Introduction to Accounting Preparing for a User’s Perspective What are the common forms of business ownership structure in the United States and what are some advantages and disadvantages of each? By Kevin C. Kimball, CPA Debits and Credits Trainer Sole Proprietorships with support from Available on the Google Play Store www. canvas. net Free Jan. 2014

Introduction to Accounting Preparing for a User’s Perspective What are the common forms of business ownership structure in the United States and what are some advantages and disadvantages of each? By Kevin C. Kimball, CPA Debits and Credits Trainer Sole Proprietorships with support from Available on the Google Play Store www. canvas. net Free Jan. 2014

Sole Decision Authority Sole = 1 And I am the 1. That would be me. And what I say rules! Who is the proprietor of this business?

Sole Decision Authority Sole = 1 And I am the 1. That would be me. And what I say rules! Who is the proprietor of this business?

Easy Set-up

Easy Set-up

Minimal Regulations Stop!! You need a license to do business here. Sales Taxes $ Excise Taxes $

Minimal Regulations Stop!! You need a license to do business here. Sales Taxes $ Excise Taxes $

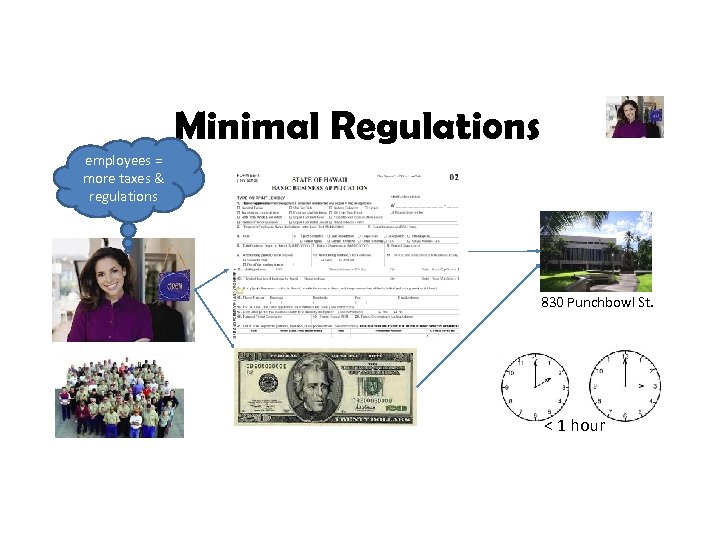

Minimal Regulations employees = more taxes & regulations 830 Punchbowl St. < 1 hour

Minimal Regulations employees = more taxes & regulations 830 Punchbowl St. < 1 hour

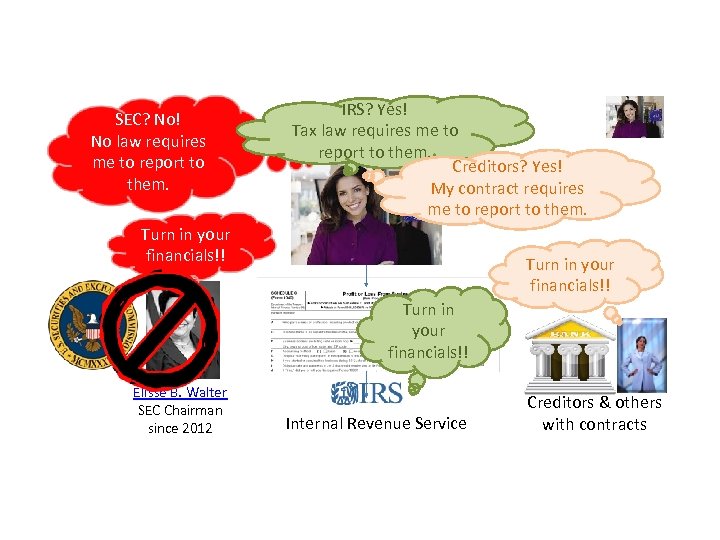

SEC? No! No law requires me to report to them. IRS? Yes! Tax law requires me to report to them. Creditors? Yes! My contract requires me to report to them. Turn in your financials!! Elisse B. Walter SEC Chairman since 2012 Internal Revenue Service Creditors & others with contracts

SEC? No! No law requires me to report to them. IRS? Yes! Tax law requires me to report to them. Creditors? Yes! My contract requires me to report to them. Turn in your financials!! Elisse B. Walter SEC Chairman since 2012 Internal Revenue Service Creditors & others with contracts

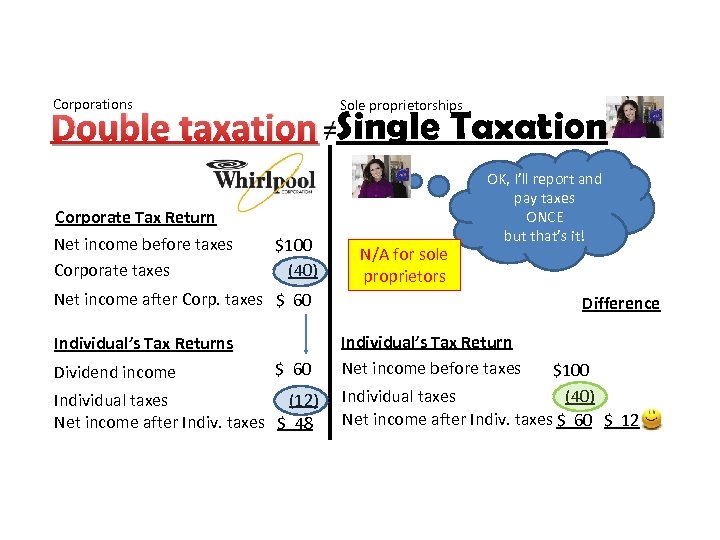

Corporations Sole proprietorships Double taxation Single Taxation Corporate Tax Return Net income before taxes Corporate taxes $100 (40) N/A for sole proprietors OK, I’ll report and pay taxes ONCE but that’s it! Net income after Corp. taxes $ 60 Individual’s Tax Returns Dividend income $ 60 Individual taxes (12) Net income after Indiv. taxes $ 48 Difference Individual’s Tax Return Net income before taxes $100 Individual taxes (40) Net income after Indiv. taxes $ 60 $ 12

Corporations Sole proprietorships Double taxation Single Taxation Corporate Tax Return Net income before taxes Corporate taxes $100 (40) N/A for sole proprietors OK, I’ll report and pay taxes ONCE but that’s it! Net income after Corp. taxes $ 60 Individual’s Tax Returns Dividend income $ 60 Individual taxes (12) Net income after Indiv. taxes $ 48 Difference Individual’s Tax Return Net income before taxes $100 Individual taxes (40) Net income after Indiv. taxes $ 60 $ 12

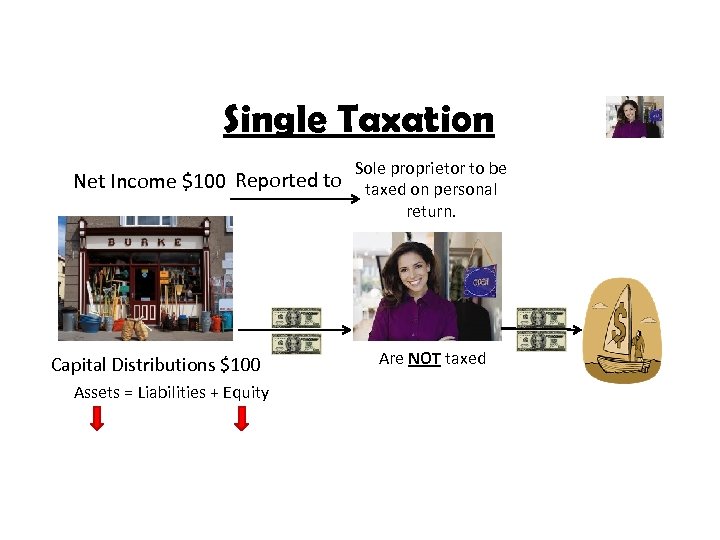

Single Taxation Net Income $100 Reported to Capital Distributions $100 Assets = Liabilities + Equity Sole proprietor to be taxed on personal return. Are NOT taxed

Single Taxation Net Income $100 Reported to Capital Distributions $100 Assets = Liabilities + Equity Sole proprietor to be taxed on personal return. Are NOT taxed

Limited Access to Expertise KEY business decision? I have final word.

Limited Access to Expertise KEY business decision? I have final word.

Limited Access to Expertise I could use a little more expertise.

Limited Access to Expertise I could use a little more expertise.

Limited Access to Capital I just need another $1, 000 for a few hotels.

Limited Access to Capital I just need another $1, 000 for a few hotels.

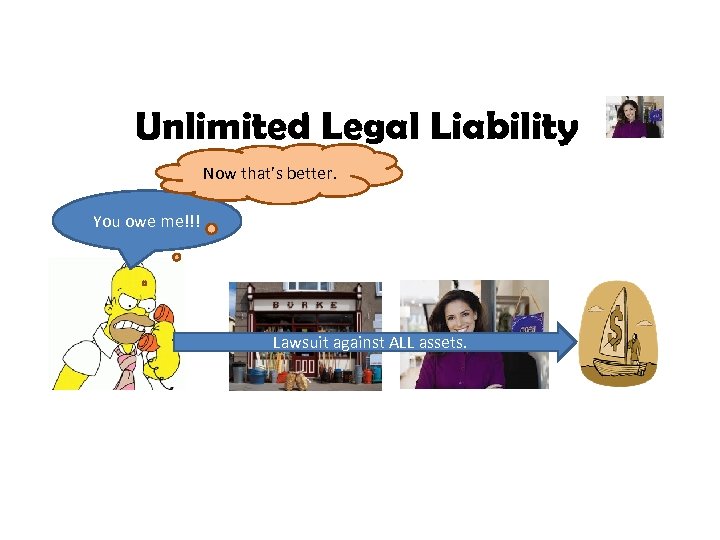

Unlimited Legal Liability Now that’s better. You owe me!!! Lawsuit against ALL assets.

Unlimited Legal Liability Now that’s better. You owe me!!! Lawsuit against ALL assets.

Limited Life Difficult Transfer of Ownership Life of Sole Proprietorship ends when

Limited Life Difficult Transfer of Ownership Life of Sole Proprietorship ends when

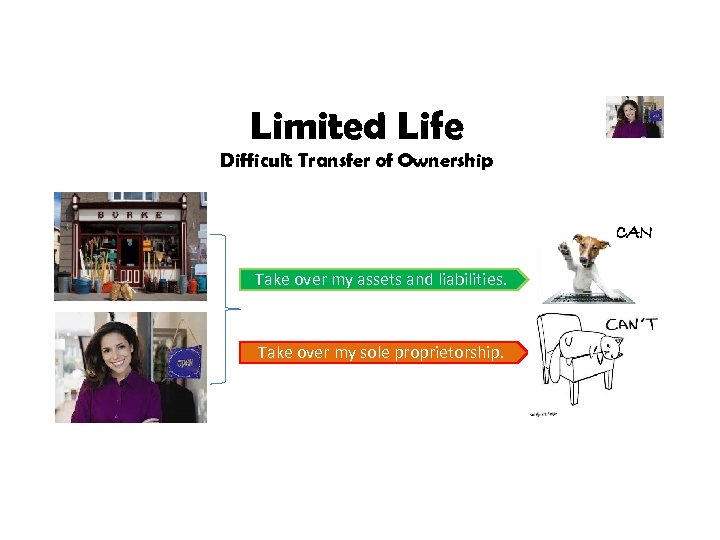

Limited Life Difficult Transfer of Ownership CAN Take over my assets and liabilities. Take over my sole proprietorship.

Limited Life Difficult Transfer of Ownership CAN Take over my assets and liabilities. Take over my sole proprietorship.

Introduction to Accounting Preparing for a User’s Perspective What are the common forms of business ownership structure in the United States and what are some advantages and disadvantages of each? By Kevin C. Kimball, CPA Debits and Credits Trainer Sole Proprietorships with support from Available on the Google Play Store www. canvas. net Free Jan. 2014

Introduction to Accounting Preparing for a User’s Perspective What are the common forms of business ownership structure in the United States and what are some advantages and disadvantages of each? By Kevin C. Kimball, CPA Debits and Credits Trainer Sole Proprietorships with support from Available on the Google Play Store www. canvas. net Free Jan. 2014