3151934628c6568916d11157197e2303.ppt

- Количество слайдов: 12

Introduction To Foreign Exchange Saeed Amen

Introduction To Foreign Exchange Saeed Amen

Introduction We present a brief introduction to the foreign exchange market What are the major currencies? How are they quoted? What is relative liquidity of different currency pairs? Brief description on how FX options are quoted.

Introduction We present a brief introduction to the foreign exchange market What are the major currencies? How are they quoted? What is relative liquidity of different currency pairs? Brief description on how FX options are quoted.

Foreign Exchange Market Volume $3. 5 tr FX spot - $1 tr Outright FX forwards - $350 mm Calls, put, straddles, strangles (buy OTM call and put) risk reversals (buy OTM call & sell put) most common vanillas More exotic instruments – barrier options, one touches, volatility swaps, correlation swaps etc. Centres Buying (selling) spot and selling (buying) forward date Common usage is to roll spot positions overnight through tom/next contract FX options - $200 bn Buying currency for future delivery – for example 1 M delivery FX swaps - $1. 7 tr (FX spot + FX forward) Buying currency for immediate delivery – settlement usually T+1 UK 34% - open during both Asian (morning) and American timezones (afternoon) US 17% Singapore 6% Switzerland 6% Japan 6% Source BIS 2007 & Wikipedia

Foreign Exchange Market Volume $3. 5 tr FX spot - $1 tr Outright FX forwards - $350 mm Calls, put, straddles, strangles (buy OTM call and put) risk reversals (buy OTM call & sell put) most common vanillas More exotic instruments – barrier options, one touches, volatility swaps, correlation swaps etc. Centres Buying (selling) spot and selling (buying) forward date Common usage is to roll spot positions overnight through tom/next contract FX options - $200 bn Buying currency for future delivery – for example 1 M delivery FX swaps - $1. 7 tr (FX spot + FX forward) Buying currency for immediate delivery – settlement usually T+1 UK 34% - open during both Asian (morning) and American timezones (afternoon) US 17% Singapore 6% Switzerland 6% Japan 6% Source BIS 2007 & Wikipedia

Major Currencies Double counting given FX transactions involve two currencies – base/terms quote G 10 (official name and “trading” name) EUR (37%) - euro, GBP (15%) – sterling/British pound, AUD (6. 7%) – Australian dollar Aussie, NZD (1. 9%) – New Zealand dollar - Kiwi, USD (86. 3%) – US dollar - dollar, CAD (4. 2%) – Canadian dollar – cad (loonie), CHF (6. 8%) – Swiss franc - Swiss, NOK (2. 2%) – Norwegian krone - Nokkie, SEK (2. 8%) – Swedish krona - Stokkie, JPY (16. 5%) Japanese yen Written in quotation order Eg. EUR always first, JPY always last Correct quotations EUR/GBP, AUD/NZD, CHF/JPY etc. Generally USD crosses traded more (except EUR/scandis) EUR/USD (27%), USD/JPY (13%), GBP/USD (12%), AUD/USD (6%), USD/CHF (5%), USD/CAD (4%), USD/SEK (2%), USD/other (19%) EUR/JPY (2%), EUR/GBP (2%), EUR/CHF (4%), EUR/other (4%) Other crosses (4%) – eg. AUD/NZD, NOK/SEK Can trade any cross indirectly if direct equivalent not traded eg. CHF/SEK = EUR/CHF and EUR/SEK

Major Currencies Double counting given FX transactions involve two currencies – base/terms quote G 10 (official name and “trading” name) EUR (37%) - euro, GBP (15%) – sterling/British pound, AUD (6. 7%) – Australian dollar Aussie, NZD (1. 9%) – New Zealand dollar - Kiwi, USD (86. 3%) – US dollar - dollar, CAD (4. 2%) – Canadian dollar – cad (loonie), CHF (6. 8%) – Swiss franc - Swiss, NOK (2. 2%) – Norwegian krone - Nokkie, SEK (2. 8%) – Swedish krona - Stokkie, JPY (16. 5%) Japanese yen Written in quotation order Eg. EUR always first, JPY always last Correct quotations EUR/GBP, AUD/NZD, CHF/JPY etc. Generally USD crosses traded more (except EUR/scandis) EUR/USD (27%), USD/JPY (13%), GBP/USD (12%), AUD/USD (6%), USD/CHF (5%), USD/CAD (4%), USD/SEK (2%), USD/other (19%) EUR/JPY (2%), EUR/GBP (2%), EUR/CHF (4%), EUR/other (4%) Other crosses (4%) – eg. AUD/NZD, NOK/SEK Can trade any cross indirectly if direct equivalent not traded eg. CHF/SEK = EUR/CHF and EUR/SEK

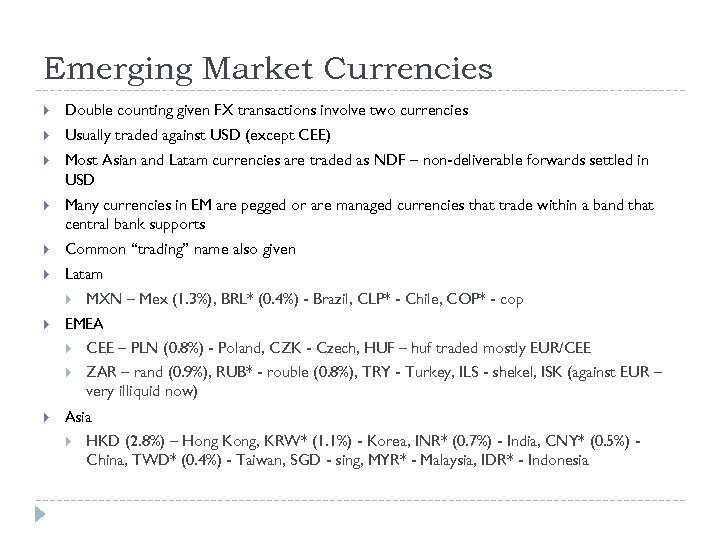

Emerging Market Currencies Double counting given FX transactions involve two currencies Usually traded against USD (except CEE) Most Asian and Latam currencies are traded as NDF – non-deliverable forwards settled in USD Many currencies in EM are pegged or are managed currencies that trade within a band that central bank supports Common “trading” name also given Latam MXN – Mex (1. 3%), BRL* (0. 4%) - Brazil, CLP* - Chile, COP* - cop EMEA CEE – PLN (0. 8%) - Poland, CZK - Czech, HUF – huf traded mostly EUR/CEE ZAR – rand (0. 9%), RUB* - rouble (0. 8%), TRY - Turkey, ILS - shekel, ISK (against EUR – very illiquid now) Asia HKD (2. 8%) – Hong Kong, KRW* (1. 1%) - Korea, INR* (0. 7%) - India, CNY* (0. 5%) China, TWD* (0. 4%) - Taiwan, SGD - sing, MYR* - Malaysia, IDR* - Indonesia

Emerging Market Currencies Double counting given FX transactions involve two currencies Usually traded against USD (except CEE) Most Asian and Latam currencies are traded as NDF – non-deliverable forwards settled in USD Many currencies in EM are pegged or are managed currencies that trade within a band that central bank supports Common “trading” name also given Latam MXN – Mex (1. 3%), BRL* (0. 4%) - Brazil, CLP* - Chile, COP* - cop EMEA CEE – PLN (0. 8%) - Poland, CZK - Czech, HUF – huf traded mostly EUR/CEE ZAR – rand (0. 9%), RUB* - rouble (0. 8%), TRY - Turkey, ILS - shekel, ISK (against EUR – very illiquid now) Asia HKD (2. 8%) – Hong Kong, KRW* (1. 1%) - Korea, INR* (0. 7%) - India, CNY* (0. 5%) China, TWD* (0. 4%) - Taiwan, SGD - sing, MYR* - Malaysia, IDR* - Indonesia

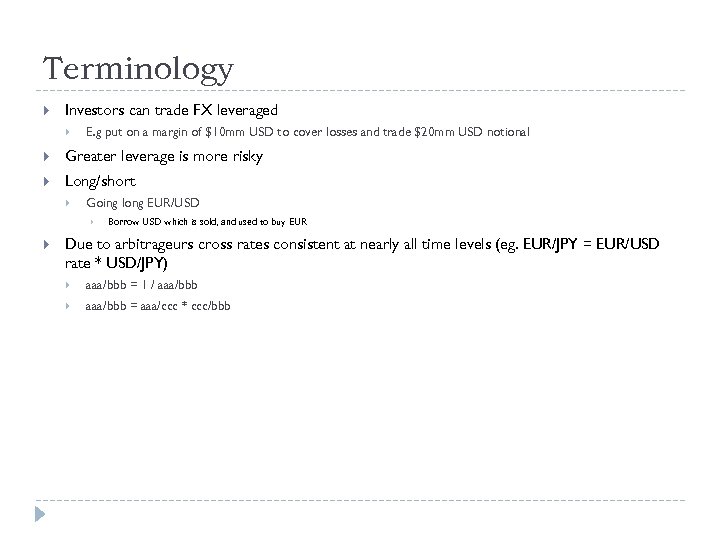

Terminology Investors can trade FX leveraged E. g put on a margin of $10 mm USD to cover losses and trade $20 mm USD notional Greater leverage is more risky Long/short Going long EUR/USD Borrow USD which is sold, and used to buy EUR Due to arbitrageurs cross rates consistent at nearly all time levels (eg. EUR/JPY = EUR/USD rate * USD/JPY) aaa/bbb = 1 / aaa/bbb = aaa/ccc * ccc/bbb

Terminology Investors can trade FX leveraged E. g put on a margin of $10 mm USD to cover losses and trade $20 mm USD notional Greater leverage is more risky Long/short Going long EUR/USD Borrow USD which is sold, and used to buy EUR Due to arbitrageurs cross rates consistent at nearly all time levels (eg. EUR/JPY = EUR/USD rate * USD/JPY) aaa/bbb = 1 / aaa/bbb = aaa/ccc * ccc/bbb

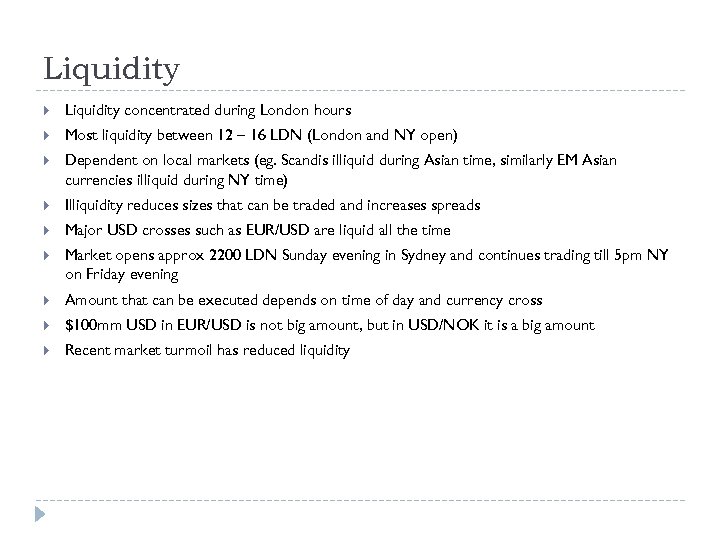

Liquidity concentrated during London hours Most liquidity between 12 – 16 LDN (London and NY open) Dependent on local markets (eg. Scandis illiquid during Asian time, similarly EM Asian currencies illiquid during NY time) Illiquidity reduces sizes that can be traded and increases spreads Major USD crosses such as EUR/USD are liquid all the time Market opens approx 2200 LDN Sunday evening in Sydney and continues trading till 5 pm NY on Friday evening Amount that can be executed depends on time of day and currency cross $100 mm USD in EUR/USD is not big amount, but in USD/NOK it is a big amount Recent market turmoil has reduced liquidity

Liquidity concentrated during London hours Most liquidity between 12 – 16 LDN (London and NY open) Dependent on local markets (eg. Scandis illiquid during Asian time, similarly EM Asian currencies illiquid during NY time) Illiquidity reduces sizes that can be traded and increases spreads Major USD crosses such as EUR/USD are liquid all the time Market opens approx 2200 LDN Sunday evening in Sydney and continues trading till 5 pm NY on Friday evening Amount that can be executed depends on time of day and currency cross $100 mm USD in EUR/USD is not big amount, but in USD/NOK it is a big amount Recent market turmoil has reduced liquidity

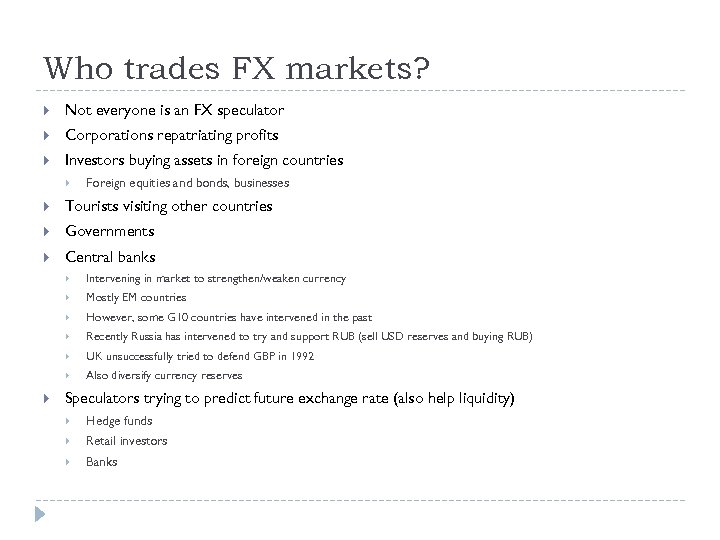

Who trades FX markets? Not everyone is an FX speculator Corporations repatriating profits Investors buying assets in foreign countries Foreign equities and bonds, businesses Tourists visiting other countries Governments Central banks Mostly EM countries However, some G 10 countries have intervened in the past Recently Russia has intervened to try and support RUB (sell USD reserves and buying RUB) UK unsuccessfully tried to defend GBP in 1992 Intervening in market to strengthen/weaken currency Also diversify currency reserves Speculators trying to predict future exchange rate (also help liquidity) Hedge funds Retail investors Banks

Who trades FX markets? Not everyone is an FX speculator Corporations repatriating profits Investors buying assets in foreign countries Foreign equities and bonds, businesses Tourists visiting other countries Governments Central banks Mostly EM countries However, some G 10 countries have intervened in the past Recently Russia has intervened to try and support RUB (sell USD reserves and buying RUB) UK unsuccessfully tried to defend GBP in 1992 Intervening in market to strengthen/weaken currency Also diversify currency reserves Speculators trying to predict future exchange rate (also help liquidity) Hedge funds Retail investors Banks

Market Makers Market makers provide liquidity Commercial and investment banks – DB, UBS, Barcap, Citi, RBS, JPMorgan, HSBC, LEH/NOM, GS, MS (order of liquidity) FX mostly traded over-the-counter Some futures are traded on exchanges (eg. at CME) G 10 FX spot bid/ask spreads are very small in most liquid crosses EUR/USD 1 or 2 pips G 10 FX spot is high volume, low margin business (compared to many other assets) In EM, volumes are lower, hence spreads are wider given that it is more difficult to hedge out risk High liquidity is an attraction for investors Interbank FX brokers Interbank electronic platforms – EBS & Reuters

Market Makers Market makers provide liquidity Commercial and investment banks – DB, UBS, Barcap, Citi, RBS, JPMorgan, HSBC, LEH/NOM, GS, MS (order of liquidity) FX mostly traded over-the-counter Some futures are traded on exchanges (eg. at CME) G 10 FX spot bid/ask spreads are very small in most liquid crosses EUR/USD 1 or 2 pips G 10 FX spot is high volume, low margin business (compared to many other assets) In EM, volumes are lower, hence spreads are wider given that it is more difficult to hedge out risk High liquidity is an attraction for investors Interbank FX brokers Interbank electronic platforms – EBS & Reuters

What influences exchange rates? Fundamental factors Interest rates Higher interest rates attract overseas capital Carry trade – investors taking advantage of carry differential between two currencies Economic situation GDP Inflation Unemployment Raft of other economic indicators – surveys, new auto sales etc. Current account Terms of Trade Effects State of the market Investor sentiment – during periods of poor investor sentiment (like now) people are not prepared to take as much risks, hits currencies that are considered risky like Turkish Lira

What influences exchange rates? Fundamental factors Interest rates Higher interest rates attract overseas capital Carry trade – investors taking advantage of carry differential between two currencies Economic situation GDP Inflation Unemployment Raft of other economic indicators – surveys, new auto sales etc. Current account Terms of Trade Effects State of the market Investor sentiment – during periods of poor investor sentiment (like now) people are not prepared to take as much risks, hits currencies that are considered risky like Turkish Lira

What influences exchange rates? Technical factors Momentum (trend following) and mean reversion (range trading) Positioning in currencies Charting – areas of resistance, support etc. Market will focus on different aspects at different times, sometimes totally ignoring factors. Need to adapt to changes in the market. Each trader has a different take – some look at fundamentals, others at technical factors, but most at a mixture of both. There is no “right” way to view the market.

What influences exchange rates? Technical factors Momentum (trend following) and mean reversion (range trading) Positioning in currencies Charting – areas of resistance, support etc. Market will focus on different aspects at different times, sometimes totally ignoring factors. Need to adapt to changes in the market. Each trader has a different take – some look at fundamentals, others at technical factors, but most at a mixture of both. There is no “right” way to view the market.

FX Options Traders typically quote implied vols for different tenors (ON, 1 W, 1 M etc. ) ATM implied vol – what strike ATM is depends on the currency pair and tenor! 10 d and 25 d risk reversals – give the skewness of the smile – call & put OTM RR 25 d = IV(25 d call) – IV(25 d put) – roughly 10 d and 25 d strangles – gives the curvature of the smile – call & put OTM SM 25 d = (IV(25 d call) + IV(25 d put))/2 - ATM Can create a vol surface from these quotes to price any strike & tenor options Calculate option price using a model like Black-Scholes Rationale is that spot is very volatile, where as vols are not, so don’t need to keep updating prices Smile is not sticky, moves with spot NOT like in equities where a price is quoted by traders and we back out implied vol from price Terminology USD/JPY call = USD call / JPY put NOT USD put / JPY call Clearly a big subject! Peter Carr has good presentation that introduces FX options http: //www. samsi. info/200506/fmse/workinggroup/lp/Presentations/Carr 2. pdf

FX Options Traders typically quote implied vols for different tenors (ON, 1 W, 1 M etc. ) ATM implied vol – what strike ATM is depends on the currency pair and tenor! 10 d and 25 d risk reversals – give the skewness of the smile – call & put OTM RR 25 d = IV(25 d call) – IV(25 d put) – roughly 10 d and 25 d strangles – gives the curvature of the smile – call & put OTM SM 25 d = (IV(25 d call) + IV(25 d put))/2 - ATM Can create a vol surface from these quotes to price any strike & tenor options Calculate option price using a model like Black-Scholes Rationale is that spot is very volatile, where as vols are not, so don’t need to keep updating prices Smile is not sticky, moves with spot NOT like in equities where a price is quoted by traders and we back out implied vol from price Terminology USD/JPY call = USD call / JPY put NOT USD put / JPY call Clearly a big subject! Peter Carr has good presentation that introduces FX options http: //www. samsi. info/200506/fmse/workinggroup/lp/Presentations/Carr 2. pdf