d8a46760a68c7407f76c7967423257df.ppt

- Количество слайдов: 23

International Convergence of Accounting Standards: A Case Study of Malaysia 23 May 2006 1

International Convergence of Accounting Standards: A Case Study of Malaysia 23 May 2006 1

How A Developing Economy Embraces IFRS: Malaysia 2

How A Developing Economy Embraces IFRS: Malaysia 2

How Malaysia Embraces IFRS n Embrace: “Integral part of …” n n Malaysia’s experience vs Asia’s experience n n Historical, structural, political (will) Looking back 1972 - 2001 n n IFRS an integral part of the capital market & corporate governance structure Strategy & Challenges Looking forward 2006 - beyond n Strategy & Challenges 3

How Malaysia Embraces IFRS n Embrace: “Integral part of …” n n Malaysia’s experience vs Asia’s experience n n Historical, structural, political (will) Looking back 1972 - 2001 n n IFRS an integral part of the capital market & corporate governance structure Strategy & Challenges Looking forward 2006 - beyond n Strategy & Challenges 3

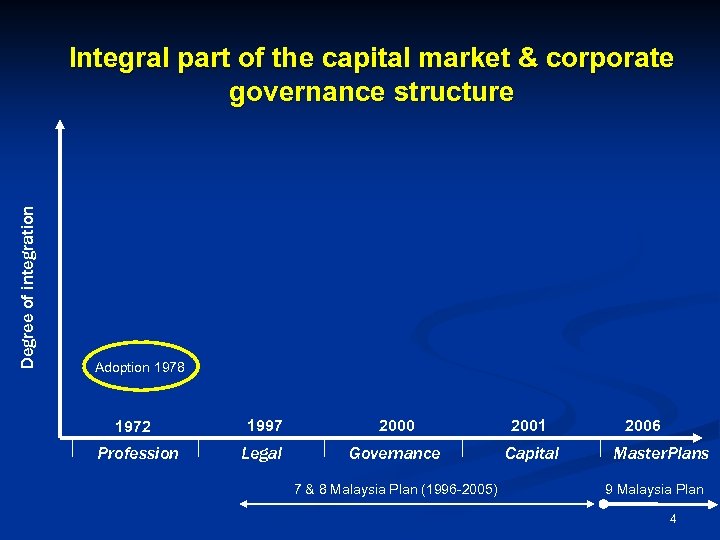

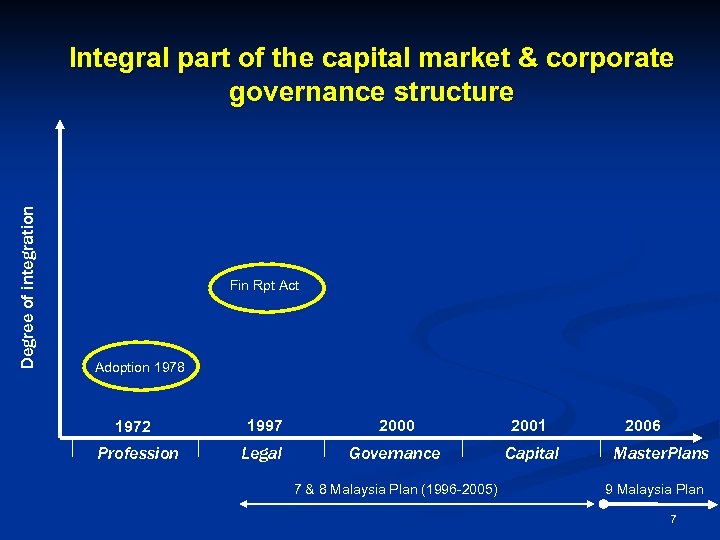

Degree of integration Integral part of the capital market & corporate governance structure Adoption 1978 1972 Profession 1997 2000 2001 Legal Governance Capital 7 & 8 Malaysia Plan (1996 -2005) 2006 Master. Plans 9 Malaysia Plan 4

Degree of integration Integral part of the capital market & corporate governance structure Adoption 1978 1972 Profession 1997 2000 2001 Legal Governance Capital 7 & 8 Malaysia Plan (1996 -2005) 2006 Master. Plans 9 Malaysia Plan 4

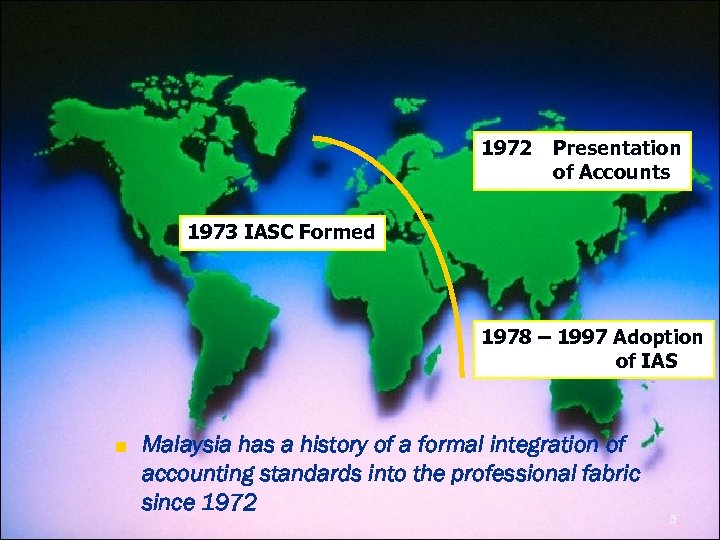

1972 Presentation of Accounts 1973 IASC Formed 1978 – 1997 Adoption of IAS n Malaysia has a history of a formal integration of accounting standards into the professional fabric since 1972 5

1972 Presentation of Accounts 1973 IASC Formed 1978 – 1997 Adoption of IAS n Malaysia has a history of a formal integration of accounting standards into the professional fabric since 1972 5

n essio rof P 1978 - 1997 n 1978 Adoption of first 4 IAS by MACPA n 1986 Next 13 IAS adopted n 1992 All IAS adopted by MACPA and MIA n 1997 Accounting standards setting function taken over by Malaysian Accounting Standards Board under Act of Parliament 6

n essio rof P 1978 - 1997 n 1978 Adoption of first 4 IAS by MACPA n 1986 Next 13 IAS adopted n 1992 All IAS adopted by MACPA and MIA n 1997 Accounting standards setting function taken over by Malaysian Accounting Standards Board under Act of Parliament 6

Degree of integration Integral part of the capital market & corporate governance structure Fin Rpt Act Adoption 1978 1972 Profession 1997 2000 2001 Legal Governance Capital 7 & 8 Malaysia Plan (1996 -2005) 2006 Master. Plans 9 Malaysia Plan 7

Degree of integration Integral part of the capital market & corporate governance structure Fin Rpt Act Adoption 1978 1972 Profession 1997 2000 2001 Legal Governance Capital 7 & 8 Malaysia Plan (1996 -2005) 2006 Master. Plans 9 Malaysia Plan 7

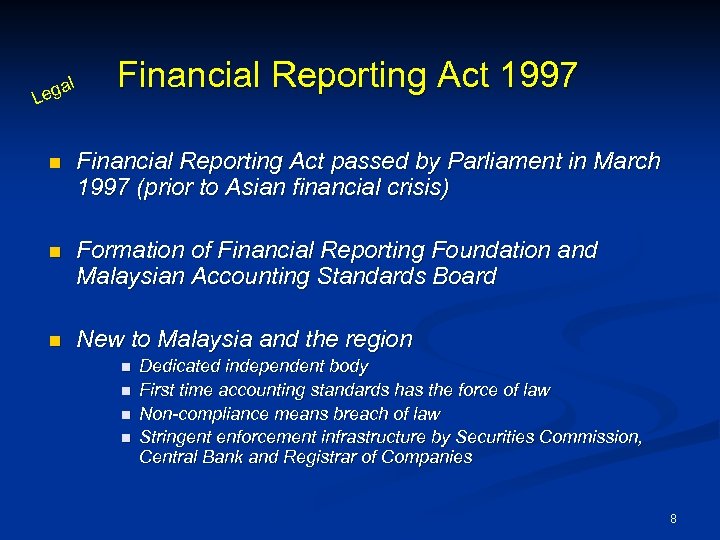

l ega L Financial Reporting Act 1997 n Financial Reporting Act passed by Parliament in March 1997 (prior to Asian financial crisis) n Formation of Financial Reporting Foundation and Malaysian Accounting Standards Board n New to Malaysia and the region n n Dedicated independent body First time accounting standards has the force of law Non-compliance means breach of law Stringent enforcement infrastructure by Securities Commission, Central Bank and Registrar of Companies 8

l ega L Financial Reporting Act 1997 n Financial Reporting Act passed by Parliament in March 1997 (prior to Asian financial crisis) n Formation of Financial Reporting Foundation and Malaysian Accounting Standards Board n New to Malaysia and the region n n Dedicated independent body First time accounting standards has the force of law Non-compliance means breach of law Stringent enforcement infrastructure by Securities Commission, Central Bank and Registrar of Companies 8

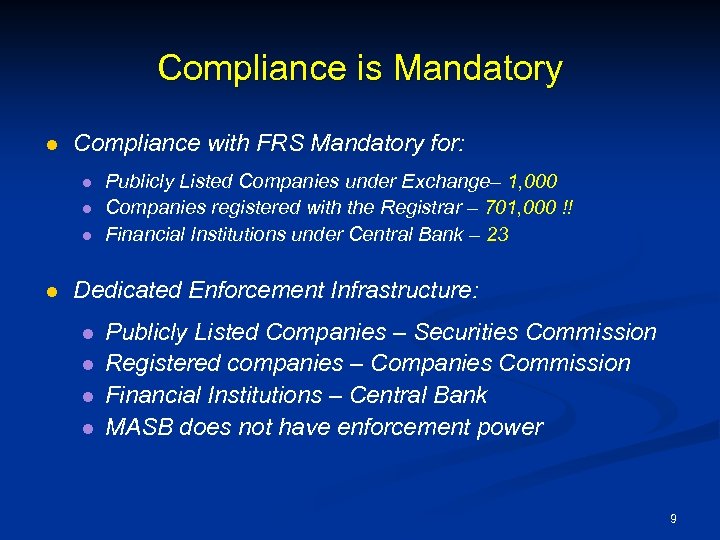

Compliance is Mandatory l Compliance with FRS Mandatory for: l l Publicly Listed Companies under Exchange– 1, 000 Companies registered with the Registrar – 701, 000 !! Financial Institutions under Central Bank – 23 Dedicated Enforcement Infrastructure: l l Publicly Listed Companies – Securities Commission Registered companies – Companies Commission Financial Institutions – Central Bank MASB does not have enforcement power 9

Compliance is Mandatory l Compliance with FRS Mandatory for: l l Publicly Listed Companies under Exchange– 1, 000 Companies registered with the Registrar – 701, 000 !! Financial Institutions under Central Bank – 23 Dedicated Enforcement Infrastructure: l l Publicly Listed Companies – Securities Commission Registered companies – Companies Commission Financial Institutions – Central Bank MASB does not have enforcement power 9

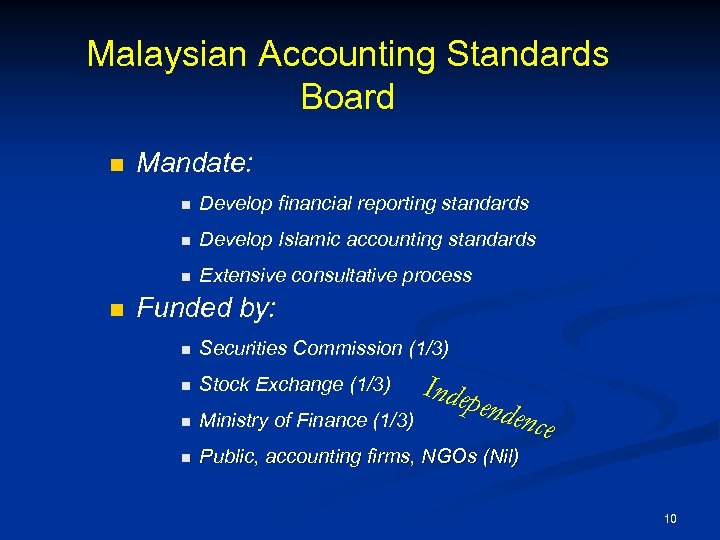

Malaysian Accounting Standards Board n Mandate: n n Develop Islamic accounting standards n n Develop financial reporting standards Extensive consultative process Funded by: n Securities Commission (1/3) n Stock Exchange (1/3) n Ministry of Finance (1/3) n Public, accounting firms, NGOs (Nil) Indep e nden ce 10

Malaysian Accounting Standards Board n Mandate: n n Develop Islamic accounting standards n n Develop financial reporting standards Extensive consultative process Funded by: n Securities Commission (1/3) n Stock Exchange (1/3) n Ministry of Finance (1/3) n Public, accounting firms, NGOs (Nil) Indep e nden ce 10

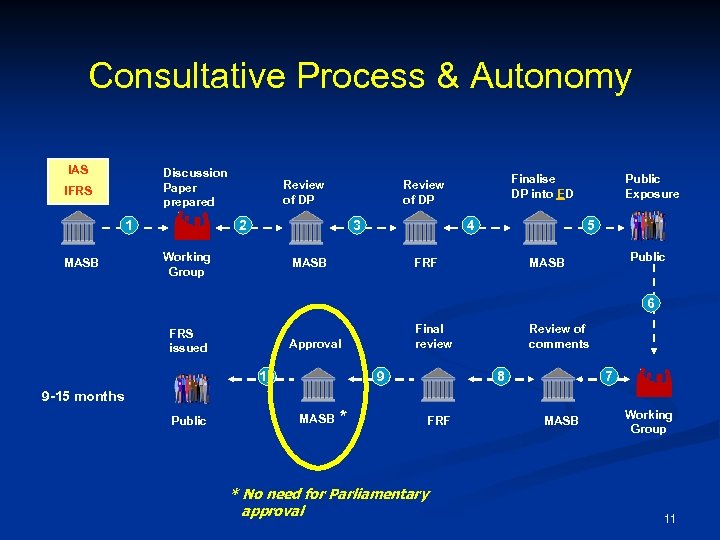

Consultative Process & Autonomy IAS Discussion Paper prepared IFRS 1 MASB Review of DP 2 3 Working Group Finalise DP into ED Review of DP 4 MASB Public Exposure 5 FRF Public MASB 6 FRS issued Final review Approval 10 9 Review of comments 8 7 9 -15 months Public MASB * FRF * No need for Parliamentary approval MASB Working Group 11

Consultative Process & Autonomy IAS Discussion Paper prepared IFRS 1 MASB Review of DP 2 3 Working Group Finalise DP into ED Review of DP 4 MASB Public Exposure 5 FRF Public MASB 6 FRS issued Final review Approval 10 9 Review of comments 8 7 9 -15 months Public MASB * FRF * No need for Parliamentary approval MASB Working Group 11

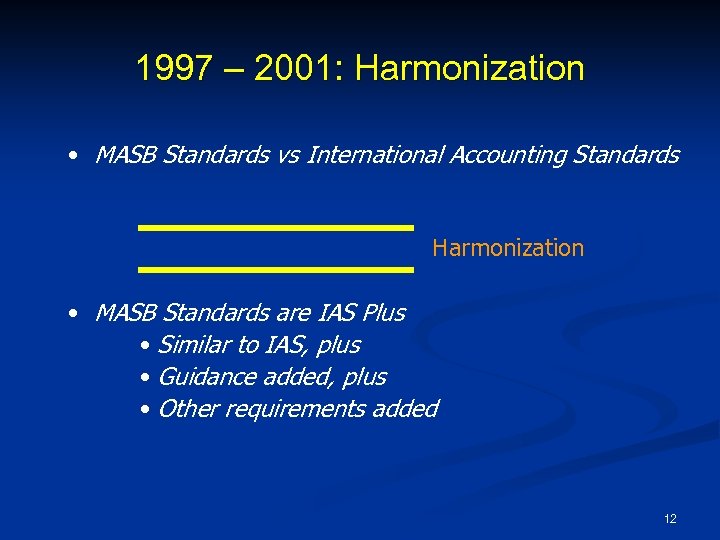

1997 – 2001: Harmonization • MASB Standards vs International Accounting Standards Harmonization • MASB Standards are IAS Plus • Similar to IAS, plus • Guidance added, plus • Other requirements added 12

1997 – 2001: Harmonization • MASB Standards vs International Accounting Standards Harmonization • MASB Standards are IAS Plus • Similar to IAS, plus • Guidance added, plus • Other requirements added 12

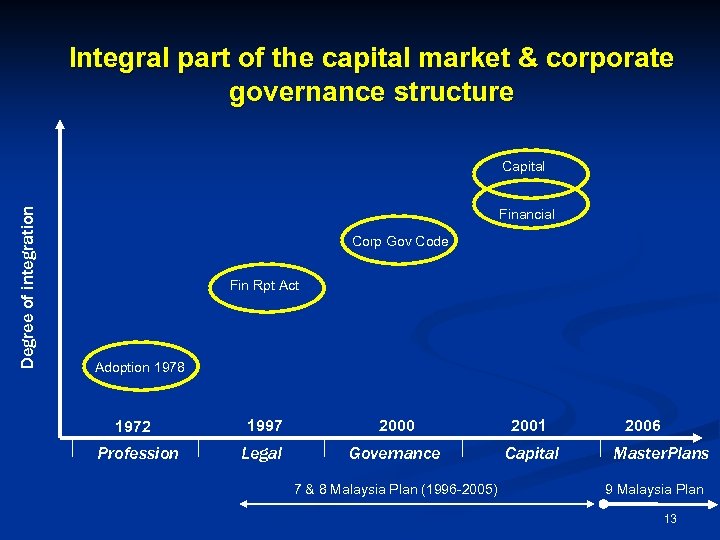

Integral part of the capital market & corporate governance structure Degree of integration Capital Financial Corp Gov Code Fin Rpt Act Adoption 1978 1972 Profession 1997 2000 2001 Legal Governance Capital 7 & 8 Malaysia Plan (1996 -2005) 2006 Master. Plans 9 Malaysia Plan 13

Integral part of the capital market & corporate governance structure Degree of integration Capital Financial Corp Gov Code Fin Rpt Act Adoption 1978 1972 Profession 1997 2000 2001 Legal Governance Capital 7 & 8 Malaysia Plan (1996 -2005) 2006 Master. Plans 9 Malaysia Plan 13

al an & ce rn ve C it ap Integration with Master Plans Go n Malaysia’s 5 -year Master Plans n Code of Corporate Governance issued in 2000 n Capital Market Masterplan n Financial Sector Masterplan n “Recommendations for achieving highest standard for financial reporting for corporate governance among capital and financial market players in Malaysia” issued in 2001 14

al an & ce rn ve C it ap Integration with Master Plans Go n Malaysia’s 5 -year Master Plans n Code of Corporate Governance issued in 2000 n Capital Market Masterplan n Financial Sector Masterplan n “Recommendations for achieving highest standard for financial reporting for corporate governance among capital and financial market players in Malaysia” issued in 2001 14

2005: Convergence Harmonization Convergence 15

2005: Convergence Harmonization Convergence 15

Strategy n Malaysia n n n n Support convergence. IFRS Convergence not an issue. Question of managing implementation Sufficient buy-in Discretion to determine implementation date Participate early in standards setting development Alliance with recognized bodies, lead if necessary Asia n Developing economies seem to have no choice but to converge n participate in free trade/globalization n funding for industrialization n No choice but to participate regionally, greater representation n No choice but to have regular discourse to identify commonalities, or diversities 16

Strategy n Malaysia n n n n Support convergence. IFRS Convergence not an issue. Question of managing implementation Sufficient buy-in Discretion to determine implementation date Participate early in standards setting development Alliance with recognized bodies, lead if necessary Asia n Developing economies seem to have no choice but to converge n participate in free trade/globalization n funding for industrialization n No choice but to participate regionally, greater representation n No choice but to have regular discourse to identify commonalities, or diversities 16

Challenges n Malaysia n n n Managing change Mindset – old habits die hard, price for having long history Interpretations Cost of complex standards vs benefits to owner manager companies Region n n Lack of regional participation Lack of voice, representation n Where problems are common, countries must be forthcoming Where problems are not common, endeavour to find a consensus IASB n n n Developed economies focus Board representation Changing goalpost 17

Challenges n Malaysia n n n Managing change Mindset – old habits die hard, price for having long history Interpretations Cost of complex standards vs benefits to owner manager companies Region n n Lack of regional participation Lack of voice, representation n Where problems are common, countries must be forthcoming Where problems are not common, endeavour to find a consensus IASB n n n Developed economies focus Board representation Changing goalpost 17

Addressing Challenges – Changing mindset n Convergence impact: n n n Tough for many countries Suddenly have to migrate to new environment Accounting standards are now law of these countries n n n Europe (2005), Philippines (2004) Language matters Malaysia – not as bad …relatively n n n Have been on IAS all along Standards are law in 1997 Standards in English, no need for translation 18

Addressing Challenges – Changing mindset n Convergence impact: n n n Tough for many countries Suddenly have to migrate to new environment Accounting standards are now law of these countries n n n Europe (2005), Philippines (2004) Language matters Malaysia – not as bad …relatively n n n Have been on IAS all along Standards are law in 1997 Standards in English, no need for translation 18

Addressing Challenges - Interpretations Degree of Buy-in Discourse with Affected Parties 19

Addressing Challenges - Interpretations Degree of Buy-in Discourse with Affected Parties 19

Addressing Challenges – Sharing with others n n n Australia China/HK N. Zealand Singapore Malaysia - intangibles state controlled entities, leases agriculture, leases related party, agriculture 20

Addressing Challenges – Sharing with others n n n Australia China/HK N. Zealand Singapore Malaysia - intangibles state controlled entities, leases agriculture, leases related party, agriculture 20

Addressing Challenges – Costs vs Benefits n In Malaysia, 95% of 701, 000 companies are SMEs. Initial intent to cover ALL companies was noble. n But as Standards become more complex… n Burden of compliance by SMEs becomes main issue n MASB announced 2 – tier reporting standard 1. 1. 2006 n IFRS (international GAAP) for PLCs, subsidiaries, assoc. , JV n Choice of IFRS or MASB Standards (which are IAS compliant) for private entities n Currently working on private entity reporting standards (PERS) 21

Addressing Challenges – Costs vs Benefits n In Malaysia, 95% of 701, 000 companies are SMEs. Initial intent to cover ALL companies was noble. n But as Standards become more complex… n Burden of compliance by SMEs becomes main issue n MASB announced 2 – tier reporting standard 1. 1. 2006 n IFRS (international GAAP) for PLCs, subsidiaries, assoc. , JV n Choice of IFRS or MASB Standards (which are IAS compliant) for private entities n Currently working on private entity reporting standards (PERS) 21

Moving Forward n Convergence is the way forward n Understanding the needs of developing economies important for significant buy-ins in the region n Challenges: Regional diversity remains a challenge n Help is needed: n n Goalposts keeps changing n n IFRS likely to remain complex Implementation remains an issue Malaysia stands ready to offer: n MASB has significant learning curve n MASB is active in Islamic accounting standards n MASB has a good understanding about SMEs in the region n MASB has models to follow 22

Moving Forward n Convergence is the way forward n Understanding the needs of developing economies important for significant buy-ins in the region n Challenges: Regional diversity remains a challenge n Help is needed: n n Goalposts keeps changing n n IFRS likely to remain complex Implementation remains an issue Malaysia stands ready to offer: n MASB has significant learning curve n MASB is active in Islamic accounting standards n MASB has a good understanding about SMEs in the region n MASB has models to follow 22

Conclusion n Success of convergence contingent upon how developing economies “embrace” IFRS n Malaysia fortunate to have: n n a history infrastructure political will … to drive international convergence n Others may not be as fortunate, but n Asia can learn from each other n Asian diversity is a beauty n Malaysia stands ready to offer assistance 23

Conclusion n Success of convergence contingent upon how developing economies “embrace” IFRS n Malaysia fortunate to have: n n a history infrastructure political will … to drive international convergence n Others may not be as fortunate, but n Asia can learn from each other n Asian diversity is a beauty n Malaysia stands ready to offer assistance 23