Introduction to Accounting Preparing for a User’s Perspective Compute and understand the Cash Conversion Cycle By Kevin C. Kimball, CPA with support from Debits and Credits Trainer www. canvas. net Free Jan. 2014 Available on the Google Play Store

Introduction to Accounting Preparing for a User’s Perspective Compute and understand the Cash Conversion Cycle By Kevin C. Kimball, CPA with support from Debits and Credits Trainer www. canvas. net Free Jan. 2014 Available on the Google Play Store

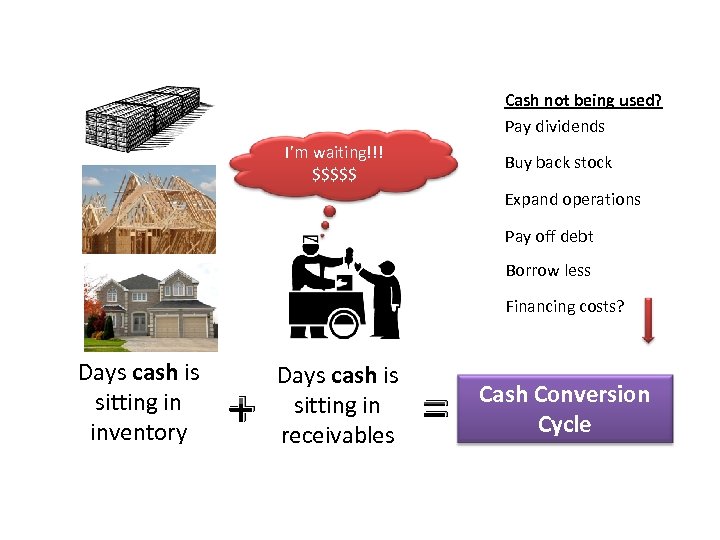

Cash not being used? Pay dividends I’m waiting!!! $$$$$ Buy back stock Expand operations Pay off debt Borrow less Financing costs? Days cash is sitting in inventory + Days cash is sitting in receivables = Cash Conversion Cycle

Cash not being used? Pay dividends I’m waiting!!! $$$$$ Buy back stock Expand operations Pay off debt Borrow less Financing costs? Days cash is sitting in inventory + Days cash is sitting in receivables = Cash Conversion Cycle

Cash Conversion Cycle Management

Cash Conversion Cycle Management

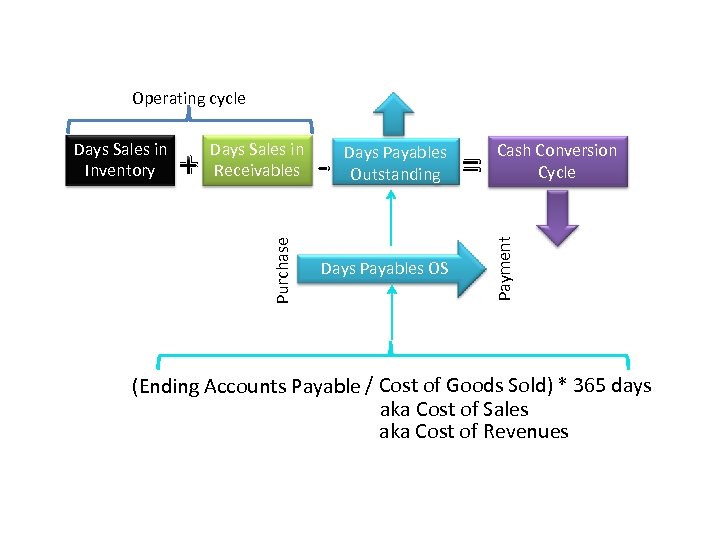

Operating cycle - Days Payables Outstanding Days Payables OS = Cash Conversion Cycle Payment + Days Sales in Receivables Purchase Days Sales in Inventory (Ending Accounts Payable / Cost of Goods Sold) * 365 days aka Cost of Sales aka Cost of Revenues

Operating cycle - Days Payables Outstanding Days Payables OS = Cash Conversion Cycle Payment + Days Sales in Receivables Purchase Days Sales in Inventory (Ending Accounts Payable / Cost of Goods Sold) * 365 days aka Cost of Sales aka Cost of Revenues

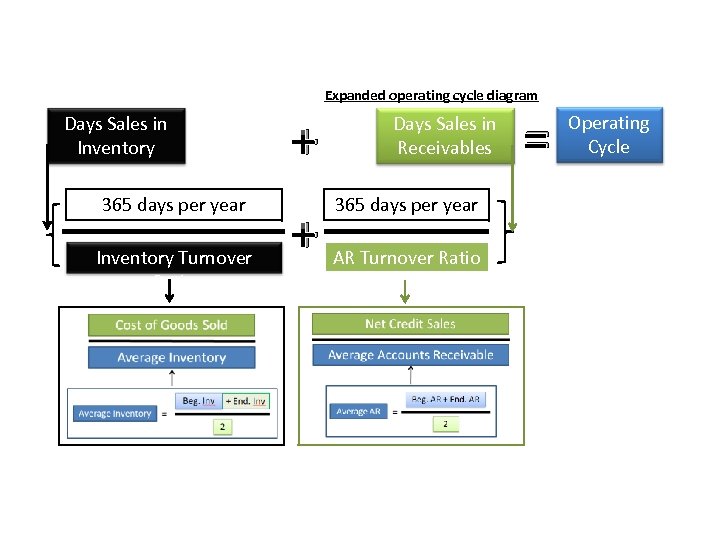

Expanded operating cycle diagram Days Sales in Inventory 365 days per year Inventory Turnover Ratio + + Days Sales in Receivables 365 days per year AR Turnover Ratio = Operating Cycle

Expanded operating cycle diagram Days Sales in Inventory 365 days per year Inventory Turnover Ratio + + Days Sales in Receivables 365 days per year AR Turnover Ratio = Operating Cycle

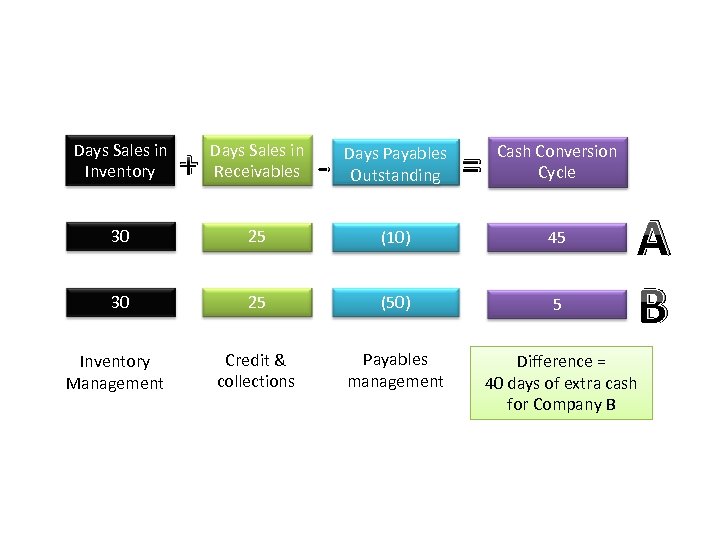

Days Sales in Inventory + Days Sales in Receivables - Days Payables Outstanding = Cash Conversion Cycle 30 25 (10) 45 30 25 (50) 5 Credit & collections Payables management Inventory Management A B Difference = 40 days of extra cash for Company B

Days Sales in Inventory + Days Sales in Receivables - Days Payables Outstanding = Cash Conversion Cycle 30 25 (10) 45 30 25 (50) 5 Credit & collections Payables management Inventory Management A B Difference = 40 days of extra cash for Company B

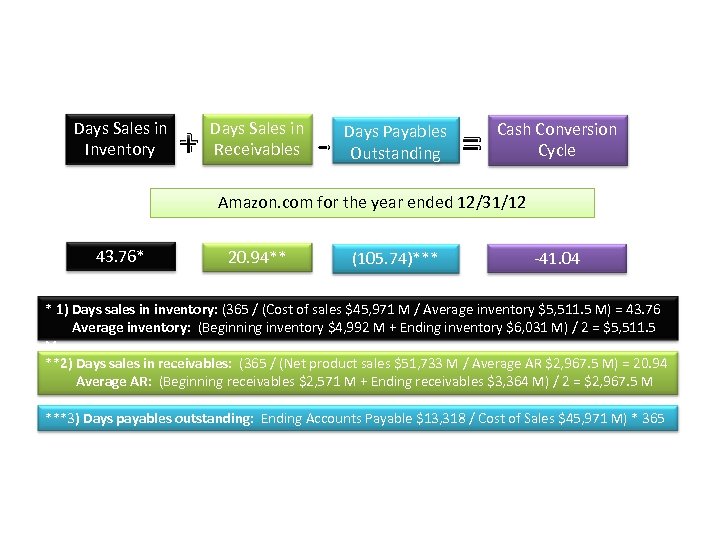

Days Sales in Inventory + Days Sales in Receivables - Days Payables Outstanding = Cash Conversion Cycle Amazon. com for the year ended 12/31/12 43. 76* 20. 94** (105. 74)*** -41. 04 * 1) Days sales in inventory: (365 / (Cost of sales $45, 971 M / Average inventory $5, 511. 5 M) = 43. 76 Average inventory: (Beginning inventory $4, 992 M + Ending inventory $6, 031 M) / 2 = $5, 511. 5 M **2) Days sales in receivables: (365 / (Net product sales $51, 733 M / Average AR $2, 967. 5 M) = 20. 94 Average AR: (Beginning receivables $2, 571 M + Ending receivables $3, 364 M) / 2 = $2, 967. 5 M ***3) Days payables outstanding: Ending Accounts Payable $13, 318 / Cost of Sales $45, 971 M) * 365

Days Sales in Inventory + Days Sales in Receivables - Days Payables Outstanding = Cash Conversion Cycle Amazon. com for the year ended 12/31/12 43. 76* 20. 94** (105. 74)*** -41. 04 * 1) Days sales in inventory: (365 / (Cost of sales $45, 971 M / Average inventory $5, 511. 5 M) = 43. 76 Average inventory: (Beginning inventory $4, 992 M + Ending inventory $6, 031 M) / 2 = $5, 511. 5 M **2) Days sales in receivables: (365 / (Net product sales $51, 733 M / Average AR $2, 967. 5 M) = 20. 94 Average AR: (Beginning receivables $2, 571 M + Ending receivables $3, 364 M) / 2 = $2, 967. 5 M ***3) Days payables outstanding: Ending Accounts Payable $13, 318 / Cost of Sales $45, 971 M) * 365

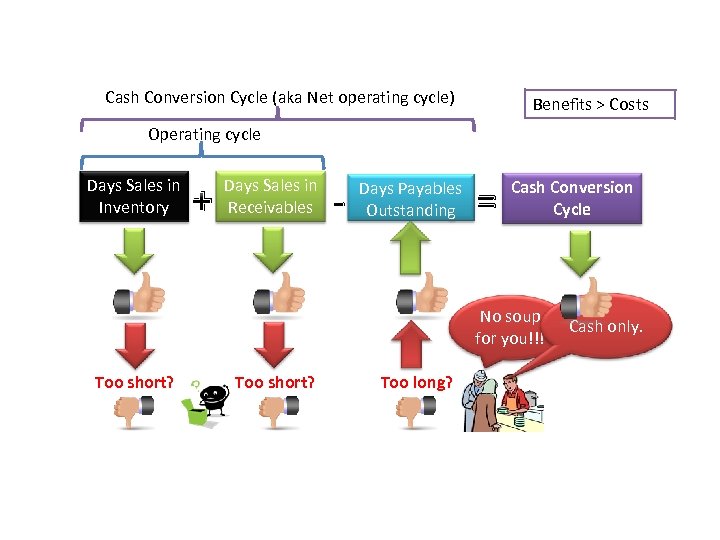

Cash Conversion Cycle (aka Net operating cycle) Benefits > Costs Operating cycle Days Sales in Inventory + Days Sales in Receivables - Days Payables Outstanding = Cash Conversion Cycle No soup for you!!! Too short? Too long? Cash only.

Cash Conversion Cycle (aka Net operating cycle) Benefits > Costs Operating cycle Days Sales in Inventory + Days Sales in Receivables - Days Payables Outstanding = Cash Conversion Cycle No soup for you!!! Too short? Too long? Cash only.

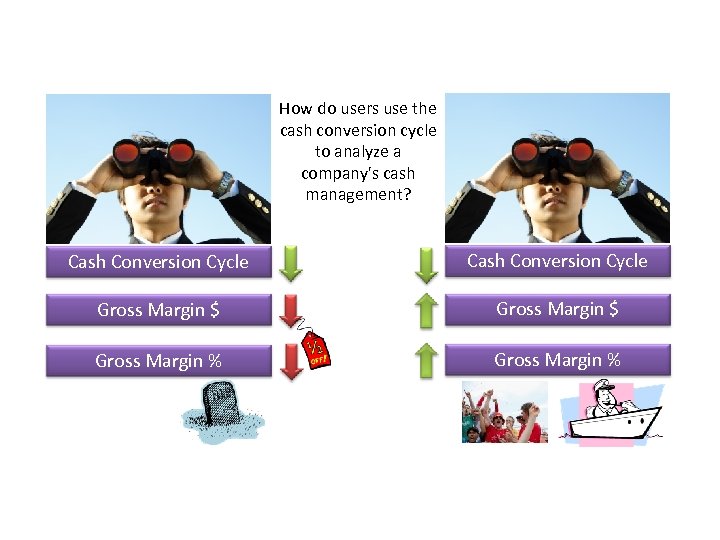

How do users use the cash conversion cycle to analyze a company's cash management? Cash Conversion Cycle Gross Margin $ Gross Margin %

How do users use the cash conversion cycle to analyze a company's cash management? Cash Conversion Cycle Gross Margin $ Gross Margin %

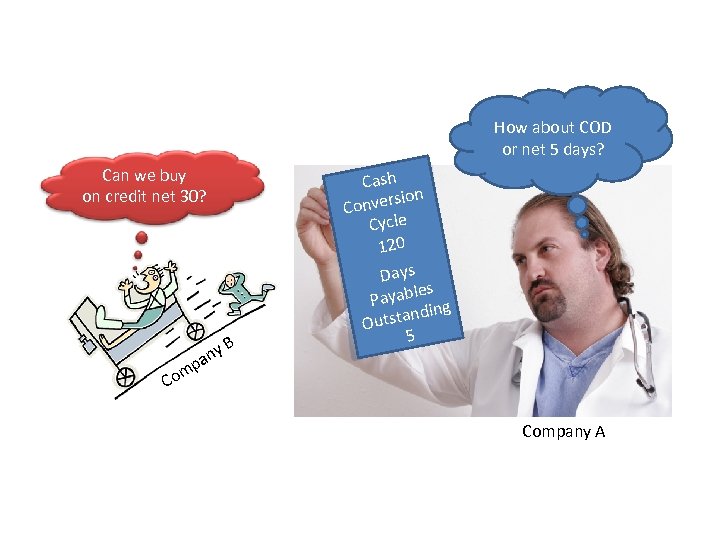

How about COD or net 5 days? Can we buy on credit net 30? m Co B ny a Cash sion Conver Cycle 120 Days les Payab ng di utstan O 5 p Company A

How about COD or net 5 days? Can we buy on credit net 30? m Co B ny a Cash sion Conver Cycle 120 Days les Payab ng di utstan O 5 p Company A

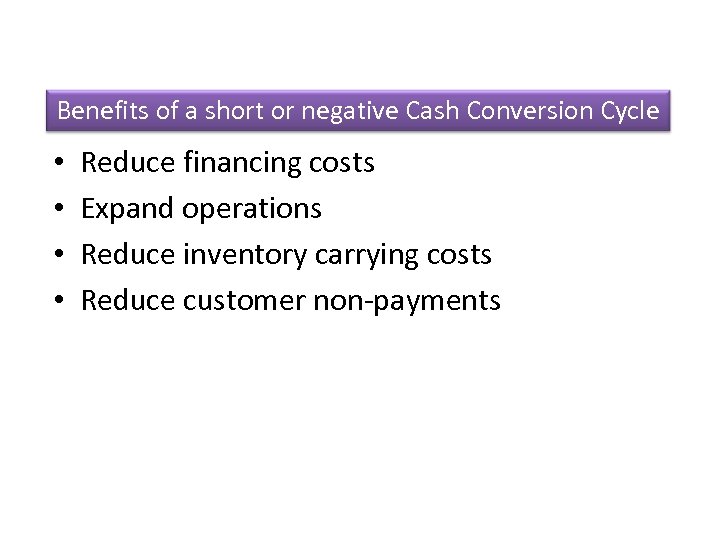

Benefits of a short or negative Cash Conversion Cycle • • Reduce financing costs Expand operations Reduce inventory carrying costs Reduce customer non-payments

Benefits of a short or negative Cash Conversion Cycle • • Reduce financing costs Expand operations Reduce inventory carrying costs Reduce customer non-payments

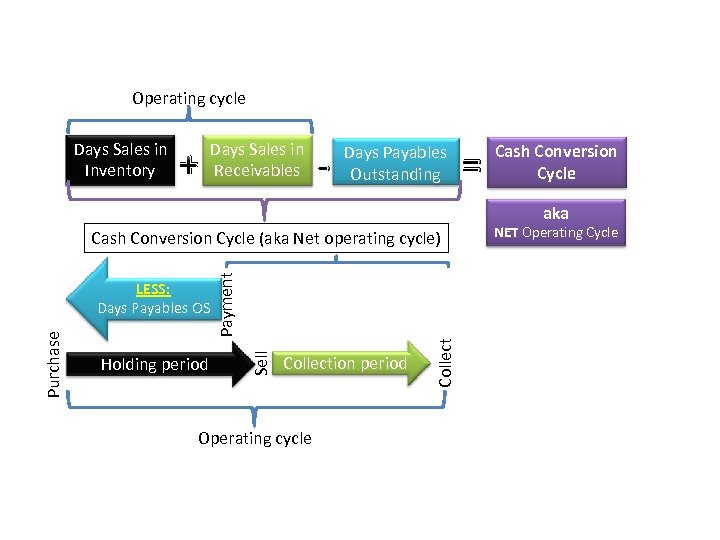

Operating cycle Days Sales in Inventory + Days Sales in Receivables - Days Payables Outstanding = Cash Conversion Cycle aka Collection period Operating cycle Collect Holding period Sell Purchase LESS: Days Payables OS Payment Cash Conversion Cycle (aka Net operating cycle) NET Operating Cycle

Operating cycle Days Sales in Inventory + Days Sales in Receivables - Days Payables Outstanding = Cash Conversion Cycle aka Collection period Operating cycle Collect Holding period Sell Purchase LESS: Days Payables OS Payment Cash Conversion Cycle (aka Net operating cycle) NET Operating Cycle

Introduction to Accounting Preparing for a User’s Perspective Compute and understand the Cash Conversion Cycle By Kevin C. Kimball, CPA with support from Debits and Credits Trainer www. canvas. net Free Jan. 2014 Available on the Google Play Store

Introduction to Accounting Preparing for a User’s Perspective Compute and understand the Cash Conversion Cycle By Kevin C. Kimball, CPA with support from Debits and Credits Trainer www. canvas. net Free Jan. 2014 Available on the Google Play Store