6753120344bf2cb49c9c7fa34418203b.ppt

- Количество слайдов: 29

INTERNATIONAL SETTLEMENTS Teaching materials: tjfsu 09@163. com Password: 09 tjfsu My Email Address: nkcindy@126. com My Cell-phone Number: 13820530619

INTERNATIONAL SETTLEMENTS Teaching materials: tjfsu 09@163. com Password: 09 tjfsu My Email Address: nkcindy@126. com My Cell-phone Number: 13820530619

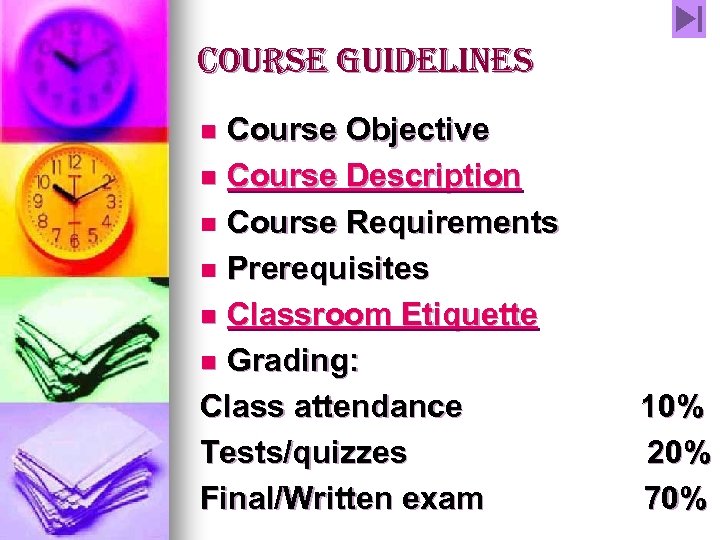

Course Guidelines Course Objective n Course Description n Course Requirements n Prerequisites n Classroom Etiquette n Grading: Class attendance Tests/quizzes Final/Written exam n 10% 20% 70%

Course Guidelines Course Objective n Course Description n Course Requirements n Prerequisites n Classroom Etiquette n Grading: Class attendance Tests/quizzes Final/Written exam n 10% 20% 70%

Topic Classhours 1 General Introduction 3 2 Instruments 7 3 Remittance 2 4 Collection 6 5 Letter of credit 10 6 Other methods 2 7 Documents required Non-trade settlement and cyber payments 4 8 2

Topic Classhours 1 General Introduction 3 2 Instruments 7 3 Remittance 2 4 Collection 6 5 Letter of credit 10 6 Other methods 2 7 Documents required Non-trade settlement and cyber payments 4 8 2

n. Keep quite. n. All mobile phones must be turned off.

n. Keep quite. n. All mobile phones must be turned off.

Reference books: 1. 吴国新主编,《International Settlements》,清华大学出版社, 2008年。 2. 苏宗祥主编,《国际结算》(第三版) ,中国金融出版社,2004年。 3. 苏宗祥主编,《国际结算》(练习册) ,中国金融出版社,2004年。 4. 史万钧编著,《International Settlements》, 中国金融出版社, 2003年。

Reference books: 1. 吴国新主编,《International Settlements》,清华大学出版社, 2008年。 2. 苏宗祥主编,《国际结算》(第三版) ,中国金融出版社,2004年。 3. 苏宗祥主编,《国际结算》(练习册) ,中国金融出版社,2004年。 4. 史万钧编著,《International Settlements》, 中国金融出版社, 2003年。

Chapter 1 Introduction u. Introduction to International Settlements u. Introduction to International Trade

Chapter 1 Introduction u. Introduction to International Settlements u. Introduction to International Trade

Introduction to International Settlements v 1. 1 Origin and development of international settlement v 1. 2 Basis and conditions of international settlement

Introduction to International Settlements v 1. 1 Origin and development of international settlement v 1. 2 Basis and conditions of international settlement

1. 1 Origin and development of international settlement • Basic concepts and content of international settlement • Evolution of international concept • Characteristics of modern international settlements

1. 1 Origin and development of international settlement • Basic concepts and content of international settlement • Evolution of international concept • Characteristics of modern international settlements

1. Concept of International Settlement the financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to settle accounts, claims and debts that have emerged in the course of political, economic or cultural contacts among them.

1. Concept of International Settlement the financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to settle accounts, claims and debts that have emerged in the course of political, economic or cultural contacts among them.

2. Types of international settlement ① International Trade Settlement ② International Non-trade Settlement: o invisible trade o financial transactions o payments between governments o others

2. Types of international settlement ① International Trade Settlement ② International Non-trade Settlement: o invisible trade o financial transactions o payments between governments o others

3. Basic content of international settlement q. Negotiable instruments/financial documents q. Payment methods q. Commercial documents

3. Basic content of international settlement q. Negotiable instruments/financial documents q. Payment methods q. Commercial documents

Relative security Basic Methods of International Payments and Settlements o. Remittance o. Collection o. Letter of credit o. Bank guarantee/ Standby L/C…

Relative security Basic Methods of International Payments and Settlements o. Remittance o. Collection o. Letter of credit o. Bank guarantee/ Standby L/C…

4. Evolution of international settlement o From cash settlement to non-cash settlement o From direct payment between traders to indirect payment o From payments under simple price terms to payments under more complex price terms o Settlement through the Internet

4. Evolution of international settlement o From cash settlement to non-cash settlement o From direct payment between traders to indirect payment o From payments under simple price terms to payments under more complex price terms o Settlement through the Internet

5. Characteristics of modern international settlements u Safe u Convenient u Quick u Standard

5. Characteristics of modern international settlements u Safe u Convenient u Quick u Standard

1. 2 Basis and conditions of international settlement o Correspondent banks o Some organizations relevant to international settlement

1. 2 Basis and conditions of international settlement o Correspondent banks o Some organizations relevant to international settlement

1. Correspondent banks “a bank having direct connection or friendly service relations with another bank. ”

1. Correspondent banks “a bank having direct connection or friendly service relations with another bank. ”

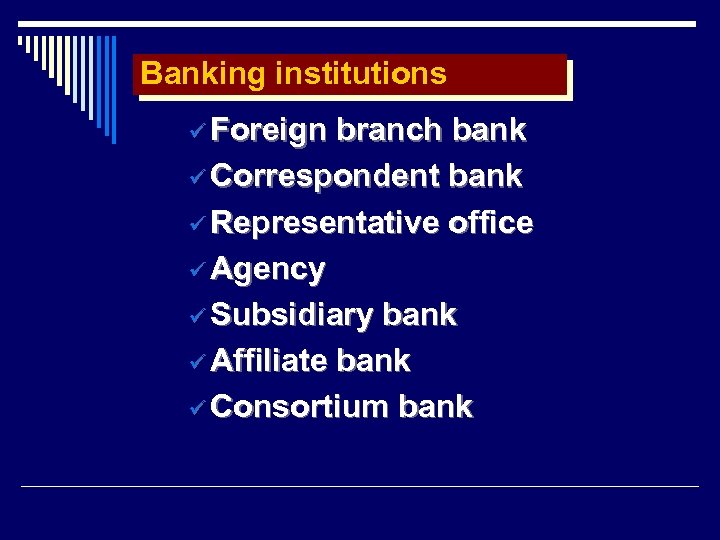

Banking institutions ü Foreign branch bank ü Correspondent bank ü Representative office ü Agency ü Subsidiary bank ü Affiliate bank ü Consortium bank

Banking institutions ü Foreign branch bank ü Correspondent bank ü Representative office ü Agency ü Subsidiary bank ü Affiliate bank ü Consortium bank

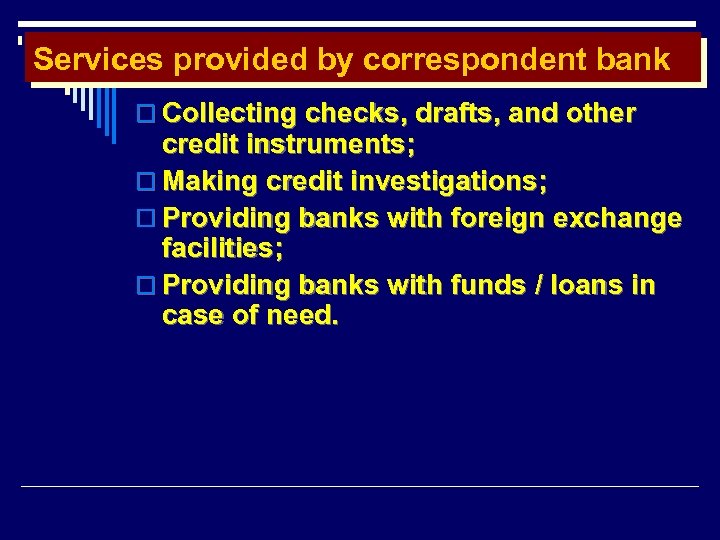

Services provided by correspondent bank o Collecting checks, drafts, and other credit instruments; o Making credit investigations; o Providing banks with foreign exchange facilities; o Providing banks with funds / loans in case of need.

Services provided by correspondent bank o Collecting checks, drafts, and other credit instruments; o Making credit investigations; o Providing banks with foreign exchange facilities; o Providing banks with funds / loans in case of need.

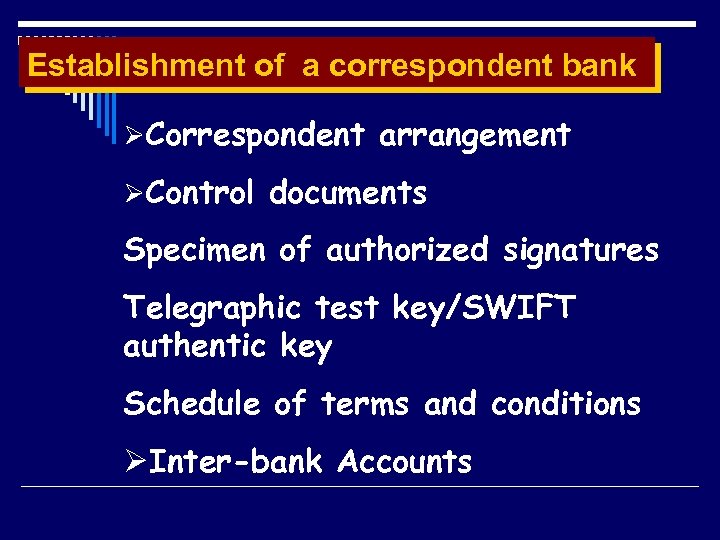

Establishment of a correspondent bank ØCorrespondent arrangement ØControl documents Specimen of authorized signatures Telegraphic test key/SWIFT authentic key Schedule of terms and conditions ØInter-bank Accounts

Establishment of a correspondent bank ØCorrespondent arrangement ØControl documents Specimen of authorized signatures Telegraphic test key/SWIFT authentic key Schedule of terms and conditions ØInter-bank Accounts

2. Some organizations relevant to international settlement o IMF o The World Bank Group o The International Chamber of Commerce o The ICC Commission on Banking Technique and Practice

2. Some organizations relevant to international settlement o IMF o The World Bank Group o The International Chamber of Commerce o The ICC Commission on Banking Technique and Practice

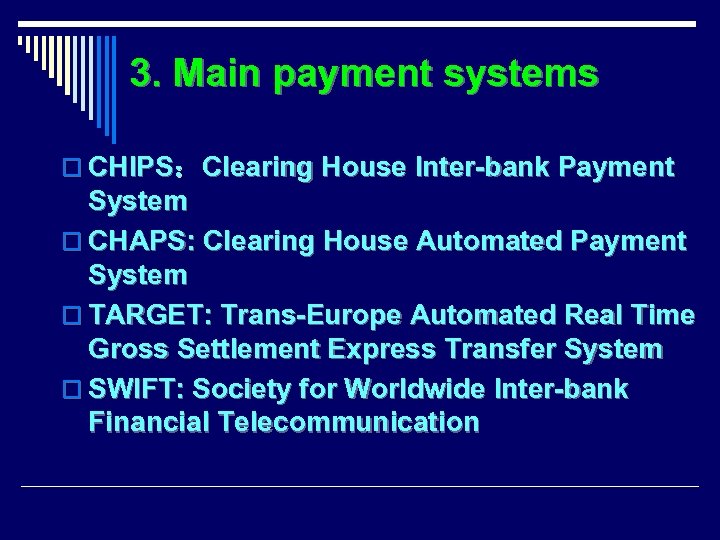

3. Main payment systems o CHIPS:Clearing House Inter-bank Payment System o CHAPS: Clearing House Automated Payment System o TARGET: Trans-Europe Automated Real Time Gross Settlement Express Transfer System o SWIFT: Society for Worldwide Inter-bank Financial Telecommunication

3. Main payment systems o CHIPS:Clearing House Inter-bank Payment System o CHAPS: Clearing House Automated Payment System o TARGET: Trans-Europe Automated Real Time Gross Settlement Express Transfer System o SWIFT: Society for Worldwide Inter-bank Financial Telecommunication

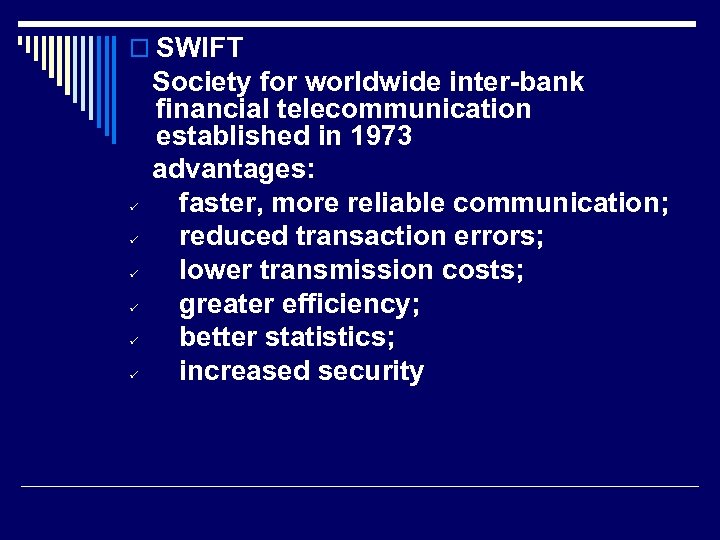

o SWIFT ü ü ü Society for worldwide inter-bank financial telecommunication established in 1973 advantages: faster, more reliable communication; reduced transaction errors; lower transmission costs; greater efficiency; better statistics; increased security

o SWIFT ü ü ü Society for worldwide inter-bank financial telecommunication established in 1973 advantages: faster, more reliable communication; reduced transaction errors; lower transmission costs; greater efficiency; better statistics; increased security

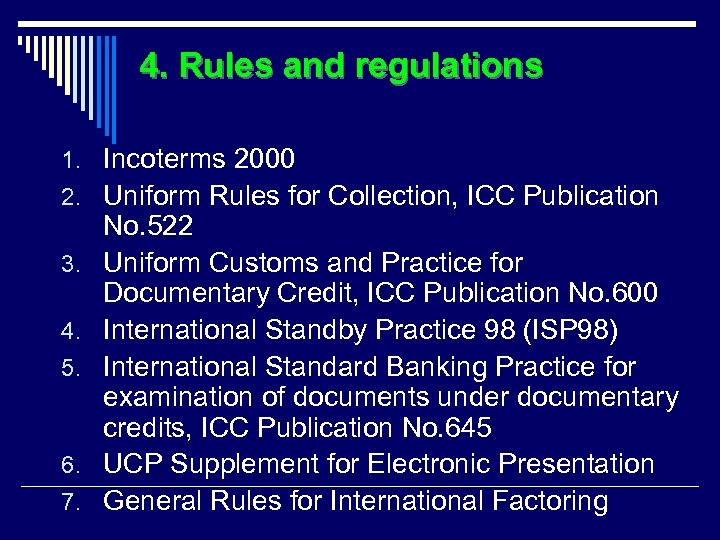

4. Rules and regulations 1. Incoterms 2000 2. Uniform Rules for Collection, ICC Publication 3. 4. 5. 6. 7. No. 522 Uniform Customs and Practice for Documentary Credit, ICC Publication No. 600 International Standby Practice 98 (ISP 98) International Standard Banking Practice for examination of documents under documentary credits, ICC Publication No. 645 UCP Supplement for Electronic Presentation General Rules for International Factoring

4. Rules and regulations 1. Incoterms 2000 2. Uniform Rules for Collection, ICC Publication 3. 4. 5. 6. 7. No. 522 Uniform Customs and Practice for Documentary Credit, ICC Publication No. 600 International Standby Practice 98 (ISP 98) International Standard Banking Practice for examination of documents under documentary credits, ICC Publication No. 645 UCP Supplement for Electronic Presentation General Rules for International Factoring

Review of International Trade 1. What is international trade? 2. The major participants in international trade 3. Major processes of international trade 4. Trade terms, Incoterms 2000

Review of International Trade 1. What is international trade? 2. The major participants in international trade 3. Major processes of international trade 4. Trade terms, Incoterms 2000

DIFFERENCES? • EXW EX WORKS (. . . named place) USD 1 O. OO per set Ex seller's works Tianjin • FCA FREE CARRIER (. . . named place) USD 15. 00 per piece FCA Hengchiao Airport • FAS FREE ALONGSIDE SHIP (. . . named port of shipment) USD 120. 00 per metric ton FAS Chingdao • FOB FREE ON BOARD (. . . named port of shipment) USD 28. 00 per set FOB Guangzhou

DIFFERENCES? • EXW EX WORKS (. . . named place) USD 1 O. OO per set Ex seller's works Tianjin • FCA FREE CARRIER (. . . named place) USD 15. 00 per piece FCA Hengchiao Airport • FAS FREE ALONGSIDE SHIP (. . . named port of shipment) USD 120. 00 per metric ton FAS Chingdao • FOB FREE ON BOARD (. . . named port of shipment) USD 28. 00 per set FOB Guangzhou

• CFR COST AND FREIGHT (. . . named port of destination) USD 12. 00 per kilo CFR New York • CIF COST, INSURANCE AND FREIGHT (… named port of destination) USD 30. 00 per case CIF Kobe • CPT CARRIAGE PAID TO (. . . named place of destination) USD 68. 00 per carton CPT Chicago • CIP CARRIAGE AND INSURANCE PAID TO (. . . named place of destination) USD 68. 00 per carton CIP Chicago

• CFR COST AND FREIGHT (. . . named port of destination) USD 12. 00 per kilo CFR New York • CIF COST, INSURANCE AND FREIGHT (… named port of destination) USD 30. 00 per case CIF Kobe • CPT CARRIAGE PAID TO (. . . named place of destination) USD 68. 00 per carton CPT Chicago • CIP CARRIAGE AND INSURANCE PAID TO (. . . named place of destination) USD 68. 00 per carton CIP Chicago

• DAF DELIVERED AT FRONTIER (. . . named place) • DES DELIVERED EX SHIP (. . . named port of destination) • DEQ DELIVERED EX QUAY (. . . named place of destination) • DDU DELIVERED DUTY UNPAID (. . . named place of destination) • DDP DELIVERED DUTY PAID (. . . named place of destination)

• DAF DELIVERED AT FRONTIER (. . . named place) • DES DELIVERED EX SHIP (. . . named port of destination) • DEQ DELIVERED EX QUAY (. . . named place of destination) • DDU DELIVERED DUTY UNPAID (. . . named place of destination) • DDP DELIVERED DUTY PAID (. . . named place of destination)

What "Incoterms" do not deal with • transfer of property / legal title • breach of contract / deficiency in the merchandise • terms of payment • place of jurisdiction

What "Incoterms" do not deal with • transfer of property / legal title • breach of contract / deficiency in the merchandise • terms of payment • place of jurisdiction

summary • • Concept of international settlements Types of international settlements Evolution of international settlements Trade terms

summary • • Concept of international settlements Types of international settlements Evolution of international settlements Trade terms