91b75fb137f78170c3b7f56e91319fec.ppt

- Количество слайдов: 30

Introduction to Auctions David M. Pennock

Introduction to Auctions David M. Pennock

Auctions: yesterday Going once, … going twice, . . .

Auctions: yesterday Going once, … going twice, . . .

Auctions: today Ebay: – 4 million auctions – 450 k new/day >800 others – auctionrover. com – biddersedge. com

Auctions: today Ebay: – 4 million auctions – 450 k new/day >800 others – auctionrover. com – biddersedge. com

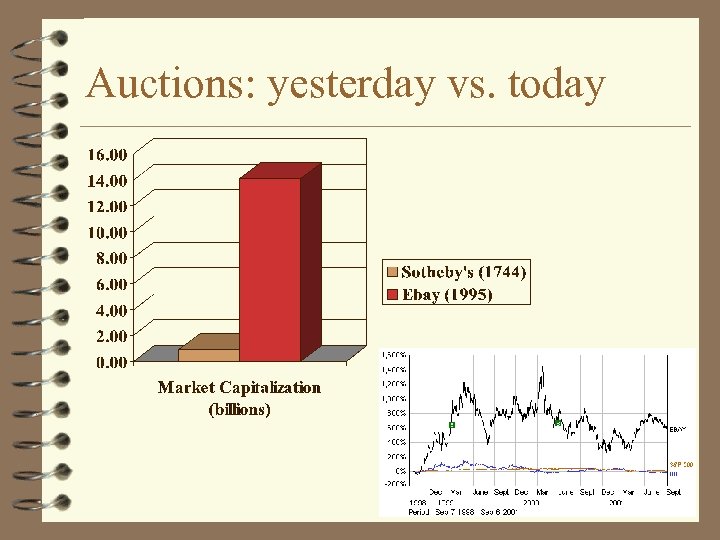

Auctions: yesterday vs. today

Auctions: yesterday vs. today

![What is an auction? Definition [Mc. Afee & Mc. Millan, JEL 1987]: – a What is an auction? Definition [Mc. Afee & Mc. Millan, JEL 1987]: – a](https://present5.com/presentation/91b75fb137f78170c3b7f56e91319fec/image-5.jpg) What is an auction? Definition [Mc. Afee & Mc. Millan, JEL 1987]: – a market institution with an – explicit set of rules – determining resource allocation and prices – on the basis of bids from the market participants. Examples:

What is an auction? Definition [Mc. Afee & Mc. Millan, JEL 1987]: – a market institution with an – explicit set of rules – determining resource allocation and prices – on the basis of bids from the market participants. Examples:

B 2 B auctions and ecommerce Online B 2 B marketplaces have been established recently for more than a dozen major industries, including the automotive; pharmaceuticals; scientific supplies; asset management; building and construction; plastics and chemicals; steel and metals; computer; credit and financing; energy; news and information; and livestock sectors. – Reuters March 29, 2000

B 2 B auctions and ecommerce Online B 2 B marketplaces have been established recently for more than a dozen major industries, including the automotive; pharmaceuticals; scientific supplies; asset management; building and construction; plastics and chemicals; steel and metals; computer; credit and financing; energy; news and information; and livestock sectors. – Reuters March 29, 2000

Why auctions? For object of unknown value Flexible Dynamic Mechanized – reduces complexity of negotiations – ideal for computer implementation Economically efficient!

Why auctions? For object of unknown value Flexible Dynamic Mechanized – reduces complexity of negotiations – ideal for computer implementation Economically efficient!

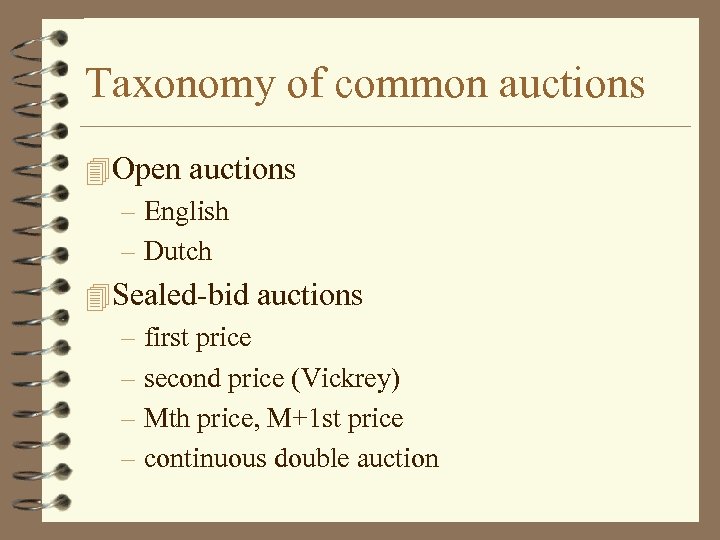

Taxonomy of common auctions Open auctions – English – Dutch Sealed-bid auctions – first price – second price (Vickrey) – Mth price, M+1 st price – continuous double auction

Taxonomy of common auctions Open auctions – English – Dutch Sealed-bid auctions – first price – second price (Vickrey) – Mth price, M+1 st price – continuous double auction

English auction Open One item for sale Auctioneer begins low; typically with seller’s reserve price Buyers call out bids to beat the current price Last buyer remaining wins; pays the price that (s)he bid

English auction Open One item for sale Auctioneer begins low; typically with seller’s reserve price Buyers call out bids to beat the current price Last buyer remaining wins; pays the price that (s)he bid

Dutch auction Open One item for sale Auctioneer begins high; above the maximum foreseeable bid Auctioneer lowers price in increments First buyer willing to accept price wins; pays last announced price less information

Dutch auction Open One item for sale Auctioneer begins high; above the maximum foreseeable bid Auctioneer lowers price in increments First buyer willing to accept price wins; pays last announced price less information

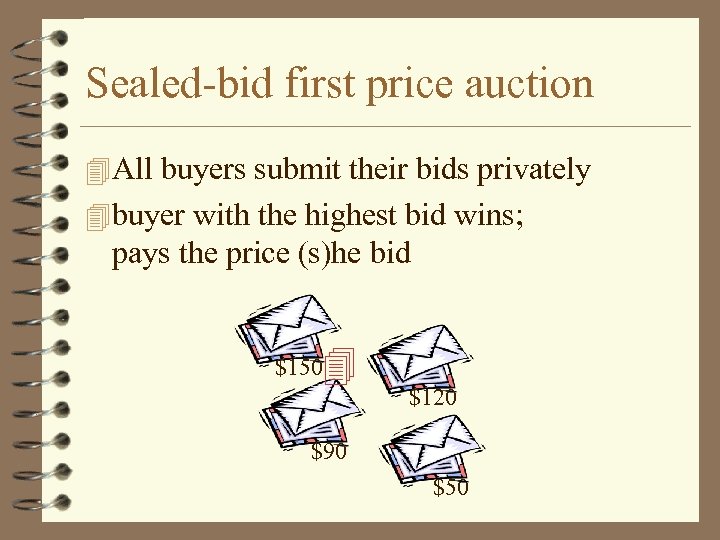

Sealed-bid first price auction All buyers submit their bids privately buyer with the highest bid wins; pays the price (s)he bid $150 $120 $90 $50

Sealed-bid first price auction All buyers submit their bids privately buyer with the highest bid wins; pays the price (s)he bid $150 $120 $90 $50

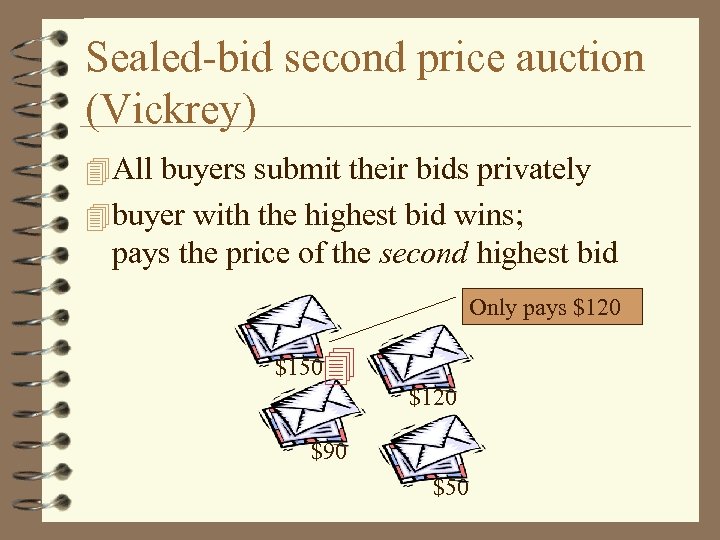

Sealed-bid second price auction (Vickrey) All buyers submit their bids privately buyer with the highest bid wins; pays the price of the second highest bid Only pays $120 $150 $120 $90 $50

Sealed-bid second price auction (Vickrey) All buyers submit their bids privately buyer with the highest bid wins; pays the price of the second highest bid Only pays $120 $150 $120 $90 $50

Incentive compatibility Telling the truth is optimal in second-price auction Suppose your value for the item is $100; if you win, your net gain (loss) is $100 - price If you bid more than $100: – you increase your chances of winning at price >$100 – you do not improve your chance of winning for < $100 If you bid less than $100: – you reduce your chances of winning at price < $100 – there is no effect on the price you pay if you do win Dominant optimal strategy: bid $100 – Key: the price you pay is out of your control

Incentive compatibility Telling the truth is optimal in second-price auction Suppose your value for the item is $100; if you win, your net gain (loss) is $100 - price If you bid more than $100: – you increase your chances of winning at price >$100 – you do not improve your chance of winning for < $100 If you bid less than $100: – you reduce your chances of winning at price < $100 – there is no effect on the price you pay if you do win Dominant optimal strategy: bid $100 – Key: the price you pay is out of your control

Collusion Notice that, if some bidders collude, they might do better by lying (e. g. , by forming a ring) In general, essentially all auctions are subject to some sort of manipulation by collusion among buyers, sellers, and/or auctioneer.

Collusion Notice that, if some bidders collude, they might do better by lying (e. g. , by forming a ring) In general, essentially all auctions are subject to some sort of manipulation by collusion among buyers, sellers, and/or auctioneer.

Revenue equivalence Which auction is best for the seller? In second-price auction, buyer pays < bid In first-price auction, buyers “shade” bids Theorem: – expected revenue for seller is the same! – requires technical assumptions on buyers, including “independent private values” – English = 2 nd price; Dutch = 1 st price

Revenue equivalence Which auction is best for the seller? In second-price auction, buyer pays < bid In first-price auction, buyers “shade” bids Theorem: – expected revenue for seller is the same! – requires technical assumptions on buyers, including “independent private values” – English = 2 nd price; Dutch = 1 st price

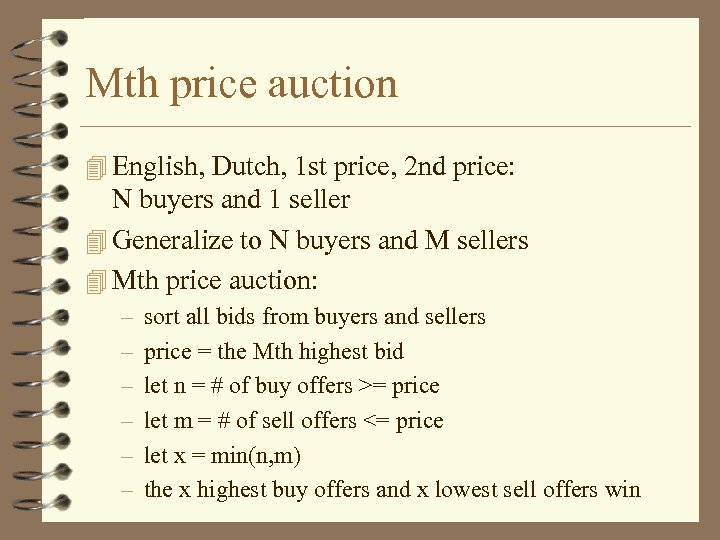

Mth price auction English, Dutch, 1 st price, 2 nd price: N buyers and 1 seller Generalize to N buyers and M sellers Mth price auction: – – – sort all bids from buyers and sellers price = the Mth highest bid let n = # of buy offers >= price let m = # of sell offers <= price let x = min(n, m) the x highest buy offers and x lowest sell offers win

Mth price auction English, Dutch, 1 st price, 2 nd price: N buyers and 1 seller Generalize to N buyers and M sellers Mth price auction: – – – sort all bids from buyers and sellers price = the Mth highest bid let n = # of buy offers >= price let m = # of sell offers <= price let x = min(n, m) the x highest buy offers and x lowest sell offers win

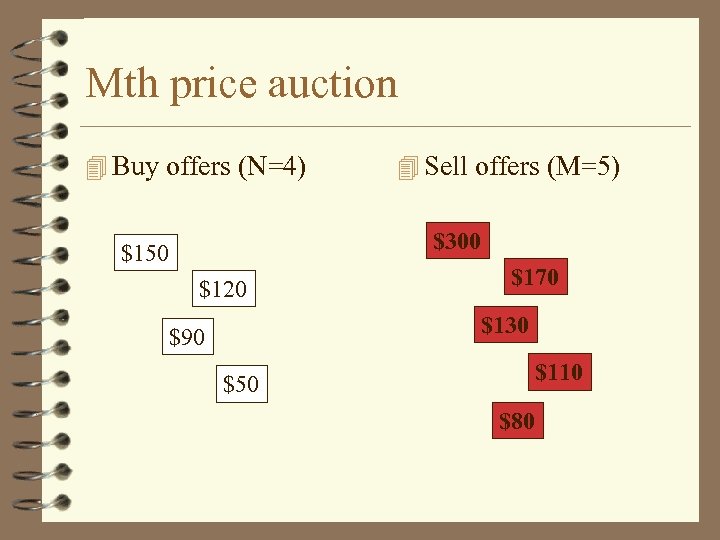

Mth price auction Buy offers (N=4) Sell offers (M=5) $300 $150 $120 $170 $130 $90 $110 $50 $80

Mth price auction Buy offers (N=4) Sell offers (M=5) $300 $150 $120 $170 $130 $90 $110 $50 $80

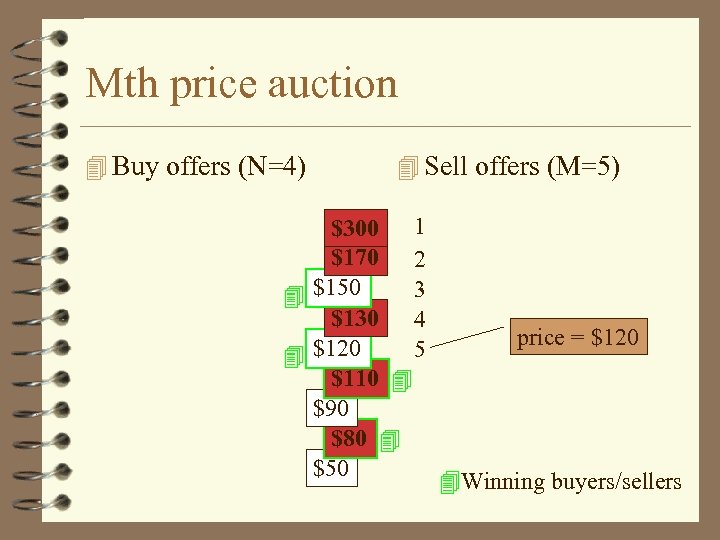

Mth price auction Buy offers (N=4) Sell offers (M=5) $300 1 $170 2 3 $150 $130 4 5 $120 $110 $90 $80 $50 price = $120 Winning buyers/sellers

Mth price auction Buy offers (N=4) Sell offers (M=5) $300 1 $170 2 3 $150 $130 4 5 $120 $110 $90 $80 $50 price = $120 Winning buyers/sellers

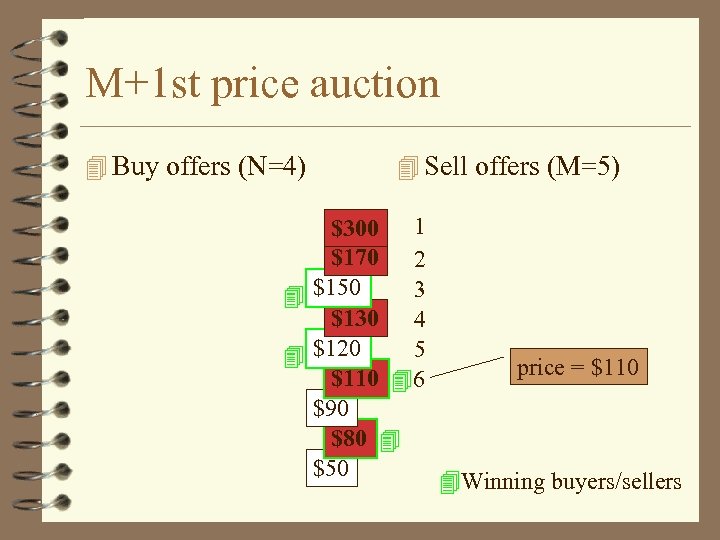

M+1 st price auction Buy offers (N=4) Sell offers (M=5) $300 1 $170 2 3 $150 $130 4 5 $120 $110 6 $90 $80 $50 price = $110 Winning buyers/sellers

M+1 st price auction Buy offers (N=4) Sell offers (M=5) $300 1 $170 2 3 $150 $130 4 5 $120 $110 6 $90 $80 $50 price = $110 Winning buyers/sellers

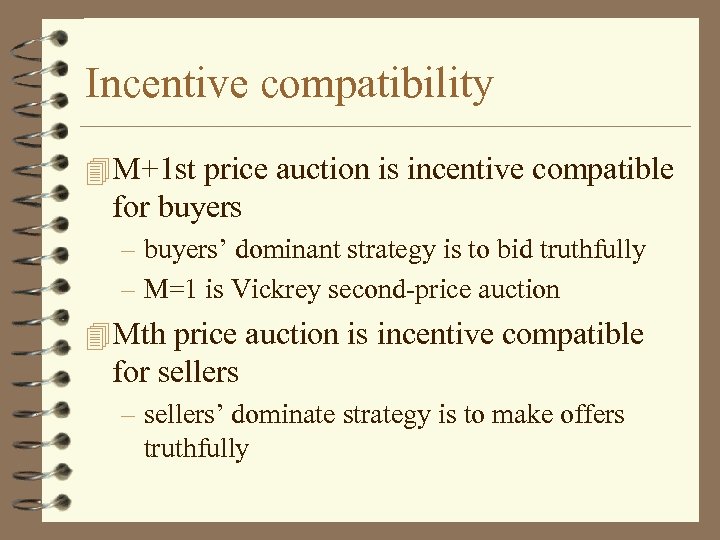

Incentive compatibility M+1 st price auction is incentive compatible for buyers – buyers’ dominant strategy is to bid truthfully – M=1 is Vickrey second-price auction Mth price auction is incentive compatible for sellers – sellers’ dominate strategy is to make offers truthfully

Incentive compatibility M+1 st price auction is incentive compatible for buyers – buyers’ dominant strategy is to bid truthfully – M=1 is Vickrey second-price auction Mth price auction is incentive compatible for sellers – sellers’ dominate strategy is to make offers truthfully

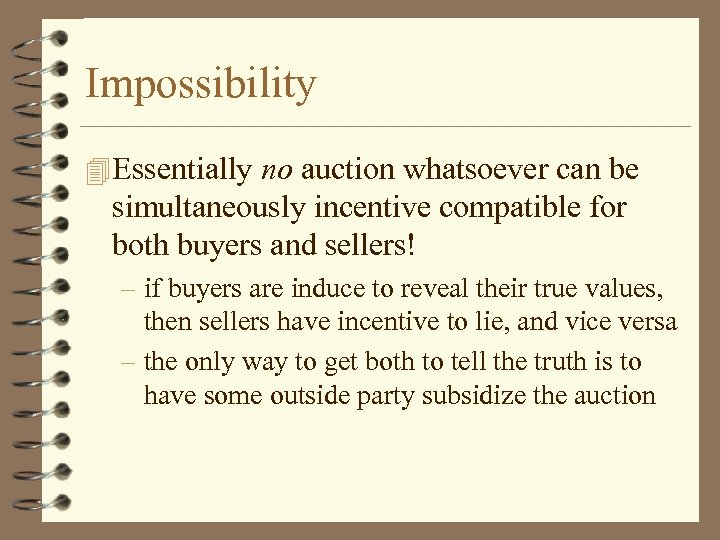

Impossibility Essentially no auction whatsoever can be simultaneously incentive compatible for both buyers and sellers! – if buyers are induce to reveal their true values, then sellers have incentive to lie, and vice versa – the only way to get both to tell the truth is to have some outside party subsidize the auction

Impossibility Essentially no auction whatsoever can be simultaneously incentive compatible for both buyers and sellers! – if buyers are induce to reveal their true values, then sellers have incentive to lie, and vice versa – the only way to get both to tell the truth is to have some outside party subsidize the auction

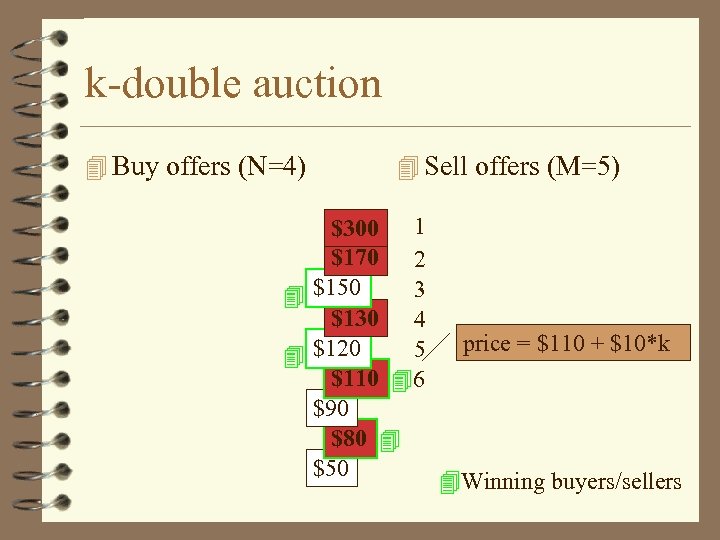

k-double auction Buy offers (N=4) Sell offers (M=5) $300 1 $170 2 3 $150 $130 4 5 $120 $110 6 $90 $80 $50 price = $110 + $10*k Winning buyers/sellers

k-double auction Buy offers (N=4) Sell offers (M=5) $300 1 $170 2 3 $150 $130 4 5 $120 $110 6 $90 $80 $50 price = $110 + $10*k Winning buyers/sellers

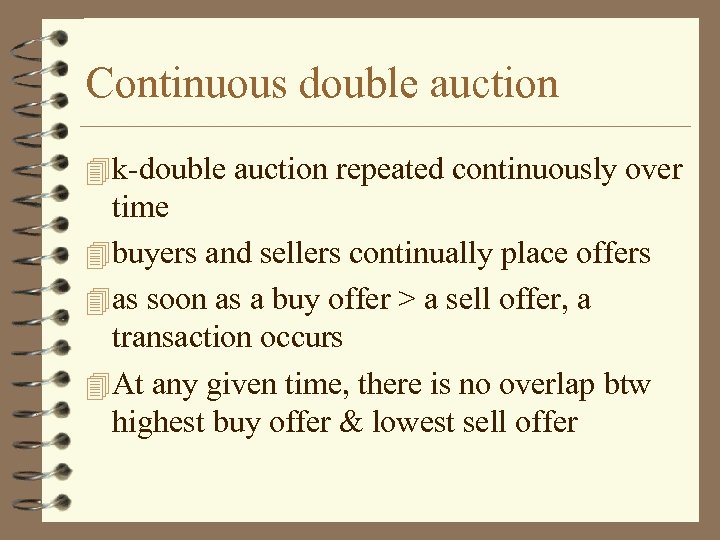

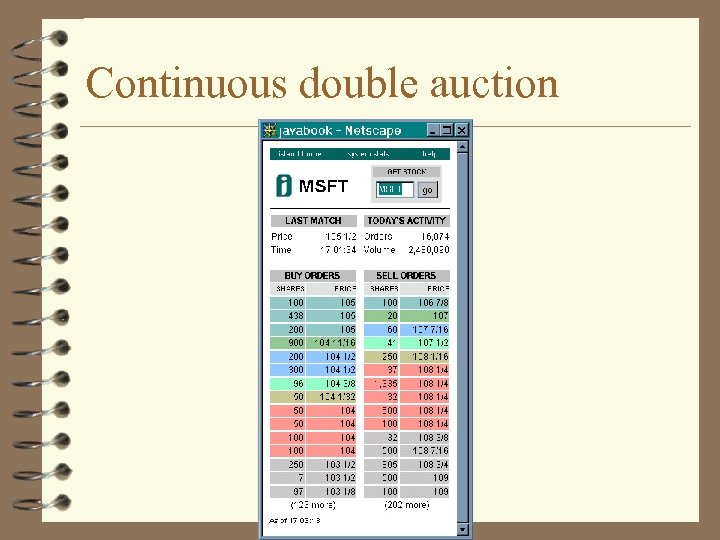

Continuous double auction k-double auction repeated continuously over time buyers and sellers continually place offers as soon as a buy offer > a sell offer, a transaction occurs At any given time, there is no overlap btw highest buy offer & lowest sell offer

Continuous double auction k-double auction repeated continuously over time buyers and sellers continually place offers as soon as a buy offer > a sell offer, a transaction occurs At any given time, there is no overlap btw highest buy offer & lowest sell offer

Continuous double auction

Continuous double auction

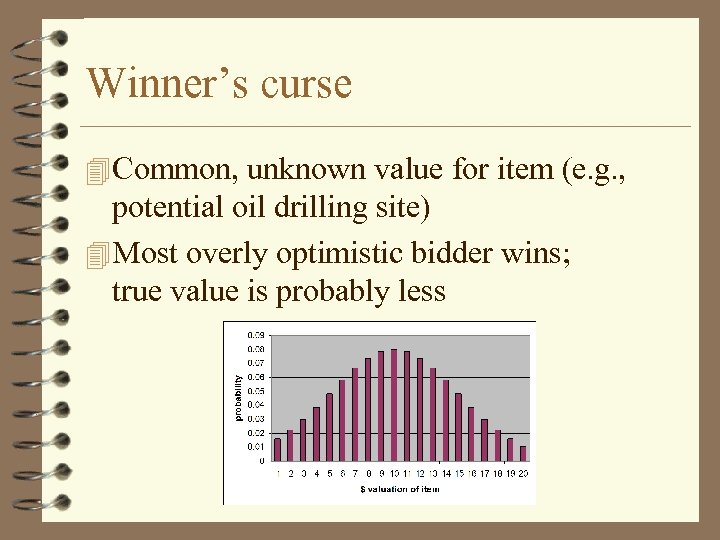

Winner’s curse Common, unknown value for item (e. g. , potential oil drilling site) Most overly optimistic bidder wins; true value is probably less

Winner’s curse Common, unknown value for item (e. g. , potential oil drilling site) Most overly optimistic bidder wins; true value is probably less

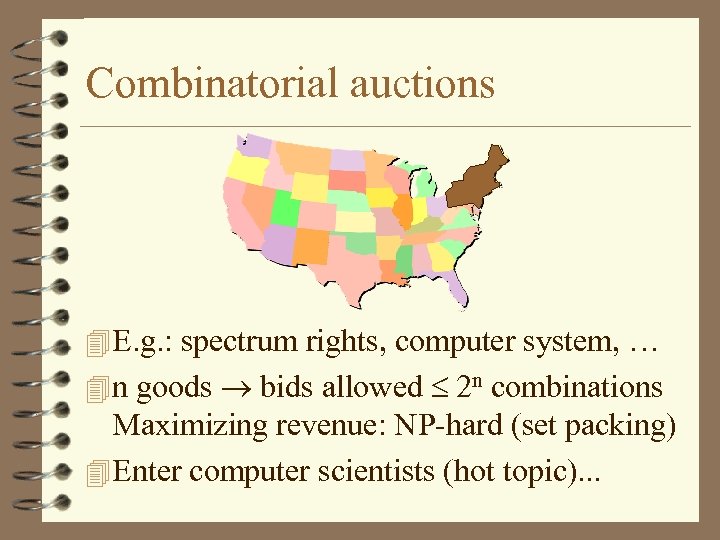

Combinatorial auctions E. g. : spectrum rights, computer system, … n goods bids allowed 2 n combinations Maximizing revenue: NP-hard (set packing) Enter computer scientists (hot topic). . .

Combinatorial auctions E. g. : spectrum rights, computer system, … n goods bids allowed 2 n combinations Maximizing revenue: NP-hard (set packing) Enter computer scientists (hot topic). . .

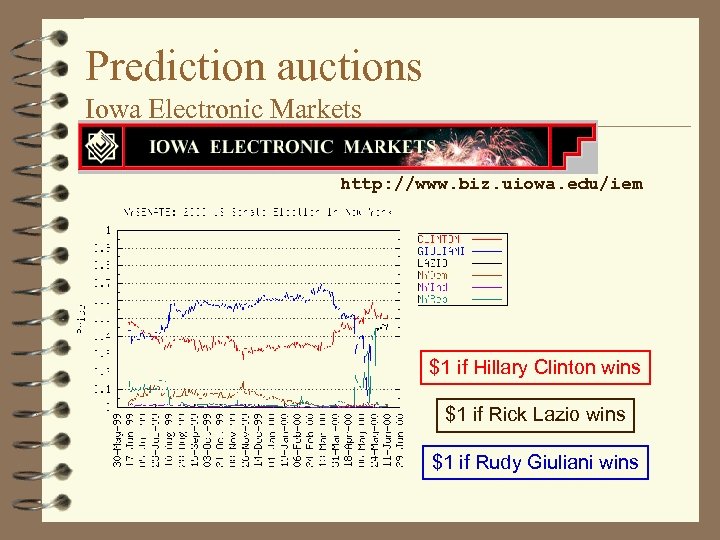

Prediction auctions Iowa Electronic Markets http: //www. biz. uiowa. edu/iem $1 if Hillary Clinton wins $1 if Rick Lazio wins $1 if Rudy Giuliani wins

Prediction auctions Iowa Electronic Markets http: //www. biz. uiowa. edu/iem $1 if Hillary Clinton wins $1 if Rick Lazio wins $1 if Rudy Giuliani wins

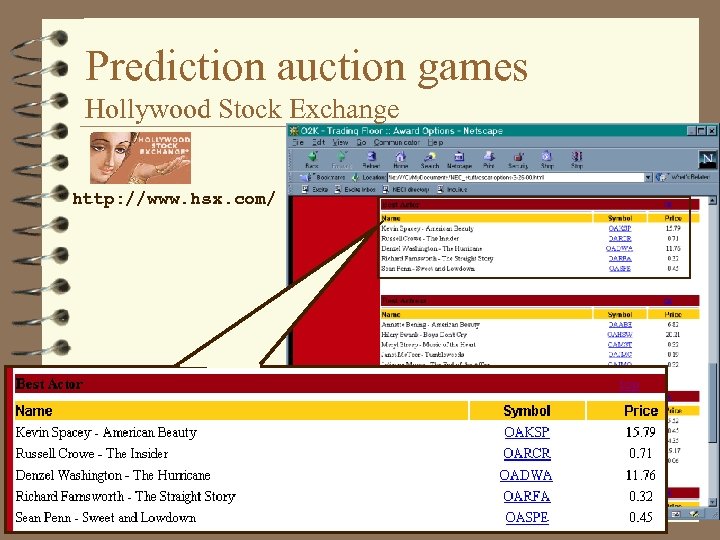

Prediction auction games Hollywood Stock Exchange http: //www. hsx. com/

Prediction auction games Hollywood Stock Exchange http: //www. hsx. com/

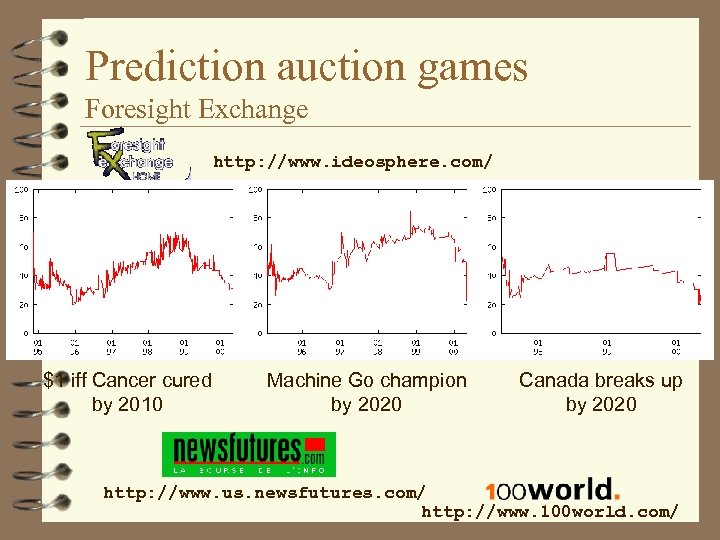

Prediction auction games Foresight Exchange http: //www. ideosphere. com/ $1 iff Cancer cured by 2010 Machine Go champion by 2020 Canada breaks up by 2020 http: //www. us. newsfutures. com/ http: //www. 100 world. com/

Prediction auction games Foresight Exchange http: //www. ideosphere. com/ $1 iff Cancer cured by 2010 Machine Go champion by 2020 Canada breaks up by 2020 http: //www. us. newsfutures. com/ http: //www. 100 world. com/

Prediction markets

Prediction markets