1aefac174843c362b85e0ab8a7cd0432.ppt

- Количество слайдов: 17

INTERNATIONAL MARKETING 6 e Chapter 5 The Financial Environment Copyright © 2001 by Harcourt, Inc. . All rights reserved. Requests for permissions to make copies of any part of the Copyright © 2001 to Harcourt, Inc. All rights reserved. work should be mailed by the following address: Permissions Department, Harcourt, Inc. , 6277 Sea Harbor Drive, Orlando, Florida 32887 -6777.

INTERNATIONAL MARKETING 6 e Chapter 5 The Financial Environment Copyright © 2001 by Harcourt, Inc. . All rights reserved. Requests for permissions to make copies of any part of the Copyright © 2001 to Harcourt, Inc. All rights reserved. work should be mailed by the following address: Permissions Department, Harcourt, Inc. , 6277 Sea Harbor Drive, Orlando, Florida 32887 -6777.

Credit Policy u The extent of credit offered is determined by • Firm-specific factors – firm size, international trade experience, and capacity for financing transactions • Market characteristics – economic development and means of payment • Factors particular to the transaction – payment amount, terms, type of goods, trading partner u Credit • • • policy allows exporters to: Determine the risk they are willing to absorb. Explore new ways of financing exports. Prepare for a changing environment. Copyright © 2001 by Harcourt, Inc. All rights reserved. 2

Credit Policy u The extent of credit offered is determined by • Firm-specific factors – firm size, international trade experience, and capacity for financing transactions • Market characteristics – economic development and means of payment • Factors particular to the transaction – payment amount, terms, type of goods, trading partner u Credit • • • policy allows exporters to: Determine the risk they are willing to absorb. Explore new ways of financing exports. Prepare for a changing environment. Copyright © 2001 by Harcourt, Inc. All rights reserved. 2

Types of Financial Risk Commercial Risk Other Risks (e. g. , inflation) The Financial Environment Political Risk Foreign Exchange Risk Copyright © 2001 by Harcourt, Inc. All rights reserved. 3

Types of Financial Risk Commercial Risk Other Risks (e. g. , inflation) The Financial Environment Political Risk Foreign Exchange Risk Copyright © 2001 by Harcourt, Inc. All rights reserved. 3

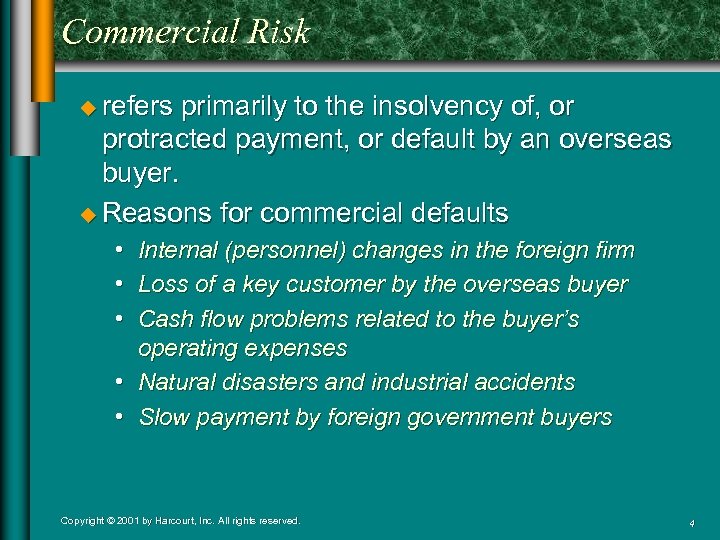

Commercial Risk u refers primarily to the insolvency of, or protracted payment, or default by an overseas buyer. u Reasons for commercial defaults • Internal (personnel) changes in the foreign firm • Loss of a key customer by the overseas buyer • Cash flow problems related to the buyer’s operating expenses • Natural disasters and industrial accidents • Slow payment by foreign government buyers Copyright © 2001 by Harcourt, Inc. All rights reserved. 4

Commercial Risk u refers primarily to the insolvency of, or protracted payment, or default by an overseas buyer. u Reasons for commercial defaults • Internal (personnel) changes in the foreign firm • Loss of a key customer by the overseas buyer • Cash flow problems related to the buyer’s operating expenses • Natural disasters and industrial accidents • Slow payment by foreign government buyers Copyright © 2001 by Harcourt, Inc. All rights reserved. 4

Political Risk u is the risk of an exchange transfer delay caused by the actions of a third party and beyond the control of the buyer or the seller. Copyright © 2001 by Harcourt, Inc. All rights reserved. 5

Political Risk u is the risk of an exchange transfer delay caused by the actions of a third party and beyond the control of the buyer or the seller. Copyright © 2001 by Harcourt, Inc. All rights reserved. 5

Foreign Exchange Risk u refers to the effects of fluctuating exchange rates on sellers and buyers who must protect themselves from unfavorable changes in the value of the currency used in transactions. Copyright © 2001 by Harcourt, Inc. All rights reserved. 6

Foreign Exchange Risk u refers to the effects of fluctuating exchange rates on sellers and buyers who must protect themselves from unfavorable changes in the value of the currency used in transactions. Copyright © 2001 by Harcourt, Inc. All rights reserved. 6

Sources of Financing u Commercial banks • have strong collateral requirements for lending • may lack the experience and connections to conduct international transactions u Forfaiting by banks • exporter receives immediate cash by selling importer’s guaranteed bank note for a discounted amount to a bank which assumes the risk of collecting the note. u Factoring houses • The purchase of an exporter’s receivables for a discounted price. Factoring terms may include recourse if the buyer defaults on payment. Copyright © 2001 by Harcourt, Inc. All rights reserved. 7

Sources of Financing u Commercial banks • have strong collateral requirements for lending • may lack the experience and connections to conduct international transactions u Forfaiting by banks • exporter receives immediate cash by selling importer’s guaranteed bank note for a discounted amount to a bank which assumes the risk of collecting the note. u Factoring houses • The purchase of an exporter’s receivables for a discounted price. Factoring terms may include recourse if the buyer defaults on payment. Copyright © 2001 by Harcourt, Inc. All rights reserved. 7

Official Trade Finance u The Export-Import Bank (Ex-Im Bank) • “to aid in financing and facilitating exports” u Pre-export Support • the Working Capital Guarantee Program (WCG) – guarantees the lender against default by exporter u Export Credit Insurance • meets the exporter’s need to offer credit terms to foreign customers – Multi-buyer policies cover short- or medium-term sales or a combination of both – Single-buyer policies exporters select the sales they desire to insure Copyright © 2001 by Harcourt, Inc. All rights reserved. 8

Official Trade Finance u The Export-Import Bank (Ex-Im Bank) • “to aid in financing and facilitating exports” u Pre-export Support • the Working Capital Guarantee Program (WCG) – guarantees the lender against default by exporter u Export Credit Insurance • meets the exporter’s need to offer credit terms to foreign customers – Multi-buyer policies cover short- or medium-term sales or a combination of both – Single-buyer policies exporters select the sales they desire to insure Copyright © 2001 by Harcourt, Inc. All rights reserved. 8

Loan Guarantees by the Ex-Im Bank u Medium-term • • • transactions up to $10 million repayment term not to exceed 7 years foreign buyer makes a 15% cash down payment u Long-term • • • Guarantees for transactions in excess of $10 million repayment period of 8 or more years commercial and political risk coverage is 100% Copyright © 2001 by Harcourt, Inc. All rights reserved. 9

Loan Guarantees by the Ex-Im Bank u Medium-term • • • transactions up to $10 million repayment term not to exceed 7 years foreign buyer makes a 15% cash down payment u Long-term • • • Guarantees for transactions in excess of $10 million repayment period of 8 or more years commercial and political risk coverage is 100% Copyright © 2001 by Harcourt, Inc. All rights reserved. 9

Financial Risk Management u Problems in assessing a foreign buyer’s creditworthiness • • • Credit reports may not be reliable. Audited reports may not be available. Financial reports may be in a different format. Asset valuation may be distorted. Statements are in local currency. Buyer may not be able to covert local currency to dollars due to exchange controls. Copyright © 2001 by Harcourt, Inc. All rights reserved. 12

Financial Risk Management u Problems in assessing a foreign buyer’s creditworthiness • • • Credit reports may not be reliable. Audited reports may not be available. Financial reports may be in a different format. Asset valuation may be distorted. Statements are in local currency. Buyer may not be able to covert local currency to dollars due to exchange controls. Copyright © 2001 by Harcourt, Inc. All rights reserved. 12

Other Financial Controls: u Countertrade • is the practice of accepting or including the purchase of locally produced goods by a foreign seller as part of financing arrangements with a local buyer. u Debt/equity swap • A firm purchases part of the national debt of a country and uses the converted debt as equity to invest in a local firm in that country. u Debt/product swap • Countries repay creditors at a ratio tied to the amount of local goods purchased by the creditors. Copyright © 2001 by Harcourt, Inc. All rights reserved. 13

Other Financial Controls: u Countertrade • is the practice of accepting or including the purchase of locally produced goods by a foreign seller as part of financing arrangements with a local buyer. u Debt/equity swap • A firm purchases part of the national debt of a country and uses the converted debt as equity to invest in a local firm in that country. u Debt/product swap • Countries repay creditors at a ratio tied to the amount of local goods purchased by the creditors. Copyright © 2001 by Harcourt, Inc. All rights reserved. 13

Foreign Exchange Risk u Exchange Rate Fluctuation • In a transaction in which payment to the seller is to be made in a currency foreign to the seller, there is a risk that the currency used for payment will decline in value (relative to the seller’s currency) before payment is received by the seller. = Copyright © 2001 by Harcourt, Inc. All rights reserved. 14

Foreign Exchange Risk u Exchange Rate Fluctuation • In a transaction in which payment to the seller is to be made in a currency foreign to the seller, there is a risk that the currency used for payment will decline in value (relative to the seller’s currency) before payment is received by the seller. = Copyright © 2001 by Harcourt, Inc. All rights reserved. 14

The Foreign Exchange Market u Exchange rate • The price of one currency in terms of another. u Spot market • The exchange of currencies priced for immediate delivery (the same day). u Forward market • The exchange of currencies with future delivery dates (30, 60, 90 days) u Hedge • a currency purchase contract that provides protection against currency fluctuations by guaranteeing the forward exchange rate. Copyright © 2001 by Harcourt, Inc. All rights reserved. 16

The Foreign Exchange Market u Exchange rate • The price of one currency in terms of another. u Spot market • The exchange of currencies priced for immediate delivery (the same day). u Forward market • The exchange of currencies with future delivery dates (30, 60, 90 days) u Hedge • a currency purchase contract that provides protection against currency fluctuations by guaranteeing the forward exchange rate. Copyright © 2001 by Harcourt, Inc. All rights reserved. 16

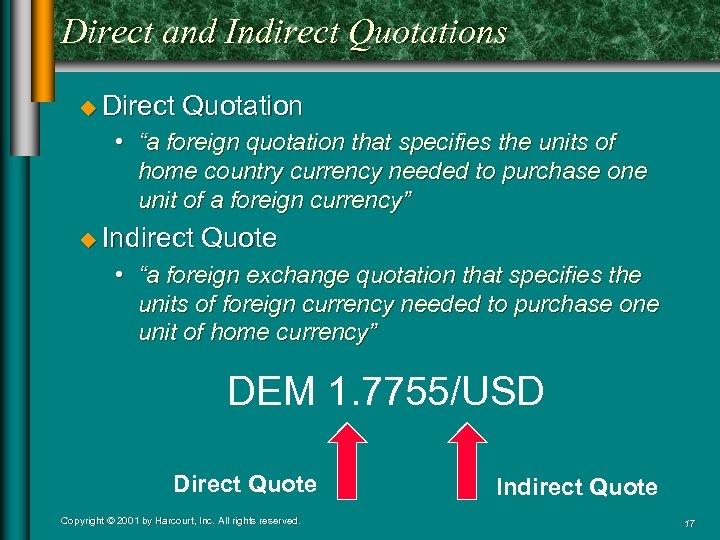

Direct and Indirect Quotations u Direct Quotation • “a foreign quotation that specifies the units of home country currency needed to purchase one unit of a foreign currency” u Indirect Quote • “a foreign exchange quotation that specifies the units of foreign currency needed to purchase one unit of home currency” DEM 1. 7755/USD Direct Quote Copyright © 2001 by Harcourt, Inc. All rights reserved. Indirect Quote 17

Direct and Indirect Quotations u Direct Quotation • “a foreign quotation that specifies the units of home country currency needed to purchase one unit of a foreign currency” u Indirect Quote • “a foreign exchange quotation that specifies the units of foreign currency needed to purchase one unit of home currency” DEM 1. 7755/USD Direct Quote Copyright © 2001 by Harcourt, Inc. All rights reserved. Indirect Quote 17

Currency Exchange Examples u Exchange rate • The price of one currency in terms of another. • $1. 6170 U. S. Dollars were equal to one Pound Sterling on 2/09/2000. u Spot market • Buying or selling currency on a given day. • To buy 100 Pounds Sterling on 2/09/2000 would cost $161. 70 US Dollars. u Forward market • The market for future currency purchases • 100 Pounds Sterling to be delivered in 6 months (8/09/2000) would have cost $ 161. 72 US Dollars. Copyright © 2001 by Harcourt, Inc. All rights reserved. 18

Currency Exchange Examples u Exchange rate • The price of one currency in terms of another. • $1. 6170 U. S. Dollars were equal to one Pound Sterling on 2/09/2000. u Spot market • Buying or selling currency on a given day. • To buy 100 Pounds Sterling on 2/09/2000 would cost $161. 70 US Dollars. u Forward market • The market for future currency purchases • 100 Pounds Sterling to be delivered in 6 months (8/09/2000) would have cost $ 161. 72 US Dollars. Copyright © 2001 by Harcourt, Inc. All rights reserved. 18

The Management of Foreign Exchange Risk u Transaction exposure • The risk is that the exchange rate may change between the present date and the settlement date. u Translation exposure • Translation of foreign currencydominated financial statements of subsidiaries into the home currency of the parent firm u Economic = exposure • The change in the value of the firm arising from unexpected changes in exchange rates. Copyright © 2001 by Harcourt, Inc. All rights reserved. 19

The Management of Foreign Exchange Risk u Transaction exposure • The risk is that the exchange rate may change between the present date and the settlement date. u Translation exposure • Translation of foreign currencydominated financial statements of subsidiaries into the home currency of the parent firm u Economic = exposure • The change in the value of the firm arising from unexpected changes in exchange rates. Copyright © 2001 by Harcourt, Inc. All rights reserved. 19

Options and Futures Currency Markets u This market allows firms engaged in international trade to lock in exchange rates and lower their risks. u Options • give the holder the right (not the obligation) to buy or sell foreign currency at either a pre-specified price or on a pre-specified day. u Futures • impose an obligation to buy a pre-specified amount of currency at some point in the future at a pre-specified price Copyright © 2001 by Harcourt, Inc. All rights reserved. 20

Options and Futures Currency Markets u This market allows firms engaged in international trade to lock in exchange rates and lower their risks. u Options • give the holder the right (not the obligation) to buy or sell foreign currency at either a pre-specified price or on a pre-specified day. u Futures • impose an obligation to buy a pre-specified amount of currency at some point in the future at a pre-specified price Copyright © 2001 by Harcourt, Inc. All rights reserved. 20