07735694289cc17989eea012b8031c90.ppt

- Количество слайдов: 25

International Banking

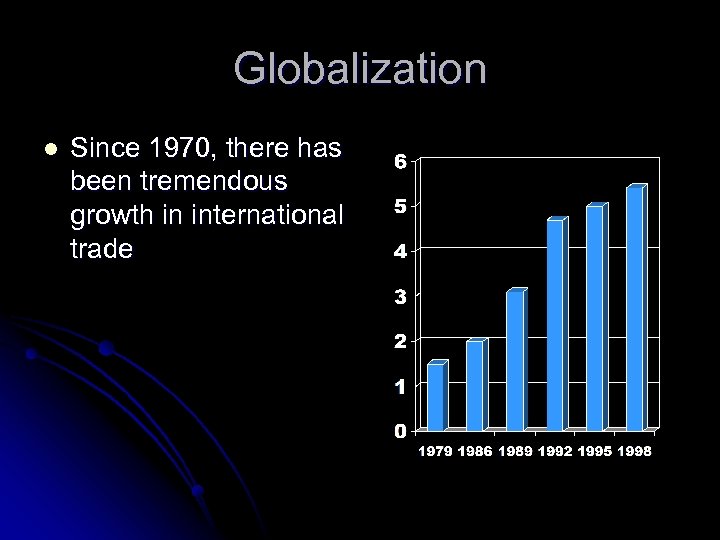

Globalization l Since 1970, there has been tremendous growth in international trade

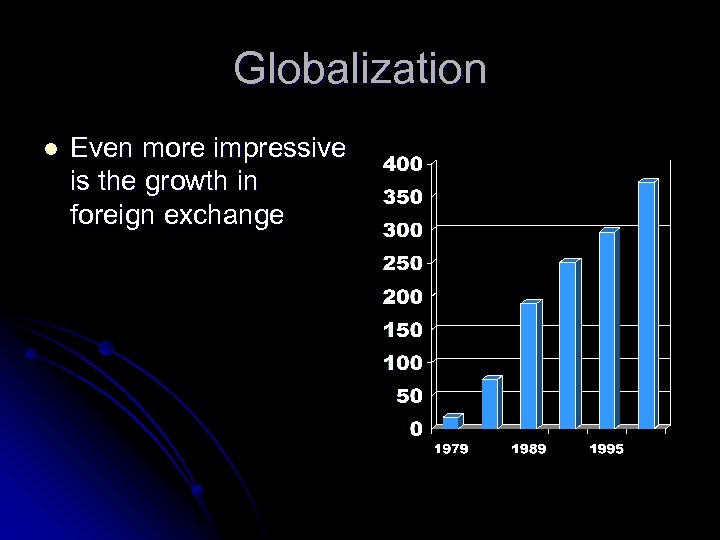

Globalization l Even more impressive is the growth in foreign exchange

International Banking l Citigroup has over 50% of its assets ($600 B) located outside the US. Citigroup provides banking and investment services in over 100 countries around the world!

International Banking l Citigroup has over 50% of its assets ($600 B) located outside the US. Citigroup provides banking and investment services in over 100 countries around the world! l General Motors has an established relationship to buy auto parts from a Mexican supplier. GM may find it convenient to have an account with Citibank in Mexico (Banamex)

International Banking l Citigroup has over 50% of its assets ($600 B) located outside the US. Citigroup provides banking and investment services in over 100 countries around the world! l Honda has a manufacturing plant outside of Columbus, Ohio. It might be convenient for Honda to open an account with Deutschebank in the US to finance its US operations.

International Banking l Citigroup has over 50% of its assets ($600 B) located outside the US. Citigroup provides banking and investment services in over 100 countries around the world! l Fidelity operates a global bond fund. It may be convenient for the to have several accounts around the world to manage the flow of interest payments.

International Banking Facilitation of international transactions l Managing exchange risk l Avoiding Regulation (Eurodollars) l Avoiding Taxes (Offshore Banking) l

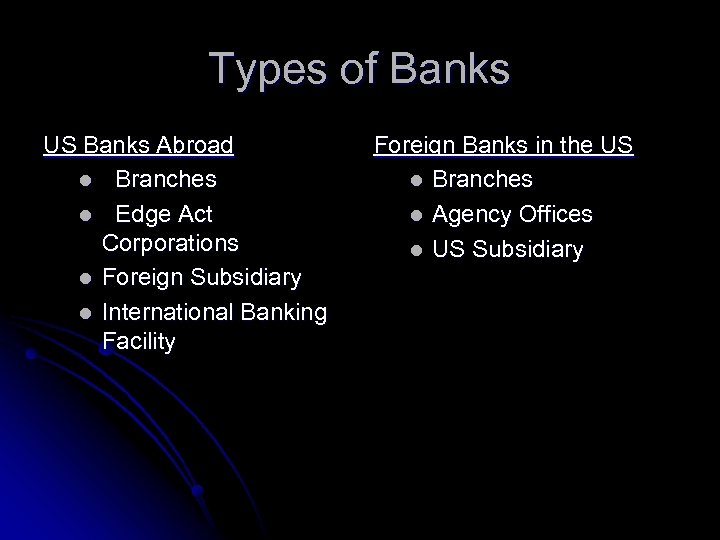

Types of Banks US Banks Abroad l Branches l Edge Act Corporations l Foreign Subsidiary l International Banking Facility Foreign Banks in the US l Branches l Agency Offices l US Subsidiary

Eurodollars l l l Since WWII, the dollar has become the premier international currency. Therefore, many foreign companies and governments hold dollars rather than their own currency. Further, to avoid interest rate restrictions, US banks began offering dollar denominated accounts at their foreign branches. These accounts became known as Eurodollar accounts. Euromarkets have expanded into Eurobonds, Euroloans, Euro Commercial paper. There is currently over $30 Trillion in Eurodeposits around the world.

Exchange Rate Risk l In addition to information, liquidity, and interest rate risk, international banks must also deal with exchange rate risk.

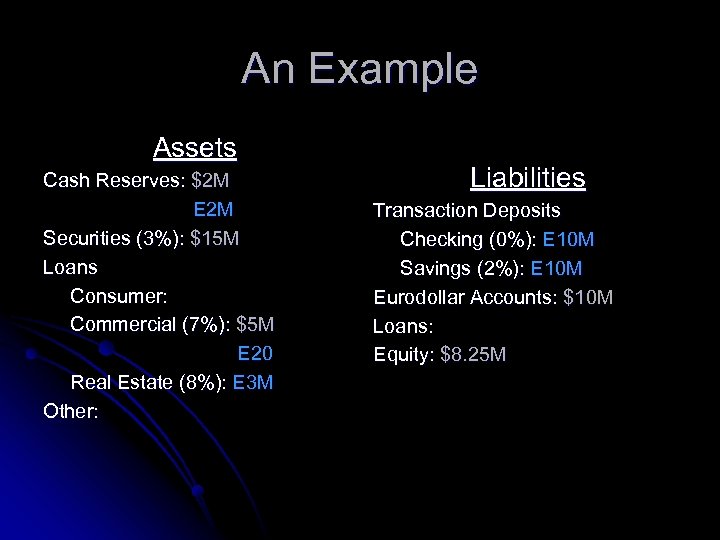

An Example Assets Cash Reserves: $2 M E 2 M Securities (3%): $15 M Loans Consumer: Commercial (7%): $5 M E 20 Real Estate (8%): E 3 M Other: Liabilities Transaction Deposits Checking (0%): E 10 M Savings (2%): E 10 M Eurodollar Accounts: $10 M Loans: Equity: $8. 25 M

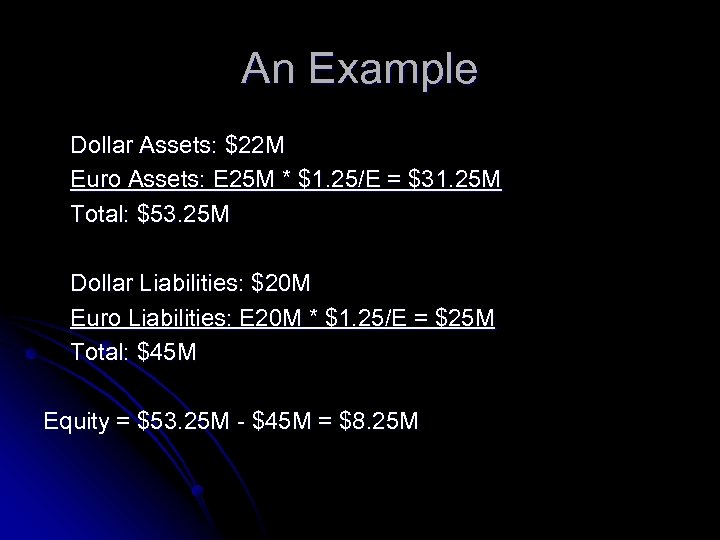

An Example Dollar Assets: $22 M Euro Assets: E 25 M * $1. 25/E = $31. 25 M Total: $53. 25 M Dollar Liabilities: $20 M Euro Liabilities: E 20 M * $1. 25/E = $25 M Total: $45 M Equity = $53. 25 M - $45 M = $8. 25 M

Exchange Rate Risk In addition to information, liquidity, and interest rate risk, international banks must also deal with exchange rate risk. l Suppose that the dollar depreciates to $1. 30 l

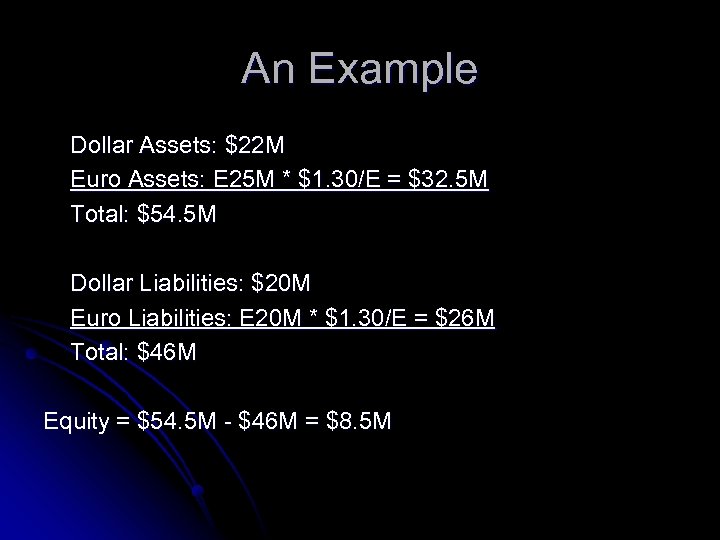

An Example Dollar Assets: $22 M Euro Assets: E 25 M * $1. 30/E = $32. 5 M Total: $54. 5 M Dollar Liabilities: $20 M Euro Liabilities: E 20 M * $1. 30/E = $26 M Total: $46 M Equity = $54. 5 M - $46 M = $8. 5 M

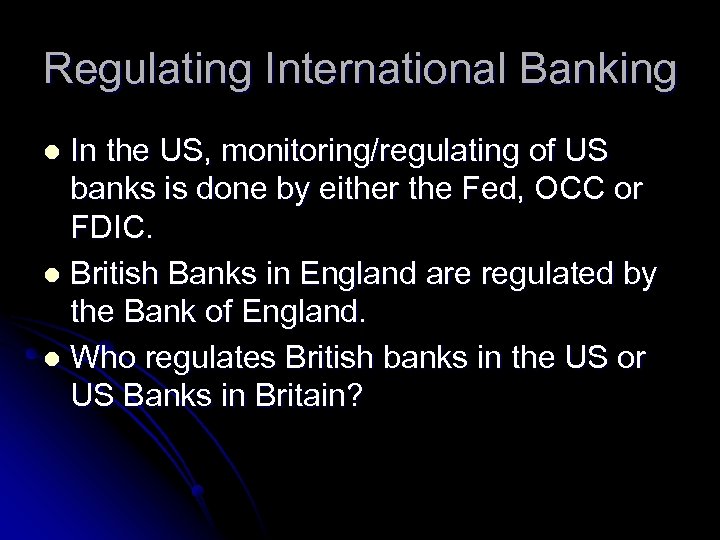

Regulating International Banking In the US, monitoring/regulating of US banks is done by either the Fed, OCC or FDIC. l British Banks in England are regulated by the Bank of England. l Who regulates British banks in the US or US Banks in Britain? l

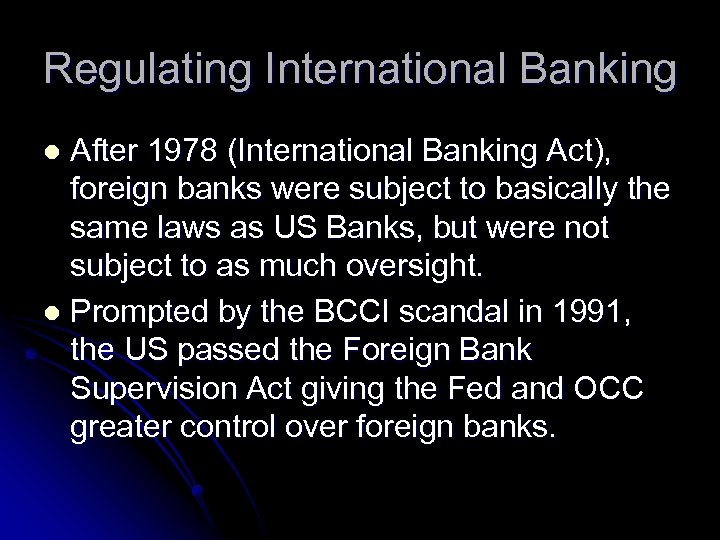

Regulating International Banking After 1978 (International Banking Act), foreign banks were subject to basically the same laws as US Banks, but were not subject to as much oversight. l Prompted by the BCCI scandal in 1991, the US passed the Foreign Bank Supervision Act giving the Fed and OCC greater control over foreign banks. l

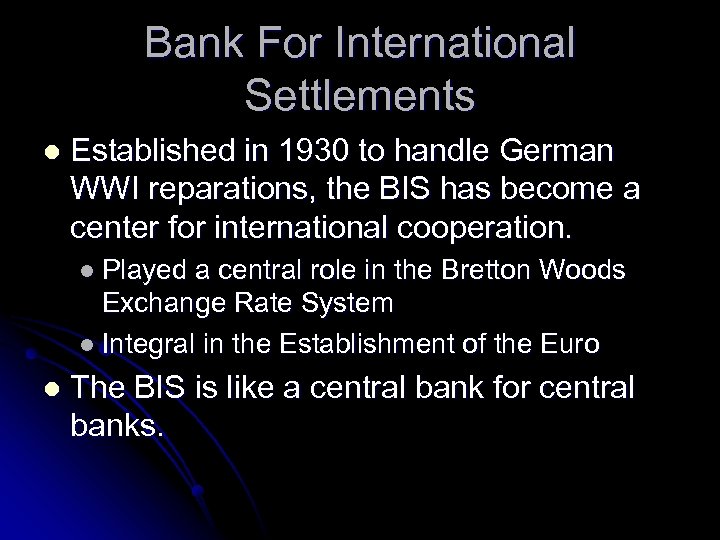

Bank For International Settlements l Established in 1930 to handle German WWI reparations, the BIS has become a center for international cooperation. l Played a central role in the Bretton Woods Exchange Rate System l Integral in the Establishment of the Euro l The BIS is like a central bank for central banks.

Basle Accords l In 1988, the G-10 countries established uniform worldwide standards for: l Capital Requirements l Off Balance Sheet Assessments l Risk Weighting l Interest rate sensitivity

Problems with International Regulation l The key issue is that the banking industry in Japan and Europe is Fundamentally different.

Top Ten World Banks Bank Assets (Billions) Citigroup (US) 1, 497 JP Morgan + Bank One (US) 1, 097 Mizuho Financial Group (Japan) 1, 080 Bank of America + First Union (US) 851 UBS (Switzerland) 851 Sumitomo Mitsui (Japan) 844 Deutsche. Bank (Germany) 795 Mitsubishi Tokyo (Japan) 781 HSBC (UK) 759 BNP Paribas (France) 744

European Banking Unlike the US, European Banks are allowed to engage in securities markets (universal banking) l In fact, in Europe, banks are generally significant shareholders in European companies. l Banks rely much more on equity than deposits. l

Japanese Banking l Japanese industry is organized into industrial groups (keiretsu) l l l l Mitsubishi Mitsui Sumitomo Fuyo Daiichii Kangyo Sanwa

Japanese Banking l These “groups” are both vertically and horizontally integrated and are comprised of a very large number of companies: l Sumitomo has 15 divisions ranging from electronics to mining to consumer goods. l Sumitomo controls assets equal to $50 T.

Japanese Banking l Each “group” has its own bank which handles its finances. This “main” bank l Owns equity in member firms l Monitors member firms l Provides credit for member firms.

07735694289cc17989eea012b8031c90.ppt