bf6787db534e8709f1345bb25cf96d65.ppt

- Количество слайдов: 67

International Financial Reporting Standards 1 IFRS for SMEs Joint DUBAI SME-ASCA-IFRS Foundation Workshop 27– 29 September 2011 Dubai, UAE Copyright © 2011 IFRS Foundation. All rights reserved. The Arab Society of Certified Accountants (ASCA)

International Financial Reporting Standards 1 IFRS for SMEs Joint DUBAI SME-ASCA-IFRS Foundation Workshop 27– 29 September 2011 Dubai, UAE Copyright © 2011 IFRS Foundation. All rights reserved. The Arab Society of Certified Accountants (ASCA)

2 This presentation may be modified from time to time. The latest version may be downloaded from: http: //www. ifrs. org/IFRS+for+SMEs/SME+Workshops. htm The accounting requirements applicable to small and medium‑sized entities (SMEs) are set out in the International Financial Reporting Standard (IFRS) for SMEs, which was issued by the IASB in July 2009. The IFRS Foundation, the authors, the presenters and the publishers do not accept responsibility for loss caused to any person who acts or refrains from acting in reliance on the material in this Power. Point presentation, whether such loss is caused by negligence or otherwise. The Arab Society of Certified Accountants (ASCA)

2 This presentation may be modified from time to time. The latest version may be downloaded from: http: //www. ifrs. org/IFRS+for+SMEs/SME+Workshops. htm The accounting requirements applicable to small and medium‑sized entities (SMEs) are set out in the International Financial Reporting Standard (IFRS) for SMEs, which was issued by the IASB in July 2009. The IFRS Foundation, the authors, the presenters and the publishers do not accept responsibility for loss caused to any person who acts or refrains from acting in reliance on the material in this Power. Point presentation, whether such loss is caused by negligence or otherwise. The Arab Society of Certified Accountants (ASCA)

The IFRS for SMEs Topic 2. 2 Quiz and Discussion Section 11 Basic Financial Instruments Section 12 Other Financial Inst. Issues Section 22 Liabilities and Equity Paul Pacter The Arab Society of Certified Accountants (ASCA)

The IFRS for SMEs Topic 2. 2 Quiz and Discussion Section 11 Basic Financial Instruments Section 12 Other Financial Inst. Issues Section 22 Liabilities and Equity Paul Pacter The Arab Society of Certified Accountants (ASCA)

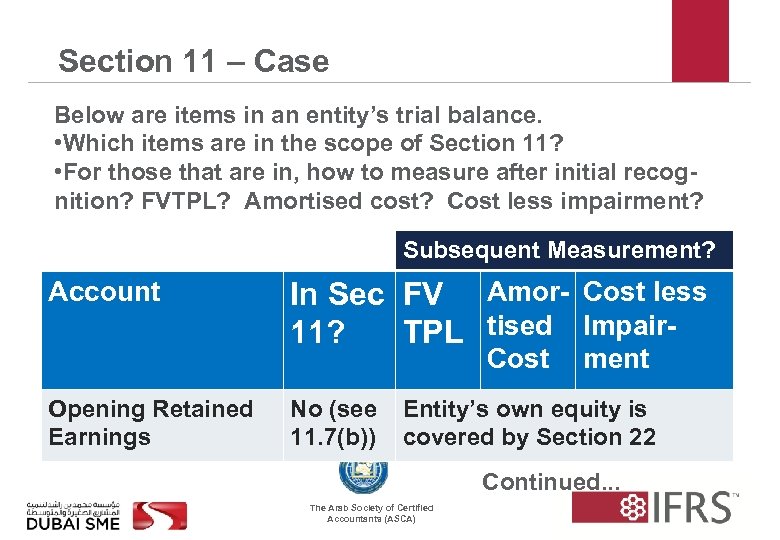

Section 11 – Case Below are items in an entity’s trial balance. • Which items are in the scope of Section 11? • For those that are in, how to measure after initial recognition? FVTPL? Amortised cost? Cost less impairment? Subsequent Measurement? Account In Sec FV Amor- Cost less 11? TPL tised Impair. Cost Opening Retained Earnings No (see 11. 7(b)) ment Entity’s own equity is covered by Section 22 Continued. . . The Arab Society of Certified Accountants (ASCA)

Section 11 – Case Below are items in an entity’s trial balance. • Which items are in the scope of Section 11? • For those that are in, how to measure after initial recognition? FVTPL? Amortised cost? Cost less impairment? Subsequent Measurement? Account In Sec FV Amor- Cost less 11? TPL tised Impair. Cost Opening Retained Earnings No (see 11. 7(b)) ment Entity’s own equity is covered by Section 22 Continued. . . The Arab Society of Certified Accountants (ASCA)

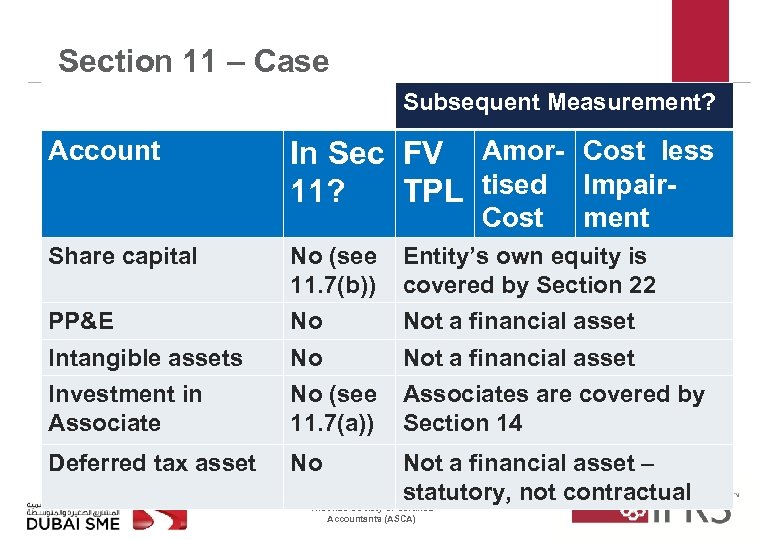

Section 11 – Case Subsequent Measurement? Account In Sec FV Amor- Cost less 11? TPL tised Impair. Cost ment Share capital No (see 11. 7(b)) Entity’s own equity is covered by Section 22 PP&E No Not a financial asset Intangible assets No Not a financial asset Investment in Associate No (see 11. 7(a)) Associates are covered by Section 14 Deferred tax asset No Not a financial asset – statutory, not contractual The Arab Society of Certified Accountants (ASCA)

Section 11 – Case Subsequent Measurement? Account In Sec FV Amor- Cost less 11? TPL tised Impair. Cost ment Share capital No (see 11. 7(b)) Entity’s own equity is covered by Section 22 PP&E No Not a financial asset Intangible assets No Not a financial asset Investment in Associate No (see 11. 7(a)) Associates are covered by Section 14 Deferred tax asset No Not a financial asset – statutory, not contractual The Arab Society of Certified Accountants (ASCA)

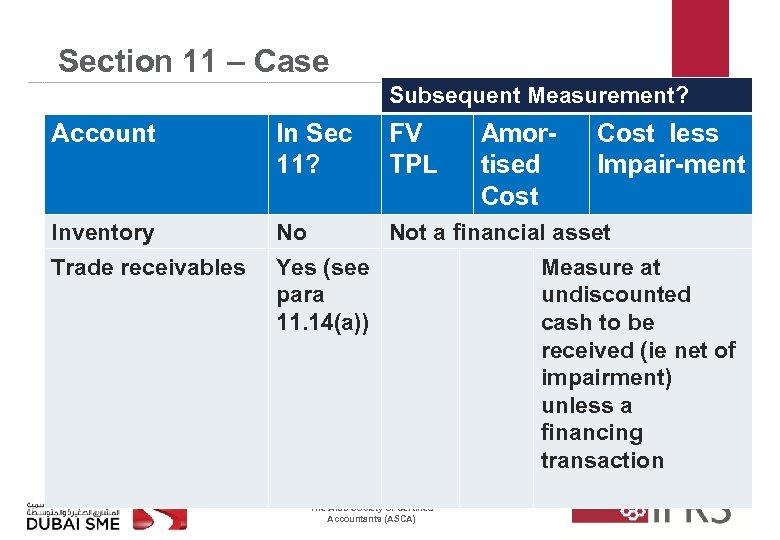

Section 11 – Case Subsequent Measurement? Account In Sec 11? FV TPL Inventory No Not a financial asset Trade receivables Yes (see para 11. 14(a)) The Arab Society of Certified Accountants (ASCA) Amortised Cost less Impair-ment Measure at undiscounted cash to be received (ie net of impairment) unless a financing transaction

Section 11 – Case Subsequent Measurement? Account In Sec 11? FV TPL Inventory No Not a financial asset Trade receivables Yes (see para 11. 14(a)) The Arab Society of Certified Accountants (ASCA) Amortised Cost less Impair-ment Measure at undiscounted cash to be received (ie net of impairment) unless a financing transaction

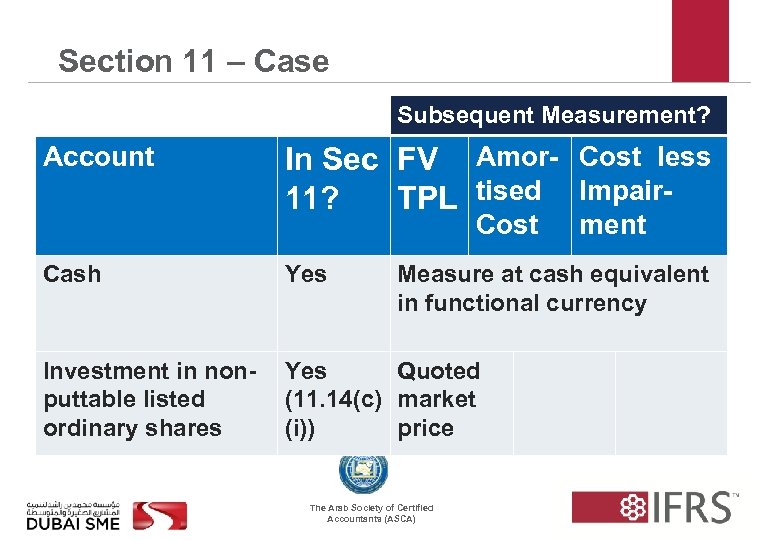

Section 11 – Case Subsequent Measurement? Account In Sec FV Amor- Cost less 11? TPL tised Impair. Cost Cash Yes Investment in nonputtable listed ordinary shares Yes Quoted (11. 14(c) market (i)) price ment Measure at cash equivalent in functional currency The Arab Society of Certified Accountants (ASCA)

Section 11 – Case Subsequent Measurement? Account In Sec FV Amor- Cost less 11? TPL tised Impair. Cost Cash Yes Investment in nonputtable listed ordinary shares Yes Quoted (11. 14(c) market (i)) price ment Measure at cash equivalent in functional currency The Arab Society of Certified Accountants (ASCA)

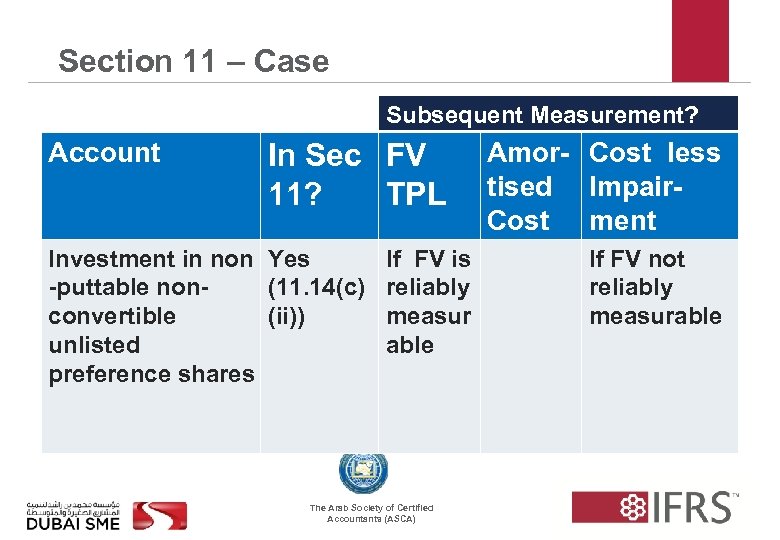

Section 11 – Case Subsequent Measurement? Account In Sec FV 11? TPL Investment in non Yes -puttable non(11. 14(c) convertible (ii)) unlisted preference shares If FV is reliably measur able The Arab Society of Certified Accountants (ASCA) Amor- Cost less tised Impair. Cost ment If FV not reliably measurable

Section 11 – Case Subsequent Measurement? Account In Sec FV 11? TPL Investment in non Yes -puttable non(11. 14(c) convertible (ii)) unlisted preference shares If FV is reliably measur able The Arab Society of Certified Accountants (ASCA) Amor- Cost less tised Impair. Cost ment If FV not reliably measurable

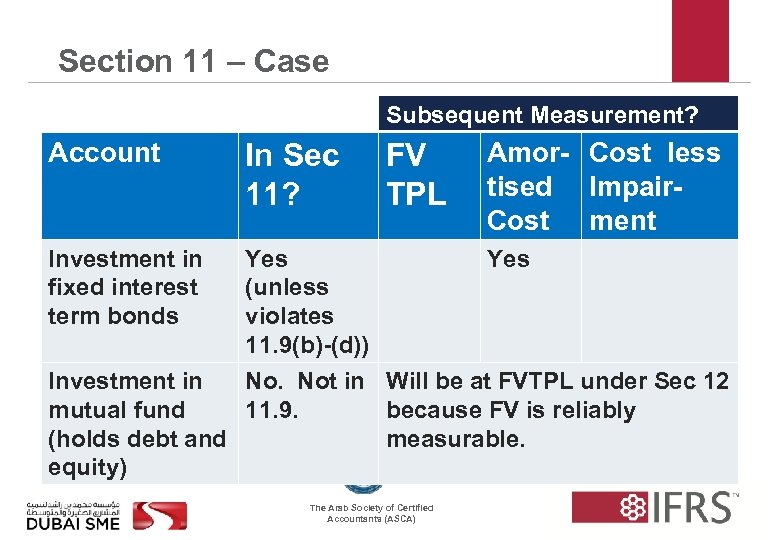

Section 11 – Case Subsequent Measurement? Account In Sec 11? FV TPL Investment in fixed interest term bonds Amor- Cost less tised Impair. Cost ment Yes (unless violates 11. 9(b)-(d)) Investment in No. Not in Will be at FVTPL under Sec 12 mutual fund 11. 9. because FV is reliably (holds debt and measurable. equity) The Arab Society of Certified Accountants (ASCA)

Section 11 – Case Subsequent Measurement? Account In Sec 11? FV TPL Investment in fixed interest term bonds Amor- Cost less tised Impair. Cost ment Yes (unless violates 11. 9(b)-(d)) Investment in No. Not in Will be at FVTPL under Sec 12 mutual fund 11. 9. because FV is reliably (holds debt and measurable. equity) The Arab Society of Certified Accountants (ASCA)

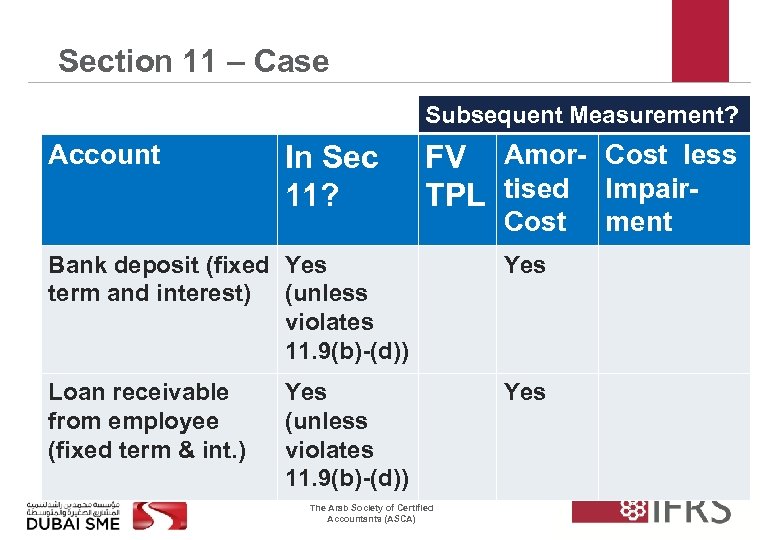

Section 11 – Case Subsequent Measurement? Account In Sec 11? FV Amor- Cost less TPL tised Impair. Cost Bank deposit (fixed Yes term and interest) (unless violates 11. 9(b)-(d)) Yes Loan receivable from employee (fixed term & int. ) Yes (unless violates 11. 9(b)-(d)) The Arab Society of Certified Accountants (ASCA) ment

Section 11 – Case Subsequent Measurement? Account In Sec 11? FV Amor- Cost less TPL tised Impair. Cost Bank deposit (fixed Yes term and interest) (unless violates 11. 9(b)-(d)) Yes Loan receivable from employee (fixed term & int. ) Yes (unless violates 11. 9(b)-(d)) The Arab Society of Certified Accountants (ASCA) ment

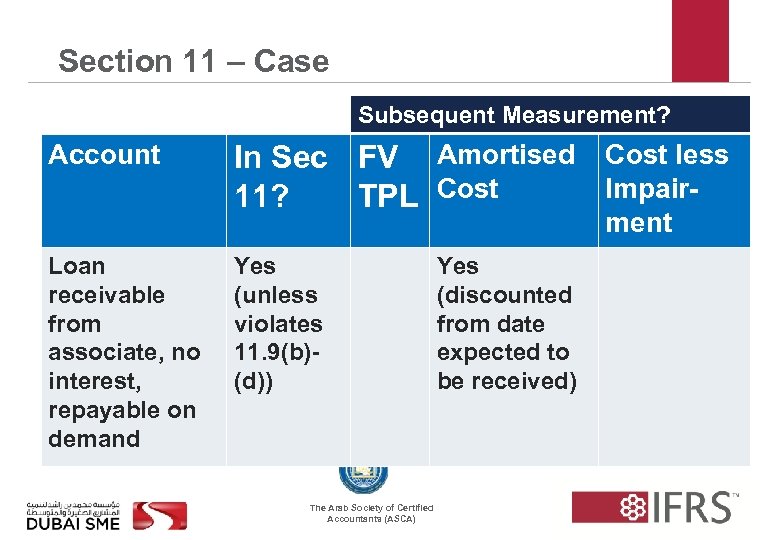

Section 11 – Case Subsequent Measurement? Account In Sec FV Amortised Cost less Impair 11? TPL Cost ment Loan receivable from associate, no interest, repayable on demand Yes (unless violates 11. 9(b)(d)) The Arab Society of Certified Accountants (ASCA) Yes (discounted from date expected to be received)

Section 11 – Case Subsequent Measurement? Account In Sec FV Amortised Cost less Impair 11? TPL Cost ment Loan receivable from associate, no interest, repayable on demand Yes (unless violates 11. 9(b)(d)) The Arab Society of Certified Accountants (ASCA) Yes (discounted from date expected to be received)

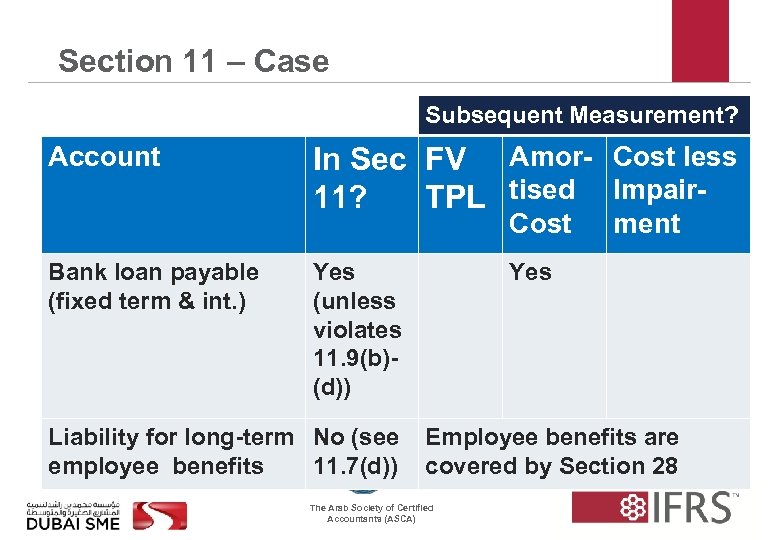

Section 11 – Case Subsequent Measurement? Account In Sec FV Amor- Cost less 11? TPL tised Impair. Cost Bank loan payable (fixed term & int. ) Yes (unless violates 11. 9(b)(d)) Liability for long-term No (see employee benefits 11. 7(d)) ment Yes Employee benefits are covered by Section 28 The Arab Society of Certified Accountants (ASCA)

Section 11 – Case Subsequent Measurement? Account In Sec FV Amor- Cost less 11? TPL tised Impair. Cost Bank loan payable (fixed term & int. ) Yes (unless violates 11. 9(b)(d)) Liability for long-term No (see employee benefits 11. 7(d)) ment Yes Employee benefits are covered by Section 28 The Arab Society of Certified Accountants (ASCA)

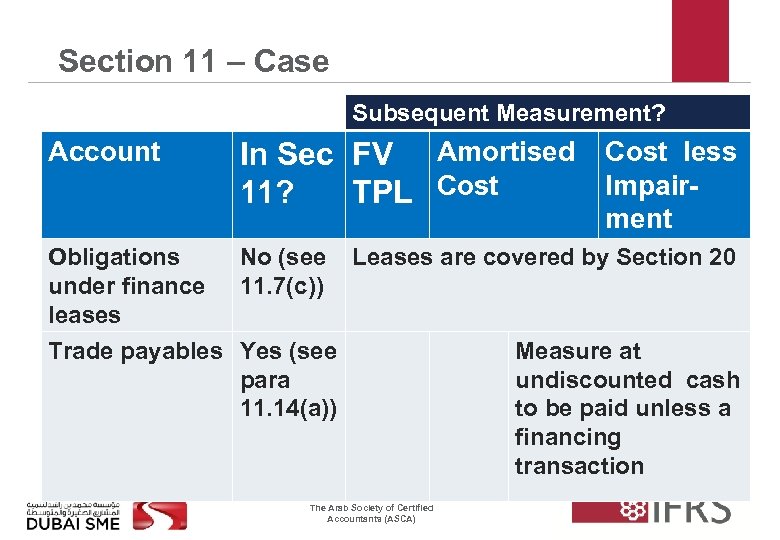

Section 11 – Case Subsequent Measurement? Account In Sec FV Amortised Cost less Impair 11? TPL Cost ment Obligations under finance leases No (see 11. 7(c)) Leases are covered by Section 20 Trade payables Yes (see para 11. 14(a)) The Arab Society of Certified Accountants (ASCA) Measure at undiscounted cash to be paid unless a financing transaction

Section 11 – Case Subsequent Measurement? Account In Sec FV Amortised Cost less Impair 11? TPL Cost ment Obligations under finance leases No (see 11. 7(c)) Leases are covered by Section 20 Trade payables Yes (see para 11. 14(a)) The Arab Society of Certified Accountants (ASCA) Measure at undiscounted cash to be paid unless a financing transaction

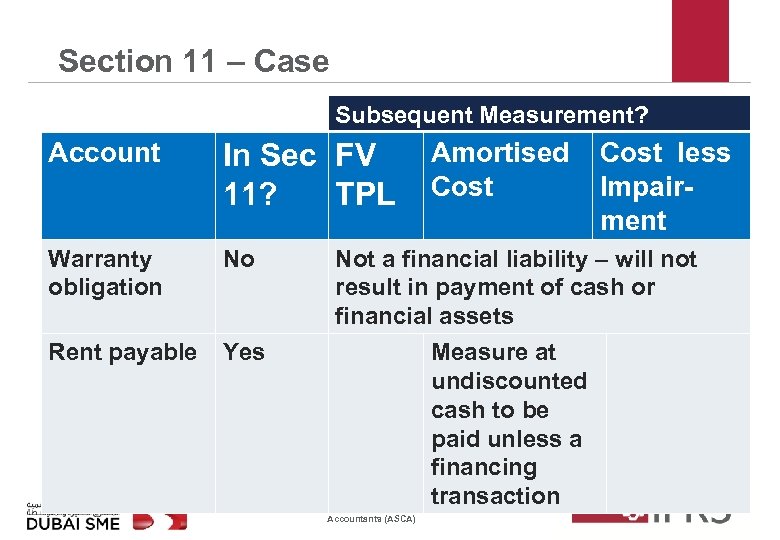

Section 11 – Case Subsequent Measurement? Account In Sec FV 11? TPL Amortised Cost Warranty obligation No Not a financial liability – will not result in payment of cash or financial assets Rent payable Yes Measure at undiscounted cash to be paid unless a financing transaction The Arab Society of Certified Accountants (ASCA) Cost less Impairment

Section 11 – Case Subsequent Measurement? Account In Sec FV 11? TPL Amortised Cost Warranty obligation No Not a financial liability – will not result in payment of cash or financial assets Rent payable Yes Measure at undiscounted cash to be paid unless a financing transaction The Arab Society of Certified Accountants (ASCA) Cost less Impairment

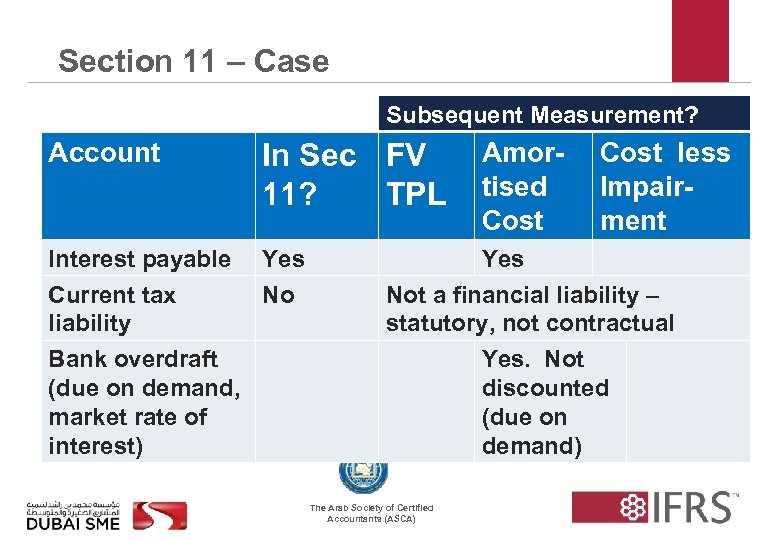

Section 11 – Case Subsequent Measurement? Account In Sec FV 11? TPL Amortised Cost Interest payable Yes Current tax liability No Cost less Impairment Not a financial liability – statutory, not contractual Bank overdraft (due on demand, market rate of interest) Yes. Not discounted (due on demand) The Arab Society of Certified Accountants (ASCA)

Section 11 – Case Subsequent Measurement? Account In Sec FV 11? TPL Amortised Cost Interest payable Yes Current tax liability No Cost less Impairment Not a financial liability – statutory, not contractual Bank overdraft (due on demand, market rate of interest) Yes. Not discounted (due on demand) The Arab Society of Certified Accountants (ASCA)

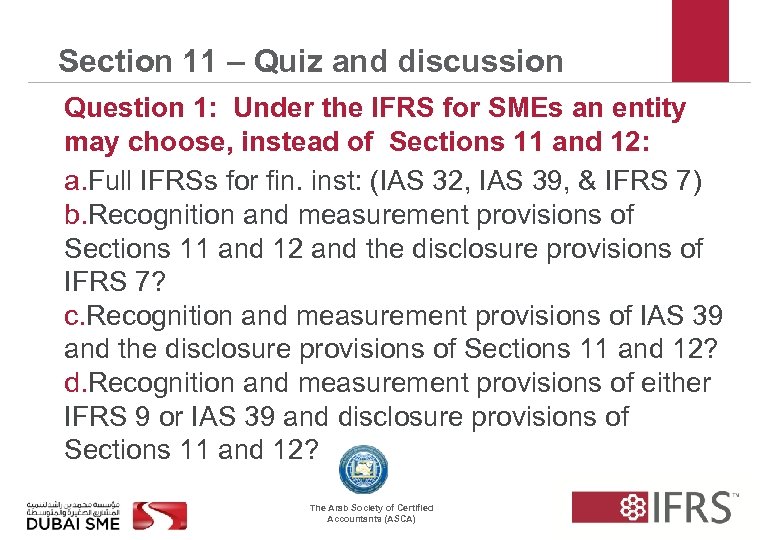

Section 11 – Quiz and discussion Question 1: Under the IFRS for SMEs an entity may choose, instead of Sections 11 and 12: a. Full IFRSs for fin. inst: (IAS 32, IAS 39, & IFRS 7) b. Recognition and measurement provisions of Sections 11 and 12 and the disclosure provisions of IFRS 7? c. Recognition and measurement provisions of IAS 39 and the disclosure provisions of Sections 11 and 12? d. Recognition and measurement provisions of either IFRS 9 or IAS 39 and disclosure provisions of Sections 11 and 12? The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 1: Under the IFRS for SMEs an entity may choose, instead of Sections 11 and 12: a. Full IFRSs for fin. inst: (IAS 32, IAS 39, & IFRS 7) b. Recognition and measurement provisions of Sections 11 and 12 and the disclosure provisions of IFRS 7? c. Recognition and measurement provisions of IAS 39 and the disclosure provisions of Sections 11 and 12? d. Recognition and measurement provisions of either IFRS 9 or IAS 39 and disclosure provisions of Sections 11 and 12? The Arab Society of Certified Accountants (ASCA)

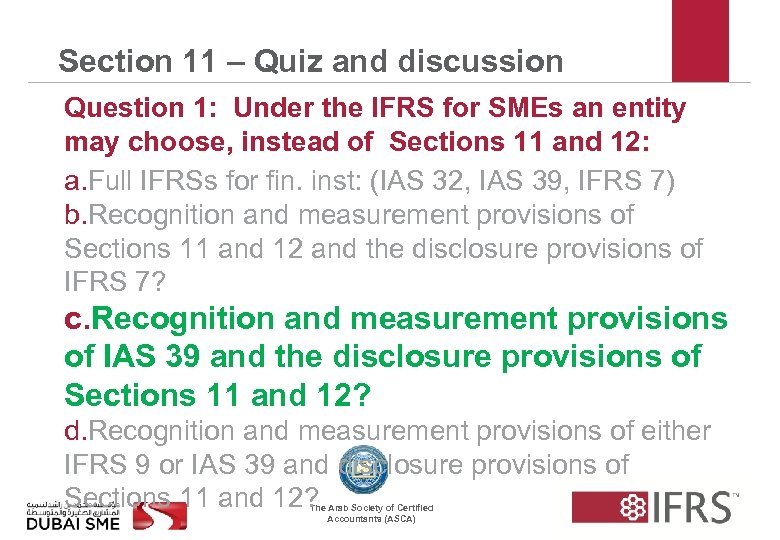

Section 11 – Quiz and discussion Question 1: Under the IFRS for SMEs an entity may choose, instead of Sections 11 and 12: a. Full IFRSs for fin. inst: (IAS 32, IAS 39, IFRS 7) b. Recognition and measurement provisions of Sections 11 and 12 and the disclosure provisions of IFRS 7? c. Recognition and measurement provisions of IAS 39 and the disclosure provisions of Sections 11 and 12? d. Recognition and measurement provisions of either IFRS 9 or IAS 39 and disclosure provisions of Sections 11 and 12? The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 1: Under the IFRS for SMEs an entity may choose, instead of Sections 11 and 12: a. Full IFRSs for fin. inst: (IAS 32, IAS 39, IFRS 7) b. Recognition and measurement provisions of Sections 11 and 12 and the disclosure provisions of IFRS 7? c. Recognition and measurement provisions of IAS 39 and the disclosure provisions of Sections 11 and 12? d. Recognition and measurement provisions of either IFRS 9 or IAS 39 and disclosure provisions of Sections 11 and 12? The Arab Society of Certified Accountants (ASCA)

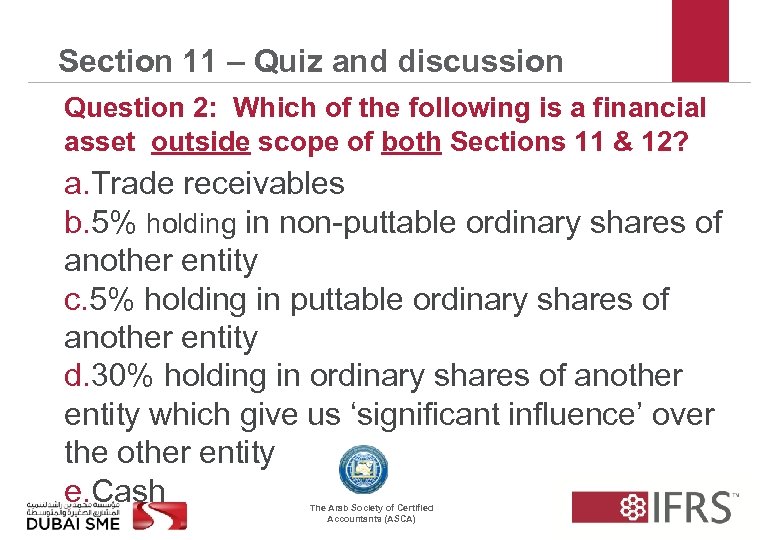

Section 11 – Quiz and discussion Question 2: Which of the following is a financial asset outside scope of both Sections 11 & 12? a. Trade receivables b. 5% holding in non-puttable ordinary shares of another entity c. 5% holding in puttable ordinary shares of another entity d. 30% holding in ordinary shares of another entity which give us ‘significant influence’ over the other entity e. Cash The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 2: Which of the following is a financial asset outside scope of both Sections 11 & 12? a. Trade receivables b. 5% holding in non-puttable ordinary shares of another entity c. 5% holding in puttable ordinary shares of another entity d. 30% holding in ordinary shares of another entity which give us ‘significant influence’ over the other entity e. Cash The Arab Society of Certified Accountants (ASCA)

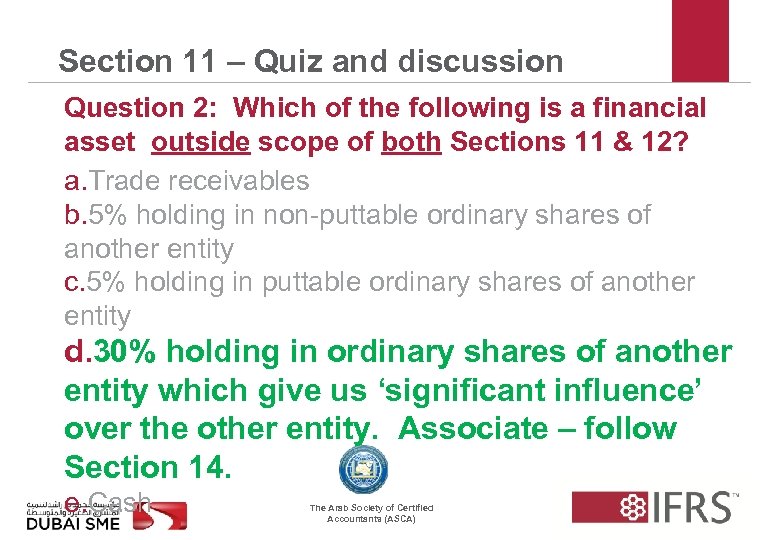

Section 11 – Quiz and discussion Question 2: Which of the following is a financial asset outside scope of both Sections 11 & 12? a. Trade receivables b. 5% holding in non-puttable ordinary shares of another entity c. 5% holding in puttable ordinary shares of another entity d. 30% holding in ordinary shares of another entity which give us ‘significant influence’ over the other entity. Associate – follow Section 14. e. Cash The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 2: Which of the following is a financial asset outside scope of both Sections 11 & 12? a. Trade receivables b. 5% holding in non-puttable ordinary shares of another entity c. 5% holding in puttable ordinary shares of another entity d. 30% holding in ordinary shares of another entity which give us ‘significant influence’ over the other entity. Associate – follow Section 14. e. Cash The Arab Society of Certified Accountants (ASCA)

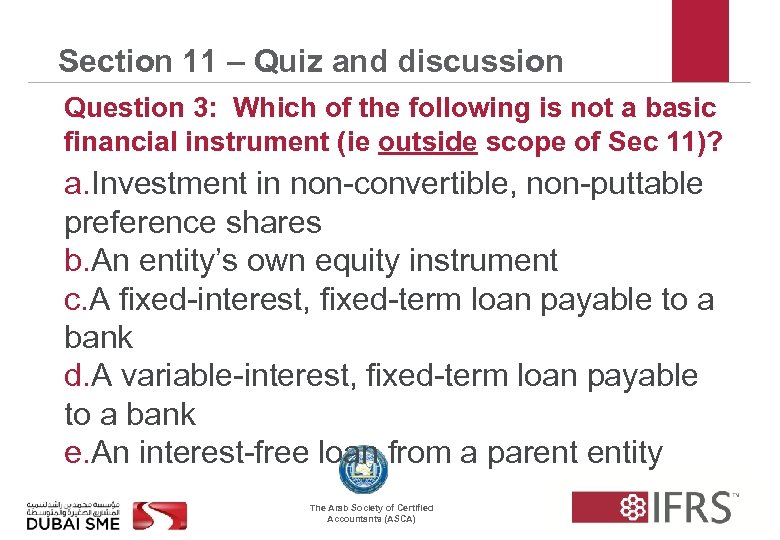

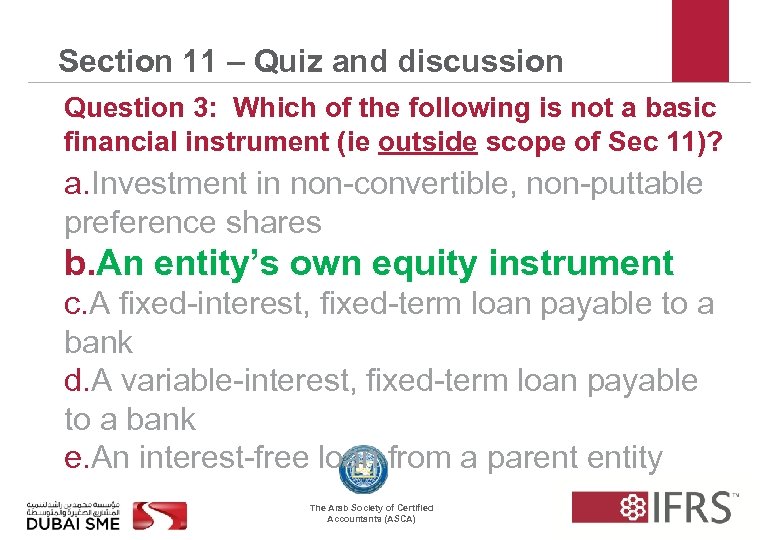

Section 11 – Quiz and discussion Question 3: Which of the following is not a basic financial instrument (ie outside scope of Sec 11)? a. Investment in non-convertible, non-puttable preference shares b. An entity’s own equity instrument c. A fixed-interest, fixed-term loan payable to a bank d. A variable-interest, fixed-term loan payable to a bank e. An interest-free loan from a parent entity The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 3: Which of the following is not a basic financial instrument (ie outside scope of Sec 11)? a. Investment in non-convertible, non-puttable preference shares b. An entity’s own equity instrument c. A fixed-interest, fixed-term loan payable to a bank d. A variable-interest, fixed-term loan payable to a bank e. An interest-free loan from a parent entity The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 3: Which of the following is not a basic financial instrument (ie outside scope of Sec 11)? a. Investment in non-convertible, non-puttable preference shares b. An entity’s own equity instrument c. A fixed-interest, fixed-term loan payable to a bank d. A variable-interest, fixed-term loan payable to a bank e. An interest-free loan from a parent entity The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 3: Which of the following is not a basic financial instrument (ie outside scope of Sec 11)? a. Investment in non-convertible, non-puttable preference shares b. An entity’s own equity instrument c. A fixed-interest, fixed-term loan payable to a bank d. A variable-interest, fixed-term loan payable to a bank e. An interest-free loan from a parent entity The Arab Society of Certified Accountants (ASCA)

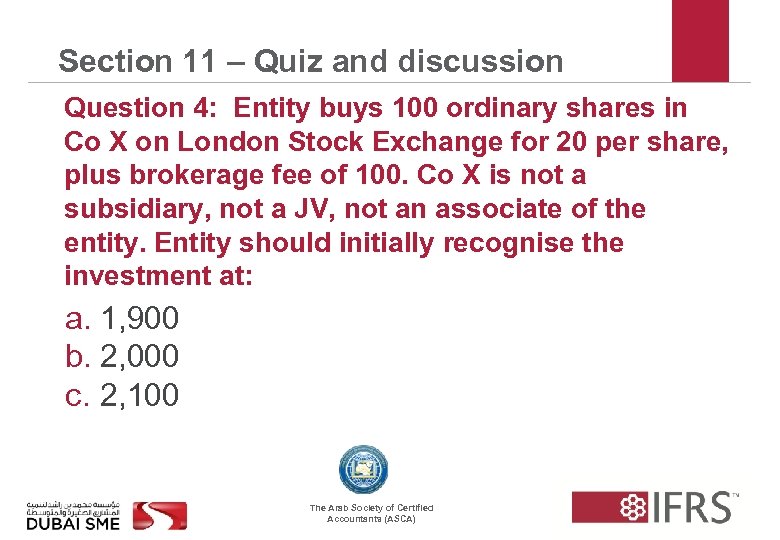

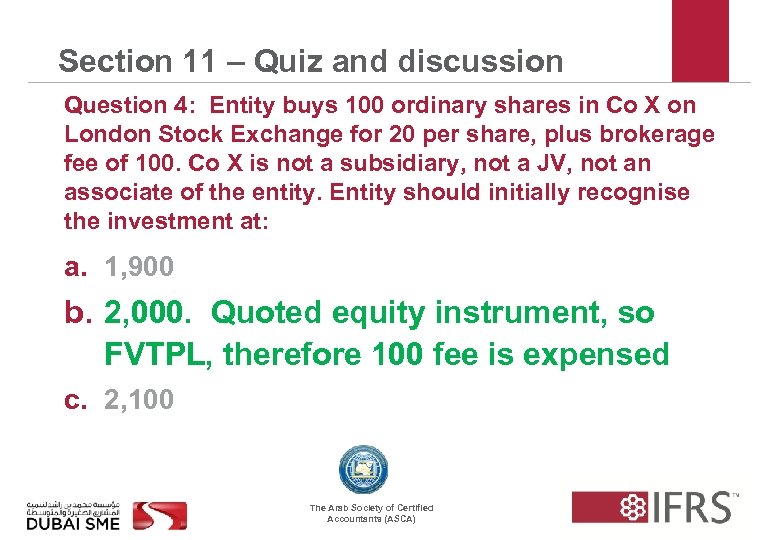

Section 11 – Quiz and discussion Question 4: Entity buys 100 ordinary shares in Co X on London Stock Exchange for 20 per share, plus brokerage fee of 100. Co X is not a subsidiary, not a JV, not an associate of the entity. Entity should initially recognise the investment at: a. 1, 900 b. 2, 000 c. 2, 100 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 4: Entity buys 100 ordinary shares in Co X on London Stock Exchange for 20 per share, plus brokerage fee of 100. Co X is not a subsidiary, not a JV, not an associate of the entity. Entity should initially recognise the investment at: a. 1, 900 b. 2, 000 c. 2, 100 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 4: Entity buys 100 ordinary shares in Co X on London Stock Exchange for 20 per share, plus brokerage fee of 100. Co X is not a subsidiary, not a JV, not an associate of the entity. Entity should initially recognise the investment at: a. 1, 900 b. 2, 000. Quoted equity instrument, so FVTPL, therefore 100 fee is expensed c. 2, 100 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 4: Entity buys 100 ordinary shares in Co X on London Stock Exchange for 20 per share, plus brokerage fee of 100. Co X is not a subsidiary, not a JV, not an associate of the entity. Entity should initially recognise the investment at: a. 1, 900 b. 2, 000. Quoted equity instrument, so FVTPL, therefore 100 fee is expensed c. 2, 100 The Arab Society of Certified Accountants (ASCA)

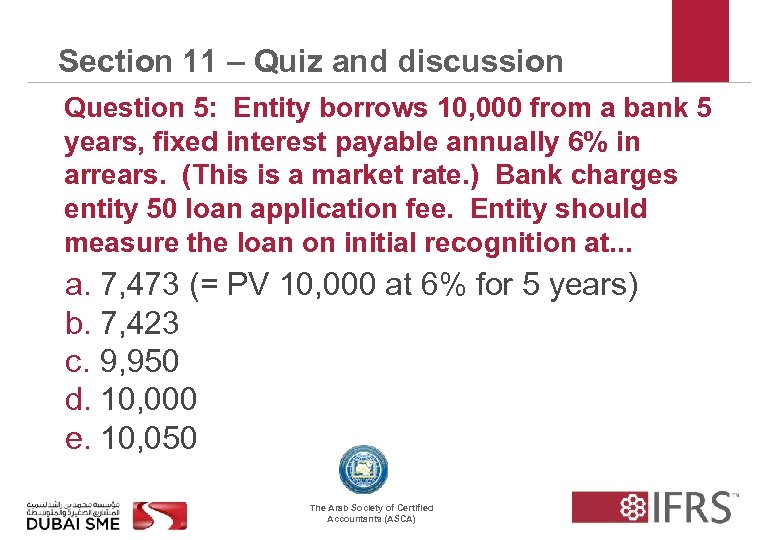

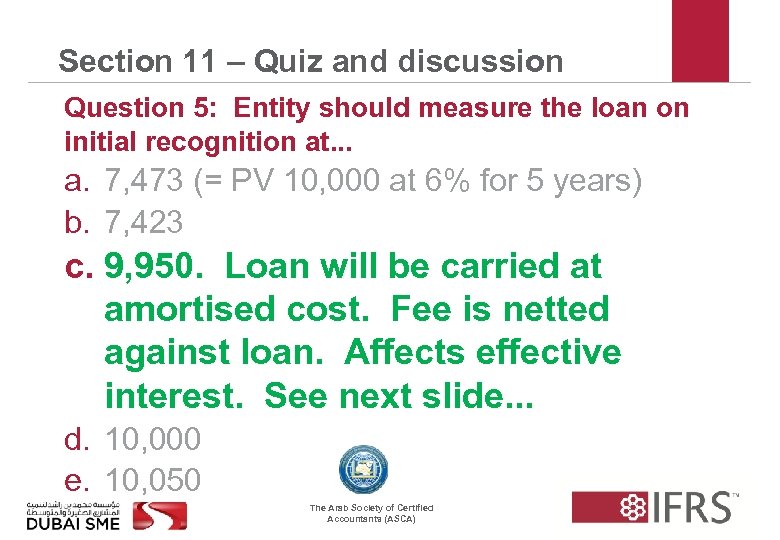

Section 11 – Quiz and discussion Question 5: Entity borrows 10, 000 from a bank 5 years, fixed interest payable annually 6% in arrears. (This is a market rate. ) Bank charges entity 50 loan application fee. Entity should measure the loan on initial recognition at. . . a. 7, 473 (= PV 10, 000 at 6% for 5 years) b. 7, 423 c. 9, 950 d. 10, 000 e. 10, 050 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 5: Entity borrows 10, 000 from a bank 5 years, fixed interest payable annually 6% in arrears. (This is a market rate. ) Bank charges entity 50 loan application fee. Entity should measure the loan on initial recognition at. . . a. 7, 473 (= PV 10, 000 at 6% for 5 years) b. 7, 423 c. 9, 950 d. 10, 000 e. 10, 050 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 5: Entity should measure the loan on initial recognition at. . . a. 7, 473 (= PV 10, 000 at 6% for 5 years) b. 7, 423 c. 9, 950. Loan will be carried at amortised cost. Fee is netted against loan. Affects effective interest. See next slide. . . d. 10, 000 e. 10, 050 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 5: Entity should measure the loan on initial recognition at. . . a. 7, 473 (= PV 10, 000 at 6% for 5 years) b. 7, 423 c. 9, 950. Loan will be carried at amortised cost. Fee is netted against loan. Affects effective interest. See next slide. . . d. 10, 000 e. 10, 050 The Arab Society of Certified Accountants (ASCA)

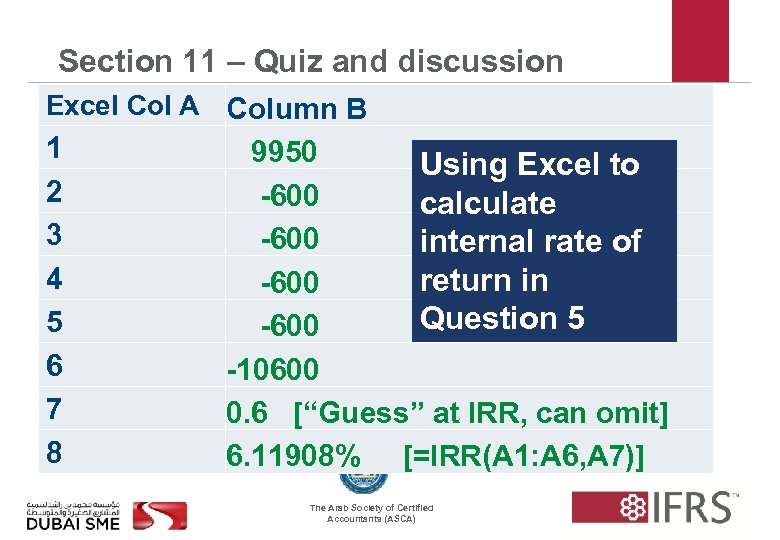

Section 11 – Quiz and discussion Excel Col A Column B 1 2 3 4 5 6 7 8 9950 Using Excel to -600 calculate -600 internal rate of return in -600 Question 5 -600 -10600 0. 6 [“Guess” at IRR, can omit] 6. 11908% [=IRR(A 1: A 6, A 7)] The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Excel Col A Column B 1 2 3 4 5 6 7 8 9950 Using Excel to -600 calculate -600 internal rate of return in -600 Question 5 -600 -10600 0. 6 [“Guess” at IRR, can omit] 6. 11908% [=IRR(A 1: A 6, A 7)] The Arab Society of Certified Accountants (ASCA)

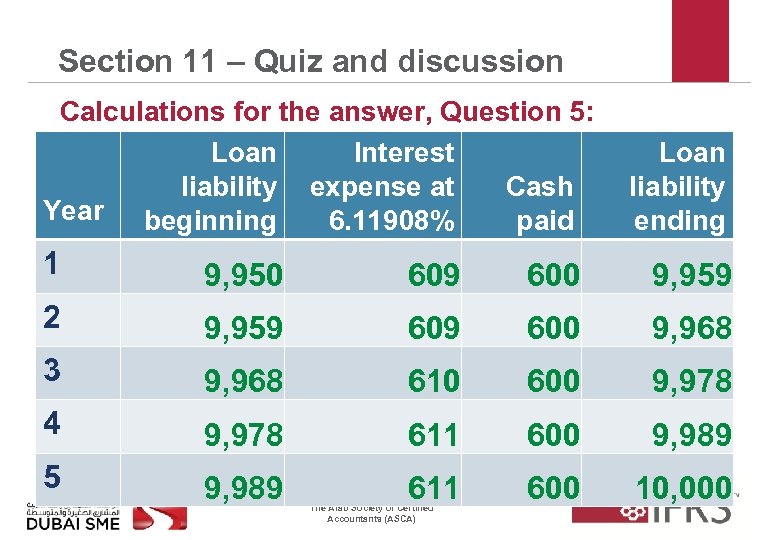

Section 11 – Quiz and discussion Calculations for the answer, Question 5: Loan Interest liability expense at Cash Year beginning 6. 11908% paid Loan liability ending 1 9, 950 609 600 9, 959 2 9, 959 600 9, 968 3 9, 968 610 600 9, 978 4 9, 978 611 600 9, 989 5 9, 989 611 600 10, 000 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Calculations for the answer, Question 5: Loan Interest liability expense at Cash Year beginning 6. 11908% paid Loan liability ending 1 9, 950 609 600 9, 959 2 9, 959 600 9, 968 3 9, 968 610 600 9, 978 4 9, 978 611 600 9, 989 5 9, 989 611 600 10, 000 The Arab Society of Certified Accountants (ASCA)

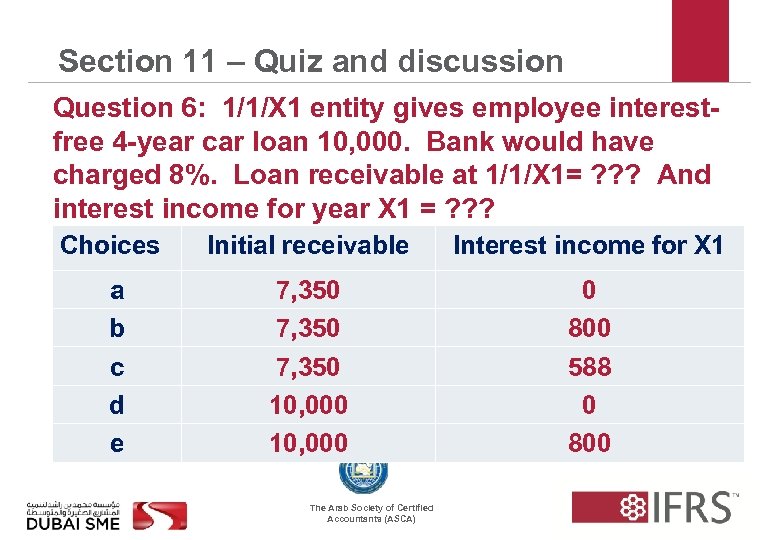

Section 11 – Quiz and discussion Question 6: 1/1/X 1 entity gives employee interestfree 4 -year car loan 10, 000. Bank would have charged 8%. Loan receivable at 1/1/X 1= ? ? ? And interest income for year X 1 = ? ? ? Choices Initial receivable Interest income for X 1 a b c d e 7, 350 10, 000 0 800 588 0 800 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 6: 1/1/X 1 entity gives employee interestfree 4 -year car loan 10, 000. Bank would have charged 8%. Loan receivable at 1/1/X 1= ? ? ? And interest income for year X 1 = ? ? ? Choices Initial receivable Interest income for X 1 a b c d e 7, 350 10, 000 0 800 588 0 800 The Arab Society of Certified Accountants (ASCA)

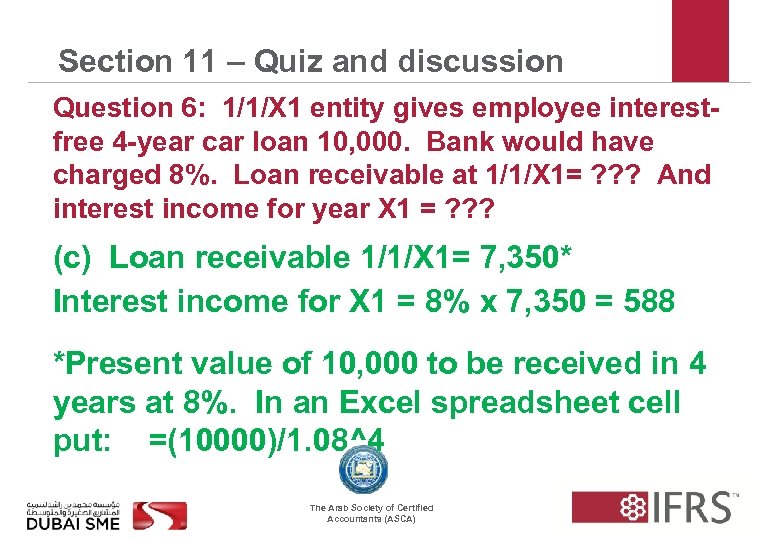

Section 11 – Quiz and discussion Question 6: 1/1/X 1 entity gives employee interestfree 4 -year car loan 10, 000. Bank would have charged 8%. Loan receivable at 1/1/X 1= ? ? ? And interest income for year X 1 = ? ? ? (c) Loan receivable 1/1/X 1= 7, 350* Interest income for X 1 = 8% x 7, 350 = 588 *Present value of 10, 000 to be received in 4 years at 8%. In an Excel spreadsheet cell put: =(10000)/1. 08^4 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 6: 1/1/X 1 entity gives employee interestfree 4 -year car loan 10, 000. Bank would have charged 8%. Loan receivable at 1/1/X 1= ? ? ? And interest income for year X 1 = ? ? ? (c) Loan receivable 1/1/X 1= 7, 350* Interest income for X 1 = 8% x 7, 350 = 588 *Present value of 10, 000 to be received in 4 years at 8%. In an Excel spreadsheet cell put: =(10000)/1. 08^4 The Arab Society of Certified Accountants (ASCA)

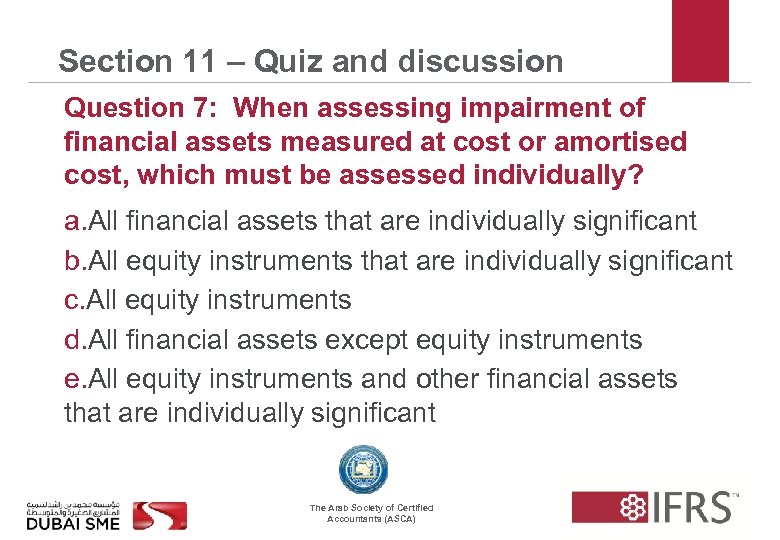

Section 11 – Quiz and discussion Question 7: When assessing impairment of financial assets measured at cost or amortised cost, which must be assessed individually? a. All financial assets that are individually significant b. All equity instruments that are individually significant c. All equity instruments d. All financial assets except equity instruments e. All equity instruments and other financial assets that are individually significant The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 7: When assessing impairment of financial assets measured at cost or amortised cost, which must be assessed individually? a. All financial assets that are individually significant b. All equity instruments that are individually significant c. All equity instruments d. All financial assets except equity instruments e. All equity instruments and other financial assets that are individually significant The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 7: Which must be assessed individually? a. All financial assets that are individually significant b. All equity instruments that are individually significant c. All equity instruments d. All financial assets except equity instruments e. All equity instruments and other financial assets that are individually significant The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 7: Which must be assessed individually? a. All financial assets that are individually significant b. All equity instruments that are individually significant c. All equity instruments d. All financial assets except equity instruments e. All equity instruments and other financial assets that are individually significant The Arab Society of Certified Accountants (ASCA)

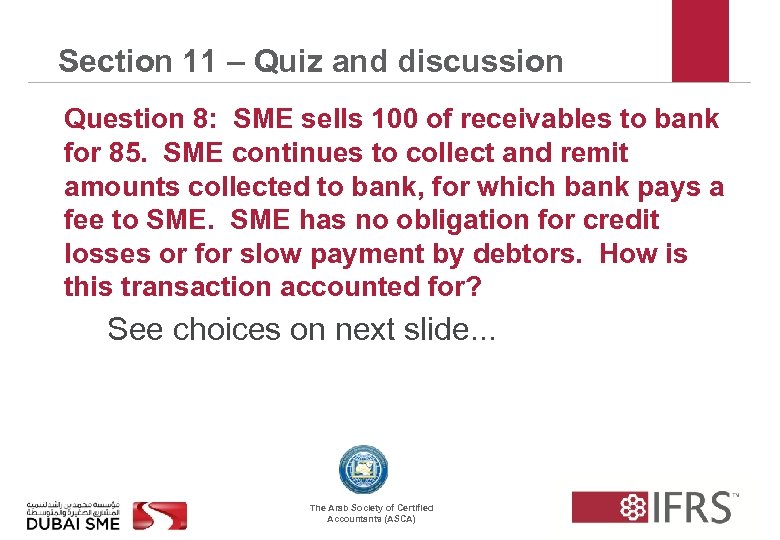

Section 11 – Quiz and discussion Question 8: SME sells 100 of receivables to bank for 85. SME continues to collect and remit amounts collected to bank, for which bank pays a fee to SME has no obligation for credit losses or for slow payment by debtors. How is this transaction accounted for? See choices on next slide. . . The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 8: SME sells 100 of receivables to bank for 85. SME continues to collect and remit amounts collected to bank, for which bank pays a fee to SME has no obligation for credit losses or for slow payment by debtors. How is this transaction accounted for? See choices on next slide. . . The Arab Society of Certified Accountants (ASCA)

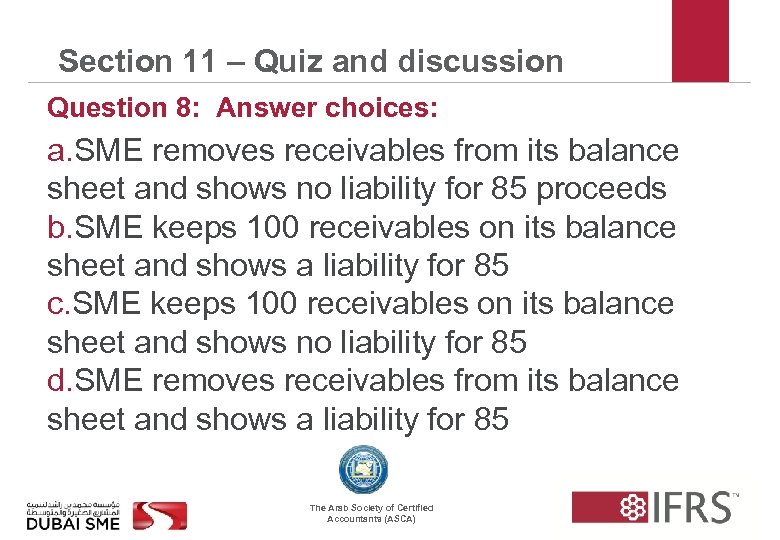

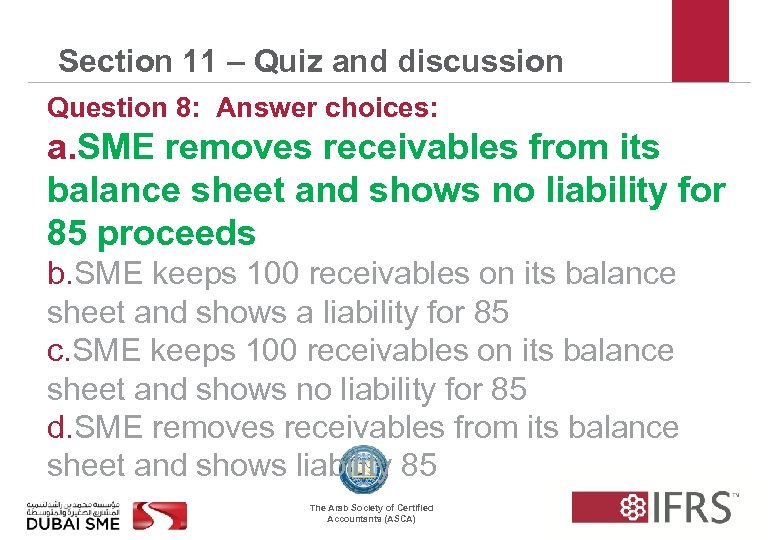

Section 11 – Quiz and discussion Question 8: Answer choices: a. SME removes receivables from its balance sheet and shows no liability for 85 proceeds b. SME keeps 100 receivables on its balance sheet and shows a liability for 85 c. SME keeps 100 receivables on its balance sheet and shows no liability for 85 d. SME removes receivables from its balance sheet and shows a liability for 85 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 8: Answer choices: a. SME removes receivables from its balance sheet and shows no liability for 85 proceeds b. SME keeps 100 receivables on its balance sheet and shows a liability for 85 c. SME keeps 100 receivables on its balance sheet and shows no liability for 85 d. SME removes receivables from its balance sheet and shows a liability for 85 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 8: Answer choices: a. SME removes receivables from its balance sheet and shows no liability for 85 proceeds b. SME keeps 100 receivables on its balance sheet and shows a liability for 85 c. SME keeps 100 receivables on its balance sheet and shows no liability for 85 d. SME removes receivables from its balance sheet and shows liability 85 The Arab Society of Certified Accountants (ASCA)

Section 11 – Quiz and discussion Question 8: Answer choices: a. SME removes receivables from its balance sheet and shows no liability for 85 proceeds b. SME keeps 100 receivables on its balance sheet and shows a liability for 85 c. SME keeps 100 receivables on its balance sheet and shows no liability for 85 d. SME removes receivables from its balance sheet and shows liability 85 The Arab Society of Certified Accountants (ASCA)

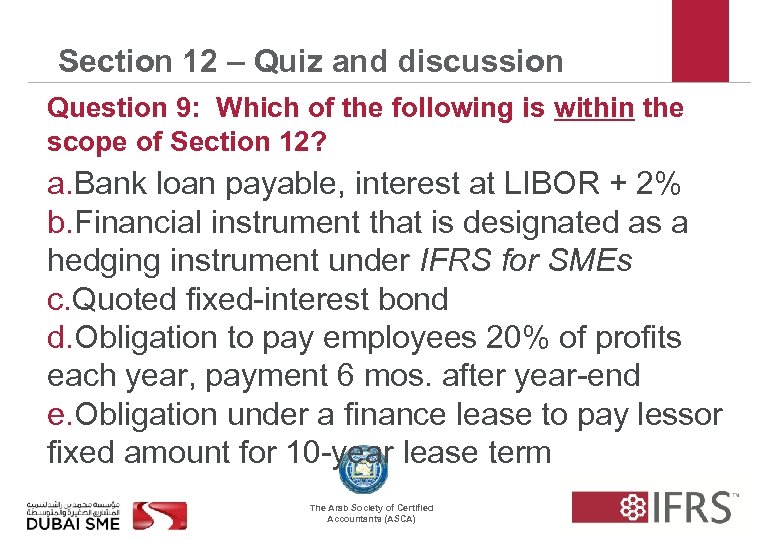

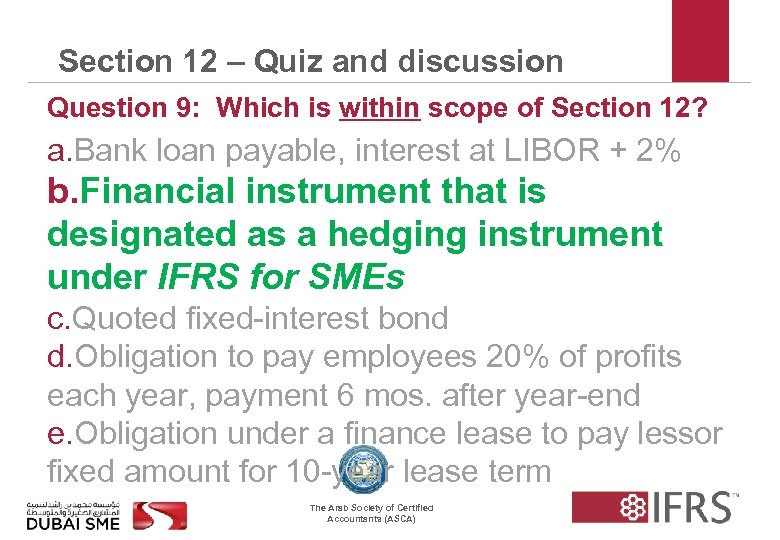

Section 12 – Quiz and discussion Question 9: Which of the following is within the scope of Section 12? a. Bank loan payable, interest at LIBOR + 2% b. Financial instrument that is designated as a hedging instrument under IFRS for SMEs c. Quoted fixed-interest bond d. Obligation to pay employees 20% of profits each year, payment 6 mos. after year-end e. Obligation under a finance lease to pay lessor fixed amount for 10 -year lease term The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 9: Which of the following is within the scope of Section 12? a. Bank loan payable, interest at LIBOR + 2% b. Financial instrument that is designated as a hedging instrument under IFRS for SMEs c. Quoted fixed-interest bond d. Obligation to pay employees 20% of profits each year, payment 6 mos. after year-end e. Obligation under a finance lease to pay lessor fixed amount for 10 -year lease term The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 9: Which is within scope of Section 12? a. Bank loan payable, interest at LIBOR + 2% b. Financial instrument that is designated as a hedging instrument under IFRS for SMEs c. Quoted fixed-interest bond d. Obligation to pay employees 20% of profits each year, payment 6 mos. after year-end e. Obligation under a finance lease to pay lessor fixed amount for 10 -year lease term The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 9: Which is within scope of Section 12? a. Bank loan payable, interest at LIBOR + 2% b. Financial instrument that is designated as a hedging instrument under IFRS for SMEs c. Quoted fixed-interest bond d. Obligation to pay employees 20% of profits each year, payment 6 mos. after year-end e. Obligation under a finance lease to pay lessor fixed amount for 10 -year lease term The Arab Society of Certified Accountants (ASCA)

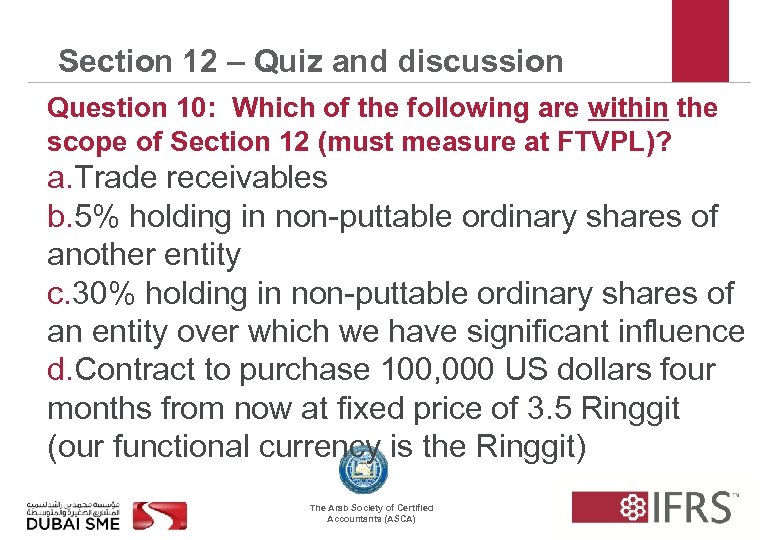

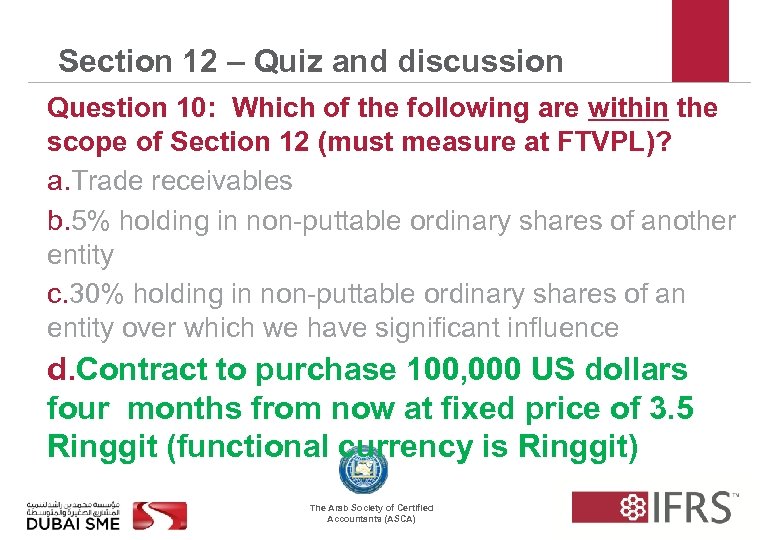

Section 12 – Quiz and discussion Question 10: Which of the following are within the scope of Section 12 (must measure at FTVPL)? a. Trade receivables b. 5% holding in non-puttable ordinary shares of another entity c. 30% holding in non-puttable ordinary shares of an entity over which we have significant influence d. Contract to purchase 100, 000 US dollars four months from now at fixed price of 3. 5 Ringgit (our functional currency is the Ringgit) The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 10: Which of the following are within the scope of Section 12 (must measure at FTVPL)? a. Trade receivables b. 5% holding in non-puttable ordinary shares of another entity c. 30% holding in non-puttable ordinary shares of an entity over which we have significant influence d. Contract to purchase 100, 000 US dollars four months from now at fixed price of 3. 5 Ringgit (our functional currency is the Ringgit) The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 10: Which of the following are within the scope of Section 12 (must measure at FTVPL)? a. Trade receivables b. 5% holding in non-puttable ordinary shares of another entity c. 30% holding in non-puttable ordinary shares of an entity over which we have significant influence d. Contract to purchase 100, 000 US dollars four months from now at fixed price of 3. 5 Ringgit (functional currency is Ringgit) The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 10: Which of the following are within the scope of Section 12 (must measure at FTVPL)? a. Trade receivables b. 5% holding in non-puttable ordinary shares of another entity c. 30% holding in non-puttable ordinary shares of an entity over which we have significant influence d. Contract to purchase 100, 000 US dollars four months from now at fixed price of 3. 5 Ringgit (functional currency is Ringgit) The Arab Society of Certified Accountants (ASCA)

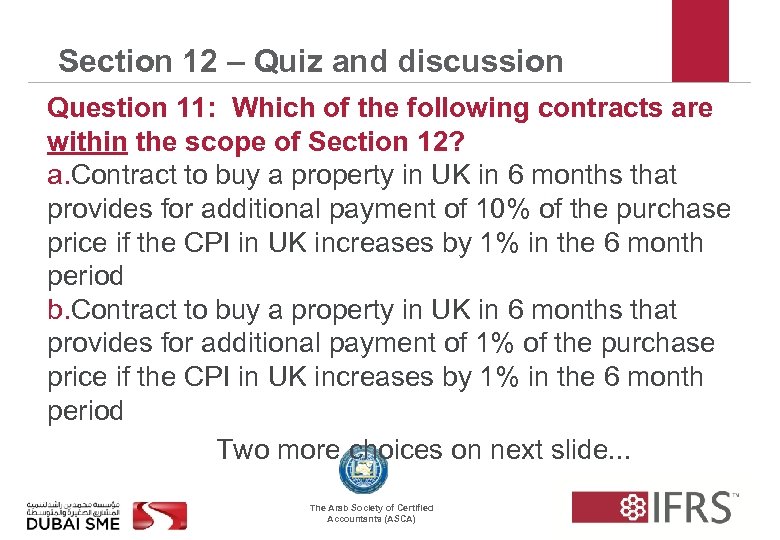

Section 12 – Quiz and discussion Question 11: Which of the following contracts are within the scope of Section 12? a. Contract to buy a property in UK in 6 months that provides for additional payment of 10% of the purchase price if the CPI in UK increases by 1% in the 6 month period b. Contract to buy a property in UK in 6 months that provides for additional payment of 1% of the purchase price if the CPI in UK increases by 1% in the 6 month period Two more choices on next slide. . . The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 11: Which of the following contracts are within the scope of Section 12? a. Contract to buy a property in UK in 6 months that provides for additional payment of 10% of the purchase price if the CPI in UK increases by 1% in the 6 month period b. Contract to buy a property in UK in 6 months that provides for additional payment of 1% of the purchase price if the CPI in UK increases by 1% in the 6 month period Two more choices on next slide. . . The Arab Society of Certified Accountants (ASCA)

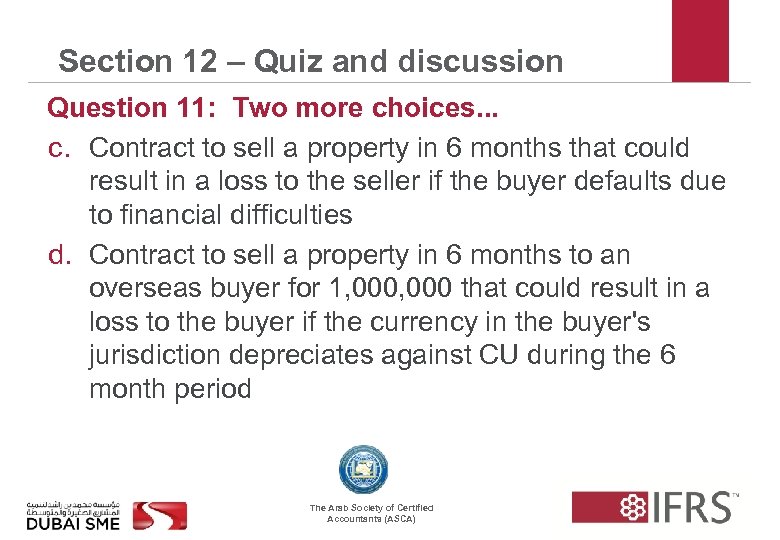

Section 12 – Quiz and discussion Question 11: Two more choices. . . c. Contract to sell a property in 6 months that could result in a loss to the seller if the buyer defaults due to financial difficulties d. Contract to sell a property in 6 months to an overseas buyer for 1, 000 that could result in a loss to the buyer if the currency in the buyer's jurisdiction depreciates against CU during the 6 month period The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 11: Two more choices. . . c. Contract to sell a property in 6 months that could result in a loss to the seller if the buyer defaults due to financial difficulties d. Contract to sell a property in 6 months to an overseas buyer for 1, 000 that could result in a loss to the buyer if the currency in the buyer's jurisdiction depreciates against CU during the 6 month period The Arab Society of Certified Accountants (ASCA)

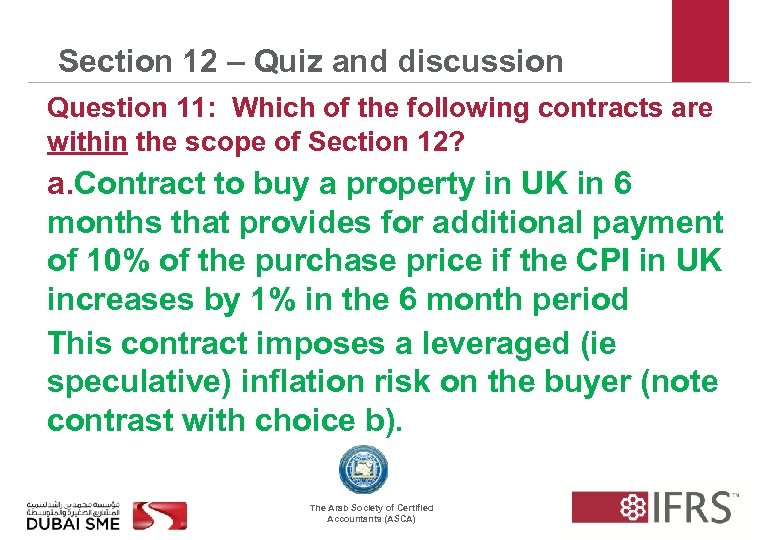

Section 12 – Quiz and discussion Question 11: Which of the following contracts are within the scope of Section 12? a. Contract to buy a property in UK in 6 months that provides for additional payment of 10% of the purchase price if the CPI in UK increases by 1% in the 6 month period This contract imposes a leveraged (ie speculative) inflation risk on the buyer (note contrast with choice b). The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 11: Which of the following contracts are within the scope of Section 12? a. Contract to buy a property in UK in 6 months that provides for additional payment of 10% of the purchase price if the CPI in UK increases by 1% in the 6 month period This contract imposes a leveraged (ie speculative) inflation risk on the buyer (note contrast with choice b). The Arab Society of Certified Accountants (ASCA)

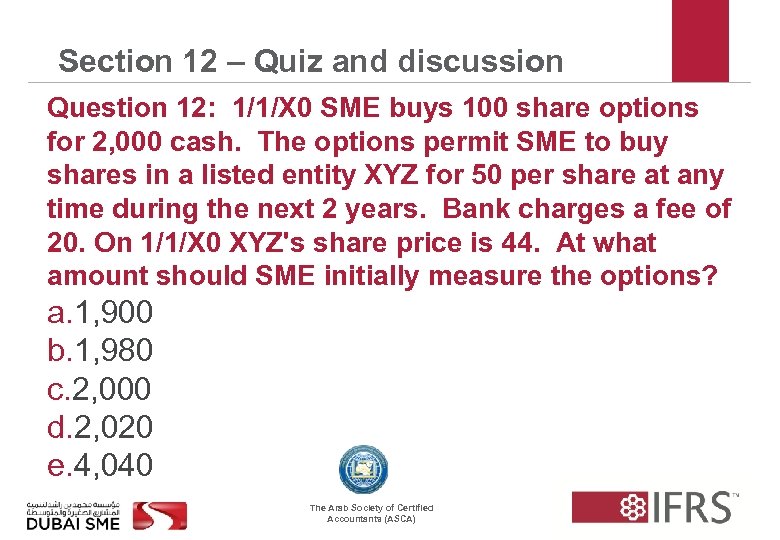

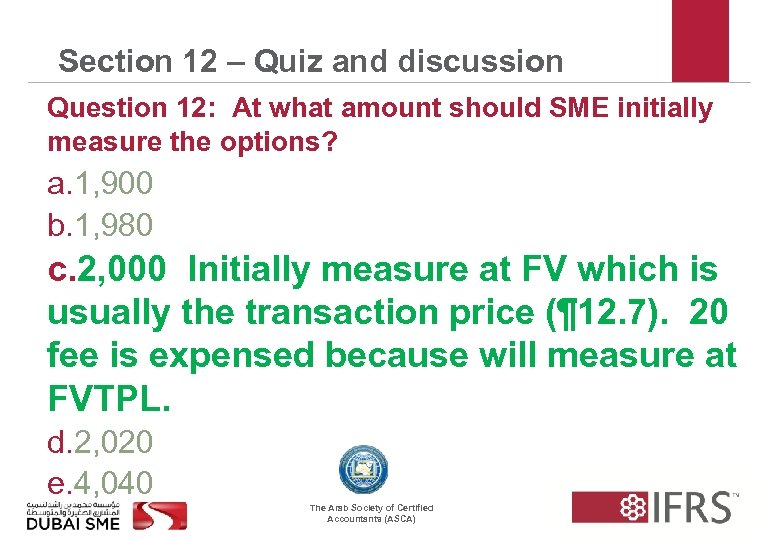

Section 12 – Quiz and discussion Question 12: 1/1/X 0 SME buys 100 share options for 2, 000 cash. The options permit SME to buy shares in a listed entity XYZ for 50 per share at any time during the next 2 years. Bank charges a fee of 20. On 1/1/X 0 XYZ's share price is 44. At what amount should SME initially measure the options? a. 1, 900 b. 1, 980 c. 2, 000 d. 2, 020 e. 4, 040 The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 12: 1/1/X 0 SME buys 100 share options for 2, 000 cash. The options permit SME to buy shares in a listed entity XYZ for 50 per share at any time during the next 2 years. Bank charges a fee of 20. On 1/1/X 0 XYZ's share price is 44. At what amount should SME initially measure the options? a. 1, 900 b. 1, 980 c. 2, 000 d. 2, 020 e. 4, 040 The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 12: At what amount should SME initially measure the options? a. 1, 900 b. 1, 980 c. 2, 000 Initially measure at FV which is usually the transaction price (¶ 12. 7). 20 fee is expensed because will measure at FVTPL. d. 2, 020 e. 4, 040 The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 12: At what amount should SME initially measure the options? a. 1, 900 b. 1, 980 c. 2, 000 Initially measure at FV which is usually the transaction price (¶ 12. 7). 20 fee is expensed because will measure at FVTPL. d. 2, 020 e. 4, 040 The Arab Society of Certified Accountants (ASCA)

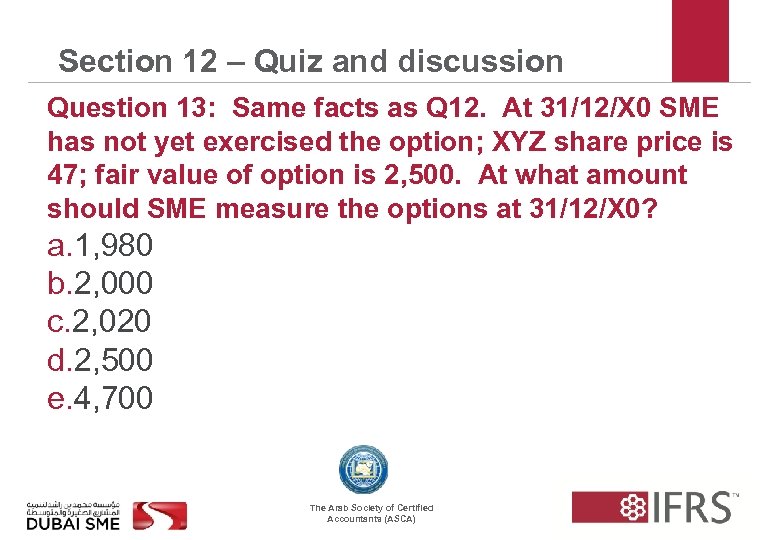

Section 12 – Quiz and discussion Question 13: Same facts as Q 12. At 31/12/X 0 SME has not yet exercised the option; XYZ share price is 47; fair value of option is 2, 500. At what amount should SME measure the options at 31/12/X 0? a. 1, 980 b. 2, 000 c. 2, 020 d. 2, 500 e. 4, 700 The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 13: Same facts as Q 12. At 31/12/X 0 SME has not yet exercised the option; XYZ share price is 47; fair value of option is 2, 500. At what amount should SME measure the options at 31/12/X 0? a. 1, 980 b. 2, 000 c. 2, 020 d. 2, 500 e. 4, 700 The Arab Society of Certified Accountants (ASCA)

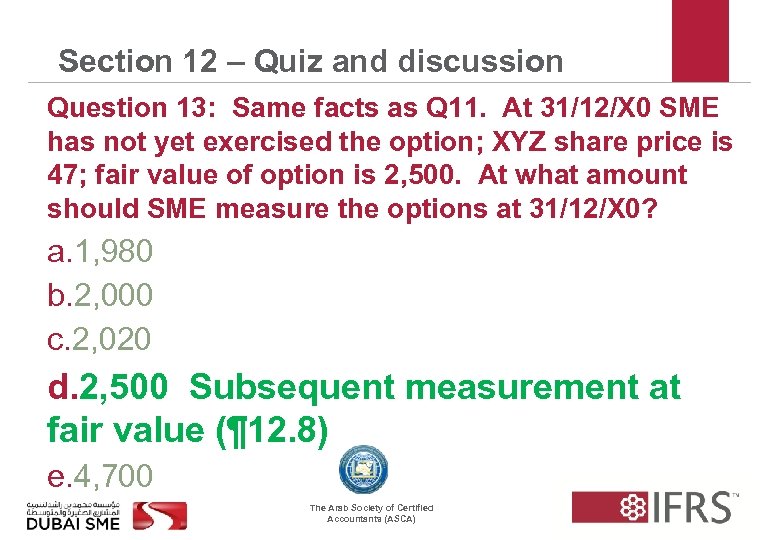

Section 12 – Quiz and discussion Question 13: Same facts as Q 11. At 31/12/X 0 SME has not yet exercised the option; XYZ share price is 47; fair value of option is 2, 500. At what amount should SME measure the options at 31/12/X 0? a. 1, 980 b. 2, 000 c. 2, 020 d. 2, 500 Subsequent measurement at fair value (¶ 12. 8) e. 4, 700 The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 13: Same facts as Q 11. At 31/12/X 0 SME has not yet exercised the option; XYZ share price is 47; fair value of option is 2, 500. At what amount should SME measure the options at 31/12/X 0? a. 1, 980 b. 2, 000 c. 2, 020 d. 2, 500 Subsequent measurement at fair value (¶ 12. 8) e. 4, 700 The Arab Society of Certified Accountants (ASCA)

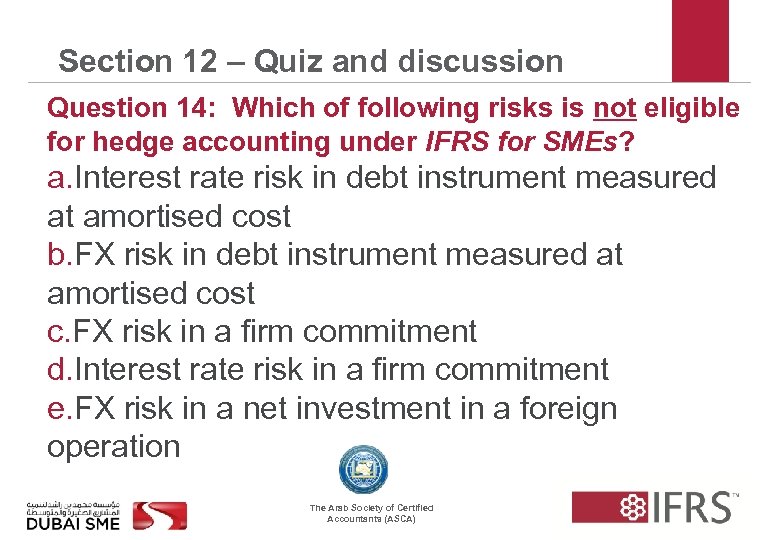

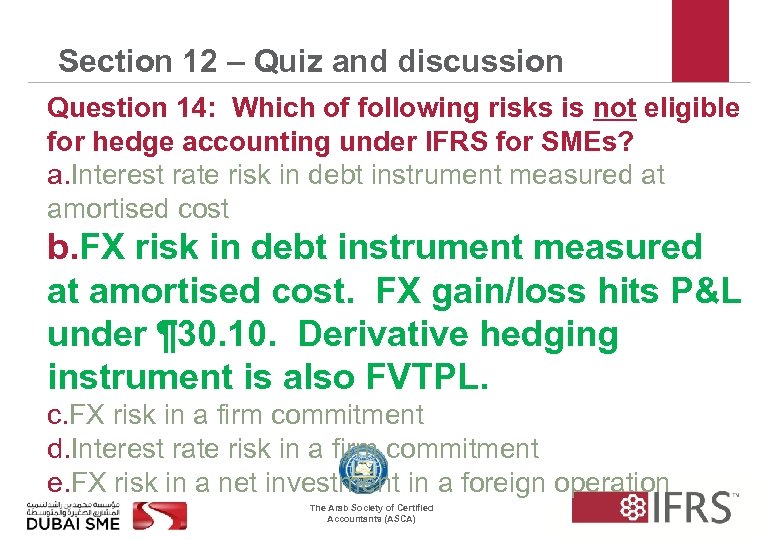

Section 12 – Quiz and discussion Question 14: Which of following risks is not eligible for hedge accounting under IFRS for SMEs? a. Interest rate risk in debt instrument measured at amortised cost b. FX risk in debt instrument measured at amortised cost c. FX risk in a firm commitment d. Interest rate risk in a firm commitment e. FX risk in a net investment in a foreign operation The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 14: Which of following risks is not eligible for hedge accounting under IFRS for SMEs? a. Interest rate risk in debt instrument measured at amortised cost b. FX risk in debt instrument measured at amortised cost c. FX risk in a firm commitment d. Interest rate risk in a firm commitment e. FX risk in a net investment in a foreign operation The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 14: Which of following risks is not eligible for hedge accounting under IFRS for SMEs? a. Interest rate risk in debt instrument measured at amortised cost b. FX risk in debt instrument measured at amortised cost. FX gain/loss hits P&L under ¶ 30. 10. Derivative hedging instrument is also FVTPL. c. FX risk in a firm commitment d. Interest rate risk in a firm commitment e. FX risk in a net investment in a foreign operation The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 14: Which of following risks is not eligible for hedge accounting under IFRS for SMEs? a. Interest rate risk in debt instrument measured at amortised cost b. FX risk in debt instrument measured at amortised cost. FX gain/loss hits P&L under ¶ 30. 10. Derivative hedging instrument is also FVTPL. c. FX risk in a firm commitment d. Interest rate risk in a firm commitment e. FX risk in a net investment in a foreign operation The Arab Society of Certified Accountants (ASCA)

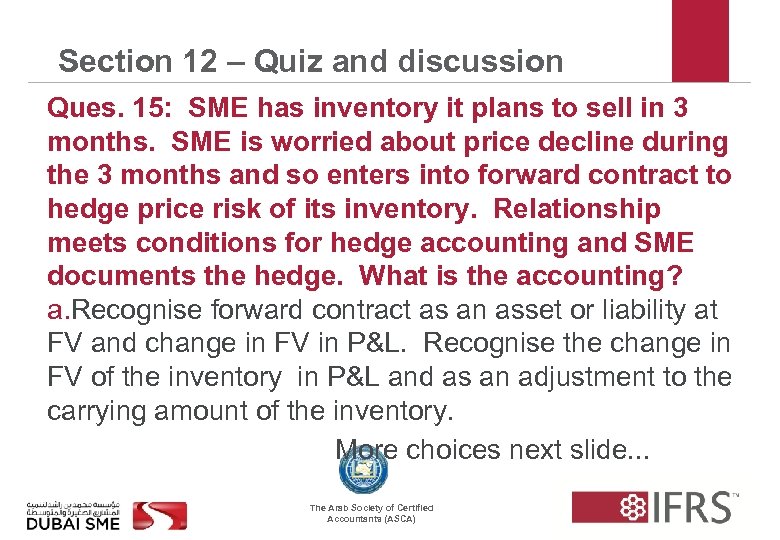

Section 12 – Quiz and discussion Ques. 15: SME has inventory it plans to sell in 3 months. SME is worried about price decline during the 3 months and so enters into forward contract to hedge price risk of its inventory. Relationship meets conditions for hedge accounting and SME documents the hedge. What is the accounting? a. Recognise forward contract as an asset or liability at FV and change in FV in P&L. Recognise the change in FV of the inventory in P&L and as an adjustment to the carrying amount of the inventory. More choices next slide. . . The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Ques. 15: SME has inventory it plans to sell in 3 months. SME is worried about price decline during the 3 months and so enters into forward contract to hedge price risk of its inventory. Relationship meets conditions for hedge accounting and SME documents the hedge. What is the accounting? a. Recognise forward contract as an asset or liability at FV and change in FV in P&L. Recognise the change in FV of the inventory in P&L and as an adjustment to the carrying amount of the inventory. More choices next slide. . . The Arab Society of Certified Accountants (ASCA)

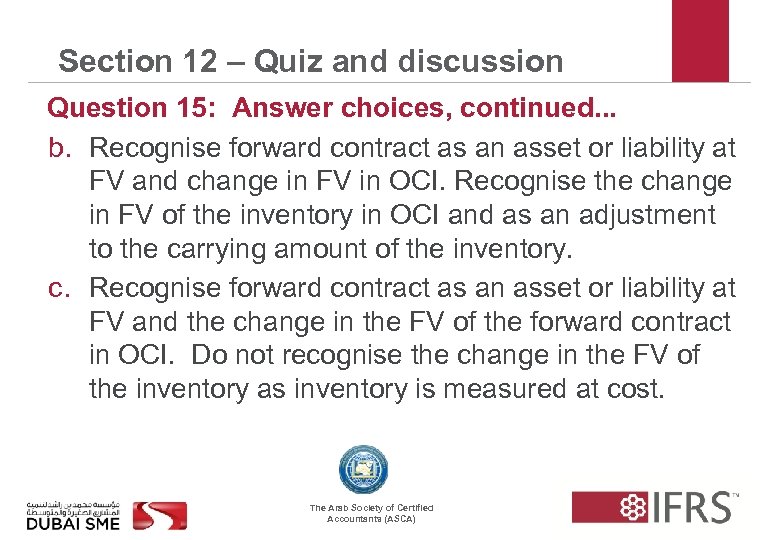

Section 12 – Quiz and discussion Question 15: Answer choices, continued. . . b. Recognise forward contract as an asset or liability at FV and change in FV in OCI. Recognise the change in FV of the inventory in OCI and as an adjustment to the carrying amount of the inventory. c. Recognise forward contract as an asset or liability at FV and the change in the FV of the forward contract in OCI. Do not recognise the change in the FV of the inventory as inventory is measured at cost. The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Question 15: Answer choices, continued. . . b. Recognise forward contract as an asset or liability at FV and change in FV in OCI. Recognise the change in FV of the inventory in OCI and as an adjustment to the carrying amount of the inventory. c. Recognise forward contract as an asset or liability at FV and the change in the FV of the forward contract in OCI. Do not recognise the change in the FV of the inventory as inventory is measured at cost. The Arab Society of Certified Accountants (ASCA)

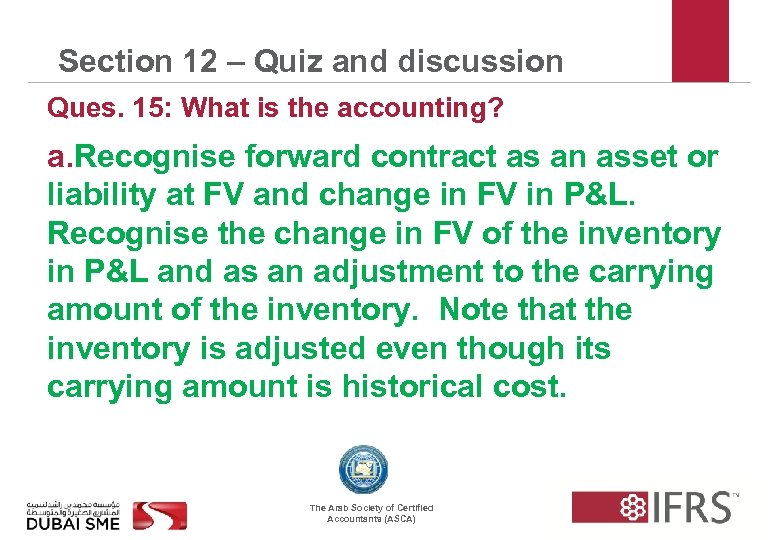

Section 12 – Quiz and discussion Ques. 15: What is the accounting? a. Recognise forward contract as an asset or liability at FV and change in FV in P&L. Recognise the change in FV of the inventory in P&L and as an adjustment to the carrying amount of the inventory. Note that the inventory is adjusted even though its carrying amount is historical cost. The Arab Society of Certified Accountants (ASCA)

Section 12 – Quiz and discussion Ques. 15: What is the accounting? a. Recognise forward contract as an asset or liability at FV and change in FV in P&L. Recognise the change in FV of the inventory in P&L and as an adjustment to the carrying amount of the inventory. Note that the inventory is adjusted even though its carrying amount is historical cost. The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 16: A financial instrument that is designated as a hedging instrument is always measured at Fair Value Through Profit or Loss under Section 12? a. True b. False The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 16: A financial instrument that is designated as a hedging instrument is always measured at Fair Value Through Profit or Loss under Section 12? a. True b. False The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 16: A financial instrument that is designated as a hedging instrument is always measured at Fair Value Through Profit or Loss under Section 12? a. True b. False. If it is a hedge of interest in a recognised financial instrument, or hedge of firm commitment or forecast transaction, hedging instrument is measured at FV through OCI, with subsequent recycling. The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 16: A financial instrument that is designated as a hedging instrument is always measured at Fair Value Through Profit or Loss under Section 12? a. True b. False. If it is a hedge of interest in a recognised financial instrument, or hedge of firm commitment or forecast transaction, hedging instrument is measured at FV through OCI, with subsequent recycling. The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 17: An entity measures equity instruments it has issued at: a. Cost b. Market value of a similar instrument c. Fair value of the cash or other resources received or receivable The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 17: An entity measures equity instruments it has issued at: a. Cost b. Market value of a similar instrument c. Fair value of the cash or other resources received or receivable The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 17: An entity measures equity instruments it has issued at: a. Cost b. Market value of a similar instrument c. Fair value of the cash or other resources received or receivable The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 17: An entity measures equity instruments it has issued at: a. Cost b. Market value of a similar instrument c. Fair value of the cash or other resources received or receivable The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 18: On the balance sheet, an entity presents non-controlling interest in consolidated subsidiaries: a. Within equity b. Within liabilities c. Between liabilities and equity d. Accounting policy choice of (a) or (c) above (choice must be applied consistently from year to year) The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 18: On the balance sheet, an entity presents non-controlling interest in consolidated subsidiaries: a. Within equity b. Within liabilities c. Between liabilities and equity d. Accounting policy choice of (a) or (c) above (choice must be applied consistently from year to year) The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 18: On the balance sheet, an entity presents non-controlling interest in consolidated subsidiaries: a. Within equity b. Within liabilities c. Between liabilities and equity d. Accounting policy choice of (a) or (c) above (choice must be applied consistently from year to year) The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 18: On the balance sheet, an entity presents non-controlling interest in consolidated subsidiaries: a. Within equity b. Within liabilities c. Between liabilities and equity d. Accounting policy choice of (a) or (c) above (choice must be applied consistently from year to year) The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 19: On 20/12/X 4, SME A voted to split its ordinary shares, two-for-one as of 15/1/X 5. The equity of SME a will. . . a. Increase on 20/12/X 4 b. Increase on 15/1/X 5 c. Decrease on 20/12/X 4 d. Decrease on 15/1/X 5 e. Remain unchanged as a result of the stock split The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 19: On 20/12/X 4, SME A voted to split its ordinary shares, two-for-one as of 15/1/X 5. The equity of SME a will. . . a. Increase on 20/12/X 4 b. Increase on 15/1/X 5 c. Decrease on 20/12/X 4 d. Decrease on 15/1/X 5 e. Remain unchanged as a result of the stock split The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 19: On 20/12/X 4, SME A voted to split the ordinary shares of A two-for-one as of 15/1/X 5. The equity of SME a will. . . a. Increase on 20/12/X 4 b. Increase on 15/1/X 5 c. Decrease on 20/12/X 4 d. Decrease on 15/1/X 5 e. Remain unchanged as a result of the stock split The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 19: On 20/12/X 4, SME A voted to split the ordinary shares of A two-for-one as of 15/1/X 5. The equity of SME a will. . . a. Increase on 20/12/X 4 b. Increase on 15/1/X 5 c. Decrease on 20/12/X 4 d. Decrease on 15/1/X 5 e. Remain unchanged as a result of the stock split The Arab Society of Certified Accountants (ASCA)

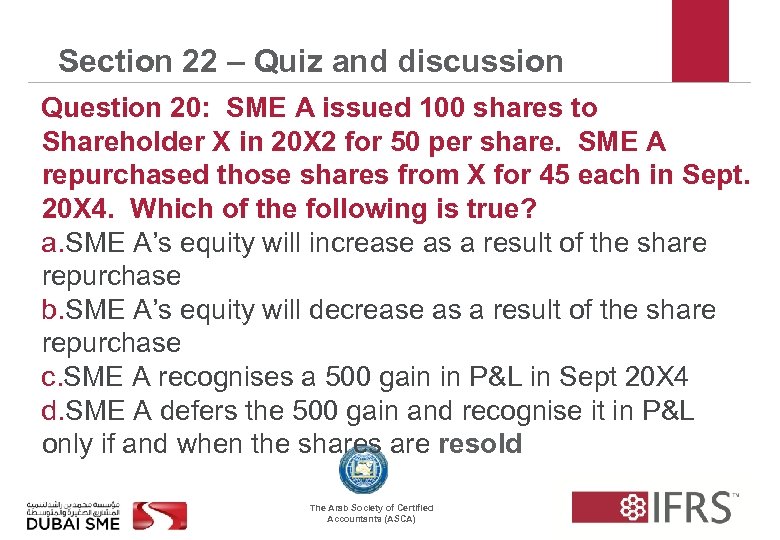

Section 22 – Quiz and discussion Question 20: SME A issued 100 shares to Shareholder X in 20 X 2 for 50 per share. SME A repurchased those shares from X for 45 each in Sept. 20 X 4. Which of the following is true? a. SME A’s equity will increase as a result of the share repurchase b. SME A’s equity will decrease as a result of the share repurchase c. SME A recognises a 500 gain in P&L in Sept 20 X 4 d. SME A defers the 500 gain and recognise it in P&L only if and when the shares are resold The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 20: SME A issued 100 shares to Shareholder X in 20 X 2 for 50 per share. SME A repurchased those shares from X for 45 each in Sept. 20 X 4. Which of the following is true? a. SME A’s equity will increase as a result of the share repurchase b. SME A’s equity will decrease as a result of the share repurchase c. SME A recognises a 500 gain in P&L in Sept 20 X 4 d. SME A defers the 500 gain and recognise it in P&L only if and when the shares are resold The Arab Society of Certified Accountants (ASCA)

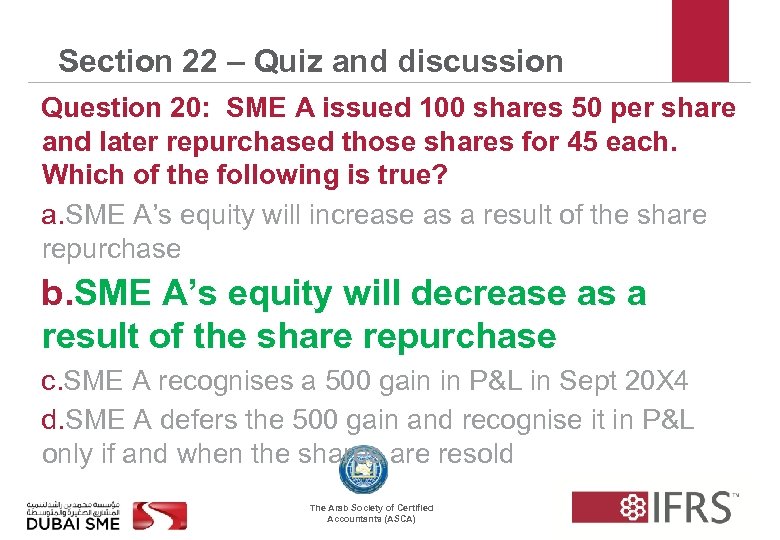

Section 22 – Quiz and discussion Question 20: SME A issued 100 shares 50 per share and later repurchased those shares for 45 each. Which of the following is true? a. SME A’s equity will increase as a result of the share repurchase b. SME A’s equity will decrease as a result of the share repurchase c. SME A recognises a 500 gain in P&L in Sept 20 X 4 d. SME A defers the 500 gain and recognise it in P&L only if and when the shares are resold The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 20: SME A issued 100 shares 50 per share and later repurchased those shares for 45 each. Which of the following is true? a. SME A’s equity will increase as a result of the share repurchase b. SME A’s equity will decrease as a result of the share repurchase c. SME A recognises a 500 gain in P&L in Sept 20 X 4 d. SME A defers the 500 gain and recognise it in P&L only if and when the shares are resold The Arab Society of Certified Accountants (ASCA)

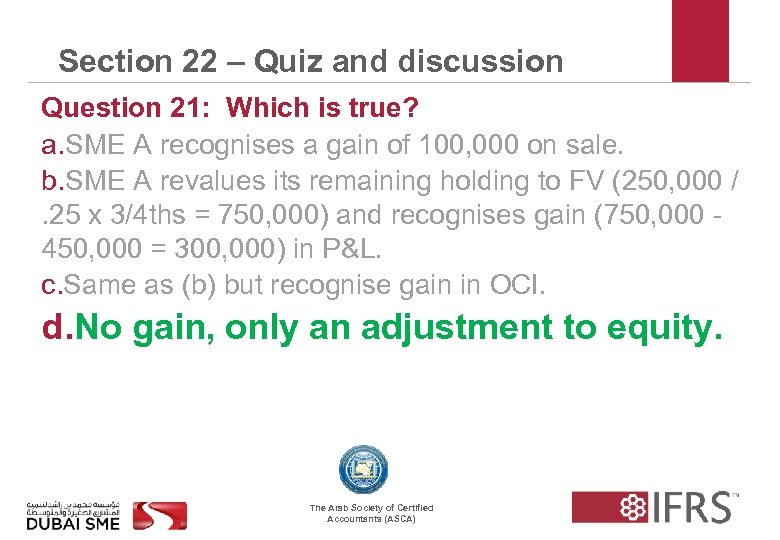

Section 22 – Quiz and discussion Question 21: In 20 X 6 SME A bought 80% of shares of X for 600, 000. Prepared consolidated F/S for 20 X 6, X 7, and X 8. A sold 1/4 th of its holding in X in 20 X 9 for 250, 000 (so now owns 60%). Which is true? a. SME A recognises a gain of 100, 000 on sale. b. SME A revalues its remaining holding to FV (250, 000 /. 25 x 3/4 ths = 750, 000) and recognises gain (750, 000 - 450, 000 = 300, 000) in P&L. c. Same as (b) but recognise gain in OCI. d. No gain, only an adjustment to equity. The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 21: In 20 X 6 SME A bought 80% of shares of X for 600, 000. Prepared consolidated F/S for 20 X 6, X 7, and X 8. A sold 1/4 th of its holding in X in 20 X 9 for 250, 000 (so now owns 60%). Which is true? a. SME A recognises a gain of 100, 000 on sale. b. SME A revalues its remaining holding to FV (250, 000 /. 25 x 3/4 ths = 750, 000) and recognises gain (750, 000 - 450, 000 = 300, 000) in P&L. c. Same as (b) but recognise gain in OCI. d. No gain, only an adjustment to equity. The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 21: Which is true? a. SME A recognises a gain of 100, 000 on sale. b. SME A revalues its remaining holding to FV (250, 000 / . 25 x 3/4 ths = 750, 000) and recognises gain (750, 000 - 450, 000 = 300, 000) in P&L. c. Same as (b) but recognise gain in OCI. d. No gain, only an adjustment to equity. The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 21: Which is true? a. SME A recognises a gain of 100, 000 on sale. b. SME A revalues its remaining holding to FV (250, 000 / . 25 x 3/4 ths = 750, 000) and recognises gain (750, 000 - 450, 000 = 300, 000) in P&L. c. Same as (b) but recognise gain in OCI. d. No gain, only an adjustment to equity. The Arab Society of Certified Accountants (ASCA)

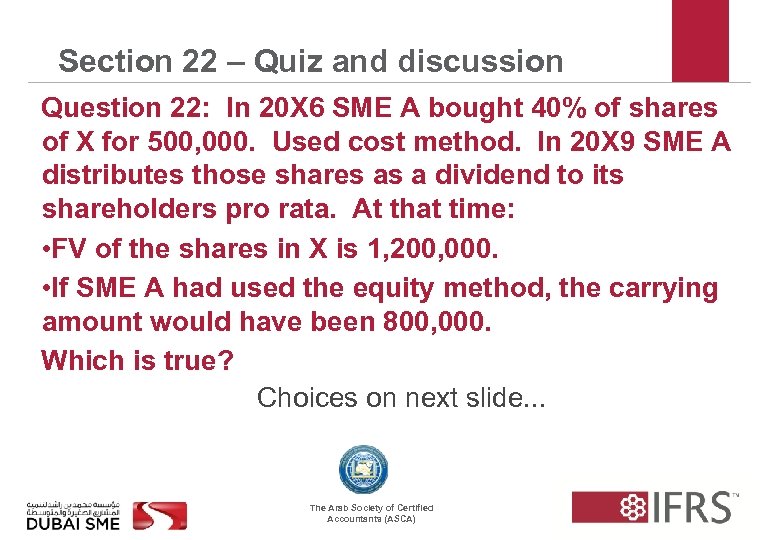

Section 22 – Quiz and discussion Question 22: In 20 X 6 SME A bought 40% of shares of X for 500, 000. Used cost method. In 20 X 9 SME A distributes those shares as a dividend to its shareholders pro rata. At that time: • FV of the shares in X is 1, 200, 000. • If SME A had used the equity method, the carrying amount would have been 800, 000. Which is true? Choices on next slide. . . The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 22: In 20 X 6 SME A bought 40% of shares of X for 500, 000. Used cost method. In 20 X 9 SME A distributes those shares as a dividend to its shareholders pro rata. At that time: • FV of the shares in X is 1, 200, 000. • If SME A had used the equity method, the carrying amount would have been 800, 000. Which is true? Choices on next slide. . . The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 22: Answer choices. . . a. SME A recognises a gain of 300, 000 on the distribution. b. SME A recognises a gain of 700, 000 on the distribution. c. SME A recognises a gain of 280, 000 on the distribution. d. The distribution is an equity transaction with shareholders and no gain or loss is recognised. The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 22: Answer choices. . . a. SME A recognises a gain of 300, 000 on the distribution. b. SME A recognises a gain of 700, 000 on the distribution. c. SME A recognises a gain of 280, 000 on the distribution. d. The distribution is an equity transaction with shareholders and no gain or loss is recognised. The Arab Society of Certified Accountants (ASCA)

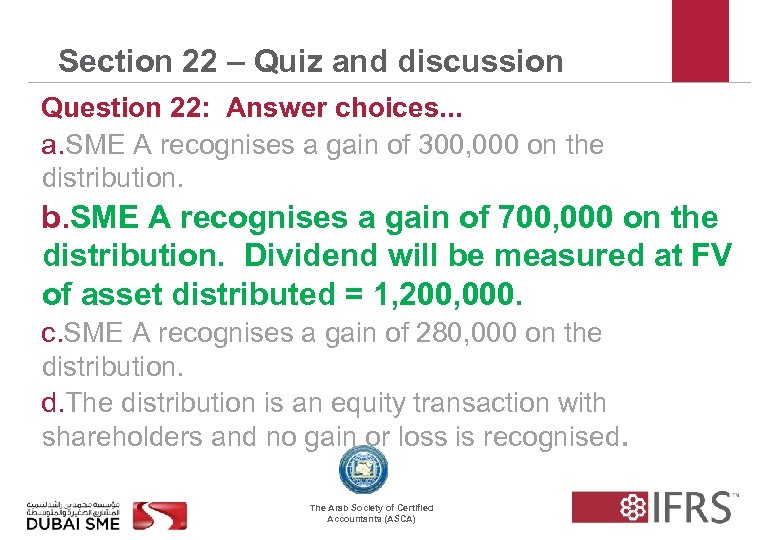

Section 22 – Quiz and discussion Question 22: Answer choices. . . a. SME A recognises a gain of 300, 000 on the distribution. b. SME A recognises a gain of 700, 000 on the distribution. Dividend will be measured at FV of asset distributed = 1, 200, 000. c. SME A recognises a gain of 280, 000 on the distribution. d. The distribution is an equity transaction with shareholders and no gain or loss is recognised. The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 22: Answer choices. . . a. SME A recognises a gain of 300, 000 on the distribution. b. SME A recognises a gain of 700, 000 on the distribution. Dividend will be measured at FV of asset distributed = 1, 200, 000. c. SME A recognises a gain of 280, 000 on the distribution. d. The distribution is an equity transaction with shareholders and no gain or loss is recognised. The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 23: 1/1/X 1 SME A issues at par a 5% tenyear convertible bond. Par and maturity amount = 100, 000. If no conversion feature, SME A would have paid 12%. Which is true? a. The bond liability at 31/12/X 1 shown in the balance sheet will be 100, 000 b. The bond liability at 31/12/X 1 shown in the balance sheet will be greater than 100, 000 c. Interest expense for X 1 will be greater than 5, 000 d. Interest expense for X 1 will be less than 5, 000 e. Interest expense for X 1 will be exactly 5, 000 The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 23: 1/1/X 1 SME A issues at par a 5% tenyear convertible bond. Par and maturity amount = 100, 000. If no conversion feature, SME A would have paid 12%. Which is true? a. The bond liability at 31/12/X 1 shown in the balance sheet will be 100, 000 b. The bond liability at 31/12/X 1 shown in the balance sheet will be greater than 100, 000 c. Interest expense for X 1 will be greater than 5, 000 d. Interest expense for X 1 will be less than 5, 000 e. Interest expense for X 1 will be exactly 5, 000 The Arab Society of Certified Accountants (ASCA)

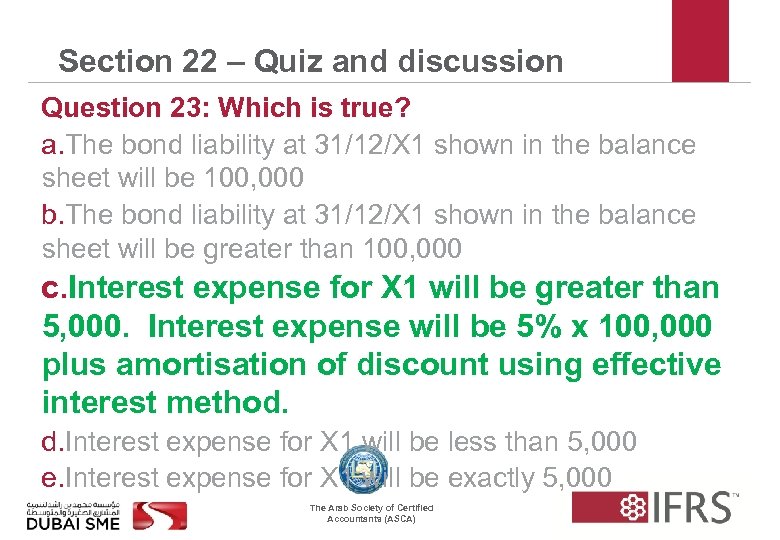

Section 22 – Quiz and discussion Question 23: Which is true? a. The bond liability at 31/12/X 1 shown in the balance sheet will be 100, 000 b. The bond liability at 31/12/X 1 shown in the balance sheet will be greater than 100, 000 c. Interest expense for X 1 will be greater than 5, 000. Interest expense will be 5% x 100, 000 plus amortisation of discount using effective interest method. d. Interest expense for X 1 will be less than 5, 000 e. Interest expense for X 1 will be exactly 5, 000 The Arab Society of Certified Accountants (ASCA)

Section 22 – Quiz and discussion Question 23: Which is true? a. The bond liability at 31/12/X 1 shown in the balance sheet will be 100, 000 b. The bond liability at 31/12/X 1 shown in the balance sheet will be greater than 100, 000 c. Interest expense for X 1 will be greater than 5, 000. Interest expense will be 5% x 100, 000 plus amortisation of discount using effective interest method. d. Interest expense for X 1 will be less than 5, 000 e. Interest expense for X 1 will be exactly 5, 000 The Arab Society of Certified Accountants (ASCA)