Introduction to private equity.pptx

- Количество слайдов: 14

Introduction To Private Equity © Igor Rozdestvenskiy 2013

Introduction To Private Equity © Igor Rozdestvenskiy 2013

Economics and chrematistics • Economics (from Greek word οἰκονομία) – "household management". • Chrematistics (from Greek: χρηματιστική) according to Thales of Miletus is the art of

Economics and chrematistics • Economics (from Greek word οἰκονομία) – "household management". • Chrematistics (from Greek: χρηματιστική) according to Thales of Miletus is the art of

Henry Ford "Nothing can be made except by makers, nothing can be managed except by managers. Money cannot make anything and money cannot manage anything. “ "Two classes of people lose money; those who are too weak to guard what they have; those who win money by trick. They both lose in the end. “ "When people are 'stung' in false investment schemes there are three causes; greed of something for nothing; sheer inability to know their mind; or infantile trustfulness. “ "What right have you, save service to the world, to think that other men's labor should contribute to your gains? "

Henry Ford "Nothing can be made except by makers, nothing can be managed except by managers. Money cannot make anything and money cannot manage anything. “ "Two classes of people lose money; those who are too weak to guard what they have; those who win money by trick. They both lose in the end. “ "When people are 'stung' in false investment schemes there are three causes; greed of something for nothing; sheer inability to know their mind; or infantile trustfulness. “ "What right have you, save service to the world, to think that other men's labor should contribute to your gains? "

WIKI: What is private equity Private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange. [1] A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture

WIKI: What is private equity Private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange. [1] A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture

WIKI: What is private equity Bloomberg Businessweek has called private equity a rebranding of leveraged buyout firms after the 1980 s. Among the most common investment strategies in private equity are: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged buyout transaction, a private equity firm buys majority control of an existing or mature firm. This is distinct from a venture capital or growth capital

WIKI: What is private equity Bloomberg Businessweek has called private equity a rebranding of leveraged buyout firms after the 1980 s. Among the most common investment strategies in private equity are: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged buyout transaction, a private equity firm buys majority control of an existing or mature firm. This is distinct from a venture capital or growth capital

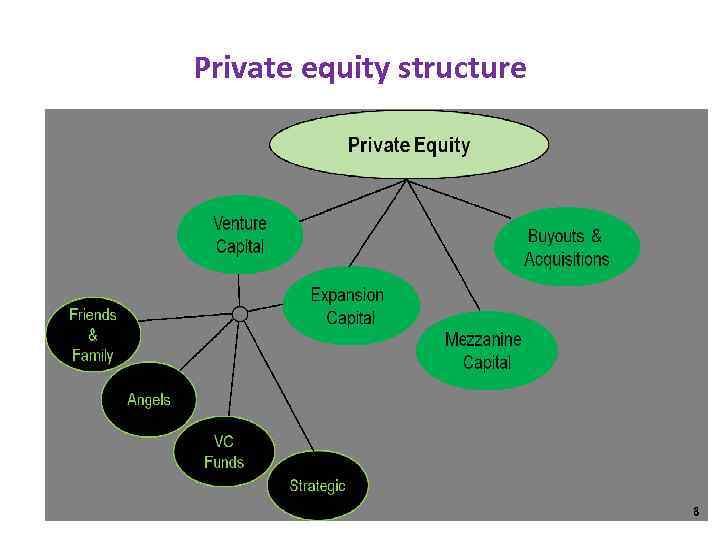

Private equity structure

Private equity structure

WIKI: What is venture capital Venture capital (VC) is financial capital provided to early-stage, highpotential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as biotechnology, IT and software. The typical venture capital investment occurs after the seed funding round as growth

WIKI: What is venture capital Venture capital (VC) is financial capital provided to early-stage, highpotential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as biotechnology, IT and software. The typical venture capital investment occurs after the seed funding round as growth

WIKI: What is expansion capital Growth capital (also called expansion capital and growth equity) is a type of private equity investment, most often a minority investment, in relatively mature companies that are looking for capital to expand or restructure operations, enter new markets or finance a significant acquisition without a change of control of the business. [1] Companies that seek growth capital will often do so in order to finance a

WIKI: What is expansion capital Growth capital (also called expansion capital and growth equity) is a type of private equity investment, most often a minority investment, in relatively mature companies that are looking for capital to expand or restructure operations, enter new markets or finance a significant acquisition without a change of control of the business. [1] Companies that seek growth capital will often do so in order to finance a

WIKI: What is mezzanine capital Mezzanine capital, in finance, refers to a subordinated debt or preferred equity instrument that represents a claim on a company's assets which is senior only to that of the common shares. Mezzanine financings can be structured either as debt (typically an unsecured and subordinated note) or preferred stock. Mezzanine capital is often a more expensive financing source for a company than secured

WIKI: What is mezzanine capital Mezzanine capital, in finance, refers to a subordinated debt or preferred equity instrument that represents a claim on a company's assets which is senior only to that of the common shares. Mezzanine financings can be structured either as debt (typically an unsecured and subordinated note) or preferred stock. Mezzanine capital is often a more expensive financing source for a company than secured

WIKI: What is mezzanine capital. The higher cost of capital associated with mezzanine financings is the result of it being an unsecured, subordinated (or junior) obligation in a company's capital structure (i. e. , in the event of default, the mezzanine financing is only repaid after all senior obligations have been satisfied). Additionally, mezzanine financings, which are usually private placements, are often used by smaller companies and may involve greater overall levels of leverage than issues in

WIKI: What is mezzanine capital. The higher cost of capital associated with mezzanine financings is the result of it being an unsecured, subordinated (or junior) obligation in a company's capital structure (i. e. , in the event of default, the mezzanine financing is only repaid after all senior obligations have been satisfied). Additionally, mezzanine financings, which are usually private placements, are often used by smaller companies and may involve greater overall levels of leverage than issues in

WIKI: What is buyout and acquisition A takeover is the purchase of one company (the target) by another (the acquirer, or bidder). In UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to the acquisition of a private company. Buyout is an investment transaction by which the ownership equity of a company, or

WIKI: What is buyout and acquisition A takeover is the purchase of one company (the target) by another (the acquirer, or bidder). In UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to the acquisition of a private company. Buyout is an investment transaction by which the ownership equity of a company, or

Warren Buffet: Discipline, Patience and Value "The essence of Warren's thinking is that the business world is divided into a tiny number of wonderful businesses – well worth investing in at a price – and a large number of bad or mediocre businesses that are not attractive as longterm investments. Most of the time, most businesses are not worth what they are selling for, but on rare occasions the wonderful businesses are almost given away. When that happens, buy boldly, paying no attention to current gloomy economic and stock market forecasts. " John Train, "The Money Masters"(1980) Buffett's criteria for "wonderful businesses" include, among others, the following: They have a good return on capital without a lot of debt. • They are understandable. • They see their profits in cash flow. • They have strong franchises and, therefore, freedom to price. • They don't take a genius to run. • Their earnings are predictable.

Warren Buffet: Discipline, Patience and Value "The essence of Warren's thinking is that the business world is divided into a tiny number of wonderful businesses – well worth investing in at a price – and a large number of bad or mediocre businesses that are not attractive as longterm investments. Most of the time, most businesses are not worth what they are selling for, but on rare occasions the wonderful businesses are almost given away. When that happens, buy boldly, paying no attention to current gloomy economic and stock market forecasts. " John Train, "The Money Masters"(1980) Buffett's criteria for "wonderful businesses" include, among others, the following: They have a good return on capital without a lot of debt. • They are understandable. • They see their profits in cash flow. • They have strong franchises and, therefore, freedom to price. • They don't take a genius to run. • Their earnings are predictable.

George Soros Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected. As quoted in "Great Money Minds" by Chris Stallman at Teen. Analyst. com (5 May 2005) If investing is entertaining, if you're having fun, you're probably not making any money. Good investing is boring. As quoted in The Winning Investment Habits of Warren Buffett & George Soros (2006) by Mark Tier, p. 217 The main difference between me and other people who have amassed this kind of money is that I am primarily interested in ideas, and I don't have much personal use for money. But I hate to think what would have happened if I hadn't made money: My ideas would not have gotten much play. As quoted in The Winning Investment Habits of Warren Buffett & George Soros (2006) by Mark Tier, p. 219

George Soros Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected. As quoted in "Great Money Minds" by Chris Stallman at Teen. Analyst. com (5 May 2005) If investing is entertaining, if you're having fun, you're probably not making any money. Good investing is boring. As quoted in The Winning Investment Habits of Warren Buffett & George Soros (2006) by Mark Tier, p. 217 The main difference between me and other people who have amassed this kind of money is that I am primarily interested in ideas, and I don't have much personal use for money. But I hate to think what would have happened if I hadn't made money: My ideas would not have gotten much play. As quoted in The Winning Investment Habits of Warren Buffett & George Soros (2006) by Mark Tier, p. 219