01ea1a65eb2e18ee0e0bdaacb0a0b5e7.ppt

- Количество слайдов: 7

International Cross. Border Use Cases Regarding SOA in Tax & Revenue

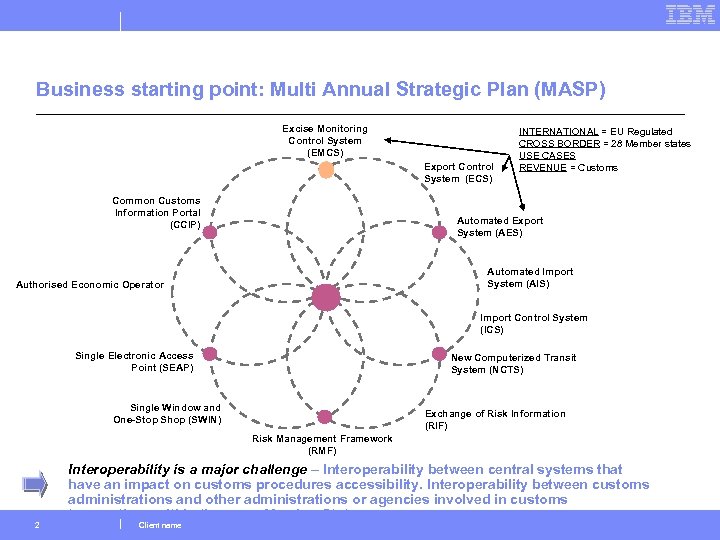

Business starting point: Multi Annual Strategic Plan (MASP) Excise Monitoring Control System (EMCS) Export Control System (ECS) Common Customs Information Portal (CCIP) INTERNATIONAL = EU Regulated CROSS BORDER = 28 Member states USE CASES REVENUE = Customs Automated Export System (AES) Automated Import System (AIS) Authorised Economic Operator Import Control System (ICS) Single Electronic Access Point (SEAP) New Computerized Transit System (NCTS) Single Window and One-Stop Shop (SWIN) Exchange of Risk Information (RIF) Risk Management Framework (RMF) 2 Interoperability is a major challenge – Interoperability between central systems that have an impact on customs procedures accessibility. Interoperability between customs administrations and other administrations or agencies involved in customs transactions within the same Member State. Client name

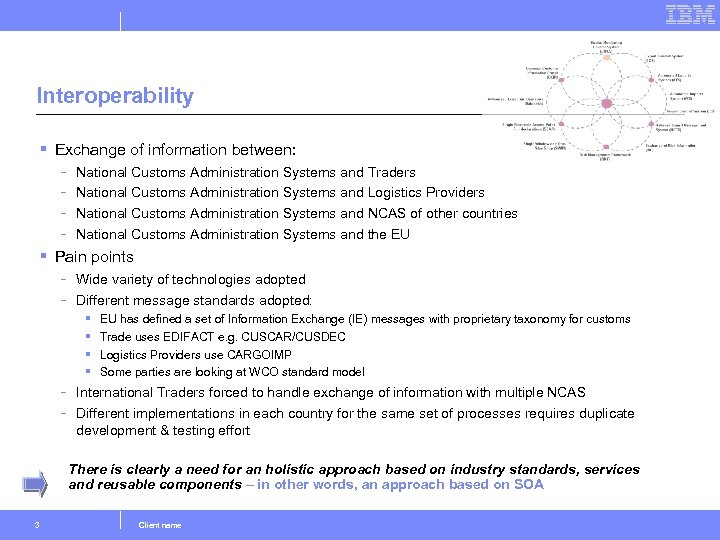

Interoperability § Exchange of information between: - National Customs Administration Systems and Traders National Customs Administration Systems and Logistics Providers National Customs Administration Systems and NCAS of other countries National Customs Administration Systems and the EU § Pain points - Wide variety of technologies adopted Different message standards adopted: § § - EU has defined a set of Information Exchange (IE) messages with proprietary taxonomy for customs Trade uses EDIFACT e. g. CUSCAR/CUSDEC Logistics Providers use CARGOIMP Some parties are looking at WCO standard model International Traders forced to handle exchange of information with multiple NCAS Different implementations in each country for the same set of processes requires duplicate development & testing effort There is clearly a need for an holistic approach based on industry standards, services and reusable components – in other words, an approach based on SOA 3 Client name

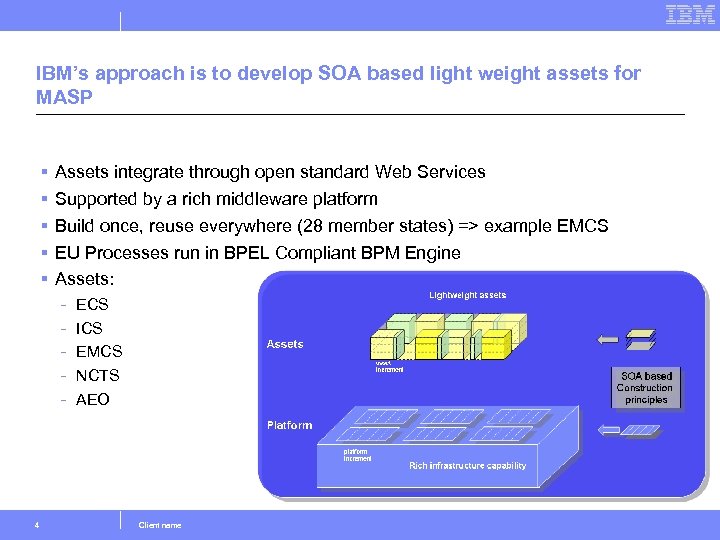

IBM’s approach is to develop SOA based light weight assets for MASP § § § Assets integrate through open standard Web Services Supported by a rich middleware platform Build once, reuse everywhere (28 member states) => example EMCS EU Processes run in BPEL Compliant BPM Engine Assets: - 4 ECS ICS EMCS NCTS AEO Client name

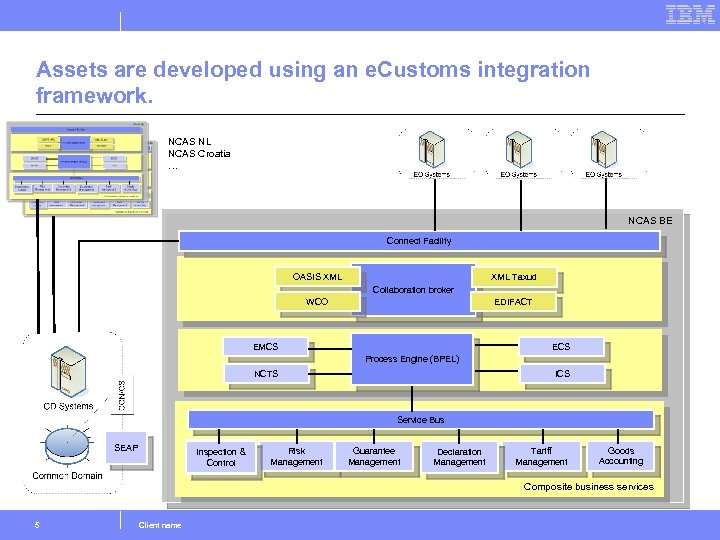

Assets are developed using an e. Customs integration framework. NCAS NL NCAS Croatia … NCAS BE Connect Facility OASIS XML Taxud Collaboration broker WCO EDIFACT EMCS ECS Process Engine (BPEL) NCTS ICS Service Bus SEAP Inspection & Control Risk Management Guarantee Management Declaration Management Tariff Management Goods Accounting Composite business services 5 Client name

Key success factors § There is a need to stick to 1 global e. Customs standard: - Transport e. g. through Web Services Strictly XML only to facilitate and accelerate implementation in a multi country, multi trader environment § Communication with Common domain (DG Taxud) is very well specified and standardized § Communication protocols between NCAS & the industry varies from country to country § There is also a need to communicate with non-EU Traders & Logistic Providers - 1 single Taxonomy conforming with § § Security Amendment 1870 with Annex 30 bis Taxud Specifications Industry Specifications e. g LLoydsnumber etc. . WCO model (due to global communications) § EORI deployed on a European level - 6 Single source of truth for economic operator identification Every country uses the same EO identification Link needed with global identification of Traders => issue Client name

Questions and answers

01ea1a65eb2e18ee0e0bdaacb0a0b5e7.ppt