INF LEC2.ppt

- Количество слайдов: 51

International Finance Module Convenor Dr. Xiuping Hua University of Nottingham Ningbo China

International Finance Module Convenor Dr. Xiuping Hua University of Nottingham Ningbo China

Favorite quotes v Imperfection is beauty, madness is genius and it's better to be absolutely ridiculous than absolutely boring. ——Marilyn Monroe v I can accept failure but I can't accept not trying. —— Michael Jordan

Favorite quotes v Imperfection is beauty, madness is genius and it's better to be absolutely ridiculous than absolutely boring. ——Marilyn Monroe v I can accept failure but I can't accept not trying. —— Michael Jordan

Absolutely ridiculous or absolutely boring? v Importance of the Individual!

Absolutely ridiculous or absolutely boring? v Importance of the Individual!

Karl Popper v v Austro-British philosopher and professor at the London School of Economics; one of the greatest philosophers of science of the 20 th century; scientific theory, and human knowledge generally, is irreducibly conjectural or hypothetical, and is generated by the creative imagination in order to solve problems that have arisen in specific historio-cultural settings. to take falsifiability as his criterion of demarcation between what is and is not genuinely scientific: a theory should be considered scientific if and only if it is falsifiable.

Karl Popper v v Austro-British philosopher and professor at the London School of Economics; one of the greatest philosophers of science of the 20 th century; scientific theory, and human knowledge generally, is irreducibly conjectural or hypothetical, and is generated by the creative imagination in order to solve problems that have arisen in specific historio-cultural settings. to take falsifiability as his criterion of demarcation between what is and is not genuinely scientific: a theory should be considered scientific if and only if it is falsifiable.

Thomas Kuhn v v v A. B. C. D. American historian and philosopher of science; The Structure of Scientific Revolutions (1962) Concerning the progress of scientific knowledge: Scientific fields undergo periodic "paradigm shifts" rather than solely progressing in a linear and continuous way; these paradigm shifts open up new approaches to understanding that scientists would never have considered valid before; the notion of scientific truth cannot be established solely by objective criteria but is defined by a consensus of a scientific community; Our comprehension of science can never rely on full "objectivity"; we must account for subjective perspectives as well;

Thomas Kuhn v v v A. B. C. D. American historian and philosopher of science; The Structure of Scientific Revolutions (1962) Concerning the progress of scientific knowledge: Scientific fields undergo periodic "paradigm shifts" rather than solely progressing in a linear and continuous way; these paradigm shifts open up new approaches to understanding that scientists would never have considered valid before; the notion of scientific truth cannot be established solely by objective criteria but is defined by a consensus of a scientific community; Our comprehension of science can never rely on full "objectivity"; we must account for subjective perspectives as well;

Lecture 2 Foreign Exchange and International Monetary System

Lecture 2 Foreign Exchange and International Monetary System

Objectives To distinguish between different systems of exchange rate determination; To describe the history of the international monetary system; To explain the European Monetary System and Monetary Union; To discuss the possible regional monetary arrangements in Asia.

Objectives To distinguish between different systems of exchange rate determination; To describe the history of the international monetary system; To explain the European Monetary System and Monetary Union; To discuss the possible regional monetary arrangements in Asia.

Importance of Exchange Rate v exchange rate is the key relative price in international finance; v the rapid pace of internationalization in goods and asset markets has only enhanced the importance of this variable;

Importance of Exchange Rate v exchange rate is the key relative price in international finance; v the rapid pace of internationalization in goods and asset markets has only enhanced the importance of this variable;

Alternative exchange rate systems 1 v 1) A free float is where market forces largely set the exchange rate v 2) A managed float is when a nation, from time-to-time, attempts to reduce the impact of market forces on its exchange rates, through its central bank. • Managed floats are probably most common among major currencies.

Alternative exchange rate systems 1 v 1) A free float is where market forces largely set the exchange rate v 2) A managed float is when a nation, from time-to-time, attempts to reduce the impact of market forces on its exchange rates, through its central bank. • Managed floats are probably most common among major currencies.

Alternative exchange rate systems 2 v 3) A fixed exchange rate: the currency has a target rate based on another currency or a basket of other currencies. v v This group includes many smaller countries, and many developing countries; For instance, China, Malaysia, Ukraine, et al. (Shapiro, 2006, P. 94)

Alternative exchange rate systems 2 v 3) A fixed exchange rate: the currency has a target rate based on another currency or a basket of other currencies. v v This group includes many smaller countries, and many developing countries; For instance, China, Malaysia, Ukraine, et al. (Shapiro, 2006, P. 94)

Alternative exchange rate systems 3 v 4) A target-Zone arrangement: the currency has a target rate based on another currency or a basket of other currencies. • The old European Monetary System (EMS) was an example of a target-zone arrangement. • The currencies in the EMS were tied to one another (really they were anchored to the Deutsche Mark), but allowed to fluctuate within a specific band. • This arrangement was the predecessor for a single currency, the Euro, replacing 12 or more different European currencies.

Alternative exchange rate systems 3 v 4) A target-Zone arrangement: the currency has a target rate based on another currency or a basket of other currencies. • The old European Monetary System (EMS) was an example of a target-zone arrangement. • The currencies in the EMS were tied to one another (really they were anchored to the Deutsche Mark), but allowed to fluctuate within a specific band. • This arrangement was the predecessor for a single currency, the Euro, replacing 12 or more different European currencies.

Alternative exchange rate systems 4 Current System can best be characterized as a hybrid system. • Major currencies such as the Dollar, Yen, Euro, and Pound use a largely floating method • While others move in and out of various fixed-rate or loosely-linked systems. v

Alternative exchange rate systems 4 Current System can best be characterized as a hybrid system. • Major currencies such as the Dollar, Yen, Euro, and Pound use a largely floating method • While others move in and out of various fixed-rate or loosely-linked systems. v

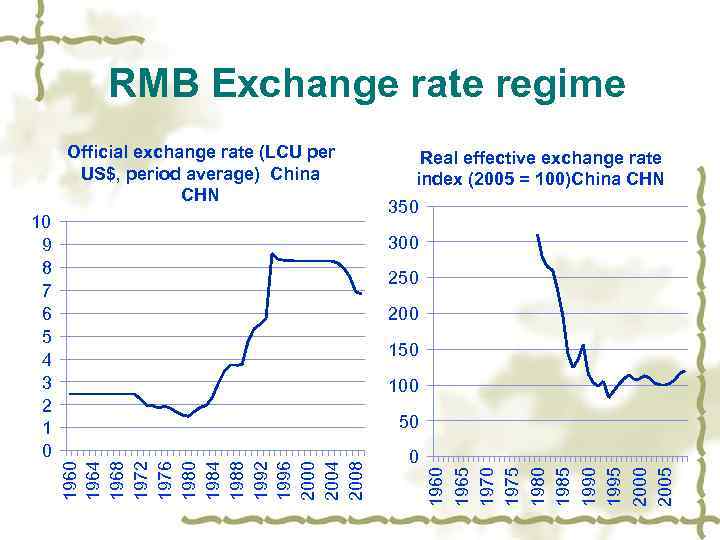

RMB Exchange rate regime v v One of the most visible hotspots in the U. S. -China relationship; Proponents of a flexible yuan: v the need for macroeconomic flexibility in the economic catch-up process of the Chinese economy a substantial appreciation of the Chinese yuan would help to prevent a possible overheating of the Chinese economy and to correct the trade imbalance between China and the US v Proponents of the Chinese dollar peg: v v growth tends to be led by exports and China's fast rising international assets are denominated in foreign currency; for countries in the economic catch-up process fixed exchange rates provide a more stable framework for the adjustment of labour and asset markets; Japan's repeated attempts to soften (productivity driven) appreciation pressure by interest rate cuts have finally led Japan into the liquidity trap.

RMB Exchange rate regime v v One of the most visible hotspots in the U. S. -China relationship; Proponents of a flexible yuan: v the need for macroeconomic flexibility in the economic catch-up process of the Chinese economy a substantial appreciation of the Chinese yuan would help to prevent a possible overheating of the Chinese economy and to correct the trade imbalance between China and the US v Proponents of the Chinese dollar peg: v v growth tends to be led by exports and China's fast rising international assets are denominated in foreign currency; for countries in the economic catch-up process fixed exchange rates provide a more stable framework for the adjustment of labour and asset markets; Japan's repeated attempts to soften (productivity driven) appreciation pressure by interest rate cuts have finally led Japan into the liquidity trap.

RMB Exchange rate regime Official exchange rate (LCU per US$, period average) China CHN 10 9 8 7 6 5 4 3 2 1 0 Real effective exchange rate index (2005 = 100)China CHN 350 300 250 200 150 100 0 1965 1970 1975 1980 1985 1990 1995 2000 2005 1960 1964 1968 1972 1976 1980 1984 1988 1992 1996 2000 2004 2008 50

RMB Exchange rate regime Official exchange rate (LCU per US$, period average) China CHN 10 9 8 7 6 5 4 3 2 1 0 Real effective exchange rate index (2005 = 100)China CHN 350 300 250 200 150 100 0 1965 1970 1975 1980 1985 1990 1995 2000 2005 1960 1964 1968 1972 1976 1980 1984 1988 1992 1996 2000 2004 2008 50

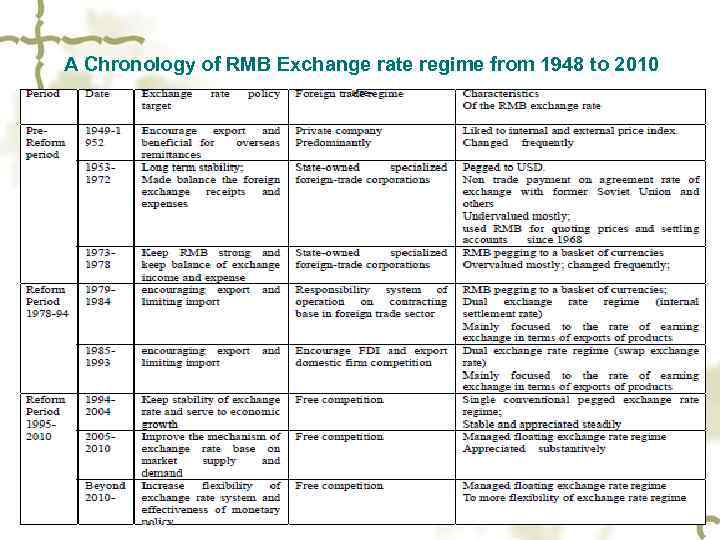

A Chronology of RMB Exchange rate regime from 1948 to 2010

A Chronology of RMB Exchange rate regime from 1948 to 2010

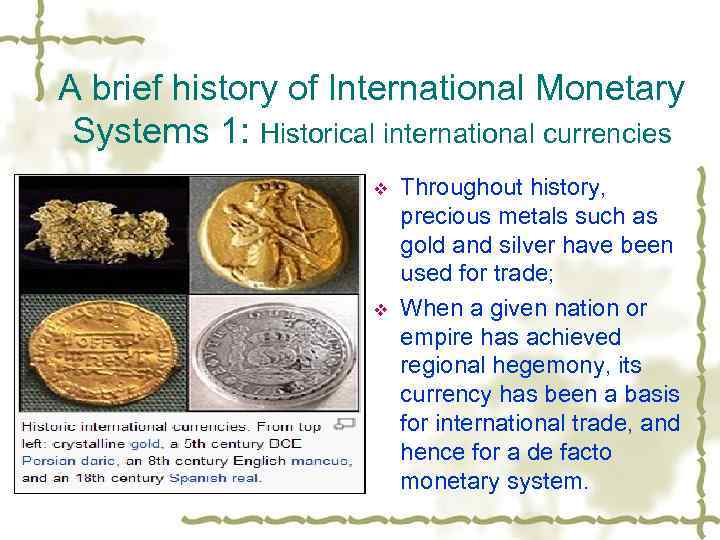

A brief history of International Monetary Systems 1: Historical international currencies v v Throughout history, precious metals such as gold and silver have been used for trade; When a given nation or empire has achieved regional hegemony, its currency has been a basis for international trade, and hence for a de facto monetary system.

A brief history of International Monetary Systems 1: Historical international currencies v v Throughout history, precious metals such as gold and silver have been used for trade; When a given nation or empire has achieved regional hegemony, its currency has been a basis for international trade, and hence for a de facto monetary system.

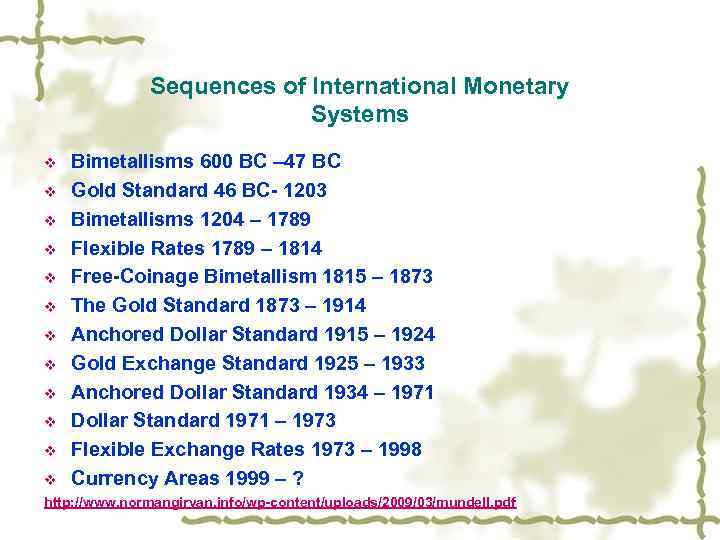

Sequences of International Monetary Systems v v v Bimetallisms 600 BC – 47 BC Gold Standard 46 BC- 1203 Bimetallisms 1204 – 1789 Flexible Rates 1789 – 1814 Free-Coinage Bimetallism 1815 – 1873 The Gold Standard 1873 – 1914 Anchored Dollar Standard 1915 – 1924 Gold Exchange Standard 1925 – 1933 Anchored Dollar Standard 1934 – 1971 Dollar Standard 1971 – 1973 Flexible Exchange Rates 1973 – 1998 Currency Areas 1999 – ? v http: //www. normangirvan. info/wp-content/uploads/2009/03/mundell. pdf

Sequences of International Monetary Systems v v v Bimetallisms 600 BC – 47 BC Gold Standard 46 BC- 1203 Bimetallisms 1204 – 1789 Flexible Rates 1789 – 1814 Free-Coinage Bimetallism 1815 – 1873 The Gold Standard 1873 – 1914 Anchored Dollar Standard 1915 – 1924 Gold Exchange Standard 1925 – 1933 Anchored Dollar Standard 1934 – 1971 Dollar Standard 1971 – 1973 Flexible Exchange Rates 1973 – 1998 Currency Areas 1999 – ? v http: //www. normangirvan. info/wp-content/uploads/2009/03/mundell. pdf

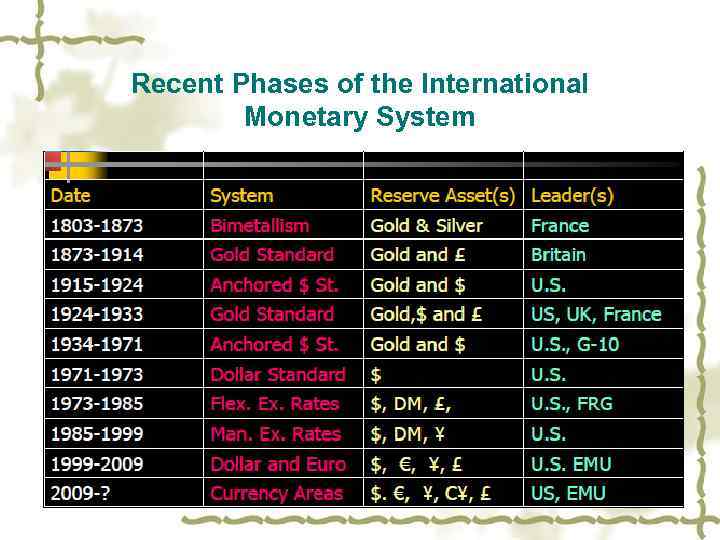

Recent Phases of the International Monetary System

Recent Phases of the International Monetary System

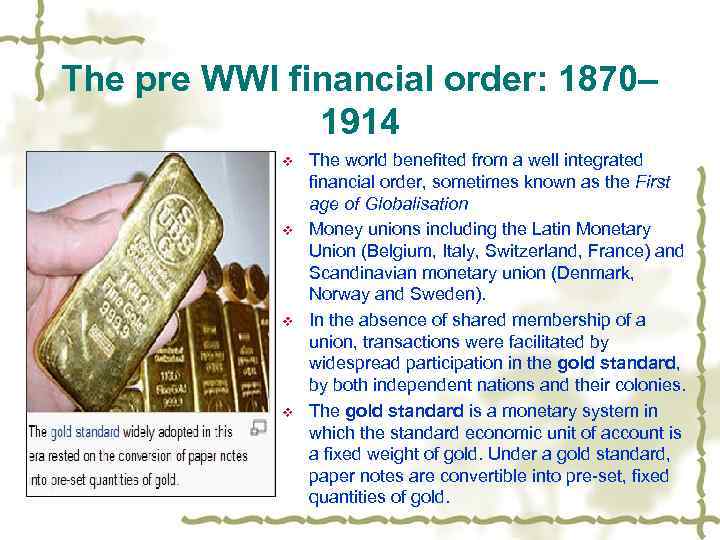

The pre WWI financial order: 1870– 1914 v v The world benefited from a well integrated financial order, sometimes known as the First age of Globalisation Money unions including the Latin Monetary Union (Belgium, Italy, Switzerland, France) and Scandinavian monetary union (Denmark, Norway and Sweden). In the absence of shared membership of a union, transactions were facilitated by widespread participation in the gold standard, by both independent nations and their colonies. The gold standard is a monetary system in which the standard economic unit of account is a fixed weight of gold. Under a gold standard, paper notes are convertible into pre-set, fixed quantities of gold.

The pre WWI financial order: 1870– 1914 v v The world benefited from a well integrated financial order, sometimes known as the First age of Globalisation Money unions including the Latin Monetary Union (Belgium, Italy, Switzerland, France) and Scandinavian monetary union (Denmark, Norway and Sweden). In the absence of shared membership of a union, transactions were facilitated by widespread participation in the gold standard, by both independent nations and their colonies. The gold standard is a monetary system in which the standard economic unit of account is a fixed weight of gold. Under a gold standard, paper notes are convertible into pre-set, fixed quantities of gold.

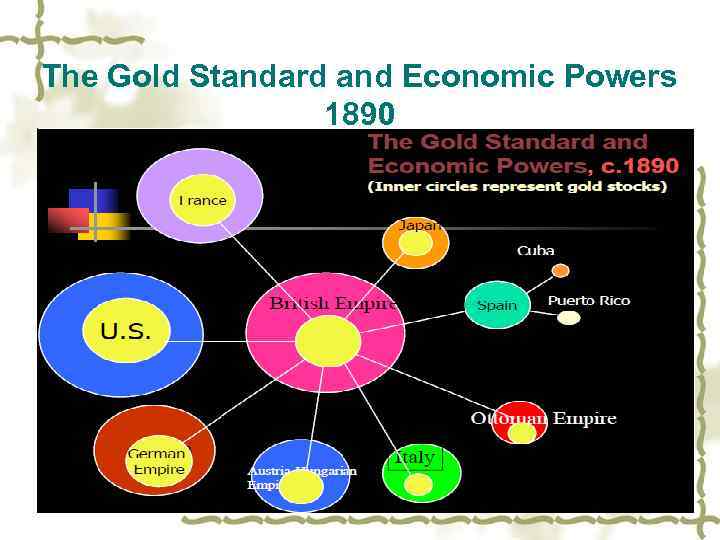

The Gold Standard and Economic Powers 1890

The Gold Standard and Economic Powers 1890

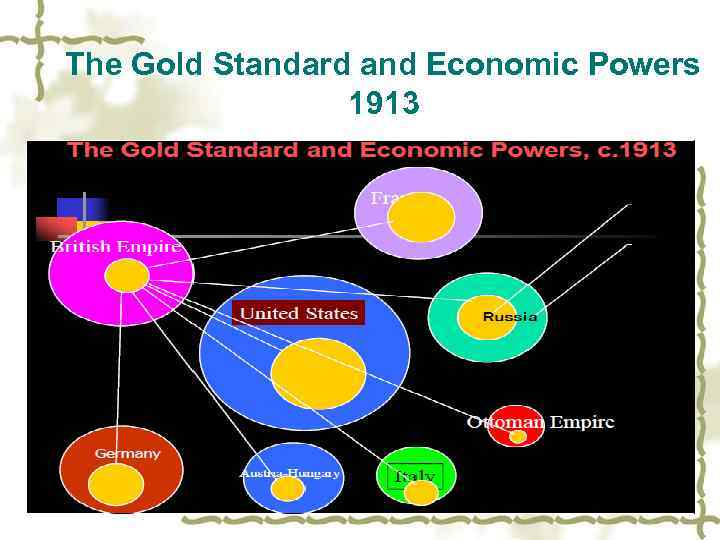

The Gold Standard and Economic Powers 1913

The Gold Standard and Economic Powers 1913

Between the World Wars: 1919 – 1939 v v v described as a period of de-globalisation, as both international trade and capital flows shrank compared to the period before World War I; During World War I countries had abandoned the gold standard and, except for the United States, returned to it only briefly. By the early 30's the prevailing order was essentially a fragmented system of floating exchange rates; To protect their reserves of gold countries would need to raise interest rates and generally follow a deflationary policy. The greatest need for this could arise in a downturn, just when leaders would have preferred to lower rates to encourage growth.

Between the World Wars: 1919 – 1939 v v v described as a period of de-globalisation, as both international trade and capital flows shrank compared to the period before World War I; During World War I countries had abandoned the gold standard and, except for the United States, returned to it only briefly. By the early 30's the prevailing order was essentially a fragmented system of floating exchange rates; To protect their reserves of gold countries would need to raise interest rates and generally follow a deflationary policy. The greatest need for this could arise in a downturn, just when leaders would have preferred to lower rates to encourage growth.

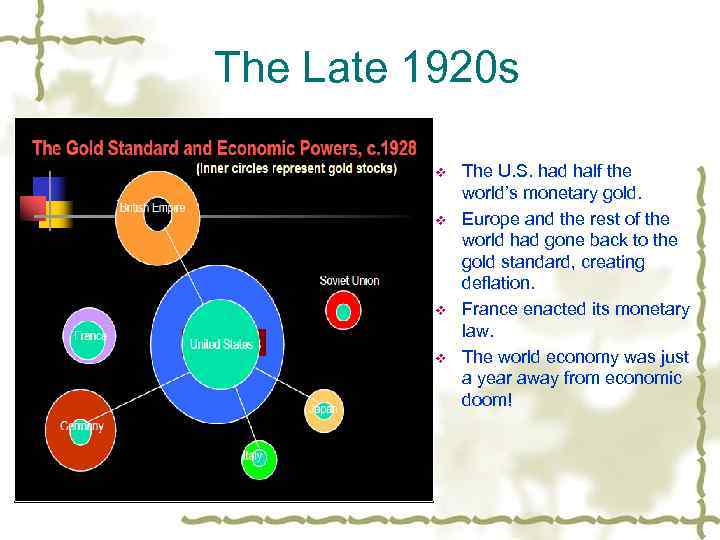

The Late 1920 s v v The U. S. had half the world’s monetary gold. Europe and the rest of the world had gone back to the gold standard, creating deflation. France enacted its monetary law. The world economy was just a year away from economic doom!

The Late 1920 s v v The U. S. had half the world’s monetary gold. Europe and the rest of the world had gone back to the gold standard, creating deflation. France enacted its monetary law. The world economy was just a year away from economic doom!

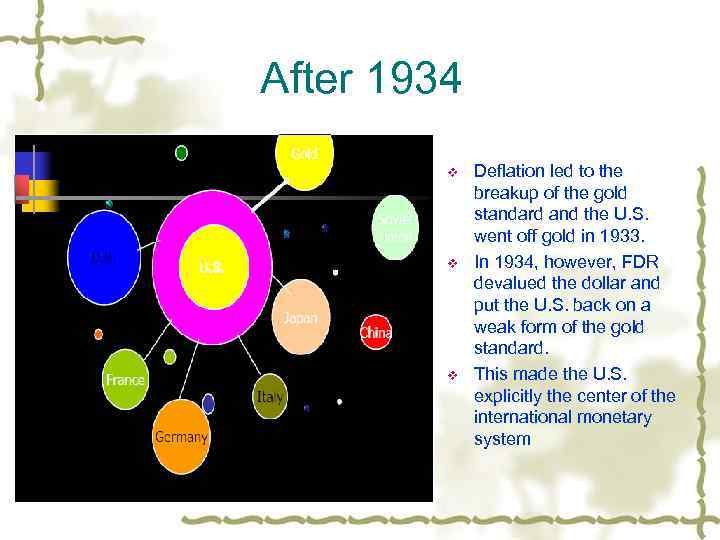

After 1934 v v v Deflation led to the breakup of the gold standard and the U. S. went off gold in 1933. In 1934, however, FDR devalued the dollar and put the U. S. back on a weak form of the gold standard. This made the U. S. explicitly the center of the international monetary system

After 1934 v v v Deflation led to the breakup of the gold standard and the U. S. went off gold in 1933. In 1934, however, FDR devalued the dollar and put the U. S. back on a weak form of the gold standard. This made the U. S. explicitly the center of the international monetary system

The Bretton Woods Era: 1945– 1971 v v v 42 countries attending the 1944 Bretton Woods conference; Keynes had argued against the dollar having such a central role in the monetary system, and suggested an international currency called Bancor be used instead, but he was overruled by the Americans. a system of fixed but adjustable exchange rates where the currencies were pegged against the dollar, with the dollar itself convertible into gold; a gold – dollar exchange standard; Two international institutions, the International Monetary Fund (IMF) and the World Bank were created; A key part of their function was to replace private finance as more reliable source of lending for investment projects in developing states.

The Bretton Woods Era: 1945– 1971 v v v 42 countries attending the 1944 Bretton Woods conference; Keynes had argued against the dollar having such a central role in the monetary system, and suggested an international currency called Bancor be used instead, but he was overruled by the Americans. a system of fixed but adjustable exchange rates where the currencies were pegged against the dollar, with the dollar itself convertible into gold; a gold – dollar exchange standard; Two international institutions, the International Monetary Fund (IMF) and the World Bank were created; A key part of their function was to replace private finance as more reliable source of lending for investment projects in developing states.

Defects of the Bretton Woods System v There was no world currency. v There was no mechanism for keeping the world price level in line with the fixed price of gold (US sterilization). v IMF assets included junk currencies that had no use internationally, so it couldn’t be a revolving credit system.

Defects of the Bretton Woods System v There was no world currency. v There was no mechanism for keeping the world price level in line with the fixed price of gold (US sterilization). v IMF assets included junk currencies that had no use internationally, so it couldn’t be a revolving credit system.

The post Bretton Woods system: 1971 – present v v An alternative name for the post Bretton Woods system is the Washington Consensus; The Bretton Wood system is considered by economic historians to have broken down in the 1970 s: crucial events being Nixon suspending the dollar's convertibility into gold in 1971, the United states abandonment of Capital Controls in 1974, and Great Britain's ending of capital controls in 1979 which was swiftly copied by most other major economies; Market friendly policies that were generally advised and implemented both for advanced and emerging economies; More exchange rate flexibility and international capital mobility.

The post Bretton Woods system: 1971 – present v v An alternative name for the post Bretton Woods system is the Washington Consensus; The Bretton Wood system is considered by economic historians to have broken down in the 1970 s: crucial events being Nixon suspending the dollar's convertibility into gold in 1971, the United states abandonment of Capital Controls in 1974, and Great Britain's ending of capital controls in 1979 which was swiftly copied by most other major economies; Market friendly policies that were generally advised and implemented both for advanced and emerging economies; More exchange rate flexibility and international capital mobility.

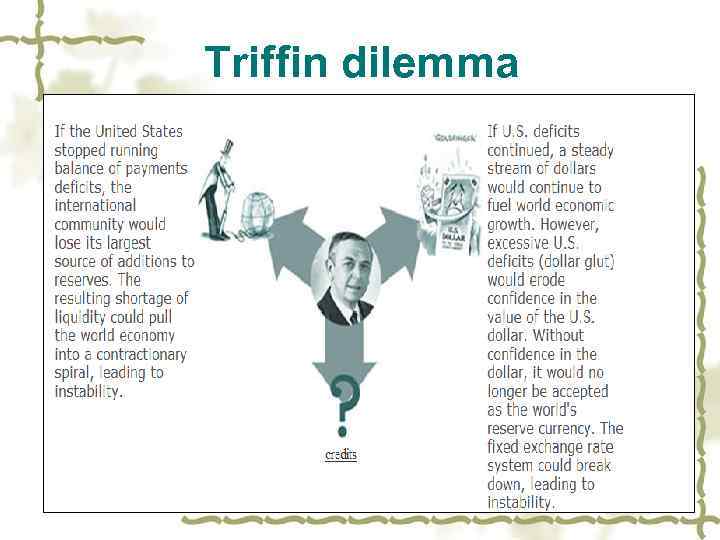

Triffin dilemma

Triffin dilemma

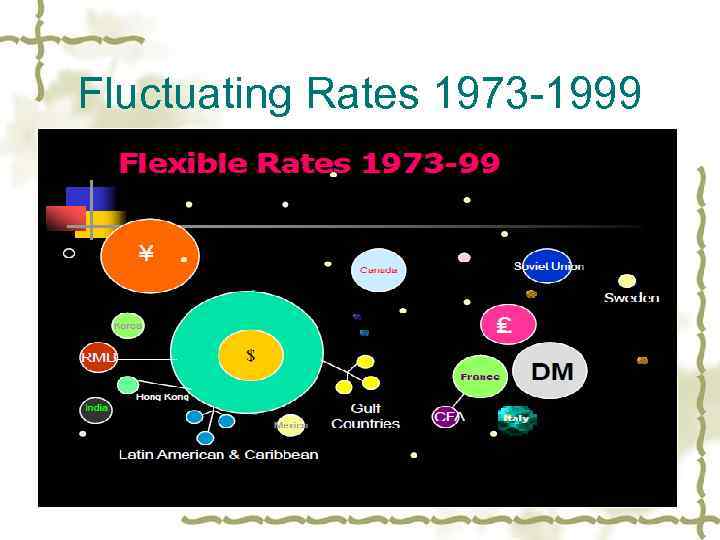

Fluctuating Rates 1973 -1999

Fluctuating Rates 1973 -1999

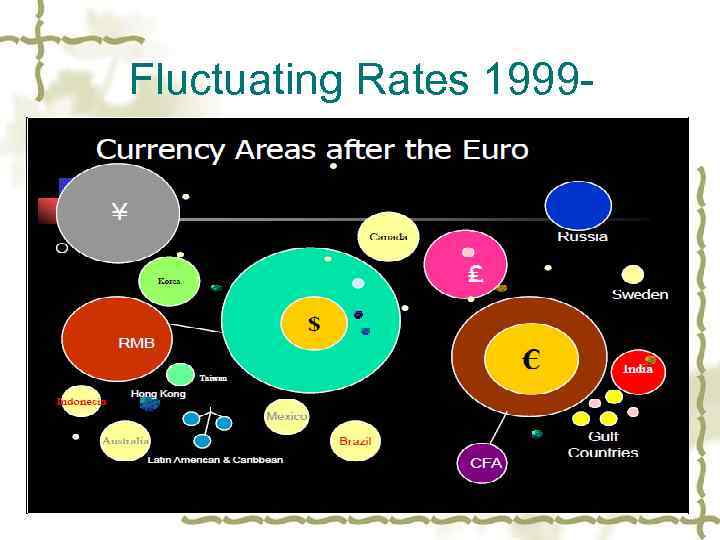

Fluctuating Rates 1999 -

Fluctuating Rates 1999 -

Fluctuating Rates v Monetary Nationalism v v Fluctuating exchange rates meant that each country was responsible for its own monetary stability. It inaugurated an era of monetary nationalism. v Robert Mundell in 2009 v A Chaotic System: There are 185 members of the IMF today. v Scores of countries on flexible rates would have meant chaos. E. G. if there are N = 200 countries in the world with separate currencies, there are ½ x N x (N-l) = 19, 900 exchange rates! The smallest countries lose the most, the biggest countries might gain. The idea was invented by the superpowers, Britain in 19 th C and U. S. in 20 th C. , but never subjected to careful scrutiny. v v

Fluctuating Rates v Monetary Nationalism v v Fluctuating exchange rates meant that each country was responsible for its own monetary stability. It inaugurated an era of monetary nationalism. v Robert Mundell in 2009 v A Chaotic System: There are 185 members of the IMF today. v Scores of countries on flexible rates would have meant chaos. E. G. if there are N = 200 countries in the world with separate currencies, there are ½ x N x (N-l) = 19, 900 exchange rates! The smallest countries lose the most, the biggest countries might gain. The idea was invented by the superpowers, Britain in 19 th C and U. S. in 20 th C. , but never subjected to careful scrutiny. v v

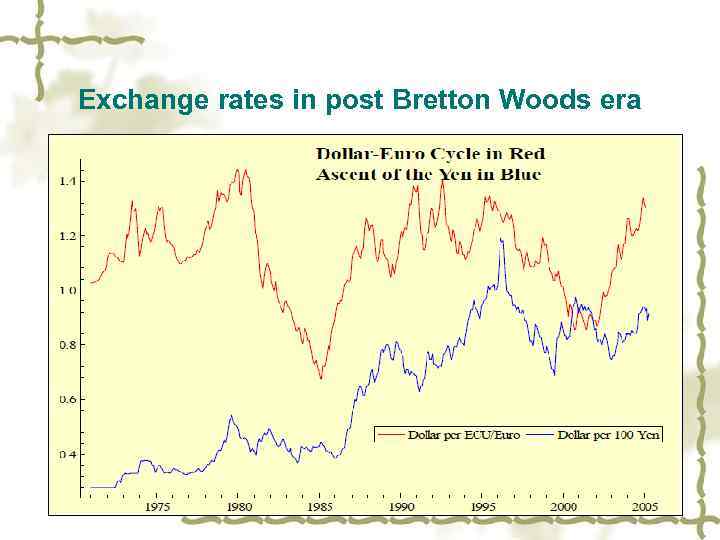

Exchange rates in post Bretton Woods era

Exchange rates in post Bretton Woods era

The behaviour of the exchange rate has been a matter of significant policy concern: US v v v For the first 4 years of the Reagan Administration, the U. S. government (almost) completely avoided any official intervention and left the FE value of the U. S. dollar to be determined exclusively by market forces. By early 1985, U. S. policymakers perceived that the very strong dollar was undermining international competitiveness and contributing to massive trade and current account deficits that were fuelling protectionist sentiment. The Plaza Accord of September 1985, an agreement between the governments of France, West Germany, Japan, the United States, and the United Kingdom, to depreciate the U. S. dollar in relation to the Japanese yen and German Deutsche Mark by intervening in currency markets; After a substantial further depreciation of the U. S. dollar, the G-7 countries agreed in the Louvre Accord of February 1987 that exchange rates were broadly in line with fundamentals, and until the stock-market crash in October, multilateral efforts were made to stem further dollar depreciation. Since 1987, the U. S. authorities have occasionally joined in efforts to resist exchange rate movements that were perceived as erratic and excessive.

The behaviour of the exchange rate has been a matter of significant policy concern: US v v v For the first 4 years of the Reagan Administration, the U. S. government (almost) completely avoided any official intervention and left the FE value of the U. S. dollar to be determined exclusively by market forces. By early 1985, U. S. policymakers perceived that the very strong dollar was undermining international competitiveness and contributing to massive trade and current account deficits that were fuelling protectionist sentiment. The Plaza Accord of September 1985, an agreement between the governments of France, West Germany, Japan, the United States, and the United Kingdom, to depreciate the U. S. dollar in relation to the Japanese yen and German Deutsche Mark by intervening in currency markets; After a substantial further depreciation of the U. S. dollar, the G-7 countries agreed in the Louvre Accord of February 1987 that exchange rates were broadly in line with fundamentals, and until the stock-market crash in October, multilateral efforts were made to stem further dollar depreciation. Since 1987, the U. S. authorities have occasionally joined in efforts to resist exchange rate movements that were perceived as erratic and excessive.

Japan v v The exchange rate value of the dollar versus the yen declined by 51% from 1985 to 1987; The sharp appreciation of the yen against the U. S. dollar became a matter of serious concern; After the stock-market crash in October 1987, the Japanese authorities sought unilaterally to resist yen appreciation against the dollar; During 1993 and 1994, the Japanese authorities was concerned that a sharp appreciation of the yen was frustrating prospects of recovery after a dramatic slowdown of economic activity following the drop in Japanese equity and real-estate prices: official intervention to resist the rise of the yen;

Japan v v The exchange rate value of the dollar versus the yen declined by 51% from 1985 to 1987; The sharp appreciation of the yen against the U. S. dollar became a matter of serious concern; After the stock-market crash in October 1987, the Japanese authorities sought unilaterally to resist yen appreciation against the dollar; During 1993 and 1994, the Japanese authorities was concerned that a sharp appreciation of the yen was frustrating prospects of recovery after a dramatic slowdown of economic activity following the drop in Japanese equity and real-estate prices: official intervention to resist the rise of the yen;

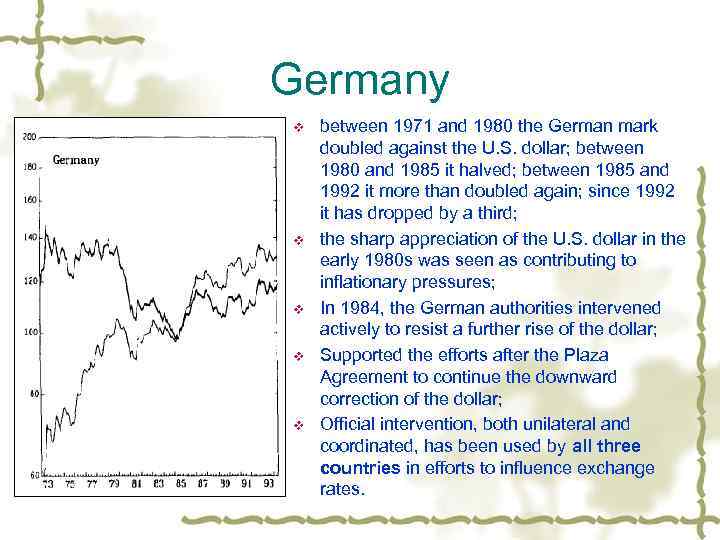

Germany v v v between 1971 and 1980 the German mark doubled against the U. S. dollar; between 1980 and 1985 it halved; between 1985 and 1992 it more than doubled again; since 1992 it has dropped by a third; the sharp appreciation of the U. S. dollar in the early 1980 s was seen as contributing to inflationary pressures; In 1984, the German authorities intervened actively to resist a further rise of the dollar; Supported the efforts after the Plaza Agreement to continue the downward correction of the dollar; Official intervention, both unilateral and coordinated, has been used by all three countries in efforts to influence exchange rates.

Germany v v v between 1971 and 1980 the German mark doubled against the U. S. dollar; between 1980 and 1985 it halved; between 1985 and 1992 it more than doubled again; since 1992 it has dropped by a third; the sharp appreciation of the U. S. dollar in the early 1980 s was seen as contributing to inflationary pressures; In 1984, the German authorities intervened actively to resist a further rise of the dollar; Supported the efforts after the Plaza Agreement to continue the downward correction of the dollar; Official intervention, both unilateral and coordinated, has been used by all three countries in efforts to influence exchange rates.

Plaza Accord v v v v Aims: to reduce the U. S. current account deficit, which had reached 3. 5% of the GDP; to help the U. S. economy to emerge from a serious recession that began in the early 1980 s Results: Successful in reducing the U. S. trade deficit with Western European nations; But largely failed to alleviate the trade deficit with Japan: Japan's structural restrictions on imports; Japan's export-dependent economy : the expansionary monetary policies led to the Japanese asset price bubble of the late 1980 s. Ended-up in a serious recession, the so-called Lost Decade (1991 -2000).

Plaza Accord v v v v Aims: to reduce the U. S. current account deficit, which had reached 3. 5% of the GDP; to help the U. S. economy to emerge from a serious recession that began in the early 1980 s Results: Successful in reducing the U. S. trade deficit with Western European nations; But largely failed to alleviate the trade deficit with Japan: Japan's structural restrictions on imports; Japan's export-dependent economy : the expansionary monetary policies led to the Japanese asset price bubble of the late 1980 s. Ended-up in a serious recession, the so-called Lost Decade (1991 -2000).

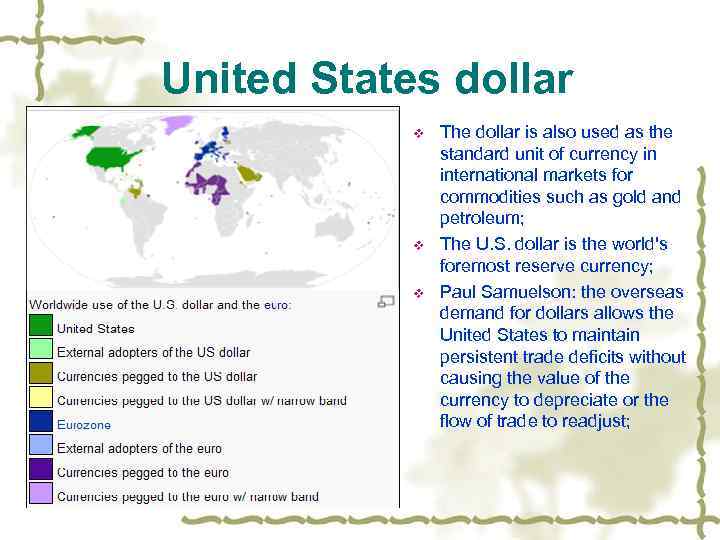

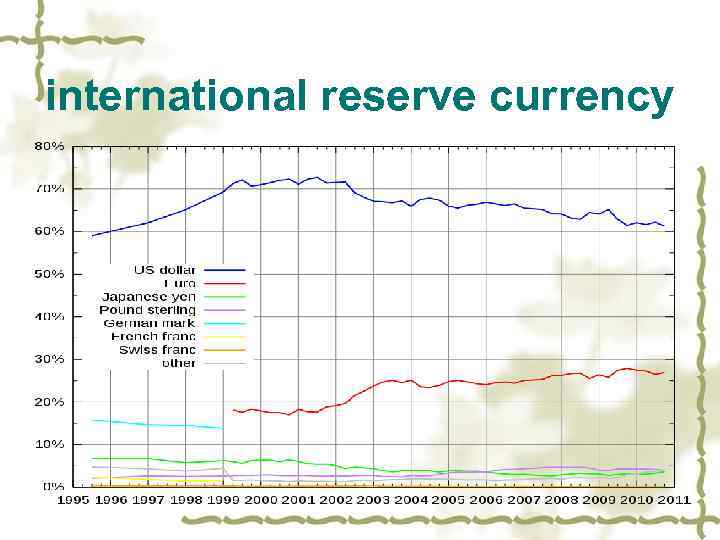

United States dollar v v v The dollar is also used as the standard unit of currency in international markets for commodities such as gold and petroleum; The U. S. dollar is the world's foremost reserve currency; Paul Samuelson: the overseas demand for dollars allows the United States to maintain persistent trade deficits without causing the value of the currency to depreciate or the flow of trade to readjust;

United States dollar v v v The dollar is also used as the standard unit of currency in international markets for commodities such as gold and petroleum; The U. S. dollar is the world's foremost reserve currency; Paul Samuelson: the overseas demand for dollars allows the United States to maintain persistent trade deficits without causing the value of the currency to depreciate or the flow of trade to readjust;

international reserve currency

international reserve currency

Reform of the International Monetary System Robert Mundell in 2009 v v Regionalism: Asia and the other continents should act for itself by creating an Asian currency; World Currency: The Long Run Goal is a Global Currency. Zhou Xiaochuan in 2009 v v Transform IMF’s SDR into a true global currency; Improving distribution of SDR among all IMF members and increasing the size of its issuance; Expanding usage of SDR in international economic transactions; Forming SDR‐priced open‐ended funds to manage pooled foreign reserves.

Reform of the International Monetary System Robert Mundell in 2009 v v Regionalism: Asia and the other continents should act for itself by creating an Asian currency; World Currency: The Long Run Goal is a Global Currency. Zhou Xiaochuan in 2009 v v Transform IMF’s SDR into a true global currency; Improving distribution of SDR among all IMF members and increasing the size of its issuance; Expanding usage of SDR in international economic transactions; Forming SDR‐priced open‐ended funds to manage pooled foreign reserves.

Optimal currency area v developed by Mundell (1961), Mc. Kinnon (1963) and Kenen (1969); v a geographical region to use absolutely fixed exchange rates or to share a single currency; v criteria include: the symmetry of external shocks; the degree of labour mobility; the degree of openness; the extent of economic diversification; flexible price and wage determination; v Other conditions: regional economic integration; a free trade area;

Optimal currency area v developed by Mundell (1961), Mc. Kinnon (1963) and Kenen (1969); v a geographical region to use absolutely fixed exchange rates or to share a single currency; v criteria include: the symmetry of external shocks; the degree of labour mobility; the degree of openness; the extent of economic diversification; flexible price and wage determination; v Other conditions: regional economic integration; a free trade area;

European Monetary System and Monetary Union v EMS: March, 1979 v Purpose: to foster monetary stability in the European Community. European Currency Unit (ECU) v The basic elements of the arrangement v v v The ECU: A basket of currencies, preventing movements above 2. 25% (6% for Italy) around parity in bilateral exchange rates with other member countries. An Exchange Rate Mechanism (ERM) An extension of European credit facilities. The European Monetary Cooperation Fund: created in October 1972 and allocates ECUs to members' central banks in exchange for gold and US dollar deposits.

European Monetary System and Monetary Union v EMS: March, 1979 v Purpose: to foster monetary stability in the European Community. European Currency Unit (ECU) v The basic elements of the arrangement v v v The ECU: A basket of currencies, preventing movements above 2. 25% (6% for Italy) around parity in bilateral exchange rates with other member countries. An Exchange Rate Mechanism (ERM) An extension of European credit facilities. The European Monetary Cooperation Fund: created in October 1972 and allocates ECUs to members' central banks in exchange for gold and US dollar deposits.

Currency Crisis in September, 1992 v v v In the early 1990 s the EMS was strained by the differing economic policies and conditions of its members; Britain permanently withdrew from the system in September 1992. Black Wednesday: 16 September 1992, the British Conservative government was forced to withdraw the pound sterling from the European Exchange Rate Mechanism (ERM). George Soros, the most high profile of the currency market investors, made over US$1 billion profit by short selling sterling. On 17 September 1992 Italy withdrew from ERM; Speculative attacks on the French Franc during the following year led to the so-called Brussels Compromise in August 1993 which established a new fluctuation band of +15%.

Currency Crisis in September, 1992 v v v In the early 1990 s the EMS was strained by the differing economic policies and conditions of its members; Britain permanently withdrew from the system in September 1992. Black Wednesday: 16 September 1992, the British Conservative government was forced to withdraw the pound sterling from the European Exchange Rate Mechanism (ERM). George Soros, the most high profile of the currency market investors, made over US$1 billion profit by short selling sterling. On 17 September 1992 Italy withdrew from ERM; Speculative attacks on the French Franc during the following year led to the so-called Brussels Compromise in August 1993 which established a new fluctuation band of +15%.

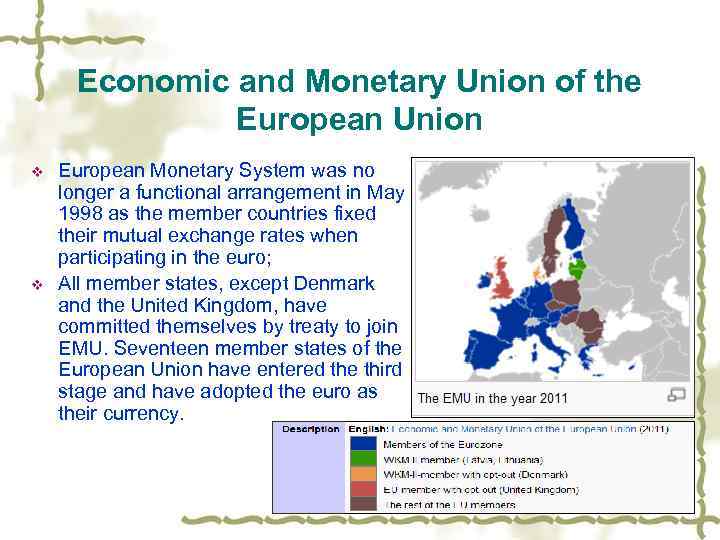

Economic and Monetary Union of the European Union v v European Monetary System was no longer a functional arrangement in May 1998 as the member countries fixed their mutual exchange rates when participating in the euro; All member states, except Denmark and the United Kingdom, have committed themselves by treaty to join EMU. Seventeen member states of the European Union have entered the third stage and have adopted the euro as their currency.

Economic and Monetary Union of the European Union v v European Monetary System was no longer a functional arrangement in May 1998 as the member countries fixed their mutual exchange rates when participating in the euro; All member states, except Denmark and the United Kingdom, have committed themselves by treaty to join EMU. Seventeen member states of the European Union have entered the third stage and have adopted the euro as their currency.

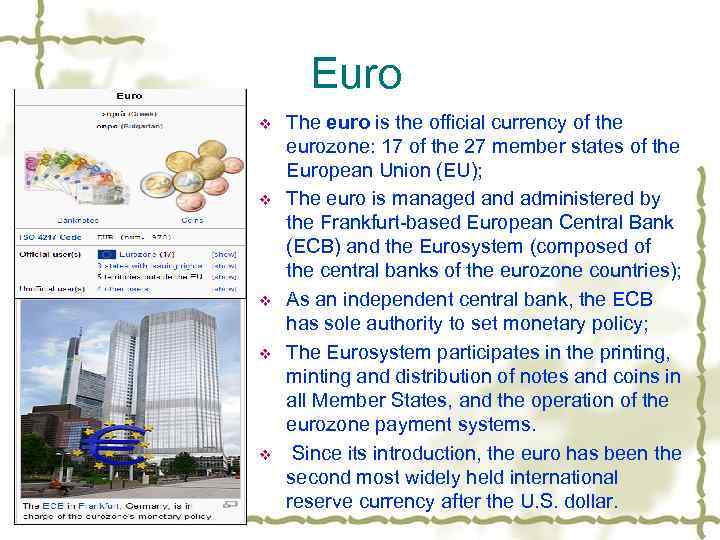

Euro v v v The euro is the official currency of the eurozone: 17 of the 27 member states of the European Union (EU); The euro is managed and administered by the Frankfurt-based European Central Bank (ECB) and the Eurosystem (composed of the central banks of the eurozone countries); As an independent central bank, the ECB has sole authority to set monetary policy; The Eurosystem participates in the printing, minting and distribution of notes and coins in all Member States, and the operation of the eurozone payment systems. Since its introduction, the euro has been the second most widely held international reserve currency after the U. S. dollar.

Euro v v v The euro is the official currency of the eurozone: 17 of the 27 member states of the European Union (EU); The euro is managed and administered by the Frankfurt-based European Central Bank (ECB) and the Eurosystem (composed of the central banks of the eurozone countries); As an independent central bank, the ECB has sole authority to set monetary policy; The Eurosystem participates in the printing, minting and distribution of notes and coins in all Member States, and the operation of the eurozone payment systems. Since its introduction, the euro has been the second most widely held international reserve currency after the U. S. dollar.

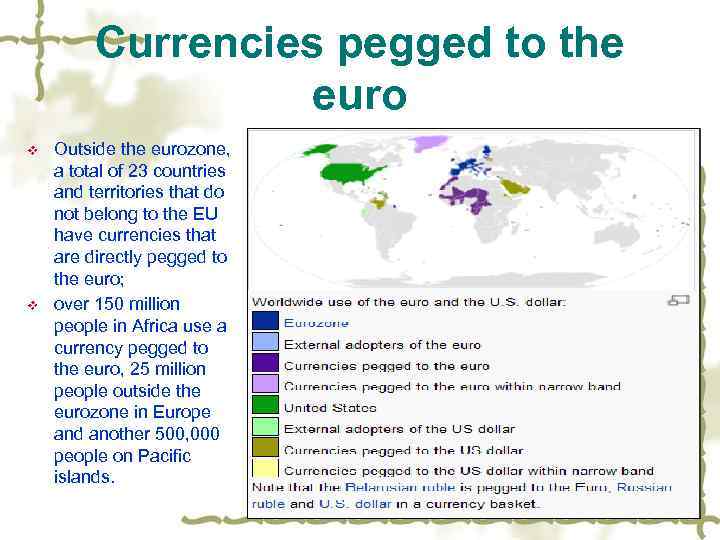

Currencies pegged to the euro v v Outside the eurozone, a total of 23 countries and territories that do not belong to the EU have currencies that are directly pegged to the euro; over 150 million people in Africa use a currency pegged to the euro, 25 million people outside the eurozone in Europe and another 500, 000 people on Pacific islands.

Currencies pegged to the euro v v Outside the eurozone, a total of 23 countries and territories that do not belong to the EU have currencies that are directly pegged to the euro; over 150 million people in Africa use a currency pegged to the euro, 25 million people outside the eurozone in Europe and another 500, 000 people on Pacific islands.

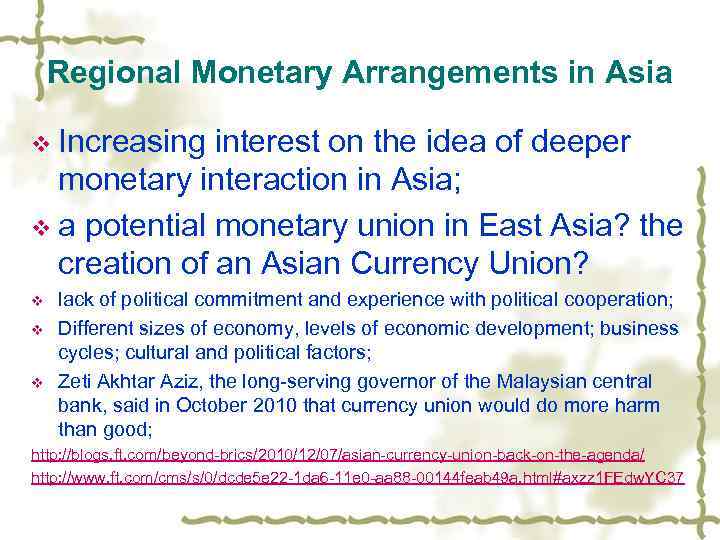

Regional Monetary Arrangements in Asia v Increasing interest on the idea of deeper monetary interaction in Asia; v a potential monetary union in East Asia? the creation of an Asian Currency Union? v v v lack of political commitment and experience with political cooperation; Different sizes of economy, levels of economic development; business cycles; cultural and political factors; Zeti Akhtar Aziz, the long-serving governor of the Malaysian central bank, said in October 2010 that currency union would do more harm than good; http: //blogs. ft. com/beyond-brics/2010/12/07/asian-currency-union-back-on-the-agenda/ http: //www. ft. com/cms/s/0/dcde 5 e 22 -1 da 6 -11 e 0 -aa 88 -00144 feab 49 a. html#axzz 1 FEdw. YC 37

Regional Monetary Arrangements in Asia v Increasing interest on the idea of deeper monetary interaction in Asia; v a potential monetary union in East Asia? the creation of an Asian Currency Union? v v v lack of political commitment and experience with political cooperation; Different sizes of economy, levels of economic development; business cycles; cultural and political factors; Zeti Akhtar Aziz, the long-serving governor of the Malaysian central bank, said in October 2010 that currency union would do more harm than good; http: //blogs. ft. com/beyond-brics/2010/12/07/asian-currency-union-back-on-the-agenda/ http: //www. ft. com/cms/s/0/dcde 5 e 22 -1 da 6 -11 e 0 -aa 88 -00144 feab 49 a. html#axzz 1 FEdw. YC 37

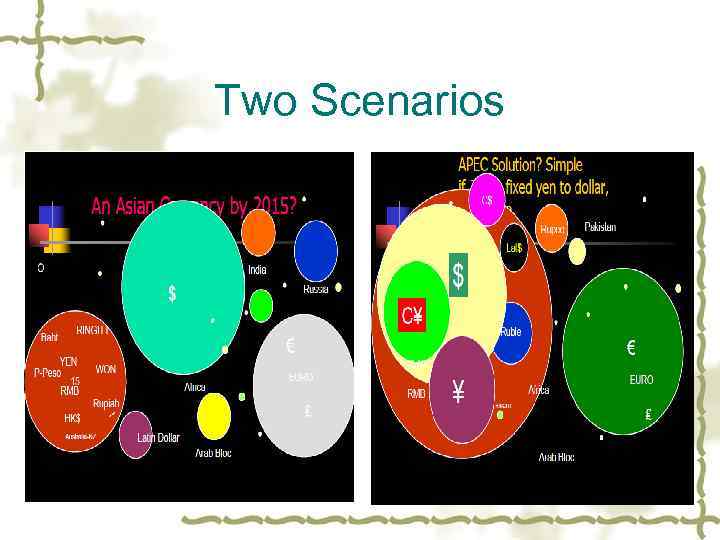

Two Scenarios

Two Scenarios

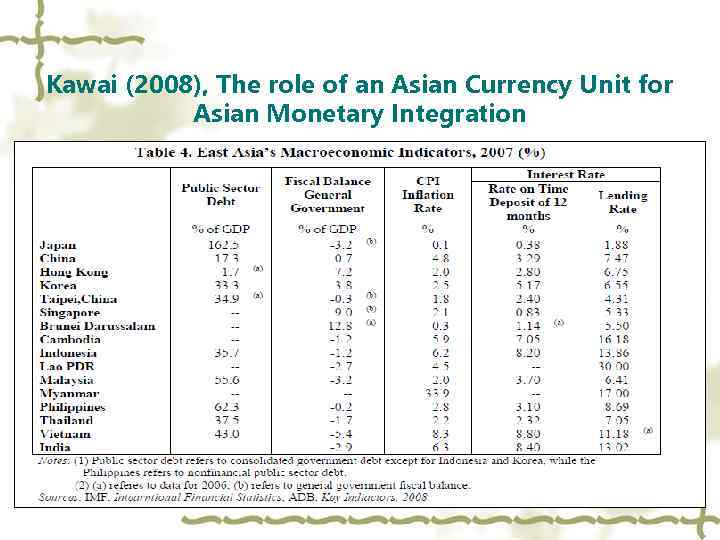

Kawai (2008), The role of an Asian Currency Unit for Asian Monetary Integration

Kawai (2008), The role of an Asian Currency Unit for Asian Monetary Integration

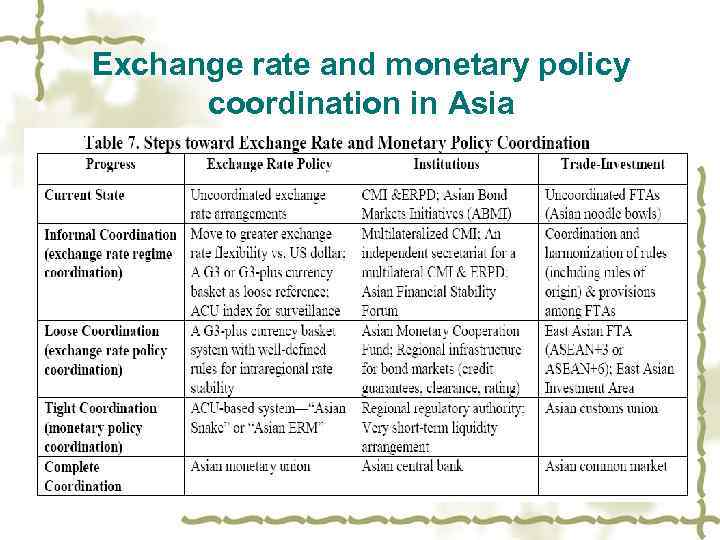

Exchange rate and monetary policy coordination in Asia

Exchange rate and monetary policy coordination in Asia

Question: from dollars to Bancor? http: //endtimeproof. org/? p=245 v Benefits? v Shortcomings? v Possibilities?

Question: from dollars to Bancor? http: //endtimeproof. org/? p=245 v Benefits? v Shortcomings? v Possibilities?

Thank You!

Thank You!