02c09cf48b5c5fdf3682847ad888d49f.ppt

- Количество слайдов: 30

Introduction to Macroeconomics Chapter 5. Measuring Changes in Prices

Introduction to Macroeconomics Chapter 5. Measuring Changes in Prices

Chapter 5. Measuring Changes in Prices 1. Inflation and deflation 2. Costs of inflation 3. Measuring inflation with price indexes 4. Causes of inflation Introduction to Macroeconomics

Chapter 5. Measuring Changes in Prices 1. Inflation and deflation 2. Costs of inflation 3. Measuring inflation with price indexes 4. Causes of inflation Introduction to Macroeconomics

1. Inflation and Deflation Definitions Inflation = Increase in average level of prices Deflation = Decrease in average level of prices Introduction to Macroeconomics

1. Inflation and Deflation Definitions Inflation = Increase in average level of prices Deflation = Decrease in average level of prices Introduction to Macroeconomics

1. Inflation and Deflation Hyperinflation = a very high rate of inflation over 50% per month over 200% per year Generally caused by governments printing money to finance large fiscal deficits caused by wars, revolutions, the establishment of new states, or exorbitant social programs. Introduction to Macroeconomics

1. Inflation and Deflation Hyperinflation = a very high rate of inflation over 50% per month over 200% per year Generally caused by governments printing money to finance large fiscal deficits caused by wars, revolutions, the establishment of new states, or exorbitant social programs. Introduction to Macroeconomics

2. Costs of Inflation • Purchasing power • Menu costs • Expected versus unexpected inflation Introduction to Macroeconomics

2. Costs of Inflation • Purchasing power • Menu costs • Expected versus unexpected inflation Introduction to Macroeconomics

2. Costs of Inflation Purchasing Power = the quantity of goods and services that can be purchased with a given amount of money; the value of money. Introduction to Macroeconomics

2. Costs of Inflation Purchasing Power = the quantity of goods and services that can be purchased with a given amount of money; the value of money. Introduction to Macroeconomics

2. Costs of Inflation Menu Costs = opportunity costs of resources required (e. g. , cash costs) to change prices. Introduction to Macroeconomics

2. Costs of Inflation Menu Costs = opportunity costs of resources required (e. g. , cash costs) to change prices. Introduction to Macroeconomics

2. Costs of Inflation Unanticipated Inflation • Arbitrary redistribution of income between borrowers and lenders, between employers and labor • Uncertainty - more difficult to enter into contracts • Uncertainty - change in relative versus change in average prices Introduction to Macroeconomics

2. Costs of Inflation Unanticipated Inflation • Arbitrary redistribution of income between borrowers and lenders, between employers and labor • Uncertainty - more difficult to enter into contracts • Uncertainty - change in relative versus change in average prices Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes • • • Price indexes GDP deflator Consumer price index (CPI) GDP deflator - CPI differences Problems with price indexes Chain-weighted index Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes • • • Price indexes GDP deflator Consumer price index (CPI) GDP deflator - CPI differences Problems with price indexes Chain-weighted index Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes Price Index - a measure of the change in the average level of prices • GDP Deflator • Consumer Price Index Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes Price Index - a measure of the change in the average level of prices • GDP Deflator • Consumer Price Index Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes GDP Deflator • Nominal GDP – Value of output measured at actual prices (current dollar output) – Does not correct for inflation • Real GDP – Value of output based on prices of some base period (“constant” dollar output) – eliminates effect of inflation • GDP Deflator = Nominal GDP x 100 Real GDP Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes GDP Deflator • Nominal GDP – Value of output measured at actual prices (current dollar output) – Does not correct for inflation • Real GDP – Value of output based on prices of some base period (“constant” dollar output) – eliminates effect of inflation • GDP Deflator = Nominal GDP x 100 Real GDP Introduction to Macroeconomics

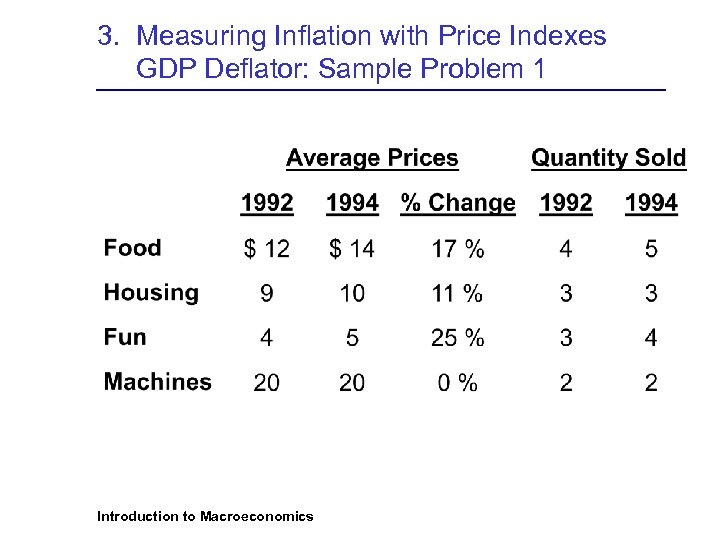

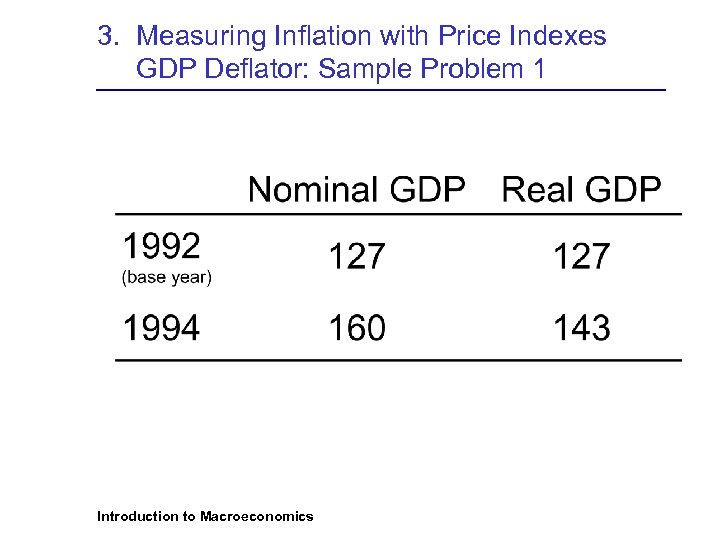

3. Measuring Inflation with Price Indexes GDP Deflator: Sample Problem 1 Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes GDP Deflator: Sample Problem 1 Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes Nominal and Real GDP Nominal GDP = Current year Quantities x Current year Prices Real GDP = Current year Quantities x Base year Prices Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes Nominal and Real GDP Nominal GDP = Current year Quantities x Current year Prices Real GDP = Current year Quantities x Base year Prices Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes GDP Deflator: Sample Problem 1 Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes GDP Deflator: Sample Problem 1 Introduction to Macroeconomics

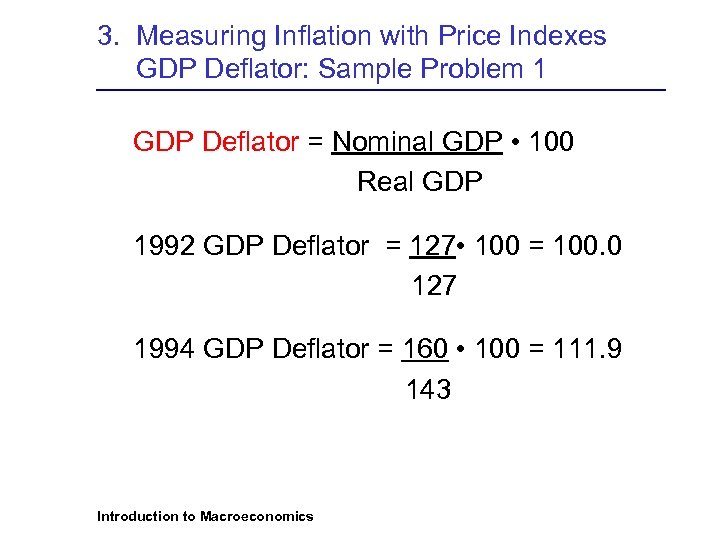

3. Measuring Inflation with Price Indexes GDP Deflator: Sample Problem 1 GDP Deflator = Nominal GDP • 100 Real GDP 1992 GDP Deflator = 127 • 100 = 100. 0 127 1994 GDP Deflator = 160 • 100 = 111. 9 143 Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes GDP Deflator: Sample Problem 1 GDP Deflator = Nominal GDP • 100 Real GDP 1992 GDP Deflator = 127 • 100 = 100. 0 127 1994 GDP Deflator = 160 • 100 = 111. 9 143 Introduction to Macroeconomics

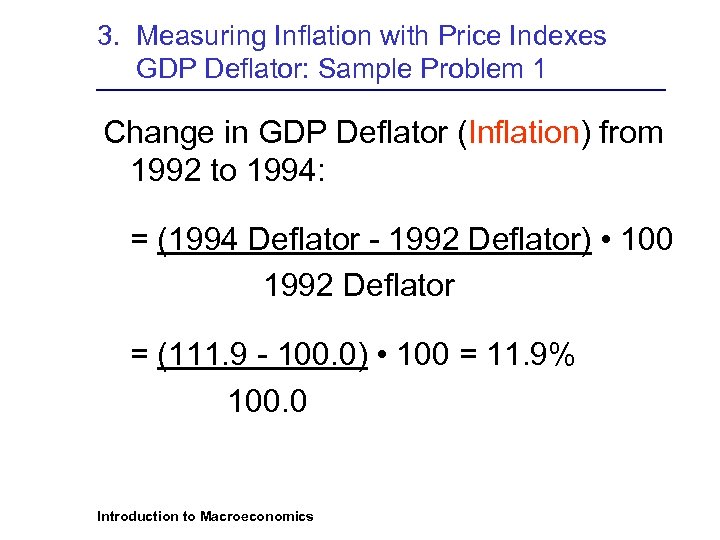

3. Measuring Inflation with Price Indexes GDP Deflator: Sample Problem 1 Change in GDP Deflator (Inflation) from 1992 to 1994: = (1994 Deflator - 1992 Deflator) • 100 1992 Deflator = (111. 9 - 100. 0) • 100 = 11. 9% 100. 0 Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes GDP Deflator: Sample Problem 1 Change in GDP Deflator (Inflation) from 1992 to 1994: = (1994 Deflator - 1992 Deflator) • 100 1992 Deflator = (111. 9 - 100. 0) • 100 = 11. 9% 100. 0 Introduction to Macroeconomics

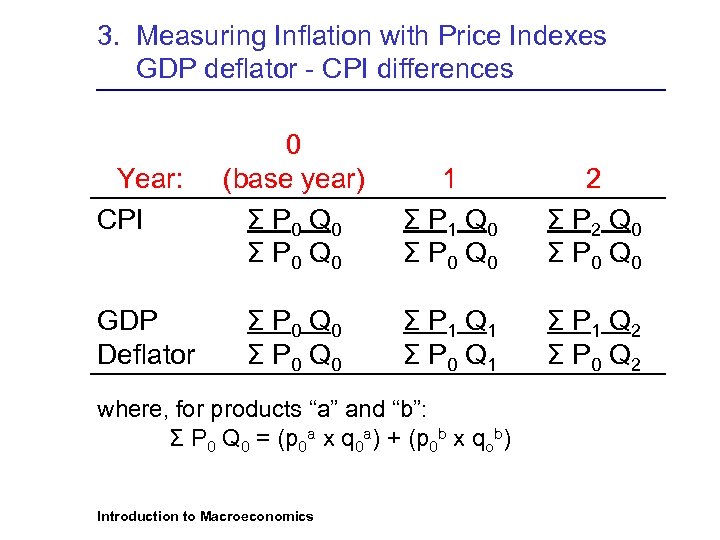

3. Measuring Inflation with Price Indexes GDP deflator - CPI differences Year: CPI 0 (base year) Σ P 0 Q 0 1 Σ P 1 Q 0 Σ P 0 Q 0 2 Σ P 2 Q 0 Σ P 0 Q 0 GDP Deflator Σ P 0 Q 0 Σ P 1 Q 1 Σ P 0 Q 1 Σ P 1 Q 2 Σ P 0 Q 2 where, for products “a” and “b”: Σ P 0 Q 0 = (p 0 a x q 0 a) + (p 0 b x qob) Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes GDP deflator - CPI differences Year: CPI 0 (base year) Σ P 0 Q 0 1 Σ P 1 Q 0 Σ P 0 Q 0 2 Σ P 2 Q 0 Σ P 0 Q 0 GDP Deflator Σ P 0 Q 0 Σ P 1 Q 1 Σ P 0 Q 1 Σ P 1 Q 2 Σ P 0 Q 2 where, for products “a” and “b”: Σ P 0 Q 0 = (p 0 a x q 0 a) + (p 0 b x qob) Introduction to Macroeconomics

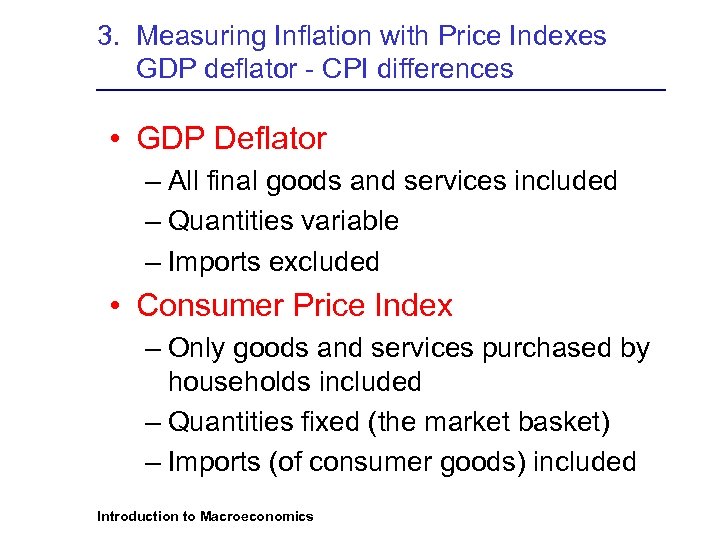

3. Measuring Inflation with Price Indexes GDP deflator - CPI differences • GDP Deflator – All final goods and services included – Quantities variable – Imports excluded • Consumer Price Index – Only goods and services purchased by households included – Quantities fixed (the market basket) – Imports (of consumer goods) included Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes GDP deflator - CPI differences • GDP Deflator – All final goods and services included – Quantities variable – Imports excluded • Consumer Price Index – Only goods and services purchased by households included – Quantities fixed (the market basket) – Imports (of consumer goods) included Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes Problems With Price Indexes • Substitution bias - changes in relative prices – between goods (butter vs margarine) – between stores (small mom and pop versus large discount stores) • Quality changes and new products Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes Problems With Price Indexes • Substitution bias - changes in relative prices – between goods (butter vs margarine) – between stores (small mom and pop versus large discount stores) • Quality changes and new products Introduction to Macroeconomics

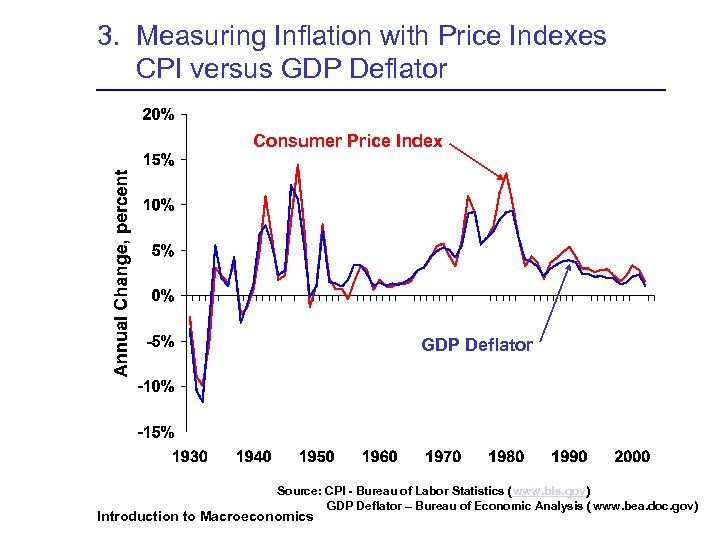

3. Measuring Inflation with Price Indexes CPI versus GDP Deflator Consumer Price Index GDP Deflator Source: CPI - Bureau of Labor Statistics (www. bls. gov) GDP Deflator – Bureau of Economic Analysis (www. bea. doc. gov) Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes CPI versus GDP Deflator Consumer Price Index GDP Deflator Source: CPI - Bureau of Labor Statistics (www. bls. gov) GDP Deflator – Bureau of Economic Analysis (www. bea. doc. gov) Introduction to Macroeconomics

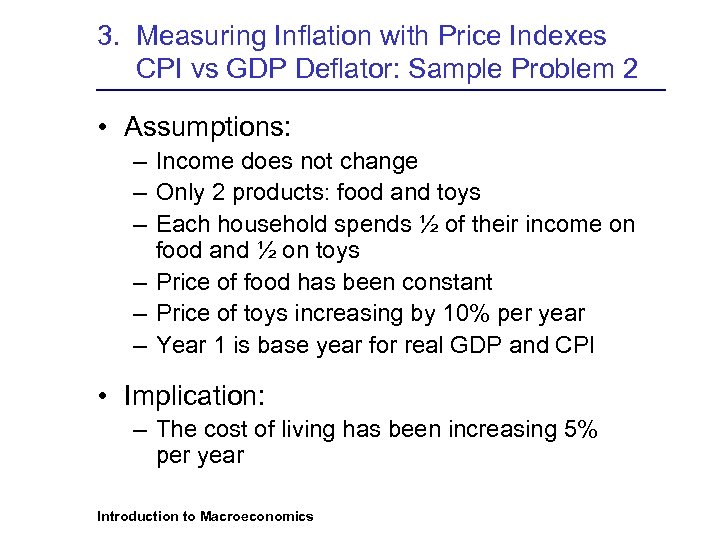

3. Measuring Inflation with Price Indexes CPI vs GDP Deflator: Sample Problem 2 • Assumptions: – Income does not change – Only 2 products: food and toys – Each household spends ½ of their income on food and ½ on toys – Price of food has been constant – Price of toys increasing by 10% per year – Year 1 is base year for real GDP and CPI • Implication: – The cost of living has been increasing 5% per year Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes CPI vs GDP Deflator: Sample Problem 2 • Assumptions: – Income does not change – Only 2 products: food and toys – Each household spends ½ of their income on food and ½ on toys – Price of food has been constant – Price of toys increasing by 10% per year – Year 1 is base year for real GDP and CPI • Implication: – The cost of living has been increasing 5% per year Introduction to Macroeconomics

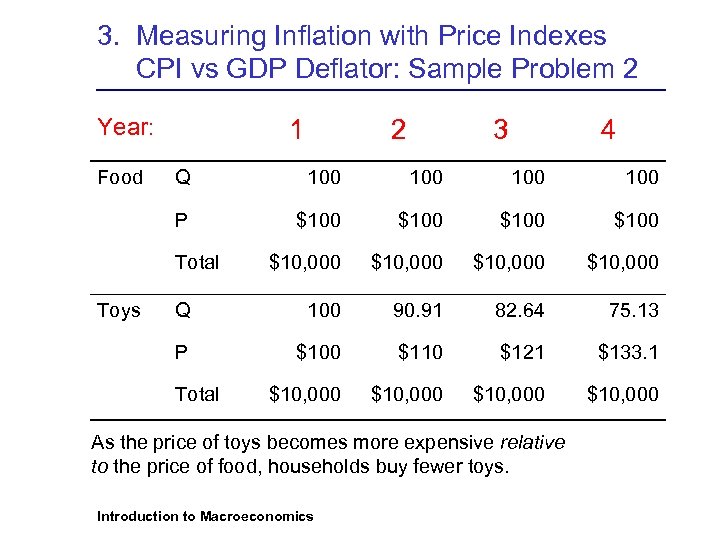

3. Measuring Inflation with Price Indexes CPI vs GDP Deflator: Sample Problem 2 Year: Food 1 2 3 4 Q 100 100 P $100 $10, 000 Q 100 90. 91 82. 64 75. 13 P $100 $110 $121 $133. 1 $10, 000 Total Toys Total As the price of toys becomes more expensive relative to the price of food, households buy fewer toys. Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes CPI vs GDP Deflator: Sample Problem 2 Year: Food 1 2 3 4 Q 100 100 P $100 $10, 000 Q 100 90. 91 82. 64 75. 13 P $100 $110 $121 $133. 1 $10, 000 Total Toys Total As the price of toys becomes more expensive relative to the price of food, households buy fewer toys. Introduction to Macroeconomics

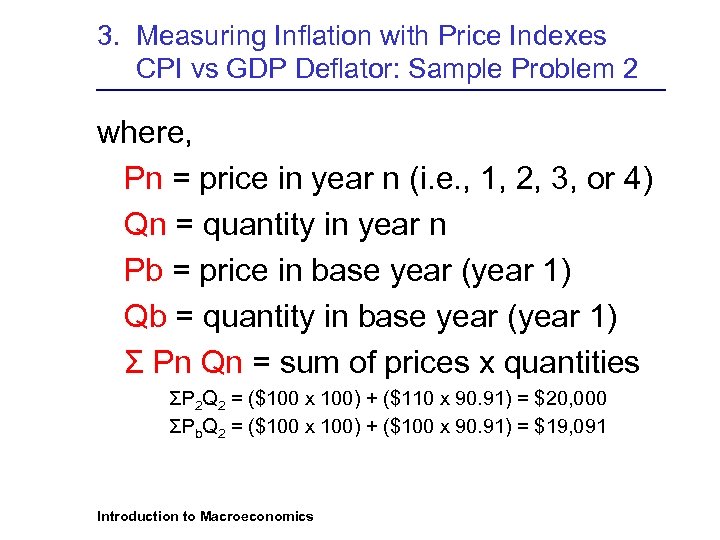

3. Measuring Inflation with Price Indexes CPI vs GDP Deflator: Sample Problem 2 where, Pn = price in year n (i. e. , 1, 2, 3, or 4) Qn = quantity in year n Pb = price in base year (year 1) Qb = quantity in base year (year 1) Σ Pn Qn = sum of prices x quantities ΣP 2 Q 2 = ($100 x 100) + ($110 x 90. 91) = $20, 000 ΣPb. Q 2 = ($100 x 100) + ($100 x 90. 91) = $19, 091 Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes CPI vs GDP Deflator: Sample Problem 2 where, Pn = price in year n (i. e. , 1, 2, 3, or 4) Qn = quantity in year n Pb = price in base year (year 1) Qb = quantity in base year (year 1) Σ Pn Qn = sum of prices x quantities ΣP 2 Q 2 = ($100 x 100) + ($110 x 90. 91) = $20, 000 ΣPb. Q 2 = ($100 x 100) + ($100 x 90. 91) = $19, 091 Introduction to Macroeconomics

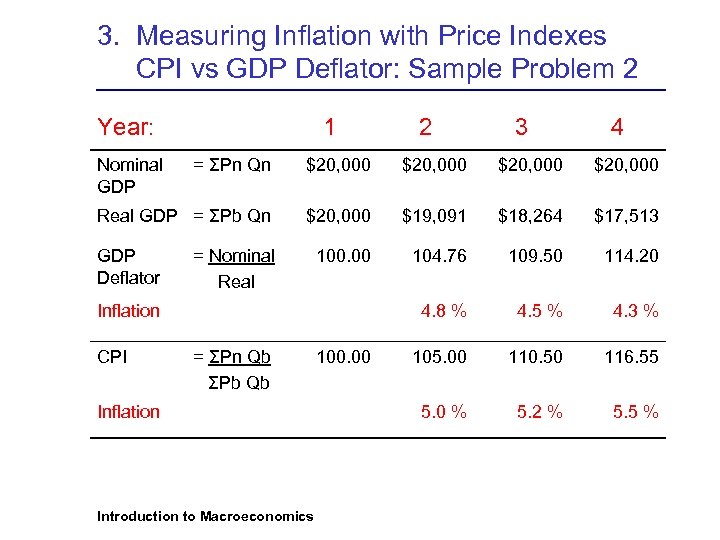

3. Measuring Inflation with Price Indexes CPI vs GDP Deflator: Sample Problem 2 Year: Nominal GDP 1 2 3 4 = ΣPn Qn $20, 000 Real GDP = ΣPb Qn $20, 000 $19, 091 $18, 264 $17, 513 100. 00 104. 76 109. 50 114. 20 4. 8 % 4. 5 % 4. 3 % 105. 00 110. 50 116. 55 5. 0 % 5. 2 % 5. 5 % GDP Deflator = Nominal Real Inflation CPI = ΣPn Qb ΣPb Qb Inflation Introduction to Macroeconomics 100. 00

3. Measuring Inflation with Price Indexes CPI vs GDP Deflator: Sample Problem 2 Year: Nominal GDP 1 2 3 4 = ΣPn Qn $20, 000 Real GDP = ΣPb Qn $20, 000 $19, 091 $18, 264 $17, 513 100. 00 104. 76 109. 50 114. 20 4. 8 % 4. 5 % 4. 3 % 105. 00 110. 50 116. 55 5. 0 % 5. 2 % 5. 5 % GDP Deflator = Nominal Real Inflation CPI = ΣPn Qb ΣPb Qb Inflation Introduction to Macroeconomics 100. 00

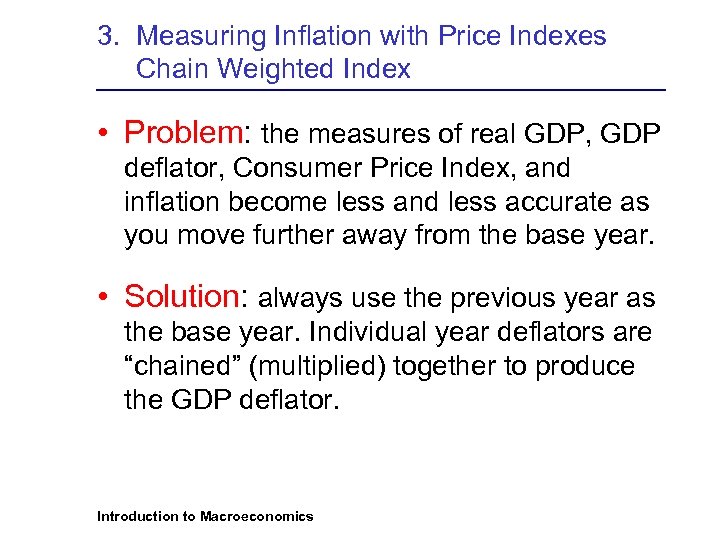

3. Measuring Inflation with Price Indexes Chain Weighted Index • Problem: the measures of real GDP, GDP deflator, Consumer Price Index, and inflation become less and less accurate as you move further away from the base year. • Solution: always use the previous year as the base year. Individual year deflators are “chained” (multiplied) together to produce the GDP deflator. Introduction to Macroeconomics

3. Measuring Inflation with Price Indexes Chain Weighted Index • Problem: the measures of real GDP, GDP deflator, Consumer Price Index, and inflation become less and less accurate as you move further away from the base year. • Solution: always use the previous year as the base year. Individual year deflators are “chained” (multiplied) together to produce the GDP deflator. Introduction to Macroeconomics

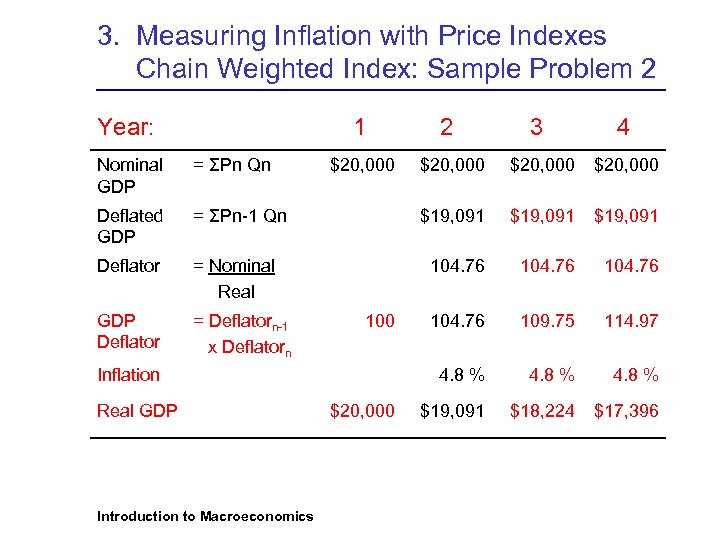

3. Measuring Inflation with Price Indexes Chain Weighted Index: Sample Problem 2 Year: 1 Nominal GDP = ΣPn Qn Deflated GDP = Deflatorn-1 x Deflatorn 4 $20, 000 $19, 091 104. 76 109. 75 114. 97 4. 8 % $19, 091 $18, 224 $17, 396 = Nominal Real GDP Deflator 3 = ΣPn-1 Qn Deflator 2 100 Inflation Real GDP Introduction to Macroeconomics $20, 000

3. Measuring Inflation with Price Indexes Chain Weighted Index: Sample Problem 2 Year: 1 Nominal GDP = ΣPn Qn Deflated GDP = Deflatorn-1 x Deflatorn 4 $20, 000 $19, 091 104. 76 109. 75 114. 97 4. 8 % $19, 091 $18, 224 $17, 396 = Nominal Real GDP Deflator 3 = ΣPn-1 Qn Deflator 2 100 Inflation Real GDP Introduction to Macroeconomics $20, 000

4. Causes of Inflation • Money supply • Demand-pull and cost-push inflation • Expectations Introduction to Macroeconomics

4. Causes of Inflation • Money supply • Demand-pull and cost-push inflation • Expectations Introduction to Macroeconomics

4. Causes of Inflation Money Supply Introduction to Macroeconomics

4. Causes of Inflation Money Supply Introduction to Macroeconomics

4. Causes of Inflation Demand-Pull and Cost-Push Inflation • Demand-Pull Inflation - caused by an increase in aggregate demand for goods and services. • Cost-Push Inflation - caused by an increase in the costs of production of goods and services. Introduction to Macroeconomics

4. Causes of Inflation Demand-Pull and Cost-Push Inflation • Demand-Pull Inflation - caused by an increase in aggregate demand for goods and services. • Cost-Push Inflation - caused by an increase in the costs of production of goods and services. Introduction to Macroeconomics

4. Causes of Inflation Expectations Introduction to Macroeconomics

4. Causes of Inflation Expectations Introduction to Macroeconomics