8f828454e20ac25bd357e1764c5e7a9b.ppt

- Количество слайдов: 102

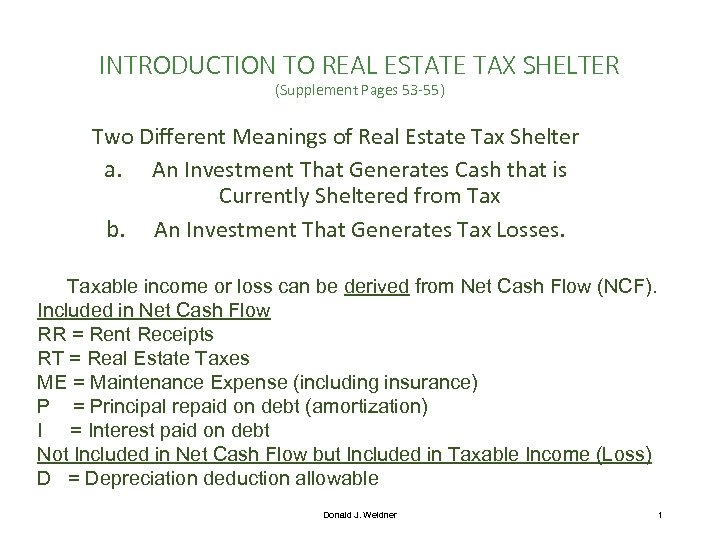

INTRODUCTION TO REAL ESTATE TAX SHELTER (Supplement Pages 53 -55) Two Different Meanings of Real Estate Tax Shelter a. An Investment That Generates Cash that is Currently Sheltered from Tax b. An Investment That Generates Tax Losses. Taxable income or loss can be derived from Net Cash Flow (NCF). Included in Net Cash Flow RR = Rent Receipts RT = Real Estate Taxes ME = Maintenance Expense (including insurance) P = Principal repaid on debt (amortization) I = Interest paid on debt Not Included in Net Cash Flow but Included in Taxable Income (Loss) D = Depreciation deduction allowable Donald J. Weidner 1

INTRODUCTION TO REAL ESTATE TAX SHELTER (Supplement Pages 53 -55) Two Different Meanings of Real Estate Tax Shelter a. An Investment That Generates Cash that is Currently Sheltered from Tax b. An Investment That Generates Tax Losses. Taxable income or loss can be derived from Net Cash Flow (NCF). Included in Net Cash Flow RR = Rent Receipts RT = Real Estate Taxes ME = Maintenance Expense (including insurance) P = Principal repaid on debt (amortization) I = Interest paid on debt Not Included in Net Cash Flow but Included in Taxable Income (Loss) D = Depreciation deduction allowable Donald J. Weidner 1

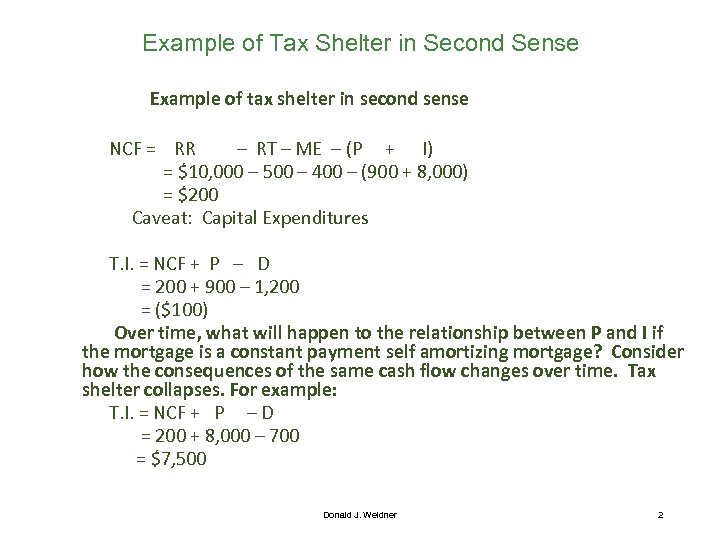

Example of Tax Shelter in Second Sense Example of tax shelter in second sense NCF = RR – RT – ME – (P + I) = $10, 000 – 500 – 400 – (900 + 8, 000) = $200 Caveat: Capital Expenditures T. I. = NCF + P – D = 200 + 900 – 1, 200 = ($100) Over time, what will happen to the relationship between P and I if the mortgage is a constant payment self amortizing mortgage? Consider how the consequences of the same cash flow changes over time. Tax shelter collapses. For example: T. I. = NCF + P – D = 200 + 8, 000 – 700 = $7, 500 Donald J. Weidner 2

Example of Tax Shelter in Second Sense Example of tax shelter in second sense NCF = RR – RT – ME – (P + I) = $10, 000 – 500 – 400 – (900 + 8, 000) = $200 Caveat: Capital Expenditures T. I. = NCF + P – D = 200 + 900 – 1, 200 = ($100) Over time, what will happen to the relationship between P and I if the mortgage is a constant payment self amortizing mortgage? Consider how the consequences of the same cash flow changes over time. Tax shelter collapses. For example: T. I. = NCF + P – D = 200 + 8, 000 – 700 = $7, 500 Donald J. Weidner 2

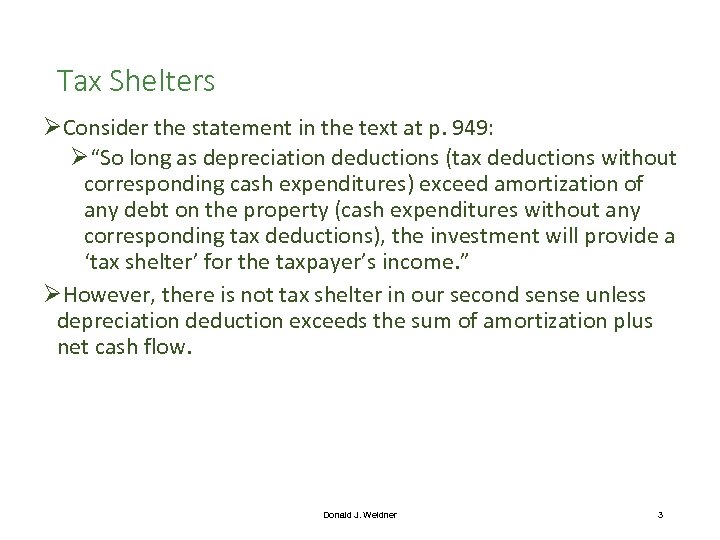

Tax Shelters ØConsider the statement in the text at p. 949: Ø“So long as depreciation deductions (tax deductions without corresponding cash expenditures) exceed amortization of any debt on the property (cash expenditures without any corresponding tax deductions), the investment will provide a ‘tax shelter’ for the taxpayer’s income. ” ØHowever, there is not tax shelter in our second sense unless depreciation deduction exceeds the sum of amortization plus net cash flow. Donald J. Weidner 3

Tax Shelters ØConsider the statement in the text at p. 949: Ø“So long as depreciation deductions (tax deductions without corresponding cash expenditures) exceed amortization of any debt on the property (cash expenditures without any corresponding tax deductions), the investment will provide a ‘tax shelter’ for the taxpayer’s income. ” ØHowever, there is not tax shelter in our second sense unless depreciation deduction exceeds the sum of amortization plus net cash flow. Donald J. Weidner 3

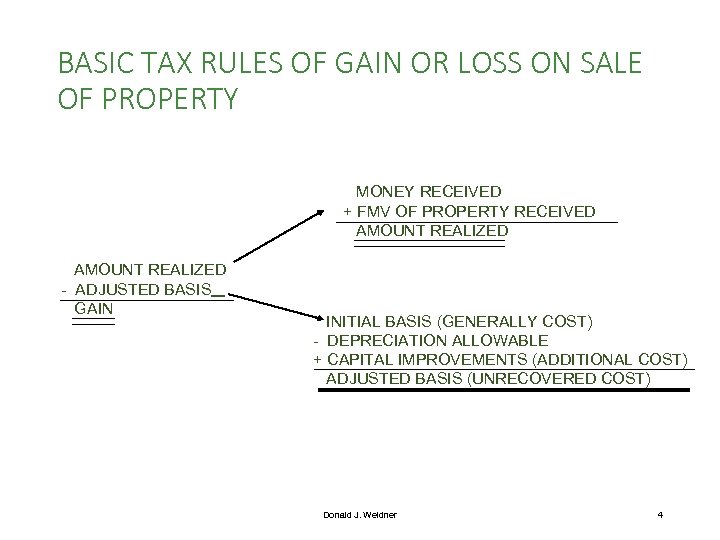

BASIC TAX RULES OF GAIN OR LOSS ON SALE OF PROPERTY MONEY RECEIVED + FMV OF PROPERTY RECEIVED AMOUNT REALIZED - ADJUSTED BASIS GAIN INITIAL BASIS (GENERALLY COST) - DEPRECIATION ALLOWABLE + CAPITAL IMPROVEMENTS (ADDITIONAL COST) ADJUSTED BASIS (UNRECOVERED COST) Donald J. Weidner 4

BASIC TAX RULES OF GAIN OR LOSS ON SALE OF PROPERTY MONEY RECEIVED + FMV OF PROPERTY RECEIVED AMOUNT REALIZED - ADJUSTED BASIS GAIN INITIAL BASIS (GENERALLY COST) - DEPRECIATION ALLOWABLE + CAPITAL IMPROVEMENTS (ADDITIONAL COST) ADJUSTED BASIS (UNRECOVERED COST) Donald J. Weidner 4

On Purchase of Land Building 1. Allocate cost between land building. The investment in the land is an investment in a nondepreciable asset—an asset that does not waste away and therefore has an unlimited useful life. No depreciation deductions (generally). 2. The building is presumably a wasting asset (through obsolescence or physical deterioration). The investment in the building is depreciable if the building is: (a) used in a trade or business; or (b) held for the production of income. Ex. A buyer pays $100 total cost for land building. That total cost must be allocated, say, $20 to the land $80 to the building. Only the $80 allocable to the building is depreciable. Donald J. Weidner 5

On Purchase of Land Building 1. Allocate cost between land building. The investment in the land is an investment in a nondepreciable asset—an asset that does not waste away and therefore has an unlimited useful life. No depreciation deductions (generally). 2. The building is presumably a wasting asset (through obsolescence or physical deterioration). The investment in the building is depreciable if the building is: (a) used in a trade or business; or (b) held for the production of income. Ex. A buyer pays $100 total cost for land building. That total cost must be allocated, say, $20 to the land $80 to the building. Only the $80 allocable to the building is depreciable. Donald J. Weidner 5

On Purchase of Land Building (cont’d) 3. Because the taxpayer is not permitted to deduct the entire cost of the building as soon as it is purchased, the taxpayer will be forced to spread the depreciation deductions over some number of years into the future (generally, to have some semblance of matching receipts with the cost of generating those receipts. Step three is to determine the number of years. 1. Determine the “applicable [cost] recovery period” (formerly known as “useful life”) for the asset being depreciated). Code sec. 168(c) says --39 years for nonresidential, --27. 5 years for residential rental. Donald J. Weidner 6

On Purchase of Land Building (cont’d) 3. Because the taxpayer is not permitted to deduct the entire cost of the building as soon as it is purchased, the taxpayer will be forced to spread the depreciation deductions over some number of years into the future (generally, to have some semblance of matching receipts with the cost of generating those receipts. Step three is to determine the number of years. 1. Determine the “applicable [cost] recovery period” (formerly known as “useful life”) for the asset being depreciated). Code sec. 168(c) says --39 years for nonresidential, --27. 5 years for residential rental. Donald J. Weidner 6

On Purchase of Land Building (cont’d) 4. Determine how the depreciation deductions will be spread over the mandated period (ex. evenly, more at the beginning, more at the end, etc. ). Allocate the building cost over the applicable recovery period (39 years for nonresidential real estate). • Code sec. 168(b)(3) says the “straight line” method is the only method that may be used to compute depreciation deductions on either nonresidential property or residential rental property. Ø The depreciation deduction will be the same every year of the cost recovery period • That is, the deductions may not be “accelerated”—bunched up in the early years of the cost recovery period. Donald J. Weidner 7

On Purchase of Land Building (cont’d) 4. Determine how the depreciation deductions will be spread over the mandated period (ex. evenly, more at the beginning, more at the end, etc. ). Allocate the building cost over the applicable recovery period (39 years for nonresidential real estate). • Code sec. 168(b)(3) says the “straight line” method is the only method that may be used to compute depreciation deductions on either nonresidential property or residential rental property. Ø The depreciation deduction will be the same every year of the cost recovery period • That is, the deductions may not be “accelerated”—bunched up in the early years of the cost recovery period. Donald J. Weidner 7

Nonrecourse Financing and Crane ØMortgage debt gets to be treated as part of an investor’s “cost” of property. ØIn tax terms, the debt is included in the taxpayer’s depreciable “basis” in property, giving rise to what some refer to as “leveraged depreciation. ” ØDebt that is included in basis includes not only funds borrowed by the investor, but any debt to which the property is “subject” at the time of the acquisition. ØIn the 1940 s, the Supreme Court held that basis includes debt on which the investor has no personal liability. ØSee text p. 951 -52, discussing Crane v. Commissioner, 331 U. S. 1 (1947). Donald J. Weidner 8

Nonrecourse Financing and Crane ØMortgage debt gets to be treated as part of an investor’s “cost” of property. ØIn tax terms, the debt is included in the taxpayer’s depreciable “basis” in property, giving rise to what some refer to as “leveraged depreciation. ” ØDebt that is included in basis includes not only funds borrowed by the investor, but any debt to which the property is “subject” at the time of the acquisition. ØIn the 1940 s, the Supreme Court held that basis includes debt on which the investor has no personal liability. ØSee text p. 951 -52, discussing Crane v. Commissioner, 331 U. S. 1 (1947). Donald J. Weidner 8

Crane v. Commissioner 331 U. S. 1 (1947) (discussed in Mayerson at Supp. p. 56) Ms. Crane sold apartment bldg for (1) $ 2, 500 cash “subject to” (2) 255, 000 Mortgage (principal) ______ IRS said: $257, 500, the sum of the cash plus the principal balance on the mortgage, is the “amount realized” on the sale. Recall: The Code defines “Amount Realized” as “the sum of [1] any money received plus [2] the fair market value of the property (other than money) received. ” Donald J. Weidner 9

Crane v. Commissioner 331 U. S. 1 (1947) (discussed in Mayerson at Supp. p. 56) Ms. Crane sold apartment bldg for (1) $ 2, 500 cash “subject to” (2) 255, 000 Mortgage (principal) ______ IRS said: $257, 500, the sum of the cash plus the principal balance on the mortgage, is the “amount realized” on the sale. Recall: The Code defines “Amount Realized” as “the sum of [1] any money received plus [2] the fair market value of the property (other than money) received. ” Donald J. Weidner 9

Crane (Cont’d) ØMs. Crane conceded “that if she had been personally liable on the mortgage and the purchaser had either paid or assumed it, ” the amount so paid or assumed would be a part of her amount realized. ØPrevious cases had said that an “actual receipt” was not necessary. If the buyer paid or promised to pay the mortgage, the seller was “as real and substantial” a beneficiary as if the money had been paid by buyer to seller and then to the creditor. ØEven though payment and promise to pay are economically very different Donald J. Weidner 10

Crane (Cont’d) ØMs. Crane conceded “that if she had been personally liable on the mortgage and the purchaser had either paid or assumed it, ” the amount so paid or assumed would be a part of her amount realized. ØPrevious cases had said that an “actual receipt” was not necessary. If the buyer paid or promised to pay the mortgage, the seller was “as real and substantial” a beneficiary as if the money had been paid by buyer to seller and then to the creditor. ØEven though payment and promise to pay are economically very different Donald J. Weidner 10

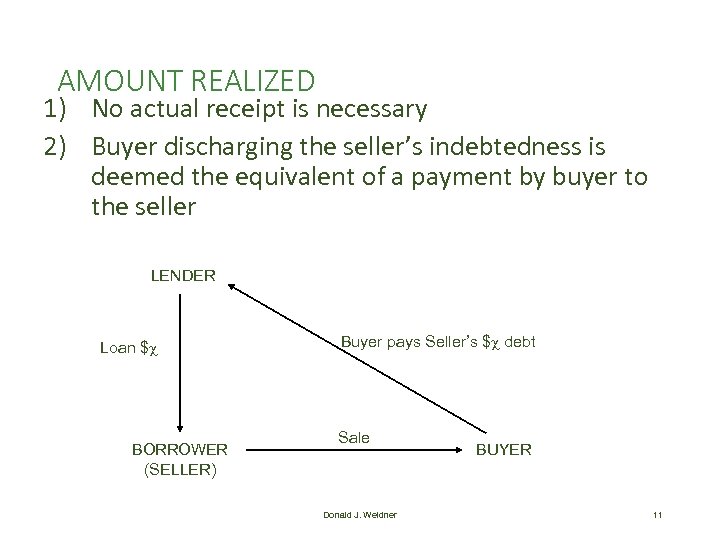

AMOUNT REALIZED 1) No actual receipt is necessary 2) Buyer discharging the seller’s indebtedness is deemed the equivalent of a payment by buyer to the seller LENDER Loan $ BORROWER (SELLER) Buyer pays Seller’s $ debt Sale Donald J. Weidner BUYER 11

AMOUNT REALIZED 1) No actual receipt is necessary 2) Buyer discharging the seller’s indebtedness is deemed the equivalent of a payment by buyer to the seller LENDER Loan $ BORROWER (SELLER) Buyer pays Seller’s $ debt Sale Donald J. Weidner BUYER 11

Crane (Cont’d) ØMs. Crane said it was not the same as if she had been paid the amount of the mortgage balance: (1) she was not personally liable on the mortgage (2) nor did her buyer become personally liable. ØShe had inherited the property 7 years earlier, when the mortgage encumbering it was already in default. ØShe entered into an agreement that gave the mortgagee all the net cash flow ØEven so, no principal was paid and the interest in arrears doubled. ØThe transaction was, she said, “by all dictates of common sense, a ruinous disaster. ” However: she had been claiming depreciation deductions. Donald J. Weidner 12

Crane (Cont’d) ØMs. Crane said it was not the same as if she had been paid the amount of the mortgage balance: (1) she was not personally liable on the mortgage (2) nor did her buyer become personally liable. ØShe had inherited the property 7 years earlier, when the mortgage encumbering it was already in default. ØShe entered into an agreement that gave the mortgagee all the net cash flow ØEven so, no principal was paid and the interest in arrears doubled. ØThe transaction was, she said, “by all dictates of common sense, a ruinous disaster. ” However: she had been claiming depreciation deductions. Donald J. Weidner 12

Crane v. Commissioner (cont’d) Supreme Court in Crane stated what has become known as the “economic benefit” theory: “We are rather concerned with the reality that an owner of property, mortgaged at a figure less than that at which the property will sell, must and will treat the conditions of the mortgage exactly as if they were his personal obligations. ” ØShe will have to pay off the mortgage to access the equity (see text p. 952) “If he transfers subject to the mortgage, the benefit to him is as real and substantial as if the mortgage were discharged, or as if a personal debt in an equal amount had been assumed by another. ” Donald J. Weidner 13

Crane v. Commissioner (cont’d) Supreme Court in Crane stated what has become known as the “economic benefit” theory: “We are rather concerned with the reality that an owner of property, mortgaged at a figure less than that at which the property will sell, must and will treat the conditions of the mortgage exactly as if they were his personal obligations. ” ØShe will have to pay off the mortgage to access the equity (see text p. 952) “If he transfers subject to the mortgage, the benefit to him is as real and substantial as if the mortgage were discharged, or as if a personal debt in an equal amount had been assumed by another. ” Donald J. Weidner 13

Crane’s Footnote 37 As a result of the economic benefit theory, Ms. Crane, a seller who was “above water, ” was required to include, as part of her “amount realized, ” the full amount of the nonrecourse mortgage from which she was “relieved” when she sold the property. The following footnote # 37 from Crane reflected the economic benefit theory in a way that years later gave hope to sellers in a down market--who were “underwater”--that they would not be required to include the amount of their nonrecourse mortgage in “amount realized: ” “Obviously, if the value of the property is less than the amount of the mortgage, a mortgagor who is not personally liable cannot realize a benefit equal to the mortgage. Consequently, a different problem might be encountered where a mortgagor abandoned the property or transferred it subject to the mortgage without receiving boot. ” Commissioner v. Tufts (text p. 940) put FN. 37 to death. Donald J. Weidner 14

Crane’s Footnote 37 As a result of the economic benefit theory, Ms. Crane, a seller who was “above water, ” was required to include, as part of her “amount realized, ” the full amount of the nonrecourse mortgage from which she was “relieved” when she sold the property. The following footnote # 37 from Crane reflected the economic benefit theory in a way that years later gave hope to sellers in a down market--who were “underwater”--that they would not be required to include the amount of their nonrecourse mortgage in “amount realized: ” “Obviously, if the value of the property is less than the amount of the mortgage, a mortgagor who is not personally liable cannot realize a benefit equal to the mortgage. Consequently, a different problem might be encountered where a mortgagor abandoned the property or transferred it subject to the mortgage without receiving boot. ” Commissioner v. Tufts (text p. 940) put FN. 37 to death. Donald J. Weidner 14

Crane v. Commissioner (cont’d) ØThere is one other part of the opinion that got less attention. ØRecall that Ms. Crane had been taking depreciation deductions. ØNear the end of its opinion, the Court said: Ø“The crux of this case, really, is whether the law permits her to exclude allowable deductions from consideration in computing gain. ” ØWe’ll return to the proper analysis to apply to mortgage discharge when we consider the Supreme Court’s more recent opinion in Tufts. ØFirst, we consider Mayerson, a major taxpayer victory on the ability to include a nonrecourse mortgage in depreciable basis. Donald J. Weidner 15

Crane v. Commissioner (cont’d) ØThere is one other part of the opinion that got less attention. ØRecall that Ms. Crane had been taking depreciation deductions. ØNear the end of its opinion, the Court said: Ø“The crux of this case, really, is whether the law permits her to exclude allowable deductions from consideration in computing gain. ” ØWe’ll return to the proper analysis to apply to mortgage discharge when we consider the Supreme Court’s more recent opinion in Tufts. ØFirst, we consider Mayerson, a major taxpayer victory on the ability to include a nonrecourse mortgage in depreciable basis. Donald J. Weidner 15

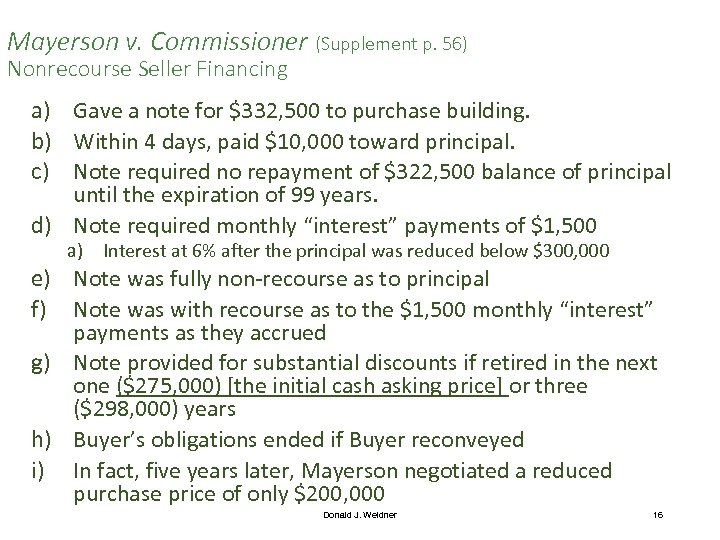

Mayerson v. Commissioner (Supplement p. 56) Nonrecourse Seller Financing a) Gave a note for $332, 500 to purchase building. b) Within 4 days, paid $10, 000 toward principal. c) Note required no repayment of $322, 500 balance of principal until the expiration of 99 years. d) Note required monthly “interest” payments of $1, 500 a) Interest at 6% after the principal was reduced below $300, 000 e) Note was fully non-recourse as to principal f) Note was with recourse as to the $1, 500 monthly “interest” payments as they accrued g) Note provided for substantial discounts if retired in the next one ($275, 000) [the initial cash asking price] or three ($298, 000) years h) Buyer’s obligations ended if Buyer reconveyed i) In fact, five years later, Mayerson negotiated a reduced purchase price of only $200, 000 Donald J. Weidner 16

Mayerson v. Commissioner (Supplement p. 56) Nonrecourse Seller Financing a) Gave a note for $332, 500 to purchase building. b) Within 4 days, paid $10, 000 toward principal. c) Note required no repayment of $322, 500 balance of principal until the expiration of 99 years. d) Note required monthly “interest” payments of $1, 500 a) Interest at 6% after the principal was reduced below $300, 000 e) Note was fully non-recourse as to principal f) Note was with recourse as to the $1, 500 monthly “interest” payments as they accrued g) Note provided for substantial discounts if retired in the next one ($275, 000) [the initial cash asking price] or three ($298, 000) years h) Buyer’s obligations ended if Buyer reconveyed i) In fact, five years later, Mayerson negotiated a reduced purchase price of only $200, 000 Donald J. Weidner 16

MAYERSON (Cont’d) ARGUMENTS OF IRS 1. Mayerson did not acquire a depreciable interest in the building because he made no investment in it (one depreciates one’s “investment” in business property rather than the property itself). IRS: The note does not qualify as an investment because a. It puts nothing at economic risk; and b. It is too contingent an obligation. Ø Ex ante and Ex post—look at the discounts. The stated principal was never intended to be paid, as confirmed by the ultimate $200, 000 taken in satisfaction of the note. The benefit of the depreciation deduction, a deduction given for a non-cash expense on the assumption that there is or may be economic depreciation taking place, should follow the person who bears the risk of economic depreciation. --Mayerson made no investment that would be subject to a risk of depreciation. Donald J. Weidner 17

MAYERSON (Cont’d) ARGUMENTS OF IRS 1. Mayerson did not acquire a depreciable interest in the building because he made no investment in it (one depreciates one’s “investment” in business property rather than the property itself). IRS: The note does not qualify as an investment because a. It puts nothing at economic risk; and b. It is too contingent an obligation. Ø Ex ante and Ex post—look at the discounts. The stated principal was never intended to be paid, as confirmed by the ultimate $200, 000 taken in satisfaction of the note. The benefit of the depreciation deduction, a deduction given for a non-cash expense on the assumption that there is or may be economic depreciation taking place, should follow the person who bears the risk of economic depreciation. --Mayerson made no investment that would be subject to a risk of depreciation. Donald J. Weidner 17

Mayerson (IRS Arguments Cont’d) 2. Alternatively, if Mayerson did acquire a depreciable interest in the building, the note is too contingent to be included in his basis in the building. --His basis in the building was merely his $10, 000 cash downpayment 3. The economic substance of Mayerson’s investment was merely a lease with an option to purchase. --Under this theory, how did the IRS recharacterize the $10, 000 down payment? ØAs a $10, 000 premium paid for a favorable lease Ø Which Mayerson could “amortize” over 99 years. 4. Other possibility: The $10, 000 payment was a fee paid to the seller for “orchestrating” a tax shelter. Donald J. Weidner 18

Mayerson (IRS Arguments Cont’d) 2. Alternatively, if Mayerson did acquire a depreciable interest in the building, the note is too contingent to be included in his basis in the building. --His basis in the building was merely his $10, 000 cash downpayment 3. The economic substance of Mayerson’s investment was merely a lease with an option to purchase. --Under this theory, how did the IRS recharacterize the $10, 000 down payment? ØAs a $10, 000 premium paid for a favorable lease Ø Which Mayerson could “amortize” over 99 years. 4. Other possibility: The $10, 000 payment was a fee paid to the seller for “orchestrating” a tax shelter. Donald J. Weidner 18

Mayerson: Present Value ØWhat is the present value of the right to receive $322, 500 at the end of 100 years? ØThe present value, of course, depends upon the discount rate ØAt a 6% rate, compounded monthly, the present value is $811 ØWhat is the present value of the right to receive $1, 500 a month for 100 years? ØThat, again, depends upon the discount rate ØAt 6% interest, compounded monthly, the present value of that income stream is $299, 245 Donald J. Weidner 19

Mayerson: Present Value ØWhat is the present value of the right to receive $322, 500 at the end of 100 years? ØThe present value, of course, depends upon the discount rate ØAt a 6% rate, compounded monthly, the present value is $811 ØWhat is the present value of the right to receive $1, 500 a month for 100 years? ØThat, again, depends upon the discount rate ØAt 6% interest, compounded monthly, the present value of that income stream is $299, 245 Donald J. Weidner 19

MAYERSON The Tax Court agreed with 2 propositions: 1. 2. “It is well accepted that depreciation is not predicated upon ownership of property but rather upon an investment in property, ” and that “the benefit of the depreciation deduction should inure to those who suffer an economic loss caused by wear and exhaustion of the business property. ” Given these two assumptions, how could Mayerson possibly win? Donald J. Weidner 20

MAYERSON The Tax Court agreed with 2 propositions: 1. 2. “It is well accepted that depreciation is not predicated upon ownership of property but rather upon an investment in property, ” and that “the benefit of the depreciation deduction should inure to those who suffer an economic loss caused by wear and exhaustion of the business property. ” Given these two assumptions, how could Mayerson possibly win? Donald J. Weidner 20

More on Mayerson ØCrane decided the amount realized on the sale of property that had been inherited whereas Mayerson decided the initial basis of property that was being purchased. ØNevertheless, Mayerson said that, under Crane: “the basis of the property was the value at the date of death undiminished by the mortgage. ” ØStated differently, the basis included the amount of the mortgage and not just the Owner’s equity Ø“The inclusion of the indebtedness in basis was balanced by a similar inclusion of the indebtedness in amount realized upon the ultimate sale of the property to a nonassuming grantee. ” ØThe court seems to be saying: it is not so bad to include the debt in basis when the property is acquired because that inclusion in basis will later be “balanced” or “offset” by an equal inclusion in the amount realized when the property is sold (if and to the extent the debt has not been “amortized” [paid off]). Donald J. Weidner 21

More on Mayerson ØCrane decided the amount realized on the sale of property that had been inherited whereas Mayerson decided the initial basis of property that was being purchased. ØNevertheless, Mayerson said that, under Crane: “the basis of the property was the value at the date of death undiminished by the mortgage. ” ØStated differently, the basis included the amount of the mortgage and not just the Owner’s equity Ø“The inclusion of the indebtedness in basis was balanced by a similar inclusion of the indebtedness in amount realized upon the ultimate sale of the property to a nonassuming grantee. ” ØThe court seems to be saying: it is not so bad to include the debt in basis when the property is acquired because that inclusion in basis will later be “balanced” or “offset” by an equal inclusion in the amount realized when the property is sold (if and to the extent the debt has not been “amortized” [paid off]). Donald J. Weidner 21

More on Mayerson ØThe Code says that the basis for computing depreciation shall be the same as the basis for computing gain or loss on a sale or exchange. Therefore: ØCrane “constitutes strong authority for the proposition that the basis used for depreciation as well as the computation of gain or loss would include the amount of an unassumed mortgage on the property. ” (emphasis added) ØGiven that depreciable basis generally includes the amount of the mortgage, the question was whether Mayerson is an exception, either because the financing was seller-provided or because the note to the seller was nonrecourse. Donald J. Weidner 22

More on Mayerson ØThe Code says that the basis for computing depreciation shall be the same as the basis for computing gain or loss on a sale or exchange. Therefore: ØCrane “constitutes strong authority for the proposition that the basis used for depreciation as well as the computation of gain or loss would include the amount of an unassumed mortgage on the property. ” (emphasis added) ØGiven that depreciable basis generally includes the amount of the mortgage, the question was whether Mayerson is an exception, either because the financing was seller-provided or because the note to the seller was nonrecourse. Donald J. Weidner 22

Yet More on Mayerson ØConsider the court’s first policy goal: 1. Equate seller financing with third party financing. Ø “[A] purchase money debt obligation for part of the price will be included in basis. This is necessary in order to equate a purchase money mortgage situation with the situation in which the buyer borrows the full amount of the purchase price from the third party and pays the seller in cash. It is clear that the depreciable basis should be the same in both instances. ” ØIs it clear that these two situations are economically the same? Donald J. Weidner 23

Yet More on Mayerson ØConsider the court’s first policy goal: 1. Equate seller financing with third party financing. Ø “[A] purchase money debt obligation for part of the price will be included in basis. This is necessary in order to equate a purchase money mortgage situation with the situation in which the buyer borrows the full amount of the purchase price from the third party and pays the seller in cash. It is clear that the depreciable basis should be the same in both instances. ” ØIs it clear that these two situations are economically the same? Donald J. Weidner 23

Yet More on Mayerson ØContrary to the court’s first policy goal, Congress subsequently declared that seller-provided nonrecourse financing must be distinguished from third-party nonrecourse financing ØDo you see why nonrecourse financing provided by a seller is more subject to abuse (for tax purposes) than nonrecourse financing provided by a third party? ØIn the seller-provided purchase money financing, no third party, or anyone, puts up cash in the face amount of the note ØConsider Leonard Marcus, T. C. M. 1971 -299 (buyer insists on paying more but only with nonrecourse notes). ØSee longstanding Section 108(e)(5) (Supp. p. 64) Donald J. Weidner 24

Yet More on Mayerson ØContrary to the court’s first policy goal, Congress subsequently declared that seller-provided nonrecourse financing must be distinguished from third-party nonrecourse financing ØDo you see why nonrecourse financing provided by a seller is more subject to abuse (for tax purposes) than nonrecourse financing provided by a third party? ØIn the seller-provided purchase money financing, no third party, or anyone, puts up cash in the face amount of the note ØConsider Leonard Marcus, T. C. M. 1971 -299 (buyer insists on paying more but only with nonrecourse notes). ØSee longstanding Section 108(e)(5) (Supp. p. 64) Donald J. Weidner 24

Yet More on Mayerson ØSection 108(e)(5) treats the reduction in seller-provided financing as a purchase price readjustment ØRather than as discharge of indebtedness income Ø Provided the reduction does not occur in a bankruptcy reorganization or insolvency case Donald J. Weidner 25

Yet More on Mayerson ØSection 108(e)(5) treats the reduction in seller-provided financing as a purchase price readjustment ØRather than as discharge of indebtedness income Ø Provided the reduction does not occur in a bankruptcy reorganization or insolvency case Donald J. Weidner 25

And Even More on Mayerson ØConsider the court’s second policy goal: 2. Equate nonrecourse financing with recourse financing: “Taxpayers who are not personally liable for encumbrances on property should be allowed depreciation deductions affording competitive equality with taxpayers who are personally liable for encumbrances or taxpayers who own encumbered property. ” ØIn general, this policy continues with respect to real estate ØHowever Congress introduced the “at risk” rules to reverse the policy in other contexts Donald J. Weidner 26

And Even More on Mayerson ØConsider the court’s second policy goal: 2. Equate nonrecourse financing with recourse financing: “Taxpayers who are not personally liable for encumbrances on property should be allowed depreciation deductions affording competitive equality with taxpayers who are personally liable for encumbrances or taxpayers who own encumbered property. ” ØIn general, this policy continues with respect to real estate ØHowever Congress introduced the “at risk” rules to reverse the policy in other contexts Donald J. Weidner 26

At Risk ØThe basic idea behind the “at risk” rules is that a taxpayer should not be able to claim deductions from an investment beyond the amount the taxpayer has “at risk” in that investment. ØIn general (outside real property), a taxpayer is “at risk” only to the extent the taxpayer has either Øcash in an investment, or Øa recourse liability in the investment Donald J. Weidner 27

At Risk ØThe basic idea behind the “at risk” rules is that a taxpayer should not be able to claim deductions from an investment beyond the amount the taxpayer has “at risk” in that investment. ØIn general (outside real property), a taxpayer is “at risk” only to the extent the taxpayer has either Øcash in an investment, or Øa recourse liability in the investment Donald J. Weidner 27

![And Even More on Mayerson Ø“The effect of [the Mayerson] policy [of including a And Even More on Mayerson Ø“The effect of [the Mayerson] policy [of including a](https://present5.com/presentation/8f828454e20ac25bd357e1764c5e7a9b/image-28.jpg) And Even More on Mayerson Ø“The effect of [the Mayerson] policy [of including a nonrecourse mortgage in depreciable basis] is to give the taxpayer an advance credit for the amount of the mortgage. ” Ø“This appears to be reasonable since it can be assumed that a capital investment in the amount of the mortgage will eventually occur despite the absence of personal liability. ” ØSounds like Crane: As a practical matter, the buyer will treat the debt as if it were recourse. ØThe doctrine is self-limiting: ØThis assumption that the mortgage will eventually be repaid can not be made if the amount due on the mortgage exceeds the value of the property. ØAs it did in the “inflated purchase price” Leonard Marcus (bowling alley) case Donald J. Weidner 28

And Even More on Mayerson Ø“The effect of [the Mayerson] policy [of including a nonrecourse mortgage in depreciable basis] is to give the taxpayer an advance credit for the amount of the mortgage. ” Ø“This appears to be reasonable since it can be assumed that a capital investment in the amount of the mortgage will eventually occur despite the absence of personal liability. ” ØSounds like Crane: As a practical matter, the buyer will treat the debt as if it were recourse. ØThe doctrine is self-limiting: ØThis assumption that the mortgage will eventually be repaid can not be made if the amount due on the mortgage exceeds the value of the property. ØAs it did in the “inflated purchase price” Leonard Marcus (bowling alley) case Donald J. Weidner 28

Seller-Provided Financing: Purchase Price Reduction ØWhat are the tax consequences to a buyer in a Mayerson situation who satisfies the note to his seller at a lower amount than the amount due? ØSection 108(e)(5) ØApplies to the debt a purchaser of property owes to the seller ØIf the note is reduced, it will be treated as a purchase price adjustment Ø rather than discharge of indebtedness income Øprovided the purchaser/debtor is solvent. Ø If the debtor is insolvent, the indebtedness is excluded from the taxpayer’s gross income Donald J. Weidner 29

Seller-Provided Financing: Purchase Price Reduction ØWhat are the tax consequences to a buyer in a Mayerson situation who satisfies the note to his seller at a lower amount than the amount due? ØSection 108(e)(5) ØApplies to the debt a purchaser of property owes to the seller ØIf the note is reduced, it will be treated as a purchase price adjustment Ø rather than discharge of indebtedness income Øprovided the purchaser/debtor is solvent. Ø If the debtor is insolvent, the indebtedness is excluded from the taxpayer’s gross income Donald J. Weidner 29

Notes following Mayerson ØWhat are the tax consequences to me if my bank allows me to prepay my $100, 000 home mortgage for only $80, 000? Øwhich it might do if the mortgage is more than the value of the property, or if it is at an interest rate significantly lower than the current rate ØThe mortgage in Rev. Rul. 82 -202 (Supp. p. 64) was nonrecourse(saying the same result for recourse) ØRev. Rul. 82 -202 says: Ø I have $20, 000 Discharge of Indebtedness Income ØCiting Kirby Lumber (my net worth is increased) Ø The Section 108(a) exclusion of discharge of indebtedness income is only available if I am bankrupt or insolvent. Donald J. Weidner 30

Notes following Mayerson ØWhat are the tax consequences to me if my bank allows me to prepay my $100, 000 home mortgage for only $80, 000? Øwhich it might do if the mortgage is more than the value of the property, or if it is at an interest rate significantly lower than the current rate ØThe mortgage in Rev. Rul. 82 -202 (Supp. p. 64) was nonrecourse(saying the same result for recourse) ØRev. Rul. 82 -202 says: Ø I have $20, 000 Discharge of Indebtedness Income ØCiting Kirby Lumber (my net worth is increased) Ø The Section 108(a) exclusion of discharge of indebtedness income is only available if I am bankrupt or insolvent. Donald J. Weidner 30

Tax Relief on Mortgage Discharge in the Wake of The Financial Crisis ØIn December, 2007, President Bush signed the Mortgage Forgiveness Debt Relief Act of 2007. ØIt amended section 108(a)(1) to allow an exclusion for a discharge of “qualified principal residence acquisition indebtedness. ” ØUp to $2 million ØNot including home equity indebtedness ØEven if the person is not insolvent (even if the person has a positive net worth and that net worth is enhanced by the discharge) ØThe amount excluded reduces (but not below zero) the basis of the principal residence ØThe exclusion shall not apply if the discharge “is. . . not directly related to a decline in the value of the residence or to the financial condition of the taxpayer. ” ØInitially retroactive to 1/1/07 and expiring 12/31/09. ØExtended repeatedly Donald J. Weidner 31

Tax Relief on Mortgage Discharge in the Wake of The Financial Crisis ØIn December, 2007, President Bush signed the Mortgage Forgiveness Debt Relief Act of 2007. ØIt amended section 108(a)(1) to allow an exclusion for a discharge of “qualified principal residence acquisition indebtedness. ” ØUp to $2 million ØNot including home equity indebtedness ØEven if the person is not insolvent (even if the person has a positive net worth and that net worth is enhanced by the discharge) ØThe amount excluded reduces (but not below zero) the basis of the principal residence ØThe exclusion shall not apply if the discharge “is. . . not directly related to a decline in the value of the residence or to the financial condition of the taxpayer. ” ØInitially retroactive to 1/1/07 and expiring 12/31/09. ØExtended repeatedly Donald J. Weidner 31

Seller-Provided Financing: Not “At Risk” (Supp. 96) ØSection 465(b)(6)(D)(ii) Ø“Qualified Nonrecourse Financing” is treated as an amount “at risk. ” Ø It must be from a “qualified person. ” ØThe seller is not a “qualified person. ” See Section 49(a)(1)(D)(iv)(II). ØHowever, nonrecourse financing from a third person that is related to the taxpayer can qualify Ø but only if it is “commercially reasonable and on substantially the same terms as loans involving unrelated persons. ” Donald J. Weidner 32

Seller-Provided Financing: Not “At Risk” (Supp. 96) ØSection 465(b)(6)(D)(ii) Ø“Qualified Nonrecourse Financing” is treated as an amount “at risk. ” Ø It must be from a “qualified person. ” ØThe seller is not a “qualified person. ” See Section 49(a)(1)(D)(iv)(II). ØHowever, nonrecourse financing from a third person that is related to the taxpayer can qualify Ø but only if it is “commercially reasonable and on substantially the same terms as loans involving unrelated persons. ” Donald J. Weidner 32

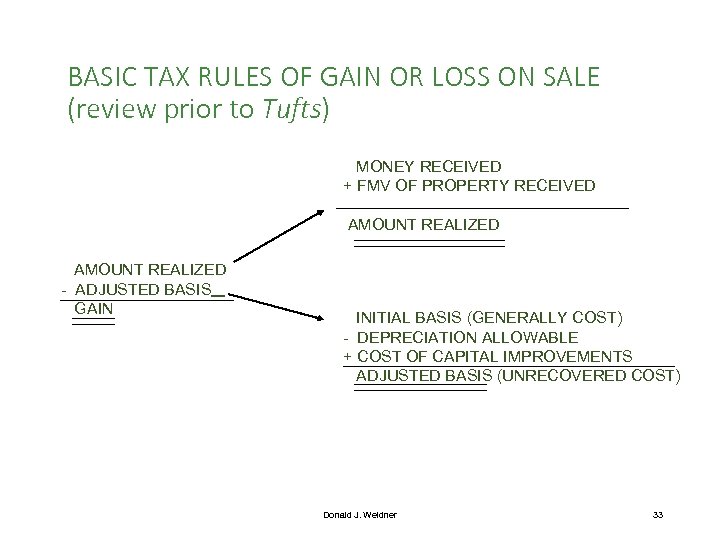

BASIC TAX RULES OF GAIN OR LOSS ON SALE (review prior to Tufts) MONEY RECEIVED + FMV OF PROPERTY RECEIVED AMOUNT REALIZED - ADJUSTED BASIS GAIN INITIAL BASIS (GENERALLY COST) - DEPRECIATION ALLOWABLE + COST OF CAPITAL IMPROVEMENTS ADJUSTED BASIS (UNRECOVERED COST) Donald J. Weidner 33

BASIC TAX RULES OF GAIN OR LOSS ON SALE (review prior to Tufts) MONEY RECEIVED + FMV OF PROPERTY RECEIVED AMOUNT REALIZED - ADJUSTED BASIS GAIN INITIAL BASIS (GENERALLY COST) - DEPRECIATION ALLOWABLE + COST OF CAPITAL IMPROVEMENTS ADJUSTED BASIS (UNRECOVERED COST) Donald J. Weidner 33

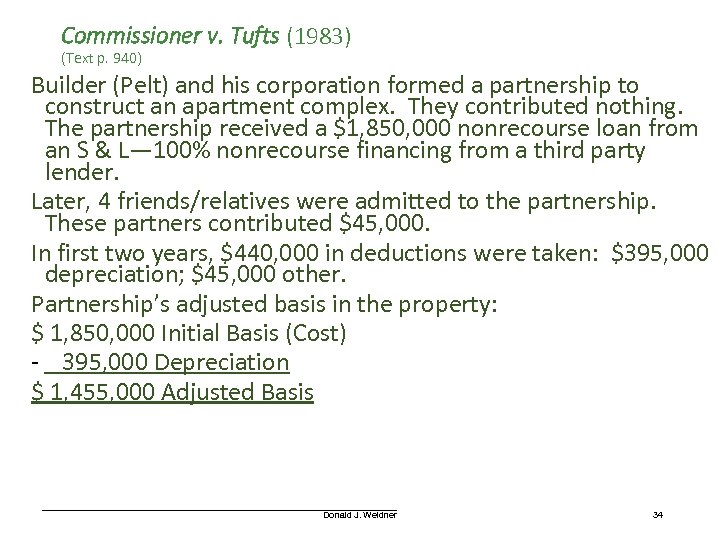

Commissioner v. Tufts (1983) (Text p. 940) Builder (Pelt) and his corporation formed a partnership to construct an apartment complex. They contributed nothing. The partnership received a $1, 850, 000 nonrecourse loan from an S & L— 100% nonrecourse financing from a third party lender. Later, 4 friends/relatives were admitted to the partnership. These partners contributed $45, 000. In first two years, $440, 000 in deductions were taken: $395, 000 depreciation; $45, 000 other. Partnership’s adjusted basis in the property: $ 1, 850, 000 Initial Basis (Cost) - 395, 000 Depreciation $ 1, 455, 000 Adjusted Basis Donald J. Weidner 34

Commissioner v. Tufts (1983) (Text p. 940) Builder (Pelt) and his corporation formed a partnership to construct an apartment complex. They contributed nothing. The partnership received a $1, 850, 000 nonrecourse loan from an S & L— 100% nonrecourse financing from a third party lender. Later, 4 friends/relatives were admitted to the partnership. These partners contributed $45, 000. In first two years, $440, 000 in deductions were taken: $395, 000 depreciation; $45, 000 other. Partnership’s adjusted basis in the property: $ 1, 850, 000 Initial Basis (Cost) - 395, 000 Depreciation $ 1, 455, 000 Adjusted Basis Donald J. Weidner 34

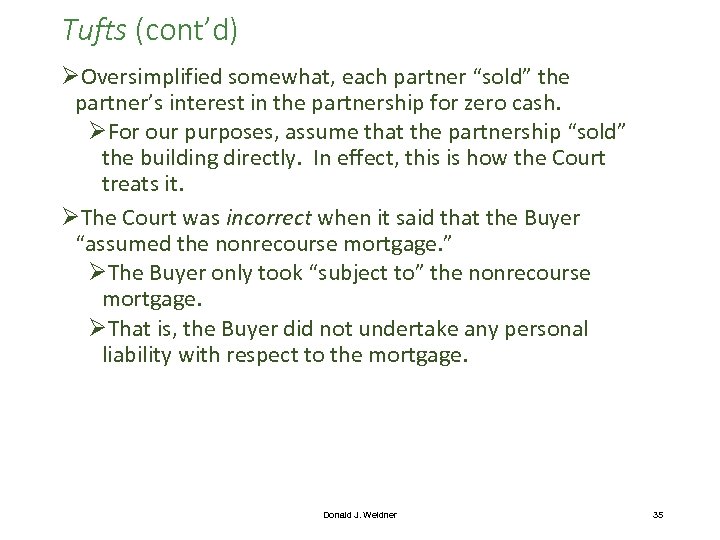

Tufts (cont’d) ØOversimplified somewhat, each partner “sold” the partner’s interest in the partnership for zero cash. ØFor our purposes, assume that the partnership “sold” the building directly. In effect, this is how the Court treats it. ØThe Court was incorrect when it said that the Buyer “assumed the nonrecourse mortgage. ” ØThe Buyer only took “subject to” the nonrecourse mortgage. ØThat is, the Buyer did not undertake any personal liability with respect to the mortgage. Donald J. Weidner 35

Tufts (cont’d) ØOversimplified somewhat, each partner “sold” the partner’s interest in the partnership for zero cash. ØFor our purposes, assume that the partnership “sold” the building directly. In effect, this is how the Court treats it. ØThe Court was incorrect when it said that the Buyer “assumed the nonrecourse mortgage. ” ØThe Buyer only took “subject to” the nonrecourse mortgage. ØThat is, the Buyer did not undertake any personal liability with respect to the mortgage. Donald J. Weidner 35

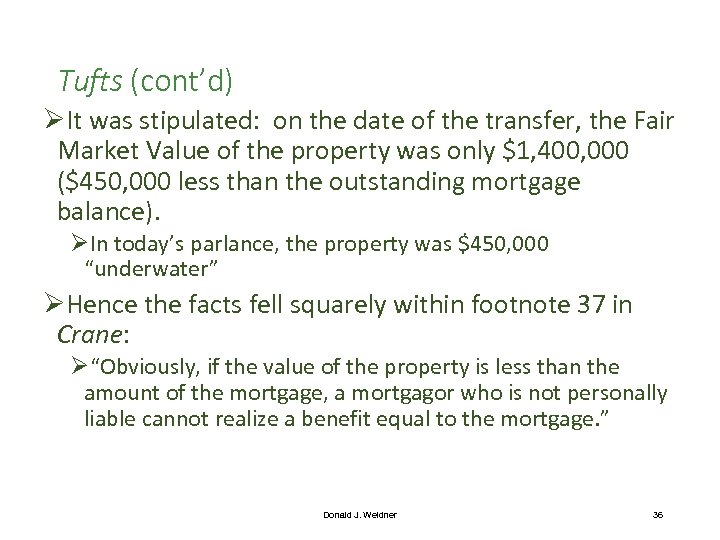

Tufts (cont’d) ØIt was stipulated: on the date of the transfer, the Fair Market Value of the property was only $1, 400, 000 ($450, 000 less than the outstanding mortgage balance). ØIn today’s parlance, the property was $450, 000 “underwater” ØHence the facts fell squarely within footnote 37 in Crane: Ø“Obviously, if the value of the property is less than the amount of the mortgage, a mortgagor who is not personally liable cannot realize a benefit equal to the mortgage. ” Donald J. Weidner 36

Tufts (cont’d) ØIt was stipulated: on the date of the transfer, the Fair Market Value of the property was only $1, 400, 000 ($450, 000 less than the outstanding mortgage balance). ØIn today’s parlance, the property was $450, 000 “underwater” ØHence the facts fell squarely within footnote 37 in Crane: Ø“Obviously, if the value of the property is less than the amount of the mortgage, a mortgagor who is not personally liable cannot realize a benefit equal to the mortgage. ” Donald J. Weidner 36

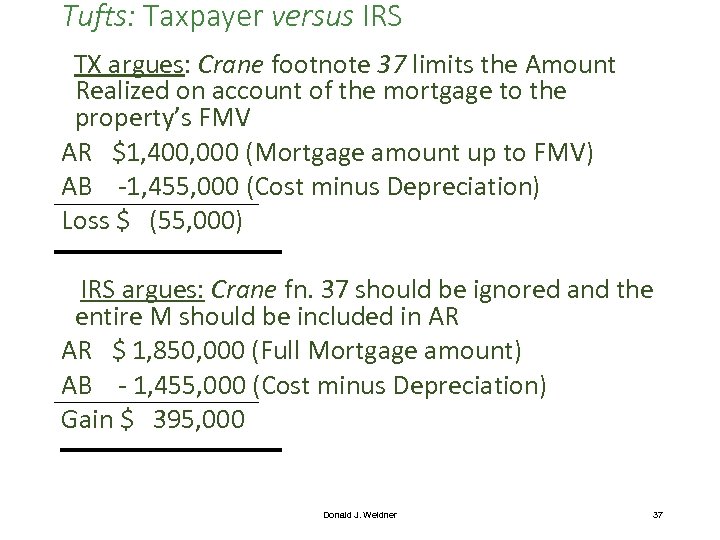

Tufts: Taxpayer versus IRS TX argues: Crane footnote 37 limits the Amount Realized on account of the mortgage to the property’s FMV AR $1, 400, 000 (Mortgage amount up to FMV) AB -1, 455, 000 (Cost minus Depreciation) Loss $ (55, 000) IRS argues: Crane fn. 37 should be ignored and the entire M should be included in AR AR $ 1, 850, 000 (Full Mortgage amount) AB - 1, 455, 000 (Cost minus Depreciation) Gain $ 395, 000 Donald J. Weidner 37

Tufts: Taxpayer versus IRS TX argues: Crane footnote 37 limits the Amount Realized on account of the mortgage to the property’s FMV AR $1, 400, 000 (Mortgage amount up to FMV) AB -1, 455, 000 (Cost minus Depreciation) Loss $ (55, 000) IRS argues: Crane fn. 37 should be ignored and the entire M should be included in AR AR $ 1, 850, 000 (Full Mortgage amount) AB - 1, 455, 000 (Cost minus Depreciation) Gain $ 395, 000 Donald J. Weidner 37

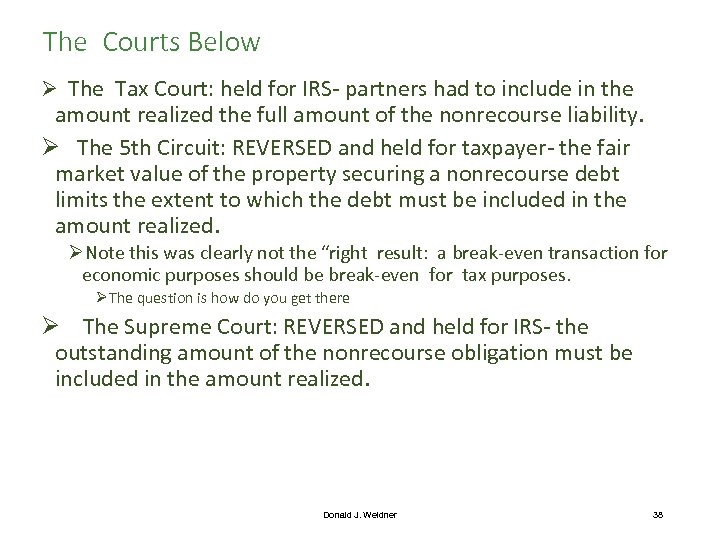

The Courts Below Ø The Tax Court: held for IRS- partners had to include in the amount realized the full amount of the nonrecourse liability. Ø The 5 th Circuit: REVERSED and held for taxpayer- the fair market value of the property securing a nonrecourse debt limits the extent to which the debt must be included in the amount realized. ØNote this was clearly not the “right result: a break-even transaction for economic purposes should be break-even for tax purposes. ØThe question is how do you get there Ø The Supreme Court: REVERSED and held for IRS- the outstanding amount of the nonrecourse obligation must be included in the amount realized. Donald J. Weidner 38

The Courts Below Ø The Tax Court: held for IRS- partners had to include in the amount realized the full amount of the nonrecourse liability. Ø The 5 th Circuit: REVERSED and held for taxpayer- the fair market value of the property securing a nonrecourse debt limits the extent to which the debt must be included in the amount realized. ØNote this was clearly not the “right result: a break-even transaction for economic purposes should be break-even for tax purposes. ØThe question is how do you get there Ø The Supreme Court: REVERSED and held for IRS- the outstanding amount of the nonrecourse obligation must be included in the amount realized. Donald J. Weidner 38

TUFTS THEORIES OF TAX TREATMENT ON “RELIEF” FROM THE MORTGAGE 1) 2) 3) 4) 5) 6) 7) THEORIES MENTIONED BY JUSTICE BLACKMUN Economic Benefit Cancellation of Indebtedness Co-Investment Tax Benefit Double Deduction Bifurcated Transaction Balancing Entry Donald J. Weidner 39

TUFTS THEORIES OF TAX TREATMENT ON “RELIEF” FROM THE MORTGAGE 1) 2) 3) 4) 5) 6) 7) THEORIES MENTIONED BY JUSTICE BLACKMUN Economic Benefit Cancellation of Indebtedness Co-Investment Tax Benefit Double Deduction Bifurcated Transaction Balancing Entry Donald J. Weidner 39

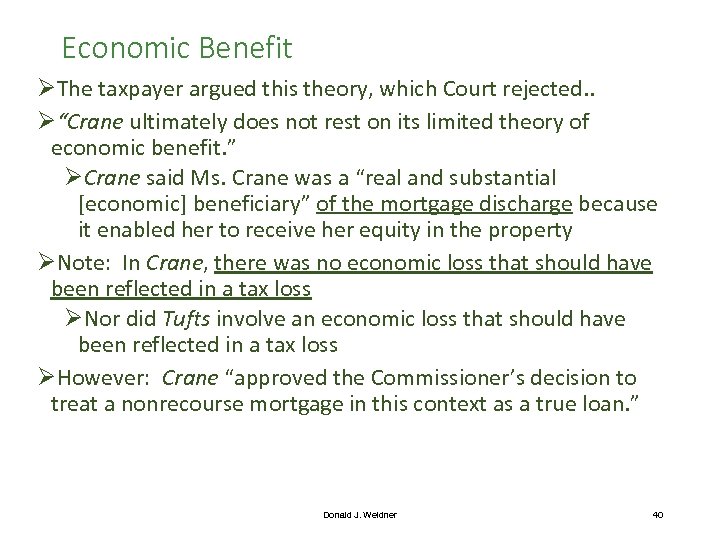

Economic Benefit ØThe taxpayer argued this theory, which Court rejected. . Ø“Crane ultimately does not rest on its limited theory of economic benefit. ” ØCrane said Ms. Crane was a “real and substantial [economic] beneficiary” of the mortgage discharge because it enabled her to receive her equity in the property ØNote: In Crane, there was no economic loss that should have been reflected in a tax loss ØNor did Tufts involve an economic loss that should have been reflected in a tax loss ØHowever: Crane “approved the Commissioner’s decision to treat a nonrecourse mortgage in this context as a true loan. ” Donald J. Weidner 40

Economic Benefit ØThe taxpayer argued this theory, which Court rejected. . Ø“Crane ultimately does not rest on its limited theory of economic benefit. ” ØCrane said Ms. Crane was a “real and substantial [economic] beneficiary” of the mortgage discharge because it enabled her to receive her equity in the property ØNote: In Crane, there was no economic loss that should have been reflected in a tax loss ØNor did Tufts involve an economic loss that should have been reflected in a tax loss ØHowever: Crane “approved the Commissioner’s decision to treat a nonrecourse mortgage in this context as a true loan. ” Donald J. Weidner 40

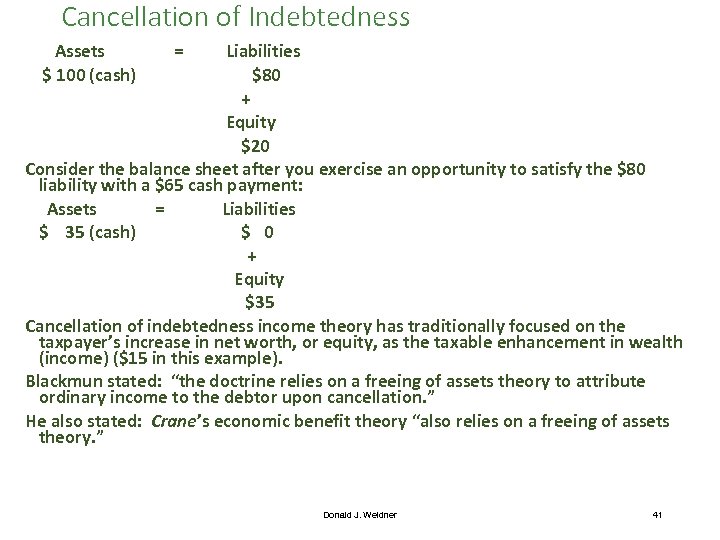

Cancellation of Indebtedness Assets = Liabilities $ 100 (cash) $80 + Equity $20 Consider the balance sheet after you exercise an opportunity to satisfy the $80 liability with a $65 cash payment: Assets = Liabilities $ 35 (cash) $ 0 + Equity $35 Cancellation of indebtedness income theory has traditionally focused on the taxpayer’s increase in net worth, or equity, as the taxable enhancement in wealth (income) ($15 in this example). Blackmun stated: “the doctrine relies on a freeing of assets theory to attribute ordinary income to the debtor upon cancellation. ” He also stated: Crane’s economic benefit theory “also relies on a freeing of assets theory. ” Donald J. Weidner 41

Cancellation of Indebtedness Assets = Liabilities $ 100 (cash) $80 + Equity $20 Consider the balance sheet after you exercise an opportunity to satisfy the $80 liability with a $65 cash payment: Assets = Liabilities $ 35 (cash) $ 0 + Equity $35 Cancellation of indebtedness income theory has traditionally focused on the taxpayer’s increase in net worth, or equity, as the taxable enhancement in wealth (income) ($15 in this example). Blackmun stated: “the doctrine relies on a freeing of assets theory to attribute ordinary income to the debtor upon cancellation. ” He also stated: Crane’s economic benefit theory “also relies on a freeing of assets theory. ” Donald J. Weidner 41

Coinvestment Theory ØBasic concept: the nonrecourse lender is, as a practical economic matter, a co-investor with the borrower and should be so treated (making part of the investment qualifies you for part of the basis) ØIRS and Court reject the coinvestment theory ØCourt says Crane stands for the proposition that the lender gets no basis (made no investment). See fn. 5: “The [IRS] might have adopted theory. . . that a nonrecourse mortgage is not true debt, but, instead, is a form of joint investment by the mortgagor and the mortgagee. On this approach, nonrecourse debt would be considered a contingent liability, under which the mortgagor’s payments on the debt gradually increase his interest in the property while decreasing that of the mortgagee. Because the taxpayer’s investment in the property would not include the nonrecourse debt, the taxpayer would not be permitted to include that debt in basis. ” Donald J. Weidner 42

Coinvestment Theory ØBasic concept: the nonrecourse lender is, as a practical economic matter, a co-investor with the borrower and should be so treated (making part of the investment qualifies you for part of the basis) ØIRS and Court reject the coinvestment theory ØCourt says Crane stands for the proposition that the lender gets no basis (made no investment). See fn. 5: “The [IRS] might have adopted theory. . . that a nonrecourse mortgage is not true debt, but, instead, is a form of joint investment by the mortgagor and the mortgagee. On this approach, nonrecourse debt would be considered a contingent liability, under which the mortgagor’s payments on the debt gradually increase his interest in the property while decreasing that of the mortgagee. Because the taxpayer’s investment in the property would not include the nonrecourse debt, the taxpayer would not be permitted to include that debt in basis. ” Donald J. Weidner 42

Tax Benefit Theory A tax benefit approach might focus on the $395, 000 depreciation deductions that were taken by a taxpayer who suffered no economic depreciation. ØThat is, there is a need to offset an earlier deduction that was permitted because of an economic assumption that was subsequently proven to have been incorrect Ø Analogy: if I deduct a payment as a business expense this year, and get a refund of that payment next year, I must correct the error. ØConversely, if I report a retainer as income this year and have to refund it next year, I get to correct the earlier inclusion in income. Tufts rejected a tax benefit approach: “Our analysis applies even in the situation in which no deductions are taken. ” Donald J. Weidner 43

Tax Benefit Theory A tax benefit approach might focus on the $395, 000 depreciation deductions that were taken by a taxpayer who suffered no economic depreciation. ØThat is, there is a need to offset an earlier deduction that was permitted because of an economic assumption that was subsequently proven to have been incorrect Ø Analogy: if I deduct a payment as a business expense this year, and get a refund of that payment next year, I must correct the error. ØConversely, if I report a retainer as income this year and have to refund it next year, I get to correct the earlier inclusion in income. Tufts rejected a tax benefit approach: “Our analysis applies even in the situation in which no deductions are taken. ” Donald J. Weidner 43

Tax Benefit Theory (cont’d) ØSee footnote 8: “Our analysis. . . focuses on the obligation to repay and its subsequent extinguishment, not on the taking and recovery of deductions. ” ØThe tax benefit the IRS focused on was the depreciation deductions. ØQuestion: Is not an exclusion a tax benefit that is similar to a deduction? ØConsider the prior untaxed receipt of the purchase money loan proceeds Øthe taxpayer does not report the loan proceeds as income because their receipt is offset by an accompanying obligation to repay ØPerhaps the receipt of loan proceeds is not like a deduction because there is no enhancement in wealth Donald J. Weidner 44

Tax Benefit Theory (cont’d) ØSee footnote 8: “Our analysis. . . focuses on the obligation to repay and its subsequent extinguishment, not on the taking and recovery of deductions. ” ØThe tax benefit the IRS focused on was the depreciation deductions. ØQuestion: Is not an exclusion a tax benefit that is similar to a deduction? ØConsider the prior untaxed receipt of the purchase money loan proceeds Øthe taxpayer does not report the loan proceeds as income because their receipt is offset by an accompanying obligation to repay ØPerhaps the receipt of loan proceeds is not like a deduction because there is no enhancement in wealth Donald J. Weidner 44

Double Deduction Theory Ø Millar v. Commissioner, 557 F. 2 d 212 (3 d Cir. 1978), had held that the principal reason for the Crane holding was to prevent taxpayers from enjoying a double deduction. ØThe taxpayer here took the position that, after taking the $395, 000 depreciation deduction, it also should be allowed a $55, 000 loss on sale Ødespite an economic break-even result ØThe IRS argued that this falls within the "double deduction" concern. ØThe Supreme Court took a different approach. Donald J. Weidner 45

Double Deduction Theory Ø Millar v. Commissioner, 557 F. 2 d 212 (3 d Cir. 1978), had held that the principal reason for the Crane holding was to prevent taxpayers from enjoying a double deduction. ØThe taxpayer here took the position that, after taking the $395, 000 depreciation deduction, it also should be allowed a $55, 000 loss on sale Ødespite an economic break-even result ØThe IRS argued that this falls within the "double deduction" concern. ØThe Supreme Court took a different approach. Donald J. Weidner 45

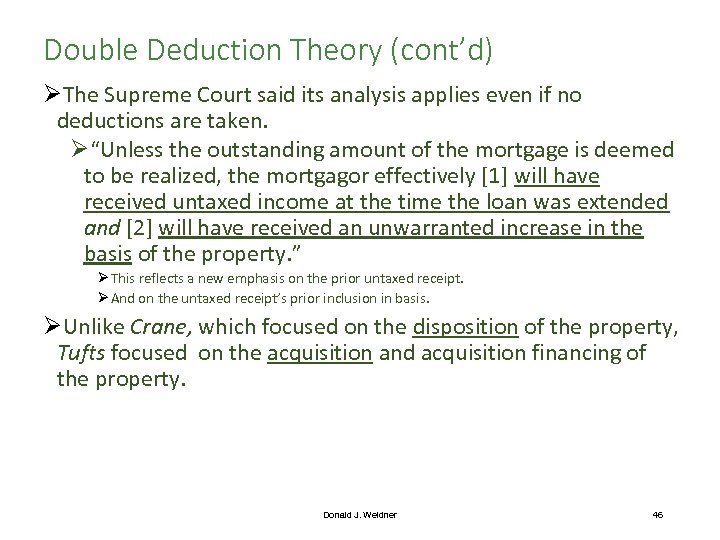

Double Deduction Theory (cont’d) ØThe Supreme Court said its analysis applies even if no deductions are taken. Ø“Unless the outstanding amount of the mortgage is deemed to be realized, the mortgagor effectively [1] will have received untaxed income at the time the loan was extended and [2] will have received an unwarranted increase in the basis of the property. ” Ø This reflects a new emphasis on the prior untaxed receipt. Ø And on the untaxed receipt’s prior inclusion in basis. ØUnlike Crane, which focused on the disposition of the property, Tufts focused on the acquisition and acquisition financing of the property. Donald J. Weidner 46

Double Deduction Theory (cont’d) ØThe Supreme Court said its analysis applies even if no deductions are taken. Ø“Unless the outstanding amount of the mortgage is deemed to be realized, the mortgagor effectively [1] will have received untaxed income at the time the loan was extended and [2] will have received an unwarranted increase in the basis of the property. ” Ø This reflects a new emphasis on the prior untaxed receipt. Ø And on the untaxed receipt’s prior inclusion in basis. ØUnlike Crane, which focused on the disposition of the property, Tufts focused on the acquisition and acquisition financing of the property. Donald J. Weidner 46

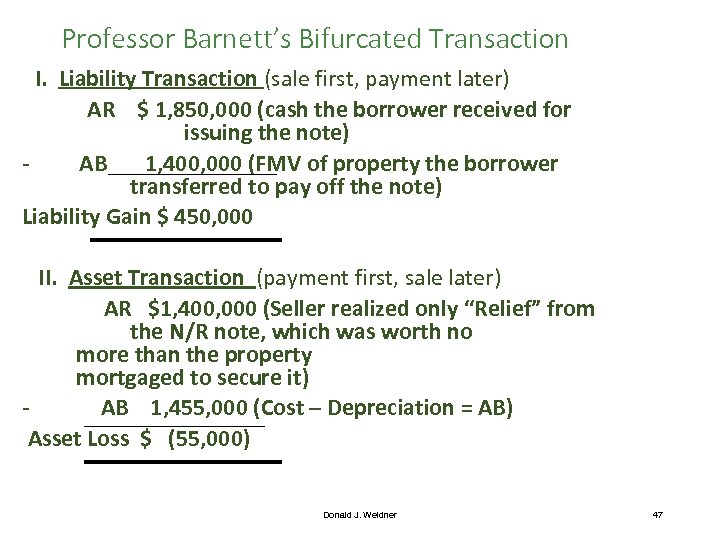

Professor Barnett’s Bifurcated Transaction I. Liability Transaction (sale first, payment later) AR $ 1, 850, 000 (cash the borrower received for issuing the note) AB 1, 400, 000 (FMV of property the borrower transferred to pay off the note) Liability Gain $ 450, 000 II. Asset Transaction (payment first, sale later) AR $1, 400, 000 (Seller realized only “Relief” from the N/R note, which was worth no more than the property mortgaged to secure it) AB 1, 455, 000 (Cost – Depreciation = AB) Asset Loss $ (55, 000) Donald J. Weidner 47

Professor Barnett’s Bifurcated Transaction I. Liability Transaction (sale first, payment later) AR $ 1, 850, 000 (cash the borrower received for issuing the note) AB 1, 400, 000 (FMV of property the borrower transferred to pay off the note) Liability Gain $ 450, 000 II. Asset Transaction (payment first, sale later) AR $1, 400, 000 (Seller realized only “Relief” from the N/R note, which was worth no more than the property mortgaged to secure it) AB 1, 455, 000 (Cost – Depreciation = AB) Asset Loss $ (55, 000) Donald J. Weidner 47

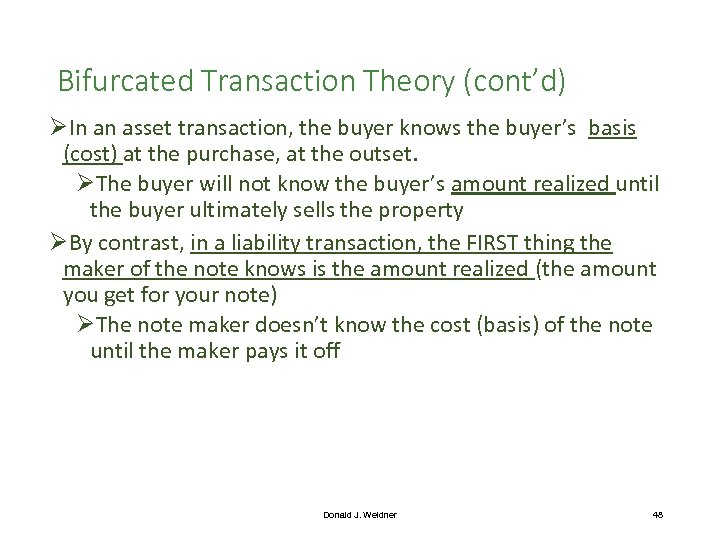

Bifurcated Transaction Theory (cont’d) ØIn an asset transaction, the buyer knows the buyer’s basis (cost) at the purchase, at the outset. ØThe buyer will not know the buyer’s amount realized until the buyer ultimately sells the property ØBy contrast, in a liability transaction, the FIRST thing the maker of the note knows is the amount realized (the amount you get for your note) ØThe note maker doesn’t know the cost (basis) of the note until the maker pays it off Donald J. Weidner 48

Bifurcated Transaction Theory (cont’d) ØIn an asset transaction, the buyer knows the buyer’s basis (cost) at the purchase, at the outset. ØThe buyer will not know the buyer’s amount realized until the buyer ultimately sells the property ØBy contrast, in a liability transaction, the FIRST thing the maker of the note knows is the amount realized (the amount you get for your note) ØThe note maker doesn’t know the cost (basis) of the note until the maker pays it off Donald J. Weidner 48

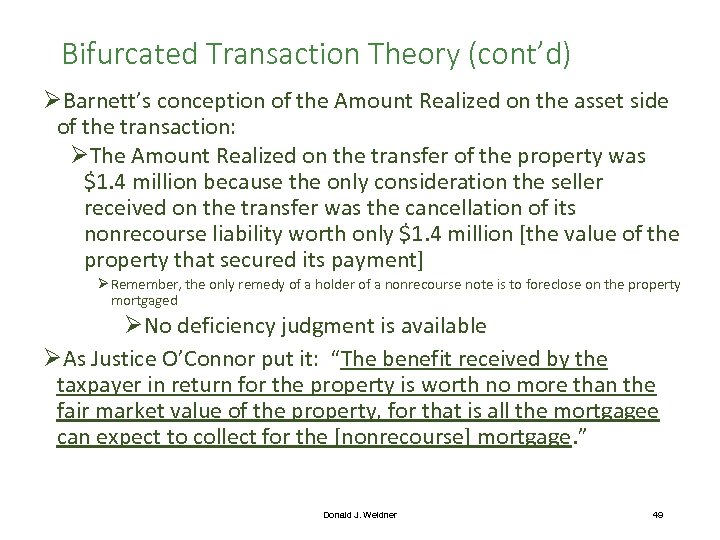

Bifurcated Transaction Theory (cont’d) ØBarnett’s conception of the Amount Realized on the asset side of the transaction: ØThe Amount Realized on the transfer of the property was $1. 4 million because the only consideration the seller received on the transfer was the cancellation of its nonrecourse liability worth only $1. 4 million [the value of the property that secured its payment] Ø Remember, the only remedy of a holder of a nonrecourse note is to foreclose on the property mortgaged ØNo deficiency judgment is available ØAs Justice O’Connor put it: “The benefit received by the taxpayer in return for the property is worth no more than the fair market value of the property, for that is all the mortgagee can expect to collect for the [nonrecourse] mortgage. ” Donald J. Weidner 49

Bifurcated Transaction Theory (cont’d) ØBarnett’s conception of the Amount Realized on the asset side of the transaction: ØThe Amount Realized on the transfer of the property was $1. 4 million because the only consideration the seller received on the transfer was the cancellation of its nonrecourse liability worth only $1. 4 million [the value of the property that secured its payment] Ø Remember, the only remedy of a holder of a nonrecourse note is to foreclose on the property mortgaged ØNo deficiency judgment is available ØAs Justice O’Connor put it: “The benefit received by the taxpayer in return for the property is worth no more than the fair market value of the property, for that is all the mortgagee can expect to collect for the [nonrecourse] mortgage. ” Donald J. Weidner 49

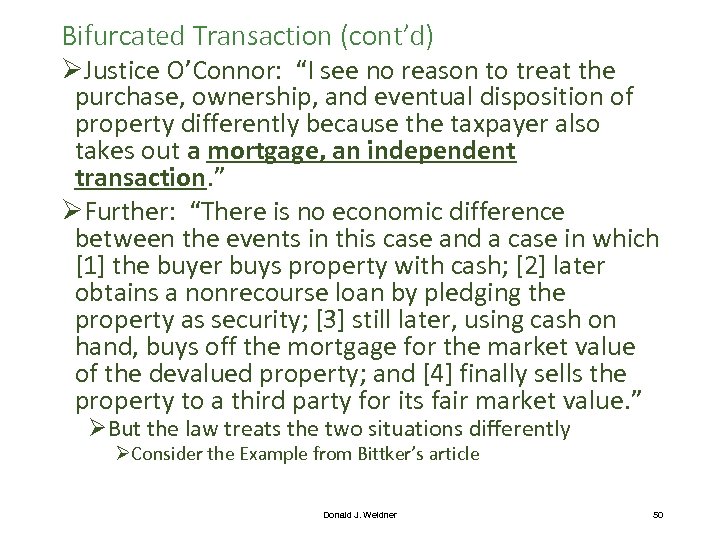

Bifurcated Transaction (cont’d) ØJustice O’Connor: “I see no reason to treat the purchase, ownership, and eventual disposition of property differently because the taxpayer also takes out a mortgage, an independent transaction. ” ØFurther: “There is no economic difference between the events in this case and a case in which [1] the buyer buys property with cash; [2] later obtains a nonrecourse loan by pledging the property as security; [3] still later, using cash on hand, buys off the mortgage for the market value of the devalued property; and [4] finally sells the property to a third party for its fair market value. ” ØBut the law treats the two situations differently ØConsider the Example from Bittker’s article Donald J. Weidner 50

Bifurcated Transaction (cont’d) ØJustice O’Connor: “I see no reason to treat the purchase, ownership, and eventual disposition of property differently because the taxpayer also takes out a mortgage, an independent transaction. ” ØFurther: “There is no economic difference between the events in this case and a case in which [1] the buyer buys property with cash; [2] later obtains a nonrecourse loan by pledging the property as security; [3] still later, using cash on hand, buys off the mortgage for the market value of the devalued property; and [4] finally sells the property to a third party for its fair market value. ” ØBut the law treats the two situations differently ØConsider the Example from Bittker’s article Donald J. Weidner 50

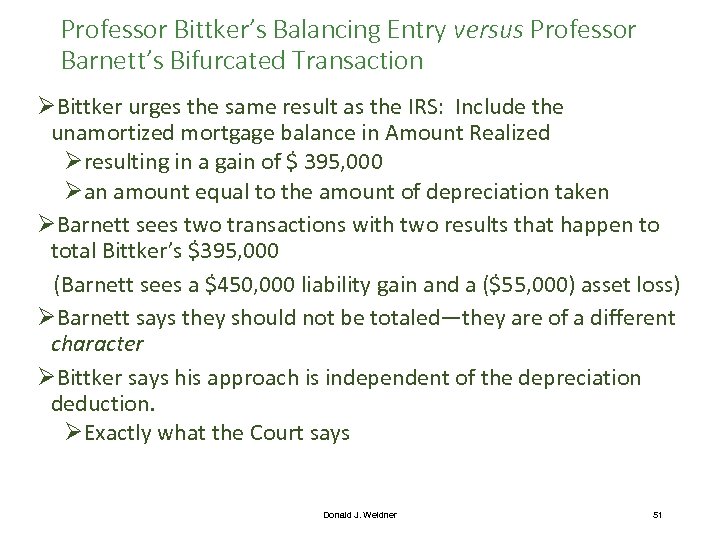

Professor Bittker’s Balancing Entry versus Professor Barnett’s Bifurcated Transaction ØBittker urges the same result as the IRS: Include the unamortized mortgage balance in Amount Realized Øresulting in a gain of $ 395, 000 Øan amount equal to the amount of depreciation taken ØBarnett sees two transactions with two results that happen to total Bittker’s $395, 000 (Barnett sees a $450, 000 liability gain and a ($55, 000) asset loss) ØBarnett says they should not be totaled—they are of a different character ØBittker says his approach is independent of the depreciation deduction. ØExactly what the Court says Donald J. Weidner 51

Professor Bittker’s Balancing Entry versus Professor Barnett’s Bifurcated Transaction ØBittker urges the same result as the IRS: Include the unamortized mortgage balance in Amount Realized Øresulting in a gain of $ 395, 000 Øan amount equal to the amount of depreciation taken ØBarnett sees two transactions with two results that happen to total Bittker’s $395, 000 (Barnett sees a $450, 000 liability gain and a ($55, 000) asset loss) ØBarnett says they should not be totaled—they are of a different character ØBittker says his approach is independent of the depreciation deduction. ØExactly what the Court says Donald J. Weidner 51

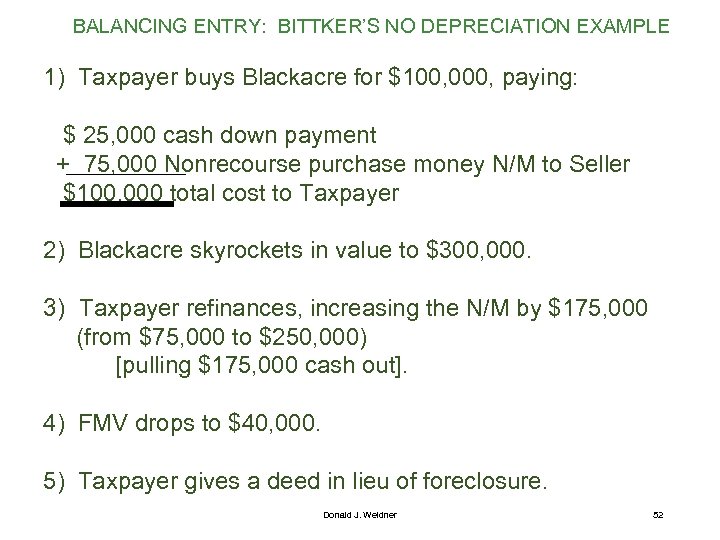

BALANCING ENTRY: BITTKER’S NO DEPRECIATION EXAMPLE 1) Taxpayer buys Blackacre for $100, 000, paying: $ 25, 000 cash down payment + 75, 000 Nonrecourse purchase money N/M to Seller $100, 000 total cost to Taxpayer 2) Blackacre skyrockets in value to $300, 000. 3) Taxpayer refinances, increasing the N/M by $175, 000 (from $75, 000 to $250, 000) [pulling $175, 000 cash out]. 4) FMV drops to $40, 000. 5) Taxpayer gives a deed in lieu of foreclosure. Donald J. Weidner 52

BALANCING ENTRY: BITTKER’S NO DEPRECIATION EXAMPLE 1) Taxpayer buys Blackacre for $100, 000, paying: $ 25, 000 cash down payment + 75, 000 Nonrecourse purchase money N/M to Seller $100, 000 total cost to Taxpayer 2) Blackacre skyrockets in value to $300, 000. 3) Taxpayer refinances, increasing the N/M by $175, 000 (from $75, 000 to $250, 000) [pulling $175, 000 cash out]. 4) FMV drops to $40, 000. 5) Taxpayer gives a deed in lieu of foreclosure. Donald J. Weidner 52

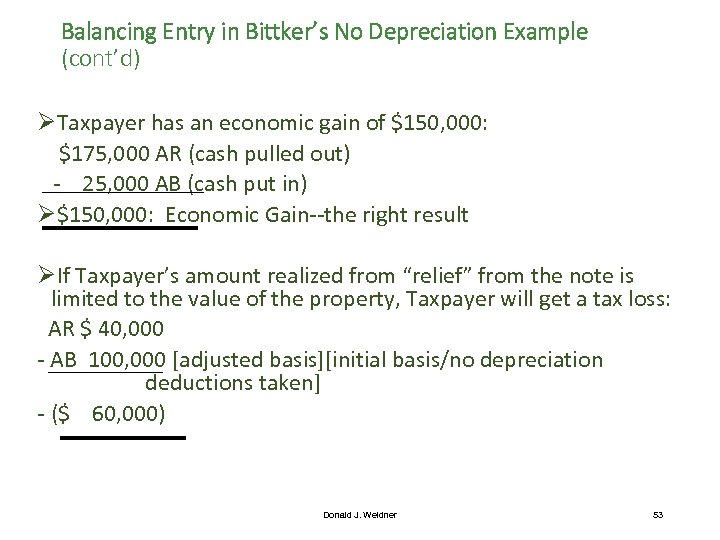

Balancing Entry in Bittker’s No Depreciation Example (cont’d) ØTaxpayer has an economic gain of $150, 000: $175, 000 AR (cash pulled out) - 25, 000 AB (cash put in) Ø$150, 000: Economic Gain--the right result ØIf Taxpayer’s amount realized from “relief” from the note is limited to the value of the property, Taxpayer will get a tax loss: AR $ 40, 000 - AB 100, 000 [adjusted basis][initial basis/no depreciation deductions taken] - ($ 60, 000) Donald J. Weidner 53

Balancing Entry in Bittker’s No Depreciation Example (cont’d) ØTaxpayer has an economic gain of $150, 000: $175, 000 AR (cash pulled out) - 25, 000 AB (cash put in) Ø$150, 000: Economic Gain--the right result ØIf Taxpayer’s amount realized from “relief” from the note is limited to the value of the property, Taxpayer will get a tax loss: AR $ 40, 000 - AB 100, 000 [adjusted basis][initial basis/no depreciation deductions taken] - ($ 60, 000) Donald J. Weidner 53

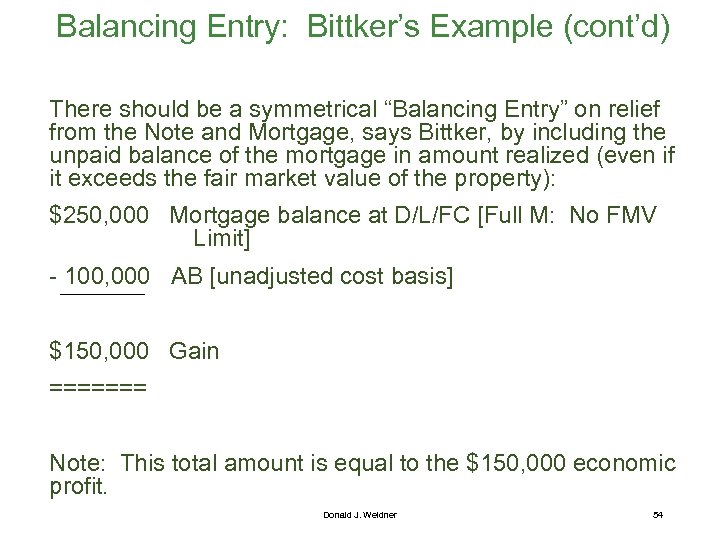

Balancing Entry: Bittker’s Example (cont’d) There should be a symmetrical “Balancing Entry” on relief from the Note and Mortgage, says Bittker, by including the unpaid balance of the mortgage in amount realized (even if it exceeds the fair market value of the property): $250, 000 Mortgage balance at D/L/FC [Full M: No FMV Limit] - 100, 000 AB [unadjusted cost basis] $150, 000 Gain ======= Note: This total amount is equal to the $150, 000 economic profit. Donald J. Weidner 54

Balancing Entry: Bittker’s Example (cont’d) There should be a symmetrical “Balancing Entry” on relief from the Note and Mortgage, says Bittker, by including the unpaid balance of the mortgage in amount realized (even if it exceeds the fair market value of the property): $250, 000 Mortgage balance at D/L/FC [Full M: No FMV Limit] - 100, 000 AB [unadjusted cost basis] $150, 000 Gain ======= Note: This total amount is equal to the $150, 000 economic profit. Donald J. Weidner 54

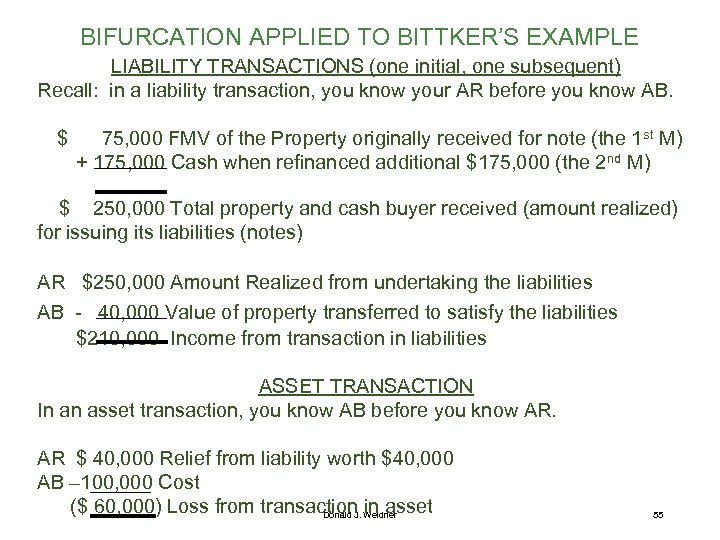

BIFURCATION APPLIED TO BITTKER’S EXAMPLE LIABILITY TRANSACTIONS (one initial, one subsequent) Recall: in a liability transaction, you know your AR before you know AB. $ 75, 000 FMV of the Property originally received for note (the 1 st M) + 175, 000 Cash when refinanced additional $175, 000 (the 2 nd M) $ 250, 000 Total property and cash buyer received (amount realized) for issuing its liabilities (notes) AR $250, 000 Amount Realized from undertaking the liabilities AB - 40, 000 Value of property transferred to satisfy the liabilities $210, 000 Income from transaction in liabilities ASSET TRANSACTION In an asset transaction, you know AB before you know AR. AR $ 40, 000 Relief from liability worth $40, 000 AB – 100, 000 Cost ($ 60, 000) Loss from transaction Weidner in asset Donald J. 55

BIFURCATION APPLIED TO BITTKER’S EXAMPLE LIABILITY TRANSACTIONS (one initial, one subsequent) Recall: in a liability transaction, you know your AR before you know AB. $ 75, 000 FMV of the Property originally received for note (the 1 st M) + 175, 000 Cash when refinanced additional $175, 000 (the 2 nd M) $ 250, 000 Total property and cash buyer received (amount realized) for issuing its liabilities (notes) AR $250, 000 Amount Realized from undertaking the liabilities AB - 40, 000 Value of property transferred to satisfy the liabilities $210, 000 Income from transaction in liabilities ASSET TRANSACTION In an asset transaction, you know AB before you know AR. AR $ 40, 000 Relief from liability worth $40, 000 AB – 100, 000 Cost ($ 60, 000) Loss from transaction Weidner in asset Donald J. 55

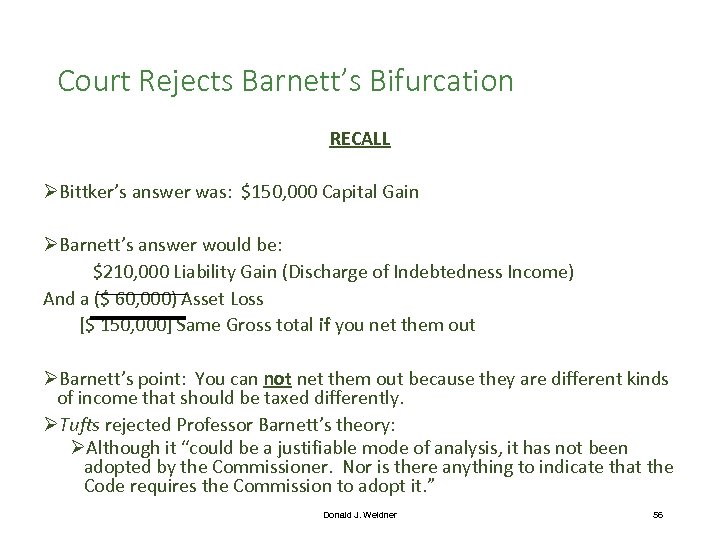

Court Rejects Barnett’s Bifurcation RECALL ØBittker’s answer was: $150, 000 Capital Gain ØBarnett’s answer would be: $210, 000 Liability Gain (Discharge of Indebtedness Income) And a ($ 60, 000) Asset Loss [$ 150, 000] Same Gross total if you net them out ØBarnett’s point: You can not net them out because they are different kinds of income that should be taxed differently. ØTufts rejected Professor Barnett’s theory: ØAlthough it “could be a justifiable mode of analysis, it has not been adopted by the Commissioner. Nor is there anything to indicate that the Code requires the Commission to adopt it. ” Donald J. Weidner 56

Court Rejects Barnett’s Bifurcation RECALL ØBittker’s answer was: $150, 000 Capital Gain ØBarnett’s answer would be: $210, 000 Liability Gain (Discharge of Indebtedness Income) And a ($ 60, 000) Asset Loss [$ 150, 000] Same Gross total if you net them out ØBarnett’s point: You can not net them out because they are different kinds of income that should be taxed differently. ØTufts rejected Professor Barnett’s theory: ØAlthough it “could be a justifiable mode of analysis, it has not been adopted by the Commissioner. Nor is there anything to indicate that the Code requires the Commission to adopt it. ” Donald J. Weidner 56

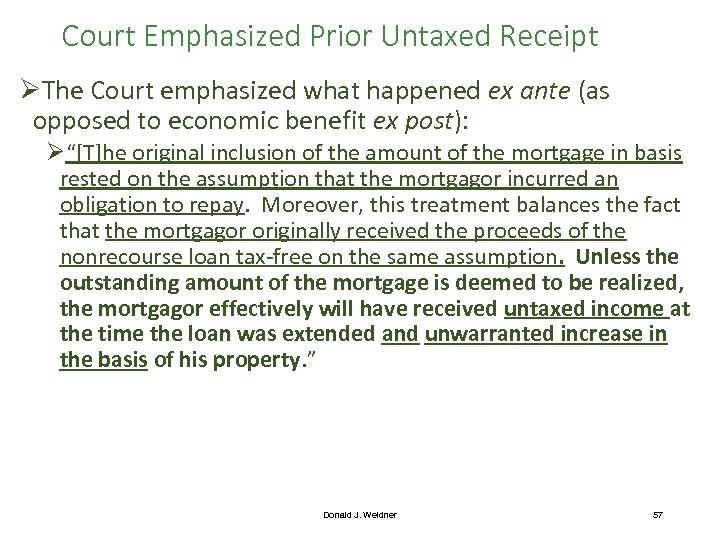

Court Emphasized Prior Untaxed Receipt ØThe Court emphasized what happened ex ante (as opposed to economic benefit ex post): Ø“[T]he original inclusion of the amount of the mortgage in basis rested on the assumption that the mortgagor incurred an obligation to repay. Moreover, this treatment balances the fact that the mortgagor originally received the proceeds of the nonrecourse loan tax-free on the same assumption. Unless the outstanding amount of the mortgage is deemed to be realized, the mortgagor effectively will have received untaxed income at the time the loan was extended and unwarranted increase in the basis of his property. ” Donald J. Weidner 57

Court Emphasized Prior Untaxed Receipt ØThe Court emphasized what happened ex ante (as opposed to economic benefit ex post): Ø“[T]he original inclusion of the amount of the mortgage in basis rested on the assumption that the mortgagor incurred an obligation to repay. Moreover, this treatment balances the fact that the mortgagor originally received the proceeds of the nonrecourse loan tax-free on the same assumption. Unless the outstanding amount of the mortgage is deemed to be realized, the mortgagor effectively will have received untaxed income at the time the loan was extended and unwarranted increase in the basis of his property. ” Donald J. Weidner 57

Tufts: Changed Little ØThe Tufts opinion itself left intact tax shelters that offer both ØConversion and ØDeferral ØThe Tufts opinion itself left intact the use of nonrecourse mortgages. ØThe Tufts opinion said that the nonrecourse nature of a loan Ø“does not alter the nature of the obligation; its only effect is to shift from the borrower to the lender any potential loss caused by devaluation of the property. ” Donald J. Weidner 58

Tufts: Changed Little ØThe Tufts opinion itself left intact tax shelters that offer both ØConversion and ØDeferral ØThe Tufts opinion itself left intact the use of nonrecourse mortgages. ØThe Tufts opinion said that the nonrecourse nature of a loan Ø“does not alter the nature of the obligation; its only effect is to shift from the borrower to the lender any potential loss caused by devaluation of the property. ” Donald J. Weidner 58

Tufts: Requires Symmetry Ø“We. . . hold that a taxpayer must account for the proceeds of obligations he has received tax-free and included in basis. Nothing. . . requires the Commissioner to permit a taxpayer to treat a sale of encumbered property asymmetrically, by including the proceeds of the nonrecourse obligation in basis but not accounting for the proceeds upon transfer of the property. ” ØThis sounds like Bittker’s Balancing Entry approach Donald J. Weidner 59

Tufts: Requires Symmetry Ø“We. . . hold that a taxpayer must account for the proceeds of obligations he has received tax-free and included in basis. Nothing. . . requires the Commissioner to permit a taxpayer to treat a sale of encumbered property asymmetrically, by including the proceeds of the nonrecourse obligation in basis but not accounting for the proceeds upon transfer of the property. ” ØThis sounds like Bittker’s Balancing Entry approach Donald J. Weidner 59

Tufts Does Not Validate Inclusion of Inflated Purchase Money Notes in Basis ØThe Court does not state that a nonrecourse purchase money note in excess of the value of property may be included in basis at the outset. ØThe law has never said that nonrecourse notes inflated past value may be included in basis (recall Leonard Marcus). ØThe Court only states how a nonrecourse note that was initially properly included in basis must be treated when the taxpayer ultimately transfers the property. Donald J. Weidner 60

Tufts Does Not Validate Inclusion of Inflated Purchase Money Notes in Basis ØThe Court does not state that a nonrecourse purchase money note in excess of the value of property may be included in basis at the outset. ØThe law has never said that nonrecourse notes inflated past value may be included in basis (recall Leonard Marcus). ØThe Court only states how a nonrecourse note that was initially properly included in basis must be treated when the taxpayer ultimately transfers the property. Donald J. Weidner 60

Some Discharge on Transfer Is Discharge of Indebtedness Income (Supplement pp. 95, 93) ØIRC sec. 7701(g) (Supp. 95)(enacted in 1984)(the year after Tufts): Ø“[I]n determining the amount of any gain or loss. . . with respect to any property, the fair market value of such property shall be treated as being not less than the amount of any nonrecourse indebtedness to which such property is subject. ” ØHowever: Some mortgage discharge on disposition is treated as discharge of indebtedness income. ØTreas. Reg. sec. 1. 1001 -2(a), Ex. 8 (Supp. P. 93) deals with a transfer of property to a creditor in which the creditor discharges a recourse note in excess of the value of property. It states that the note is included in Amount Realized only to the extent of the value of the property, and results in discharge of indebtedness income beyond that. Donald J. Weidner 61

Some Discharge on Transfer Is Discharge of Indebtedness Income (Supplement pp. 95, 93) ØIRC sec. 7701(g) (Supp. 95)(enacted in 1984)(the year after Tufts): Ø“[I]n determining the amount of any gain or loss. . . with respect to any property, the fair market value of such property shall be treated as being not less than the amount of any nonrecourse indebtedness to which such property is subject. ” ØHowever: Some mortgage discharge on disposition is treated as discharge of indebtedness income. ØTreas. Reg. sec. 1. 1001 -2(a), Ex. 8 (Supp. P. 93) deals with a transfer of property to a creditor in which the creditor discharges a recourse note in excess of the value of property. It states that the note is included in Amount Realized only to the extent of the value of the property, and results in discharge of indebtedness income beyond that. Donald J. Weidner 61

Discharge of Recourse Obligation (cont’d) ØExample 8 provides for the case of an underwater recourse note: ØIn 1980, F transfers to a creditor an asset with a fair market value of $6, 000 and the creditor discharges $7, 500 of indebtedness for which F is personally liable. The amount realized on the disposition of the asset is its fair market value ($6, 000). In addition, F has income from the discharge of indebtedness of $1, 500 ($7, 500 - $6, 000). Donald J. Weidner 62

Discharge of Recourse Obligation (cont’d) ØExample 8 provides for the case of an underwater recourse note: ØIn 1980, F transfers to a creditor an asset with a fair market value of $6, 000 and the creditor discharges $7, 500 of indebtedness for which F is personally liable. The amount realized on the disposition of the asset is its fair market value ($6, 000). In addition, F has income from the discharge of indebtedness of $1, 500 ($7, 500 - $6, 000). Donald J. Weidner 62

Occasional Favorable Treatment of Discharge of Indebtedness Income Ø Discharge of indebtedness income sometimes receives preferential treatment. Ø Rev. Rul. 90 -16 (Supp. p. 94) takes Example (8) one step further and states that the taxpayer’s discharge of indebtedness income is excluded from gross income when the taxpayer is insolvent Ø and the discharge of indebtedness income does not exceed the amount by which the taxpayer is insolvent. Donald J. Weidner 63

Occasional Favorable Treatment of Discharge of Indebtedness Income Ø Discharge of indebtedness income sometimes receives preferential treatment. Ø Rev. Rul. 90 -16 (Supp. p. 94) takes Example (8) one step further and states that the taxpayer’s discharge of indebtedness income is excluded from gross income when the taxpayer is insolvent Ø and the discharge of indebtedness income does not exceed the amount by which the taxpayer is insolvent. Donald J. Weidner 63

Three Rules Confining Tax Shelters ØThere will be more on the subsequent history of real estate tax shelters later in the course. In short, the principal developments since Tufts are: 1. The at risk rules disqualify seller-provided nonrecourse financing but leave intact third-party nonrecourse financing of commercial real estate. 2. The passive loss rules, however, dramatically restrict real estate tax shelters. Although deductions may continue to be computed on a basis that includes nonrecourse financing, passive investors may not use those deductions, or the resulting losses, to “shelter” their personal service income or their other investment income. 3. Ordinary income sheltered by depreciation deductions is “recaptured”—the gain is taxed more like ordinary income. Donald J. Weidner 64

Three Rules Confining Tax Shelters ØThere will be more on the subsequent history of real estate tax shelters later in the course. In short, the principal developments since Tufts are: 1. The at risk rules disqualify seller-provided nonrecourse financing but leave intact third-party nonrecourse financing of commercial real estate. 2. The passive loss rules, however, dramatically restrict real estate tax shelters. Although deductions may continue to be computed on a basis that includes nonrecourse financing, passive investors may not use those deductions, or the resulting losses, to “shelter” their personal service income or their other investment income. 3. Ordinary income sheltered by depreciation deductions is “recaptured”—the gain is taxed more like ordinary income. Donald J. Weidner 64

The Passive Loss Rules ØThe Passive Loss Rules, introduced in 1986 (three years after Tufts), gut tax shelters (in our second sense) as they existed at the time of Tufts. Øunless a real estate investor is a real estate professional, the investor may not use real estate partnership or limited liability company losses to offset or shelter, either their 1. earned income; or 2. other portfolio income. Donald J. Weidner 65

The Passive Loss Rules ØThe Passive Loss Rules, introduced in 1986 (three years after Tufts), gut tax shelters (in our second sense) as they existed at the time of Tufts. Øunless a real estate investor is a real estate professional, the investor may not use real estate partnership or limited liability company losses to offset or shelter, either their 1. earned income; or 2. other portfolio income. Donald J. Weidner 65

The Passive Loss Rules (cont’d) ØLosses from “passive activities” may be set off only against income from other “passive activities” (but not other portfolio income generally) Ø“Unused passive losses can be carried forward and set off against passive income in subsequent tax years. ” Text at 954. ØIn 1993, the passive loss rules were amended “to relieve bona fide real estate professionals from the passive loss limitations. ” Text at 956. Donald J. Weidner 66

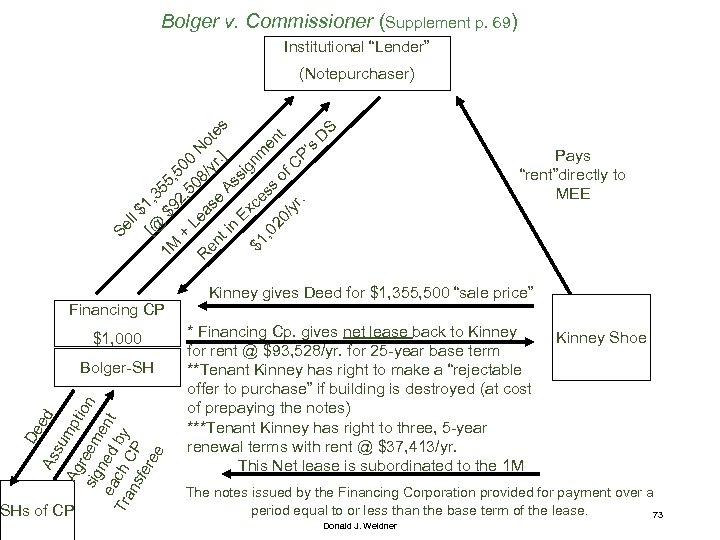

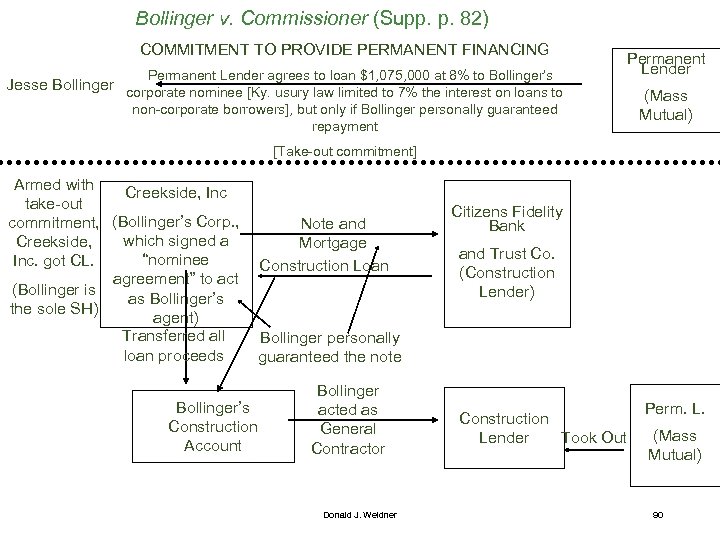

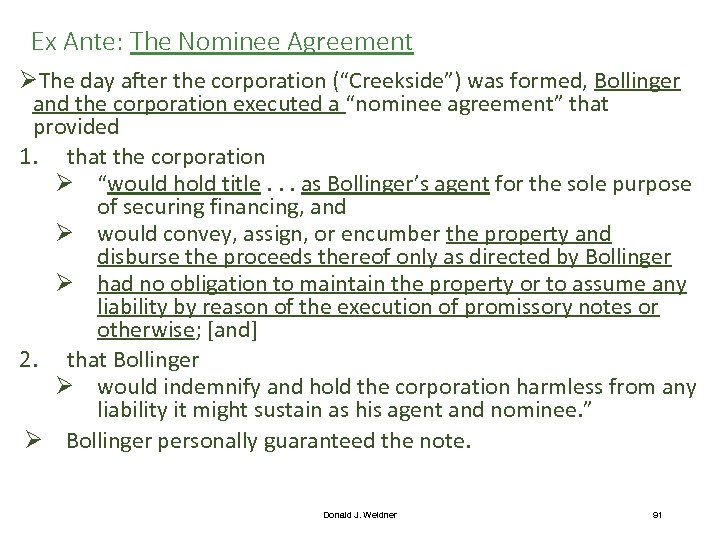

The Passive Loss Rules (cont’d) ØLosses from “passive activities” may be set off only against income from other “passive activities” (but not other portfolio income generally) Ø“Unused passive losses can be carried forward and set off against passive income in subsequent tax years. ” Text at 954. ØIn 1993, the passive loss rules were amended “to relieve bona fide real estate professionals from the passive loss limitations. ” Text at 956. Donald J. Weidner 66