c3a336d83932b441d204cde6430f2b05.ppt

- Количество слайдов: 58

Introdución a SWIFT: Facilitando ventajas competitivas a través de estándares comunes y una plataforma compartida Lambert Timmermans Gerente América Latina, SWIFT sc Cartagena - Agosto 2005 Slide 1

Introdución a SWIFT: Facilitando ventajas competitivas a través de estándares comunes y una plataforma compartida Lambert Timmermans Gerente América Latina, SWIFT sc Cartagena - Agosto 2005 Slide 1

SWIFT Plenary - Agenda < The 2010 Strategy of SWIFT < SWIFT in Latin America < SWIFTNet solutions helping you building competitive advantage Slide 2

SWIFT Plenary - Agenda < The 2010 Strategy of SWIFT < SWIFT in Latin America < SWIFTNet solutions helping you building competitive advantage Slide 2

SWIFT Plenary - Agenda < The 2010 Strategy of SWIFT < SWIFT in Latin America < SWIFTNet solutions helping you building competitive advantage Slide 3

SWIFT Plenary - Agenda < The 2010 Strategy of SWIFT < SWIFT in Latin America < SWIFTNet solutions helping you building competitive advantage Slide 3

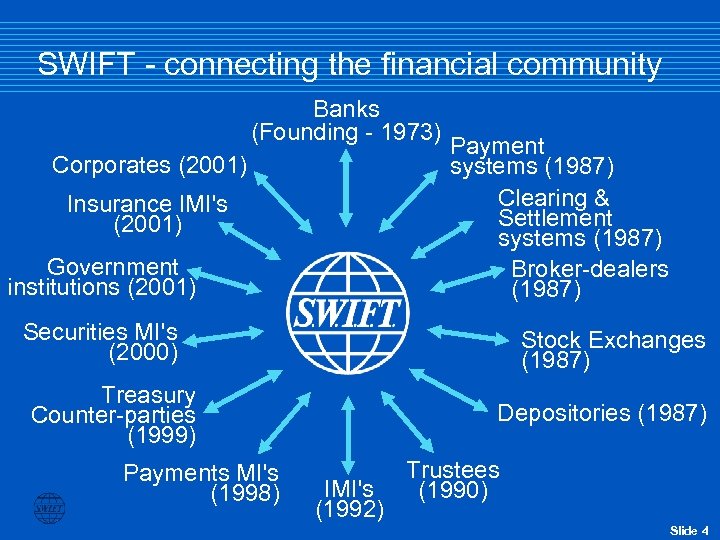

SWIFT - connecting the financial community Banks (Founding - 1973) Corporates (2001) Insurance IMI's (2001) Government institutions (2001) Payment systems (1987) Clearing & Settlement systems (1987) Broker-dealers (1987) Securities MI's (2000) Stock Exchanges (1987) Treasury Counter-parties (1999) Payments MI's (1998) Depositories (1987) IMI's (1992) Trustees (1990) Slide 4

SWIFT - connecting the financial community Banks (Founding - 1973) Corporates (2001) Insurance IMI's (2001) Government institutions (2001) Payment systems (1987) Clearing & Settlement systems (1987) Broker-dealers (1987) Securities MI's (2000) Stock Exchanges (1987) Treasury Counter-parties (1999) Payments MI's (1998) Depositories (1987) IMI's (1992) Trustees (1990) Slide 4

Visión SWIFT 2006 "Nuestra misión es ser la infraestructura de mensajería de la comunidad financiera, aportando el menor riesgo y los mayores niveles de contingencia. " Slide 5

Visión SWIFT 2006 "Nuestra misión es ser la infraestructura de mensajería de la comunidad financiera, aportando el menor riesgo y los mayores niveles de contingencia. " Slide 5

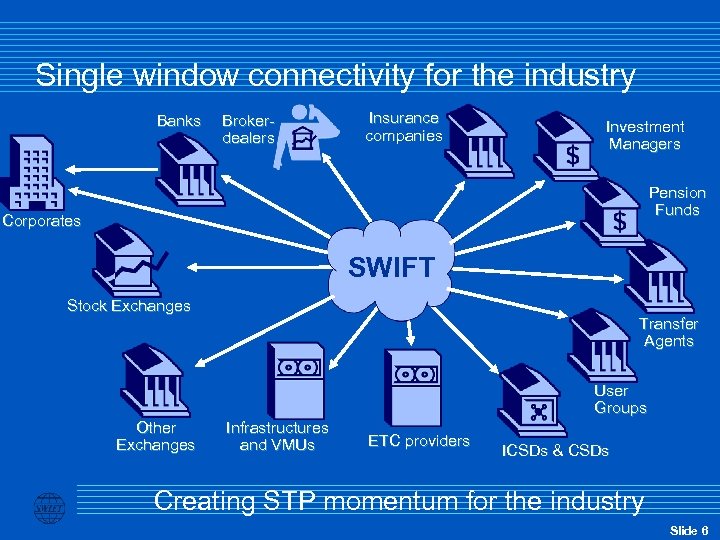

Single window connectivity for the industry Banks Brokerdealers Insurance companies Investment Managers Pension Funds Corporates SWIFT Stock Exchanges Transfer Agents User Groups Other Exchanges Infrastructures and VMUs ETC providers ICSDs & CSDs Creating STP momentum for the industry Slide 6

Single window connectivity for the industry Banks Brokerdealers Insurance companies Investment Managers Pension Funds Corporates SWIFT Stock Exchanges Transfer Agents User Groups Other Exchanges Infrastructures and VMUs ETC providers ICSDs & CSDs Creating STP momentum for the industry Slide 6

SWIFT 2006 Making financial messaging safer and less costly Slide 7

SWIFT 2006 Making financial messaging safer and less costly Slide 7

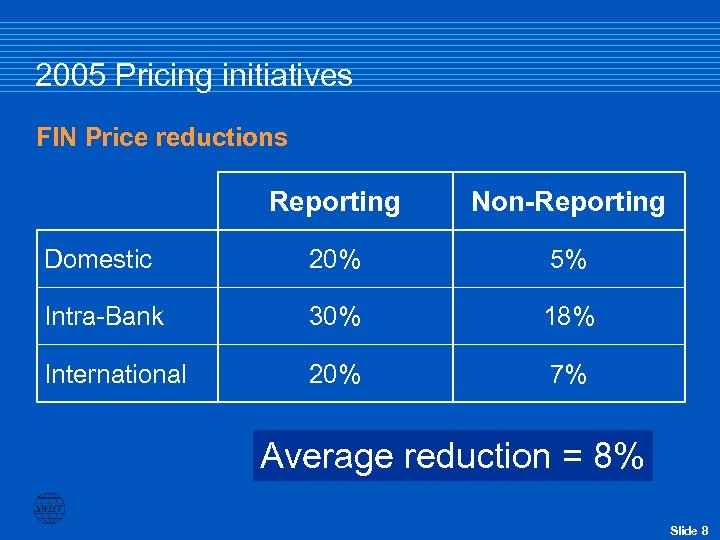

2005 Pricing initiatives FIN Price reductions Reporting Non-Reporting Domestic 20% 5% Intra-Bank 30% 18% International 20% 7% Average reduction = 8% Slide 8

2005 Pricing initiatives FIN Price reductions Reporting Non-Reporting Domestic 20% 5% Intra-Bank 30% 18% International 20% 7% Average reduction = 8% Slide 8

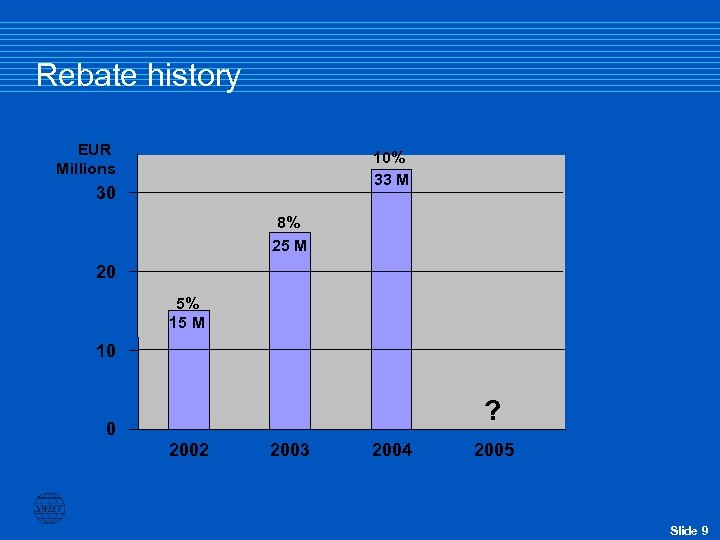

Rebate history EUR Millions 10% 33 M 30 8% 25 M 20 5% 15 M 10 ? 0 2002 2003 2004 2005 Slide 9

Rebate history EUR Millions 10% 33 M 30 8% 25 M 20 5% 15 M 10 ? 0 2002 2003 2004 2005 Slide 9

Reducing total cost of ownership Service bureaux Introductory packages for small users ISP local loop Member concentrator model approved SWIFTAlliance starter set ($ 4, 750) fee waived Slide 10

Reducing total cost of ownership Service bureaux Introductory packages for small users ISP local loop Member concentrator model approved SWIFTAlliance starter set ($ 4, 750) fee waived Slide 10

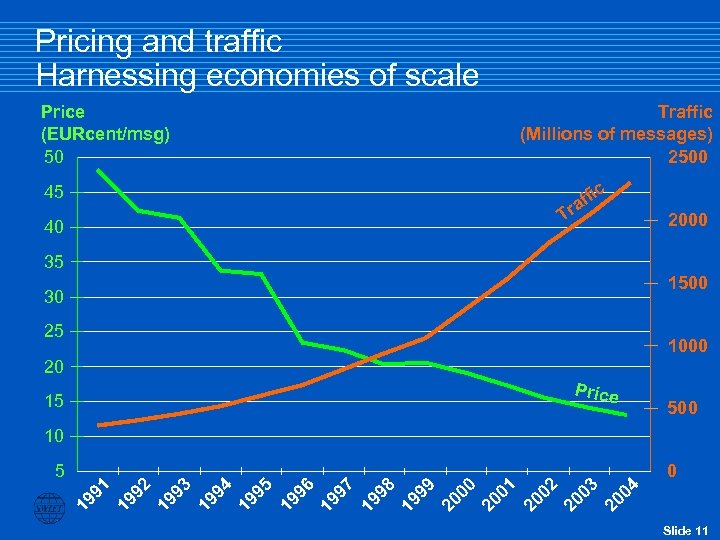

Pricing and traffic Harnessing economies of scale Price (EURcent/msg) 50 Traffic (Millions of messages) 2500 c ffi a 45 Tr 40 2000 35 1500 30 25 1000 20 Price 15 500 10 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 4 19 9 93 19 19 2 0 91 5 Slide 11

Pricing and traffic Harnessing economies of scale Price (EURcent/msg) 50 Traffic (Millions of messages) 2500 c ffi a 45 Tr 40 2000 35 1500 30 25 1000 20 Price 15 500 10 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 4 19 9 93 19 19 2 0 91 5 Slide 11

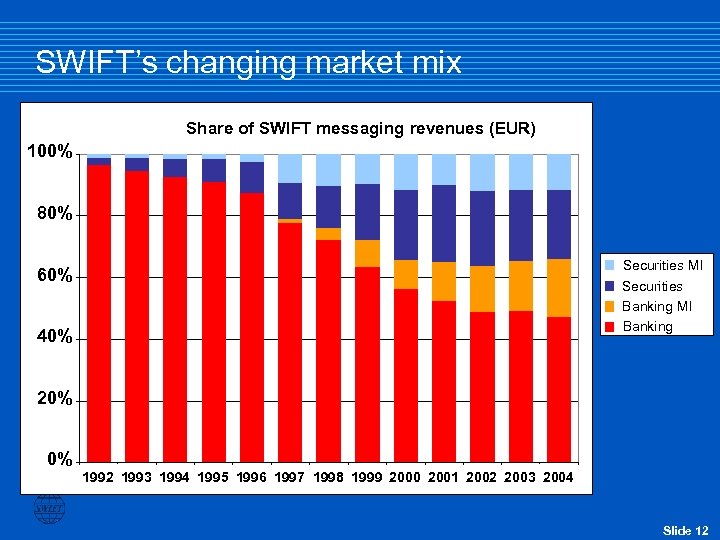

SWIFT’s changing market mix Share of SWIFT messaging revenues (EUR) 100% 80% Securities MI Securities Banking MI Banking 60% 40% 20% 0% 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Slide 12

SWIFT’s changing market mix Share of SWIFT messaging revenues (EUR) 100% 80% Securities MI Securities Banking MI Banking 60% 40% 20% 0% 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Slide 12

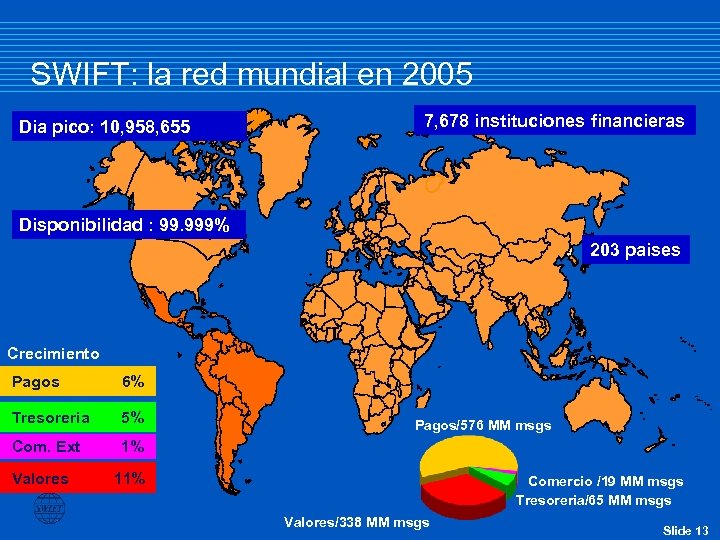

SWIFT: la red mundial en 2005 Dia pico: 10, 958, 655 7, 678 instituciones financieras Disponibilidad : 99. 999% 203 paises Crecimiento Pagos 6% Tresoreria 5% Com. Ext 1% Valores Pagos/576 MM msgs 11% Comercio /19 MM msgs Tresoreria/65 MM msgs Valores/338 MM msgs Slide 13

SWIFT: la red mundial en 2005 Dia pico: 10, 958, 655 7, 678 instituciones financieras Disponibilidad : 99. 999% 203 paises Crecimiento Pagos 6% Tresoreria 5% Com. Ext 1% Valores Pagos/576 MM msgs 11% Comercio /19 MM msgs Tresoreria/65 MM msgs Valores/338 MM msgs Slide 13

Banking market infrastructures in 1995 EBA Norway Slide 14

Banking market infrastructures in 1995 EBA Norway Slide 14

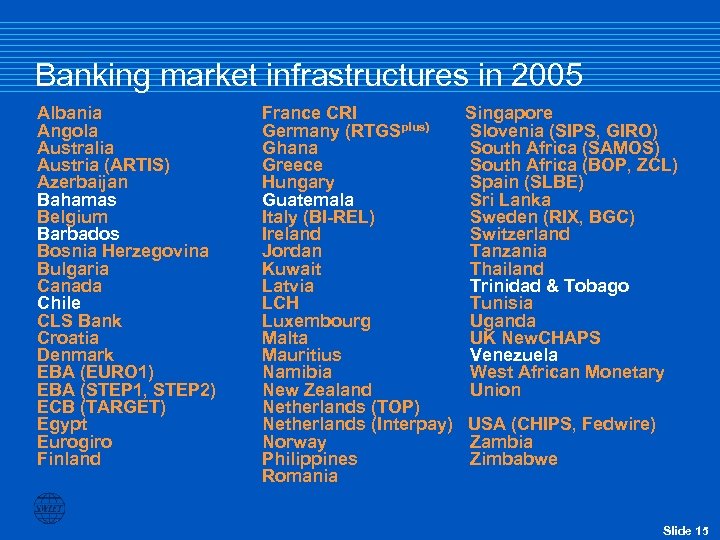

Banking market infrastructures in 2005 Albania Angola Australia Austria (ARTIS) Azerbaijan Bahamas Belgium Barbados Bosnia Herzegovina Bulgaria Canada Chile CLS Bank Croatia Denmark EBA (EURO 1) EBA (STEP 1, STEP 2) ECB (TARGET) Egypt Eurogiro Finland France CRI Germany (RTGSplus) Ghana Greece Hungary Guatemala Italy (BI-REL) Ireland Jordan Kuwait Latvia LCH Luxembourg Malta Mauritius Namibia New Zealand Netherlands (TOP) Netherlands (Interpay) Norway Philippines Romania Singapore Slovenia (SIPS, GIRO) South Africa (SAMOS) South Africa (BOP, ZCL) Spain (SLBE) Sri Lanka Sweden (RIX, BGC) Switzerland Tanzania Thailand Trinidad & Tobago Tunisia Uganda UK New. CHAPS Venezuela West African Monetary Union USA (CHIPS, Fedwire) Zambia Zimbabwe Slide 15

Banking market infrastructures in 2005 Albania Angola Australia Austria (ARTIS) Azerbaijan Bahamas Belgium Barbados Bosnia Herzegovina Bulgaria Canada Chile CLS Bank Croatia Denmark EBA (EURO 1) EBA (STEP 1, STEP 2) ECB (TARGET) Egypt Eurogiro Finland France CRI Germany (RTGSplus) Ghana Greece Hungary Guatemala Italy (BI-REL) Ireland Jordan Kuwait Latvia LCH Luxembourg Malta Mauritius Namibia New Zealand Netherlands (TOP) Netherlands (Interpay) Norway Philippines Romania Singapore Slovenia (SIPS, GIRO) South Africa (SAMOS) South Africa (BOP, ZCL) Spain (SLBE) Sri Lanka Sweden (RIX, BGC) Switzerland Tanzania Thailand Trinidad & Tobago Tunisia Uganda UK New. CHAPS Venezuela West African Monetary Union USA (CHIPS, Fedwire) Zambia Zimbabwe Slide 15

Securities market infrastructures 1995 JP Morgan Cedel Slide 16

Securities market infrastructures 1995 JP Morgan Cedel Slide 16

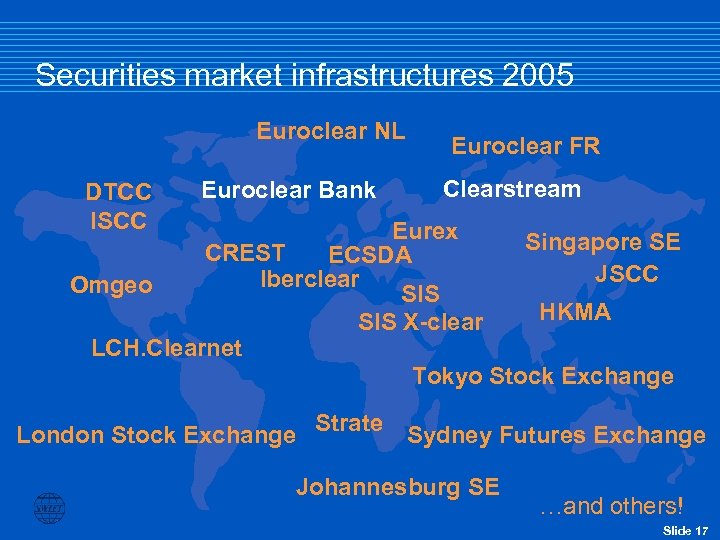

Securities market infrastructures 2005 Euroclear NL DTCC ISCC Euroclear Bank Euroclear FR Clearstream Eurex Singapore SE CREST ECSDA JSCC Iberclear Omgeo SIS HKMA SIS X-clear LCH. Clearnet Tokyo Stock Exchange London Stock Exchange Strate Sydney Futures Exchange Johannesburg SE …and others! Slide 17

Securities market infrastructures 2005 Euroclear NL DTCC ISCC Euroclear Bank Euroclear FR Clearstream Eurex Singapore SE CREST ECSDA JSCC Iberclear Omgeo SIS HKMA SIS X-clear LCH. Clearnet Tokyo Stock Exchange London Stock Exchange Strate Sydney Futures Exchange Johannesburg SE …and others! Slide 17

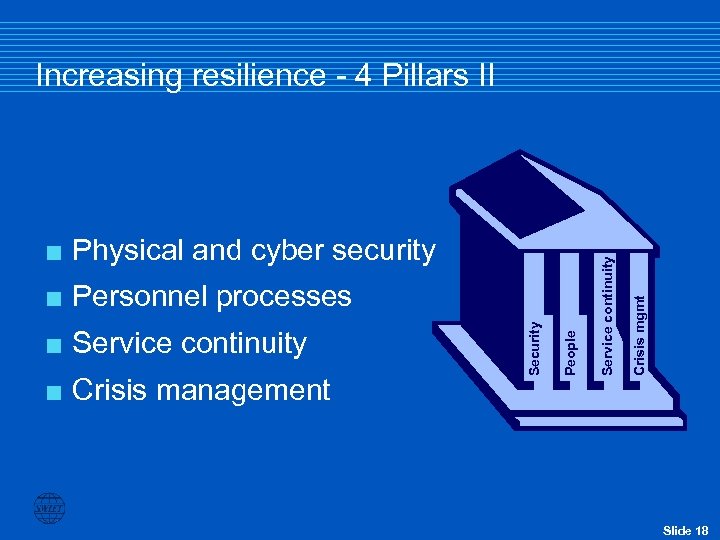

< Service < Crisis processes continuity management People < Personnel Crisis mgmt and cyber security Security < Physical Service continuity Increasing resilience - 4 Pillars II Slide 18

< Service < Crisis processes continuity management People < Personnel Crisis mgmt and cyber security Security < Physical Service continuity Increasing resilience - 4 Pillars II Slide 18

Visión SWIFT 2010? "Nuestra visión es de llegar a ser la principal infraestructura de la comunidad financiera global para la gestión de transacciones con el menor riesgo y la mayor fiabilidad. " Slide 19

Visión SWIFT 2010? "Nuestra visión es de llegar a ser la principal infraestructura de la comunidad financiera global para la gestión de transacciones con el menor riesgo y la mayor fiabilidad. " Slide 19

SWIFT Plenary - Agenda < The 2010 Strategy of SWIFT < SWIFT in Latin America < SWIFTNet solutions helping you building competitive advantage Slide 20

SWIFT Plenary - Agenda < The 2010 Strategy of SWIFT < SWIFT in Latin America < SWIFTNet solutions helping you building competitive advantage Slide 20

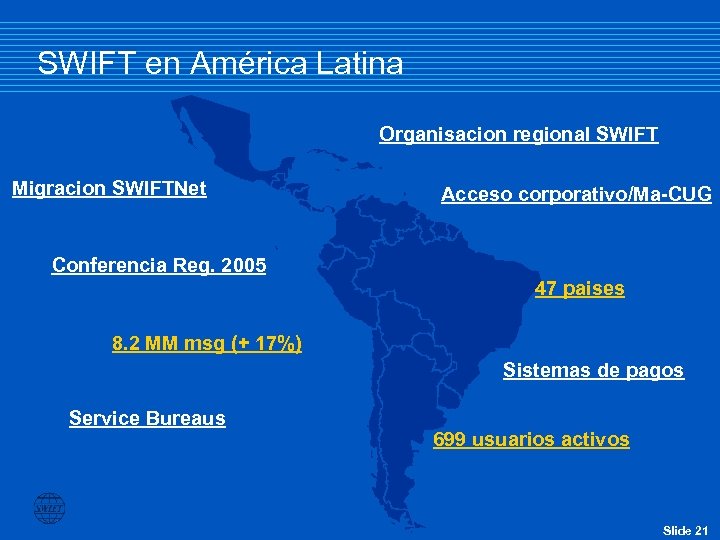

SWIFT en América Latina Organisacion regional SWIFT Migracion SWIFTNet Acceso corporativo/Ma-CUG Conferencia Reg. 2005 47 paises 8. 2 MM msg (+ 17%) Sistemas de pagos Service Bureaus 699 usuarios activos Slide 21

SWIFT en América Latina Organisacion regional SWIFT Migracion SWIFTNet Acceso corporativo/Ma-CUG Conferencia Reg. 2005 47 paises 8. 2 MM msg (+ 17%) Sistemas de pagos Service Bureaus 699 usuarios activos Slide 21

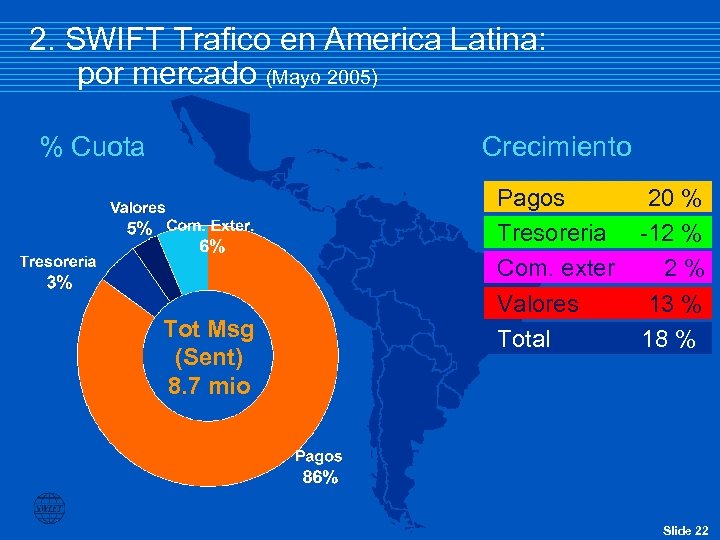

2. SWIFT Trafico en America Latina: por mercado (Mayo 2005) % Cuota Crecimiento Tot Msg (Sent) 8. 7 mio Pagos Tresoreria Com. exter Valores Total 20 % -12 % 2% 13 % 18 % Slide 22

2. SWIFT Trafico en America Latina: por mercado (Mayo 2005) % Cuota Crecimiento Tot Msg (Sent) 8. 7 mio Pagos Tresoreria Com. exter Valores Total 20 % -12 % 2% 13 % 18 % Slide 22

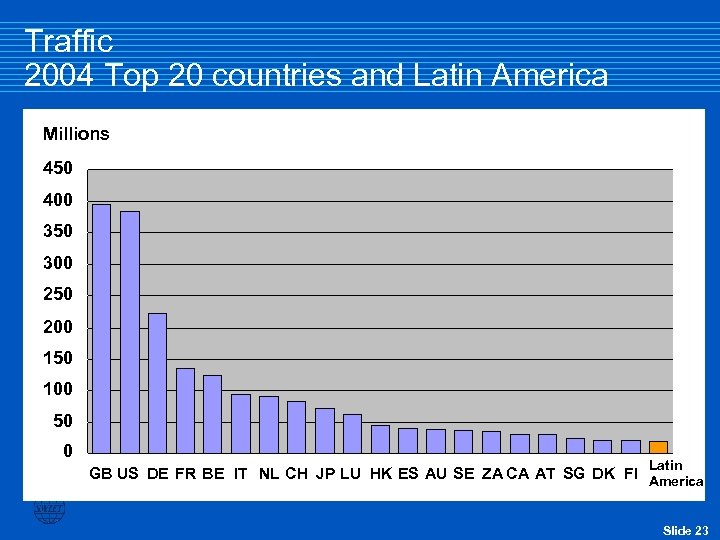

Traffic 2004 Top 20 countries and Latin America Millions 450 400 350 300 250 200 150 100 50 0 Latin GB US DE FR BE IT NL CH JP LU HK ES AU SE ZA CA AT SG DK FI America Slide 23

Traffic 2004 Top 20 countries and Latin America Millions 450 400 350 300 250 200 150 100 50 0 Latin GB US DE FR BE IT NL CH JP LU HK ES AU SE ZA CA AT SG DK FI America Slide 23

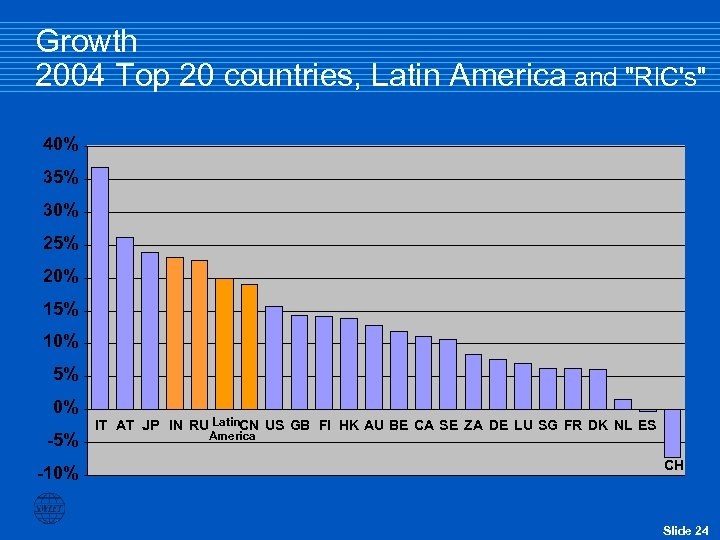

Growth 2004 Top 20 countries, Latin America and "RIC's" 40% 35% 30% 25% 20% 15% 10% 5% 0% -5% -10% IT AT JP IN RU Latin. CN US GB FI HK AU BE CA SE ZA DE LU SG FR DK NL ES America CH Slide 24

Growth 2004 Top 20 countries, Latin America and "RIC's" 40% 35% 30% 25% 20% 15% 10% 5% 0% -5% -10% IT AT JP IN RU Latin. CN US GB FI HK AU BE CA SE ZA DE LU SG FR DK NL ES America CH Slide 24

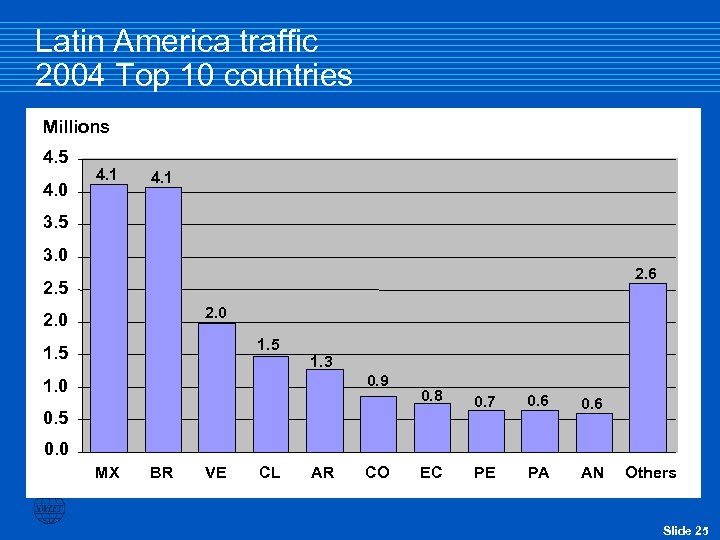

Latin America traffic 2004 Top 10 countries Millions 4. 5 4. 0 4. 1 3. 5 3. 0 2. 6 2. 5 2. 0 1. 5 1. 3 0. 9 1. 0 0. 8 0. 7 0. 6 EC PE PA AN 0. 5 0. 0 MX BR VE CL AR CO Others Slide 25

Latin America traffic 2004 Top 10 countries Millions 4. 5 4. 0 4. 1 3. 5 3. 0 2. 6 2. 5 2. 0 1. 5 1. 3 0. 9 1. 0 0. 8 0. 7 0. 6 EC PE PA AN 0. 5 0. 0 MX BR VE CL AR CO Others Slide 25

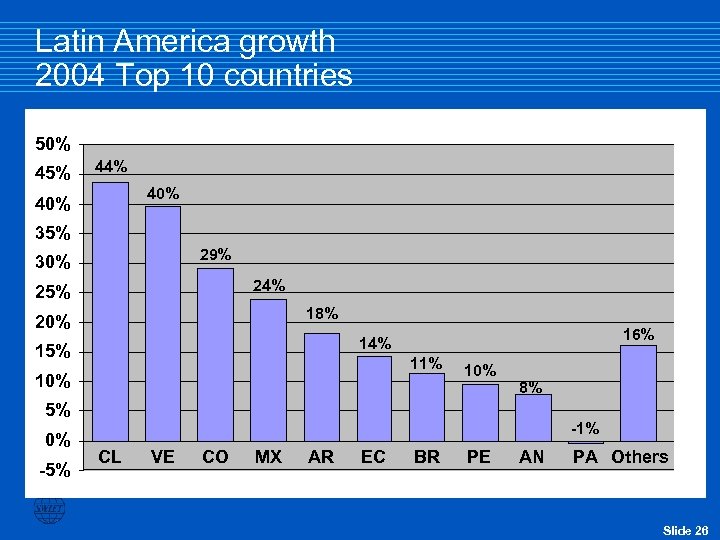

Latin America growth 2004 Top 10 countries 50% 45% 44% 40% 35% 29% 30% 24% 25% 18% 20% 16% 14% 15% 11% 10% 8% 5% 0% -5% -1% CL VE CO MX AR EC BR PE AN PA Others Slide 26

Latin America growth 2004 Top 10 countries 50% 45% 44% 40% 35% 29% 30% 24% 25% 18% 20% 16% 14% 15% 11% 10% 8% 5% 0% -5% -1% CL VE CO MX AR EC BR PE AN PA Others Slide 26

SWIFT Plenary - Agenda < The 2010 Strategy of SWIFT < SWIFT in Latin America < SWIFTNet solutions helping you building competitive advantage Slide 27

SWIFT Plenary - Agenda < The 2010 Strategy of SWIFT < SWIFT in Latin America < SWIFTNet solutions helping you building competitive advantage Slide 27

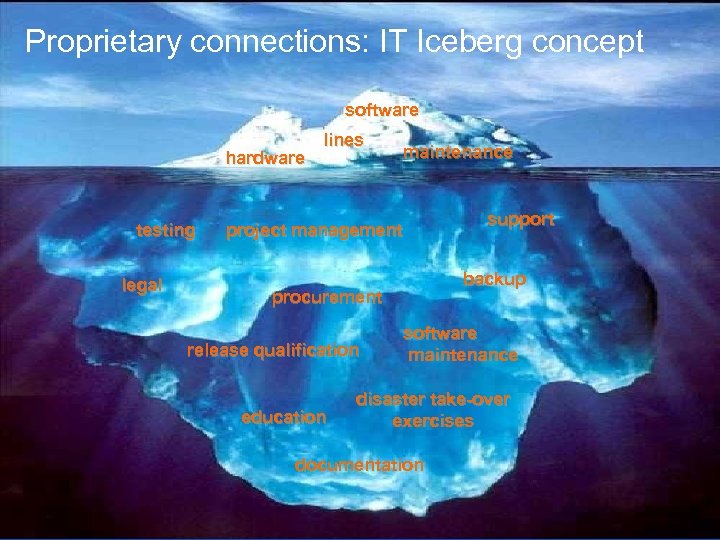

Proprietary connections: IT Iceberg concept software hardware testing legal lines maintenance support project management backup procurement release qualification education software maintenance disaster take-over exercises documentation Slide 28

Proprietary connections: IT Iceberg concept software hardware testing legal lines maintenance support project management backup procurement release qualification education software maintenance disaster take-over exercises documentation Slide 28

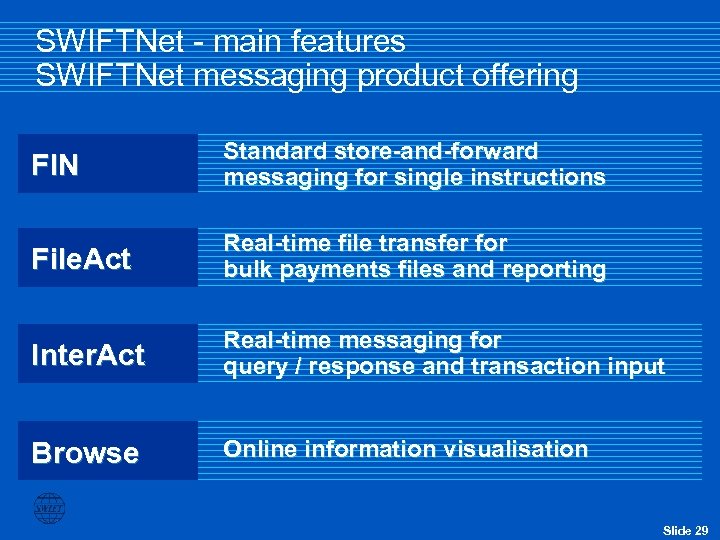

SWIFTNet - main features SWIFTNet messaging product offering FIN Standard store-and-forward messaging for single instructions File. Act Real-time file transfer for bulk payments files and reporting Inter. Act Real-time messaging for query / response and transaction input Browse Online information visualisation Slide 29

SWIFTNet - main features SWIFTNet messaging product offering FIN Standard store-and-forward messaging for single instructions File. Act Real-time file transfer for bulk payments files and reporting Inter. Act Real-time messaging for query / response and transaction input Browse Online information visualisation Slide 29

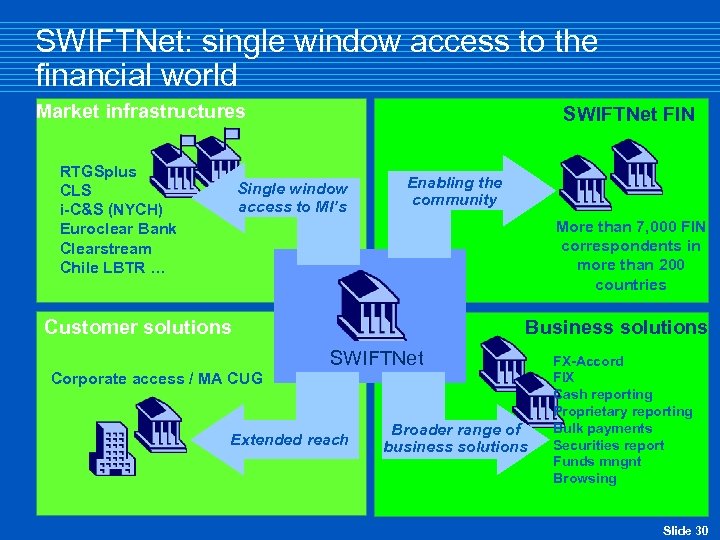

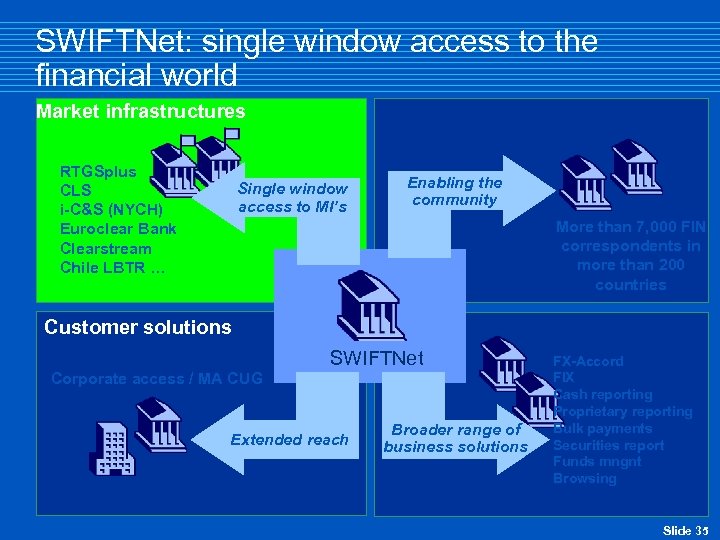

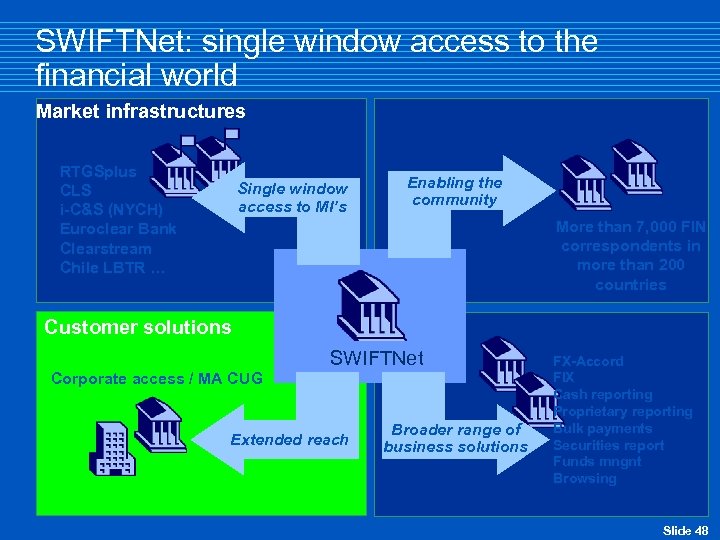

SWIFTNet: single window access to the financial world Market infrastructures RTGSplus CLS i-C&S (NYCH) Euroclear Bank Clearstream Chile LBTR … SWIFTNet FIN Single window access to MI’s Enabling the community More than 7, 000 FIN correspondents in more than 200 countries Customer solutions Business solutions SWIFTNet Corporate access / MA CUG Extended reach Broader range of business solutions FX-Accord FIX Cash reporting Proprietary reporting Bulk payments Securities report Funds mngnt Browsing Slide 30

SWIFTNet: single window access to the financial world Market infrastructures RTGSplus CLS i-C&S (NYCH) Euroclear Bank Clearstream Chile LBTR … SWIFTNet FIN Single window access to MI’s Enabling the community More than 7, 000 FIN correspondents in more than 200 countries Customer solutions Business solutions SWIFTNet Corporate access / MA CUG Extended reach Broader range of business solutions FX-Accord FIX Cash reporting Proprietary reporting Bulk payments Securities report Funds mngnt Browsing Slide 30

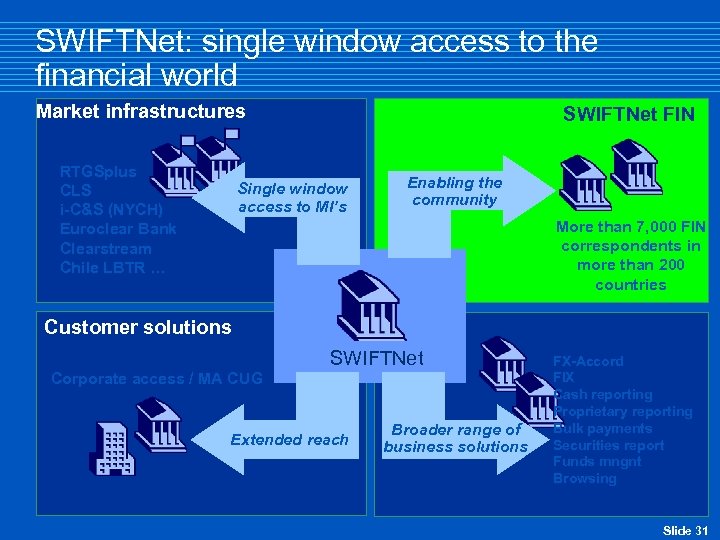

SWIFTNet: single window access to the financial world Market infrastructures RTGSplus CLS i-C&S (NYCH) Euroclear Bank Clearstream Chile LBTR … SWIFTNet FIN Single window access to MI’s Enabling the community More than 7, 000 FIN correspondents in more than 200 countries Customer solutions Business solutions SWIFTNet Corporate access / MA CUG Extended reach Broader range of business solutions FX-Accord FIX Cash reporting Proprietary reporting Bulk payments Securities report Funds mngnt Browsing Slide 31

SWIFTNet: single window access to the financial world Market infrastructures RTGSplus CLS i-C&S (NYCH) Euroclear Bank Clearstream Chile LBTR … SWIFTNet FIN Single window access to MI’s Enabling the community More than 7, 000 FIN correspondents in more than 200 countries Customer solutions Business solutions SWIFTNet Corporate access / MA CUG Extended reach Broader range of business solutions FX-Accord FIX Cash reporting Proprietary reporting Bulk payments Securities report Funds mngnt Browsing Slide 31

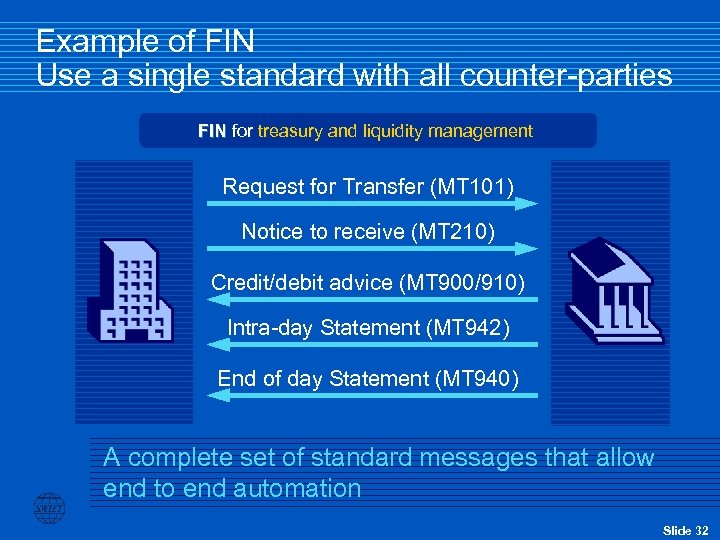

Example of FIN Use a single standard with all counter-parties FIN for treasury and liquidity management Request for Transfer (MT 101) Notice to receive (MT 210) Credit/debit advice (MT 900/910) Intra-day Statement (MT 942) End of day Statement (MT 940) A complete set of standard messages that allow end to end automation Slide 32

Example of FIN Use a single standard with all counter-parties FIN for treasury and liquidity management Request for Transfer (MT 101) Notice to receive (MT 210) Credit/debit advice (MT 900/910) Intra-day Statement (MT 942) End of day Statement (MT 940) A complete set of standard messages that allow end to end automation Slide 32

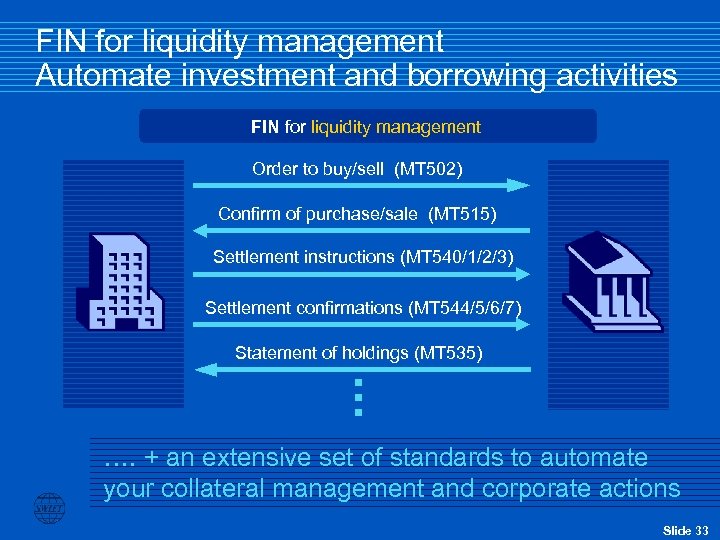

FIN for liquidity management Automate investment and borrowing activities FIN for liquidity management Order to buy/sell (MT 502) Confirm of purchase/sale (MT 515) Settlement instructions (MT 540/1/2/3) Settlement confirmations (MT 544/5/6/7) Statement of holdings (MT 535) …. + an extensive set of standards to automate your collateral management and corporate actions Slide 33

FIN for liquidity management Automate investment and borrowing activities FIN for liquidity management Order to buy/sell (MT 502) Confirm of purchase/sale (MT 515) Settlement instructions (MT 540/1/2/3) Settlement confirmations (MT 544/5/6/7) Statement of holdings (MT 535) …. + an extensive set of standards to automate your collateral management and corporate actions Slide 33

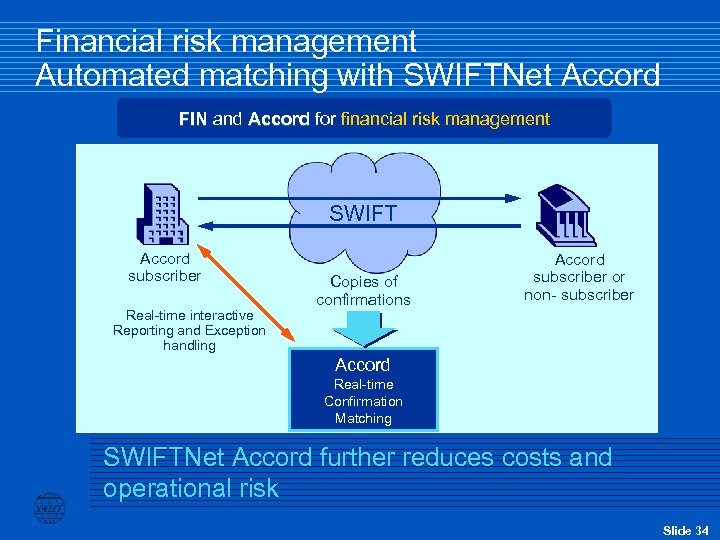

Financial risk management Automated matching with SWIFTNet Accord FIN and Accord for financial risk management SWIFT Accord subscriber Real-time interactive Reporting and Exception handling Copies of confirmations Accord subscriber or non- subscriber Accord Real-time Confirmation Matching SWIFTNet Accord further reduces costs and operational risk Slide 34

Financial risk management Automated matching with SWIFTNet Accord FIN and Accord for financial risk management SWIFT Accord subscriber Real-time interactive Reporting and Exception handling Copies of confirmations Accord subscriber or non- subscriber Accord Real-time Confirmation Matching SWIFTNet Accord further reduces costs and operational risk Slide 34

SWIFTNet: single window access to the financial world Market infrastructures RTGSplus CLS i-C&S (NYCH) Euroclear Bank Clearstream Chile LBTR … SWIFTNet FIN Single window access to MI’s Enabling the community More than 7, 000 FIN correspondents in more than 200 countries Customer solutions Business solutions SWIFTNet Corporate access / MA CUG Extended reach Broader range of business solutions FX-Accord FIX Cash reporting Proprietary reporting Bulk payments Securities report Funds mngnt Browsing Slide 35

SWIFTNet: single window access to the financial world Market infrastructures RTGSplus CLS i-C&S (NYCH) Euroclear Bank Clearstream Chile LBTR … SWIFTNet FIN Single window access to MI’s Enabling the community More than 7, 000 FIN correspondents in more than 200 countries Customer solutions Business solutions SWIFTNet Corporate access / MA CUG Extended reach Broader range of business solutions FX-Accord FIX Cash reporting Proprietary reporting Bulk payments Securities report Funds mngnt Browsing Slide 35

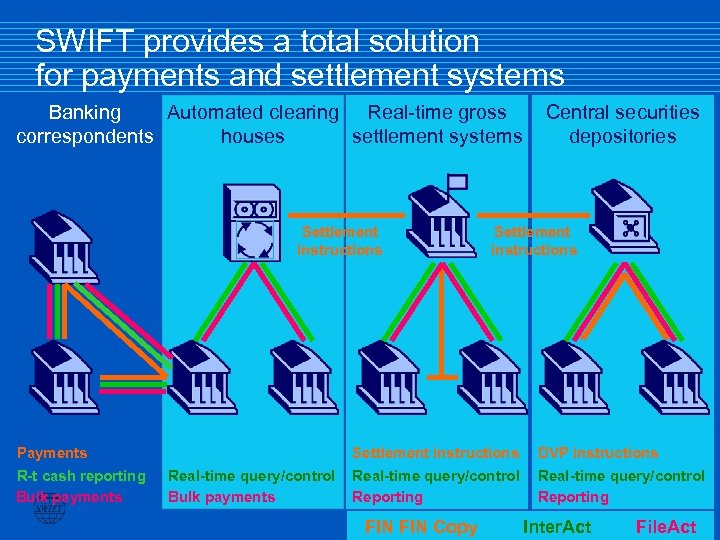

SWIFT provides a total solution for payments and settlement systems Banking Automated clearing Real-time gross correspondents houses settlement systems Settlement instructions Payments R-t cash reporting Bulk payments Central securities depositories Settlement instructions Real-time query/control Bulk payments DVP instructions Real-time query/control Reporting FIN Copy Inter. Act File. Act 36 Slide

SWIFT provides a total solution for payments and settlement systems Banking Automated clearing Real-time gross correspondents houses settlement systems Settlement instructions Payments R-t cash reporting Bulk payments Central securities depositories Settlement instructions Real-time query/control Bulk payments DVP instructions Real-time query/control Reporting FIN Copy Inter. Act File. Act 36 Slide

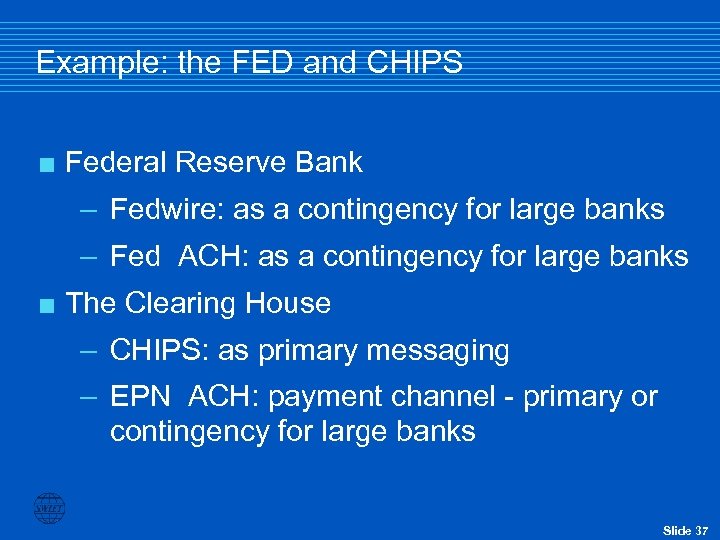

Example: the FED and CHIPS < Federal Reserve Bank – Fedwire: as a contingency for large banks – Fed ACH: as a contingency for large banks < The Clearing House – CHIPS: as primary messaging – EPN ACH: payment channel - primary or contingency for large banks Slide 37

Example: the FED and CHIPS < Federal Reserve Bank – Fedwire: as a contingency for large banks – Fed ACH: as a contingency for large banks < The Clearing House – CHIPS: as primary messaging – EPN ACH: payment channel - primary or contingency for large banks Slide 37

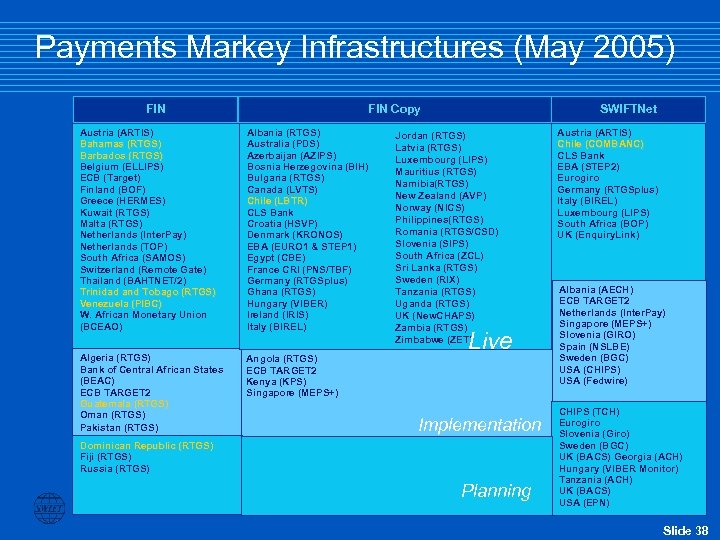

Payments Markey Infrastructures (May 2005) FIN Copy Austria (ARTIS) Bahamas (RTGS) Barbados (RTGS) Belgium (ELLIPS) ECB (Target) Finland (BOF) Greece (HERMES) Kuwait (RTGS) Malta (RTGS) Netherlands (Inter. Pay) Netherlands (TOP) South Africa (SAMOS) Switzerland (Remote Gate) Thailand (BAHTNET/2) Trinidad and Tobago (RTGS) Venezuela (PIBC) W. African Monetary Union (BCEAO) Albania (RTGS) Australia (PDS) Azerbaijan (AZIPS) Bosnia Herzegovina (BIH) Bulgaria (RTGS) Canada (LVTS) Chile (LBTR) CLS Bank Croatia (HSVP) Denmark (KRONOS) EBA (EURO 1 & STEP 1) Egypt (CBE) France CRI (PNS/TBF) Germany (RTGSplus) Ghana (RTGS) Hungary (VIBER) Ireland (IRIS) Italy (BIREL) Algeria (RTGS) Bank of Central African States (BEAC) ECB TARGET 2 Guatemala (RTGS) Oman (RTGS) Pakistan (RTGS) Angola (RTGS) ECB TARGET 2 Kenya (KPS) Singapore (MEPS+) Dominican Republic (RTGS) Fiji (RTGS) Russia (RTGS) SWIFTNet Ireland Jordan (RTGS) Italy Latvia (RTGS) Jordan Luxembourg (LIPS) Latvia Mauritius (RTGS) Luxembourg Namibia(RTGS) Mauritius New Zealand (AVP) Namibia Norway (NICS) New Zealand Philippines(RTGS) Norway Romania (RTGS/CSD) Philippines Slovenia (SIPS) Slovenia South Africa (ZCL) Spain (SPI) Sri Lanka (RTGS) Sri Lanka Sweden (RIX) Sweden Tanzania (RTGS) UK New. CHAPS Uganda (RTGS) (€ & £) Zimbabwe UK (New. CHAPS) Zambia (RTGS) Zimbabwe (ZET) Live Implementation Discussion Planning Austria (ARTIS) Chile (COMBANC) CLS Bank EBA (STEP 2) Eurogiro Germany (RTGSplus) Italy (BIREL) Luxembourg (LIPS) South Africa (BOP) UK (Enquiry. Link) Albania (AECH) ECB TARGET 2 Netherlands (Inter. Pay) Singapore (MEPS+) Slovenia (GIRO) Spain (NSLBE) Sweden (BGC) USA (CHIPS) USA (Fedwire) CHIPS (TCH) Eurogiro Slovenia (Giro) Sweden (BGC) UK (BACS) Georgia (ACH) Hungary (VIBER Monitor) Tanzania (ACH) UK (BACS) USA (EPN) Slide 38

Payments Markey Infrastructures (May 2005) FIN Copy Austria (ARTIS) Bahamas (RTGS) Barbados (RTGS) Belgium (ELLIPS) ECB (Target) Finland (BOF) Greece (HERMES) Kuwait (RTGS) Malta (RTGS) Netherlands (Inter. Pay) Netherlands (TOP) South Africa (SAMOS) Switzerland (Remote Gate) Thailand (BAHTNET/2) Trinidad and Tobago (RTGS) Venezuela (PIBC) W. African Monetary Union (BCEAO) Albania (RTGS) Australia (PDS) Azerbaijan (AZIPS) Bosnia Herzegovina (BIH) Bulgaria (RTGS) Canada (LVTS) Chile (LBTR) CLS Bank Croatia (HSVP) Denmark (KRONOS) EBA (EURO 1 & STEP 1) Egypt (CBE) France CRI (PNS/TBF) Germany (RTGSplus) Ghana (RTGS) Hungary (VIBER) Ireland (IRIS) Italy (BIREL) Algeria (RTGS) Bank of Central African States (BEAC) ECB TARGET 2 Guatemala (RTGS) Oman (RTGS) Pakistan (RTGS) Angola (RTGS) ECB TARGET 2 Kenya (KPS) Singapore (MEPS+) Dominican Republic (RTGS) Fiji (RTGS) Russia (RTGS) SWIFTNet Ireland Jordan (RTGS) Italy Latvia (RTGS) Jordan Luxembourg (LIPS) Latvia Mauritius (RTGS) Luxembourg Namibia(RTGS) Mauritius New Zealand (AVP) Namibia Norway (NICS) New Zealand Philippines(RTGS) Norway Romania (RTGS/CSD) Philippines Slovenia (SIPS) Slovenia South Africa (ZCL) Spain (SPI) Sri Lanka (RTGS) Sri Lanka Sweden (RIX) Sweden Tanzania (RTGS) UK New. CHAPS Uganda (RTGS) (€ & £) Zimbabwe UK (New. CHAPS) Zambia (RTGS) Zimbabwe (ZET) Live Implementation Discussion Planning Austria (ARTIS) Chile (COMBANC) CLS Bank EBA (STEP 2) Eurogiro Germany (RTGSplus) Italy (BIREL) Luxembourg (LIPS) South Africa (BOP) UK (Enquiry. Link) Albania (AECH) ECB TARGET 2 Netherlands (Inter. Pay) Singapore (MEPS+) Slovenia (GIRO) Spain (NSLBE) Sweden (BGC) USA (CHIPS) USA (Fedwire) CHIPS (TCH) Eurogiro Slovenia (Giro) Sweden (BGC) UK (BACS) Georgia (ACH) Hungary (VIBER Monitor) Tanzania (ACH) UK (BACS) USA (EPN) Slide 38

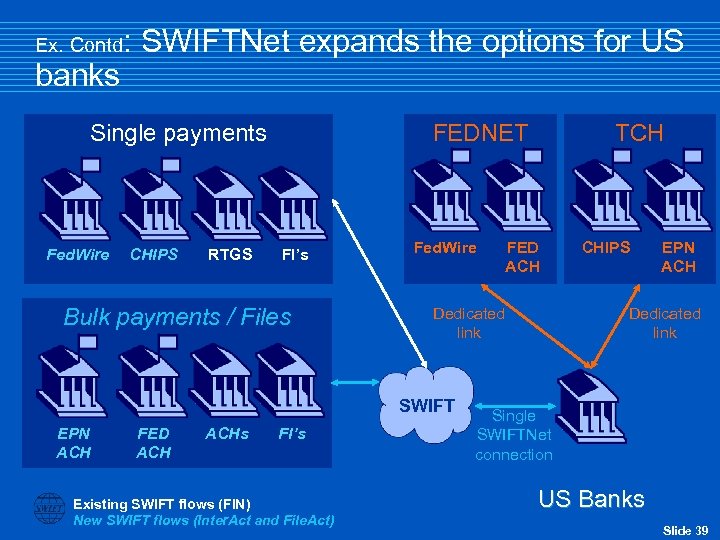

Ex. Contd banks : SWIFTNet expands the options for US Single payments Fed. Wire CHIPS RTGS FEDNET FI’s Bulk payments / Files Fed. Wire FED ACHs FI’s Existing SWIFT flows (FIN) New SWIFT flows (Inter. Act and File. Act) FED ACH Dedicated link SWIFT EPN ACH TCH CHIPS EPN ACH Dedicated link Single SWIFTNet connection US Banks Slide 39

Ex. Contd banks : SWIFTNet expands the options for US Single payments Fed. Wire CHIPS RTGS FEDNET FI’s Bulk payments / Files Fed. Wire FED ACHs FI’s Existing SWIFT flows (FIN) New SWIFT flows (Inter. Act and File. Act) FED ACH Dedicated link SWIFT EPN ACH TCH CHIPS EPN ACH Dedicated link Single SWIFTNet connection US Banks Slide 39

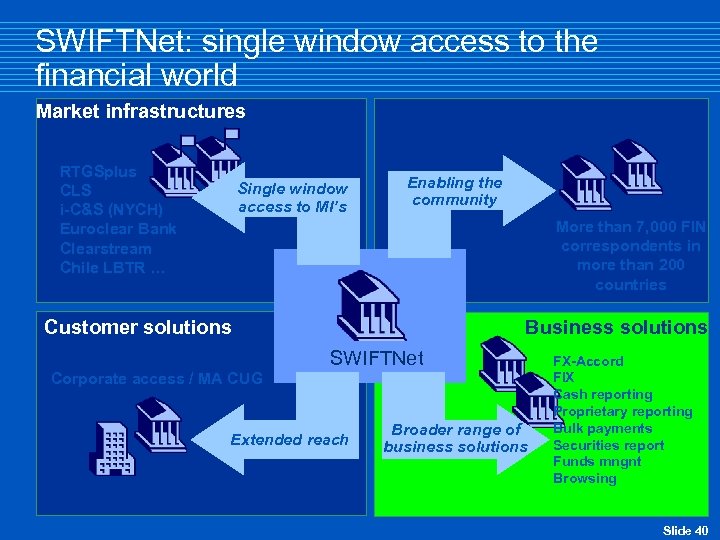

SWIFTNet: single window access to the financial world Market infrastructures RTGSplus CLS i-C&S (NYCH) Euroclear Bank Clearstream Chile LBTR … SWIFTNet FIN Single window access to MI’s Enabling the community More than 7, 000 FIN correspondents in more than 200 countries Customer solutions Business solutions SWIFTNet Corporate access / MA CUG Extended reach Broader range of business solutions FX-Accord FIX Cash reporting Proprietary reporting Bulk payments Securities report Funds mngnt Browsing Slide 40

SWIFTNet: single window access to the financial world Market infrastructures RTGSplus CLS i-C&S (NYCH) Euroclear Bank Clearstream Chile LBTR … SWIFTNet FIN Single window access to MI’s Enabling the community More than 7, 000 FIN correspondents in more than 200 countries Customer solutions Business solutions SWIFTNet Corporate access / MA CUG Extended reach Broader range of business solutions FX-Accord FIX Cash reporting Proprietary reporting Bulk payments Securities report Funds mngnt Browsing Slide 40

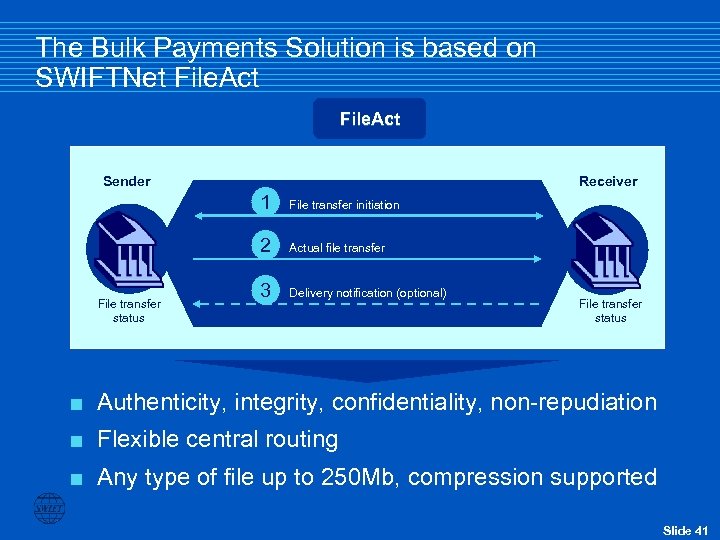

The Bulk Payments Solution is based on SWIFTNet File. Act Sender Receiver 1 2 File transfer status File transfer initiation Actual file transfer 3 Delivery notification (optional) File transfer status < Authenticity, integrity, confidentiality, non-repudiation < Flexible central routing < Any type of file up to 250 Mb, compression supported Slide 41

The Bulk Payments Solution is based on SWIFTNet File. Act Sender Receiver 1 2 File transfer status File transfer initiation Actual file transfer 3 Delivery notification (optional) File transfer status < Authenticity, integrity, confidentiality, non-repudiation < Flexible central routing < Any type of file up to 250 Mb, compression supported Slide 41

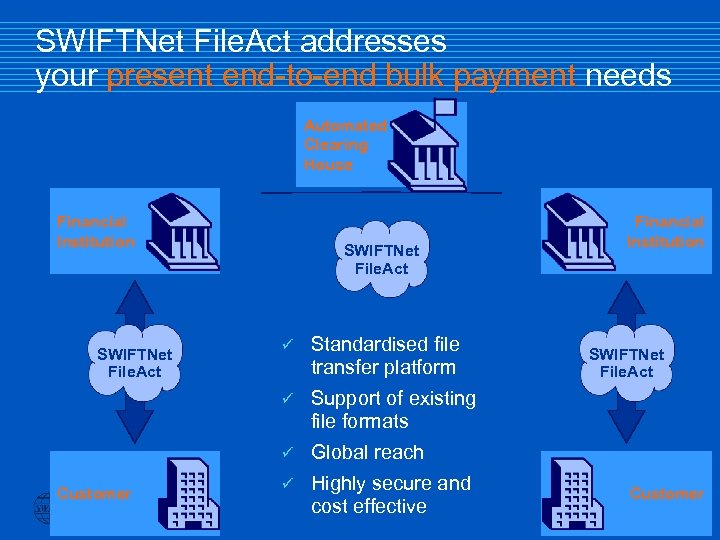

SWIFTNet File. Act addresses your present end-to-end bulk payment needs Automated Clearing House Financial Institution SWIFTNet File. Act Standardised file transfer platform Support of existing file formats Customer SWIFTNet File. Act Global reach Highly secure and cost effective Financial Institution SWIFTNet File. Act Customer Slide 42

SWIFTNet File. Act addresses your present end-to-end bulk payment needs Automated Clearing House Financial Institution SWIFTNet File. Act Standardised file transfer platform Support of existing file formats Customer SWIFTNet File. Act Global reach Highly secure and cost effective Financial Institution SWIFTNet File. Act Customer Slide 42

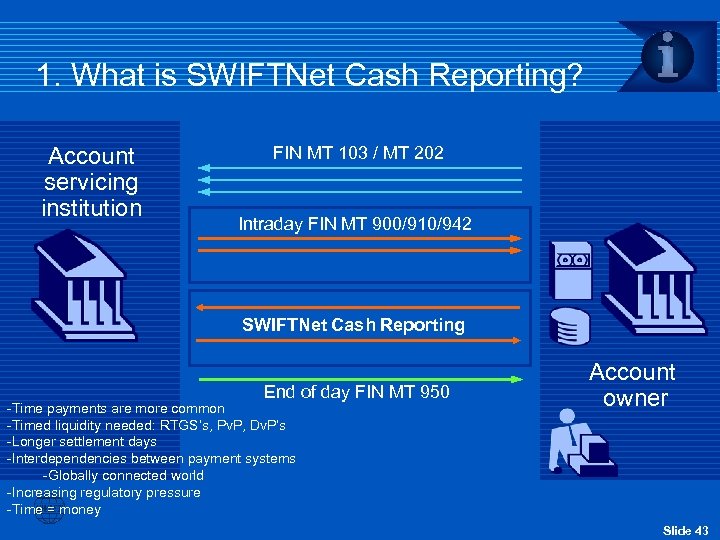

1. What is SWIFTNet Cash Reporting? Account servicing institution FIN MT 103 / MT 202 Intraday FIN MT 900/910/942 SWIFTNet Cash Reporting End of day FIN MT 950 -Time payments are more common -Timed liquidity needed: RTGS’s, Pv. P, Dv. P’s -Longer settlement days -Interdependencies between payment systems -Globally connected world -Increasing regulatory pressure -Time = money Account owner Slide 43

1. What is SWIFTNet Cash Reporting? Account servicing institution FIN MT 103 / MT 202 Intraday FIN MT 900/910/942 SWIFTNet Cash Reporting End of day FIN MT 950 -Time payments are more common -Timed liquidity needed: RTGS’s, Pv. P, Dv. P’s -Longer settlement days -Interdependencies between payment systems -Globally connected world -Increasing regulatory pressure -Time = money Account owner Slide 43

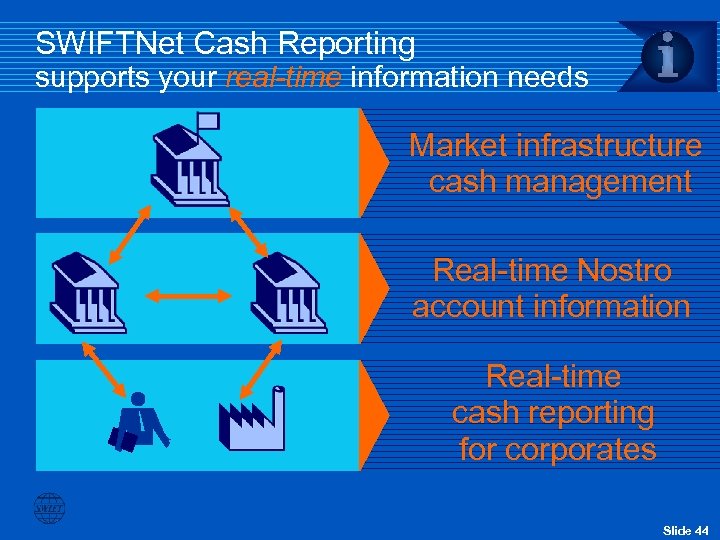

SWIFTNet Cash Reporting supports your real-time information needs Market infrastructure cash management Real-time Nostro account information Real-time cash reporting for corporates SWIFTStandards XML Slide 44

SWIFTNet Cash Reporting supports your real-time information needs Market infrastructure cash management Real-time Nostro account information Real-time cash reporting for corporates SWIFTStandards XML Slide 44

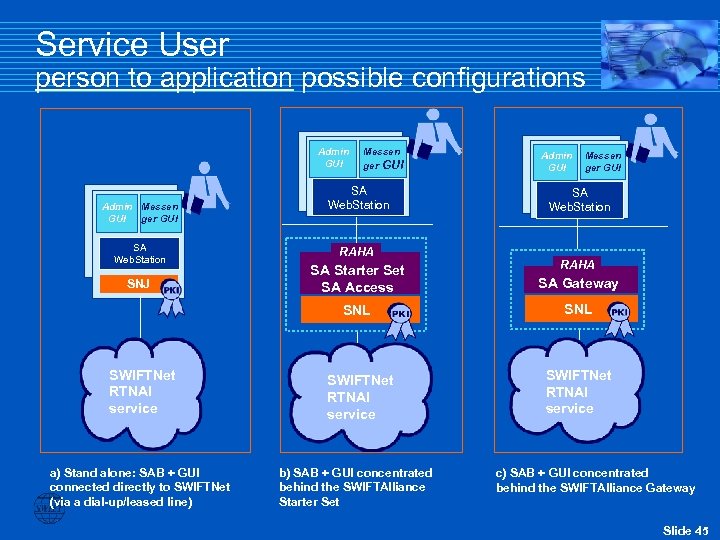

Service User person to application possible configurations Admin GUI Admin Messen GUI ger GUI SA Web. Station Messen ger GUI SA Web. Station RAHA Admin GUI Messen ger GUI SA Web. Station SWIFTNet RTNAI service a) Stand alone: SAB + GUI connected directly to SWIFTNet (via a dial-up/leased line) RAHA SAG SA Gateway SNL SNJ SA Starter Set SAG SA Access SNL SWIFTNet RTNAI service b) SAB + GUI concentrated behind the SWIFTAlliance Starter Set c) SAB + GUI concentrated behind the SWIFTAlliance Gateway Slide 45

Service User person to application possible configurations Admin GUI Admin Messen GUI ger GUI SA Web. Station Messen ger GUI SA Web. Station RAHA Admin GUI Messen ger GUI SA Web. Station SWIFTNet RTNAI service a) Stand alone: SAB + GUI connected directly to SWIFTNet (via a dial-up/leased line) RAHA SAG SA Gateway SNL SNJ SA Starter Set SAG SA Access SNL SWIFTNet RTNAI service b) SAB + GUI concentrated behind the SWIFTAlliance Starter Set c) SAB + GUI concentrated behind the SWIFTAlliance Gateway Slide 45

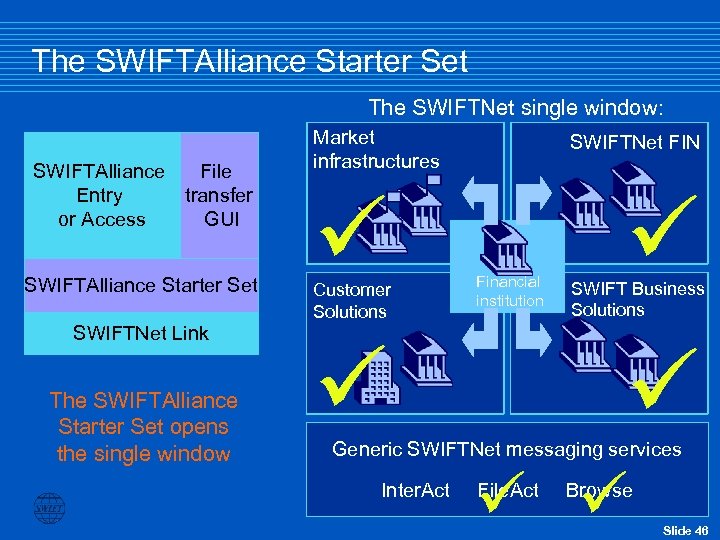

The SWIFTAlliance Starter Set The SWIFTNet single window: SWIFTAlliance File Entry transfer or Access GUI SWIFTAlliance Starter Set SWIFTNet Link The SWIFTAlliance Starter Set opens the single window Market infrastructures Customer Solutions SWIFTNet FIN Financial institution SWIFT Business Solutions Generic SWIFTNet messaging services Inter. Act File. Act Browse Slide 46

The SWIFTAlliance Starter Set The SWIFTNet single window: SWIFTAlliance File Entry transfer or Access GUI SWIFTAlliance Starter Set SWIFTNet Link The SWIFTAlliance Starter Set opens the single window Market infrastructures Customer Solutions SWIFTNet FIN Financial institution SWIFT Business Solutions Generic SWIFTNet messaging services Inter. Act File. Act Browse Slide 46

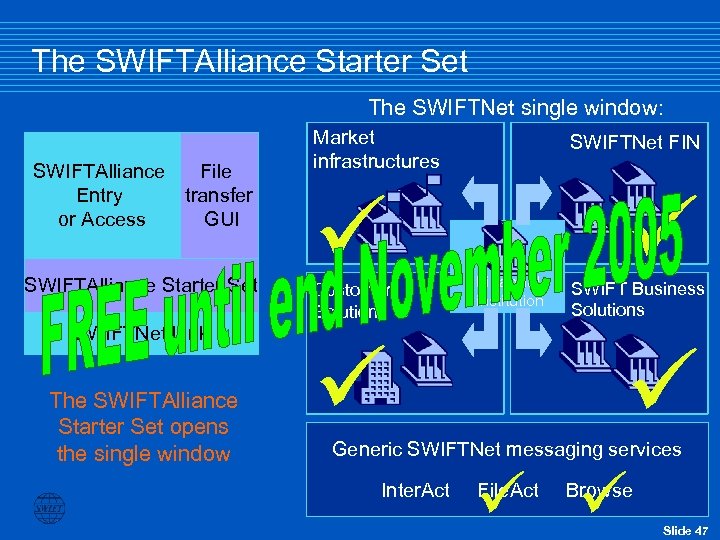

The SWIFTAlliance Starter Set The SWIFTNet single window: SWIFTAlliance File Entry transfer or Access GUI SWIFTAlliance Starter Set SWIFTNet Link The SWIFTAlliance Starter Set opens the single window Market infrastructures Customer Solutions SWIFTNet FIN Financial institution SWIFT Business Solutions Generic SWIFTNet messaging services Inter. Act File. Act Browse Slide 47

The SWIFTAlliance Starter Set The SWIFTNet single window: SWIFTAlliance File Entry transfer or Access GUI SWIFTAlliance Starter Set SWIFTNet Link The SWIFTAlliance Starter Set opens the single window Market infrastructures Customer Solutions SWIFTNet FIN Financial institution SWIFT Business Solutions Generic SWIFTNet messaging services Inter. Act File. Act Browse Slide 47

SWIFTNet: single window access to the financial world Market infrastructures RTGSplus CLS i-C&S (NYCH) Euroclear Bank Clearstream Chile LBTR … SWIFTNet FIN Single window access to MI’s Enabling the community More than 7, 000 FIN correspondents in more than 200 countries Customer solutions Business solutions SWIFTNet Corporate access / MA CUG Extended reach Broader range of business solutions FX-Accord FIX Cash reporting Proprietary reporting Bulk payments Securities report Funds mngnt Browsing Slide 48

SWIFTNet: single window access to the financial world Market infrastructures RTGSplus CLS i-C&S (NYCH) Euroclear Bank Clearstream Chile LBTR … SWIFTNet FIN Single window access to MI’s Enabling the community More than 7, 000 FIN correspondents in more than 200 countries Customer solutions Business solutions SWIFTNet Corporate access / MA CUG Extended reach Broader range of business solutions FX-Accord FIX Cash reporting Proprietary reporting Bulk payments Securities report Funds mngnt Browsing Slide 48

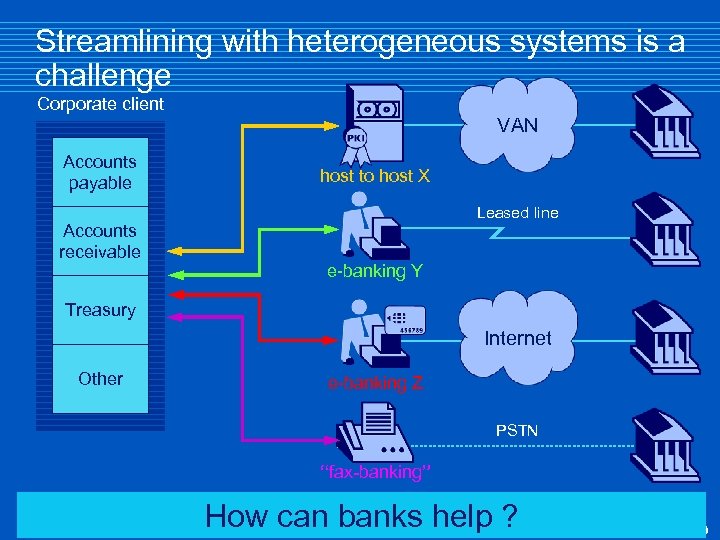

Streamlining with heterogeneous systems is a challenge Corporate client VAN Accounts payable Accounts receivable host to host X Leased line e-banking Y Treasury Internet Other e-banking Z PSTN “fax-banking” How can banks help ? Slide 49

Streamlining with heterogeneous systems is a challenge Corporate client VAN Accounts payable Accounts receivable host to host X Leased line e-banking Y Treasury Internet Other e-banking Z PSTN “fax-banking” How can banks help ? Slide 49

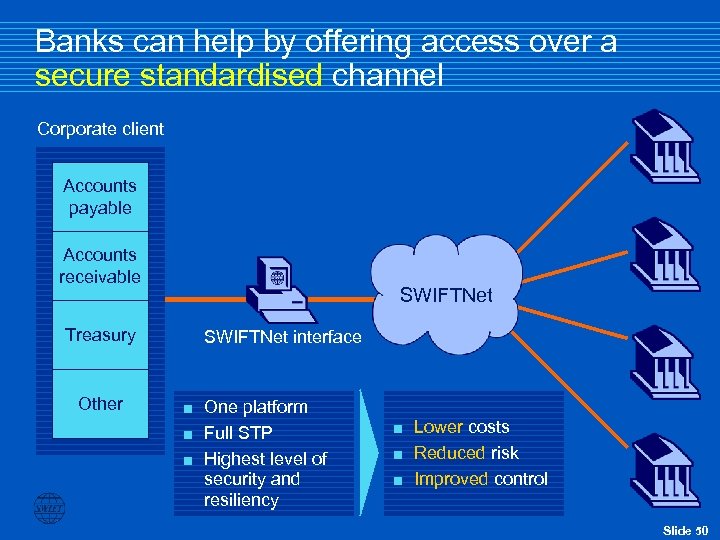

Banks can help by offering access over a secure standardised channel Corporate client Accounts payable Accounts receivable SWIFTNet Treasury Other SWIFTNet interface One platform < Full STP < Highest level of security and resiliency < Lower costs < Reduced risk < Improved control < Slide 50

Banks can help by offering access over a secure standardised channel Corporate client Accounts payable Accounts receivable SWIFTNet Treasury Other SWIFTNet interface One platform < Full STP < Highest level of security and resiliency < Lower costs < Reduced risk < Improved control < Slide 50

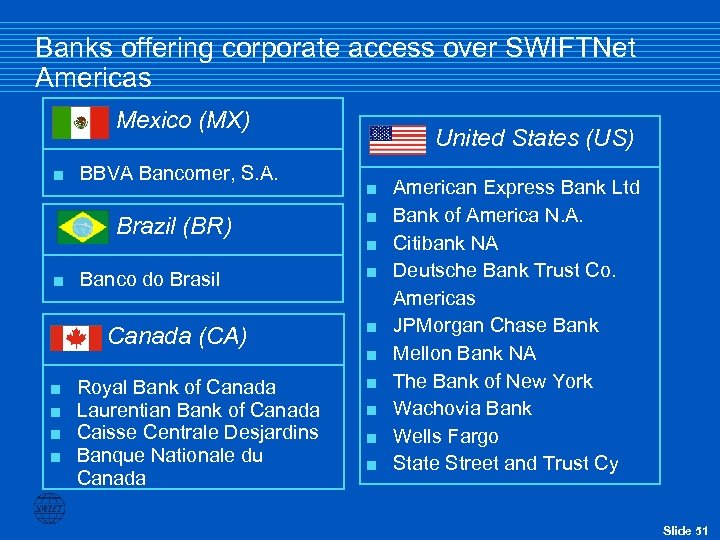

Banks offering corporate access over SWIFTNet Americas Mexico (MX) < BBVA Bancomer, S. A. Brazil (BR) < Banco do Brasil Canada (CA) < < Royal Bank of Canada Laurentian Bank of Canada Caisse Centrale Desjardins Banque Nationale du Canada United States (US) < < < < < American Express Bank Ltd Bank of America N. A. Citibank NA Deutsche Bank Trust Co. Americas JPMorgan Chase Bank Mellon Bank NA The Bank of New York Wachovia Bank Wells Fargo State Street and Trust Cy Slide 51

Banks offering corporate access over SWIFTNet Americas Mexico (MX) < BBVA Bancomer, S. A. Brazil (BR) < Banco do Brasil Canada (CA) < < Royal Bank of Canada Laurentian Bank of Canada Caisse Centrale Desjardins Banque Nationale du Canada United States (US) < < < < < American Express Bank Ltd Bank of America N. A. Citibank NA Deutsche Bank Trust Co. Americas JPMorgan Chase Bank Mellon Bank NA The Bank of New York Wachovia Bank Wells Fargo State Street and Trust Cy Slide 51

Banks offering corporate access over SWIFTNet ES PT Spain (ES) < < < < Banco Bilbao Vizcaya Argentaria, S. A. Banco Cooperativo Espanol, S. A. Banco Espanol de Credito S. A. Banco Popular Espanol Caixa d'Estalvis i Pensions de Barcelona "La Caixa“ Santander Central Hispano Investment S. A. Bankinter, S. A. Portugal (PT) Banco Comercial Portugues, S. A. < Caixa Geral de Depositos, Lisboa < Slide 52

Banks offering corporate access over SWIFTNet ES PT Spain (ES) < < < < Banco Bilbao Vizcaya Argentaria, S. A. Banco Cooperativo Espanol, S. A. Banco Espanol de Credito S. A. Banco Popular Espanol Caixa d'Estalvis i Pensions de Barcelona "La Caixa“ Santander Central Hispano Investment S. A. Bankinter, S. A. Portugal (PT) Banco Comercial Portugues, S. A. < Caixa Geral de Depositos, Lisboa < Slide 52

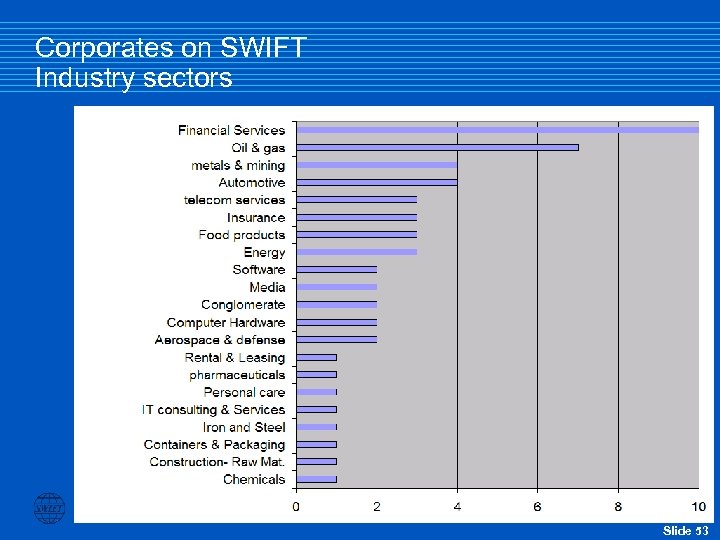

Corporates on SWIFT Industry sectors Slide 53

Corporates on SWIFT Industry sectors Slide 53

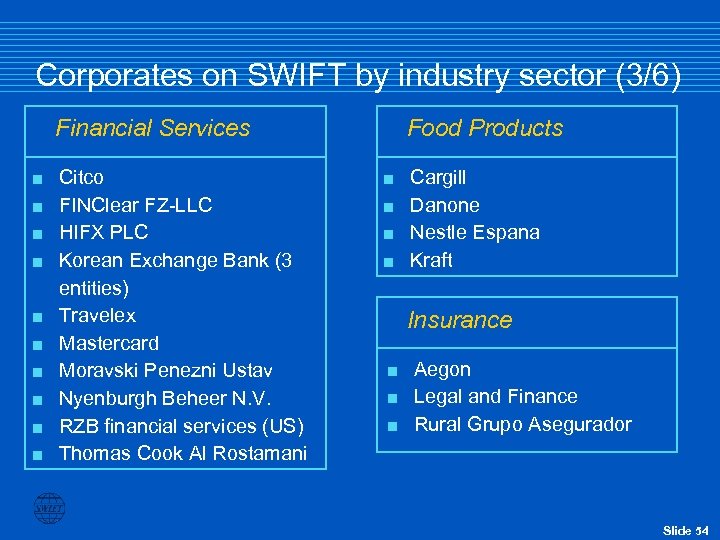

Corporates on SWIFT by industry sector (3/6) Financial Services < < < < < Citco FINClear FZ-LLC HIFX PLC Korean Exchange Bank (3 entities) Travelex Mastercard Moravski Penezni Ustav Nyenburgh Beheer N. V. RZB financial services (US) Thomas Cook Al Rostamani Food Products Cargill < Danone < Nestle Espana < Kraft < Insurance Aegon < Legal and Finance < Rural Grupo Asegurador < Slide 54

Corporates on SWIFT by industry sector (3/6) Financial Services < < < < < Citco FINClear FZ-LLC HIFX PLC Korean Exchange Bank (3 entities) Travelex Mastercard Moravski Penezni Ustav Nyenburgh Beheer N. V. RZB financial services (US) Thomas Cook Al Rostamani Food Products Cargill < Danone < Nestle Espana < Kraft < Insurance Aegon < Legal and Finance < Rural Grupo Asegurador < Slide 54

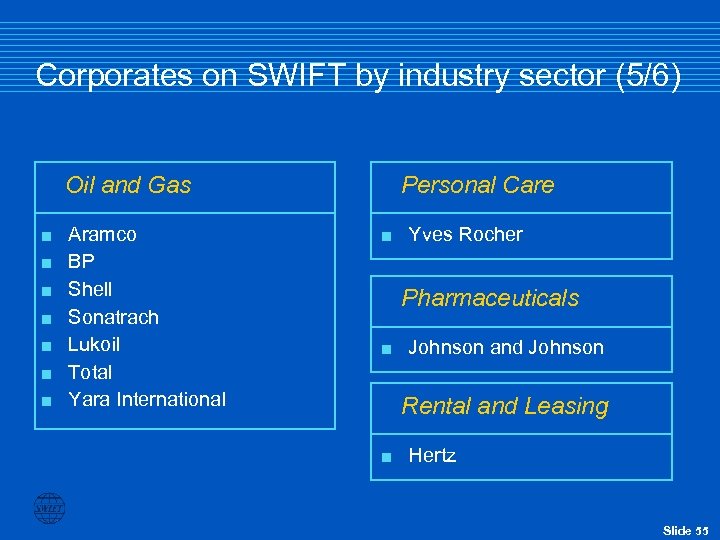

Corporates on SWIFT by industry sector (5/6) Oil and Gas < < < < Aramco BP Shell Sonatrach Lukoil Total Yara International Personal Care < Yves Rocher Pharmaceuticals < Johnson and Johnson Rental and Leasing < Hertz Slide 55

Corporates on SWIFT by industry sector (5/6) Oil and Gas < < < < Aramco BP Shell Sonatrach Lukoil Total Yara International Personal Care < Yves Rocher Pharmaceuticals < Johnson and Johnson Rental and Leasing < Hertz Slide 55

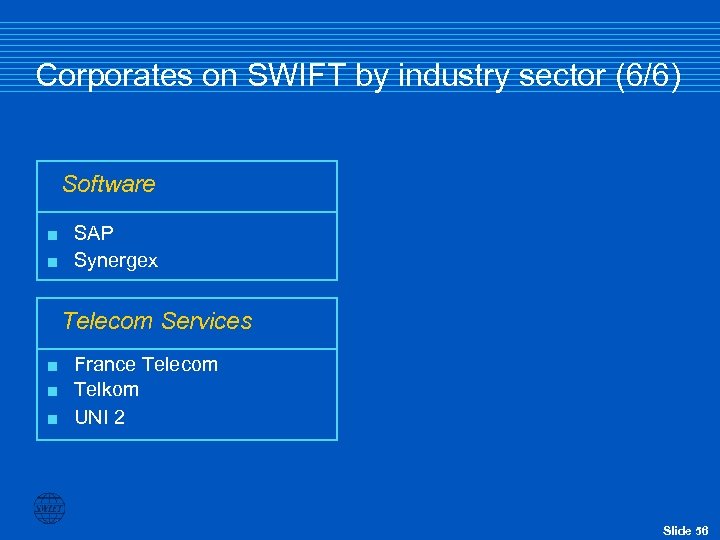

Corporates on SWIFT by industry sector (6/6) Software SAP < Synergex < Telecom Services France Telecom < Telkom < UNI 2 < Slide 56

Corporates on SWIFT by industry sector (6/6) Software SAP < Synergex < Telecom Services France Telecom < Telkom < UNI 2 < Slide 56

The guiding principles of SWIFT are clear To offer the financial services industry a common platform of advanced technology and access to shared solutions through which each member can build its competitive edge. Slide 57

The guiding principles of SWIFT are clear To offer the financial services industry a common platform of advanced technology and access to shared solutions through which each member can build its competitive edge. Slide 57

Thank you! Questions and answers Slide 58

Thank you! Questions and answers Slide 58