e5a4046420ad7469d9b35550a6a0c0d3.ppt

- Количество слайдов: 99

Introduction to Federal Accounting Presented by: John Reifsnyder, CDFM Graduate School Instructor johnreifsnyder@cox. net 1

Accounting n The Systematic - Classification Of the financial - Recording records of an - Reporting enterprise - Analyzing - Interpretation used to - recognize the factors that determine financial condition - evaluate the progress or failures of an activity 2

Common Accounting Terms Accounting Cycle n Double Entry Accounting n General Journal n Ledger Accounts n General Ledger n Cash and Accrual Basis of Accounting n details later 3

The United States Constitution “No money shall be drawn from the Treasury but in consequence of appropriations made by law. . . ” – and – “. . . A regular statement and account of receipts and expenditures of all public money. . . shall be published from time to time. ” (Article 1, Sec 9, Clause 7) 4

Accounting Introduction Federal accounting framework § Budgetary accounting § Financial accounting § Managerial cost accounting Users of Federal Financial Information § External users (citizens and Congress) § Internal users (agency heads and management) 5

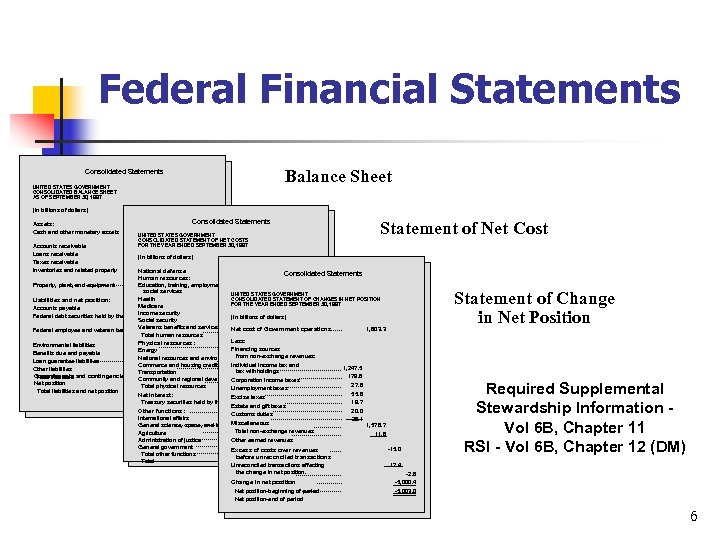

Federal Financial Statements Balance Sheet Consolidated Statements UNITED STATES GOVERNMENT CONSOLIDATED BALANCE SHEET AS OF SEPTEMBER 30, 1997 (In billions of dollars) Assets: Cash and other monetary assets Accounts receivable Loans receivable Taxes receivable Inventories and related property Property, plant, and equipment Other assets net position: Liabilities and Total assets Accounts payable Federal debt securities held by the Federal employee and veteran ben Environmental liabilities Benefits due and payable Loan guarantee liabilities Other liabilities Commitments and contingencie Total liabilities Net position Total liabilities and net position Statement of Net Cost Consolidated Statements UNITED STATES GOVERNMENT CONSOLIDATED STATEMENT OF NET COSTS FOR THE YEAR ENDED SEPTEMBER 30, 1997 (In billions of dollars) National defense Human resources: Education, training, employme social services Health Medicare Income security Social security Veterans benefits and services Total human resources Physical resources: Energy National resources and enviro Commerce and housing credit Transportation Community and regional devel Total physical resources Net interest: Treasury securities held by th Other functions: International affairs General science, space, and te Agriculture Administration of justice General government Total other functions Total Consolidated Statements Statement of Change in Net Position UNITED STATES GOVERNMENT CONSOLIDATED STATEMENT OF CHANGES IN NET POSITION FOR THE YEAR ENDED SEPTEMBER 30, 1997 (In billions of dollars) Net cost of Government operations Less: Financing sources from non-exchange revenues: Individual income tax and tax withholdings Corporation income taxes Unemployment taxes Excise taxes Estate and gift taxes Customs duties Miscellaneous Total non-exchange revenues Other earned revenues Excess of costs over revenues before unreconciled transactions Unreconciled transactions affecting the change in net position. Change in net position Net position-beginning of period Net position-end of period 1, 603. 3 1, 247. 5 179. 8 27. 8 55. 8 19. 7 20. 0 26. 1 1, 576. 7 11. 6 -15. 0 Required Supplemental Stewardship Information Vol 6 B, Chapter 11 RSI - Vol 6 B, Chapter 12 (DM) 12. 4 -2. 6 -5, 000. 4 -5, 003. 0 6

Accounting-Related Legislation n BUDGET AND ACCOUNTING ACT OF 1921: - ESTABLISHED AN EXECUTIVE BUDGET PROCESS - REQUIRED THE PRESIDENT TO SUBMIT HIS BUDGET RECOMMENDATIONS TO CONGRESS EACH YEAR. TO ASSIST HIM, THE BUREAU OF THE BUDGET WAS CREATED - CONGRESS WOULD BETTER COORDINATE REVENUE AND SPENDING DECISIONS - APPROPRIATIONS COMMITTEES JURISDICTION OVER SPENDING WAS STRENGTHENED - GOVERNMENT ACCOUNTABILITY OFFICE (GAO) WAS ESTABLISHED 7

Accounting-Related Legislation 1950 BUDGET AND ACCOUNTING ACT q q q Amended the 1921 Budget and Accounting Act. Assigned to the executive branch the responsibility for maintaining accounting systems and producing financial reports. The Comptroller General, in consultation with the Director of OMB, was required to prescribe the principles, standards, and related requirements for accounting to be observed by the executive agencies. Each was given the responsibility for establishing and maintaining systems of accounting and internal controls. Established accounting systems of executive agencies were required to conform to the principles, standards, and related requirements prescribed by the CG. 8

Accounting-Related Legislation • THE CONGRESSIONAL BUDGET AND IMPOUNDMENT CONTROL ACT OF 1974 - Changed the fiscal year to October 1 through September 30 - Established the Congressional Budget Office (CBO) -Established to provide data to the Congress on and analysis of the federal budget - Established the House and Senate Budget Committees -Charged with development of a “Concurrent Resolution on the Budget”

Accounting-Related Legislation n 1982 Federal Managers’ Financial Integrity Act: n Each agency reports the results of a self-evaluation of the adequacy of systems of internal control n Assurance that agencies are managed properly n Obligations and costs comply with applicable laws n Funds, property and other assets are safeguarded against waste, loss, and unauthorized use 10

Accounting-Related Legislation n Prompt Payment Act of 1982 Pay vendors on time or pay interest 11

Accounting-Related Legislation n Chief Financial Officers Act of 1990 - Required the establishment of CFOs in cabinet departments and specified agencies - CFOs charged with overseeing financial management activities 12

Accounting-Related Legislation n Government Performance and Results Act of 1993 Requires agencies: n to submit 5 -year strategic plans…Do. D must update at least every 4 years n to submit annual performance plans n Now part of Performance Budget n to report prior year program performance by November 15 th of each year n Performance and Accountability Report (PAR) or separate Performance and Accountability reports n Shifts focus of programs from workload activities to performance metric outputs and outcomes. 13

Accounting-Related Legislation n Government Management Reform Act – 1994 - Required systems to: -- support the control of cost of government -- support full cost reporting and full disclosure of financial data - Required application of accounting standards to produce consistency in financial reporting 14

Accounting-Related Legislation n n Federal Financial Management Improvement Act – 1996 Each agency head establish, evaluate, and maintain adequate systems of accounting and internal control Incorporate accounting standards and reporting objectives Each audit of an agency’s financial statements shall report if the agency is in compliance with the preceding requirements 15

Federal Accounting Standards Advisory Board (FASAB) n n Develops and recommends federal accounting concepts and standards n established in 1990 n 5 Concepts n 36 Standards Federal Generally Accepted Accounting Principles (GAAP) 16

Implementation of Federal Accounting Standards Office of Management and Budget (OMB) Government Accountability Office (GAO) Department of Treasury 17

Types of Government Funds Department of Defense: § Appropriated Funds § Reimbursable Funds § Revolving Funds § Trust Funds § Nonappropriated Funds 18

Budgetary Accounting n n Budgetary accounting is often referred to as fund accounting. Budgetary accounts are a set of accounts that are self-balancing and represent different levels of obligational authority for different units. 19

Budgetary Accounting n Purpose n n Record appropriation status Record subdivisions of budgetary authorities Record valid commitments, obligations, expenditures, outlays Control use of budgetary authorities n Use for appropriate purpose n Use during time provided n Use within amount provided 20

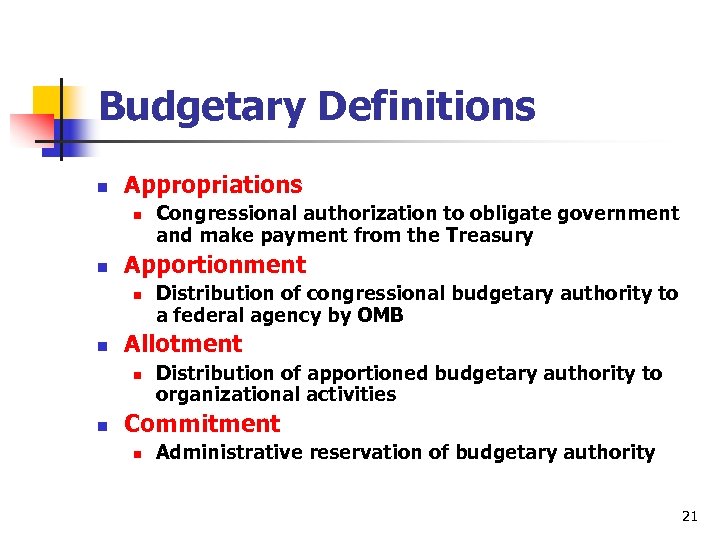

Budgetary Definitions n Appropriations n n Apportionment n n Distribution of congressional budgetary authority to a federal agency by OMB Allotment n n Congressional authorization to obligate government and make payment from the Treasury Distribution of apportioned budgetary authority to organizational activities Commitment n Administrative reservation of budgetary authority 21

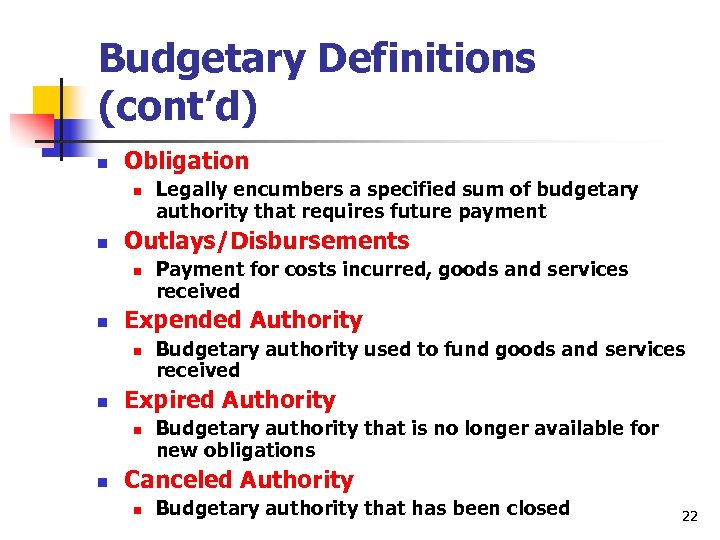

Budgetary Definitions (cont’d) n Obligation n n Outlays/Disbursements n n Budgetary authority used to fund goods and services received Expired Authority n n Payment for costs incurred, goods and services received Expended Authority n n Legally encumbers a specified sum of budgetary authority that requires future payment Budgetary authority that is no longer available for new obligations Canceled Authority n Budgetary authority that has been closed 22

Categories of Appropriations § Annual Appropriations § Multiyear Appropriations § No-Year Appropriations § Permanent (Indefinite) Appropriations 23

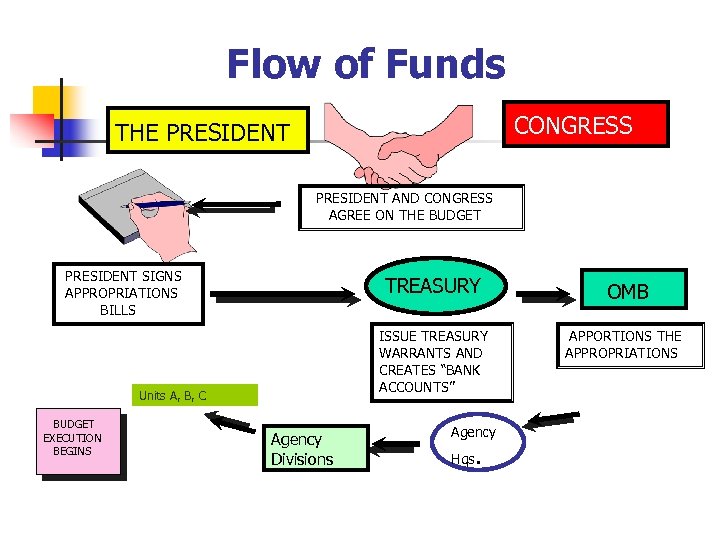

Flow of Funds CONGRESS THE PRESIDENT AND CONGRESS AGREE ON THE BUDGET PRESIDENT SIGNS APPROPRIATIONS BILLS TREASURY ISSUE TREASURY WARRANTS AND CREATES “BANK ACCOUNTS” Units A, B, C BUDGET EXECUTION BEGINS Agency Divisions OMB APPORTIONS THE APPROPRIATIONS Agency Hqs .

Fiscal Law § An agency may obligate and expend appropriations: § § § Only for a proper purpose Only within the authorized time limits Within the amounts established by Congress for a bona fide need 25

Purpose Proper Purpose Rule: For the purposes for which they were appropriated per 31 U. S. C. 1301 (a): “ Appropriations shall be applied only to the objects for which the appropriations were made except as otherwise provided by law ” 26

Time n Within the authorized time limits: § § Expenditure of funds must be incurred within the time for which the appropriation was made available. Do not execute current year funds for prior or future year expenditures. (31 USC 1502) 27

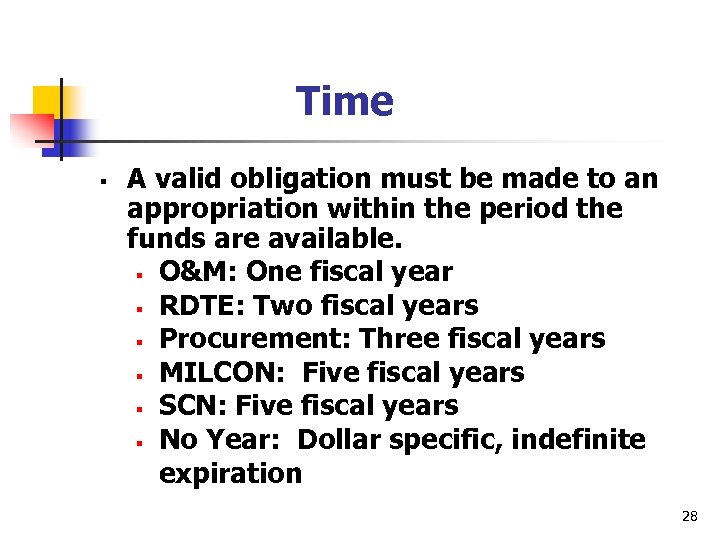

Time § A valid obligation must be made to an appropriation within the period the funds are available. § O&M: One fiscal year § RDTE: Two fiscal years § Procurement: Three fiscal years § MILCON: Five fiscal years § SCN: Five fiscal years § No Year: Dollar specific, indefinite expiration 28

Amount § Within the amounts established by Congress: § The obligation may not exceed the amount appropriated by statute, nor may it be incurred before the appropriation becomes law (31 U. S. C. 1341) 29

No-Year Appropriations n 31 U. S. C. 1555 n A No-Year Account is to be Closed If: n n Agency Head or President Determines Purpose Fulfilled No Disbursements Have Been Made for Two Years 30

Flow of Resources § Commitments (FMR Volume 3 Chapter 8) § Obligations (Bona fide need - FMR Volume 11 A 020507) Ø Obligating Documents • Contracts, Purchase Orders • Travel Orders • Requisitions • Military Interdepartmental Purchase Requests (MIPR) – Project Orders (FMR Volume 11 A, Chapter 2) – Economy Act Orders (FMR Volume 11 A, Chapter 3) § Outlays 31

Accounting Classification § § Identifies the source of funding and purpose for which used Creates an audit trail 32

What is an Obligation? 33

Government Definition § § Orders placed, Contracts awarded, Grants issued, Services received, etc. --- that will require payments (“outlays”) during the same or a future period. 34

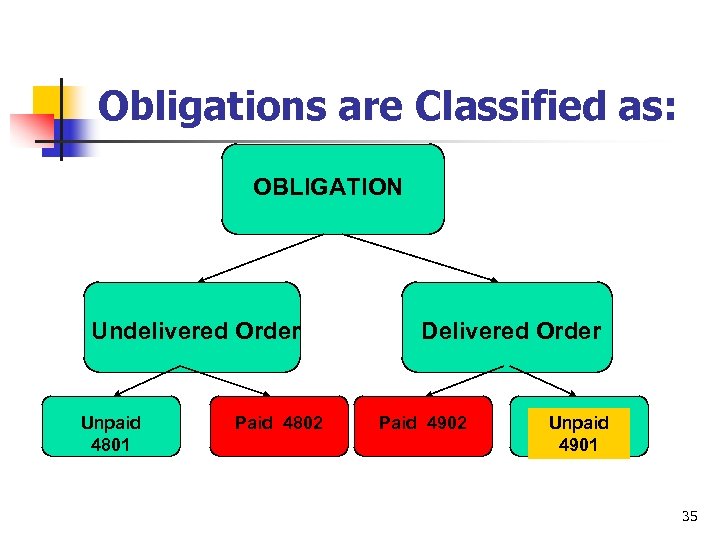

Obligations are Classified as: OBLIGATION Undelivered Order Unpaid 4801 Paid 4802 Delivered Order Paid 4902 Unpaid 4901 35

What is an “Accrued Expenditure”? Charges…that reflect liabilities incurred and the need to pay for: q q q services… goods…received… amounts becoming owed under programs for which no current service or performance is required (such as annuities, benefit payments. . )* Expenditures accrue regardless of when cash payments are made…* *GAO, “Glossary of Federal Terms Used in the Federal Budget Process”, 1981. 36

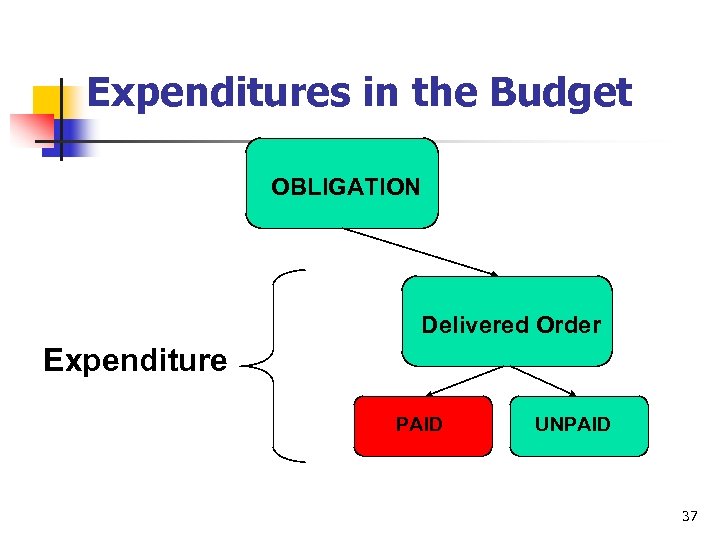

Expenditures in the Budget OBLIGATION Delivered Order Expenditure PAID UNPAID 37

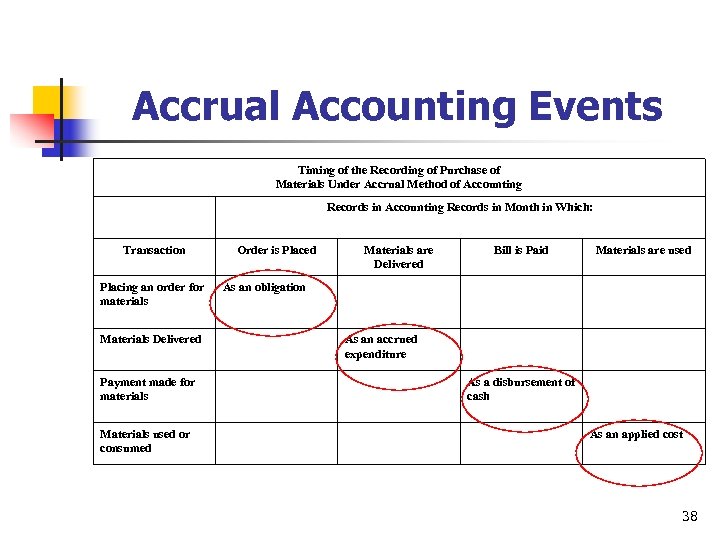

Accrual Accounting Events Timing of the Recording of Purchase of Materials Under Accrual Method of Accounting Records in Month in Which: Transaction Placing an order for materials Materials Delivered Payment made for materials Materials used or consumed Order is Placed Materials are Delivered Bill is Paid Materials are used As an obligation As an accrued expenditure As a disbursement of cash As an applied cost 38

What is an Outlay ? 39

§ § § A payment of an obligation Once all payments are made, the obligation goes away (is “liquidated”) Outlays during a fiscal year may be for payment of obligations incurred in prior years or in the same year 40

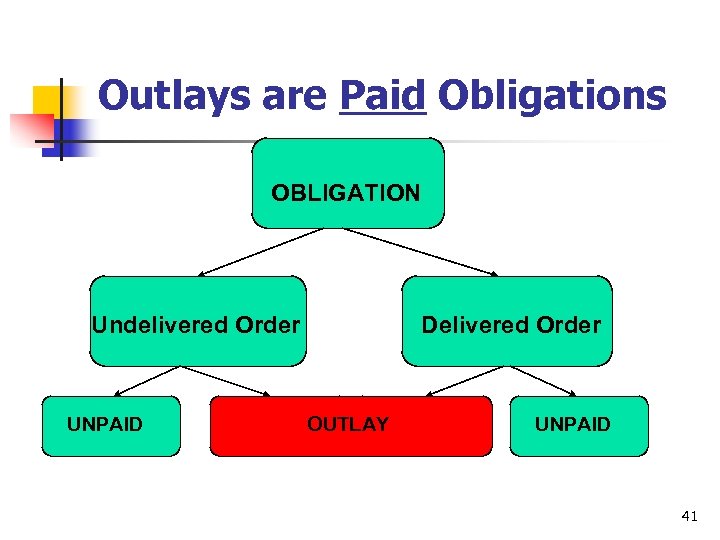

Outlays are Paid Obligations OBLIGATION Undelivered Order UNPAID Delivered Order PAID OUTLAY PAID UNPAID 41

Reimbursements n Project Order (41 U. S. C. 23): n Placed with and accepted by: § § A Do. D Government Owned and Government Operated (GOGO) establishment. Shipyard, arsenal, ordinance plant or other manufacturing plant or shop. 42

Project Orders n Same as a commercial contract to the customers’ appropriation n n n Extends beyond the life of the appropriation. Up to five years after the appropriation expires for new obligations Over-billing may create a 31 USC 1517 violation Normally issued for the overhaul or manufacturing of a specific number of items within a specific time frame for a specific price Performing activity should incur costs of not less than 51% of the total costs of performing the work The performing activity must not accept the project order if the requirements of the project order regulations are not met A Military Interdepartmental Purchase Request (DD 448 Form) is used to issue project orders 43

Project Order Characteristics n n Specific regarding work to be done Single purpose with identification to a final product or end item n Includes a production schedule n Includes funded cost per item n Usually mission oriented n Be performed in house n Bona fide need in the year executed n Commence work within a reasonable time (90 days) n Return orders for cancellation if work financed by an expiring appropriation is not started by 1 January 44

Economy Act Orders n n Must be closed-out by 30 September. Change in dollar amount requires: n An amendment to the original MIPR (DD Form 448). n Acceptance (DD Form 448 -2) of the amendment by the performing activity. n Adjust the obligation in accounting based on the acceptance of (DD Form 448 -2). 45

Non-Economy Act Orders n n n Non-Economy Act orders are for intragovernmental support, where a Do. D activity needing goods and services obtains them from a Non-Do. D agency. Specific statutory authority is required to place an order with a Non-Do. D agency for goods or services, and to pay the associated cost. If specific statutory authority does not exist, the default will be the Economy Act, 31 U. S. C. 1535.

Customer/Provider Scenario n n n Customer (ordering agency) prepares MIPR requesting the repair and overhaul of 400 widgets for a total cost of $ 1, 300, 000. The MIPR was issued as a Project Order and is funded with an annual O&M appropriation Performing agency accepts the MIPR and prepares a MIPR acceptance, DD Form 448 -2 Based on the MIPR acceptance the ordering agency records an obligation in their accounting records and the performing agency records an order received in their accounting records in the amount of $1, 300, 000 47

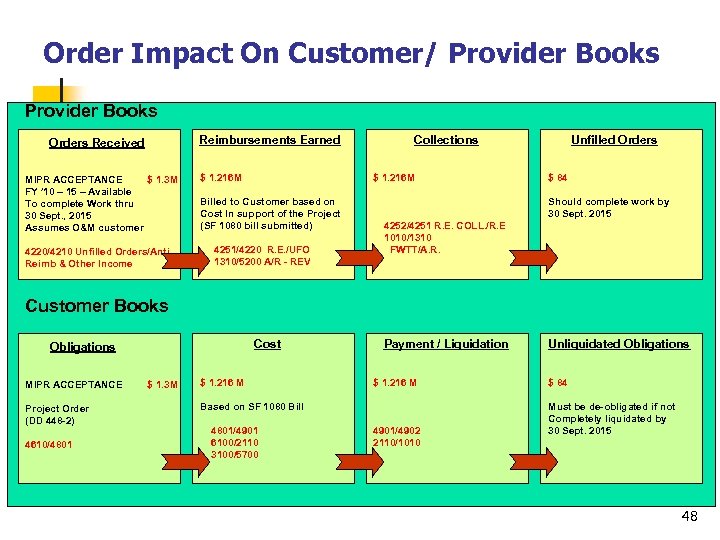

Order Impact On Customer/ Provider Books Reimbursements Earned Orders Received MIPR ACCEPTANCE $ 1. 3 M FY ’ 10 – 15 – Available To complete Work thru 30 Sept. , 2015 Assumes O&M customer 4220/4210 Unfilled Orders/Anti. Reimb & Other Income $ 1. 216 M Collections $ 1. 216 M Billed to Customer based on Cost In support of the Project (SF 1080 bill submitted) 4251/4220 R. E. /UFO 1310/5200 A/R - REV Unfilled Orders $ 84 Should complete work by 30 Sept. 2015 4252/4251 R. E. COLL. /R. E 1010/1310 FWTT/A. R. Customer Books Cost Obligations MIPR ACCEPTANCE Project Order (DD 448 -2) 4610/4801 $ 1. 3 M $ 1. 216 M Payment / Liquidation $ 1. 216 M Based on SF 1080 Bill 4801/4901 6100/2110 3100/5700 4901/4902 2110/1010 Unliquidated Obligations $ 84 Must be de-obligated if not Completely liquidated by 30 Sept. 2015 48

How do we Link to the Budget? n n Accounting events are assigned unique identifiers from a standard government-wide list (U. S. Standard General Ledger) All federal agencies are required to use these standard accounts in order to properly link to the Budget 49

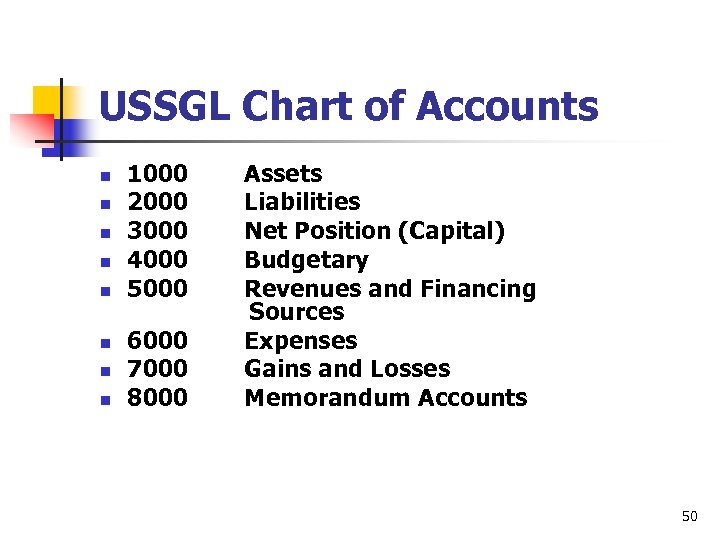

USSGL Chart of Accounts n n n n 1000 2000 3000 4000 5000 6000 7000 8000 Assets Liabilities Net Position (Capital) Budgetary Revenues and Financing Sources Expenses Gains and Losses Memorandum Accounts 50

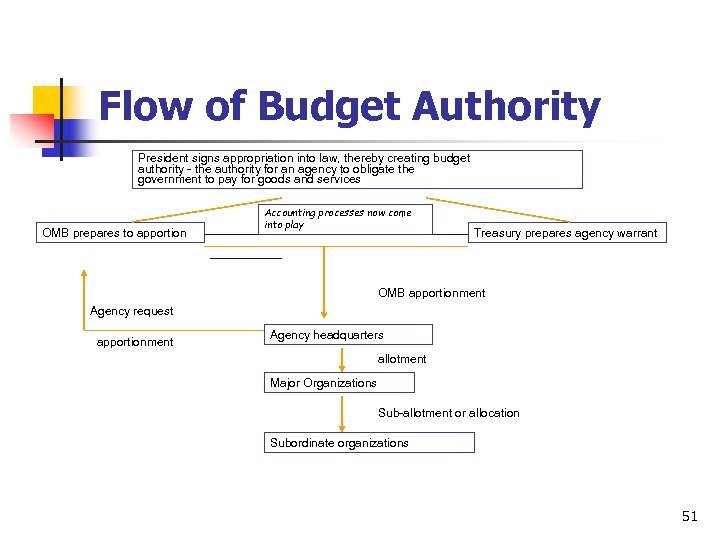

Flow of Budget Authority President signs appropriation into law, thereby creating budget authority - the authority for an agency to obligate the government to pay for goods and services OMB prepares to apportion Accounting processes now come into play Treasury prepares agency warrant OMB apportionment Agency request apportionment Agency headquarters allotment Major Organizations Sub-allotment or allocation Subordinate organizations 51

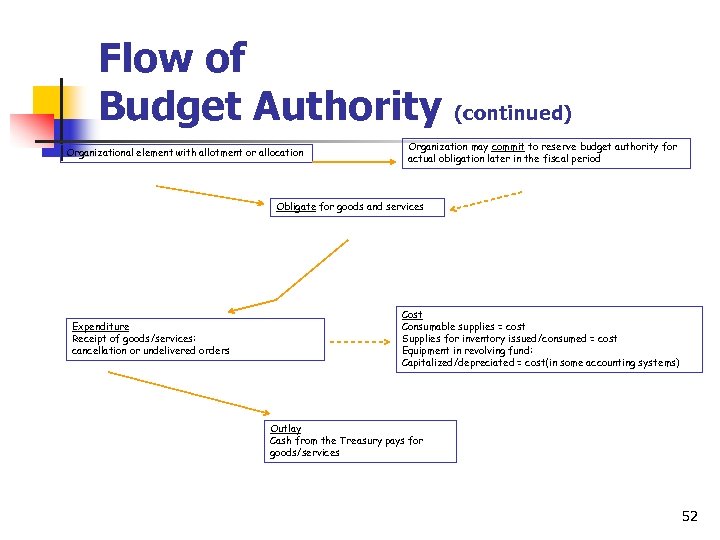

Flow of Budget Authority Organizational element with allotment or allocation (continued) Organization may commit to reserve budget authority for actual obligation later in the fiscal period Obligate for goods and services Expenditure Receipt of goods/services: cancellation or undelivered orders Cost Consumable supplies = cost Supplies for inventory issued/consumed = cost Equipment in revolving fund: Capitalized/depreciated = cost(in some accounting systems) Outlay Cash from the Treasury pays for goods/services 52

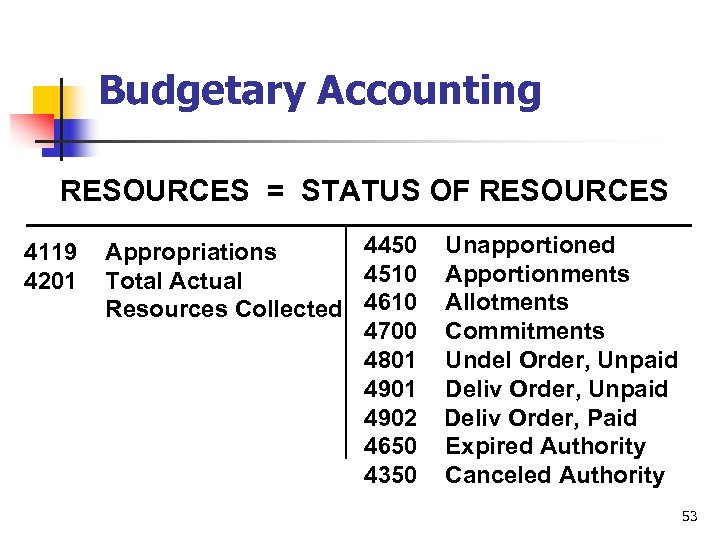

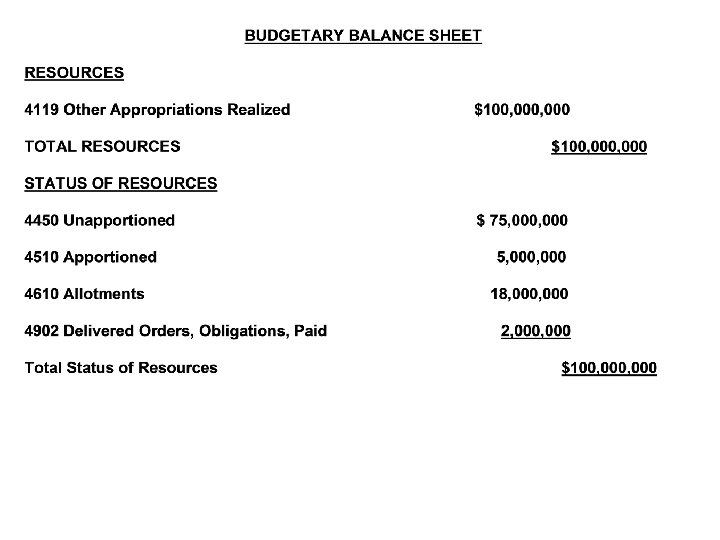

Budgetary Accounting RESOURCES = STATUS OF RESOURCES 4119 4201 4450 Appropriations 4510 Total Actual Resources Collected 4610 4700 4801 4902 4650 4350 Unapportioned Apportionments Allotments Commitments Undel Order, Unpaid Deliv Order, Paid Expired Authority Canceled Authority 53

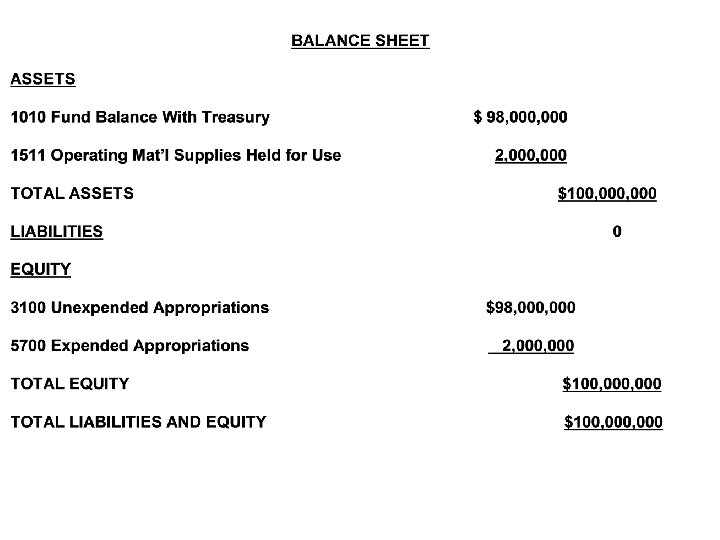

Proprietary Accounting n Purpose n n n Accounting for assets and liabilities Accounting for revenues and expenses Determining financial position Determining results of operations SFFAS NO. 7 54

Proprietary Accounting n Balance Sheet n n n Assets = Liabilities + Net Position 1000 Assets = 2000 Liabilities + 3000 Net Position (Capital) Statement of Net Cost n Expenses – Exchange Revenue = Net Cost of Operations 55

The Historical Cost Concept n n Generally accepted accounting principles (GAAP) requires that assets always be stated at their actual cost rather than at their current market values Accounting is concerned with what you paid for something, not what it is worth today 56

The Matching Principle Concept n n n Expenses of a period that are recorded and reported are only those incurred to produce the revenues generated for the same period Some expenses require periodic adjustment to reflect only the amount of expenses for the financial period Examples: n Prepaid Insurance n Prepaid Rent n Depreciation of Capital Assets 57

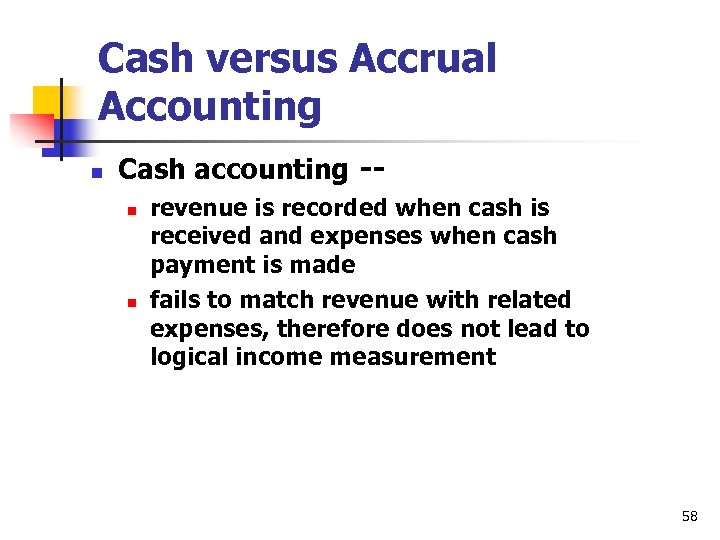

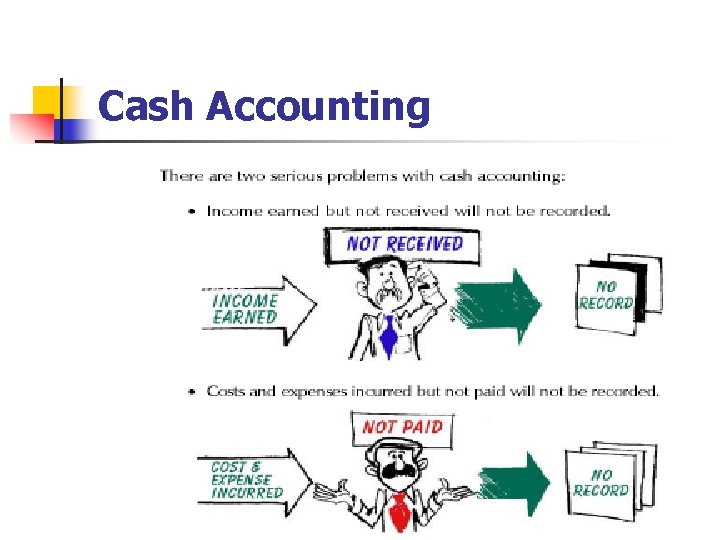

Cash versus Accrual Accounting n Cash accounting -n n revenue is recorded when cash is received and expenses when cash payment is made fails to match revenue with related expenses, therefore does not lead to logical income measurement 58

Cash Accounting 59

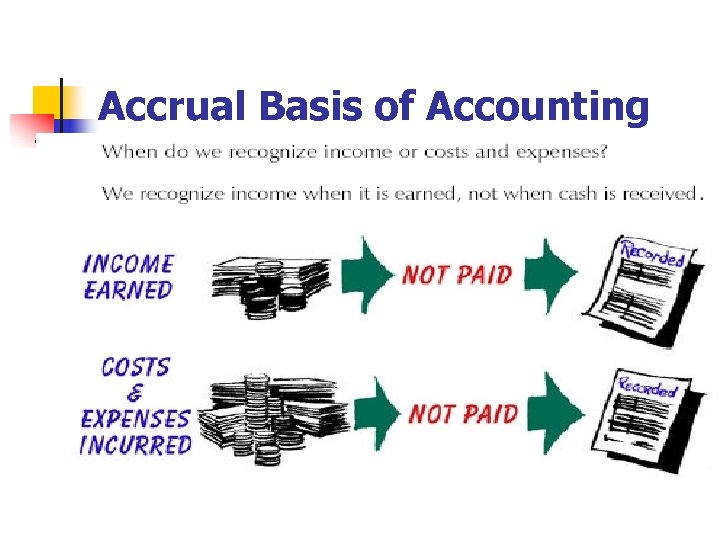

Accrual Basis of Accounting 60

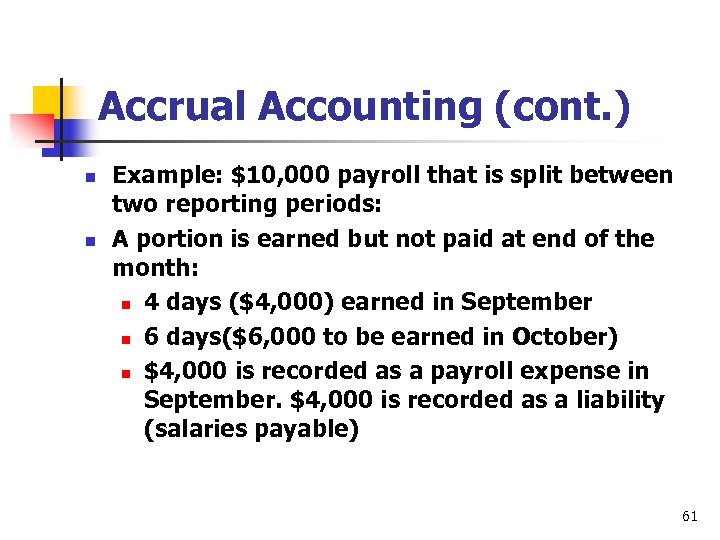

Accrual Accounting (cont. ) n n Example: $10, 000 payroll that is split between two reporting periods: A portion is earned but not paid at end of the month: n 4 days ($4, 000) earned in September n 6 days($6, 000 to be earned in October) n $4, 000 is recorded as a payroll expense in September. $4, 000 is recorded as a liability (salaries payable) 61

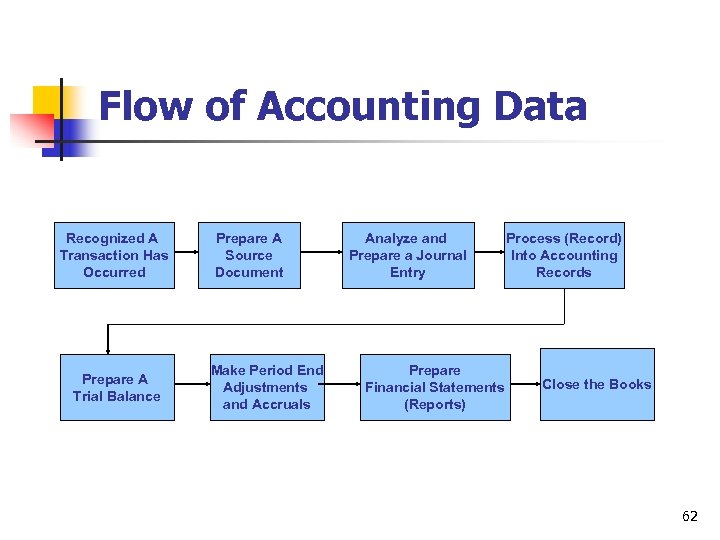

Flow of Accounting Data Recognized A Transaction Has Occurred Prepare A Trial Balance Prepare A Source Document Make Period End Adjustments and Accruals Analyze and Prepare a Journal Entry Prepare Financial Statements (Reports) Process (Record) Into Accounting Records Close the Books 62

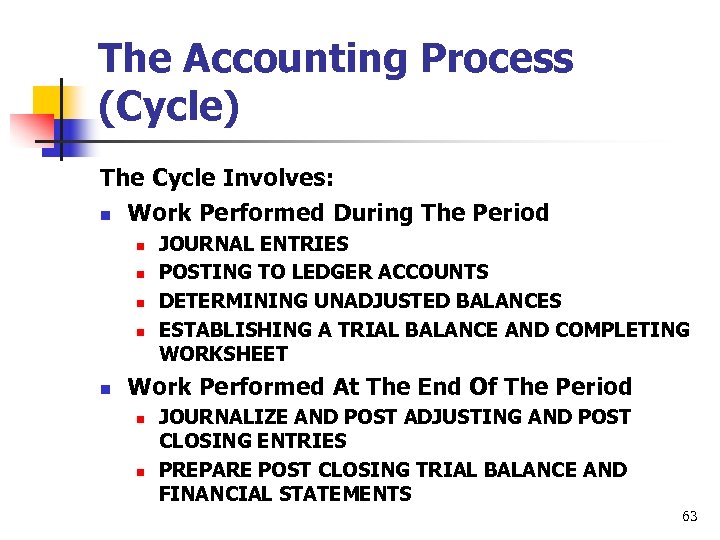

The Accounting Process (Cycle) The Cycle Involves: n Work Performed During The Period n n n JOURNAL ENTRIES POSTING TO LEDGER ACCOUNTS DETERMINING UNADJUSTED BALANCES ESTABLISHING A TRIAL BALANCE AND COMPLETING WORKSHEET Work Performed At The End Of The Period n n JOURNALIZE AND POST ADJUSTING AND POST CLOSING ENTRIES PREPARE POST CLOSING TRIAL BALANCE AND FINANCIAL STATEMENTS 63

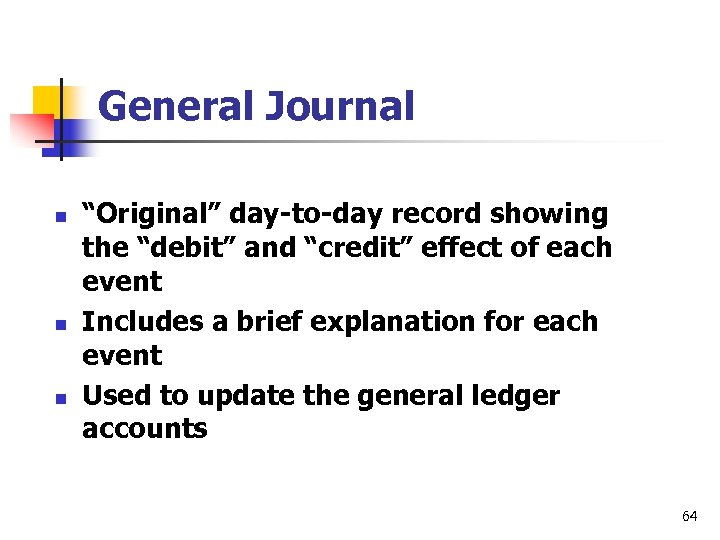

General Journal n n n “Original” day-to-day record showing the “debit” and “credit” effect of each event Includes a brief explanation for each event Used to update the general ledger accounts 64

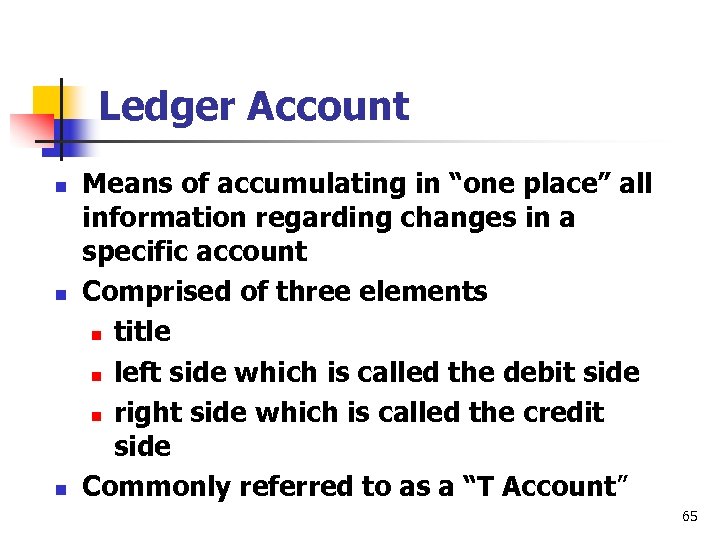

Ledger Account n n n Means of accumulating in “one place” all information regarding changes in a specific account Comprised of three elements n title n left side which is called the debit side n right side which is called the credit side Commonly referred to as a “T Account” 65

General Ledger n n All ledger accounts are maintained within the general ledger Federal government general ledger account structure is established, maintained, and updated by the Treasury Department 66

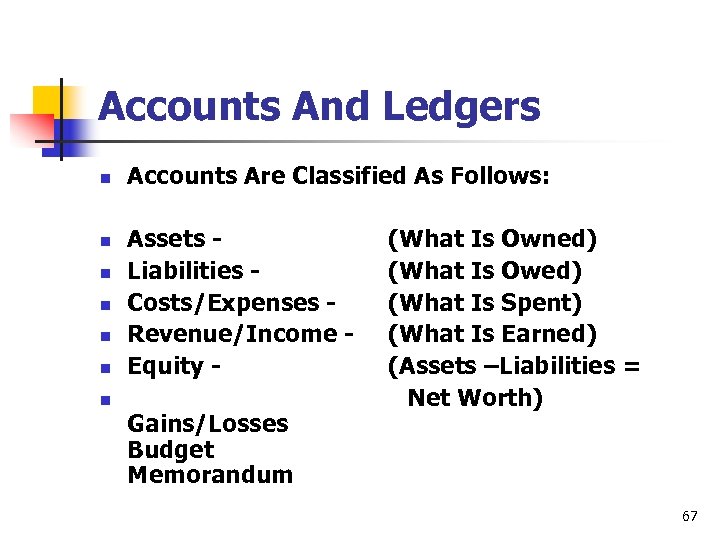

Accounts And Ledgers n n n n Accounts Are Classified As Follows: Assets Liabilities Costs/Expenses Revenue/Income Equity Gains/Losses Budget Memorandum (What Is Owned) (What Is Owed) (What Is Spent) (What Is Earned) (Assets –Liabilities = Net Worth) 67

The Accounting Equation n Assets = Liabilities + Equity Or n A=L+E Or A–L=E Given The Accounting Equation, With Any Two Of The Three Factors, We Can Determine Third Factor 68

Double Entry Accounting n n Forms the basis for most current day accounting operations Every business transaction affects two or more accounts Equal debit and credit entries are made for every transaction Total of all debit entries must equal the total of all credit entries 69

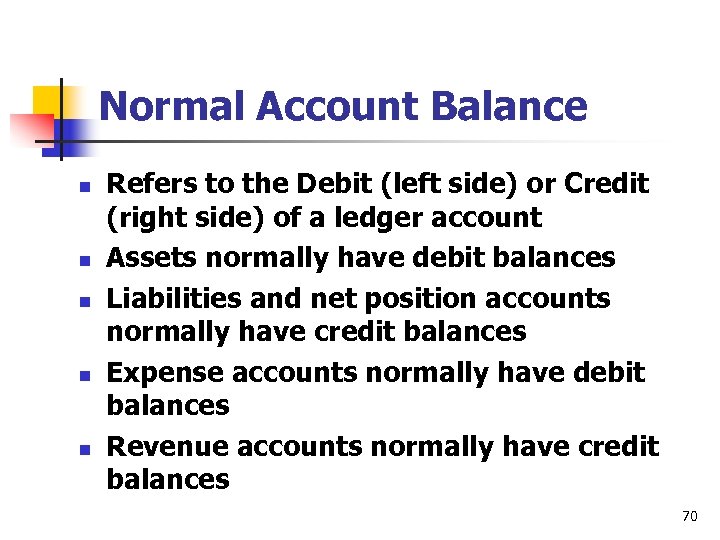

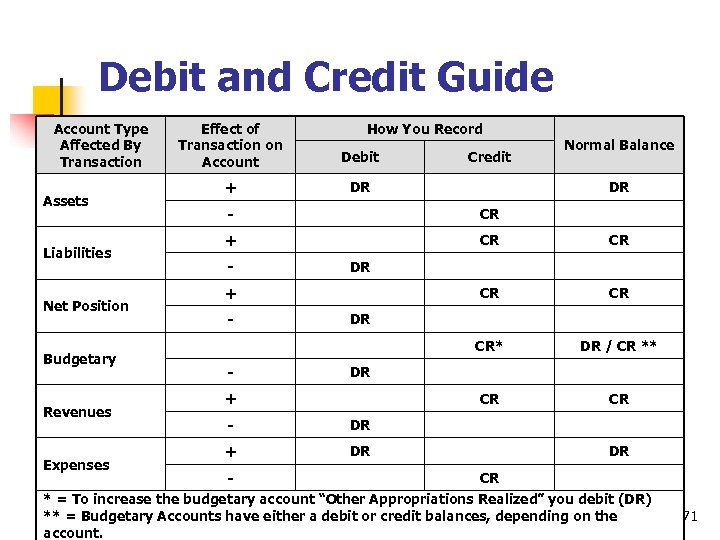

Normal Account Balance n n n Refers to the Debit (left side) or Credit (right side) of a ledger account Assets normally have debit balances Liabilities and net position accounts normally have credit balances Expense accounts normally have debit balances Revenue accounts normally have credit balances 70

Debit and Credit Guide Account Type Affected By Transaction Assets Liabilities Net Position Budgetary Revenues Expenses Effect of Transaction on Account How You Record Debit + DR Credit Normal Balance DR - CR + CR CR CR* DR / CR ** CR CR - DR + DR - DR CR * = To increase the budgetary account “Other Appropriations Realized” you debit (DR) ** = Budgetary Accounts have either a debit or credit balances, depending on the account. 71

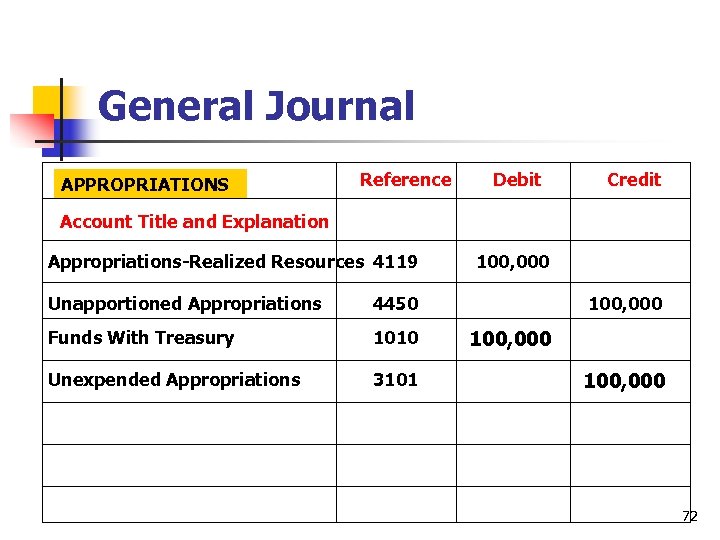

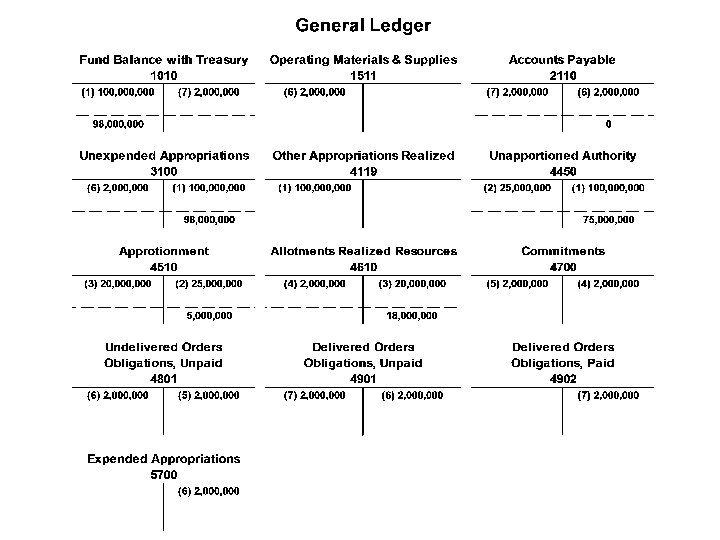

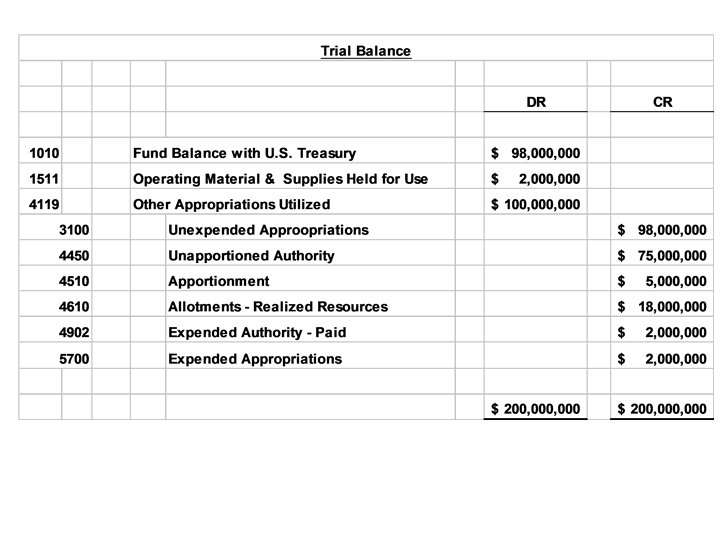

General Journal APPROPRIATIONS Reference Debit Credit Account Title and Explanation Appropriations-Realized Resources 4119 Unapportioned Appropriations 4450 Funds With Treasury 1010 Unexpended Appropriations 3101 100, 000 72

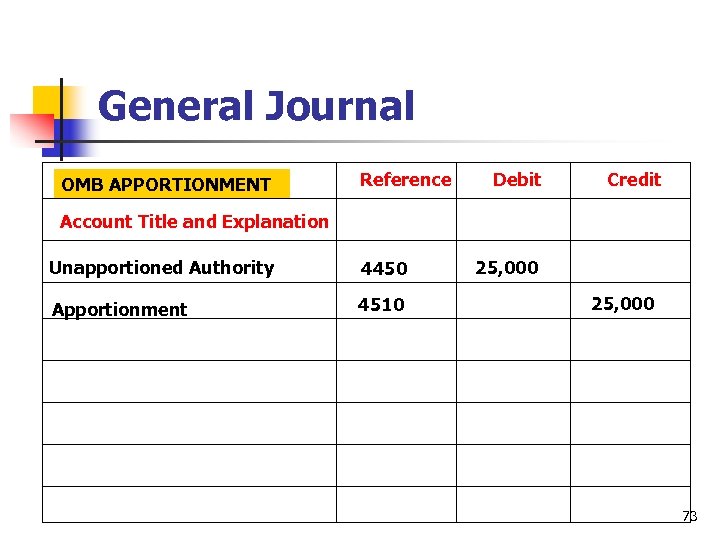

General Journal OMB APPORTIONMENT Reference Debit Credit Account Title and Explanation Unapportioned Authority 4450 Apportionment 4510 25, 000 73

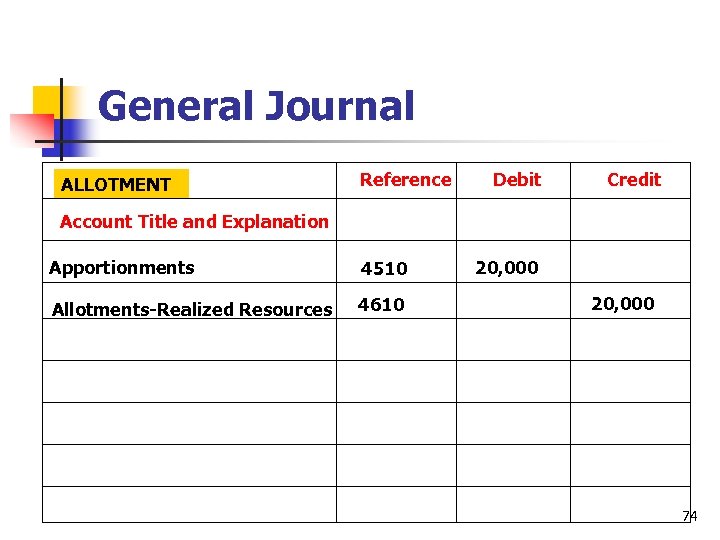

General Journal ALLOTMENT Reference Debit Credit Account Title and Explanation Apportionments 4510 Allotments-Realized Resources 4610 20, 000 74

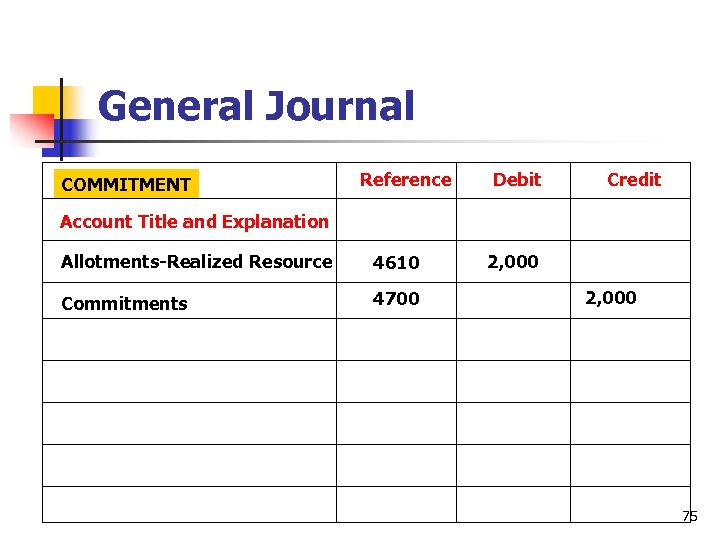

General Journal COMMITMENT Reference Debit Credit Account Title and Explanation Allotments-Realized Resource 4610 Commitments 4700 2, 000 75

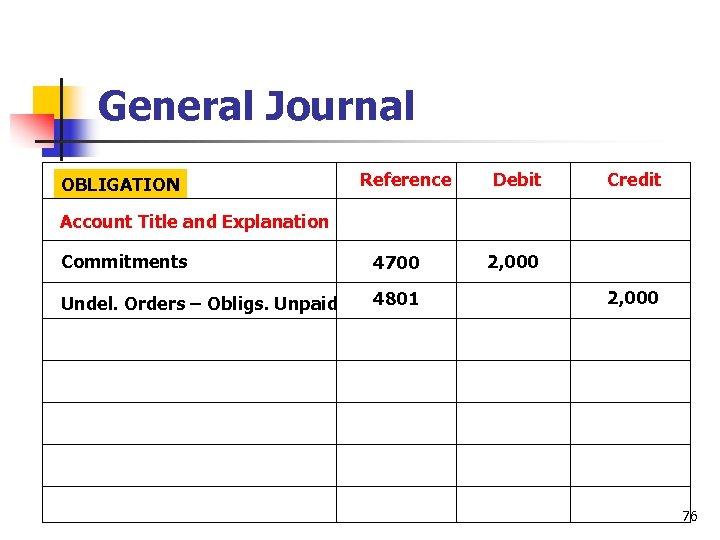

General Journal OBLIGATION Reference Debit Credit Account Title and Explanation Commitments 4700 Undel. Orders – Obligs. Unpaid 4801 2, 000 76

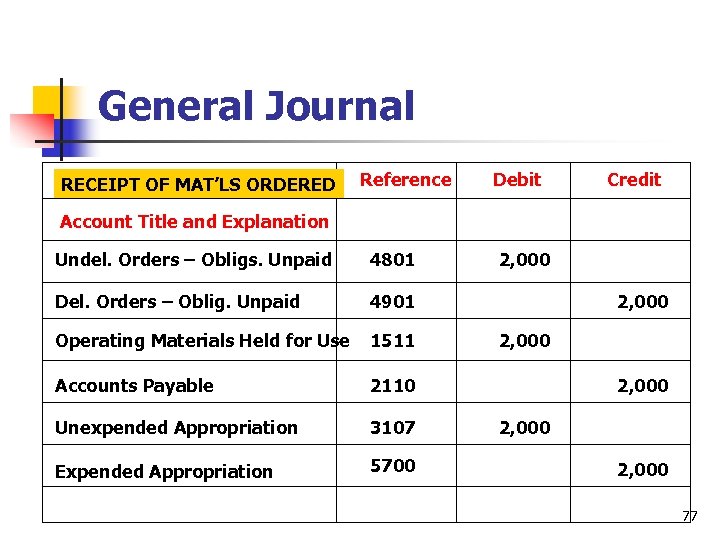

General Journal RECEIPT OF MAT’LS ORDERED Reference Debit Credit Account Title and Explanation Undel. Orders – Obligs. Unpaid 4801 Del. Orders – Oblig. Unpaid 4901 Operating Materials Held for Use 1511 Accounts Payable 2110 Unexpended Appropriation 3107 Expended Appropriation 5700 2, 000 2, 000 77

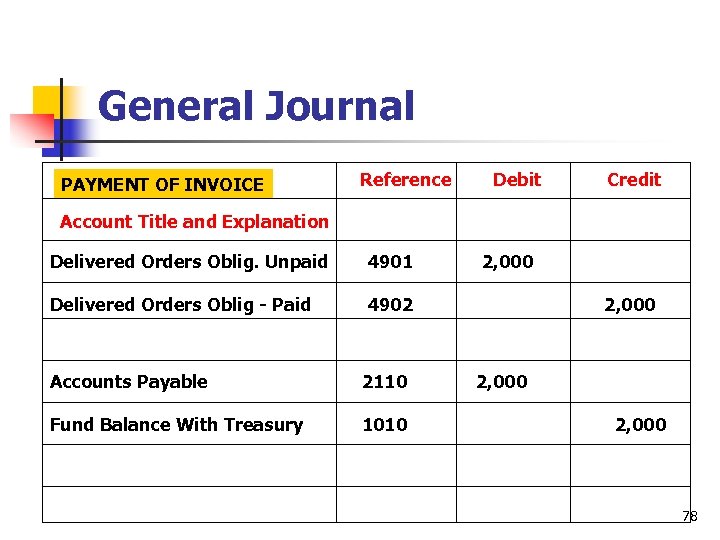

General Journal PAYMENT OF INVOICE Reference Debit Credit Account Title and Explanation Delivered Orders Oblig. Unpaid 4901 Delivered Orders Oblig - Paid 4902 Accounts Payable 2110 Fund Balance With Treasury 1010 2, 000 78

79

80

81

82

Managerial Cost Accounting n Is the process of: - Accumulating - Measuring - Analyzing - Interpreting - Reporting Cost Source: SFFAS No. 4 83

Managerial Cost Accounting n Full Cost n Direct Costs (Direct Labor/Direct Material) n Indirect Costs (Overhead) n Intra-entity Costs (General and Administrative) n Inter-entity Costs n Cost of goods and services received from other entities n Providing entity responsible for providing cost data n Recognition limited to material amounts 84

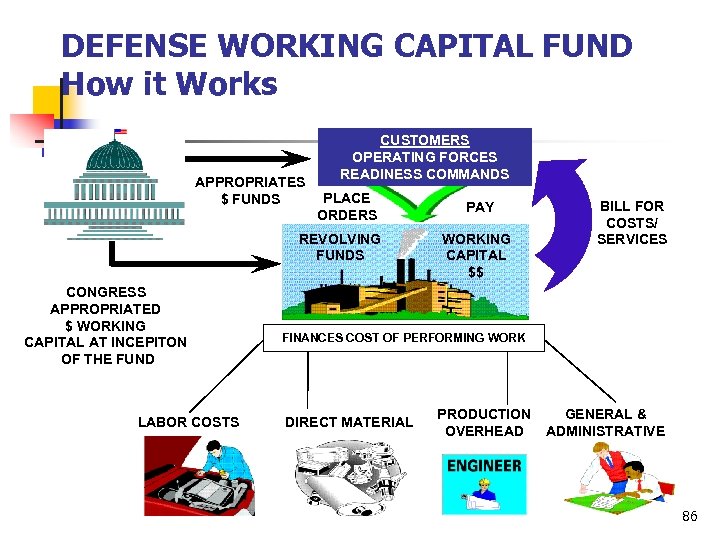

Working Capital Funds n n n Established to satisfy recurring Do. D requirements using a businesslike buyer-andseller approach. Have a goal to breakeven over the long term. Use the funds collected to pay for acquisition of resources needed to operate the fund. Reference - 10 U. S. C. , Section 2208 Do. DFMR Volume 3, Chapter 19 85

DEFENSE WORKING CAPITAL FUND How it Works APPROPRIATES $ FUNDS CUSTOMERS OPERATING FORCES READINESS COMMANDS PLACE ORDERS REVOLVING FUNDS CONGRESS APPROPRIATED $ WORKING CAPITAL AT INCEPITON OF THE FUND LABOR COSTS PAY WORKING CAPITAL $$ BILL FOR COSTS/ SERVICES FINANCES COST OF PERFORMING WORK DIRECT MATERIAL PRODUCTION OVERHEAD GENERAL & ADMINISTRATIVE 86

Objectives of Federal Financial Reporting n Budgetary Integrity n n Operating Performance n n Funding properly spent? Outputs and outcomes? Controls n Safeguarding assets? 87

Federal Financial Reporting Do. DFMR Volume 6 B § Balance Sheet (Chapter 4) § Statement of Net Cost (Chapter 5) § Statement of Changes in Net Position (Chapter 6) § Statement of Budgetary Resources (Chapter 7) § Statement of Custodial Activity (Chapter 9) 88

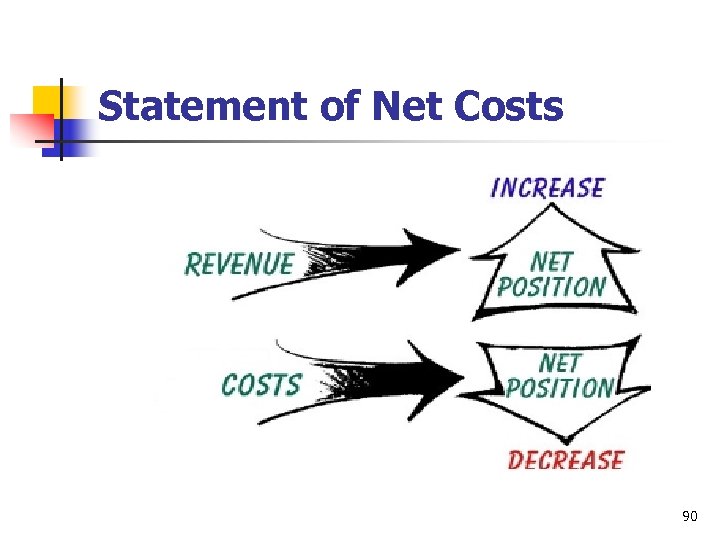

Statement of Net Costs n Also Referred to as: n n n Purpose n n n Statement of Operations Income statement intended to provide revenue and expense details reports results (net profit or net loss) Prepared on basis of general ledger 5000 and 6000 account balances 89

Statement of Net Costs 90

Statement of Changes in Net Position n Reports the n n beginning net position effect of those transactions that caused the net position to change ending net position Prepared on the basis of the Statement of Net Costs and the “Financing Sources” 91

Statement of Changes in Net Position n n ITEMS THAT INCREASE NET POSITION Excess of revenue over cost (net income) Legislative appropriations Property obtained from another govt. agency for which no reimbursed is required n n n ITEMS THAT DECREASE NET POSITION Excess of cost over revenue (net loss or net cost of operations) Property provided to another agency for which no reimbursement is expected Funds returned to the Treasury Appropriations returned 92

Statement of Financial Position n Also referred to as the Balance Sheet n assets n dollar amount of future economic benefits owned and managed by the agency n liabilities n dollar amounts owed by the agency n net position (equity) n the difference between assets and liabilities 93

Statement of Financial Position n n Summarizes the net worth or liquidity of an entity at a particular time Changes from day to day Accounts on this statement are permanent accounts Is a summary of accounting equation Assets = Liabilities + Government Equity 94

Statement of Financial Position 95

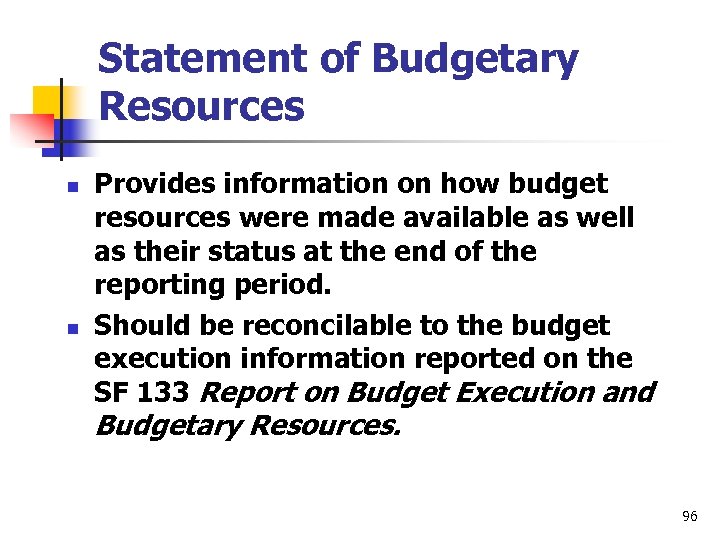

Statement of Budgetary Resources n n Provides information on how budget resources were made available as well as their status at the end of the reporting period. Should be reconcilable to the budget execution information reported on the SF 133 Report on Budget Execution and Budgetary Resources. 96

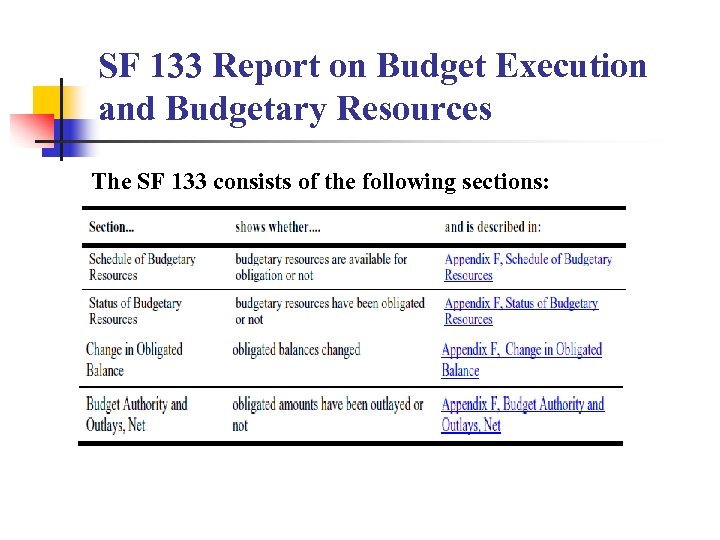

SF 133 Report on Budget Execution and Budgetary Resources The SF 133 consists of the following sections:

Questions? ? ? 98

Good Luck and Happy Trails johnreifsnyder@cox. net 99

e5a4046420ad7469d9b35550a6a0c0d3.ppt