80cbba2ecb5493b91a1a395b4e2526a2.ppt

- Количество слайдов: 11

International Trade and Finance: Exchange Rates and Macroeconomic Policy AP Economics Mr. Bordelon

International Trade and Finance: Exchange Rates and Macroeconomic Policy AP Economics Mr. Bordelon

Devaluation and Revaluation of Fixed Exchange Rate Regimes • Devaluation. Reduction in the value of a currency that is set under a fixed exchange rate regime. • Revaluation. Increase in the value of a currency that is set under a fixed exchange rate regime.

Devaluation and Revaluation of Fixed Exchange Rate Regimes • Devaluation. Reduction in the value of a currency that is set under a fixed exchange rate regime. • Revaluation. Increase in the value of a currency that is set under a fixed exchange rate regime.

Devaluation and Revaluation of Fixed Exchange Rate Regimes • Devaluation makes domestic goods cheaper in terms of foreign currency, leading to higher exports, and makes foreign goods more expensive in terms of domestic currency, leading to fewer imports. • Increases balance of payments on current account.

Devaluation and Revaluation of Fixed Exchange Rate Regimes • Devaluation makes domestic goods cheaper in terms of foreign currency, leading to higher exports, and makes foreign goods more expensive in terms of domestic currency, leading to fewer imports. • Increases balance of payments on current account.

Devaluation and Revaluation of Fixed Exchange Rate Regimes • Revaluation makes domestic goods more expensive in terms of foreign currency, leading to fewer exports, and makes foreign goods cheaper in domestic currency, leading to higher imports. • Revaluation reduces balance of payments on current accounts.

Devaluation and Revaluation of Fixed Exchange Rate Regimes • Revaluation makes domestic goods more expensive in terms of foreign currency, leading to fewer exports, and makes foreign goods cheaper in domestic currency, leading to higher imports. • Revaluation reduces balance of payments on current accounts.

Devaluation and Revaluation of Fixed Exchange Rate Regimes • Why devalue or revalue a currency? • Used to eliminate shortages or surpluses in the foreign exchange market. • Used as tools of macroeconomic policy. • Devaluation increases exports and decreases imports, which increases AD. Devaluation can be used to reduce or eliminate a recessionary gap. • Revaluation decreases exports and increases imports, which decreases AD. Revaluation can be used to reduce or eliminate an inflationary gap.

Devaluation and Revaluation of Fixed Exchange Rate Regimes • Why devalue or revalue a currency? • Used to eliminate shortages or surpluses in the foreign exchange market. • Used as tools of macroeconomic policy. • Devaluation increases exports and decreases imports, which increases AD. Devaluation can be used to reduce or eliminate a recessionary gap. • Revaluation decreases exports and increases imports, which decreases AD. Revaluation can be used to reduce or eliminate an inflationary gap.

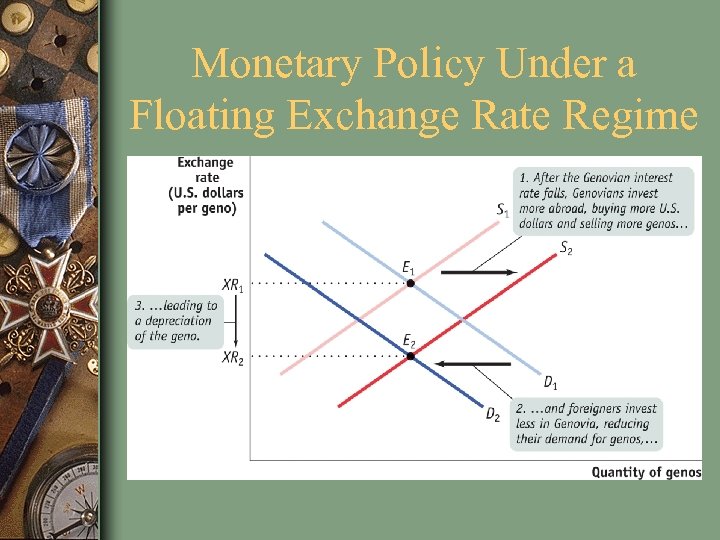

Monetary Policy Under a Floating Exchange Rate Regime

Monetary Policy Under a Floating Exchange Rate Regime

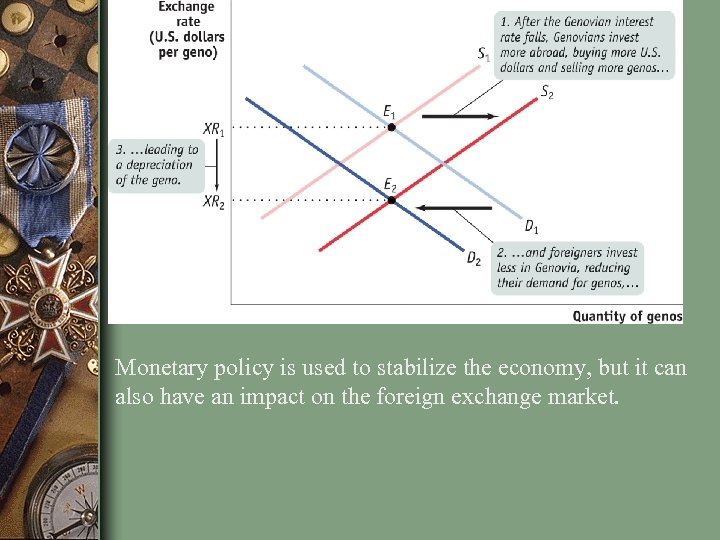

Monetary policy is used to stabilize the economy, but it can also have an impact on the foreign exchange market.

Monetary policy is used to stabilize the economy, but it can also have an impact on the foreign exchange market.

Suppose the market for the geno is competitive and the exchange rate with the dollar is floating. What would happen if the central bank of Genovia increased MS? Refer to the graph on the previous slide. • Interest rates would fall with expansionary monetary policy, domestic investment would increase, and AD would increase. • Genovians would seek countries with higher rates of return on investment, buying more U. S. dollars, and selling more genos. Supply of genos increases. • Foreign investors, however, will look elsewhere, and invest less in Genovia, reducing demand for genos. • With an increased supply and decreased demand, value of geno depreciates against the dollar. • Depreciated currency will make products made in Genovia less expensive to American consumers, thus there would be an increase in NX and another increase in AD. • In other words, depreciation resulting from an interest rate cut increases exports, and reduces imports, increasing AD.

Suppose the market for the geno is competitive and the exchange rate with the dollar is floating. What would happen if the central bank of Genovia increased MS? Refer to the graph on the previous slide. • Interest rates would fall with expansionary monetary policy, domestic investment would increase, and AD would increase. • Genovians would seek countries with higher rates of return on investment, buying more U. S. dollars, and selling more genos. Supply of genos increases. • Foreign investors, however, will look elsewhere, and invest less in Genovia, reducing demand for genos. • With an increased supply and decreased demand, value of geno depreciates against the dollar. • Depreciated currency will make products made in Genovia less expensive to American consumers, thus there would be an increase in NX and another increase in AD. • In other words, depreciation resulting from an interest rate cut increases exports, and reduces imports, increasing AD.

Suppose the market for the geno is competitive and the exchange rate with the dollar is floating. What would happen if the central bank of Genovia decreased MS? Refer to the graph on the previous slide. • Interest rates would increase with contractionary monetary policy, domestic investment would decrease, and AD would decrease. • Genovians would invest more at home since it has a higher rate of return, selling more U. S. dollars and buying more genos. Supply of genos decreases. • Foreign investors, however, will look towards Genovia, with its high rate of return on investment, and invest more in Genovia, increasing demand for genos. • With a decreased supply and increased demand, value of geno appreciates against the dollar. • Appreciated currency will make products made in Genovia more expensive to American consumers, thus there would be an decrease in NX and decrease in AD. • In other words, appreciation resulting from an interest rate increase decreases exports, and increases imports, decreasing AD.

Suppose the market for the geno is competitive and the exchange rate with the dollar is floating. What would happen if the central bank of Genovia decreased MS? Refer to the graph on the previous slide. • Interest rates would increase with contractionary monetary policy, domestic investment would decrease, and AD would decrease. • Genovians would invest more at home since it has a higher rate of return, selling more U. S. dollars and buying more genos. Supply of genos decreases. • Foreign investors, however, will look towards Genovia, with its high rate of return on investment, and invest more in Genovia, increasing demand for genos. • With a decreased supply and increased demand, value of geno appreciates against the dollar. • Appreciated currency will make products made in Genovia more expensive to American consumers, thus there would be an decrease in NX and decrease in AD. • In other words, appreciation resulting from an interest rate increase decreases exports, and increases imports, decreasing AD.

International Business Cycles • A recession in Canada, the biggest trading partner with the U. S. , will likely cause a decrease in real GDP in the U. S. Why? • Canadians buy many goods made in America, so a recession in Canada means American firms will shift fewer products to Canadian customers. Exports will decrease and AD will decrease with it. • But this straightforward chain of events is

International Business Cycles • A recession in Canada, the biggest trading partner with the U. S. , will likely cause a decrease in real GDP in the U. S. Why? • Canadians buy many goods made in America, so a recession in Canada means American firms will shift fewer products to Canadian customers. Exports will decrease and AD will decrease with it. • But this straightforward chain of events is

International Business Cycles • This can also affect the exchange rate regime in the U. S. • Example. A recession hits the Canadian economy. Canadians decrease D for U. S. goods. This amounts to a decrease in D for U. S. dollar, and U. S. dollar depreciates. • Depreciating U. S. dollar means that goods made in America become more affordable to Canadian consumers. • Depreciating U. S. dollar eases the diminished exports to Canada and negative impact on U. S. economy is lessened. • Key point. In theory a free-floating exchange rate allows a nation some insulation from recessions that begin in other nations.

International Business Cycles • This can also affect the exchange rate regime in the U. S. • Example. A recession hits the Canadian economy. Canadians decrease D for U. S. goods. This amounts to a decrease in D for U. S. dollar, and U. S. dollar depreciates. • Depreciating U. S. dollar means that goods made in America become more affordable to Canadian consumers. • Depreciating U. S. dollar eases the diminished exports to Canada and negative impact on U. S. economy is lessened. • Key point. In theory a free-floating exchange rate allows a nation some insulation from recessions that begin in other nations.