987fcdd2bb66c79f8764e16297164c7f.ppt

- Количество слайдов: 39

Introduction to Agricultural and Natural Resources The Financial Markets FREC 150 Dr. Steven E. Hastings

Introduction to Agricultural and Natural Resources The Financial Markets FREC 150 Dr. Steven E. Hastings

The Financial Markets • Sources of Capital for Business Firms and Entrepreneurs – Suppose you want to start a business… – Example – The Hastings Chair Company (HCC)! – Where do you get ?

The Financial Markets • Sources of Capital for Business Firms and Entrepreneurs – Suppose you want to start a business… – Example – The Hastings Chair Company (HCC)! – Where do you get ?

Stocks • Stocks – What is a stock? • Shares of ownership in a publicly owned company. • Issued buy companies to finance their business activities. – Stocks bought and sold in exchanges (markets). – Many types that appeal to different investors – “large cap”, “small cap”, growth, value, domestic, international, etc.

Stocks • Stocks – What is a stock? • Shares of ownership in a publicly owned company. • Issued buy companies to finance their business activities. – Stocks bought and sold in exchanges (markets). – Many types that appeal to different investors – “large cap”, “small cap”, growth, value, domestic, international, etc.

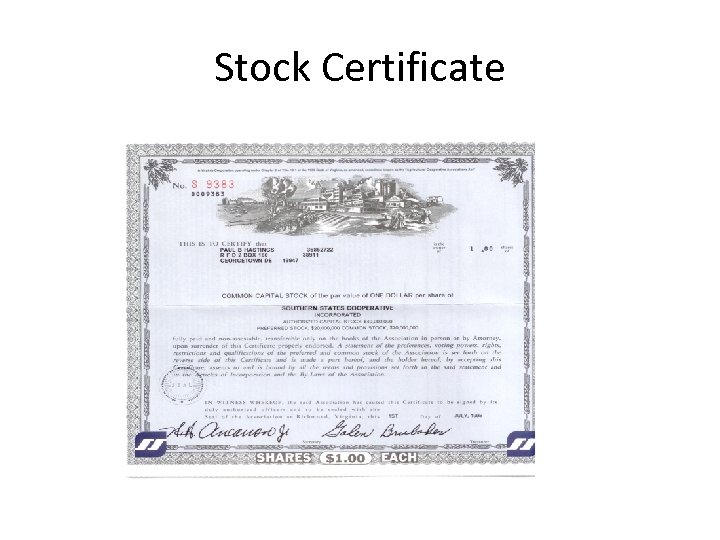

Stock Certificate

Stock Certificate

Types of Stocks • Blue chip stocks are stocks of well-established companies that have stable earnings and no extensive liabilities. • Penny stocks are low-priced, speculative and risky securities which are traded over-the-counter (OTC); i. e. outside of one of the major exchanges. • Income stocks offer a higher dividend in relation to their market price. • Growth stocks are securities which appreciate in value and yield a high return. Their profits are typically re-invested to expand the business • Value stocks are securities which investors consider to be undervalued. They feel that the stock is being traded below market value, and they believe in the long-term growth of the issuing company. • Source: www. finweb. com/investing/types-of-stocks. html

Types of Stocks • Blue chip stocks are stocks of well-established companies that have stable earnings and no extensive liabilities. • Penny stocks are low-priced, speculative and risky securities which are traded over-the-counter (OTC); i. e. outside of one of the major exchanges. • Income stocks offer a higher dividend in relation to their market price. • Growth stocks are securities which appreciate in value and yield a high return. Their profits are typically re-invested to expand the business • Value stocks are securities which investors consider to be undervalued. They feel that the stock is being traded below market value, and they believe in the long-term growth of the issuing company. • Source: www. finweb. com/investing/types-of-stocks. html

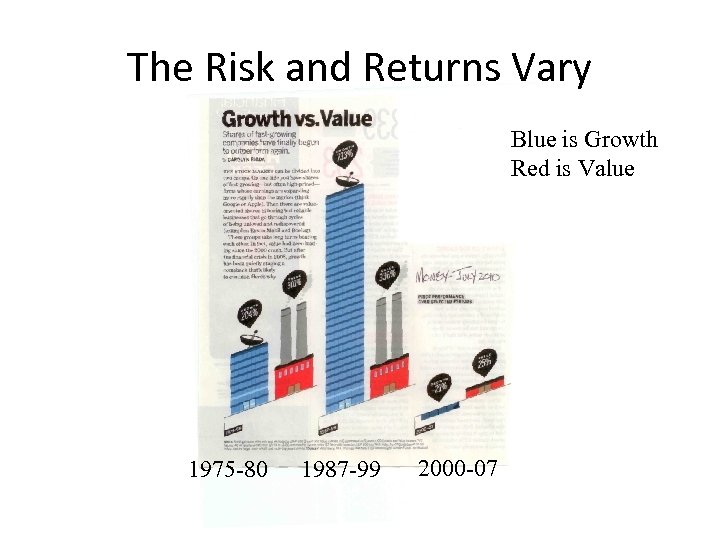

The Risk and Returns Vary Blue is Growth Red is Value 1975 -80 1987 -99 2000 -07

The Risk and Returns Vary Blue is Growth Red is Value 1975 -80 1987 -99 2000 -07

Stocks – Why buy stocks? • Receive dividends (share of profits) and equity (stock price can go up or down; no guarantee). – Who buys them? • Most (more that 50% by 2001) Americans, institutions, retirement funds, college funds, other companies, etc. own equities.

Stocks – Why buy stocks? • Receive dividends (share of profits) and equity (stock price can go up or down; no guarantee). – Who buys them? • Most (more that 50% by 2001) Americans, institutions, retirement funds, college funds, other companies, etc. own equities.

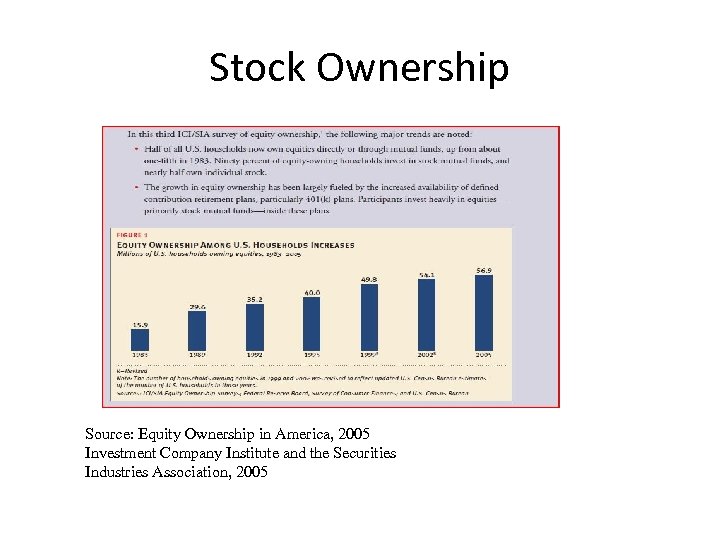

Stock Ownership Source: Equity Ownership in America, 2005 Investment Company Institute and the Securities Industries Association, 2005

Stock Ownership Source: Equity Ownership in America, 2005 Investment Company Institute and the Securities Industries Association, 2005

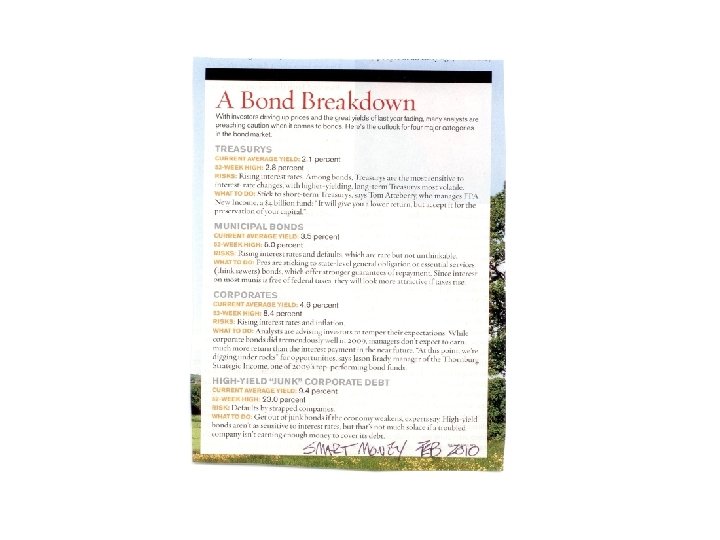

Fixed Income Securities (2 types) – Bonds • What is a bond? – Debt obligations (loans or IOU) issued by corporations, universities, and state and local governments. • Where do bonds originate? – Issued as another source of revenue beyond stocks, taxes, tuition, etc. • Bonds issued and then resold in secondary markets; investors can but a variety of different bonds at any time. • Price that you pay for a bond affects the yield (actual return).

Fixed Income Securities (2 types) – Bonds • What is a bond? – Debt obligations (loans or IOU) issued by corporations, universities, and state and local governments. • Where do bonds originate? – Issued as another source of revenue beyond stocks, taxes, tuition, etc. • Bonds issued and then resold in secondary markets; investors can but a variety of different bonds at any time. • Price that you pay for a bond affects the yield (actual return).

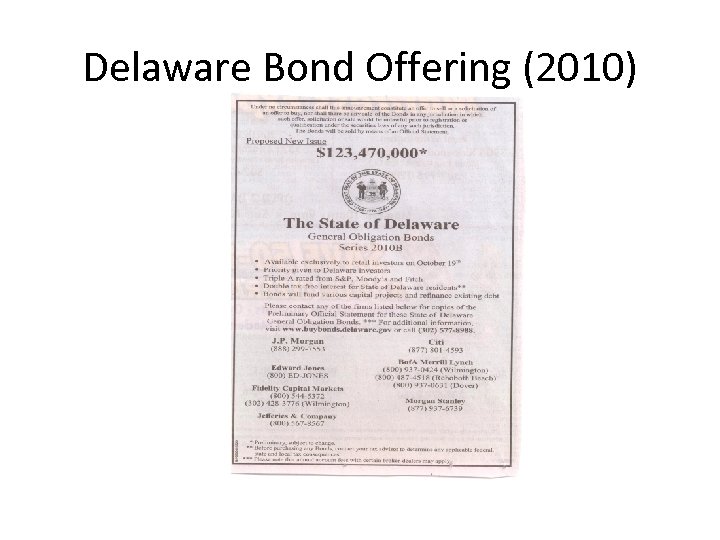

Delaware Bond Offering (2010)

Delaware Bond Offering (2010)

Corporate Bonds

Corporate Bonds

FREC 150 – Economics of Agricultural and Natural Resources

FREC 150 – Economics of Agricultural and Natural Resources

Fixed Income Securities • Why buy bonds? – Receive interest annually (fixed mount) and debt (guaranteed). – Bond issuers are “rated” (A, AA, etc. ) to guide investors. • Who buys them? – Most Americans, institutions, retirement funds, college funds, other companies, etc. own bonds.

Fixed Income Securities • Why buy bonds? – Receive interest annually (fixed mount) and debt (guaranteed). – Bond issuers are “rated” (A, AA, etc. ) to guide investors. • Who buys them? – Most Americans, institutions, retirement funds, college funds, other companies, etc. own bonds.

Headlines

Headlines

Fixed Income Securities – Money Market Securities • Include Treasury bills, bank certificate of deposit (CD’s), banker’s acceptances, and commercial papers issued by corporations. • Pay fixed rates of return (low) – secure investments • See Reading List

Fixed Income Securities – Money Market Securities • Include Treasury bills, bank certificate of deposit (CD’s), banker’s acceptances, and commercial papers issued by corporations. • Pay fixed rates of return (low) – secure investments • See Reading List

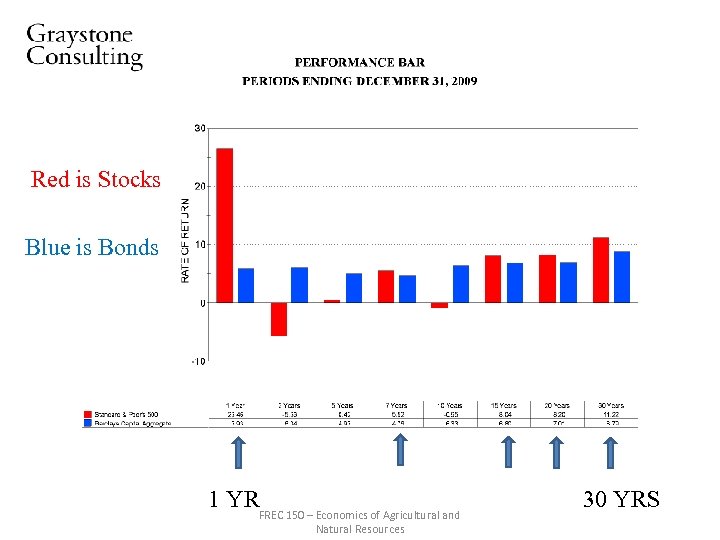

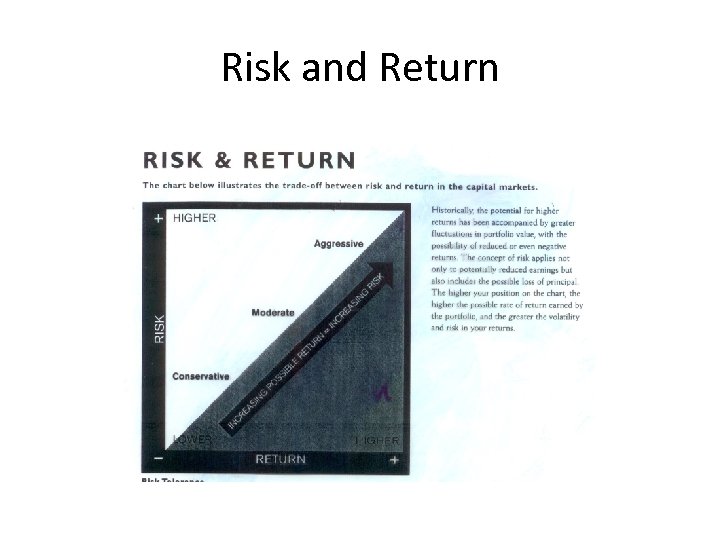

Why Buy Stocks vs. Bonds? • Difference in stocks and bonds – Stocks • (Dividend – Equity) – neither is guaranteed! • Greater risk; greater return. – Bonds • (Interest - Debt) - both are guarenteed! • Less risk; less return. – Historical Comparisons of Returns

Why Buy Stocks vs. Bonds? • Difference in stocks and bonds – Stocks • (Dividend – Equity) – neither is guaranteed! • Greater risk; greater return. – Bonds • (Interest - Debt) - both are guarenteed! • Less risk; less return. – Historical Comparisons of Returns

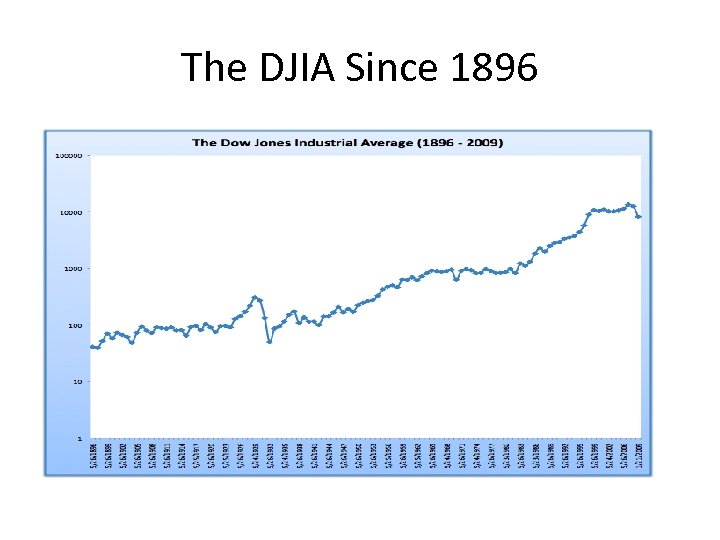

The DJIA Since 1896

The DJIA Since 1896

Red is Stocks Blue is Bonds 1 YR FREC 150 – Economics of Agricultural and Natural Resources 30 YRS

Red is Stocks Blue is Bonds 1 YR FREC 150 – Economics of Agricultural and Natural Resources 30 YRS

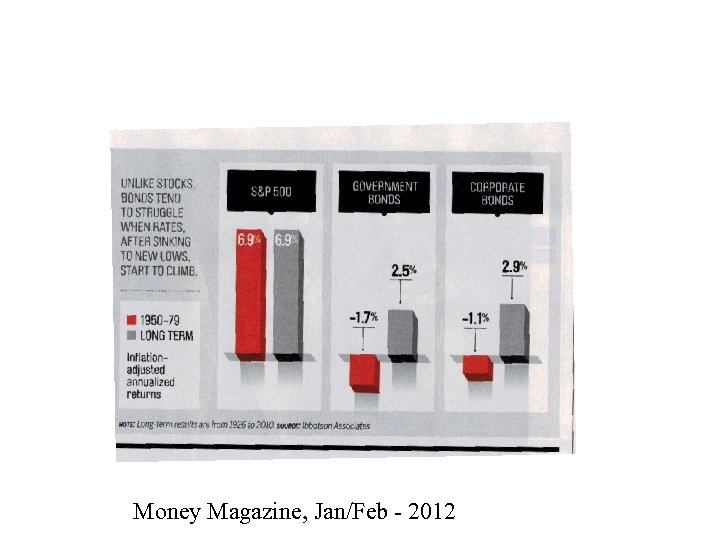

Money Magazine, Jan/Feb - 2012

Money Magazine, Jan/Feb - 2012

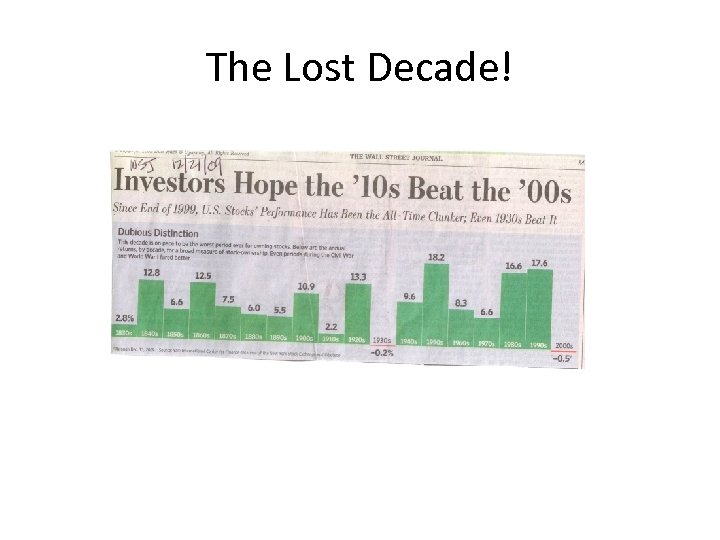

The Lost Decade!

The Lost Decade!

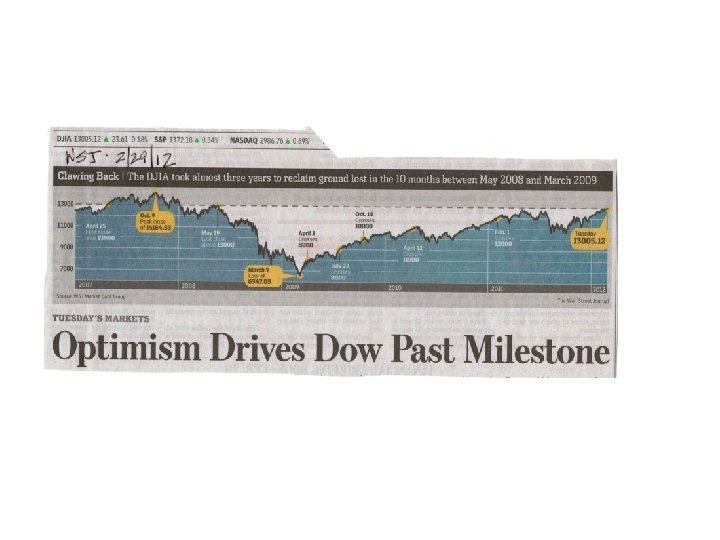

Recovery Under Way!

Recovery Under Way!

Risk and Return

Risk and Return

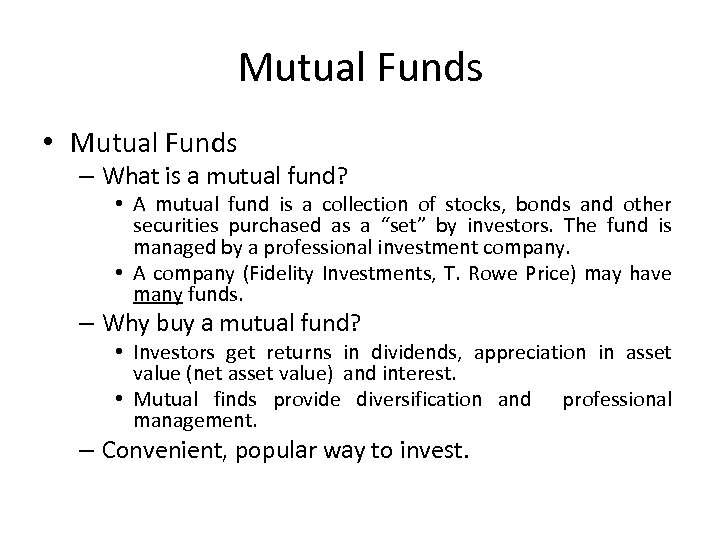

Mutual Funds • Mutual Funds – What is a mutual fund? • A mutual fund is a collection of stocks, bonds and other securities purchased as a “set” by investors. The fund is managed by a professional investment company. • A company (Fidelity Investments, T. Rowe Price) may have many funds. – Why buy a mutual fund? • Investors get returns in dividends, appreciation in asset value (net asset value) and interest. • Mutual finds provide diversification and professional management. – Convenient, popular way to invest.

Mutual Funds • Mutual Funds – What is a mutual fund? • A mutual fund is a collection of stocks, bonds and other securities purchased as a “set” by investors. The fund is managed by a professional investment company. • A company (Fidelity Investments, T. Rowe Price) may have many funds. – Why buy a mutual fund? • Investors get returns in dividends, appreciation in asset value (net asset value) and interest. • Mutual finds provide diversification and professional management. – Convenient, popular way to invest.

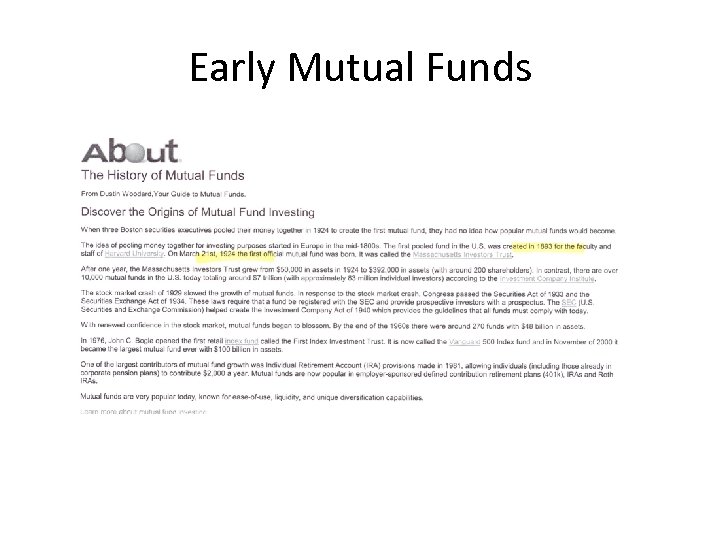

Early Mutual Funds

Early Mutual Funds

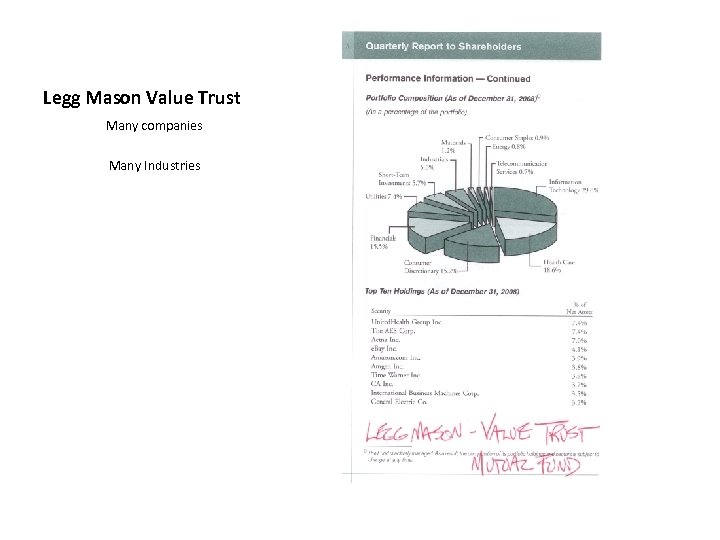

Legg Mason Value Trust Many companies Many Industries

Legg Mason Value Trust Many companies Many Industries

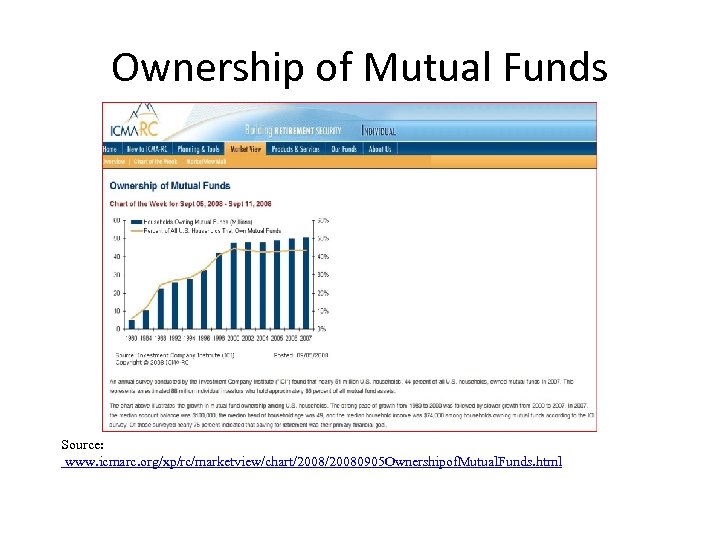

Ownership of Mutual Funds Source: www. icmarc. org/xp/rc/marketview/chart/20080905 Ownershipof. Mutual. Funds. html

Ownership of Mutual Funds Source: www. icmarc. org/xp/rc/marketview/chart/20080905 Ownershipof. Mutual. Funds. html

Trillions ($) in Mutual Funds Source: www. ici. org/research/stats/trends_07_09

Trillions ($) in Mutual Funds Source: www. ici. org/research/stats/trends_07_09

Mutual Funds – A fund may be: • “managed” or “indexed”, • “open” or “closed”, • “load” or “no-load”, etc. – Investment objectives differ – the “Prospectus” is important. – Investors pay various fees to management company. – Many thousands of funds exist – trillions of dollars invested!

Mutual Funds – A fund may be: • “managed” or “indexed”, • “open” or “closed”, • “load” or “no-load”, etc. – Investment objectives differ – the “Prospectus” is important. – Investors pay various fees to management company. – Many thousands of funds exist – trillions of dollars invested!

Where do you buy S and B? • Stock and Bond Markets (Exchanges) – Traditional – seats or memberships required. • First was in Philadelphia – 1790. • New York Stock Exchange formed in 1817 on Wall Street. • American Stock Exchange (a rival) founded in 1842. – Electronic Stock Market • National Association of Securities Dealers (NASDAQ) operates an electronic market where brokers trade from their offices. – Requirements to trade differ for markets.

Where do you buy S and B? • Stock and Bond Markets (Exchanges) – Traditional – seats or memberships required. • First was in Philadelphia – 1790. • New York Stock Exchange formed in 1817 on Wall Street. • American Stock Exchange (a rival) founded in 1842. – Electronic Stock Market • National Association of Securities Dealers (NASDAQ) operates an electronic market where brokers trade from their offices. – Requirements to trade differ for markets.

New York Stock Exchange

New York Stock Exchange

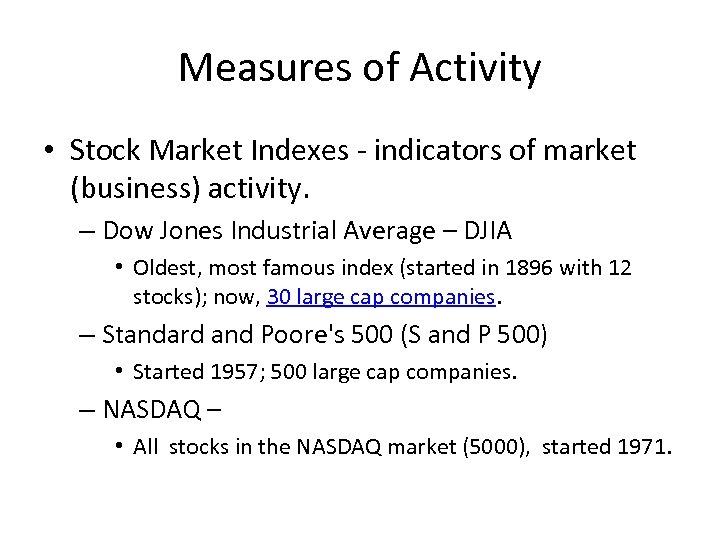

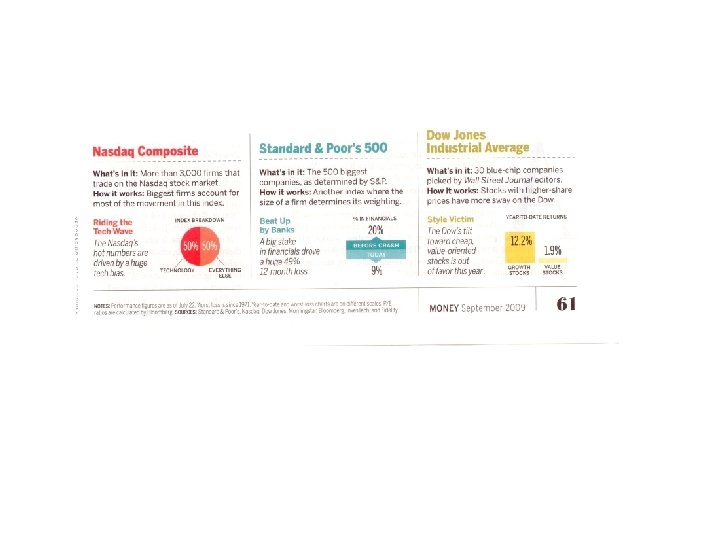

Measures of Activity • Stock Market Indexes - indicators of market (business) activity. – Dow Jones Industrial Average – DJIA • Oldest, most famous index (started in 1896 with 12 stocks); now, 30 large cap companies. – Standard and Poore's 500 (S and P 500) • Started 1957; 500 large cap companies. – NASDAQ – • All stocks in the NASDAQ market (5000), started 1971.

Measures of Activity • Stock Market Indexes - indicators of market (business) activity. – Dow Jones Industrial Average – DJIA • Oldest, most famous index (started in 1896 with 12 stocks); now, 30 large cap companies. – Standard and Poore's 500 (S and P 500) • Started 1957; 500 large cap companies. – NASDAQ – • All stocks in the NASDAQ market (5000), started 1971.

Measures of Activity – Russell 2000 • Represents 2000 smaller companies. – Wilshire 5000 – • The “whole enchilada” – all stock market activity; has more that 5000 stocks. – Many other indexes exist.

Measures of Activity – Russell 2000 • Represents 2000 smaller companies. – Wilshire 5000 – • The “whole enchilada” – all stock market activity; has more that 5000 stocks. – Many other indexes exist.

Summary • Why Monitor the Stock Market? – All of you will invest in the future – maybe, now! – Great way to monitor the (macro) economy! • The financial markets are an important part of our economic system. • Virtually all Americans are affected by the financial markets. • Lecture Sources: Miscellaneous Materials

Summary • Why Monitor the Stock Market? – All of you will invest in the future – maybe, now! – Great way to monitor the (macro) economy! • The financial markets are an important part of our economic system. • Virtually all Americans are affected by the financial markets. • Lecture Sources: Miscellaneous Materials

Assignment #2 • • • Review Assignment in Class Pick a “publicly traded” company Pick a mutual fund Identify a source for data Start recording data – 6 weeks or so This assignment is 10% for your class grade!

Assignment #2 • • • Review Assignment in Class Pick a “publicly traded” company Pick a mutual fund Identify a source for data Start recording data – 6 weeks or so This assignment is 10% for your class grade!