Int Business Integration Lecture 5 edt.ppt

- Количество слайдов: 31

International Trade Lecture 4 Free Trade & Protectionism

International Trade Lecture 4 Free Trade & Protectionism

2

2

Free Trade vs. Protectionism • Free Trade: when government put in place policies that allow producers from overseas nations to freely sell their goods in our country (promote trade). • Protectionism: when government put in place policies to stop overseas producers freely selling goods in our country (restrict trade). 3

Free Trade vs. Protectionism • Free Trade: when government put in place policies that allow producers from overseas nations to freely sell their goods in our country (promote trade). • Protectionism: when government put in place policies to stop overseas producers freely selling goods in our country (restrict trade). 3

Arguments for protectionism Ø If international trade is so good why is it that countries don’t all trade freely? Ø Why do they often protect their economies from imports? Ø Here are some of the arguments Ø Protecting Domestic employment Ø At any given time in an economy there will be some industries in decline (sunset industries) Free Trade: no barriers to trade put in place by governments or international organisations Ø They cannot compete with foreign competition Ø If the industry is large it will cause high levels of structural unemployment Ø Governments often attempt to protect the industry to prevent the unemployment Ø Evaluation – this argument is not very strong; protecting the industry may just prolong the process of decline Ø Even though there will be short run social costs, it might be better to let the resources move to other industries expanding other areas of the economy Ø The negative externalities of a rapidly declining major industry may be so great that government feels it has to protect 4

Arguments for protectionism Ø If international trade is so good why is it that countries don’t all trade freely? Ø Why do they often protect their economies from imports? Ø Here are some of the arguments Ø Protecting Domestic employment Ø At any given time in an economy there will be some industries in decline (sunset industries) Free Trade: no barriers to trade put in place by governments or international organisations Ø They cannot compete with foreign competition Ø If the industry is large it will cause high levels of structural unemployment Ø Governments often attempt to protect the industry to prevent the unemployment Ø Evaluation – this argument is not very strong; protecting the industry may just prolong the process of decline Ø Even though there will be short run social costs, it might be better to let the resources move to other industries expanding other areas of the economy Ø The negative externalities of a rapidly declining major industry may be so great that government feels it has to protect 4

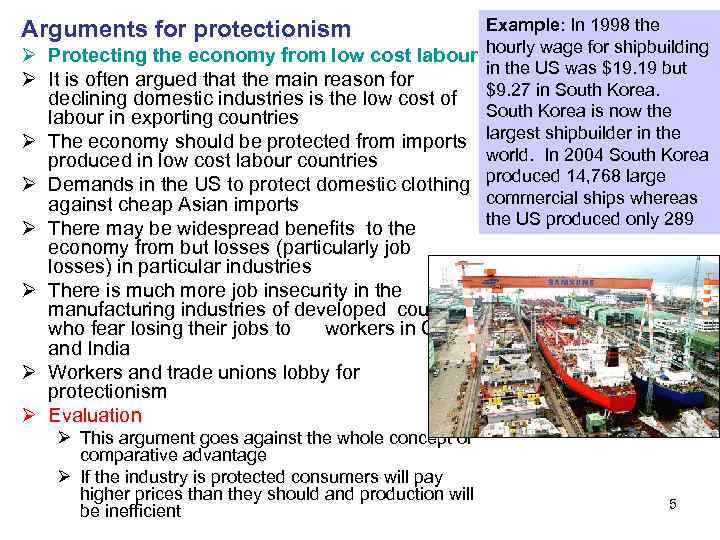

Example: In 1998 the Protecting the economy from low cost labour hourly wage for shipbuilding in the US was $19. 19 but It is often argued that the main reason for declining domestic industries is the low cost of $9. 27 in South Korea is now the labour in exporting countries The economy should be protected from imports largest shipbuilder in the world. In 2004 South Korea produced in low cost labour countries Demands in the US to protect domestic clothing produced 14, 768 large commercial ships whereas against cheap Asian imports the US produced only 289 Arguments for protectionism Ø Ø Ø There may be widespread benefits to the economy from but losses (particularly job losses) in particular industries Ø There is much more job insecurity in the manufacturing industries of developed countries who fear losing their jobs to workers in China and India Ø Workers and trade unions lobby for protectionism Ø Evaluation Ø This argument goes against the whole concept of comparative advantage Ø If the industry is protected consumers will pay higher prices than they should and production will be inefficient 5

Example: In 1998 the Protecting the economy from low cost labour hourly wage for shipbuilding in the US was $19. 19 but It is often argued that the main reason for declining domestic industries is the low cost of $9. 27 in South Korea is now the labour in exporting countries The economy should be protected from imports largest shipbuilder in the world. In 2004 South Korea produced in low cost labour countries Demands in the US to protect domestic clothing produced 14, 768 large commercial ships whereas against cheap Asian imports the US produced only 289 Arguments for protectionism Ø Ø Ø There may be widespread benefits to the economy from but losses (particularly job losses) in particular industries Ø There is much more job insecurity in the manufacturing industries of developed countries who fear losing their jobs to workers in China and India Ø Workers and trade unions lobby for protectionism Ø Evaluation Ø This argument goes against the whole concept of comparative advantage Ø If the industry is protected consumers will pay higher prices than they should and production will be inefficient 5

Arguments for protectionism Important!! Ø Protecting the economy from low cost labour Ø Comparative advantage will change over time Ø The US may have had a comparative advantage in shipbuilding at one time Ø As relative factor costs change resources should move freely Ø Supply side policies that focus on labour markets emphasise the importance of making labour flexible to adapt to changing economic circumstances Ø If governments don’t help create a flexible workforce they will have to financially help the unemployed caused by increased international competition 6

Arguments for protectionism Important!! Ø Protecting the economy from low cost labour Ø Comparative advantage will change over time Ø The US may have had a comparative advantage in shipbuilding at one time Ø As relative factor costs change resources should move freely Ø Supply side policies that focus on labour markets emphasise the importance of making labour flexible to adapt to changing economic circumstances Ø If governments don’t help create a flexible workforce they will have to financially help the unemployed caused by increased international competition 6

Arguments for protectionism Ø Protecting and infant (sunrise) industry Ø Many governments argue that new developing industries do not have the economies of scale advantages Ø Until it can gain Eo. S it can’t compete Ø It needs to be protected until it achieves size Ø Evaluation: this argument may not work for developed countries Ø They have access to capital markets to start off big Ø Saudi Arabian government recently diversified into petrochemical production – worked with Chevron, BP and Exxon Mobil to build some of the largest plants in the world Ø This argument may be more applicable to developing countries Ø but they may not have the international political power to impose protectionist policies without complains and action from developed countries. 7

Arguments for protectionism Ø Protecting and infant (sunrise) industry Ø Many governments argue that new developing industries do not have the economies of scale advantages Ø Until it can gain Eo. S it can’t compete Ø It needs to be protected until it achieves size Ø Evaluation: this argument may not work for developed countries Ø They have access to capital markets to start off big Ø Saudi Arabian government recently diversified into petrochemical production – worked with Chevron, BP and Exxon Mobil to build some of the largest plants in the world Ø This argument may be more applicable to developing countries Ø but they may not have the international political power to impose protectionist policies without complains and action from developed countries. 7

Arguments for protectionism Ø To avoid the risks of overspecialisation Ø Governments may want to avoid putting all their eggs in one basket Ø The country could become dependent on export sales of one or two products Ø If demand changes there will be serious consequences Ø The invention of synthetic rubber had a large negative effect on the rubber industry in Malaysia Ø The oversupply of coffee on the world market causing falling prices did the same for Ethiopia Ø Evaluation: there are no real arguments against this view! Example: the development of the quartz crystal severely damaged the Swiss wristwatch industry damaging the economy Exports of Swiss mechanical watches plummeted from 40 million in 1973 to only three million ten years later. While some Swiss watch companies did manufacture quartz watches, Japan and Hong Kong dominated the quartz segment and decimated the Swiss industry. Many small- to medium-sized watch companies in Switzerland closed their doors by the end of the 1970 s. The number of workers in the industry plunged from nearly 90, 000 in 1970 to 47, 000 by 1980 8

Arguments for protectionism Ø To avoid the risks of overspecialisation Ø Governments may want to avoid putting all their eggs in one basket Ø The country could become dependent on export sales of one or two products Ø If demand changes there will be serious consequences Ø The invention of synthetic rubber had a large negative effect on the rubber industry in Malaysia Ø The oversupply of coffee on the world market causing falling prices did the same for Ethiopia Ø Evaluation: there are no real arguments against this view! Example: the development of the quartz crystal severely damaged the Swiss wristwatch industry damaging the economy Exports of Swiss mechanical watches plummeted from 40 million in 1973 to only three million ten years later. While some Swiss watch companies did manufacture quartz watches, Japan and Hong Kong dominated the quartz segment and decimated the Swiss industry. Many small- to medium-sized watch companies in Switzerland closed their doors by the end of the 1970 s. The number of workers in the industry plunged from nearly 90, 000 in 1970 to 47, 000 by 1980 8

Arguments for protectionism Ø Strategic reasons Ø It is sometimes argued that certain industries need to be protected in case they are needed in times of war Ø E. g. agriculture, steel, power generation Ø Evaluation: A good excuse for protectionism? ! In many cases it is unlikely that countries will go to war and that they will be completely cut off from all supplies 9

Arguments for protectionism Ø Strategic reasons Ø It is sometimes argued that certain industries need to be protected in case they are needed in times of war Ø E. g. agriculture, steel, power generation Ø Evaluation: A good excuse for protectionism? ! In many cases it is unlikely that countries will go to war and that they will be completely cut off from all supplies 9

Arguments for protectionism Dumping: the selling by a country of Ø To prevent dumping large quantities of a commodity at a Ø Dumping can ruin domestic price lower than its production cost in producers another country Ø Where countries can prove that their industries have been severely damaged their governments are allowed under international trade rules to impose anti-dumping measures to reduce the damage Ø Evaluation: it is very difficult to prove Ø Countries argue that when the EU exports subsidized sugar it is actually dumping because the price doesn’t reflect the actual costs of the EU sugar producers Ø If dumping happens it is more likely that there will be a need for talks between governments rather than protectionism Ø Protectionism may invite retaliation reducing the benefits gained by consumers and 10 Read case study & Answer Q’s P 255/6 producers

Arguments for protectionism Dumping: the selling by a country of Ø To prevent dumping large quantities of a commodity at a Ø Dumping can ruin domestic price lower than its production cost in producers another country Ø Where countries can prove that their industries have been severely damaged their governments are allowed under international trade rules to impose anti-dumping measures to reduce the damage Ø Evaluation: it is very difficult to prove Ø Countries argue that when the EU exports subsidized sugar it is actually dumping because the price doesn’t reflect the actual costs of the EU sugar producers Ø If dumping happens it is more likely that there will be a need for talks between governments rather than protectionism Ø Protectionism may invite retaliation reducing the benefits gained by consumers and 10 Read case study & Answer Q’s P 255/6 producers

Arguments for protectionism Ø To protect product standards Ø A country might wish to impose safety, health or environmental standards on goods being imported into its domestic market Ø This will ensure that products match the standards of domestic goods Ø The EU banned the importing of American beef because it has been treated with hormones Ø Evaluation: This is a valid argument if the concerns are valid Ø The US don’t believe the EU has a valid reason as they have no proof that the hormones are bad for consumers Ø They say it is an excuse for protectionism Ø The US retaliated in 1999 by imposing trade sanctions on $117 m worth of European imports 11

Arguments for protectionism Ø To protect product standards Ø A country might wish to impose safety, health or environmental standards on goods being imported into its domestic market Ø This will ensure that products match the standards of domestic goods Ø The EU banned the importing of American beef because it has been treated with hormones Ø Evaluation: This is a valid argument if the concerns are valid Ø The US don’t believe the EU has a valid reason as they have no proof that the hormones are bad for consumers Ø They say it is an excuse for protectionism Ø The US retaliated in 1999 by imposing trade sanctions on $117 m worth of European imports 11

Arguments for protectionism Ø To raise government revenue Ø In developing countries where it is difficult to collect tax governments impose import taxes (tariffs) to raise revenue Ø The IMF estimated that import duties account for approximately 15% of total government revenue in developing countries Ø Evaluation: This is not so much an argument for protectionism but a reason why it happens Ø To correct a balance of payments deficit Ø Governments sometimes impose protectionist methods to reduce import expenditure and improve the current account deficit Ø Evaluation: This will only work in the short run and does not fix the actual cause of the deficit Ø Other countries may also retaliate 12

Arguments for protectionism Ø To raise government revenue Ø In developing countries where it is difficult to collect tax governments impose import taxes (tariffs) to raise revenue Ø The IMF estimated that import duties account for approximately 15% of total government revenue in developing countries Ø Evaluation: This is not so much an argument for protectionism but a reason why it happens Ø To correct a balance of payments deficit Ø Governments sometimes impose protectionist methods to reduce import expenditure and improve the current account deficit Ø Evaluation: This will only work in the short run and does not fix the actual cause of the deficit Ø Other countries may also retaliate 12

Arguments against protectionism Ø These arguments are really related to the reasons why countries trade Ø In brief these are Ø Protectionism raises prices to the consumers and producers of the imports Ø Leads to less choice for consumers Ø Competition would diminish and domestic firms would become inefficient (innovation may also be reduced) Ø Comparative advantage is distorted leading to inefficient use of world resources Ø Economic growth will be reduced 13

Arguments against protectionism Ø These arguments are really related to the reasons why countries trade Ø In brief these are Ø Protectionism raises prices to the consumers and producers of the imports Ø Leads to less choice for consumers Ø Competition would diminish and domestic firms would become inefficient (innovation may also be reduced) Ø Comparative advantage is distorted leading to inefficient use of world resources Ø Economic growth will be reduced 13

Types of Protectionism Ø Before we look at the types of protectionism we are going to look at how we illustrate a country that has free trade (we will use wheat as an example) Ø If there is no foreign trade the domestic farmers would produce Qe tons of wheat and the price will be Pe Ø If we then introduce foreign trade and the world price is Pw which lower than Pe the situation changes Ø Consumers can now import as much wheat as they like at the lower price Ø The world supply curve is perfectly elastic because there are so many suppliers (it doesn’t really matter how much demand there is it will not affect the price) Ø Sworld has to be lower than Pe otherwise there would be no point in trading 14

Types of Protectionism Ø Before we look at the types of protectionism we are going to look at how we illustrate a country that has free trade (we will use wheat as an example) Ø If there is no foreign trade the domestic farmers would produce Qe tons of wheat and the price will be Pe Ø If we then introduce foreign trade and the world price is Pw which lower than Pe the situation changes Ø Consumers can now import as much wheat as they like at the lower price Ø The world supply curve is perfectly elastic because there are so many suppliers (it doesn’t really matter how much demand there is it will not affect the price) Ø Sworld has to be lower than Pe otherwise there would be no point in trading 14

Types of Protectionism Ø With free trade the price of what will be Sworld Ø At this price domestic farmers will only be prepared to supply Q 1 tons but the demand will be Q 2 Ø Imports will satisfy the surplus demand Ø Q 1 Q 2 tons of wheat will be supplied by foreign suppliers Ø Consumers get to consume Qe. Q 2 more at the lower price Ø Lets now apply some different types of protectionism Insert fig 24. 1 15

Types of Protectionism Ø With free trade the price of what will be Sworld Ø At this price domestic farmers will only be prepared to supply Q 1 tons but the demand will be Q 2 Ø Imports will satisfy the surplus demand Ø Q 1 Q 2 tons of wheat will be supplied by foreign suppliers Ø Consumers get to consume Qe. Q 2 more at the lower price Ø Lets now apply some different types of protectionism Insert fig 24. 1 15

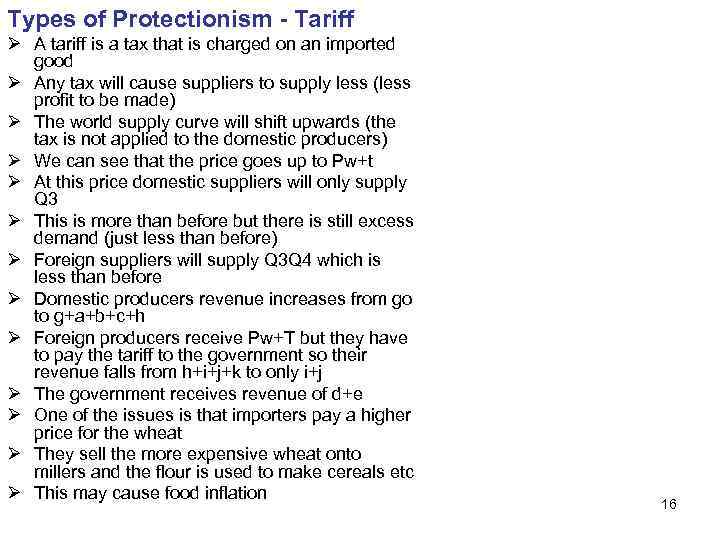

Types of Protectionism - Tariff Ø A tariff is a tax that is charged on an imported good Ø Any tax will cause suppliers to supply less (less profit to be made) Ø The world supply curve will shift upwards (the tax is not applied to the domestic producers) Ø We can see that the price goes up to Pw+t Ø At this price domestic suppliers will only supply Q 3 Ø This is more than before but there is still excess demand (just less than before) Ø Foreign suppliers will supply Q 3 Q 4 which is less than before Ø Domestic producers revenue increases from go to g+a+b+c+h Ø Foreign producers receive Pw+T but they have to pay the tariff to the government so their revenue falls from h+i+j+k to only i+j Ø The government receives revenue of d+e Ø One of the issues is that importers pay a higher price for the wheat Ø They sell the more expensive wheat onto millers and the flour is used to make cereals etc Ø This may cause food inflation 16

Types of Protectionism - Tariff Ø A tariff is a tax that is charged on an imported good Ø Any tax will cause suppliers to supply less (less profit to be made) Ø The world supply curve will shift upwards (the tax is not applied to the domestic producers) Ø We can see that the price goes up to Pw+t Ø At this price domestic suppliers will only supply Q 3 Ø This is more than before but there is still excess demand (just less than before) Ø Foreign suppliers will supply Q 3 Q 4 which is less than before Ø Domestic producers revenue increases from go to g+a+b+c+h Ø Foreign producers receive Pw+T but they have to pay the tariff to the government so their revenue falls from h+i+j+k to only i+j Ø The government receives revenue of d+e Ø One of the issues is that importers pay a higher price for the wheat Ø They sell the more expensive wheat onto millers and the flour is used to make cereals etc Ø This may cause food inflation 16

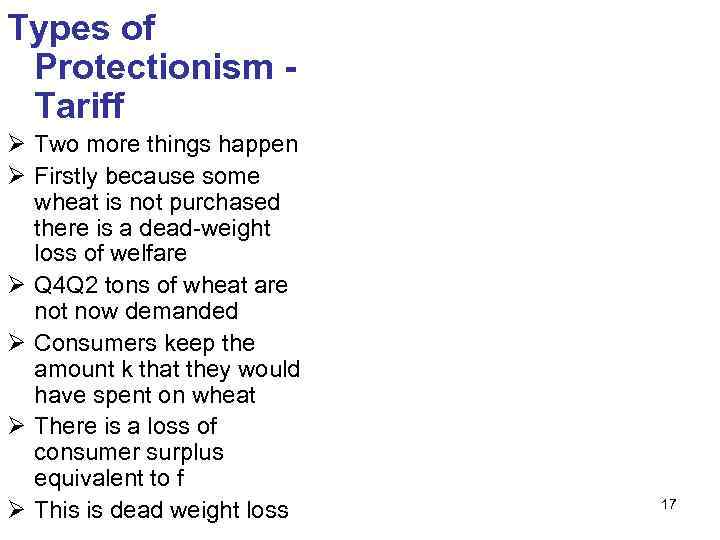

Types of Protectionism Tariff Ø Two more things happen Ø Firstly because some wheat is not purchased there is a dead-weight loss of welfare Ø Q 4 Q 2 tons of wheat are not now demanded Ø Consumers keep the amount k that they would have spent on wheat Ø There is a loss of consumer surplus equivalent to f Ø This is dead weight loss 17

Types of Protectionism Tariff Ø Two more things happen Ø Firstly because some wheat is not purchased there is a dead-weight loss of welfare Ø Q 4 Q 2 tons of wheat are not now demanded Ø Consumers keep the amount k that they would have spent on wheat Ø There is a loss of consumer surplus equivalent to f Ø This is dead weight loss 17

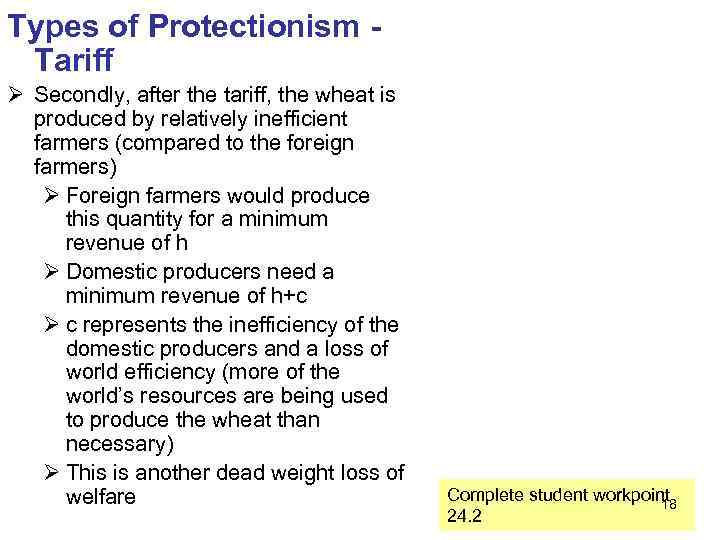

Types of Protectionism Tariff Ø Secondly, after the tariff, the wheat is produced by relatively inefficient farmers (compared to the foreign farmers) Ø Foreign farmers would produce this quantity for a minimum revenue of h Ø Domestic producers need a minimum revenue of h+c Ø c represents the inefficiency of the domestic producers and a loss of world efficiency (more of the world’s resources are being used to produce the wheat than necessary) Ø This is another dead weight loss of welfare Complete student workpoint 18 24. 2

Types of Protectionism Tariff Ø Secondly, after the tariff, the wheat is produced by relatively inefficient farmers (compared to the foreign farmers) Ø Foreign farmers would produce this quantity for a minimum revenue of h Ø Domestic producers need a minimum revenue of h+c Ø c represents the inefficiency of the domestic producers and a loss of world efficiency (more of the world’s resources are being used to produce the wheat than necessary) Ø This is another dead weight loss of welfare Complete student workpoint 18 24. 2

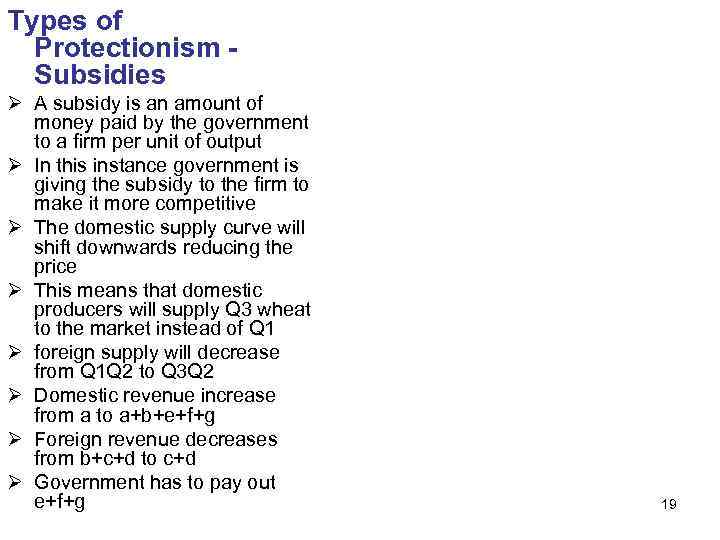

Types of Protectionism Subsidies Ø A subsidy is an amount of money paid by the government to a firm per unit of output Ø In this instance government is giving the subsidy to the firm to make it more competitive Ø The domestic supply curve will shift downwards reducing the price Ø This means that domestic producers will supply Q 3 wheat to the market instead of Q 1 Ø foreign supply will decrease from Q 1 Q 2 to Q 3 Q 2 Ø Domestic revenue increase from a to a+b+e+f+g Ø Foreign revenue decreases from b+c+d to c+d Ø Government has to pay out e+f+g 19

Types of Protectionism Subsidies Ø A subsidy is an amount of money paid by the government to a firm per unit of output Ø In this instance government is giving the subsidy to the firm to make it more competitive Ø The domestic supply curve will shift downwards reducing the price Ø This means that domestic producers will supply Q 3 wheat to the market instead of Q 1 Ø foreign supply will decrease from Q 1 Q 2 to Q 3 Q 2 Ø Domestic revenue increase from a to a+b+e+f+g Ø Foreign revenue decreases from b+c+d to c+d Ø Government has to pay out e+f+g 19

Types of Protectionism Subsidies Ø At this tariff Q 1 Q 3 tons of what are now produced by relatively inefficient farmers Ø Foreign farmers would produce for revenue b Ø Domestic farmers would produce for b+g Ø g represents the inefficiency (misallocation of world resources) – dead-weight loss of welfare Ø There is no loss of consumer surplus because price does not change Ø Consumers are indirectly affected as governments use tax revenues to fund the surplus Ø This could lead to higher taxes and is an opportunity cost – government could spend the taxes on other things Complete student workpoint 20 24. 3

Types of Protectionism Subsidies Ø At this tariff Q 1 Q 3 tons of what are now produced by relatively inefficient farmers Ø Foreign farmers would produce for revenue b Ø Domestic farmers would produce for b+g Ø g represents the inefficiency (misallocation of world resources) – dead-weight loss of welfare Ø There is no loss of consumer surplus because price does not change Ø Consumers are indirectly affected as governments use tax revenues to fund the surplus Ø This could lead to higher taxes and is an opportunity cost – government could spend the taxes on other things Complete student workpoint 20 24. 3

Types of Protectionism - Quotas Ø Quotas are a physical limit on the numbers or value of goods that can be imported into a country Ø The EU imposes quotas on Chinese garlic and mushrooms Ø This has a strange effect on the free trade diagram Ø Let us assume that the government imposes a quota of Q 1 Q 3 Ø Domestic producers supply Q 1 Ø Foreign suppliers produce Q 1 Q 3 Ø There is still excess demand of Q 3 Q 2 at the price Pw and so the price begins to rise Ø As the price rises importers are not allowed to supply more Ø Domestic producers begin to enter the market attracted by the high price of wheat Ø The domestic supply curve shifts to the right above Pw Ø Eventually the price settles at Pquota and the Quantity drops to Q 4 21

Types of Protectionism - Quotas Ø Quotas are a physical limit on the numbers or value of goods that can be imported into a country Ø The EU imposes quotas on Chinese garlic and mushrooms Ø This has a strange effect on the free trade diagram Ø Let us assume that the government imposes a quota of Q 1 Q 3 Ø Domestic producers supply Q 1 Ø Foreign suppliers produce Q 1 Q 3 Ø There is still excess demand of Q 3 Q 2 at the price Pw and so the price begins to rise Ø As the price rises importers are not allowed to supply more Ø Domestic producers begin to enter the market attracted by the high price of wheat Ø The domestic supply curve shifts to the right above Pw Ø Eventually the price settles at Pquota and the Quantity drops to Q 4 21

Types of Protectionism - Quotas Ø Domestic producers now supply Q 1 and Q 3 Q 4 tons of wheat at a price of Pquota Ø Their revenue rises from a to a+c+d+f+i+j Ø Foreign producers now supply their quota of Q 1 Q 3 at Pquota Ø Their income changes from b+d+c+e to b+g+h Ø This is a fall in income but in theory does not have to be Ø There are two areas of deadweight loss of welfare caused by the quota 22

Types of Protectionism - Quotas Ø Domestic producers now supply Q 1 and Q 3 Q 4 tons of wheat at a price of Pquota Ø Their revenue rises from a to a+c+d+f+i+j Ø Foreign producers now supply their quota of Q 1 Q 3 at Pquota Ø Their income changes from b+d+c+e to b+g+h Ø This is a fall in income but in theory does not have to be Ø There are two areas of deadweight loss of welfare caused by the quota 22

Types of Protectionism – Voluntary export restraints (VERs) Ø VERs are agreements between exporting and importing countries in which the exporting country agrees to limit the quantity of exports of a specific good below a certain level Ø China has agreed to limit its export of textiles to South Africa 23

Types of Protectionism – Voluntary export restraints (VERs) Ø VERs are agreements between exporting and importing countries in which the exporting country agrees to limit the quantity of exports of a specific good below a certain level Ø China has agreed to limit its export of textiles to South Africa 23

Types of Protectionism – Administrative barriers Ø When goods are imported there always administrative processes e. g. paper work to be stamped etc Ø This is called red tape Ø These can take time and make it difficult for exporters Ø It can also raise their costs Ø Sometimes countries may designate certain ports of entry that are difficult to reach and also more expensive Ø This is designed to put off the exporter Complete workpoint 24. 6 for homework 24

Types of Protectionism – Administrative barriers Ø When goods are imported there always administrative processes e. g. paper work to be stamped etc Ø This is called red tape Ø These can take time and make it difficult for exporters Ø It can also raise their costs Ø Sometimes countries may designate certain ports of entry that are difficult to reach and also more expensive Ø This is designed to put off the exporter Complete workpoint 24. 6 for homework 24

Types of protectionism Health and safety standards and environmental standards Ø This is when restrictions are put on the types of goods that can be sold in the domestic market or on the way they are manufactured Ø They may set quality or safety standards that are hard to meet Ø The certification may be very difficult and expensive to gain Ø It is important that government looks after its people but important that the country is behaving legitimately Embargoes Ø Complete ban on imports Ø US has not traded with Cuba for 50 years National campaigns Ø Marketing campaigns to encourage people to buy domestic goods 25

Types of protectionism Health and safety standards and environmental standards Ø This is when restrictions are put on the types of goods that can be sold in the domestic market or on the way they are manufactured Ø They may set quality or safety standards that are hard to meet Ø The certification may be very difficult and expensive to gain Ø It is important that government looks after its people but important that the country is behaving legitimately Embargoes Ø Complete ban on imports Ø US has not traded with Cuba for 50 years National campaigns Ø Marketing campaigns to encourage people to buy domestic goods 25

WTO (World Trade Organisation) • The only global international organisation dealing with the rules of trade between nations. • Their goal is to help producers of goods and services, exporters and importers conduct their business through: – Negotiating agreements between member countries/nations aimed at reducing or eliminating obstacles to international trade (tariffs, rules and regulations, etc). – Monitoring the agreements, ensuring member countries are adhering to the agreements. – Settling disputes among members (in terms of the interpretation of the agreements). 26

WTO (World Trade Organisation) • The only global international organisation dealing with the rules of trade between nations. • Their goal is to help producers of goods and services, exporters and importers conduct their business through: – Negotiating agreements between member countries/nations aimed at reducing or eliminating obstacles to international trade (tariffs, rules and regulations, etc). – Monitoring the agreements, ensuring member countries are adhering to the agreements. – Settling disputes among members (in terms of the interpretation of the agreements). 26

WTO (World Trade Organisation) • • FACT FILE Location: Geneva, Switzerland Established: 1 January 1995 Created by: Uruguay Round negotiations (1986 -94) Membership: 157 countries on 23 July 2008 Budget: 196 million Swiss francs for 2011 Secretariat staff: 640 Head: Pascal Lamy (Director-General) • • • Functions: • Administering WTO trade agreements • Forum for trade negotiations • Handling trade disputes • Monitoring national trade policies • Technical assistance and training for developing countries • Cooperation with other international organizations • 27

WTO (World Trade Organisation) • • FACT FILE Location: Geneva, Switzerland Established: 1 January 1995 Created by: Uruguay Round negotiations (1986 -94) Membership: 157 countries on 23 July 2008 Budget: 196 million Swiss francs for 2011 Secretariat staff: 640 Head: Pascal Lamy (Director-General) • • • Functions: • Administering WTO trade agreements • Forum for trade negotiations • Handling trade disputes • Monitoring national trade policies • Technical assistance and training for developing countries • Cooperation with other international organizations • 27

EU (European Union) • Free trade between union countries and a common external trade policy for non-members. • Member Nations: (27) Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom 28

EU (European Union) • Free trade between union countries and a common external trade policy for non-members. • Member Nations: (27) Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom 28

European Union • Common Agriculture Policy (CAP) – A system of European Union Subsidies and guarantees of high prices to farmers. This includes implementing the following on certain goods – Tariffs – Minimum Prices – Quotas 29

European Union • Common Agriculture Policy (CAP) – A system of European Union Subsidies and guarantees of high prices to farmers. This includes implementing the following on certain goods – Tariffs – Minimum Prices – Quotas 29

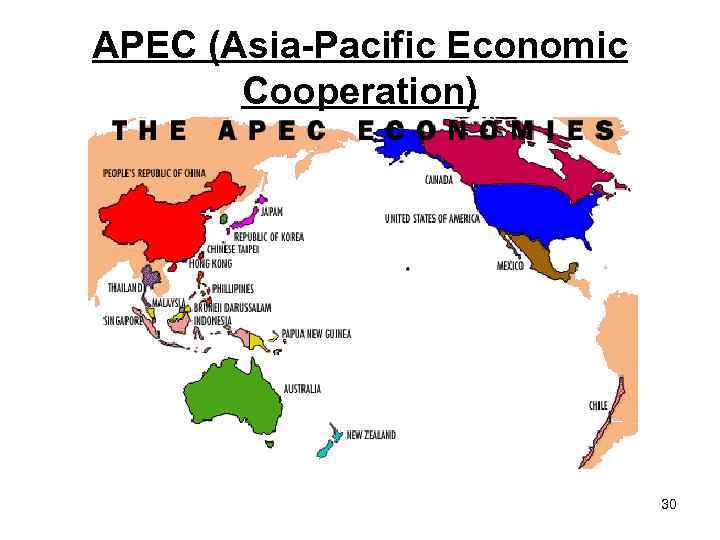

APEC (Asia-Pacific Economic Cooperation) 30

APEC (Asia-Pacific Economic Cooperation) 30

APEC • Member Nations include: Argentina, Australia, Bolivia, Brazil, Canada, Chile, China, Hong Kong, Indonesia, Japan, Malaysia, Mexico, Papua New Guinea, Peru, the Philippines, Russia, Singapore, South Korea, Thailand, US, Vietnam, NZ. • Formed in 1989. APEC member nations work together to sustain economic growth via committing themselves to free trade, investment and economic reform. • Reducing tariffs and other barriers has meant APEC member nations have become more efficient and export levels have largely increased. • Standard of living has increased in these countries as a result of cheaper goods and services being available to consumers. 31

APEC • Member Nations include: Argentina, Australia, Bolivia, Brazil, Canada, Chile, China, Hong Kong, Indonesia, Japan, Malaysia, Mexico, Papua New Guinea, Peru, the Philippines, Russia, Singapore, South Korea, Thailand, US, Vietnam, NZ. • Formed in 1989. APEC member nations work together to sustain economic growth via committing themselves to free trade, investment and economic reform. • Reducing tariffs and other barriers has meant APEC member nations have become more efficient and export levels have largely increased. • Standard of living has increased in these countries as a result of cheaper goods and services being available to consumers. 31