efdf6f59c9c84fea6e3cebbe86a044bf.ppt

- Количество слайдов: 127

International Trade: Principles of Finance and Law

International Trade: Principles of Finance and Law

International Trade: Principles of Finance and Law[ Facilitator Name : Hamidreza Ghaffarzadeh Education: Ph. D Urban Development Studies (Univ Aberdeen) ; M. A Economics ( Univ Essex); Diploma Economics ( Univ Lancaster), B. A Economics ( Univ Tehran ) Work : Contracts Sn. Officer , Mins of Energy & Heavy Industries (1980 - 1986); Programme Officer, Economist, Manager, UN( 1986 - 2009); Lecturer ( full time 2009 till now) , Official Translator (1981 till now ) , Contracts and Commerce Consultant ( 1982 till now ) Contact details: hamid. ghaffarzadeh@gmail. com; phone 09123715908

International Trade: Principles of Finance and Law[ Facilitator Name : Hamidreza Ghaffarzadeh Education: Ph. D Urban Development Studies (Univ Aberdeen) ; M. A Economics ( Univ Essex); Diploma Economics ( Univ Lancaster), B. A Economics ( Univ Tehran ) Work : Contracts Sn. Officer , Mins of Energy & Heavy Industries (1980 - 1986); Programme Officer, Economist, Manager, UN( 1986 - 2009); Lecturer ( full time 2009 till now) , Official Translator (1981 till now ) , Contracts and Commerce Consultant ( 1982 till now ) Contact details: hamid. ghaffarzadeh@gmail. com; phone 09123715908

International Trade: Principles of Finance and Law Points to Observe : • Power points in English but teaching in Farsi • Participation in and contribution to the discussions is strongly encouraged. • Mutual respect desired : no late arrivals ; no mobile phone talks permitted; no private chats ; no leaving of class without prior permission • Strict attendance record observed.

International Trade: Principles of Finance and Law Points to Observe : • Power points in English but teaching in Farsi • Participation in and contribution to the discussions is strongly encouraged. • Mutual respect desired : no late arrivals ; no mobile phone talks permitted; no private chats ; no leaving of class without prior permission • Strict attendance record observed.

International Trade: Principles of Finance and Law Structure of the Course • Economic importance of the trade • An introduction to theoretical basis • Major elements of the institutional setting • Major elements of the legal setting • International Commercial Terms ( INCOTERMS) • An introduction to the mechanisms of payment • An introduction to International contracts

International Trade: Principles of Finance and Law Structure of the Course • Economic importance of the trade • An introduction to theoretical basis • Major elements of the institutional setting • Major elements of the legal setting • International Commercial Terms ( INCOTERMS) • An introduction to the mechanisms of payment • An introduction to International contracts

International Trade: Principles of Finance and Law Reading materials • ﺣﻘﻮﻕ ﺗﺠﺎﺭﺕ ﺑیﻦ ﺍﻟﻤﻠﻞ , ﻋﺒﺪﺍﻟﺤﺴیﻦ ﺷیﺮﻭی, ﺳﺎﺯﻣﺎﻥ ﻣﻄﺎﻟﻌﻪ ﻭ ﺗﺪﻭیﻦ کﺘﺐ ﻋﻠﻮﻡ ﺍﻧﺴﺎﻧی ﺩﺍﻧﺸگﺎﻩ ﻫﺎ ” ﺳﻤﺖ“ • ﺣﻘﻮﻕ ﺗﺠﺎﺭﺕ ﺑیﻦ ﺍﻟﻤﻠﻞ, کﻼیﻮ ﺍﻡ ﺍﺷﻤیﺘﻮﻑ , ﺗﺮﺟﻤﻪ ﺍﺧﻼﻗی ﻭ ﺩیگﺮﺍﻥ , ﺍﻧﺘﺸﺎﺭﺍﺕ ”ﺳﻤﺖ“ • ﺗﺠﺎﺭﺕ ﺑیﻦ ﺍﻟﻤﻠﻞ , ﺳﺎﻟﻮﺍﺗﻮﺭﻩ , ﺗﺮﺟﻤﻪ ﺍﺭﺑﺎﺏ , ﻧﺸﺮ ﻧی • ﻣﺎﻟیﻪ ﺑیﻦ ﺍﻟﻤﻠﻞ , ﺳﺎﻟﻮﺍﺗﻮﺭﻩ , ﺗﺮﺟﻤﻪ ﺍﺭﺑﺎﺏ, ﻧﺸﺮ ﻧی • ﺍییﻦ ﺗﻨﻈیﻢ ﻗﺮﺍﺭﺩﺍ ﺩﻫﺎی ﺑیﻦ ﺍﻟﻤﻠﻞ , ﺭﺿﺎ پﺎکﺪﺍﻣﻦ , ﺍﻧﺘﺸﺎﺭﺍﺕ ﺧﺮﺳﻨﺪی • ﺍیﻨکﻮﺗﺮﻣﺰ 0102 , ﺗﺮﺟﻤﻪ ﻃﺎﺭﻡ ﺳﺮی , ﻣﻮﺳﺴﻪ ﻣﻄﺎﻟﻌﺎﺕ ﻭ پژﻮﻫﺶ ﻫﺎی ﺑﺎﺯﺭگﺎﻧی • ﺍﻋﺘﻨﺒﺎﺭﺍﺕ ﺍﺳﻨﺎ ﺩ ی

International Trade: Principles of Finance and Law Reading materials • ﺣﻘﻮﻕ ﺗﺠﺎﺭﺕ ﺑیﻦ ﺍﻟﻤﻠﻞ , ﻋﺒﺪﺍﻟﺤﺴیﻦ ﺷیﺮﻭی, ﺳﺎﺯﻣﺎﻥ ﻣﻄﺎﻟﻌﻪ ﻭ ﺗﺪﻭیﻦ کﺘﺐ ﻋﻠﻮﻡ ﺍﻧﺴﺎﻧی ﺩﺍﻧﺸگﺎﻩ ﻫﺎ ” ﺳﻤﺖ“ • ﺣﻘﻮﻕ ﺗﺠﺎﺭﺕ ﺑیﻦ ﺍﻟﻤﻠﻞ, کﻼیﻮ ﺍﻡ ﺍﺷﻤیﺘﻮﻑ , ﺗﺮﺟﻤﻪ ﺍﺧﻼﻗی ﻭ ﺩیگﺮﺍﻥ , ﺍﻧﺘﺸﺎﺭﺍﺕ ”ﺳﻤﺖ“ • ﺗﺠﺎﺭﺕ ﺑیﻦ ﺍﻟﻤﻠﻞ , ﺳﺎﻟﻮﺍﺗﻮﺭﻩ , ﺗﺮﺟﻤﻪ ﺍﺭﺑﺎﺏ , ﻧﺸﺮ ﻧی • ﻣﺎﻟیﻪ ﺑیﻦ ﺍﻟﻤﻠﻞ , ﺳﺎﻟﻮﺍﺗﻮﺭﻩ , ﺗﺮﺟﻤﻪ ﺍﺭﺑﺎﺏ, ﻧﺸﺮ ﻧی • ﺍییﻦ ﺗﻨﻈیﻢ ﻗﺮﺍﺭﺩﺍ ﺩﻫﺎی ﺑیﻦ ﺍﻟﻤﻠﻞ , ﺭﺿﺎ پﺎکﺪﺍﻣﻦ , ﺍﻧﺘﺸﺎﺭﺍﺕ ﺧﺮﺳﻨﺪی • ﺍیﻨکﻮﺗﺮﻣﺰ 0102 , ﺗﺮﺟﻤﻪ ﻃﺎﺭﻡ ﺳﺮی , ﻣﻮﺳﺴﻪ ﻣﻄﺎﻟﻌﺎﺕ ﻭ پژﻮﻫﺶ ﻫﺎی ﺑﺎﺯﺭگﺎﻧی • ﺍﻋﺘﻨﺒﺎﺭﺍﺕ ﺍﺳﻨﺎ ﺩ ی

International Trade: Principles of Finance and Law Economic Importance of Int. trade

International Trade: Principles of Finance and Law Economic Importance of Int. trade

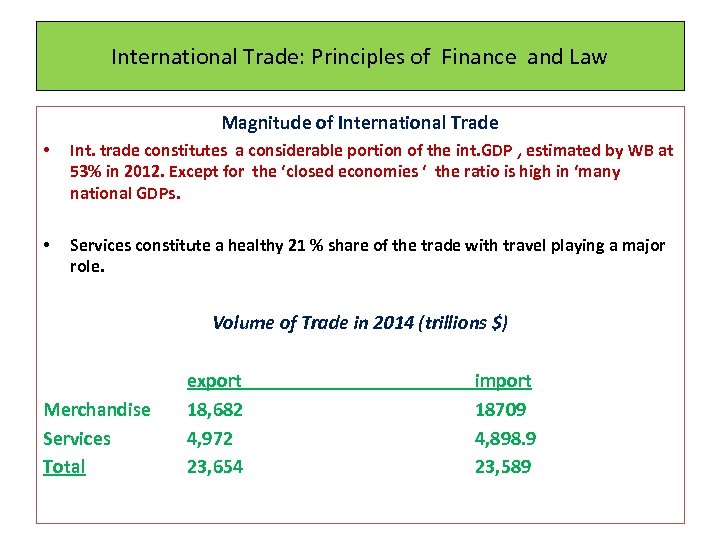

International Trade: Principles of Finance and Law Magnitude of International Trade • Int. trade constitutes a considerable portion of the int. GDP , estimated by WB at 53% in 2012. Except for the ‘closed economies ‘ the ratio is high in ‘many national GDPs. • Services constitute a healthy 21 % share of the trade with travel playing a major role. Volume of Trade in 2014 (trillions $) Merchandise Services Total export 18, 682 4, 972 23, 654 import 18709 4, 898. 9 23, 589

International Trade: Principles of Finance and Law Magnitude of International Trade • Int. trade constitutes a considerable portion of the int. GDP , estimated by WB at 53% in 2012. Except for the ‘closed economies ‘ the ratio is high in ‘many national GDPs. • Services constitute a healthy 21 % share of the trade with travel playing a major role. Volume of Trade in 2014 (trillions $) Merchandise Services Total export 18, 682 4, 972 23, 654 import 18709 4, 898. 9 23, 589

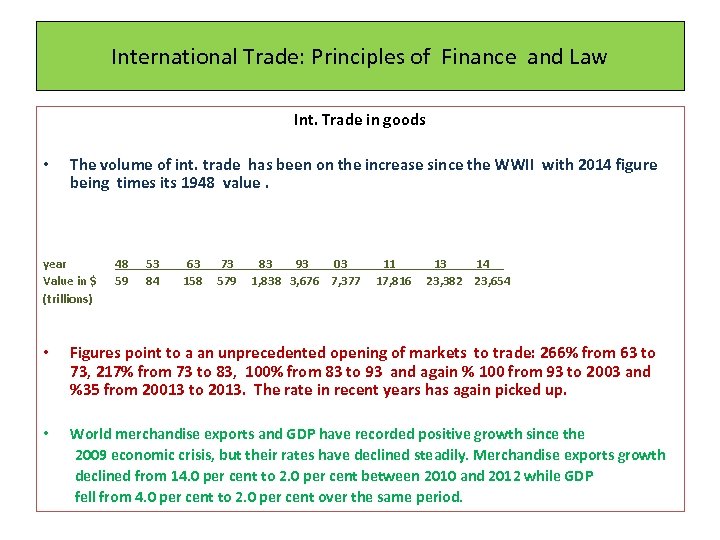

International Trade: Principles of Finance and Law Int. Trade in goods • The volume of int. trade has been on the increase since the WWII with 2014 figure being times its 1948 value. year Value in $ (trillions) 48 53 63 73 83 93 03 11 13 14 59 84 158 579 1, 838 3, 676 7, 377 17, 816 23, 382 23, 654 • Figures point to a an unprecedented opening of markets to trade: 266% from 63 to 73, 217% from 73 to 83, 100% from 83 to 93 and again % 100 from 93 to 2003 and %35 from 20013 to 2013. The rate in recent years has again picked up. • World merchandise exports and GDP have recorded positive growth since the 2009 economic crisis, but their rates have declined steadily. Merchandise exports growth declined from 14. 0 per cent to 2. 0 per cent between 2010 and 2012 while GDP fell from 4. 0 per cent to 2. 0 per cent over the same period.

International Trade: Principles of Finance and Law Int. Trade in goods • The volume of int. trade has been on the increase since the WWII with 2014 figure being times its 1948 value. year Value in $ (trillions) 48 53 63 73 83 93 03 11 13 14 59 84 158 579 1, 838 3, 676 7, 377 17, 816 23, 382 23, 654 • Figures point to a an unprecedented opening of markets to trade: 266% from 63 to 73, 217% from 73 to 83, 100% from 83 to 93 and again % 100 from 93 to 2003 and %35 from 20013 to 2013. The rate in recent years has again picked up. • World merchandise exports and GDP have recorded positive growth since the 2009 economic crisis, but their rates have declined steadily. Merchandise exports growth declined from 14. 0 per cent to 2. 0 per cent between 2010 and 2012 while GDP fell from 4. 0 per cent to 2. 0 per cent over the same period.

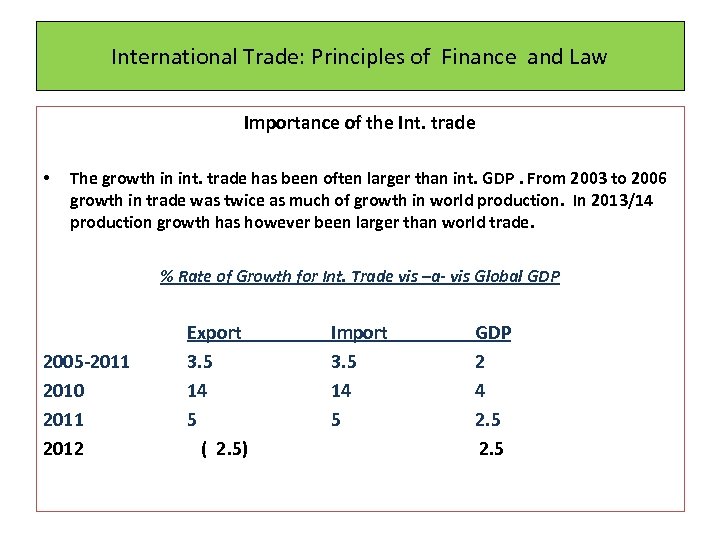

International Trade: Principles of Finance and Law Importance of the Int. trade • The growth in int. trade has been often larger than int. GDP. From 2003 to 2006 growth in trade was twice as much of growth in world production. In 2013/14 production growth has however been larger than world trade. % Rate of Growth for Int. Trade vis –a- vis Global GDP Export Import GDP 2005 -2011 3. 5 2 2010 14 14 4 2011 5 5 2012 ( 2. 5) 2. 5

International Trade: Principles of Finance and Law Importance of the Int. trade • The growth in int. trade has been often larger than int. GDP. From 2003 to 2006 growth in trade was twice as much of growth in world production. In 2013/14 production growth has however been larger than world trade. % Rate of Growth for Int. Trade vis –a- vis Global GDP Export Import GDP 2005 -2011 3. 5 2 2010 14 14 4 2011 5 5 2012 ( 2. 5) 2. 5

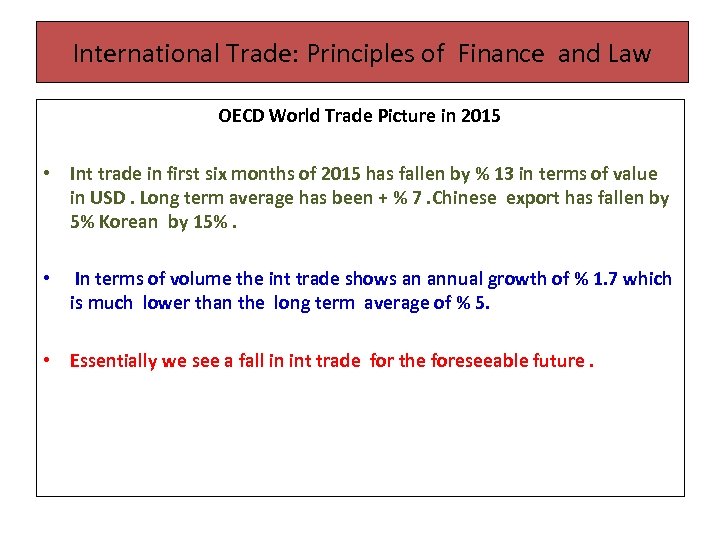

International Trade: Principles of Finance and Law OECD World Trade Picture in 2015 • Int trade in first six months of 2015 has fallen by % 13 in terms of value in USD. Long term average has been + % 7. Chinese export has fallen by 5% Korean by 15%. • In terms of volume the int trade shows an annual growth of % 1. 7 which is much lower than the long term average of % 5. • Essentially we see a fall in int trade for the foreseeable future.

International Trade: Principles of Finance and Law OECD World Trade Picture in 2015 • Int trade in first six months of 2015 has fallen by % 13 in terms of value in USD. Long term average has been + % 7. Chinese export has fallen by 5% Korean by 15%. • In terms of volume the int trade shows an annual growth of % 1. 7 which is much lower than the long term average of % 5. • Essentially we see a fall in int trade for the foreseeable future.

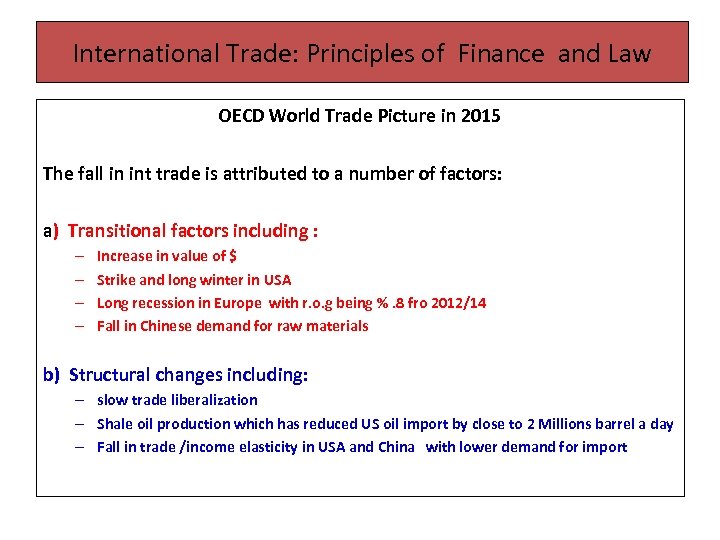

International Trade: Principles of Finance and Law OECD World Trade Picture in 2015 The fall in int trade is attributed to a number of factors: a) Transitional factors including : – – Increase in value of $ Strike and long winter in USA Long recession in Europe with r. o. g being %. 8 fro 2012/14 Fall in Chinese demand for raw materials b) Structural changes including: – slow trade liberalization – Shale oil production which has reduced US oil import by close to 2 Millions barrel a day – Fall in trade /income elasticity in USA and China with lower demand for import

International Trade: Principles of Finance and Law OECD World Trade Picture in 2015 The fall in int trade is attributed to a number of factors: a) Transitional factors including : – – Increase in value of $ Strike and long winter in USA Long recession in Europe with r. o. g being %. 8 fro 2012/14 Fall in Chinese demand for raw materials b) Structural changes including: – slow trade liberalization – Shale oil production which has reduced US oil import by close to 2 Millions barrel a day – Fall in trade /income elasticity in USA and China with lower demand for import

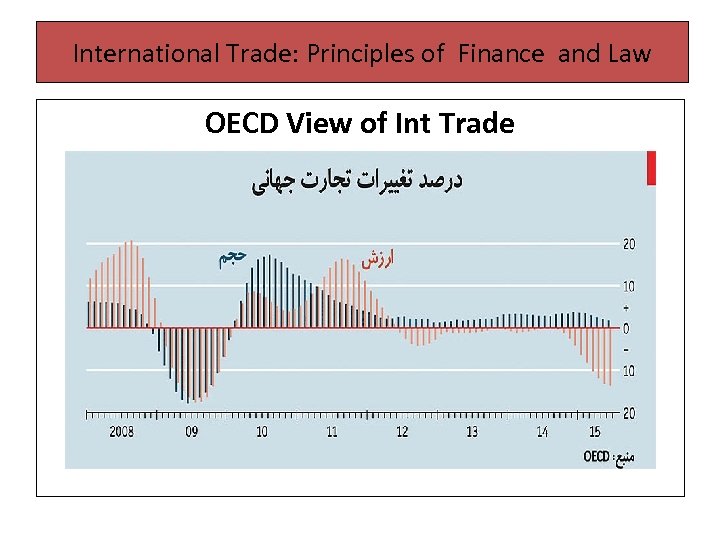

International Trade: Principles of Finance and Law OECD View of Int Trade

International Trade: Principles of Finance and Law OECD View of Int Trade

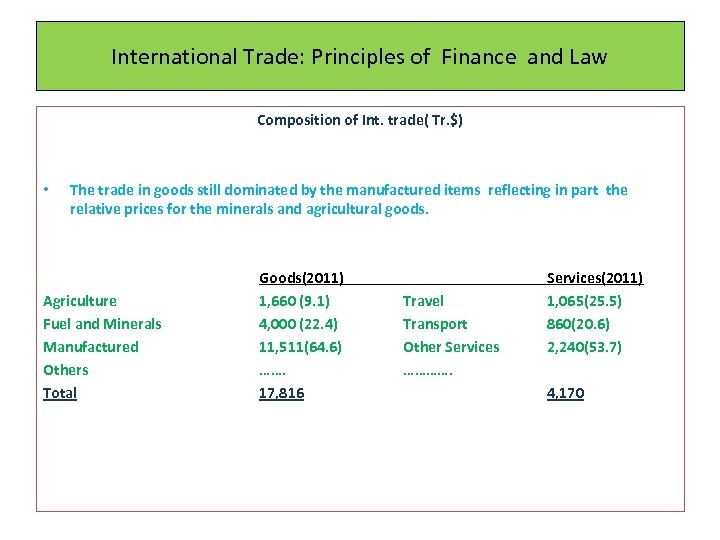

International Trade: Principles of Finance and Law Composition of Int. trade( Tr. $) • The trade in goods still dominated by the manufactured items reflecting in part the relative prices for the minerals and agricultural goods. Agriculture Fuel and Minerals Manufactured Others Total Goods(2011) 1, 660 (9. 1) 4, 000 (22. 4) 11, 511(64. 6) ……. 17, 816 Travel Transport Other Services …………. Services(2011) 1, 065(25. 5) 860(20. 6) 2, 240(53. 7) 4, 170

International Trade: Principles of Finance and Law Composition of Int. trade( Tr. $) • The trade in goods still dominated by the manufactured items reflecting in part the relative prices for the minerals and agricultural goods. Agriculture Fuel and Minerals Manufactured Others Total Goods(2011) 1, 660 (9. 1) 4, 000 (22. 4) 11, 511(64. 6) ……. 17, 816 Travel Transport Other Services …………. Services(2011) 1, 065(25. 5) 860(20. 6) 2, 240(53. 7) 4, 170

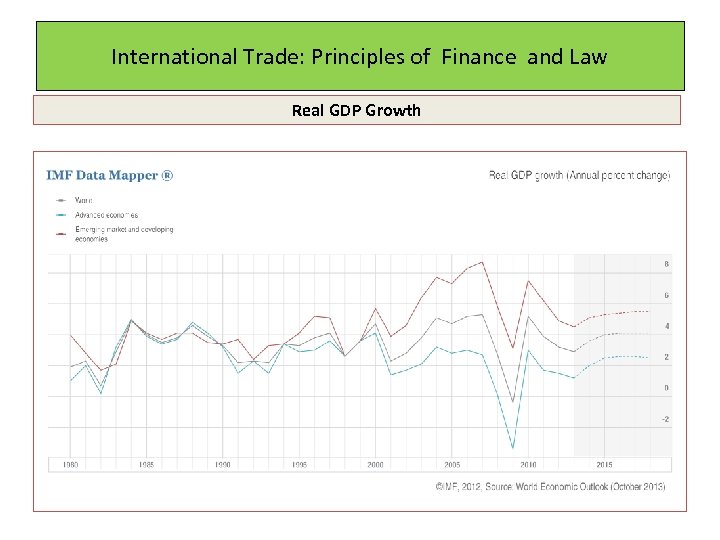

International Trade: Principles of Finance and Law Real GDP Growth

International Trade: Principles of Finance and Law Real GDP Growth

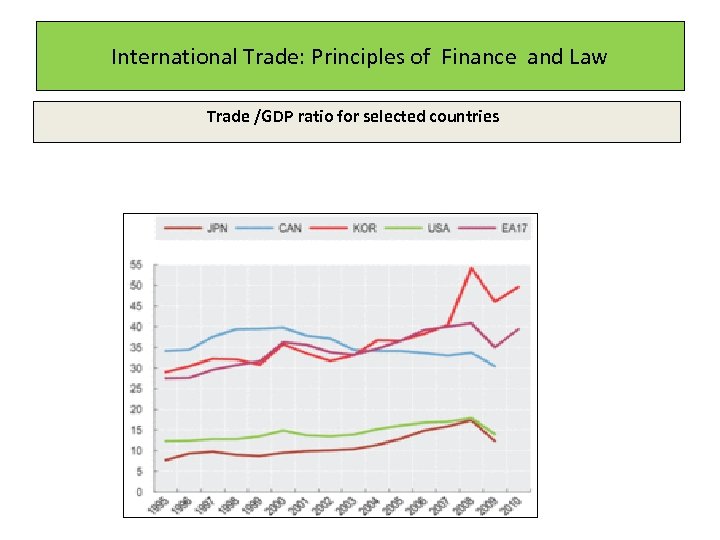

International Trade: Principles of Finance and Law Trade /GDP ratio for selected countries

International Trade: Principles of Finance and Law Trade /GDP ratio for selected countries

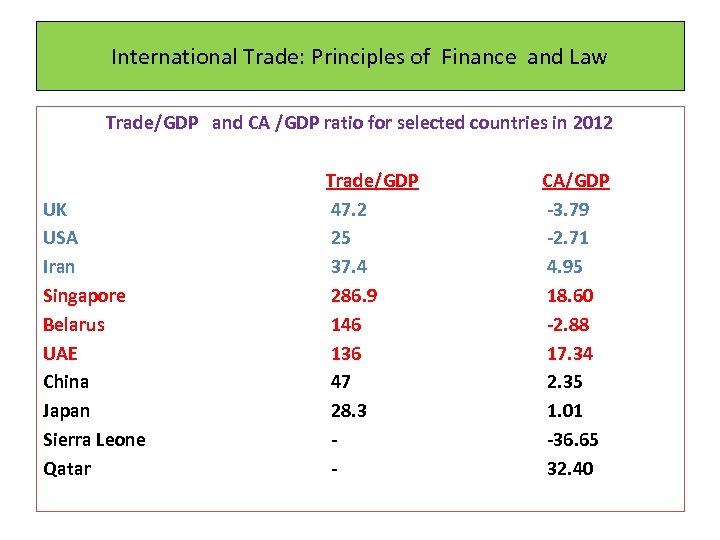

International Trade: Principles of Finance and Law Trade/GDP and CA /GDP ratio for selected countries in 2012 UK USA Iran Singapore Belarus UAE China Japan Sierra Leone Qatar Trade/GDP 47. 2 25 37. 4 286. 9 146 136 47 28. 3 - CA/GDP -3. 79 -2. 71 4. 95 18. 60 -2. 88 17. 34 2. 35 1. 01 -36. 65 32. 40

International Trade: Principles of Finance and Law Trade/GDP and CA /GDP ratio for selected countries in 2012 UK USA Iran Singapore Belarus UAE China Japan Sierra Leone Qatar Trade/GDP 47. 2 25 37. 4 286. 9 146 136 47 28. 3 - CA/GDP -3. 79 -2. 71 4. 95 18. 60 -2. 88 17. 34 2. 35 1. 01 -36. 65 32. 40

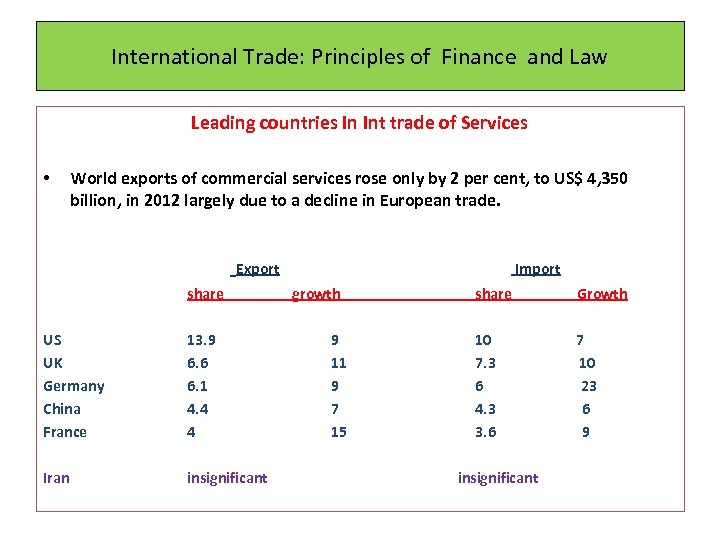

International Trade: Principles of Finance and Law Leading countries In Int trade of Services • World exports of commercial services rose only by 2 per cent, to US$ 4, 350 billion, in 2012 largely due to a decline in European trade. Export Import share growth share Growth US UK Germany China France 13. 9 6. 6 6. 1 4. 4 4 9 11 9 7 15 10 7 7. 3 10 6 23 4. 3 6 3. 6 9 Iran insignificant insignificant

International Trade: Principles of Finance and Law Leading countries In Int trade of Services • World exports of commercial services rose only by 2 per cent, to US$ 4, 350 billion, in 2012 largely due to a decline in European trade. Export Import share growth share Growth US UK Germany China France 13. 9 6. 6 6. 1 4. 4 4 9 11 9 7 15 10 7 7. 3 10 6 23 4. 3 6 3. 6 9 Iran insignificant insignificant

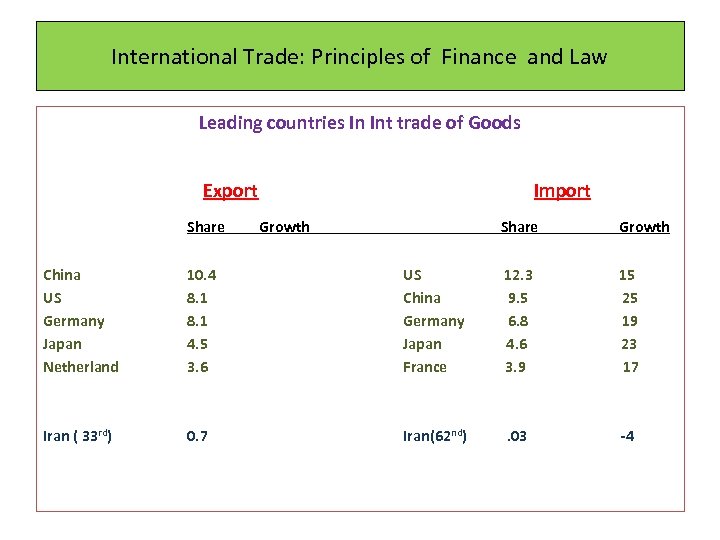

International Trade: Principles of Finance and Law Leading countries In Int trade of Goods Export Share Import Growth Share Growth China US Germany Japan Netherland 10. 4 8. 1 4. 5 3. 6 US 12. 3 15 China 9. 5 25 Germany 6. 8 19 Japan 4. 6 23 France 3. 9 17 Iran ( 33 rd) 0. 7 Iran(62 nd) . 03 -4

International Trade: Principles of Finance and Law Leading countries In Int trade of Goods Export Share Import Growth Share Growth China US Germany Japan Netherland 10. 4 8. 1 4. 5 3. 6 US 12. 3 15 China 9. 5 25 Germany 6. 8 19 Japan 4. 6 23 France 3. 9 17 Iran ( 33 rd) 0. 7 Iran(62 nd) . 03 -4

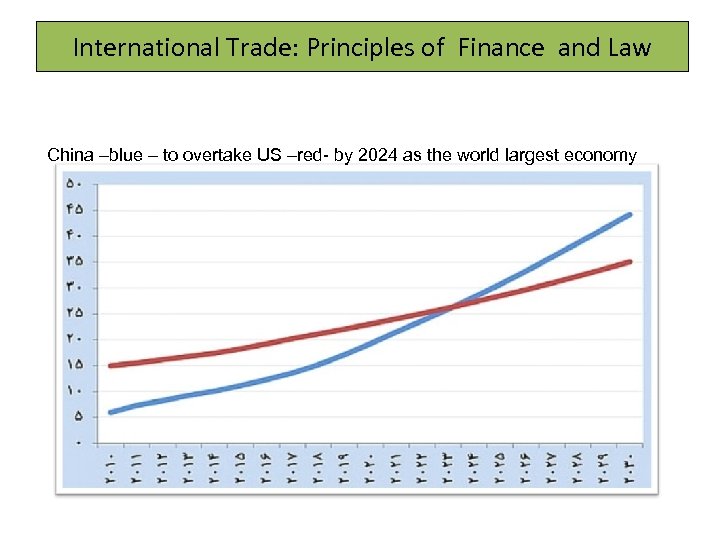

International Trade: Principles of Finance and Law China –blue – to overtake US –red- by 2024 as the world largest economy

International Trade: Principles of Finance and Law China –blue – to overtake US –red- by 2024 as the world largest economy

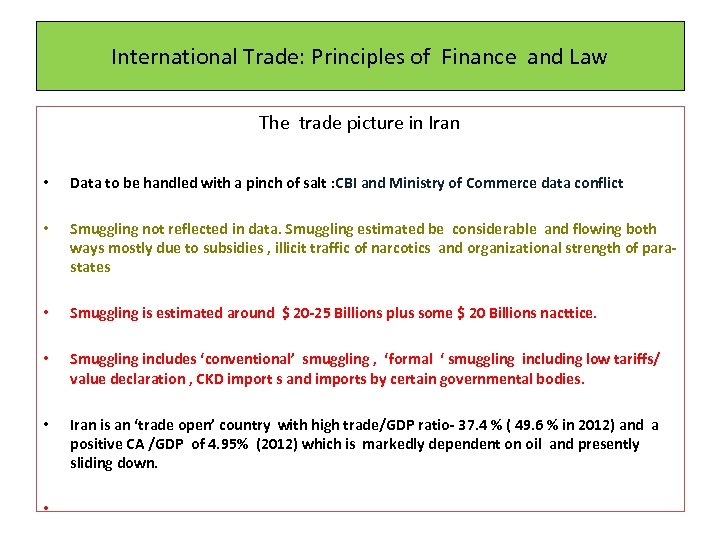

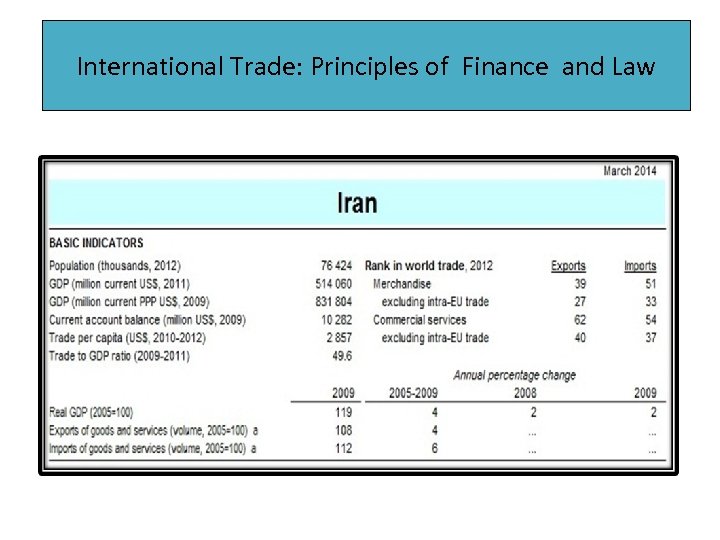

International Trade: Principles of Finance and Law The trade picture in Iran • Data to be handled with a pinch of salt : CBI and Ministry of Commerce data conflict • Smuggling not reflected in data. Smuggling estimated be considerable and flowing both ways mostly due to subsidies , illicit traffic of narcotics and organizational strength of parastates • Smuggling is estimated around $ 20 -25 Billions plus some $ 20 Billions nacttice. • Smuggling includes ‘conventional’ smuggling , ‘formal ‘ smuggling including low tariffs/ value declaration , CKD import s and imports by certain governmental bodies. • Iran is an ‘trade open’ country with high trade/GDP ratio- 37. 4 % ( 49. 6 % in 2012) and a positive CA /GDP of 4. 95% (2012) which is markedly dependent on oil and presently sliding down. •

International Trade: Principles of Finance and Law The trade picture in Iran • Data to be handled with a pinch of salt : CBI and Ministry of Commerce data conflict • Smuggling not reflected in data. Smuggling estimated be considerable and flowing both ways mostly due to subsidies , illicit traffic of narcotics and organizational strength of parastates • Smuggling is estimated around $ 20 -25 Billions plus some $ 20 Billions nacttice. • Smuggling includes ‘conventional’ smuggling , ‘formal ‘ smuggling including low tariffs/ value declaration , CKD import s and imports by certain governmental bodies. • Iran is an ‘trade open’ country with high trade/GDP ratio- 37. 4 % ( 49. 6 % in 2012) and a positive CA /GDP of 4. 95% (2012) which is markedly dependent on oil and presently sliding down. •

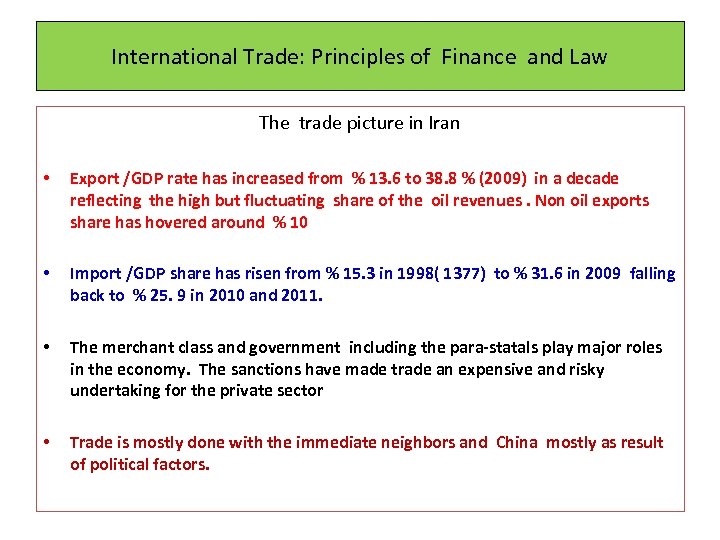

International Trade: Principles of Finance and Law The trade picture in Iran • Export /GDP rate has increased from % 13. 6 to 38. 8 % (2009) in a decade reflecting the high but fluctuating share of the oil revenues. Non oil exports share has hovered around % 10 • Import /GDP share has risen from % 15. 3 in 1998( 1377) to % 31. 6 in 2009 falling back to % 25. 9 in 2010 and 2011. • The merchant class and government including the para-statals play major roles in the economy. The sanctions have made trade an expensive and risky undertaking for the private sector • Trade is mostly done with the immediate neighbors and China mostly as result of political factors.

International Trade: Principles of Finance and Law The trade picture in Iran • Export /GDP rate has increased from % 13. 6 to 38. 8 % (2009) in a decade reflecting the high but fluctuating share of the oil revenues. Non oil exports share has hovered around % 10 • Import /GDP share has risen from % 15. 3 in 1998( 1377) to % 31. 6 in 2009 falling back to % 25. 9 in 2010 and 2011. • The merchant class and government including the para-statals play major roles in the economy. The sanctions have made trade an expensive and risky undertaking for the private sector • Trade is mostly done with the immediate neighbors and China mostly as result of political factors.

International Trade: Principles of Finance and Law

International Trade: Principles of Finance and Law

International Trade: Principles of Finance and Law

International Trade: Principles of Finance and Law

International Trade: Principles of Finance and Law

International Trade: Principles of Finance and Law

Economy of Iran

Economy of Iran

Economy of Iran

Economy of Iran

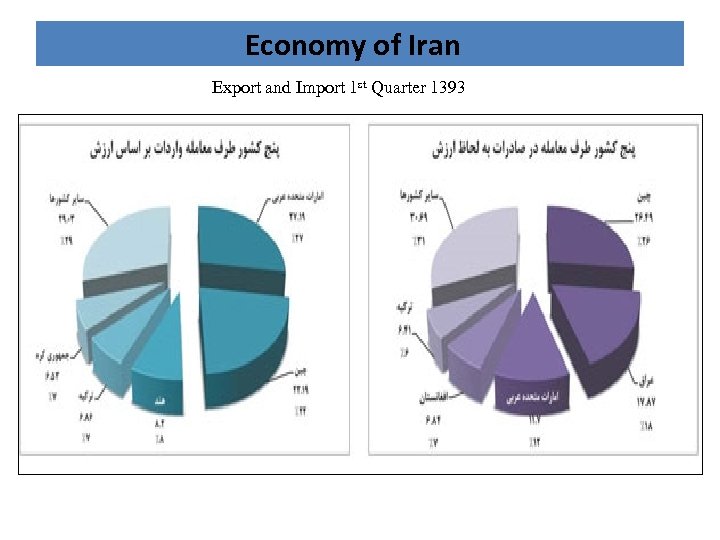

Economy of Iran Export and Import 1 st Quarter 1393

Economy of Iran Export and Import 1 st Quarter 1393

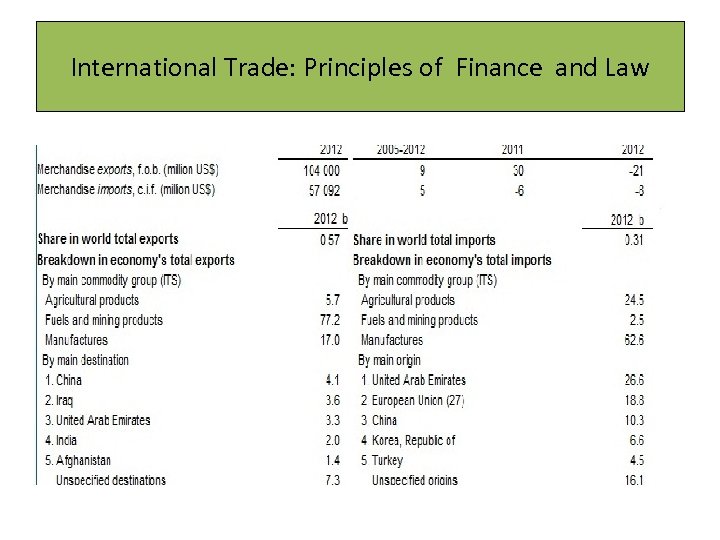

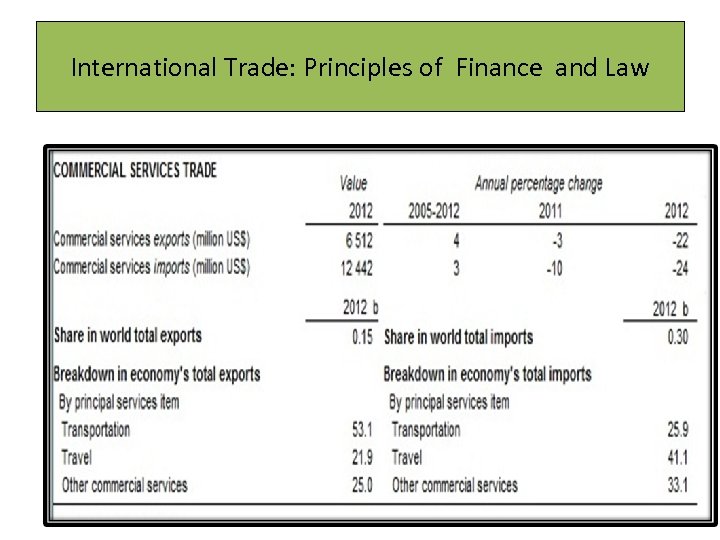

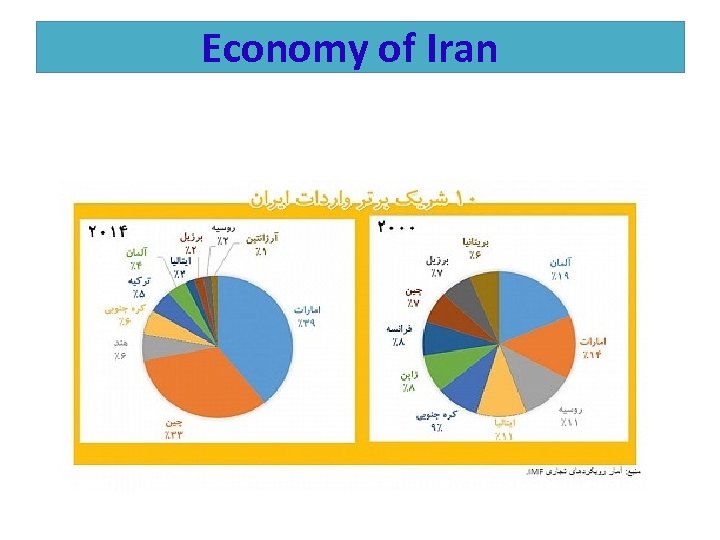

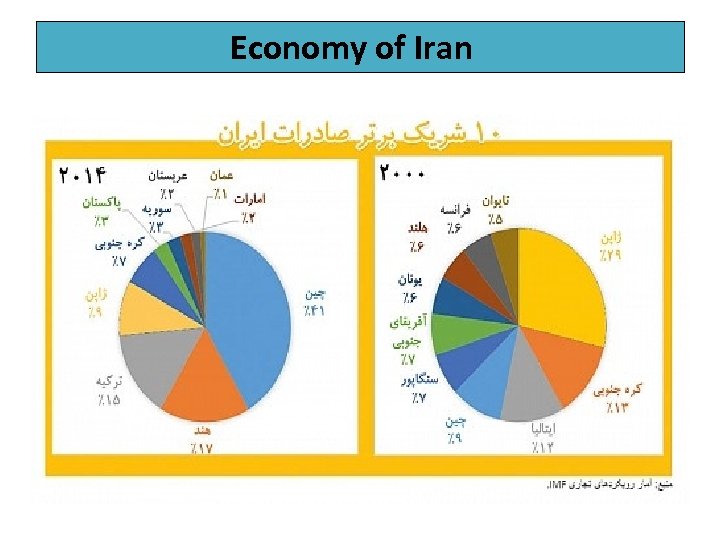

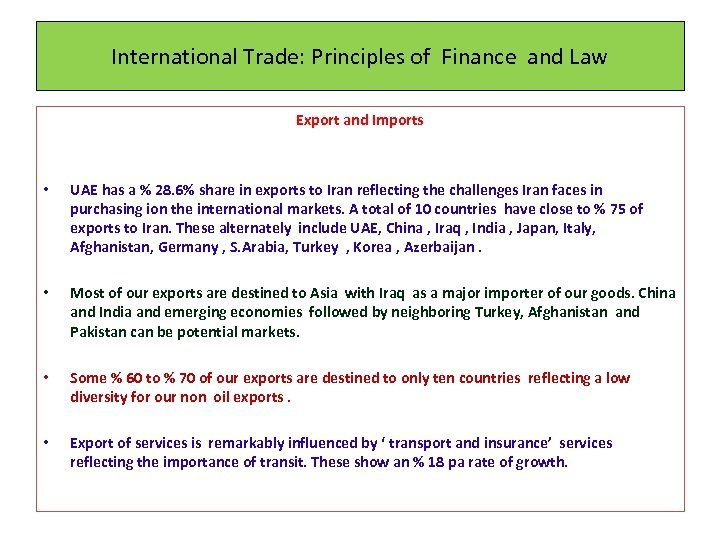

International Trade: Principles of Finance and Law Export and Imports • UAE has a % 28. 6% share in exports to Iran reflecting the challenges Iran faces in purchasing ion the international markets. A total of 10 countries have close to % 75 of exports to Iran. These alternately include UAE, China , Iraq , India , Japan, Italy, Afghanistan, Germany , S. Arabia, Turkey , Korea , Azerbaijan. • Most of our exports are destined to Asia with Iraq as a major importer of our goods. China and India and emerging economies followed by neighboring Turkey, Afghanistan and Pakistan can be potential markets. • Some % 60 to % 70 of our exports are destined to only ten countries reflecting a low diversity for our non oil exports. • Export of services is remarkably influenced by ‘ transport and insurance’ services reflecting the importance of transit. These show an % 18 pa rate of growth.

International Trade: Principles of Finance and Law Export and Imports • UAE has a % 28. 6% share in exports to Iran reflecting the challenges Iran faces in purchasing ion the international markets. A total of 10 countries have close to % 75 of exports to Iran. These alternately include UAE, China , Iraq , India , Japan, Italy, Afghanistan, Germany , S. Arabia, Turkey , Korea , Azerbaijan. • Most of our exports are destined to Asia with Iraq as a major importer of our goods. China and India and emerging economies followed by neighboring Turkey, Afghanistan and Pakistan can be potential markets. • Some % 60 to % 70 of our exports are destined to only ten countries reflecting a low diversity for our non oil exports. • Export of services is remarkably influenced by ‘ transport and insurance’ services reflecting the importance of transit. These show an % 18 pa rate of growth.

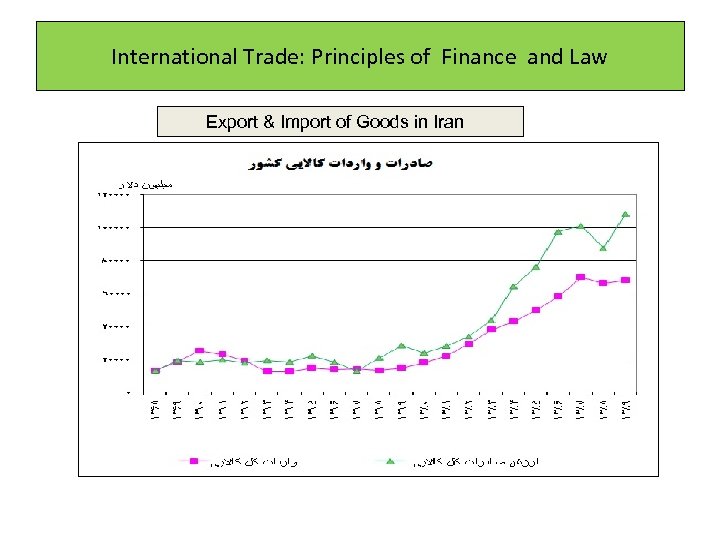

International Trade: Principles of Finance and Law Export & Import of Goods in Iran

International Trade: Principles of Finance and Law Export & Import of Goods in Iran

International Trade: Principles of Finance and Law

International Trade: Principles of Finance and Law

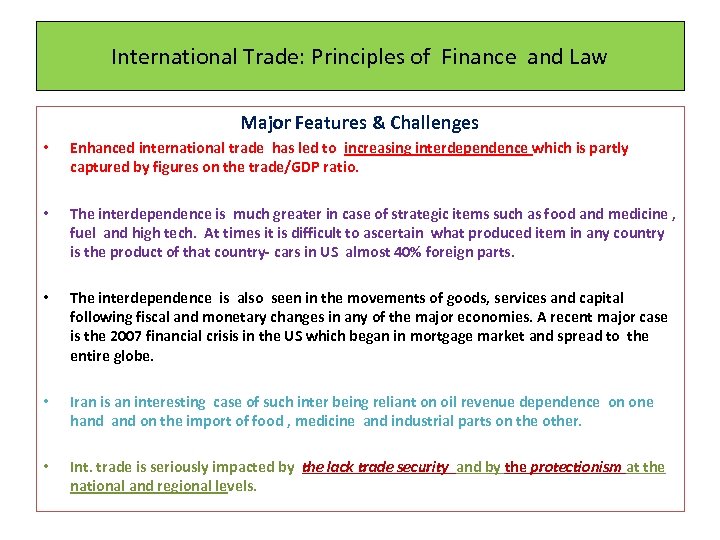

International Trade: Principles of Finance and Law Major Features & Challenges • Enhanced international trade has led to increasing interdependence which is partly captured by figures on the trade/GDP ratio. • The interdependence is much greater in case of strategic items such as food and medicine , fuel and high tech. At times it is difficult to ascertain what produced item in any country is the product of that country- cars in US almost 40% foreign parts. • The interdependence is also seen in the movements of goods, services and capital following fiscal and monetary changes in any of the major economies. A recent major case is the 2007 financial crisis in the US which began in mortgage market and spread to the entire globe. • Iran is an interesting case of such inter being reliant on oil revenue dependence on one hand on the import of food , medicine and industrial parts on the other. • Int. trade is seriously impacted by the lack trade security and by the protectionism at the national and regional levels.

International Trade: Principles of Finance and Law Major Features & Challenges • Enhanced international trade has led to increasing interdependence which is partly captured by figures on the trade/GDP ratio. • The interdependence is much greater in case of strategic items such as food and medicine , fuel and high tech. At times it is difficult to ascertain what produced item in any country is the product of that country- cars in US almost 40% foreign parts. • The interdependence is also seen in the movements of goods, services and capital following fiscal and monetary changes in any of the major economies. A recent major case is the 2007 financial crisis in the US which began in mortgage market and spread to the entire globe. • Iran is an interesting case of such inter being reliant on oil revenue dependence on one hand on the import of food , medicine and industrial parts on the other. • Int. trade is seriously impacted by the lack trade security and by the protectionism at the national and regional levels.

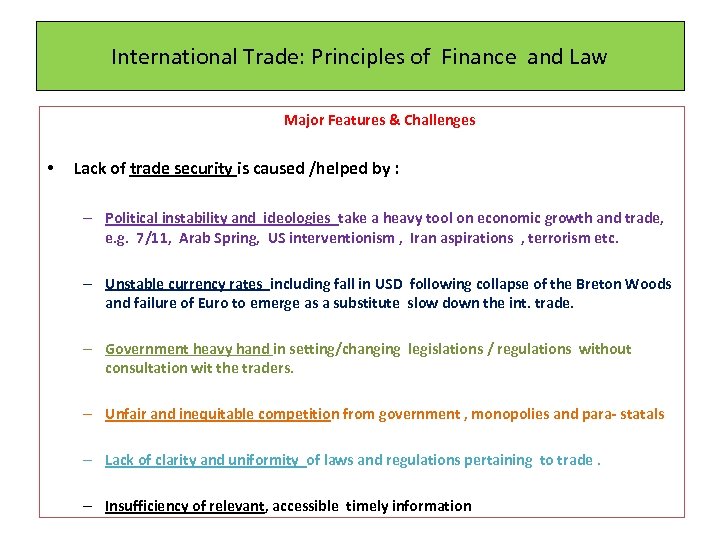

International Trade: Principles of Finance and Law Major Features & Challenges • Lack of trade security is caused /helped by : – Political instability and ideologies take a heavy tool on economic growth and trade, e. g. 7/11, Arab Spring, US interventionism , Iran aspirations , terrorism etc. – Unstable currency rates including fall in USD following collapse of the Breton Woods and failure of Euro to emerge as a substitute slow down the int. trade. – Government heavy hand in setting/changing legislations / regulations without consultation wit the traders. – Unfair and inequitable competition from government , monopolies and para- statals – Lack of clarity and uniformity of laws and regulations pertaining to trade. – Insufficiency of relevant, accessible timely information

International Trade: Principles of Finance and Law Major Features & Challenges • Lack of trade security is caused /helped by : – Political instability and ideologies take a heavy tool on economic growth and trade, e. g. 7/11, Arab Spring, US interventionism , Iran aspirations , terrorism etc. – Unstable currency rates including fall in USD following collapse of the Breton Woods and failure of Euro to emerge as a substitute slow down the int. trade. – Government heavy hand in setting/changing legislations / regulations without consultation wit the traders. – Unfair and inequitable competition from government , monopolies and para- statals – Lack of clarity and uniformity of laws and regulations pertaining to trade. – Insufficiency of relevant, accessible timely information

International Trade: Principles of Finance and Law Major Features & Challenges • Protectionism is applied through Tariff and non tariff barriers. It has led to a drive for self- sufficiency in many countries , the failure of Uruguay and Doha Rounds , formation of trade blocks etc. • Protectionism has resulted in the regional trade within trade blocks e. g. EC, BAFTA etc overrun global trade. • A number of reasons for the protectionism include : – China and the emerging economies are capturing int. trade – arguably based on cheap labor and under-valued currencies, poor working standards, neglect of environment. The rise is threatening US and Europe as well as the developing countries unable to cope.

International Trade: Principles of Finance and Law Major Features & Challenges • Protectionism is applied through Tariff and non tariff barriers. It has led to a drive for self- sufficiency in many countries , the failure of Uruguay and Doha Rounds , formation of trade blocks etc. • Protectionism has resulted in the regional trade within trade blocks e. g. EC, BAFTA etc overrun global trade. • A number of reasons for the protectionism include : – China and the emerging economies are capturing int. trade – arguably based on cheap labor and under-valued currencies, poor working standards, neglect of environment. The rise is threatening US and Europe as well as the developing countries unable to cope.

International Trade: Principles of Finance and Law Major Features & Challenges – Slow economic growth of Europe – a structural unemployment rate of more than 10%- and the near stagnation of the Japanese economy are dragging the world growth down. There is s strong resistance to the needed substantial changes in both economies. – Financial crisis in market based economies keep occurring often when the repayments of short terms loans become due. Mexico crisis of 94/5, Tiger economies in 1997, Russia an 1999, Turkey and Argentine and Brazil in early years of the millennium, USA and EU in 2007 onwards. Every crisis severely impacts the trade. – Structural reforms in the economies in transition mostly in eastern Europe impacted the trade and can lead to reemergence of crisis in future. – Poverty of the developing countries- more than one Billion with less than 1 $ a day- especially in Sub Sahara Africa put a dent in in the volume of int. trade , lead to unequal trade deals and breed unrest and terrorism.

International Trade: Principles of Finance and Law Major Features & Challenges – Slow economic growth of Europe – a structural unemployment rate of more than 10%- and the near stagnation of the Japanese economy are dragging the world growth down. There is s strong resistance to the needed substantial changes in both economies. – Financial crisis in market based economies keep occurring often when the repayments of short terms loans become due. Mexico crisis of 94/5, Tiger economies in 1997, Russia an 1999, Turkey and Argentine and Brazil in early years of the millennium, USA and EU in 2007 onwards. Every crisis severely impacts the trade. – Structural reforms in the economies in transition mostly in eastern Europe impacted the trade and can lead to reemergence of crisis in future. – Poverty of the developing countries- more than one Billion with less than 1 $ a day- especially in Sub Sahara Africa put a dent in in the volume of int. trade , lead to unequal trade deals and breed unrest and terrorism.

International Trade: Principles of Finance and Law Major Features & Challenges • Expansion of the int. trade is tied with globalization and how the countries accept and deal with the trend. : – Is globalization beneficial to the global economy and the national economies? What do theories and paratactic tell us ? – How do we create an ‘environment’- political , legal and financial conducive to the trade ?

International Trade: Principles of Finance and Law Major Features & Challenges • Expansion of the int. trade is tied with globalization and how the countries accept and deal with the trend. : – Is globalization beneficial to the global economy and the national economies? What do theories and paratactic tell us ? – How do we create an ‘environment’- political , legal and financial conducive to the trade ?

International Trade: Principles of Finance and Law An introduction to theoretical basis

International Trade: Principles of Finance and Law An introduction to theoretical basis

International Trade: Principles of Finance and Law Early Modern Paradigm: Mercantilism • Mercantilism argues that a nation benefits by accumulating monetary reserves through a positive balance of trade, especially of finished goods. Mercantilism dominated Western European economic policy and discourse from the 16 th to late-18 th centuries. • Mercantilism was the dominant school of thought in Europe throughout the late Renaissance and early modern period (from the 15 th to the 18 th century). Mercantilism encouraged the many intra-European wars of the period and arguably fueled European expansion and imperialism – both in Europe and throughout the rest of the world – until the 19 th century or early 20 th century • Islamic approach to trade and development in middle ages – and even present time- may be considered as mercantilism

International Trade: Principles of Finance and Law Early Modern Paradigm: Mercantilism • Mercantilism argues that a nation benefits by accumulating monetary reserves through a positive balance of trade, especially of finished goods. Mercantilism dominated Western European economic policy and discourse from the 16 th to late-18 th centuries. • Mercantilism was the dominant school of thought in Europe throughout the late Renaissance and early modern period (from the 15 th to the 18 th century). Mercantilism encouraged the many intra-European wars of the period and arguably fueled European expansion and imperialism – both in Europe and throughout the rest of the world – until the 19 th century or early 20 th century • Islamic approach to trade and development in middle ages – and even present time- may be considered as mercantilism

International Trade: Principles of Finance and Law Mercantilism • High tariffs, especially on manufactured goods, are an almost universal feature of mercantilist policy. Other policies have included: – – – – – • Building a network of overseas colonies; Forbidding colonies to trade with other nations; Monopolizing markets with staple ports; Banning the export of gold and silver, even for payments; Forbidding trade to be carried in foreign ships; Export subsidies; Promoting manufacturing with research or direct subsidies; Limiting wages; Maximizing the use of domestic resources; Restricting domestic consumption with non-tariff barriers to trade. Mercantilism still alive in form of tariffs and non tariff barriers set up against free flow of trade !

International Trade: Principles of Finance and Law Mercantilism • High tariffs, especially on manufactured goods, are an almost universal feature of mercantilist policy. Other policies have included: – – – – – • Building a network of overseas colonies; Forbidding colonies to trade with other nations; Monopolizing markets with staple ports; Banning the export of gold and silver, even for payments; Forbidding trade to be carried in foreign ships; Export subsidies; Promoting manufacturing with research or direct subsidies; Limiting wages; Maximizing the use of domestic resources; Restricting domestic consumption with non-tariff barriers to trade. Mercantilism still alive in form of tariffs and non tariff barriers set up against free flow of trade !

International Trade: Principles of Finance and Law Comparative Absolute Advantage (CAA) • Adam Smith , the first Classic, argues that two countries should trade on the basis of the ‘comparative absolute advantage’ -CAA- ensuring ‘mutually beneficially trade”. This indicates division of labor and specialization. • This implies that if country A produces commodity X more efficiently in comparison with county B - has absolute then both countries will benefit if they specialize in the production and export of the commodity for which they have CAA. This will lead to the optimum and effective allocation of resources and higher level of production of both commodities. • This view point leads to the call for lassie faire and call for small government- except for security related production. • The ratio of benefit each country enjoys will not be equal but both will benefit. • Situation of the CAD is rare , perhaps only in trade between the Developed and Developing countries.

International Trade: Principles of Finance and Law Comparative Absolute Advantage (CAA) • Adam Smith , the first Classic, argues that two countries should trade on the basis of the ‘comparative absolute advantage’ -CAA- ensuring ‘mutually beneficially trade”. This indicates division of labor and specialization. • This implies that if country A produces commodity X more efficiently in comparison with county B - has absolute then both countries will benefit if they specialize in the production and export of the commodity for which they have CAA. This will lead to the optimum and effective allocation of resources and higher level of production of both commodities. • This view point leads to the call for lassie faire and call for small government- except for security related production. • The ratio of benefit each country enjoys will not be equal but both will benefit. • Situation of the CAD is rare , perhaps only in trade between the Developed and Developing countries.

International Trade: Principles of Finance and Law Comparative Relative Advantage (CRA) • The CRA, developed by Ricardo in 1871, is an undisputed and major applied economic law till today. In brief it deals with cases when a country does not have absolute advantage in the production of anything but it has relative comparative relative advantage in production of one vis-a-the other. . • In such cases if country A produces both commodity X and commodity y less efficiently in comparison with county B but the efficiency in the production of commodity x is higher than the efficiency in the production of Y then both countries will benefit if country A specialize in the production and export of the commodity for which it has better efficiency i. e. commodity x. This will lead to the optimum and effective allocation of resources and higher level of production of both commodities. • This principle holds if the absolute disadvantage is not equal for both commodities and therefore there is an incentive for trade.

International Trade: Principles of Finance and Law Comparative Relative Advantage (CRA) • The CRA, developed by Ricardo in 1871, is an undisputed and major applied economic law till today. In brief it deals with cases when a country does not have absolute advantage in the production of anything but it has relative comparative relative advantage in production of one vis-a-the other. . • In such cases if country A produces both commodity X and commodity y less efficiently in comparison with county B but the efficiency in the production of commodity x is higher than the efficiency in the production of Y then both countries will benefit if country A specialize in the production and export of the commodity for which it has better efficiency i. e. commodity x. This will lead to the optimum and effective allocation of resources and higher level of production of both commodities. • This principle holds if the absolute disadvantage is not equal for both commodities and therefore there is an incentive for trade.

International Trade: Principles of Finance and Law Comparative Relative Advantage (CRA) • It should be noted that the trade in such cases if beneficial for both if the price for the commodity X is also lower taking into account the cost of production - in classical terms the wages – and the parity rate is also favorable. In other words the wages should be low enough and /or the currency cheap enough to allow for beneficial trade. • It should be further noted that the CRA assumes : – – – – • Two countries and two commodities Free trade Free movement of capital and labour Fixed production cost Zero transport cost No technological progress Labour theory of value The Labour theory of value assumes that labour is the only source of value and it is homogenous. These assumption are doubtful to say the least.

International Trade: Principles of Finance and Law Comparative Relative Advantage (CRA) • It should be noted that the trade in such cases if beneficial for both if the price for the commodity X is also lower taking into account the cost of production - in classical terms the wages – and the parity rate is also favorable. In other words the wages should be low enough and /or the currency cheap enough to allow for beneficial trade. • It should be further noted that the CRA assumes : – – – – • Two countries and two commodities Free trade Free movement of capital and labour Fixed production cost Zero transport cost No technological progress Labour theory of value The Labour theory of value assumes that labour is the only source of value and it is homogenous. These assumption are doubtful to say the least.

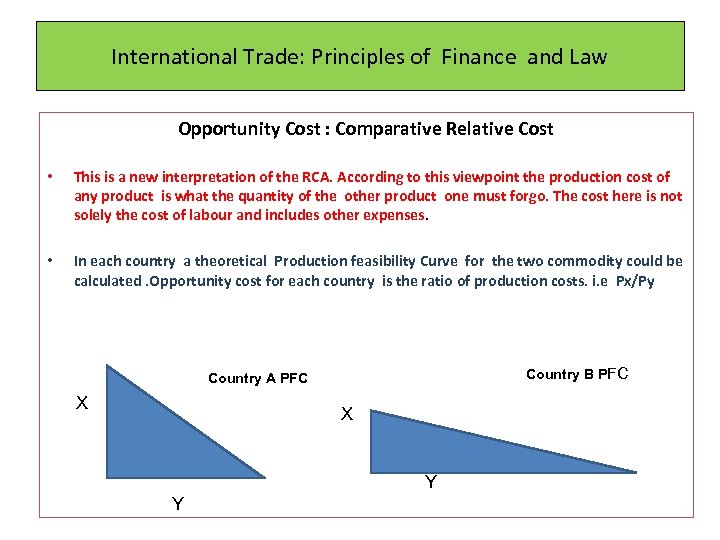

International Trade: Principles of Finance and Law Opportunity Cost : Comparative Relative Cost • This is a new interpretation of the RCA. According to this viewpoint the production cost of any product is what the quantity of the other product one must forgo. The cost here is not solely the cost of labour and includes other expenses. • In each country a theoretical Production feasibility Curve for the two commodity could be calculated. Opportunity cost for each country is the ratio of production costs. i. e Px/Py Country B PFC Country A PFC X X Y Y

International Trade: Principles of Finance and Law Opportunity Cost : Comparative Relative Cost • This is a new interpretation of the RCA. According to this viewpoint the production cost of any product is what the quantity of the other product one must forgo. The cost here is not solely the cost of labour and includes other expenses. • In each country a theoretical Production feasibility Curve for the two commodity could be calculated. Opportunity cost for each country is the ratio of production costs. i. e Px/Py Country B PFC Country A PFC X X Y Y

International Trade: Principles of Finance and Law Opportunity Cost : Comparative Relative Cost • Each country should therefore focus on the production of products for which it has comparative cost advantages, i. e. less opportunity cost . The total production will increase and total consumption will increase. Both countries will benefit although their share is not equal. • Note that theory is based on the fixed opportunity cost. It also ignores the demand. • If the Demand curve is added to the discussion then depending on the strength of the demand for the exchangable products it would be possible that a small country might reap all the benefits – significance of being insignificant ! • Studies show that the Ricardo theory can to a reasonable extent explain the world trade. Studies also show that exports of the countries have a clear negative relation with the comparative cost of labor.

International Trade: Principles of Finance and Law Opportunity Cost : Comparative Relative Cost • Each country should therefore focus on the production of products for which it has comparative cost advantages, i. e. less opportunity cost . The total production will increase and total consumption will increase. Both countries will benefit although their share is not equal. • Note that theory is based on the fixed opportunity cost. It also ignores the demand. • If the Demand curve is added to the discussion then depending on the strength of the demand for the exchangable products it would be possible that a small country might reap all the benefits – significance of being insignificant ! • Studies show that the Ricardo theory can to a reasonable extent explain the world trade. Studies also show that exports of the countries have a clear negative relation with the comparative cost of labor.

International Trade: Principles of Finance and Law Opportunity Cost : Comparative Relative Cost • In cases where the marginal cost of production increases then the marginal opportunity cost of trade also increases. In other words the Marginal rate of Transformation ( MRT) , the gradient of the Production Feasibility Curve will increase. • The reasons for the increasing MRT include: – Heterogeneous factors of production – Factors of production are not used infixed proportion in all products Production Feasibility Curve

International Trade: Principles of Finance and Law Opportunity Cost : Comparative Relative Cost • In cases where the marginal cost of production increases then the marginal opportunity cost of trade also increases. In other words the Marginal rate of Transformation ( MRT) , the gradient of the Production Feasibility Curve will increase. • The reasons for the increasing MRT include: – Heterogeneous factors of production – Factors of production are not used infixed proportion in all products Production Feasibility Curve

International Trade: Principles of Finance and Law Opportunity Cost : Comparative Relative Cost • The impact of the increasing MRT are manifold: – Neither of the trading countries fully specialize in one product, i. e. both produce both products till MRT equals the relative prices. Data shows that countries produce most of the goods but have comparative advantage in some as reflected by difference between the export and import ratios of the goods to the total export and import – Both countries benefit from trade – Trade would impact the Social Indifference Curve (SIC) shifting it or changing its gradient similar to the impact of the technological change or income change. – The implication of the change in the SIC is change in the welfare of the exporters and importers: some lose some win through change in sales , prices and employmenet. This is why some call for the Compensation Funds ! l

International Trade: Principles of Finance and Law Opportunity Cost : Comparative Relative Cost • The impact of the increasing MRT are manifold: – Neither of the trading countries fully specialize in one product, i. e. both produce both products till MRT equals the relative prices. Data shows that countries produce most of the goods but have comparative advantage in some as reflected by difference between the export and import ratios of the goods to the total export and import – Both countries benefit from trade – Trade would impact the Social Indifference Curve (SIC) shifting it or changing its gradient similar to the impact of the technological change or income change. – The implication of the change in the SIC is change in the welfare of the exporters and importers: some lose some win through change in sales , prices and employmenet. This is why some call for the Compensation Funds ! l

International Trade: Principles of Finance and Law Hecksher –Ohlin Theory • The Heckscher–Ohlin model (H–O model) was developed by Eli and Berti Ohlin in the 30’s. • It builds on theory of comparative advantage but tries to explain reasons for a country having comparative advantage overt the other in production of a commodity. It further tries to discern the impact of trade on the income of the factor of production. • Essentially it attempts to relate the patterns of commerce and production to the factor endowments ; in other words the relative abundance of the factors of production in different countries.

International Trade: Principles of Finance and Law Hecksher –Ohlin Theory • The Heckscher–Ohlin model (H–O model) was developed by Eli and Berti Ohlin in the 30’s. • It builds on theory of comparative advantage but tries to explain reasons for a country having comparative advantage overt the other in production of a commodity. It further tries to discern the impact of trade on the income of the factor of production. • Essentially it attempts to relate the patterns of commerce and production to the factor endowments ; in other words the relative abundance of the factors of production in different countries.

International Trade: Principles of Finance and Law Hecksher –Ohlin Theory • The O-H model essentially says that countries will export products that use their abundant and cheap factor(s) of production and import products that use the countries' scarce factor(s). Assumption s include: – – – – – Two countries two goods Similar technology Commodity x being capital intensive and commodity being labour intensive Fixed return to scale Perfect competition similar tastes Free move of capital and labour Zero transport Free trede Imperfect allocation of resources

International Trade: Principles of Finance and Law Hecksher –Ohlin Theory • The O-H model essentially says that countries will export products that use their abundant and cheap factor(s) of production and import products that use the countries' scarce factor(s). Assumption s include: – – – – – Two countries two goods Similar technology Commodity x being capital intensive and commodity being labour intensive Fixed return to scale Perfect competition similar tastes Free move of capital and labour Zero transport Free trede Imperfect allocation of resources

International Trade: Principles of Finance and Law Hecksher –Ohlin Theory • The O-H Theory argues that relative endowments of the factors of production determine a country's comparative advantage. Countries have comparative advantages in those goods for which the required factors of production are relatively abundant locally. • Profitability of goods is determined by input costs. Goods that require inputs that are locally abundant will be cheaper to produce than those goods that require inputs that are locally scarce. • The exports of a capital-abundant country will be from capital-intensive industries, and labour-abundant countries will import such goods, exporting labour intensive goods in return. Competitive pressures within the H–O model produce this prediction fairly straightforwardly. Conveniently, this is an easily testable hypothesis. • This is called the O-H Theorem.

International Trade: Principles of Finance and Law Hecksher –Ohlin Theory • The O-H Theory argues that relative endowments of the factors of production determine a country's comparative advantage. Countries have comparative advantages in those goods for which the required factors of production are relatively abundant locally. • Profitability of goods is determined by input costs. Goods that require inputs that are locally abundant will be cheaper to produce than those goods that require inputs that are locally scarce. • The exports of a capital-abundant country will be from capital-intensive industries, and labour-abundant countries will import such goods, exporting labour intensive goods in return. Competitive pressures within the H–O model produce this prediction fairly straightforwardly. Conveniently, this is an easily testable hypothesis. • This is called the O-H Theorem.

International Trade: Principles of Finance and Law Hecksher –Ohlin Theory • Modern econometric estimates have shown the O-H model to perform poorly, however, and adjustments have been suggested, most importantly the assumption that technology is not the same everywhere. This change would mean abandoning the pure H–O model. • In 1954 an econometric test of the H–O model by V. Leontif found that the US, despite having a relative abundance of capital, tended to export labor intensive goods and import capital-intensive goods. This problem became known as the Leontief paradox. • Alternative trade models and various explanations for the paradox have emerged as a result of the paradox. One such trade model, the Linder hypothesis, suggests that goods are traded based on similar demand rather than differences in supply side factors (i. e. , H–O's factor endowments).

International Trade: Principles of Finance and Law Hecksher –Ohlin Theory • Modern econometric estimates have shown the O-H model to perform poorly, however, and adjustments have been suggested, most importantly the assumption that technology is not the same everywhere. This change would mean abandoning the pure H–O model. • In 1954 an econometric test of the H–O model by V. Leontif found that the US, despite having a relative abundance of capital, tended to export labor intensive goods and import capital-intensive goods. This problem became known as the Leontief paradox. • Alternative trade models and various explanations for the paradox have emerged as a result of the paradox. One such trade model, the Linder hypothesis, suggests that goods are traded based on similar demand rather than differences in supply side factors (i. e. , H–O's factor endowments).

International Trade: Principles of Finance and Law Imperialism& Trade • This view is attributable to Lenin and Kaotesky. • To Lenin there was difference between the competitive capitalism of Marx era and the monopoly capitalism of the early 2 th century. To him the growth of the monopoly capitalism leads to the imperialist domination of the poorer countries by the rich and hence there is international class conflict between the rich and the poor. • In this view international trade essentially is seen as means of domination through Imperialism.

International Trade: Principles of Finance and Law Imperialism& Trade • This view is attributable to Lenin and Kaotesky. • To Lenin there was difference between the competitive capitalism of Marx era and the monopoly capitalism of the early 2 th century. To him the growth of the monopoly capitalism leads to the imperialist domination of the poorer countries by the rich and hence there is international class conflict between the rich and the poor. • In this view international trade essentially is seen as means of domination through Imperialism.

International Trade: Principles of Finance and Law Dependency Theories : Imperialism redefined • Paul Baran incorporated Lenin views of Imperialism in his theory of growth and recession. He argues that capitalism in LDCs is not endogenous and essentially is due to transfer of monopolies, business activities and trade from abroad. To him any coalition of national progressive forces will eventually be radicalized and polarized and would move towards riots and revolution. International trade is seen, naturally, as a vehicle of capitalist domination to be treated with suspicion and caution, to say the least. • According to Celso Furtado from the 18 th century and following global changes in demand a new international division of labour has taken place in which the ‘peripheral countries’ in Asia, Africa and Latin America specialize in producing primary products in ‘ enclaves ‘ controlled by foreigners while importing ‘consumer goods’ that are e produced by ‘ central countries’ of the west equipped with modern technology. The increased productivity and the new consumption patterns in the peripheral countries have given rise to a small ruling class and its allies who cooperate with the DCs towards modernization. The result is the ‘ peripheral capitalism’ which is unable to generate innovations and is dependent on the decisions from outside for transformation.

International Trade: Principles of Finance and Law Dependency Theories : Imperialism redefined • Paul Baran incorporated Lenin views of Imperialism in his theory of growth and recession. He argues that capitalism in LDCs is not endogenous and essentially is due to transfer of monopolies, business activities and trade from abroad. To him any coalition of national progressive forces will eventually be radicalized and polarized and would move towards riots and revolution. International trade is seen, naturally, as a vehicle of capitalist domination to be treated with suspicion and caution, to say the least. • According to Celso Furtado from the 18 th century and following global changes in demand a new international division of labour has taken place in which the ‘peripheral countries’ in Asia, Africa and Latin America specialize in producing primary products in ‘ enclaves ‘ controlled by foreigners while importing ‘consumer goods’ that are e produced by ‘ central countries’ of the west equipped with modern technology. The increased productivity and the new consumption patterns in the peripheral countries have given rise to a small ruling class and its allies who cooperate with the DCs towards modernization. The result is the ‘ peripheral capitalism’ which is unable to generate innovations and is dependent on the decisions from outside for transformation.

International Trade: Principles of Finance and Law Dependency Theories : Imperialism redefined • Andre Gundar Frank argued that the contemporary underdeveloped countries did not resemble the early years of the now developed countries which were never underdeveloped. Underdevelopment does not mean ‘traditional economic, social and political institutions’ but the subjection of an LDC to the colonial rule and the domination of foreign powers. Development is hindered by dependence. The LDcs become satellites of the DCs- case of Brazil. LDCs cities are satellites of the Dcs. The less dependence means more development – case of Japan is telling. • To him more development in DCs slows down developments in LDCs. Transfer of capital , values and institutions from the developed to the underdeveloped is not the solution to under development. The reasons for being underdeveloped are therefore local enterprise being replaced by modern multinationals; unskilled workers in industry and agriculture while the educated are placed in post colonial positions ; migration to cities that are dominated by west; markets are open to imperialist forces. • He sees the solution in moving out of the capitalist world. Trade with the west is not favoured.

International Trade: Principles of Finance and Law Dependency Theories : Imperialism redefined • Andre Gundar Frank argued that the contemporary underdeveloped countries did not resemble the early years of the now developed countries which were never underdeveloped. Underdevelopment does not mean ‘traditional economic, social and political institutions’ but the subjection of an LDC to the colonial rule and the domination of foreign powers. Development is hindered by dependence. The LDcs become satellites of the DCs- case of Brazil. LDCs cities are satellites of the Dcs. The less dependence means more development – case of Japan is telling. • To him more development in DCs slows down developments in LDCs. Transfer of capital , values and institutions from the developed to the underdeveloped is not the solution to under development. The reasons for being underdeveloped are therefore local enterprise being replaced by modern multinationals; unskilled workers in industry and agriculture while the educated are placed in post colonial positions ; migration to cities that are dominated by west; markets are open to imperialist forces. • He sees the solution in moving out of the capitalist world. Trade with the west is not favoured.

International Trade: Principles of Finance and Law Major elements of the institutional setting

International Trade: Principles of Finance and Law Major elements of the institutional setting

International Trade: Principles of Finance and Law UNCITRAL • United Nations Commission on International Trade( UNCITRAL) was established in 1966 with the General Assembly to promote the progressive harmonization and unification of international trade law. • It is the core legal body of the United Nations system in the field of international trade law. UNCITRAL carries out its work at annual sessions held alternately in New York and Vienna • UNCITRAL's original membership comprised 29 states, and was expanded to 36 in 1973, and again to 60 in 2004. Member states of UNCITRAL are representing different legal traditions and levels of economic development, as well as different geographic regions. The Commission member States are elected by the General Assembly. Membership is structured so as to be representative of the world's various geographic regions and its principal economic and legal systems. Members of the commission are elected for terms of six years, the terms of half the members expiring every three years. •

International Trade: Principles of Finance and Law UNCITRAL • United Nations Commission on International Trade( UNCITRAL) was established in 1966 with the General Assembly to promote the progressive harmonization and unification of international trade law. • It is the core legal body of the United Nations system in the field of international trade law. UNCITRAL carries out its work at annual sessions held alternately in New York and Vienna • UNCITRAL's original membership comprised 29 states, and was expanded to 36 in 1973, and again to 60 in 2004. Member states of UNCITRAL are representing different legal traditions and levels of economic development, as well as different geographic regions. The Commission member States are elected by the General Assembly. Membership is structured so as to be representative of the world's various geographic regions and its principal economic and legal systems. Members of the commission are elected for terms of six years, the terms of half the members expiring every three years. •

International Trade: Principles of Finance and Law • UNCITRAL It is a legal body with universal membership – including Iran- specializing in commercial law reform worldwide. UNCITRAL's business includes: – – – Conventions, model laws and rules which are acceptable worldwide Legal and legislative guides and recommendations of practical value Updated information on case law and enactments of uniform commercial law Technical assistance in law reform projects Regional and national seminars on uniform commercial law • UNCITRAL contributions are legislative, contractual and explanatory

International Trade: Principles of Finance and Law • UNCITRAL It is a legal body with universal membership – including Iran- specializing in commercial law reform worldwide. UNCITRAL's business includes: – – – Conventions, model laws and rules which are acceptable worldwide Legal and legislative guides and recommendations of practical value Updated information on case law and enactments of uniform commercial law Technical assistance in law reform projects Regional and national seminars on uniform commercial law • UNCITRAL contributions are legislative, contractual and explanatory

International Trade: Principles of Finance and Law UNCITRAL • The methods of work are organized at three levels: – UNCITRAL as the Commission , which holds an annual plenary session. – The intergovernmental working groups which is developing the topics on UNCITRAL's work program. Texts designed to simplify trade transactions and reduce associated costs are developed by working groups comprising all member States of UNCITRAL, which meet once or twice per year. Non-member States and interested international and regional organizations are also invited and can actively contribute to the work since decisions are taken by consensus, not by vote. – The International Trade Law Division of the United Nations Office of Legal Affairs provides substantive secretariat services to UNCITRAL, such as conducting research and preparing studies and drafts. This is the third level, which assists the other two in the preparation and conduct of their work.

International Trade: Principles of Finance and Law UNCITRAL • The methods of work are organized at three levels: – UNCITRAL as the Commission , which holds an annual plenary session. – The intergovernmental working groups which is developing the topics on UNCITRAL's work program. Texts designed to simplify trade transactions and reduce associated costs are developed by working groups comprising all member States of UNCITRAL, which meet once or twice per year. Non-member States and interested international and regional organizations are also invited and can actively contribute to the work since decisions are taken by consensus, not by vote. – The International Trade Law Division of the United Nations Office of Legal Affairs provides substantive secretariat services to UNCITRAL, such as conducting research and preparing studies and drafts. This is the third level, which assists the other two in the preparation and conduct of their work.

International Trade: Principles of Finance and Law UNCITRAL conventions Include : • • • the Convention on the Limitation Period in the International Sale of Goods (1974) the United Nations Convention on the Carriage of Goods by Sea (1978) the United Nations Convention on Contracts for the International Sale of Goods (1980) the United Nations Convention on International Bills of Exchange and International Promissory Notes (1988) the United Nations Convention on the Liability of Operators of Transport Terminals in International Trade (1991) the United Nations Convention on Independent Guarantees and Stand-by Letters of Credit (1995) the United Nations Convention on the Assignment of Receivables in International Trade (2001) the United Nations Convention on the Use of Electronic Communications in International Contracts (2005) the United Nations Convention on Contracts for the International Carriage of Goods Wholly or Partly by Sea (2008

International Trade: Principles of Finance and Law UNCITRAL conventions Include : • • • the Convention on the Limitation Period in the International Sale of Goods (1974) the United Nations Convention on the Carriage of Goods by Sea (1978) the United Nations Convention on Contracts for the International Sale of Goods (1980) the United Nations Convention on International Bills of Exchange and International Promissory Notes (1988) the United Nations Convention on the Liability of Operators of Transport Terminals in International Trade (1991) the United Nations Convention on Independent Guarantees and Stand-by Letters of Credit (1995) the United Nations Convention on the Assignment of Receivables in International Trade (2001) the United Nations Convention on the Use of Electronic Communications in International Contracts (2005) the United Nations Convention on Contracts for the International Carriage of Goods Wholly or Partly by Sea (2008

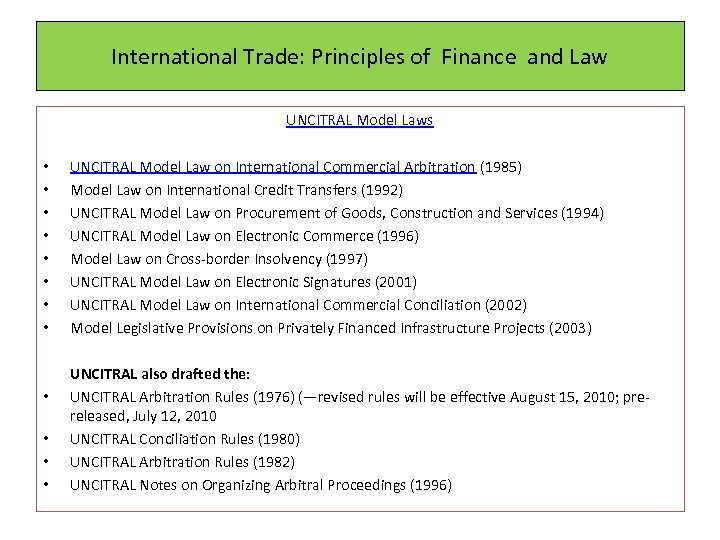

International Trade: Principles of Finance and Law UNCITRAL Model Laws • • • UNCITRAL Model Law on International Commercial Arbitration (1985) Model Law on International Credit Transfers (1992) UNCITRAL Model Law on Procurement of Goods, Construction and Services (1994) UNCITRAL Model Law on Electronic Commerce (1996) Model Law on Cross-border Insolvency (1997) UNCITRAL Model Law on Electronic Signatures (2001) UNCITRAL Model Law on International Commercial Conciliation (2002) Model Legislative Provisions on Privately Financed Infrastructure Projects (2003) UNCITRAL also drafted the: UNCITRAL Arbitration Rules (1976) (—revised rules will be effective August 15, 2010; prereleased, July 12, 2010 UNCITRAL Conciliation Rules (1980) UNCITRAL Arbitration Rules (1982) UNCITRAL Notes on Organizing Arbitral Proceedings (1996)

International Trade: Principles of Finance and Law UNCITRAL Model Laws • • • UNCITRAL Model Law on International Commercial Arbitration (1985) Model Law on International Credit Transfers (1992) UNCITRAL Model Law on Procurement of Goods, Construction and Services (1994) UNCITRAL Model Law on Electronic Commerce (1996) Model Law on Cross-border Insolvency (1997) UNCITRAL Model Law on Electronic Signatures (2001) UNCITRAL Model Law on International Commercial Conciliation (2002) Model Legislative Provisions on Privately Financed Infrastructure Projects (2003) UNCITRAL also drafted the: UNCITRAL Arbitration Rules (1976) (—revised rules will be effective August 15, 2010; prereleased, July 12, 2010 UNCITRAL Conciliation Rules (1980) UNCITRAL Arbitration Rules (1982) UNCITRAL Notes on Organizing Arbitral Proceedings (1996)

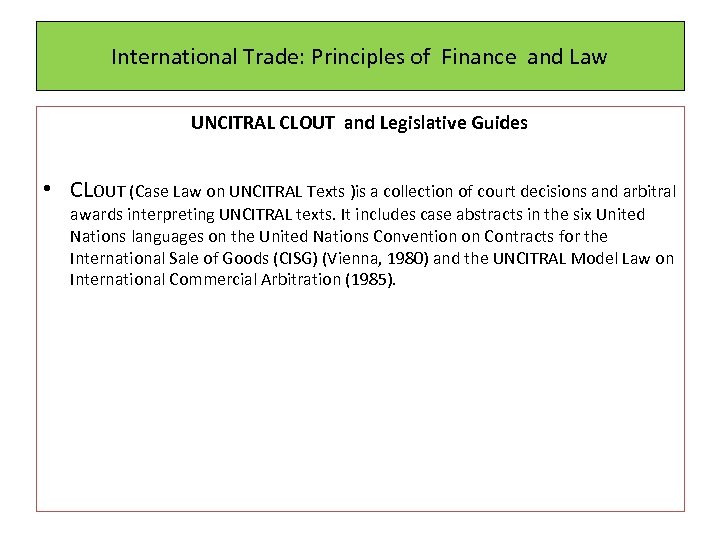

International Trade: Principles of Finance and Law UNCITRAL CLOUT and Legislative Guides • CLOUT (Case Law on UNCITRAL Texts )is a collection of court decisions and arbitral awards interpreting UNCITRAL texts. It includes case abstracts in the six United Nations languages on the United Nations Convention on Contracts for the International Sale of Goods (CISG) (Vienna, 1980) and the UNCITRAL Model Law on International Commercial Arbitration (1985).

International Trade: Principles of Finance and Law UNCITRAL CLOUT and Legislative Guides • CLOUT (Case Law on UNCITRAL Texts )is a collection of court decisions and arbitral awards interpreting UNCITRAL texts. It includes case abstracts in the six United Nations languages on the United Nations Convention on Contracts for the International Sale of Goods (CISG) (Vienna, 1980) and the UNCITRAL Model Law on International Commercial Arbitration (1985).

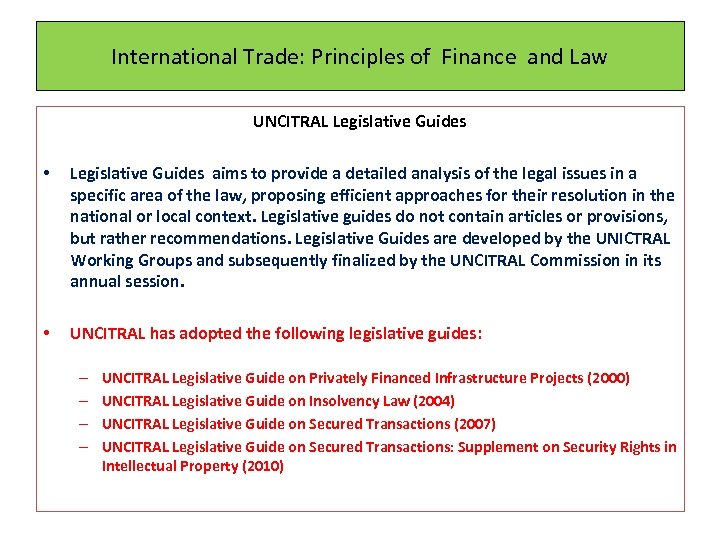

International Trade: Principles of Finance and Law UNCITRAL Legislative Guides • Legislative Guides aims to provide a detailed analysis of the legal issues in a specific area of the law, proposing efficient approaches for their resolution in the national or local context. Legislative guides do not contain articles or provisions, but rather recommendations. Legislative Guides are developed by the UNICTRAL Working Groups and subsequently finalized by the UNCITRAL Commission in its annual session. • UNCITRAL has adopted the following legislative guides: – – UNCITRAL Legislative Guide on Privately Financed Infrastructure Projects (2000) UNCITRAL Legislative Guide on Insolvency Law (2004) UNCITRAL Legislative Guide on Secured Transactions (2007) UNCITRAL Legislative Guide on Secured Transactions: Supplement on Security Rights in Intellectual Property (2010)

International Trade: Principles of Finance and Law UNCITRAL Legislative Guides • Legislative Guides aims to provide a detailed analysis of the legal issues in a specific area of the law, proposing efficient approaches for their resolution in the national or local context. Legislative guides do not contain articles or provisions, but rather recommendations. Legislative Guides are developed by the UNICTRAL Working Groups and subsequently finalized by the UNCITRAL Commission in its annual session. • UNCITRAL has adopted the following legislative guides: – – UNCITRAL Legislative Guide on Privately Financed Infrastructure Projects (2000) UNCITRAL Legislative Guide on Insolvency Law (2004) UNCITRAL Legislative Guide on Secured Transactions (2007) UNCITRAL Legislative Guide on Secured Transactions: Supplement on Security Rights in Intellectual Property (2010)

International Trade: Principles of Finance and Law The United Nations Convention On Contracts for the International Sale of Goods (CISG; the Vienna Convention)

International Trade: Principles of Finance and Law The United Nations Convention On Contracts for the International Sale of Goods (CISG; the Vienna Convention)

International Trade: Principles of Finance and Law Background • CISG is a treaty, that is a uniform international sales law. • It was developed by the UNCITRAL , was signed in Vienna in 1980 and came into force on 1 January 1988, after being ratified by 11 countries. As of September 2014, it has been ratified by 83 countries accounting for significant world trade. • The CISG is a success for the UNCITRAL, and the "most successful international document so far“ , being accepted by 81 states from "every geographical region, every stage of economic development and every major legal, social and economic system“.

International Trade: Principles of Finance and Law Background • CISG is a treaty, that is a uniform international sales law. • It was developed by the UNCITRAL , was signed in Vienna in 1980 and came into force on 1 January 1988, after being ratified by 11 countries. As of September 2014, it has been ratified by 83 countries accounting for significant world trade. • The CISG is a success for the UNCITRAL, and the "most successful international document so far“ , being accepted by 81 states from "every geographical region, every stage of economic development and every major legal, social and economic system“.

International Trade: Principles of Finance and Law Goals • The CISG allows exporters to avoid Choice of Law issues, as it offers "accepted substantive rules on which contracting parties, courts, and arbitrators may rely. • Unless excluded by the express terms of a contract the CISG is deemed to be incorporated into (and supplant) any otherwise applicable domestic laws w. r. t to a transaction in goods between parties from different Contracting States. • It success is in part due to its flexibility in allowing Contracting States the option of taking exception to certain specified articles. This was instrumental in convincing states with disparate legal traditions to subscribe to an otherwise uniform code. 56 out of 81 have made no reservations.

International Trade: Principles of Finance and Law Goals • The CISG allows exporters to avoid Choice of Law issues, as it offers "accepted substantive rules on which contracting parties, courts, and arbitrators may rely. • Unless excluded by the express terms of a contract the CISG is deemed to be incorporated into (and supplant) any otherwise applicable domestic laws w. r. t to a transaction in goods between parties from different Contracting States. • It success is in part due to its flexibility in allowing Contracting States the option of taking exception to certain specified articles. This was instrumental in convincing states with disparate legal traditions to subscribe to an otherwise uniform code. 56 out of 81 have made no reservations.

International Trade: Principles of Finance and Law Application and Major Features • The CISG applies to contracts of the sale of goods between parties whose places of business are in different States, when the States are Contracting States. • The CISG also applies if the parties are situated in different countries (which need not be Contracting States) and the conflict of law rules lead to the application of the law of a Contracting State. • The CISG is intended to apply to commercial goods and products only. With some limited exceptions, the CISG does not apply to personal, family, or household goods, nor does it apply to auctions, ships, aircraft, or intangibles and services. • The position of computer software is ‘controversial’ and will depend upon various conditions and situations. • .

International Trade: Principles of Finance and Law Application and Major Features • The CISG applies to contracts of the sale of goods between parties whose places of business are in different States, when the States are Contracting States. • The CISG also applies if the parties are situated in different countries (which need not be Contracting States) and the conflict of law rules lead to the application of the law of a Contracting State. • The CISG is intended to apply to commercial goods and products only. With some limited exceptions, the CISG does not apply to personal, family, or household goods, nor does it apply to auctions, ships, aircraft, or intangibles and services. • The position of computer software is ‘controversial’ and will depend upon various conditions and situations. • .

International Trade: Principles of Finance and Law Application and Major Features • Parties to a contract may exclude or vary the application of the CISG. Interpretation of the CISG is to take account of the ‘international character’ of the Convention, the need for uniform application, and the need for good faith in international trade. • An offer to contract must be addressed to a person, be sufficiently definite – that is, describe the goods, quantity, and price – and indicate an intention for the offeror to be bound on acceptance. • CISG does not appear to recognise Common Law unilateral contracts but, subject to clear indication by the offeror, treats any proposal not addressed to a specific person as only an invitation to make an offer.

International Trade: Principles of Finance and Law Application and Major Features • Parties to a contract may exclude or vary the application of the CISG. Interpretation of the CISG is to take account of the ‘international character’ of the Convention, the need for uniform application, and the need for good faith in international trade. • An offer to contract must be addressed to a person, be sufficiently definite – that is, describe the goods, quantity, and price – and indicate an intention for the offeror to be bound on acceptance. • CISG does not appear to recognise Common Law unilateral contracts but, subject to clear indication by the offeror, treats any proposal not addressed to a specific person as only an invitation to make an offer.

International Trade: Principles of Finance and Law Application and Major Features • The seller must deliver the goods, hand over any documents relating to them, and transfer the property in the goods, as required by the contract • Similarly, the buyer is to take all steps ‘which could reasonably be expected to take delivery of the goods, and to pay for them. • Generally, the goods must be of the quality, quantity, and description required by the contract, be suitably packaged and fit for purpose. • The seller is obliged to deliver goods that are not subject to claims from a third party for infringement of industrial or intellectual property rights in the State where the goods are to be sold. • The buyer is obliged to promptly examine the goods and, subject to some qualifications, must advise the seller of any lack of conformity within ‘a reasonable time’ and no later than within two years of receipt.

International Trade: Principles of Finance and Law Application and Major Features • The seller must deliver the goods, hand over any documents relating to them, and transfer the property in the goods, as required by the contract • Similarly, the buyer is to take all steps ‘which could reasonably be expected to take delivery of the goods, and to pay for them. • Generally, the goods must be of the quality, quantity, and description required by the contract, be suitably packaged and fit for purpose. • The seller is obliged to deliver goods that are not subject to claims from a third party for infringement of industrial or intellectual property rights in the State where the goods are to be sold. • The buyer is obliged to promptly examine the goods and, subject to some qualifications, must advise the seller of any lack of conformity within ‘a reasonable time’ and no later than within two years of receipt.

International Trade: Principles of Finance and Law Application and Major Features • The CISG describes when the risk passes from the seller to the buyer although in practice most contracts define the ‘seller's delivery obligations quite precisely by adopting an established shipment term such as FOB and CIF • Remedies of the buyer and seller depend upon the character of a breach of the contract. If the breach is not fundamental, then the contract is not avoided and remedies may be sought including claiming damages, specific performance, and adjustment of price. • The CISG excuses a party from liability to a claim of damages where a failure to perform is attributable to an impediment beyond the party’s, or a third party sub-contractor’s, control that could not have been reasonably expected. • Where a seller has to refund the price paid, then the seller must also pay interest to the buyer from the date of not of the buyer's right to claim damages. In a mirror of the seller’s obligations, where a buyer has to return goods the buyer is accountable for any benefits received.

International Trade: Principles of Finance and Law Application and Major Features • The CISG describes when the risk passes from the seller to the buyer although in practice most contracts define the ‘seller's delivery obligations quite precisely by adopting an established shipment term such as FOB and CIF • Remedies of the buyer and seller depend upon the character of a breach of the contract. If the breach is not fundamental, then the contract is not avoided and remedies may be sought including claiming damages, specific performance, and adjustment of price. • The CISG excuses a party from liability to a claim of damages where a failure to perform is attributable to an impediment beyond the party’s, or a third party sub-contractor’s, control that could not have been reasonably expected. • Where a seller has to refund the price paid, then the seller must also pay interest to the buyer from the date of not of the buyer's right to claim damages. In a mirror of the seller’s obligations, where a buyer has to return goods the buyer is accountable for any benefits received.

International Trade: Principles of Finance and Law

International Trade: Principles of Finance and Law

International Trade: Principles of Finance and Law WTO and Predecessors • The World Trade Organization (WTO) is an organization that intends to supervise and promote international trade through its liberalization. • Essentially it is a rethink of the International Trade Organization (ITO) which was planned to be established same time 1947 as WB and IMF after the WWII but failed to materialize after the US opposition- based on its broad terms of reference and presumed conflict with national sovereignty. • ITO and latter the GATT and WTO were the world response to the trade restrictions of the 30’s which restrained world trade and growth. Free trade based on comparative advantage on balance was to be to the benefit of all. • Simultaneously a group of 23 countries negotiated and agreed on the General Agreement on Tariffs and Trade (GATT) which as a precaution included provisions that it would be partly replaced by ITO if it were formed but otherwise would continue to be applicable.

International Trade: Principles of Finance and Law WTO and Predecessors • The World Trade Organization (WTO) is an organization that intends to supervise and promote international trade through its liberalization. • Essentially it is a rethink of the International Trade Organization (ITO) which was planned to be established same time 1947 as WB and IMF after the WWII but failed to materialize after the US opposition- based on its broad terms of reference and presumed conflict with national sovereignty. • ITO and latter the GATT and WTO were the world response to the trade restrictions of the 30’s which restrained world trade and growth. Free trade based on comparative advantage on balance was to be to the benefit of all. • Simultaneously a group of 23 countries negotiated and agreed on the General Agreement on Tariffs and Trade (GATT) which as a precaution included provisions that it would be partly replaced by ITO if it were formed but otherwise would continue to be applicable.

International Trade: Principles of Finance and Law WTO and Predecessors • GATT was signed by US administration which was not legally obliged send it to the Congress for endorsement. It became legally binding for the signatories in 1948. • In practice GATT although an agreement worked as an organization with a small secretariat in lieu of the ITO for some 48 years until it was replaced with the WTO. • During its life time GATT organized a number of Rounds of Multilateral Negotiations including Geneva , Annecy 49, Torquay 51, Dillon 60 -62, Kennedy 62 -67, Tokyo 73 -79 and Uruguay 86 -94 resulting in – reduced tariffs , – anti dumping , – additional agreements concerning intellectuals property and services, dispute resolution – and finally the WTO.

International Trade: Principles of Finance and Law WTO and Predecessors • GATT was signed by US administration which was not legally obliged send it to the Congress for endorsement. It became legally binding for the signatories in 1948. • In practice GATT although an agreement worked as an organization with a small secretariat in lieu of the ITO for some 48 years until it was replaced with the WTO. • During its life time GATT organized a number of Rounds of Multilateral Negotiations including Geneva , Annecy 49, Torquay 51, Dillon 60 -62, Kennedy 62 -67, Tokyo 73 -79 and Uruguay 86 -94 resulting in – reduced tariffs , – anti dumping , – additional agreements concerning intellectuals property and services, dispute resolution – and finally the WTO.