stable NR B + Stable Lesotho NR BB- Stable Malawi NR CCC+ Stable Madagascar B Stable NR NR Mali B Stable NR B- Stable Mozambique B Positive NR B Stable Senegal B+ Stable NR NR Uganda NR NR B Stable 4

B+ or Lower Rated African Countries Country S&P Moody’s Fitch Benin B+ Stable NR B Stable Burkina Faso B Stable NR Cameroon CCC Stable NR B- Stable Cape Verde NR B+ Stable Gambia NR NR CCC+ Stable Ghana B+ Stable NR B + Stable Lesotho NR BB- Stable Malawi NR CCC+ Stable Madagascar B Stable NR NR Mali B Stable NR B- Stable Mozambique B Positive NR B Stable Senegal B+ Stable NR NR Uganda NR NR B Stable 4

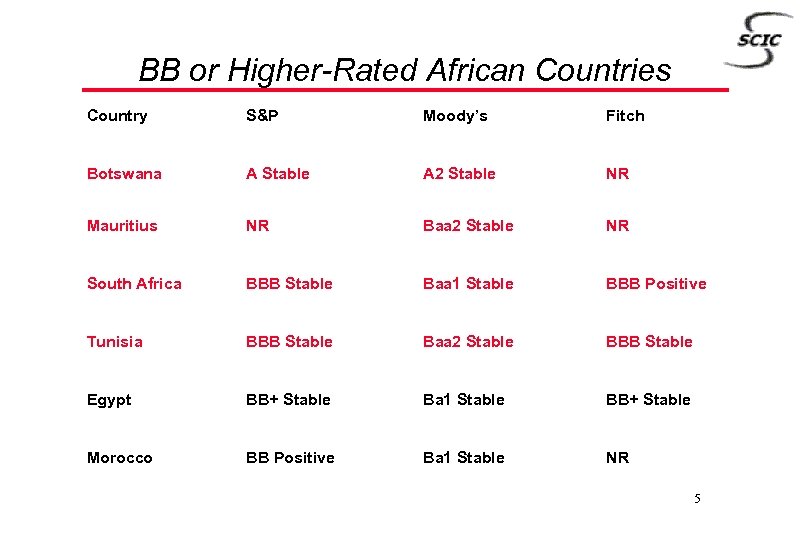

BB or Higher-Rated African Countries Country S&P Moody’s Fitch Botswana A Stable A 2 Stable NR Mauritius NR Baa 2 Stable NR South Africa BBB Stable Baa 1 Stable BBB Positive Tunisia BBB Stable Baa 2 Stable BBB Stable Egypt BB+ Stable Ba 1 Stable BB+ Stable Morocco BB Positive Ba 1 Stable NR 5

BB or Higher-Rated African Countries Country S&P Moody’s Fitch Botswana A Stable A 2 Stable NR Mauritius NR Baa 2 Stable NR South Africa BBB Stable Baa 1 Stable BBB Positive Tunisia BBB Stable Baa 2 Stable BBB Stable Egypt BB+ Stable Ba 1 Stable BB+ Stable Morocco BB Positive Ba 1 Stable NR 5

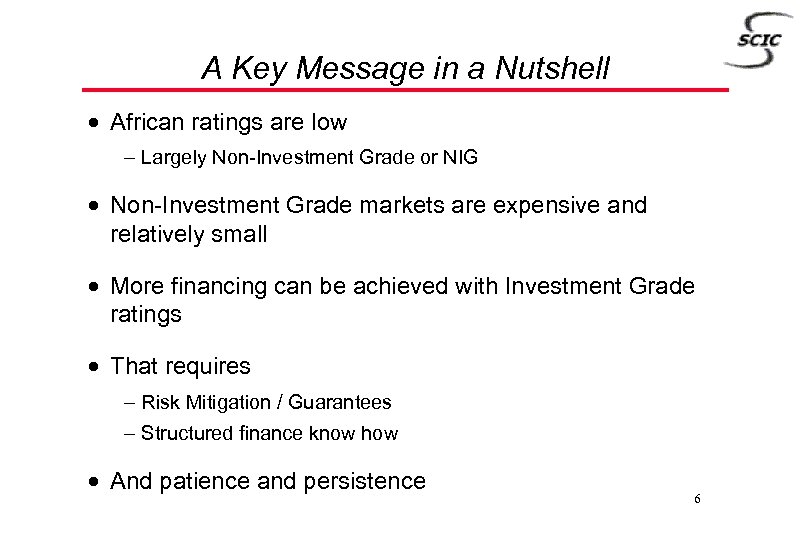

A Key Message in a Nutshell · African ratings are low - Largely Non-Investment Grade or NIG · Non-Investment Grade markets are expensive and relatively small · More financing can be achieved with Investment Grade ratings · That requires - Risk Mitigation / Guarantees - Structured finance know how · And patience and persistence 6

A Key Message in a Nutshell · African ratings are low - Largely Non-Investment Grade or NIG · Non-Investment Grade markets are expensive and relatively small · More financing can be achieved with Investment Grade ratings · That requires - Risk Mitigation / Guarantees - Structured finance know how · And patience and persistence 6

Risk Mitigation – An Overview 7

Risk Mitigation – An Overview 7

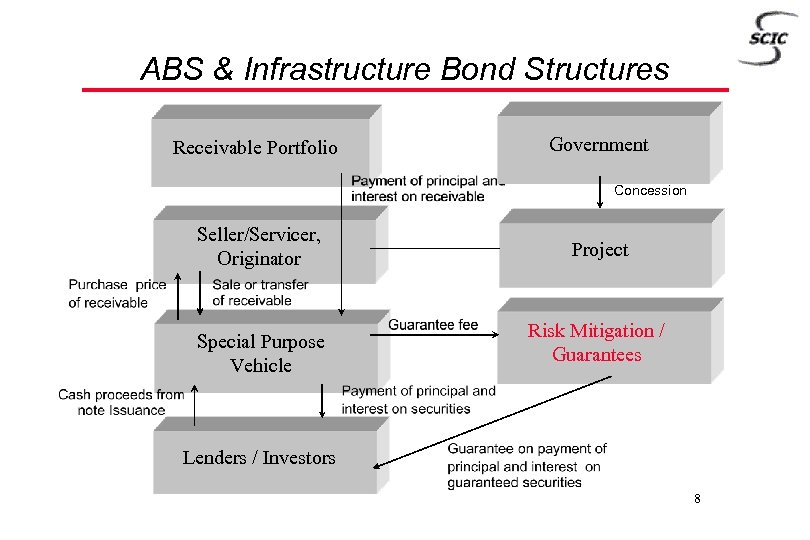

ABS & Infrastructure Bond Structures Receivable Portfolio Government Concession Seller/Servicer, Originator Special Purpose Vehicle Project Risk Mitigation / Guarantees Lenders / Investors 8

ABS & Infrastructure Bond Structures Receivable Portfolio Government Concession Seller/Servicer, Originator Special Purpose Vehicle Project Risk Mitigation / Guarantees Lenders / Investors 8

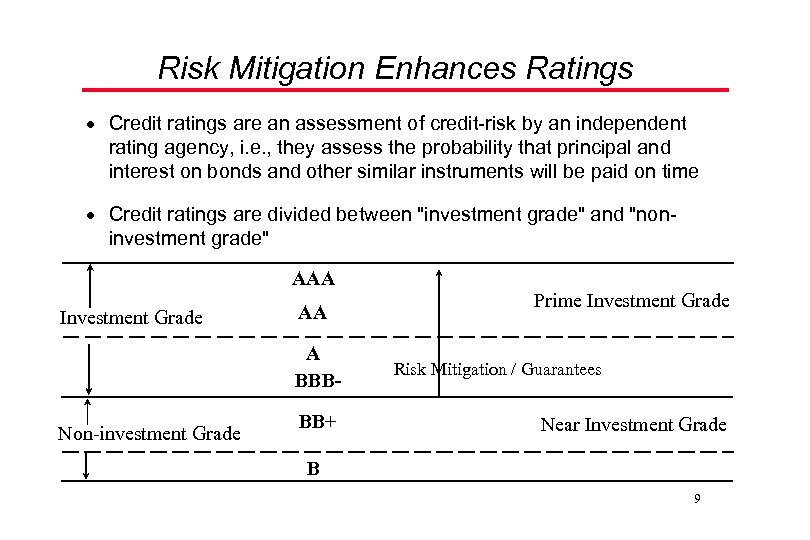

Risk Mitigation Enhances Ratings · Credit ratings are an assessment of credit-risk by an independent rating agency, i. e. , they assess the probability that principal and interest on bonds and other similar instruments will be paid on time · Credit ratings are divided between "investment grade" and "noninvestment grade" AAA Investment Grade AA A BBB- Non-investment Grade BB+ Prime Investment Grade Risk Mitigation / Guarantees Near Investment Grade B 9

Risk Mitigation Enhances Ratings · Credit ratings are an assessment of credit-risk by an independent rating agency, i. e. , they assess the probability that principal and interest on bonds and other similar instruments will be paid on time · Credit ratings are divided between "investment grade" and "noninvestment grade" AAA Investment Grade AA A BBB- Non-investment Grade BB+ Prime Investment Grade Risk Mitigation / Guarantees Near Investment Grade B 9

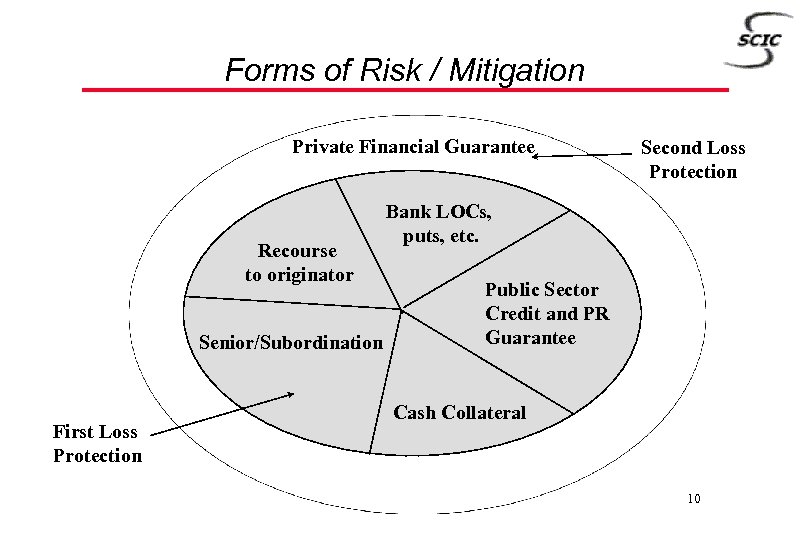

Forms of Risk / Mitigation Private Financial Guarantee Recourse to originator Senior/Subordination First Loss Protection Second Loss Protection Bank LOCs, puts, etc. Public Sector Credit and PR Guarantee Cash Collateral 10

Forms of Risk / Mitigation Private Financial Guarantee Recourse to originator Senior/Subordination First Loss Protection Second Loss Protection Bank LOCs, puts, etc. Public Sector Credit and PR Guarantee Cash Collateral 10

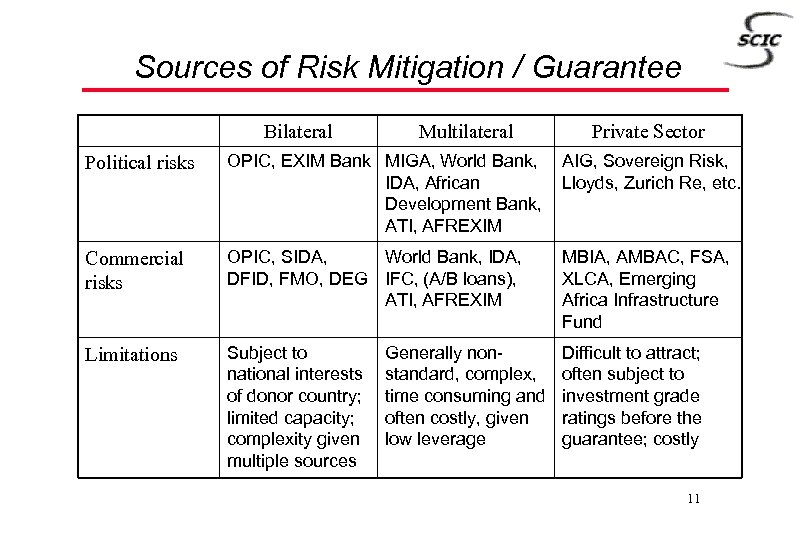

Sources of Risk Mitigation / Guarantee Bilateral Multilateral Private Sector Political risks OPIC, EXIM Bank MIGA, World Bank, IDA, African Development Bank, ATI, AFREXIM AIG, Sovereign Risk, Lloyds, Zurich Re, etc. Commercial risks OPIC, SIDA, World Bank, IDA, DFID, FMO, DEG IFC, (A/B loans), ATI, AFREXIM MBIA, AMBAC, FSA, XLCA, Emerging Africa Infrastructure Fund Limitations Subject to national interests of donor country; limited capacity; complexity given multiple sources Difficult to attract; often subject to investment grade ratings before the guarantee; costly Generally nonstandard, complex, time consuming and often costly, given low leverage 11

Sources of Risk Mitigation / Guarantee Bilateral Multilateral Private Sector Political risks OPIC, EXIM Bank MIGA, World Bank, IDA, African Development Bank, ATI, AFREXIM AIG, Sovereign Risk, Lloyds, Zurich Re, etc. Commercial risks OPIC, SIDA, World Bank, IDA, DFID, FMO, DEG IFC, (A/B loans), ATI, AFREXIM MBIA, AMBAC, FSA, XLCA, Emerging Africa Infrastructure Fund Limitations Subject to national interests of donor country; limited capacity; complexity given multiple sources Difficult to attract; often subject to investment grade ratings before the guarantee; costly Generally nonstandard, complex, time consuming and often costly, given low leverage 11

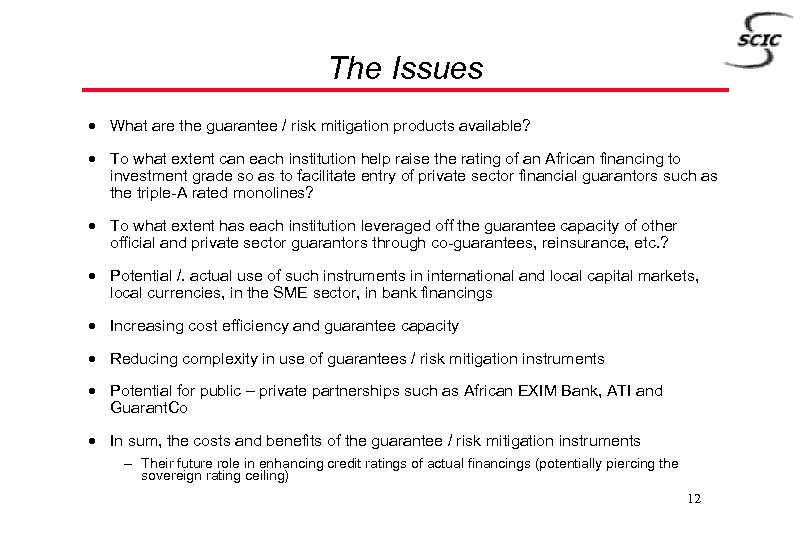

The Issues · What are the guarantee / risk mitigation products available? · To what extent can each institution help raise the rating of an African financing to investment grade so as to facilitate entry of private sector financial guarantors such as the triple-A rated monolines? · To what extent has each institution leveraged off the guarantee capacity of other official and private sector guarantors through co-guarantees, reinsurance, etc. ? · Potential /. actual use of such instruments in international and local capital markets, local currencies, in the SME sector, in bank financings · Increasing cost efficiency and guarantee capacity · Reducing complexity in use of guarantees / risk mitigation instruments · Potential for public – private partnerships such as African EXIM Bank, ATI and Guarant. Co · In sum, the costs and benefits of the guarantee / risk mitigation instruments - Their future role in enhancing credit ratings of actual financings (potentially piercing the sovereign rating ceiling) 12

The Issues · What are the guarantee / risk mitigation products available? · To what extent can each institution help raise the rating of an African financing to investment grade so as to facilitate entry of private sector financial guarantors such as the triple-A rated monolines? · To what extent has each institution leveraged off the guarantee capacity of other official and private sector guarantors through co-guarantees, reinsurance, etc. ? · Potential /. actual use of such instruments in international and local capital markets, local currencies, in the SME sector, in bank financings · Increasing cost efficiency and guarantee capacity · Reducing complexity in use of guarantees / risk mitigation instruments · Potential for public – private partnerships such as African EXIM Bank, ATI and Guarant. Co · In sum, the costs and benefits of the guarantee / risk mitigation instruments - Their future role in enhancing credit ratings of actual financings (potentially piercing the sovereign rating ceiling) 12

Risk Mitigation – The Panel 13

Risk Mitigation – The Panel 13

Knowledgeable Workshop Panel · Moderator - Mr. Mahesh Kotecha, President, Structured Credit International Corp · Ms. Maureen Miskovic, COO, The Eurasia Group - Provides an investor’s risk assessment framework · Ms. Ileana Boza, Head Global Finance, MIGA - Presents MIGA products, aggregate public sector claims data, and interesting African case studies · Mr. Jean-Louis Ekra, President, African Export-Import Bank - Presents an African experience in risk mitigation · Mr. Kenneth Tinsley, Vice-President Credit Underwriting, U. S. EXIM - Presents EXIM products and experience 14

Knowledgeable Workshop Panel · Moderator - Mr. Mahesh Kotecha, President, Structured Credit International Corp · Ms. Maureen Miskovic, COO, The Eurasia Group - Provides an investor’s risk assessment framework · Ms. Ileana Boza, Head Global Finance, MIGA - Presents MIGA products, aggregate public sector claims data, and interesting African case studies · Mr. Jean-Louis Ekra, President, African Export-Import Bank - Presents an African experience in risk mitigation · Mr. Kenneth Tinsley, Vice-President Credit Underwriting, U. S. EXIM - Presents EXIM products and experience 14

Appendix 15

Appendix 15

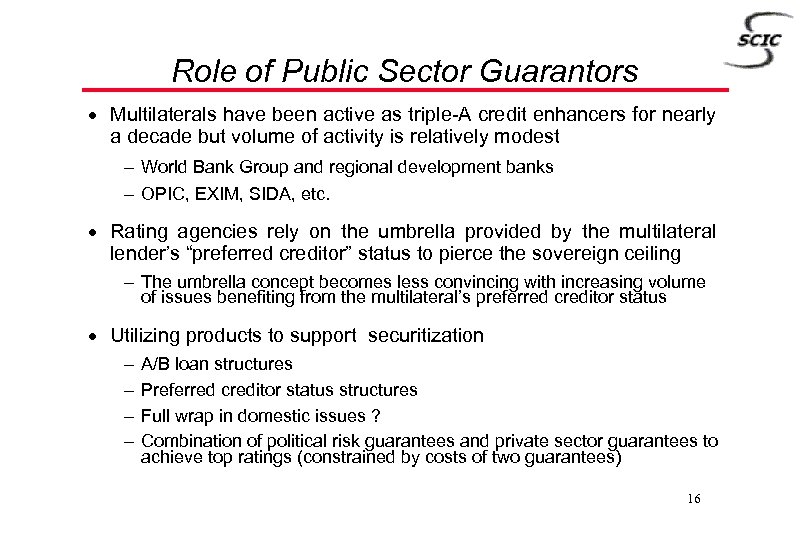

Role of Public Sector Guarantors · Multilaterals have been active as triple-A credit enhancers for nearly a decade but volume of activity is relatively modest - World Bank Group and regional development banks - OPIC, EXIM, SIDA, etc. · Rating agencies rely on the umbrella provided by the multilateral lender’s “preferred creditor” status to pierce the sovereign ceiling - The umbrella concept becomes less convincing with increasing volume of issues benefiting from the multilateral’s preferred creditor status · Utilizing products to support securitization - A/B loan structures Preferred creditor status structures Full wrap in domestic issues ? Combination of political risk guarantees and private sector guarantees to achieve top ratings (constrained by costs of two guarantees) 16

Role of Public Sector Guarantors · Multilaterals have been active as triple-A credit enhancers for nearly a decade but volume of activity is relatively modest - World Bank Group and regional development banks - OPIC, EXIM, SIDA, etc. · Rating agencies rely on the umbrella provided by the multilateral lender’s “preferred creditor” status to pierce the sovereign ceiling - The umbrella concept becomes less convincing with increasing volume of issues benefiting from the multilateral’s preferred creditor status · Utilizing products to support securitization - A/B loan structures Preferred creditor status structures Full wrap in domestic issues ? Combination of political risk guarantees and private sector guarantees to achieve top ratings (constrained by costs of two guarantees) 16

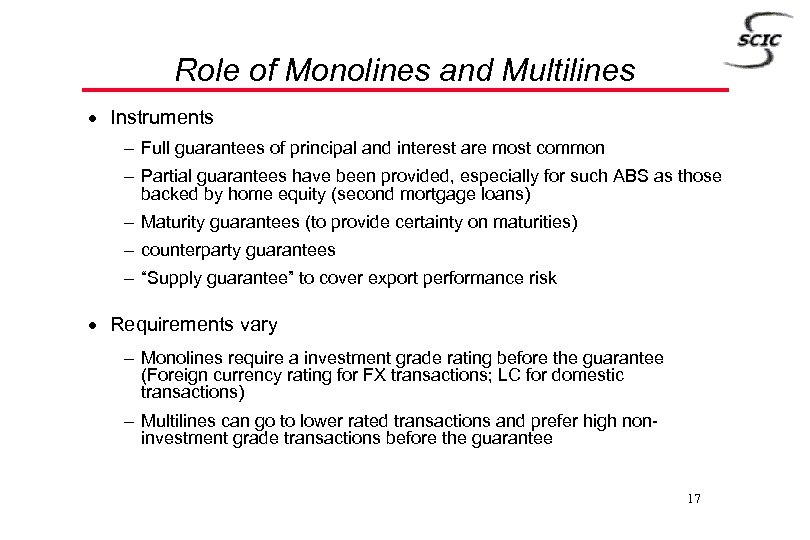

Role of Monolines and Multilines · Instruments - Full guarantees of principal and interest are most common - Partial guarantees have been provided, especially for such ABS as those backed by home equity (second mortgage loans) - Maturity guarantees (to provide certainty on maturities) - counterparty guarantees - “Supply guarantee” to cover export performance risk · Requirements vary - Monolines require a investment grade rating before the guarantee (Foreign currency rating for FX transactions; LC for domestic transactions) - Multilines can go to lower rated transactions and prefer high noninvestment grade transactions before the guarantee 17

Role of Monolines and Multilines · Instruments - Full guarantees of principal and interest are most common - Partial guarantees have been provided, especially for such ABS as those backed by home equity (second mortgage loans) - Maturity guarantees (to provide certainty on maturities) - counterparty guarantees - “Supply guarantee” to cover export performance risk · Requirements vary - Monolines require a investment grade rating before the guarantee (Foreign currency rating for FX transactions; LC for domestic transactions) - Multilines can go to lower rated transactions and prefer high noninvestment grade transactions before the guarantee 17

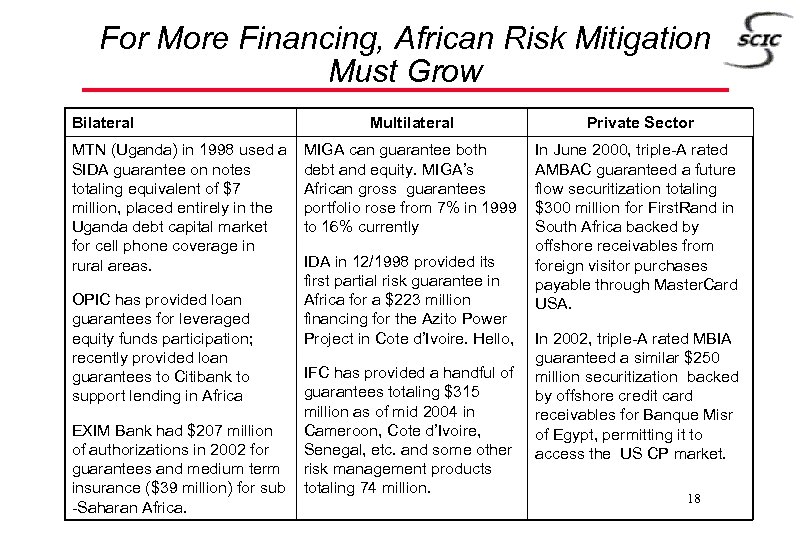

For More Financing, African Risk Mitigation Must Grow Bilateral MTN (Uganda) in 1998 used a SIDA guarantee on notes totaling equivalent of $7 million, placed entirely in the Uganda debt capital market for cell phone coverage in rural areas. OPIC has provided loan guarantees for leveraged equity funds participation; recently provided loan guarantees to Citibank to support lending in Africa EXIM Bank had $207 million of authorizations in 2002 for guarantees and medium term insurance ($39 million) for sub -Saharan Africa. Multilateral MIGA can guarantee both debt and equity. MIGA’s African gross guarantees portfolio rose from 7% in 1999 to 16% currently IDA in 12/1998 provided its first partial risk guarantee in Africa for a $223 million financing for the Azito Power Project in Cote d’Ivoire. Hello, IFC has provided a handful of guarantees totaling $315 million as of mid 2004 in Cameroon, Cote d’Ivoire, Senegal, etc. and some other risk management products totaling 74 million. Private Sector In June 2000, triple-A rated AMBAC guaranteed a future flow securitization totaling $300 million for First. Rand in South Africa backed by offshore receivables from foreign visitor purchases payable through Master. Card USA. In 2002, triple-A rated MBIA guaranteed a similar $250 million securitization backed by offshore credit card receivables for Banque Misr of Egypt, permitting it to access the US CP market. 18

For More Financing, African Risk Mitigation Must Grow Bilateral MTN (Uganda) in 1998 used a SIDA guarantee on notes totaling equivalent of $7 million, placed entirely in the Uganda debt capital market for cell phone coverage in rural areas. OPIC has provided loan guarantees for leveraged equity funds participation; recently provided loan guarantees to Citibank to support lending in Africa EXIM Bank had $207 million of authorizations in 2002 for guarantees and medium term insurance ($39 million) for sub -Saharan Africa. Multilateral MIGA can guarantee both debt and equity. MIGA’s African gross guarantees portfolio rose from 7% in 1999 to 16% currently IDA in 12/1998 provided its first partial risk guarantee in Africa for a $223 million financing for the Azito Power Project in Cote d’Ivoire. Hello, IFC has provided a handful of guarantees totaling $315 million as of mid 2004 in Cameroon, Cote d’Ivoire, Senegal, etc. and some other risk management products totaling 74 million. Private Sector In June 2000, triple-A rated AMBAC guaranteed a future flow securitization totaling $300 million for First. Rand in South Africa backed by offshore receivables from foreign visitor purchases payable through Master. Card USA. In 2002, triple-A rated MBIA guaranteed a similar $250 million securitization backed by offshore credit card receivables for Banque Misr of Egypt, permitting it to access the US CP market. 18