e805f81d2275da54ceeb6a87e4b73f0b.ppt

- Количество слайдов: 19

Introduction to 2007 1

SEB Enskilda – The No. 1 Nordic investment bank Helsinki Corporate Finance Equities Equity Research Stockholm Corporate Finance Equities Equity Research • • London Corporate Finance Equities Equity Research ECM Corporate Finance SEB Enskilda is the market leader in the provision of specialist advice in Mergers and Acquisitions and Equity Finance, principally in Nordic related transactions Oslo Corporate Finance Equities Equity Research Copenhagen Corporate Finance Equities Equity Research SEB Enskilda is the leading Nordic investment bank employing around 450 Corporate Finance and Equities professionals in 8 offices • Pan Nordic presence SEB Enskilda has investment banking and broking operations in all Nordic and Baltic countries as well as London, New York, and Frankfurt 2 Tallinn Corporate Finance Equities Equity Research Riga Corporate Finance Equities Equity Research Vilnius Corporate Finance Equities Equity Research Frankfurt Equities New York Equities Corporate Finance alliance with The Blackstone Group

SEB Enskilda awards Thompson Financial Best research house in the Nordic Countries Best research house in Sweden 5 consecutive years 4 consecutive years June 2006 No. 1 Research house in the Nordic countries Best equity research in Sweden No. 1 in Corporate Finance for Sweden, Norway, Finland Denmark May 2005 No. 1 stockbroker in Sweden, Norway and Denmark 3 consecutive years 4 consecutive years December 2005 November 2005 December 2005 3 Best research house for the Nordic region No. 1 for equity research in Norway 2 consecutive years February 2006 January 2006 Overall No. 1 in research on Nordic shares - UK, US and Continental Europe Best Equity house in the Nordic/ Baltic Region 4 consecutive years 3 consecutive years May 2006 June 2004

Corporate Finance 4

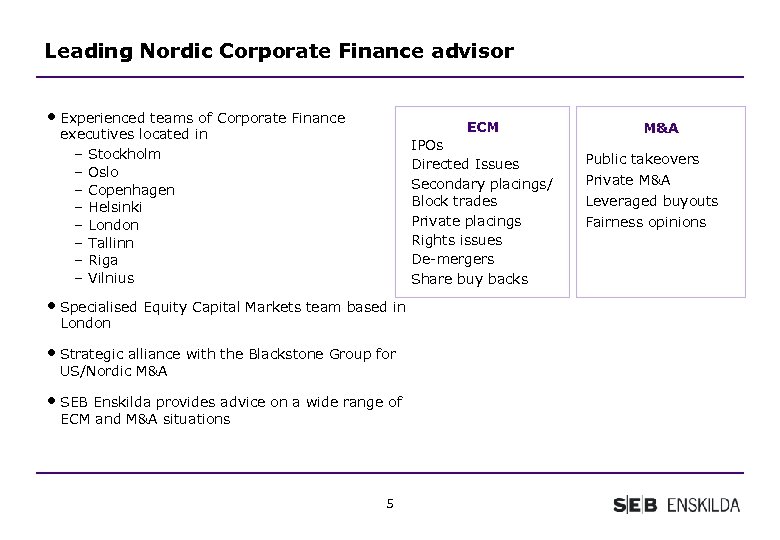

Leading Nordic Corporate Finance advisor • Experienced teams of Corporate Finance ECM executives located in – Stockholm – Oslo – Copenhagen – Helsinki – London – Tallinn – Riga – Vilnius IPOs Directed Issues Secondary placings/ Block trades Private placings Rights issues De-mergers Share buy backs • Specialised Equity Capital Markets team based in London • Strategic alliance with the Blackstone Group for US/Nordic M&A • SEB Enskilda provides advice on a wide range of ECM and M&A situations 5 M&A Public takeovers Private M&A Leveraged buyouts Fairness opinions

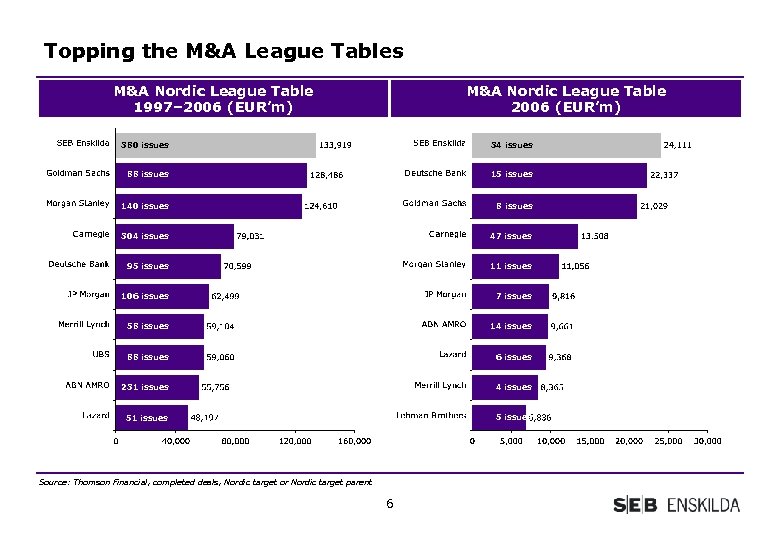

Topping the M&A League Tables M&A Nordic League Table 1997– 2006 (EUR’m) M&A Nordic League Table 2006 (EUR’m) 380 issues 34 issues 88 issues 15 issues 140 issues 8 issues 304 issues 47 issues 95 issues 11 issues 106 issues 7 issues 58 issues 14 issues 88 issues 6 issues 231 issues 4 issues 51 issues 5 issues Source: Thomson Financial, completed deals, Nordic target or Nordic target parent 6

Equities 7

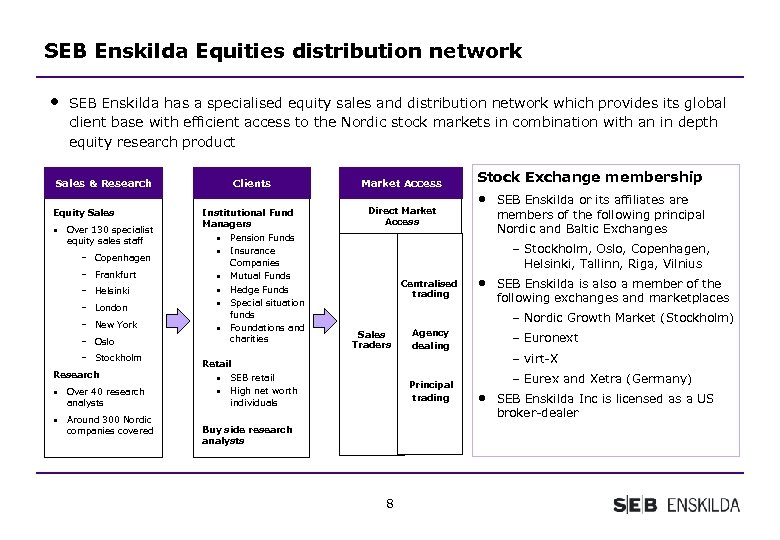

SEB Enskilda Equities distribution network • SEB Enskilda has a specialised equity sales and distribution network which provides its global client base with efficient access to the Nordic stock markets in combination with an in depth equity research product Sales & Research Equity Sales • Over 130 specialist equity sales staff – Copenhagen – Frankfurt – Helsinki – London – New York – Oslo – Stockholm Research • Over 40 research analysts • Around 300 Nordic companies covered Clients Institutional Fund Managers • Pension Funds • Insurance Companies Market Access Direct Market Access Stock Exchange membership • – Stockholm, Oslo, Copenhagen, Helsinki, Tallinn, Riga, Vilnius • Mutual Funds • Hedge Funds • Special situation Centralised trading • funds • Foundations and charities SEB Enskilda or its affiliates are members of the following principal Nordic and Baltic Exchanges SEB Enskilda is also a member of the following exchanges and marketplaces – Nordic Growth Market (Stockholm) Sales Traders Agency dealing – Euronext – virt-X Retail • SEB retail • High net worth Principal trading individuals Buy side research analysts 8 – Eurex and Xetra (Germany) • SEB Enskilda Inc is licensed as a US broker-dealer

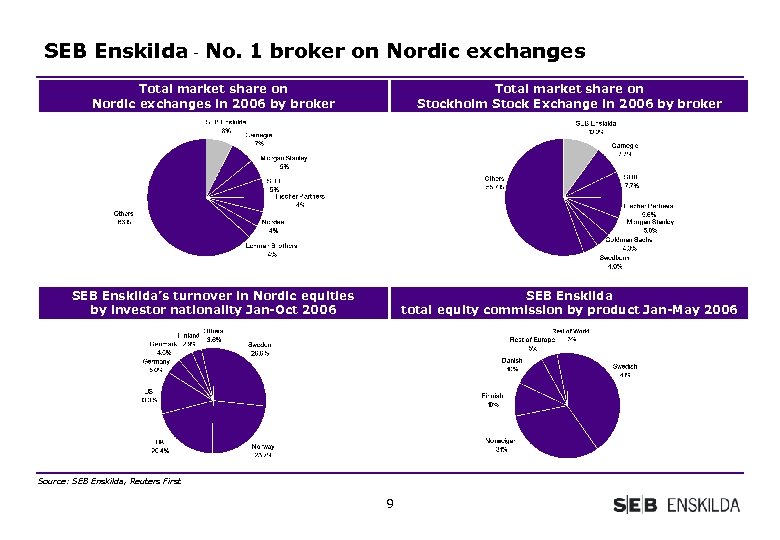

SEB Enskilda - No. 1 broker on Nordic exchanges Total market share on Nordic exchanges in 2006 by broker Total market share on Stockholm Stock Exchange in 2006 by broker SEB Enskilda’s turnover in Nordic equities by investor nationality Jan-Oct 2006 SEB Enskilda total equity commission by product Jan-May 2006 Source: SEB Enskilda, Reuters First 9

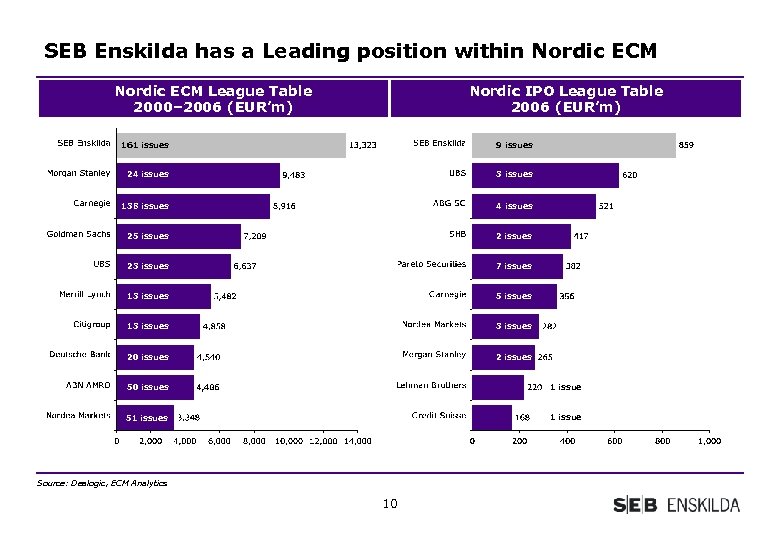

SEB Enskilda has a Leading position within Nordic ECM League Table 2000– 2006 (EUR’m) Nordic IPO League Table 2006 (EUR’m) 161 issues 9 issues 24 issues 3 issues 138 issues 4 issues 25 issues 23 issues 7 issues 13 issues 5 issues 13 issues 20 issues 2 issues 50 issues 1 issue 51 issues 1 issue Source: Dealogic, ECM Analytics 10

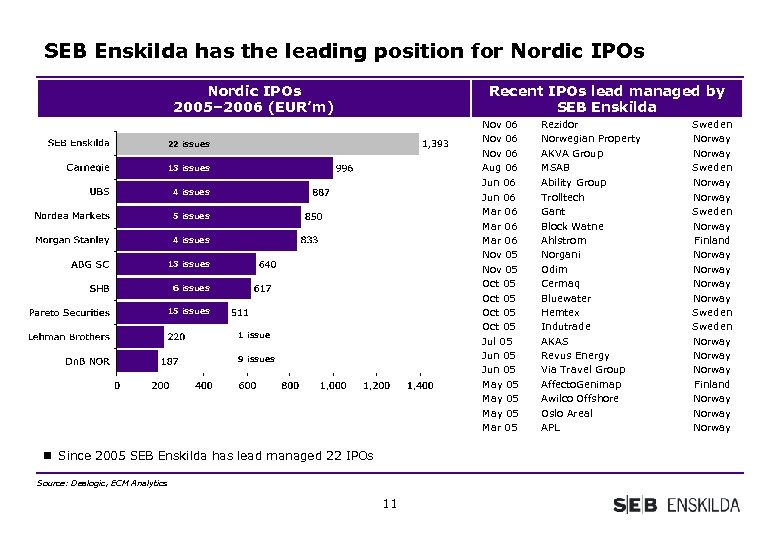

SEB Enskilda has the leading position for Nordic IPOs 2005– 2006 (EUR’m) Recent IPOs lead managed by SEB Enskilda Nov 06 Aug 06 Jun 06 13 issues 4 issues 5 issues 4 issues 13 issues 6 issues 15 issues 1 issue 9 issues n Since 2005 SEB Enskilda has lead managed 22 IPOs Source: Dealogic, ECM Analytics 11 Sweden Norway Jun 06 Mar 06 Nov 05 Oct 05 Jul 05 Jun 05 May 05 Mar 05 22 issues Rezidor Norwegian Property AKVA Group MSAB Ability Group Trolltech Gant Block Watne Ahlstrom Norgani Odim Cermaq Bluewater Hemtex Indutrade AKAS Revus Energy Via Travel Group Affecto. Genimap Awilco Offshore Oslo Areal APL Norway Sweden Norway Finland Norway Sweden Norway Finland Norway

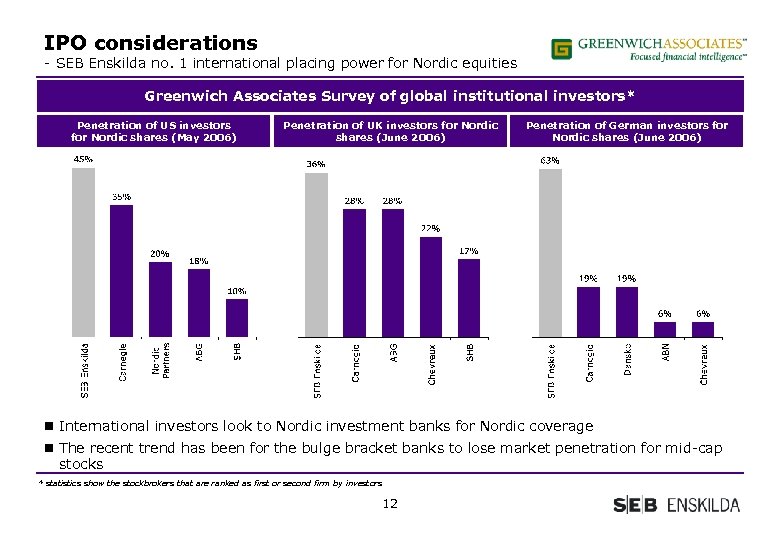

IPO considerations - SEB Enskilda no. 1 international placing power for Nordic equities Greenwich Associates Survey of global institutional investors* Penetration of US investors for Nordic shares (May 2006) Penetration of UK investors for Nordic shares (June 2006) Penetration of German investors for Nordic shares (June 2006) n International investors look to Nordic investment banks for Nordic coverage n The recent trend has been for the bulge bracket banks to lose market penetration for mid-cap stocks * statistics show the stockbrokers that are ranked as first or second firm by investors 12

Research 13

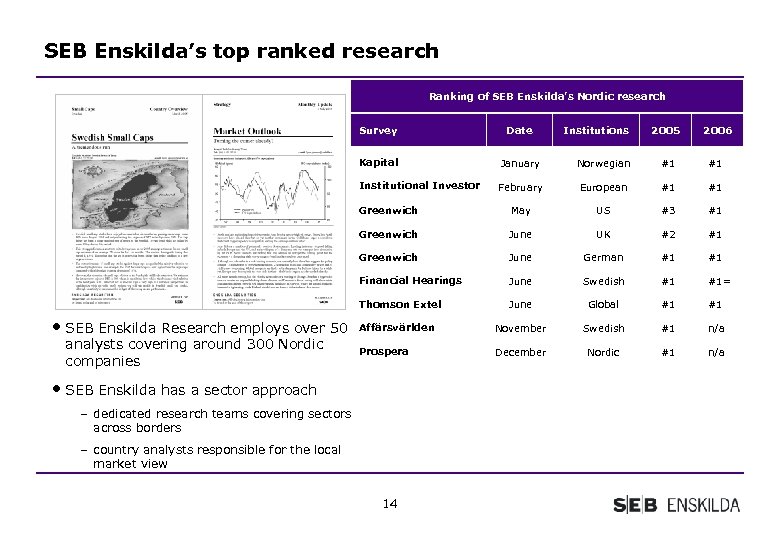

SEB Enskilda’s top ranked research Ranking of SEB Enskilda’s Nordic research Survey Kapital 2005 2006 Norwegian #1 #1 February European #1 #1 Greenwich May US #3 #1 Greenwich June UK #2 #1 Greenwich June German #1 #1 Financial Hearings June Swedish #1 #1= Thomson Extel analysts covering around 300 Nordic companies January Institutional Investor • SEB Enskilda Research employs over 50 Date June Global #1 #1 Affärsvärlden November Swedish #1 n/a Prospera December Nordic #1 n/a • SEB Enskilda has a sector approach – dedicated research teams covering sectors across borders – country analysts responsible for the local market view 14 Institutions

Research surveys - Sweden Affärsvärlden’s yearly survey of Equity Research in Sweden • Sweden’s largest investors all agree that SEB Enskilda is the best research house in the country – best research house overall – best in communication of their research Best equity research in Sweden – best strategy research 2 consecutive years – no. 1 in 8 of 14 sectors November 2004 – no. 2 in 3 sectors Financial Hearings’ yearly survey of Equity Research in Sweden • • Best equity research in Sweden SEB Enskilda was voted Best Research House in Sweden by a wide margin for the second year in a row Companies gave SEB Enskilda analysts 5 top rankings out of 14 possible on industry knowledge 3 consecutive years June 2005 15

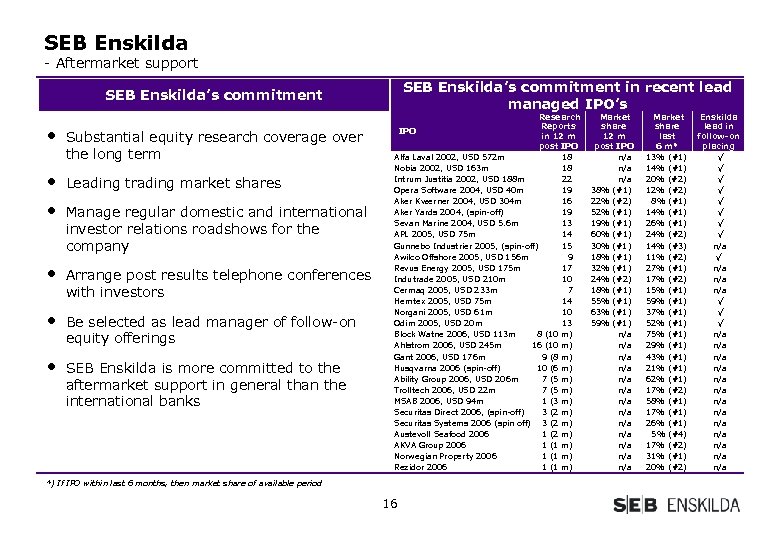

SEB Enskilda - Aftermarket support SEB Enskilda’s commitment in recent lead managed IPO’s SEB Enskilda’s commitment • Substantial equity research coverage over the long term • Leading trading market shares • Manage regular domestic and international investor relations roadshows for the company • Arrange post results telephone conferences with investors • Be selected as lead manager of follow-on equity offerings • SEB Enskilda is more committed to the aftermarket support in general than the international banks Research Reports IPO in 12 m post IPO Alfa Laval 2002, USD 572 m 18 Nobia 2002, USD 163 m 18 Intrum Justitia 2002, USD 188 m 22 Opera Software 2004, USD 40 m 19 Aker Kværner 2004, USD 304 m 16 Aker Yards 2004, (spin-off) 19 Sevan Marine 2004, USD 5. 6 m 13 APL 2005, USD 75 m 14 Gunnebo Industrier 2005, (spin-off) 15 Awilco Offshore 2005, USD 156 m 9 Revus Energy 2005, USD 175 m 17 Indutrade 2005, USD 210 m 10 Cermaq 2005, USD 233 m 7 Hemtex 2005, USD 75 m 14 Norgani 2005, USD 61 m 10 Odim 2005, USD 20 m 13 Block Watne 2006, USD 113 m 8 (10 m) Ahlstrom 2006, USD 245 m 16 (10 m) Gant 2006, USD 176 m 9 (8 m) Husqvarna 2006 (spin-off) 10 (6 m) Ability Group 2006, USD 206 m 7 (5 m) Trolltech 2006, USD 22 m 7 (5 m) MSAB 2006, USD 94 m 1 (3 m) Securitas Direct 2006, (spin-off) 3 (2 m) Securitas Systems 2006 (spin off) 3 (2 m) Austevoll Seafood 2006 1 (2 m) AKVA Group 2006 1 (1 m) Norwegian Property 2006 1 (1 m) Rezidor 2006 1 (1 m) *) If IPO within last 6 months, then market share of available period 16 Market share 12 m post IPO n/a n/a 38% (#1) 22% (#2) 52% (#1) 19% (#1) 60% (#1) 30% (#1) 18% (#1) 32% (#1) 24% (#2) 18% (#1) 55% (#1) 63% (#1) 59% (#1) n/a n/a n/a n/a Market share last 6 m* 13% (#1) 14% (#1) 20% (#2) 12% (#2) 8% (#1) 14% (#1) 26% (#1) 24% (#2) 14% (#3) 11% (#2) 27% (#1) 17% (#2) 15% (#1) 59% (#1) 37% (#1) 52% (#1) 75% (#1) 29% (#1) 43% (#1) 21% (#1) 62% (#1) 17% (#2) 58% (#1) 17% (#1) 26% (#1) 5% (#4) 17% (#2) 31% (#1) 20% (#2) Enskilda lead in follow-on placing √ √ √ √ n/a n/a √ √ √ n/a n/a n/a n/a

SEB Enskilda in the Baltics 17

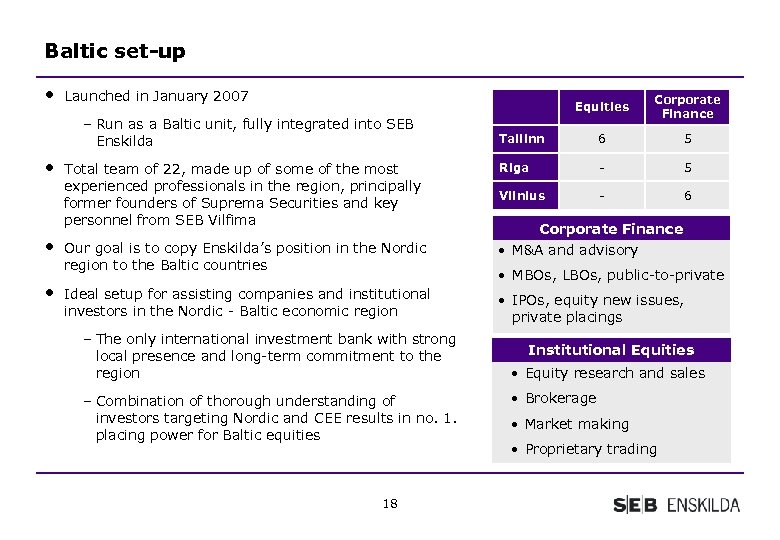

Baltic set-up • Launched in January 2007 Equities Corporate Finance Tallinn 6 5 Total team of 22, made up of some of the most experienced professionals in the region, principally former founders of Suprema Securities and key personnel from SEB Vilfima Riga - 5 Vilnius - 6 Our goal is to copy Enskilda’s position in the Nordic region to the Baltic countries • M&A and advisory Ideal setup for assisting companies and institutional investors in the Nordic - Baltic economic region • IPOs, equity new issues, private placings – Run as a Baltic unit, fully integrated into SEB Enskilda • • • – The only international investment bank with strong local presence and long-term commitment to the region – Combination of thorough understanding of investors targeting Nordic and CEE results in no. 1. placing power for Baltic equities 18 Corporate Finance • MBOs, LBOs, public-to-private Institutional Equities • Equity research and sales • Brokerage • Market making • Proprietary trading

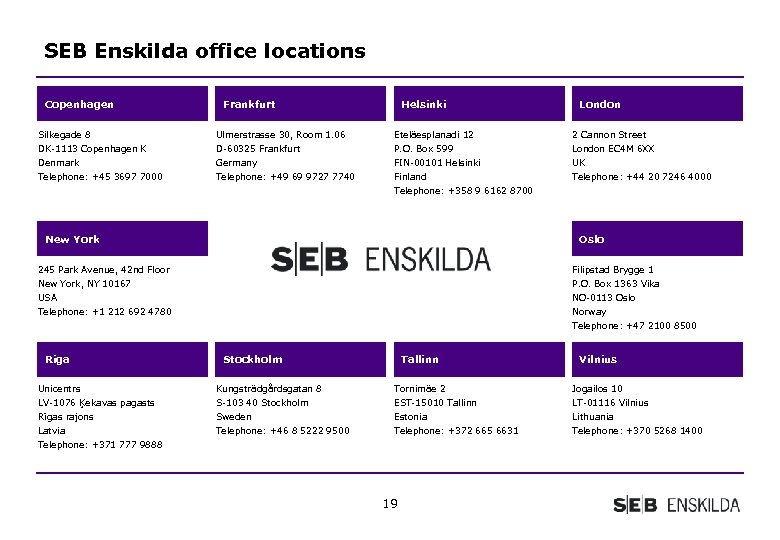

SEB Enskilda office locations Copenhagen Frankfurt Helsinki London Silkegade 8 Ulmerstrasse 30, Room 1. 06 Eteläesplanadi 12 2 Cannon Street DK-1113 Copenhagen K D-60325 Frankfurt P. O. Box 599 London EC 4 M 6 XX Denmark Germany FIN-00101 Helsinki UK Telephone: +45 3697 7000 Telephone: +49 69 9727 7740 Finland Telephone: +44 20 7246 4000 Telephone: +358 9 6162 8700 Oslo New York 245 Park Avenue, 42 nd Floor Filipstad Brygge 1 New York, NY 10167 P. O. Box 1363 Vika USA NO-0113 Oslo Telephone: +1 212 692 4780 Norway Telephone: +47 2100 8500 Riga Stockholm Tallinn Vilnius Unicentrs Kungsträdgårdsgatan 8 Tornimäe 2 Jogailos 10 LV-1076 Ķekavas pagasts S-103 40 Stockholm EST-15010 Tallinn LT-01116 Vilnius Rīgas rajons Sweden Estonia Lithuania Latvia Telephone: +46 8 5222 9500 Telephone: +372 665 6631 Telephone: +370 5268 1400 Telephone: +371 777 9888 19

e805f81d2275da54ceeb6a87e4b73f0b.ppt