faacf8a2fd1ac7f9b7ead441f3a46c8f.ppt

- Количество слайдов: 30

International Economics Basics of International Trade Theory Prof. D. Sunitha Raju

The International Economy : Introduction International Economics 1. Firm/Industry Competitiveness • relative prices 2. A country’s international competitiveness • relative productivities

Trade Theory : Discussion Issues International Economics 1. What is the basis for trade between countries? 2. How are gains from trade defined/ measured. 3. Can theory explain the pattern of global trade flows.

Developments in Trade Theory International Economics 1. Mercantilism • • Wealth measured by stock of precious metals When net exports rise, accumulation of wealth takes place Gain for some nations at the cost of others • In the long run, not sustainable

Absolute Advantage (Adam Smith) International Economics • Unless all trading nations gain, trade will not take place • Cost differences determine the movement of goods between countries • Countries produce and exchange of commodity in which they have absolute advantage which leads to specialization Nations gain from trade and policy of laissez-faire maximises output and welfare

Absolute Advantage: Basic Assumptions International Economics a) Labour is the only factor of production and is homogenous b) Cost and price of good depends on the labour required to produce it

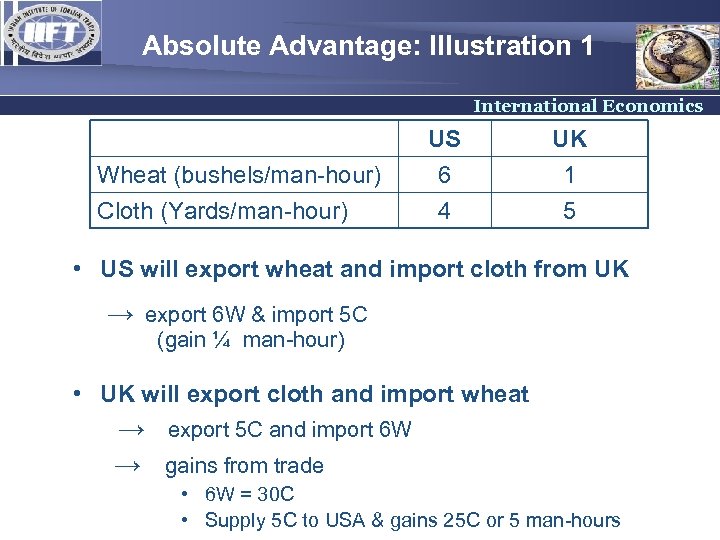

Absolute Advantage: Illustration 1 International Economics Wheat (bushels/man-hour) Cloth (Yards/man-hour) US 6 4 UK 1 5 • US will export wheat and import cloth from UK → export 6 W & import 5 C (gain ¼ man-hour) • UK will export cloth and import wheat → export 5 C and import 6 W → gains from trade • 6 W = 30 C • Supply 5 C to USA & gains 25 C or 5 man-hours

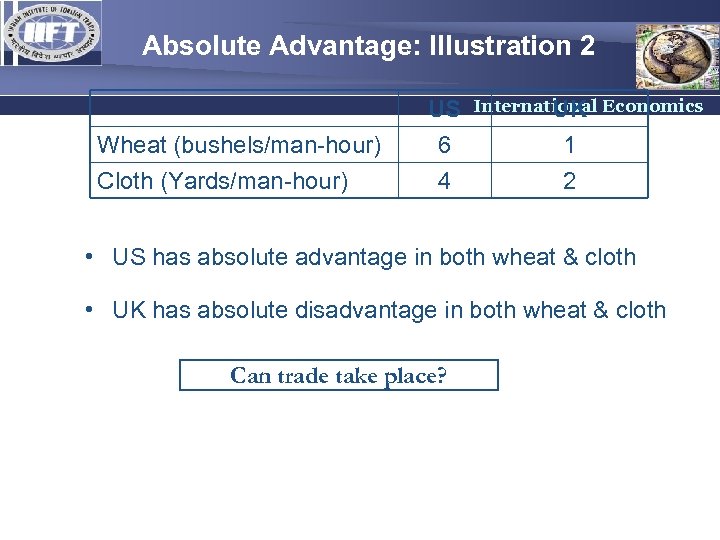

Absolute Advantage: Illustration 2 Wheat (bushels/man-hour) Cloth (Yards/man-hour) US 6 4 International Economics UK 1 2 • US has absolute advantage in both wheat & cloth • UK has absolute disadvantage in both wheat & cloth Can trade take place?

Principle of Comparative Advantage (Ricardo) International Economics • Comparison of relative advantage or disadvantage between countries • US has 6 to 1 advantage in wheat and 2 to 1 advantage in textiles (over UK) • UK has greater disadvantage in wheat than in cloth. Wheat : 1 to 6 Cloth : 1 to 2 Comparison of relative cost differences for Trade to take place

Comparative Advantage: Basic Assumptions International Economics • The world consists of two nations • Labor is the only input • Labor is fully employed and homogenous • Labor can move freely among industries within a nation, but is incapable of moving between nations • All firms within each nation utilize a common production method for each commodity • Costs do not vary with the level of production • Transportation costs are zero

Comparative Advantage: Resource Cost International Economics US • Domestically, 6 W can be produced if 4 C is given up (opportunity cost) • 1 C costs 1 W and 1 W costs C UK • 2 C can be produced if 1 W is given up • 1 C costs ½ W and 1 W costs 2 C Therefore, cloth is relatively cheaper in UK and wheat in USA

Comparative Advantage: Gains from Trade International Economics US (cloth) • Import of cloth takes place if 6 W can be exchanged for greater than 4 C if 1 C is less than 1½ W UK (cloth) • Export of cloth takes place if 2 C can be exchanged for greater than 1 W If 1 C is greater than ½ W Both US & UK gain if the price of cloth (in terms of wheat) is 1 W

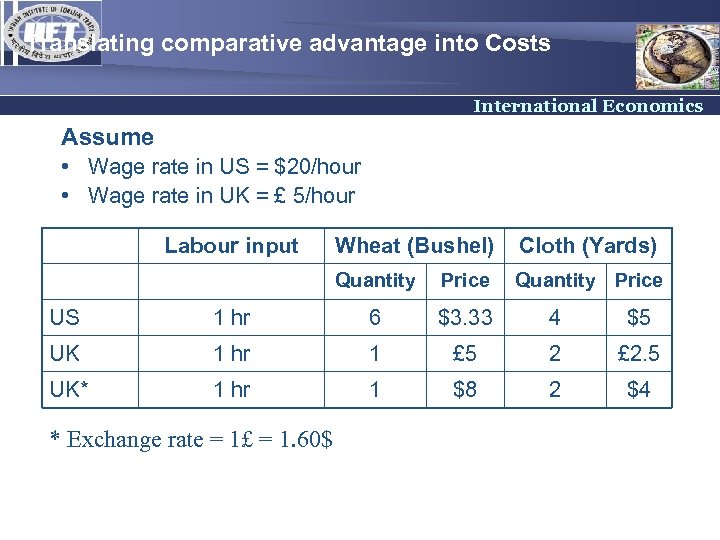

Translating comparative advantage into Costs International Economics Assume • Wage rate in US = $20/hour • Wage rate in UK = £ 5/hour Labour input Wheat (Bushel) Cloth (Yards) Quantity Price US 1 hr 6 $3. 33 4 $5 UK 1 hr 1 £ 5 2 £ 2. 5 UK* 1 hr 1 $8 2 $4 * Exchange rate = 1£ = 1. 60$

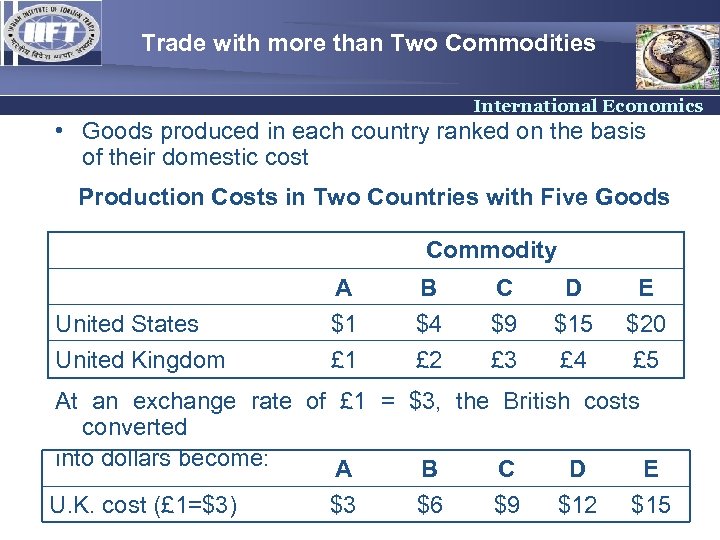

Trade with more than Two Commodities International Economics • Goods produced in each country ranked on the basis of their domestic cost Production Costs in Two Countries with Five Goods Commodity United States United Kingdom A $1 £ 1 B $4 £ 2 C $9 £ 3 D $15 £ 4 E $20 £ 5 At an exchange rate of £ 1 = $3, the British costs converted into dollars become: A B C D E U. K. cost (£ 1=$3) $3 $6 $9 $12 $15

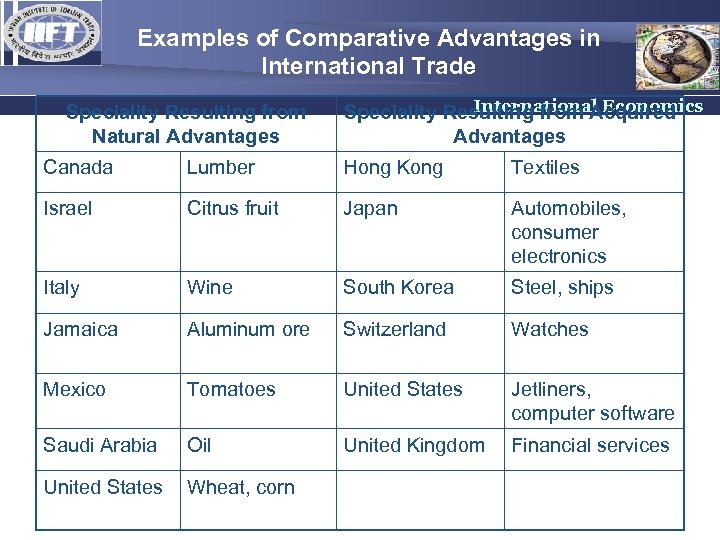

Examples of Comparative Advantages in International Trade Speciality Resulting from Natural Advantages International Economics Speciality Resulting from Acquired Advantages Canada Lumber Hong Kong Textiles Israel Citrus fruit Japan Automobiles, consumer electronics Italy Wine South Korea Steel, ships Jamaica Aluminum ore Switzerland Watches Mexico Tomatoes United States Jetliners, computer software Saudi Arabia Oil United Kingdom Financial services United States Wheat, corn

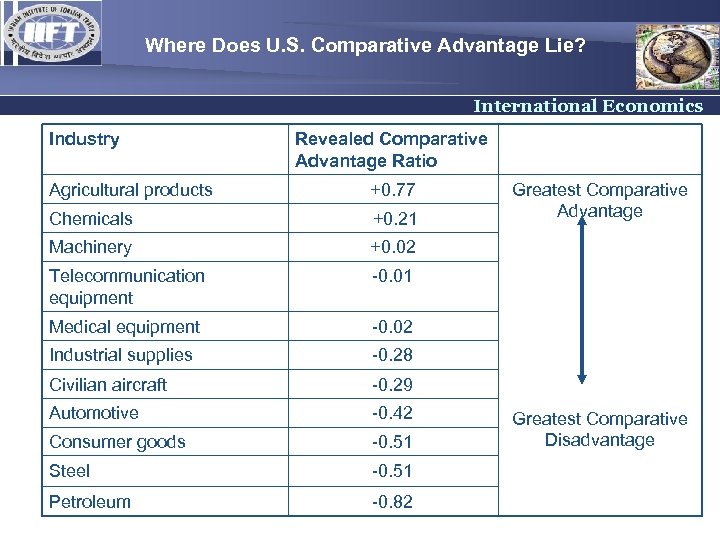

Where Does U. S. Comparative Advantage Lie? International Economics Industry Revealed Comparative Advantage Ratio Agricultural products +0. 77 Chemicals +0. 21 Machinery +0. 02 Telecommunication equipment -0. 01 Medical equipment -0. 02 Industrial supplies -0. 28 Civilian aircraft -0. 29 Automotive -0. 42 Consumer goods -0. 51 Steel -0. 51 Petroleum -0. 82 Greatest Comparative Advantage Greatest Comparative Disadvantage

Competitiveness under Varying Production Condition International Economics 1. Production under Constant Cost 2. Production under Increasing Cost

Production Possibilities Schedule (PPS) International Economics • PPS shows various combinations of 2 goods that a country can produce when all inputs (land, labour capital & Entrepreneurship) are used most efficiently. • Under constant cost conditions, relative cost of producing one good in terms of other remains same MRT =

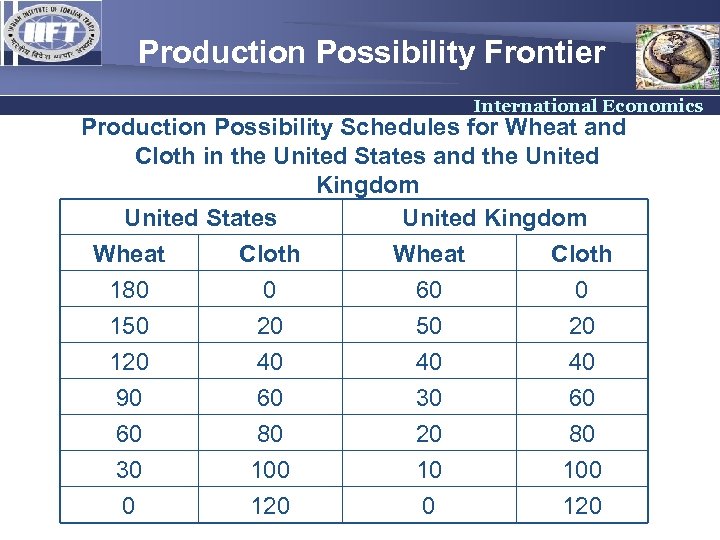

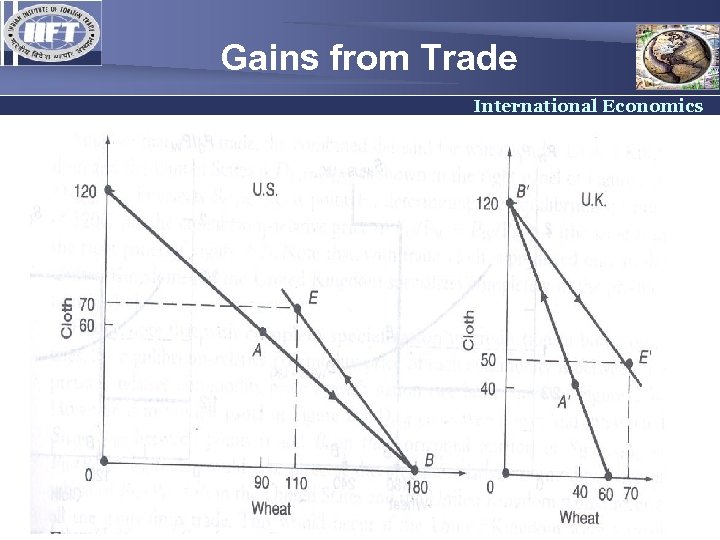

Production Possibility Frontier International Economics Production Possibility Schedules for Wheat and Cloth in the United States and the United Kingdom United States United Kingdom Wheat Cloth 180 0 60 0 150 20 120 90 60 30 0 40 60 80 100 120 40 30 20 10 0 40 60 80 100 120

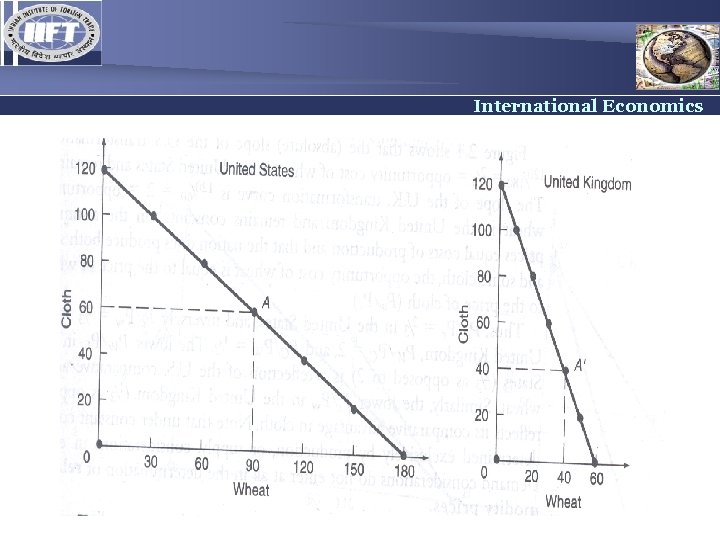

International Economics

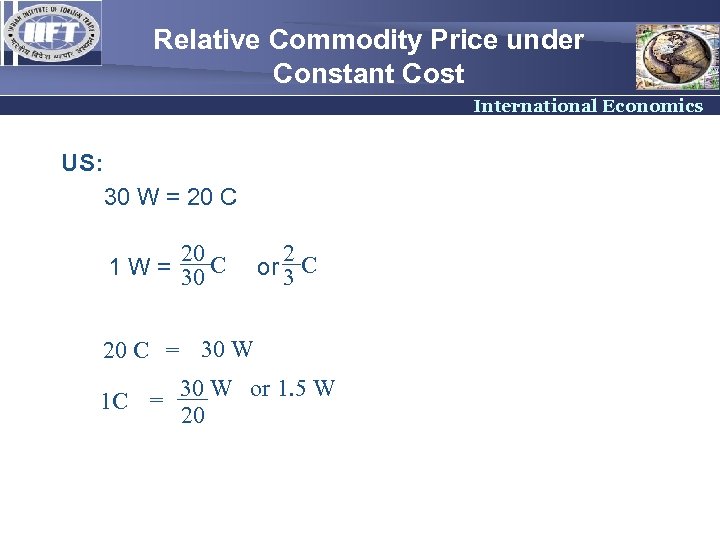

Relative Commodity Price under Constant Cost International Economics US: 30 W = 20 C 20 1 W = 30 C 2 or 3 C 20 C = 30 W or 1. 5 W 1 C 20

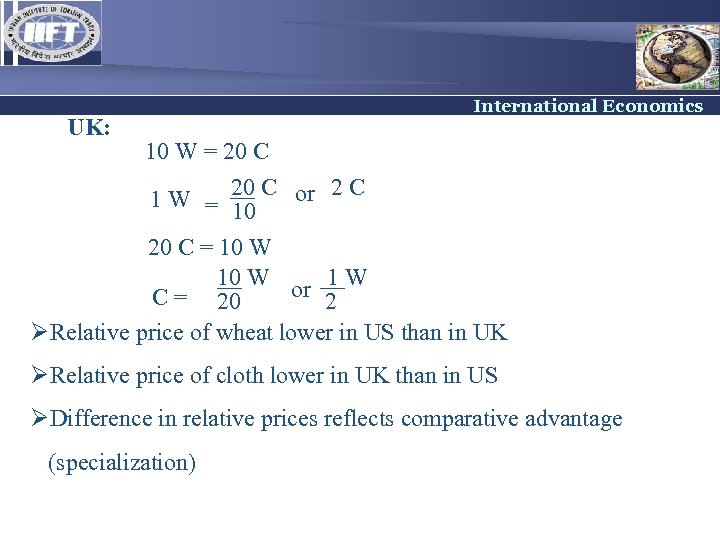

UK: International Economics 10 W = 20 C 1 W = 20 C or 2 C 10 20 C = 10 W or 1 W C = 20 2 ØRelative price of wheat lower in US than in UK ØRelative price of cloth lower in UK than in US ØDifference in relative prices reflects comparative advantage (specialization)

Consumption/Demand Issues International Economics • Consumer demand preferences or utility is underlined by tastes/ • How much of the goods produced will be consumed depends on consumer preferences – Consumer Indifference Curve – Slope of the Indifference Curve represents consumers’ trade off between two goods, i. e. Marginal Rate of Substitution

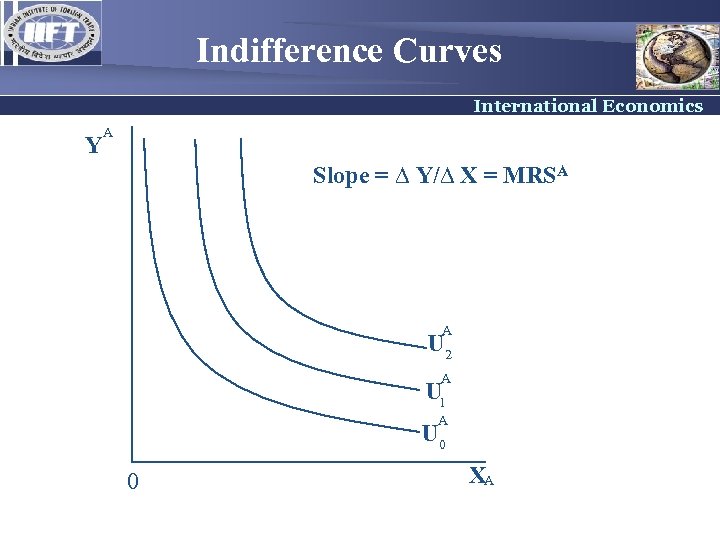

Indifference Curves International Economics Y A Slope = ∆ Y/∆ X = MRSA A U 2 A U 1 A U 0 0 XA

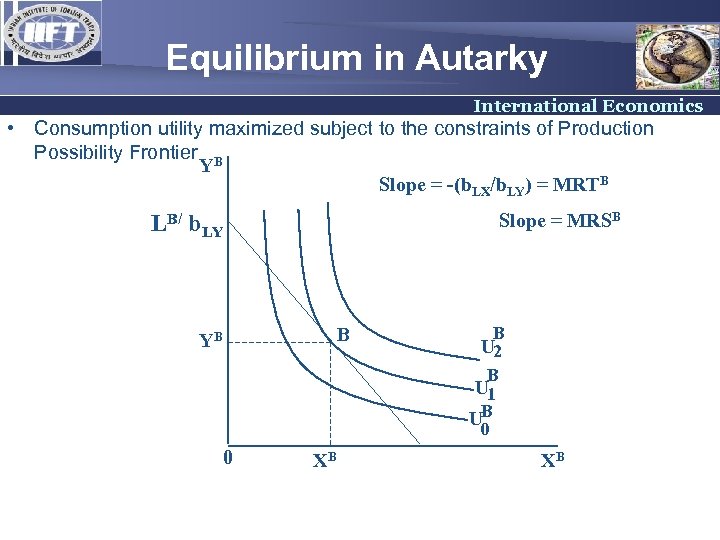

Equilibrium in Autarky International Economics • Consumption utility maximized subject to the constraints of Production Possibility Frontier B Y Slope = -(b. LX/b. LY) = MRTB Slope = MRSB LB/ b. LY B YB 0 XB B U 2 B U 1 UB 0 XB

Gains from Trade International Economics

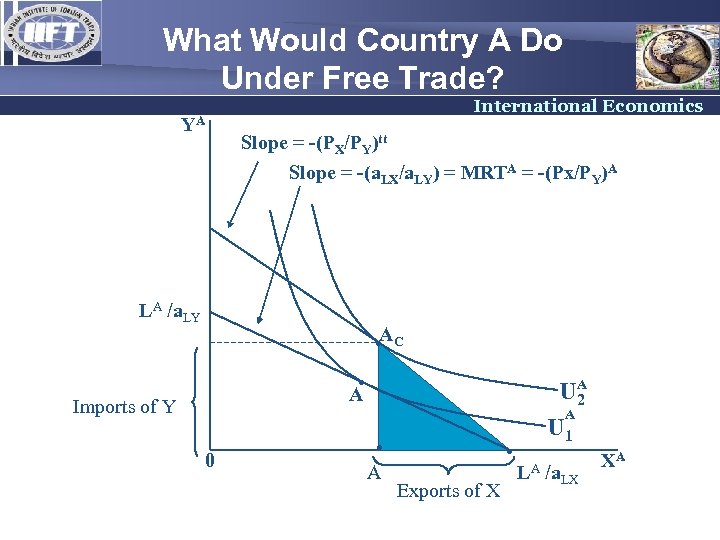

What Would Country A Do Under Free Trade? International Economics YA Slope = -(PX/PY)tt Slope = -(a. LX/a. LY) = MRTA = -(Px/PY)A LA /a. LY ∙ AC ∙ A U 2 A U 1 A Imports of Y 0 ∙ A Exports of X ∙L A /a. LX XA

Trading under Constant Costs (a) Basis for Trade International Economics • Slopes of the production possibilities schedules give the relative cost of one product in terms of other • Differences in relative costs provide the basis for mutually favourable trade (b) Production gains from Specialisation • A country will specialise in the production of the good in which it has comparative advantage • A country will trade part of this production for the good in which it has comparative disadvantage

(c) Consumption gains from Trade International Economics • Consumption alternatives limited by the domestic production possibilities schedules • The exact consumption will be determined by the tastes & preferences • Specialization & free trade care achieve post-trade consumption outside domestic production possibilities schedules trade results in consumption gains for both countries (d) Terms of Trade • Domestic terms of trade represents the relative prices at which goods are exchanged at home • A country will exports/import goods internationally if the terms of trade are more favourable than domestic terms of trade

Changing Comparative Advantage International Economics 1. Technological improvements 2. Trade restrictions 3. High Transaction Costs

faacf8a2fd1ac7f9b7ead441f3a46c8f.ppt