c3c6bef3edfbb0bea56a41121ae9c001.ppt

- Количество слайдов: 37

Introduction to the Trade Facilitation Programme Cairo, 23 rd April 2012

Introduction to the Trade Facilitation Programme Cairo, 23 rd April 2012

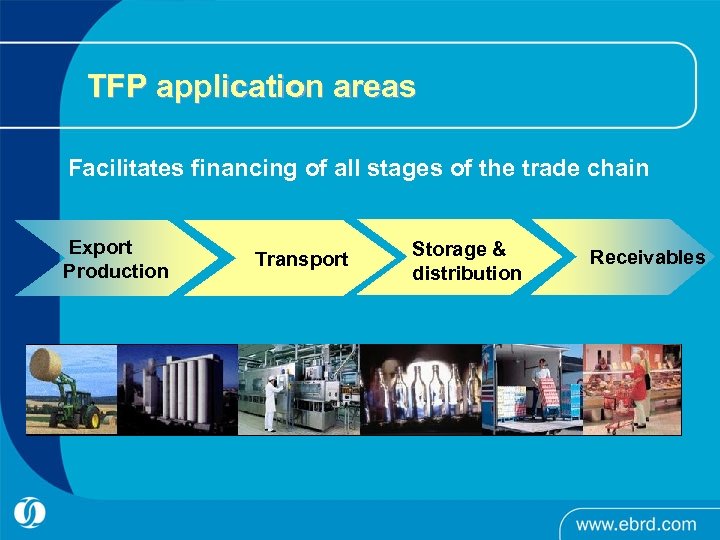

TFP application areas Facilitates financing of all stages of the trade chain Export Production Transport Storage & distribution Receivables

TFP application areas Facilitates financing of all stages of the trade chain Export Production Transport Storage & distribution Receivables

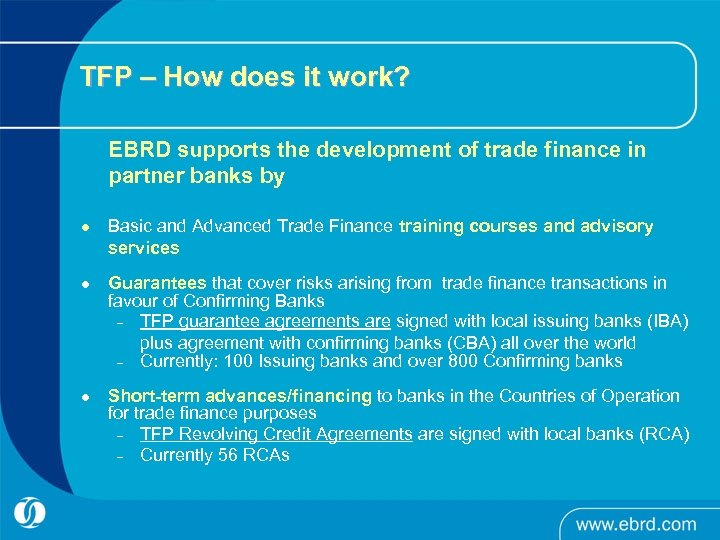

TFP – How does it work? EBRD supports the development of trade finance in partner banks by l l l Basic and Advanced Trade Finance training courses and advisory services Guarantees that cover risks arising from trade finance transactions in favour of Confirming Banks – TFP guarantee agreements are signed with local issuing banks (IBA) plus agreement with confirming banks (CBA) all over the world – Currently: 100 Issuing banks and over 800 Confirming banks Short-term advances/financing to banks in the Countries of Operation for trade finance purposes – TFP Revolving Credit Agreements are signed with local banks (RCA) – Currently 56 RCAs

TFP – How does it work? EBRD supports the development of trade finance in partner banks by l l l Basic and Advanced Trade Finance training courses and advisory services Guarantees that cover risks arising from trade finance transactions in favour of Confirming Banks – TFP guarantee agreements are signed with local issuing banks (IBA) plus agreement with confirming banks (CBA) all over the world – Currently: 100 Issuing banks and over 800 Confirming banks Short-term advances/financing to banks in the Countries of Operation for trade finance purposes – TFP Revolving Credit Agreements are signed with local banks (RCA) – Currently 56 RCAs

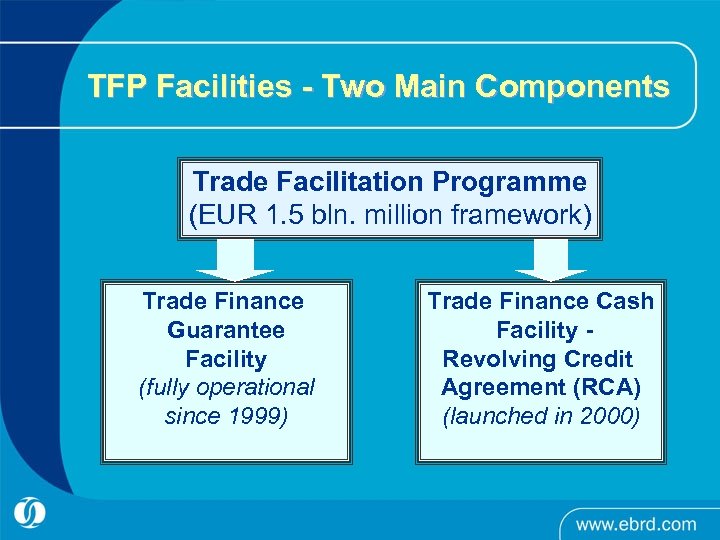

TFP Facilities - Two Main Components Trade Facilitation Programme (EUR 1. 5 bln. million framework) Trade Finance Guarantee Facility (fully operational since 1999) Trade Finance Cash Facility Revolving Credit Agreement (RCA) (launched in 2000)

TFP Facilities - Two Main Components Trade Facilitation Programme (EUR 1. 5 bln. million framework) Trade Finance Guarantee Facility (fully operational since 1999) Trade Finance Cash Facility Revolving Credit Agreement (RCA) (launched in 2000)

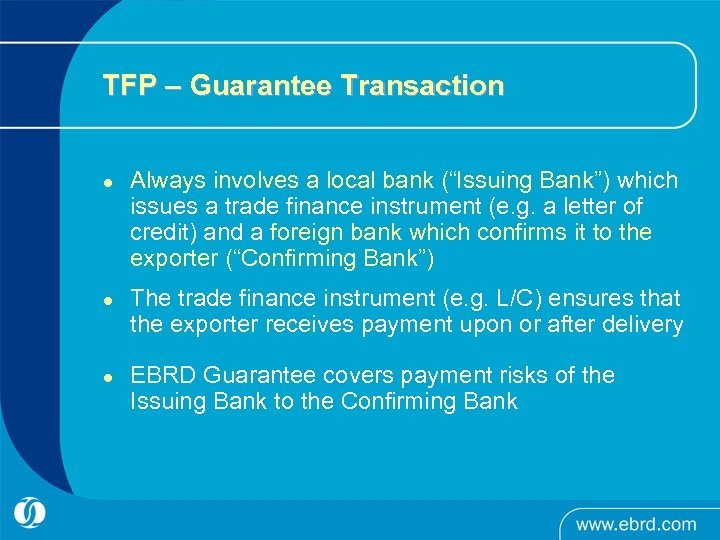

TFP – Guarantee Transaction l l l Always involves a local bank (“Issuing Bank”) which issues a trade finance instrument (e. g. a letter of credit) and a foreign bank which confirms it to the exporter (“Confirming Bank”) The trade finance instrument (e. g. L/C) ensures that the exporter receives payment upon or after delivery EBRD Guarantee covers payment risks of the Issuing Bank to the Confirming Bank

TFP – Guarantee Transaction l l l Always involves a local bank (“Issuing Bank”) which issues a trade finance instrument (e. g. a letter of credit) and a foreign bank which confirms it to the exporter (“Confirming Bank”) The trade finance instrument (e. g. L/C) ensures that the exporter receives payment upon or after delivery EBRD Guarantee covers payment risks of the Issuing Bank to the Confirming Bank

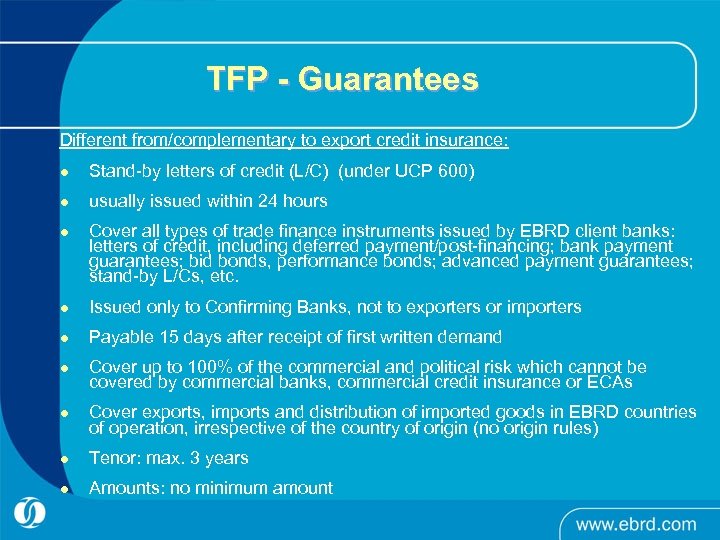

TFP - Guarantees Different from/complementary to export credit insurance: l Stand-by letters of credit (L/C) (under UCP 600) l usually issued within 24 hours l Cover all types of trade finance instruments issued by EBRD client banks: letters of credit, including deferred payment/post-financing; bank payment guarantees; bid bonds, performance bonds; advanced payment guarantees; stand-by L/Cs, etc. l Issued only to Confirming Banks, not to exporters or importers l Payable 15 days after receipt of first written demand l Cover up to 100% of the commercial and political risk which cannot be covered by commercial banks, commercial credit insurance or ECAs l Cover exports, imports and distribution of imported goods in EBRD countries of operation, irrespective of the country of origin (no origin rules) l Tenor: max. 3 years l Amounts: no minimum amount

TFP - Guarantees Different from/complementary to export credit insurance: l Stand-by letters of credit (L/C) (under UCP 600) l usually issued within 24 hours l Cover all types of trade finance instruments issued by EBRD client banks: letters of credit, including deferred payment/post-financing; bank payment guarantees; bid bonds, performance bonds; advanced payment guarantees; stand-by L/Cs, etc. l Issued only to Confirming Banks, not to exporters or importers l Payable 15 days after receipt of first written demand l Cover up to 100% of the commercial and political risk which cannot be covered by commercial banks, commercial credit insurance or ECAs l Cover exports, imports and distribution of imported goods in EBRD countries of operation, irrespective of the country of origin (no origin rules) l Tenor: max. 3 years l Amounts: no minimum amount

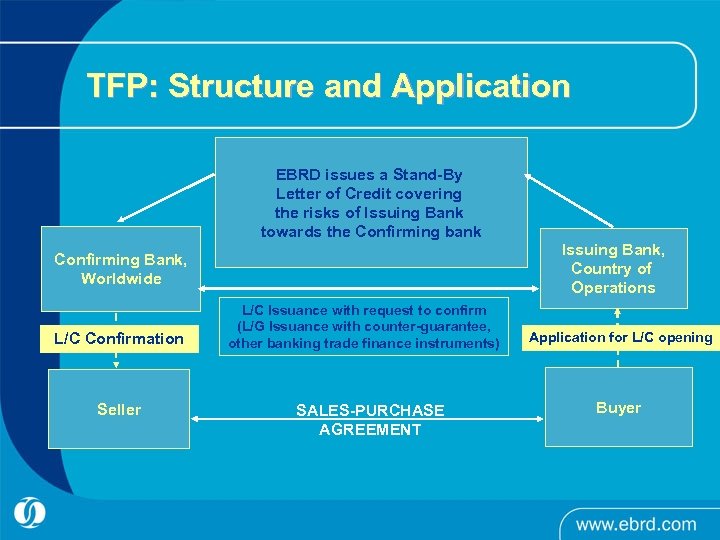

TFP: Structure and Application EBRD issues a Stand-By Letter of Credit covering the risks of Issuing Bank towards the Confirming bank Confirming Bank, Worldwide L/C Confirmation Seller L/C Issuance with request to confirm (L/G Issuance with counter-guarantee, other banking trade finance instruments) SALES-PURCHASE AGREEMENT Issuing Bank, Country of Operations Application for L/C opening Buyer

TFP: Structure and Application EBRD issues a Stand-By Letter of Credit covering the risks of Issuing Bank towards the Confirming bank Confirming Bank, Worldwide L/C Confirmation Seller L/C Issuance with request to confirm (L/G Issuance with counter-guarantee, other banking trade finance instruments) SALES-PURCHASE AGREEMENT Issuing Bank, Country of Operations Application for L/C opening Buyer

Example – Import of foodstuff from Europe to Egypt l l l An Egyptian supermarket chain buys foodstuff from Italy An Egyptian bank issues a letter of credit, confirmed by an Italian bank EBRD guarantees up to 100% of the political and commercial payment risk

Example – Import of foodstuff from Europe to Egypt l l l An Egyptian supermarket chain buys foodstuff from Italy An Egyptian bank issues a letter of credit, confirmed by an Italian bank EBRD guarantees up to 100% of the political and commercial payment risk

Example – Exports from Egypt to FYR Macedonia l l l An Egyptian company sells air conditioners plus spare parts to an importer in FYR Macedonia A Macedonian bank issues a letter of credit, confirmed by an Egyptian bank EBRD guarantees up to 100% of the political and commercial payment risk

Example – Exports from Egypt to FYR Macedonia l l l An Egyptian company sells air conditioners plus spare parts to an importer in FYR Macedonia A Macedonian bank issues a letter of credit, confirmed by an Egyptian bank EBRD guarantees up to 100% of the political and commercial payment risk

Example – Exports from Egypt to Russian Federation l l l An Egyptian exporter sells fruits to an importer in Novorossiysk, Russia Federation A Russian bank issues a letter of credit, confirmed by an Egyptian bank EBRD guarantees up to 100% of the political and commercial payment risk

Example – Exports from Egypt to Russian Federation l l l An Egyptian exporter sells fruits to an importer in Novorossiysk, Russia Federation A Russian bank issues a letter of credit, confirmed by an Egyptian bank EBRD guarantees up to 100% of the political and commercial payment risk

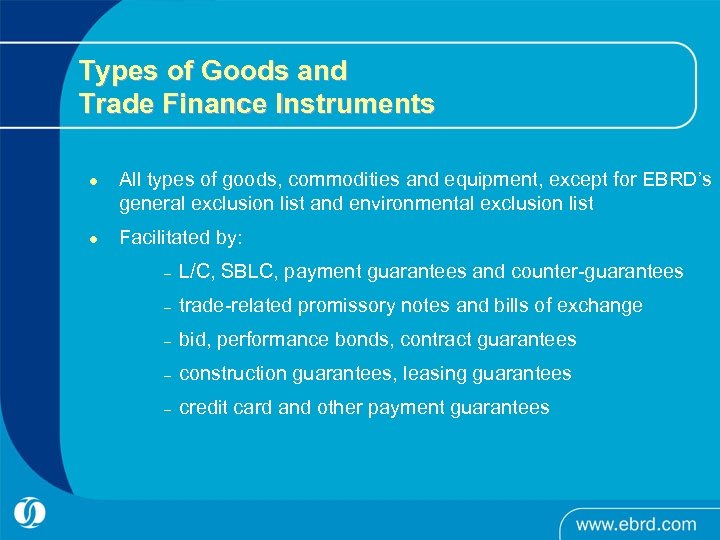

Types of Goods and Trade Finance Instruments l l All types of goods, commodities and equipment, except for EBRD’s general exclusion list and environmental exclusion list Facilitated by: – L/C, SBLC, payment guarantees and counter-guarantees – trade-related promissory notes and bills of exchange – bid, performance bonds, contract guarantees – construction guarantees, leasing guarantees – credit card and other payment guarantees

Types of Goods and Trade Finance Instruments l l All types of goods, commodities and equipment, except for EBRD’s general exclusion list and environmental exclusion list Facilitated by: – L/C, SBLC, payment guarantees and counter-guarantees – trade-related promissory notes and bills of exchange – bid, performance bonds, contract guarantees – construction guarantees, leasing guarantees – credit card and other payment guarantees

How Egyptian banks can join the EBRD TFP Issuing Bank or/and Confirming Bank

How Egyptian banks can join the EBRD TFP Issuing Bank or/and Confirming Bank

100 Issuing Banks (IB) in 18 Countries Country IB # Armenia 9 FYR Macedonia 5 Azerbaijan 7 Moldova 4 Belarus 9 Mongolia 2 Bosnia & Herzegovina 2 Romania 2 Georgia 6 Russia 26 Kazakhstan 5 Serbia 7 Kyrgyz Republic 2 Tajikistan 4 Lithuania 1 Turkmenistan 1 Latvia 1 Ukraine 7

100 Issuing Banks (IB) in 18 Countries Country IB # Armenia 9 FYR Macedonia 5 Azerbaijan 7 Moldova 4 Belarus 9 Mongolia 2 Bosnia & Herzegovina 2 Romania 2 Georgia 6 Russia 26 Kazakhstan 5 Serbia 7 Kyrgyz Republic 2 Tajikistan 4 Lithuania 1 Turkmenistan 1 Latvia 1 Ukraine 7

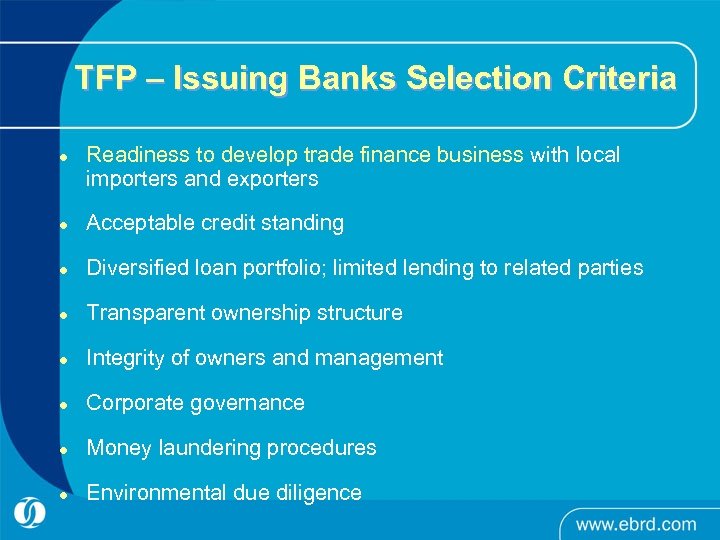

TFP – Issuing Banks Selection Criteria l Readiness to develop trade finance business with local importers and exporters l Acceptable credit standing l Diversified loan portfolio; limited lending to related parties l Transparent ownership structure l Integrity of owners and management l Corporate governance l Money laundering procedures l Environmental due diligence

TFP – Issuing Banks Selection Criteria l Readiness to develop trade finance business with local importers and exporters l Acceptable credit standing l Diversified loan portfolio; limited lending to related parties l Transparent ownership structure l Integrity of owners and management l Corporate governance l Money laundering procedures l Environmental due diligence

800 Confirming Banks in 77 Countries

800 Confirming Banks in 77 Countries

TFP – Confirming Banks Selection Criteria • Readiness and interest to develop and conduct trade finance business with EBRD countries of operation • Advanced and experienced trade finance procedures and operations • Standardised confirming bank agreement (signed by 800 banks)

TFP – Confirming Banks Selection Criteria • Readiness and interest to develop and conduct trade finance business with EBRD countries of operation • Advanced and experienced trade finance procedures and operations • Standardised confirming bank agreement (signed by 800 banks)

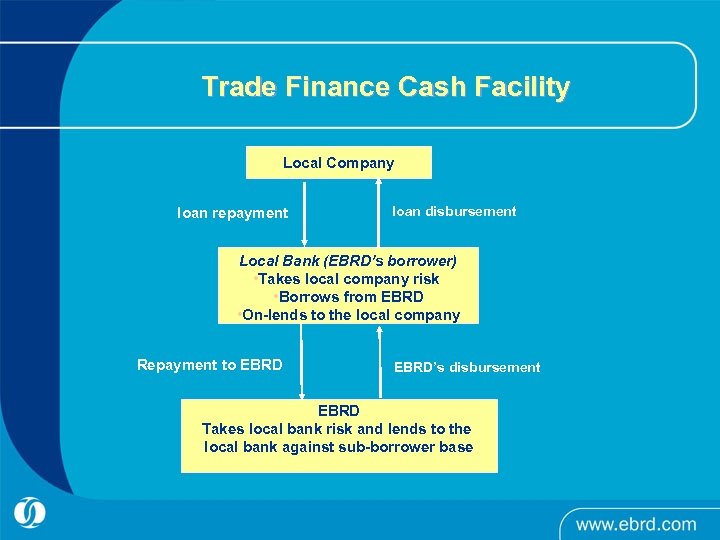

Trade Finance Cash Facility Local Company loan repayment loan disbursement Local Bank (EBRD’s borrower) • Takes local company risk • Borrows from EBRD • On-lends to the local company Repayment to EBRD’s disbursement EBRD Takes local bank risk and lends to the local bank against sub-borrower base

Trade Finance Cash Facility Local Company loan repayment loan disbursement Local Bank (EBRD’s borrower) • Takes local company risk • Borrows from EBRD • On-lends to the local company Repayment to EBRD’s disbursement EBRD Takes local bank risk and lends to the local bank against sub-borrower base

Case study – Import of insulators into Kazakhstan l l l Saint-Gobain Isover (Finland) sells heat insulator to an importer in Kazakhstan Bank in Kazakhstan request a cash disbursement from the TFP of the EBRD disburses EUR 0. 5 million for 1 year to cover the post-import financing

Case study – Import of insulators into Kazakhstan l l l Saint-Gobain Isover (Finland) sells heat insulator to an importer in Kazakhstan Bank in Kazakhstan request a cash disbursement from the TFP of the EBRD disburses EUR 0. 5 million for 1 year to cover the post-import financing

Case study: Export of wine from Moldova l l A Moldovan wine producer requires pre-export finance for purchase of agrochemicals and equipment and export of wine to Russia EBRD grants a loan to a Moldovan bank which the bank can use to fund a loan to the Moldovan exporter (amount USD 170, 000, tenor 8 months)

Case study: Export of wine from Moldova l l A Moldovan wine producer requires pre-export finance for purchase of agrochemicals and equipment and export of wine to Russia EBRD grants a loan to a Moldovan bank which the bank can use to fund a loan to the Moldovan exporter (amount USD 170, 000, tenor 8 months)

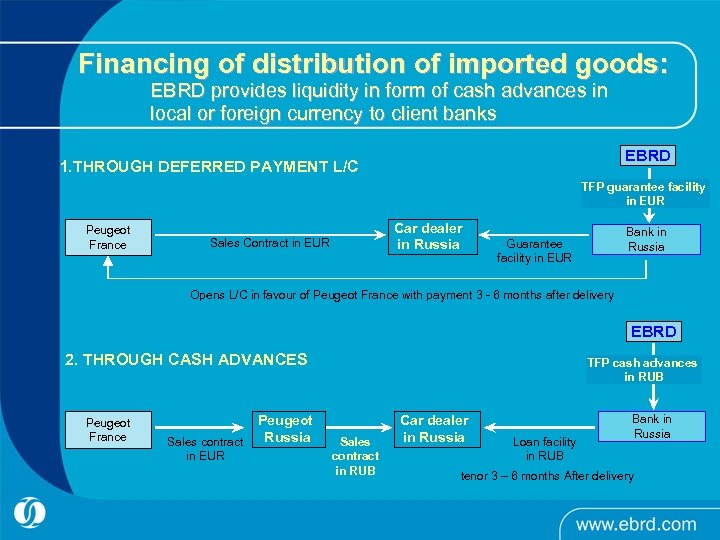

Financing of distribution of imported goods: EBRD provides liquidity in form of cash advances in local or foreign currency to client banks EBRD 1. THROUGH DEFERRED PAYMENT L/C TFP guarantee facility in EUR Peugeot France Car dealer in Russia Sales Contract in EUR Bank in Russia Guarantee facility in EUR Opens L/C in favour of Peugeot France with payment 3 - 6 months after delivery EBRD 2. THROUGH CASH ADVANCES Peugeot France Sales contract in EUR Peugeot Russia TFP cash advances in RUB Sales contract in RUB Car dealer in Russia Loan facility in RUB Bank in Russia tenor 3 – 6 months After delivery

Financing of distribution of imported goods: EBRD provides liquidity in form of cash advances in local or foreign currency to client banks EBRD 1. THROUGH DEFERRED PAYMENT L/C TFP guarantee facility in EUR Peugeot France Car dealer in Russia Sales Contract in EUR Bank in Russia Guarantee facility in EUR Opens L/C in favour of Peugeot France with payment 3 - 6 months after delivery EBRD 2. THROUGH CASH ADVANCES Peugeot France Sales contract in EUR Peugeot Russia TFP cash advances in RUB Sales contract in RUB Car dealer in Russia Loan facility in RUB Bank in Russia tenor 3 – 6 months After delivery

EBRD TFP - Factoring Facilities l l EBRD grants loan facilities to local banks and factoring companies to fund their portfolio of domestic and export factoring transactions. Tenors: max. 6 months, revolving; typically 90 days. Closely matching asset conversion cycle with monthly up-dates on list of invoices which have been financed. First factoring facilities were approved in 2007 for Promsvyazbank Russia and Ukreximbank in Ukraine and Credit Bank of Moscow in 2008.

EBRD TFP - Factoring Facilities l l EBRD grants loan facilities to local banks and factoring companies to fund their portfolio of domestic and export factoring transactions. Tenors: max. 6 months, revolving; typically 90 days. Closely matching asset conversion cycle with monthly up-dates on list of invoices which have been financed. First factoring facilities were approved in 2007 for Promsvyazbank Russia and Ukreximbank in Ukraine and Credit Bank of Moscow in 2008.

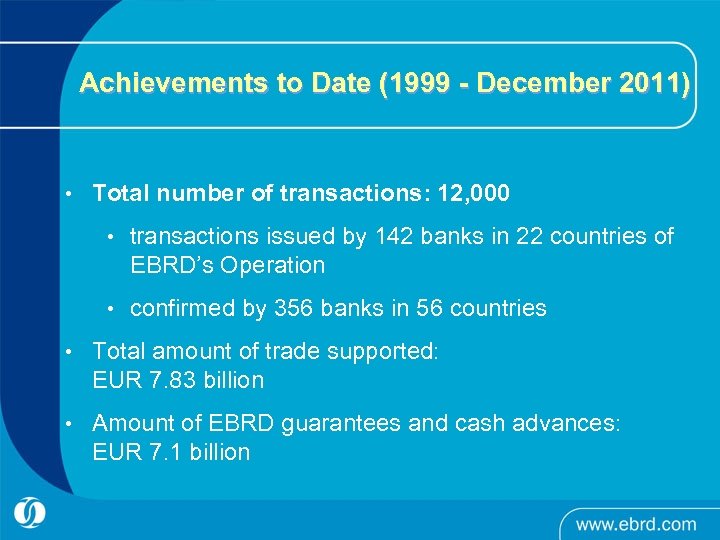

Achievements to Date (1999 - December 2011) • Total number of transactions: 12, 000 • transactions issued by 142 banks in 22 countries of EBRD’s Operation • confirmed by 356 banks in 56 countries • Total amount of trade supported: EUR 7. 83 billion • Amount of EBRD guarantees and cash advances: EUR 7. 1 billion

Achievements to Date (1999 - December 2011) • Total number of transactions: 12, 000 • transactions issued by 142 banks in 22 countries of EBRD’s Operation • confirmed by 356 banks in 56 countries • Total amount of trade supported: EUR 7. 83 billion • Amount of EBRD guarantees and cash advances: EUR 7. 1 billion

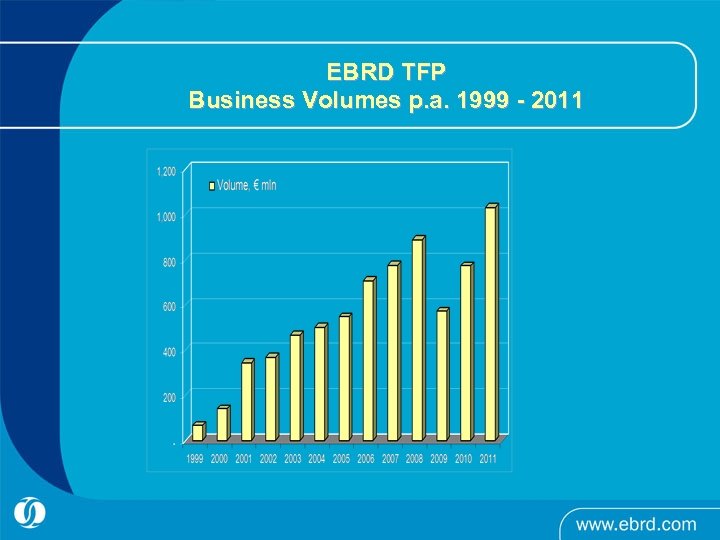

EBRD TFP Business Volumes p. a. 1999 - 2011

EBRD TFP Business Volumes p. a. 1999 - 2011

TFP – 1, 616 Trade Finance Transactions in 2011 1. Belarus (381) 9. 2. Russia (300) 10. 3. Georgia (277) 4. Ukraine (144) 11. Serbia (13) 5. Armenia (141) 12. Tajikistan (9) 6. Kazakhstan (117) 13. Croatia (5) 7. Azerbaijan (80) 14. Turkmenistan (4) 8. Moldova (64) 15. Kyrgyz Republic (2) 16. Mongolia (2) FYR Macedonia (63) Bosnia & Herzegovina(14)

TFP – 1, 616 Trade Finance Transactions in 2011 1. Belarus (381) 9. 2. Russia (300) 10. 3. Georgia (277) 4. Ukraine (144) 11. Serbia (13) 5. Armenia (141) 12. Tajikistan (9) 6. Kazakhstan (117) 13. Croatia (5) 7. Azerbaijan (80) 14. Turkmenistan (4) 8. Moldova (64) 15. Kyrgyz Republic (2) 16. Mongolia (2) FYR Macedonia (63) Bosnia & Herzegovina(14)

EBRD TFP – Exports from Egypt to Eastern Europe & CIS countries - Cosmetic products to Armenia - Rice to Bosnia and Herzegovina - Air conditioners to Croatia - Charter flights to Georgia - Marble and granite to Macedonia - Oranges and fruits to Russia - Medicine to Tajikistan - Machinery to Ukraine

EBRD TFP – Exports from Egypt to Eastern Europe & CIS countries - Cosmetic products to Armenia - Rice to Bosnia and Herzegovina - Air conditioners to Croatia - Charter flights to Georgia - Marble and granite to Macedonia - Oranges and fruits to Russia - Medicine to Tajikistan - Machinery to Ukraine

TFP in Egypt 4 Confirming Banks: - Commercial International Bank - Egyptian Gulf Bank - National Bank of Egypt - Suez Canal Bank Issuing Banks: Q 3 onwards

TFP in Egypt 4 Confirming Banks: - Commercial International Bank - Egyptian Gulf Bank - National Bank of Egypt - Suez Canal Bank Issuing Banks: Q 3 onwards

TFP – Technical Cooperation Projects EUR 6. 5 million have been used for TFP TC consultancy services and trainings of over 1, 000 trade finance professionals from 210 banks in 17 of EBRD’s countries of operation

TFP – Technical Cooperation Projects EUR 6. 5 million have been used for TFP TC consultancy services and trainings of over 1, 000 trade finance professionals from 210 banks in 17 of EBRD’s countries of operation

TFP Trade Finance Training & Advisory Projects 2010 & 2011 Topics: l Trade Finance Practices l Advanced and Structured Trade Finance l Factoring l UCP 600 l Fraud Prevention l Correspondent Banking l Restructuring Trade Finance Deals l Legal Proceedings in connection with defaulted trade finance transactions l e-learning Projects were generously sponsored by Taipei China, Switzerland, Italy, the Netherlands, New Norway Cooperation Fund, Western Balkans Fund, Early Transition Country Fund, Special Share-holder Fund of EBRD.

TFP Trade Finance Training & Advisory Projects 2010 & 2011 Topics: l Trade Finance Practices l Advanced and Structured Trade Finance l Factoring l UCP 600 l Fraud Prevention l Correspondent Banking l Restructuring Trade Finance Deals l Legal Proceedings in connection with defaulted trade finance transactions l e-learning Projects were generously sponsored by Taipei China, Switzerland, Italy, the Netherlands, New Norway Cooperation Fund, Western Balkans Fund, Early Transition Country Fund, Special Share-holder Fund of EBRD.

EBRD E-Learning Programme l l l The ICC’s technology partner Coastline Solutions has assisted EBRD to develop an online training programme, incorporating ICC content on rules and operations in trade finance; Project funded by the EBRD’s special shareholder’s fund and offered free of charge to Issuing Banks in EBRD’s countries of operations. To date over 300 trade professionals from over 80 banks in 21 countries have enrolled.

EBRD E-Learning Programme l l l The ICC’s technology partner Coastline Solutions has assisted EBRD to develop an online training programme, incorporating ICC content on rules and operations in trade finance; Project funded by the EBRD’s special shareholder’s fund and offered free of charge to Issuing Banks in EBRD’s countries of operations. To date over 300 trade professionals from over 80 banks in 21 countries have enrolled.

EBRD Trade Finance e-Learning Programme

EBRD Trade Finance e-Learning Programme

2012 Graduation Ceremony – 7 Feb in Moscow In partnership with l l 5 th Annual Russia & Eurasia Trade & Export Finance Conference Best students received further scholarships and sponsored training programmes in leading European confirming banks and training companies

2012 Graduation Ceremony – 7 Feb in Moscow In partnership with l l 5 th Annual Russia & Eurasia Trade & Export Finance Conference Best students received further scholarships and sponsored training programmes in leading European confirming banks and training companies

EBRD TFP - Co-Financing Partners l ACE Global Markets (AGM) & Lloyd´s of London l Confirming Banks l Donor Risk Sharing Funds l Export Credit Agencies l FMO Netherlands l OPEC Fund for International Development l Private Investment Funds

EBRD TFP - Co-Financing Partners l ACE Global Markets (AGM) & Lloyd´s of London l Confirming Banks l Donor Risk Sharing Funds l Export Credit Agencies l FMO Netherlands l OPEC Fund for International Development l Private Investment Funds

EBRD – Best Development Bank in Trade l l Readers of Global Trade Review (GTR), Trade & Forfaiting Review (TFR) and Trade Finance Magazine have voted the EBRD “Worldwide Best Development Bank in Trade in 2008, 2009, 2010 and 2011” EBRD invites other development banks, commercial financial institutions, export credit agencies and donors to co-finance or cofinance with the EBRD

EBRD – Best Development Bank in Trade l l Readers of Global Trade Review (GTR), Trade & Forfaiting Review (TFR) and Trade Finance Magazine have voted the EBRD “Worldwide Best Development Bank in Trade in 2008, 2009, 2010 and 2011” EBRD invites other development banks, commercial financial institutions, export credit agencies and donors to co-finance or cofinance with the EBRD

EBRD TFP – Advantages for Issuing Banks and Confirming Banks in Egypt l l l Banks in Egypt can join the programme as Issuing Banks and/or Confirming Banks and benefit from EBRD’s network of more than 800 Issuing Banks and Confirming Banks worldwide Benefit from EBRD’s high level trade finance training programmes and advisory services (offered free of charge to Issuing Banks in Egypt) Benefit from EBRD’s additional risk taking capacity when foreign commercial banks cannot provide sufficient risk cover or liquidity; sometimes also longer tenors (maximum 3 years) and/or higher transaction amounts than commercial banks can provide Fees and interest charged only in case of utilisation and in line with the pricing charged by foreign commercial banks Fast decisions and processing, usually within 24 hours EBRD invites commercial banks, insurance underwriters and development agencies to co-finance with the EBRD

EBRD TFP – Advantages for Issuing Banks and Confirming Banks in Egypt l l l Banks in Egypt can join the programme as Issuing Banks and/or Confirming Banks and benefit from EBRD’s network of more than 800 Issuing Banks and Confirming Banks worldwide Benefit from EBRD’s high level trade finance training programmes and advisory services (offered free of charge to Issuing Banks in Egypt) Benefit from EBRD’s additional risk taking capacity when foreign commercial banks cannot provide sufficient risk cover or liquidity; sometimes also longer tenors (maximum 3 years) and/or higher transaction amounts than commercial banks can provide Fees and interest charged only in case of utilisation and in line with the pricing charged by foreign commercial banks Fast decisions and processing, usually within 24 hours EBRD invites commercial banks, insurance underwriters and development agencies to co-finance with the EBRD

EBRD TFP – Conditions for joining the TFP as Issuing Bank l l Meet all covenants and conditions of the EBRD Issuing Bank agreement Regular reporting to the EBRD (financial reports, reports on underlying trade finance transactions for which TFP facilities have been used, statistics, etc. )

EBRD TFP – Conditions for joining the TFP as Issuing Bank l l Meet all covenants and conditions of the EBRD Issuing Bank agreement Regular reporting to the EBRD (financial reports, reports on underlying trade finance transactions for which TFP facilities have been used, statistics, etc. )

www. ebrd. com/tfp

www. ebrd. com/tfp

Contacts Financial Institutions – Trade Facilitation Programme TFP) European Bank for Reconstruction and Development One Exchange Square London EC 2 A 2 JN United Kingdom Tel: +44 20 7338 7614 Fax: +44 20 7338 6119/7029 e-mail: nindlm@ebrd. com www. ebrd. com/tfp

Contacts Financial Institutions – Trade Facilitation Programme TFP) European Bank for Reconstruction and Development One Exchange Square London EC 2 A 2 JN United Kingdom Tel: +44 20 7338 7614 Fax: +44 20 7338 6119/7029 e-mail: nindlm@ebrd. com www. ebrd. com/tfp