dc7913695cc850bdc3b106040b5599b6.ppt

- Количество слайдов: 20

Introduction to Legal & Contracting Issues in the CDM Glenn S. Hodes Energy Economist, UNEP Risø glenn. hodes@risoe. dk CD 4 CDM Ghana - Third National Workshop, Accra, 15 September 2006

Introduction to Legal & Contracting Issues in the CDM Glenn S. Hodes Energy Economist, UNEP Risø glenn. hodes@risoe. dk CD 4 CDM Ghana - Third National Workshop, Accra, 15 September 2006

An Overview of Guidebook Builds on previous CD 4 CDM Guidebooks with a focus on: • • Interaction domestic and international law • Identifying and managing CDM project related risks • CDM project structuring and contracting approaches to creating and transferring CERs • Potential structures for CDM Projects • http: //cd 4 cdm. org/publication Legal requirements of CDM Projects CDM contract drafting and negotiation

An Overview of Guidebook Builds on previous CD 4 CDM Guidebooks with a focus on: • • Interaction domestic and international law • Identifying and managing CDM project related risks • CDM project structuring and contracting approaches to creating and transferring CERs • Potential structures for CDM Projects • http: //cd 4 cdm. org/publication Legal requirements of CDM Projects CDM contract drafting and negotiation

Key Legal Issues for Project Developers • Complexity of emerging CDM rules • Limited Host Country expertise and weak/resource poor DNAs • Integration of CDM approval and national laws/permits • Agreements effective to attracting underlying finance (i. e. addressing risk concerns of potential investors) • Creating and transacting CERs (i. e. ownership rights) • Allocation of transaction costs

Key Legal Issues for Project Developers • Complexity of emerging CDM rules • Limited Host Country expertise and weak/resource poor DNAs • Integration of CDM approval and national laws/permits • Agreements effective to attracting underlying finance (i. e. addressing risk concerns of potential investors) • Creating and transacting CERs (i. e. ownership rights) • Allocation of transaction costs

Essential Legal Requirements • Project operates in manner that reduces, abates, or sequestered GHGs • Monitoring plan followed and certified periodic verification reports by DOE • Host country has ratified Kyoto Protocol • Formal written approval from DNA, including authorization of voluntary participation of Participants, statement of nondiversion of ODA - helpful if approval letter also indicates clear assignment of title. • Validated PDD with accepted baseline methodology + EB registration • Project meets domestic EIA requirements and has all necessary permits

Essential Legal Requirements • Project operates in manner that reduces, abates, or sequestered GHGs • Monitoring plan followed and certified periodic verification reports by DOE • Host country has ratified Kyoto Protocol • Formal written approval from DNA, including authorization of voluntary participation of Participants, statement of nondiversion of ODA - helpful if approval letter also indicates clear assignment of title. • Validated PDD with accepted baseline methodology + EB registration • Project meets domestic EIA requirements and has all necessary permits

Project Structures All CDM Projects entail a number of risks for participants and investors. Project structure will depend on nature of project, number of participants and role which CERs play in the financing or economics of project. Potential project structures : • Direct sale of CERs from a Host Country driven CDM Project • Provision of debt finance in return for part payment in CERs • Equity investment in return for revenue stream from CERs • Non-recourse project finance

Project Structures All CDM Projects entail a number of risks for participants and investors. Project structure will depend on nature of project, number of participants and role which CERs play in the financing or economics of project. Potential project structures : • Direct sale of CERs from a Host Country driven CDM Project • Provision of debt finance in return for part payment in CERs • Equity investment in return for revenue stream from CERs • Non-recourse project finance

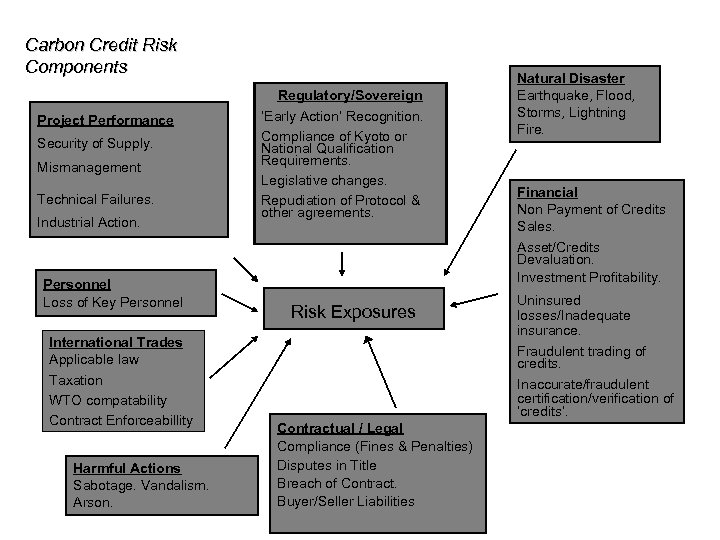

Carbon Credit Risk Components Regulatory/Sovereign Project Performance Security of Supply. Mismanagement Technical Failures. Industrial Action. Personnel Loss of Key Personnel ‘Early Action’ Recognition. Compliance of Kyoto or National Qualification Requirements. Legislative changes. Repudiation of Protoco. I & other agreements. Harmful Actions Sabotage. Vandalism. Arson. Financial Non Payment of Credits Sales. Asset/Credits Devaluation. Investment Profitability. Risk Exposures International Trades Applicable law Taxation WTO compatability Contract Enforceabillity Natural Disaster Earthquake, Flood, Storms, Lightning Fire. Uninsured losses/Inadequate insurance. Fraudulent trading of credits. Inaccurate/fraudulent certification/verification of ‘credits’. Contractual / Legal Compliance (Fines & Penalties) Disputes in Title Breach of Contract. Buyer/Seller Liabilities

Carbon Credit Risk Components Regulatory/Sovereign Project Performance Security of Supply. Mismanagement Technical Failures. Industrial Action. Personnel Loss of Key Personnel ‘Early Action’ Recognition. Compliance of Kyoto or National Qualification Requirements. Legislative changes. Repudiation of Protoco. I & other agreements. Harmful Actions Sabotage. Vandalism. Arson. Financial Non Payment of Credits Sales. Asset/Credits Devaluation. Investment Profitability. Risk Exposures International Trades Applicable law Taxation WTO compatability Contract Enforceabillity Natural Disaster Earthquake, Flood, Storms, Lightning Fire. Uninsured losses/Inadequate insurance. Fraudulent trading of credits. Inaccurate/fraudulent certification/verification of ‘credits’. Contractual / Legal Compliance (Fines & Penalties) Disputes in Title Breach of Contract. Buyer/Seller Liabilities

CDM Contracts • Variety of approaches (competitive tender processes, transacting through independent brokers, individual contractual negotiations • As with project structures, contracts can assign CERs in a variety of ways (e. g. spot transactions, forward sales and option arrangements). • Current structures largely influenced by major purchasers • Alternative contracting approaches possible (see guidebook). -direct sale of CERs if purchaser not involved in underlying

CDM Contracts • Variety of approaches (competitive tender processes, transacting through independent brokers, individual contractual negotiations • As with project structures, contracts can assign CERs in a variety of ways (e. g. spot transactions, forward sales and option arrangements). • Current structures largely influenced by major purchasers • Alternative contracting approaches possible (see guidebook). -direct sale of CERs if purchaser not involved in underlying

Basic Legal Documentation for Carbon Projects

Basic Legal Documentation for Carbon Projects

1. Letter of Endorsement / Non-objection • Between Seller/Buyer and Host Country • Expression of Support / Non Objection • Evidence that the Host Country has been informed and endorses the project • No binding endorsement which creates a right to any future approval

1. Letter of Endorsement / Non-objection • Between Seller/Buyer and Host Country • Expression of Support / Non Objection • Evidence that the Host Country has been informed and endorses the project • No binding endorsement which creates a right to any future approval

2. Letter of Approval • Between the Host Country and the Project Developer • But also: between the Host Country and the Annex I country • Should be unconditional • Not clear whether or under what circumstances can be withdrawn

2. Letter of Approval • Between the Host Country and the Project Developer • But also: between the Host Country and the Annex I country • Should be unconditional • Not clear whether or under what circumstances can be withdrawn

3. Letter of Intent • • Between Seller and Purchaser Early legal document (Mandate Letter) Secures exclusivity – right but not obligation Cost recovery in case the project sponsor unilaterally decides not to move forward with the negotiations • Helps the project sponsor to obtain financing

3. Letter of Intent • • Between Seller and Purchaser Early legal document (Mandate Letter) Secures exclusivity – right but not obligation Cost recovery in case the project sponsor unilaterally decides not to move forward with the negotiations • Helps the project sponsor to obtain financing

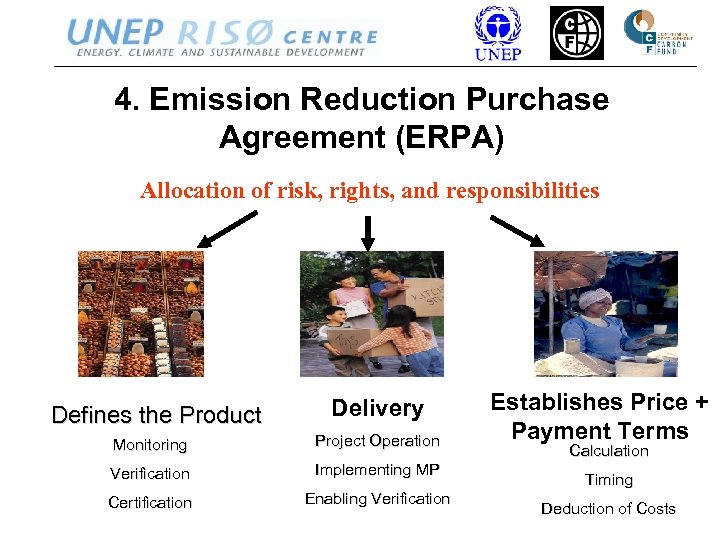

4. Emission Reduction Purchase Agreement (ERPA) Allocation of risk, rights, and responsibilities Defines the Product Delivery Monitoring Project Operation Verification Implementing MP Certification Enabling Verification Establishes Price + Payment Terms Calculation Timing Deduction of Costs

4. Emission Reduction Purchase Agreement (ERPA) Allocation of risk, rights, and responsibilities Defines the Product Delivery Monitoring Project Operation Verification Implementing MP Certification Enabling Verification Establishes Price + Payment Terms Calculation Timing Deduction of Costs

General Overview of Issues in Structuring CDM Projects • The Guidebook discusses means of identifying, allocating and assigning risks through negotiations and contracts.

General Overview of Issues in Structuring CDM Projects • The Guidebook discusses means of identifying, allocating and assigning risks through negotiations and contracts.

Host Country Political and Sovereign Risks • Potential investors and developers will carefully assess the perceived level of sovereign and political risk in Host Country before becoming involved. • Many Host Country decisions or events can adversely impact upon a CDM Project (for example, change in law, currency fluctuations, excessive administrative burdens) which may be out of the control of all parties to Project • The Host Country Government (e. g. the DNA) could assist potential investors to understand the nature and extent of Host Country political and sovereign risks by explaining issues such as CDM policy and relevant legal frameworks which will impact the project. • Investors are likely to prefer Host Countries with an established legal and political system which clearly recognise and support CDM investment.

Host Country Political and Sovereign Risks • Potential investors and developers will carefully assess the perceived level of sovereign and political risk in Host Country before becoming involved. • Many Host Country decisions or events can adversely impact upon a CDM Project (for example, change in law, currency fluctuations, excessive administrative burdens) which may be out of the control of all parties to Project • The Host Country Government (e. g. the DNA) could assist potential investors to understand the nature and extent of Host Country political and sovereign risks by explaining issues such as CDM policy and relevant legal frameworks which will impact the project. • Investors are likely to prefer Host Countries with an established legal and political system which clearly recognise and support CDM investment.

General Project Risks • These risks include the risk of force majeure events, project underperformance (e. g. due to human error or delayed construction) and cost overrun in developing and commissioning the Project. • Common to projects other than CDM and Host Country project developers may have experience in managing and mitigating them. • Cost risk is particularly important to consider. Requires input from a number of consultants (e. g. DOEs) the development of highly technical documents such as baseline methodologies. • Early purchasers have sometimes paid costs to develop and register a CDM Project upfront (with such costs deducted from later payments for CERs) but this practice may not continue as the CDM market develops

General Project Risks • These risks include the risk of force majeure events, project underperformance (e. g. due to human error or delayed construction) and cost overrun in developing and commissioning the Project. • Common to projects other than CDM and Host Country project developers may have experience in managing and mitigating them. • Cost risk is particularly important to consider. Requires input from a number of consultants (e. g. DOEs) the development of highly technical documents such as baseline methodologies. • Early purchasers have sometimes paid costs to develop and register a CDM Project upfront (with such costs deducted from later payments for CERs) but this practice may not continue as the CDM market develops

Regulatory Risks • These risks include: • Inability to develop baseline methodology acceptable to Executive Board • Legal title disputes over CERs • Incorrect monitoring of emission reductions • Community or NGO opposition • These risks should be dealt with in the preparation and management of the Project as well as contractually through the agreements to sell CERs. Ultimately the level of risk taken on by the Buyer will affect the price it will pay for CERs.

Regulatory Risks • These risks include: • Inability to develop baseline methodology acceptable to Executive Board • Legal title disputes over CERs • Incorrect monitoring of emission reductions • Community or NGO opposition • These risks should be dealt with in the preparation and management of the Project as well as contractually through the agreements to sell CERs. Ultimately the level of risk taken on by the Buyer will affect the price it will pay for CERs.

VER vs. CERs • Sponsors should consider selling CERs if they: – thoroughly understand baseline methodologies and CER/ERU registration process and – are prepared to assume delivery risk – guess risk worth it in exchange for a higher price – do not need to borrow against ER cash flows • Sponsors should consider selling VERs if they: – – are not prepared to take VER-CER conversion risk cannot / do not want to guarantee delivery need to finance preparation costs need to borrow against ER cash flows

VER vs. CERs • Sponsors should consider selling CERs if they: – thoroughly understand baseline methodologies and CER/ERU registration process and – are prepared to assume delivery risk – guess risk worth it in exchange for a higher price – do not need to borrow against ER cash flows • Sponsors should consider selling VERs if they: – – are not prepared to take VER-CER conversion risk cannot / do not want to guarantee delivery need to finance preparation costs need to borrow against ER cash flows

Case of CDCF – Purchases both CERs as well as VERs, also credits post 2012 (70: 30). – Takes responsibility for developing (and renewing) the baseline, creating the monitoring plan, selecting and contracting the DOE (i. e. assumes most ‘regulatory’ risk) – Reserves sole right to communicate with CDM regulator – Contracts at fixed prices for majority of credits – Project preparation, verification, certification, and supervision costs (capped) are deducted from payments to Participants – Penalty only in event of fraud, gross negligence, wilful misconduct (eg 3 rd party sales)

Case of CDCF – Purchases both CERs as well as VERs, also credits post 2012 (70: 30). – Takes responsibility for developing (and renewing) the baseline, creating the monitoring plan, selecting and contracting the DOE (i. e. assumes most ‘regulatory’ risk) – Reserves sole right to communicate with CDM regulator – Contracts at fixed prices for majority of credits – Project preparation, verification, certification, and supervision costs (capped) are deducted from payments to Participants – Penalty only in event of fraud, gross negligence, wilful misconduct (eg 3 rd party sales)

Management of Key Project Risks • Generally parties will allocate risk to the party which is best able to control that risk. • The allocation of risks which neither party is able to control should be reflected in the price paid for CERs. • Risk allocation can be dealt with through measures such as: • Conditions precedent to the entry into force of a contract • Guarantees companies from Host Countries or parent • Force majeure clauses • Laying off risks to third parties such as contractors or DOEs

Management of Key Project Risks • Generally parties will allocate risk to the party which is best able to control that risk. • The allocation of risks which neither party is able to control should be reflected in the price paid for CERs. • Risk allocation can be dealt with through measures such as: • Conditions precedent to the entry into force of a contract • Guarantees companies from Host Countries or parent • Force majeure clauses • Laying off risks to third parties such as contractors or DOEs

A final note about Pricing and Negotiations… • Price is ultimately a function of overall market dynamics as well as asset quality, risk and sharing of risk – Kyoto / Baseline / Regulatory risk – Project risk – Country risk – Market risk

A final note about Pricing and Negotiations… • Price is ultimately a function of overall market dynamics as well as asset quality, risk and sharing of risk – Kyoto / Baseline / Regulatory risk – Project risk – Country risk – Market risk