5cf0bcad8c1aa2bb06af7efa07e07fd2.ppt

- Количество слайдов: 34

INTERNATIONAL FINANCIAL MANAGEMENT Fifth Edition EUN / RESNICK Mc. Graw-Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

INTERNATIONAL FINANCIAL MANAGEMENT Fifth Edition EUN / RESNICK Mc. Graw-Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

International Equity Markets 13 Chapter Thirteen Chapter Objective: This chapter continues discussion of international capital markets with a discussion of both the Fifth Edition primary and secondary equity markets throughout EUN / RESNICK the world. 13 -1

International Equity Markets 13 Chapter Thirteen Chapter Objective: This chapter continues discussion of international capital markets with a discussion of both the Fifth Edition primary and secondary equity markets throughout EUN / RESNICK the world. 13 -1

Chapter Outline l l l A Statistical Perspective l Market Capitalization of Developed and Costs Market Structure, Trading Practices, Countries l Market Capitalization of Developing Countries International Equity Market Benchmarks Trading in International Equities l Measures of l Magnitude Equity Market Benchmarks i Shares MSCILiquidity International of International Equity Trading l Measures of of Shares l Cross-Listing Trading in International Equities i Shares MSCIMarket Concentration Market Structure, Trading Practices, and Costs l Yankee Stock Offerings Factors Affecting International Equity Returns Trading in International Equities l The European Stock Market l Macroeconomic Factors l American Depository Receipts International Equity Market Benchmarks l Exchange Rates International Equity Market Benchmarks i Shares MSCI l Industrial Structure i Shares. Affecting International Equity Returns Factors MSCI 13 -2

Chapter Outline l l l A Statistical Perspective l Market Capitalization of Developed and Costs Market Structure, Trading Practices, Countries l Market Capitalization of Developing Countries International Equity Market Benchmarks Trading in International Equities l Measures of l Magnitude Equity Market Benchmarks i Shares MSCILiquidity International of International Equity Trading l Measures of of Shares l Cross-Listing Trading in International Equities i Shares MSCIMarket Concentration Market Structure, Trading Practices, and Costs l Yankee Stock Offerings Factors Affecting International Equity Returns Trading in International Equities l The European Stock Market l Macroeconomic Factors l American Depository Receipts International Equity Market Benchmarks l Exchange Rates International Equity Market Benchmarks i Shares MSCI l Industrial Structure i Shares. Affecting International Equity Returns Factors MSCI 13 -2

A Statistical Perspective l l 13 -3 Market Capitalization of Developed Countries Market Capitalization of Developing Countries Measures of Liquidity Measures of Market Concentration

A Statistical Perspective l l 13 -3 Market Capitalization of Developed Countries Market Capitalization of Developing Countries Measures of Liquidity Measures of Market Concentration

Market Capitalization of Developed Countries l l 13 -4 At year-end 2006, total market capitalization of the world’s equity markets stood at $54, 195 billion. Of this amount, 81 percent is accounted for by the market capitalization of the major equity markets from 29 developed countries.

Market Capitalization of Developed Countries l l 13 -4 At year-end 2006, total market capitalization of the world’s equity markets stood at $54, 195 billion. Of this amount, 81 percent is accounted for by the market capitalization of the major equity markets from 29 developed countries.

Market Capitalization of Developing Countries l The other 19% is accounted for by the market capitalization of developing countries in “emerging markets”. l l 13 -5 Latin America Asia Eastern Europe Mideast/Africa

Market Capitalization of Developing Countries l The other 19% is accounted for by the market capitalization of developing countries in “emerging markets”. l l 13 -5 Latin America Asia Eastern Europe Mideast/Africa

Emerging Markets l Standard & Poor’s Emerging Markets Data Base classifies a stock market as “emerging” if it meets at least one of two general criteria: l l 13 -6 (1) it is located in a low- or middle-income economy as defined by the World Bank, and/or (2) its investable market capitalization is low relative to its most recent GNI figures.

Emerging Markets l Standard & Poor’s Emerging Markets Data Base classifies a stock market as “emerging” if it meets at least one of two general criteria: l l 13 -6 (1) it is located in a low- or middle-income economy as defined by the World Bank, and/or (2) its investable market capitalization is low relative to its most recent GNI figures.

Measures of Liquidity l The equity markets of the developed world tend to be much more liquid than emerging markets. l l 13 -7 Liquidity refers to how quickly an asset can be sold without a major price concession. So, while investments in emerging markets may be profitable, the investor’s focus should be on the long term.

Measures of Liquidity l The equity markets of the developed world tend to be much more liquid than emerging markets. l l 13 -7 Liquidity refers to how quickly an asset can be sold without a major price concession. So, while investments in emerging markets may be profitable, the investor’s focus should be on the long term.

Measures of Market Concentration l Emerging Markets tend to be much more concentrated than our markets. l l l 13 -8 Concentrated in relatively few companies. That is, a few issues account for a much larger percentage of the overall market capitalization in emerging markets than in the equity markets of the developed world. The number of equity investment opportunities in emerging stock markets in developing countries has not been improving in recent years.

Measures of Market Concentration l Emerging Markets tend to be much more concentrated than our markets. l l l 13 -8 Concentrated in relatively few companies. That is, a few issues account for a much larger percentage of the overall market capitalization in emerging markets than in the equity markets of the developed world. The number of equity investment opportunities in emerging stock markets in developing countries has not been improving in recent years.

Market Structure, Trading Practices, and Costs l Primary Markets l l Secondary Markets l 13 -9 Shares offered for sale directly from the issuing company. Provide market participants with marketability and share valuation.

Market Structure, Trading Practices, and Costs l Primary Markets l l Secondary Markets l 13 -9 Shares offered for sale directly from the issuing company. Provide market participants with marketability and share valuation.

Market Structure, Trading Practices, and Costs l Market Order l l Limit Order l l 13 -10 An order to your broker to buy or sell share immediately at the market price. An order to your broker to buy or sell at the at a price you want, when and if he can. If immediate execution is more important than the price, use a market order.

Market Structure, Trading Practices, and Costs l Market Order l l Limit Order l l 13 -10 An order to your broker to buy or sell share immediately at the market price. An order to your broker to buy or sell at the at a price you want, when and if he can. If immediate execution is more important than the price, use a market order.

Market Structure, Trading Practices, and Costs l Dealer Market l l l Auction Market l l Organized exchanges have specialists who match buy and sell orders. Buy and sell orders may get matched without the specialist buying and selling as a dealer. Automated Exchanges l 13 -11 The stock is sold by dealers, who stand ready to buy and sell the security for their own account. In the U. S. , the OTC market is a dealer market. Computers match buy and sell orders.

Market Structure, Trading Practices, and Costs l Dealer Market l l l Auction Market l l Organized exchanges have specialists who match buy and sell orders. Buy and sell orders may get matched without the specialist buying and selling as a dealer. Automated Exchanges l 13 -11 The stock is sold by dealers, who stand ready to buy and sell the security for their own account. In the U. S. , the OTC market is a dealer market. Computers match buy and sell orders.

Market Consolidations And Mergers l There approximately 80 major national stock markets. l l l 13 -12 Western and Eastern Europe once had more than 20 national stock exchanges where at least 15 different languages were spoken. It appears that over time a European stock exchange will eventually develop. However, a lack of common securities regulations, even among the countries of the European Union, is hindering this development. Today, stock markets around the world are under pressure from clients to combine or buy stakes in one other to trade shares of companies anywhere, at a faster pace.

Market Consolidations And Mergers l There approximately 80 major national stock markets. l l l 13 -12 Western and Eastern Europe once had more than 20 national stock exchanges where at least 15 different languages were spoken. It appears that over time a European stock exchange will eventually develop. However, a lack of common securities regulations, even among the countries of the European Union, is hindering this development. Today, stock markets around the world are under pressure from clients to combine or buy stakes in one other to trade shares of companies anywhere, at a faster pace.

Trading in International Equities l l l 13 -13 Magnitude of International Equity Trading Cross-Listing of Shares Yankee Stock Offerings The European Stock Market American Depository Receipts

Trading in International Equities l l l 13 -13 Magnitude of International Equity Trading Cross-Listing of Shares Yankee Stock Offerings The European Stock Market American Depository Receipts

Magnitude of International Equity Trading l l 13 -14 During the 1980 s world capital markets began a trend toward greater global integration. Diversification, reduced regulation, improvements in computer and communications technology, increased demand from MNCs for global issuance.

Magnitude of International Equity Trading l l 13 -14 During the 1980 s world capital markets began a trend toward greater global integration. Diversification, reduced regulation, improvements in computer and communications technology, increased demand from MNCs for global issuance.

Cross-Listing of Shares l l 13 -15 Cross-Listing refers to a firm having its equity shares listed on one or more foreign exchanges. The number of firms doing this has exploded in recent years.

Cross-Listing of Shares l l 13 -15 Cross-Listing refers to a firm having its equity shares listed on one or more foreign exchanges. The number of firms doing this has exploded in recent years.

Advantages of Cross-Listing l It expands the investor base for a firm. l l 13 -16 Very important reason for firms from emerging market countries with limited capital markets. Establishes name recognition for the firm in new capital markets, paving the way for new issues. May offer marketing advantages. May mitigate possibility of hostile takeovers.

Advantages of Cross-Listing l It expands the investor base for a firm. l l 13 -16 Very important reason for firms from emerging market countries with limited capital markets. Establishes name recognition for the firm in new capital markets, paving the way for new issues. May offer marketing advantages. May mitigate possibility of hostile takeovers.

Yankee Stock Offerings l The direct sale of new equity capital to U. S. public investors by foreign firms. l l 13 -17 Privatization in South America and Eastern Europe Equity sales by Mexican firms trying to “cash in” following implementation of NAFTA

Yankee Stock Offerings l The direct sale of new equity capital to U. S. public investors by foreign firms. l l 13 -17 Privatization in South America and Eastern Europe Equity sales by Mexican firms trying to “cash in” following implementation of NAFTA

American Depository Receipts l l l 13 -18 Foreign stocks often trade on U. S. exchanges as ADRs. It is a receipt that represents the number of foreign shares that are deposited at a U. S. bank. The bank serves as a transfer agent for the ADRs

American Depository Receipts l l l 13 -18 Foreign stocks often trade on U. S. exchanges as ADRs. It is a receipt that represents the number of foreign shares that are deposited at a U. S. bank. The bank serves as a transfer agent for the ADRs

American Depository Receipts l There are many advantages to trading ADRs as opposed to direct investment in the company’s shares: l l l 13 -19 ADRs are denominated in U. S. dollars, trade on U. S. exchanges and can be bought through any broker. Dividends are paid in U. S. dollars. Most underlying stocks are bearer securities, the ADRs are registered.

American Depository Receipts l There are many advantages to trading ADRs as opposed to direct investment in the company’s shares: l l l 13 -19 ADRs are denominated in U. S. dollars, trade on U. S. exchanges and can be bought through any broker. Dividends are paid in U. S. dollars. Most underlying stocks are bearer securities, the ADRs are registered.

Volvo ADR l l A good example of a familiar firm that trades in a U. S. as an ADR is Volvo AB, the Swedish car maker. Volvo trades in the U. S. on the NASDAQ under the ticker VOLVY. l l l 13 -20 The depository institution is JPMorgan ADR Group. The custodian is a Swedish firm, S E Banken Custody. Of course, Volvo also trades on the Stockholm Stock Exchange under the ticker VOLVB.

Volvo ADR l l A good example of a familiar firm that trades in a U. S. as an ADR is Volvo AB, the Swedish car maker. Volvo trades in the U. S. on the NASDAQ under the ticker VOLVY. l l l 13 -20 The depository institution is JPMorgan ADR Group. The custodian is a Swedish firm, S E Banken Custody. Of course, Volvo also trades on the Stockholm Stock Exchange under the ticker VOLVB.

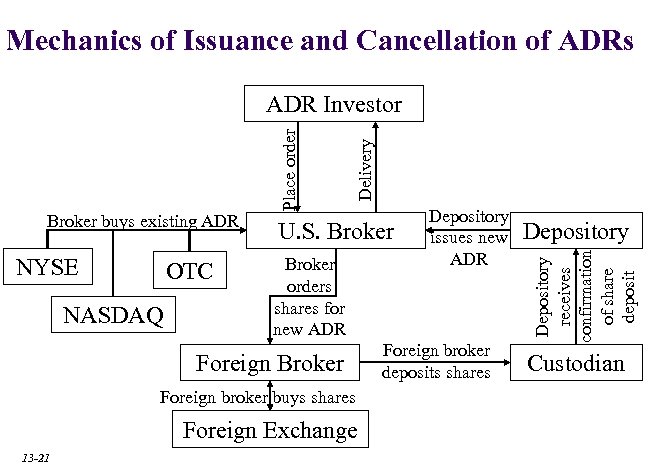

Mechanics of Issuance and Cancellation of ADRs NYSE OTC NASDAQ U. S. Broker orders shares for new ADR Foreign Broker Foreign broker buys shares Foreign Exchange 13 -21 Depository issues new ADR Foreign broker deposits shares Depository receives confirmation of share deposit Broker buys existing ADR Delivery Place order ADR Investor Custodian

Mechanics of Issuance and Cancellation of ADRs NYSE OTC NASDAQ U. S. Broker orders shares for new ADR Foreign Broker Foreign broker buys shares Foreign Exchange 13 -21 Depository issues new ADR Foreign broker deposits shares Depository receives confirmation of share deposit Broker buys existing ADR Delivery Place order ADR Investor Custodian

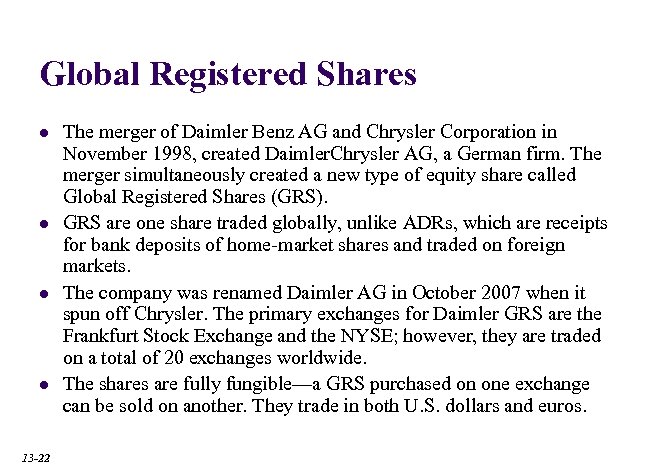

Global Registered Shares l l 13 -22 The merger of Daimler Benz AG and Chrysler Corporation in November 1998, created Daimler. Chrysler AG, a German firm. The merger simultaneously created a new type of equity share called Global Registered Shares (GRS). GRS are one share traded globally, unlike ADRs, which are receipts for bank deposits of home-market shares and traded on foreign markets. The company was renamed Daimler AG in October 2007 when it spun off Chrysler. The primary exchanges for Daimler GRS are the Frankfurt Stock Exchange and the NYSE; however, they are traded on a total of 20 exchanges worldwide. The shares are fully fungible—a GRS purchased on one exchange can be sold on another. They trade in both U. S. dollars and euros.

Global Registered Shares l l 13 -22 The merger of Daimler Benz AG and Chrysler Corporation in November 1998, created Daimler. Chrysler AG, a German firm. The merger simultaneously created a new type of equity share called Global Registered Shares (GRS). GRS are one share traded globally, unlike ADRs, which are receipts for bank deposits of home-market shares and traded on foreign markets. The company was renamed Daimler AG in October 2007 when it spun off Chrysler. The primary exchanges for Daimler GRS are the Frankfurt Stock Exchange and the NYSE; however, they are traded on a total of 20 exchanges worldwide. The shares are fully fungible—a GRS purchased on one exchange can be sold on another. They trade in both U. S. dollars and euros.

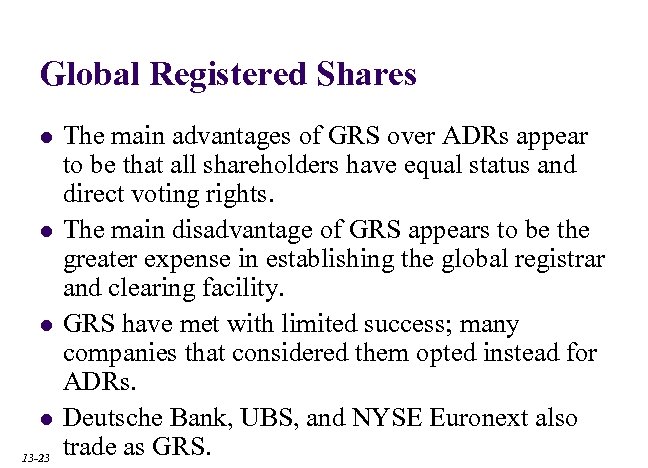

Global Registered Shares l l 13 -23 The main advantages of GRS over ADRs appear to be that all shareholders have equal status and direct voting rights. The main disadvantage of GRS appears to be the greater expense in establishing the global registrar and clearing facility. GRS have met with limited success; many companies that considered them opted instead for ADRs. Deutsche Bank, UBS, and NYSE Euronext also trade as GRS.

Global Registered Shares l l 13 -23 The main advantages of GRS over ADRs appear to be that all shareholders have equal status and direct voting rights. The main disadvantage of GRS appears to be the greater expense in establishing the global registrar and clearing facility. GRS have met with limited success; many companies that considered them opted instead for ADRs. Deutsche Bank, UBS, and NYSE Euronext also trade as GRS.

International Equity Market Benchmarks l l l 13 -24 North America Europe Asia/Pacific Rim

International Equity Market Benchmarks l l l 13 -24 North America Europe Asia/Pacific Rim

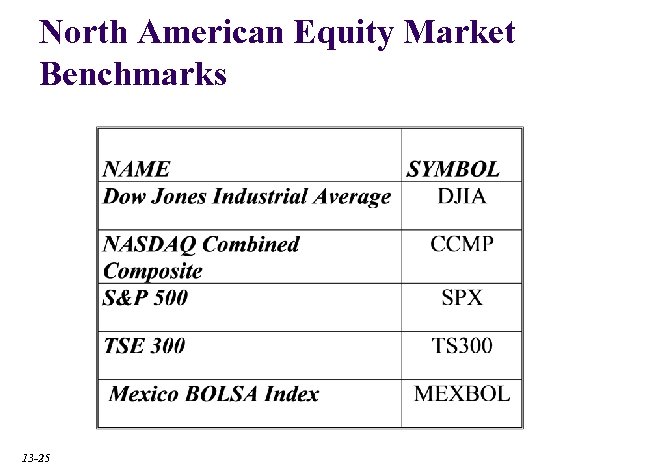

North American Equity Market Benchmarks 13 -25

North American Equity Market Benchmarks 13 -25

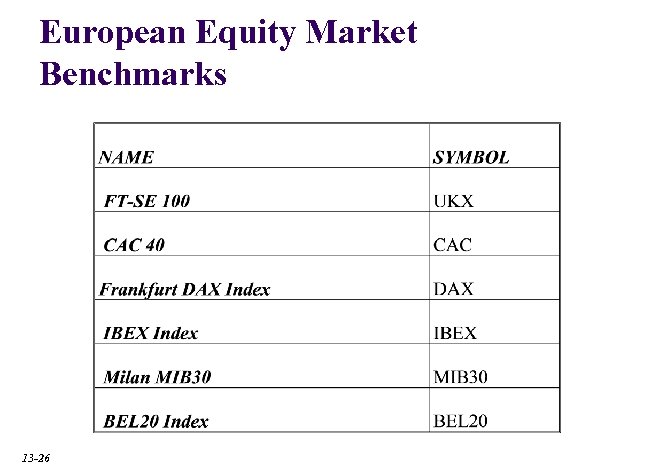

European Equity Market Benchmarks 13 -26

European Equity Market Benchmarks 13 -26

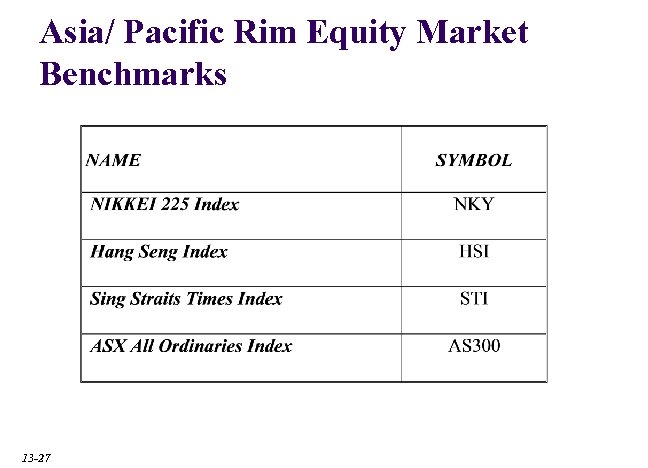

Asia/ Pacific Rim Equity Market Benchmarks 13 -27

Asia/ Pacific Rim Equity Market Benchmarks 13 -27

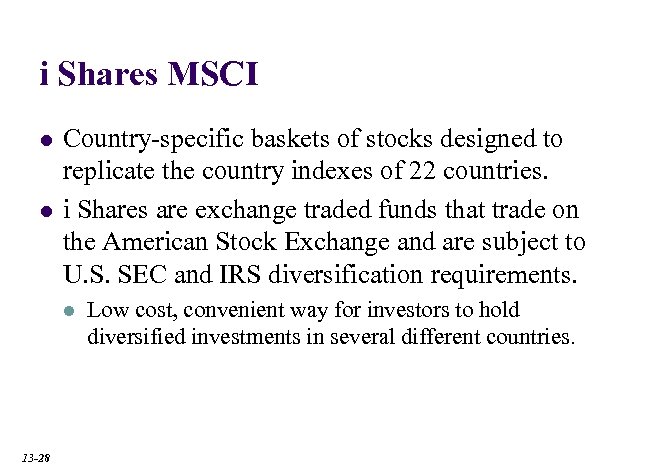

i Shares MSCI l l Country-specific baskets of stocks designed to replicate the country indexes of 22 countries. i Shares are exchange traded funds that trade on the American Stock Exchange and are subject to U. S. SEC and IRS diversification requirements. l 13 -28 Low cost, convenient way for investors to hold diversified investments in several different countries.

i Shares MSCI l l Country-specific baskets of stocks designed to replicate the country indexes of 22 countries. i Shares are exchange traded funds that trade on the American Stock Exchange and are subject to U. S. SEC and IRS diversification requirements. l 13 -28 Low cost, convenient way for investors to hold diversified investments in several different countries.

Factors Affecting International Equity Returns l l l 13 -29 Macroeconomic Factors Exchange Rates Industrial Structure

Factors Affecting International Equity Returns l l l 13 -29 Macroeconomic Factors Exchange Rates Industrial Structure

Macroeconomic Factors Affecting International Equity Returns l l 13 -30 The data do not support the notion that equity returns are strongly influenced by macro factors. That is correspondent with findings for U. S. equity markets.

Macroeconomic Factors Affecting International Equity Returns l l 13 -30 The data do not support the notion that equity returns are strongly influenced by macro factors. That is correspondent with findings for U. S. equity markets.

Exchange Rates l l 13 -31 Exchange rate movements in a given country appear to reinforce the stock market movements within that country. One should be careful not to confuse correlation with causality.

Exchange Rates l l 13 -31 Exchange rate movements in a given country appear to reinforce the stock market movements within that country. One should be careful not to confuse correlation with causality.

Industrial Structure l 13 -32 Studies examining the influence of industrial structure on foreign equity returns are inconclusive.

Industrial Structure l 13 -32 Studies examining the influence of industrial structure on foreign equity returns are inconclusive.

End Chapter Thirteen 13 -33

End Chapter Thirteen 13 -33