a83f26483a981f156ed9b878a7f2bdeb.ppt

- Количество слайдов: 19

Internet Power Shift Trends to Watch in 2005 Jay Adelson Founder, Chief Technology Officer Equinix, Inc. Telecosm 2004 October 19, 2004

Internet Power Shift Trends to Watch in 2005 Jay Adelson Founder, Chief Technology Officer Equinix, Inc. Telecosm 2004 October 19, 2004

Forward Looking Statements & Pro Forma Information Except for historical information, our presentation today contains forward-looking statements which include words such as “believe”, “anticipate” and “expect”. These forward-looking statements involve risks and uncertainties that may cause Equinix’s actual results to differ materially from those expressed or implied by these statements. Factors that may affect Equinix’s results are summarized in our quarterly report on Form 10 -Q filed August 2 nd, 2004. Pro Forma and non-GAAP information contained in this presentation can be found in our current Report on Form 8 -K filed with the SEC on April 22 nd, 2004 and July 28 th, 2004.

Forward Looking Statements & Pro Forma Information Except for historical information, our presentation today contains forward-looking statements which include words such as “believe”, “anticipate” and “expect”. These forward-looking statements involve risks and uncertainties that may cause Equinix’s actual results to differ materially from those expressed or implied by these statements. Factors that may affect Equinix’s results are summarized in our quarterly report on Form 10 -Q filed August 2 nd, 2004. Pro Forma and non-GAAP information contained in this presentation can be found in our current Report on Form 8 -K filed with the SEC on April 22 nd, 2004 and July 28 th, 2004.

Agenda § Brief introduction to Equinix § Brief snapshot of how Internet traffic currently passes in the United States § Massive power shifts in the Internet infrastructure over the past two years § Case studies

Agenda § Brief introduction to Equinix § Brief snapshot of how Internet traffic currently passes in the United States § Massive power shifts in the Internet infrastructure over the past two years § Case studies

Business Highlights § Operates 14 network neutral Internet Business Exchanges (IBXs) in the U. S. and Asia-Pacific for over 830 customers where: ü 200+ of the largest networks interconnect ü 8 of 10 largest content sites* colocate ü Enterprise and US Government colocate their IT Infrastructure ü The largest integrators host their Fortune 500 customers § 2004 revenue guidance** of $160 - $163 million; 37% year-over-year growth (at midpoint) § 2004 EBITDA** guidance of $32 - $35 million; > 70% incremental EBITDA flow-through * Nielsen-Netratings (July 2004), Media Metrix (February 2004) ** Refer to 8 -K filed on July 28, 2004 for explanation of guidance, non-GAAP metrics and reconciliation to GAAP metrics

Business Highlights § Operates 14 network neutral Internet Business Exchanges (IBXs) in the U. S. and Asia-Pacific for over 830 customers where: ü 200+ of the largest networks interconnect ü 8 of 10 largest content sites* colocate ü Enterprise and US Government colocate their IT Infrastructure ü The largest integrators host their Fortune 500 customers § 2004 revenue guidance** of $160 - $163 million; 37% year-over-year growth (at midpoint) § 2004 EBITDA** guidance of $32 - $35 million; > 70% incremental EBITDA flow-through * Nielsen-Netratings (July 2004), Media Metrix (February 2004) ** Refer to 8 -K filed on July 28, 2004 for explanation of guidance, non-GAAP metrics and reconciliation to GAAP metrics

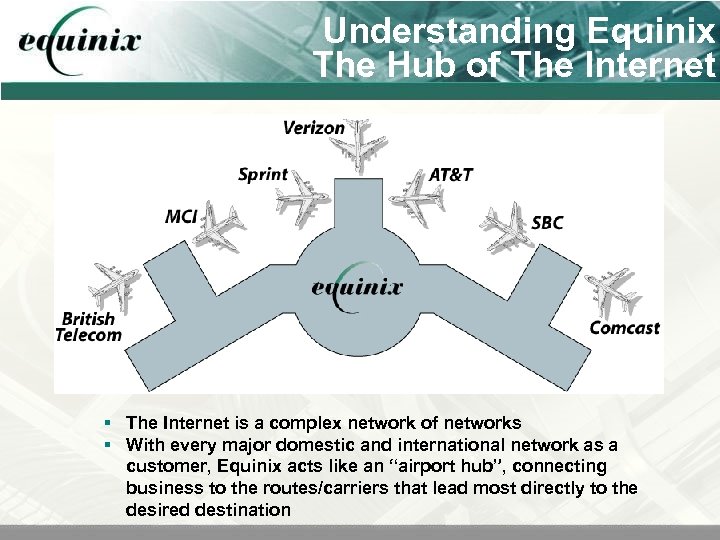

Understanding Equinix The Hub of The Internet § The Internet is a complex network of networks § With every major domestic and international network as a customer, Equinix acts like an “airport hub”, connecting business to the routes/carriers that lead most directly to the desired destination

Understanding Equinix The Hub of The Internet § The Internet is a complex network of networks § With every major domestic and international network as a customer, Equinix acts like an “airport hub”, connecting business to the routes/carriers that lead most directly to the desired destination

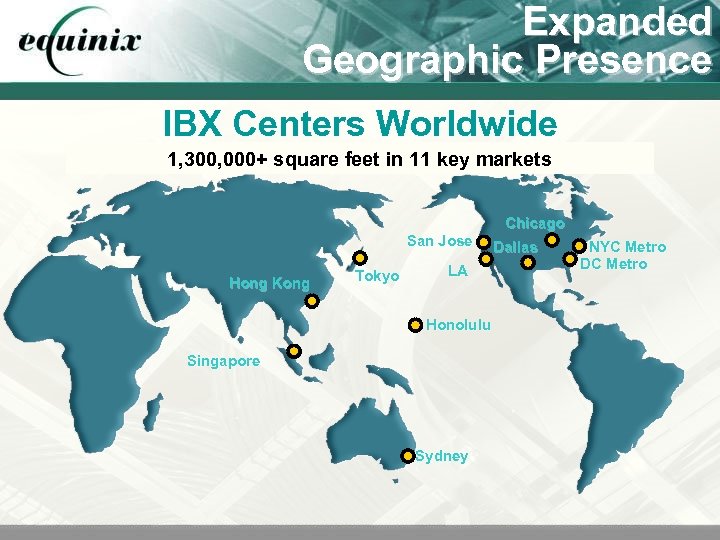

Expanded Geographic Presence IBX Centers Worldwide 1, 300, 000+ square feet in 11 key markets Chicago San Jose Hong Kong Tokyo LA Honolulu Singapore Sydney Dallas NYC Metro DC Metro

Expanded Geographic Presence IBX Centers Worldwide 1, 300, 000+ square feet in 11 key markets Chicago San Jose Hong Kong Tokyo LA Honolulu Singapore Sydney Dallas NYC Metro DC Metro

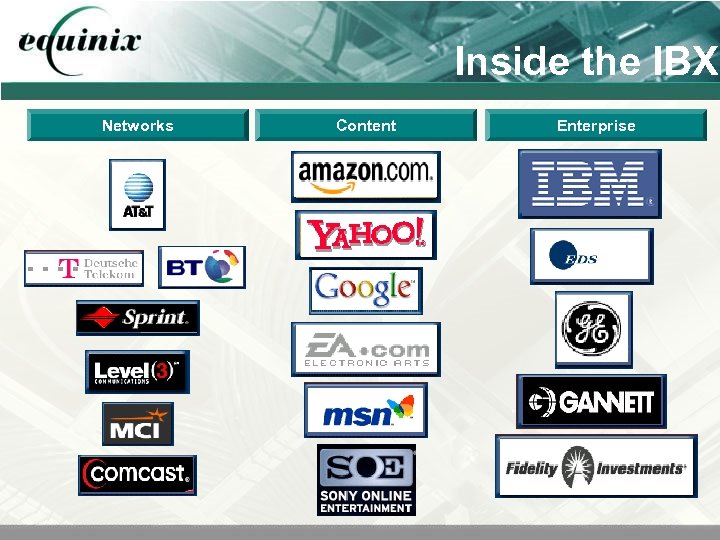

Inside the IBX Networks Content Enterprise

Inside the IBX Networks Content Enterprise

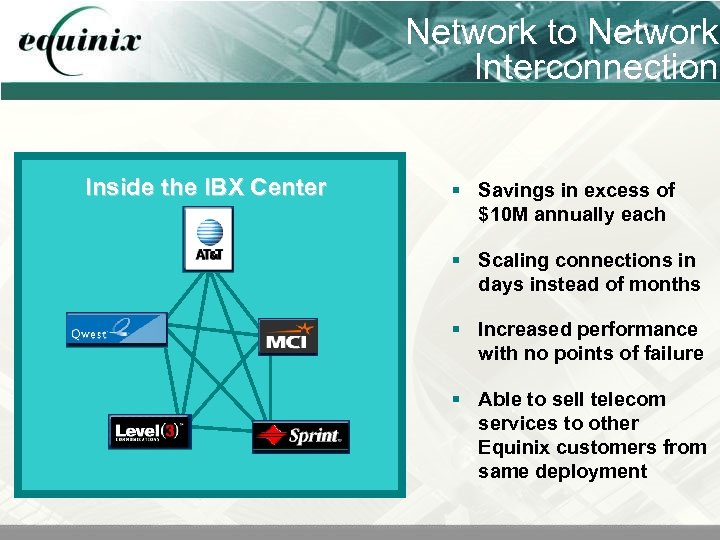

Network to Network Interconnection Inside the IBX Center § Savings in excess of $10 M annually each § Scaling connections in days instead of months § Increased performance with no points of failure § Able to sell telecom services to other Equinix customers from same deployment

Network to Network Interconnection Inside the IBX Center § Savings in excess of $10 M annually each § Scaling connections in days instead of months § Increased performance with no points of failure § Able to sell telecom services to other Equinix customers from same deployment

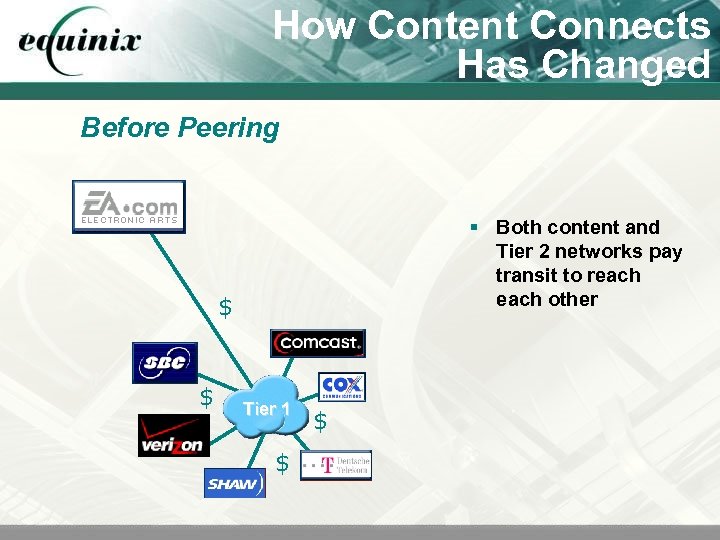

How Content Connects Has Changed Before Peering § Both content and Tier 2 networks pay transit to reach other $ $ Tier 1 $ $

How Content Connects Has Changed Before Peering § Both content and Tier 2 networks pay transit to reach other $ $ Tier 1 $ $

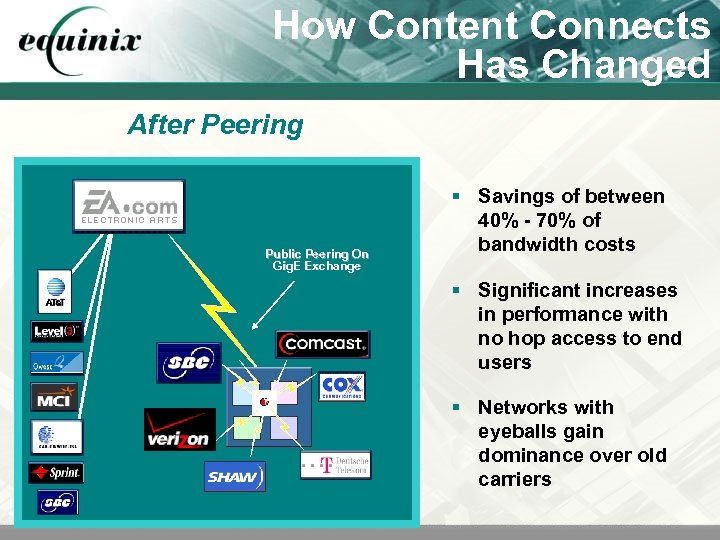

How Content Connects Has Changed After Peering Public Peering On Gig. E Exchange § Significant increases in performance with no hop access to end users $ $ § Savings of between 40% - 70% of bandwidth costs Tier 1 $ $ § Networks with eyeballs gain dominance over old carriers

How Content Connects Has Changed After Peering Public Peering On Gig. E Exchange § Significant increases in performance with no hop access to end users $ $ § Savings of between 40% - 70% of bandwidth costs Tier 1 $ $ § Networks with eyeballs gain dominance over old carriers

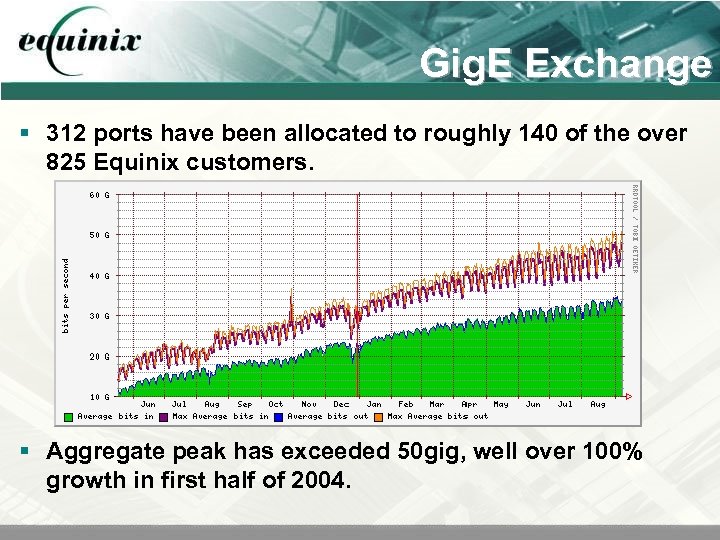

Gig. E Exchange § 312 ports have been allocated to roughly 140 of the over 825 Equinix customers. § Aggregate peak has exceeded 50 gig, well over 100% growth in first half of 2004.

Gig. E Exchange § 312 ports have been allocated to roughly 140 of the over 825 Equinix customers. § Aggregate peak has exceeded 50 gig, well over 100% growth in first half of 2004.

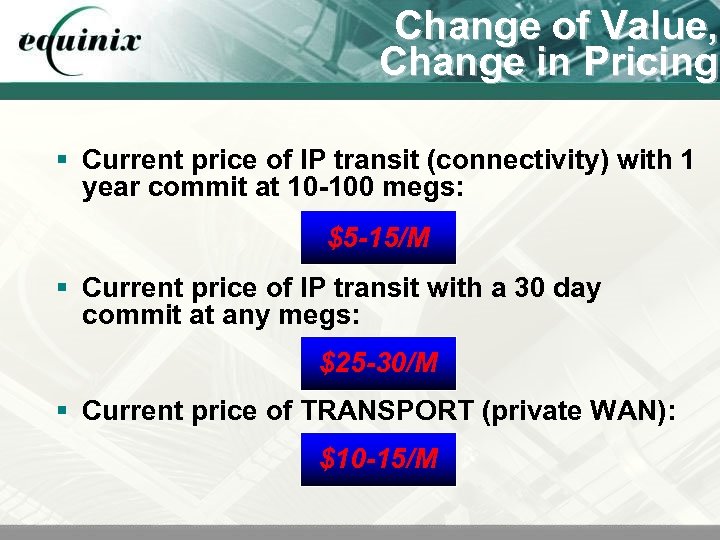

Change of Value, Change in Pricing § Current price of IP transit (connectivity) with 1 year commit at 10 -100 megs: $5 -15/M § Current price of IP transit with a 30 day commit at any megs: $25 -30/M § Current price of TRANSPORT (private WAN): $10 -15/M

Change of Value, Change in Pricing § Current price of IP transit (connectivity) with 1 year commit at 10 -100 megs: $5 -15/M § Current price of IP transit with a 30 day commit at any megs: $25 -30/M § Current price of TRANSPORT (private WAN): $10 -15/M

Before The Shift § In 2001, most content and eyeball networks were 100% transit § A typical broadband network or content paid for every packet delivered § Demands on broadband were limited § Costs were rapidly accelerating § “We’re waiting for the killer app. ” § “We’re waiting for proliferation of broadband. ”

Before The Shift § In 2001, most content and eyeball networks were 100% transit § A typical broadband network or content paid for every packet delivered § Demands on broadband were limited § Costs were rapidly accelerating § “We’re waiting for the killer app. ” § “We’re waiting for proliferation of broadband. ”

After The Shift § In 2004, major content is over 50% peered § In 2004, major broadband is over 70 -80% peered § Since 2002, report from FCC (September, 2004) indicates the number of broadband users have tripled to 48 million subs § Networks without eyeballs or content have limited value § New applications driving massive change in Internet food chain

After The Shift § In 2004, major content is over 50% peered § In 2004, major broadband is over 70 -80% peered § Since 2002, report from FCC (September, 2004) indicates the number of broadband users have tripled to 48 million subs § Networks without eyeballs or content have limited value § New applications driving massive change in Internet food chain

Case Study: Yahoo! and SBC § In 2000/2001, Yahoo! paid for every packet delivered (transit or CDN) § In 2004, to SBC alone, Yahoo! provisions over 25 -30 gigabytes/sec, more than any other broadband network § In total, Yahoo! sends out about 40 -50 gigs § SBC now handling more eyeballs and content than most other broadband networks § Next month, all of these figures will TRIPLE. § SBC buys the remainder from Sprint… ? § Comcast is waiting in the wings…

Case Study: Yahoo! and SBC § In 2000/2001, Yahoo! paid for every packet delivered (transit or CDN) § In 2004, to SBC alone, Yahoo! provisions over 25 -30 gigabytes/sec, more than any other broadband network § In total, Yahoo! sends out about 40 -50 gigs § SBC now handling more eyeballs and content than most other broadband networks § Next month, all of these figures will TRIPLE. § SBC buys the remainder from Sprint… ? § Comcast is waiting in the wings…

Case Study: Netflix § In 2004, Netflix announces they will be offering downloadable 4 gig movies § In 2004, Netflix announces relationship with Tivo § In 2005, Netflix will offer these downloads to their over 2. 5 MILLION users on broadband… § Not even technically possible without direct to eyeball network relationships! § Announcements from Amazon. com and Wal-Mart offering identical offerings

Case Study: Netflix § In 2004, Netflix announces they will be offering downloadable 4 gig movies § In 2004, Netflix announces relationship with Tivo § In 2005, Netflix will offer these downloads to their over 2. 5 MILLION users on broadband… § Not even technically possible without direct to eyeball network relationships! § Announcements from Amazon. com and Wal-Mart offering identical offerings

Case Study: Apple § Apple i. Tunes offers the legal digital distribution of large copyrighted content § In 2004, Apple uses a combination of transit, peering and CDN to accommodate demand § Audible. com, Audio. Feast and others add other materials, such as books on tape § Volume of content forcing bypass of commodity networks

Case Study: Apple § Apple i. Tunes offers the legal digital distribution of large copyrighted content § In 2004, Apple uses a combination of transit, peering and CDN to accommodate demand § Audible. com, Audio. Feast and others add other materials, such as books on tape § Volume of content forcing bypass of commodity networks

Case Study: Vo. IP § Expectation is that broadband is required for consumer Vo. IP § Vo. IP providers offering voicemail and other features stored centrally § Non-tech consumers, with adapters, expected to adopt seamlessly § Unknown volume impact, though broadband providers implementing Qo. S for inter-provider connections

Case Study: Vo. IP § Expectation is that broadband is required for consumer Vo. IP § Vo. IP providers offering voicemail and other features stored centrally § Non-tech consumers, with adapters, expected to adopt seamlessly § Unknown volume impact, though broadband providers implementing Qo. S for inter-provider connections

Jay Adelson, Founder, CTO adelson@equinix. com

Jay Adelson, Founder, CTO adelson@equinix. com