2217ec8f66478d4c2879810372534238.ppt

- Количество слайдов: 15

International Trade and Finance: Exchange Rate Policy AP Economics Mr. Bordelon

International Trade and Finance: Exchange Rate Policy AP Economics Mr. Bordelon

Exchange Rate Regimes • Nominal exchange rate is a price that is determined by free market forces of supply and demand. • Countries can deliberately manipulate the exchange rate of its own currency to achieve certain economic goals. • Why would a country do this? Because the exchange rate has a great deal of influence on net exports. • If your nation’s currency is inexpensive, foreigners will find your goods to be inexpensive and your net exports will rise.

Exchange Rate Regimes • Nominal exchange rate is a price that is determined by free market forces of supply and demand. • Countries can deliberately manipulate the exchange rate of its own currency to achieve certain economic goals. • Why would a country do this? Because the exchange rate has a great deal of influence on net exports. • If your nation’s currency is inexpensive, foreigners will find your goods to be inexpensive and your net exports will rise.

Exchange Rate Regimes • Exchange rate regime. Rule governing policy toward the exchange rate. • Fixed exchange rate. When the government keeps the exchange rate against some other currency at or near a particular target. • Example. Hong Kong has an official policy of setting an exchange rate of HK$7. 80 per $1. • Floating exchange rate. When the government lets the exchange rate go wherever the market takes it. • Example. U. S. , U. K. , Canada.

Exchange Rate Regimes • Exchange rate regime. Rule governing policy toward the exchange rate. • Fixed exchange rate. When the government keeps the exchange rate against some other currency at or near a particular target. • Example. Hong Kong has an official policy of setting an exchange rate of HK$7. 80 per $1. • Floating exchange rate. When the government lets the exchange rate go wherever the market takes it. • Example. U. S. , U. K. , Canada.

Exchange Rate Regimes • If exchange rates are determined by the free market, then how can an exchange rate be fixed? • Exchange market intervention. Government purchases or sales of currency in the foreign exchange market. • Foreign exchange reserves. Stocks of foreign currency that governments maintain to buy their own currency on the foreign exchange market.

Exchange Rate Regimes • If exchange rates are determined by the free market, then how can an exchange rate be fixed? • Exchange market intervention. Government purchases or sales of currency in the foreign exchange market. • Foreign exchange reserves. Stocks of foreign currency that governments maintain to buy their own currency on the foreign exchange market.

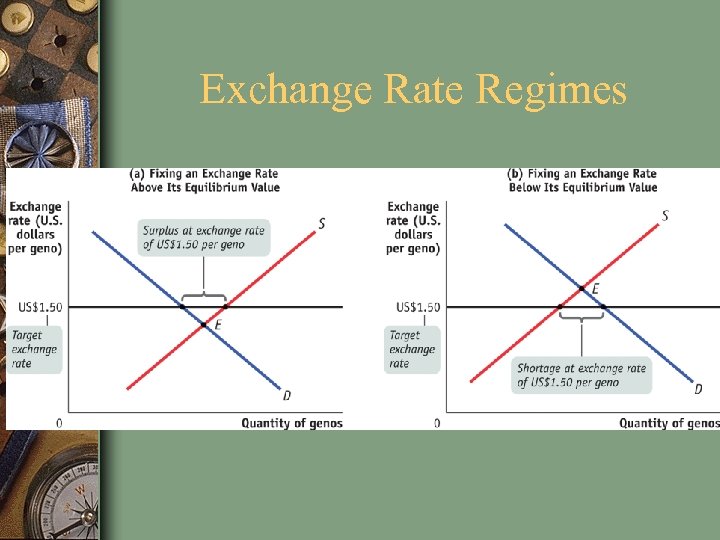

Exchange Rate Regimes

Exchange Rate Regimes

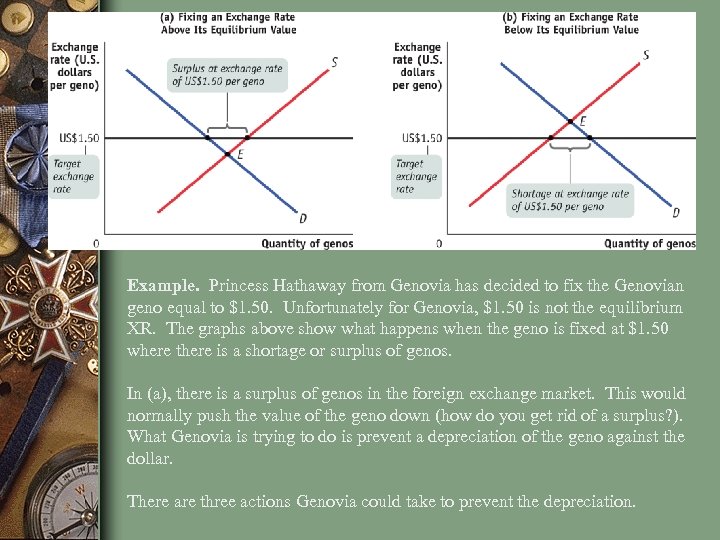

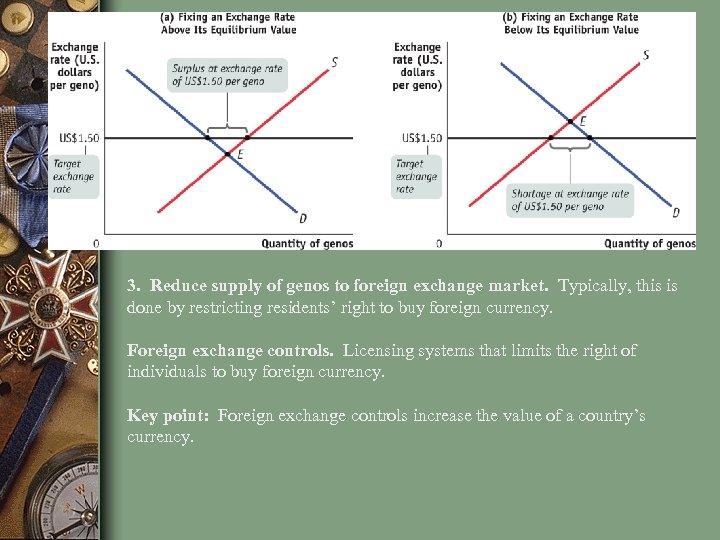

Example. Princess Hathaway from Genovia has decided to fix the Genovian geno equal to $1. 50. Unfortunately for Genovia, $1. 50 is not the equilibrium XR. The graphs above show what happens when the geno is fixed at $1. 50 where there is a shortage or surplus of genos. In (a), there is a surplus of genos in the foreign exchange market. This would normally push the value of the geno down (how do you get rid of a surplus? ). What Genovia is trying to do is prevent a depreciation of the geno against the dollar. There are three actions Genovia could take to prevent the depreciation.

Example. Princess Hathaway from Genovia has decided to fix the Genovian geno equal to $1. 50. Unfortunately for Genovia, $1. 50 is not the equilibrium XR. The graphs above show what happens when the geno is fixed at $1. 50 where there is a shortage or surplus of genos. In (a), there is a surplus of genos in the foreign exchange market. This would normally push the value of the geno down (how do you get rid of a surplus? ). What Genovia is trying to do is prevent a depreciation of the geno against the dollar. There are three actions Genovia could take to prevent the depreciation.

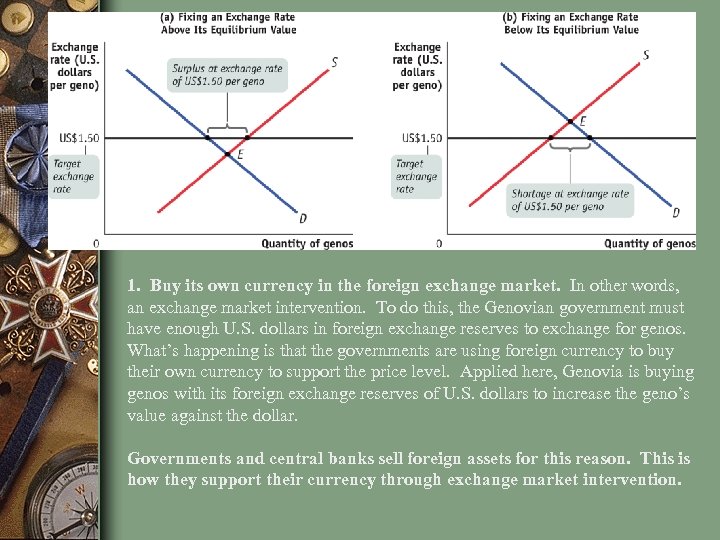

1. Buy its own currency in the foreign exchange market. In other words, an exchange market intervention. To do this, the Genovian government must have enough U. S. dollars in foreign exchange reserves to exchange for genos. What’s happening is that the governments are using foreign currency to buy their own currency to support the price level. Applied here, Genovia is buying genos with its foreign exchange reserves of U. S. dollars to increase the geno’s value against the dollar. Governments and central banks sell foreign assets for this reason. This is how they support their currency through exchange market intervention.

1. Buy its own currency in the foreign exchange market. In other words, an exchange market intervention. To do this, the Genovian government must have enough U. S. dollars in foreign exchange reserves to exchange for genos. What’s happening is that the governments are using foreign currency to buy their own currency to support the price level. Applied here, Genovia is buying genos with its foreign exchange reserves of U. S. dollars to increase the geno’s value against the dollar. Governments and central banks sell foreign assets for this reason. This is how they support their currency through exchange market intervention.

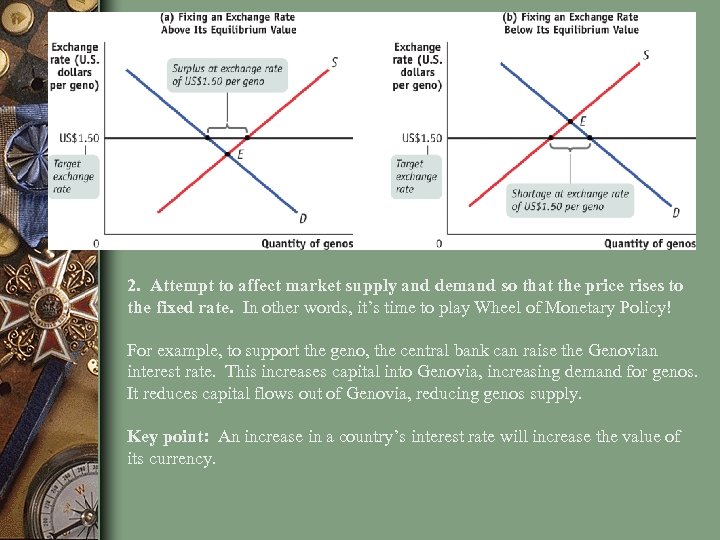

2. Attempt to affect market supply and demand so that the price rises to the fixed rate. In other words, it’s time to play Wheel of Monetary Policy! For example, to support the geno, the central bank can raise the Genovian interest rate. This increases capital into Genovia, increasing demand for genos. It reduces capital flows out of Genovia, reducing genos supply. Key point: An increase in a country’s interest rate will increase the value of its currency.

2. Attempt to affect market supply and demand so that the price rises to the fixed rate. In other words, it’s time to play Wheel of Monetary Policy! For example, to support the geno, the central bank can raise the Genovian interest rate. This increases capital into Genovia, increasing demand for genos. It reduces capital flows out of Genovia, reducing genos supply. Key point: An increase in a country’s interest rate will increase the value of its currency.

3. Reduce supply of genos to foreign exchange market. Typically, this is done by restricting residents’ right to buy foreign currency. Foreign exchange controls. Licensing systems that limits the right of individuals to buy foreign currency. Key point: Foreign exchange controls increase the value of a country’s currency.

3. Reduce supply of genos to foreign exchange market. Typically, this is done by restricting residents’ right to buy foreign currency. Foreign exchange controls. Licensing systems that limits the right of individuals to buy foreign currency. Key point: Foreign exchange controls increase the value of a country’s currency.

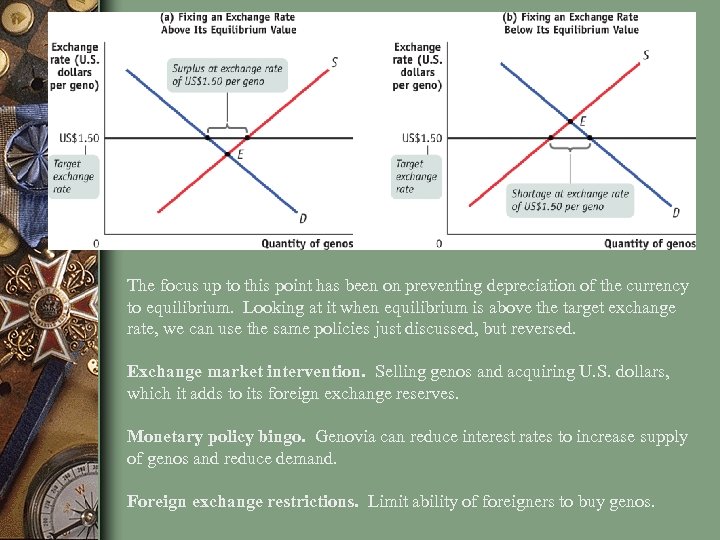

The focus up to this point has been on preventing depreciation of the currency to equilibrium. Looking at it when equilibrium is above the target exchange rate, we can use the same policies just discussed, but reversed. Exchange market intervention. Selling genos and acquiring U. S. dollars, which it adds to its foreign exchange reserves. Monetary policy bingo. Genovia can reduce interest rates to increase supply of genos and reduce demand. Foreign exchange restrictions. Limit ability of foreigners to buy genos.

The focus up to this point has been on preventing depreciation of the currency to equilibrium. Looking at it when equilibrium is above the target exchange rate, we can use the same policies just discussed, but reversed. Exchange market intervention. Selling genos and acquiring U. S. dollars, which it adds to its foreign exchange reserves. Monetary policy bingo. Genovia can reduce interest rates to increase supply of genos and reduce demand. Foreign exchange restrictions. Limit ability of foreigners to buy genos.

Advantages and Disadvantages of Exchange Rate Regimes • Advantages • Stability. Fixed exchange rate provides stability in foreign transactions in the same way Americans conduct transactions across state lines. • Example. If Katie takes her dollars from Florida to Georgia, she knows that the value of her dollars is unchanged. But if she takes her dollars from Florida to Europe, the value of those dollars can change daily. Fixed exchange rates avoids this uncertainty.

Advantages and Disadvantages of Exchange Rate Regimes • Advantages • Stability. Fixed exchange rate provides stability in foreign transactions in the same way Americans conduct transactions across state lines. • Example. If Katie takes her dollars from Florida to Georgia, she knows that the value of her dollars is unchanged. But if she takes her dollars from Florida to Europe, the value of those dollars can change daily. Fixed exchange rates avoids this uncertainty.

Advantages and Disadvantages of Exchange Rate Regimes • Advantages • Fixed exchange rate also “commits” central banks to monetary policies that would not upset the exchange rate. • Example. If central bank adhered to the exchange rate regime, central bank could not increase MS. This would cause inflation and reduce the value of the currency. In other words, more stability.

Advantages and Disadvantages of Exchange Rate Regimes • Advantages • Fixed exchange rate also “commits” central banks to monetary policies that would not upset the exchange rate. • Example. If central bank adhered to the exchange rate regime, central bank could not increase MS. This would cause inflation and reduce the value of the currency. In other words, more stability.

Advantages and Disadvantages of Fixed Exchange Rate Regimes • Disadvantages • To stabilize an exchange rate through intervention, a country must keep large quantities of foreign currency on hand, and that currency is usually a low-return investment. • Large reserves can be exhausted when there are large capital flows out of a country.

Advantages and Disadvantages of Fixed Exchange Rate Regimes • Disadvantages • To stabilize an exchange rate through intervention, a country must keep large quantities of foreign currency on hand, and that currency is usually a low-return investment. • Large reserves can be exhausted when there are large capital flows out of a country.

Advantages and Disadvantages of Fixed Exchange Rate Regimes • Disadvantages • If a country chooses to stabilize an exchange rate by adjusting monetary policy rather than through intervention, it must divert monetary policy from other goals, notably stabilizing the economy and managing the inflation rate. • Foreign exchange controls distort incentives for importing and exporting g/s. • Bureaucracy and corruption.

Advantages and Disadvantages of Fixed Exchange Rate Regimes • Disadvantages • If a country chooses to stabilize an exchange rate by adjusting monetary policy rather than through intervention, it must divert monetary policy from other goals, notably stabilizing the economy and managing the inflation rate. • Foreign exchange controls distort incentives for importing and exporting g/s. • Bureaucracy and corruption.

Question 1 Suppose the United States and China were the only two countries in the world. a. Draw a correctly labeled graph of the foreign exchange market for U. S. dollars showing the equilibrium in the market. The currency in China is the yuan. b. On your graph, indicate a fixed exchange rate set below the equilibrium exchange rate. Does the fixed exchange rate lead to a surplus or shortage of U. S. dollars? Explain and show the amount of the surplus/shortage on your graph. c. To bring the foreign exchange market back to an equilibrium at the fixed exchange rate, would the U. S. government need to buy or sell dollars? On your graph, illustrate how the government buying or selling dollars would bring the equilibrium exchange rate back to the desired fixed rate. d. Suppose that instead of buying or selling dollars, the Federal Reserve was going to engage in monetary policy to bring the foreign exchange market back to an equilibrium at the fixed exchange rate. Should the Fed buy or sell Treasury securities in an open-market operation? Explain.

Question 1 Suppose the United States and China were the only two countries in the world. a. Draw a correctly labeled graph of the foreign exchange market for U. S. dollars showing the equilibrium in the market. The currency in China is the yuan. b. On your graph, indicate a fixed exchange rate set below the equilibrium exchange rate. Does the fixed exchange rate lead to a surplus or shortage of U. S. dollars? Explain and show the amount of the surplus/shortage on your graph. c. To bring the foreign exchange market back to an equilibrium at the fixed exchange rate, would the U. S. government need to buy or sell dollars? On your graph, illustrate how the government buying or selling dollars would bring the equilibrium exchange rate back to the desired fixed rate. d. Suppose that instead of buying or selling dollars, the Federal Reserve was going to engage in monetary policy to bring the foreign exchange market back to an equilibrium at the fixed exchange rate. Should the Fed buy or sell Treasury securities in an open-market operation? Explain.