International Money and Finance (advanced level) Part

- Размер: 278 Кб

- Количество слайдов: 58

Описание презентации International Money and Finance (advanced level) Part по слайдам

International Money and Finance (advanced level) Part 1 Lecturer: Nikita Lisitsyn, Ph.

International Money and Finance (advanced level) Part 1 Lecturer: Nikita Lisitsyn, Ph.

International Money and Finance Reasons to study global finance. Why IM&F studies are important: – They give an overview of the fastest growing sector of global economy; – They present key solutions vs. major global challenges; – They give general understanding of the global trends (both in economy and politics) driven by changes in finance (e. g. , Great Recession)

International Money and Finance Reasons to study global finance. Why IM&F studies are important: – They give an overview of the fastest growing sector of global economy; – They present key solutions vs. major global challenges; – They give general understanding of the global trends (both in economy and politics) driven by changes in finance (e. g. , Great Recession)

International Money and Finance IM&F Development The Gold Standard Stage 1 • Paris Conference of 1867 • Main GS principals: • Major type of international money – gold coins • Floating exchange rates near “golden points” • Compulsory exchange of paper and other types of money into gold • Mutual assistance of member-countries WW I (1914 -18)

International Money and Finance IM&F Development The Gold Standard Stage 1 • Paris Conference of 1867 • Main GS principals: • Major type of international money – gold coins • Floating exchange rates near “golden points” • Compulsory exchange of paper and other types of money into gold • Mutual assistance of member-countries WW I (1914 -18)

International Money and Finance IM&F Development The Gold Standard Stage 2 • Genova Conference of 1922 • Main GES principals: • Major type of international money – gold and member-countries currencies in addition • Formality and reality • Floating exchange rates near “golden points” • Compulsory exchange of paper and other types of money into gold Great Depression of 1929 -33 WW II (1939 -45)

International Money and Finance IM&F Development The Gold Standard Stage 2 • Genova Conference of 1922 • Main GES principals: • Major type of international money – gold and member-countries currencies in addition • Formality and reality • Floating exchange rates near “golden points” • Compulsory exchange of paper and other types of money into gold Great Depression of 1929 -33 WW II (1939 -45)

International Money and Finance IM&F Development The Bretton Woods system (BWS) • Bretton Woods Conference of 1944 • International Monetary Fund (1944) • Main BWS principals: • International money – gold and reserve currencies (US$ and GBP) • Special role of US$ • Reserve currencies rights and obligations

International Money and Finance IM&F Development The Bretton Woods system (BWS) • Bretton Woods Conference of 1944 • International Monetary Fund (1944) • Main BWS principals: • International money – gold and reserve currencies (US$ and GBP) • Special role of US$ • Reserve currencies rights and obligations

International Money and Finance IM&F Development The Bretton Woods system (BWS) • Compulsory golden parities • Official price of gold (US$ 35. 00 = 1 Troy ounce of gold) • Fixed exchange rates near golden parities • +/- 1. 00% (+/- 0. 75%)

International Money and Finance IM&F Development The Bretton Woods system (BWS) • Compulsory golden parities • Official price of gold (US$ 35. 00 = 1 Troy ounce of gold) • Fixed exchange rates near golden parities • +/- 1. 00% (+/- 0. 75%)

International Money and Finance IM&F Development The Bretton Woods system (BWS) • Crisis and crush of BWS • USA vs. other World • Trade Deficit • “ Black market” reaction • “ French attack” on USD • from USD 35. 00 to 38. 00 (1971) and from USD 38. 00 to 43. 00 (1973) • End of reserve currency status • “ Temporary cancellation” of USD exchange into gold (1971) • “ Final cancellation” of USD exchange into gold (1973)

International Money and Finance IM&F Development The Bretton Woods system (BWS) • Crisis and crush of BWS • USA vs. other World • Trade Deficit • “ Black market” reaction • “ French attack” on USD • from USD 35. 00 to 38. 00 (1971) and from USD 38. 00 to 43. 00 (1973) • End of reserve currency status • “ Temporary cancellation” of USD exchange into gold (1971) • “ Final cancellation” of USD exchange into gold (1973)

International Money and Finance IM&F Development The Modern (Jamaica) System (JS) Kingston (Jamaica) IMF Conference in 1976 IMF “Articles of Agreement” revision JS Principles

International Money and Finance IM&F Development The Modern (Jamaica) System (JS) Kingston (Jamaica) IMF Conference in 1976 IMF “Articles of Agreement” revision JS Principles

International Money and Finance IM&F Development JS Principles: • International money – national currencies (free convertible currencies) • Gold Demonetarization • Golden parities cancellation • Official price of gold cancellation Reserve currencies status cancellation • Equality of the national currencies • Exchange rates regime liberalization

International Money and Finance IM&F Development JS Principles: • International money – national currencies (free convertible currencies) • Gold Demonetarization • Golden parities cancellation • Official price of gold cancellation Reserve currencies status cancellation • Equality of the national currencies • Exchange rates regime liberalization

International Money and Finance IM&F Development • End of Golden Standard System in 1970 -ies • Jamaica System of floating rates and IMF • Stagflation as a general pattern of global IM&F in the 1970 -ies • Neoclassical theories and practices • First efforts to build EMU failed

International Money and Finance IM&F Development • End of Golden Standard System in 1970 -ies • Jamaica System of floating rates and IMF • Stagflation as a general pattern of global IM&F in the 1970 -ies • Neoclassical theories and practices • First efforts to build EMU failed

International Money and Finance IM&F Development • Start of neoclassical reforms in developed economies: implications for IM&F Sector • The 1980 -ies: Reaganomics and Paul Walker, way to stronger currencies • Capital inflow, new modes (developing economies invest in developed countries) • Creation of G 7 in Finance

International Money and Finance IM&F Development • Start of neoclassical reforms in developed economies: implications for IM&F Sector • The 1980 -ies: Reaganomics and Paul Walker, way to stronger currencies • Capital inflow, new modes (developing economies invest in developed countries) • Creation of G 7 in Finance

International Money and Finance IM&F Development • Creation of global TNCs and globalization of their financial flows • Banks and insurance companies merging • Fall of Berlin Wall and its consequences for the global finance • Liberalization of financial markets in USA and worldwide in 1990 -ies

International Money and Finance IM&F Development • Creation of global TNCs and globalization of their financial flows • Banks and insurance companies merging • Fall of Berlin Wall and its consequences for the global finance • Liberalization of financial markets in USA and worldwide in 1990 -ies

International Money and Finance IM&F Development • “ Booming Age” of 1990 -2007, boom in financial sector • Federal Reserve: Alan Greenspan and his ideology • Japan: the first victim of the “Booming Age”, end of the “ Japanese Miracle ” • Post-socialist and developing countries: too weak to compete

International Money and Finance IM&F Development • “ Booming Age” of 1990 -2007, boom in financial sector • Federal Reserve: Alan Greenspan and his ideology • Japan: the first victim of the “Booming Age”, end of the “ Japanese Miracle ” • Post-socialist and developing countries: too weak to compete

International Money and Finance IM&F Development Building EMU • Maastricht Treaty and its criteria • Difficulties in 1995, at pre-EMU’s initial stage: a first case of PIGS’ case • Economic growth: an external pre-condition • ECB and its creation, see www. ecb. int • Two-phase launch of Euro-project: 1999 and 2002. The EMU-12 • Expansion of EMU in 2002 -2008: way to EMU-16 • The in-built weaknesses of EMU

International Money and Finance IM&F Development Building EMU • Maastricht Treaty and its criteria • Difficulties in 1995, at pre-EMU’s initial stage: a first case of PIGS’ case • Economic growth: an external pre-condition • ECB and its creation, see www. ecb. int • Two-phase launch of Euro-project: 1999 and 2002. The EMU-12 • Expansion of EMU in 2002 -2008: way to EMU-16 • The in-built weaknesses of EMU

International Money and Finance IM&F Development IM&F system at present (pre-crisis) • Dominant position of reserve currencies (USD, EUR, JPY, GBP + CHF) • Second raw of convertible currencies: AUD, CAD, NZD, SGD, HKD, NOK, SEK, DKK • Possible rivals: BRIC currencies (RMB, Rupee, Ruble, Braz Real)

International Money and Finance IM&F Development IM&F system at present (pre-crisis) • Dominant position of reserve currencies (USD, EUR, JPY, GBP + CHF) • Second raw of convertible currencies: AUD, CAD, NZD, SGD, HKD, NOK, SEK, DKK • Possible rivals: BRIC currencies (RMB, Rupee, Ruble, Braz Real)

International Money and Finance IM&F Development Present IM&F : Regulators • Main central banks: FRS, ECB, Bof. E, Bof. J, CB of Sw • The IMF and its role in global finance in a pre-crisis era • The G 7 -G 8 -G

International Money and Finance IM&F Development Present IM&F : Regulators • Main central banks: FRS, ECB, Bof. E, Bof. J, CB of Sw • The IMF and its role in global finance in a pre-crisis era • The G 7 -G 8 -G

International Money and Finance IM&F at Present: 1. Stimulating policy of FRS under Alan Greenspan (low rates, week USD) 2. More freedom to large financial holdings (cases of Morgan Stanley, JP Morgan, Goldman Sachs, Citigroup). Glass-Steagull’s Act of 1933 3. Liberalization of markets + globalization of world economy 4. Speculative practices: money from money, carry trade, boom of commodity prices – economy of bubbles

International Money and Finance IM&F at Present: 1. Stimulating policy of FRS under Alan Greenspan (low rates, week USD) 2. More freedom to large financial holdings (cases of Morgan Stanley, JP Morgan, Goldman Sachs, Citigroup). Glass-Steagull’s Act of 1933 3. Liberalization of markets + globalization of world economy 4. Speculative practices: money from money, carry trade, boom of commodity prices – economy of bubbles

International Money and Finance IM&F at Present: Stages of the Global Crisis • Mortgage crisis in USA • Collapse of Lehman Brothers • Fall of global markets • Fighting deflation scenario • FOMC meeting on March 18, 2009 • G 20 summit on April 20, 2009 • ECB stimulus package

International Money and Finance IM&F at Present: Stages of the Global Crisis • Mortgage crisis in USA • Collapse of Lehman Brothers • Fall of global markets • Fighting deflation scenario • FOMC meeting on March 18, 2009 • G 20 summit on April 20, 2009 • ECB stimulus package

International Money and Finance International Monetary Fund (IMF) • Established 22. 07. 1944 at Bretton Woods conference, effective 27. 12. 1945 • Aim – to promote world monetary stability and economic development; a UN specialized agency • Members – (187) majority of the UN members including Russia • Headquarter – Washington, DC, US

International Money and Finance International Monetary Fund (IMF) • Established 22. 07. 1944 at Bretton Woods conference, effective 27. 12. 1945 • Aim – to promote world monetary stability and economic development; a UN specialized agency • Members – (187) majority of the UN members including Russia • Headquarter – Washington, DC, US

International Money and Finance IMF • The IMF was established to promote international monetary cooperation, exchange stability, and orderly exchange arrangements; to foster economic growth and high levels of employment; and to provide temporary financial assistance to countries to help ease balance of payments adjustment. • Since the IMF was established its purposes have remained unchanged but its operations — which involve surveillance, financial assistance, and technical assistance — have developed to meet the changing needs of its member countries in an evolving world economy.

International Money and Finance IMF • The IMF was established to promote international monetary cooperation, exchange stability, and orderly exchange arrangements; to foster economic growth and high levels of employment; and to provide temporary financial assistance to countries to help ease balance of payments adjustment. • Since the IMF was established its purposes have remained unchanged but its operations — which involve surveillance, financial assistance, and technical assistance — have developed to meet the changing needs of its member countries in an evolving world economy.

International Money and Finance IMF Structure: Governing Bodies: • Board of Governors • Executive Board (Directorate) • Managing Director

International Money and Finance IMF Structure: Governing Bodies: • Board of Governors • Executive Board (Directorate) • Managing Director

International Money and Finance IMF • Board of Governors This is the highest Governing Body of the IMF. It consists of all Member States and it meets once every year in regular sessions, but may also meet in an extraordinary session if necessary. The governor is appointed by the member country and is usually the minister of finance or the governor of the central bank. All powers of the IMF are vested in the Board of Governors. The Board of Governors is responsible for voting the membership issues, approving the work program, voting the budget and determining the financial arrangements (profit distribution) of the IMF. The Board of Governors also elects the Executive Board (Directorate) • Voting procedure: Member States have number of votes according to quotas: every Member State has 250 basic votes + 1 additional vote per every SDR 100, 000. 00 paid according to IMF quota

International Money and Finance IMF • Board of Governors This is the highest Governing Body of the IMF. It consists of all Member States and it meets once every year in regular sessions, but may also meet in an extraordinary session if necessary. The governor is appointed by the member country and is usually the minister of finance or the governor of the central bank. All powers of the IMF are vested in the Board of Governors. The Board of Governors is responsible for voting the membership issues, approving the work program, voting the budget and determining the financial arrangements (profit distribution) of the IMF. The Board of Governors also elects the Executive Board (Directorate) • Voting procedure: Member States have number of votes according to quotas: every Member State has 250 basic votes + 1 additional vote per every SDR 100, 000. 00 paid according to IMF quota

International Money and Finance IMF • Executive Board (Directorate) Major function – to determine the IMF loans conditions Executive Board members • The IMF Articles of Agreement (Constitution) provides that in electing the Members of the Executive Board shall observe the following criteria: • (a) five shall be States with the largest quotas: United States, Japan , Germany, United Kingdom, France; • (b ) one shall be another State with the 6 th largest quota (Saudi Arabia) + other two States with the large quota and high political importance (China, Russian Federation); • (c) sixteen shall be States not elected under (a) or (b) and whose election to the Executive Board will ensure the representation of all major geographic areas of the world. This Members of the Council elected for 2 years, selected on rotating basis from all regions;

International Money and Finance IMF • Executive Board (Directorate) Major function – to determine the IMF loans conditions Executive Board members • The IMF Articles of Agreement (Constitution) provides that in electing the Members of the Executive Board shall observe the following criteria: • (a) five shall be States with the largest quotas: United States, Japan , Germany, United Kingdom, France; • (b ) one shall be another State with the 6 th largest quota (Saudi Arabia) + other two States with the large quota and high political importance (China, Russian Federation); • (c) sixteen shall be States not elected under (a) or (b) and whose election to the Executive Board will ensure the representation of all major geographic areas of the world. This Members of the Council elected for 2 years, selected on rotating basis from all regions;

International Money and Finance IMF • Managing Director • Traditionally Western European • Christine Lagarde ( France) • since 2011 after Dominique Strauss-Kahn

International Money and Finance IMF • Managing Director • Traditionally Western European • Christine Lagarde ( France) • since 2011 after Dominique Strauss-Kahn

International Money and Finance IMF • The IMF gets its money principally from quota subscriptions (something like membership dues) paid by its 18 7 member countries, but also by occasionally borrowing from rich countries. It lends this money to member countries that are having trouble keeping up current payments to other countries. The IMF is committed to poverty reduction and lends, under special conditions, to poor countries and to countries that are deep ly indebt ed.

International Money and Finance IMF • The IMF gets its money principally from quota subscriptions (something like membership dues) paid by its 18 7 member countries, but also by occasionally borrowing from rich countries. It lends this money to member countries that are having trouble keeping up current payments to other countries. The IMF is committed to poverty reduction and lends, under special conditions, to poor countries and to countries that are deep ly indebt ed.

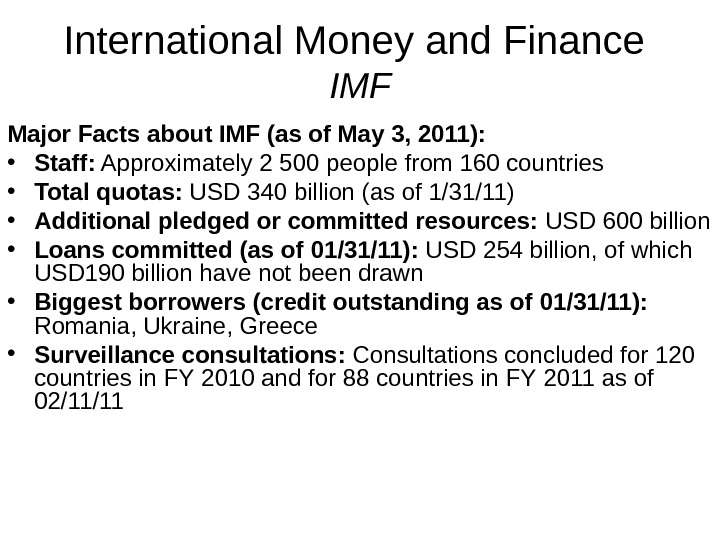

International Money and Finance IMF Major Facts about IMF (as of Ma y 3 , 20 11 ) : • Staff: Approximately 2 500 people from 160 countries • Total quotas: US D 340 billion (as of 1/31/11) • Additional pledged or committed resources: US D 600 billion • Loans committed (as o f 0 1/31/11): US D 254 billion, of which US D 190 billion have not been drawn • Biggest borrowers (credit outstanding as of 0 1/31/11): Romania, Ukraine, Greece • Surveillance consultations: Consultations concluded for 120 countries in FY 2010 and for 88 countries in FY 2011 as of 02/11/

International Money and Finance IMF Major Facts about IMF (as of Ma y 3 , 20 11 ) : • Staff: Approximately 2 500 people from 160 countries • Total quotas: US D 340 billion (as of 1/31/11) • Additional pledged or committed resources: US D 600 billion • Loans committed (as o f 0 1/31/11): US D 254 billion, of which US D 190 billion have not been drawn • Biggest borrowers (credit outstanding as of 0 1/31/11): Romania, Ukraine, Greece • Surveillance consultations: Consultations concluded for 120 countries in FY 2010 and for 88 countries in FY 2011 as of 02/11/

International Money and Finance IM

International Money and Finance IM

International Money and Finance IM

International Money and Finance IM

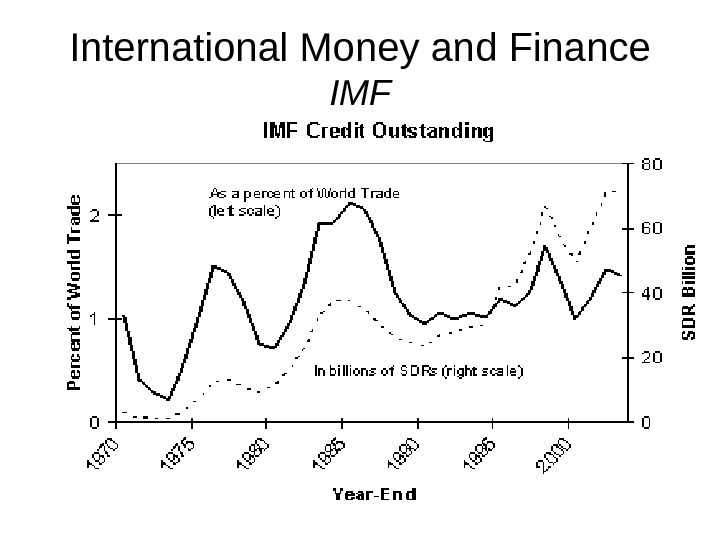

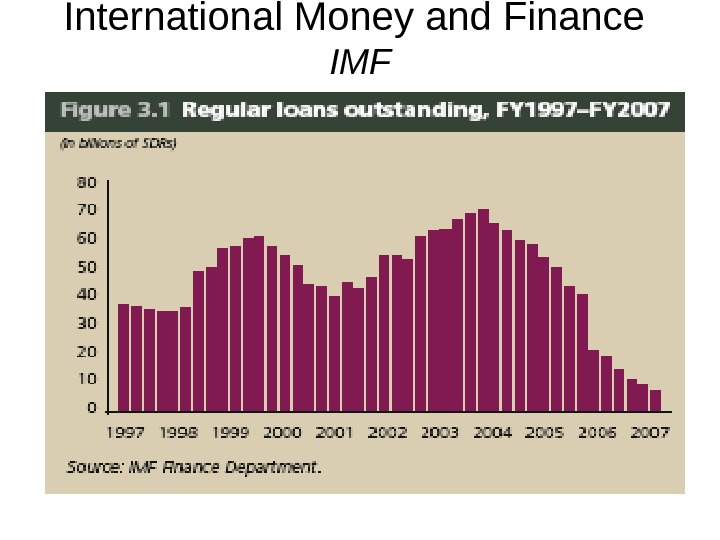

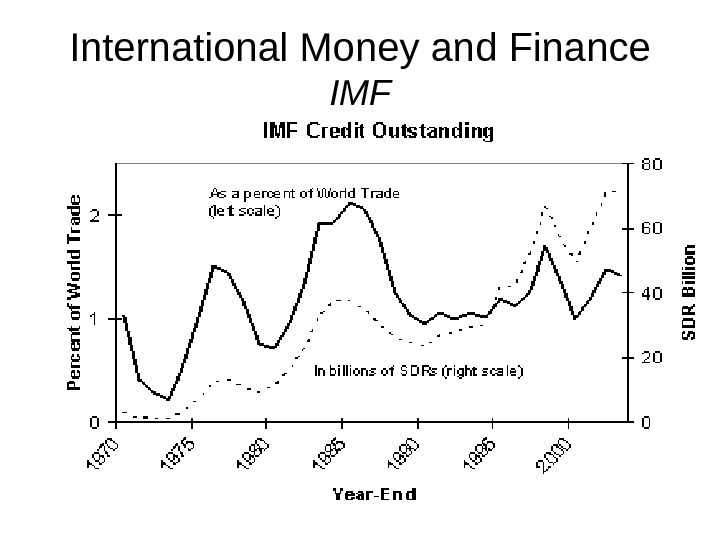

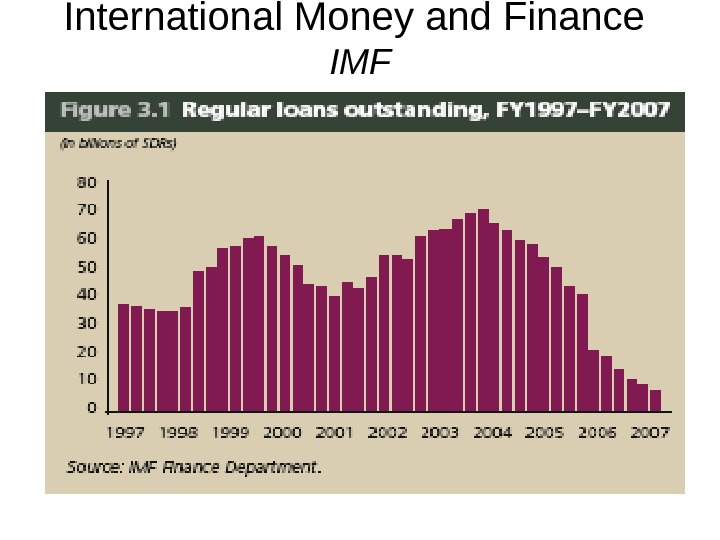

International Money and Finance IMF The changing nature of IMF lending: The volume of loans provided by the IMF has fluctuated significantly over time. The oil shock of the 1970 s and the debt crisis of the 1980 s were both followed by sharp increases in IMF lending. In the 1990 s, the transition process in Central and Eastern Europe and the crises in emerging market economies led to further surges in the demand for IMF resources.

International Money and Finance IMF The changing nature of IMF lending: The volume of loans provided by the IMF has fluctuated significantly over time. The oil shock of the 1970 s and the debt crisis of the 1980 s were both followed by sharp increases in IMF lending. In the 1990 s, the transition process in Central and Eastern Europe and the crises in emerging market economies led to further surges in the demand for IMF resources.

International Money and Finance IMF • IMF Lending A core responsibility of the IMF is to provide loans to countries experiencing balance-of-payments problems. This financial assistance enables countries to rebuild their international reserves, stabilize their currencies, continue paying for imports, and restore conditions for strong economic growth. Unlike development banks, the IMF does not lend for specific projects. • When can a country borrow from the IMF? A member country may request IMF financial assistance if it has a balance of payments need–that is, if it cannot find sufficient financing on affordable terms to meet its net international payments. An IMF loan eases the adjustment policies and reforms that a country must make to correct its balance of payments problem and restore conditions for strong economic growth.

International Money and Finance IMF • IMF Lending A core responsibility of the IMF is to provide loans to countries experiencing balance-of-payments problems. This financial assistance enables countries to rebuild their international reserves, stabilize their currencies, continue paying for imports, and restore conditions for strong economic growth. Unlike development banks, the IMF does not lend for specific projects. • When can a country borrow from the IMF? A member country may request IMF financial assistance if it has a balance of payments need–that is, if it cannot find sufficient financing on affordable terms to meet its net international payments. An IMF loan eases the adjustment policies and reforms that a country must make to correct its balance of payments problem and restore conditions for strong economic growth.

International Money and Finance IMF The process of IMF lending: • An IMF loan is usually provided under an «arrangement, » which stipulates the specific policies and measures a country has agreed to implement in order to resolve its balance of payments problem. The economic program underlying an arrangement is formulated by the country in consultation with the IMF, and is presented to the Fund’s Executive Board in a «Letter of Intent. » Once an arrangement is approved by the Board, the loan is released in phased installments as the program is carried out. Questions and discussion

International Money and Finance IMF The process of IMF lending: • An IMF loan is usually provided under an «arrangement, » which stipulates the specific policies and measures a country has agreed to implement in order to resolve its balance of payments problem. The economic program underlying an arrangement is formulated by the country in consultation with the IMF, and is presented to the Fund’s Executive Board in a «Letter of Intent. » Once an arrangement is approved by the Board, the loan is released in phased installments as the program is carried out. Questions and discussion

International Money and Finance Exchange rate regimes Fixed exchange rate regime based on state regulation. Float exchange rate regime based on supply/demand balance Each exchange rate regime has its advantages and disadvantages

International Money and Finance Exchange rate regimes Fixed exchange rate regime based on state regulation. Float exchange rate regime based on supply/demand balance Each exchange rate regime has its advantages and disadvantages

International Money and Finance Exchange rate regimes Fixed exchange rate regime: • Predictability of the rate (+) • Long-term decision making possible (+) • Inflation under control (+) • Stabilizing role, especially for emerging markets (+) • Removes “the invisible hand” of the market (-) • Can be very costly for regulators, namely for state or Central Bank (-) • Creates imbalances in economy (-)

International Money and Finance Exchange rate regimes Fixed exchange rate regime: • Predictability of the rate (+) • Long-term decision making possible (+) • Inflation under control (+) • Stabilizing role, especially for emerging markets (+) • Removes “the invisible hand” of the market (-) • Can be very costly for regulators, namely for state or Central Bank (-) • Creates imbalances in economy (-)

International Money and Finance Exchange rate regimes Float exchange rate regime: • More market-driven and effective (+) • Removes the imbalances in economy (+) • Does not require any significant resources spending by regulators, namely by state or Central Bank (+) • Is used by the leading Central Banks, namely the Federal Reserve, ECB, Bof. J, Bof. E (+) • Can provoke higher inflation (-) • Creates uncertainty and obstacles for long-term planning (-) • Destabilizing role, especially for weak currencies

International Money and Finance Exchange rate regimes Float exchange rate regime: • More market-driven and effective (+) • Removes the imbalances in economy (+) • Does not require any significant resources spending by regulators, namely by state or Central Bank (+) • Is used by the leading Central Banks, namely the Federal Reserve, ECB, Bof. J, Bof. E (+) • Can provoke higher inflation (-) • Creates uncertainty and obstacles for long-term planning (-) • Destabilizing role, especially for weak currencies

International Money and Finance Exchange rate regimes Factors that determine exchange rate: • Purchasing Power Parity (PPP) • Inflation • Interest rates • Economic growth rates • Trade balance • Other major macroeconomic indicators • Government’s regulation policies

International Money and Finance Exchange rate regimes Factors that determine exchange rate: • Purchasing Power Parity (PPP) • Inflation • Interest rates • Economic growth rates • Trade balance • Other major macroeconomic indicators • Government’s regulation policies

International Money and Finance Exchange rate regimes Purchasing Power Parity (PPP): • How much of goods and services one can buy for the unit of national currency • Price comparison between two countries

International Money and Finance Exchange rate regimes Purchasing Power Parity (PPP): • How much of goods and services one can buy for the unit of national currency • Price comparison between two countries

International Money and Finance Exchange rate regimes The same basket of goods and services costs different amounts of local currency units in each of the two countries PPP is the result of division of the country A’s sum by country B’s sum Question: Build your own basket of basic goods and services (min. 5 items) with prices in Russia (in RUR) and any other country (in local currency). Calculate your PPP!

International Money and Finance Exchange rate regimes The same basket of goods and services costs different amounts of local currency units in each of the two countries PPP is the result of division of the country A’s sum by country B’s sum Question: Build your own basket of basic goods and services (min. 5 items) with prices in Russia (in RUR) and any other country (in local currency). Calculate your PPP!

International Money and Finance Exchange rate regimes Trade balance and exchange rate: • Low exchange rate leads to higher export efficiency • High exchange rate leads to higher import efficiency

International Money and Finance Exchange rate regimes Trade balance and exchange rate: • Low exchange rate leads to higher export efficiency • High exchange rate leads to higher import efficiency

International Money and Finance Balance of payments T he balance of payments, (or BOP) measures the payments that flow between any individual country and all other countries. It is used to summari s e all international economic transactions for that country during a specific time period, usually a year. The BOP is determined by the country’s exports and imports of goods, services, and flows of financial capital. It reflects all payments and liabilities to foreigners (debits) and all payments and obligations received from foreigners (credits). Balance of payments is one of the major indicators of a country’s status in international trade.

International Money and Finance Balance of payments T he balance of payments, (or BOP) measures the payments that flow between any individual country and all other countries. It is used to summari s e all international economic transactions for that country during a specific time period, usually a year. The BOP is determined by the country’s exports and imports of goods, services, and flows of financial capital. It reflects all payments and liabilities to foreigners (debits) and all payments and obligations received from foreigners (credits). Balance of payments is one of the major indicators of a country’s status in international trade.

International Money and Finance Balance of payments The balance, like other accounting statements, is prepared in a single currency, usually the domestic one. Foreign assets and flows are valued at the exchange rate of the time of transaction

International Money and Finance Balance of payments The balance, like other accounting statements, is prepared in a single currency, usually the domestic one. Foreign assets and flows are valued at the exchange rate of the time of transaction

International Money and Finance Balance of payments • The IMF definition: «Balance of Payments is a statistical statement that summari s es transactions between residents and non — residents within a period. “ • The balance of payments comprises the current account and the capital account (or the financial account). «Together, these accounts balance in the sense that the sum of the entries is conceptually zero. «

International Money and Finance Balance of payments • The IMF definition: «Balance of Payments is a statistical statement that summari s es transactions between residents and non — residents within a period. “ • The balance of payments comprises the current account and the capital account (or the financial account). «Together, these accounts balance in the sense that the sum of the entries is conceptually zero. «

International Money and Finance Balance of payments • Balance of payments identity is a key formula • The balance of payments identity states that: Current Account = Capital Account + Financial Account + Net Errors and Omissions

International Money and Finance Balance of payments • Balance of payments identity is a key formula • The balance of payments identity states that: Current Account = Capital Account + Financial Account + Net Errors and Omissions

International Money and Finance Balance of payments • The basic principle behind the identity is that a country can only consume more than it can produce (a current account deficit) if it is supplied capital from abroad (a capital account surplus) • Mercantilism is in favour of a so-called balance of payments surplus , where the net current account has surplus or, more specifically, balance of trade is positive

International Money and Finance Balance of payments • The basic principle behind the identity is that a country can only consume more than it can produce (a current account deficit) if it is supplied capital from abroad (a capital account surplus) • Mercantilism is in favour of a so-called balance of payments surplus , where the net current account has surplus or, more specifically, balance of trade is positive

International Money and Finance Balance of payments A balance of payments equilibrium is defined as a condition where the sum of debits and credits from the current account and the capital and financial accounts equal to zero Questions and discussion

International Money and Finance Balance of payments A balance of payments equilibrium is defined as a condition where the sum of debits and credits from the current account and the capital and financial accounts equal to zero Questions and discussion

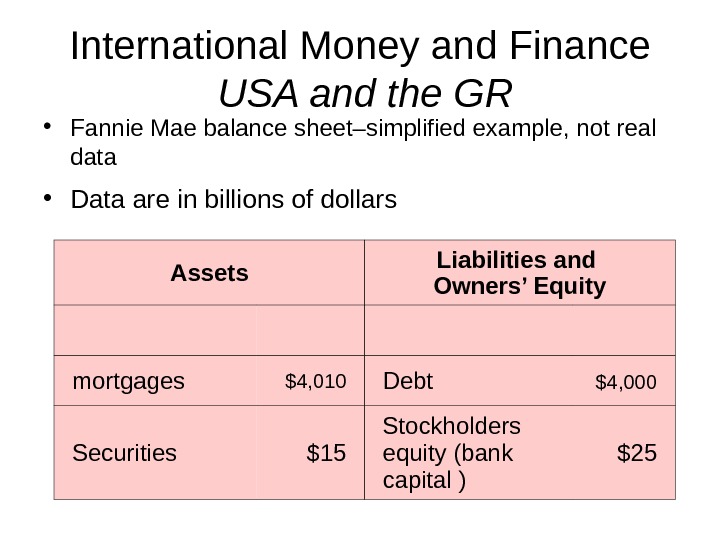

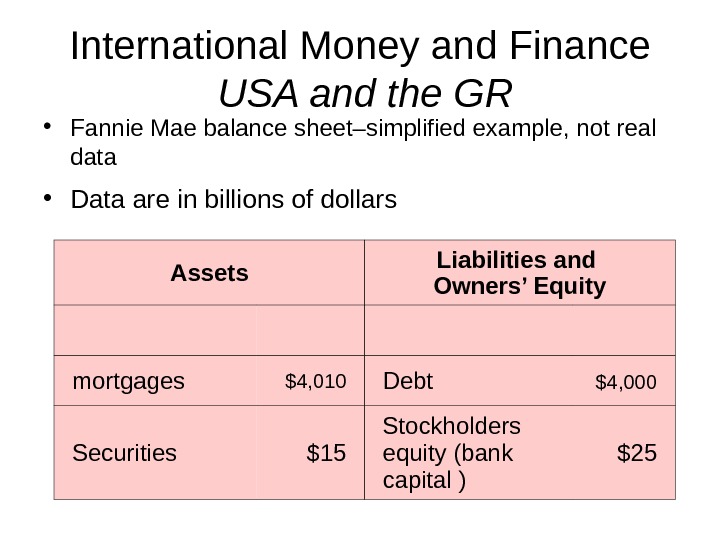

International Money and Finance USA and the GR • Fannie Mae balance sheet–simplified example, not real data • Data are in billions of dollars Assets Liabilities and Owners’ Equity mortgages $4, 010 Debt $4, 000 Securities $15 Stockholders equity (bank capital ) $

International Money and Finance USA and the GR • Fannie Mae balance sheet–simplified example, not real data • Data are in billions of dollars Assets Liabilities and Owners’ Equity mortgages $4, 010 Debt $4, 000 Securities $15 Stockholders equity (bank capital ) $

International Money and Finance USA and the GR • The GSEs bought about 50% of the toxic mortgages (Pinto, 2008). • Why did the private sector buy the other 50%? • Reason was regulation: widening Home Ownership Mission again • To increase home ownership, regulations enforcing the Community Reinvestment Act were changed and phased in from 1995 -1997. • Required banks to use “flexible and innovative standards” to address credit needs of low and moderate income (LMI) borrowers. The “sub-prime” mortgages. • Banks to be judged on outcomes not efforts. • Failure to comply would result in denial to merge.

International Money and Finance USA and the GR • The GSEs bought about 50% of the toxic mortgages (Pinto, 2008). • Why did the private sector buy the other 50%? • Reason was regulation: widening Home Ownership Mission again • To increase home ownership, regulations enforcing the Community Reinvestment Act were changed and phased in from 1995 -1997. • Required banks to use “flexible and innovative standards” to address credit needs of low and moderate income (LMI) borrowers. The “sub-prime” mortgages. • Banks to be judged on outcomes not efforts. • Failure to comply would result in denial to merge.

International Money and Finance USA and the GR • From the current handwringing, you’d think that the banks came up with the idea of looser underwriting standards on their own, with regulators just asleep on the job. In fact, it was the regulators who relaxed these standards—at the behest of community groups and “progressive political forces. ” • Professor Stan Leibowitz, University of Texas,

International Money and Finance USA and the GR • From the current handwringing, you’d think that the banks came up with the idea of looser underwriting standards on their own, with regulators just asleep on the job. In fact, it was the regulators who relaxed these standards—at the behest of community groups and “progressive political forces. ” • Professor Stan Leibowitz, University of Texas,

International Money and Finance USA and the GR Clear need for new regulation and there were missed opportunities for regulation: • US financial market deregulation was not the cause of the crisis. • The private market problems originate in securitization and sub-prime lending. Securitization had been around since the 1970 s • Sub-prime lending was inappropriately facilitated by regulation changes in the mid-1990 s, but not as an act of financial market deregulation.

International Money and Finance USA and the GR Clear need for new regulation and there were missed opportunities for regulation: • US financial market deregulation was not the cause of the crisis. • The private market problems originate in securitization and sub-prime lending. Securitization had been around since the 1970 s • Sub-prime lending was inappropriately facilitated by regulation changes in the mid-1990 s, but not as an act of financial market deregulation.

International Money and Finance USA and the GR • General upturn in US economy took place in mid-2011 • Savings increase, expenditures stagnate • USTs as “safe-havens” enjoy cheap financing: below 2% for 10 -year US state bonds • High unemployment and stagnating demand still hamper sustainable recovery

International Money and Finance USA and the GR • General upturn in US economy took place in mid-2011 • Savings increase, expenditures stagnate • USTs as “safe-havens” enjoy cheap financing: below 2% for 10 -year US state bonds • High unemployment and stagnating demand still hamper sustainable recovery

International Money and Finance EU and the Debt Crisis • Maastricht Treaty and its Criteria • Obligation of all EMU member states to follow the Maastricht Criteria • Criterion 1: Budget deficit below 3% of GDP • Criterion 2: Government debt not exceeding 60% of GDP

International Money and Finance EU and the Debt Crisis • Maastricht Treaty and its Criteria • Obligation of all EMU member states to follow the Maastricht Criteria • Criterion 1: Budget deficit below 3% of GDP • Criterion 2: Government debt not exceeding 60% of GDP

International Money and Finance EU and the Debt Crisis • Criterion 3: Inflation not bigger than +1. 5% over the average of three EMU economies with the lowest inflation rate, namely “ The Leaders ” (inflation rate nearly 2%, so the upper limit is 3. 5%) • Criterion 4: L ong-term interest rate must not be more than 2 % higher than in T he Leaders • Criterion 5: Being in exchange rate mechanism: all EMU states are there since the euro has been introduced ( pre-euro criterion )

International Money and Finance EU and the Debt Crisis • Criterion 3: Inflation not bigger than +1. 5% over the average of three EMU economies with the lowest inflation rate, namely “ The Leaders ” (inflation rate nearly 2%, so the upper limit is 3. 5%) • Criterion 4: L ong-term interest rate must not be more than 2 % higher than in T he Leaders • Criterion 5: Being in exchange rate mechanism: all EMU states are there since the euro has been introduced ( pre-euro criterion )

International Money and Finance EU and the Debt Crisis • By 2011: Germany and Luxembourg alone follow all the criteria (earlier Finland included) • Diverse behavior of EMU states during the crisis: relatively strong and stable economies and “the losers” • The top-strongest: Germany, Luxembourg, Netherlands, Austria

International Money and Finance EU and the Debt Crisis • By 2011: Germany and Luxembourg alone follow all the criteria (earlier Finland included) • Diverse behavior of EMU states during the crisis: relatively strong and stable economies and “the losers” • The top-strongest: Germany, Luxembourg, Netherlands, Austria

International Money and Finance EU and the Debt Crisis • Relatively stable: Finland, France, Belgium, Malta, Estonia, Slovenia, Slovakia • Structural difficulties: Cyprus • The PIIGS: Portugal, Ireland, Italy, Greece, Spain • Partly relevant: collapse of Iceland’s financial sector in 2008 • Threat for the EMU’s unity

International Money and Finance EU and the Debt Crisis • Relatively stable: Finland, France, Belgium, Malta, Estonia, Slovenia, Slovakia • Structural difficulties: Cyprus • The PIIGS: Portugal, Ireland, Italy, Greece, Spain • Partly relevant: collapse of Iceland’s financial sector in 2008 • Threat for the EMU’s unity

International Money and Finance EU and the Debt Crisis Measures taken by the ECB and European authorities in general: • Creation of EFSF ( European Financial Stability Facility ); • Leverage support provided by the ECB; • Issuing unified euro-bonds and its possible disadvantages • Increasing unity and financial discipline in EU and EMU: pro and contra • Position of Great Britain (also of Czech Republic and Hungary)

International Money and Finance EU and the Debt Crisis Measures taken by the ECB and European authorities in general: • Creation of EFSF ( European Financial Stability Facility ); • Leverage support provided by the ECB; • Issuing unified euro-bonds and its possible disadvantages • Increasing unity and financial discipline in EU and EMU: pro and contra • Position of Great Britain (also of Czech Republic and Hungary)

International Money and Finance Russia and IM&F Role in IM&F institutions: • Member of IMF since 1992; • Constantly present in IMF’s Directorate; • Involved in World Bank; • From debtor to creditor: The Paris Club

International Money and Finance Russia and IM&F Role in IM&F institutions: • Member of IMF since 1992; • Constantly present in IMF’s Directorate; • Involved in World Bank; • From debtor to creditor: The Paris Club

International Money and Finance Russia and IM&F Russia is an active player in cross-border investment : • Attracting foreign investments into national economy, including FDIs. Return of capital from abroad • Huge flow of outward investment from Russia to foreign markets. Also illegal outflow of capital to, e. g. , offshore residences

International Money and Finance Russia and IM&F Russia is an active player in cross-border investment : • Attracting foreign investments into national economy, including FDIs. Return of capital from abroad • Huge flow of outward investment from Russia to foreign markets. Also illegal outflow of capital to, e. g. , offshore residences

International Money and Finance Russia and IM&F Central Bank (Bank of Russia) regulates monetary cross-border flows and national currency’s (ruble’s) exchange rate. This type of policy includes : • Regulation of cross-border money flows; • Regulation of ruble’s international status and currency’s regime (e. g. , fixed or float) • Creating and maintaining state international reserves (e. g. , managing the reserves by choosing the appropriate currency basket) • Implementing anti-crisis monetary measures (e. g. , interventions on currency market to stabilize ruble) • Maintaining relations with IMF and World Bank

International Money and Finance Russia and IM&F Central Bank (Bank of Russia) regulates monetary cross-border flows and national currency’s (ruble’s) exchange rate. This type of policy includes : • Regulation of cross-border money flows; • Regulation of ruble’s international status and currency’s regime (e. g. , fixed or float) • Creating and maintaining state international reserves (e. g. , managing the reserves by choosing the appropriate currency basket) • Implementing anti-crisis monetary measures (e. g. , interventions on currency market to stabilize ruble) • Maintaining relations with IMF and World Bank

International Money and Finance Seminar: Presentations made by the students Main topics for the presentations: • Contemporary IM&F • Role of a chosen single economy in IM&F • Financial sectors of chosen economies • The Global Financial Crisis ( and related topics possible for presentations )

International Money and Finance Seminar: Presentations made by the students Main topics for the presentations: • Contemporary IM&F • Role of a chosen single economy in IM&F • Financial sectors of chosen economies • The Global Financial Crisis ( and related topics possible for presentations )