IBE_MBA_2015_final.pptx

- Количество слайдов: 182

International Business Environment Kingston MBA Programme Alexey Verbetsky verbetsky@yahoo. com

Business Environment and Strategy An organization’s attempt to reconcile the changes in the business environment with its internal capabilities (skills and resources) Implications for marketing, operations, HR, finance, change management, etc.

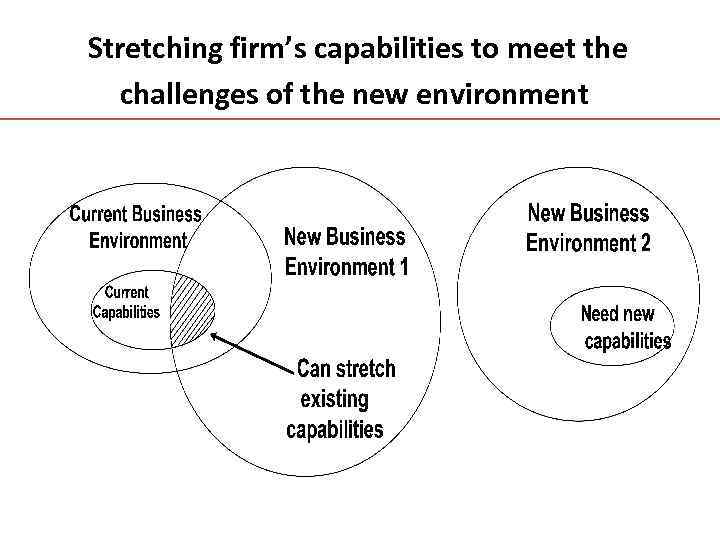

Stretching firm’s capabilities to meet the challenges of the new environment

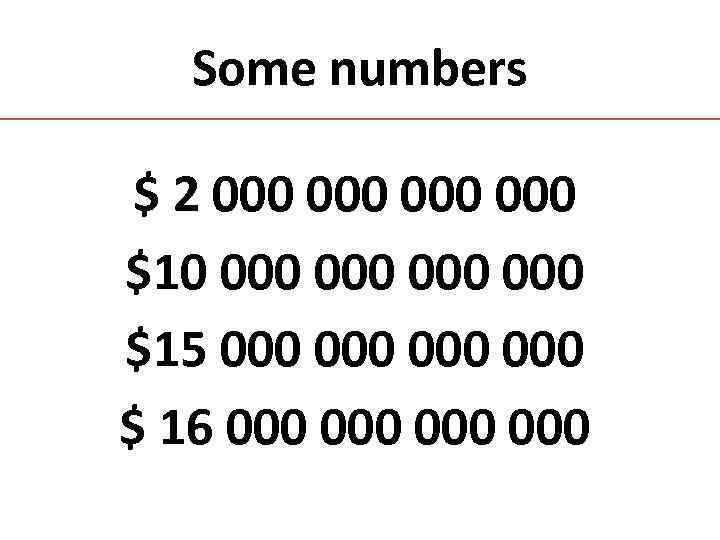

Some numbers $ 2 000 000 $10 000 000 $15 000 000 $ 16 000 000

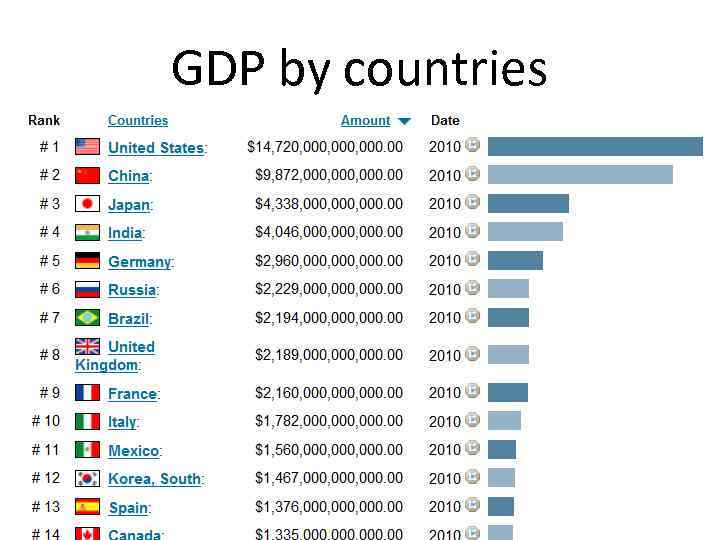

GDP by countries

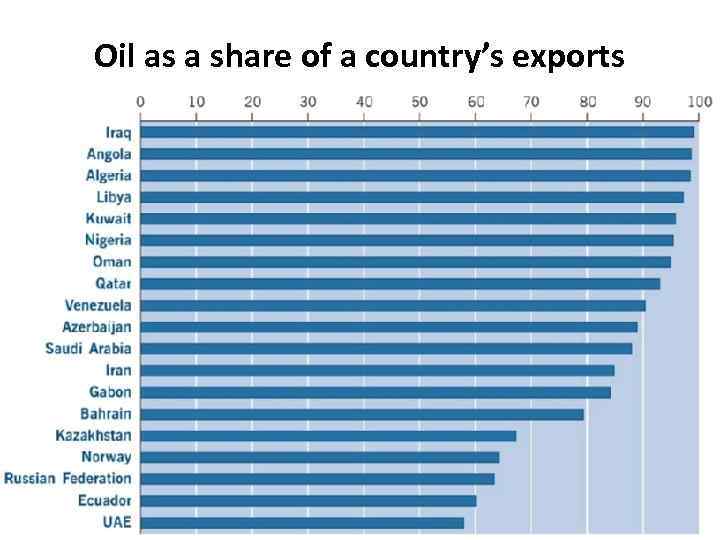

Oil as a share of a country’s exports

One Hundred Trillion dollar bill?

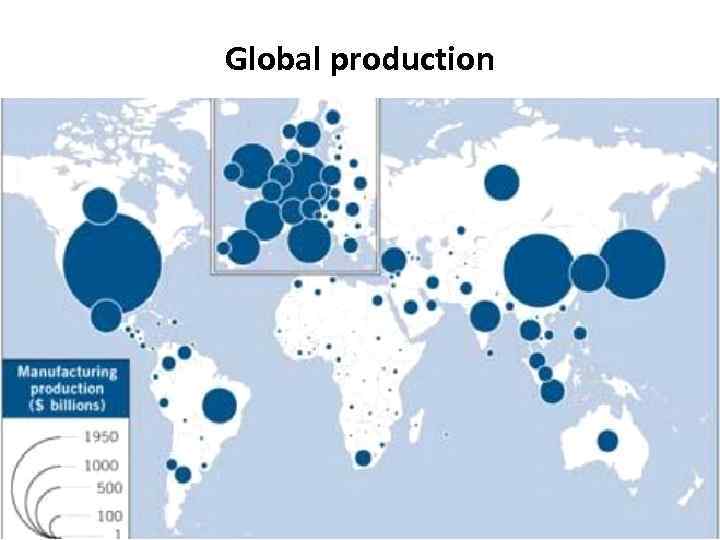

Global production

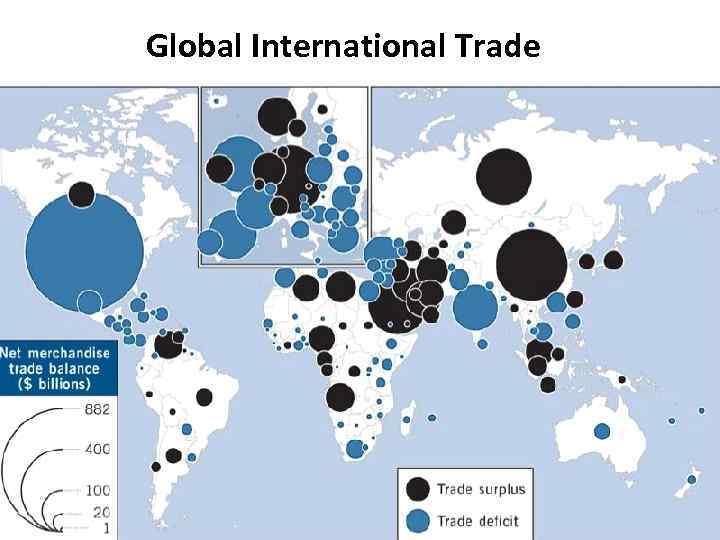

Global International Trade

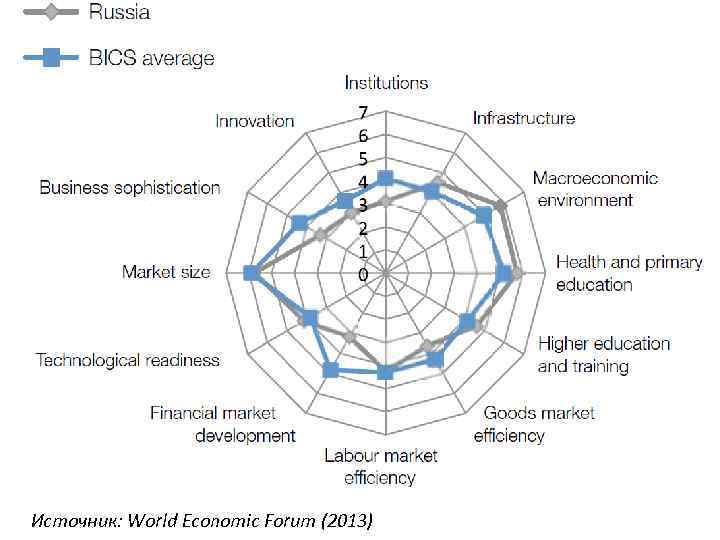

Источник: World Economic Forum (2013)

Infrastructural projects • • State-supported long-term projects Pros and contras Efficiency? The budget’s breakeven oil price – the price per barrel of oil that the government balances its budget – reached $125 per barrel in 2012 compared to around $60 in 2007

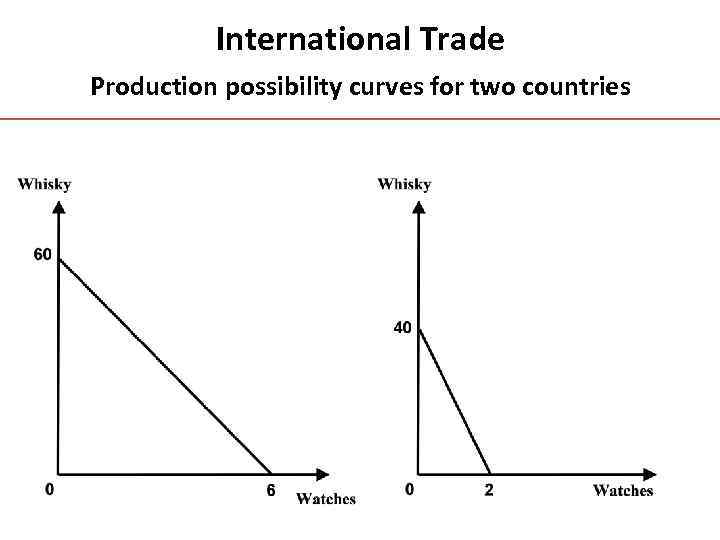

International Trade Production possibility curves for two countries

International Trade • Different price ratios: 10: 1 and 20: 1 bottles/watches • Introducing international trade: both countries gain • Comparative advantage • Relative bargaining strengths of the two countries

International Trade • Differences in labour productivity • Differences in the amount of factor endowments • Those countries with a low capital-tolabour ratio are likely to specialize in more labour-intensive/less capital-intensive goods and then export these goods

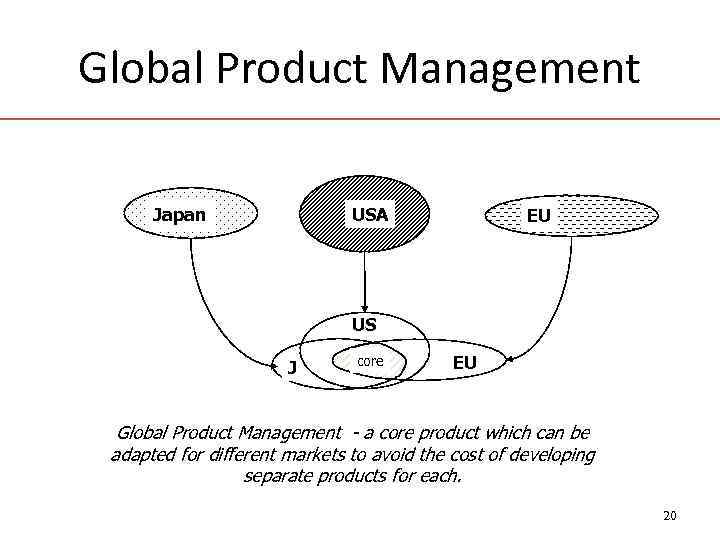

Global Product Management USA Japan EU US J core EU Global Product Management - a core product which can be adapted for different markets to avoid the cost of developing separate products for each. 20

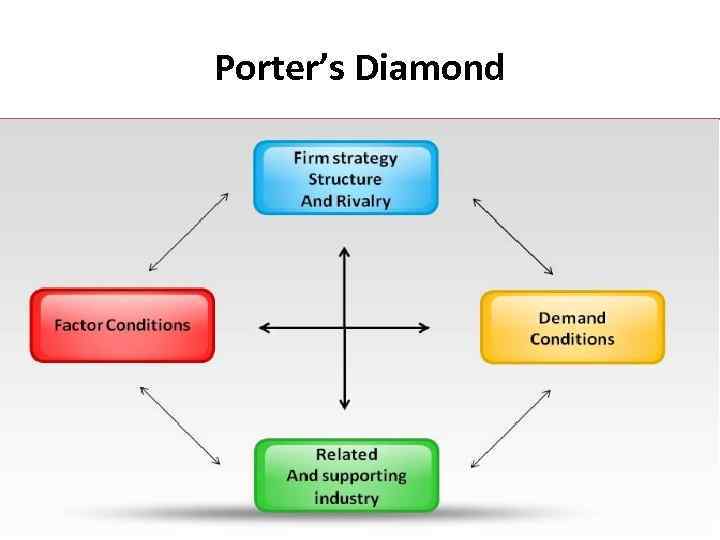

Porter’s Diamond

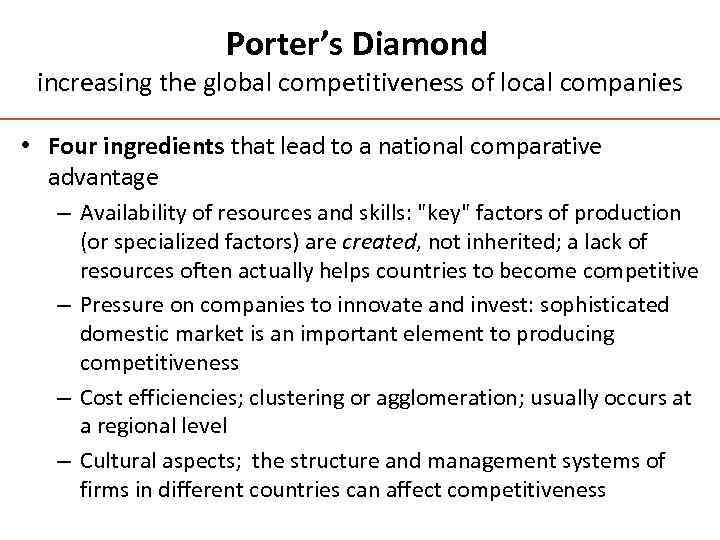

Porter’s Diamond increasing the global competitiveness of local companies • Four ingredients that lead to a national comparative advantage – Availability of resources and skills: "key" factors of production (or specialized factors) are created, not inherited; a lack of resources often actually helps countries to become competitive – Pressure on companies to innovate and invest: sophisticated domestic market is an important element to producing competitiveness – Cost efficiencies; clustering or agglomeration; usually occurs at a regional level – Cultural aspects; the structure and management systems of firms in different countries can affect competitiveness

The Role of Government • Encourage companies to improve performance – enforcement of quality standards • Stimulate demand for advanced products • Launch state-supported programs to create and develop specialized factors • Stimulate local rivalry and enforce anti-monopoly regulations

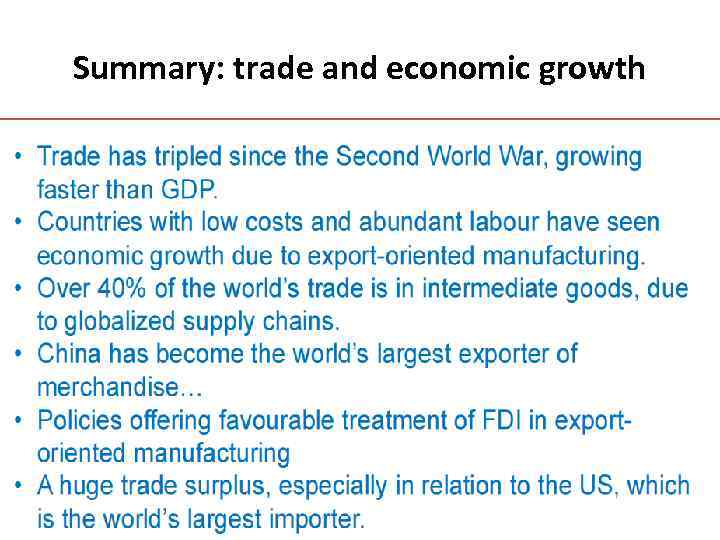

Summary: trade and economic growth

http: //papers. ssrn. com/sol 3/Display. Abstract. Search. cf m

http: //www. jstor. org/

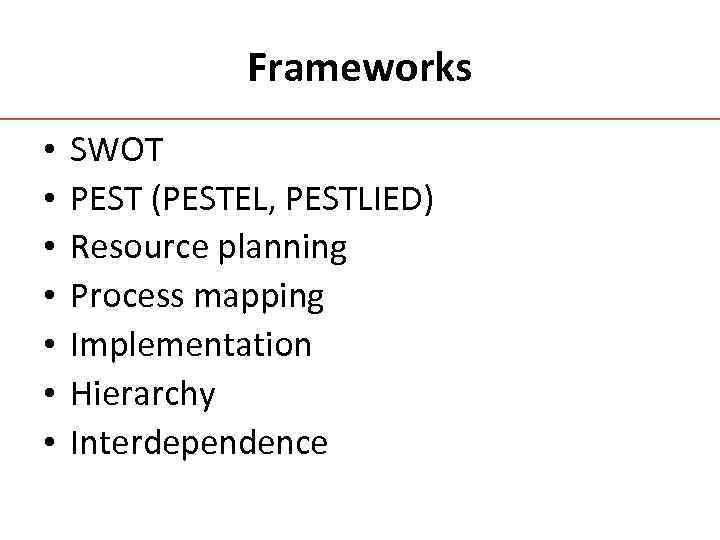

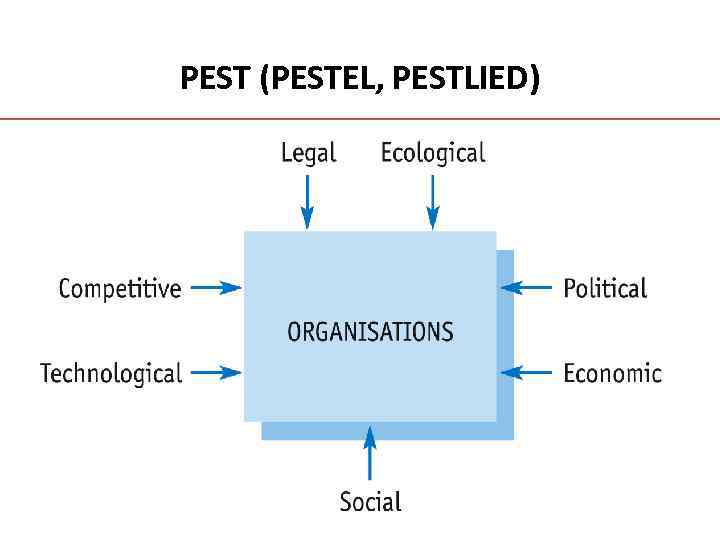

Frameworks • • SWOT PEST (PESTEL, PESTLIED) Resource planning Process mapping Implementation Hierarchy Interdependence

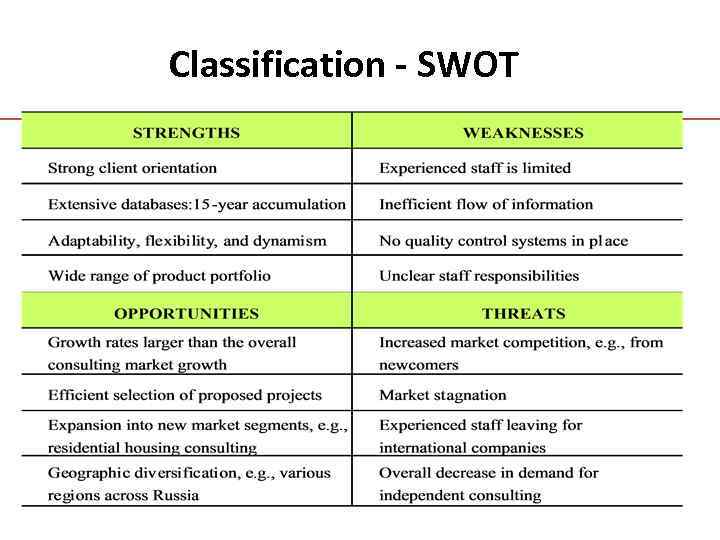

Classification - SWOT

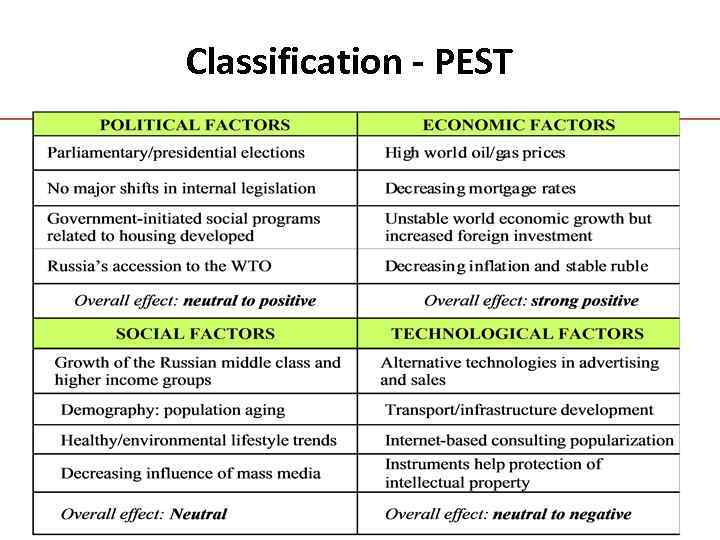

Classification - PEST

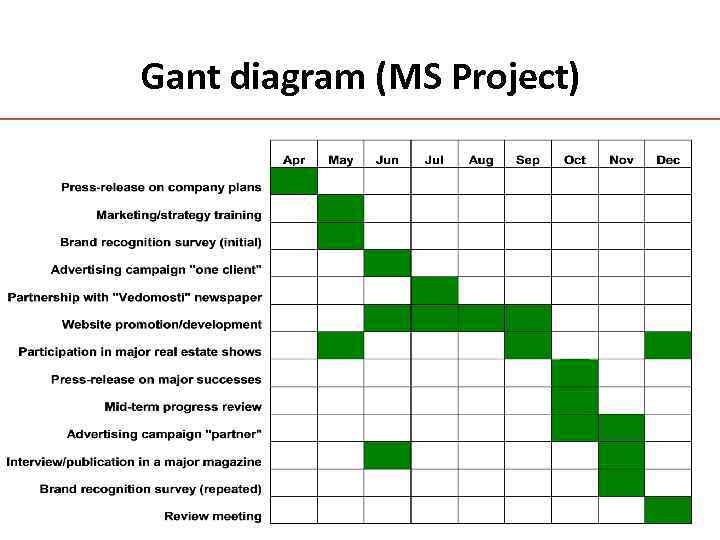

Gant diagram (MS Project)

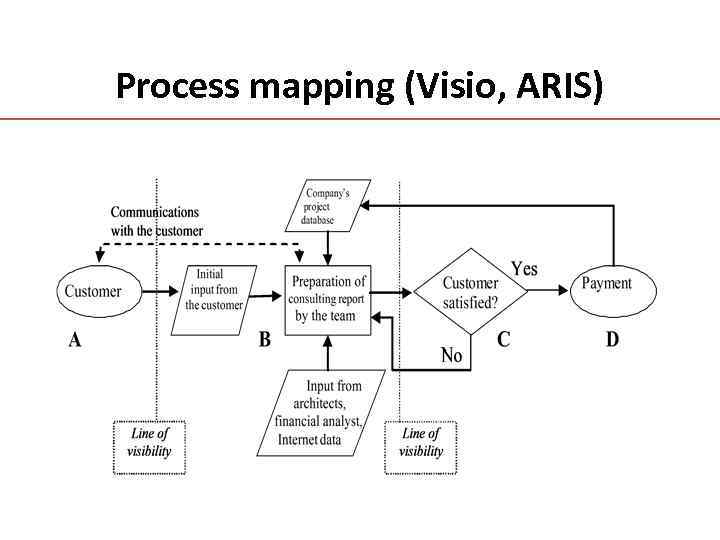

Process mapping (Visio, ARIS)

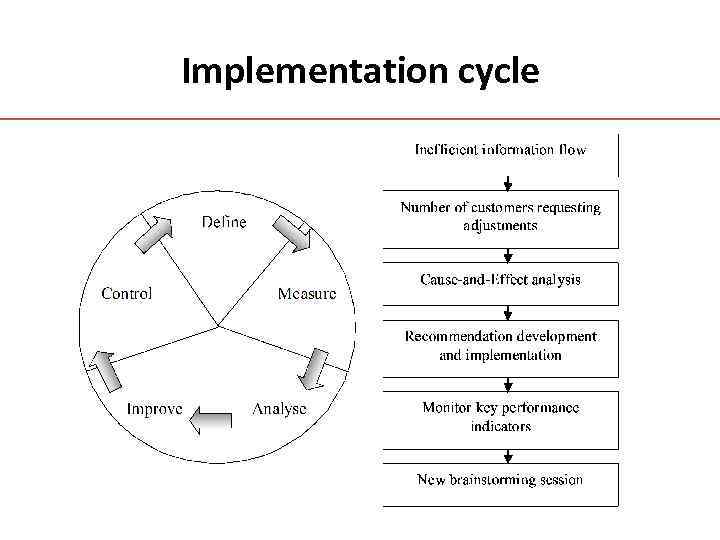

Implementation cycle

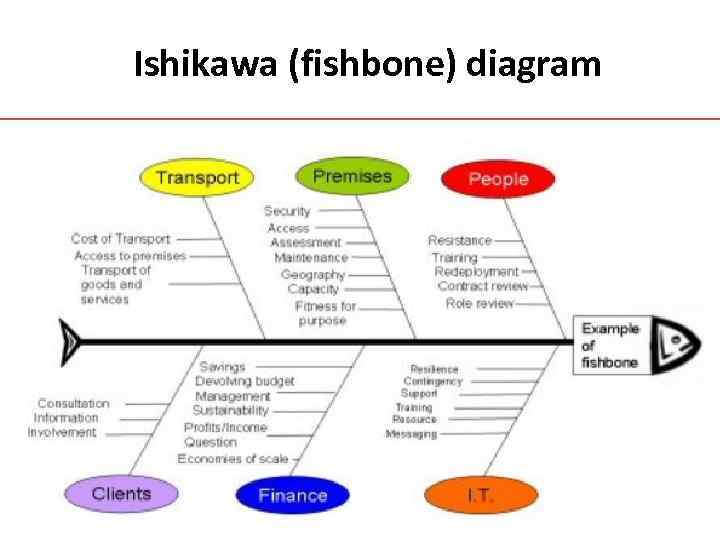

Ishikawa (fishbone) diagram

Balanced Business Scorecard

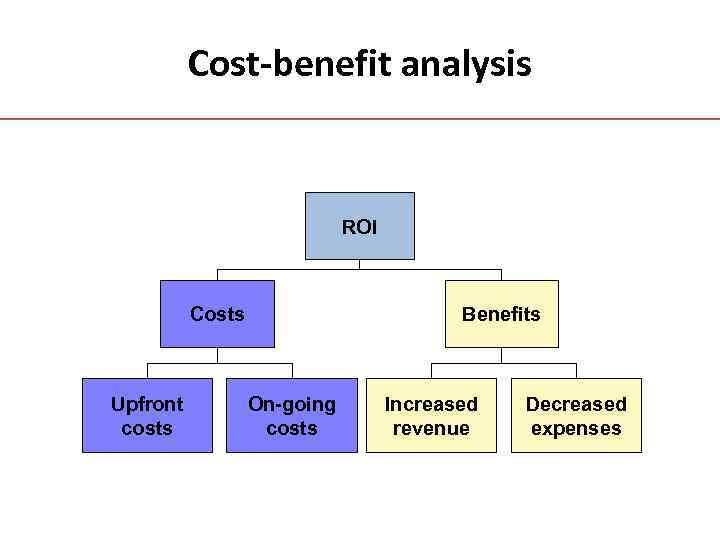

Cost-benefit analysis ROI Costs Upfront costs Benefits On-going costs Increased revenue Decreased expenses

External shocks • Inflation Ø Seasonality Ø Reasons • Exchange rate movements • Bubbles • Trends (technological, demographical, cultural, etc. )

Data analysis • Qualitative and quantitative • Cross-sectional, time-series and panel data • Seasonality Ø 10 -year data on annual (quarterly) nominal GDP dynamics for the BRIC countries Ø Monthly data on inflation (CPI) in Russia for the last 15 years • Heteroscedasticity • Multicollinearity

V, U, W, L

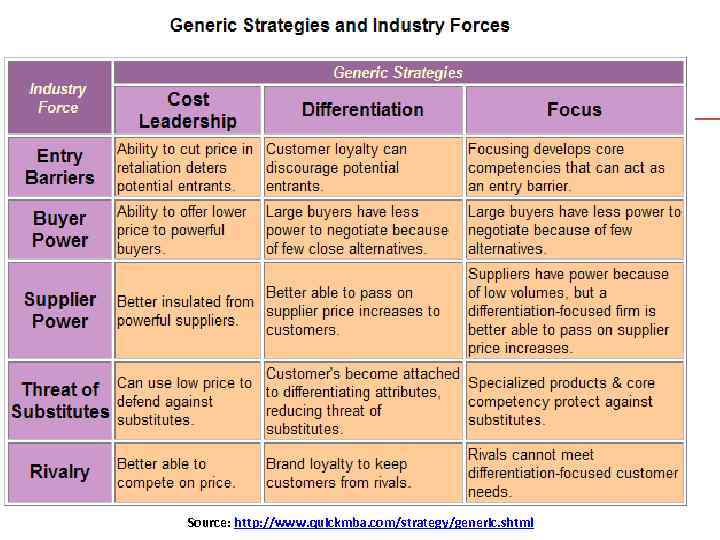

Analysis of business environment • PEST and competitor analysis • Porter’s Five Forces: analyzing industry environment • Degree of rivalry • Potential for new entrants • Ability to offer substitutes • Bargaining power of suppliers • Bargaining power of buyers

PEST (PESTEL, PESTLIED)

Group exercise #1 • Apply PEST analysis and Porter’s Five Forces frameworks to analyze the industry environment for the following companies: • • Group A: Rosbank Group B: Auto. VAZ Group C: Yandex Group D: MTS • In 10 minutes, each group reports principal findings

Globalization • Huge growth in international trade volumes • Capital flows • Travel, work and communication across the world • Increasing interdependence of the economies – 2008 -2009 global crisis

Globalization drivers (1) • Political changes – Relative peace since the World War II – China transformation – Soviet block – Asian ‘tigers’ • Technology spread – The pace of change is increasing – Convergence of computer technologies and communication technologies – Number of Internet users – network effects

Globalization drivers (2) • Economic liberalization and deregulation • Increase in international capital mobility • foreign exchange (currencies) • the debt (treasury bills, corporate bonds) • equities in private companies • Emergence of transnational companies (MNEs) due to saturation of the developed markets • Increase in the volume of trade (WTO) • Economic integration of nations (EU, NAFTA)

Flow of funds • Direct finance: lending by savers (lenders) to borrowers (spenders) • Indirect finance through financial intermediaries – Depository institutions – Contractual savings institutions – Investment intermediaries

Financial Markets (1) • Equity markets (stock exchanges); IPO – Major players: institutional investors • Bond markets (pay fixed sum on a fixed day) – Organizational and sovereign debt • Derivatives (financial contracts based on price fluctuations) – Forwards, futures, options, swaps – Hedging: risk shifting (similar to the insurance) • Securities (transformation of illiquid financial assets into marketable fixed-interest instruments) – Mortgage-backed securities – Asset-backed securities

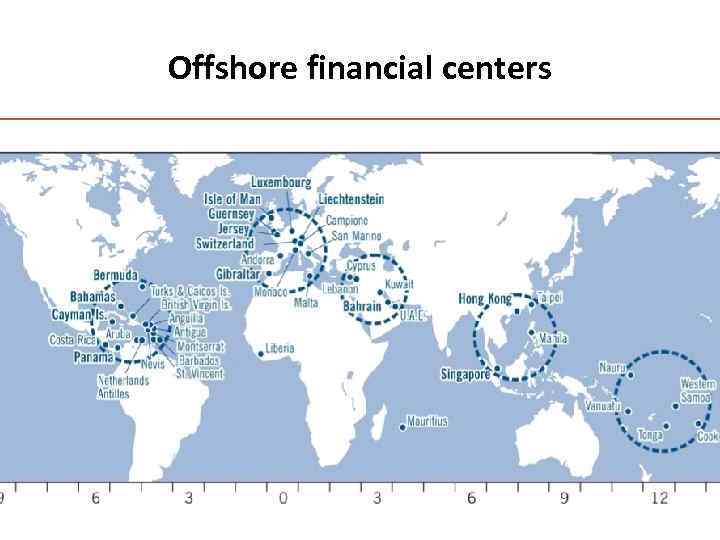

Financial Markets (2) • Money markets – Interbank market – REPO market – Foreign exchange market • Alternative markets – – – Gold and silver Commodities Energy Real estate Works of arts, gem stones, antiques, collectables • Offshoring

Offshore financial centers

Agreements and Unions • FTA - an agreement between two or more countries to remove all trade barriers between themselves • Customs Union - an agreement between two or more countries to remove tariffs between themselves and set a common external tariff on imports from non-member countries • Common Market - an agreement between two or more countries to remove all barriers to trade and allow free mobility of capital and labor across member countries • Economic Union - an agreement between two or more countries to remove barriers to trade, allow free flow of labor and capital and coordinate economic policies • Political Union - an agreement between two or more countries to coordinate their economic monetary and political systems

The World Bank • The World Bank – an international financial institution that provides leveraged loans to developing countries for capital programs • The World Bank Group : – International Bank for Reconstruction and Development (IBRD) – International Development Association (IDA) – International Finance Corporation (IFC) – Multilateral Investment Guarantee Agency (MIGA) – International Centre for Settlement of Investment Disputes (ICSID)

International Monetary Fund Foster global monetary cooperation Secure financial stability Facilitate international trade Promote high employment and sustainable economic growth • Reduce poverty • •

The World Trade Organization (WTO) • An international organization designed by its founders to supervise and liberalize international trade • Its main function is to ensure that trade flows as smoothly, predictably and freely as possible • Key instrument – provision of the legal ground rules for international commerce • GATT (General Agreement on Tariffs and Trade) 1948 -1995 • 157 member states • The biggest economy outside WTO – Iran

Globalization drivers (3) • Cost drivers – Outsourcing (lowering production costs) – Economies of scale (international expansion) • Competition – International competition increases as trade barriers are removed – Access to new markets – First mover advantage

Motives for Going International • Country-specific factors/risks to consider – Political stability – Economic potential – Government policies – Culture – Resources • Firm-specific factors – Access to new markets – Cost reduction – Access to specialized (immobile) resources

Modes of Internationalization

FDI as an indicator of globalization • Strong FDI inflows: advantageous business environment • Outflows – weaker domestic environment • FDI inflows to developing countries have been increasing

Globalization and world trade • Economic development is linked to integration in the world economy • Developing countries are becoming more active in global trade • Global strategies of MNEs have been the driver of increasing trade • The WTO has promoted multilateral agreements which bring down trade barriers • Increasing complexities for international business due to large number of regional trade agreements and protectionist measures

Group exercise #2 • Consider the impact of various aspects of globalization onto the following Russian companies: • Group A: S 7 (airlines) • Group B: Ros. Gos. Strah (insurance) • Group C: Moskvich (car manufacturer) • Group D: Sberbank • In 5 minutes, report principal findings

MESO-level analysis • Companies within the environment • SWOT • Stakeholder analysis • partnerships

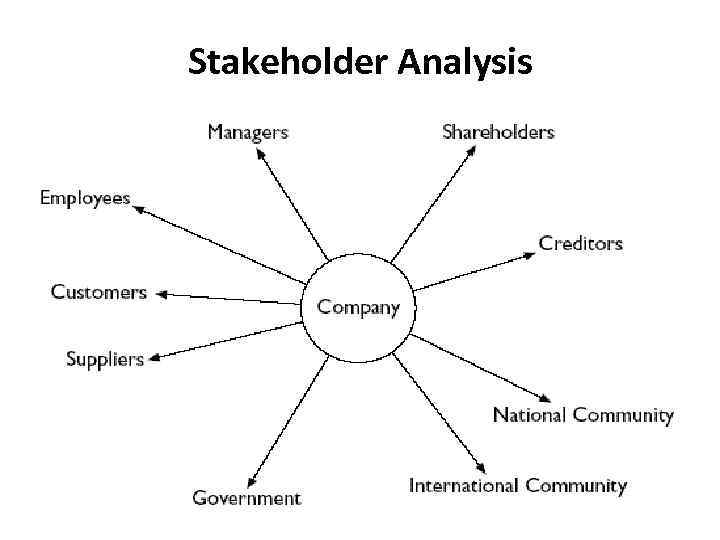

Stakeholder Analysis

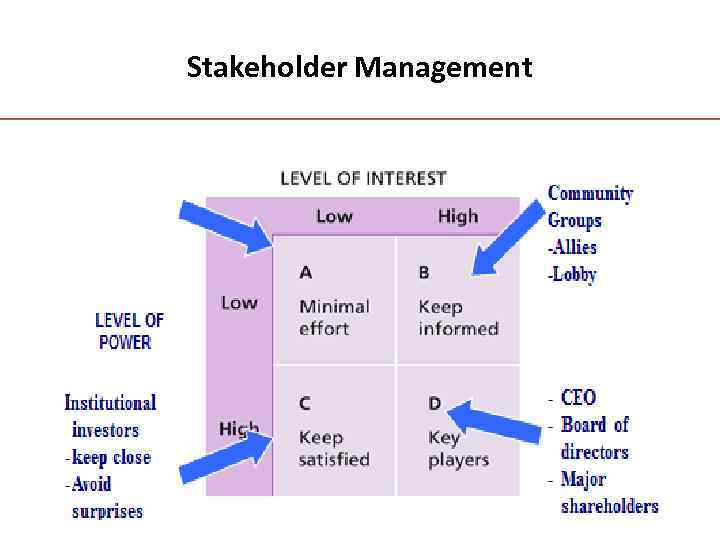

Stakeholder Management

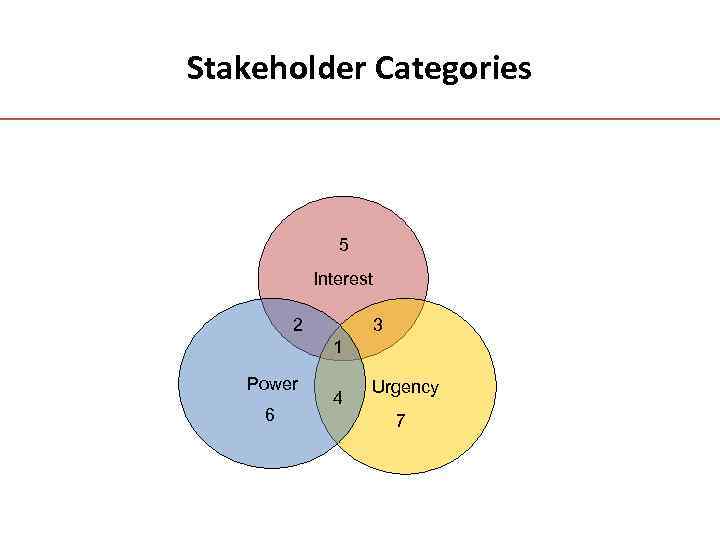

Stakeholder Categories 5 8 Non-stakeholder Interest 2 3 1 Power 6 4 Urgency 7 Mitchell, Agle and Wood (1991)

Corporate Social Responsibility • The orthodox view among free market economists: "The Social Responsibility of Business Is to Increase Its Profits. “ (Milton Friedman in The New York Times Magazine, 1970) • Rethinking this approach: other stakeholders’ interests

Corporate Social Responsibility • • • Philanthropy (donations) Sustainability: future generations Reputation Management • Strategic SCR: integrating the health of the business into the health of the society in which it operates

Selected references for further study • Business concepts, analytical tools and frameworks • http: //www. isixsigma. com/dictionary/glossary. asp • http: //www. investopedia. com/ • http: //www. consensuseconomics. com/ • Statistical data • • http: //www. worldbank. org/ http: //www. rba. co. uk/sources/stats. htm http: //www. oecd. org/statsportal/ http: //www. imf. org/external/data. htm • Debate on current economic issues • http: //www. economist. com/ • http: //www. ft. com/home/europe

Some Micro • • Budget and utility Market demand determinants Elasticity Market supply determinants Costs Factors of production Scale and scope economies

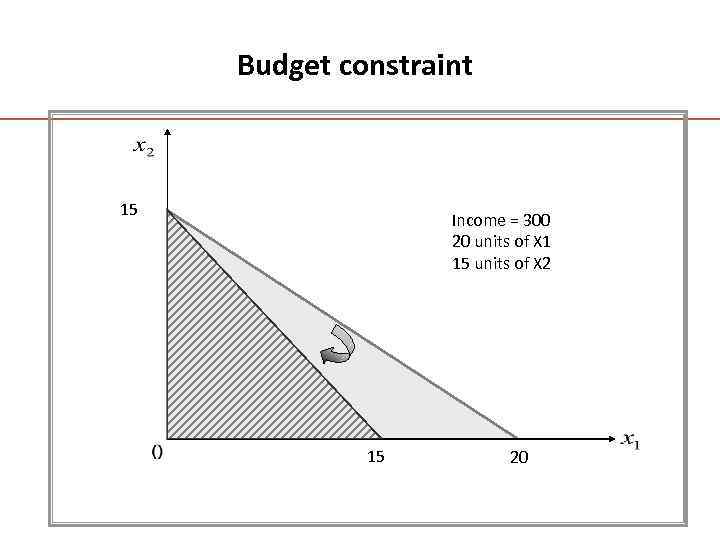

Budget constraint 15 Income = 300 20 units of X 1 15 units of X 2 15 20

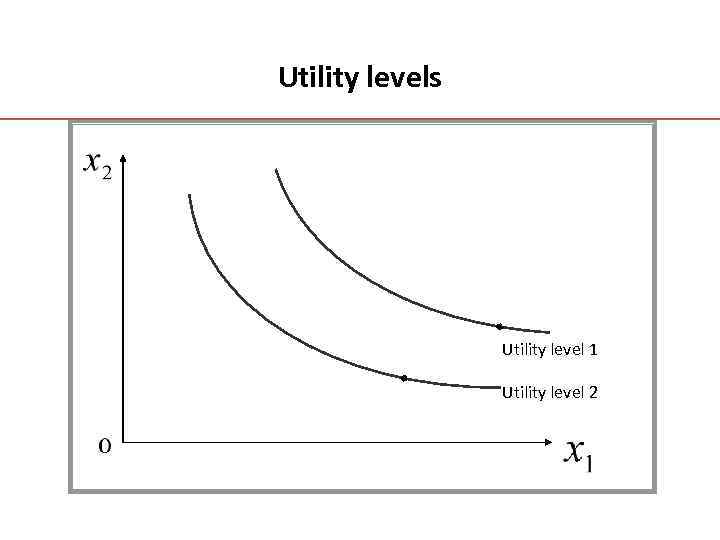

Utility levels Utility level 1 Utility level 2

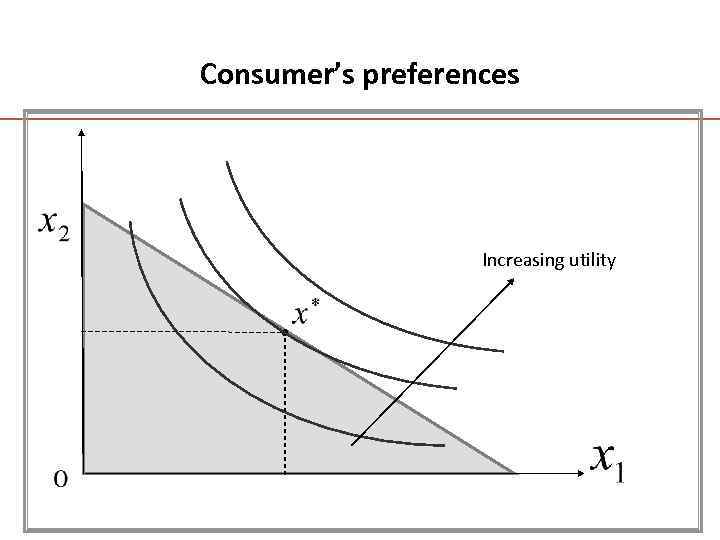

Consumer’s preferences Increasing utility

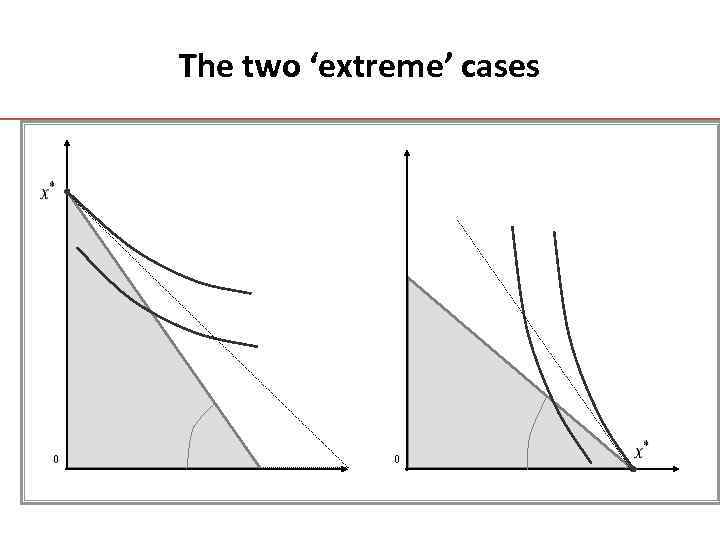

The two ‘extreme’ cases 0 0

The case of multiple economic agents • Perfect competition produces efficient allocation of resources - Pareto optimum • Pareto optimum is defined as a situation in which it is impossible to make one person better off without making another worse off • Thus, it is neutral with respect to distribution of income and wealth • It looks at the efficiency, not justice or fairness

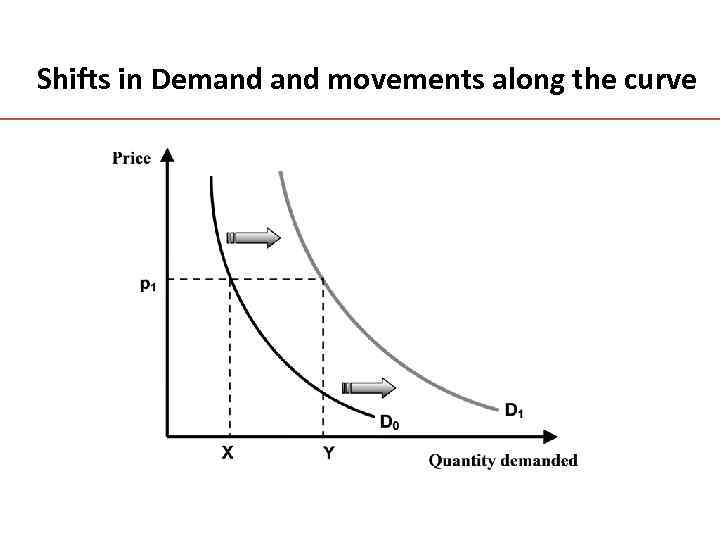

Shifts in Demand movements along the curve

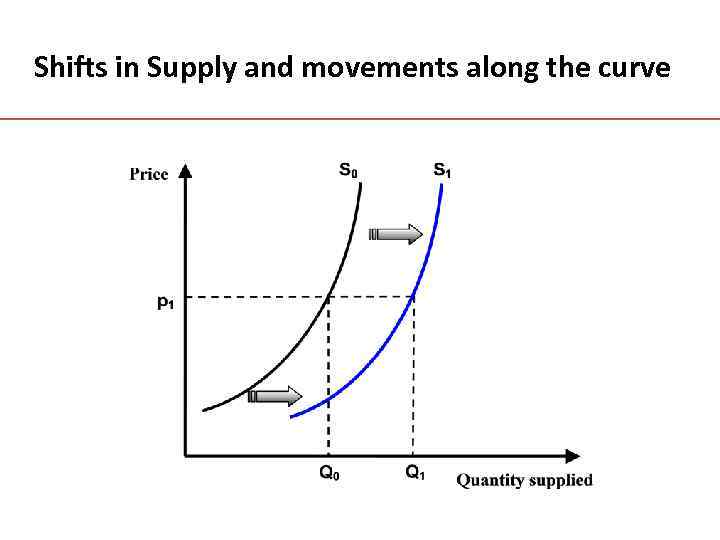

Shifts in Supply and movements along the curve

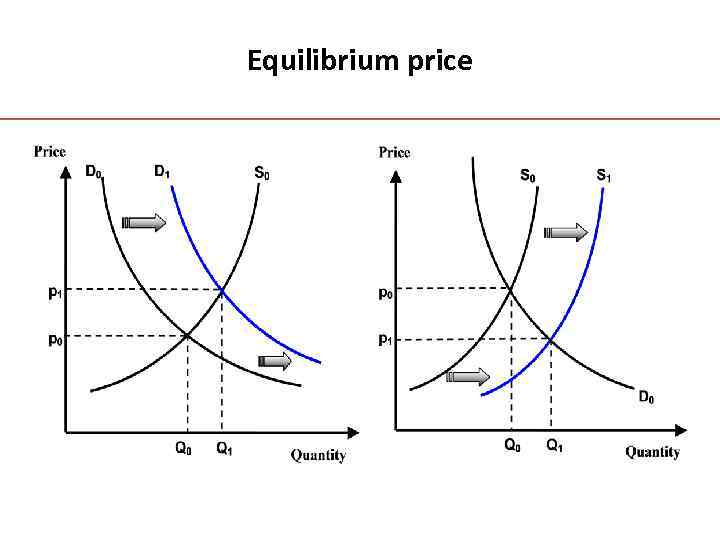

Equilibrium price

Factors influencing market demand • the price of a good • the price of substitute goods (products or services) • the price of complementary goods • the size of household income • tastes and fashion • expectations about changes in prices

Factors influencing market supply • Cost of factors of production • Prices of other goods • Technological progress • Time horizon

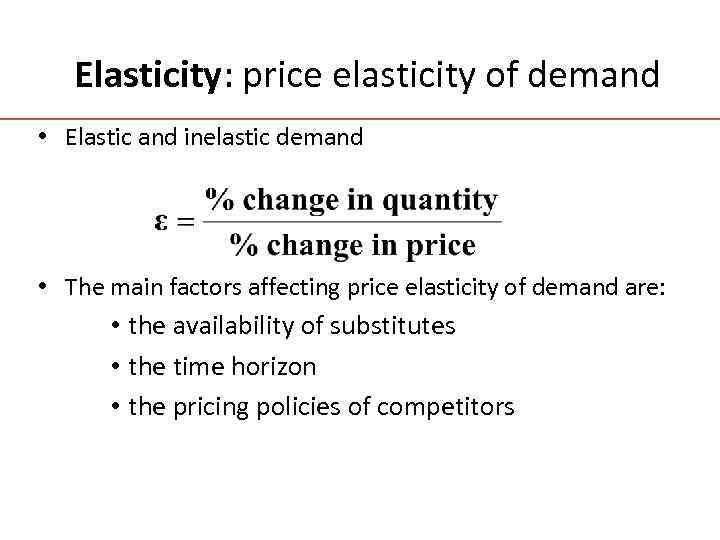

Elasticity: price elasticity of demand • Elastic and inelastic demand • The main factors affecting price elasticity of demand are: • the availability of substitutes • the time horizon • the pricing policies of competitors

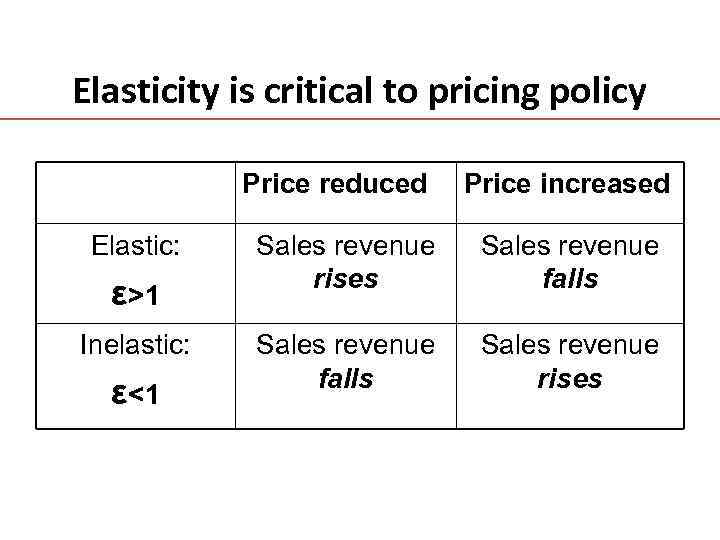

Elasticity is critical to pricing policy Price reduced Elastic: ε>1 Inelastic: ε<1 Price increased Sales revenue rises Sales revenue falls Sales revenue rises

Implications for Marketing • Products and services are vectors of characteristics: X = [C 1, C 2, C 3, …, Cm] • Product differentiation takes the form of altering vectors of characteristics • It is possible because markets are segmented (i. e. , elasticities vary)

Market segmentation • Segmentation and price discrimination • Separate markets by geography, age, and time • Airline tickets: business travelers and tourists • Increase price for business travel and reduce price for tourists • The problem of type identification • Consumer must not be able to engage in arbitrage (transfer between markets)

Implications for Marketing • • • Segmentation Targeting Positioning Developing marketing strategy Pricing policy

Group exercise #3 • Identify possible market segments and assess the differences in elasticities for the following companies : • Group A: Samsung Electronics • Group B: Marks and Spencer • Group C: Alfa-Bank • Group D: Evian • In 10 minutes, each group reports principal findings

Income elasticity of demand • Low and high income elasticity • Normal and inferior goods

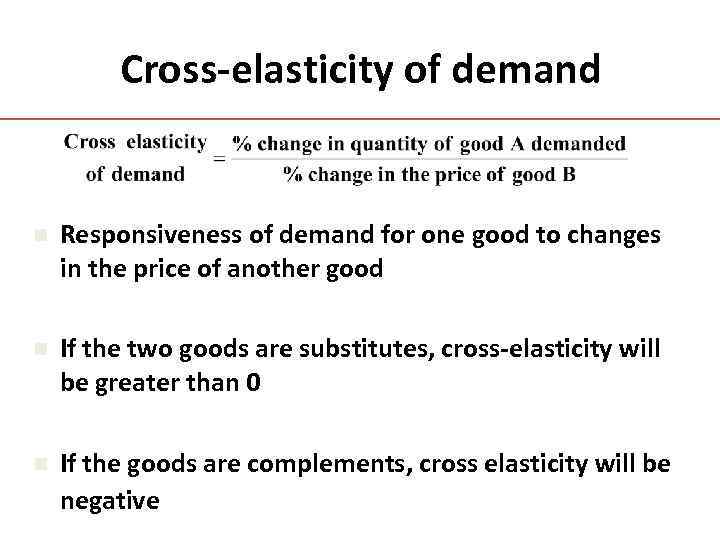

Cross-elasticity of demand n Responsiveness of demand for one good to changes in the price of another good n If the two goods are substitutes, cross-elasticity will be greater than 0 n If the goods are complements, cross elasticity will be negative

Short-run and long-run analysis • Reflects the degree of flexibility decision makers have • Short Run: some inputs variable and some fixed; New firms do not enter the industry, and existing firms do not exit • Long Run: all inputs variable, firms can enter and exit the market place • Actual time parameter varies from one industry to another

Factors of production and rewards • Land (and generally natural resources) is rewarded with rent • Labour is rewarded with wages • Capital is rewarded with interest • Entrepreneurship is rewarded with profit

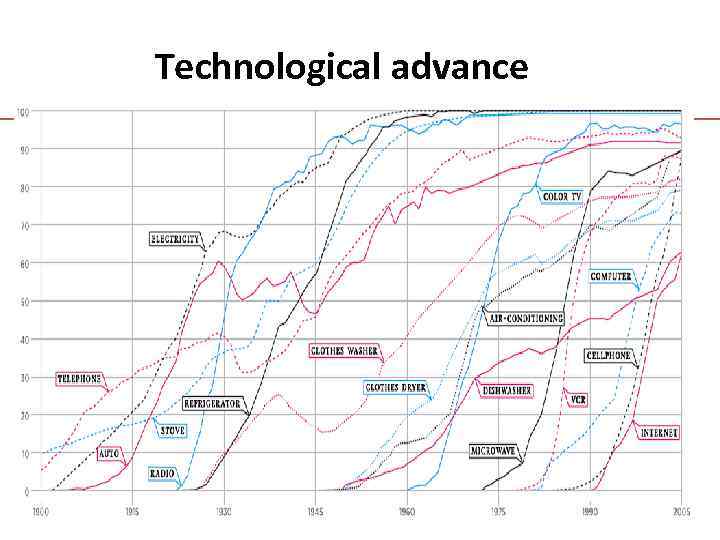

Technological advance

Economies of scale • Internal • • • Specialisation of labour Specialised machinery Buying economies Marketing economies Availability of external finance • External • Industry growth: large skilled labour force • Specialised ancillary industries • Economies of scope • Product bundling, product lining, and family branding • M&A activities

Diseconomies of scale • Difficulties with communicating information and instructions • Excessively long chains of command • Poor motivation (much worse than in smaller firms) • Difficulties for senior management in assimilating all the information they need in sufficient detail to make good quality decisions

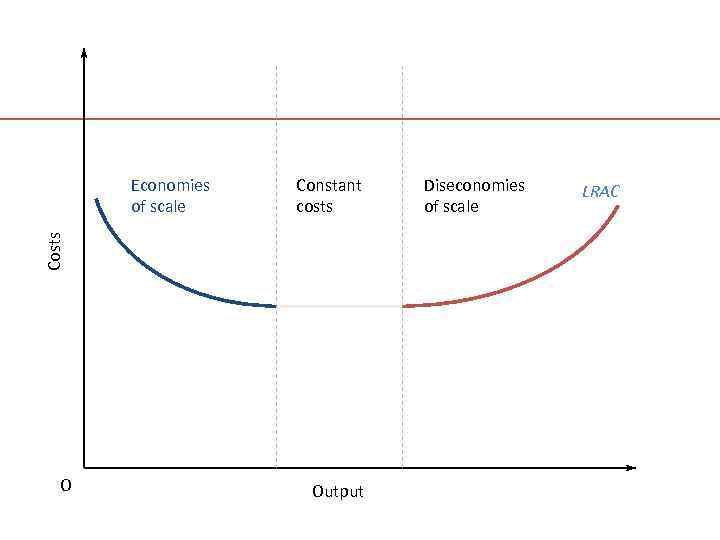

Constant costs Costs Economies of scale O Output Diseconomies of scale LRAC

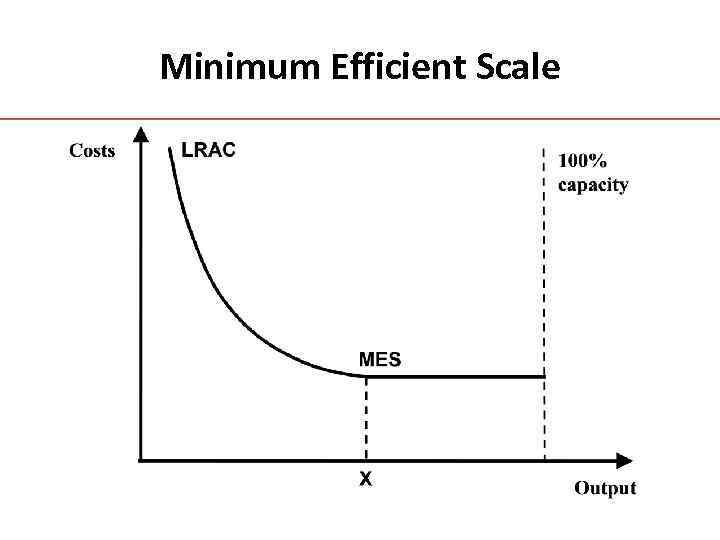

Minimum Efficient Scale

Perfect and Imperfect Markets • • • Typical market imperfections Externalities Public Goods Monopoly, Monopsony, Oligopoly Perfect Competition

Rational behavior • People make decisions about how they should act by comparing the costs and benefits of different courses of action • Tie for $3000? Or for $5000? • Common resources: coca-cola for two • Short-term vs long-term preferences • One-period vs multi-period games

Rational behavior • A complete specification of business decisions is impossible • Bounded rationality - limitations of knowledge and understanding • Procedural rationality - consistent and adaptive decision-making • Examples (learning by doing)

Decision-making: opportunity cost • Costs which are relevant to the decision • Defined by the values of what is forgone as a result of a decision or activity • The highest valued alternative foregone • Sunk costs: the component of expenditure that cannot be reversed once a commitment to the investment is undertaken

Typical market imperfections • Buyers and sellers have incomplete information about prices ruling in all other parts of the market • Sellers persuade buyers that the product is not homogeneous, but rather heterogeneous and that one brand is superior to the other • “Irrational” customer loyalty prevents rational decisions by buyers • A group of suppliers or buyers can influence quantities supplied or demanded and the price of the product • Imperfections in information (bounded rationality)

What is really exchanged in a market (capitalist) economy • Ownership • Therefore, problems arise when • private property rights are not well defined, or • resources are owned in common by society as a whole

Externalities and efficiency • Externality: activity of an entity that directly affects the welfare of another in a way that is not transmitted by market prices • Pollution: what if we could completely ban any harmful emission? No production? • Externality can lead to inefficiency (inefficient levels of production) • The problem is the missing market for the clean air: failure or inability to assign property rights

Private and Social costs • Social costs (SC) include both private costs (PC) and the external damage (D) or benefit (B) to other people and firms • Efficient output level would be derived from social marginal cost, not private marginal cost • SMC=PMC+MD or SMC=PMC-MB • Example: fishery, R&D activities, beekeeper and gardener (apple grower)

Responses to externalities: Private • Mergers: internalizing externality • Example: fishery and steel factory • An outside observer would not even see the externality

Social conventions • Individuals cannot internalize externalities • “Do unto others as you would have others do unto you” • “Before you undertake some activity, take into account its external marginal benefits and costs”

Assigning property rights • Fishery or steel factory? • Coase Theorem • The efficient solution will be achieved independently of who is assigned the ownership rights • In practice, the problem is the cost of negotiation and asymmetric information

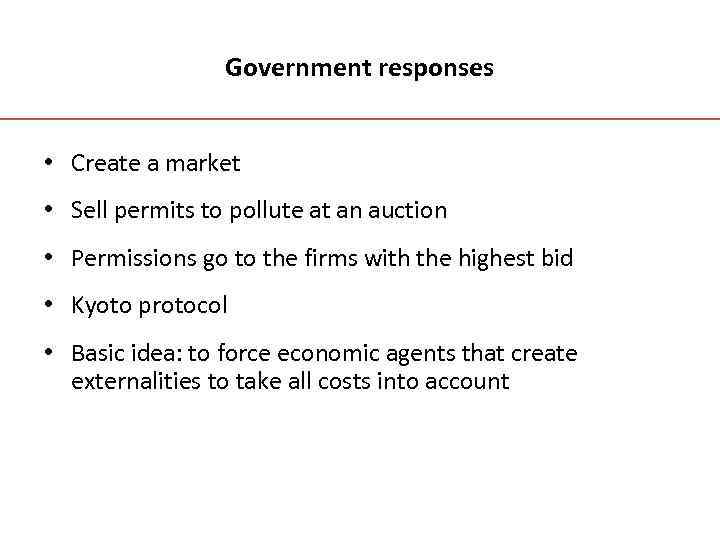

Government responses • Regulation (reduce pollution to a certain amount) • Inefficiency problem again: universal norms versus unfeasible administration costs • Example: car emission standards

Government responses • Corrective taxes • Tax the polluter: Pigou; Pigouvian tax • To implement this scheme, the government needs to know: • Which activities produce harm • What is the value of the damage done • Estimations, e. g. , housing prices

Government responses • Create a market • Sell permits to pollute at an auction • Permissions go to the firms with the highest bid • Kyoto protocol • Basic idea: to force economic agents that create externalities to take all costs into account

Public goods • the consumption of the good by one individual or group does not significantly reduce the amount available for others (non-rivalry) • it is often difficult or impossible to exclude anyone from its benefits, once the good has been provided (non-excludability) • examples: police/fire services, defense, flood barriers, primary education, street lights

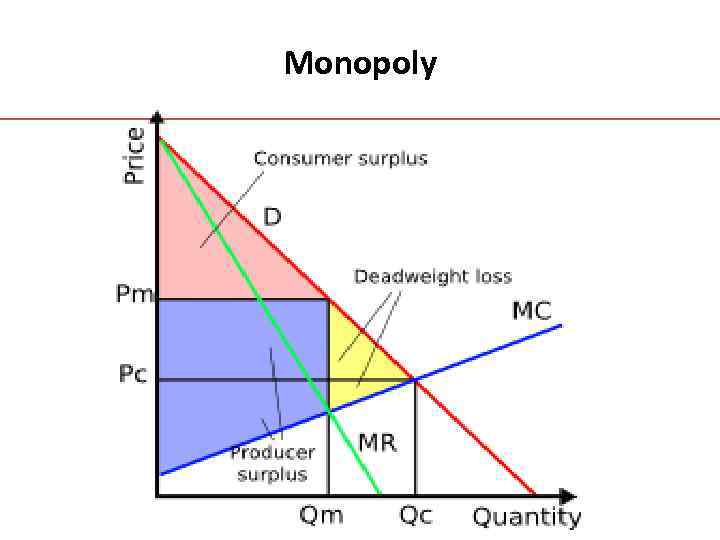

Monopoly

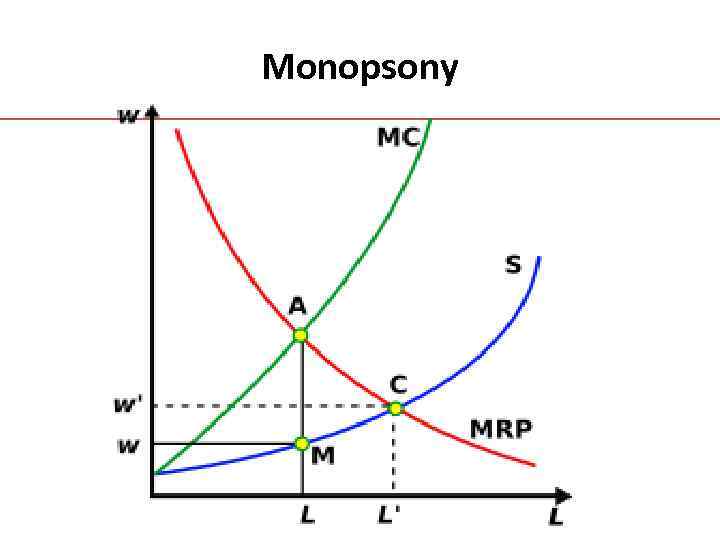

Monopsony

Oligopoly • The concentration ratio • Market share of the four largest firms in an industry • Herfindahl-Hirschman Index • Applied in competition (antitrust) law • e. g. , supervising large M&As

Perfect competition • many independent firms, each so small relative to the market that its decisions cannot affect market price (small market share) • free entry into and exit out of the market • individual producers and consumers act independently • MR (marginal revenue)=market price

Profit • Perfect competition results in zero profit (in the long run because of free entry) • In real life, profit could be viewed as a rent on firm’s special abilities (advantages over other firms) • This leads to the notion of Competitive Advantage

Impacts and Adaptation • Globalisation • Risks and Diversification • Competitive Advantage

Risks • • • Risk arises because neither the environment of firms nor their dynamic capabilities can be known with certainty The risk associated with an asset - stock or a bond - is measured by variability of its return (standard deviation or variance) The Capital Asset Pricing Model (CAPM) asserts that the higher the perceived risk of an asset the higher the expected return

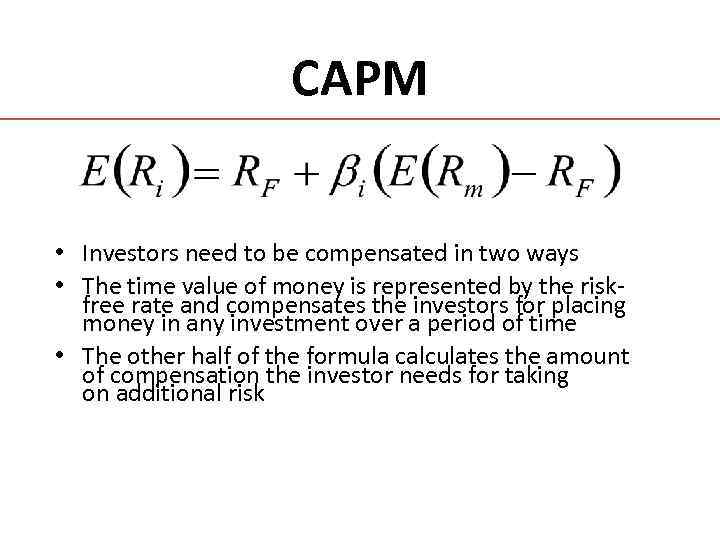

CAPM • Investors need to be compensated in two ways • The time value of money is represented by the riskfree rate and compensates the investors for placing money in any investment over a period of time • The other half of the formula calculates the amount of compensation the investor needs for taking on additional risk

Diversification • Risks are diversified by holding a portfolio of assets whose returns are not perfectly correlated • Systematic risk can be diversified away • Market risk cannot be diversified away: markets may crash, firms go bust, governments default, cyclones, earthquakes or revolutions may occur

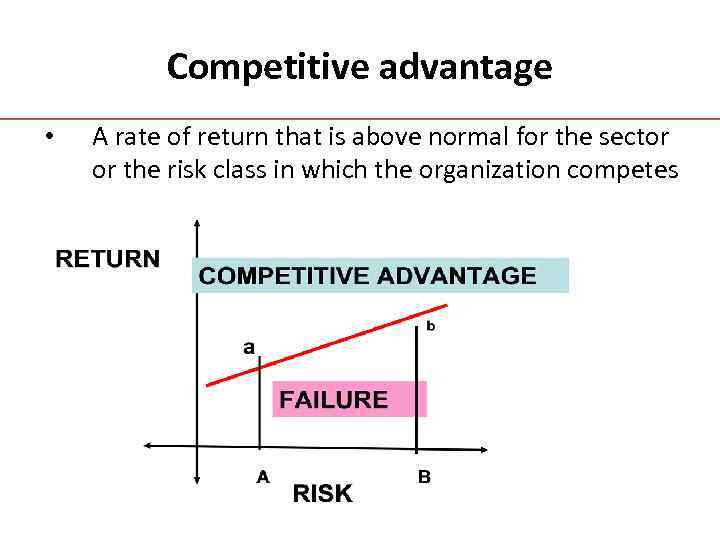

Competitive advantage • A rate of return that is above normal for the sector or the risk class in which the organization competes Source: Matthews (2008)

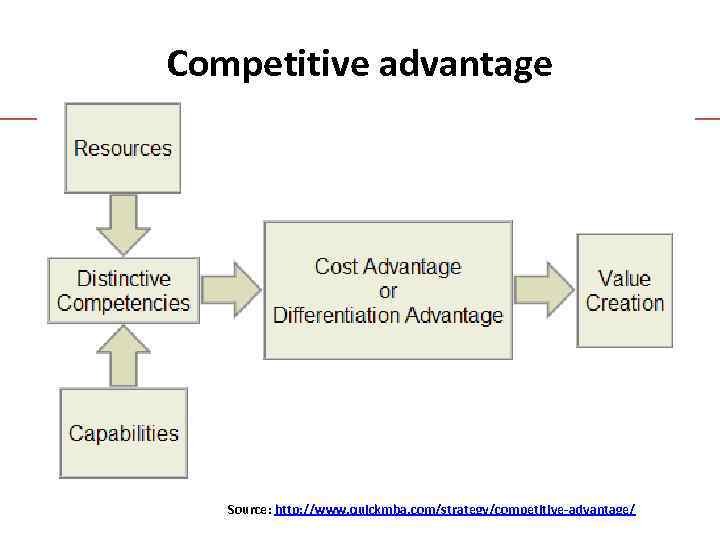

Competitive advantage • Sources of Competitive Advantage • Human capital (e. g. , management skills, leadership, corporate education system) • Unique resources (e. g. , technology, customer database, reputation) • Both tangible and intangible • Identification of these sources represent a major input into a firm’s strategy

Competitive advantage Source: http: //www. quickmba. com/strategy/competitive-advantage/

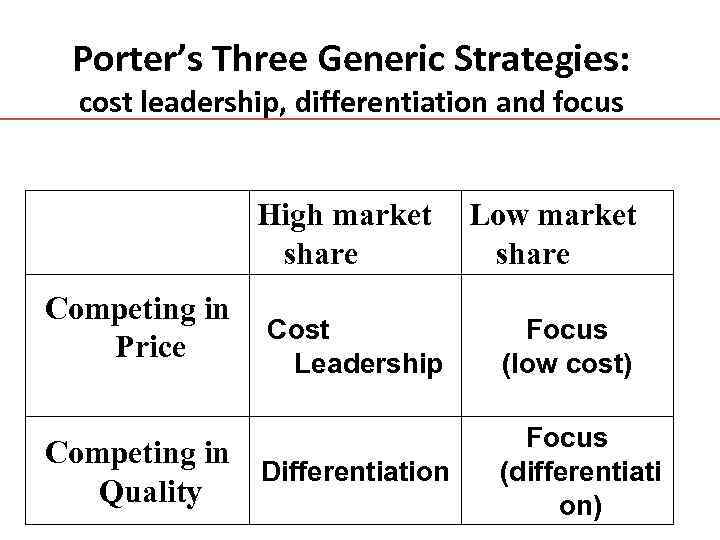

Porter’s Three Generic Strategies: cost leadership, differentiation and focus High market share Competing in Price Cost Leadership Competing in Differentiation Quality Low market share Focus (low cost) Focus (differentiati on)

Source: http: //www. quickmba. com/strategy/generic. shtml

Group exercise • Name a company that clearly follows one of the three generic strategies and could be using it against one of the five industry forces • In 5 minutes, each group reports the company names - with explanation

Dynamic capability theory • Resource based theory: creation and use of tangible and intangible assets • Capability or competence theory: the stock of knowledge existing in organizations and societies (economies) • Dynamic capability theory: capacity to learn and adapt to changing outer dynamics (plus corporate/societal cultures, structures and architectures)

Capabilities • Dynamic capabilities describe the unique qualities that organizations may possess which enable them to compete successfully and adapt to change

Management of an economy • Objectives • Instruments • Fiscal and Monetary Policy • Keynesians and Monetarists • International trade: an introduction

Objectives of economic management • Maintaining full employment • Price stability • Equilibrium of the balance of payments • Economic growth • Equity

Instruments of economic management • Fiscal policy • Taxes • Government expenditure • Monetary policy • Money supply » Interest rate policy » Open market operations » Bank reserve requirements » Credit policy

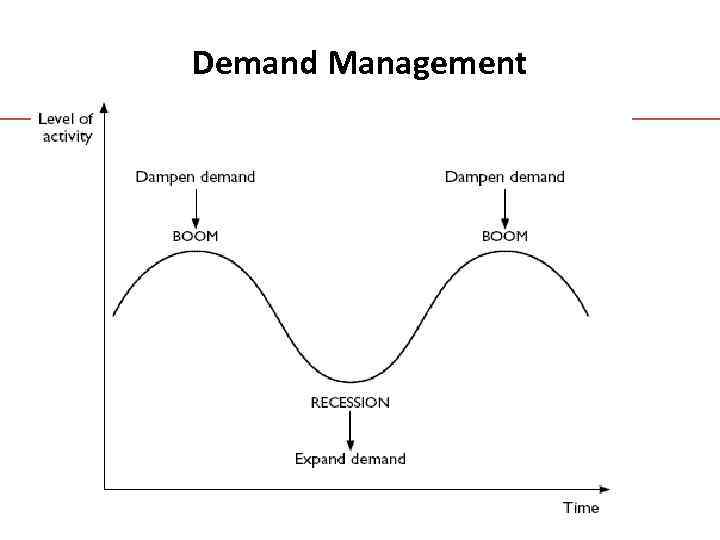

Demand Management

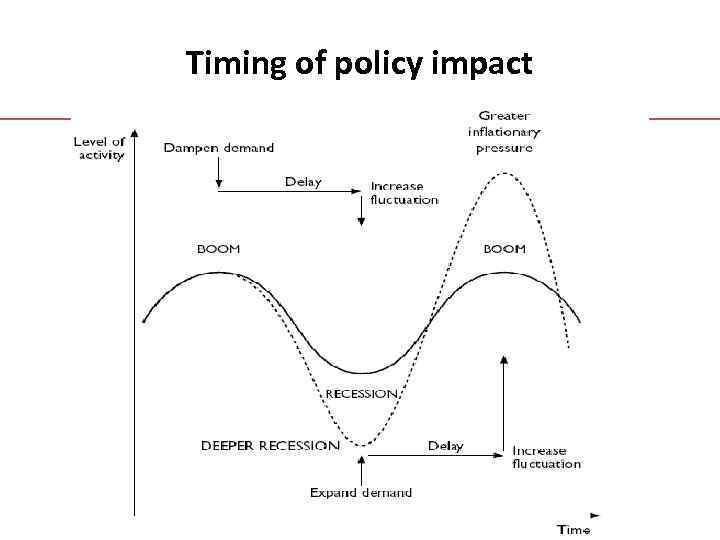

Timing of policy impact

Timing of policy impact • Reactionary policy: wait until inflation rises • Anticipatory policy: use of leading indicators to forecast changes in the economy • e. g. , prices of commodities and changes in business inventories

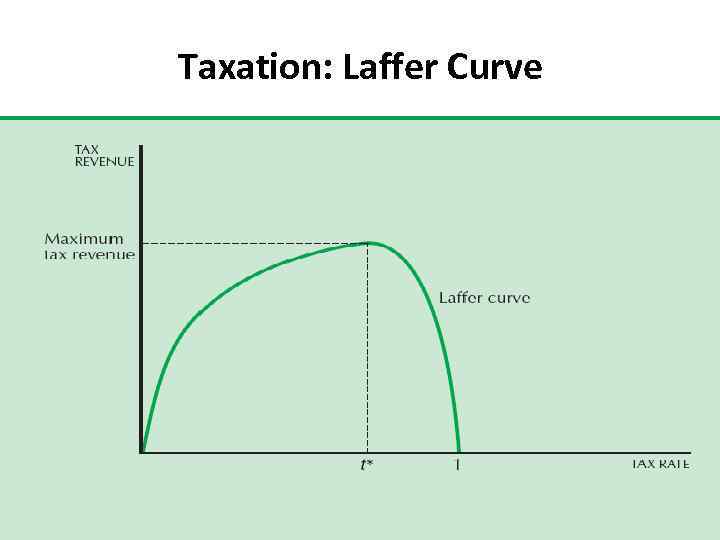

Taxation: Laffer Curve

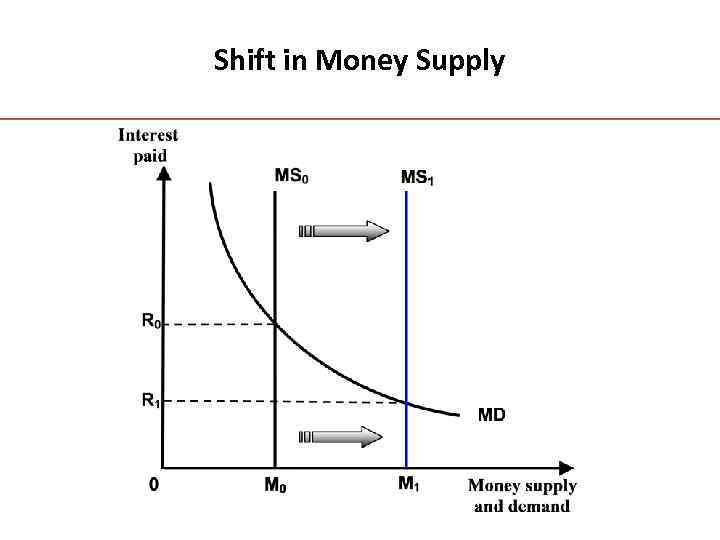

Shift in Money Supply

Keynesian ideas • Economies are subject to large fluctuations • Economic downturns are not eliminated rapidly by market forces alone – lack of aggregate demand leads to unemployment and losses of output • Governments can implement stabilization policies to prevent or counteract economic downturns • National Income Accounting formula: Consumption + Investment + Government Spending + Exports - Imports = GDP

The multiplier principle n the total impact of investment on an economy will always be greater than the original investment n decline in investment spending in one year as compared to another will cause a magnified decline in income

Monetarist ideas n Monetarists argue that market economies are self-regulating n Stable money supply is the key to stable macroeconomy n Growth is determined essentially by supply side factors (e. g. , technology)

Principal policy recommendations • Keep the rate of growth of the money supply in line with productivity • Open the economy to international trade and foreign direct investment through currency deregulation • Privatize state owned assets • Reduce the ratio of government debt relative to GDP • Reduce the fiscal deficit (the difference between government spending and taxation –this has to be financed by debt)

Policy mix • Governments and central banks try to get to an optimal policy mix to maximize growth, or minimize unemployment • The central bank avoids inflation by the control of interest rate and the money supply in circulation • The government stimulates the economy, decreasing tax and increasing the public investment • Combination of these two policies stimulates growth and generates employment (effectiveness depends on the economic reality of a country)

Exchange Rates • Fixed (China), flexible (U. S. ), and managed float (Russia) • Impact the real return of an investor's portfolio (e. g. , August 1998 crisis) • Are among the most watched, analyzed and governmentally manipulated economic measures

Exchange Rates • Play a vital role in a country's level of trade • Higher (stronger) currency makes a country's exports more expensive and imports cheaper • Higher exchange rate can be expected to lower the country's balance of trade • Exchange rate and inflation trade-off

Purchasing Power Parity (PPP) • Long-term equilibrium exchange rate of two currencies that equalizes their purchasing power • Differing prices of a traded good will tend to equalize in the absence of tariffs, other barriers to trade and prohibitively high shipping rates • Difficulties of finding comparable baskets of goods to compare purchasing power across countries • Big Mac Index introduced by The Economist in September 1986 as a humorous illustration of PPP

Central Bank of Russia: fight inflation or let the rouble get stronger • • • High levels of natural resources export Inflow of foreign currency – excess supply Threat of strong rouble Central Bank buys foreign currency Increased money supply Threat of inflation Central Bank increases interest rates Domestic assets become more attractive Inflow of foreign capital

Introduction to the assignment ©Fiona Czerniawska 2008

You are requested to produce a consultancy report to a company of your choice which intends to pursue an internationalisation strategy regarding expansion into a particular country n In this report, you are only required to examine the business environment that affects the decision makers in the company about the choices which they could make n

An executive summary where only the key findings and recommendations of your report are presented in no more than 150 words (5% mark) A clear analysis of the key global trends affecting the current and future developments of the industry or sector relevant to the company which has sought your advice. These trends could include issues such as demand, competition, supply costs, technological changes, environmental factors as well as key regulatory economic and geopolitical factors (40% mark) A clear analysis of the relevant domestic factors in the targeted country in terms of demand, competition, costs, regulations, cultural, political and ethical issues and so on (40% mark) A set of recommendations based on parts 2 and 3 of your report (15% mark)

n n n You are expected to use relevant statistical data from any reliable source and use appropriate diagrams and other illustrations to support your analysis It is important that you choose for your analysis only those issues or trends that make differential impact on the industry or sector concerned and avoid presenting a long list of any factors that might have some relevance The emphasis is on those issues that could have strategic implications for the decision makers in the company concerned

Assessment criteria Clear logic, easy-to-understand reasoning n Presentation, written skills, layout n Accurate referencing of relevant facts and ideas n Demonstration of excellent understanding of the course concepts n Complete and convincing answer with critical rather than descriptive approach n

A good essay/assignment… n n n Is written logically with clear connection to the topic Is well-structured with executive summary, analysis and recommendations sections Provides references for all ideas borrowed and facts used Demonstrates that you have mastered the material delivered during the session Is limited to 2300 -2500 words; you could be punished for exceeding the wordcount; table of contents, bibliography and appendices are not included in the word count

Suggestions Describe the limits and the context of your discussion n If you make an assumption, state it clearly n Illustrate ideas or concepts with your own examples and data n Summarise facts and relationships n Don’t be afraid to express new ideas n Make your essay clear, smooth and easy to read n

The writing style should be incisive, factually based and focused on the subject company n Avoid tutorial type explanations or general unfocused commentary n You should ensure the assignment is presented after spell checking and proof reading n Clear referencing in the text with a list of references at the end of the assignment (please use the Harvard System) n

Illustrative examples of data sources (1) Executive Summary n (2) Analysis of industry (sector) n (3) Analysis of country (economy) n (4) Recommendations n

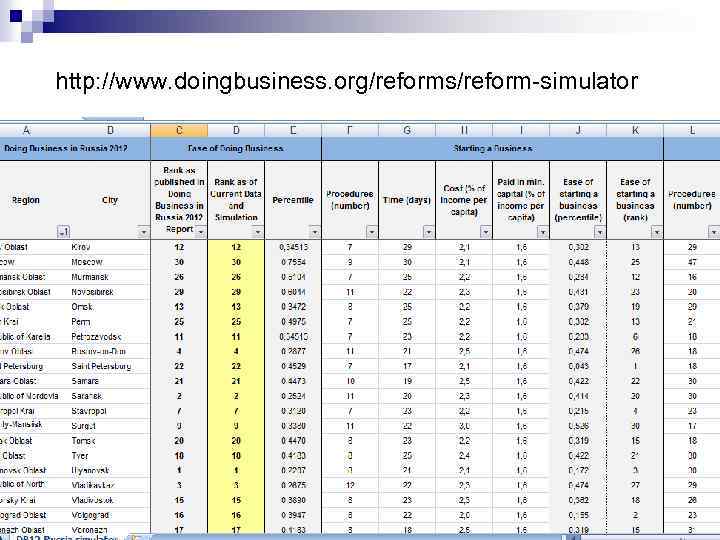

http: //www. doingbusiness. org/reforms/reform-simulator

Thank you!

IBE_MBA_2015_final.pptx