7def7baa2280f7d0eacb8dde5d5c0989.ppt

- Количество слайдов: 16

Introduction 1 (5) Bank financial statements (1) Balance Sheet (B) Liabilities ØTwo major categories of liabilities are included in the balance sheet: (1) Deposits made by and owed to various customers. (2) Non-deposits borrowing of funds in the money and capital market. 3/15/2018

Introduction 2 (5) Bank financial statements (1) Balance Sheet (B) Liabilities (1) Deposits made by and owed to various customers. v Deposits are the main source of funding for banks. v There are four kinds of deposits: (1) Demand deposits: represent customer deposits in regular checking accounts that do not pay interest. 3/15/2018

Introduction 3 (5) Bank financial statements (1) Balance Sheet (2) NOW accounts (Negotiable order accounts): represent checking accounts that pay interest. (3) Saving deposits: represent the traditional saving accounts that bear the lowest rate of interest. (4) Time deposits: represent high-yielding saving certificate offered by banks and usually carry a fixed term and a stipulated interest rate. Dr. Amr Nazieh 3/15/2018

Introduction 4 (5) Bank financial statements (1) Balance Sheet q Summary of deposit account: Noninterest-Bearing Demand Deposits or regular checking account Savings Deposits (bear the lowest interest rate) Now Accounts (Individuals and not-for profit) Time Deposits (certificate of deposits) 3/15/2018

Introduction 5 (5) Bank financial statements (1) Balance Sheet (B) Liabilities (2) Non-deposits borrowing of funds in the money and capital market. v Represent the banks temporary borrowing in the money market, mainly from reserves loaned to the bank by the Central bank in Egypt. v These transactions are carried out mainly to supplement deposits and provide the additional liquidity that cash assets and securities cannot provide. 3/15/2018

Introduction 6 (5) Bank financial statements (1) Balance Sheet (C) Owners’ Equity ØEquity capital: or the shareholders’ equity supplies the long-term and relatively stable base of financial support upon which the bank will rely to grow and to cover any extraordinary losses it incurs. 3/15/2018

Introduction 7 (5) Bank financial statements (1) Balance Sheet ØOwners’ equity includes the following: (1) Preferred Stock (2) Common Stock o Common Stock authorized and Outstanding (3) Capital Surplus. (4) Retained Earnings (Undivided Profits). (5) Treasury Stock. (6) Contingency Reserve. 3/15/2018

Introduction 8 (5) Bank financial statements (1) Balance Sheet ØLiabilities and equity capital represent accumulated sources of funds, which provide the needed spending power for the bank to acquire its assets. ØOn the other hand, a bank’s assets represent the accumulated uses of funds, which are made to generate income for shareholders, pay interest to depositors, and compensate the bank’s employees. 3/15/2018

Introduction 9 (5) Bank financial statements (1) Balance Sheet Accumulated uses of funds (Assets) Accumulated sources of funds (liabilities and equity capital) 3/15/2018

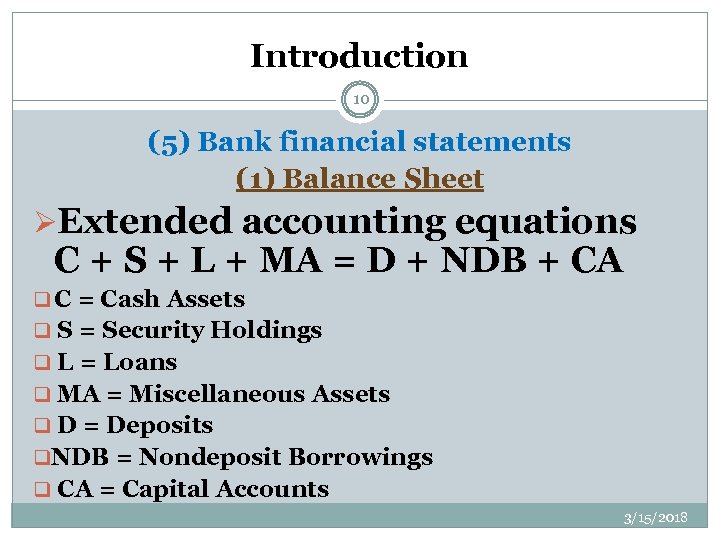

Introduction 10 (5) Bank financial statements (1) Balance Sheet ØExtended accounting equations C + S + L + MA = D + NDB + CA q C = Cash Assets q S = Security Holdings q L = Loans q MA = Miscellaneous Assets q D = Deposits q. NDB = Nondeposit Borrowings q CA = Capital Accounts 3/15/2018

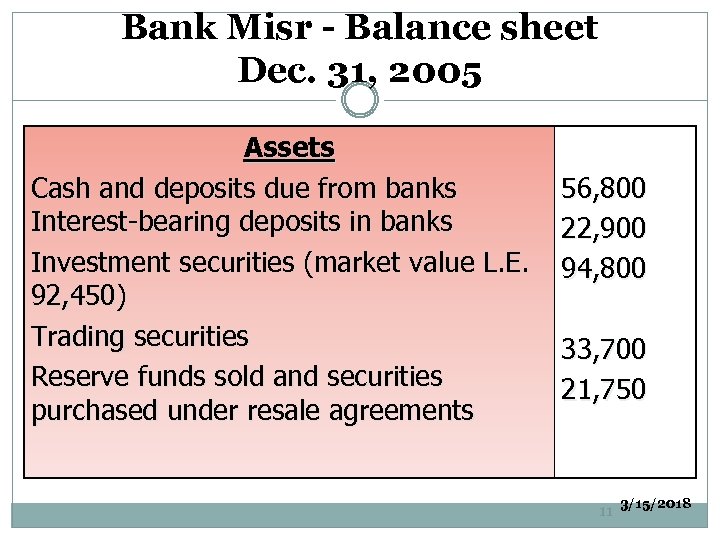

Bank Misr - Balance sheet Dec. 31, 2005 Assets Cash and deposits due from banks Interest-bearing deposits in banks Investment securities (market value L. E. 92, 450) Trading securities Reserve funds sold and securities purchased under resale agreements 56, 800 22, 900 94, 800 33, 700 21, 750 11 3/15/2018

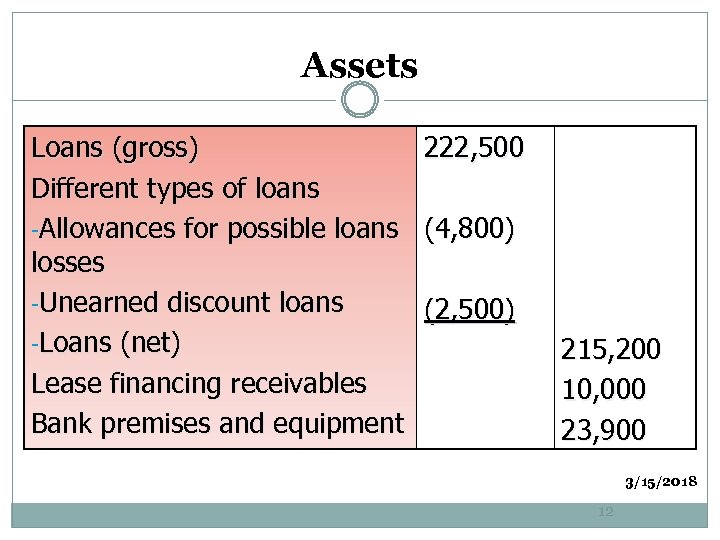

Assets Loans (gross) 222, 500 Different types of loans -Allowances for possible loans (4, 800) losses -Unearned discount loans (2, 500) -Loans (net) Lease financing receivables Bank premises and equipment 215, 200 10, 000 23, 900 3/15/2018 12

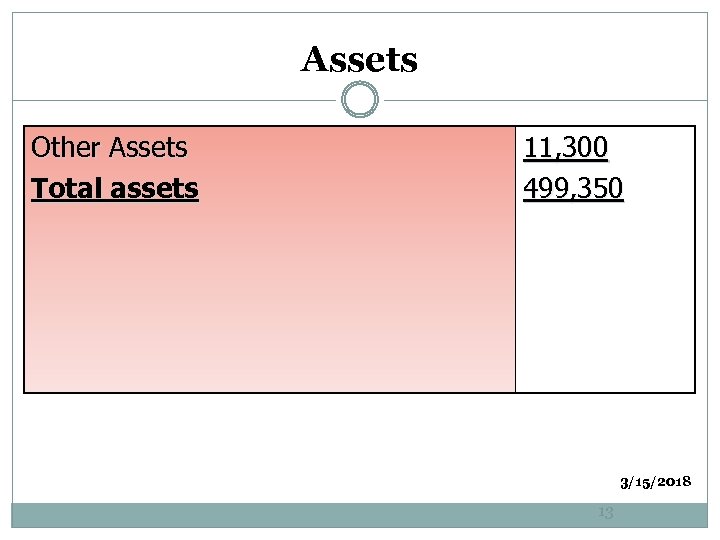

Assets Other Assets Total assets 11, 300 499, 350 3/15/2018 13

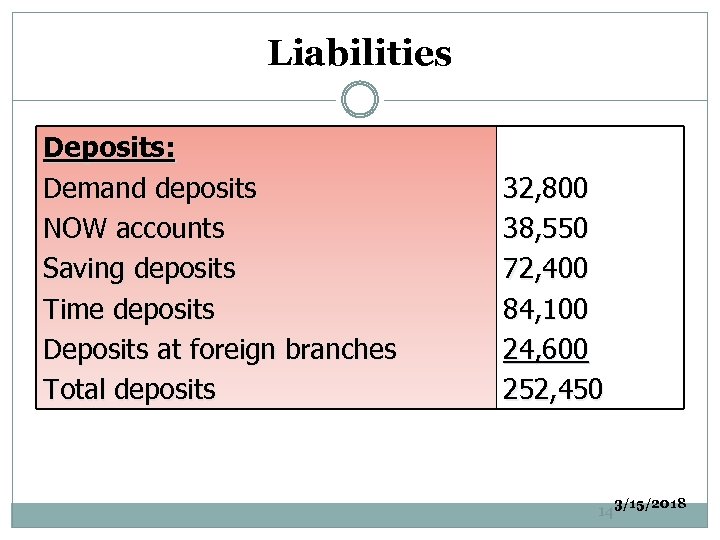

Liabilities Deposits: Demand deposits NOW accounts Saving deposits Time deposits Deposits at foreign branches Total deposits 32, 800 38, 550 72, 400 84, 100 24, 600 252, 450 14 3/15/2018

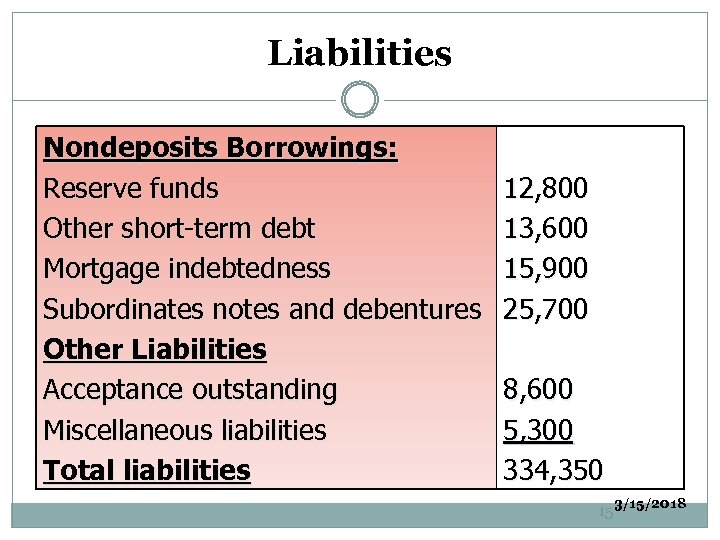

Liabilities Nondeposits Borrowings: Reserve funds Other short-term debt Mortgage indebtedness Subordinates notes and debentures Other Liabilities Acceptance outstanding Miscellaneous liabilities Total liabilities 12, 800 13, 600 15, 900 25, 700 8, 600 5, 300 334, 350 15 3/15/2018

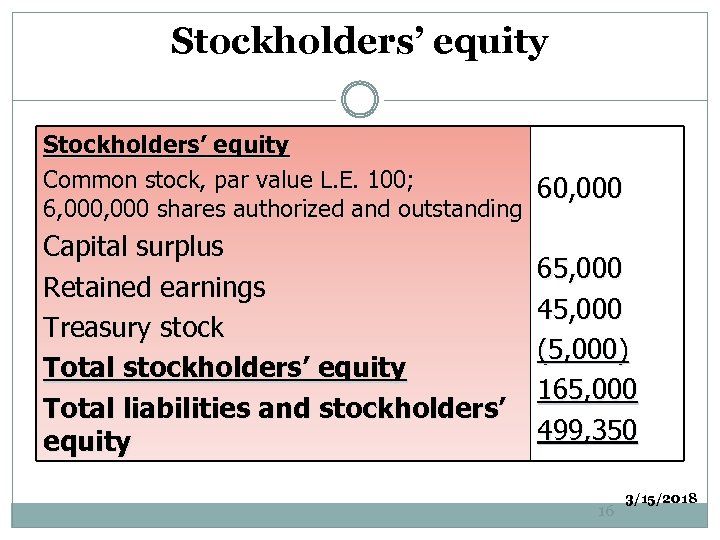

Stockholders’ equity Common stock, par value L. E. 100; 60, 000 6, 000 shares authorized and outstanding Capital surplus Retained earnings Treasury stock Total stockholders’ equity Total liabilities and stockholders’ equity 65, 000 45, 000 (5, 000) 165, 000 499, 350 16 3/15/2018

7def7baa2280f7d0eacb8dde5d5c0989.ppt