b7809c7e7153930c5432be616ff57656.ppt

- Количество слайдов: 19

INTERNATIONAL BUSINESS STRATEGIES Andrey G. Medvedev, Professor CEMS MIM Programme September 22, 2009

7. INTERNATIONAL ENTRY MODES: INVESTMENT MODES 1. MARKET AND INDUSTRY ENTRY 2. ACQUISITIONS OF FOREIGN COMPANIES 3. GREEN-FIELD PROJECTS 4. JOINT VENTURES 5. ENTRY-MIX 6. STEP-BY-STEP INTERNATIONALISATION VS. NETWORKING © Andrey Medvedev

SELECTING AN ENTRY MODE Responsibilities of International Manager: Manager n n n Evaluate opportunities and risks of entering foreign economy Define a degree of local responsiveness Analyse advantages and disadvantages of alternative foreign direct investment options Select an appropriate entry option Search for strategic partners and target companies abroad © Andrey Medvedev

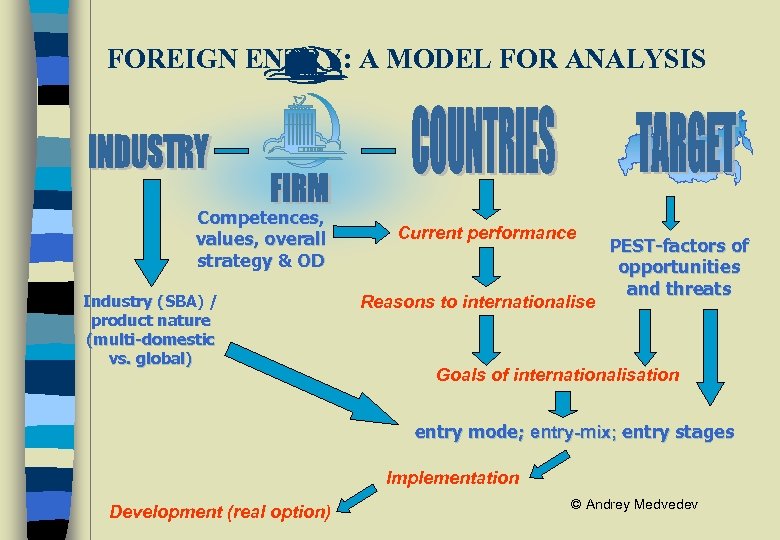

FOREIGN ENTRY: A MODEL FOR ANALYSIS Competences, values, overall strategy & OD Industry (SBA) / product nature (multi-domestic vs. global) Current performance Reasons to internationalise PEST-factors of opportunities and threats Goals of internationalisation entry mode; entry-mix; entry stages Implementation Development (real option) © Andrey Medvedev

FOREIGN DIRECT INVESTMENT n FOREIGN DIRECT INVESTMENT IS USUALLY NEEDED – THE AMOUNT INVESTED BY A HOME COUNTRY PARENT COMPANY IN A FOREIGN ENTERPRISE TO HAVE EFFECTIVE CONTROL – GENERALLY INVOLVES THE LONG-TERM COMMITMENT OF LARGE AMOUNTS OF FUNDS TO PROJECTS WHICH WILL PAY OFF OVER AN EXTENDED PERIOD n n BEING CLOSER TO THE MARKET ACHIEVING HIGHER MARKET SHARE GETTING ACCESS TO (CHEAPER) RESOURCES AND SKILLS REALISING LOCATION ECONOMY © Andrey Medvedev

HOW? FDI ENTRY MODES – INDUSTRY ENTRY n ACQUISITIONS n GREEN-FIELD ESTABLISHMENTS n JOINT VENTURES – MINORITY SHARE (ALLIANCE) – 50/50 – MAJORITY SHARE © Andrey Medvedev

STEPS OF ACQUISITION n SEARCHING FOR A TARGET COMPANY n APPRAISAL OF A TARGET COMPANY n TAKING ACCOUNT OF ACQUISITION TERMS – INVESTMENT TENDERS n MAKING POST-ACQUISITION DECISIONS © Andrey Medvedev

STRATEGIC CONTEXT OF ACQUISITIONS n COMPANY’S GLOBAL DIVERSITY COULD BE REACHED THROUGH DIFFERENT TYPES OF ACQUISITIONS n CROSS-BORDER ACQUISITION OF A “FOREIGN TARGET” TARGET – A FOREIGN COMPANY WITH OPERATIONS ONLY IN ITS HOME COUNTRY (LOCAL ACQUISITION) ACQUISITION – A MAJOR FOREIGN COMPANY WITH EXTENSIVE INTERNATIONAL OPERATIONS (GLOBAL ACQUISITION – 1) 1 n ACQUISITION OF A “DOMESTIC TARGET” TARGET – COMPANY WHICH OPERATES IN MANY COUNTRIES (GLOBAL ACQUISITION – 2) 2 © Andrey Medvedev

SUBSIDIARIES IN RUSSIA: STADA n n n In the beginning of 2005, Stada Arzneimittel AG, Germany's third. AG largest generic-drug maker, acquired 99 percent of shares in Nizhpharm OAO located in Nizhny Novgorod, Russia, for € 80 million. “Stada considers Russia an important growth market, ”' the German company said in the statement. In 2006, STADA Group sales in Russia increased by 55 percent to EUR 87. 5 million. The ongoing very positive business development of Nizhpharm mainly focuses on branded products contributed the major part of this increase. In August 2007, Nizhpharm acquired all of closely held Makiz-Pharma shares for € 135 million to get low-cost production and expand in the growing Russian market. Makiz-Pharma is one of a few domestic pharmaceuticals producers that was planned and build according to the Russian and international GMP standards. © Andrey Medvedev

GREEN-FIELD INVESTMENT: VOLKSWAGEN n n The foundation stone was laid in Kaluga on October 30, 2006 for Volkswagen's new factory, the largest foreign project Volkswagen in the Russian automobile industry. Volkswagen has reserved 800 hectares of land in Kaluga Region: 400 hectares for the factory itself, in which the company will invest 400 million euros, and 400 hectares for its partners in the automobile parts industry. The Kaluga technopark will be the largest project in the history of the post-Soviet automobile manufacturing industry. © Andrey Medvedev

UPM-KYMMENE n n UPM-Kymmene is a global forest products group with core businesses in printing papers, speciality papers, label materials and wood products. UPM has 64 wood production units in 14 countries and 21 paper mills in 8 countries (Finland, Germany, France, the UK, Austria, the US, Canada and China). They employ about 28, 000 people. The UPM’s sales in 2006 were about EUR 10 billion, of which three quarters came from Europe. In the end of 2007, UPM agreed to form a 50 -50 joint venture with Russian Sveza to invest more than 1 billion euros in Russia. The venture will produce about 800, 000 tons of pulp, 300, 000 cubic meters of wood and 450, 000 cubic meters of building panels per year. © Andrey Medvedev

THE ROLE OF A PARTNER n LOCAL PARTNER COULD SERVE AS A MARKETING SATELLITE (TRADE AND SERVICE COMPANIES, CONSULTING AGENCIES) – THEY KNOW LOCAL CONDITIONS BETTER – THEY MAY CONCENTRATE ON SALES, MARKETING AND SERVICES n LOCAL PARTNERS MAY HELP A FOREIGN FIRM LEARN AND UNDERSTAND LOCAL CONDITIONS BETTER n MANY JOINT VENTURES IN RUSSIA WERE TURNED INTO FULLY-OWNED SUBSIDIARIES AFTER FOREIGN PARTNERS HAD ACCUMULATED ENOUGH LOCAL EXPERIENCE n JOINT VENTURE MAY SERVE TEMPORARY AS A “TEST” MODE TEST © Andrey Medvedev

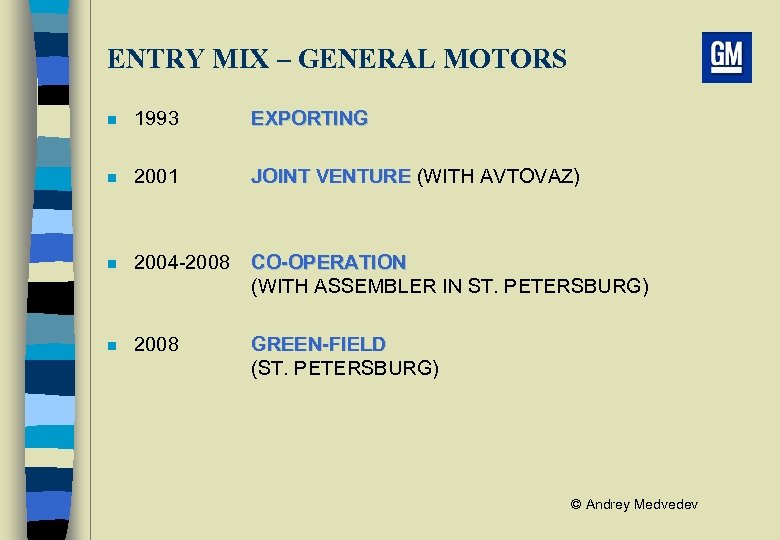

ENTRY MIX – GENERAL MOTORS n 1993 EXPORTING n 2001 JOINT VENTURE (WITH AVTOVAZ) n 2004 -2008 CO-OPERATION (WITH ASSEMBLER IN ST. PETERSBURG) n 2008 GREEN-FIELD (ST. PETERSBURG) © Andrey Medvedev

ENTRY MIX – FRANCHISING PLUS INVESTMENT: OBI n n German OBI (do-it-yourself retailer) has franchising agreements with two stores in Moscow Region and one in Leningrad Region near St. Petersburg. 49 percent of investment were made by OBI, 51 percent by franchisee, DIY Project Russia © Andrey Medvedev

ENTRY STAGES – WRIGLEY FOLLOWING WINDOW OF OPPORTUNITIES n 1991 n n 1995 1999 2004 n 2008 n INDIRECT EXPORTING LEARNING LOCAL CONDITIONS DEVELOPING DISTRIBUTION REPRESENTATION WRIGLEY’S RUSSIA GREEN-FIELD (ST. PETERSBURG) RECONSTRUCTION OF ST. PETERSBURG PLANT DIVERSIFICATION THROUGH ACQUISITION (ODINTSOVO CONFECTIONERY PLANT IN MOSCOW REGION) WRIGLEY HAS BEEN ACQUIRED BY MARS © Andrey Medvedev

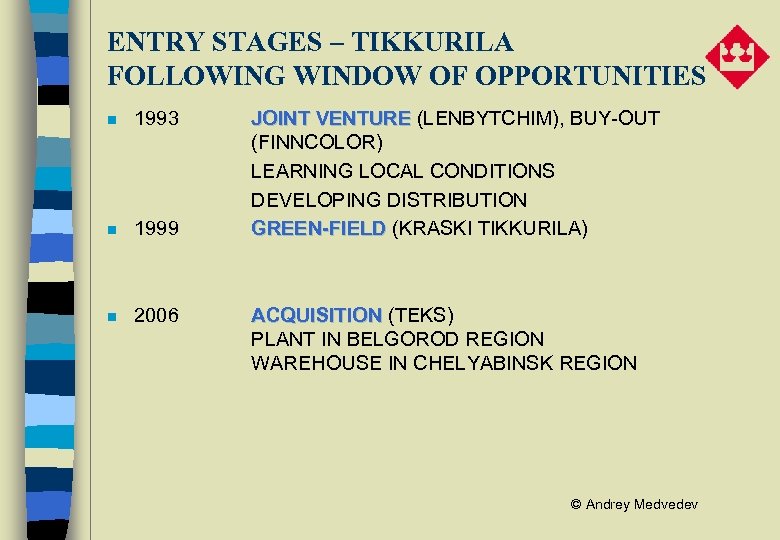

ENTRY STAGES – TIKKURILA FOLLOWING WINDOW OF OPPORTUNITIES n 1993 n 1999 n 2006 JOINT VENTURE (LENBYTCHIM), BUY-OUT (FINNCOLOR) LEARNING LOCAL CONDITIONS DEVELOPING DISTRIBUTION GREEN-FIELD (KRASKI TIKKURILA) ACQUISITION (TEKS) PLANT IN BELGOROD REGION WAREHOUSE IN CHELYABINSK REGION © Andrey Medvedev

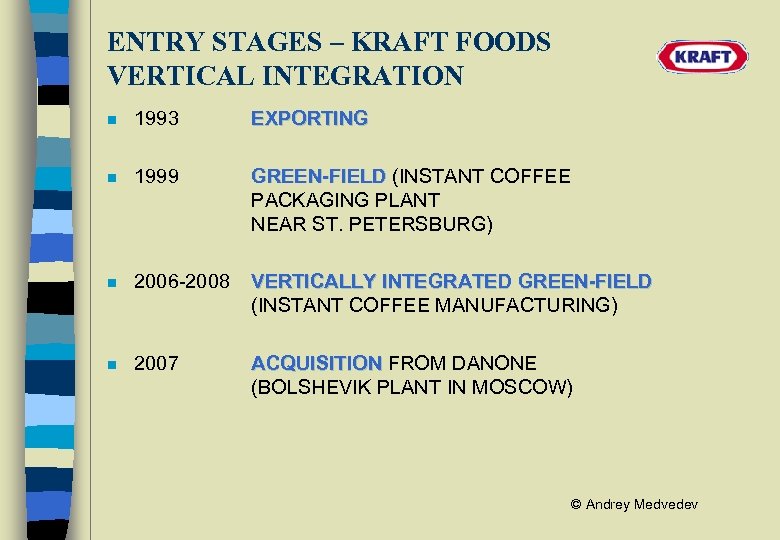

ENTRY STAGES – KRAFT FOODS VERTICAL INTEGRATION n 1993 EXPORTING n 1999 GREEN-FIELD (INSTANT COFFEE PACKAGING PLANT NEAR ST. PETERSBURG) n 2006 -2008 VERTICALLY INTEGRATED GREEN-FIELD (INSTANT COFFEE MANUFACTURING) n 2007 ACQUISITION FROM DANONE (BOLSHEVIK PLANT IN MOSCOW) © Andrey Medvedev

«SCANDINAVIAN» MODEL OF FOREIGN EXPANSION n ENTRY IS VIEWED AS A GRADUAL PROCESS THAT CAN BE SUBDIVIDED – – – EXPORTING LICENSING CONTRACT MANUFACTURING JOINT PROJECTS DIRECT INVESTMENT © Andrey Medvedev

STEP-BY-STEP INTERNATIONALISATION ADVANTAGES DISADVANTAGES n n n n © Andrey Medvedev

b7809c7e7153930c5432be616ff57656.ppt