1e905c92ba8e07accae25a0a15fee4a9.ppt

- Количество слайдов: 33

Introduction to Electronic Processing College of General Studies

Introduction to Electronic Processing College of General Studies

Agenda Industry overview n Consumer products n Players - roles & responsibilities n “A Day in the Life of a Transaction” n Seven stages of processing n 2

Agenda Industry overview n Consumer products n Players - roles & responsibilities n “A Day in the Life of a Transaction” n Seven stages of processing n 2

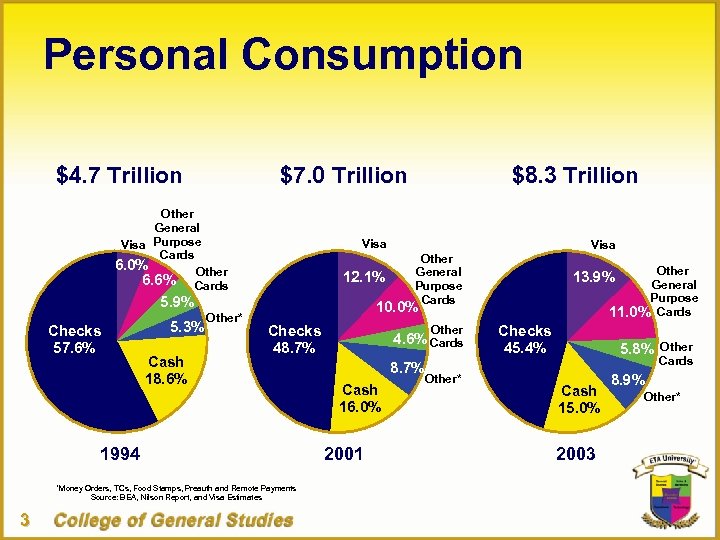

Personal Consumption $4. 7 Trillion $7. 0 Trillion Other General Visa Purpose Cards 6. 0% Other 6. 6% Cards Visa 12. 1% 5. 9% Checks 57. 6% 5. 3% Cash 18. 6% Other* Visa Other General Purpose Cards Other General Purpose 11. 0% Cards 13. 9% 10. 0% Checks 48. 7% 1994 *Money Orders, TCs, Food Stamps, Preauth and Remote Payments Source: BEA, Nilson Report, and Visa Estimates 3 $8. 3 Trillion Other 4. 6% Cards 8. 7% Cash 16. 0% 2001 Other* Checks 45. 4% 5. 8% Cash 15. 0% 2003 Other Cards 8. 9% Other*

Personal Consumption $4. 7 Trillion $7. 0 Trillion Other General Visa Purpose Cards 6. 0% Other 6. 6% Cards Visa 12. 1% 5. 9% Checks 57. 6% 5. 3% Cash 18. 6% Other* Visa Other General Purpose Cards Other General Purpose 11. 0% Cards 13. 9% 10. 0% Checks 48. 7% 1994 *Money Orders, TCs, Food Stamps, Preauth and Remote Payments Source: BEA, Nilson Report, and Visa Estimates 3 $8. 3 Trillion Other 4. 6% Cards 8. 7% Cash 16. 0% 2001 Other* Checks 45. 4% 5. 8% Cash 15. 0% 2003 Other Cards 8. 9% Other*

Consumer Products Payment n Credit cards – Classic – Commercial – Proprietary n Debit cards – Classic – Gift – EBT n 4 Checks

Consumer Products Payment n Credit cards – Classic – Commercial – Proprietary n Debit cards – Classic – Gift – EBT n 4 Checks

Consumer Products Marketing/Value Add Loyalty/frequency n Smart cards/chip cards n Contactless n – Wireless – Radio frequency 5

Consumer Products Marketing/Value Add Loyalty/frequency n Smart cards/chip cards n Contactless n – Wireless – Radio frequency 5

Consumer Products Authentication Personal Identification Number (PIN) n Smart cards/chip cards n Biometrics n Age verification n Address Verification n 6

Consumer Products Authentication Personal Identification Number (PIN) n Smart cards/chip cards n Biometrics n Age verification n Address Verification n 6

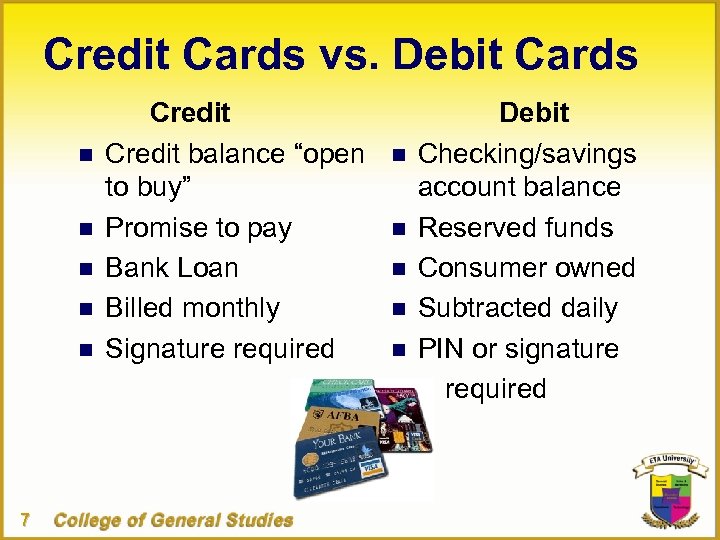

Credit Cards vs. Debit Cards n n n 7 Credit balance “open to buy” Promise to pay Bank Loan Billed monthly Signature required n n n Debit Checking/savings account balance Reserved funds Consumer owned Subtracted daily PIN or signature required

Credit Cards vs. Debit Cards n n n 7 Credit balance “open to buy” Promise to pay Bank Loan Billed monthly Signature required n n n Debit Checking/savings account balance Reserved funds Consumer owned Subtracted daily PIN or signature required

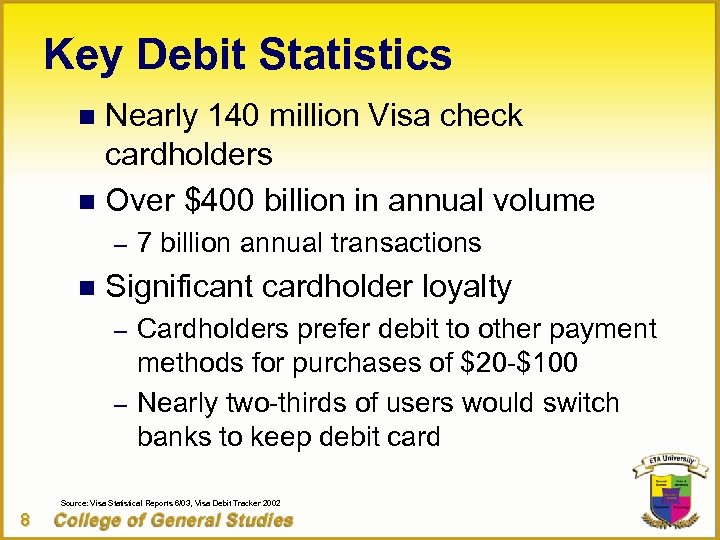

Key Debit Statistics Nearly 140 million Visa check cardholders n Over $400 billion in annual volume n – 7 billion annual transactions n Significant cardholder loyalty – Cardholders prefer debit to other payment methods for purchases of $20 -$100 – Nearly two-thirds of users would switch banks to keep debit card Source: Visa Statistical Reports 6/03, Visa Debit Tracker 2002 8

Key Debit Statistics Nearly 140 million Visa check cardholders n Over $400 billion in annual volume n – 7 billion annual transactions n Significant cardholder loyalty – Cardholders prefer debit to other payment methods for purchases of $20 -$100 – Nearly two-thirds of users would switch banks to keep debit card Source: Visa Statistical Reports 6/03, Visa Debit Tracker 2002 8

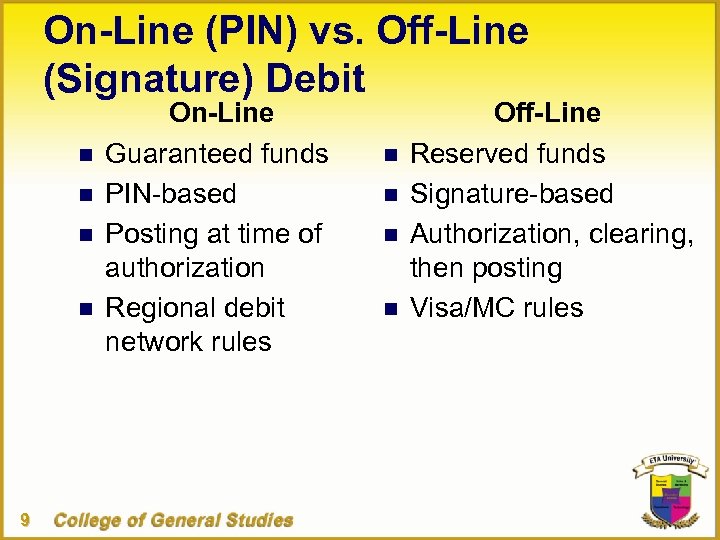

On-Line (PIN) vs. Off-Line (Signature) Debit n n 9 On-Line Guaranteed funds PIN-based Posting at time of authorization Regional debit network rules n n Off-Line Reserved funds Signature-based Authorization, clearing, then posting Visa/MC rules

On-Line (PIN) vs. Off-Line (Signature) Debit n n 9 On-Line Guaranteed funds PIN-based Posting at time of authorization Regional debit network rules n n Off-Line Reserved funds Signature-based Authorization, clearing, then posting Visa/MC rules

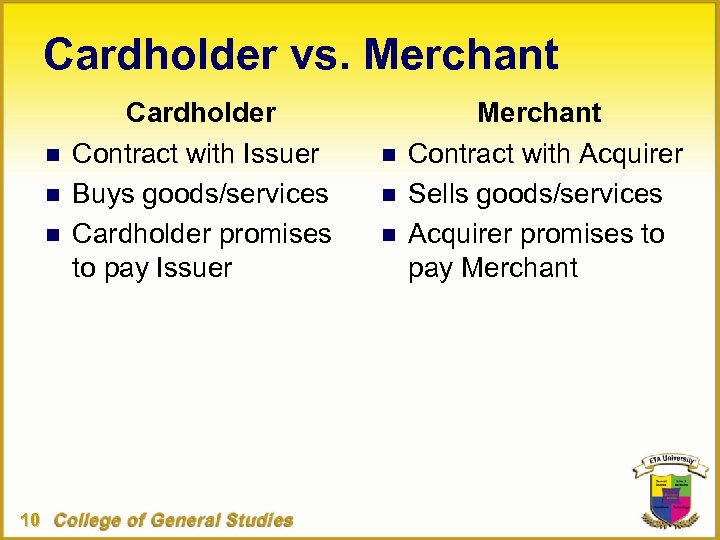

Cardholder vs. Merchant n n n 10 Cardholder Contract with Issuer Buys goods/services Cardholder promises to pay Issuer n n n Merchant Contract with Acquirer Sells goods/services Acquirer promises to pay Merchant

Cardholder vs. Merchant n n n 10 Cardholder Contract with Issuer Buys goods/services Cardholder promises to pay Issuer n n n Merchant Contract with Acquirer Sells goods/services Acquirer promises to pay Merchant

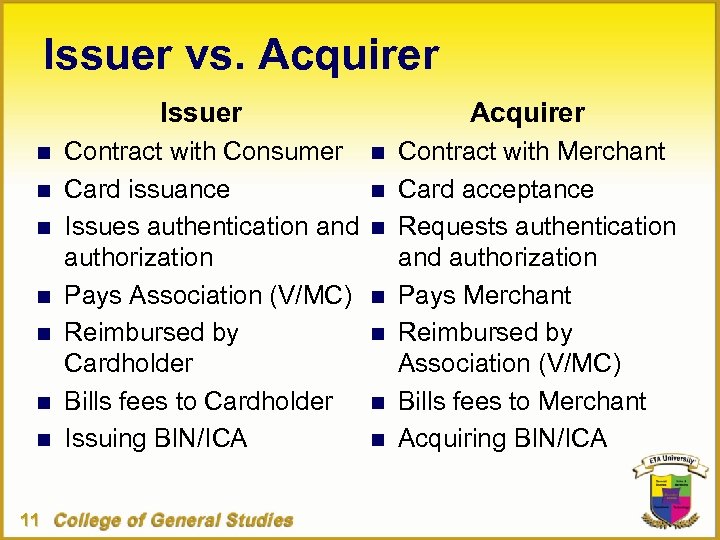

Issuer vs. Acquirer Issuer n n n n 11 Contract with Consumer Card issuance Issues authentication and authorization Pays Association (V/MC) Reimbursed by Cardholder Bills fees to Cardholder Issuing BIN/ICA Acquirer n n n n Contract with Merchant Card acceptance Requests authentication and authorization Pays Merchant Reimbursed by Association (V/MC) Bills fees to Merchant Acquiring BIN/ICA

Issuer vs. Acquirer Issuer n n n n 11 Contract with Consumer Card issuance Issues authentication and authorization Pays Association (V/MC) Reimbursed by Cardholder Bills fees to Cardholder Issuing BIN/ICA Acquirer n n n n Contract with Merchant Card acceptance Requests authentication and authorization Pays Merchant Reimbursed by Association (V/MC) Bills fees to Merchant Acquiring BIN/ICA

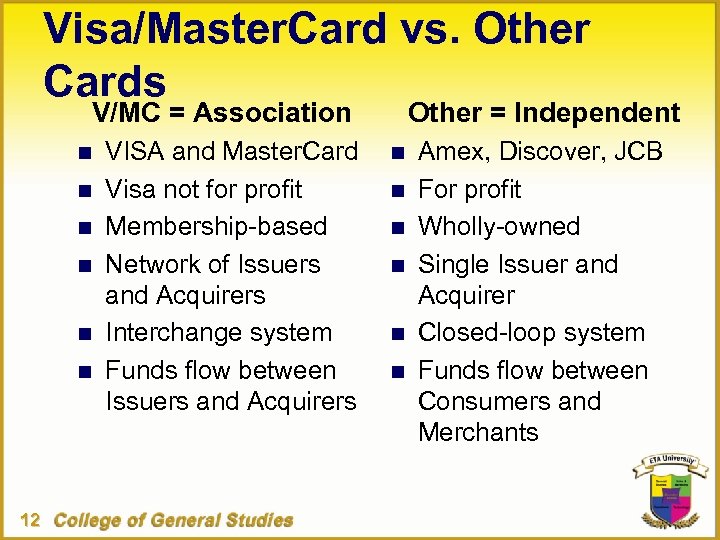

Visa/Master. Card vs. Other Cards V/MC = Association n n n 12 VISA and Master. Card Visa not for profit Membership-based Network of Issuers and Acquirers Interchange system Funds flow between Issuers and Acquirers Other = Independent n n n Amex, Discover, JCB For profit Wholly-owned Single Issuer and Acquirer Closed-loop system Funds flow between Consumers and Merchants

Visa/Master. Card vs. Other Cards V/MC = Association n n n 12 VISA and Master. Card Visa not for profit Membership-based Network of Issuers and Acquirers Interchange system Funds flow between Issuers and Acquirers Other = Independent n n n Amex, Discover, JCB For profit Wholly-owned Single Issuer and Acquirer Closed-loop system Funds flow between Consumers and Merchants

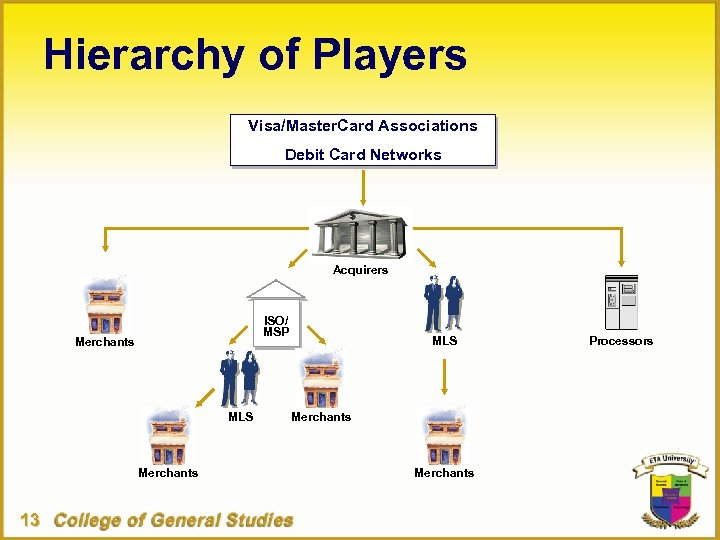

Hierarchy of Players Visa/Master. Card Associations Debit Card Networks Acquirers ISO/ MSP Merchants MLS Merchants 13 MLS Merchants Processors

Hierarchy of Players Visa/Master. Card Associations Debit Card Networks Acquirers ISO/ MSP Merchants MLS Merchants 13 MLS Merchants Processors

Roles and Responsibilities n Visa and Master. Card Associations/Debit Card Networks – Provides infrastructure for Interchange, – – – 14 clearing and settlement Monitor and produce guidelines for risk Produce operating rules and regulations Promote their brand recognition and acceptance Provide statistical analysis Develop new products, services, segments

Roles and Responsibilities n Visa and Master. Card Associations/Debit Card Networks – Provides infrastructure for Interchange, – – – 14 clearing and settlement Monitor and produce guidelines for risk Produce operating rules and regulations Promote their brand recognition and acceptance Provide statistical analysis Develop new products, services, segments

Roles and Responsibilities n Acquirer – The Association/Debit Card Network – – – 15 member Carries ultimate liability for ISO and Merchant May provide various levels of back office support May also be a Processor Third party to merchant contracts Underwriting for ISO and Merchant

Roles and Responsibilities n Acquirer – The Association/Debit Card Network – – – 15 member Carries ultimate liability for ISO and Merchant May provide various levels of back office support May also be a Processor Third party to merchant contracts Underwriting for ISO and Merchant

Acquirer n Qualifications for membership – Regulated financial institution – Able to extend Credit or accept Checking and/or Savings Accounts – Asset size may not exceed risk – May sponsor agents/MSPs • ISO, TPS, IC 16

Acquirer n Qualifications for membership – Regulated financial institution – Able to extend Credit or accept Checking and/or Savings Accounts – Asset size may not exceed risk – May sponsor agents/MSPs • ISO, TPS, IC 16

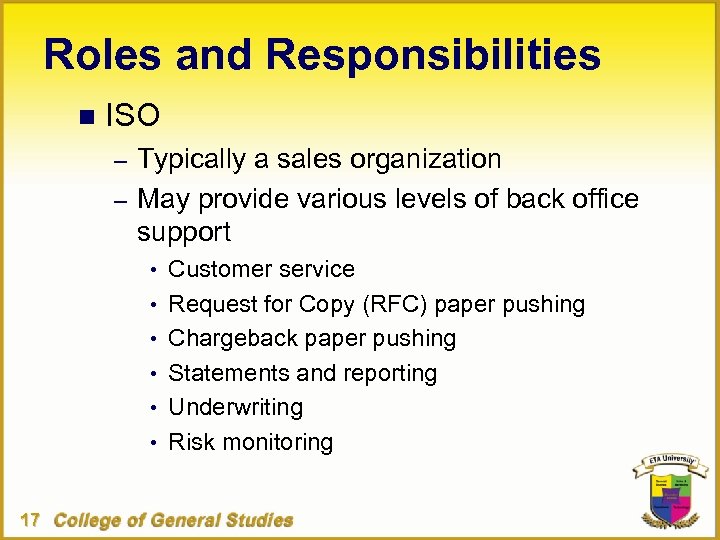

Roles and Responsibilities n ISO – Typically a sales organization – May provide various levels of back office support • Customer service • Request for Copy (RFC) paper pushing • Chargeback paper pushing • Statements and reporting • Underwriting • Risk monitoring 17

Roles and Responsibilities n ISO – Typically a sales organization – May provide various levels of back office support • Customer service • Request for Copy (RFC) paper pushing • Chargeback paper pushing • Statements and reporting • Underwriting • Risk monitoring 17

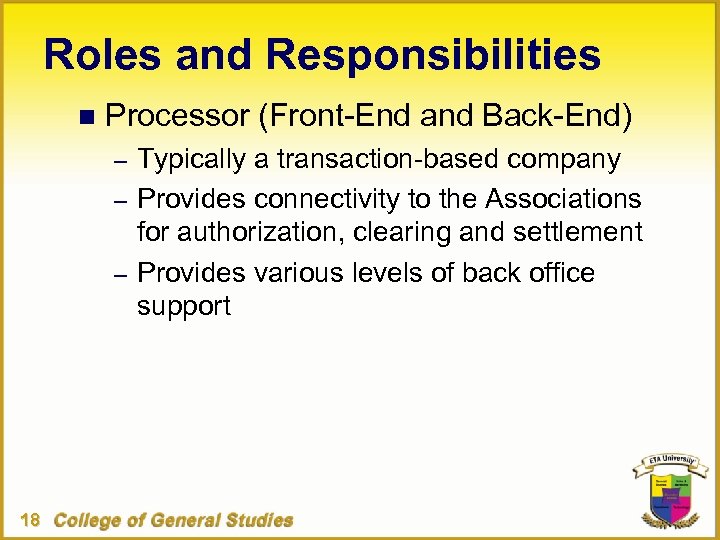

Roles and Responsibilities n Processor (Front-End and Back-End) – Typically a transaction-based company – Provides connectivity to the Associations for authorization, clearing and settlement – Provides various levels of back office support 18

Roles and Responsibilities n Processor (Front-End and Back-End) – Typically a transaction-based company – Provides connectivity to the Associations for authorization, clearing and settlement – Provides various levels of back office support 18

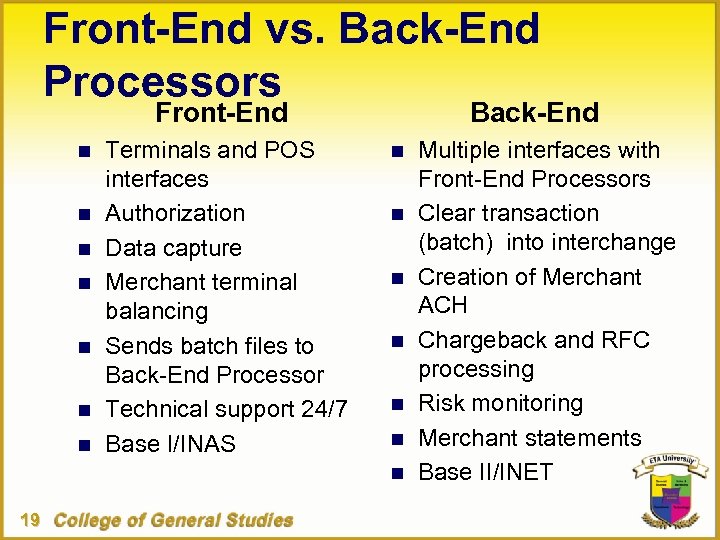

Front-End vs. Back-End Processors Front-End n n n n Terminals and POS interfaces Authorization Data capture Merchant terminal balancing Sends batch files to Back-End Processor Technical support 24/7 Base I/INAS Back-End n n n n 19 Multiple interfaces with Front-End Processors Clear transaction (batch) into interchange Creation of Merchant ACH Chargeback and RFC processing Risk monitoring Merchant statements Base II/INET

Front-End vs. Back-End Processors Front-End n n n n Terminals and POS interfaces Authorization Data capture Merchant terminal balancing Sends batch files to Back-End Processor Technical support 24/7 Base I/INAS Back-End n n n n 19 Multiple interfaces with Front-End Processors Clear transaction (batch) into interchange Creation of Merchant ACH Chargeback and RFC processing Risk monitoring Merchant statements Base II/INET

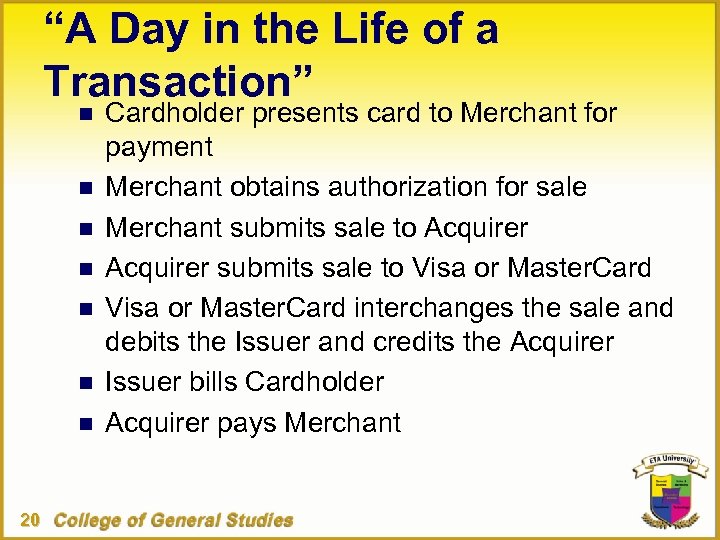

“A Day in the Life of a Transaction” n n n n 20 Cardholder presents card to Merchant for payment Merchant obtains authorization for sale Merchant submits sale to Acquirer submits sale to Visa or Master. Card interchanges the sale and debits the Issuer and credits the Acquirer Issuer bills Cardholder Acquirer pays Merchant

“A Day in the Life of a Transaction” n n n n 20 Cardholder presents card to Merchant for payment Merchant obtains authorization for sale Merchant submits sale to Acquirer submits sale to Visa or Master. Card interchanges the sale and debits the Issuer and credits the Acquirer Issuer bills Cardholder Acquirer pays Merchant

Seven Stages of Processing 1 - Authorization 2 - Merchant Balancing 3 - Capture 4 - Clearing 5 - Interchange 6 - Settlement 7 - Merchant ACH 21

Seven Stages of Processing 1 - Authorization 2 - Merchant Balancing 3 - Capture 4 - Clearing 5 - Interchange 6 - Settlement 7 - Merchant ACH 21

1 - Authorization n n 22 Merchant requests an authorization from the Front-End Processor If Visa or Master. Card (V/MC), Front-End Processor transmits authorization to V/MC and transaction is further routed to appropriate Issuing BIN Otherwise, Front-End Processor transmits authorization to appropriate card Issuer for approval (AX, DR, DC, JCB) Issuer authenticates Cardholder and approves or declines the transaction amount

1 - Authorization n n 22 Merchant requests an authorization from the Front-End Processor If Visa or Master. Card (V/MC), Front-End Processor transmits authorization to V/MC and transaction is further routed to appropriate Issuing BIN Otherwise, Front-End Processor transmits authorization to appropriate card Issuer for approval (AX, DR, DC, JCB) Issuer authenticates Cardholder and approves or declines the transaction amount

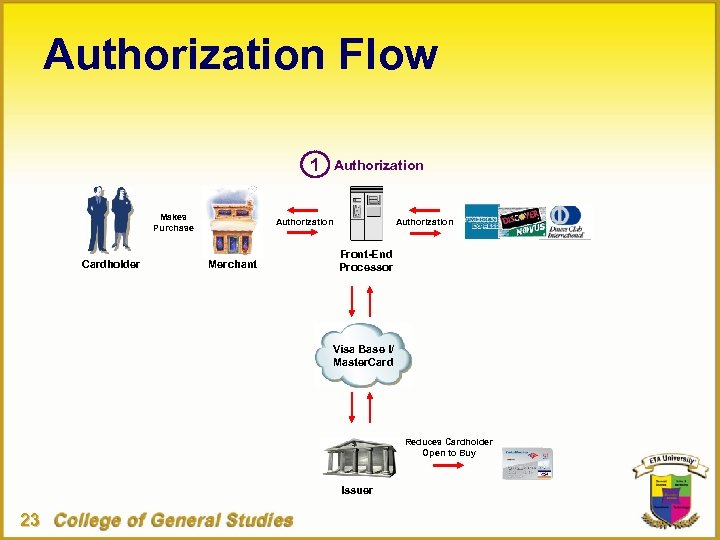

Authorization Flow 1 Makes Purchase Cardholder Authorization Merchant Front-End Processor Visa Base I/ Master. Card Reduces Cardholder Open to Buy Issuer 23

Authorization Flow 1 Makes Purchase Cardholder Authorization Merchant Front-End Processor Visa Base I/ Master. Card Reduces Cardholder Open to Buy Issuer 23

2 - Merchant Balancing Merchant totals transactions and balances by card type n Merchant either transmits his batch to the Front-End Processor or terminal may perform an auto close function at end of day n 24

2 - Merchant Balancing Merchant totals transactions and balances by card type n Merchant either transmits his batch to the Front-End Processor or terminal may perform an auto close function at end of day n 24

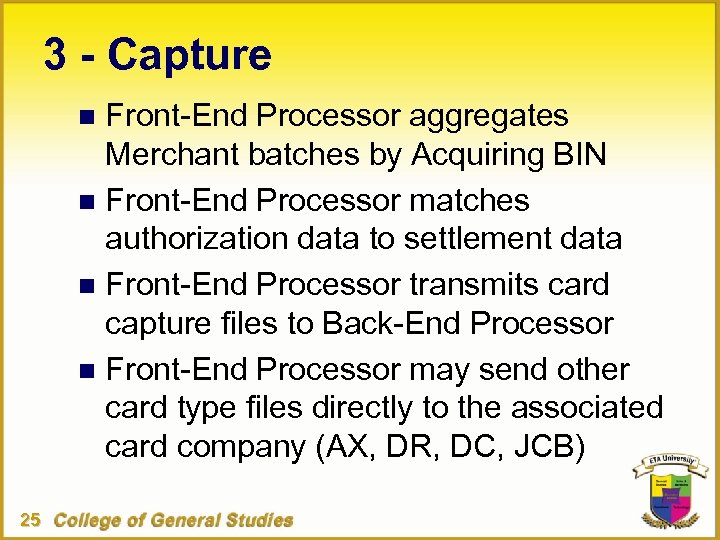

3 - Capture Front-End Processor aggregates Merchant batches by Acquiring BIN n Front-End Processor matches authorization data to settlement data n Front-End Processor transmits card capture files to Back-End Processor n Front-End Processor may send other card type files directly to the associated card company (AX, DR, DC, JCB) n 25

3 - Capture Front-End Processor aggregates Merchant batches by Acquiring BIN n Front-End Processor matches authorization data to settlement data n Front-End Processor transmits card capture files to Back-End Processor n Front-End Processor may send other card type files directly to the associated card company (AX, DR, DC, JCB) n 25

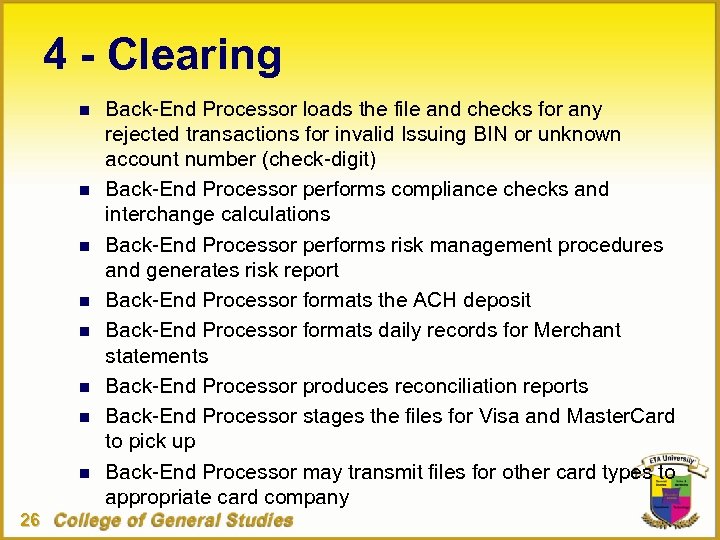

4 - Clearing n n n n 26 Back-End Processor loads the file and checks for any rejected transactions for invalid Issuing BIN or unknown account number (check-digit) Back-End Processor performs compliance checks and interchange calculations Back-End Processor performs risk management procedures and generates risk report Back-End Processor formats the ACH deposit Back-End Processor formats daily records for Merchant statements Back-End Processor produces reconciliation reports Back-End Processor stages the files for Visa and Master. Card to pick up Back-End Processor may transmit files for other card types to appropriate card company

4 - Clearing n n n n 26 Back-End Processor loads the file and checks for any rejected transactions for invalid Issuing BIN or unknown account number (check-digit) Back-End Processor performs compliance checks and interchange calculations Back-End Processor performs risk management procedures and generates risk report Back-End Processor formats the ACH deposit Back-End Processor formats daily records for Merchant statements Back-End Processor produces reconciliation reports Back-End Processor stages the files for Visa and Master. Card to pick up Back-End Processor may transmit files for other card types to appropriate card company

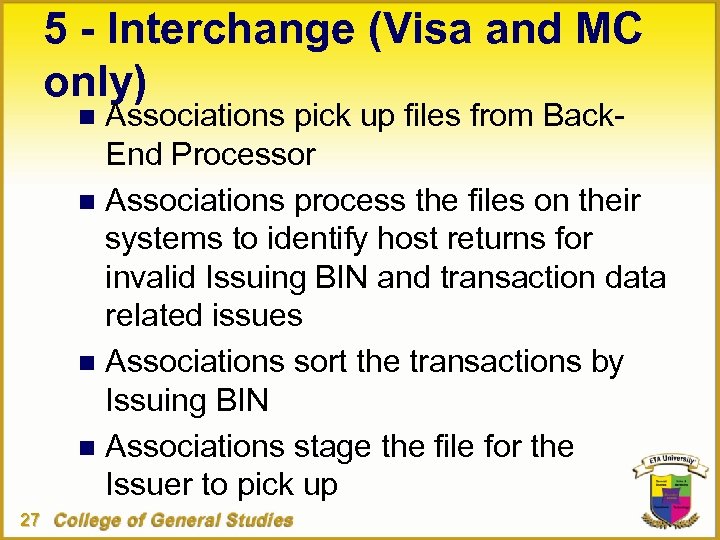

5 - Interchange (Visa and MC only) Associations pick up files from Back. End Processor n Associations process the files on their systems to identify host returns for invalid Issuing BIN and transaction data related issues n Associations sort the transactions by Issuing BIN n Associations stage the file for the Issuer to pick up n 27

5 - Interchange (Visa and MC only) Associations pick up files from Back. End Processor n Associations process the files on their systems to identify host returns for invalid Issuing BIN and transaction data related issues n Associations sort the transactions by Issuing BIN n Associations stage the file for the Issuer to pick up n 27

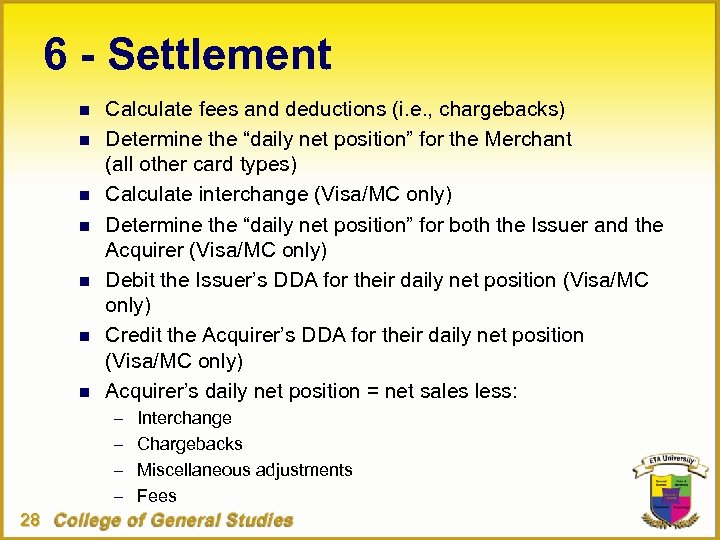

6 - Settlement n n n n Calculate fees and deductions (i. e. , chargebacks) Determine the “daily net position” for the Merchant (all other card types) Calculate interchange (Visa/MC only) Determine the “daily net position” for both the Issuer and the Acquirer (Visa/MC only) Debit the Issuer’s DDA for their daily net position (Visa/MC only) Credit the Acquirer’s DDA for their daily net position (Visa/MC only) Acquirer’s daily net position = net sales less: – Interchange – Chargebacks – Miscellaneous adjustments – Fees 28

6 - Settlement n n n n Calculate fees and deductions (i. e. , chargebacks) Determine the “daily net position” for the Merchant (all other card types) Calculate interchange (Visa/MC only) Determine the “daily net position” for both the Issuer and the Acquirer (Visa/MC only) Debit the Issuer’s DDA for their daily net position (Visa/MC only) Credit the Acquirer’s DDA for their daily net position (Visa/MC only) Acquirer’s daily net position = net sales less: – Interchange – Chargebacks – Miscellaneous adjustments – Fees 28

7 - Merchant ACH Back-End Processor transmits Visa/MC Merchant deposit to ACH n Other card types transmit Merchant deposit to ACH n Merchant’s DDA is credited for daily net deposits n 29

7 - Merchant ACH Back-End Processor transmits Visa/MC Merchant deposit to ACH n Other card types transmit Merchant deposit to ACH n Merchant’s DDA is credited for daily net deposits n 29

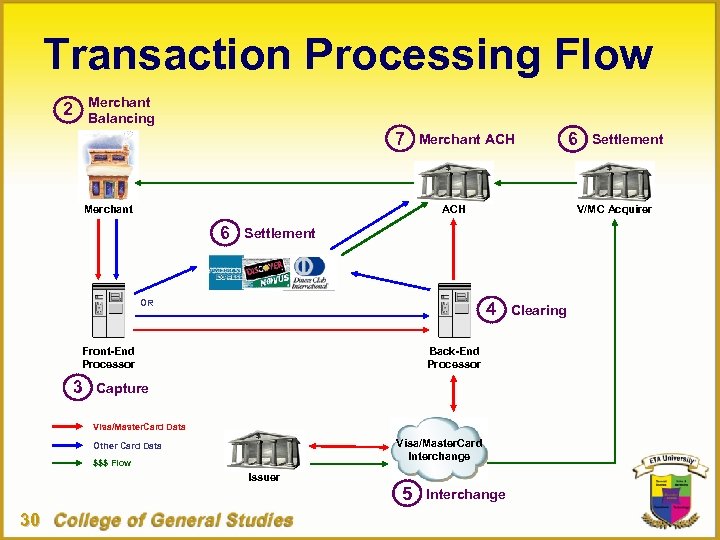

Transaction Processing Flow Merchant Balancing 2 7 Merchant ACH 6 4 Front-End Processor 3 Back-End Processor Capture Visa/Master. Card Data Visa/Master. Card Interchange Other Card Data $$$ Flow Issuer 5 30 Settlement V/MC Acquirer Settlement OR 6 Interchange Clearing

Transaction Processing Flow Merchant Balancing 2 7 Merchant ACH 6 4 Front-End Processor 3 Back-End Processor Capture Visa/Master. Card Data Visa/Master. Card Interchange Other Card Data $$$ Flow Issuer 5 30 Settlement V/MC Acquirer Settlement OR 6 Interchange Clearing

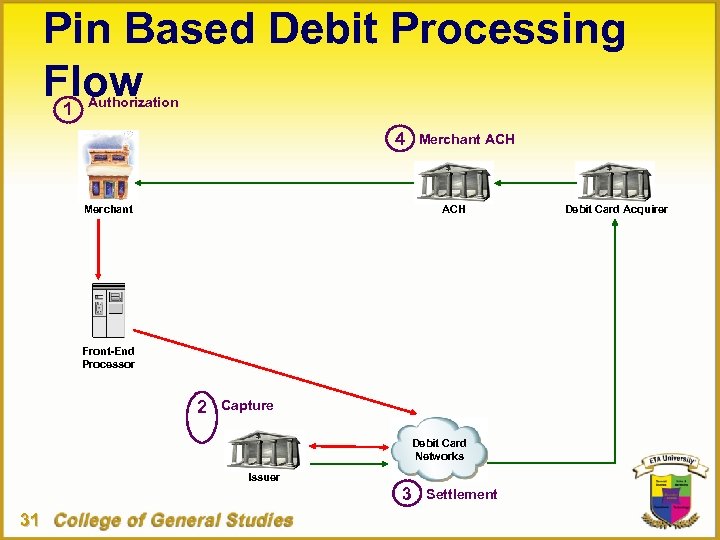

Pin Based Debit Processing Flow 1 Authorization 4 Merchant ACH Front-End Processor 2 Capture Debit Card Networks Issuer 3 31 Settlement Debit Card Acquirer

Pin Based Debit Processing Flow 1 Authorization 4 Merchant ACH Front-End Processor 2 Capture Debit Card Networks Issuer 3 31 Settlement Debit Card Acquirer

Summary Basic definition and terminology n Players and their roles and responsibilities n Seven stages of processing n “A Day in the Life of a Transaction” n 32

Summary Basic definition and terminology n Players and their roles and responsibilities n Seven stages of processing n “A Day in the Life of a Transaction” n 32

Introduction to Electronic Processing College of General Studies

Introduction to Electronic Processing College of General Studies