ITT-Autumn-2016-Lecture-1-E.ppt

- Количество слайдов: 40

International Trade: Theory and Policy Lecture 1 September, 2016 Instructor: Natalia Davidson Lecture is prepared by Prof. Sergey Kadochnikov, Natalia Davidson, Irina Aleynikova 1

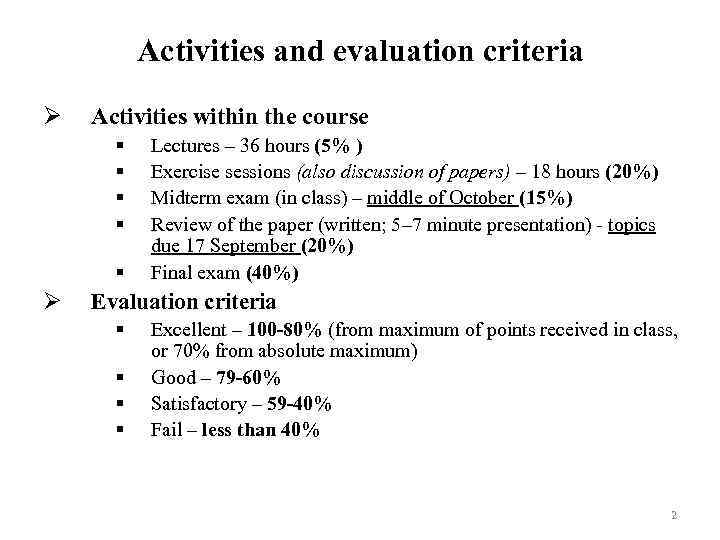

Activities and evaluation criteria Ø Activities within the course § § § Ø Lectures – 36 hours (5% ) Exercise sessions (also discussion of papers) – 18 hours (20%) Midterm exam (in class) – middle of October (15%) Review of the paper (written; 5– 7 minute presentation) - topics due 17 September (20%) Final exam (40%) Evaluation criteria § § Excellent – 100 -80% (from maximum of points received in class, or 70% from absolute maximum) Good – 79 -60% Satisfactory – 59 -40% Fail – less than 40% 2

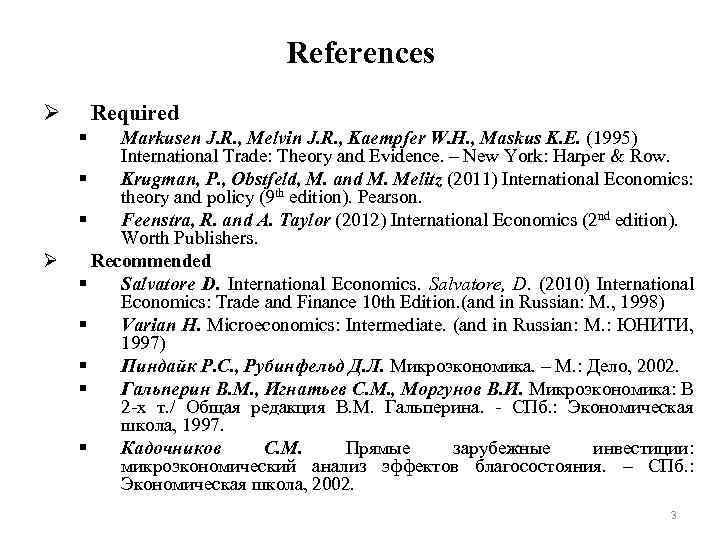

References Ø Required § Ø Markusen J. R. , Melvin J. R. , Kaempfer W. H. , Maskus K. E. (1995) International Trade: Theory and Evidence. – New York: Harper & Row. § Krugman, P. , Obstfeld, M. and M. Melitz (2011) International Economics: theory and policy (9 th edition). Pearson. § Feenstra, R. and A. Taylor (2012) International Economics (2 nd edition). Worth Publishers. Recommended § Salvatore D. International Economics. Salvatore, D. (2010) International Economics: Trade and Finance 10 th Edition. (and in Russian: М. , 1998) § Varian H. Microeconomics: Intermediate. (and in Russian: М. : ЮНИТИ, 1997) § Пиндайк Р. С. , Рубинфельд Д. Л. Микроэкономика. – М. : Дело, 2002. § Гальперин В. М. , Игнатьев С. М. , Моргунов В. И. Микроэкономика: В 2 -х т. / Общая редакция В. М. Гальперина. - СПб. : Экономическая школа, 1997. § Кадочников С. М. Прямые зарубежные инвестиции: микроэкономический анализ эффектов благосостояния. – СПб. : Экономическая школа, 2002. 3

Part I. General equilibrium in closed and open economies • Topic 1. Issues of International trade theory. Technical concepts of International Trade Theory and general equilibrium in closed economy. • Topic 2. General equilibrium of open economy • Topic 3. Gains from free international trade under perfect competition on the markets 4

Topic 1. Issues of modern International Trade Theory. Technical concepts of International Trade Theory and general equilibrium in closed economy. 1. 1. Structure, problems and specific features of International Trade Theory. What is traded? Who is trading – countries or firms? In which sort of competition on global markets? 1. 2. General equilibrium of production sector in closed economy. The concepts of technical and market efficiency in production. 1. 3. Interrelation between technology and production possibility curve. 1. 4. General equilibrium of household sector in closed economy. Concept of social indifference curves. 1. 5. General equilibrium in closed economy. 5

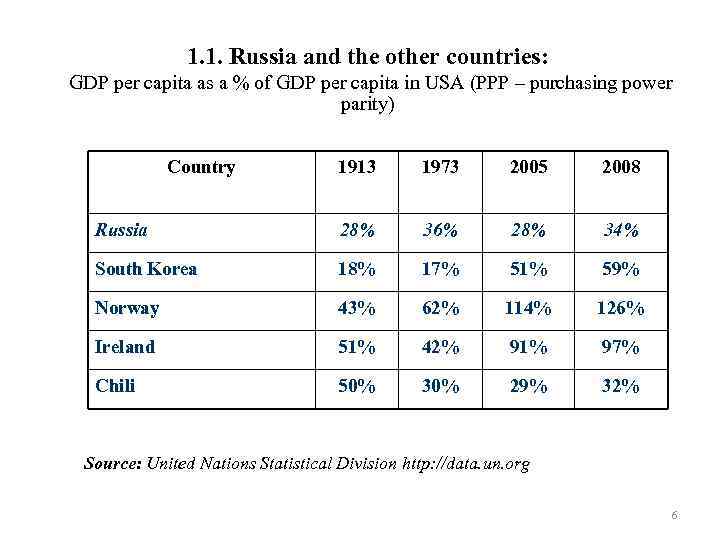

1. 1. Russia and the other countries: GDP per capita as a % of GDP per capita in USA (PPP – purchasing power parity) Country 1913 1973 2005 2008 Russia 28% 36% 28% 34% South Korea 18% 17% 51% 59% Norway 43% 62% 114% 126% Ireland 51% 42% 91% 97% Chili 50% 30% 29% 32% Source: United Nations Statistical Division http: //data. un. org 6

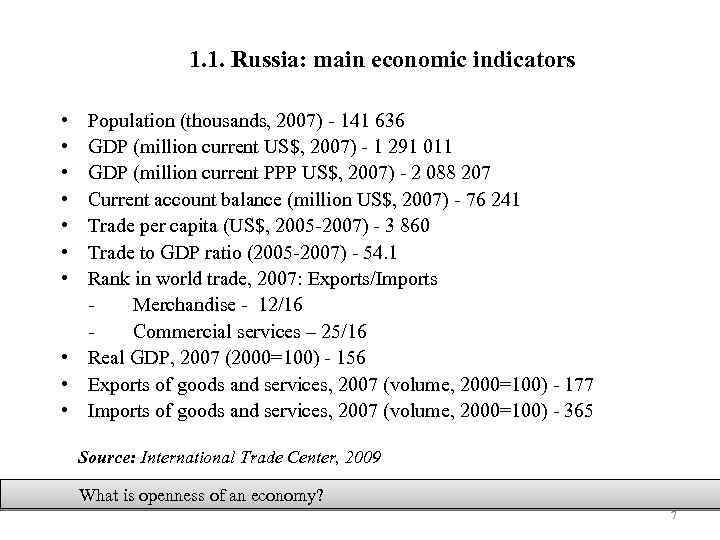

1. 1. Russia: main economic indicators • • Population (thousands, 2007) - 141 636 GDP (million current US$, 2007) - 1 291 011 GDP (million current PPP US$, 2007) - 2 088 207 Current account balance (million US$, 2007) - 76 241 Trade per capita (US$, 2005 -2007) - 3 860 Trade to GDP ratio (2005 -2007) - 54. 1 Rank in world trade, 2007: Exports/Imports Merchandise - 12/16 Commercial services – 25/16 • Real GDP, 2007 (2000=100) - 156 • Exports of goods and services, 2007 (volume, 2000=100) - 177 • Imports of goods and services, 2007 (volume, 2000=100) - 365 Source: International Trade Center, 2009 What is openness of an economy? 7

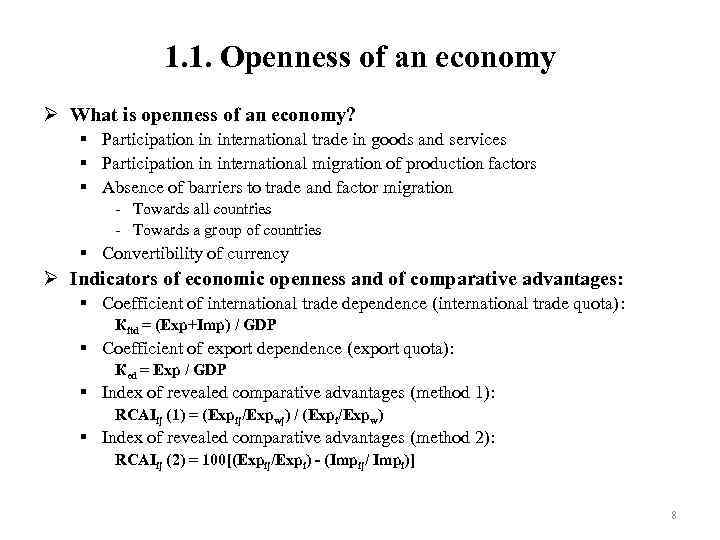

1. 1. Openness of an economy Ø What is openness of an economy? § Participation in international trade in goods and services § Participation in international migration of production factors § Absence of barriers to trade and factor migration - Towards all countries - Towards a group of countries § Convertibility of currency Ø Indicators of economic openness and of comparative advantages: § Coefficient of international trade dependence (international trade quota): Кitd = (Exp+Imp) / GDP § Coefficient of export dependence (export quota): Кеd = Exp / GDP § Index of revealed comparative advantages (method 1): RCAIij (1) = (Expij/Expwj) / (Expi/Expw) § Index of revealed comparative advantages (method 2): RCAIij (2) = 100[(Expij/Expi) - (Impij/ Impi)] 8

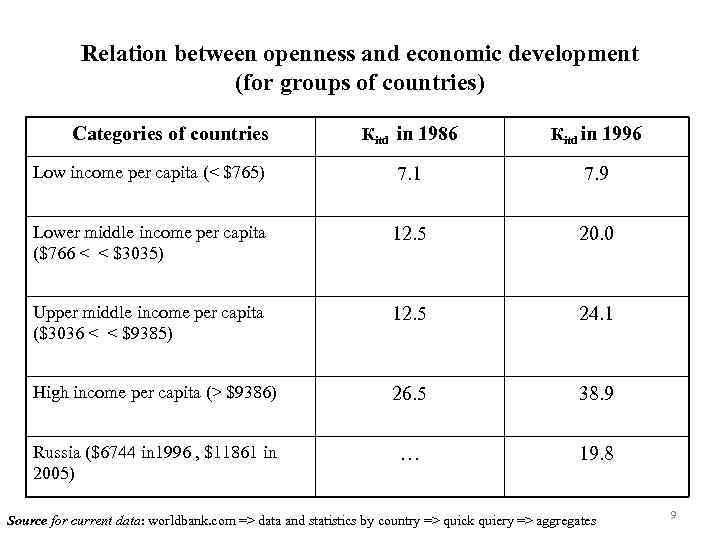

Relation between openness and economic development (for groups of countries) Categories of countries Кitd in 1986 Кitd in 1996 Low income per capita (< $765) 7. 1 7. 9 Lower middle income per capita ($766 < < $3035) 12. 5 20. 0 Upper middle income per capita ($3036 < < $9385) 12. 5 24. 1 High income per capita (> $9386) 26. 5 38. 9 Russia ($6744 in 1996 , $11861 in 2005) … 19. 8 Source for current data: worldbank. com => data and statistics by country => quick quiery => aggregates 9

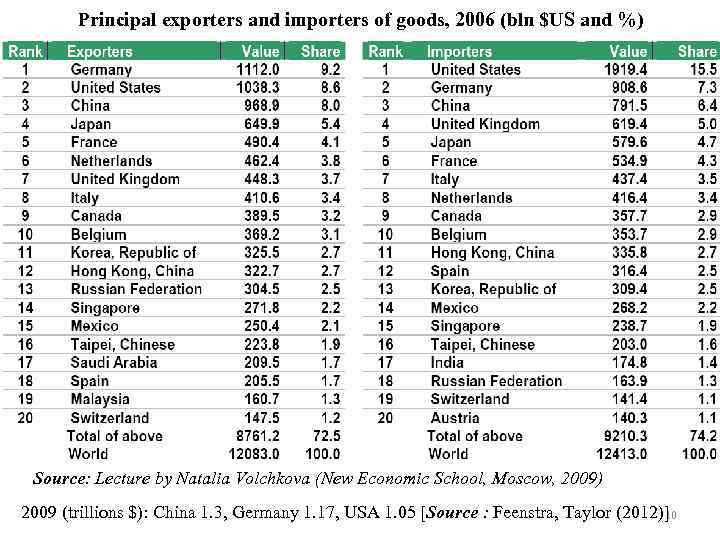

Principal exporters and importers of goods, 2006 (bln $US and %) Source: Lecture by Natalia Volchkova (New Economic School, Moscow, 2009) 2009 (trillions $): China 1. 3, Germany 1. 17, USA 1. 05 [Source : Feenstra, Taylor (2012)] 10

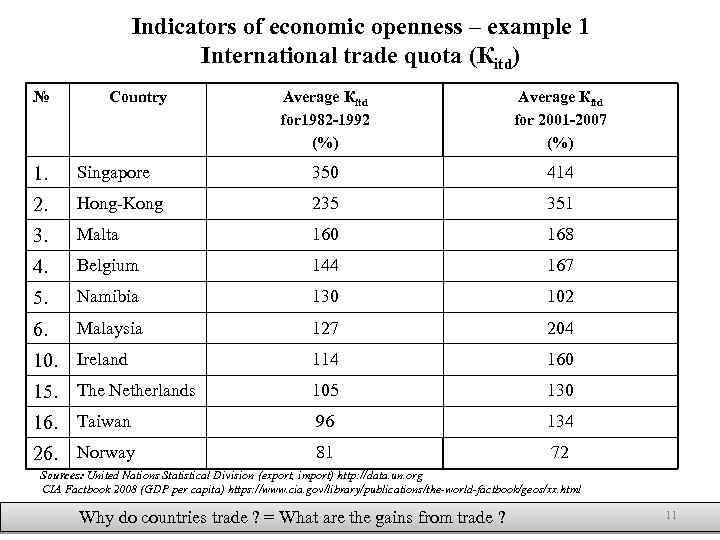

Indicators of economic openness – example 1 International trade quota (Кitd) № Country Average Кitd for 1982 -1992 (%) Average Кitd for 2001 -2007 (%) 1. Singapore 350 414 2. Hong-Kong 235 351 3. Malta 160 168 4. Belgium 144 167 5. Namibia 130 102 6. Malaysia 127 204 10. Ireland 114 160 15. The Netherlands 105 130 16. Taiwan 96 134 26. Norway 81 72 Sources: United Nations Statistical Division (export, import) http: //data. un. org CIA Factbook 2008 (GDP per capita) https: //www. cia. gov/library/publications/the-world-factbook/geos/xx. html Why do countries trade ? = What are the gains from trade ? 11

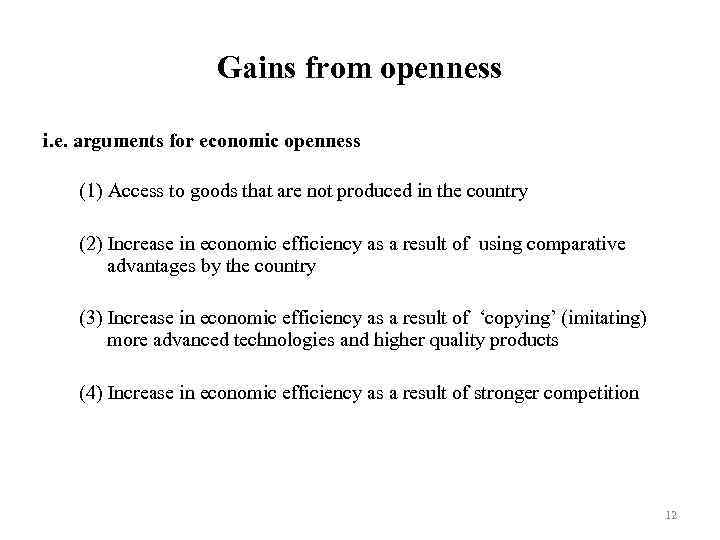

Gains from openness i. e. arguments for economic openness (1) Access to goods that are not produced in the country (2) Increase in economic efficiency as a result of using comparative advantages by the country (3) Increase in economic efficiency as a result of ‘copying’ (imitating) more advanced technologies and higher quality products (4) Increase in economic efficiency as a result of stronger competition 12

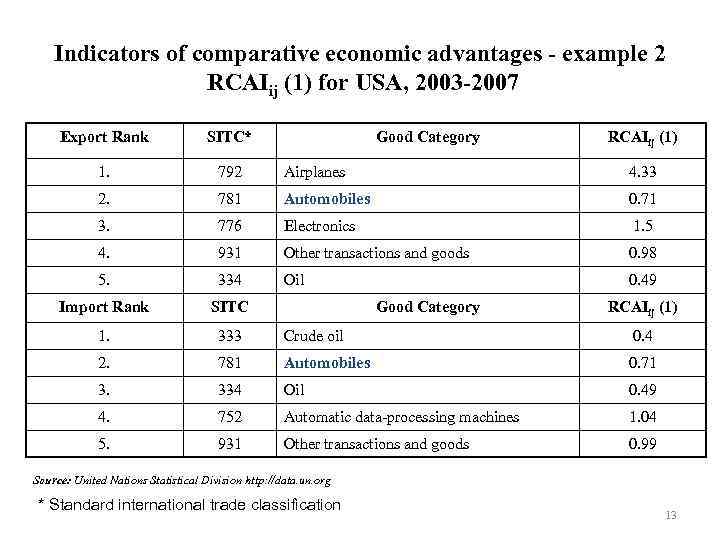

Indicators of comparative economic advantages - example 2 RCAIij (1) for USA, 2003 -2007 Export Rank SITC* Good Category 1. 792 Airplanes 4. 33 2. 781 Automobiles 0. 71 3. 776 Electronics 1. 5 4. 931 Other transactions and goods 0. 98 5. 334 Oil 0. 49 Import Rank SITC 1. 333 Crude oil 0. 4 2. 781 Automobiles 0. 71 3. 334 Oil 0. 49 4. 752 Automatic data-processing machines 1. 04 5. 931 Other transactions and goods 0. 99 Good Category RCAIij (1) Source: United Nations Statistical Division http: //data. un. org * Standard international trade classification 13

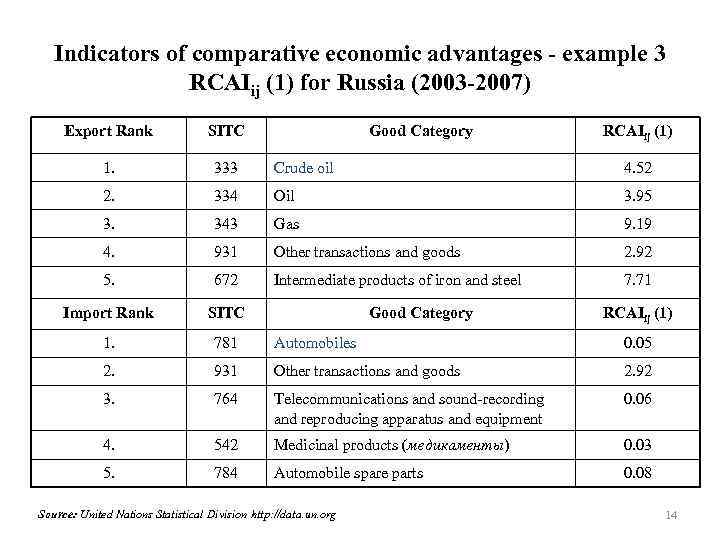

Indicators of comparative economic advantages - example 3 RCAIij (1) for Russia (2003 -2007) Export Rank SITC Good Category 1. 333 Crude oil 4. 52 2. 334 Oil 3. 95 3. 343 Gas 9. 19 4. 931 Other transactions and goods 2. 92 5. 672 Intermediate products of iron and steel 7. 71 Import Rank SITC 1. 781 Automobiles 0. 05 2. 931 Other transactions and goods 2. 92 3. 764 Telecommunications and sound-recording and reproducing apparatus and equipment 0. 06 4. 542 Medicinal products (медикаменты) 0. 03 5. 784 Automobile spare parts 0. 08 Good Category Source: United Nations Statistical Division http: //data. un. org RCAIij (1) 14

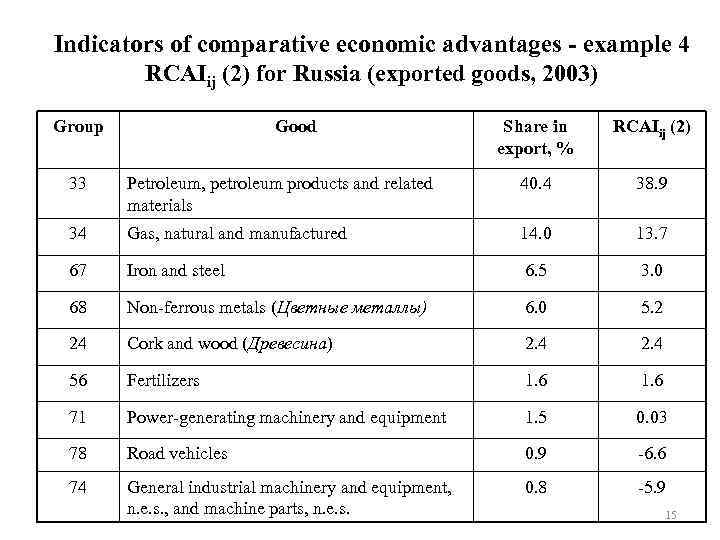

Indicators of comparative economic advantages - example 4 RCAIij (2) for Russia (exported goods, 2003) Group Good Share in export, % RCAIij (2) 33 Petroleum, petroleum products and related materials 40. 4 38. 9 34 Gas, natural and manufactured 14. 0 13. 7 67 Iron and steel 6. 5 3. 0 68 Non-ferrous metals (Цветные металлы) 6. 0 5. 2 24 Cork and wood (Древесина) 2. 4 56 Fertilizers 1. 6 71 Power-generating machinery and equipment 1. 5 0. 03 78 Road vehicles 0. 9 -6. 6 74 General industrial machinery and equipment, n. e. s. , and machine parts, n. e. s. 0. 8 -5. 9 15

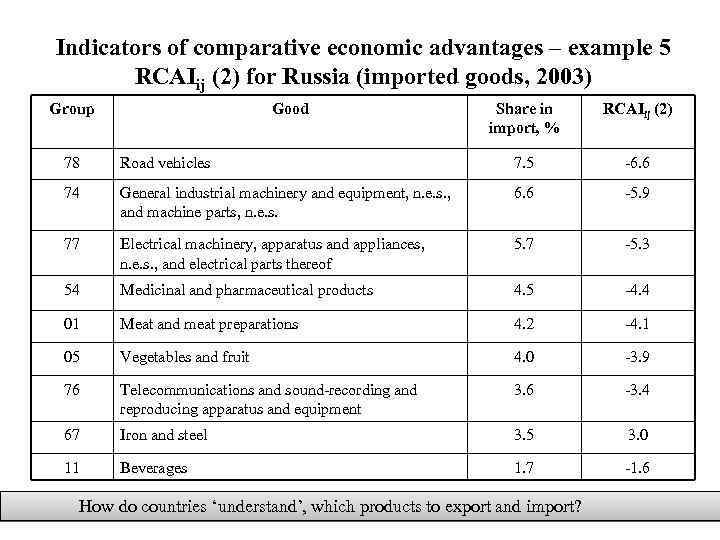

Indicators of comparative economic advantages – example 5 RCAIij (2) for Russia (imported goods, 2003) Group Good Share in import, % RCAIij (2) 78 Road vehicles 7. 5 -6. 6 74 General industrial machinery and equipment, n. e. s. , and machine parts, n. e. s. 6. 6 -5. 9 77 Electrical machinery, apparatus and appliances, n. e. s. , and electrical parts thereof 5. 7 -5. 3 54 Medicinal and pharmaceutical products 4. 5 -4. 4 01 Meat and meat preparations 4. 2 -4. 1 05 Vegetables and fruit 4. 0 -3. 9 76 Telecommunications and sound-recording and reproducing apparatus and equipment 3. 6 -3. 4 67 Iron and steel 3. 5 3. 0 11 Beverages 1. 7 -1. 6 How do countries ‘understand’, which products to export and import? 16

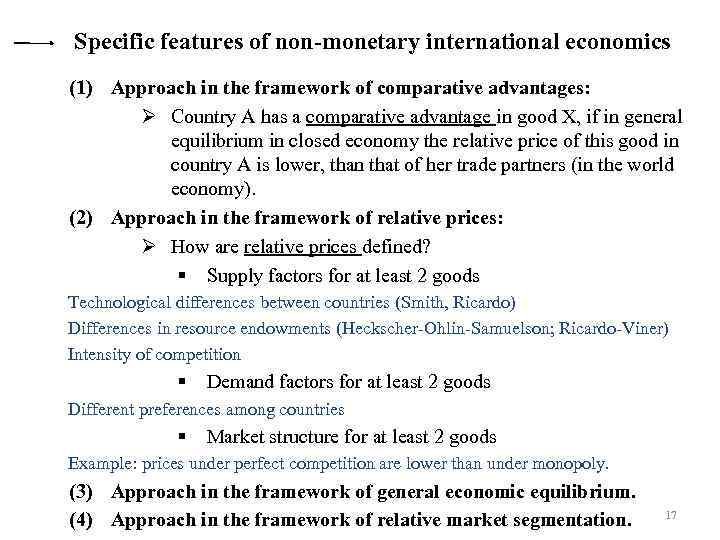

Specific features of non-monetary international economics (1) Approach in the framework of comparative advantages: Ø Country A has a comparative advantage in good X, if in general equilibrium in closed economy the relative price of this good in country A is lower, than that of her trade partners (in the world economy). (2) Approach in the framework of relative prices: Ø How are relative prices defined? § Supply factors for at least 2 goods Technological differences between countries (Smith, Ricardo) Differences in resource endowments (Heckscher-Ohlin-Samuelson; Ricardo-Viner) Intensity of competition § Demand factors for at least 2 goods Different preferences among countries § Market structure for at least 2 goods Example: prices under perfect competition are lower than under monopoly. (3) Approach in the framework of general economic equilibrium. (4) Approach in the framework of relative market segmentation. 17

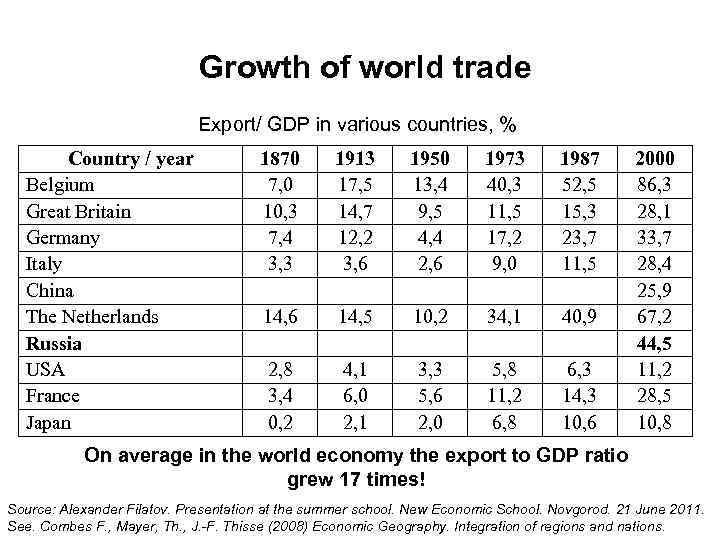

Growth of world trade Export/ GDP in various countries, % Country / year Belgium Great Britain Germany Italy China The Netherlands Russia USA France Japan 1870 7, 0 10, 3 7, 4 3, 3 1913 17, 5 14, 7 12, 2 3, 6 1950 13, 4 9, 5 4, 4 2, 6 1973 40, 3 11, 5 17, 2 9, 0 1987 52, 5 15, 3 23, 7 11, 5 14, 6 14, 5 10, 2 34, 1 40, 9 2, 8 3, 4 0, 2 4, 1 6, 0 2, 1 3, 3 5, 6 2, 0 5, 8 11, 2 6, 8 6, 3 14, 3 10, 6 2000 86, 3 28, 1 33, 7 28, 4 25, 9 67, 2 44, 5 11, 2 28, 5 10, 8 On average in the world economy the export to GDP ratio grew 17 times! Source: Alexander Filatov. Presentation at the summer school. New Economic School. Novgorod. 21 June 2011. See. Combes F. , Mayer, Th. , J. -F. Thisse (2008) Economic Geography. Integration of regions and nations.

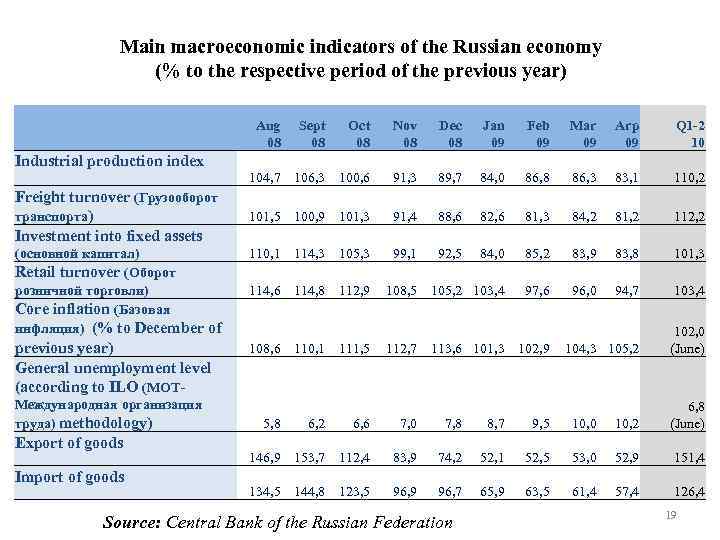

Main macroeconomic indicators of the Russian economy (% to the respective period of the previous year) Oct 08 Nov 08 Dec 08 Jan 09 Feb 09 Mar 09 Arp 09 Q 1 -2 10 104, 7 106, 3 100, 6 91, 3 89, 7 84, 0 86, 8 86, 3 83, 1 110, 2 101, 5 100, 9 101, 3 91, 4 88, 6 82, 6 81, 3 84, 2 81, 2 112, 2 (основной капитал) Retail turnover (Оборот розничной торговли) Core inflation (Базовая инфляция) (% to December of 110, 1 114, 3 105, 3 99, 1 92, 5 84, 0 85, 2 83, 9 83, 8 101, 3 108, 5 105, 2 103, 4 97, 6 96, 0 94, 7 103, 4 previous year) General unemployment level (according to ILO (МОТ- 108, 6 110, 1 111, 5 104, 3 105, 2 102, 0 (June) Industrial production index Freight turnover (Грузооборот транспорта) Investment into fixed assets Международная организация труда) methodology) Export of goods Import of goods Aug Sept 08 08 114, 6 114, 8 112, 9 112, 7 113, 6 101, 3 102, 9 6, 6 7, 0 7, 8 8, 7 9, 5 10, 0 10, 2 6, 8 (June) 146, 9 153, 7 112, 4 83, 9 74, 2 52, 1 52, 5 53, 0 52, 9 151, 4 134, 5 144, 8 123, 5 96, 9 96, 7 65, 9 63, 5 61, 4 57, 4 126, 4 5, 8 6, 2 Source: Central Bank of the Russian Federation 19

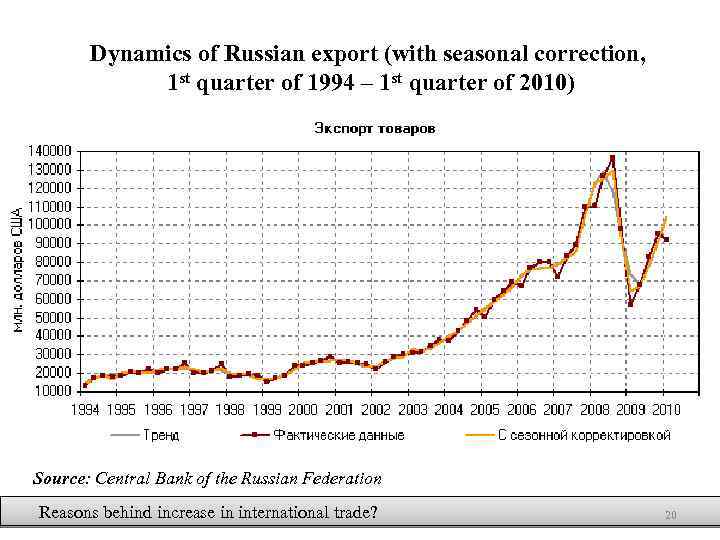

Dynamics of Russian export (with seasonal correction, 1 st quarter of 1994 – 1 st quarter of 2010) Source: Central Bank of the Russian Federation Reasons behind increase in international trade? 20

Why did the volumes of international trade grow? • Two waves of globalization connected to technological progress and trade liberalization - roughly 1870 -1914 and 1960 to present (Baldwin, Martin (1999)) • Growth of trade starting from 1950 ies. GATT and significant decrease in tariffs in the industrialized countries • By 1980 ies a number of developing countries inspired by success of South Korea and Taiwan liberalized their trade See Feenstra, Taylor (2012) Ch. 1. 21

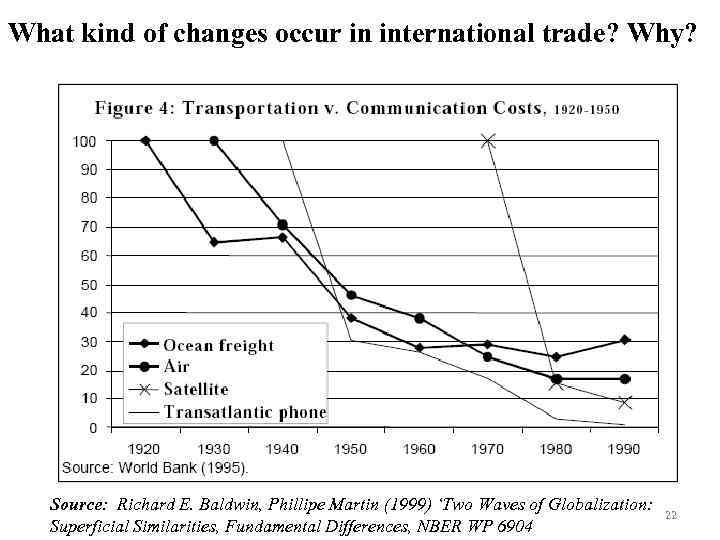

What kind of changes occur in international trade? Why? Source: Richard E. Baldwin, Phillipe Martin (1999) ‘Two Waves of Globalization: Superficial Similarities, Fundamental Differences, NBER WP 6904 22

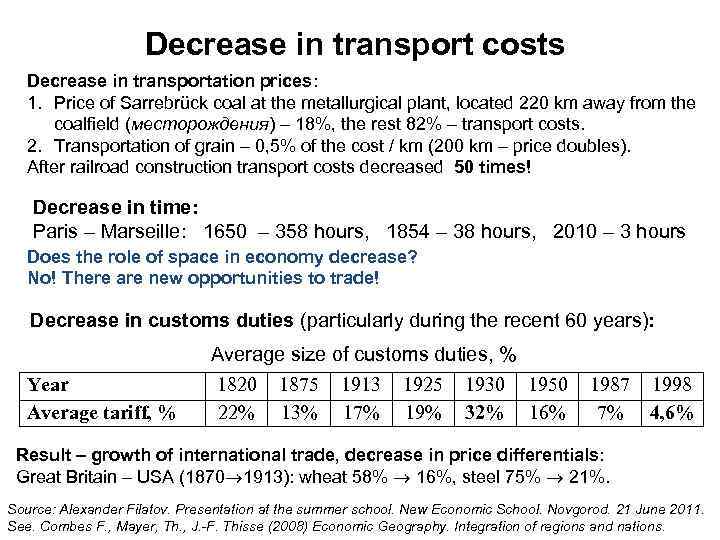

Decrease in transport costs Decrease in transportation prices: 1. Price of Sarrebrück coal at the metallurgical plant, located 220 km away from the coalfield (месторождения) – 18%, the rest 82% – transport costs. 2. Transportation of grain – 0, 5% of the cost / km (200 km – price doubles). After railroad construction transport costs decreased 50 times! Decrease in time: Paris – Marseille: 1650 – 358 hours, 1854 – 38 hours, 2010 – 3 hours Does the role of space in economy decrease? No! There are new opportunities to trade! Decrease in customs duties (particularly during the recent 60 years): Year Average tariff, % Average size of customs duties, % 1820 1875 1913 1925 1930 1950 22% 13% 17% 19% 32% 16% 1987 1998 7% 4, 6% Result – growth of international trade, decrease in price differentials: Great Britain – USA (1870 1913): wheat 58% 16%, steel 75% 21%. Source: Alexander Filatov. Presentation at the summer school. New Economic School. Novgorod. 21 June 2011. See. Combes F. , Mayer, Th. , J. -F. Thisse (2008) Economic Geography. Integration of regions and nations.

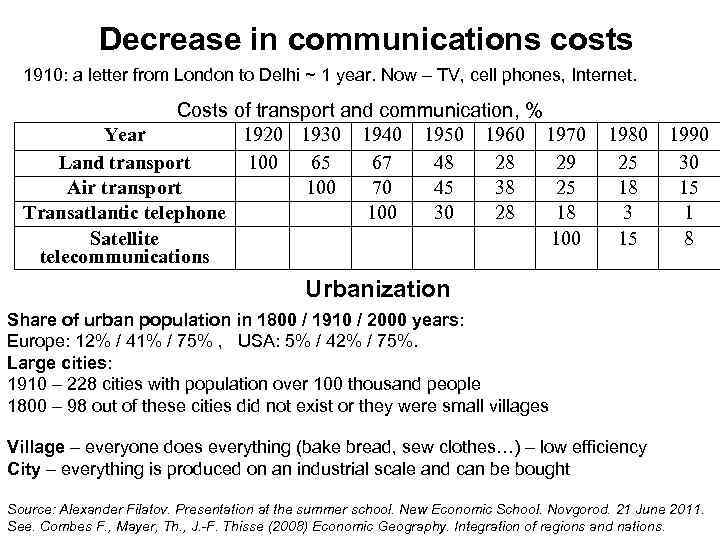

Decrease in communications costs 1910: a letter from London to Delhi ~ 1 year. Now – TV, cell phones, Internet. Costs of transport and communication, % Year 1920 1930 1940 1950 1960 1970 Land transport 100 65 67 48 28 29 Air transport 100 70 45 38 25 Transatlantic telephone 100 30 28 18 Satellite 100 telecommunications 1980 25 18 3 15 1990 30 15 1 8 Urbanization Share of urban population in 1800 / 1910 / 2000 years: Europe: 12% / 41% / 75% , USA: 5% / 42% / 75%. Large cities: 1910 – 228 cities with population over 100 thousand people 1800 – 98 out of these cities did not exist or they were small villages Village – everyone does everything (bake bread, sew clothes…) – low efficiency City – everything is produced on an industrial scale and can be bought Source: Alexander Filatov. Presentation at the summer school. New Economic School. Novgorod. 21 June 2011. See. Combes F. , Mayer, Th. , J. -F. Thisse (2008) Economic Geography. Integration of regions and nations.

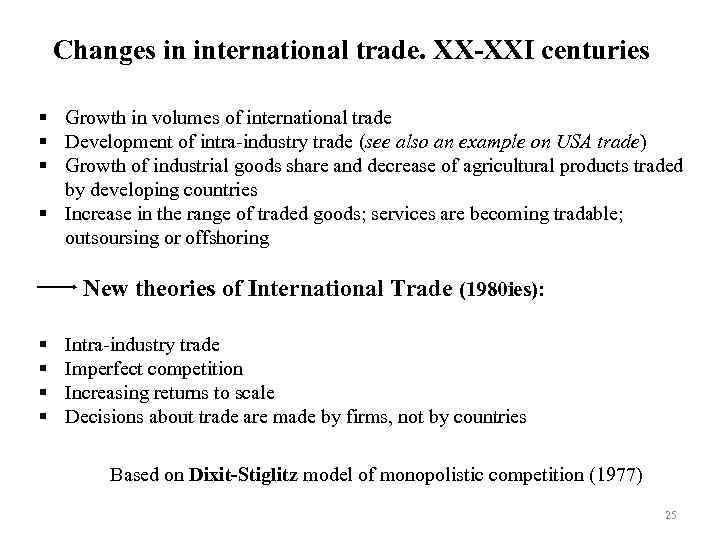

Changes in international trade. XX-XXI centuries § Growth in volumes of international trade § Development of intra-industry trade (see also an example on USA trade) § Growth of industrial goods share and decrease of agricultural products traded by developing countries § Increase in the range of traded goods; services are becoming tradable; outsoursing or offshoring New theories of International Trade (1980 ies): § § Intra-industry trade Imperfect competition Increasing returns to scale Decisions about trade are made by firms, not by countries Based on Dixit-Stiglitz model of monopolistic competition (1977) 25

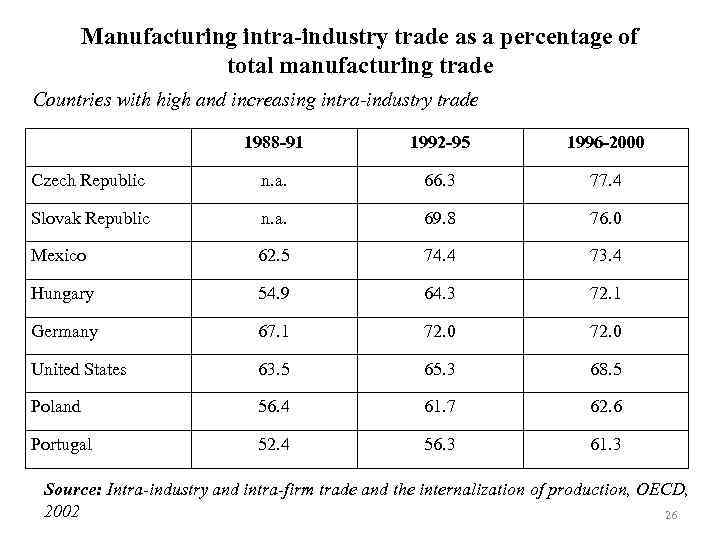

Manufacturing intra-industry trade as a percentage of total manufacturing trade Countries with high and increasing intra-industry trade 1988 -91 1992 -95 1996 -2000 Czech Republic n. a. 66. 3 77. 4 Slovak Republic n. a. 69. 8 76. 0 Mexico 62. 5 74. 4 73. 4 Hungary 54. 9 64. 3 72. 1 Germany 67. 1 72. 0 United States 63. 5 65. 3 68. 5 Poland 56. 4 61. 7 62. 6 Portugal 52. 4 56. 3 61. 3 Source: Intra-industry and intra-firm trade and the internalization of production, OECD, 2002 26

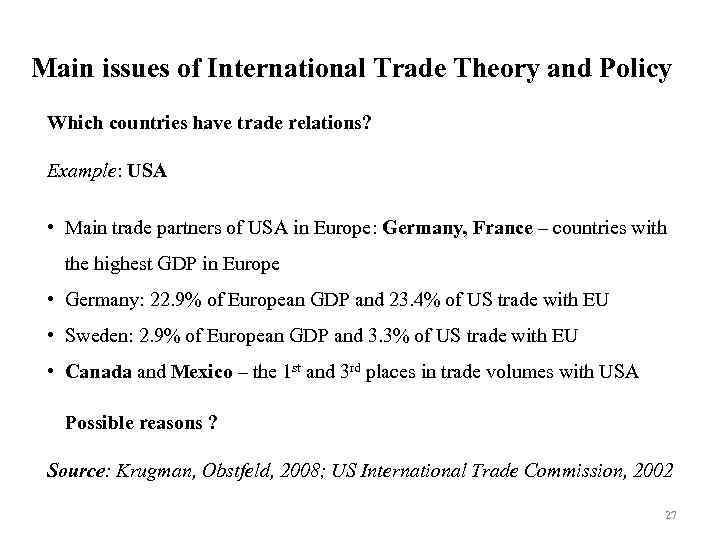

Main issues of International Trade Theory and Policy Which countries have trade relations? Example: USA • Main trade partners of USA in Europe: Germany, France – countries with the highest GDP in Europe • Germany: 22. 9% of European GDP and 23. 4% of US trade with EU • Sweden: 2. 9% of European GDP and 3. 3% of US trade with EU • Canada and Mexico – the 1 st and 3 rd places in trade volumes with USA Possible reasons ? Source: Krugman, Obstfeld, 2008; US International Trade Commission, 2002 27

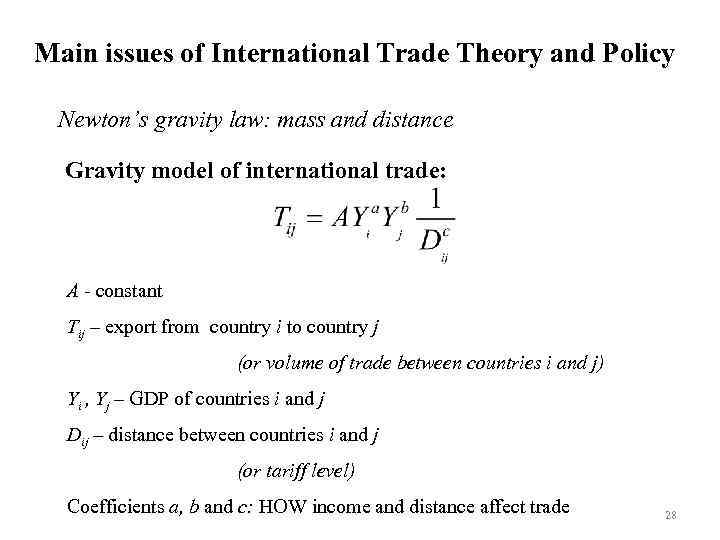

Main issues of International Trade Theory and Policy Newton’s gravity law: mass and distance Gravity model of international trade: A - constant Tij – export from country i to country j (or volume of trade between countries i and j) Yi , Yj – GDP of countries i and j Dij – distance between countries i and j (or tariff level) Coefficients a, b and c: HOW income and distance affect trade 28

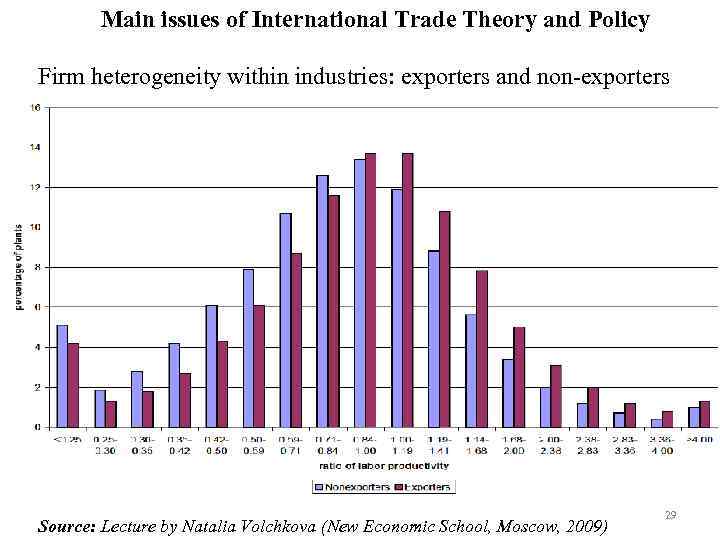

Main issues of International Trade Theory and Policy Firm heterogeneity within industries: exporters and non-exporters Source: Lecture by Natalia Volchkova (New Economic School, Moscow, 2009) 29

Models with heterogeneous firms* Scale of plants/firms heterogeneity inside industries: why is it important? • May an average firm belonging to an industry be analyzed? • Comparative advantage of a country: can it be changed? ----------------------------------------* This topic will be considered within the course of Advanced International Trade Theory 30

Structure of International Trade Theory and Policy (1) Theories of International Trade: Ø Classical theories of international trade; Ø Neoclassical theories of international trade; Ø Modern theories of international trade. (2) Theories of International Trade Policy (normative and positive analysis): Ø Neoclassical theory of international trade policy; Ø Theory of strategic trade policy; Ø Political economy of protectionism. (3) Theories of international movement of production factors: Ø Theory of international labour migration; Ø Theory of foreign portfolio investment; Ø Theory of foreign direct investment (FDI). (4) Theory of international economic integration. 31

Main issues of International Trade Theory and Policy. Trade How is structure of international trade defined? • Structure of countries’ comparative advantages • Structure of export and import of the trading countries Positive effects from international trade on the trading countries • The impact of trade on equilibrium volumes of production and consumption of goods • The impact of trade on equilibrium prices of final goods inside the countries and on the world market • The impact of trade on equilibrium prices of production factors (on the level and distribution of incomes of the owners of production factors) Normative effects from international trade on the trading countries • The impact of trade on the welfare of the world economy • Outcome of the models varies depending on assumptions: market structure, production factor mobility etc. • Different effects for different ‘interest groups’ within an economy Other issues of International Trade Theory and Policy? 32

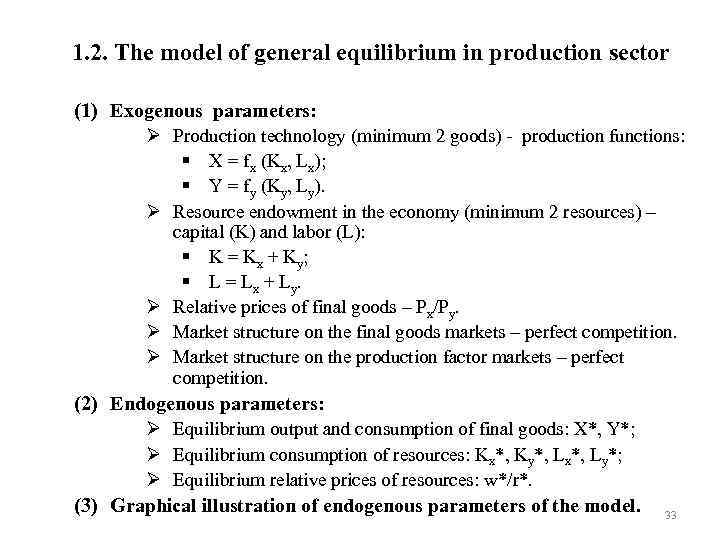

1. 2. The model of general equilibrium in production sector (1) Exogenous parameters: Ø Production technology (minimum 2 goods) - production functions: § Х = fx (Kx, Lx); § Y = fy (Ky, Ly). Ø Resource endowment in the economy (minimum 2 resources) – capital (K) and labor (L): § K = Kx + Ky; § L = Lx + Ly. Ø Relative prices of final goods – Px/Py. Ø Market structure on the final goods markets – perfect competition. Ø Market structure on the production factor markets – perfect competition. (2) Endogenous parameters: Ø Equilibrium output and consumption of final goods: X*, Y*; Ø Equilibrium consumption of resources: Kx*, Ky*, Lx*, Ly*; Ø Equilibrium relative prices of resources: w*/r*. (3) Graphical illustration of endogenous parameters of the model. 33

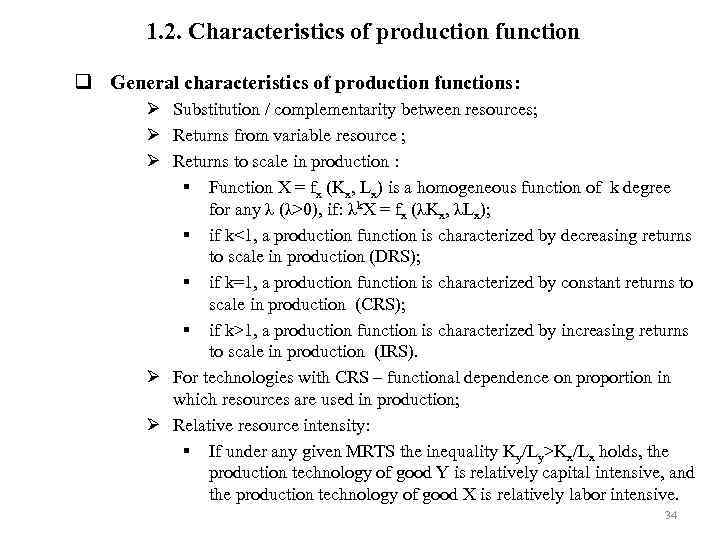

1. 2. Characteristics of production function q General characteristics of production functions: Ø Substitution / complementarity between resources; Ø Returns from variable resource ; Ø Returns to scale in production : § Function Х = fx (Kx, Lx) is a homogeneous function of k degree for any λ (λ>0), if: λk. Х = fx (λKx, λLx); § if k<1, a production function is characterized by decreasing returns to scale in production (DRS); § if k=1, a production function is characterized by constant returns to scale in production (CRS); § if k>1, a production function is characterized by increasing returns to scale in production (IRS). Ø For technologies with CRS – functional dependence on proportion in which resources are used in production; Ø Relative resource intensity: § If under any given MRTS the inequality Ky/Ly>Kx/Lx holds, the production technology of good Y is relatively capital intensive, and the production technology of good X is relatively labor intensive. 34

1. 2. Characteristics of production function - continued q Specific features of the production functions in the model: Ø Ø Incomplete substitution / complementarity between resources; Diminishing returns to a variable resource; Constant returns to scale of production ; Different resource intensity of technologies. 35

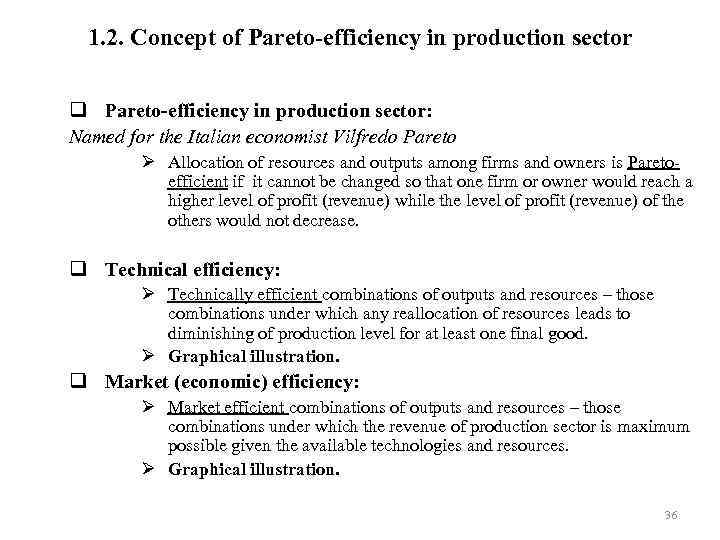

1. 2. Concept of Pareto-efficiency in production sector q Pareto-efficiency in production sector: Named for the Italian economist Vilfredo Pareto Ø Allocation of resources and outputs among firms and owners is Paretoefficient if it cannot be changed so that one firm or owner would reach a higher level of profit (revenue) while the level of profit (revenue) of the others would not decrease. q Technical efficiency: Ø Technically efficient combinations of outputs and resources – those combinations under which any reallocation of resources leads to diminishing of production level for at least one final good. Ø Graphical illustration. q Market (economic) efficiency: Ø Market efficient combinations of outputs and resources – those combinations under which the revenue of production sector is maximum possible given the available technologies and resources. Ø Graphical illustration. 36

1. 2. Algebraic solution of general equilibrium model in production sector q Algebraic solution (scheme): Ø Px. MPlx(Kx, Lx)=w; Py. MPly(Ky, Ly)=w; Px. MPkx(Kx, Lx)=r; Py. MPky(Ky, Ly)=r , то => Px/Py=MPly/MPlx (1) => Px/Py=MPky/MPkx (2) Ø According to exogenous parameters of the model the following conditions should hold: K = Kx+ Ky (3) L = Lx + Ly (4) Ø From four conditions (1), (2), (3), (4) four equilibrium parameters can be found: Kx*, Ky*, Lx*, Ly* Ø To find equilibrium production of final goods X*, Y* we plug equilibrium volumes of resources into production functions. Ø From the condition: MRTS=MPlх/MPkx=w/r equilibrium relative prices of resources can be found w*/r*. q Graphical illustration of the model solution. See Graphical illustration of endogenous parameters. 37

1. 2. Graphical illustration of general equilibrium in production sector q Graphical illustration of equilibrium on the final goods market (production possibilities curve): Ø If technologies with constant returns to scale are used in the economy, and there is perfect competition on the markets of final goods and production factors, then equilibrium production is reached at the point of production possibilities curve, where the final goods price line is tangent to production possibilities curve. q Graphical illustration of equilibrium on the production factors market (production contracts curve): Ø If technologies with constant returns to scale and incomplete substitution/complementarity between production resources are used in the economy, and there is perfect competition on the production factors markets, then in equilibrium production resources are allocated among industries in the point on the contract curve, where production factors price line is tangent to the isoquants of two industries. 38

1. 3. Interrelation between technology and production possibility curve q Properties of technologies, affecting shape of production possibility curve: (1) Returns to scale of production; (2) Relative resource intensity (difference between technologies in terms of resource intensity). q Graphical illustration (production contract curve and production possibility curve): Ø Case 1: Absence of differences in resource intensity between technologies. Ø Case 2: Presence of differences in resource intensity between technologies. Ø Case 3: Technologies with high fixed costs. q Sufficient conditions for concavity of the production possibility curve: Ø Case 1: DRS Ø Case 2: CRS, difference in resource intensity between technologies 39

Homework: (1) Exercise session 1 Some references (please see details in the problem set for exercise session 1). § § § Markusen J. R. , Melvin J. R. , Kaempfer W. H. , Maskus K. E. (1995) International Trade: Theory and Evidence. – New York: Harper & Row. – Ch. 2. Krugman, P. , Obstfeld, M. and M. Melitz (2011) International Economics: theory and policy (9 th edition). Pearson. – Ch. 1, 2. Feenstra, R. and A. Taylor (2012) International Economics (2 nd edition). Worth Publishers. – Ch. 1. (2) Think about topics for reports during exercise sessions and choose a paper for review (due 17 September 2016) To do so: 1. Read newspapers and journals on current international economic issues. 2. Look through the papers suggested for review. 3. Look through the topics in syllabus and the textbooks/papers listed there. Office hours: Friday 13: 50 – 14: 30, room 216. E-mail: natalya. davidson@gmail. com (Наталья Борисовна Давидсон) 40

ITT-Autumn-2016-Lecture-1-E.ppt