c029fca0274368196020d35aa3fae658.ppt

- Количество слайдов: 42

Introduction to the Impact Assessment Process

Introduction to the Impact Assessment Process

When are they needed? • When Government regulatory proposals: – impose or reduce costs on business / third sector – affect costs in the public sector, unless the costs fall beneath a preagreed threshold (generally £ 5 m) – involve a redistribution (eg an exchange or 'transfer' of costs or benefits from one group to another) – involve a change in administrative costs – seek collective agreement for UK negotiating positions on EU proposals – submit bids for primary legislation to the Legislative Programme Cabinet Committee

When are they needed? • When Government regulatory proposals: – impose or reduce costs on business / third sector – affect costs in the public sector, unless the costs fall beneath a preagreed threshold (generally £ 5 m) – involve a redistribution (eg an exchange or 'transfer' of costs or benefits from one group to another) – involve a change in administrative costs – seek collective agreement for UK negotiating positions on EU proposals – submit bids for primary legislation to the Legislative Programme Cabinet Committee

But not …. • where policy changes will not lead to costs or savings for business, the public sector, third sector organisations, regulators or consumers • for road closure orders • where changes to statutory fees or taxes are covered by a predetermined formula such as the rate of inflation, or in respect of other changes to taxes or tax rates where there are no associated administrative costs or savings.

But not …. • where policy changes will not lead to costs or savings for business, the public sector, third sector organisations, regulators or consumers • for road closure orders • where changes to statutory fees or taxes are covered by a predetermined formula such as the rate of inflation, or in respect of other changes to taxes or tax rates where there are no associated administrative costs or savings.

Is this a new thing? • Absolutely not. – Cost Compliance Assessments since the late 1980 s – Regulatory Impact Assessments required since mid 1990 s – Impact Assessment with fixed format introduced in 2007

Is this a new thing? • Absolutely not. – Cost Compliance Assessments since the late 1980 s – Regulatory Impact Assessments required since mid 1990 s – Impact Assessment with fixed format introduced in 2007

Why make the change? • Insufficient recognition of fundamental purpose: rigorous analysis for policy-making • RIAs often seen as the last obstacle before bringing in regulation – not properly embedded in early analysis • Often no clear statement of underlying problem • Alternatives not sufficiently considered • Critical data – especially on costs and benefits – hard to find or missing • Arguments and evidence inaccessible - narrative too discursive • RIAs often duplicate other documentation • Guidance overly bureaucratic and too long

Why make the change? • Insufficient recognition of fundamental purpose: rigorous analysis for policy-making • RIAs often seen as the last obstacle before bringing in regulation – not properly embedded in early analysis • Often no clear statement of underlying problem • Alternatives not sufficiently considered • Critical data – especially on costs and benefits – hard to find or missing • Arguments and evidence inaccessible - narrative too discursive • RIAs often duplicate other documentation • Guidance overly bureaucratic and too long

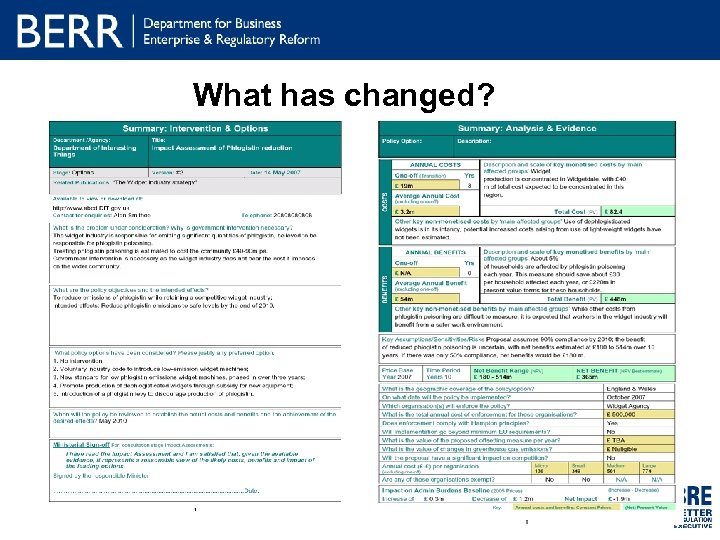

What has changed?

What has changed?

What has changed? • Improved quality of economic and other analysis that underpins policymaking – Sharpened focus on policy rationale – More prominence given to costs and benefits – Stronger commitment to specify ex post review date – Integrated with the Standard Cost Model – Integrated approach maintained – Specific Impact Tests • Increase transparency of analysis – Fixed template – Improved Ministerial Declaration – Impact assessment part of consultation and final policy decision • Embed impact assessments at the heart of policy-making

What has changed? • Improved quality of economic and other analysis that underpins policymaking – Sharpened focus on policy rationale – More prominence given to costs and benefits – Stronger commitment to specify ex post review date – Integrated with the Standard Cost Model – Integrated approach maintained – Specific Impact Tests • Increase transparency of analysis – Fixed template – Improved Ministerial Declaration – Impact assessment part of consultation and final policy decision • Embed impact assessments at the heart of policy-making

Impact Assessment Library

Impact Assessment Library

Where you can find more information • IA Guidance: http: //www. berr. gov. uk/files/file 44544. pdf • IA Toolkit: http: //www. berr. gov. uk/bre/policy/scrutinising-newregulations/preparing-impact-assessments/toolkit/page 44199. html • IA online Training: http: //www. iatraining. berr. gov. uk • Treasury Greenbook: http: //greenbook. treasury. gov. uk

Where you can find more information • IA Guidance: http: //www. berr. gov. uk/files/file 44544. pdf • IA Toolkit: http: //www. berr. gov. uk/bre/policy/scrutinising-newregulations/preparing-impact-assessments/toolkit/page 44199. html • IA online Training: http: //www. iatraining. berr. gov. uk • Treasury Greenbook: http: //greenbook. treasury. gov. uk

Measuring administrative burdens, UK outcomes and next steps

Measuring administrative burdens, UK outcomes and next steps

Headlines § § § Measurement and simplification planning exercises between May 2005 and Dec 2006 Simplification plans and measurement results published in December 2006, 2007 and 2008 Plans published for 19 departments Over 500 simplification measures identified delivering an estimated £ 3. 4 bn of savings by May 2010 240 simplification measures implemented reducing admin burdens, savings business and third sector organisations an estimated £ 1. 9 bn each year

Headlines § § § Measurement and simplification planning exercises between May 2005 and Dec 2006 Simplification plans and measurement results published in December 2006, 2007 and 2008 Plans published for 19 departments Over 500 simplification measures identified delivering an estimated £ 3. 4 bn of savings by May 2010 240 simplification measures implemented reducing admin burdens, savings business and third sector organisations an estimated £ 1. 9 bn each year

Context § Well developed better regulation agenda but no specific focus on administrative burdens § BRTF report “Less is More” stated ‘what gets measured gets done’ § Politically driven timescales – one year from start to finish § 3 exercises covering Tax and customs, Financial services and the rest of government, but led centrally § Limited information at start – number of regulations, populations, etc

Context § Well developed better regulation agenda but no specific focus on administrative burdens § BRTF report “Less is More” stated ‘what gets measured gets done’ § Politically driven timescales – one year from start to finish § 3 exercises covering Tax and customs, Financial services and the rest of government, but led centrally § Limited information at start – number of regulations, populations, etc

Key points about the Standard Cost Model § Simple, pragmatic framework for measuring costs § Indicative - not statistically representative § Means to an end: aim is reductions in burdens § Provides consistent baseline for setting targets § Rapidly growing international use, including EU and OECD, and effective SCM network

Key points about the Standard Cost Model § Simple, pragmatic framework for measuring costs § Indicative - not statistically representative § Means to an end: aim is reductions in burdens § Provides consistent baseline for setting targets § Rapidly growing international use, including EU and OECD, and effective SCM network

Main measurement exercise: approach § Departments identified regulations summer 2005 § Central procurement exercise - Pw. C appointed September 2005 § Mobilisation and mapping (legal and process) September to November 2005 § Fieldwork between October 2005 and April 2006 § Departmental reports with measurement outcomes April to July 2006

Main measurement exercise: approach § Departments identified regulations summer 2005 § Central procurement exercise - Pw. C appointed September 2005 § Mobilisation and mapping (legal and process) September to November 2005 § Fieldwork between October 2005 and April 2006 § Departmental reports with measurement outcomes April to July 2006

A sense of scale… § 20, 000 Information Obligations measured § Over 90% of baseline (by cost) measured by direct engagement with business § Over 75% through engagement with small & medium sized enterprises § Over 8, 500 interviews and over 200 expert panels § At peak over 700 Pw. C people, over 300 in departments and up to 23 in BRE team

A sense of scale… § 20, 000 Information Obligations measured § Over 90% of baseline (by cost) measured by direct engagement with business § Over 75% through engagement with small & medium sized enterprises § Over 8, 500 interviews and over 200 expert panels § At peak over 700 Pw. C people, over 300 in departments and up to 23 in BRE team

Lessons learnt § More time for preparatory work § Better departmental buy-in from outset at top level § More prioritisation and be realistic § Strong project and resource planning § Manage departments’ expectations of the extent of their involvement § Allow time to sanity check numbers before they go anywhere § Support of business stakeholders is essential

Lessons learnt § More time for preparatory work § Better departmental buy-in from outset at top level § More prioritisation and be realistic § Strong project and resource planning § Manage departments’ expectations of the extent of their involvement § Allow time to sanity check numbers before they go anywhere § Support of business stakeholders is essential

Business As Usual Adjustments

Business As Usual Adjustments

Business as usual costs § Pressure from departments and business to identify BAU costs (HMRC measurement excluded BAU costs in line with NL tax department) § Methodology developed aim to be: § Credible, pragmatic and as open as possible § Consistent across departments; § Approved by business stakeholders – independent panel to review outcomes § Net costs agreed § Enables focus on delivering visible outcomes

Business as usual costs § Pressure from departments and business to identify BAU costs (HMRC measurement excluded BAU costs in line with NL tax department) § Methodology developed aim to be: § Credible, pragmatic and as open as possible § Consistent across departments; § Approved by business stakeholders – independent panel to review outcomes § Net costs agreed § Enables focus on delivering visible outcomes

Summary of UK Administrative Burden

Summary of UK Administrative Burden

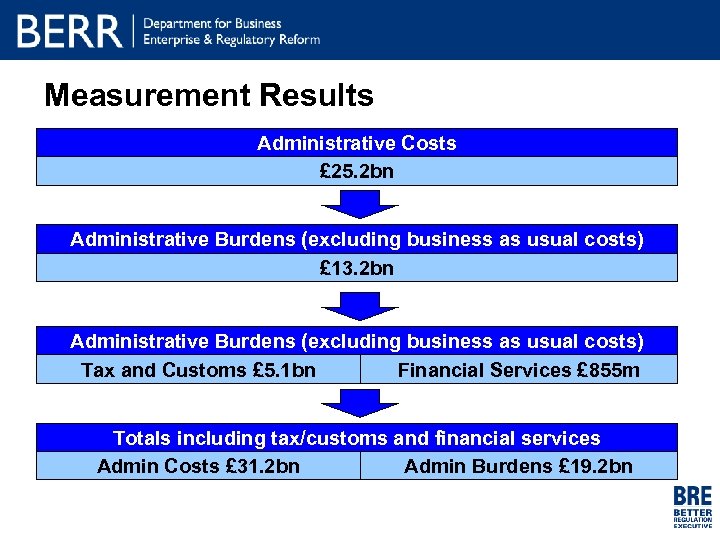

Measurement Results Administrative Costs £ 25. 2 bn Administrative Burdens (excluding business as usual costs) £ 13. 2 bn Administrative Burdens (excluding business as usual costs) Tax and Customs £ 5. 1 bn Financial Services £ 855 m Totals including tax/customs and financial services Admin Costs £ 31. 2 bn Admin Burdens £ 19. 2 bn

Measurement Results Administrative Costs £ 25. 2 bn Administrative Burdens (excluding business as usual costs) £ 13. 2 bn Administrative Burdens (excluding business as usual costs) Tax and Customs £ 5. 1 bn Financial Services £ 855 m Totals including tax/customs and financial services Admin Costs £ 31. 2 bn Admin Burdens £ 19. 2 bn

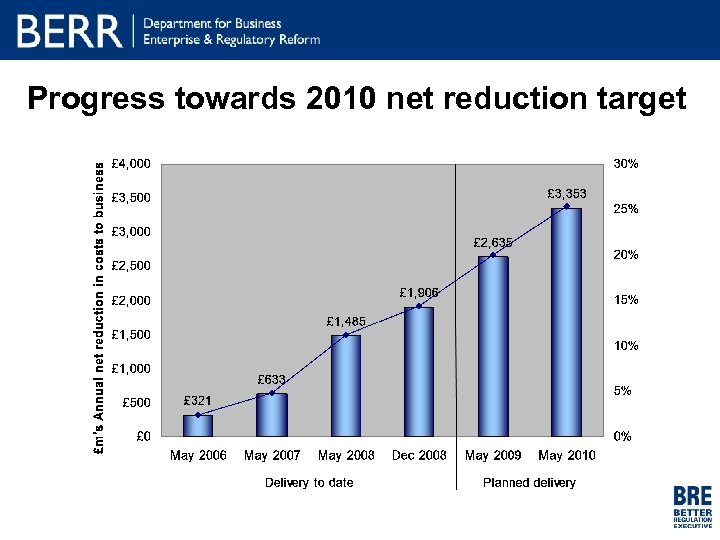

Progress towards 2010 net reduction target

Progress towards 2010 net reduction target

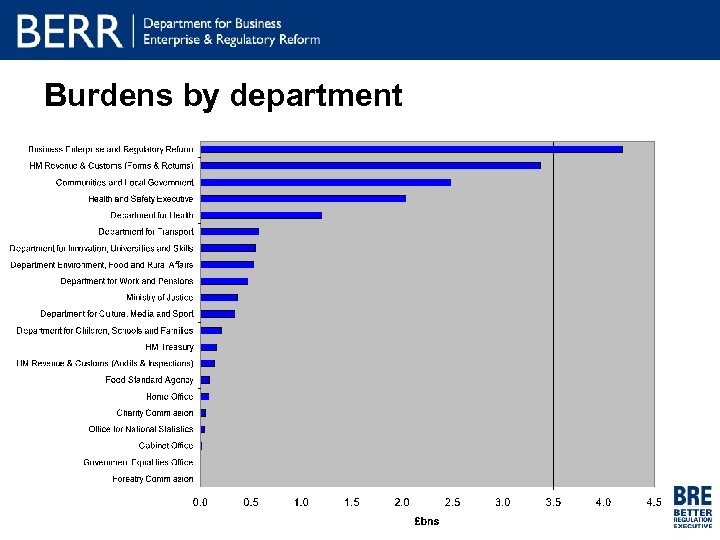

Burdens by department

Burdens by department

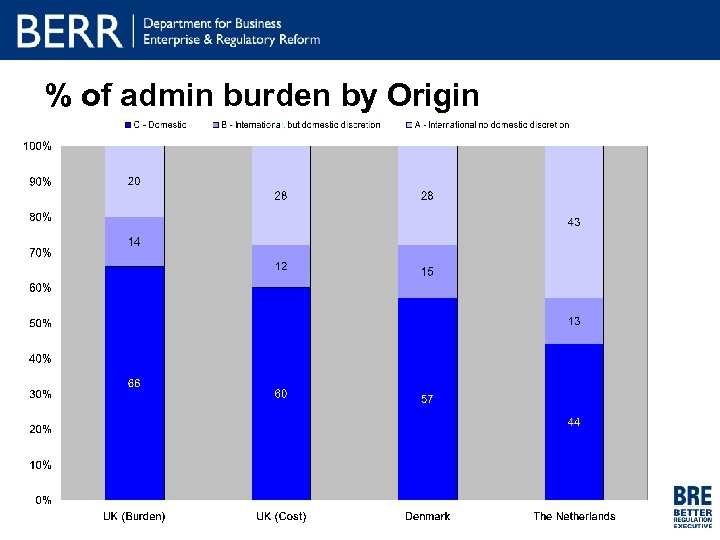

% of admin burden by Origin

% of admin burden by Origin

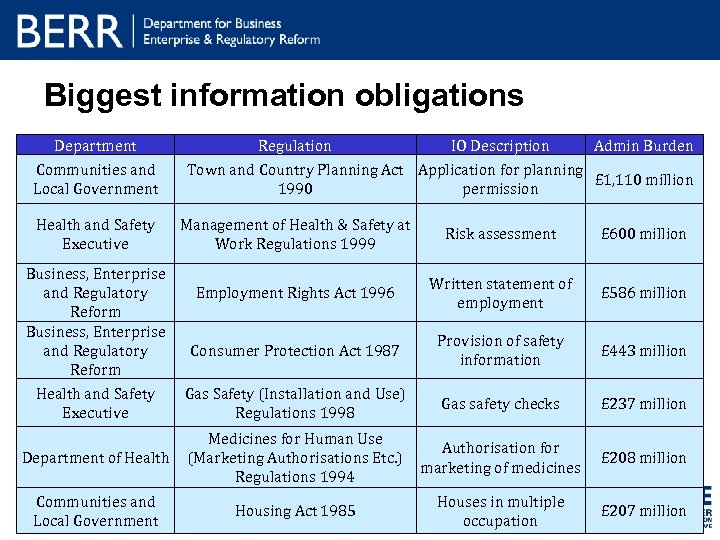

Biggest information obligations Department Communities and Local Government Health and Safety Executive Regulation IO Description Admin Burden Town and Country Planning Act Application for planning £ 1, 110 million 1990 permission Management of Health & Safety at Work Regulations 1999 Risk assessment £ 600 million Employment Rights Act 1996 Written statement of employment £ 586 million Consumer Protection Act 1987 Provision of safety information £ 443 million Health and Safety Executive Gas Safety (Installation and Use) Regulations 1998 Gas safety checks £ 237 million Department of Health Medicines for Human Use (Marketing Authorisations Etc. ) Regulations 1994 Authorisation for marketing of medicines £ 208 million Communities and Local Government Housing Act 1985 Houses in multiple occupation £ 207 million Business, Enterprise and Regulatory Reform

Biggest information obligations Department Communities and Local Government Health and Safety Executive Regulation IO Description Admin Burden Town and Country Planning Act Application for planning £ 1, 110 million 1990 permission Management of Health & Safety at Work Regulations 1999 Risk assessment £ 600 million Employment Rights Act 1996 Written statement of employment £ 586 million Consumer Protection Act 1987 Provision of safety information £ 443 million Health and Safety Executive Gas Safety (Installation and Use) Regulations 1998 Gas safety checks £ 237 million Department of Health Medicines for Human Use (Marketing Authorisations Etc. ) Regulations 1994 Authorisation for marketing of medicines £ 208 million Communities and Local Government Housing Act 1985 Houses in multiple occupation £ 207 million Business, Enterprise and Regulatory Reform

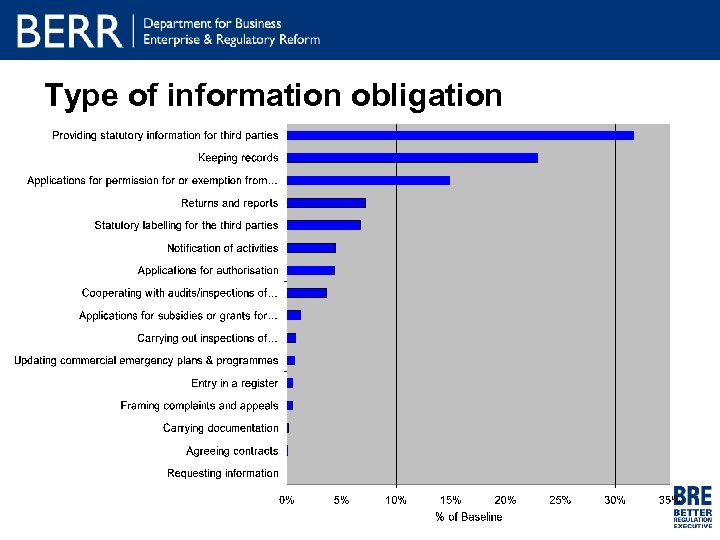

Type of information obligation

Type of information obligation

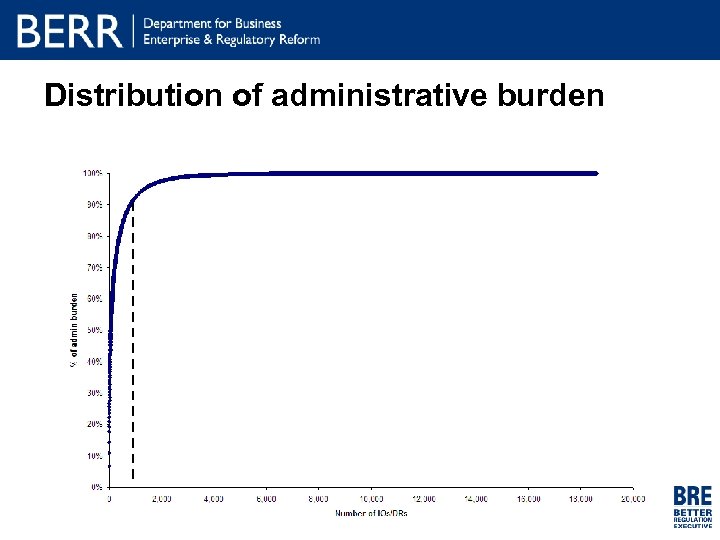

Distribution of administrative burden

Distribution of administrative burden

And after initial measurement…

And after initial measurement…

The next challenge… § Measuring administrative burden of new regulations § Identify further simplification measures § Both are crucial to ensure that net reduction targets are meet

The next challenge… § Measuring administrative burden of new regulations § Identify further simplification measures § Both are crucial to ensure that net reduction targets are meet

Measurement approaches High cost / high profile / high irritants § Use approaches developed by Pw. C including: § Interviews with business (face-to-face or telephone) § Expert Panels Low cost / low profile / low irritants § Use Admin Burdens Calculator § Identify similar regulations / obligations as a basis for modelling

Measurement approaches High cost / high profile / high irritants § Use approaches developed by Pw. C including: § Interviews with business (face-to-face or telephone) § Expert Panels Low cost / low profile / low irritants § Use Admin Burdens Calculator § Identify similar regulations / obligations as a basis for modelling

UK Framework Guidance § Simplification Guidance & checklist for departments Training § Facilitated sessions for Better Regulation Units and economists § On-line training for policy officials etc. Tools § Admin Burdens Calculator and Database § Spreadsheet

UK Framework Guidance § Simplification Guidance & checklist for departments Training § Facilitated sessions for Better Regulation Units and economists § On-line training for policy officials etc. Tools § Admin Burdens Calculator and Database § Spreadsheet

Simplification Plans

Simplification Plans

Simplification Plans • An annual insight into individual Departments’ efforts/ work to reduce administrative and policy costs and to address main regulatory irritants: - Covering: Business with a dedicated strategy for Small Firms, Third sector organisations Public sector’s front line workers (since June 2007) - Focusing on three main areas: § Whether simplifications measures that have been implemented delivered planned reductions § Further quantification for simplification measures yet to be implemented § New simplifications measures to meet reduction targets

Simplification Plans • An annual insight into individual Departments’ efforts/ work to reduce administrative and policy costs and to address main regulatory irritants: - Covering: Business with a dedicated strategy for Small Firms, Third sector organisations Public sector’s front line workers (since June 2007) - Focusing on three main areas: § Whether simplifications measures that have been implemented delivered planned reductions § Further quantification for simplification measures yet to be implemented § New simplifications measures to meet reduction targets

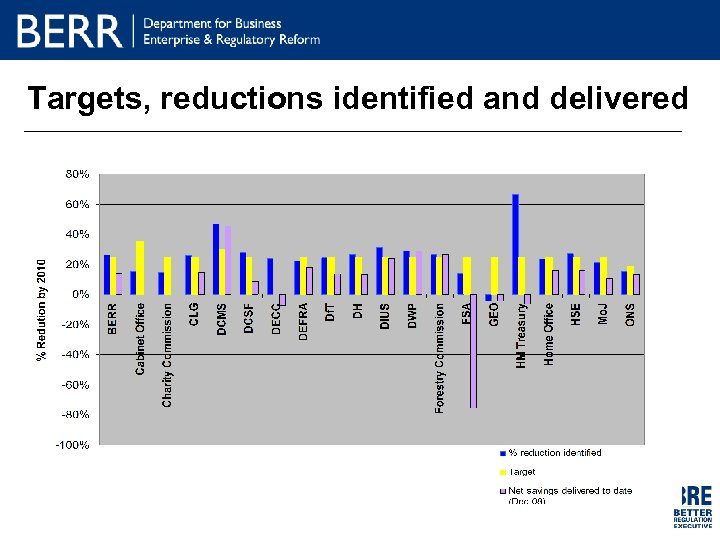

Targets, reductions identified and delivered

Targets, reductions identified and delivered

Validating achievements

Validating achievements

Making sure savings are felt by business • External Validation Panel – Members: representatives of key business organisations (British Chambers of Commerce, Confederation of British Industry, Federation of Small Businesses, Institute of Directors and the Trades Union Congress) – Role: review and challenge the assumptions underpinning the top administrative burden reductions Departments have implemented from May 2005 to May 2008 – Outcome: An estimated £ 1. 5 bn of gross simplifications approved

Making sure savings are felt by business • External Validation Panel – Members: representatives of key business organisations (British Chambers of Commerce, Confederation of British Industry, Federation of Small Businesses, Institute of Directors and the Trades Union Congress) – Role: review and challenge the assumptions underpinning the top administrative burden reductions Departments have implemented from May 2005 to May 2008 – Outcome: An estimated £ 1. 5 bn of gross simplifications approved

Examples of simplifications

Examples of simplifications

Improvements to Employment Guidance (BERR) The Employment Guidance Programme was established to reduce the administrative burdens imposed by employment law, improve peoples perceptions and drive wider business cultural change around compliance. The programme has produced and promoted free to use and legally compliant online tools, proforma letters and agreement forms, accessible through the Business. Link website. Independent research shows that peoples perceptions are changing with the introduction of these tools. £ 418 million of annual net savings have also been achieved by December 2008

Improvements to Employment Guidance (BERR) The Employment Guidance Programme was established to reduce the administrative burdens imposed by employment law, improve peoples perceptions and drive wider business cultural change around compliance. The programme has produced and promoted free to use and legally compliant online tools, proforma letters and agreement forms, accessible through the Business. Link website. Independent research shows that peoples perceptions are changing with the introduction of these tools. £ 418 million of annual net savings have also been achieved by December 2008

Fewer Annual General Meetings for private companies (BERR) Company Law has been substantially rewritten to make it easier for the UK’s one million companies to understand, and more flexible for them to manage, especially for small businesses. The changes have removed a number of outdated and often archaic rules such as the need to hold an AGM and the need for paper-based communication with shareholders. The new Companies Act also brings together measures from many separate pieces of legislation in to a single place and introduces easier and cheaper forms of decision-making for companies By simplifying company law and making it easier to understand, companies over time should be easier to manage and businesses. 500 – 750, 000 private companies no longer need to hold an annual general meeting (AGM) delivering £ 45 m annual savings delivered. Around 60, 000 private companies no longer need to appoint a company secretary, saving £ 50 – £ 100 per business each a year.

Fewer Annual General Meetings for private companies (BERR) Company Law has been substantially rewritten to make it easier for the UK’s one million companies to understand, and more flexible for them to manage, especially for small businesses. The changes have removed a number of outdated and often archaic rules such as the need to hold an AGM and the need for paper-based communication with shareholders. The new Companies Act also brings together measures from many separate pieces of legislation in to a single place and introduces easier and cheaper forms of decision-making for companies By simplifying company law and making it easier to understand, companies over time should be easier to manage and businesses. 500 – 750, 000 private companies no longer need to hold an annual general meeting (AGM) delivering £ 45 m annual savings delivered. Around 60, 000 private companies no longer need to appoint a company secretary, saving £ 50 – £ 100 per business each a year.

Sensible Risk Management– Risk Assessments (HSE) Small businesses often find it difficult to work out what health and safety rules mean for their workplace, and are unsure where to go for advice on developing a health and safety plan. The Health and Safety Executive have published guidance on how to complete a health and safety risk assessment in one place at www. hse. gov. uk/risk. The site tells them what the key risks are for their industry, what practical measures they need to have in place, and has examples on what ‘good enough’ looks like for their industry. Convenience stores, estate agencies, dry cleaners, and hairdressing salons are among the 18 sector-specific businesses that can now benefit from these example risk assessments. This means lower risk businesses will spend significantly less time completing their assessments as a result. £ 182 million of annual net savings have been achieved by December 2008

Sensible Risk Management– Risk Assessments (HSE) Small businesses often find it difficult to work out what health and safety rules mean for their workplace, and are unsure where to go for advice on developing a health and safety plan. The Health and Safety Executive have published guidance on how to complete a health and safety risk assessment in one place at www. hse. gov. uk/risk. The site tells them what the key risks are for their industry, what practical measures they need to have in place, and has examples on what ‘good enough’ looks like for their industry. Convenience stores, estate agencies, dry cleaners, and hairdressing salons are among the 18 sector-specific businesses that can now benefit from these example risk assessments. This means lower risk businesses will spend significantly less time completing their assessments as a result. £ 182 million of annual net savings have been achieved by December 2008

Electronic Planning Applications (CLG) Inconsistencies and over-regulation in the planning system have long been an irritant for business. Changes have been introduced to provide a faster, more efficient planning system with less red tape. One example is that planning applications can now be submitted electronically, using a single national application form. This makes the process for obtaining planning consents simpler and more consistent across all local authority areas, and gives businesses greater certainty for planning and fewer administration costs. Greater consistency is also being achieved through access to better information and clearer criteria on what is needed for applications. £ 120 million of annual net savings have been achieved by December 2008

Electronic Planning Applications (CLG) Inconsistencies and over-regulation in the planning system have long been an irritant for business. Changes have been introduced to provide a faster, more efficient planning system with less red tape. One example is that planning applications can now be submitted electronically, using a single national application form. This makes the process for obtaining planning consents simpler and more consistent across all local authority areas, and gives businesses greater certainty for planning and fewer administration costs. Greater consistency is also being achieved through access to better information and clearer criteria on what is needed for applications. £ 120 million of annual net savings have been achieved by December 2008

Where you can find more information § BRE site: www. berr. gov. uk/bre § Admin Burdens Calculator: https: //www. abcalculator. berr. gov. uk § SCM Training: www. scmtraining. berr. gov. uk § International SCM Network site: www. administrative-burdens. com § HMRC report: http: //www. hmrc. gov. uk/news/admin-burdens. pdf § Portal: www. betterregulation. gov. uk

Where you can find more information § BRE site: www. berr. gov. uk/bre § Admin Burdens Calculator: https: //www. abcalculator. berr. gov. uk § SCM Training: www. scmtraining. berr. gov. uk § International SCM Network site: www. administrative-burdens. com § HMRC report: http: //www. hmrc. gov. uk/news/admin-burdens. pdf § Portal: www. betterregulation. gov. uk

Any questions? Mark Hammond Better Regulation Executive, Department for Business, Enterprise and Regulatory Reform 1 Victoria Street, London, SW 1 H 0 ET Mark. Hammond@berr. gsi. gov. uk +44 20 7215 0339

Any questions? Mark Hammond Better Regulation Executive, Department for Business, Enterprise and Regulatory Reform 1 Victoria Street, London, SW 1 H 0 ET Mark. Hammond@berr. gsi. gov. uk +44 20 7215 0339