fb3e47589c53d6911a171072a9a044c5.ppt

- Количество слайдов: 68

Introduction to Economics Outline: Lecture One Information About the Course n What is economics all about? n Examples: Elements of Personal Finance n u Buying or Leasing a Car Llad Phillips 1

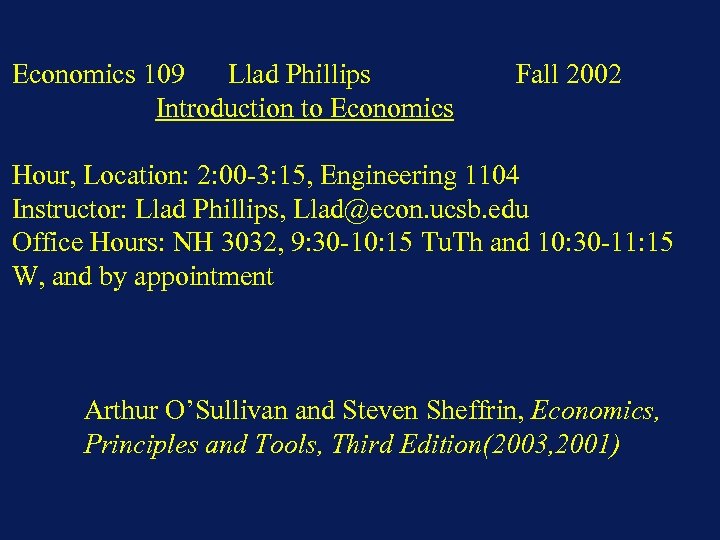

Economics 109 Llad Phillips Introduction to Economics Fall 2002 Hour, Location: 2: 00 -3: 15, Engineering 1104 Instructor: Llad Phillips, Llad@econ. ucsb. edu Office Hours: NH 3032, 9: 30 -10: 15 Tu. Th and 10: 30 -11: 15 W, and by appointment Arthur O’Sullivan and Steven Sheffrin, Economics, Principles and Tools, Third Edition(2003, 2001)

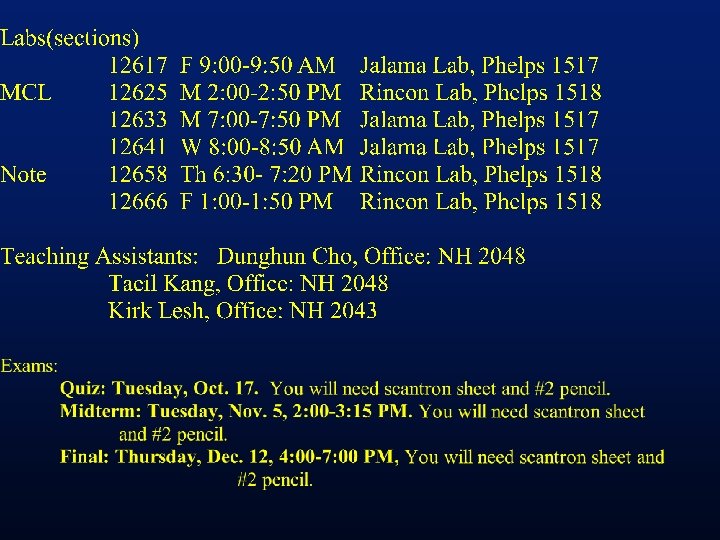

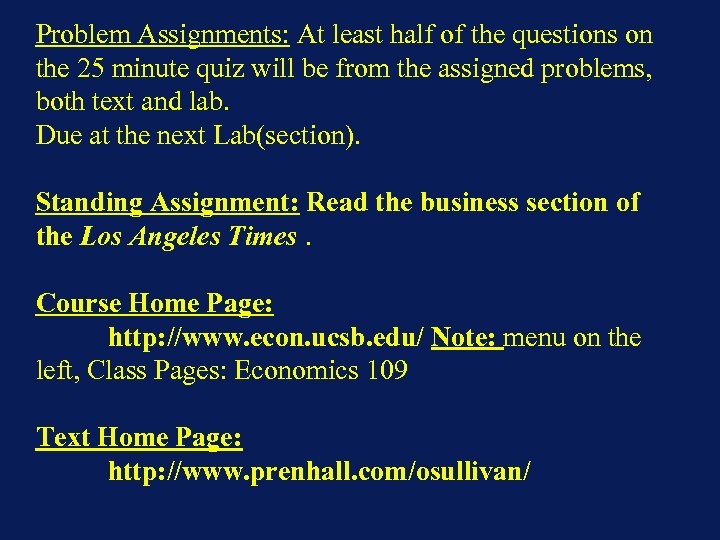

Problem Assignments: At least half of the questions on the 25 minute quiz will be from the assigned problems, both text and lab. Due at the next Lab(section). Standing Assignment: Read the business section of the Los Angeles Times. Course Home Page: http: //www. econ. ucsb. edu/ Note: menu on the left, Class Pages: Economics 109 Text Home Page: http: //www. prenhall. com/osullivan/

Lecture Topics and Reading List Part One Personal Finance: Economics in Everday Life 1. Tuesday Sept. 25, Lecture One: "Choosing a method to finance a car" Buying or Leasing a car The choice between: paying cash leasing buying on time

Reading Assignment: O’Sullivan and Sheffrin: Ch. 1, “Introduction: What is Economics? ” emphasis: concepts of scarcity and production possibilities curve O’Sullivan and Sheffrin: Appendix to Ch. 1, “Using Graphs and Formulas” Problems O & S Text: p. 13: 1, 2, 3, 4, 5. p. 21: 1, 2, 3, 4, 5, 6

Lectures: Organization of Concepts Llad Phillips 7

Collective, Group or Social Behavior Political n Social n Cultural n Economic n u How to understand cope with the economic part of life Llad Phillips 8

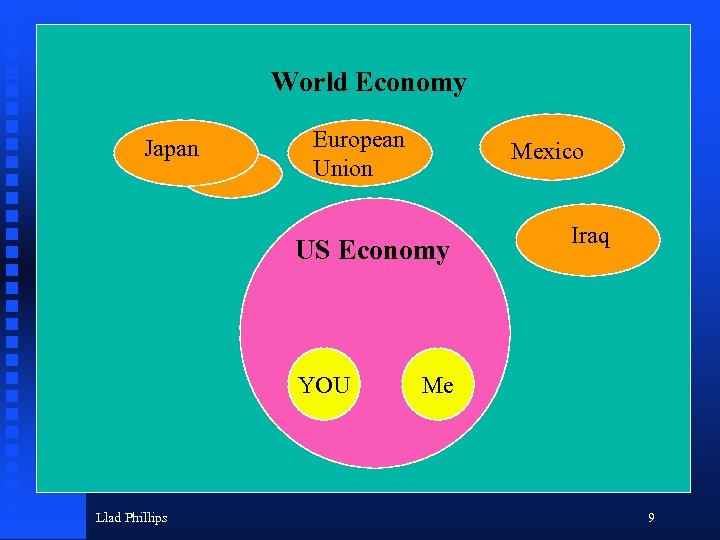

World Economy Japan European Union Mexico US Economy YOU Llad Phillips Iraq Me 9

World Economy US Economy YOU Llad Phillips Me 10

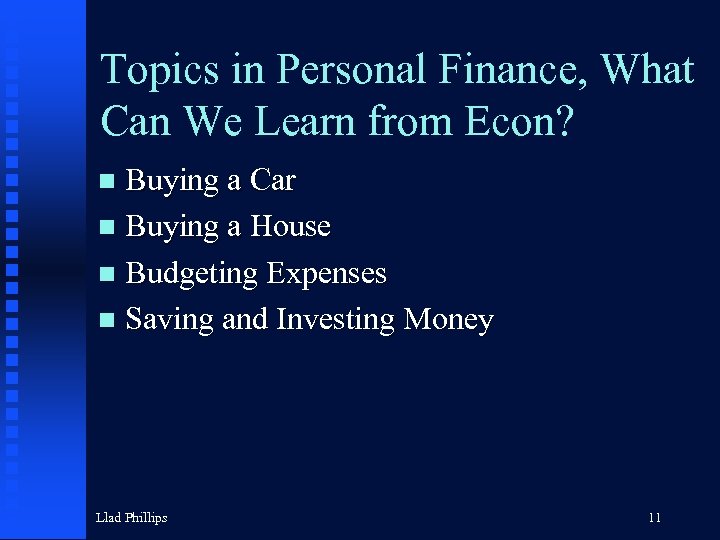

Topics in Personal Finance, What Can We Learn from Econ? Buying a Car n Buying a House n Budgeting Expenses n Saving and Investing Money n Llad Phillips 11

Concepts and Buying a Car Scarcity n Consumer Durable and Depreciation n opportunity cost n Consumer Choice n u brand model u how to pay Llad Phillips 12

Llad Phillips 13

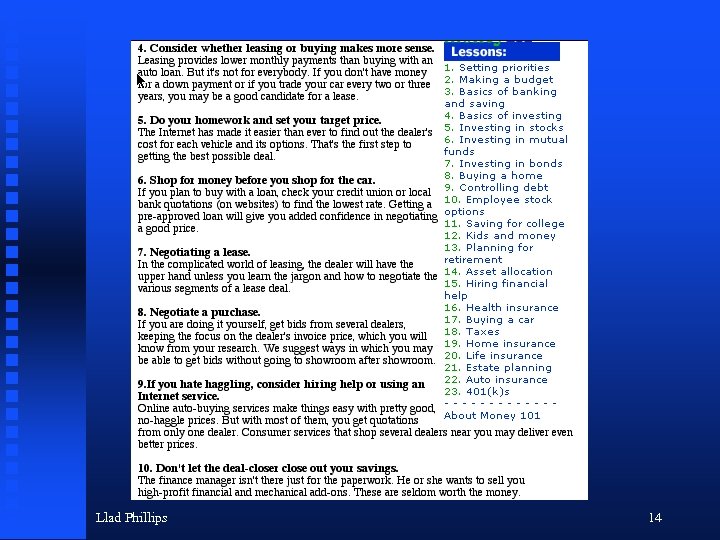

Llad Phillips 14

What is Economics All About? Llad Phillips 15

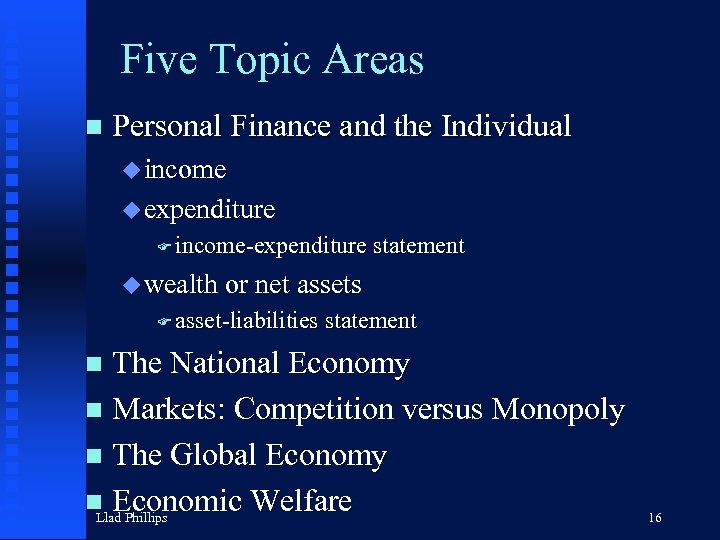

Five Topic Areas n Personal Finance and the Individual u income u expenditure F income-expenditure statement u wealth or net assets F asset-liabilities statement The National Economy n Markets: Competition versus Monopoly n The Global Economy n Economic Welfare Llad Phillips n 16

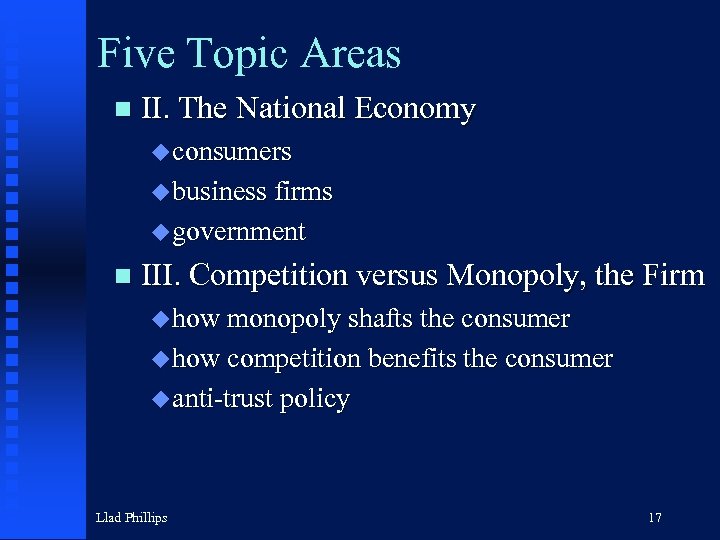

Five Topic Areas n II. The National Economy u consumers u business firms u government n III. Competition versus Monopoly, the Firm u how monopoly shafts the consumer u how competition benefits the consumer u anti-trust policy Llad Phillips 17

Five Topic Areas n IV. The Global Economy u Trade u Balance of Payments u Foreign Exchange n Economic Welfare u distribution of income u poverty u aging and health u public goods, e. g. safety Llad Phillips 18

Year Before Last Year’s (2000) Current Economic Questions Who is better for you, Bush or Gore? n Is the great bull market of the 90’s over? n Is the economy about to crash? n Is Japan going to recover? n Will the government break up Microsoft? n Llad Phillips 19

Last Year’s (2001) Current Economic Questions Are we in a recession? n How bad could it get? n How long will it last? n Will the stock market stabilize? n What kind of economic impact did the attack have? n If we continue to mobilize, what kind of economic impact will that have? n Llad Phillips 20

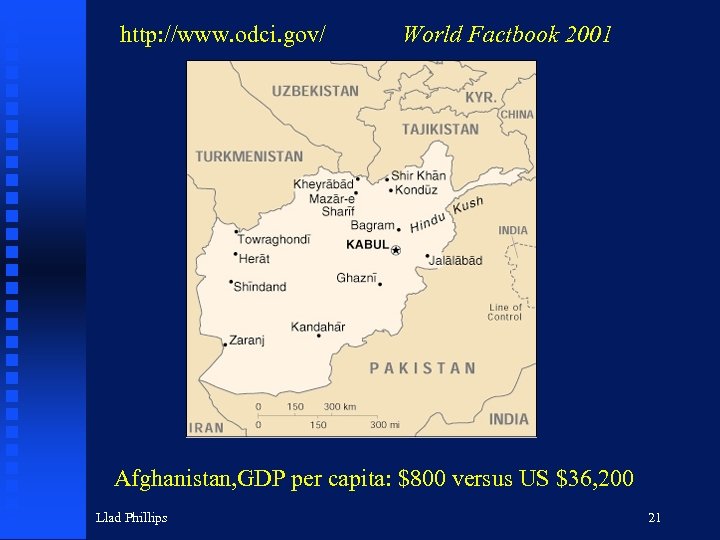

http: //www. odci. gov/ World Factbook 2001 Afghanistan, GDP per capita: $800 versus US $36, 200 Llad Phillips 21

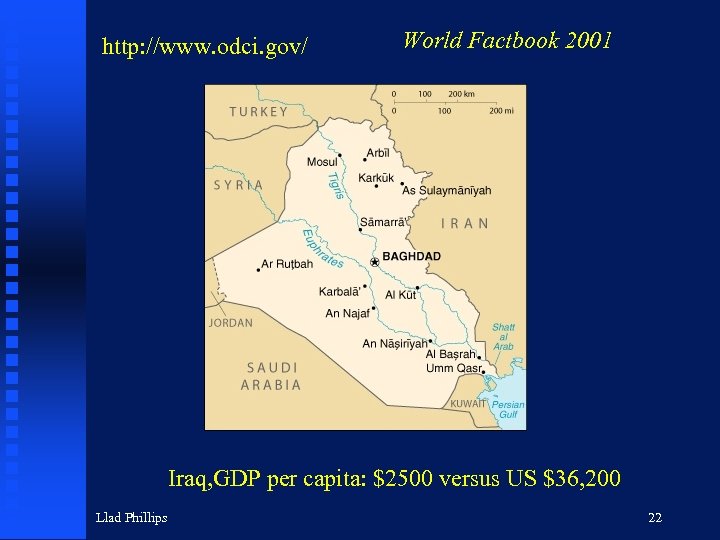

http: //www. odci. gov/ World Factbook 2001 Iraq, GDP per capita: $2500 versus US $36, 200 Llad Phillips 22

Introduction to Economics Elements of Personal Finance Llad Phillips 23

Elements of Personal Finance n Economics in every day life u buying or leasing a car u buying or renting a home u personal financial planning u managing personal investments u managing a household budget u determinants of personal income Llad Phillips 24

Buying or Leasing a Car n Your choice of vehicle u Is it what you need? u Is it what you want? u Is it what you can afford? u Loss of value through depreciation of your car F physical wear and tear F decrease in resale value: paying a premium for newness Llad Phillips 25

The Process of Economic Decision Making n Compare alternative choices u if you make a choice are you giving anything up (a cost) to get what you want? n Which is the best choice? u Criteria: lowest cost or highest benefit net of cost Llad Phillips 26

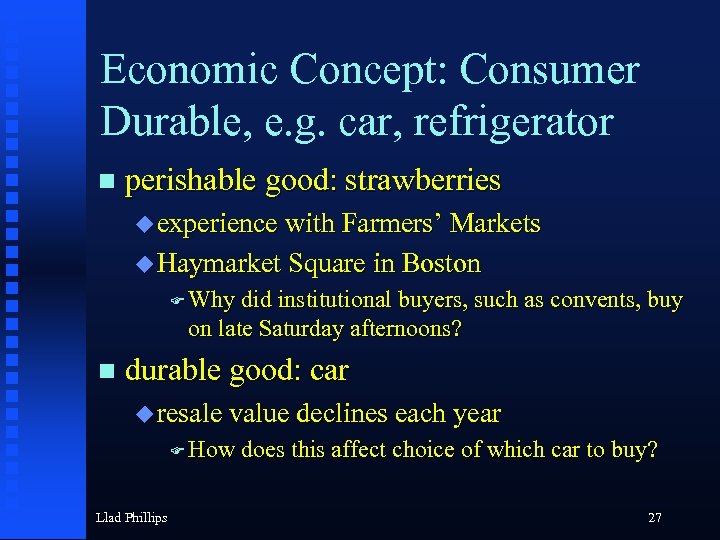

Economic Concept: Consumer Durable, e. g. car, refrigerator n perishable good: strawberries u experience with Farmers’ Markets u Haymarket Square in Boston F Why did institutional buyers, such as convents, buy on late Saturday afternoons? n durable good: car u resale value declines each year F How Llad Phillips does this affect choice of which car to buy? 27

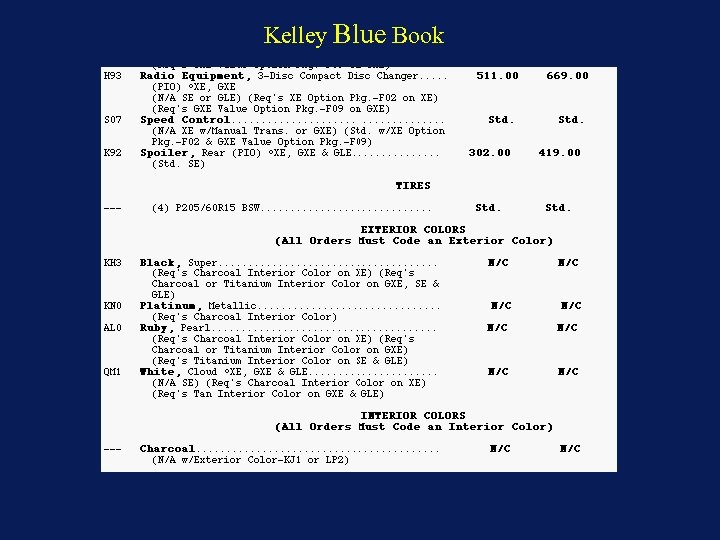

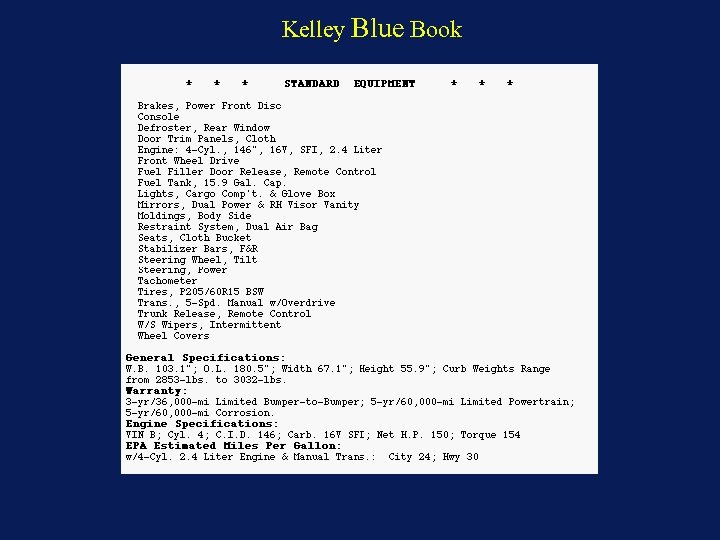

Sources of Information n Kelley Blue Book: Used Car Guide u bookstores n Kelley Blue Book: Internet u Universal Resource Locator(URL) F http: //www. kbb. com/ n Manufacturers u Nissan F http: //www. nissandriven. com/ Llad Phillips 28

2003 Nissan Altima Llad Phillips 29

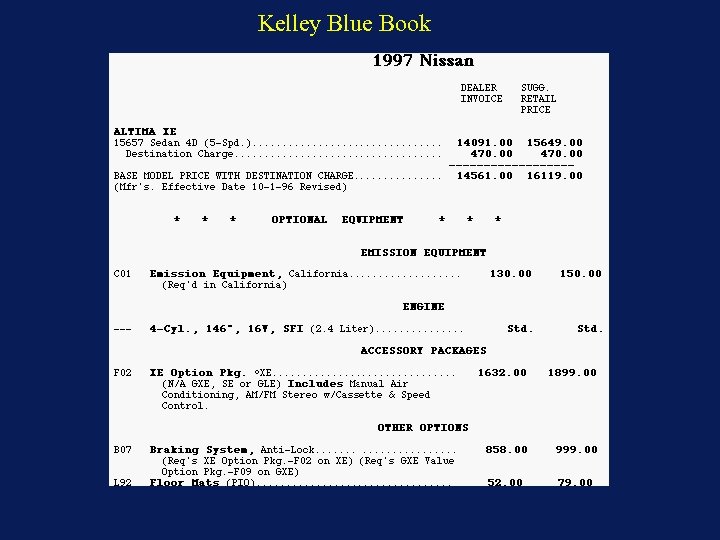

Kelley Blue Book

Kelley Blue Book

Kelley Blue Book

http: //www. nissan-usa. com/

Economic Decision Making n choice of a vehicle u Nissan Altima XE 4 -Dr Sedan u Ford Taurus 4 -Dr Sedan n choice of payment method u cash u lease u payment plan Llad Phillips 34

Economists Assume You Know What You Like n Lingo: economists call these consumer tastes or consumer preferences Llad Phillips 35

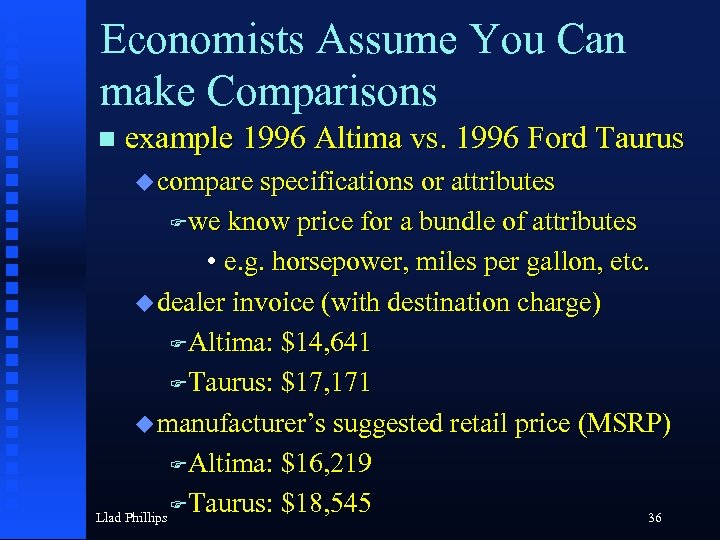

Economists Assume You Can make Comparisons n example 1996 Altima vs. 1996 Ford Taurus u compare specifications or attributes Fwe know price for a bundle of attributes • e. g. horsepower, miles per gallon, etc. u dealer invoice (with destination charge) FAltima: $14, 641 FTaurus: $17, 171 u manufacturer’s suggested retail price (MSRP) FAltima: $16, 219 FTaurus: $18, 545 Llad Phillips 36

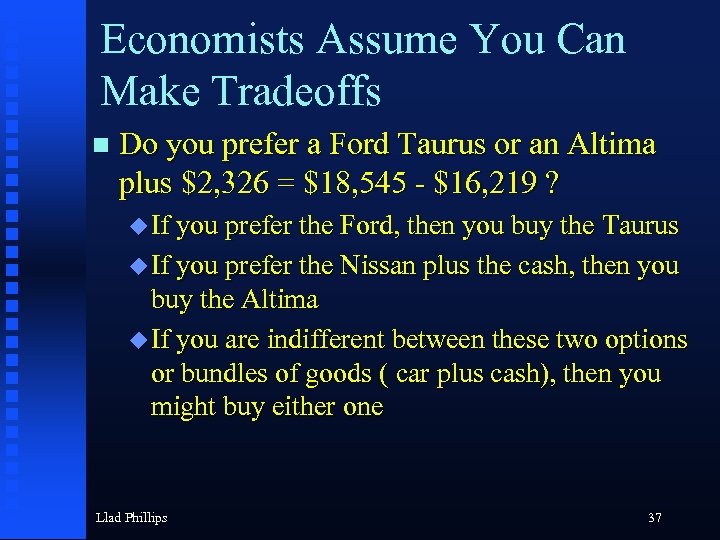

Economists Assume You Can Make Tradeoffs n Do you prefer a Ford Taurus or an Altima plus $2, 326 = $18, 545 - $16, 219 ? u If you prefer the Ford, then you buy the Taurus u If you prefer the Nissan plus the cash, then you buy the Altima u If you are indifferent between these two options or bundles of goods ( car plus cash), then you might buy either one Llad Phillips 37

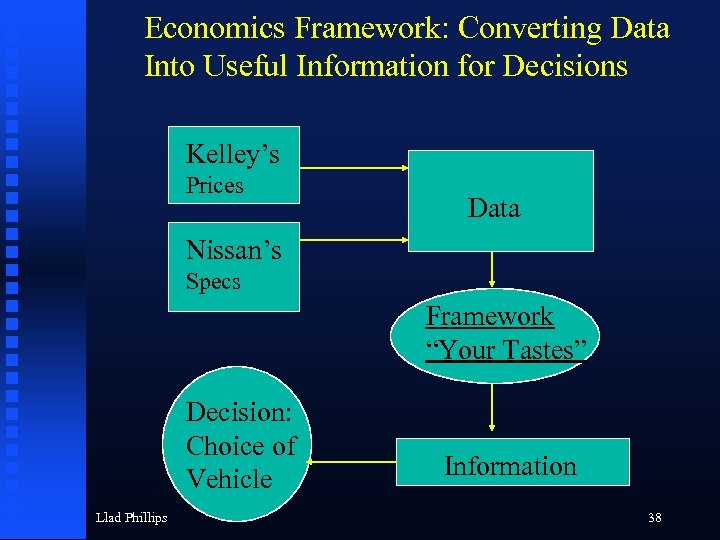

Economics Framework: Converting Data Into Useful Information for Decisions Kelley’s Prices Data Nissan’s Specs Framework “Your Tastes” Decision: Choice of Vehicle Llad Phillips Information 38

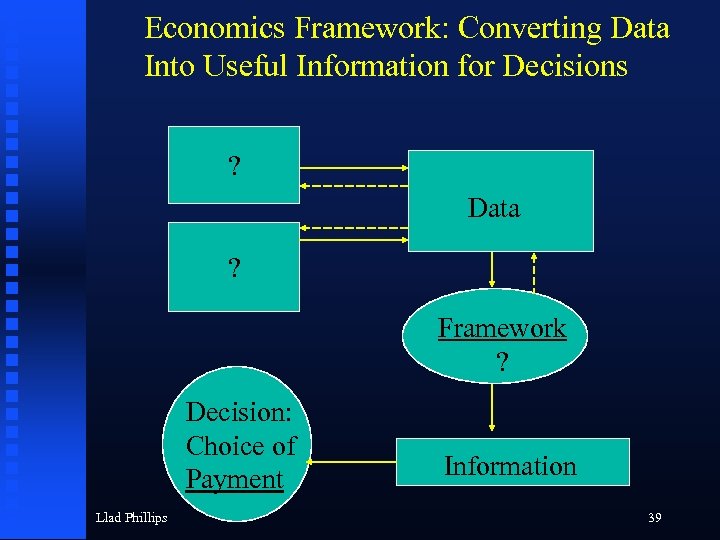

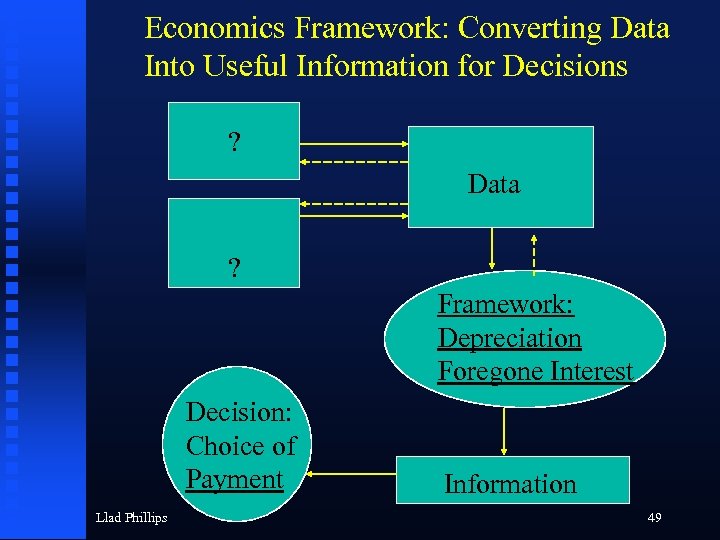

Economics Framework: Converting Data Into Useful Information for Decisions ? Data ? Framework ? Decision: Choice of Payment Llad Phillips Information 39

Choice of Payment Method cash n lease n loan n Llad Phillips 40

Cash n for cash, the bottom line is equal to: total cost - resale value Fthe total cost is going to depend on manufacturer’s suggested retail price, MSRP Fthe resale value will depend on the value lost from depreciation Llad Phillips 41

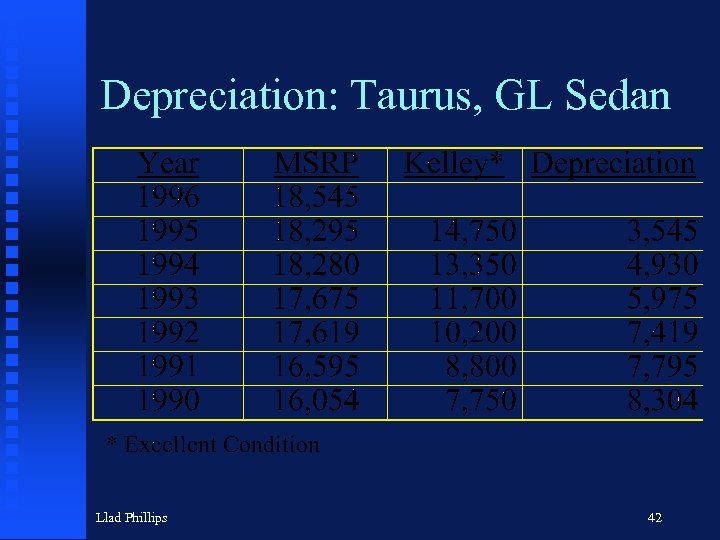

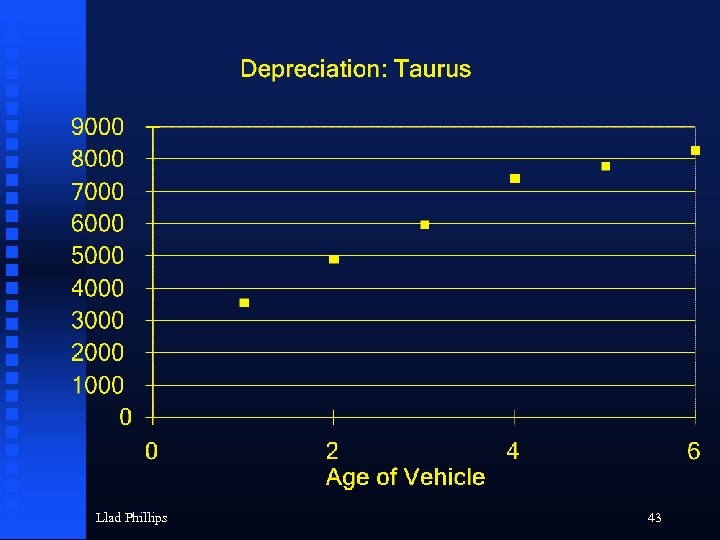

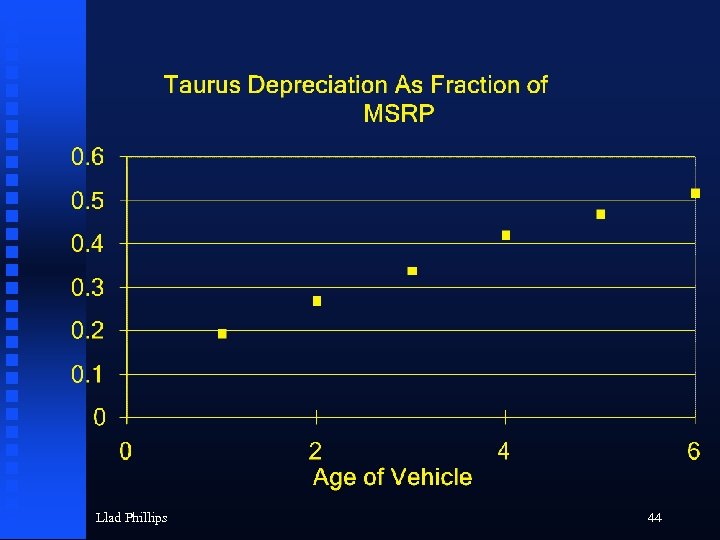

Depreciation: Taurus, GL Sedan Llad Phillips 42

Llad Phillips 43

Llad Phillips 44

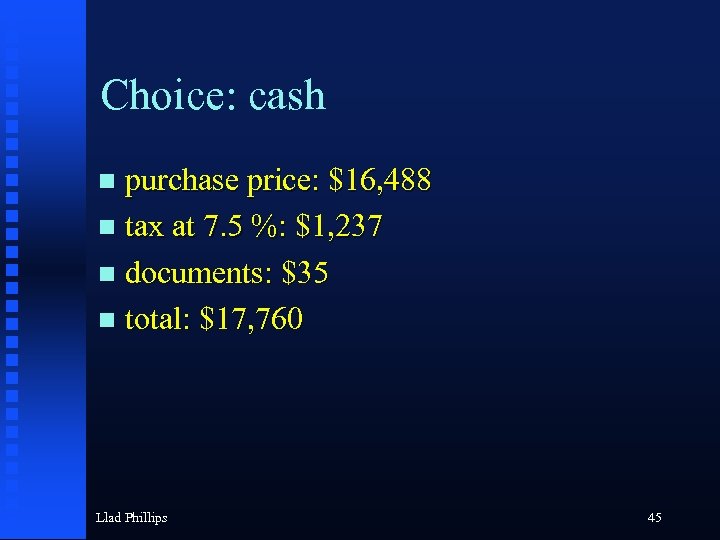

Choice: cash purchase price: $16, 488 n tax at 7. 5 %: $1, 237 n documents: $35 n total: $17, 760 n Llad Phillips 45

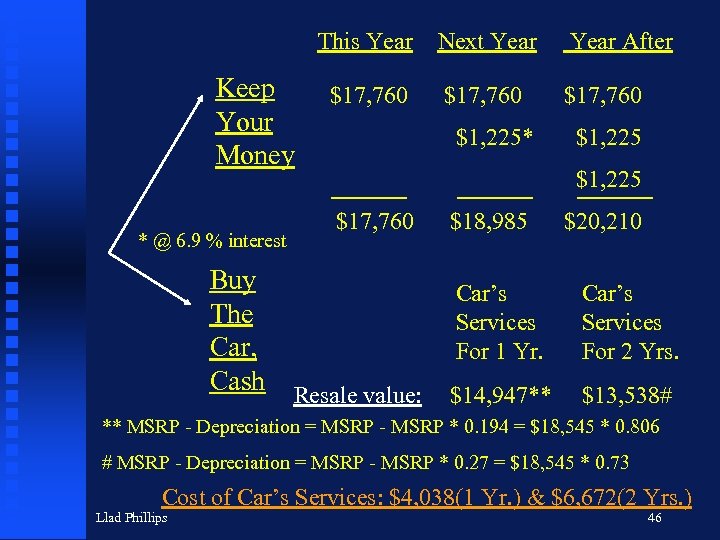

This Year Next Year Keep Your Money * @ 6. 9 % interest Buy The Car, Cash $17, 760 $1, 225* Year After $17, 760 $1, 225 $17, 760 $18, 985 $20, 210 Car’s Services For 1 Yr. Resale value: Car’s Services For 2 Yrs. $14, 947** $13, 538# ** MSRP - Depreciation = MSRP - MSRP * 0. 194 = $18, 545 * 0. 806 # MSRP - Depreciation = MSRP - MSRP * 0. 27 = $18, 545 * 0. 73 Cost of Car’s Services: $4, 038(1 Yr. ) & $6, 672(2 Yrs. ) Llad Phillips 46

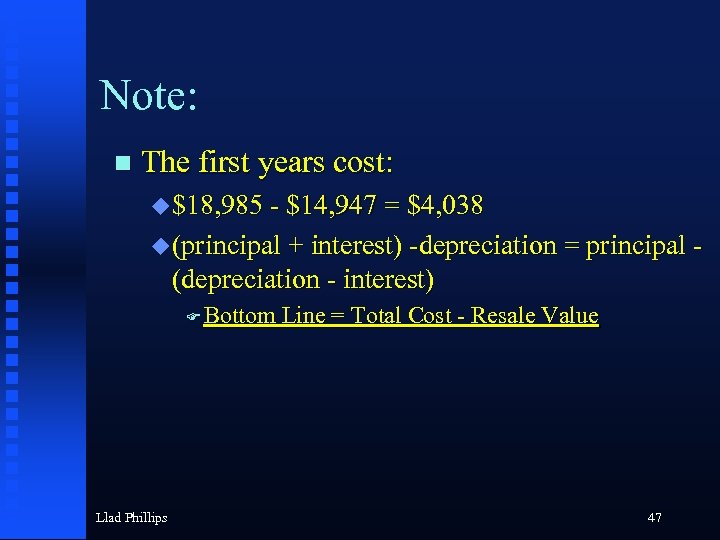

Note: n The first years cost: u $18, 985 - $14, 947 = $4, 038 u (principal + interest) -depreciation = principal - (depreciation - interest) F Bottom Llad Phillips Line = Total Cost - Resale Value 47

Economic Principles n A dollar today is not the same as a dollar tomorrow! u $10 today @ 6. 9% = $10 * 1. 069 next year The “opportunity cost” of spending your money is the foregone interest. n The cost of buying the services of the car, neglecting operating costs: n u depreciation: owning a new car u foregone interest Llad Phillips 48

Economics Framework: Converting Data Into Useful Information for Decisions ? Data ? Framework: Depreciation Foregone Interest Decision: Choice of Payment Llad Phillips Information 49

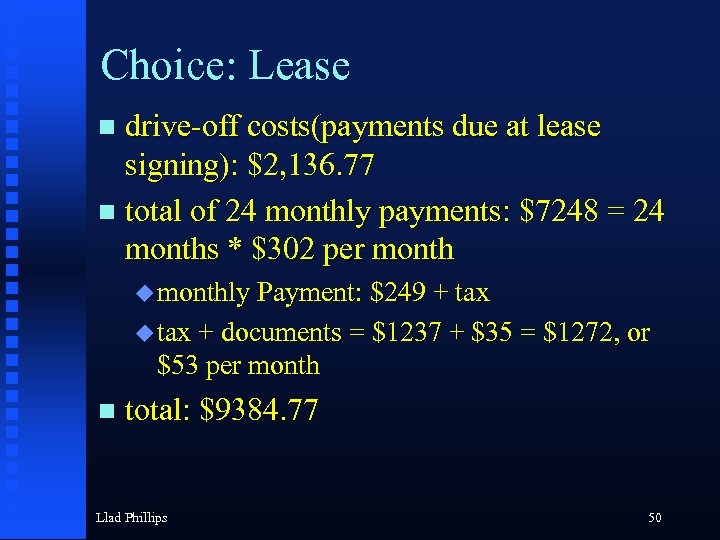

Choice: Lease drive-off costs(payments due at lease signing): $2, 136. 77 n total of 24 monthly payments: $7248 = 24 months * $302 per month n u monthly Payment: $249 + tax u tax + documents = $1237 + $35 = $1272, or $53 per month n total: $9384. 77 Llad Phillips 50

http: //www. fordcredit. com/

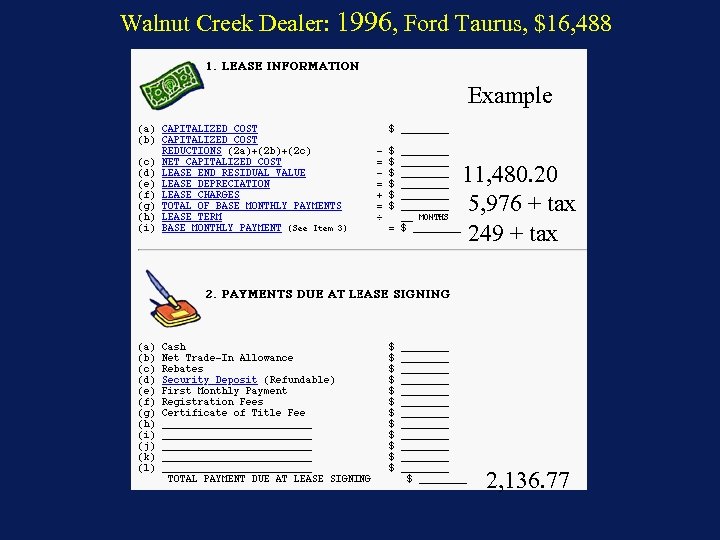

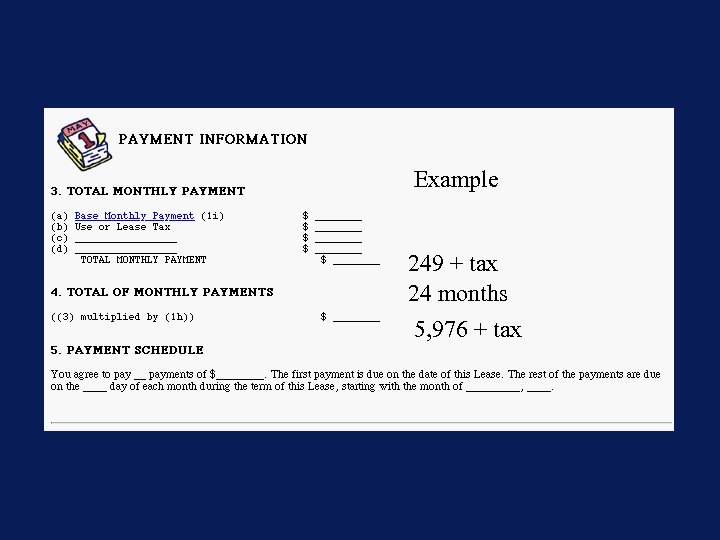

Walnut Creek Dealer: 1996, Ford Taurus, $16, 488 Example 5, 976 + tax 249 + tax

Example 249 + tax 24 months 5, 976 + tax

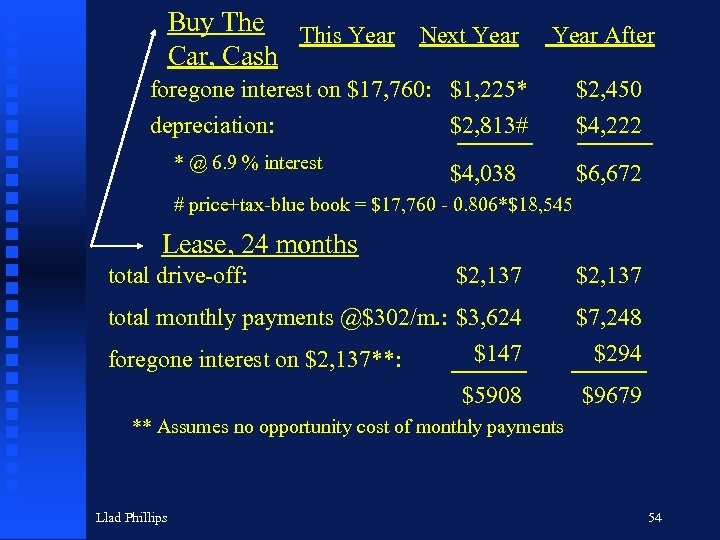

Buy The This Year Next Year Car, Cash Year After foregone interest on $17, 760: $1, 225* depreciation: $2, 813# $2, 450 $4, 222 * @ 6. 9 % interest $4, 038 $6, 672 # price+tax-blue book = $17, 760 - 0. 806*$18, 545 Lease, 24 months total drive-off: $2, 137 total monthly payments @$302/m. : $3, 624 $147 foregone interest on $2, 137**: $7, 248 $294 $5908 $9679 ** Assumes no opportunity cost of monthly payments Llad Phillips 54

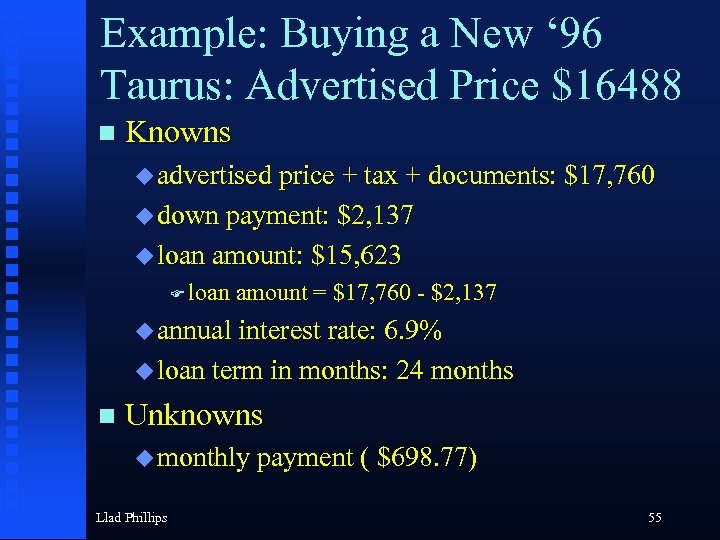

Example: Buying a New ‘ 96 Taurus: Advertised Price $16488 n Knowns u advertised price + tax + documents: $17, 760 u down payment: $2, 137 u loan amount: $15, 623 F loan amount = $17, 760 - $2, 137 u annual interest rate: 6. 9% u loan term in months: 24 months n Unknowns u monthly payment ( $698. 77) Llad Phillips 55

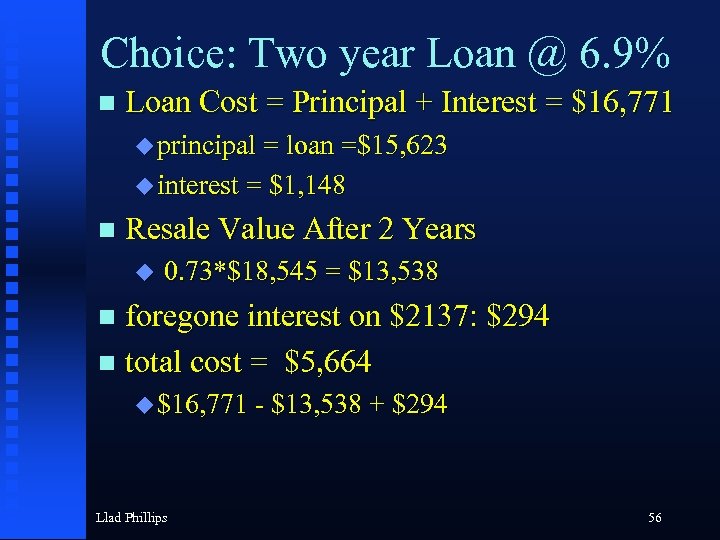

Choice: Two year Loan @ 6. 9% n Loan Cost = Principal + Interest = $16, 771 u principal = loan =$15, 623 u interest = $1, 148 n Resale Value After 2 Years u 0. 73*$18, 545 = $13, 538 foregone interest on $2137: $294 n total cost = $5, 664 n u $16, 771 - $13, 538 + $294 Llad Phillips 56

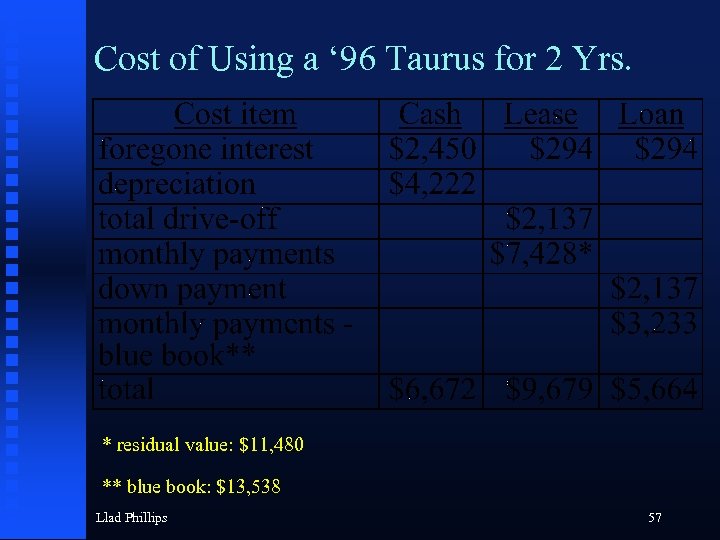

Cost of Using a ‘ 96 Taurus for 2 Yrs. * residual value: $11, 480 ** blue book: $13, 538 Llad Phillips 57

Summary - Vocabulary - Concepts opportunity cost n depreciation n interest on principal n lease n loan n services of a car n Llad Phillips 58

http: //www/latimes. com Llad Phillips 59

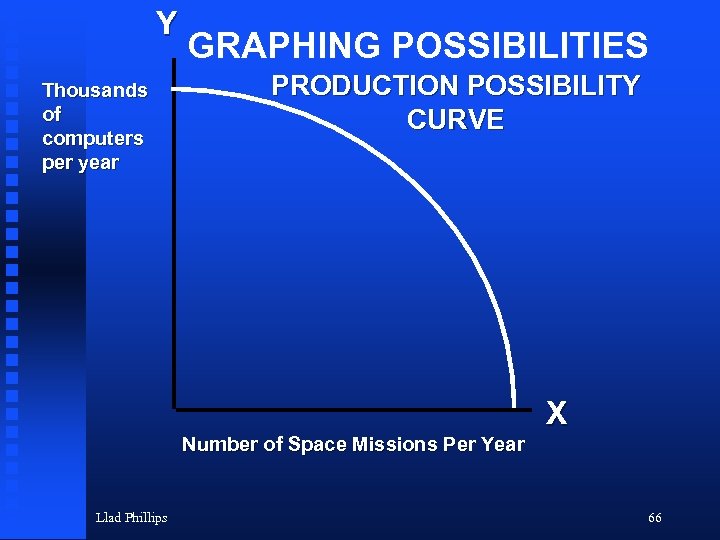

SCARCITY AND PRODUCTION POSSIBILITY CURVES n Production Possibility Curve A visual representation of tradeoffs that arise in an economy that produces two goods. A picture of the choices which can be made when considering the production of two goods. Llad Phillips 60

PRODUCTION POSSIBILITY CURVE (FRONTIER) A production possibility curve shows how all of an economies available resources can be used to produce various combinations of goods and services. Llad Phillips 61

WHAT ARE RESOURCES? Labor -- human effort used to produce n Production facilities (PHYSICAL CAPITAL) -- factories, offices, stores, restaurants • Human Capital -- knowledge and skills acquired by workers n Natural Resources (LAND) -- things created by acts of nature and used to produce n Llad Phillips 62

GRAPHING POSSIBILITIES Llad Phillips 63

Y GRAPHING POSSIBILITIES X Llad Phillips 64

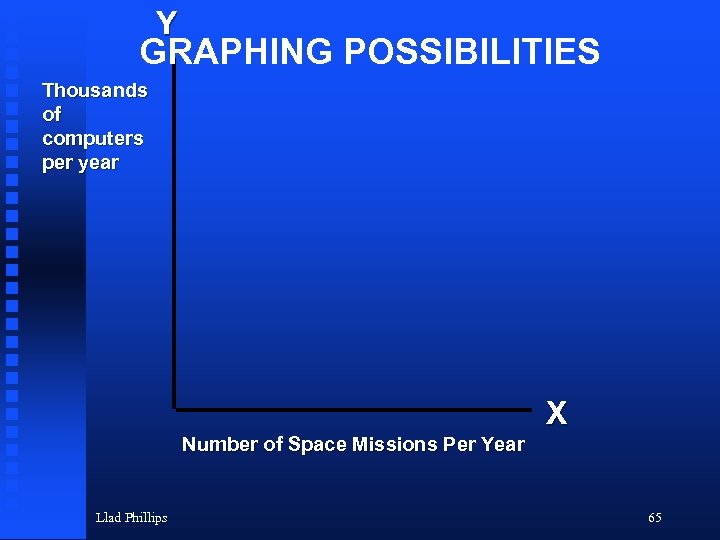

Y GRAPHING POSSIBILITIES Thousands of computers per year X Number of Space Missions Per Year Llad Phillips 65

Y Thousands of computers per year GRAPHING POSSIBILITIES PRODUCTION POSSIBILITY CURVE X Number of Space Missions Per Year Llad Phillips 66

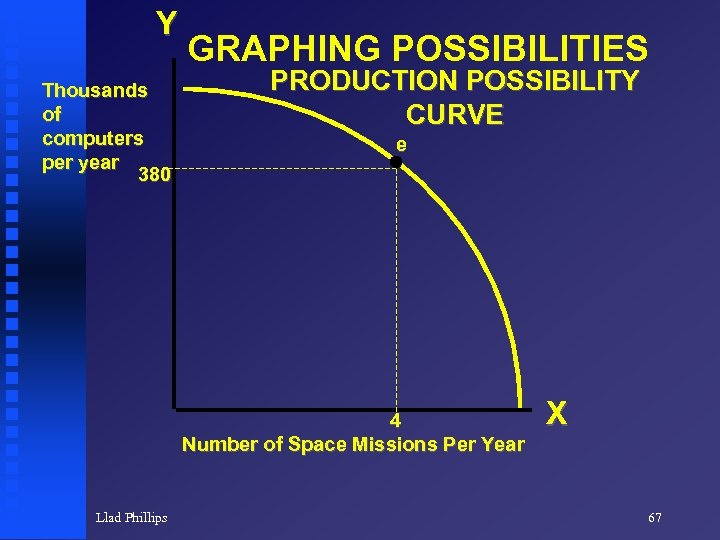

Y Thousands of computers per year 380 GRAPHING POSSIBILITIES PRODUCTION POSSIBILITY CURVE e 4 Number of Space Missions Per Year Llad Phillips X 67

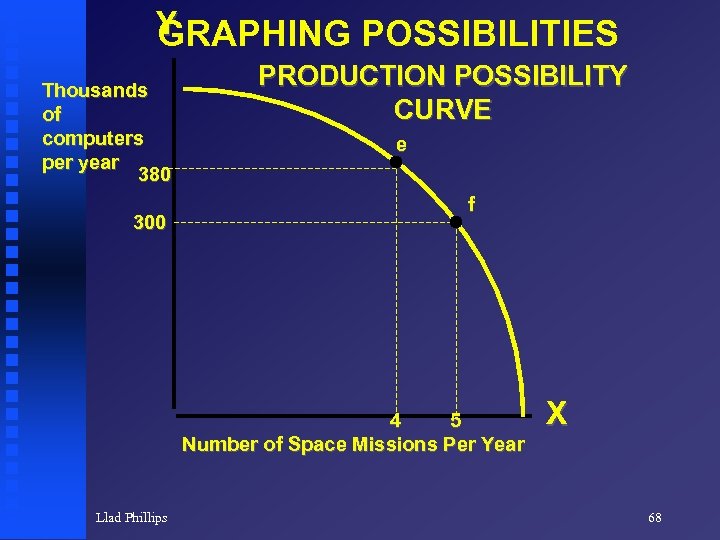

Y GRAPHING POSSIBILITIES Thousands of computers per year 380 300 PRODUCTION POSSIBILITY CURVE e f 4 5 Number of Space Missions Per Year Llad Phillips X 68

fb3e47589c53d6911a171072a9a044c5.ppt