a85b1c1d3317b17f8a7e8db26c9b4bc2.ppt

- Количество слайдов: 111

Introduction to investing Brought to you by: Online Share Trading Presented by: Simon Pateman Brown

2 “You don’t have to be wealthy to invest. But you do have to invest to be wealthy. ” Warren Buffett (Richest person in the world US$62 billion)

Why are we providing free education? 3 • A study found that people do not invest in shares when they do not understand them • An educated investor is more likely to be a successful investor and hence a long term investor • We want our clients to be successful so that they continue to invest with us • If you lose money you stop investing and we lose you as a client! • The more people invest with us the lower the fees can be – Our brokerage fees have fallen over the last 5 years

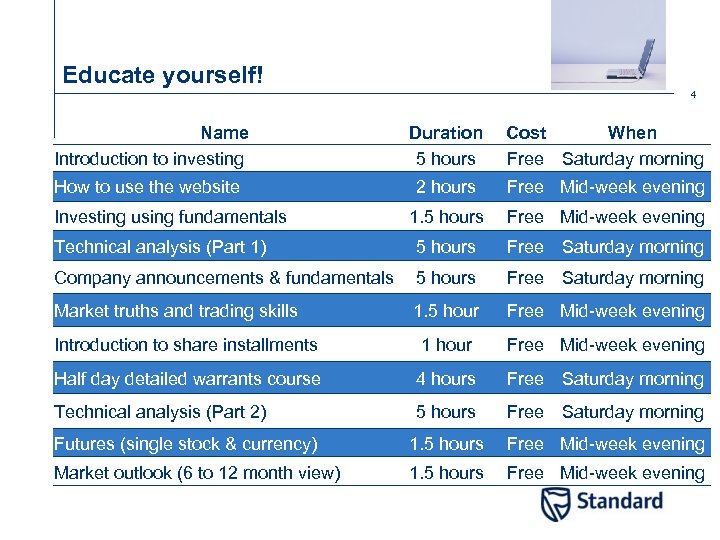

Educate yourself! 4 Name Introduction to investing Duration 5 hours Cost When Free Saturday morning How to use the website 2 hours Free Mid-week evening 1. 5 hours Free Mid-week evening Technical analysis (Part 1) 5 hours Free Saturday morning Company announcements & fundamentals 5 hours Free Saturday morning Market truths and trading skills 1. 5 hour Free Mid-week evening Introduction to share installments 1 hour Free Mid-week evening Half day detailed warrants course 4 hours Free Saturday morning Technical analysis (Part 2) 5 hours Free Saturday morning Futures (single stock & currency) 1. 5 hours Free Mid-week evening Market outlook (6 to 12 month view) 1. 5 hours Free Mid-week evening Investing using fundamentals

5 Who is the course aimed at?

Who is the course aimed at? 6 • Wide appeal. • Novice investor. • Some one new to the share market. • Review or recap on the basics.

7 What is investing?

Introduction to share investments 8 • Investing in the share market is not a pastime, is must be taken seriously. Investors require an education and the tools before they can hope for any measure of success. • There are no magic formulas or Holy Grails to becoming rich investing in shares, but through education, you will be in the driving seat regarding your financial freedom.

The general misconception 9 • Misinformation regarding the share market. – “My friend Richard made a killing in ABC company, and now he’s got another hot tip!!”. – "Watch out, with shares-you can lose your shirt in a matter of days!“. • Get rich quick mentality. – e. g. The amazing dotcom market in the late 90’s Didata. • Shares can (and do) create massive amounts of wealth, but they aren't without risks. – The key to protecting yourself in the share market is to understand where you are putting your money.

Investing and Returns 10 • What is investing? – Putting your money to work for you. – Investing is more than simply hoping that luck is on your side (Gambling). – Successful investing is committing capital only if there is a reasonable expectation of profit. • Why Invest? – Financial security. • What do you invest in? – What are your average returns? – What are the fees that you are paying?

11 Risk vs. Return

Risk 12 • Investing is all about managing risk. • Types of risks – Business risk – Financial risk – Liquidity risk – Exchange rate risk – Country / Political risk • Portfolio risk • Psychological risk • Neglect

How is risk managed 13 Diversification is a technique that reduces risk by allocating investments among various financial instruments, industries and other categories. • "Don’t put all of your eggs in one basket. ”. • Move to five shares.

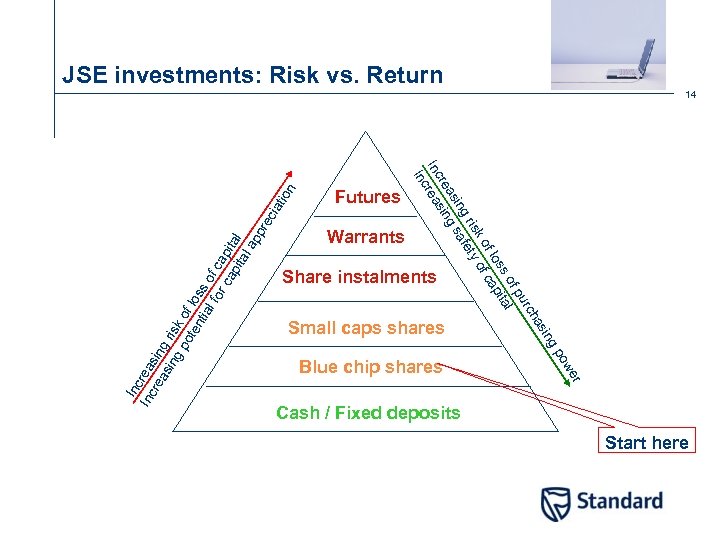

JSE investments: Risk vs. Return cia t Warrants Share instalments Small caps shares r we po Blue chip shares ing Inc rea sin g ris gp ko ote f lo nti ss al for of ca ca pit al al ap pre Futures s ha urc fp s o ital los ap of f c isk ty o g r fe sin g sa rea sin Inc rea Inc ion 14 Cash / Fixed deposits Start here

What is a reasonable return? 15 • Return must compensate for: – Time value of money during investment period – The expected rate of inflation – Risk in the business – Market return (beat the market or buy Satrix 40) • Buy the winning stock in the winning sector

16 Why the share market?

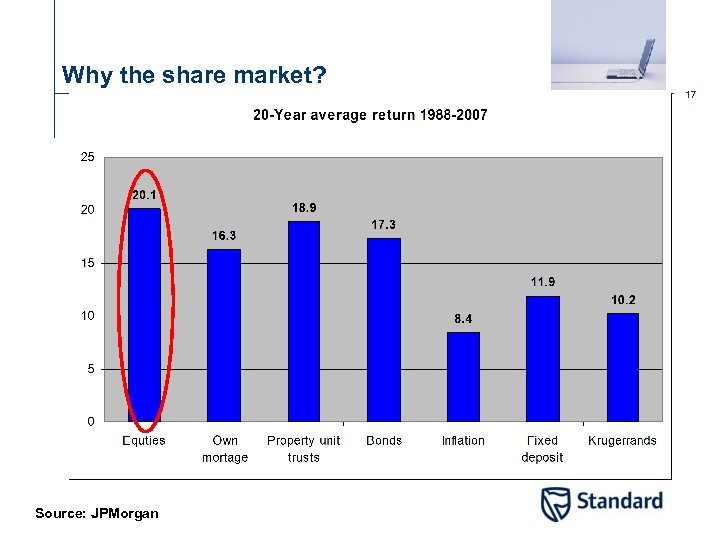

Why the share market? 17 Source: JPMorgan

Why the share market? 18 • Over a long period of time, shares generally outperform any other type of investment & often experience extreme returns. • Different types of strategies: – Growth (reinvests profits to grow the business) – Income (distributes most of profits as dividends) – Speculating (short term buy/sell) – Buy and hold • Liquidity (speed of sale or purchase) • Accessibility • You’re in control

Why the share market? 19 • An investment of R 5000 in Standard Bank in 1990 when the share price was R 1. 77. Jan 08 it was R 126, Jun 08 R 75 now worth R 211 k, a return of over 4, 220% excluding dividends (386 c in 2007). • Note that one can also experience extreme losses e. g. Didata. 18 September 1995 R 3. 20 18 September 1999 R 23. 80 18 September 2000 R 69. 60 18 September 2001 R 10. 70 18 September 2002 R 2. 40 18 September 2007 R 8. 01

20 Before you start investing

Develop an investment strategy 21 • INTENT • What stage of life are you at? – Young – Married with children – Retirement • What knowledge stage are you at? • What’s your style? “Know thyself” – What is your risk profile and risk tolerance? – Being able to master risk is being able to master the markets • Success depends on ensuring that your investment strategy fits your personal characteristics. • What is your investment time frame? • Invest, buy & hold or speculate?

Investment policy 22 • What are the real risks of an adverse financial outcome, especially in the short term? • What probable emotional reaction will I have to an adverse financial outcome? • How knowledgeable am I about investments and the share market? • What other capital or income source do I have? How important is this part of the portfolio to my overall financial position? • What, if any legal restriction maybe applicable to my investment needs? • What, if any unanticipated consequence of interim fluctuation in portfolio value. • Don’t risk more then you can afford to loose

Common Mistakes 23 • No investment strategy • Investing in individual shares instead of in a diversified portfolio of securities. • Investing in shares instead of in companies. • Buying high and selling low. • Churning your investments. • Acting on “tips” and “sound bites”. • Paying too much in fees and commissions. • Decision-making by tax avoidance. • Unrealistic expectations. • Neglect. • Not knowing your real tolerance for risk. • Averaging down.

24 The mechanics of the share market

What is a share? 25 • Your “share” of a company you have invested in. • If a company does well (is growing its profits) then its share price should rise. • Likewise if a company is not doing well (is making losses) then its share price should fall. • You can profit from share price movements and share income (dividends). • You have a right to your say.

What is a share market? 26 • Like any other market. • Requires buyers and sellers. • Shares are bought or sold when buyers and sellers agree on a price.

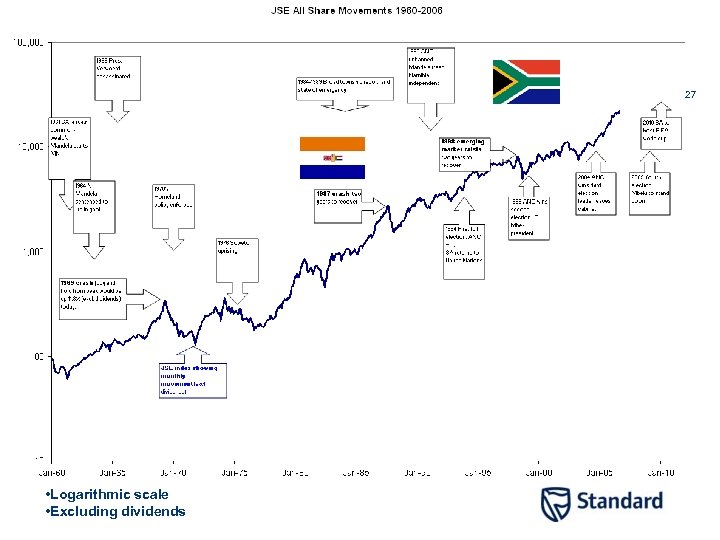

JSE Over the last 45 years 27 • Logarithmic scale • Excluding dividends

Different types of shares • Ordinary shares. • Preference shares & Retail notes (bonds). • Exchange Traded Funds (EFT). – Satrix – DB x-trackers – New. Gold – Prop. Trax • Derivatives. – Options (Warrants (calls & puts), Share Instalments) – Futures (Single Stock Futures and Currency futures) – Contract for difference - CFD 28

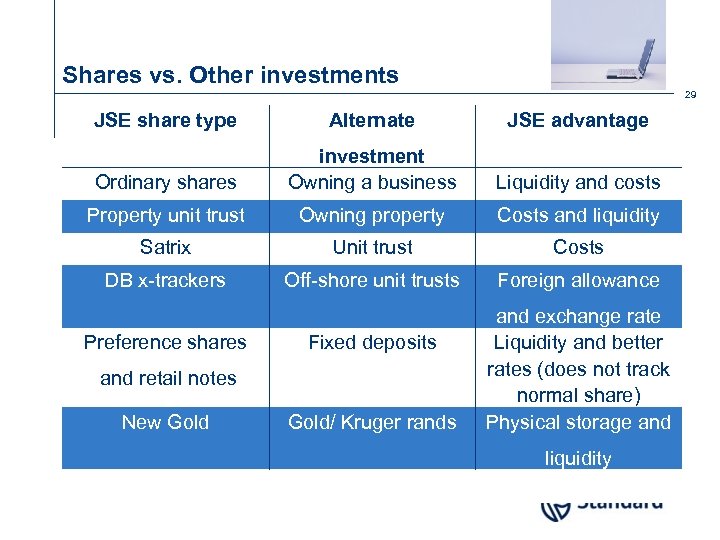

Shares vs. Other investments 29 JSE share type Alternate JSE advantage Ordinary shares investment Owning a business Liquidity and costs Property unit trust Owning property Costs and liquidity Satrix Unit trust Costs DB x-trackers Off-shore unit trusts Foreign allowance Preference shares Fixed deposits and retail notes New Gold/ Kruger rands and exchange rate Liquidity and better rates (does not track normal share) Physical storage and liquidity

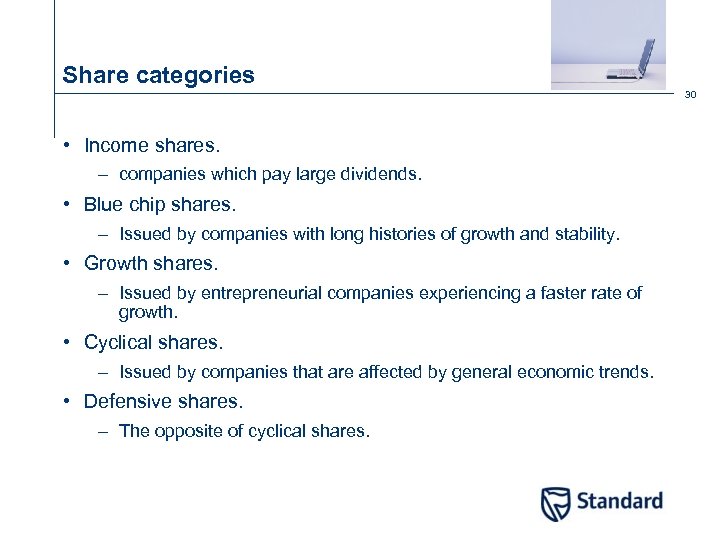

Share categories 30 • Income shares. – companies which pay large dividends. • Blue chip shares. – Issued by companies with long histories of growth and stability. • Growth shares. – Issued by entrepreneurial companies experiencing a faster rate of growth. • Cyclical shares. – Issued by companies that are affected by general economic trends. • Defensive shares. – The opposite of cyclical shares.

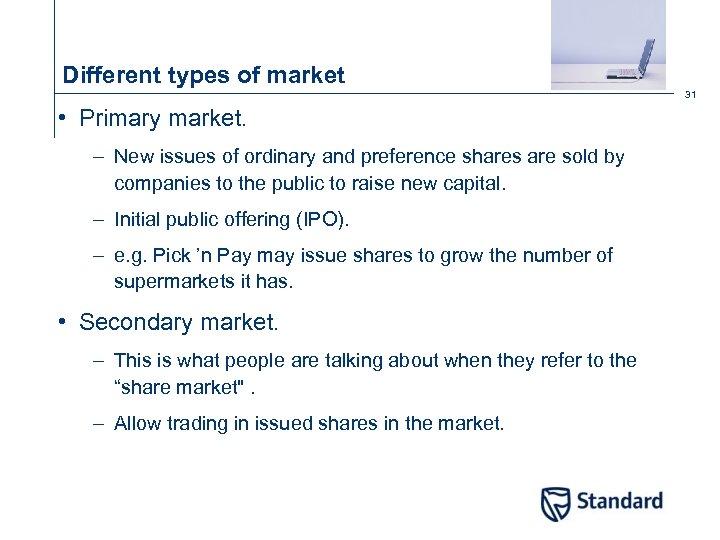

Different types of market 31 • Primary market. – New issues of ordinary and preference shares are sold by companies to the public to raise new capital. – Initial public offering (IPO). – e. g. Pick ’n Pay may issue shares to grow the number of supermarkets it has. • Secondary market. – This is what people are talking about when they refer to the “share market". – Allow trading in issued shares in the market.

Characteristics of a good share market 32 • High liquidity. • Timely and accurate information. • Price continuity. • Low transaction costs. • JSE meets all the above mentioned criteria.

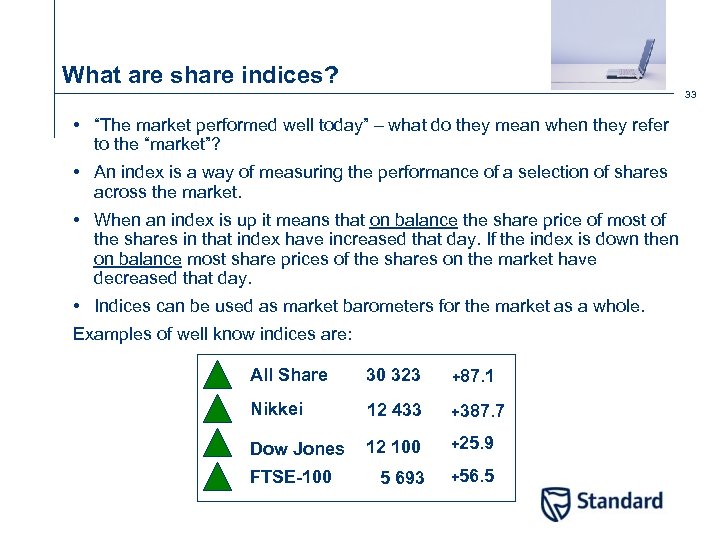

What are share indices? 33 • “The market performed well today” – what do they mean when they refer to the “market”? • An index is a way of measuring the performance of a selection of shares across the market. • When an index is up it means that on balance the share price of most of the shares in that index have increased that day. If the index is down then on balance most share prices of the shares on the market have decreased that day. • Indices can be used as market barometers for the market as a whole. Examples of well know indices are: All Share 30 323 +87. 1 Nikkei 12 433 +387. 7 Dow Jones 12 100 +25. 9 5 693 +56. 5 FTSE-100

What determines a share price? • Supply and demand. • Market Issues. – Overseas markets. – Interest rates and inflation. – The economy. – Government policy. • Company issues. – Earnings prospects. – Management. – Strategic initiatives. – Competitive environment. 34

How to make money in the stock market 35 You can make money with shares in two ways: • Buying a share at a low price and selling that share at a higher price at a future date This is referred to as capital growth. – e. g. buying Sanlam on 02 Jan 2007 for R 19. 00 per share and selling on 02 Jan 2008 for R 22. 81. A profit of R 3. 81 per share or a return of 20% over that period of time. • From dividends received from a share. This is referred to as income. • Growth and income are usually mutually exclusive.

What is a dividend? 36 • Dividends can be seen to be like tax free interest earned on the share. • Dividends are distributions of a companies’ earnings to shareholders. The dividend earned on shares depends on the profits earned by the company and payment is decided by the company. • The return that you receive from dividends can be expressed as % and is referred to as the dividend yield.

Dividend Yield 37 • The return that you receive from dividends can be expressed as % and is referred to as the dividend yield (like interest). Dividend per share • Dividend Yield = X 100 Price per share • Represents annual income from the share. • Different for different types of shares. • Income stocks DY 3 -8, growth stocks DY 0 -3.

The Dividend Yield - Example 38 • If you purchased Sanlam on 02 Jan 2007 at R 19. 00 you would have received a divided payment of R 0. 77 per share. This is a return of 4% per share (R 0. 77 / R 19. 00 = 4%) – e. g. Sanlam paid a dividend of 77 c in 2007, which is a 4% tax free yield

39 Choosing companies to invest in

Choosing companies to invest in 40 • Would you do business with them? • General long term prospects. – Will they be around in five years (or even better forever)? • Do you know a bit about the business? • Start with names you know and trust. • Sound management. • Financial strength and capital structure. • Strong companies in strong sectors.

Methods used to chose companies 41 • Fundamental analysis – Involves looking at any data, besides the trading patterns of the share itself, that can be expected to impact the price or perceived value of a share. • Technical analysis – A method of evaluating shares by analyzing statistics generated by market activity, such as past prices and volume.

Put another way Technical Analysis Fundamental Analysis 42 • “The story”- what the company does & what its outlook is (e. g. Pick ’n Pay is a supermarket chain. The outlook could be good for the economy and hence for personal spending could lead to more purchases at Pick ’n Pay hence the profits could be up and hence the share price could go up as well). • “The numbers” – review the financial statements of the company to see how healthy it is (Look at the income statement to see the profitability of Pick ’n Pay. Look at the balance sheet to see how financially secure it is). Look at the Price Earnings (PE) Ratio. • “The picture” – look at the history of the companies share price in a price chart (e. g. look at the past performance to see if the share is rising or falling, what is its trend? ).

43 Fundamental analysis

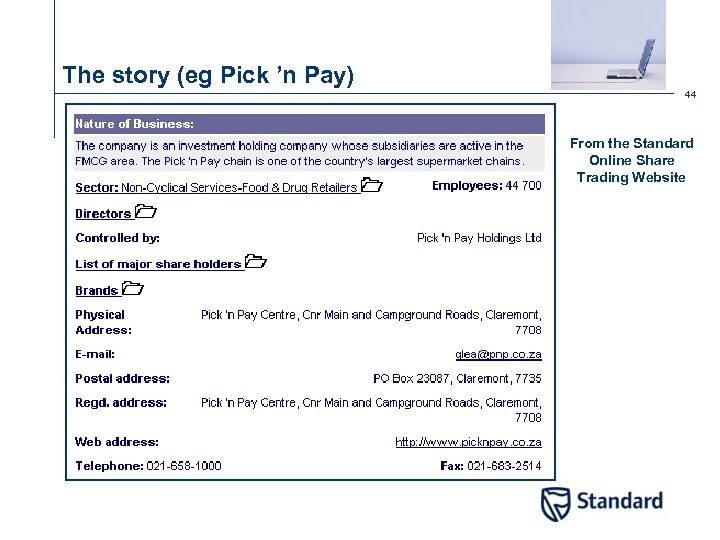

The story (eg Pick ’n Pay) 44 From the Standard Online Share Trading Website

The numbers (e. g. Pick ’n Pay) 45 From the Standard Online Share Trading Website

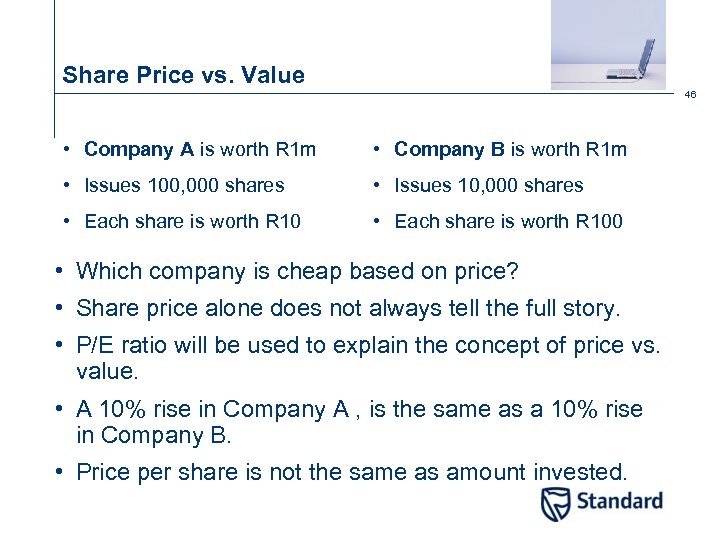

Share Price vs. Value 46 • Company A is worth R 1 m • Company B is worth R 1 m • Issues 100, 000 shares • Issues 10, 000 shares • Each share is worth R 100 • Which company is cheap based on price? • Share price alone does not always tell the full story. • P/E ratio will be used to explain the concept of price vs. value. • A 10% rise in Company A , is the same as a 10% rise in Company B. • Price per share is not the same as amount invested.

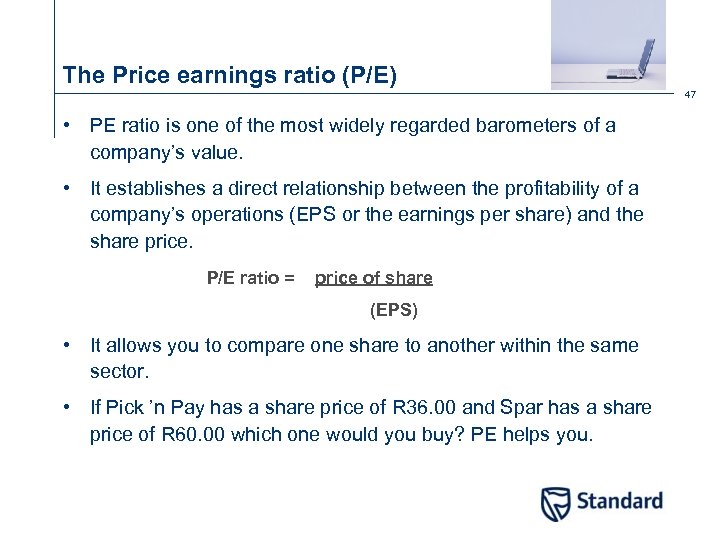

The Price earnings ratio (P/E) 47 • PE ratio is one of the most widely regarded barometers of a company’s value. • It establishes a direct relationship between the profitability of a company’s operations (EPS or the earnings per share) and the share price. P/E ratio = price of share (EPS) • It allows you to compare one share to another within the same sector. • If Pick ’n Pay has a share price of R 36. 00 and Spar has a share price of R 60. 00 which one would you buy? PE helps you.

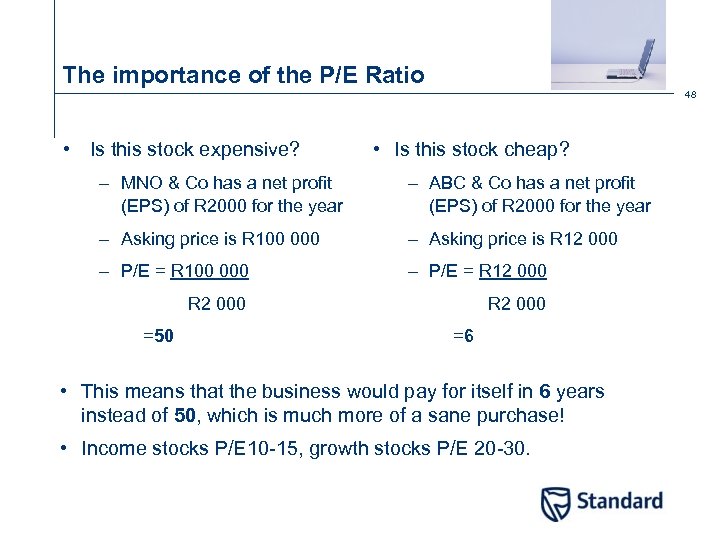

The importance of the P/E Ratio 48 • Is this stock expensive? • Is this stock cheap? – MNO & Co has a net profit (EPS) of R 2000 for the year – ABC & Co has a net profit (EPS) of R 2000 for the year – Asking price is R 100 000 – Asking price is R 12 000 – P/E = R 100 000 – P/E = R 12 000 R 2 000 =50 =6 • This means that the business would pay for itself in 6 years instead of 50, which is much more of a sane purchase! • Income stocks P/E 10 -15, growth stocks P/E 20 -30.

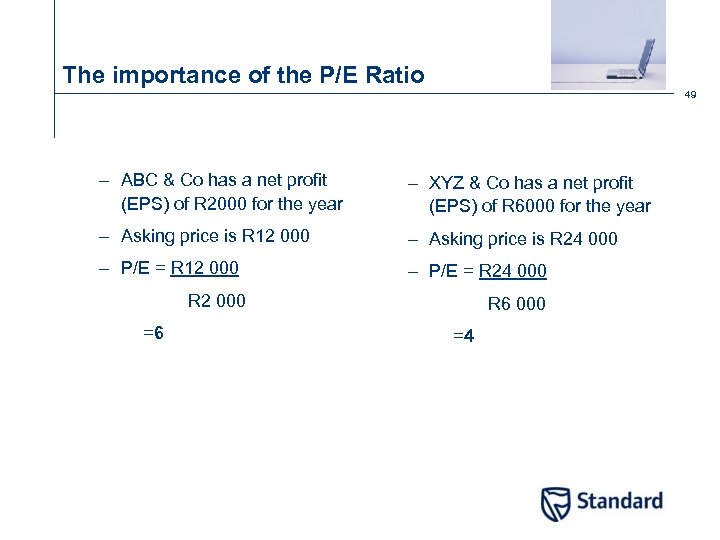

The importance of the P/E Ratio 49 – ABC & Co has a net profit (EPS) of R 2000 for the year – XYZ & Co has a net profit (EPS) of R 6000 for the year – Asking price is R 12 000 – Asking price is R 24 000 – P/E = R 12 000 – P/E = R 24 000 R 2 000 =6 R 6 000 =4

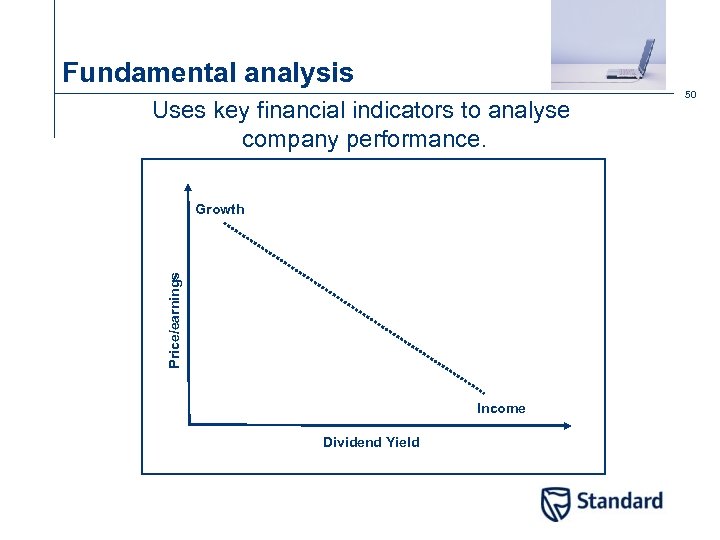

Fundamental analysis Uses key financial indicators to analyse company performance. Price/earnings Growth Income Dividend Yield 50

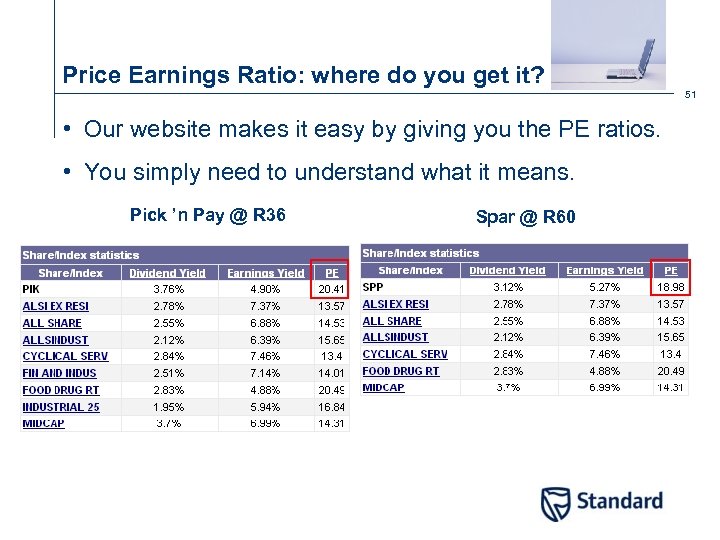

Price Earnings Ratio: where do you get it? 51 • Our website makes it easy by giving you the PE ratios. • You simply need to understand what it means. Pick ’n Pay @ R 36 Spar @ R 60

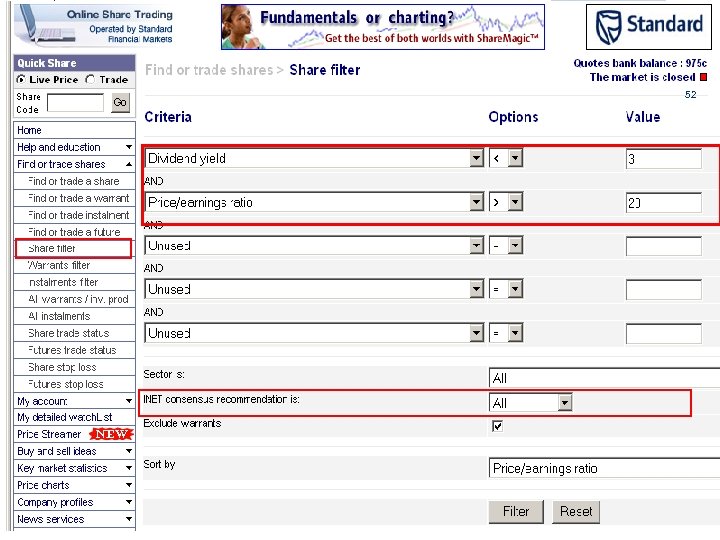

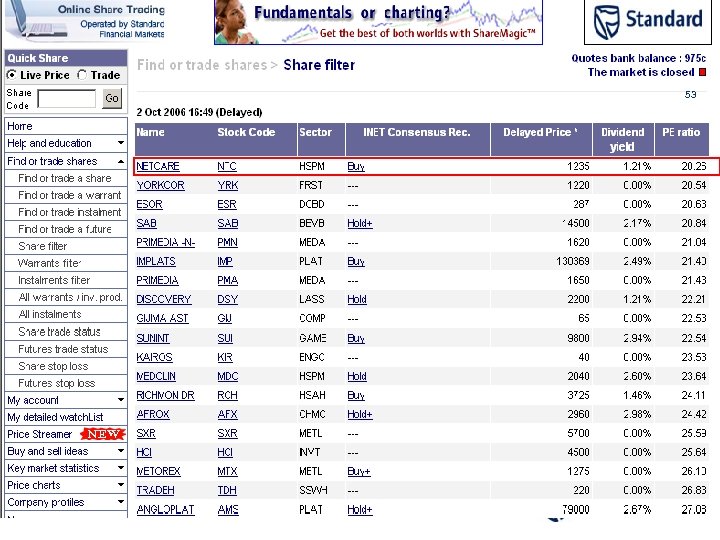

Using the website 52

Using the website 53 • The return that you receive from dividends can b

54 Technical analysis

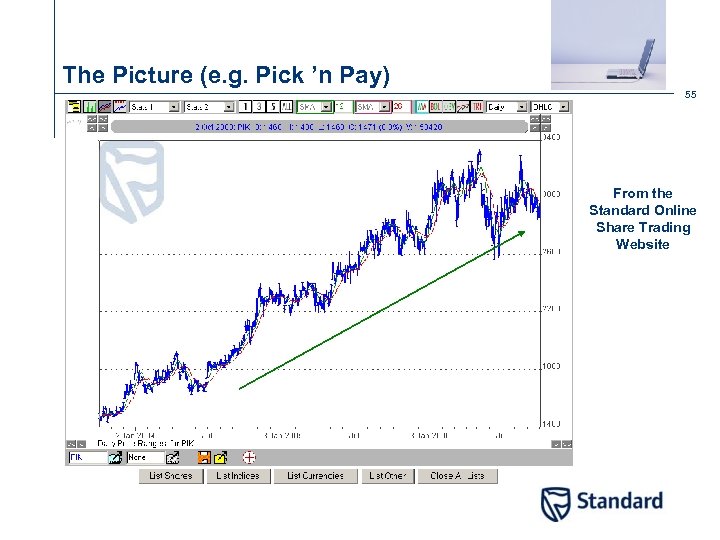

The Picture (e. g. Pick ’n Pay) 55 From the Standard Online Share Trading Website

Three core concepts of technical analysis 56 • The market discounts everything. • Price moves in trends. • History tends to repeat itself.

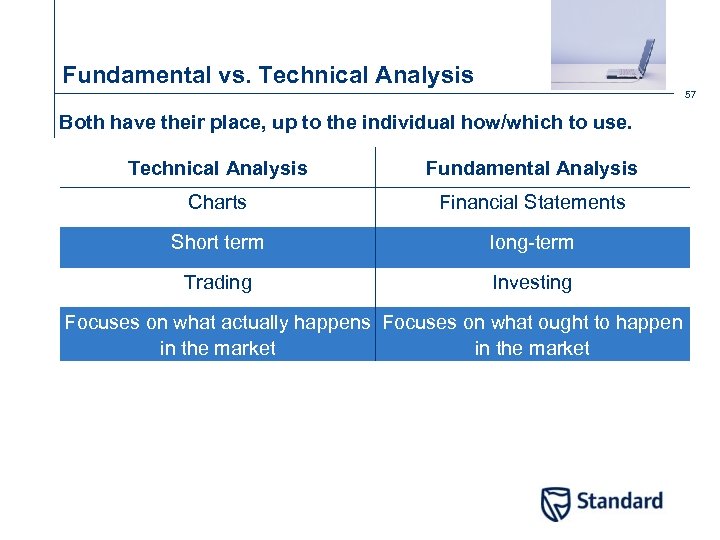

Fundamental vs. Technical Analysis 57 Both have their place, up to the individual how/which to use. Technical Analysis Fundamental Analysis Charts Financial Statements Short term long-term Trading Investing Focuses on what actually happens Focuses on what ought to happen in the market

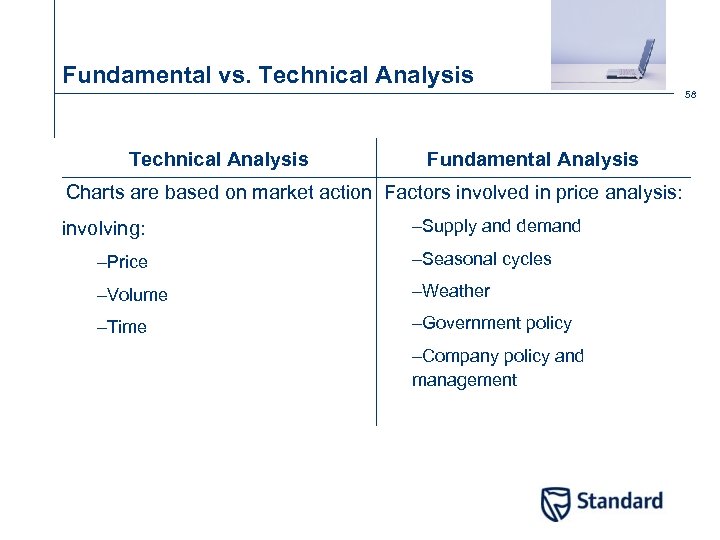

Fundamental vs. Technical Analysis 58 Technical Analysis Fundamental Analysis Charts are based on market action Factors involved in price analysis: involving: –Supply and demand –Price –Seasonal cycles –Volume –Weather –Time –Government policy –Company policy and management

In Practice 59 • One major advantage of technical analysis is that experienced analysts can follow many markets and market instruments, whereas the fundamental analyst needs to know a particular market intimately. • Use fundamentals to choose and technical's for timing.

60 Confirmation

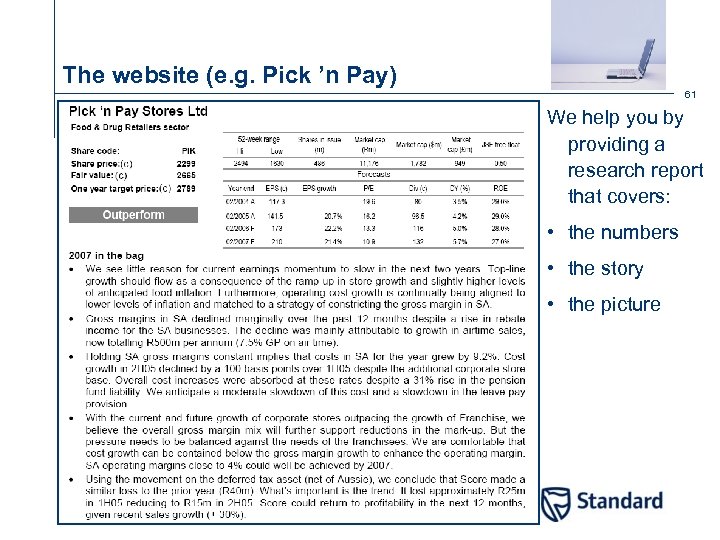

The website (e. g. Pick ’n Pay) 61 We help you by providing a research report that covers: • the numbers • the story • the picture From the Standard Bank Online Share Trading Website

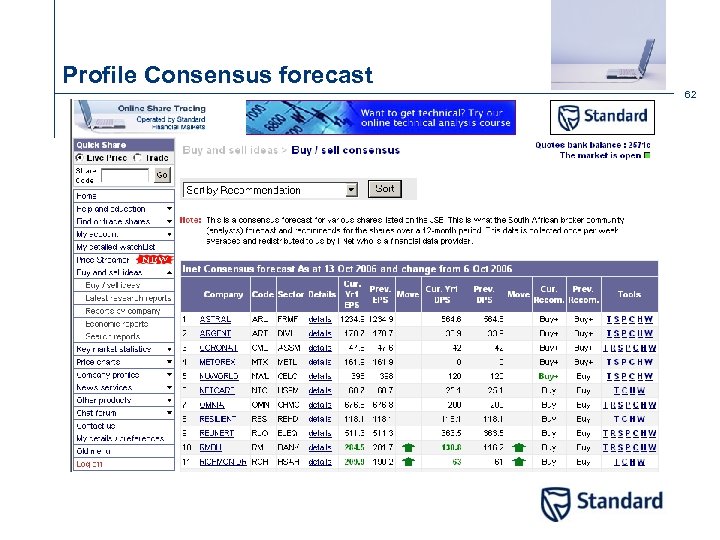

Profile Consensus forecast 62

63 Buying and selling shares

Buying and selling shares 64 Top down approach • Select strong markets • Select strong sectors within those markets • Select strong stocks within that sector

Buying and selling shares 65 • Decide what you want to do and capital out lay (quantity). • Place an order – Limit price or market price – Life of trade • Establish exit strategy • Start feeling like an owner.

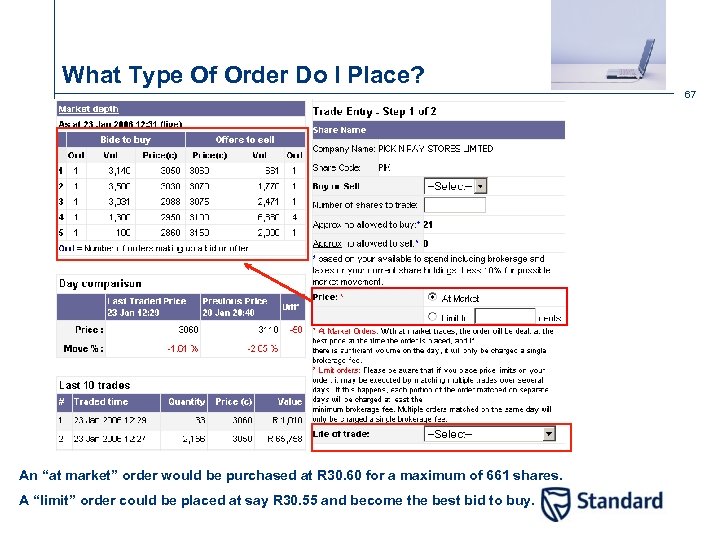

What Type Of Order Do I Place? 66 Price: • Market order – requires immediate execution of the trade at the best possible price available at that time. Be careful using these orders particularly for warrants as the market can move overnight. • Limit order – A limit order is an order to buy or sell a predetermined amount of shares at a specified price or better. Note that a limit order may match over multiple days and hence incur multiple fees. Life: • Day order – An order that expires at the end of the business day if it has not been filled. • Good Till Cancelled (GTC) – An order either to buy or sell a security that remains in effect until the customer cancels the order or alternatively until it is executed by the broker (valid for 1 month). Special orders: • Stop loss – A order that trades after a specific level has been reached (fixed or trailing - valid for 1 months).

What Type Of Order Do I Place? 67 An “at market” order would be purchased at R 30. 60 for a maximum of 661 shares. A “limit” order could be placed at say R 30. 55 and become the best bid to buy.

68 Limit order

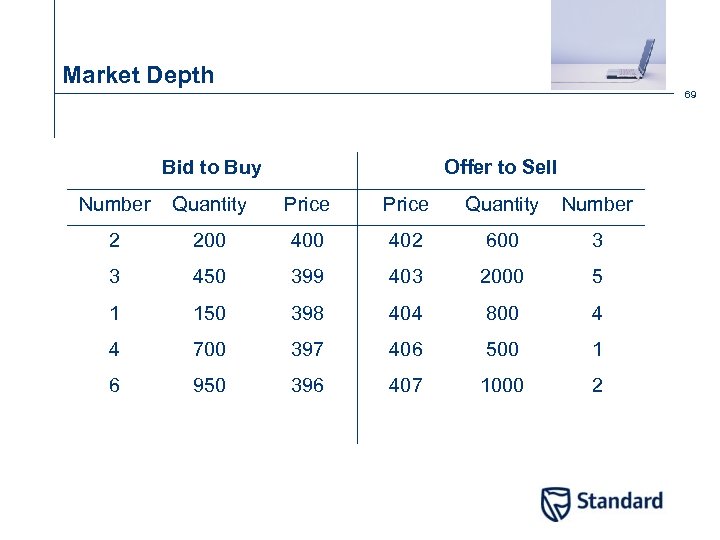

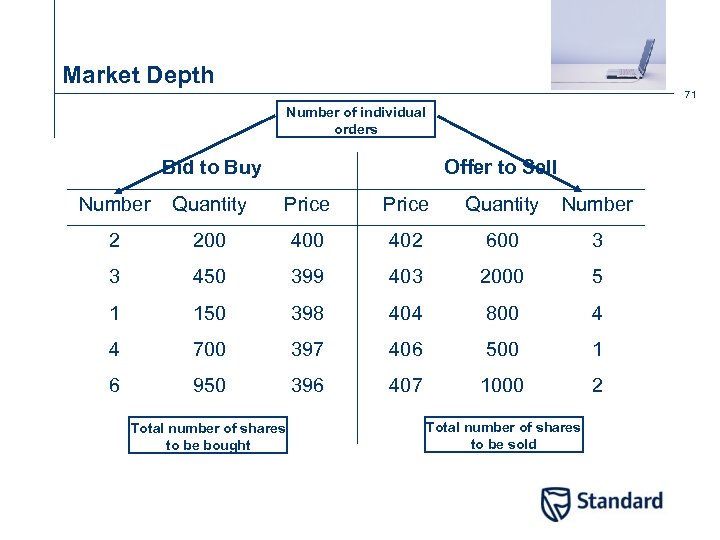

Market Depth 69 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 2 200 402 600 3 3 450 399 403 2000 5 1 150 398 404 800 4 4 700 397 406 500 1 6 950 396 407 1000 2

Market Depth 70 Price (in cents) – Time Priority Bid to Buy Offer to Sell Number Quantity Price Quantity Number 2 200 402 600 3 3 450 399 403 2000 5 1 150 398 404 800 4 4 700 397 406 500 1 6 950 396 407 1000 2 Increasing Price Decreasing Price

Market Depth 71 Number of individual orders Bid to Buy Offer to Sell Number Quantity Price Quantity Number 2 200 402 600 3 3 450 399 403 2000 5 1 150 398 404 800 4 4 700 397 406 500 1 6 950 396 407 1000 2 Total number of shares to be bought Total number of shares to be sold

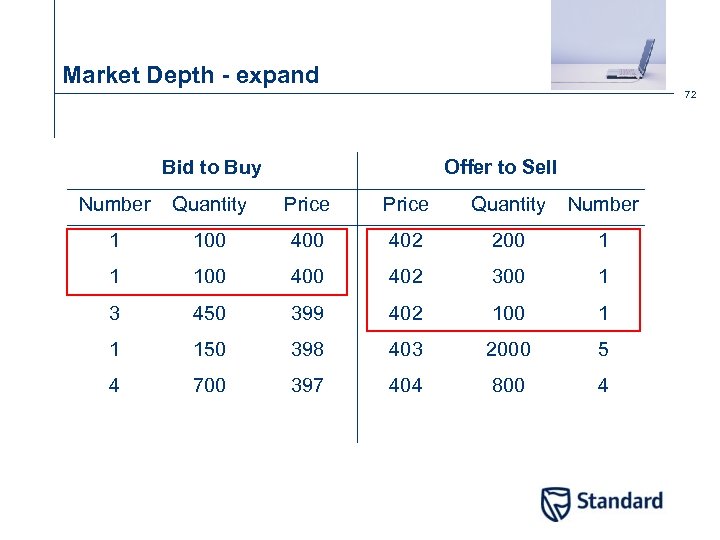

Market Depth - expand 72 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 100 402 200 1 1 100 402 300 1 3 450 399 402 100 1 1 150 398 403 2000 5 4 700 397 404 800 4

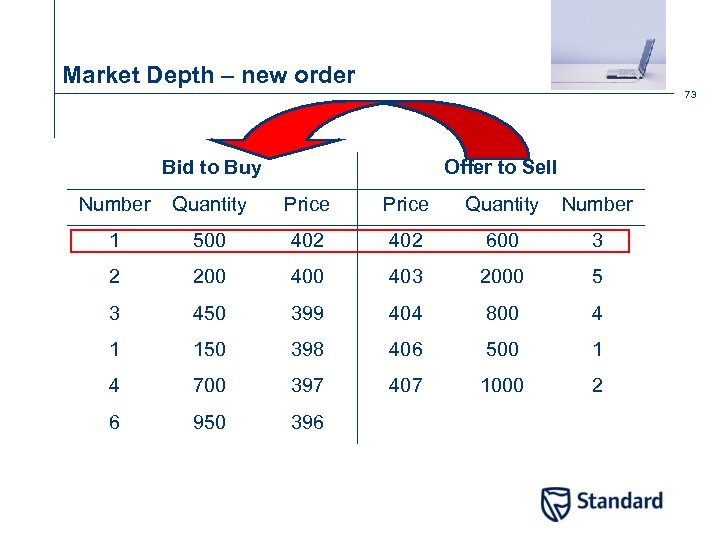

Market Depth – new order 73 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 500 402 600 3 2 200 403 2000 5 3 450 399 404 800 4 1 150 398 406 500 1 4 700 397 407 1000 2 6 950 396

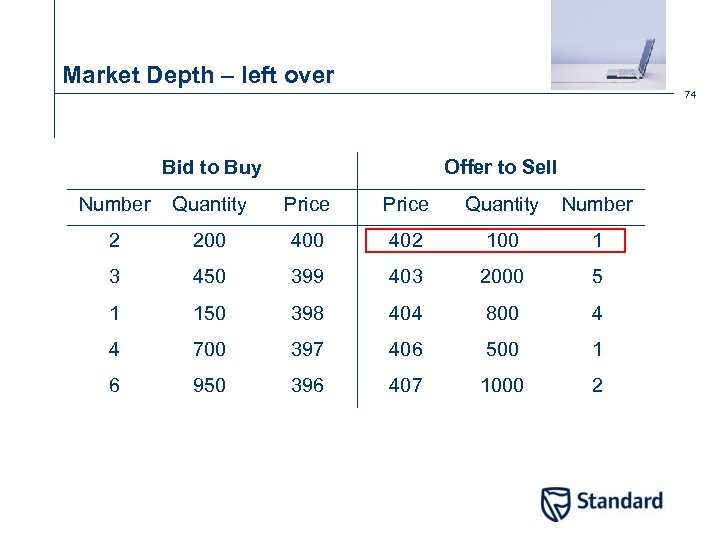

Market Depth – left over 74 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 2 200 402 100 1 3 450 399 403 2000 5 1 150 398 404 800 4 4 700 397 406 500 1 6 950 396 407 1000 2

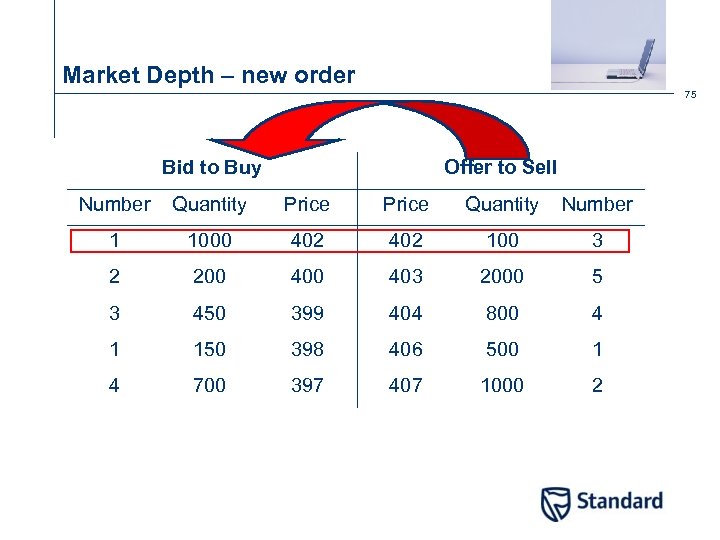

Market Depth – new order 75 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 1000 402 100 3 2 200 403 2000 5 3 450 399 404 800 4 1 150 398 406 500 1 4 700 397 407 1000 2

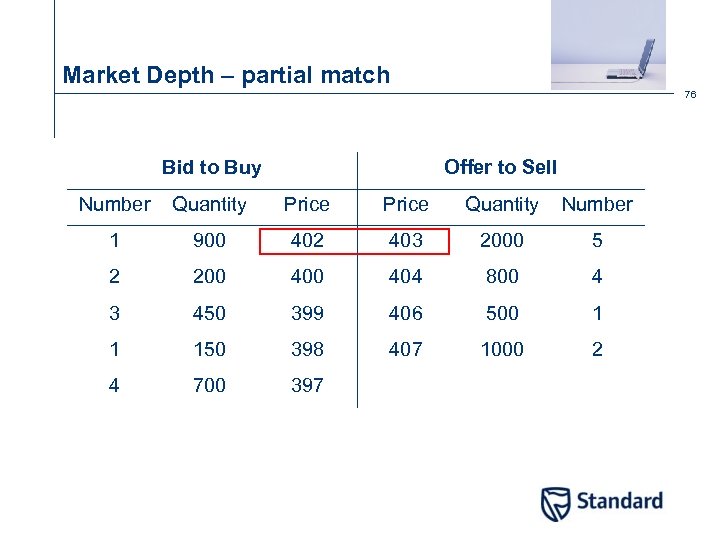

Market Depth – partial match 76 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 900 402 403 2000 5 2 200 404 800 4 3 450 399 406 500 1 1 150 398 407 1000 2 4 700 397

77 At market order

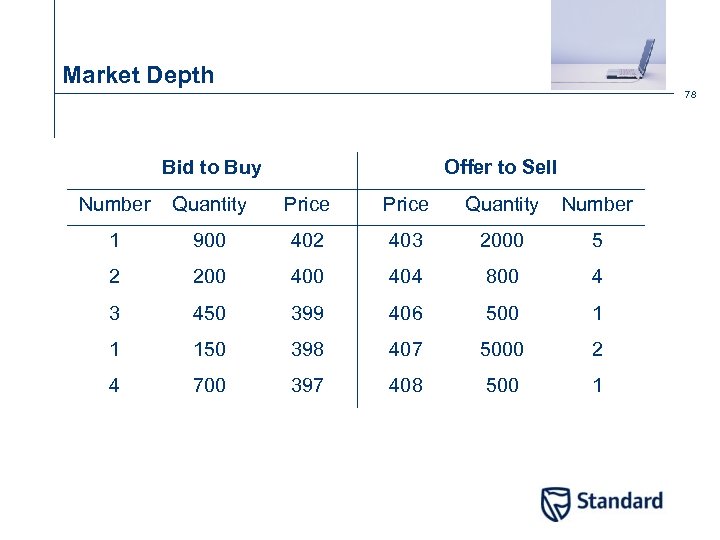

Market Depth 78 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 900 402 403 2000 5 2 200 404 800 4 3 450 399 406 500 1 1 150 398 407 5000 2 4 700 397 408 500 1

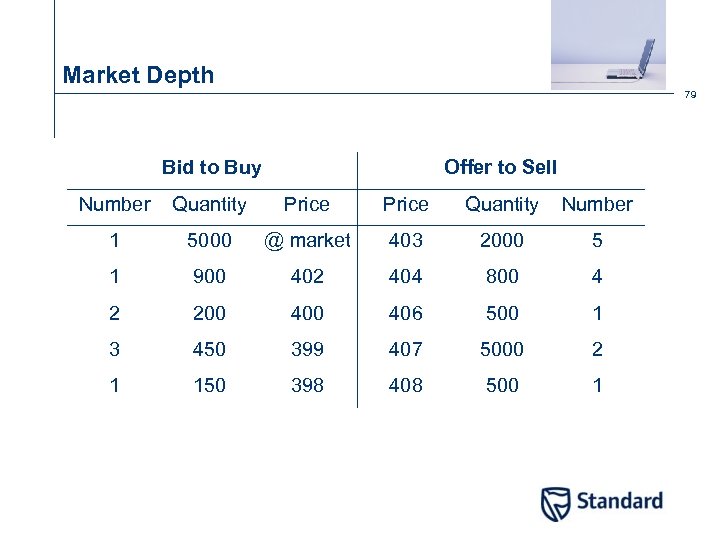

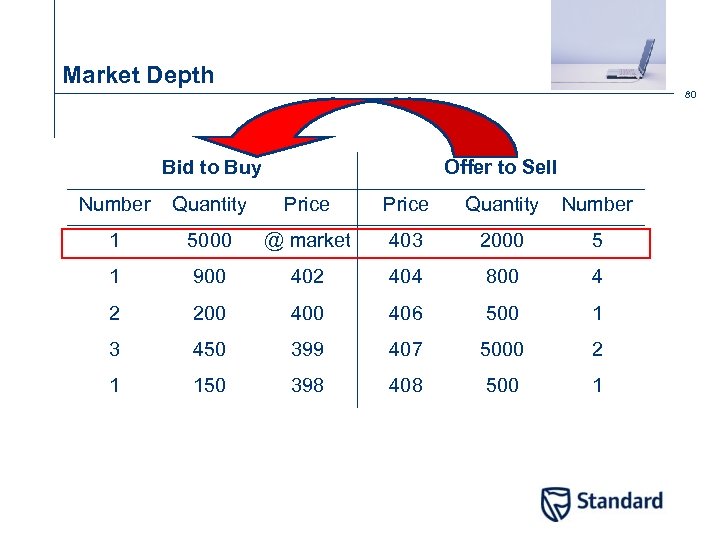

Market Depth 79 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 5000 @ market 403 2000 5 1 900 402 404 800 4 2 200 406 500 1 3 450 399 407 5000 2 1 150 398 408 500 1

Market Depth 80 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 5000 @ market 403 2000 5 1 900 402 404 800 4 2 200 406 500 1 3 450 399 407 5000 2 1 150 398 408 500 1

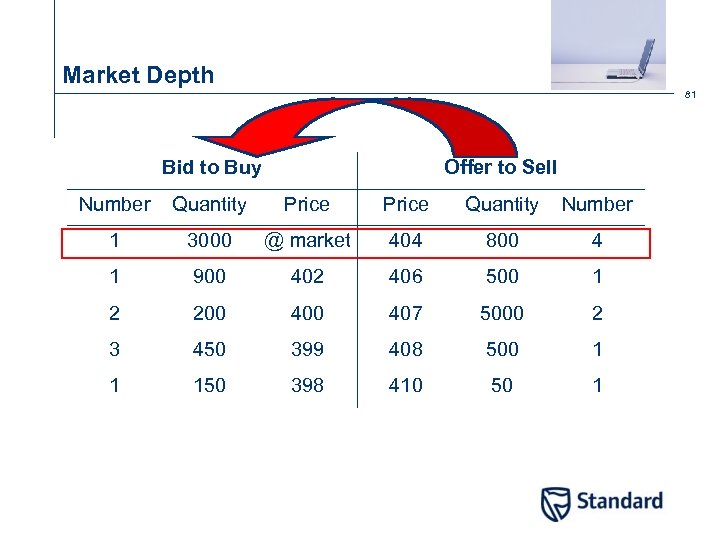

Market Depth 81 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 3000 @ market 404 800 4 1 900 402 406 500 1 2 200 407 5000 2 3 450 399 408 500 1 1 150 398 410 50 1

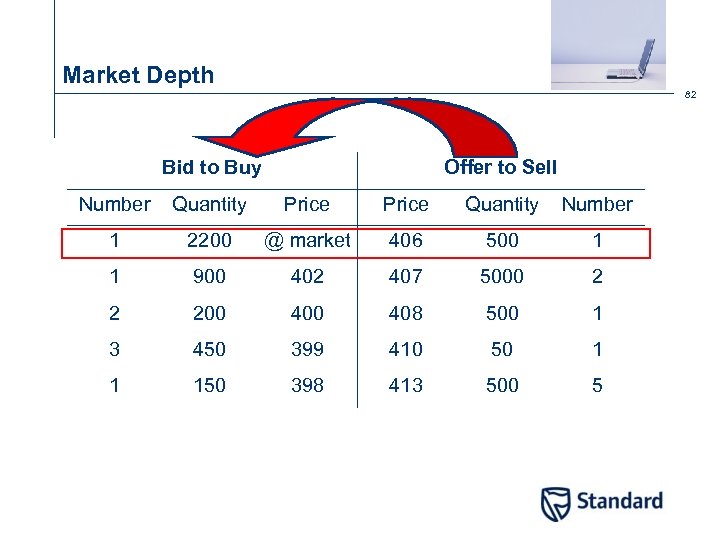

Market Depth 82 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 2200 @ market 406 500 1 1 900 402 407 5000 2 2 200 408 500 1 3 450 399 410 50 1 1 150 398 413 500 5

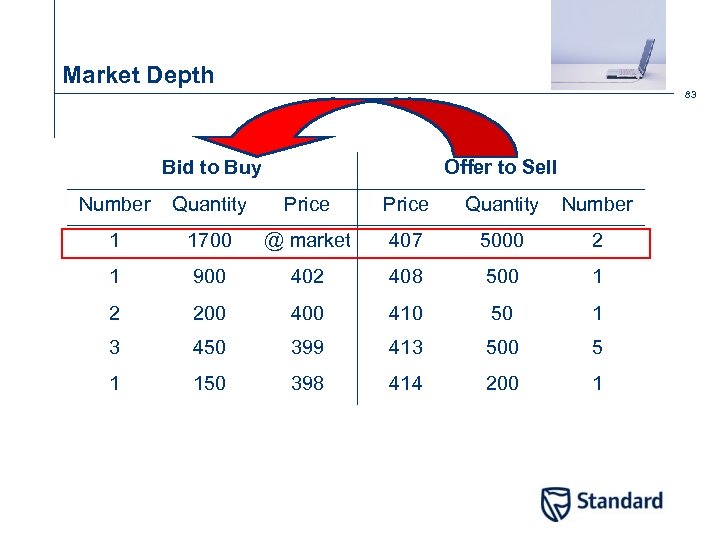

Market Depth 83 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 1700 @ market 407 5000 2 1 900 402 408 500 1 2 200 410 50 1 3 450 399 413 500 5 1 150 398 414 200 1

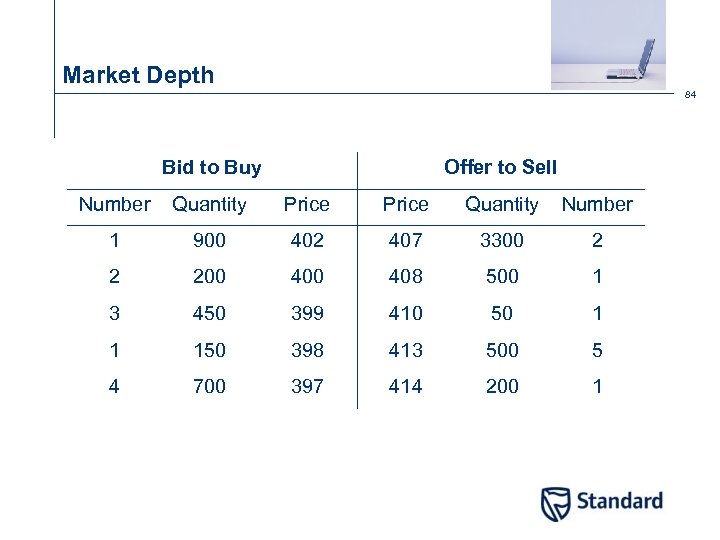

Market Depth 84 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 900 402 407 3300 2 2 200 408 500 1 3 450 399 410 50 1 1 150 398 413 500 5 4 700 397 414 200 1

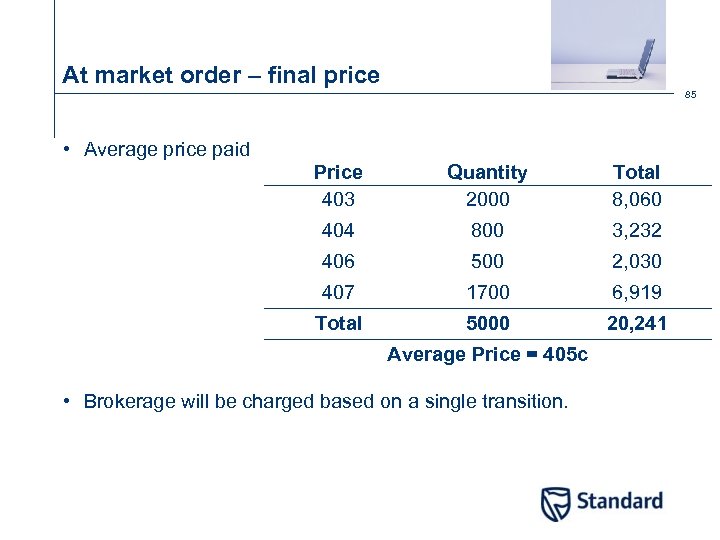

At market order – final price 85 • Average price paid Price 403 Quantity 2000 Total 8, 060 404 800 3, 232 406 500 2, 030 407 1700 6, 919 Total 5000 20, 241 Average Price = 405 c • Brokerage will be charged based on a single transition.

86 Stop Loss

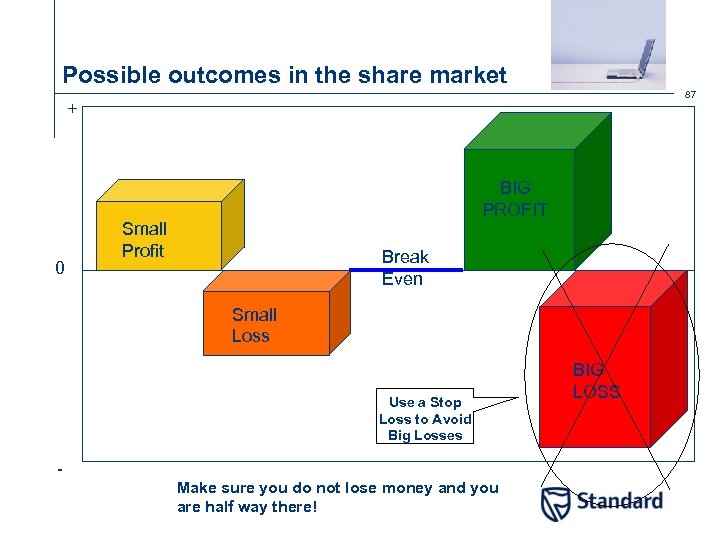

Possible outcomes in the share market 87 + 0 BIG PROFIT Small Profit Break Even Small Loss Use a Stop Loss to Avoid Big Losses - Make sure you do not lose money and you are half way there! BIG LOSS

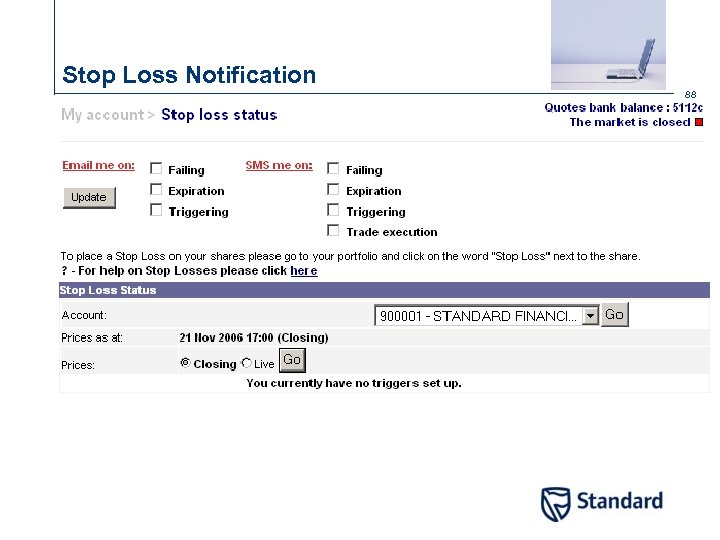

Stop Loss Notification 88

Types of stop losses 89 • An initial stop is designed to protect your capital. • A breakeven stop will help lock in a no-loss trade. • Trailing stops are designed to protect your profit. • Determine style of stop loss • Know your intent • Volatility • Previous lows

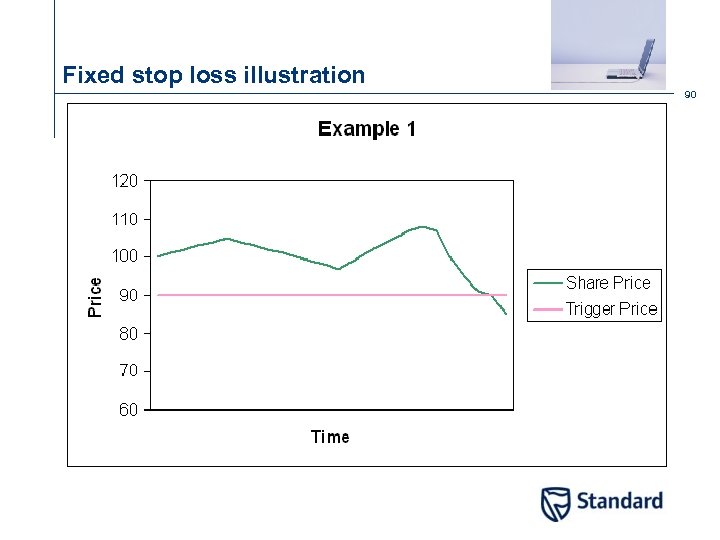

Fixed stop loss illustration 90

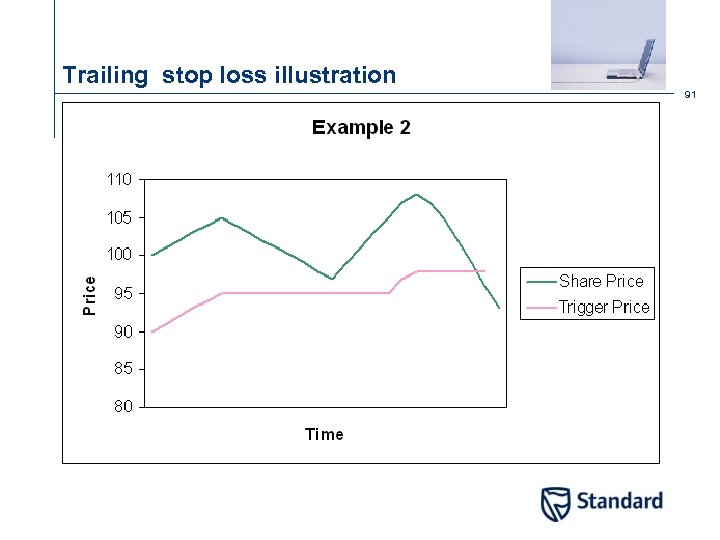

Trailing stop loss illustration 91

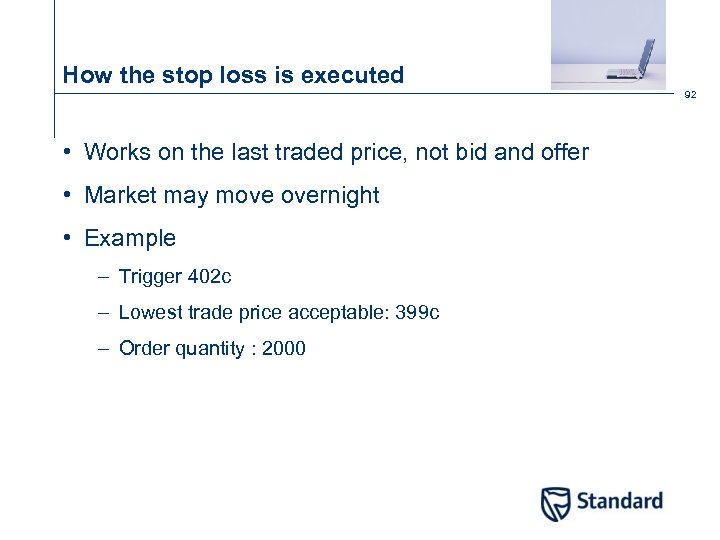

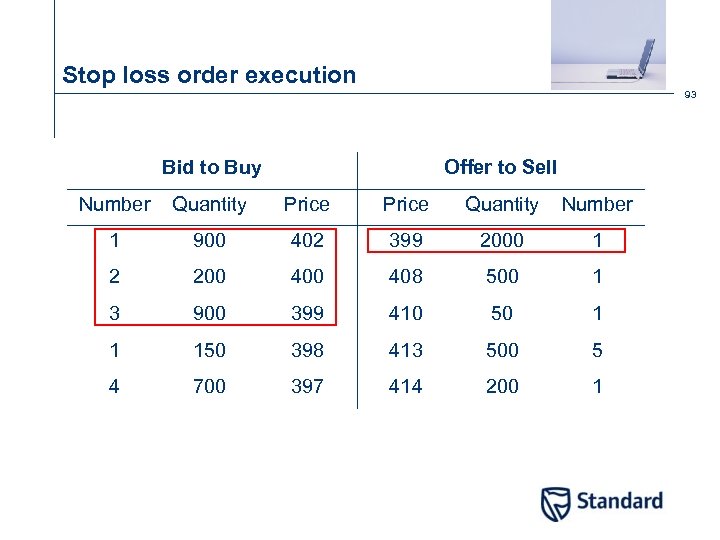

How the stop loss is executed 92 • Works on the last traded price, not bid and offer • Market may move overnight • Example – Trigger 402 c – Lowest trade price acceptable: 399 c – Order quantity : 2000

Stop loss order execution 93 Bid to Buy Offer to Sell Number Quantity Price Quantity Number 1 900 402 399 2000 1 2 200 408 500 1 3 900 399 410 50 1 1 150 398 413 500 5 4 700 397 414 200 1

94 Costs

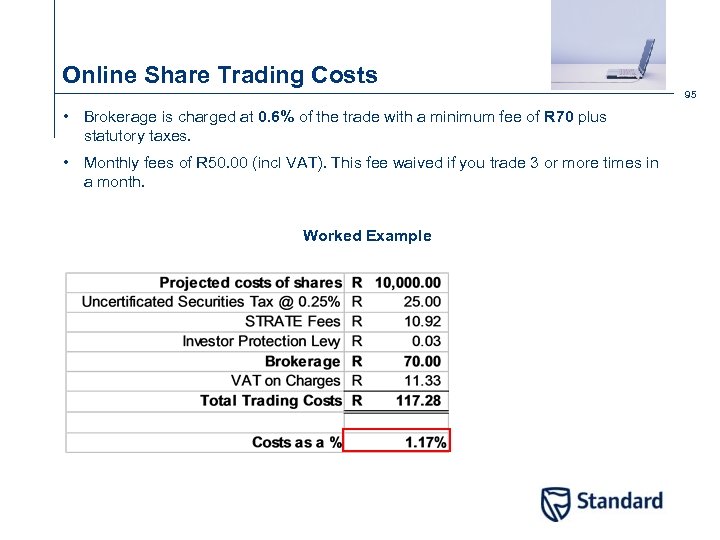

Online Share Trading Costs 95 • Brokerage is charged at 0. 6% of the trade with a minimum fee of R 70 plus statutory taxes. • Monthly fees of R 50. 00 (incl VAT). This fee waived if you trade 3 or more times in a month. Worked Example

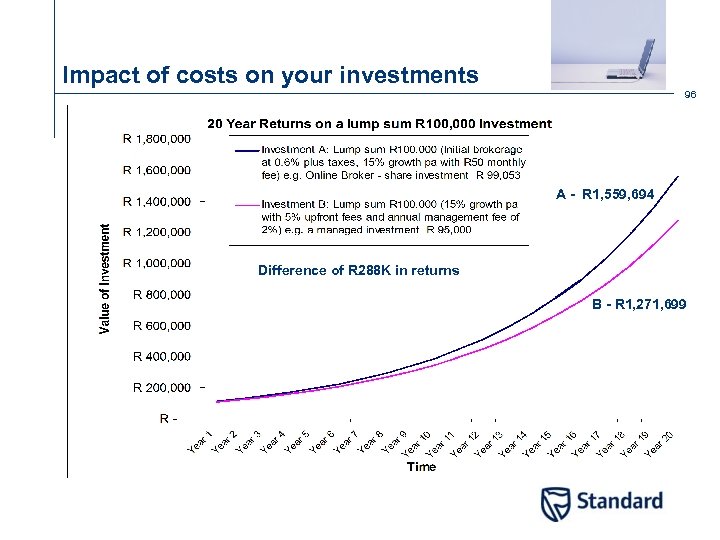

Impact of costs on your investments 96 A - R 1, 559, 694 Difference of R 288 K in returns B - R 1, 271, 699

97 Lessons from the Masters

Warren Buffet Chairman Berkshire Hathaway 98 • If past history was all there was to the game, the richest people would be librarians. • Rule No 1: Never lose money Rule No 2: Never forget rule No 1. • Risk comes from not knowing what you're doing. • Key lesson : Stop loss, education

John (Jack) Bogle Founder and Chairman of The Vanguard Group 99 If you have trouble imagining a 20% loss in the stock market, you shouldn't be in stocks. • Key lesson : Stop loss, know your risk profile

Peter Lynch Former fund manager, today he is vice-chairman of Fidelity 100 Go for a business that any idiot can run - because sooner or later, any idiot probably is going to run it. • Key lesson : Know the companies you are investing in.

George Soros Founder of Soros Fund Management 101 It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong. • Key lesson : Stop loss

John Templeton Founder of the Templeton Group 102 The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell. • Key lesson : Be contrarian.

Benjamin Graham “father of value investing” 103 To achieve satisfactory investment results is easier than most people realize; to achieve superior results is harder than it looks. • Key lesson : Do your home work.

Benjamin Graham “father of value investing” 104 Intelligent investment is more a matter of mental approach than it is of techniques. A sound mental approach toward share fluctuations is a touchstone of all successful investment under presentday conditions. • Key lesson : Don’t be emotional.

105 Summary

Summary 106 • Investing in the share market makes sense. • Good companies perform in the long term. • Jargon can be overcome. • Research before you buy. • Buying and selling share is easy. • Move towards 5 stocks quickly.

107 Next Steps?

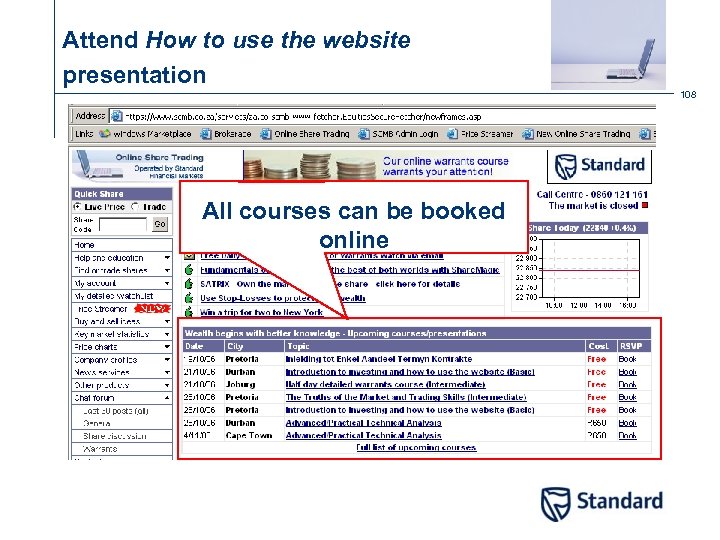

Attend How to use the website presentation 108 All courses can be booked online

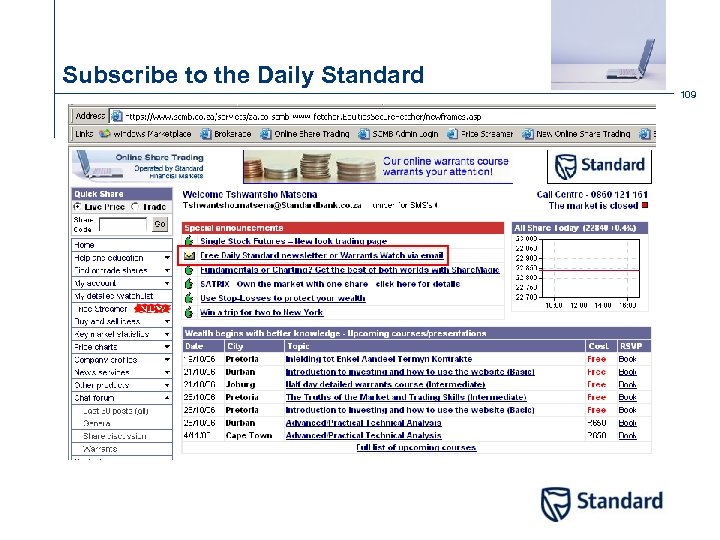

Subscribe to the Daily Standard 109

Explore the website – Site map 110

Disclaimer 111 • The information and opinions stated in this document are of a general nature, have been prepared solely for information purposes and do not constitute any advice or recommendation to conclude any transaction or enter into any agreement. It is strongly recommended that every recipient seek appropriate professional advice before acting on any information contained herein. Whilst every care has been taken in preparing this document, no representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or representations. All information contained herein is subject to change after publication at any time without notice. The past performance of any investment product is not an indication of future performance. Online Share Trading is operated by Standard Financial Markets Proprietary Limited Reg. No. 1972/008305/07, a subsidiary of the Standard Bank Group Limited and authorised user of the JSE Limited.

a85b1c1d3317b17f8a7e8db26c9b4bc2.ppt