Int Fin Mark 1,2.pptx

- Количество слайдов: 68

International Financial Markets and Investments MARINA PUCHKOVA Ph. D, Saint-Petersburg State University of Economics, Lecturer Assistant, Corporate Finance and Business Evaluation Department

International Financial Markets and Investments MARINA PUCHKOVA Ph. D, Saint-Petersburg State University of Economics, Lecturer Assistant, Corporate Finance and Business Evaluation Department

Objectives of the course TO GIVE AN OVERVIEW OF THE MAJOR COMPONENTS (INSTRUMENTS AND TECHNIQUES, ACTORS, FINANCIAL CENTERS) OF THE INTERNATIONAL FINANCIAL SYSTEM NOT TO DISCUSS THE TECHNICAL DETAILS OF THE VARIOUS FINANCIAL INSTRUMENTS BUT TO FOCUS ON THE WAY THEY ARE USED TO FINANCE INTERNATIONAL ECONOMIC ACTIVITY TO PRECISELY ASSESS THE RISKS ASSOCIATED WITH THE TECHNIQUES AND THE WAY THEY ARE MANAGED, REPACKAGED AND TRANSFERRED ACROSS THE ECONOMIC SYSTEM TO PROVIDE SOME INSIGHTS ON THE UNDERLYING CAUSES OF THE RECENT FINANCIAL CRISES, ESPECIALLY THE 2008 ONE Puchkova Marina 12. 05. 14 2

Objectives of the course TO GIVE AN OVERVIEW OF THE MAJOR COMPONENTS (INSTRUMENTS AND TECHNIQUES, ACTORS, FINANCIAL CENTERS) OF THE INTERNATIONAL FINANCIAL SYSTEM NOT TO DISCUSS THE TECHNICAL DETAILS OF THE VARIOUS FINANCIAL INSTRUMENTS BUT TO FOCUS ON THE WAY THEY ARE USED TO FINANCE INTERNATIONAL ECONOMIC ACTIVITY TO PRECISELY ASSESS THE RISKS ASSOCIATED WITH THE TECHNIQUES AND THE WAY THEY ARE MANAGED, REPACKAGED AND TRANSFERRED ACROSS THE ECONOMIC SYSTEM TO PROVIDE SOME INSIGHTS ON THE UNDERLYING CAUSES OF THE RECENT FINANCIAL CRISES, ESPECIALLY THE 2008 ONE Puchkova Marina 12. 05. 14 2

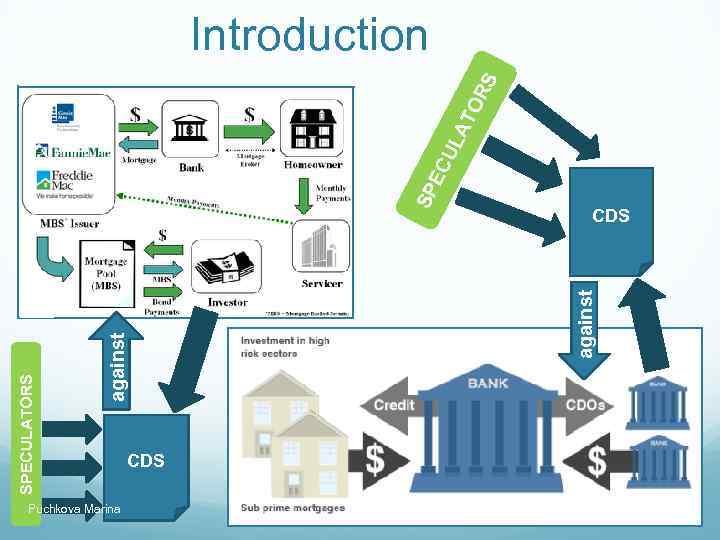

Puchkova Marina CDS against SPECULATORS SP EC UL AT OR S Introduction CDS 12. 05. 14 3

Puchkova Marina CDS against SPECULATORS SP EC UL AT OR S Introduction CDS 12. 05. 14 3

Content of the course Financial markets and intermediaries Financial crises and financial regulation Interest rates and risks Stock market International finance and monetary policy Puchkova Marina 12. 05. 14 4

Content of the course Financial markets and intermediaries Financial crises and financial regulation Interest rates and risks Stock market International finance and monetary policy Puchkova Marina 12. 05. 14 4

Preview Financial markets – markets, in which funds are transferred from people who have an excess of available fund to people who have a shortage. Security (also called a financial instrument) is a claim on the issuer’s future income or asset (any financial claim or piece of property that is the subject to ownership. Bond is a debt security that promises to make payments periodically for a specified period of time. Interest rate is the cost of borrowing or the price paid for the rental of funds. Puchkova Marina 12. 05. 14 5

Preview Financial markets – markets, in which funds are transferred from people who have an excess of available fund to people who have a shortage. Security (also called a financial instrument) is a claim on the issuer’s future income or asset (any financial claim or piece of property that is the subject to ownership. Bond is a debt security that promises to make payments periodically for a specified period of time. Interest rate is the cost of borrowing or the price paid for the rental of funds. Puchkova Marina 12. 05. 14 5

Common stock represents a share of ownership in a corporation; is the claim on the earnings and assets of the corporation. Financial intermediaries are institutions that borrow funds from people who saved and turn make loans to others. Financial crises – major disruptions in financial markets that are characterized by sharp declines in asset prices and the failures of many financial and nonfinancial firms. Banks are financial institutions that accept deposits and make loans. Financial innovation is the development of new financial products and services. Puchkova Marina 12. 05. 14 6

Common stock represents a share of ownership in a corporation; is the claim on the earnings and assets of the corporation. Financial intermediaries are institutions that borrow funds from people who saved and turn make loans to others. Financial crises – major disruptions in financial markets that are characterized by sharp declines in asset prices and the failures of many financial and nonfinancial firms. Banks are financial institutions that accept deposits and make loans. Financial innovation is the development of new financial products and services. Puchkova Marina 12. 05. 14 6

Chapter I FINANCIAL MARKETS AND INTERMEDIARIES: THEORETICAL BACKGROUND Puchkova Marina 12. 05. 14 7

Chapter I FINANCIAL MARKETS AND INTERMEDIARIES: THEORETICAL BACKGROUND Puchkova Marina 12. 05. 14 7

Function of financial markets FINANCING THE ECONOMY REQUIRES FIRST TO ATTRACT EXCESS SAVINGS FROM SOME ECONOMIC UNITS AND THEN TO CHANNEL AND ALLOCATE IT TO OTHER ECONOMIC UNITS WHICH ARE SHORT OF FINANCIAL RESOURCES TO FUND THEIR INVESTMENT PROJECTS THIS IS ACHIEVED THROUGH BOTH MARKETS OF FINANCIAL ASSETS AND FINANCIAL INTERMEDIARIES Puchkova Marina 12. 05. 14 8

Function of financial markets FINANCING THE ECONOMY REQUIRES FIRST TO ATTRACT EXCESS SAVINGS FROM SOME ECONOMIC UNITS AND THEN TO CHANNEL AND ALLOCATE IT TO OTHER ECONOMIC UNITS WHICH ARE SHORT OF FINANCIAL RESOURCES TO FUND THEIR INVESTMENT PROJECTS THIS IS ACHIEVED THROUGH BOTH MARKETS OF FINANCIAL ASSETS AND FINANCIAL INTERMEDIARIES Puchkova Marina 12. 05. 14 8

BUT FINANCING OF THE ECONOMY DOES NOT ALWAYS INVOLVE TO CREATE MONEY CREATION OCCURS ONLY AS AN OUTCOME (JOINT PRODUCT) WHEN THIS FINANCING IS PROVIDED BY COMMERCIAL BANKS THROUGH LOANS THE TWO WAYS OF FINANCING THE ECONOMY: DIRECT AND INDIRECT FINANCE Puchkova Marina 12. 05. 14 9

BUT FINANCING OF THE ECONOMY DOES NOT ALWAYS INVOLVE TO CREATE MONEY CREATION OCCURS ONLY AS AN OUTCOME (JOINT PRODUCT) WHEN THIS FINANCING IS PROVIDED BY COMMERCIAL BANKS THROUGH LOANS THE TWO WAYS OF FINANCING THE ECONOMY: DIRECT AND INDIRECT FINANCE Puchkova Marina 12. 05. 14 9

AMERICAN ECONOMISTS J. G. GURLEY AND E. S. SHAW EXPLAINED IN 1960 IN THEIR BOOK MONEY IN A THEORY OF FINANCE THAT: - AN ECONOMY NEEDS AN EFFICIENT AND STABLE FINANCIAL SYSTEM TO SUPPORT ITS ECONOMIC GROWTH - THE FINANCIAL SYSTEM ALWAYS RELIES UPON TWO COMPONENTS : * DIRECT FINANCE WHICH IS RELATED TO MARKETS OF FINANCIAL ASSETS * INDIRECT FINANCE WHICH IS PROVIDED THROUGH FINANCIAL INTERMEDIARIES, MAINLY LIKE COMMERCIAL BANKS Puchkova Marina 12. 05. 14 10

AMERICAN ECONOMISTS J. G. GURLEY AND E. S. SHAW EXPLAINED IN 1960 IN THEIR BOOK MONEY IN A THEORY OF FINANCE THAT: - AN ECONOMY NEEDS AN EFFICIENT AND STABLE FINANCIAL SYSTEM TO SUPPORT ITS ECONOMIC GROWTH - THE FINANCIAL SYSTEM ALWAYS RELIES UPON TWO COMPONENTS : * DIRECT FINANCE WHICH IS RELATED TO MARKETS OF FINANCIAL ASSETS * INDIRECT FINANCE WHICH IS PROVIDED THROUGH FINANCIAL INTERMEDIARIES, MAINLY LIKE COMMERCIAL BANKS Puchkova Marina 12. 05. 14 10

FOR THE LARGER BORROWERS, THESE TWO CHANNELS ARE BOTH COMPLEMENTARY AND SUBSTITUTES AT THE SAME TIME THESE BORROWERS INDEED TAP SIMULTANEOUSLY BOTH SOURCES OF FINANCE SO AS TO DIVERSIFY AND SPREAD THEIR RISKS OF FUNDING THEY MAY ALSO SWITCH MARGINALLY FROM ONE SOURCE TO THE OTHER AS A WAY TO TAKE THE BENEFITS OF CHANGES IN THE RESPECTIVE COSTS OF THESE TWO FUNDING SOURCES Puchkova Marina 12. 05. 14 11

FOR THE LARGER BORROWERS, THESE TWO CHANNELS ARE BOTH COMPLEMENTARY AND SUBSTITUTES AT THE SAME TIME THESE BORROWERS INDEED TAP SIMULTANEOUSLY BOTH SOURCES OF FINANCE SO AS TO DIVERSIFY AND SPREAD THEIR RISKS OF FUNDING THEY MAY ALSO SWITCH MARGINALLY FROM ONE SOURCE TO THE OTHER AS A WAY TO TAKE THE BENEFITS OF CHANGES IN THE RESPECTIVE COSTS OF THESE TWO FUNDING SOURCES Puchkova Marina 12. 05. 14 11

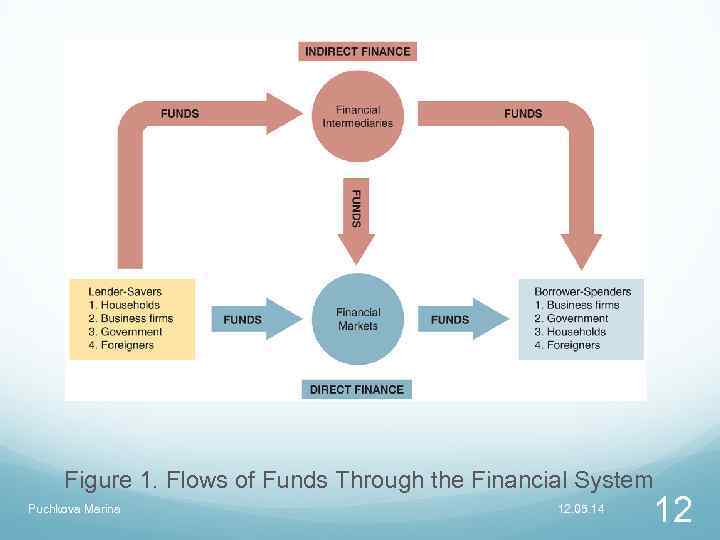

Figure 1. Flows of Funds Through the Financial System Puchkova Marina 12. 05. 14 12

Figure 1. Flows of Funds Through the Financial System Puchkova Marina 12. 05. 14 12

Structure of Financial Markets Debt and Equity Markets Debt instruments *maturity – the number of years until that instrument’s expiration date Equities (dividends) Primary and Secondary Markets Investment Banks underwrite securities in primary markets Brokers and dealers work in secondary markets Puchkova Marina 12. 05. 14 13

Structure of Financial Markets Debt and Equity Markets Debt instruments *maturity – the number of years until that instrument’s expiration date Equities (dividends) Primary and Secondary Markets Investment Banks underwrite securities in primary markets Brokers and dealers work in secondary markets Puchkova Marina 12. 05. 14 13

Exchanges and Over-the-Counter (OTC) Markets Exchanges: NYSE, Chicago Board of Trade OTC Markets: Foreign exchange, Federal funds Money and Capital Markets Money markets deal in short-term debt instruments Capital markets deal in longer-term debt and equity instruments Puchkova Marina 12. 05. 14 14

Exchanges and Over-the-Counter (OTC) Markets Exchanges: NYSE, Chicago Board of Trade OTC Markets: Foreign exchange, Federal funds Money and Capital Markets Money markets deal in short-term debt instruments Capital markets deal in longer-term debt and equity instruments Puchkova Marina 12. 05. 14 14

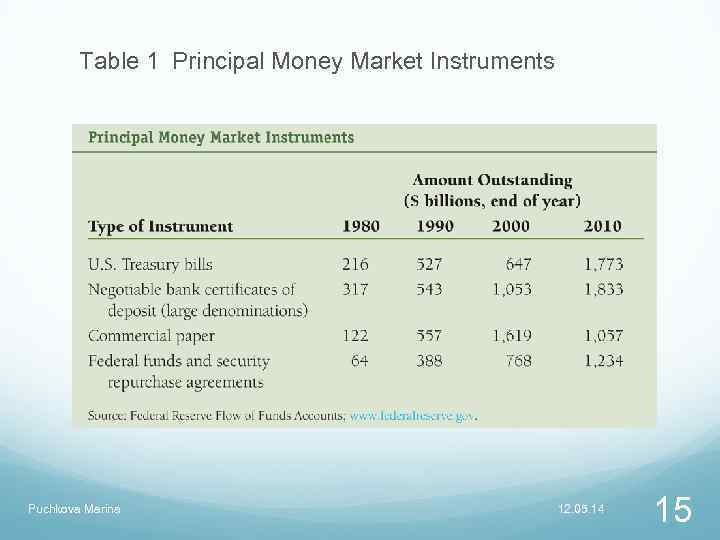

Table 1 Principal Money Market Instruments Puchkova Marina 12. 05. 14 15

Table 1 Principal Money Market Instruments Puchkova Marina 12. 05. 14 15

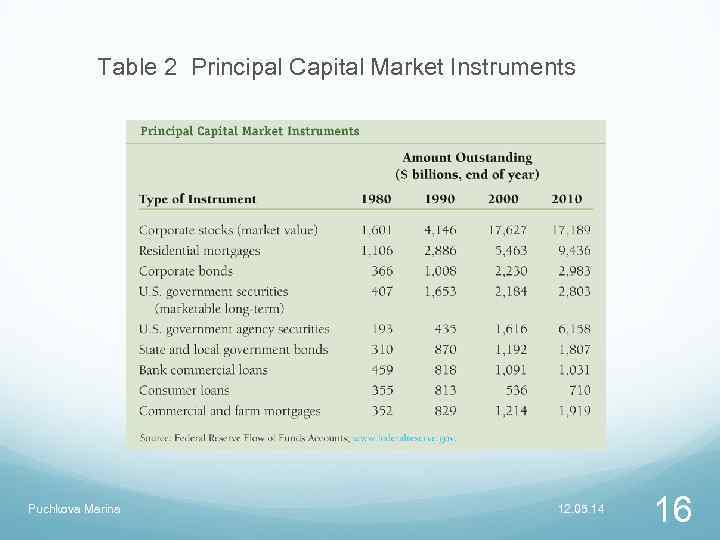

Table 2 Principal Capital Market Instruments Puchkova Marina 12. 05. 14 16

Table 2 Principal Capital Market Instruments Puchkova Marina 12. 05. 14 16

Function of Financial Intermediaries: Indirect Finance Lower transaction costs (time and money spent in carrying out financial transactions) Economies of scale Liquidity services Reduce the exposure of investors to risk Risk Sharing (Asset Transformation) Diversification Puchkova Marina 12. 05. 14 17

Function of Financial Intermediaries: Indirect Finance Lower transaction costs (time and money spent in carrying out financial transactions) Economies of scale Liquidity services Reduce the exposure of investors to risk Risk Sharing (Asset Transformation) Diversification Puchkova Marina 12. 05. 14 17

FINANCIAL INTERMEDIARIES EXIST BECAUSE THEY DEAL MORE EFFICIENTLY THAN MARKETS OF FINANCIAL ASSETS WITH - IMPERFECT AND ASYMETRIC INFORMATION BETWEEN BORROWERS AND LENDERS Puchkova Marina 12. 05. 14 18

FINANCIAL INTERMEDIARIES EXIST BECAUSE THEY DEAL MORE EFFICIENTLY THAN MARKETS OF FINANCIAL ASSETS WITH - IMPERFECT AND ASYMETRIC INFORMATION BETWEEN BORROWERS AND LENDERS Puchkova Marina 12. 05. 14 18

• Deal with asymmetric information problems (before the transaction) Adverse Selection: try to avoid selecting the risky borrower. Gather information about potential borrower. (after the transaction) Moral Hazard: ensure borrower will not engage in activities that will prevent him/her to repay the loan. Sign a contract with restrictive covenants. Puchkova Marina 12. 05. 14 19

• Deal with asymmetric information problems (before the transaction) Adverse Selection: try to avoid selecting the risky borrower. Gather information about potential borrower. (after the transaction) Moral Hazard: ensure borrower will not engage in activities that will prevent him/her to repay the loan. Sign a contract with restrictive covenants. Puchkova Marina 12. 05. 14 19

Regulation of the Financial System The government regulates financial markets and financial intermediaries for 2 main reasons: To increase the information available to investors: Reduce adverse selection and moral hazard problems Reduce insider trading (SEC). To insure the soundness of financial intermediaries Reduce possibility of appearance of financial panic Puchkova Marina 12. 05. 14 20

Regulation of the Financial System The government regulates financial markets and financial intermediaries for 2 main reasons: To increase the information available to investors: Reduce adverse selection and moral hazard problems Reduce insider trading (SEC). To insure the soundness of financial intermediaries Reduce possibility of appearance of financial panic Puchkova Marina 12. 05. 14 20

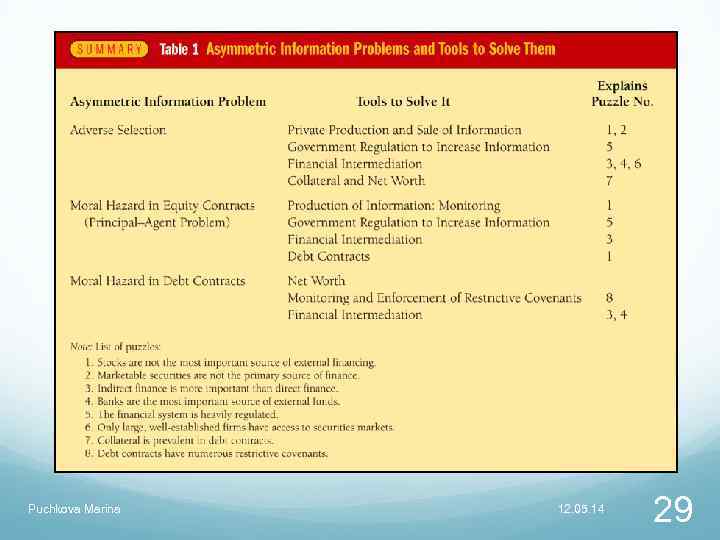

Puzzles of Financial Structure 1. Stocks are not most important source of external finance for businesses 2. Issuing marketable securities not primary funding source for businesses 3. Indirect finance (financial intermediation) is far more important than direct finance 4. Banks are most important source of external finance Puchkova Marina 12. 05. 14 21

Puzzles of Financial Structure 1. Stocks are not most important source of external finance for businesses 2. Issuing marketable securities not primary funding source for businesses 3. Indirect finance (financial intermediation) is far more important than direct finance 4. Banks are most important source of external finance Puchkova Marina 12. 05. 14 21

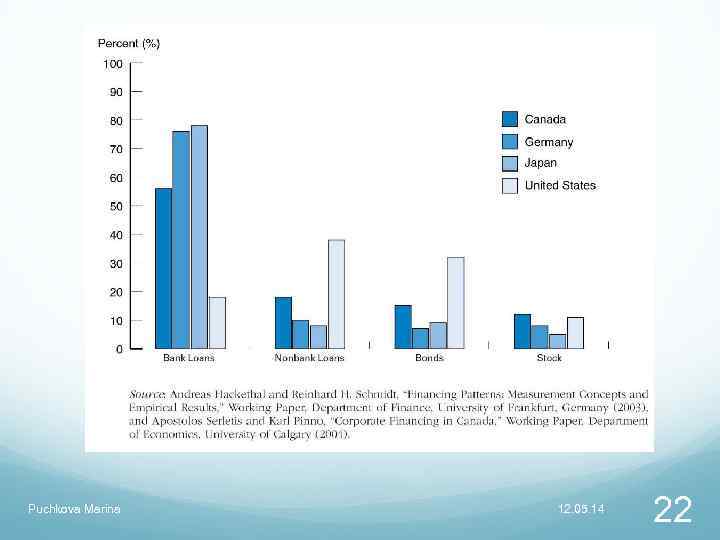

Puchkova Marina 12. 05. 14 22

Puchkova Marina 12. 05. 14 22

Puzzles of Financial Structure 5. Financial system is among most heavily regulated sectors of economy 6. Only large, well established firms have access to securities markets 7. Collateral is prevalent feature of debt contracts 8. Debt contracts are typically extremely complicated legal documents with restrictive covenants Puchkova Marina 12. 05. 14 23

Puzzles of Financial Structure 5. Financial system is among most heavily regulated sectors of economy 6. Only large, well established firms have access to securities markets 7. Collateral is prevalent feature of debt contracts 8. Debt contracts are typically extremely complicated legal documents with restrictive covenants Puchkova Marina 12. 05. 14 23

Adverse Selection and Moral Hazard Adverse Selection: 1. Before transaction occurs 2. Potential borrowers most likely to produce adverse outcomes are ones most likely to seek loans and be selected Moral Hazard: 1. After transaction occurs 2. Hazard that borrower has incentives to engage in undesirable (immoral) activities making it more likely that won’t pay loan back Puchkova Marina 12. 05. 14 24

Adverse Selection and Moral Hazard Adverse Selection: 1. Before transaction occurs 2. Potential borrowers most likely to produce adverse outcomes are ones most likely to seek loans and be selected Moral Hazard: 1. After transaction occurs 2. Hazard that borrower has incentives to engage in undesirable (immoral) activities making it more likely that won’t pay loan back Puchkova Marina 12. 05. 14 24

Adverse Selection and Financial Structure Lemons Problem in Securities Markets 1. If can’t distinguish between good and bad securities, willing to pay only average of good and bad securities’ values. 2. Result: Good securities undervalued and firms won’t issue them; bad securities overvalued, so too many issued. 3. Investors won’t want to buy bad securities, so market won’t function well. Explains Puzzle 2 and Puzzle 1. Also explains Puzzle 6: Less asymmetric information for well known firms, so smaller lemons problem Puchkova Marina 12. 05. 14 25

Adverse Selection and Financial Structure Lemons Problem in Securities Markets 1. If can’t distinguish between good and bad securities, willing to pay only average of good and bad securities’ values. 2. Result: Good securities undervalued and firms won’t issue them; bad securities overvalued, so too many issued. 3. Investors won’t want to buy bad securities, so market won’t function well. Explains Puzzle 2 and Puzzle 1. Also explains Puzzle 6: Less asymmetric information for well known firms, so smaller lemons problem Puchkova Marina 12. 05. 14 25

Tools to Help Solve Adverse Selection (Lemons) Problem 1. Private Production and Sale of Information Free-rider problem interferes with this solution 2. Government Regulation to Increase Information Explains Puzzle 5 3. Financial Intermediation A. Analogy to solution to lemons problem provided by used-car dealers B. Avoid free-rider problem by making private loans Explains Puzzles 3 and 4 4. Collateral and Net Worth Explains Puzzle 7 Puchkova Marina 12. 05. 14 26

Tools to Help Solve Adverse Selection (Lemons) Problem 1. Private Production and Sale of Information Free-rider problem interferes with this solution 2. Government Regulation to Increase Information Explains Puzzle 5 3. Financial Intermediation A. Analogy to solution to lemons problem provided by used-car dealers B. Avoid free-rider problem by making private loans Explains Puzzles 3 and 4 4. Collateral and Net Worth Explains Puzzle 7 Puchkova Marina 12. 05. 14 26

Moral Hazard: Debt versus Equity Moral Hazard in Equity: Principal-Agent Problem 1. Result of separation of ownership by stockholders (principals) from control by managers (agents) 2. Managers act in own rather than stockholders’ interest Tools to Help Solve the Principal-Agent Problem 1. Monitoring: production of information 2. Government regulation to increase information 3. Financial intermediation 4. Debt contracts Explains Puzzle 1: Why debt used more than equity Puchkova Marina 12. 05. 14 27

Moral Hazard: Debt versus Equity Moral Hazard in Equity: Principal-Agent Problem 1. Result of separation of ownership by stockholders (principals) from control by managers (agents) 2. Managers act in own rather than stockholders’ interest Tools to Help Solve the Principal-Agent Problem 1. Monitoring: production of information 2. Government regulation to increase information 3. Financial intermediation 4. Debt contracts Explains Puzzle 1: Why debt used more than equity Puchkova Marina 12. 05. 14 27

Moral Hazard and Debt Markets Moral hazard: borrower wants to take on too much risk Tools to Help Solve Moral Hazard 1. Net worth 2. Monitoring and enforcement of restrictive covenants 3. Financial intermediation Banks and other intermediaries have special advantages in monitoring Explains Puzzles 1– 4. Puchkova Marina 12. 05. 14 28

Moral Hazard and Debt Markets Moral hazard: borrower wants to take on too much risk Tools to Help Solve Moral Hazard 1. Net worth 2. Monitoring and enforcement of restrictive covenants 3. Financial intermediation Banks and other intermediaries have special advantages in monitoring Explains Puzzles 1– 4. Puchkova Marina 12. 05. 14 28

Puchkova Marina 12. 05. 14 29

Puchkova Marina 12. 05. 14 29

Conflict of interests Type of moral hazard problem caused by economies of scope Arise when an institution has multiple objectives and, as a result, has conflicts between those objectives A reduction in the quality of information in financial markets increases asymmetric information problems Financial markets do not channel funds into productive investment opportunities The economy is not as efficient as it could be Puchkova Marina 12. 05. 14 30

Conflict of interests Type of moral hazard problem caused by economies of scope Arise when an institution has multiple objectives and, as a result, has conflicts between those objectives A reduction in the quality of information in financial markets increases asymmetric information problems Financial markets do not channel funds into productive investment opportunities The economy is not as efficient as it could be Puchkova Marina 12. 05. 14 30

Why Do Conflicts of Interest Arise? Underwriting and Research in Investment Banking Information produced by researching companies is used to underwrite the securities. The bank is attempting to simultaneously serve two client groups whose information needs differ. Spinning occurs when an investment bank allocates hot, but underpriced, IPOs to executives of other companies in return for their companies’ future business Puchkova Marina 12. 05. 14 31

Why Do Conflicts of Interest Arise? Underwriting and Research in Investment Banking Information produced by researching companies is used to underwrite the securities. The bank is attempting to simultaneously serve two client groups whose information needs differ. Spinning occurs when an investment bank allocates hot, but underpriced, IPOs to executives of other companies in return for their companies’ future business Puchkova Marina 12. 05. 14 31

Auditing and Consulting in Accounting Firms Auditors may be willing to skew their judgments and opinions to win consulting business Auditors may be auditing information systems or tax and financial plans put in place by their nonaudit counterparts Auditors may provide an overly favorable audit to solicit or retain audit business Puchkova Marina 12. 05. 14 32

Auditing and Consulting in Accounting Firms Auditors may be willing to skew their judgments and opinions to win consulting business Auditors may be auditing information systems or tax and financial plans put in place by their nonaudit counterparts Auditors may provide an overly favorable audit to solicit or retain audit business Puchkova Marina 12. 05. 14 32

Conflicts of Interest: Remedies Sarbanes-Oxley Act of 2002 (Public Accounting Return and Investor Protection Act) Increases supervisory oversight to monitor and prevent conflicts of interest Establishes a Public Company Accounting Oversight Board Increases the SEC’s budget Makes it illegal for a registered public accounting firm to provide any nonaudit service to a client contemporaneously with an impermissible audit Puchkova Marina 12. 05. 14 33

Conflicts of Interest: Remedies Sarbanes-Oxley Act of 2002 (Public Accounting Return and Investor Protection Act) Increases supervisory oversight to monitor and prevent conflicts of interest Establishes a Public Company Accounting Oversight Board Increases the SEC’s budget Makes it illegal for a registered public accounting firm to provide any nonaudit service to a client contemporaneously with an impermissible audit Puchkova Marina 12. 05. 14 33

Sarbanes-Oxley Act of 2002 (cont’d) Beefs up criminal charges for white-collar crime and obstruction of official investigations Requires the CEO and CFO to certify that financial statements and disclosures are accurate Requires members of the audit committee to be independent Puchkova Marina 12. 05. 14 34

Sarbanes-Oxley Act of 2002 (cont’d) Beefs up criminal charges for white-collar crime and obstruction of official investigations Requires the CEO and CFO to certify that financial statements and disclosures are accurate Requires members of the audit committee to be independent Puchkova Marina 12. 05. 14 34

Global Legal Settlement of 2002 Requires investment banks to sever the link between research and securities underwriting Bans spinning Imposes $1. 4 billion in fines on accused investment banks Requires investment banks to make their analysts’ recommendations public Over a 5 -year period, investment banks are required to contract with at least 3 independent research firms that would provide research to their brokerage customers Puchkova Marina 12. 05. 14 35

Global Legal Settlement of 2002 Requires investment banks to sever the link between research and securities underwriting Bans spinning Imposes $1. 4 billion in fines on accused investment banks Requires investment banks to make their analysts’ recommendations public Over a 5 -year period, investment banks are required to contract with at least 3 independent research firms that would provide research to their brokerage customers Puchkova Marina 12. 05. 14 35

Financial Crises and Aggregate Economic Activity Crises can be caused by: Increases in interest rates Increases in uncertainty Asset market effects on balance sheets Stock market effects on net worth Unanticipated deflation Cash flow effects Problems in the banking sector Government fiscal imbalances Puchkova Marina 12. 05. 14 36

Financial Crises and Aggregate Economic Activity Crises can be caused by: Increases in interest rates Increases in uncertainty Asset market effects on balance sheets Stock market effects on net worth Unanticipated deflation Cash flow effects Problems in the banking sector Government fiscal imbalances Puchkova Marina 12. 05. 14 36

Chapter II FINANCIAL CRISES AND FINANCIAL REGULATION Puchkova Marina 12. 05. 14 37

Chapter II FINANCIAL CRISES AND FINANCIAL REGULATION Puchkova Marina 12. 05. 14 37

What is a Financial Crisis? A well-functioning financial system solves asymmetric information problem so that capital is allocated to its most productive users. A financial crisis occurs when there is a large disruption to information flows in financial markets Asymmetric information problem that act as a barrier to efficient allocation of capital are often described as financial frictions. A financial crisis is characterized by sharp decline in asset prices and firm failures. The result is that financial frictions increase and financial markets stop functioning Puchkova Marina 12. 05. 14 38

What is a Financial Crisis? A well-functioning financial system solves asymmetric information problem so that capital is allocated to its most productive users. A financial crisis occurs when there is a large disruption to information flows in financial markets Asymmetric information problem that act as a barrier to efficient allocation of capital are often described as financial frictions. A financial crisis is characterized by sharp decline in asset prices and firm failures. The result is that financial frictions increase and financial markets stop functioning Puchkova Marina 12. 05. 14 38

Asset Markets Effects on Balance Sheets Securities are assets for buyers but liabilities for sellers Stock market decline decreases net worth of corporations Unanticipated decline in the price level liabilities increase in real terms and net worth decreases Unanticipated decline in the value of the domestic currency (devaluation) increases debt denominated in foreign currencies and decreases net worth Puchkova Marina 12. 05. 14 39

Asset Markets Effects on Balance Sheets Securities are assets for buyers but liabilities for sellers Stock market decline decreases net worth of corporations Unanticipated decline in the price level liabilities increase in real terms and net worth decreases Unanticipated decline in the value of the domestic currency (devaluation) increases debt denominated in foreign currencies and decreases net worth Puchkova Marina 12. 05. 14 39

Dynamics of Financial Crisis in Advanced Economies Management of Financial Innovation/Liberalization, Credit boom, risky lending, deleveraging Asset Price Boom and Bust Credit book, Asset-price bubble, Asset-price bust, net worth decline, deleveraging Increase in Uncertainty During recession, high uncertainty, less lending and economic activities Puchkova Marina 12. 05. 14 40

Dynamics of Financial Crisis in Advanced Economies Management of Financial Innovation/Liberalization, Credit boom, risky lending, deleveraging Asset Price Boom and Bust Credit book, Asset-price bubble, Asset-price bust, net worth decline, deleveraging Increase in Uncertainty During recession, high uncertainty, less lending and economic activities Puchkova Marina 12. 05. 14 40

Factors Causing Financial Crises 1. Deterioration in Financial Institutions’ Balance Sheets fall in value of loans and decline in lending Specialists argue that negative shocks to real net worth can be caused by a variety of preceding shocks, as follows: Negative Stock Market Shock Negative Inflation Rate Shock Negative Exchange Rate Shock Positive Interest Rate Shock Puchkova Marina 12. 05. 14 41

Factors Causing Financial Crises 1. Deterioration in Financial Institutions’ Balance Sheets fall in value of loans and decline in lending Specialists argue that negative shocks to real net worth can be caused by a variety of preceding shocks, as follows: Negative Stock Market Shock Negative Inflation Rate Shock Negative Exchange Rate Shock Positive Interest Rate Shock Puchkova Marina 12. 05. 14 41

Factors Causing Financial Crises 2. Banking Crisis loss of information production and disintermediation Bankruptcy vs Insolvency firm is generally said to be bankrupt if it is no longer able to meet its legal obligations to its financial creditors a firm is insolvent if it has a negative net worth, meaning the present value of its liabilities exceeds the present value of its assets Puchkova Marina 12. 05. 14 42

Factors Causing Financial Crises 2. Banking Crisis loss of information production and disintermediation Bankruptcy vs Insolvency firm is generally said to be bankrupt if it is no longer able to meet its legal obligations to its financial creditors a firm is insolvent if it has a negative net worth, meaning the present value of its liabilities exceeds the present value of its assets Puchkova Marina 12. 05. 14 42

Factors Causing Financial Crises 3. Increases in Uncertainty decline in lending 4. Increases in Interest Rates increases adverse selection problem only high risk individuals are willing to pay high interest increases need for external funds and therefore adverse selection and moral hazard (lower cash flow) 5. Government Fiscal Imbalances create fears of default on government debt investors might pull their money out of the country Puchkova Marina 12. 05. 14 43

Factors Causing Financial Crises 3. Increases in Uncertainty decline in lending 4. Increases in Interest Rates increases adverse selection problem only high risk individuals are willing to pay high interest increases need for external funds and therefore adverse selection and moral hazard (lower cash flow) 5. Government Fiscal Imbalances create fears of default on government debt investors might pull their money out of the country Puchkova Marina 12. 05. 14 43

Dynamics of Financial Crises in Advanced Economies Stage One: Initiation of Financial Crisis mismanagement of financial liberalization/innovation asset price boom and bust spikes in interest rates and increase in uncertainty Stage Two: Banking Crisis Insolvency (net worth becomes negative) Bank panic (people fear that deposits are safe) Fire sales of assets (banks sell assets to rise funds) Stage Three: Debt Deflation - Sharp and un anticipated decline in price level Puchkova Marina 12. 05. 14 44

Dynamics of Financial Crises in Advanced Economies Stage One: Initiation of Financial Crisis mismanagement of financial liberalization/innovation asset price boom and bust spikes in interest rates and increase in uncertainty Stage Two: Banking Crisis Insolvency (net worth becomes negative) Bank panic (people fear that deposits are safe) Fire sales of assets (banks sell assets to rise funds) Stage Three: Debt Deflation - Sharp and un anticipated decline in price level Puchkova Marina 12. 05. 14 44

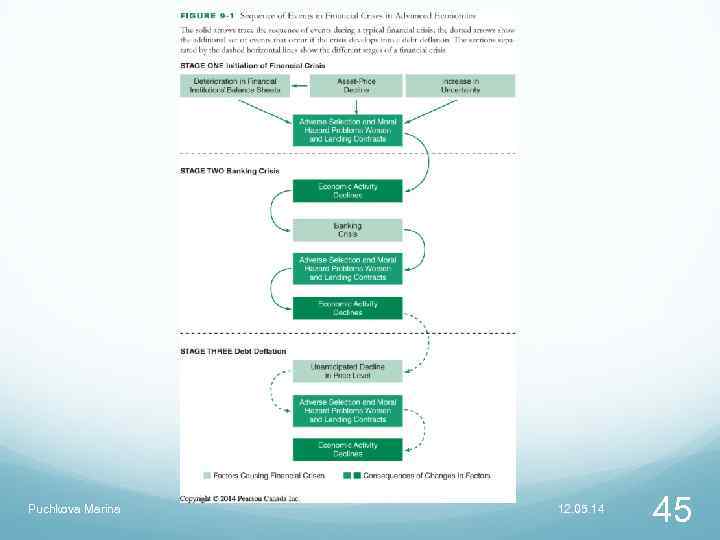

Puchkova Marina 12. 05. 14 45

Puchkova Marina 12. 05. 14 45

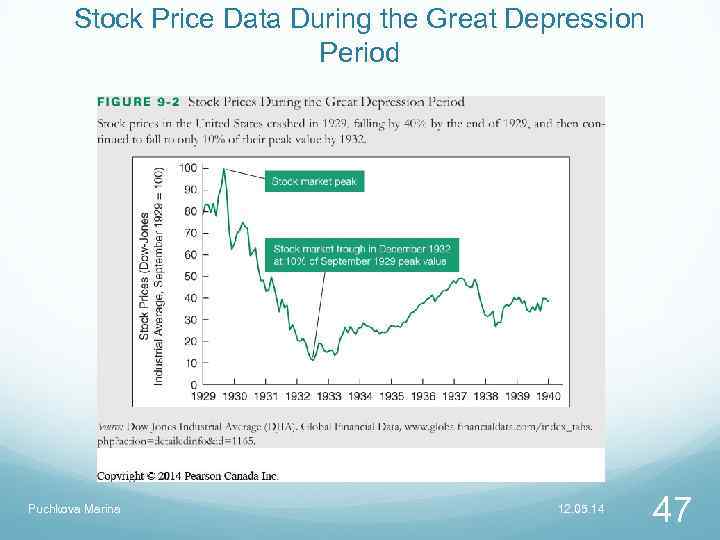

APPLICATION The Mother of All Financial Crises: The Great Depression How did a financial crisis unfold during the Great Depression and how it led to the worst economic downturn in U. S. history? This event was brought on by: Stock market crash Bank panics Continuing decline in stock prices Debt deflation Milton Friedman - The Great Depression Myth http: //www. youtube. com/watch? v=dgy. Qs. IGLt_w Puchkova Marina 12. 05. 14 46

APPLICATION The Mother of All Financial Crises: The Great Depression How did a financial crisis unfold during the Great Depression and how it led to the worst economic downturn in U. S. history? This event was brought on by: Stock market crash Bank panics Continuing decline in stock prices Debt deflation Milton Friedman - The Great Depression Myth http: //www. youtube. com/watch? v=dgy. Qs. IGLt_w Puchkova Marina 12. 05. 14 46

Stock Price Data During the Great Depression Period Puchkova Marina 12. 05. 14 47

Stock Price Data During the Great Depression Period Puchkova Marina 12. 05. 14 47

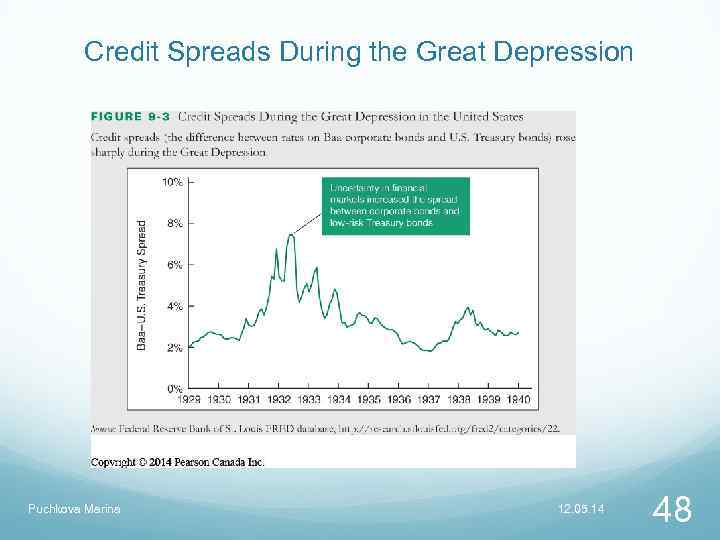

Credit Spreads During the Great Depression Puchkova Marina 12. 05. 14 48

Credit Spreads During the Great Depression Puchkova Marina 12. 05. 14 48

Application: The Global Financial Crisis of 2007 -2009 Causes: Before 2000 only the most credit-worthy borrowers could obtain residential mortgages Advances in IT (data mining) enabled quantitative evaluation of credit rick Financial innovations emerge in the mortgage markets Subprime mortgages Mortgage-backed securities (securitization) Collateralized debt obligations (CDOs): pay out income streams from a collection of underlying assets designed to have particular rick characteristics that appeal to investors with different preferences Housing price bubble forms increase in liquidity from cash flows surging to the United States Puchkova Marina 12. 05. 14 49

Application: The Global Financial Crisis of 2007 -2009 Causes: Before 2000 only the most credit-worthy borrowers could obtain residential mortgages Advances in IT (data mining) enabled quantitative evaluation of credit rick Financial innovations emerge in the mortgage markets Subprime mortgages Mortgage-backed securities (securitization) Collateralized debt obligations (CDOs): pay out income streams from a collection of underlying assets designed to have particular rick characteristics that appeal to investors with different preferences Housing price bubble forms increase in liquidity from cash flows surging to the United States Puchkova Marina 12. 05. 14 49

Collateralized Debt Obligations (CDOs) The creation of a collateralized debt obligation involves a corporate entity called a special purpose vehicle (SPV) SPV buys a collection of assets such as corporate bonds and loans, commercial real estate bonds, and mortgage-backed securities The SPV separates the payment streams (cash flows) from these assets into buckets that are referred to as tranches Puchkova Marina 12. 05. 14 50

Collateralized Debt Obligations (CDOs) The creation of a collateralized debt obligation involves a corporate entity called a special purpose vehicle (SPV) SPV buys a collection of assets such as corporate bonds and loans, commercial real estate bonds, and mortgage-backed securities The SPV separates the payment streams (cash flows) from these assets into buckets that are referred to as tranches Puchkova Marina 12. 05. 14 50

Collateralized Debt Obligations (CDOs) Highest rated tranches (super senior tranches) are paid off first and so have the least risk The lowest tranche of the CDO is the equity tranche the first set of cash flows that are not paid out if the underlying assets go into default and stop making payments this tranche has the highest risk and is often not traded Puchkova Marina 12. 05. 14 51

Collateralized Debt Obligations (CDOs) Highest rated tranches (super senior tranches) are paid off first and so have the least risk The lowest tranche of the CDO is the equity tranche the first set of cash flows that are not paid out if the underlying assets go into default and stop making payments this tranche has the highest risk and is often not traded Puchkova Marina 12. 05. 14 51

Blythe Sally Jess Masters current head of Global Commodities at J. P. Morgan Chase current board member and chair emeritus of the Securities Industry and Financial Markets Association from 2004 to 2007 - CFO of the Investment Bank, and since then served on the Investment Bank Operating Committee Invented Credit Default Swaps

Blythe Sally Jess Masters current head of Global Commodities at J. P. Morgan Chase current board member and chair emeritus of the Securities Industry and Financial Markets Association from 2004 to 2007 - CFO of the Investment Bank, and since then served on the Investment Bank Operating Committee Invented Credit Default Swaps

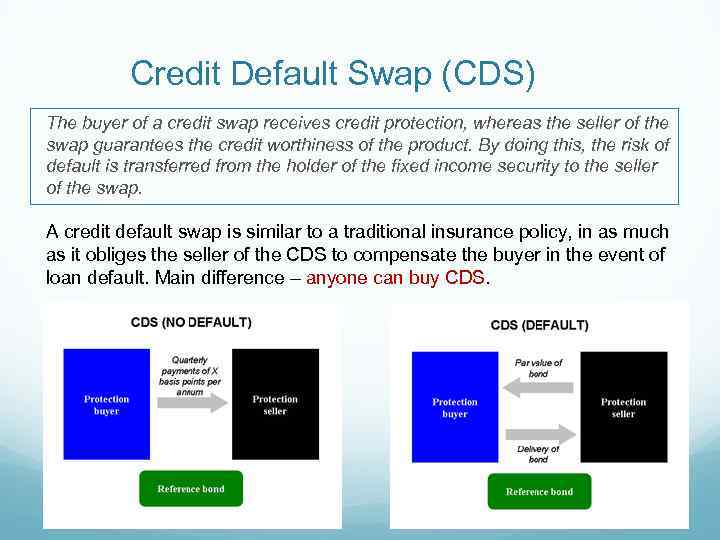

Credit Default Swap (CDS) The buyer of a credit swap receives credit protection, whereas the seller of the swap guarantees the credit worthiness of the product. By doing this, the risk of default is transferred from the holder of the fixed income security to the seller of the swap. A credit default swap is similar to a traditional insurance policy, in as much as it obliges the seller of the CDS to compensate the buyer in the event of loan default. Main difference – anyone can buy CDS.

Credit Default Swap (CDS) The buyer of a credit swap receives credit protection, whereas the seller of the swap guarantees the credit worthiness of the product. By doing this, the risk of default is transferred from the holder of the fixed income security to the seller of the swap. A credit default swap is similar to a traditional insurance policy, in as much as it obliges the seller of the CDS to compensate the buyer in the event of loan default. Main difference – anyone can buy CDS.

Application: The Global Financial Crisis of 2007 - 2009 Housing price bubble forms development of subprime mortgage market fueled housing demand housing prices Agency problems arise “originate to distribute” model is subject to principal (investor) agent (mortgage broker) problem borrowers had little incentive to disclose information about their ability to pay Puchkova Marina 12. 05. 14 54

Application: The Global Financial Crisis of 2007 - 2009 Housing price bubble forms development of subprime mortgage market fueled housing demand housing prices Agency problems arise “originate to distribute” model is subject to principal (investor) agent (mortgage broker) problem borrowers had little incentive to disclose information about their ability to pay Puchkova Marina 12. 05. 14 54

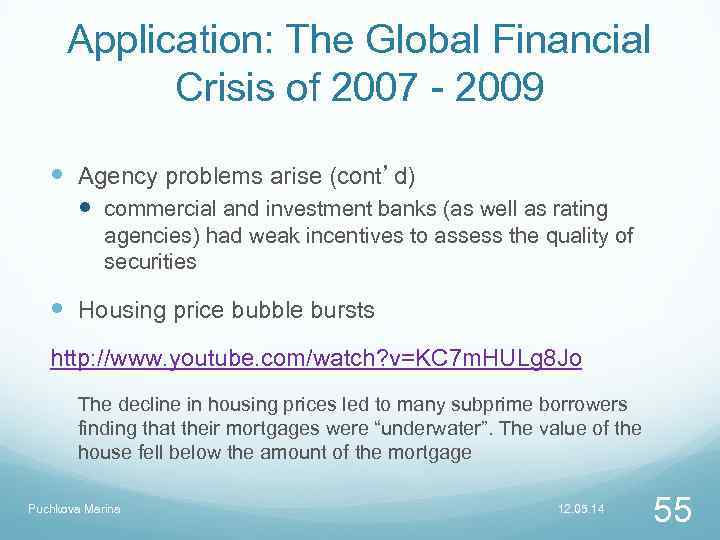

Application: The Global Financial Crisis of 2007 - 2009 Agency problems arise (cont’d) commercial and investment banks (as well as rating agencies) had weak incentives to assess the quality of securities Housing price bubble bursts http: //www. youtube. com/watch? v=KC 7 m. HULg 8 Jo The decline in housing prices led to many subprime borrowers finding that their mortgages were “underwater”. The value of the house fell below the amount of the mortgage Puchkova Marina 12. 05. 14 55

Application: The Global Financial Crisis of 2007 - 2009 Agency problems arise (cont’d) commercial and investment banks (as well as rating agencies) had weak incentives to assess the quality of securities Housing price bubble bursts http: //www. youtube. com/watch? v=KC 7 m. HULg 8 Jo The decline in housing prices led to many subprime borrowers finding that their mortgages were “underwater”. The value of the house fell below the amount of the mortgage Puchkova Marina 12. 05. 14 55

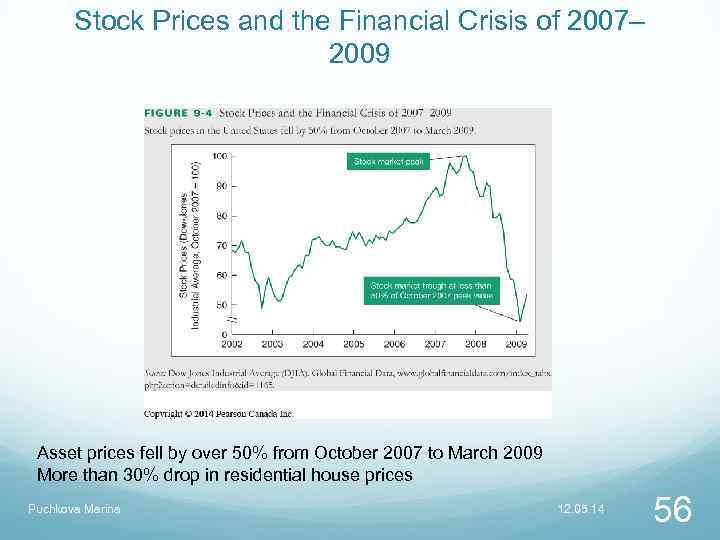

Stock Prices and the Financial Crisis of 2007– 2009 Asset prices fell by over 50% from October 2007 to March 2009 More than 30% drop in residential house prices Puchkova Marina 12. 05. 14 56

Stock Prices and the Financial Crisis of 2007– 2009 Asset prices fell by over 50% from October 2007 to March 2009 More than 30% drop in residential house prices Puchkova Marina 12. 05. 14 56

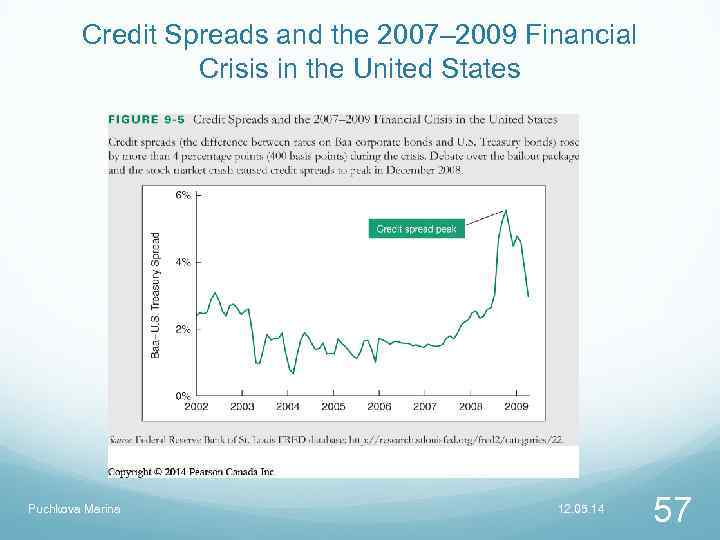

Credit Spreads and the 2007– 2009 Financial Crisis in the United States Puchkova Marina 12. 05. 14 57

Credit Spreads and the 2007– 2009 Financial Crisis in the United States Puchkova Marina 12. 05. 14 57

Canada’s Banking System: Envy of the World Canadian banks shares declined by 50% and announced huge losses U. S. and Europe have provided bailouts to their banking sector Canadian government did not provide bailout funds or rescue package Why? Puchkova Marina 12. 05. 14 58

Canada’s Banking System: Envy of the World Canadian banks shares declined by 50% and announced huge losses U. S. and Europe have provided bailouts to their banking sector Canadian government did not provide bailout funds or rescue package Why? Puchkova Marina 12. 05. 14 58

Canada’s Banking System: Envy of the World (cont’d) Canadian banks held mortgages on balance sheets ensures that borrowers were credit worthy Canadian banking regulation more conservative than U. S. higher capital requirements protected against losses Canada allows banks to go after other assets when a consumer walks away from a mortgage Canadian banks more diversified Banks can invest in mutual funds and engage in insurance business CMHC insures the mortgage of those home buyers that could not make a 25% down payment, charging them an insurance premium with the federal government backing the CMHC insurance policies with a 100% federal guarantee. Puchkova Marina 12. 05. 14 59

Canada’s Banking System: Envy of the World (cont’d) Canadian banks held mortgages on balance sheets ensures that borrowers were credit worthy Canadian banking regulation more conservative than U. S. higher capital requirements protected against losses Canada allows banks to go after other assets when a consumer walks away from a mortgage Canadian banks more diversified Banks can invest in mutual funds and engage in insurance business CMHC insures the mortgage of those home buyers that could not make a 25% down payment, charging them an insurance premium with the federal government backing the CMHC insurance policies with a 100% federal guarantee. Puchkova Marina 12. 05. 14 59

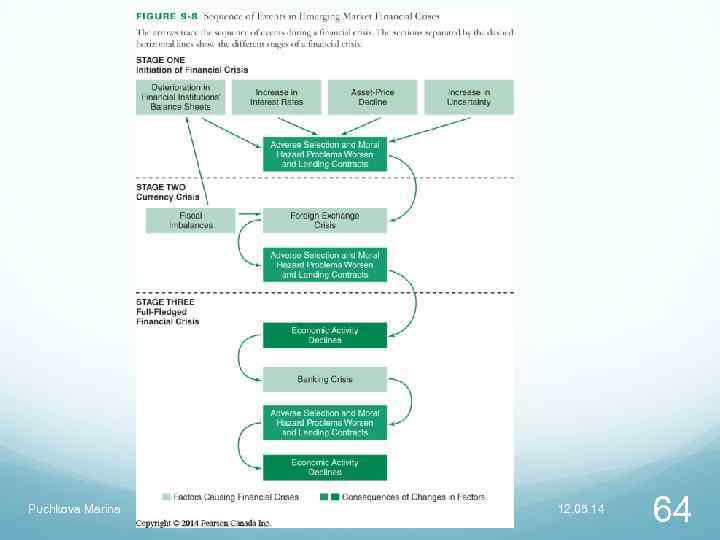

Dynamics of Financial Crises in Emerging Market Economies Emerging market economies are in the earlier stage of market development and they have recently opened up to the flow of foreign capital and firms (financial globalization). Stage one: Initiation of Financial Crisis Path one: mismanagement of financial liberalization/globalization: weak supervision and lack of expertise leads to a lending boom. domestic banks borrow from foreign banks. fixed exchange rates give a sense of lower risk. banks play a more important role in emerging market economies, since securities markets are not well developed yet Puchkova Marina 12. 05. 14 60

Dynamics of Financial Crises in Emerging Market Economies Emerging market economies are in the earlier stage of market development and they have recently opened up to the flow of foreign capital and firms (financial globalization). Stage one: Initiation of Financial Crisis Path one: mismanagement of financial liberalization/globalization: weak supervision and lack of expertise leads to a lending boom. domestic banks borrow from foreign banks. fixed exchange rates give a sense of lower risk. banks play a more important role in emerging market economies, since securities markets are not well developed yet Puchkova Marina 12. 05. 14 60

Dynamics of Financial Crises in Emerging Market Economies Path two: severe fiscal imbalances: governments in need of funds sometimes force banks to buy government debt. when government debt loses value, banks lose and their net worth decreases. Additional factors: increase in interest rates (from abroad) High interest rate; less cash flow; more demand for funds; adverse selection and moral hazard; more risky investments uncertainty linked to unstable political systems; monitoring Puchkova Marina 12. 05. 14 61

Dynamics of Financial Crises in Emerging Market Economies Path two: severe fiscal imbalances: governments in need of funds sometimes force banks to buy government debt. when government debt loses value, banks lose and their net worth decreases. Additional factors: increase in interest rates (from abroad) High interest rate; less cash flow; more demand for funds; adverse selection and moral hazard; more risky investments uncertainty linked to unstable political systems; monitoring Puchkova Marina 12. 05. 14 61

Dynamics of Financial Crises in Emerging Market Economies Stage two: Currency Crisis When banks and financial institutions are in trouble, governments have a limited number of options: (1) defending the currency by raising interest rate to increase inflow capital which is bad for financial market (2) allow the currency to depreciate. May lead to collapse of the financial sector Unstable condition and uncertainty encourage foreign firms and investors to pulling money out of the country by selling the domestic currency which leads to its collapse. Puchkova Marina 12. 05. 14 62

Dynamics of Financial Crises in Emerging Market Economies Stage two: Currency Crisis When banks and financial institutions are in trouble, governments have a limited number of options: (1) defending the currency by raising interest rate to increase inflow capital which is bad for financial market (2) allow the currency to depreciate. May lead to collapse of the financial sector Unstable condition and uncertainty encourage foreign firms and investors to pulling money out of the country by selling the domestic currency which leads to its collapse. Puchkova Marina 12. 05. 14 62

Dynamics of Financial Crises in Emerging Market Economies Stage three: Financial Crisis Emerging market economies denominate many debt contracts in foreign currency while their assets are denominated in domestic currency. Devaluation of the domestic currency increase the debt while the assets remain unchanged. Net worth value declines. increase in expected and actual inflation reduces firms’ cash flow Banks are more likely to fail: individuals are less able to pay off their debts (value of assets fall). debt denominated in foreign currency increases (value of liabilities increase) Puchkova Marina 12. 05. 14 63

Dynamics of Financial Crises in Emerging Market Economies Stage three: Financial Crisis Emerging market economies denominate many debt contracts in foreign currency while their assets are denominated in domestic currency. Devaluation of the domestic currency increase the debt while the assets remain unchanged. Net worth value declines. increase in expected and actual inflation reduces firms’ cash flow Banks are more likely to fail: individuals are less able to pay off their debts (value of assets fall). debt denominated in foreign currency increases (value of liabilities increase) Puchkova Marina 12. 05. 14 63

Puchkova Marina 12. 05. 14 64

Puchkova Marina 12. 05. 14 64

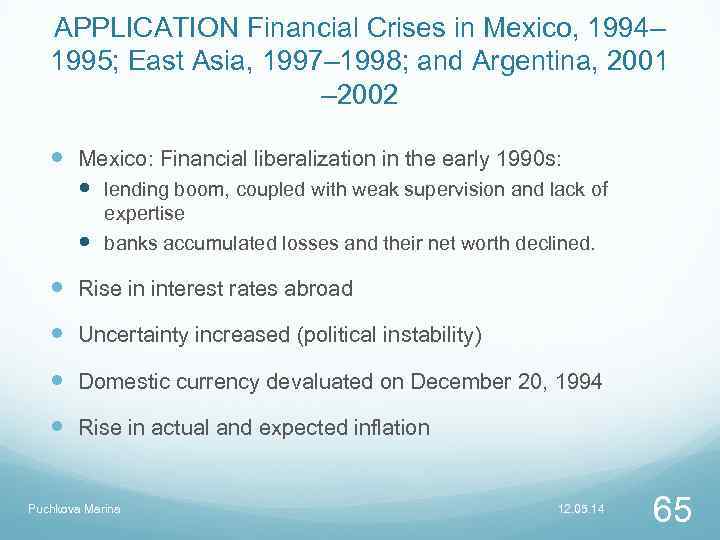

APPLICATION Financial Crises in Mexico, 1994– 1995; East Asia, 1997– 1998; and Argentina, 2001 – 2002 Mexico: Financial liberalization in the early 1990 s: lending boom, coupled with weak supervision and lack of expertise banks accumulated losses and their net worth declined. Rise in interest rates abroad Uncertainty increased (political instability) Domestic currency devaluated on December 20, 1994 Rise in actual and expected inflation Puchkova Marina 12. 05. 14 65

APPLICATION Financial Crises in Mexico, 1994– 1995; East Asia, 1997– 1998; and Argentina, 2001 – 2002 Mexico: Financial liberalization in the early 1990 s: lending boom, coupled with weak supervision and lack of expertise banks accumulated losses and their net worth declined. Rise in interest rates abroad Uncertainty increased (political instability) Domestic currency devaluated on December 20, 1994 Rise in actual and expected inflation Puchkova Marina 12. 05. 14 65

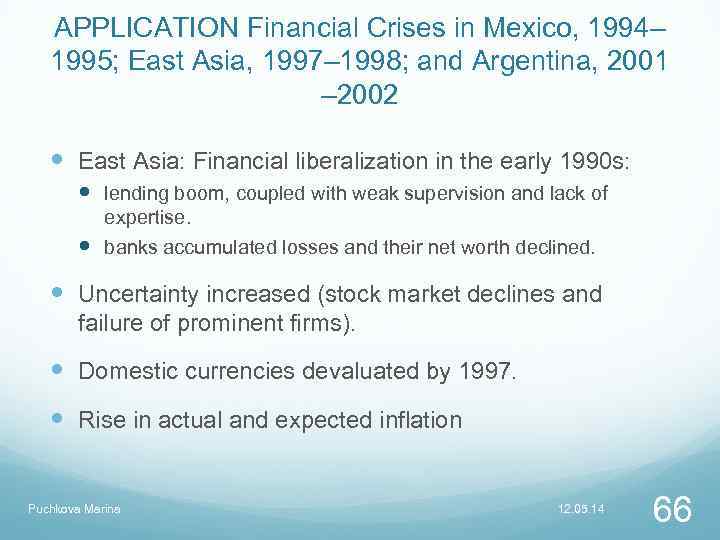

APPLICATION Financial Crises in Mexico, 1994– 1995; East Asia, 1997– 1998; and Argentina, 2001 – 2002 East Asia: Financial liberalization in the early 1990 s: lending boom, coupled with weak supervision and lack of expertise. banks accumulated losses and their net worth declined. Uncertainty increased (stock market declines and failure of prominent firms). Domestic currencies devaluated by 1997. Rise in actual and expected inflation Puchkova Marina 12. 05. 14 66

APPLICATION Financial Crises in Mexico, 1994– 1995; East Asia, 1997– 1998; and Argentina, 2001 – 2002 East Asia: Financial liberalization in the early 1990 s: lending boom, coupled with weak supervision and lack of expertise. banks accumulated losses and their net worth declined. Uncertainty increased (stock market declines and failure of prominent firms). Domestic currencies devaluated by 1997. Rise in actual and expected inflation Puchkova Marina 12. 05. 14 66

APPLICATION Financial Crises in Mexico, 1994– 1995; East Asia, 1997– 1998; and Argentina, 2001– 2002 Argentina: Government forced banks to absorb large amounts of debt due to fiscal imbalances. Rise in interest rates abroad. Uncertainty increased (ongoing recession). Domestic currency devaluated on January 6, 2002 Rise in actual and expected inflation Puchkova Marina 12. 05. 14 67

APPLICATION Financial Crises in Mexico, 1994– 1995; East Asia, 1997– 1998; and Argentina, 2001– 2002 Argentina: Government forced banks to absorb large amounts of debt due to fiscal imbalances. Rise in interest rates abroad. Uncertainty increased (ongoing recession). Domestic currency devaluated on January 6, 2002 Rise in actual and expected inflation Puchkova Marina 12. 05. 14 67

Financial Crisis and Reflexivity Theory (George Soros) George Soros has been an active promoter of the relevance of reflexivity to economics. Reflexivity is inconsistent with equilibrium theory, which emphasises that markets move towards equilibrium and that non-equilibrium fluctuations are merely random noise that will soon be corrected. In equilibrium theory, prices in the long run at equilibrium reflect the underlying fundamentals, which are unaffected by prices. Reflexivity asserts that prices do in fact influence the fundamentals and that these newlyinfluenced set of fundamentals then proceed to change expectations, thus influencing prices; the process continues in a self-reinforcing pattern. Because the pattern is selfreinforcing, markets tend towards disequilibrium. Sooner or later they reach a point where the sentiment is reversed and negative expectations become self-reinforcing in the downward direction, thereby explaining the familiar pattern of boom and bust cycles. An example Soros cites is the procyclical nature of lending, that is, the willingness of banks to ease lending standards for real estate loans when prices are rising, then raising standards when real estate prices are falling, reinforcing the boom and bust cycle. http: //www. youtube. com/watch? v=Jj. NIZvz. XQdw Puchkova Marina 12. 05. 14 68

Financial Crisis and Reflexivity Theory (George Soros) George Soros has been an active promoter of the relevance of reflexivity to economics. Reflexivity is inconsistent with equilibrium theory, which emphasises that markets move towards equilibrium and that non-equilibrium fluctuations are merely random noise that will soon be corrected. In equilibrium theory, prices in the long run at equilibrium reflect the underlying fundamentals, which are unaffected by prices. Reflexivity asserts that prices do in fact influence the fundamentals and that these newlyinfluenced set of fundamentals then proceed to change expectations, thus influencing prices; the process continues in a self-reinforcing pattern. Because the pattern is selfreinforcing, markets tend towards disequilibrium. Sooner or later they reach a point where the sentiment is reversed and negative expectations become self-reinforcing in the downward direction, thereby explaining the familiar pattern of boom and bust cycles. An example Soros cites is the procyclical nature of lending, that is, the willingness of banks to ease lending standards for real estate loans when prices are rising, then raising standards when real estate prices are falling, reinforcing the boom and bust cycle. http: //www. youtube. com/watch? v=Jj. NIZvz. XQdw Puchkova Marina 12. 05. 14 68