7ae645d68d6c4e21176a30c487fbdcb1.ppt

- Количество слайдов: 46

International and Domestic Macro Comparisons Basic Performance Measures Winter 2001 - Economics 102 Mr. Smitka

GDP levels • Y = C + I + G + X - M is our basic measure – Represents final demand • total production • thus also total income • How does the US fare? – Income per capita? – Income growth?

Comparing GDP Internationally • Growth rates can be directly compared • Still, in the long run distortions arise • Growth levels cannot be directly compared • Prices vary a lot across national borders • Exchange rates don’t solve this problem • Forex rates aren’t set by trade • Forex rates also can vary by 5% a week • GDP clearly doesn’t rise and fall that rapidly!

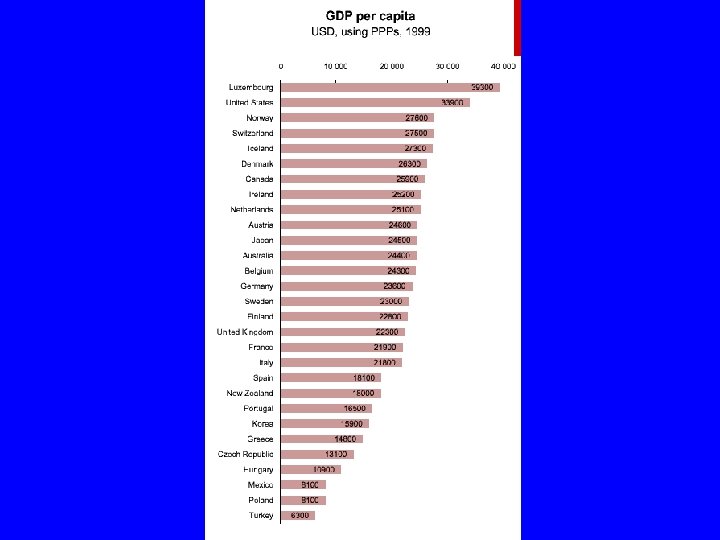

PPP comparisons • Instead of using nominal GDP data and exchange rates a common set of prices must be constructed • Output quantities in each country can then be used with such common “international” prices • PPP (purchasing power parity) is the jargon

GDP per capita • The US leads (except for tiny Luxembourg) • The EU is about 75% of the US level – Developed Asia is similar (Japan, Australia, NZ) – Iberia & Greece are at a bit lower • The developing world has far lower output – And according far lower incomes – The citizens of Mexico, Turkey & Poland receive only 25% the average income of the US – The rest of the world is poorer, often much poorer

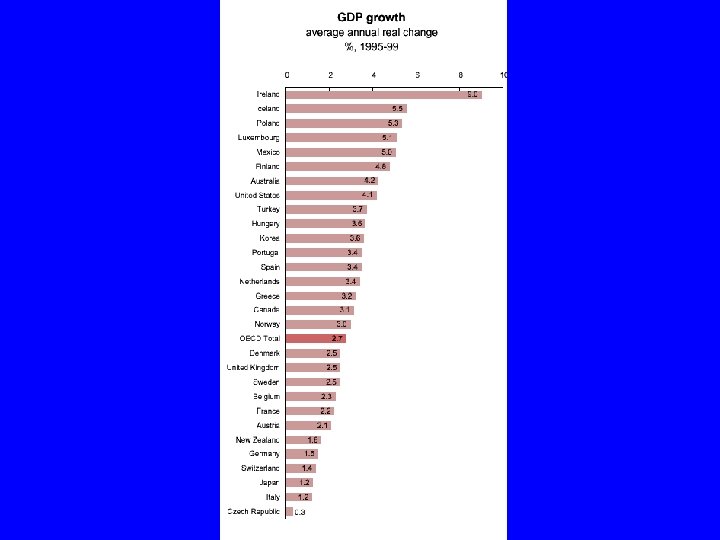

US Growth is strong, too • US real growth - 4. 1% pa - is well above average • The EU grew slowly --Italy, Germany, France, the UK - except for Spain • Japan in fact did worse in 1990 -99 as a whole (and Korea did better) • Ireland is the star -- a nice paper topic: why? ?

US cyclical performance • Postwar real GDP grew 3. 5% pa • Output thus doubled every 20 years. . . but short run growth. . . • The post-WWII recession reflected an end to wartime I, not lower C • The Great Depression remains anomalous – … thankfully!! – but such crises afflicted many developing countries

Inflation • Mild since the Civil War • Clear bouts associated with – WWII – Korean War – Vietnam War – 1 st & 2 nd Oil Crises

Growth & Inflation? ! • Periods of sustained growth often are accompanied by rising inflation – 1954 -57 – 1971 -73 – 1964 -69 – 1976 -79 • But not booms in the late 1980 s and 1990 s – other factors matter! – plus the time lag varies!

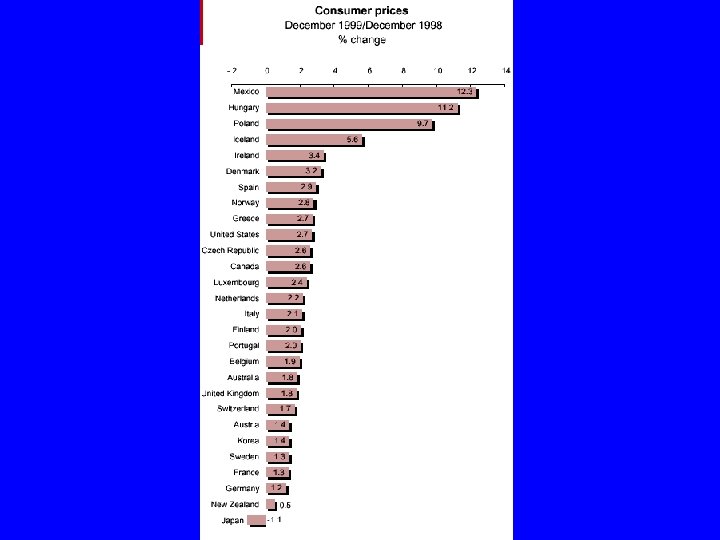

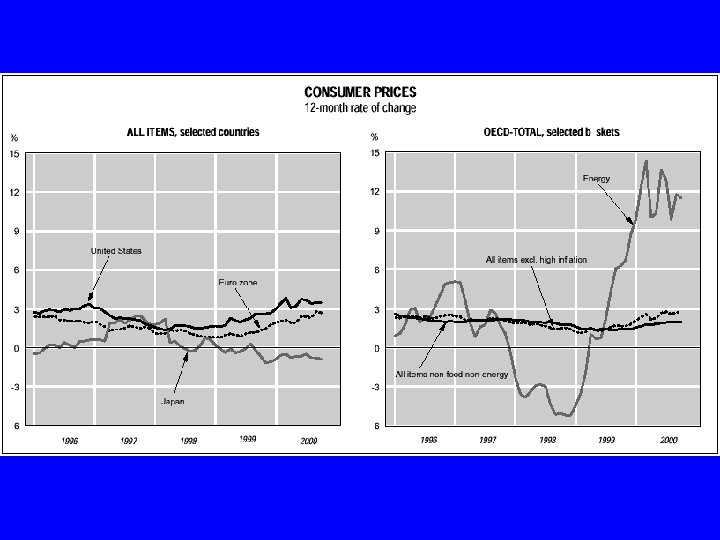

OECD Inflation Comparisons • US inflation is not high, but not low • Japan is very different - deflation!! • Mexican inflation rates are high • if continued prices double in 6 years • No country suffers hyperinflation • Linked to war or political breakdown - Russia (USSR “transition”) - some LDCs - Weimar Germany

Inflation composition • Prices move in different directions for different goods • Energy has been very volatile, up and down • Food prices also bounce around a lot – Still, focusing on “core” inflation (non-food, non-energy) can be misleading. . .

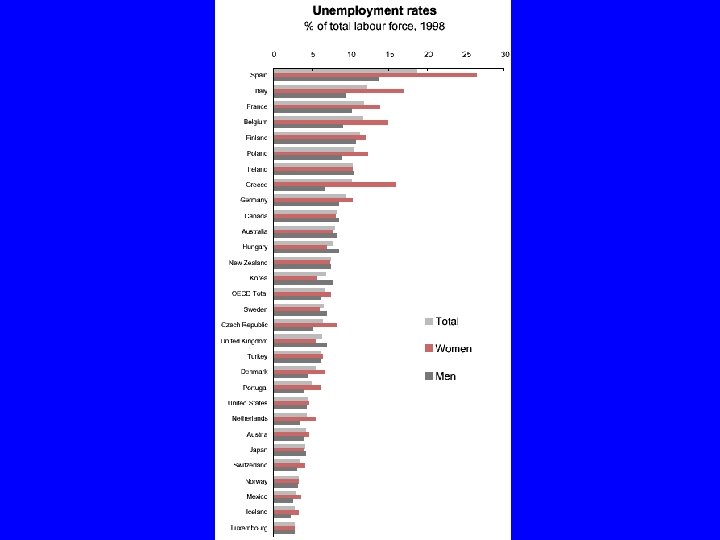

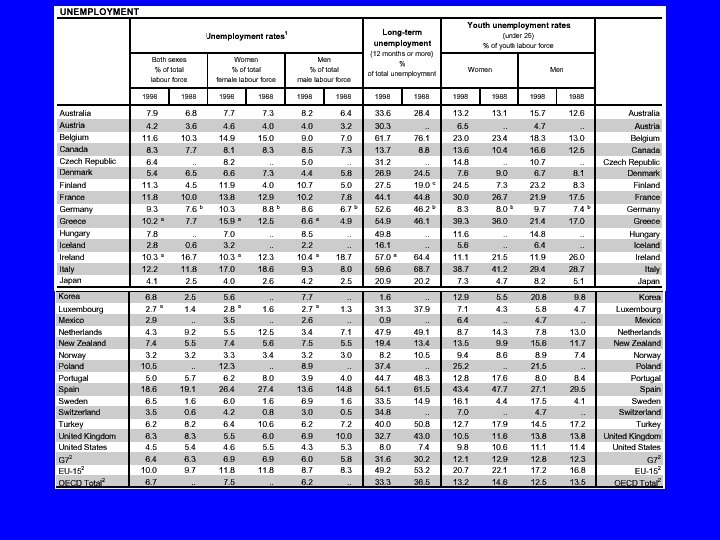

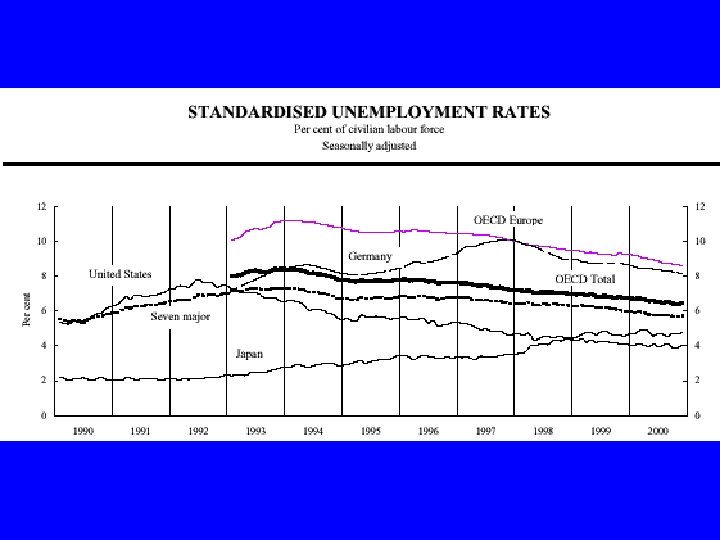

Unemployment • During the last 20 -odd years: • European U is high • Japanese U is low • US is moderate • Long-term unemployment also varies • ∑ economic structure matters • As do details of definitions of U and data collection

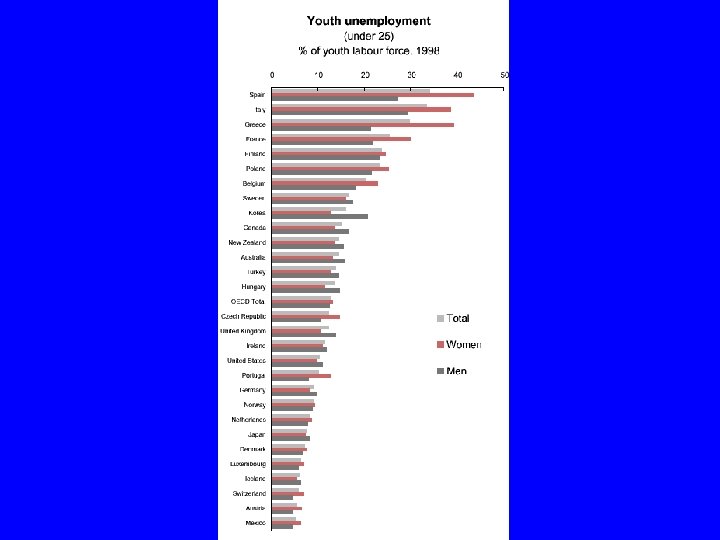

Women & youth • Women generally suffer more U • Youth suffer much higher U • In the US male youth U is high - not female • Such male youth U is geographically based • It also correlates closely with crime

Unemployment variation • It correlates with growth (surprise? !) • Cyclical factors are not the only influence • Hence we distinguish: – Cyclical U – Structural U – Frictional U

Causation • A sharp drop in investment – “causes” higher U with a lag – “causes” lower Y growth with a lag • Y growth and U are more simultaneous • The relationship is clearly complex, and is affected by other factors

Causation • So what “causes” variability • “cause” is in parentheses for now -- it merely indicates statistical correlation • A starting point: how do the elements of GDP vary • As share of GDP • In terms of growth rates

Shares of GDP • Consumption is large but steady – Some variation, and since large need to detail – In fact, the puzzle is stability, not variation! • Government is even steadier – A one-time change with Korea & Cold War – Secular shift from Federal to State & Local – See next slide….

Trade • One major shift: trade – 4% of Y in 1950 s – 8% in 1973 with oil crisis – 12%-14% today • Net trade – Remains smallish – Shift from small surplus to 3+% deficit – Some variability, too

Investment • Far more volatile than C or G – C & G are larger, but I is still 1/6 th of GDP • I is the proximate cause of business cycles – See charts following… – We’ll also see that shifts in I are amplified • What parts of I vary? – Business fixed investment – Residential (housing)

Why the business cycle? • Why does C not vary? • Life cycle models • Why does housing investment vary? • Interest rates shift mortgage costs • Why does business investment vary? • “Animal spirits” (Keynes) • Net trade? -- some impact of interest rates • Government -- fiscal policy (taxing & spending) not central

Factors Driving Business Cycles • All components of GDP shift over time • C is the largest component – It however tracks GDP (= national income) – Indeed, the puzzle is why is it so stable? • G varies primarily with war – Also long-run shift from Federal to State/local – Not a source of the business cycle

Investment • Investment is by far the most volatile item – At 1/6 th of GDP, big enough to matter – Residential investment volative • Interest rates affect it – Business plant & equipment investment • Keynes’ “animal spirits” affect it • Net trade now sometimes matters • Interest rates shift forex, shifting levels

Contribution Graph • In the previous graph, dark blue line is GDP • Bar graphs reflect contribution to change in GDP growth – Portions below 0 are slowing growth – Portions above 0 add to growth • Drops in investment drive recessions – Net trade declines contribute, too

Conclusions • We are left with questions / hypotheses – Why does investment vary? – Why doesn’t consumption vary? – How strong / constant is the link between declines in growth and unemployment? – What is the link between growth and inflation? • Why do long-run growth / U etc vary across countries?

7ae645d68d6c4e21176a30c487fbdcb1.ppt