944fcd525b266f1465790144a4022b38.ppt

- Количество слайдов: 42

INTRODUCTION TO ENGINEERING FUNDAMENTALS OF ENGINEERING PROJECT ECONOMICS - 1 Prepared by Prof T. M. Lewis

INTRODUCTION TO ENGINEERING FUNDAMENTALS OF ENGINEERING PROJECT ECONOMICS - 1 Prepared by Prof T. M. Lewis

Introduction • Our concern here is with project economics – so we are interested in how economics interfaces with engineering projects • We will look at using economics as a tool for examining the feasibility of implementing a project.

Introduction • Our concern here is with project economics – so we are interested in how economics interfaces with engineering projects • We will look at using economics as a tool for examining the feasibility of implementing a project.

Economic Analysis. • “Economic analysis as applied to engineering is concerned with assessing the real cost of using resources in order to establish priorities between competing proposals. Its purpose is to provide the engineer with a means of judging the relative economic merits of alternative schemes and of ensuring that available resources shall be used to achieve the desired end with the minimum expenditure of means” The Institution of Civil Engineers (London) • Use economics to choose between alternative projects on the basis of the returns that are generated and the resources that are consumed.

Economic Analysis. • “Economic analysis as applied to engineering is concerned with assessing the real cost of using resources in order to establish priorities between competing proposals. Its purpose is to provide the engineer with a means of judging the relative economic merits of alternative schemes and of ensuring that available resources shall be used to achieve the desired end with the minimum expenditure of means” The Institution of Civil Engineers (London) • Use economics to choose between alternative projects on the basis of the returns that are generated and the resources that are consumed.

What is Economics? The study of choice and decision-making in a world with limited resources. It explores: 1. The principles of supply and demand how prices are determined 2. Growth and productivity 3. Global interdependence and trade 4. The interrelated roles of consumers, producers, and government in an economic system

What is Economics? The study of choice and decision-making in a world with limited resources. It explores: 1. The principles of supply and demand how prices are determined 2. Growth and productivity 3. Global interdependence and trade 4. The interrelated roles of consumers, producers, and government in an economic system

Economics is based on a number of principles and assumptions: 1. People will normally act in a way that reflects their self-interest 2. People normally act rationally 3. People normally prefer more to less 4. People will normally choose to do things the easy (efficient) way rather than the harder (less efficient) way. 5. If we have to choose between buying from two suppliers we will normally choose to buy from the one with the lower price (other things being equal) 6. If it will cost more to make something than it can be sold for, we would not normally make it.

Economics is based on a number of principles and assumptions: 1. People will normally act in a way that reflects their self-interest 2. People normally act rationally 3. People normally prefer more to less 4. People will normally choose to do things the easy (efficient) way rather than the harder (less efficient) way. 5. If we have to choose between buying from two suppliers we will normally choose to buy from the one with the lower price (other things being equal) 6. If it will cost more to make something than it can be sold for, we would not normally make it.

Economics • Not all economic choices are clear cut. • People want food, clothing, shelter, security, transportation and entertainment for example • But they also want BETTER food, clothing, accommodation etc. • Choices become more complicated the more options there are.

Economics • Not all economic choices are clear cut. • People want food, clothing, shelter, security, transportation and entertainment for example • But they also want BETTER food, clothing, accommodation etc. • Choices become more complicated the more options there are.

Scarcity • Choice is a problem because of ‘scarcity’. • The problem is that we want more things than we can afford, and so we have to make choices. • Once we have to choose, it means we have to give something up, so scarcity of resources leads to the need for choices to be made.

Scarcity • Choice is a problem because of ‘scarcity’. • The problem is that we want more things than we can afford, and so we have to make choices. • Once we have to choose, it means we have to give something up, so scarcity of resources leads to the need for choices to be made.

Scarcity • There are times when we have plenty and times when we have little - sometimes, when the seine is pulled it has fish, sometimes the net is empty. • When it is full the fishermen should set something aside for the times when it is empty • People do not consume all they have immediately, they save some for later. • If what they have is perishable (farmers & fishermen) they may want to exchange it for something that is not.

Scarcity • There are times when we have plenty and times when we have little - sometimes, when the seine is pulled it has fish, sometimes the net is empty. • When it is full the fishermen should set something aside for the times when it is empty • People do not consume all they have immediately, they save some for later. • If what they have is perishable (farmers & fishermen) they may want to exchange it for something that is not.

Money • In ancient times when people had a surplus they bartered what they had for what they wanted. • The world soon became too complex for bartering to work, and besides, people wanted something more durable - so a medium of exchange as a “store of value” was introduced. At first it was some rare and precious commodity (e. g. rare shells or teeth, or precious metals – silver/gold) • Nowadays it is (mainly paper) money.

Money • In ancient times when people had a surplus they bartered what they had for what they wanted. • The world soon became too complex for bartering to work, and besides, people wanted something more durable - so a medium of exchange as a “store of value” was introduced. At first it was some rare and precious commodity (e. g. rare shells or teeth, or precious metals – silver/gold) • Nowadays it is (mainly paper) money.

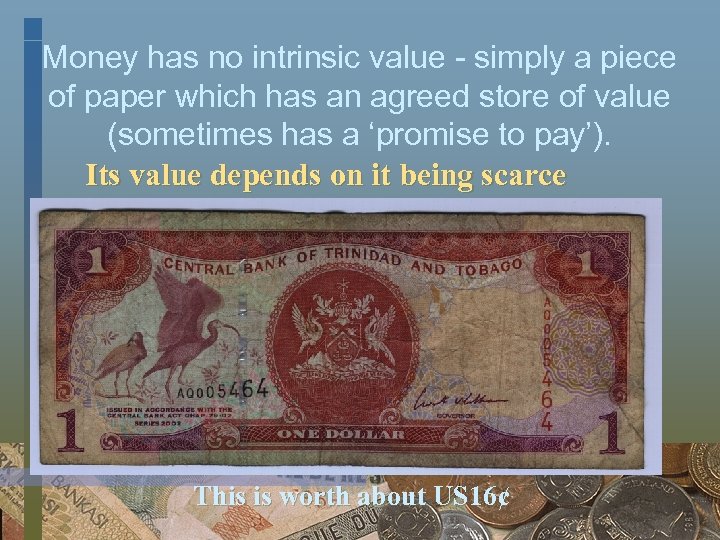

Money has no intrinsic value - simply a piece of paper which has an agreed store of value (sometimes has a ‘promise to pay’). Its value depends on it being scarce This is worth about US 16¢

Money has no intrinsic value - simply a piece of paper which has an agreed store of value (sometimes has a ‘promise to pay’). Its value depends on it being scarce This is worth about US 16¢

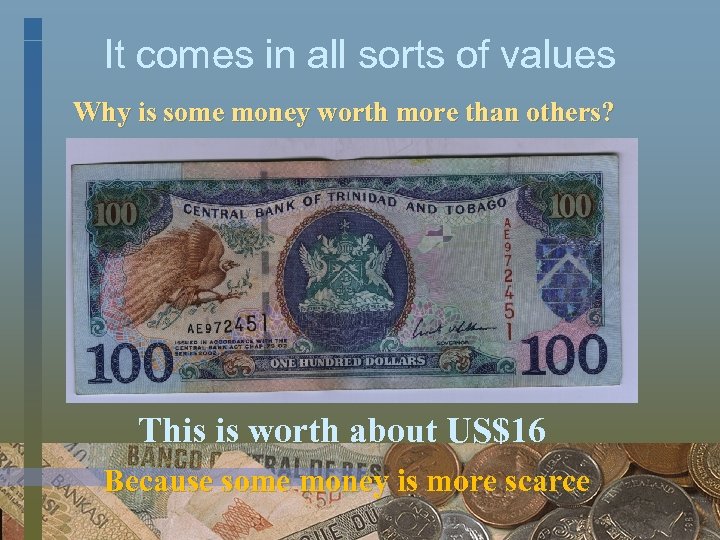

It comes in all sorts of values Why is some money worth more than others? This is worth about US$16 Because some money is more scarce

It comes in all sorts of values Why is some money worth more than others? This is worth about US$16 Because some money is more scarce

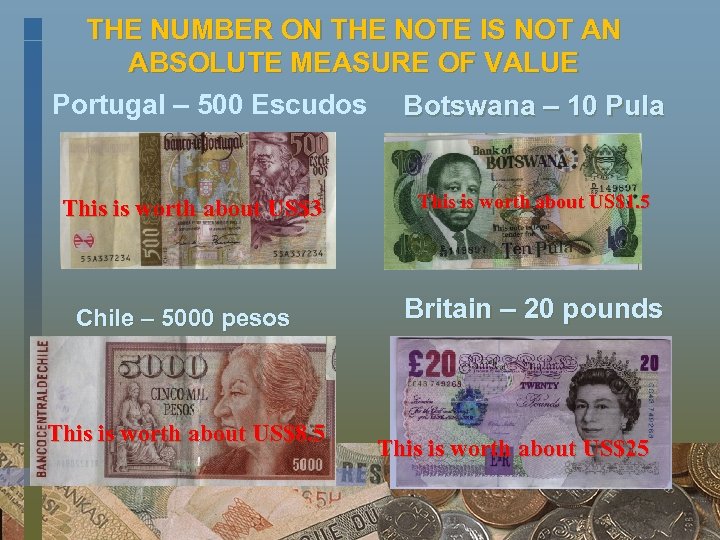

THE NUMBER ON THE NOTE IS NOT AN ABSOLUTE MEASURE OF VALUE Portugal – 500 Escudos Botswana – 10 Pula This is worth about US$3 Chile – 5000 pesos This is worth about US$8. 5 This is worth about US$1. 5 Britain – 20 pounds This is worth about US$25

THE NUMBER ON THE NOTE IS NOT AN ABSOLUTE MEASURE OF VALUE Portugal – 500 Escudos Botswana – 10 Pula This is worth about US$3 Chile – 5000 pesos This is worth about US$8. 5 This is worth about US$1. 5 Britain – 20 pounds This is worth about US$25

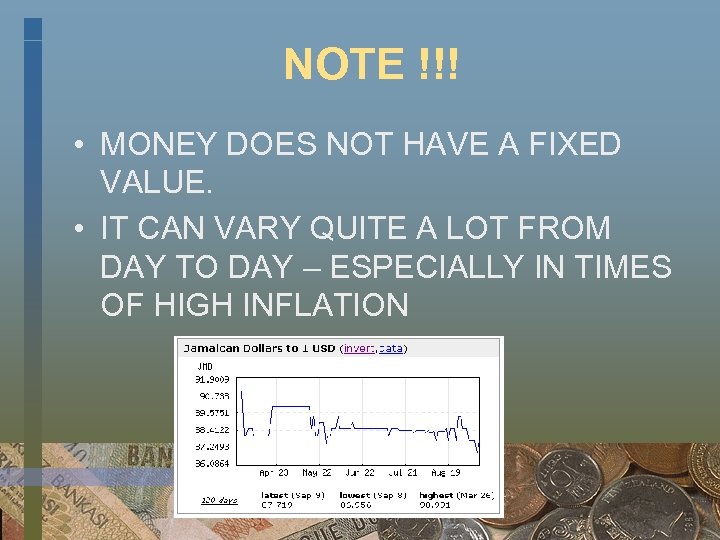

NOTE !!! • MONEY DOES NOT HAVE A FIXED VALUE. • IT CAN VARY QUITE A LOT FROM DAY TO DAY – ESPECIALLY IN TIMES OF HIGH INFLATION

NOTE !!! • MONEY DOES NOT HAVE A FIXED VALUE. • IT CAN VARY QUITE A LOT FROM DAY TO DAY – ESPECIALLY IN TIMES OF HIGH INFLATION

INFLATION • inflation is a rise in the general level of prices of goods and services in an economy over a period of time. • When the general price level rises, each unit of currency buys fewer goods and services. • So inflation also reflects an erosion in the purchasing power of money

INFLATION • inflation is a rise in the general level of prices of goods and services in an economy over a period of time. • When the general price level rises, each unit of currency buys fewer goods and services. • So inflation also reflects an erosion in the purchasing power of money

INFLATION • Inflation is often the result of an increase in the ‘money supply’ without a corresponding increase in production. • So more money is chasing the same basket of goods • There are many instances where things have gone badly wrong --- • Imagine you were a millionaire in 1980 in Zimbabwe

INFLATION • Inflation is often the result of an increase in the ‘money supply’ without a corresponding increase in production. • So more money is chasing the same basket of goods • There are many instances where things have gone badly wrong --- • Imagine you were a millionaire in 1980 in Zimbabwe

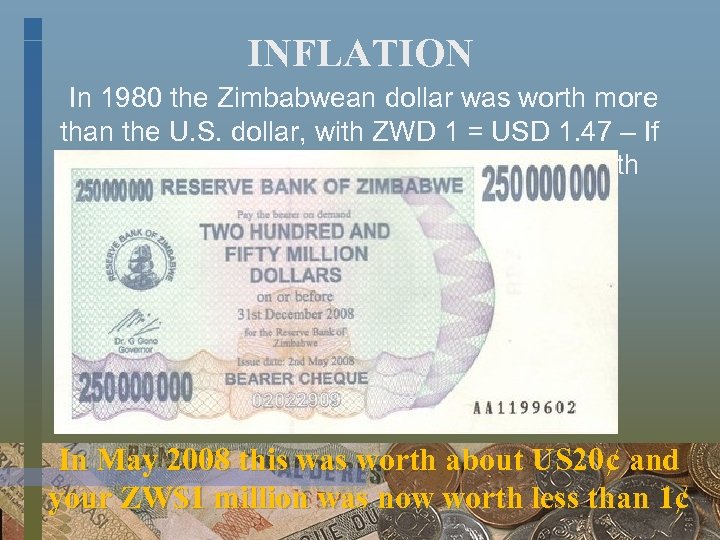

INFLATION In 1980 the Zimbabwean dollar was worth more than the U. S. dollar, with ZWD 1 = USD 1. 47 – If you had $1 million Zimbabwe you were worth nearly US$1. 5 million In May 2008 this was worth about US 20¢ and your ZW$1 million was now worth less than 1¢

INFLATION In 1980 the Zimbabwean dollar was worth more than the U. S. dollar, with ZWD 1 = USD 1. 47 – If you had $1 million Zimbabwe you were worth nearly US$1. 5 million In May 2008 this was worth about US 20¢ and your ZW$1 million was now worth less than 1¢

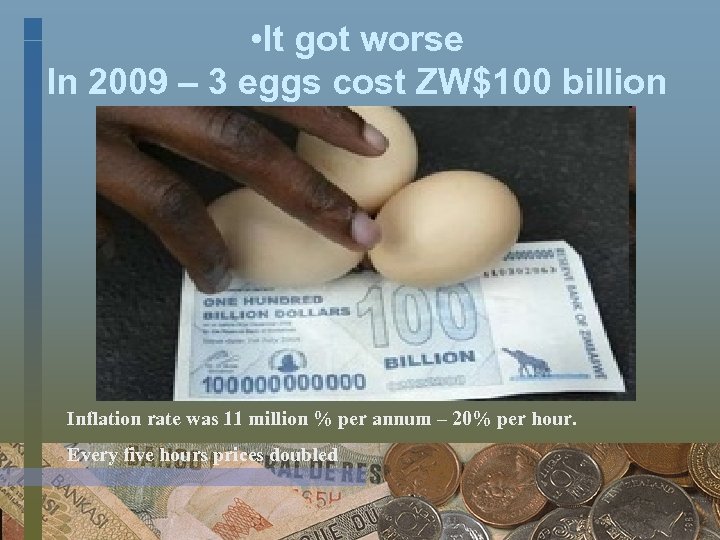

• It got worse In 2009 – 3 eggs cost ZW$100 billion Inflation rate was 11 million % per annum – 20% per hour. Every five hours prices doubled

• It got worse In 2009 – 3 eggs cost ZW$100 billion Inflation rate was 11 million % per annum – 20% per hour. Every five hours prices doubled

This is Hyper-inflation • The value of the currency keeps falling so dramatically because they keep printing more and more of it. • It is not scarce • There is no demand for it • Too much money is available and chasing the same goods

This is Hyper-inflation • The value of the currency keeps falling so dramatically because they keep printing more and more of it. • It is not scarce • There is no demand for it • Too much money is available and chasing the same goods

Inflation & Deflation • This is why governments are concerned about inflation - it can get out of control • The poor and people on fixed incomes (e. g. pensions) are very badly affected. • By comparison, deflation is a measure of the steady decrease in prices

Inflation & Deflation • This is why governments are concerned about inflation - it can get out of control • The poor and people on fixed incomes (e. g. pensions) are very badly affected. • By comparison, deflation is a measure of the steady decrease in prices

Interest & Inflation • Interest represents a rate of growth of money savings. • If you save money, interest increases its purchasing power. • Interest increases the value of your money while inflation decreases it. • The net effect is obviously important.

Interest & Inflation • Interest represents a rate of growth of money savings. • If you save money, interest increases its purchasing power. • Interest increases the value of your money while inflation decreases it. • The net effect is obviously important.

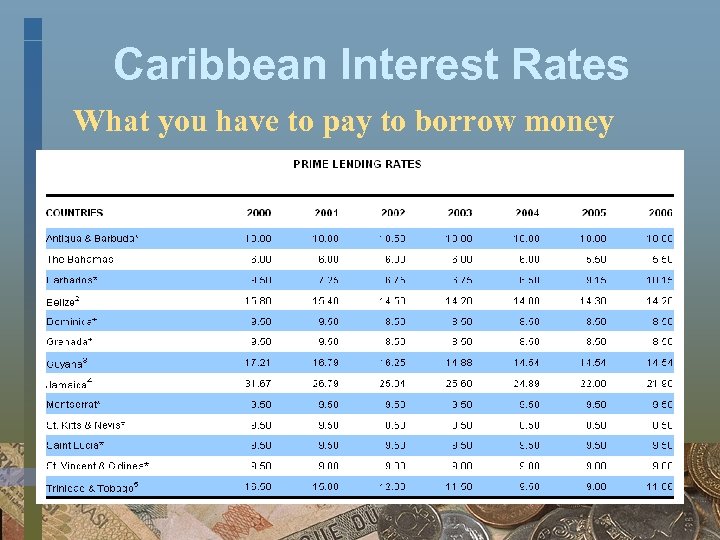

Caribbean Interest Rates What you have to pay to borrow money

Caribbean Interest Rates What you have to pay to borrow money

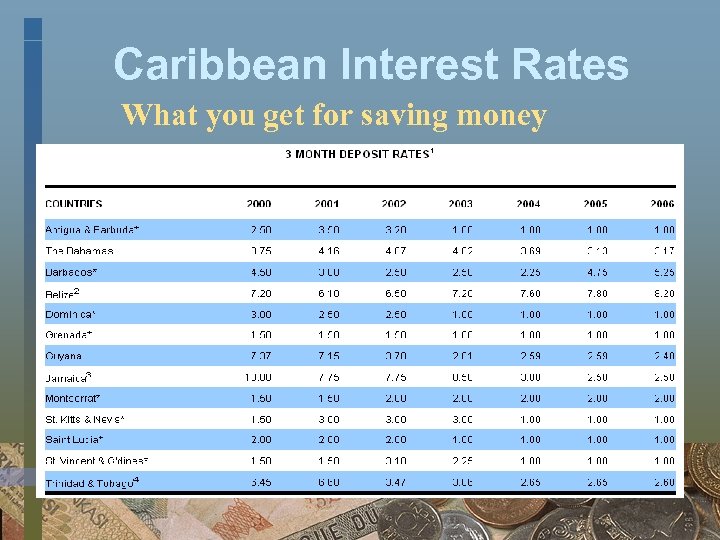

Caribbean Interest Rates What you get for saving money

Caribbean Interest Rates What you get for saving money

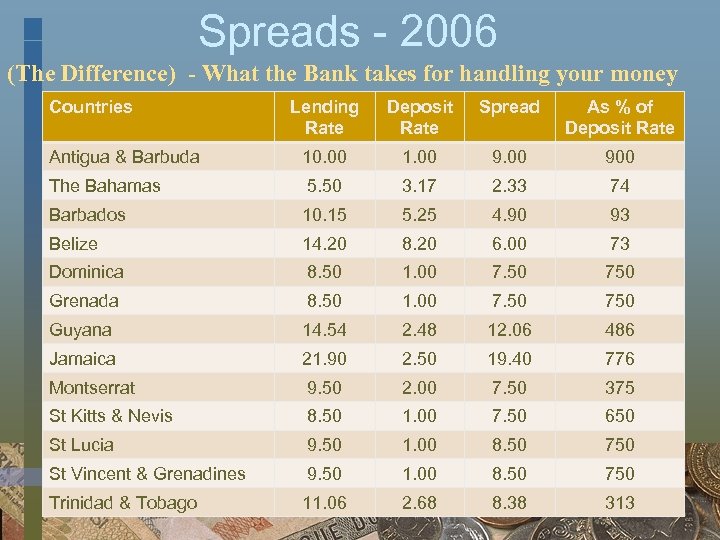

Spreads - 2006 (The Difference) - What the Bank takes for handling your money Countries Lending Rate Deposit Rate Spread As % of Deposit Rate Antigua & Barbuda 10. 00 1. 00 900 The Bahamas 5. 50 3. 17 2. 33 74 Barbados 10. 15 5. 25 4. 90 93 Belize 14. 20 8. 20 6. 00 73 Dominica 8. 50 1. 00 7. 50 750 Grenada 8. 50 1. 00 7. 50 750 Guyana 14. 54 2. 48 12. 06 486 Jamaica 21. 90 2. 50 19. 40 776 Montserrat 9. 50 2. 00 7. 50 375 St Kitts & Nevis 8. 50 1. 00 7. 50 650 St Lucia 9. 50 1. 00 8. 50 750 St Vincent & Grenadines 9. 50 1. 00 8. 50 750 Trinidad & Tobago 11. 06 2. 68 8. 38 313

Spreads - 2006 (The Difference) - What the Bank takes for handling your money Countries Lending Rate Deposit Rate Spread As % of Deposit Rate Antigua & Barbuda 10. 00 1. 00 900 The Bahamas 5. 50 3. 17 2. 33 74 Barbados 10. 15 5. 25 4. 90 93 Belize 14. 20 8. 20 6. 00 73 Dominica 8. 50 1. 00 7. 50 750 Grenada 8. 50 1. 00 7. 50 750 Guyana 14. 54 2. 48 12. 06 486 Jamaica 21. 90 2. 50 19. 40 776 Montserrat 9. 50 2. 00 7. 50 375 St Kitts & Nevis 8. 50 1. 00 7. 50 650 St Lucia 9. 50 1. 00 8. 50 750 St Vincent & Grenadines 9. 50 1. 00 8. 50 750 Trinidad & Tobago 11. 06 2. 68 8. 38 313

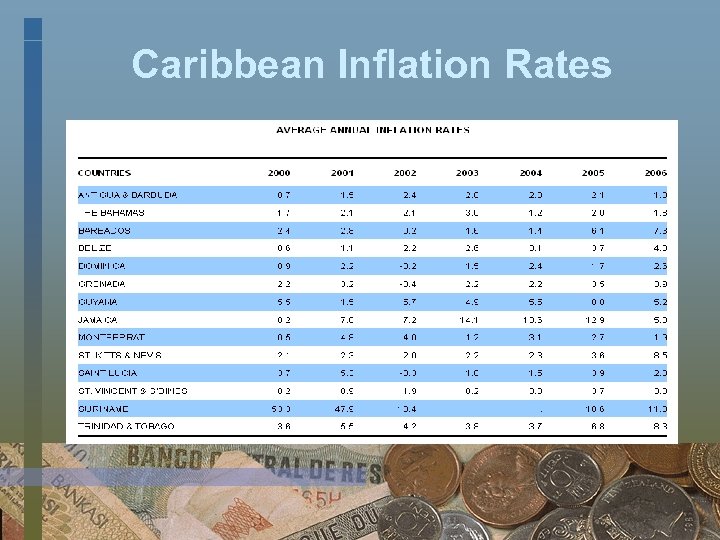

Caribbean Inflation Rates

Caribbean Inflation Rates

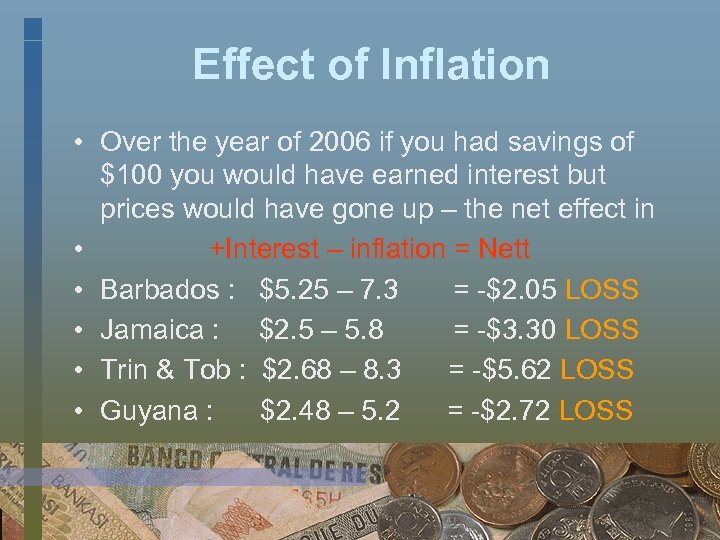

Effect of Inflation • Over the year of 2006 if you had savings of $100 you would have earned interest but prices would have gone up – the net effect in • +Interest – inflation = Nett • Barbados : $5. 25 – 7. 3 = -$2. 05 LOSS • Jamaica : $2. 5 – 5. 8 = -$3. 30 LOSS • Trin & Tob : $2. 68 – 8. 3 = -$5. 62 LOSS • Guyana : $2. 48 – 5. 2 = -$2. 72 LOSS

Effect of Inflation • Over the year of 2006 if you had savings of $100 you would have earned interest but prices would have gone up – the net effect in • +Interest – inflation = Nett • Barbados : $5. 25 – 7. 3 = -$2. 05 LOSS • Jamaica : $2. 5 – 5. 8 = -$3. 30 LOSS • Trin & Tob : $2. 68 – 8. 3 = -$5. 62 LOSS • Guyana : $2. 48 – 5. 2 = -$2. 72 LOSS

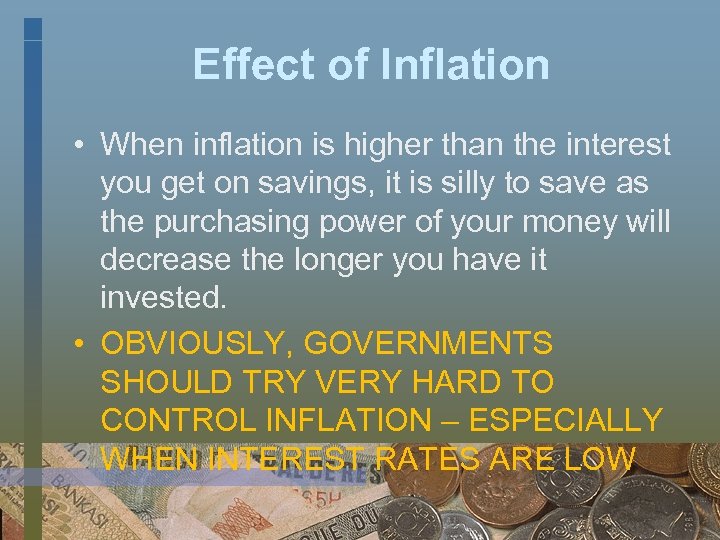

Effect of Inflation • When inflation is higher than the interest you get on savings, it is silly to save as the purchasing power of your money will decrease the longer you have it invested. • OBVIOUSLY, GOVERNMENTS SHOULD TRY VERY HARD TO CONTROL INFLATION – ESPECIALLY WHEN INTEREST RATES ARE LOW

Effect of Inflation • When inflation is higher than the interest you get on savings, it is silly to save as the purchasing power of your money will decrease the longer you have it invested. • OBVIOUSLY, GOVERNMENTS SHOULD TRY VERY HARD TO CONTROL INFLATION – ESPECIALLY WHEN INTEREST RATES ARE LOW

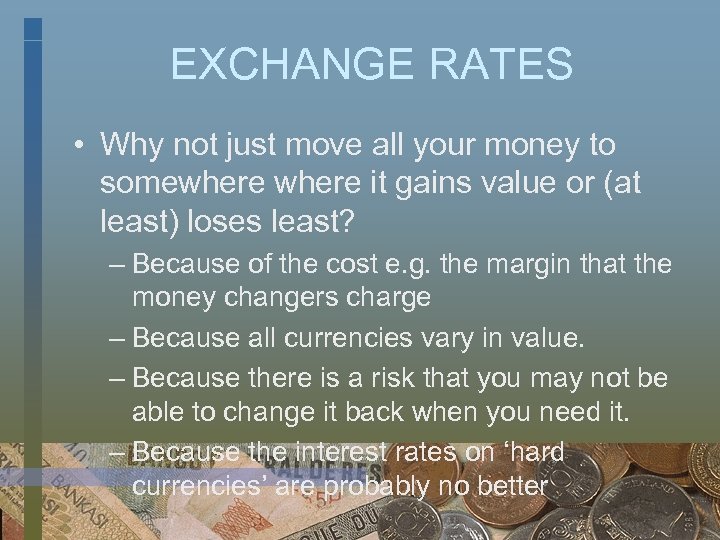

EXCHANGE RATES • Why not just move all your money to somewhere it gains value or (at least) loses least? – Because of the cost e. g. the margin that the money changers charge – Because all currencies vary in value. – Because there is a risk that you may not be able to change it back when you need it. – Because the interest rates on ‘hard currencies’ are probably no better

EXCHANGE RATES • Why not just move all your money to somewhere it gains value or (at least) loses least? – Because of the cost e. g. the margin that the money changers charge – Because all currencies vary in value. – Because there is a risk that you may not be able to change it back when you need it. – Because the interest rates on ‘hard currencies’ are probably no better

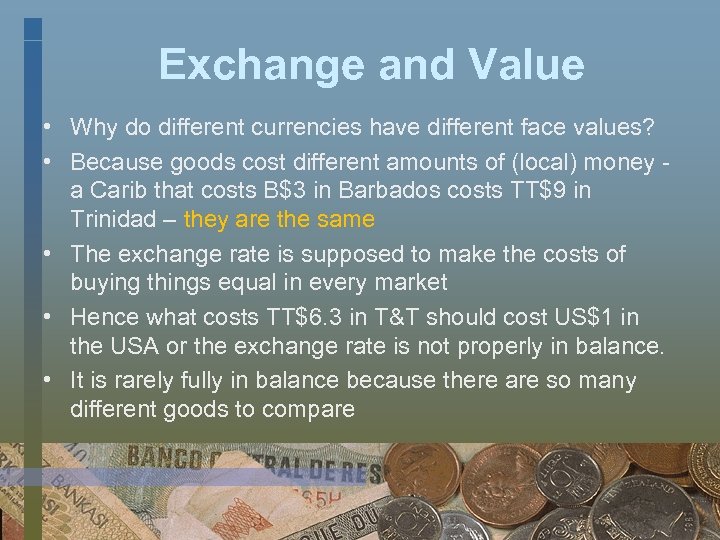

Exchange and Value • Why do different currencies have different face values? • Because goods cost different amounts of (local) money a Carib that costs B$3 in Barbados costs TT$9 in Trinidad – they are the same • The exchange rate is supposed to make the costs of buying things equal in every market • Hence what costs TT$6. 3 in T&T should cost US$1 in the USA or the exchange rate is not properly in balance. • It is rarely fully in balance because there are so many different goods to compare

Exchange and Value • Why do different currencies have different face values? • Because goods cost different amounts of (local) money a Carib that costs B$3 in Barbados costs TT$9 in Trinidad – they are the same • The exchange rate is supposed to make the costs of buying things equal in every market • Hence what costs TT$6. 3 in T&T should cost US$1 in the USA or the exchange rate is not properly in balance. • It is rarely fully in balance because there are so many different goods to compare

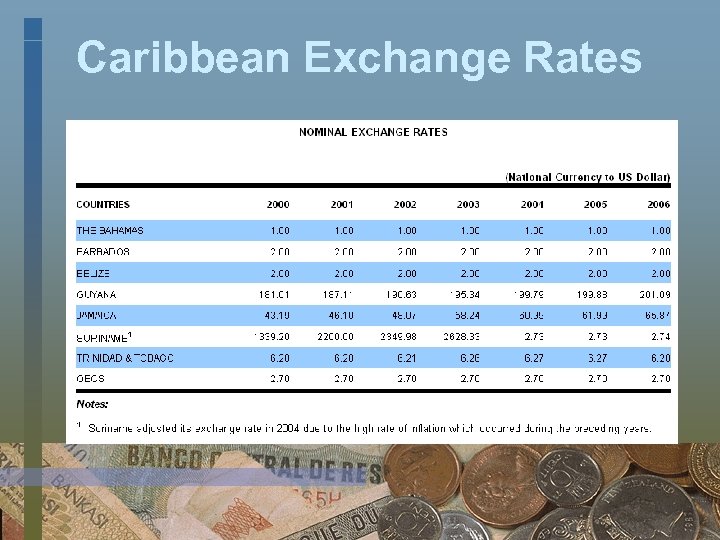

Caribbean Exchange Rates

Caribbean Exchange Rates

Money illusion • Many people think that the T&T $ is weaker than the Barbados $ because its exchange rate against the US$ is higher in T&T (6: 1) than Barbados (2: 1) - but, it all depends what you can buy for US$1 here and what that same item costs in Barbados. • In other words, people tend to think of currency in nominal, rather than real, terms – this is called Money illusion • The value on the note is NOT as important as what it can buy in that country. • Real value is determined by Purchasing Power

Money illusion • Many people think that the T&T $ is weaker than the Barbados $ because its exchange rate against the US$ is higher in T&T (6: 1) than Barbados (2: 1) - but, it all depends what you can buy for US$1 here and what that same item costs in Barbados. • In other words, people tend to think of currency in nominal, rather than real, terms – this is called Money illusion • The value on the note is NOT as important as what it can buy in that country. • Real value is determined by Purchasing Power

Purchasing Power Parity • If the exchange rates are right, the same product would cost the same everywhere in a standard currency • The US$ is normally used as the standard • Purchasing Power looks at what a product costs in US$ terms in different countries

Purchasing Power Parity • If the exchange rates are right, the same product would cost the same everywhere in a standard currency • The US$ is normally used as the standard • Purchasing Power looks at what a product costs in US$ terms in different countries

Purchasing Power Parity CHICKENOMICS • The KFC chicken sandwich is a standard ‘good’ and is available in all the Caribbean islands. • Based on prevailing exchange rates to the US$, Guyana is the cheapest place to buy a KFC chicken sandwich in the region • The most expensive is Cayman Islands with Barbados not far behind and both are more expensive than the USA i. e. their currencies are overvalued compared with the US$. • Within the OECS, St Lucia was the cheapest with Antigua & Barbuda tying with St Kitts & Nevis for most expensive. • Guyana, Suriname and Trinidad were the only countries cheaper than the United States to buy a KFC chicken sandwich – i. e. their currencies are under-valued compared with the US$.

Purchasing Power Parity CHICKENOMICS • The KFC chicken sandwich is a standard ‘good’ and is available in all the Caribbean islands. • Based on prevailing exchange rates to the US$, Guyana is the cheapest place to buy a KFC chicken sandwich in the region • The most expensive is Cayman Islands with Barbados not far behind and both are more expensive than the USA i. e. their currencies are overvalued compared with the US$. • Within the OECS, St Lucia was the cheapest with Antigua & Barbuda tying with St Kitts & Nevis for most expensive. • Guyana, Suriname and Trinidad were the only countries cheaper than the United States to buy a KFC chicken sandwich – i. e. their currencies are under-valued compared with the US$.

Project Economics • Our specific concern is with the economics of engineering projects • We want to build the projects that deliver the highest benefit at the lowest cost. • We need to be aware of the currencies that will be required, if all cannot be paid for in local $. • We need to know when the bills will have to be paid

Project Economics • Our specific concern is with the economics of engineering projects • We want to build the projects that deliver the highest benefit at the lowest cost. • We need to be aware of the currencies that will be required, if all cannot be paid for in local $. • We need to know when the bills will have to be paid

Principles of Project Appraisal • In general terms the projects with which engineers tend to be involved are investment projects (i. e. they last a relatively long time) in which a capital expenditure is involved (i. e. they generate benefits over their working life). • This usually means that there is a current outlay of cash in return for an anticipated future flow of benefits. • On public sector projects especially there will often be significant non-cash benefits

Principles of Project Appraisal • In general terms the projects with which engineers tend to be involved are investment projects (i. e. they last a relatively long time) in which a capital expenditure is involved (i. e. they generate benefits over their working life). • This usually means that there is a current outlay of cash in return for an anticipated future flow of benefits. • On public sector projects especially there will often be significant non-cash benefits

Principles of Project Appraisal • Projects with non-cash costs or benefits must involve an economic evaluation as well as a financial evaluation: – – building a school constructing a mass-transit system developing agricultural land, determining whether to rent or buy facilities, equipment or services (e. g. office buildings) – building a road, – safety equipment (lights and crash barriers) on a road – determining the degree of protection against flooding, hurricanes and earthquakes.

Principles of Project Appraisal • Projects with non-cash costs or benefits must involve an economic evaluation as well as a financial evaluation: – – building a school constructing a mass-transit system developing agricultural land, determining whether to rent or buy facilities, equipment or services (e. g. office buildings) – building a road, – safety equipment (lights and crash barriers) on a road – determining the degree of protection against flooding, hurricanes and earthquakes.

Effect of Time • In the broadest terms the principles of project appraisal relate to the quantification of costs and benefits over the life of the project. • However, it is not sufficient simply to examine the total amounts of these costs and benefits because of the 'time value of money'. • Would you rather have $100 now or in five year’s time? Why? • Well – it is at least partly because of INTEREST

Effect of Time • In the broadest terms the principles of project appraisal relate to the quantification of costs and benefits over the life of the project. • However, it is not sufficient simply to examine the total amounts of these costs and benefits because of the 'time value of money'. • Would you rather have $100 now or in five year’s time? Why? • Well – it is at least partly because of INTEREST

Effect of Time • People who receive income and do not buy all the goods to which they are entitled save, and this money is available for others to use in investments. • These people who refrain from consumption are compensated for this in the form of interest. • Interest is a reward for choosing to abstain from consumption • The people who borrow have to pay interest for the use of that money (just like rent)

Effect of Time • People who receive income and do not buy all the goods to which they are entitled save, and this money is available for others to use in investments. • These people who refrain from consumption are compensated for this in the form of interest. • Interest is a reward for choosing to abstain from consumption • The people who borrow have to pay interest for the use of that money (just like rent)

Interest • Interest is the ‘price of money’ and is determined by supply and demand • Supply is determined by people’s willingness to save – or their ‘marginal time preference rate’ • Demand is determined by people’s expectations regarding profits and inflation and is a measure of their ‘marginal propensity to consume’

Interest • Interest is the ‘price of money’ and is determined by supply and demand • Supply is determined by people’s willingness to save – or their ‘marginal time preference rate’ • Demand is determined by people’s expectations regarding profits and inflation and is a measure of their ‘marginal propensity to consume’

Savings • Savings involve risks – You may not be around to spend it – The bank may not be around – The economy may collapse so value may be destroyed or choice reduced – There may be local or international war – Alternative investment opportunities may be lost – Inflation rates may rise – Currency may be devalued • Hence the interest rate is a compensation for all these risks

Savings • Savings involve risks – You may not be around to spend it – The bank may not be around – The economy may collapse so value may be destroyed or choice reduced – There may be local or international war – Alternative investment opportunities may be lost – Inflation rates may rise – Currency may be devalued • Hence the interest rate is a compensation for all these risks

Time Value of Money • If you save $100 today and put it in account earning 5% interest per annum, for one year, how much will you have at the end of that year? • $100 + 100*. 05 = 100(1+0. 05) = $105 • If you leave the money there, how much will you have at the end of 2 years? • $105 + 105*. 05 = 100(1+. 05) =$110. 25

Time Value of Money • If you save $100 today and put it in account earning 5% interest per annum, for one year, how much will you have at the end of that year? • $100 + 100*. 05 = 100(1+0. 05) = $105 • If you leave the money there, how much will you have at the end of 2 years? • $105 + 105*. 05 = 100(1+. 05) =$110. 25

Time Value of Money • • i = interest rate n = number of periods (years) P = the sum of money you start with F = the sum of money you have in the future • This can be expressed as • F = P(1+i)n

Time Value of Money • • i = interest rate n = number of periods (years) P = the sum of money you start with F = the sum of money you have in the future • This can be expressed as • F = P(1+i)n

Time Value of Money • So if you know that F = P(1+i)n • This is the Future Worth of a sum of money • You also know that P = F/(1+i) n • This is the Present Worth of a sum of money

Time Value of Money • So if you know that F = P(1+i)n • This is the Future Worth of a sum of money • You also know that P = F/(1+i) n • This is the Present Worth of a sum of money