9c58633fa2a2965c82e63cdd7254c33d.ppt

- Количество слайдов: 15

International Finance • Balance of Payments • Foreign Exchange Markets • Foreign Exchange Rates • Spot rates and forward rates • Foreign Exchange Systems • Risk Management in International Business • Other internationally traded financial instruments

Balance of Payments • The balance of payments is an accounting listing (tabulation) of the values of economic (trade and financial) transactions between the resident of a (home) country and residents of other countries. • Balance of payments entries are recorded based on the double-entry bookkeeping principle. • The balance of payments entries are always balanced; the entries add up to zero.

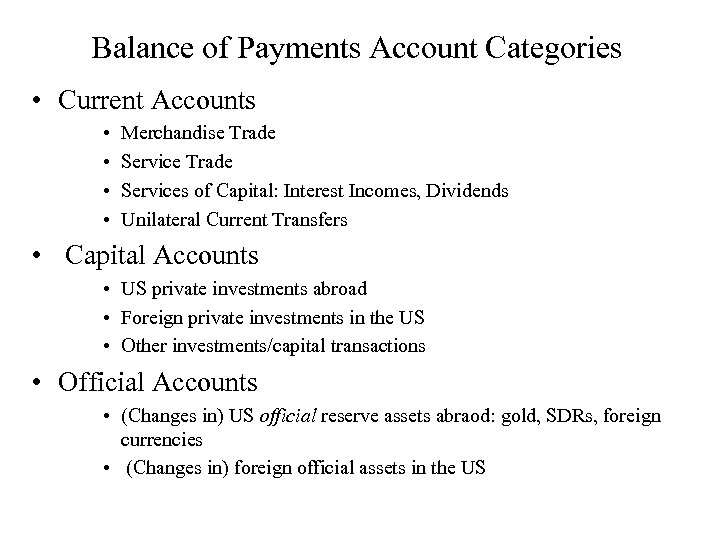

Balance of Payments Account Categories • Current Accounts • • Merchandise Trade Services of Capital: Interest Incomes, Dividends Unilateral Current Transfers • Capital Accounts • US private investments abroad • Foreign private investments in the US • Other investments/capital transactions • Official Accounts • (Changes in) US official reserve assets abraod: gold, SDRs, foreign currencies • (Changes in) foreign official assets in the US

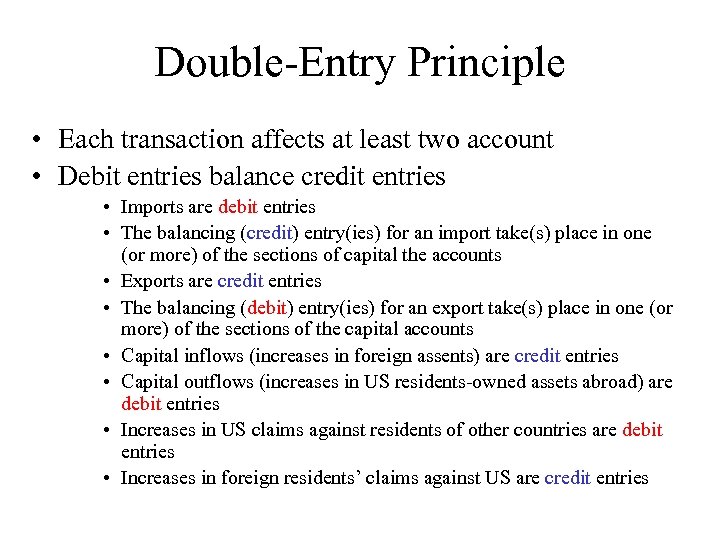

Double-Entry Principle • Each transaction affects at least two account • Debit entries balance credit entries • Imports are debit entries • The balancing (credit) entry(ies) for an import take(s) place in one (or more) of the sections of capital the accounts • Exports are credit entries • The balancing (debit) entry(ies) for an export take(s) place in one (or more) of the sections of the capital accounts • Capital inflows (increases in foreign assents) are credit entries • Capital outflows (increases in US residents-owned assets abroad) are debit entries • Increases in US claims against residents of other countries are debit entries • Increases in foreign residents’ claims against US are credit entries

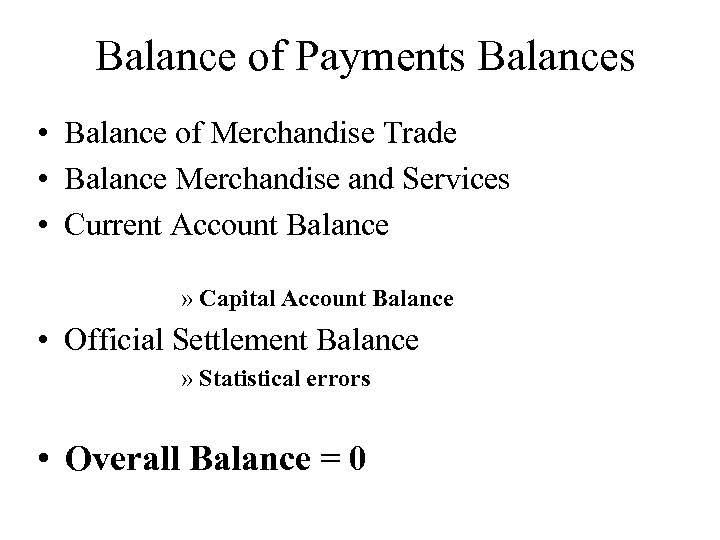

Balance of Payments Balances • Balance of Merchandise Trade • Balance Merchandise and Services • Current Account Balance » Capital Account Balance • Official Settlement Balance » Statistical errors • Overall Balance = 0

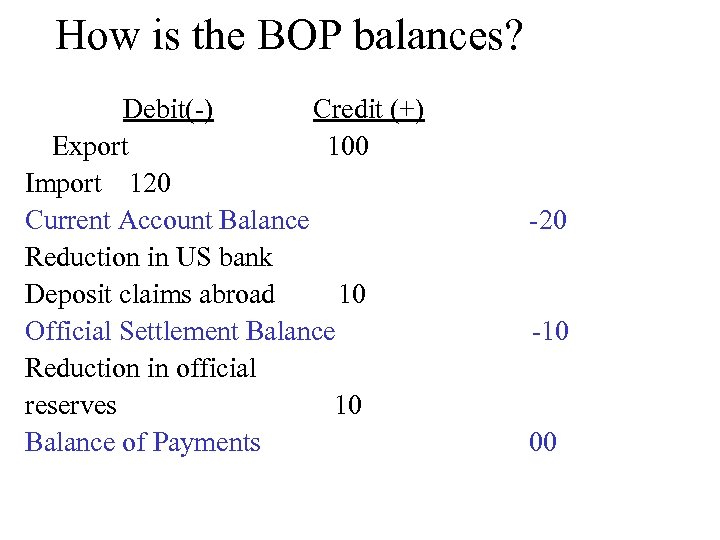

How is the BOP balances? Debit(-) Credit (+) Export 100 Import 120 Current Account Balance Reduction in US bank Deposit claims abroad 10 Official Settlement Balance Reduction in official reserves 10 Balance of Payments -20 -10 00

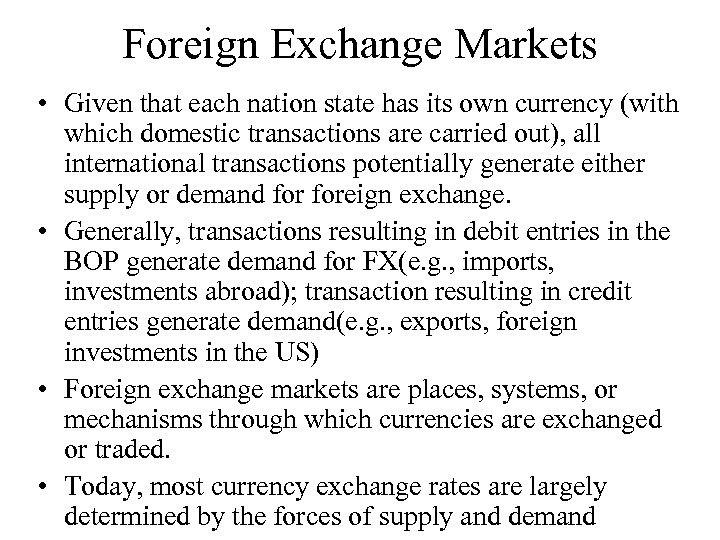

Foreign Exchange Markets • Given that each nation state has its own currency (with which domestic transactions are carried out), all international transactions potentially generate either supply or demand foreign exchange. • Generally, transactions resulting in debit entries in the BOP generate demand for FX(e. g. , imports, investments abroad); transaction resulting in credit entries generate demand(e. g. , exports, foreign investments in the US) • Foreign exchange markets are places, systems, or mechanisms through which currencies are exchanged or traded. • Today, most currency exchange rates are largely determined by the forces of supply and demand

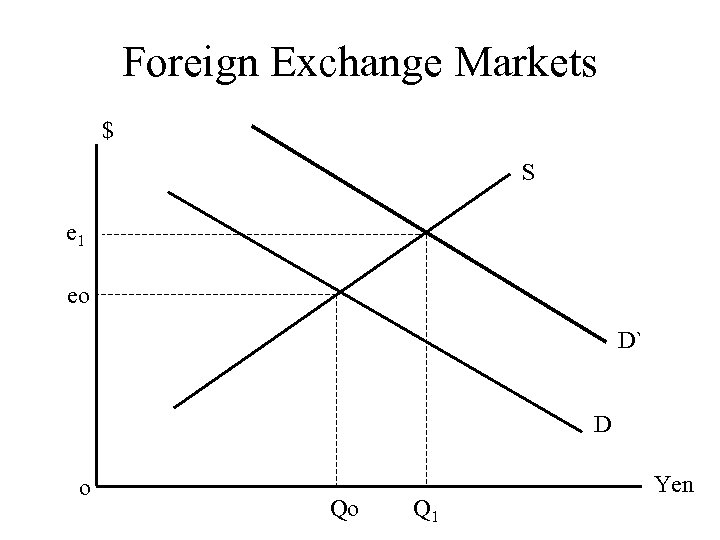

Foreign Exchange Markets $ S e 1 eo D` D o Qo Q 1 Yen

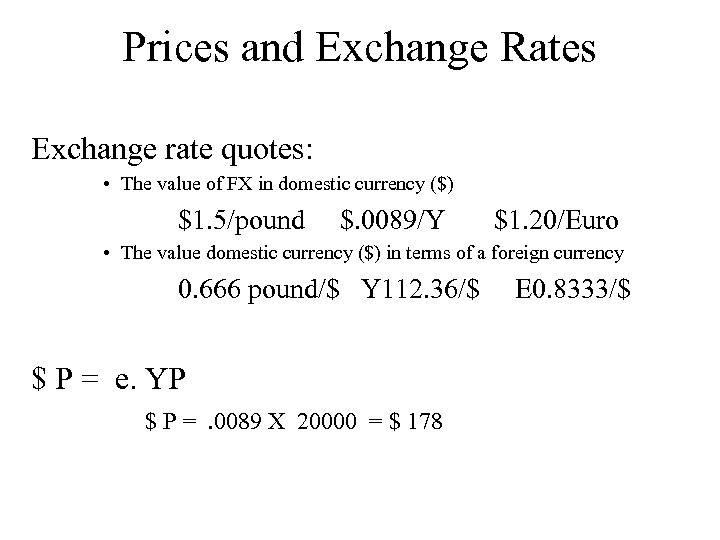

Prices and Exchange Rates Exchange rate quotes: • The value of FX in domestic currency ($) $1. 5/pound $. 0089/Y $1. 20/Euro • The value domestic currency ($) in terms of a foreign currency 0. 666 pound/$ Y 112. 36/$ $ P = e. YP $ P =. 0089 X 20000 = $ 178 E 0. 8333/$

Foreign (FX)Exchange Rates and Inflation • Changes in FX rate and domestic prices » Appreciation of a currency » Depreciation of a currency • Nominal FX rate vs. real FX rate The effect of a currency depreciation (on price) could be partly of totally off set by inflation in the prices denominated in that currency

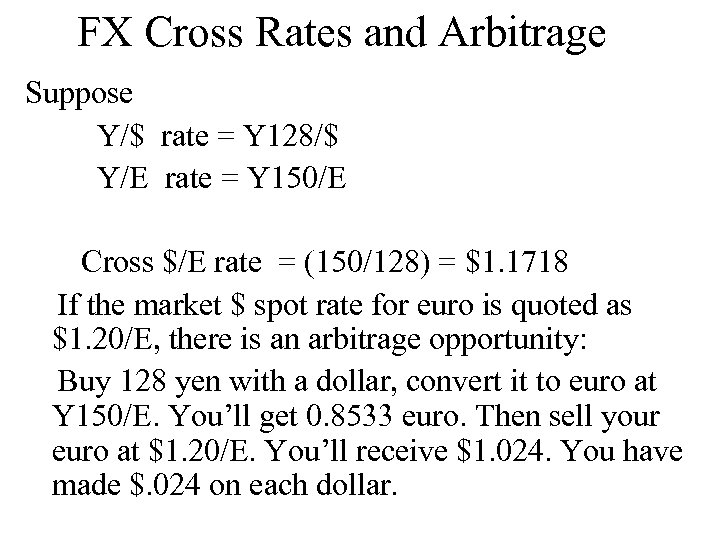

FX Cross Rates and Arbitrage Suppose Y/$ rate = Y 128/$ Y/E rate = Y 150/E Cross $/E rate = (150/128) = $1. 1718 If the market $ spot rate for euro is quoted as $1. 20/E, there is an arbitrage opportunity: Buy 128 yen with a dollar, convert it to euro at Y 150/E. You’ll get 0. 8533 euro. Then sell your euro at $1. 20/E. You’ll receive $1. 024. You have made $. 024 on each dollar.

Foreign Exchange Risk • Transaction Exposure • Accounting/Translation Exposure • Economic Exposure

FX Risk Management • FX Spot Markets Buying or selling FX for immediate delivery (on the spot) • FX Forward Markets Buying or selling FX at a predetermined (agreed upon) rate for future delivery • FX Futures Buying or selling standardized blocks of FX at (market determined) preset rates for future delivery • FX Options Buying or selling options to buy (call) or options to sell (put) standardized blocks of FX at preset prices in the future for future delivery • Currency Swaps

A Forward Transaction An American company is expecting to receive 2. 5 million euro from a German company in the first week of March. Today’s euro spot rate is $1. 17/euro. To avoid a loss from possible depreciation of the euro, through it bank, the company sells its expected euro receipt in the forward market at $1. 16 per euro for March delivery. According to this forward contract on March 3 the company will receive: 2, 500, 000 x 1. 16 = $2, 900, 000

A Call Option Transaction An American auto importer has purchased 1000 automobiles from Japan. On March 3, the importer is expected to pay for these cars in yen: 1, 320, 000 yen The importer purchases 105 blocks of yen (call) options for March settlement at 92. 5* cents per 100 yen at 1. 25 per 100 yen. Today the importer pays: 105 x(12, 500, 000/100)x. 0125 = $164, 062. 5 That is equivalent to 108. 018 yen per dollar

9c58633fa2a2965c82e63cdd7254c33d.ppt