Introduction to Ellis. Don June 2012

Introduction to Ellis. Don June 2012

Key Facts • • Founded in 1951 Canada’s 2 nd largest constructor 2011 Revenues over $3 billion International company – have worked in 17 countries • Core strength in social infrastructure – particularly healthcare and justice facilities • One of two most successful PPP developers and builders in Canada

Key Facts • • Founded in 1951 Canada’s 2 nd largest constructor 2011 Revenues over $3 billion International company – have worked in 17 countries • Core strength in social infrastructure – particularly healthcare and justice facilities • One of two most successful PPP developers and builders in Canada

Healthcare experience • • Canada’s largest hospital builder 200+ hospitals Healthcare construction value over $15 billion In last 30 years never a time when Ellis. Don wasn’t building a hospital somewhere in Canada • Almost all Ellis. Don staff have healthcare construction experience

Healthcare experience • • Canada’s largest hospital builder 200+ hospitals Healthcare construction value over $15 billion In last 30 years never a time when Ellis. Don wasn’t building a hospital somewhere in Canada • Almost all Ellis. Don staff have healthcare construction experience

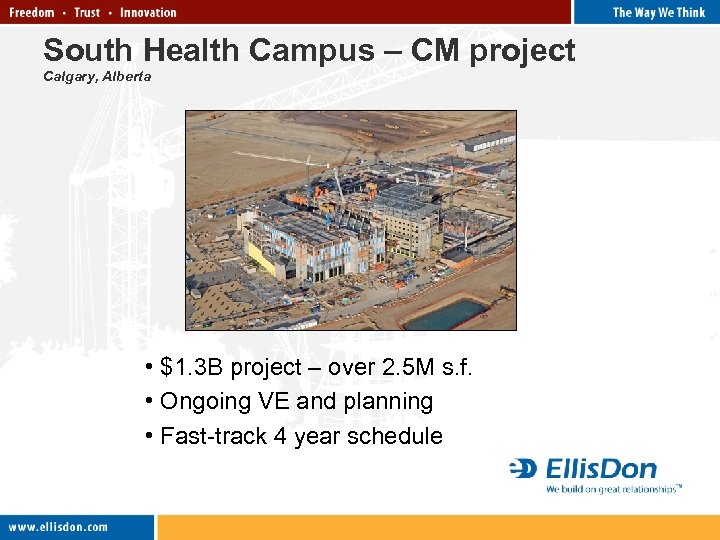

South Health Campus – CM project Calgary, Alberta • $1. 3 B project – over 2. 5 M s. f. • Ongoing VE and planning • Fast-track 4 year schedule

South Health Campus – CM project Calgary, Alberta • $1. 3 B project – over 2. 5 M s. f. • Ongoing VE and planning • Fast-track 4 year schedule

Justice Facilities • Over 150 justice projects – in Canada and the U. S. § § Prisons Courthouses Police facilities Forensic Mental Health • Currently building the largest PPP prison in Canada • Currently building two PPP courthouses

Justice Facilities • Over 150 justice projects – in Canada and the U. S. § § Prisons Courthouses Police facilities Forensic Mental Health • Currently building the largest PPP prison in Canada • Currently building two PPP courthouses

Public Private Partnerships • Won the first two Canadian PPP projects • Participate as developer, design-builder and (sometimes) facility operator • Have reached financial close on 24 PPP projects § § § Hospitals Prisons Courthouses Housing Sports/entertainment facilities

Public Private Partnerships • Won the first two Canadian PPP projects • Participate as developer, design-builder and (sometimes) facility operator • Have reached financial close on 24 PPP projects § § § Hospitals Prisons Courthouses Housing Sports/entertainment facilities

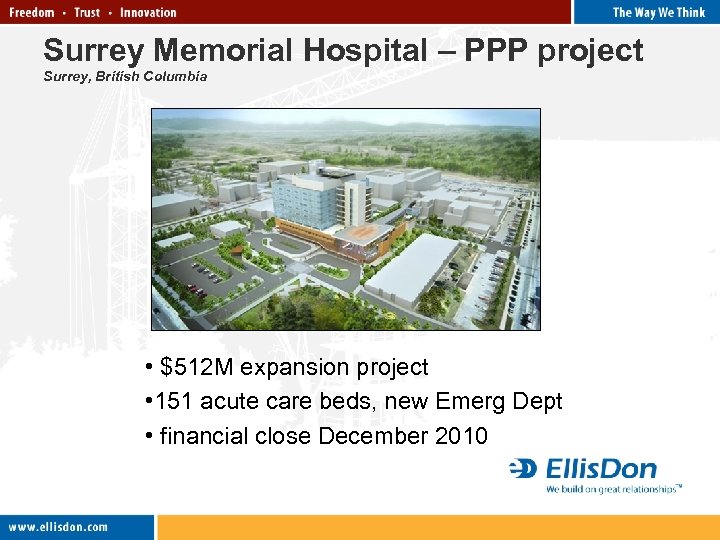

Surrey Memorial Hospital – PPP project Surrey, British Columbia • $512 M expansion project • 151 acute care beds, new Emerg Dept • financial close December 2010

Surrey Memorial Hospital – PPP project Surrey, British Columbia • $512 M expansion project • 151 acute care beds, new Emerg Dept • financial close December 2010

Public Private Partnerships • Pros § Full risk transfer for design, construction, building operations – guaranteed performance § Best-in-class asset management – FM/life cycle § Private finance provides discipline & capacity § Faster delivery – inception to completion • Cons § Higher transaction costs § Higher finance costs for the private finance portion § Less flexibility to handle changes during operating period

Public Private Partnerships • Pros § Full risk transfer for design, construction, building operations – guaranteed performance § Best-in-class asset management – FM/life cycle § Private finance provides discipline & capacity § Faster delivery – inception to completion • Cons § Higher transaction costs § Higher finance costs for the private finance portion § Less flexibility to handle changes during operating period

Comments - P 3/Concession procurement • • Output Specs typically exceed industry norms Transaction costs are relatively high Not all risk transfer is good value Expectations can be unrealistic – innovations, retail revenues etc. • Projects are most successful when all parties focus on the “partnership” • The condition of the asset during the operations phase is better than with non-P 3 assets

Comments - P 3/Concession procurement • • Output Specs typically exceed industry norms Transaction costs are relatively high Not all risk transfer is good value Expectations can be unrealistic – innovations, retail revenues etc. • Projects are most successful when all parties focus on the “partnership” • The condition of the asset during the operations phase is better than with non-P 3 assets