fea6206f09d0ed8339c88c9a19cc359c.ppt

- Количество слайдов: 71

International Finance http: //www. oanda. com/converter/classic

International Finance http: //www. oanda. com/converter/classic

Learning Objectives • Explain how international trade is financed • Describe a country’s balance of payments accounts • Explain what determines the amount of international borrowing and lending 2

Learning Objectives • Explain how international trade is financed • Describe a country’s balance of payments accounts • Explain what determines the amount of international borrowing and lending 2

Learning Objectives (cont. ) • Explain why the United States changed from being a lender to being a borrower in the mid-1980 s • Explain how the foreign exchange value of the dollar is determined • Explain why the foreign exchange value of the dollar fluctuates 3

Learning Objectives (cont. ) • Explain why the United States changed from being a lender to being a borrower in the mid-1980 s • Explain how the foreign exchange value of the dollar is determined • Explain why the foreign exchange value of the dollar fluctuates 3

Financing International Trade Balance of Payments Accounts Balance of payments accounts record a country’s international trading, borrowing, and lending. 5

Financing International Trade Balance of Payments Accounts Balance of payments accounts record a country’s international trading, borrowing, and lending. 5

Balance of Payments: Credits • Credits, + (receipts from foreigners) • • Exports of goods and services Income receipts Unilateral current transfers to the US Financial inflows • “Dollars in” 6

Balance of Payments: Credits • Credits, + (receipts from foreigners) • • Exports of goods and services Income receipts Unilateral current transfers to the US Financial inflows • “Dollars in” 6

Balance of Payments: Debits • Debits, - (payment to foreigners) • • Imports of goods and services Income payments Unilateral current transfers to foreigners Financial outflows • “Dollars out” 7

Balance of Payments: Debits • Debits, - (payment to foreigners) • • Imports of goods and services Income payments Unilateral current transfers to foreigners Financial outflows • “Dollars out” 7

Balance of Payments Paired Transactions • Every international transaction enters the balance of payments twice, once as a credit and once as a debit • If you buy something from a foreigner, you must pay her. She must then spend or store your payment. 8

Balance of Payments Paired Transactions • Every international transaction enters the balance of payments twice, once as a credit and once as a debit • If you buy something from a foreigner, you must pay her. She must then spend or store your payment. 8

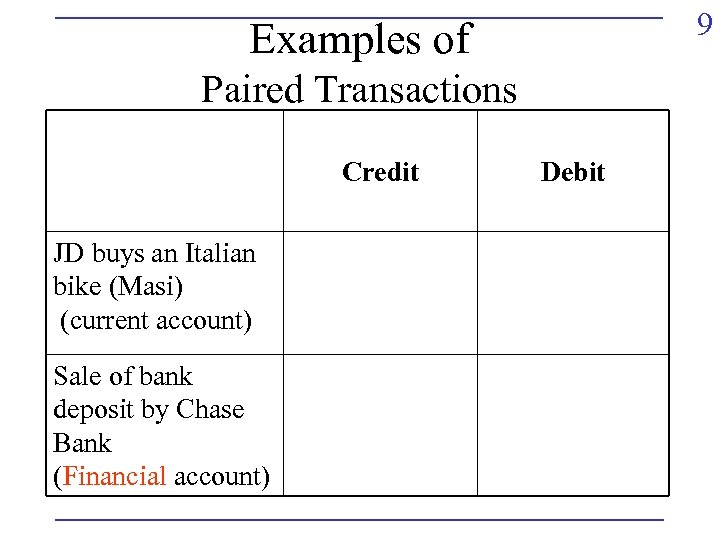

9 Examples of Paired Transactions Credit JD buys an Italian bike (Masi) (current account) Sale of bank deposit by Chase Bank (Financial account) Debit

9 Examples of Paired Transactions Credit JD buys an Italian bike (Masi) (current account) Sale of bank deposit by Chase Bank (Financial account) Debit

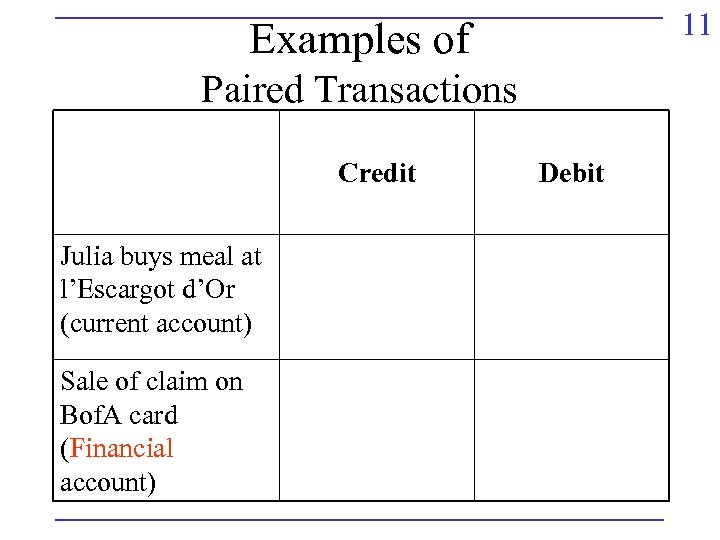

11 Examples of Paired Transactions Credit Julia buys meal at l’Escargot d’Or (current account) Sale of claim on Bof. A card (Financial account) Debit

11 Examples of Paired Transactions Credit Julia buys meal at l’Escargot d’Or (current account) Sale of claim on Bof. A card (Financial account) Debit

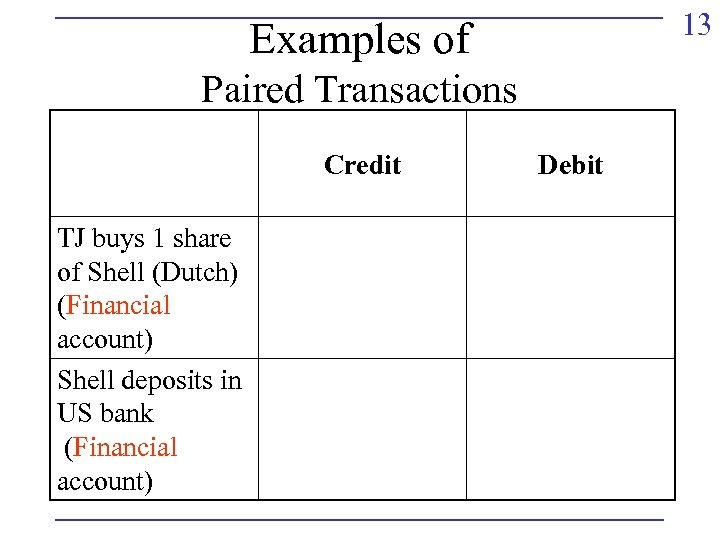

13 Examples of Paired Transactions Credit TJ buys 1 share of Shell (Dutch) (Financial account) Shell deposits in US bank (Financial account) Debit

13 Examples of Paired Transactions Credit TJ buys 1 share of Shell (Dutch) (Financial account) Shell deposits in US bank (Financial account) Debit

Credits to the Current Account • Credits, + (receipts from foreigners) • Exports of goods and services • income receipts • unilateral current transfers to the US 15

Credits to the Current Account • Credits, + (receipts from foreigners) • Exports of goods and services • income receipts • unilateral current transfers to the US 15

Debits to the Current Account • Debits, - (payment to foreigners) • Imports of goods and services • Income payments • Unilateral current transfers to foreigners 16

Debits to the Current Account • Debits, - (payment to foreigners) • Imports of goods and services • Income payments • Unilateral current transfers to foreigners 16

Credits to the Financial Account • Credits, + (receipts from foreigners) • Financial inflows • Increase in foreign-owned assets (U. S. liabilities) • Decrease in U. S. -owned assets (U. S. claims). 17

Credits to the Financial Account • Credits, + (receipts from foreigners) • Financial inflows • Increase in foreign-owned assets (U. S. liabilities) • Decrease in U. S. -owned assets (U. S. claims). 17

Debits to the Financial Account • Debits, - (payment to foreigners) • Financial outflows • Decrease in foreign-owned assets (U. S. liabilities) • Increase in U. S. -owned assets (U. S. claims) 18

Debits to the Financial Account • Debits, - (payment to foreigners) • Financial outflows • Decrease in foreign-owned assets (U. S. liabilities) • Increase in U. S. -owned assets (U. S. claims) 18

Financing International Trade The balance of payments accounts include: 1) Current account • Exports of goods and services + US income receipts • Imports of goods and services+US income payments • Unilateral current transfers, net • US receipts – US payments • “Net interest income” = US income receipts – US income payments 19

Financing International Trade The balance of payments accounts include: 1) Current account • Exports of goods and services + US income receipts • Imports of goods and services+US income payments • Unilateral current transfers, net • US receipts – US payments • “Net interest income” = US income receipts – US income payments 19

Financing International Trade The balance of payments accounts include: 2) Financial account* • Records changes in foreign assets in the United States minus changes US assets abroad * Prior to 1997, the Financial account was known as the Capital account 20

Financing International Trade The balance of payments accounts include: 2) Financial account* • Records changes in foreign assets in the United States minus changes US assets abroad * Prior to 1997, the Financial account was known as the Capital account 20

Financing International Trade The balance of payments accounts include: 3) Official settlements account • Records the change in official U. S. reserves. • Official U. S reserves -- mainly the government’s holdings of foreign currency. • If official reserves increase, the official settlements accounts balance is negative. Part of the Financial account & it’s small! 21

Financing International Trade The balance of payments accounts include: 3) Official settlements account • Records the change in official U. S. reserves. • Official U. S reserves -- mainly the government’s holdings of foreign currency. • If official reserves increase, the official settlements accounts balance is negative. Part of the Financial account & it’s small! 21

Financing International Trade 22 Fundamental balance of payments accounts identity: Current account + Financial account = 0

Financing International Trade 22 Fundamental balance of payments accounts identity: Current account + Financial account = 0

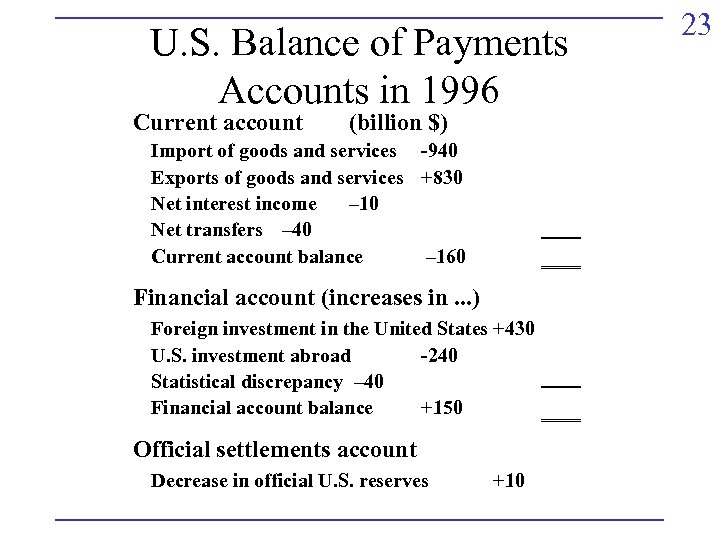

U. S. Balance of Payments Accounts in 1996 Current account (billion $) Import of goods and services -940 Exports of goods and services +830 Net interest income – 10 Net transfers – 40 Current account balance – 160 Financial account (increases in. . . ) Foreign investment in the United States +430 U. S. investment abroad -240 Statistical discrepancy – 40 Financial account balance +150 Official settlements account Decrease in official U. S. reserves +10 23

U. S. Balance of Payments Accounts in 1996 Current account (billion $) Import of goods and services -940 Exports of goods and services +830 Net interest income – 10 Net transfers – 40 Current account balance – 160 Financial account (increases in. . . ) Foreign investment in the United States +430 U. S. investment abroad -240 Statistical discrepancy – 40 Financial account balance +150 Official settlements account Decrease in official U. S. reserves +10 23

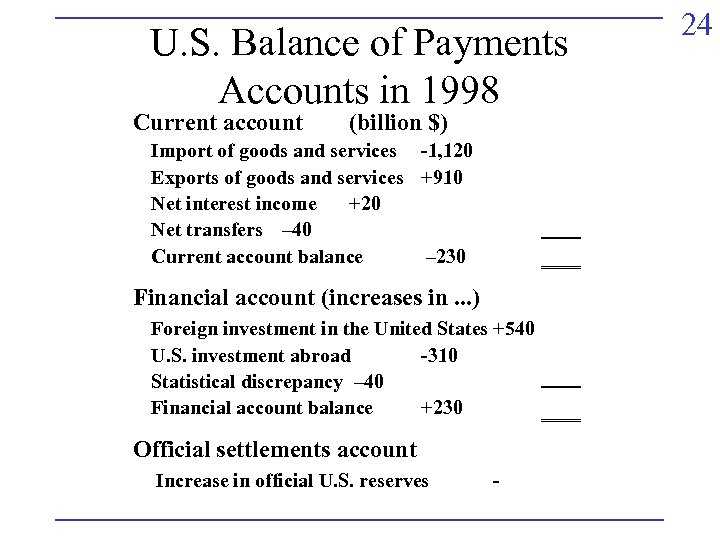

U. S. Balance of Payments Accounts in 1998 Current account (billion $) Import of goods and services -1, 120 Exports of goods and services +910 Net interest income +20 Net transfers – 40 Current account balance – 230 Financial account (increases in. . . ) Foreign investment in the United States +540 U. S. investment abroad -310 Statistical discrepancy – 40 Financial account balance +230 Official settlements account Increase in official U. S. reserves - 24

U. S. Balance of Payments Accounts in 1998 Current account (billion $) Import of goods and services -1, 120 Exports of goods and services +910 Net interest income +20 Net transfers – 40 Current account balance – 230 Financial account (increases in. . . ) Foreign investment in the United States +540 U. S. investment abroad -310 Statistical discrepancy – 40 Financial account balance +230 Official settlements account Increase in official U. S. reserves - 24

U. S. Balance of Payments • Let’s visit the Bureau of Economic Analysis http: //www. bea. doc. gov/bea/di 1. htm 28

U. S. Balance of Payments • Let’s visit the Bureau of Economic Analysis http: //www. bea. doc. gov/bea/di 1. htm 28

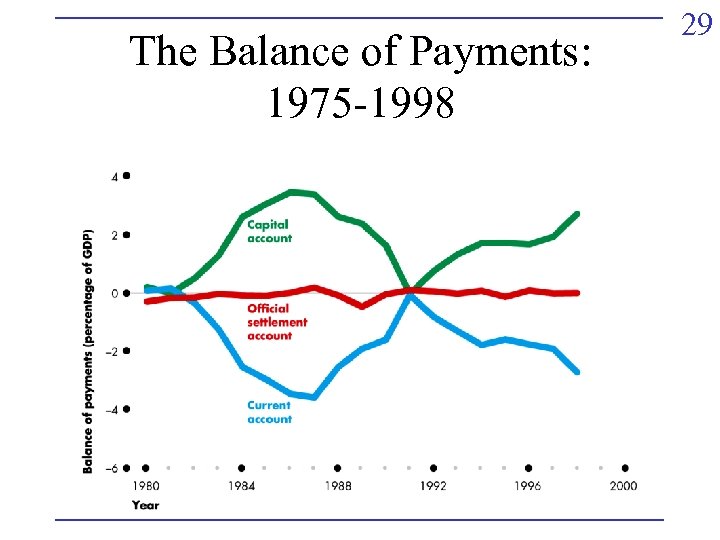

The Balance of Payments: 1975 -1998 29

The Balance of Payments: 1975 -1998 29

Financing International Trade Borrowers and Lenders, Debtors and Creditors • A net borrower is a country that is borrowing more from the rest of the world than it is lending. • A net lender is a country that is lending more than it is borrowing. 30

Financing International Trade Borrowers and Lenders, Debtors and Creditors • A net borrower is a country that is borrowing more from the rest of the world than it is lending. • A net lender is a country that is lending more than it is borrowing. 30

Financing International Trade Borrowers and Lenders, Debtors and Creditors • Debtor nations are countries that during their entire history have borrowed more from the rest of the world than they have lent to it. • Creditor nations are countries that have invested more in the rest of the world than other countries have invested in it. 31

Financing International Trade Borrowers and Lenders, Debtors and Creditors • Debtor nations are countries that during their entire history have borrowed more from the rest of the world than they have lent to it. • Creditor nations are countries that have invested more in the rest of the world than other countries have invested in it. 31

Financing International Trade Borrowers and Lenders, Debtors and Creditors • The United States is both a net borrower and a debtor nation. • We became a borrower as a result of a string of current account deficits. Is there any reason to be concerned? 33

Financing International Trade Borrowers and Lenders, Debtors and Creditors • The United States is both a net borrower and a debtor nation. • We became a borrower as a result of a string of current account deficits. Is there any reason to be concerned? 33

Financing International Trade No — if the borrowing is financing investment that is generating economic growth and higher income. Yes — if the money is being used to finance consumption. This will result in higher interest payments and consumption will eventually have to be reduced. 34

Financing International Trade No — if the borrowing is financing investment that is generating economic growth and higher income. Yes — if the money is being used to finance consumption. This will result in higher interest payments and consumption will eventually have to be reduced. 34

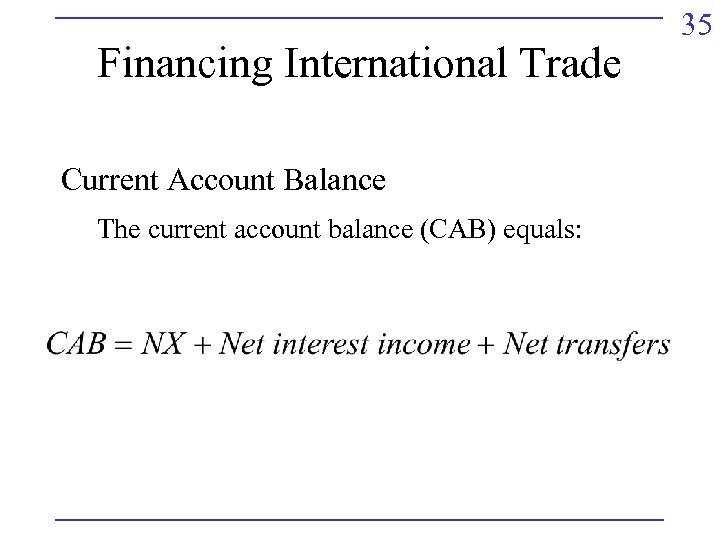

Financing International Trade Current Account Balance The current account balance (CAB) equals: 35

Financing International Trade Current Account Balance The current account balance (CAB) equals: 35

Financing International Trade Net Exports • Largest part of the current account balance. • Determined by the government budget and private saving and investment. 36

Financing International Trade Net Exports • Largest part of the current account balance. • Determined by the government budget and private saving and investment. 36

Financing International Trade Net Exports • Net exports is exports of goods and services minus imports of goods and services (X-M) • A government sector surplus or deficit is net taxes minus government purchases of goods and services (T – G) • A private sector surplus or deficit is saving minus investment (S – I) 37

Financing International Trade Net Exports • Net exports is exports of goods and services minus imports of goods and services (X-M) • A government sector surplus or deficit is net taxes minus government purchases of goods and services (T – G) • A private sector surplus or deficit is saving minus investment (S – I) 37

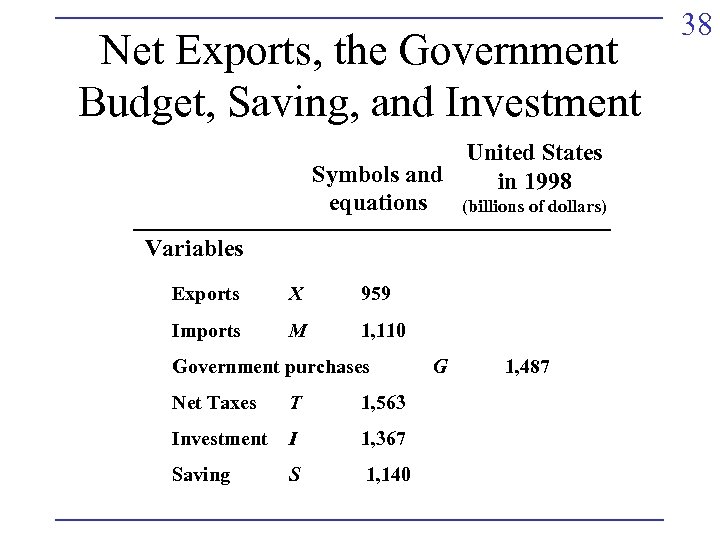

Net Exports, the Government Budget, Saving, and Investment United States Symbols and in 1998 equations (billions of dollars) Variables Exports X 959 Imports M 1, 110 Government purchases Net Taxes T 1, 563 Investment I 1, 367 Saving S 1, 140 G 1, 487 38

Net Exports, the Government Budget, Saving, and Investment United States Symbols and in 1998 equations (billions of dollars) Variables Exports X 959 Imports M 1, 110 Government purchases Net Taxes T 1, 563 Investment I 1, 367 Saving S 1, 140 G 1, 487 38

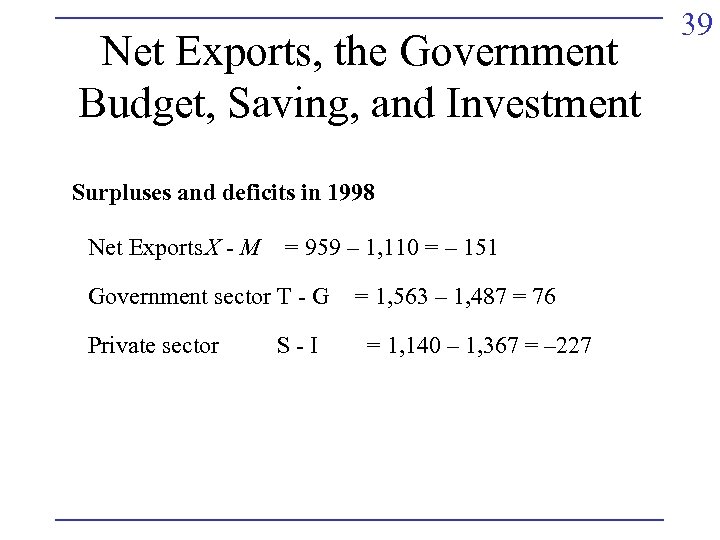

Net Exports, the Government Budget, Saving, and Investment Surpluses and deficits in 1998 Net Exports. X - M = 959 – 1, 110 = – 151 Government sector T - G = 1, 563 – 1, 487 = 76 Private sector S - I = 1, 140 – 1, 367 = – 227 39

Net Exports, the Government Budget, Saving, and Investment Surpluses and deficits in 1998 Net Exports. X - M = 959 – 1, 110 = – 151 Government sector T - G = 1, 563 – 1, 487 = 76 Private sector S - I = 1, 140 – 1, 367 = – 227 39

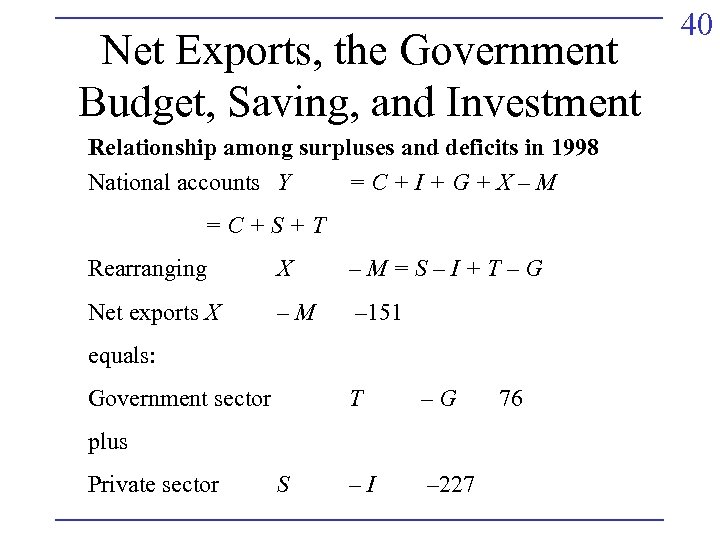

Net Exports, the Government Budget, Saving, and Investment Relationship among surpluses and deficits in 1998 National accounts Y =C+I+G+X–M =C+S+T Rearranging X –M=S–I+T–G Net exports X –M – 151 equals: Government sector T –G –I – 227 plus Private sector S 76 40

Net Exports, the Government Budget, Saving, and Investment Relationship among surpluses and deficits in 1998 National accounts Y =C+I+G+X–M =C+S+T Rearranging X –M=S–I+T–G Net exports X –M – 151 equals: Government sector T –G –I – 227 plus Private sector S 76 40

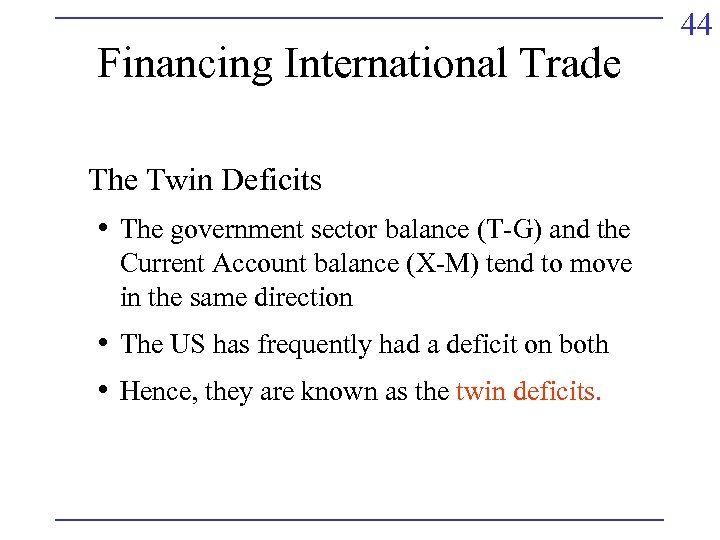

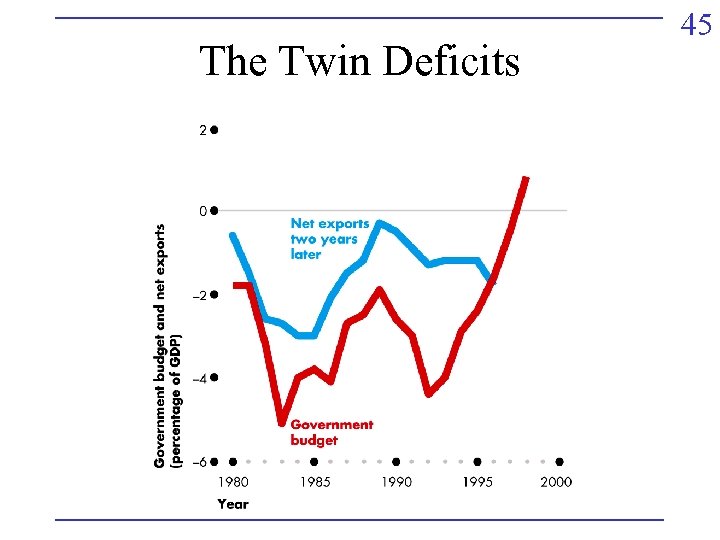

Financing International Trade The Twin Deficits • The government sector balance (T-G) and the Current Account balance (X-M) tend to move in the same direction • The US has frequently had a deficit on both • Hence, they are known as the twin deficits. 44

Financing International Trade The Twin Deficits • The government sector balance (T-G) and the Current Account balance (X-M) tend to move in the same direction • The US has frequently had a deficit on both • Hence, they are known as the twin deficits. 44

The Twin Deficits 45

The Twin Deficits 45

Financing International Trade Is U. S. Borrowing for Consumption or Investment • Net exports were –$99 billion in 1996 • The government buys structures (e. g. highways, dams) that exceed $200 billion/year. • The government spends on education and health care—increases human capital. 46

Financing International Trade Is U. S. Borrowing for Consumption or Investment • Net exports were –$99 billion in 1996 • The government buys structures (e. g. highways, dams) that exceed $200 billion/year. • The government spends on education and health care—increases human capital. 46

Financing International Trade Is U. S. Borrowing for Consumption or Investment Our borrowing is financing investment 47

Financing International Trade Is U. S. Borrowing for Consumption or Investment Our borrowing is financing investment 47

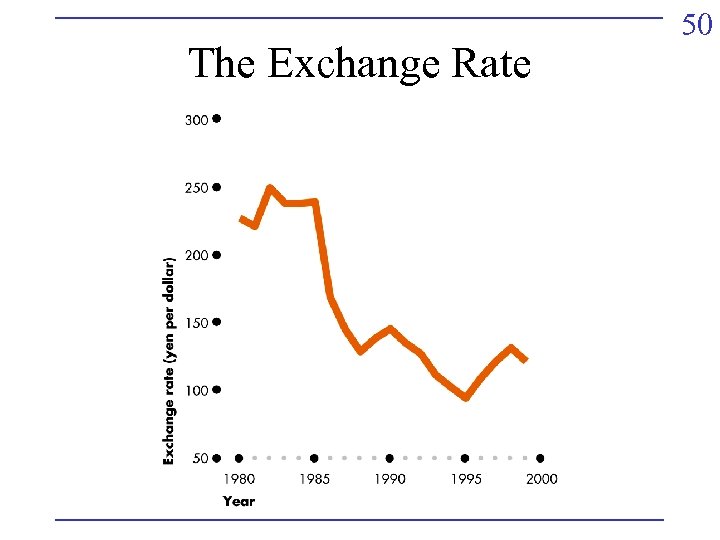

The Exchange Rate • The foreign exchange market is the market in which the currency of one country is exchanged for the currency of another. • The foreign exchange rate is the price at which one currency exchanges for another. • In April 1997==>$1 = 123 Japanese yen 49

The Exchange Rate • The foreign exchange market is the market in which the currency of one country is exchanged for the currency of another. • The foreign exchange rate is the price at which one currency exchanges for another. • In April 1997==>$1 = 123 Japanese yen 49

The Exchange Rate 50

The Exchange Rate 50

The Exchange Rate Currency depreciation is the fall in the value of one currency in terms of another. • The dollar depreciates if in later months it will buy less yen than before (e. g. 90 yen as compared to 114). Currency appreciation is the rise in the value of one currency in terms of another currency. 51

The Exchange Rate Currency depreciation is the fall in the value of one currency in terms of another. • The dollar depreciates if in later months it will buy less yen than before (e. g. 90 yen as compared to 114). Currency appreciation is the rise in the value of one currency in terms of another currency. 51

The Exchange Rate Demand in the Foreign Exchange Market The quantity of dollars demanded in the foreign exchange market depends upon: 1) The exchange rate 2) Interest rates in the United States and other countries 3) The expected future exchange rate 52

The Exchange Rate Demand in the Foreign Exchange Market The quantity of dollars demanded in the foreign exchange market depends upon: 1) The exchange rate 2) Interest rates in the United States and other countries 3) The expected future exchange rate 52

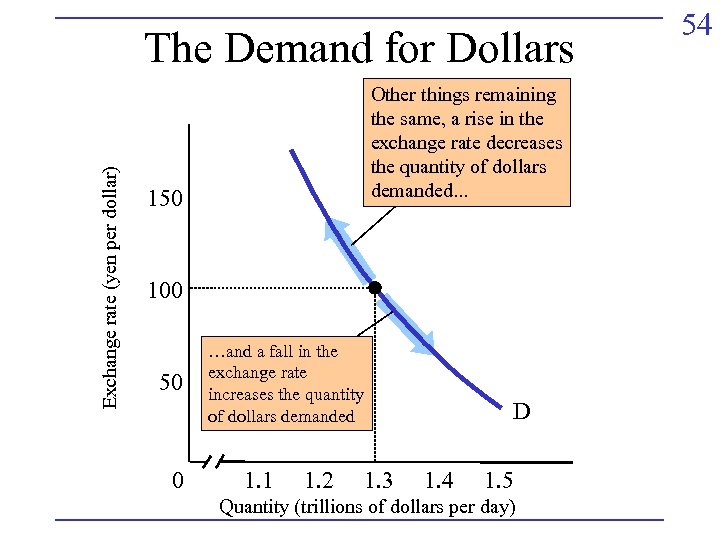

The Exchange Rate The Law of Demand for Foreign Exchange • The demand for dollars is a derived demand. • They (Ro. W) buy dollars in order to buy U. S. -made goods and services. • Holding other things the same, the higher the exchange rate, the less is the quantity of dollars demanded. 53

The Exchange Rate The Law of Demand for Foreign Exchange • The demand for dollars is a derived demand. • They (Ro. W) buy dollars in order to buy U. S. -made goods and services. • Holding other things the same, the higher the exchange rate, the less is the quantity of dollars demanded. 53

Exchange rate (yen per dollar) The Demand for Dollars Other things remaining the same, a rise in the exchange rate decreases the quantity of dollars demanded. . . 150 100 50 0 …and a fall in the exchange rate increases the quantity of dollars demanded 1. 1 1. 2 1. 3 D 1. 4 1. 5 Quantity (trillions of dollars per day) 54

Exchange rate (yen per dollar) The Demand for Dollars Other things remaining the same, a rise in the exchange rate decreases the quantity of dollars demanded. . . 150 100 50 0 …and a fall in the exchange rate increases the quantity of dollars demanded 1. 1 1. 2 1. 3 D 1. 4 1. 5 Quantity (trillions of dollars per day) 54

The Exchange Rate Why do exchange rates influence the quantity of dollars demanded? 1) Exports Effect 2) Expected Profit Effect 55

The Exchange Rate Why do exchange rates influence the quantity of dollars demanded? 1) Exports Effect 2) Expected Profit Effect 55

The Exchange Rate Changes in the Demand for Dollars A change in any other influence on the dollars that people plan to buy in the foreign exchange market: • Changes the demand for dollars • Shifts the demand curve for dollars 56

The Exchange Rate Changes in the Demand for Dollars A change in any other influence on the dollars that people plan to buy in the foreign exchange market: • Changes the demand for dollars • Shifts the demand curve for dollars 56

The Exchange Rate The other factors that change the demand for dollars are: 1) Interest rates in the United States and other countries interest rate differential = US rate – other rate 2) The expected future exchange rate 57

The Exchange Rate The other factors that change the demand for dollars are: 1) Interest rates in the United States and other countries interest rate differential = US rate – other rate 2) The expected future exchange rate 57

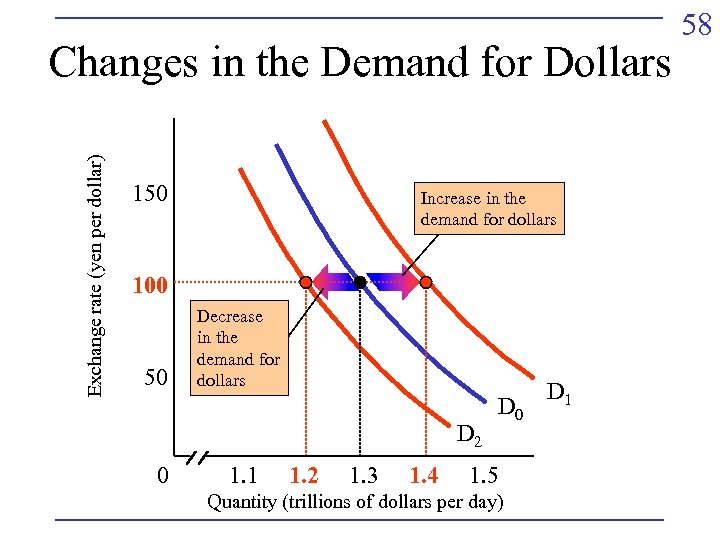

Exchange rate (yen per dollar) Changes in the Demand for Dollars 150 Increase in the demand for dollars 100 50 Decrease in the demand for dollars D 2 0 1. 1 1. 2 1. 3 1. 4 D 0 1. 5 Quantity (trillions of dollars per day) D 1 58

Exchange rate (yen per dollar) Changes in the Demand for Dollars 150 Increase in the demand for dollars 100 50 Decrease in the demand for dollars D 2 0 1. 1 1. 2 1. 3 1. 4 D 0 1. 5 Quantity (trillions of dollars per day) D 1 58

Changes in the Demand for Dollars The demand for dollars increases if: The demand for dollars decreases if: • The U. S interest rate • The U. S. interest rate differential increases differential decreases • The expected future exchange rate rises exchange rate falls 59

Changes in the Demand for Dollars The demand for dollars increases if: The demand for dollars decreases if: • The U. S interest rate • The U. S. interest rate differential increases differential decreases • The expected future exchange rate rises exchange rate falls 59

The Exchange Rate Supply in the Foreign Exchange Market The quantity of dollars supplied in the foreign exchange market depends upon: 1) The exchange rate 2) Interest rates in the United States and other countries 3) The expected future exchange rate 60

The Exchange Rate Supply in the Foreign Exchange Market The quantity of dollars supplied in the foreign exchange market depends upon: 1) The exchange rate 2) Interest rates in the United States and other countries 3) The expected future exchange rate 60

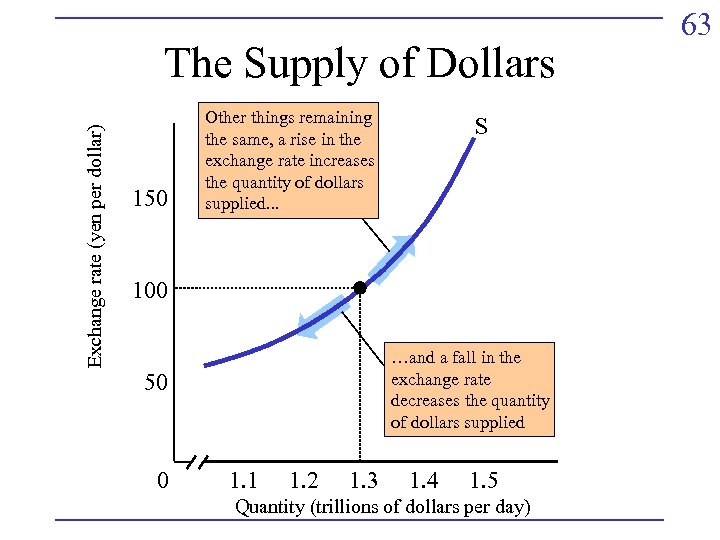

The Exchange Rate The Law of Supply for Foreign Exchange • U. S. residents supply dollars in the foreign exchange market when they buy imports. • Holding other things the same, the higher the exchange rate, the higher is the quantity of dollars supplied. 61

The Exchange Rate The Law of Supply for Foreign Exchange • U. S. residents supply dollars in the foreign exchange market when they buy imports. • Holding other things the same, the higher the exchange rate, the higher is the quantity of dollars supplied. 61

The Exchange Rate Why do exchange rates influence the quantity of dollars supplied? 1) Imports Effect 2) Expected Profit Effect 62

The Exchange Rate Why do exchange rates influence the quantity of dollars supplied? 1) Imports Effect 2) Expected Profit Effect 62

Exchange rate (yen per dollar) The Supply of Dollars 150 Other things remaining the same, a rise in the exchange rate increases the quantity of dollars supplied. . . S 100 …and a fall in the exchange rate decreases the quantity of dollars supplied 50 0 1. 1 1. 2 1. 3 1. 4 1. 5 Quantity (trillions of dollars per day) 63

Exchange rate (yen per dollar) The Supply of Dollars 150 Other things remaining the same, a rise in the exchange rate increases the quantity of dollars supplied. . . S 100 …and a fall in the exchange rate decreases the quantity of dollars supplied 50 0 1. 1 1. 2 1. 3 1. 4 1. 5 Quantity (trillions of dollars per day) 63

The Exchange Rate Changes in the Supply of Dollars A change in any other influence on the dollars that people plan to sell in the foreign exchange market: • Changes the supply of dollars • Shifts the supply curve of dollars 64

The Exchange Rate Changes in the Supply of Dollars A change in any other influence on the dollars that people plan to sell in the foreign exchange market: • Changes the supply of dollars • Shifts the supply curve of dollars 64

The Exchange Rate The other factors that change the supply of dollars are: 1) Interest rates in the United States and other countries 2) The expected future exchange rate 65

The Exchange Rate The other factors that change the supply of dollars are: 1) Interest rates in the United States and other countries 2) The expected future exchange rate 65

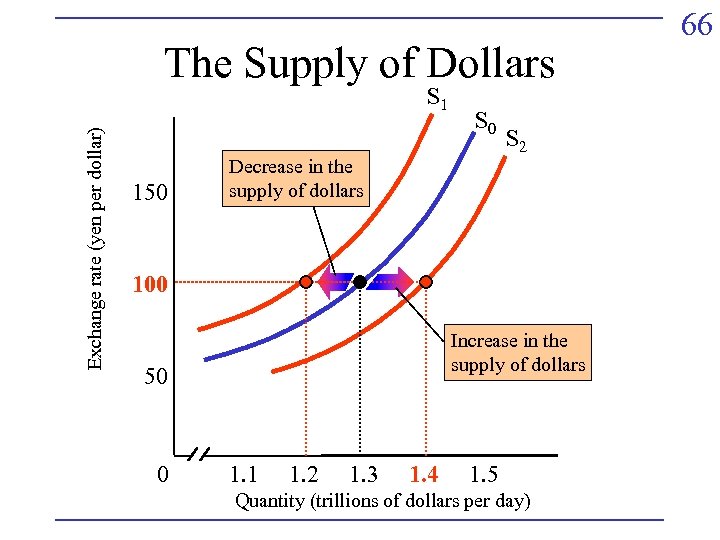

The Supply of Dollars Exchange rate (yen per dollar) S 1 150 S 0 Decrease in the supply of dollars S 2 100 Increase in the supply of dollars 50 0 1. 1 1. 2 1. 3 1. 4 1. 5 Quantity (trillions of dollars per day) 66

The Supply of Dollars Exchange rate (yen per dollar) S 1 150 S 0 Decrease in the supply of dollars S 2 100 Increase in the supply of dollars 50 0 1. 1 1. 2 1. 3 1. 4 1. 5 Quantity (trillions of dollars per day) 66

Changes in the Supply of Dollars The supply of dollars increases if: The supply of dollars decreases if: • The U. S interest rate • The U. S. interest rate differential decreases differential increases • The expected future exchange rate falls exchange rate rises 67

Changes in the Supply of Dollars The supply of dollars increases if: The supply of dollars decreases if: • The U. S interest rate • The U. S. interest rate differential decreases differential increases • The expected future exchange rate falls exchange rate rises 67

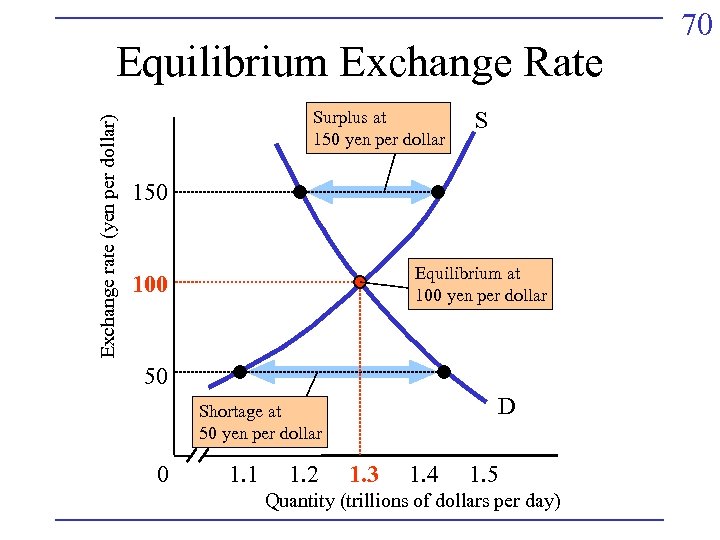

The Exchange Rate Market Equilibrium • If the exchange rate is too high, there is a surplus of dollars. • If the exchange rate is too low, there is a shortage of dollars. 68

The Exchange Rate Market Equilibrium • If the exchange rate is too high, there is a surplus of dollars. • If the exchange rate is too low, there is a shortage of dollars. 68

The Exchange Rate Market Equilibrium At the equilibrium exchange rate, there is neither a shortage nor a surplus. 69

The Exchange Rate Market Equilibrium At the equilibrium exchange rate, there is neither a shortage nor a surplus. 69

Exchange rate (yen per dollar) Equilibrium Exchange Rate Surplus at 150 yen per dollar S 150 Equilibrium at 100 yen per dollar 100 50 D Shortage at 50 yen per dollar 0 1. 1 1. 2 1. 3 1. 4 1. 5 Quantity (trillions of dollars per day) 70

Exchange rate (yen per dollar) Equilibrium Exchange Rate Surplus at 150 yen per dollar S 150 Equilibrium at 100 yen per dollar 100 50 D Shortage at 50 yen per dollar 0 1. 1 1. 2 1. 3 1. 4 1. 5 Quantity (trillions of dollars per day) 70

The Exchange Rate Changes in the Exchange Rate Why the Exchange Rate is Volatile • Supply and demand are not independent of each other. • A change in the expected future exchange rate or U. S. interest rate differential shifts both supply and demand. 72

The Exchange Rate Changes in the Exchange Rate Why the Exchange Rate is Volatile • Supply and demand are not independent of each other. • A change in the expected future exchange rate or U. S. interest rate differential shifts both supply and demand. 72

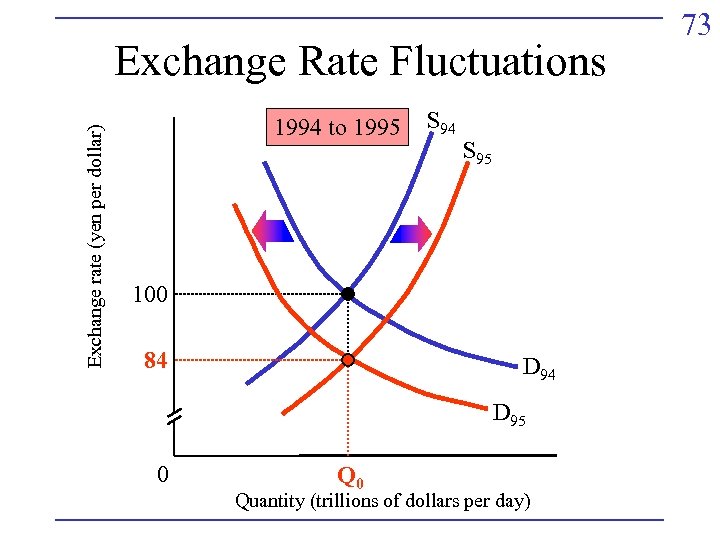

Exchange rate (yen per dollar) Exchange Rate Fluctuations 1994 to 1995 S 94 S 95 100 84 D 95 0 Quantity (trillions of dollars per day) 73

Exchange rate (yen per dollar) Exchange Rate Fluctuations 1994 to 1995 S 94 S 95 100 84 D 95 0 Quantity (trillions of dollars per day) 73

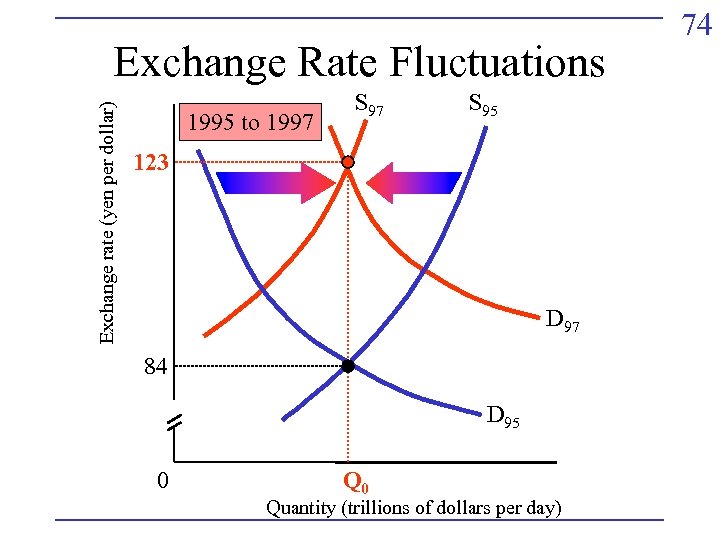

Exchange rate (yen per dollar) Exchange Rate Fluctuations 1995 to 1997 S 95 123 D 97 84 D 95 0 Quantity (trillions of dollars per day) 74

Exchange rate (yen per dollar) Exchange Rate Fluctuations 1995 to 1997 S 95 123 D 97 84 D 95 0 Quantity (trillions of dollars per day) 74

The Exchange Rate Expectations Two expectations that effect the value of money are: 1) Purchasing power parity 2) Interest rate parity 75

The Exchange Rate Expectations Two expectations that effect the value of money are: 1) Purchasing power parity 2) Interest rate parity 75

The Exchange Rate Purchasing Power Parity • Money is worth what it will buy. • Purchasing power parity means equal value of money. 76

The Exchange Rate Purchasing Power Parity • Money is worth what it will buy. • Purchasing power parity means equal value of money. 76

The Exchange Rate Purchasing Power Parity • If prices increase in other countries but remain constant in the United States, people will generally expect that the value of the U. S. dollar is too low and will expect it to rise. • Supply of and demand for dollars change • The exchange rate changes 77

The Exchange Rate Purchasing Power Parity • If prices increase in other countries but remain constant in the United States, people will generally expect that the value of the U. S. dollar is too low and will expect it to rise. • Supply of and demand for dollars change • The exchange rate changes 77

The Exchange Rate Interest Rate Parity • Money is worth what it can earn. • Interest rate parity means equal interest rates. 78

The Exchange Rate Interest Rate Parity • Money is worth what it can earn. • Interest rate parity means equal interest rates. 78

The Exchange Rate Interest Rate Parity If the rate of return is higher in the United States than in another country, the demand for U. S. dollars rise and the exchange rate rises until expected interest rates are equal. 79

The Exchange Rate Interest Rate Parity If the rate of return is higher in the United States than in another country, the demand for U. S. dollars rise and the exchange rate rises until expected interest rates are equal. 79

The Exchange Rate The Fed in the Foreign Exchange Market • Since the Fed influences the supply of money, it also has an impact on the exchange rate • The Fed can intervene in the foreign exchange market and smooth out fluctuations in the exchange rate 80

The Exchange Rate The Fed in the Foreign Exchange Market • Since the Fed influences the supply of money, it also has an impact on the exchange rate • The Fed can intervene in the foreign exchange market and smooth out fluctuations in the exchange rate 80

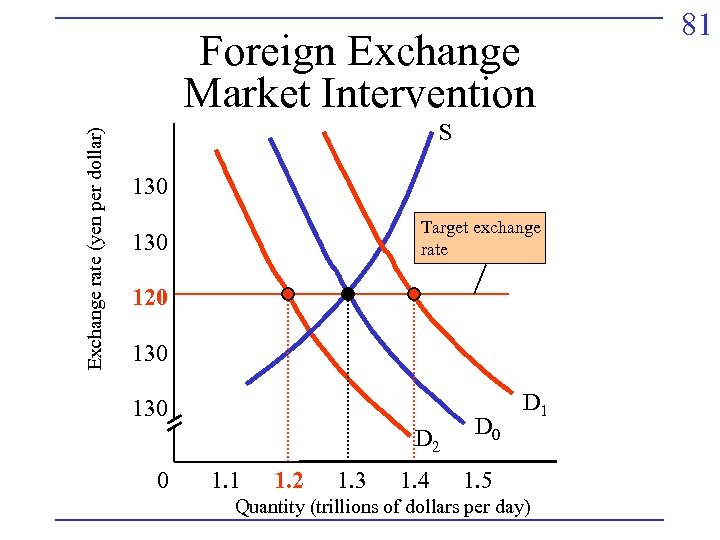

Exchange rate (yen per dollar) Foreign Exchange Market Intervention S 130 Target exchange rate 130 120 130 D 2 0 1. 1 1. 2 1. 3 1. 4 D 0 D 1 1. 5 Quantity (trillions of dollars per day) 81

Exchange rate (yen per dollar) Foreign Exchange Market Intervention S 130 Target exchange rate 130 120 130 D 2 0 1. 1 1. 2 1. 3 1. 4 D 0 D 1 1. 5 Quantity (trillions of dollars per day) 81

Financing International Trade The balance of payments accounts include: 4) Balance of official reserve transactions equals: • Net increase in foreign official reserve claims on the US • less: the net increase in US official reserves • Measures the degree to which monetary authorities in the US and abroad joined with other lenders to cover the US current account deficit • The bookkeeping offset to this is the official settlements accounts balance 84

Financing International Trade The balance of payments accounts include: 4) Balance of official reserve transactions equals: • Net increase in foreign official reserve claims on the US • less: the net increase in US official reserves • Measures the degree to which monetary authorities in the US and abroad joined with other lenders to cover the US current account deficit • The bookkeeping offset to this is the official settlements accounts balance 84

Financing International Trade Official settlements accounts balance (a. k. a “the balance of payments”) equals: • Current account balance • plus: the non-reserve portion of the capital & financial account balance • plus: the statistical discrepancy • Measures the payments gap that official reserve transactions need to cover 85

Financing International Trade Official settlements accounts balance (a. k. a “the balance of payments”) equals: • Current account balance • plus: the non-reserve portion of the capital & financial account balance • plus: the statistical discrepancy • Measures the payments gap that official reserve transactions need to cover 85

Financing International Trade 86 Official settlements accounts balance (a. k. a “the balance of payments”) • Played an important historical role as a measure of disequilibrium in international payments (still plays this role for many countries) • Negative balance of payments (deficit) may signal a crisis – means a country is running down its foreign reserves (or borrowing foreign reserves)

Financing International Trade 86 Official settlements accounts balance (a. k. a “the balance of payments”) • Played an important historical role as a measure of disequilibrium in international payments (still plays this role for many countries) • Negative balance of payments (deficit) may signal a crisis – means a country is running down its foreign reserves (or borrowing foreign reserves)