done.pptx

- Количество слайдов: 33

INTERNATIONAL BUSINESS STRATEGY - Internationalization of a Russian aluminium company Alexander Bogdanov Clementine Chevallier Elisa Tilley Alla Mosina Anatoly Simonov Zauresh Zhumaeva

SUMMARY INTRODUCTION HISTORY OF RUSAL COMPANY POSITION BEFORE INTERNATIONALIZATION MARKET ANALYSIS OF ALUMINIUM INDUSTRY INTERNATIONALIZATION OF RUSAL COMPANY POSITION AFTER INTERNATIONALIZATION CONCLUSION

INTRODUCTION Aluminium as a new industry Rusal’s leader position since 2007, thanks to its international expansion. Rusal’s internationalization has some special characteristics.

SUMMARY INTRODUCTION HISTORY OF RUSAL COMPANY POSITION BEFORE INTERNATIONALIZATION MARKET ANALYSIS OF ALUMINIUM INDUSTRY INTERNATIONALIZATION OF RUSAL COMPANY POSITION AFTER INTERNATIONALIZATION CONCLUSION

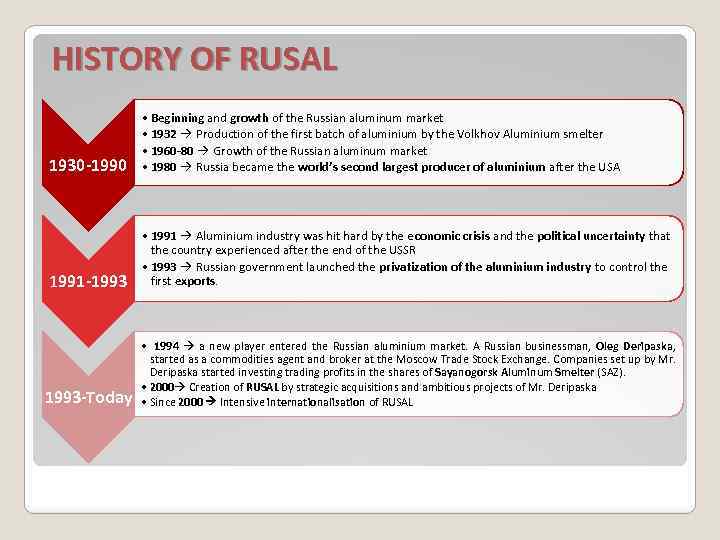

HISTORY OF RUSAL 1930 -1990 • Beginning and growth of the Russian aluminum market • 1932 Production of the first batch of aluminium by the Volkhov Aluminium smelter • 1960 -80 Growth of the Russian aluminum market • 1980 Russia became the world’s second largest producer of aluminium after the USA 1991 -1993 • 1991 Aluminium industry was hit hard by the e conomic crisis and the political uncertainty that the country experienced after the end of the USSR • 1993 Russian government launched the privatization of the aluminium industry to control the first exports. 1993 -Today • 1994 a new player entered the Russian aluminium market. A Russian businessman, Oleg Deripaska, started as a commodities agent and broker at the Moscow Trade Stock Exchange. Companies set up by Mr. Deripaska started investing trading profits in the shares of Sayanogorsk Aluminum Smelter (SAZ). • 2000 Creation of RUSAL by strategic acquisitions and ambitious projects of Mr. Deripaska • Since 2000 Intensive internationalisation of RUSAL

SUMMARY INTRODUCTION HISTORY OF RUSAL COMPANY POSITION BEFORE INTERNATIONALIZATION MARKET ANALYSIS OF ALUMINIUM INDUSTRY INTERNATIONALIZATION OF RUSAL COMPANY POSITION AFTER INTERNATIONALIZATION CONCLUSION

COMPANY POSITION BEFORE INTERNATIONALIZATION § 1985, start of production on Sayanogorsk Aluminium Smelter: • state-of-the-art technologies and equipment; • high capacity - SAZ produced 213, 854 t of primary aluminium while the world production was 8350 kt; • the newest and most modern aluminium plants built in Soviet times → huge competitive advantage to RUSAL. § Early 90 s: the Russian aluminium industry is in a tight spot -hyperinflation along with budget cuts halted the smelters' operations. § Collapse of Soviet Union forced to cut aluminium consumption by almost nine times. § The only way for the Russian aluminium industry to tackle the crisis was to shift its focus towards the export markets. That's why the internationalization begun

SUMMARY INTRODUCTION HISTORY OF RUSAL COMPANY POSITION BEFORE INTERNATIONALIZATION MARKET ANALYSIS OF ALUMINIUM INDUSTRY INTERNATIONALIZATION OF RUSAL COMPANY POSITION AFTER INTERNATIONALIZATION CONCLUSION

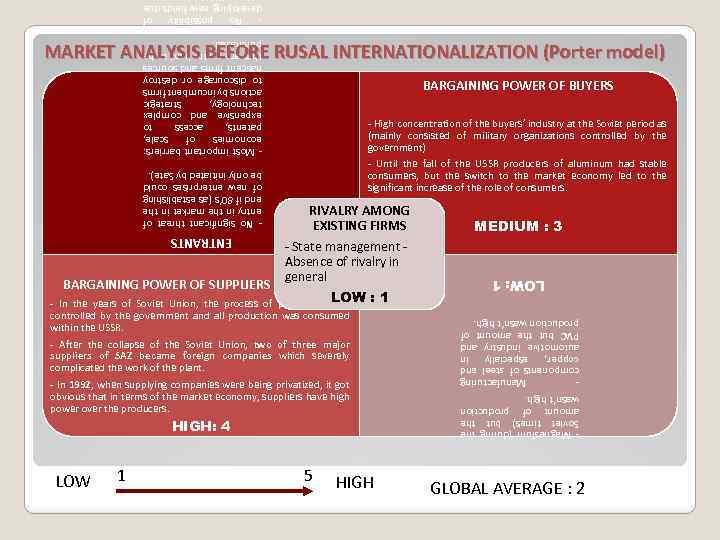

- No possibility of developing new fields due - Most important barriers: economies of scale, patents, access to expensive and complex technology, strategic actions by incumbent firms to discourage or destroy nascent firms and sources that are pretty hard to be purchased. MARKET ANALYSIS BEFORE RUSAL INTERNATIONALIZATION (Porter model) - High concentration of the buyers’ industry at the Soviet period as (mainly consisted of military organizations controlled by the government) - Until the fall of the USSR producers of aluminum had stable consumers, but the switch to the market economy led to the significant increase of the role of consumers. THREAT OF NEW ENTRANTS - In the years of Soviet Union, the process of production LOW was controlled by the government and all production was consumed within the USSR. : 1 - After the collapse of the Soviet Union, two of three major suppliers of SAZ became foreign companies which severely complicated the work of the plant. - In 1992, when supplying companies were being privatized, it got obvious that in terms of the market economy, suppliers have high power over the producers. HIGH: 4 LOW 1 5 HIGH THREAT OF SUBSTITUTES - State management Absence of rivalry in general MEDIUM : 3 - Magnesium (during the Soviet times) but the amount of production wasn’t high. Manufacturing components of steel and copper, especially in automotive industry and PVC but the amount of production wasn’t high. RIVALRY AMONG EXISTING FIRMS LOW: 1 - No significant threat of entry in the market in the end if 80’s (as establishing of new enterprises could be only initiated by Sate). BARGAINING POWER OF SUPPLIERS BARGAINING POWER OF BUYERS GLOBAL AVERAGE : 2

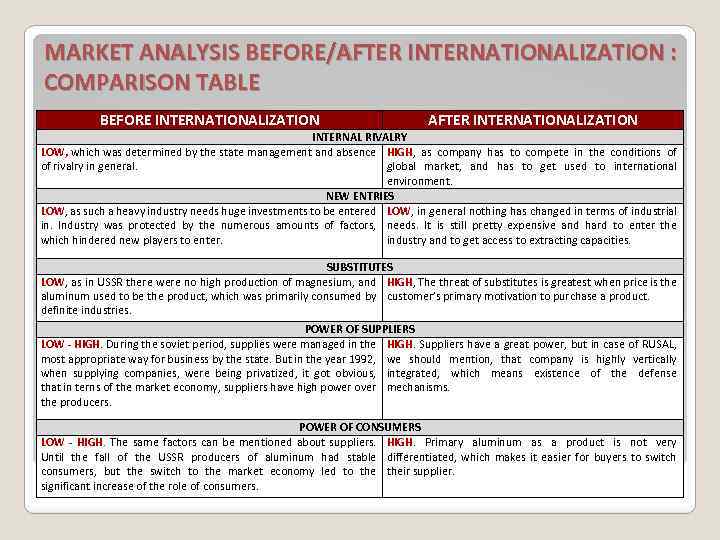

MARKET ANALYSIS BEFORE/AFTER INTERNATIONALIZATION : COMPARISON TABLE BEFORE INTERNATIONALIZATION AFTER INTERNATIONALIZATION INTERNAL RIVALRY LOW, which was determined by the state management and absence HIGH, as company has to compete in the conditions of of rivalry in general. global market, and has to get used to international environment. NEW ENTRIES LOW, as such a heavy industry needs huge investments to be entered LOW, in general nothing has changed in terms of industrial in. Industry was protected by the numerous amounts of factors, needs. It is still pretty expensive and hard to enter the which hindered new players to enter. industry and to get access to extracting capacities. SUBSTITUTES LOW, as in USSR there were no high production of magnesium, and HIGH, The threat of substitutes is greatest when price is the aluminum used to be the product, which was primarily consumed by customer’s primary motivation to purchase a product. definite industries. POWER OF SUPPLIERS LOW - HIGH. During the soviet period, supplies were managed in the HIGH. Suppliers have a great power, but in case of RUSAL, most appropriate way for business by the state. But in the year 1992, we should mention, that company is highly vertically when supplying companies, were being privatized, it got obvious, integrated, which means existence of the defense that in terns of the market economy, suppliers have high power over mechanisms. the producers. POWER OF CONSUMERS LOW - HIGH. The same factors can be mentioned about suppliers. HIGH. Primary aluminum as a product is not very Until the fall of the USSR producers of aluminum had stable differentiated, which makes it easier for buyers to switch consumers, but the switch to the market economy led to their supplier. significant increase of the role of consumers.

SUMMARY INTRODUCTION HISTORY OF RUSAL COMPANY POSITION BEFORE INTERNATIONALIZATION MARKET ANALYSIS OF ALUMINIUM INDUSTRY INTERNATIONALIZATION OF RUSAL COMPANY POSITION AFTER INTERNATIONALIZATION CONCLUSION

REASONS FOR SPECIFICS OF ALUMINIUM INDUSTRY • Aluminium industry is highly consolidated • Aluminium industry is vertically integrated COLLAPSE OF THE USSR OTHER FACTORS • Production facilities were spread within the one state territory but the collapse of the USSR brake that supply and technological chain. • Pavlodar and Nikolayev alumina plants, that were two major suppliers, automatically became foreign companies. • It affected shipping prices (train tarifs foreign countries were higher) and customs fees. • So the smelters found themselves in situation when the internationalization was the only alternative of ceasing to exists. • Electricity Price • Exchange rates • Trade policies • Global shift in the consumption region

OPTIONS FOR Russian Experience / Foreign Strategy Being a capital-intensive industry, aluminium production has been always dominated by large, vertically integrated companies. Major mining-holding companies also had steel, copper and other units and therefore, processed efficiently an entire field. Ex. : COMALCO, BILLITON, ALCOA, CHALCO Specialized on aluminium only - relatively small and balanced holdings which then were acquired by larger companies. GIANTS – CHALCO, ALCOA In Perspective Follow the strategy of COMALCO. Continue M&As on internal market. Introduce new facilities. Export to the West.

UKRAINE: NYKOLAEVSKY ALUMINA PLANT 2000, acquisition REASON OF THE PARTNERSHIP Access to raw materials PROBLEMS OF THE PARTNERSHIP Governmental claims Labor Union strikes Cross-cultural issues weren’t considered

UKRAINE: ZAPOROZHSKY ALUMINA MILL 2000, acquisition REASON OF THE PARTNERSHIP Access to raw materials PROBLEMS OF THE PARTNERSHIP worn-out equipment debts of the plant before intermediaries $ 80 million debt before government In 2012 this mill was returned back to the Ukrainian State

KAZAKHSTAN: BOGATYR KOMIR 1995, 50/50 joint venture REASON OF THE PARTNERSHIP supplementary, constant and reliable power energy source establishing connections with Kazakh largest and governmental-owned energy enterprise PROBLEMS OF THE PARTNERSHIP -

ARMENIA: ARMENAL 2000 -2003, acquisition REASON OF THE PARTNERSHIP PROBLEMS OF THE PARTNERSHIP Kanakerski aluminum smelter, one of the largest aluminum foil mills in Europe was seeking for strategic partner who would lead the plant out of crisis For RUSAL – expansion to international market No any serious difficulties. ARMENAL is precisely one of the best examples of Russian capital expansion. As a result of the modernization the plant has increased its efficiency and became one of the most environmentally friendly foil companies in the world.

CHINA: Shanxi Catod, Baoguan 2005 -2008, acquisition REASON OF THE PARTNERSHIP to achieve self-sufficiency in raw materials (in 2008 these covered 60% of RUSAL’s demand) to reduce shipping costs of cathodes (RUSAL had a lot of facilities in Syberia) PROBLEMS OF THE PARTNERSHIP It was win-win contract as RUSAL pledged to invest more than 20 m. USD in the Chinese facilities

SWEDEN: KUBIKENBORG ALUMINIUM AB 2000, FDI, acquisition REASON OF THE PARTNERSHIP innovative technology ability to expand on European market PROBLEMS OF THE PARTNERSHIP ecological issues

ITALY: EURALLUMINA 2006, acquisition REASON OF THE PARTNERSHIP Access to raw materials Expanding presence on European market PROBLEMS OF THE PARTNERSHIP European Commission has obliged Italy to recover previously provided assistance to subsidize electricity tariffs (5 mln. Euro)

AUSTRALIA: QUEENSLAND ALUMINA Ltd. 2004, 20/80 joint venture REASON OF THE PARTNERSHIP Access to raw materials (+22% to material base) Expanding global presence PROBLEMS OF THE PARTNERSHIP Paying Kaiser’s debts Increase in fuel prices Australian dollar fluctuations Carbon tax and emission schemes imposed by government ($400 mln. tax)

GUINEA: FRIGUA ALUMINA REFINERY 2002, acquisition REASON OF THE PARTNERSHIP Access to raw materials PROBLEMS OF THE PARTNERSHIP worn-out equipment debts of the plant before intermediaries $ 80 million debt before government

GUINEA: BAUXITE COMPANY OF GUYANA 2004 -2006, acquisition REASON OF THE PARTNERSHIP to provide a stable supply of bauxite for expanding capacity of Nikolaev alumina refinery in Ukraine to increase the efficiency of alumina production through the use of raw materials of higher quality PROBLEMS OF THE PARTNERSHIP Cross-cultural issues: October 2011 - more than 500 workers went on strike to protest against planned layoffs November 2011 – because of an accident at mine a worker was killed, and another one was injured

NIGERIA: ALSCON 2009, acquisition REASON OF THE PARTNERSHIP Access to raw materials Vertically integrated company Own gas power station Access to transportation channel – company has river port PROBLEMS OF THE PARTNERSHIP 2008, power outages are paralyzed High political risk - Nigeria's government began to challenge the legality of privatization High crime level – murder of 6 Russian employees

JAMAICA: ALPART&WINDALCO 2004 -2007, acquisitions REASON OF THE PARTNERSHIP Access to raw materials (5% of the world’s bauxite reserves ) Well-developed alumina production infrastructure Vital for planned introduction of Taishet and Boguchany smelters. PROBLEMS OF THE PARTNERSHIP From 2009 Alpart is temporarily closed due to overcapacity in the market It’s necessary to restructure the plants in order for them to use coal or gas as a fuel

SUMMARY INTRODUCTION HISTORY OF RUSAL COMPANY POSITION BEFORE INTERNATIONALIZATION MARKET ANALYSIS OF ALUMINIUM INDUSTRY INTERNATIONALIZATION OF RUSAL COMPANY POSITION AFTER INTERNATIONALIZATION CONCLUSION

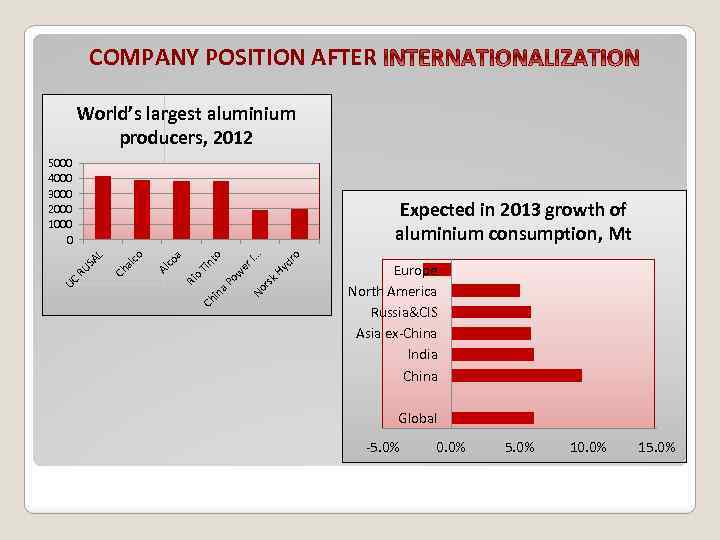

COMPANY POSITION AFTER INTERNATIONALIZATION

COMPANY POSITION AFTER World’s largest aluminium producers, 2012 5000 4000 3000 2000 1000 0 ro rs k. H er I No ow a. P in yd . . . o nt Ti o Ch Al co co al Ch a Ri UC RU SA L Expected in 2013 growth of aluminium consumption, Mt Europe North America Russia&CIS Asia ex-China India China Global -5. 0% 0. 0% 5. 0% 10. 0% 15. 0%

COMPANY POSITION AFTER INTERNATIONALIZATION A new 10 -year strategy: 1. Reinforce the leadership in the global aluminium industry through raising production efficiency 2. Ensure the best capital structure possible and boost the shares liquidity 3. Diversify business through creating and developing the company’s own power generating capacities 4. Bolster positions in the key sales markets, expanding sales to the growing markets of Russia and Asia 5. Satisfy the growing production with own raw materials 6. Ensure production sustainability through access to cost-competitive renewable energy sources. 7. Ensure the sustainable growth of business through streamlining logistics 8. Enhance the leading positions in technological innovations through developing and implementing technical policy 9. Ensure continuous improvement of the company’s environmental performance 10. Strengthen the company's position as popular and reliable employer

SUMMARY INTRODUCTION HISTORY OF RUSAL COMPANY POSITION BEFORE INTERNATIONALIZATION MARKET ANALYSIS OF ALUMINIUM INDUSTRY INTERNATIONALIZATION OF RUSAL COMPANY POSITION AFTER INTERNATIONALIZATION CONCLUSION

CONCLUSION The main peculiarities of RUSAL internationalization: • Economic environment in post-soviet territory; • Acquisition – the main strategy, JV – second best; • Huge investments in modernization of acquired capacities; • 100% ownership in most of foreign subsidiaries; • Loyalty of some foreign governments; • Bad perception in African countries; • The main problems are the consequences of market situation as a whole.

Questions & Answers

Thanks for your attention. Alexander Bogdanov Clementine Chevallier Elisa Tilley Alla Mosina Anatoly Simonov Zauresh Zhumaeva

done.pptx