dea1d484db30635a5ae1e41a39e8d3af.ppt

- Количество слайдов: 37

Interim Results and Dividend Announcement For the six months to June 2006

Interim Results and Dividend Announcement For the six months to June 2006

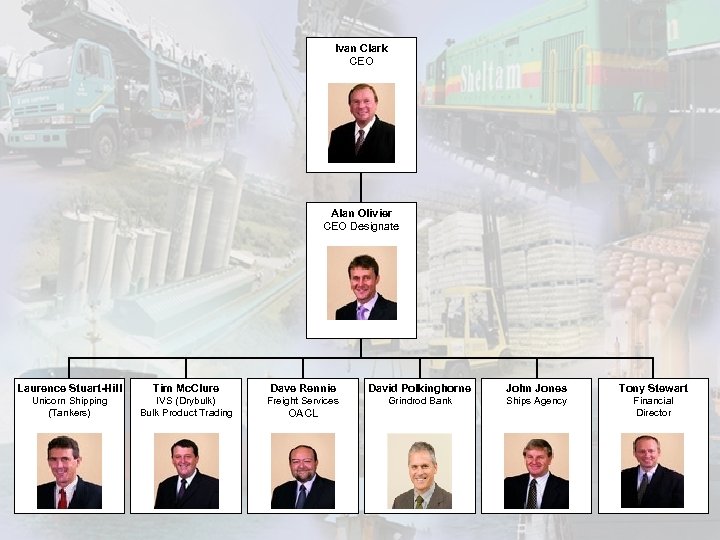

Ivan Clark CEO Alan Olivier CEO Designate Laurence Stuart-Hill Tim Mc. Clure Dave Rennie David Polkinghorne John Jones Tony Stewart Unicorn Shipping (Tankers) IVS (Drybulk) Bulk Product Trading Freight Services Grindrod Bank Ships Agency Financial Director OACL

Ivan Clark CEO Alan Olivier CEO Designate Laurence Stuart-Hill Tim Mc. Clure Dave Rennie David Polkinghorne John Jones Tony Stewart Unicorn Shipping (Tankers) IVS (Drybulk) Bulk Product Trading Freight Services Grindrod Bank Ships Agency Financial Director OACL

Presentation Content • Interim Results • Interim Update • Conclusion

Presentation Content • Interim Results • Interim Update • Conclusion

INTERIM RESULTS

INTERIM RESULTS

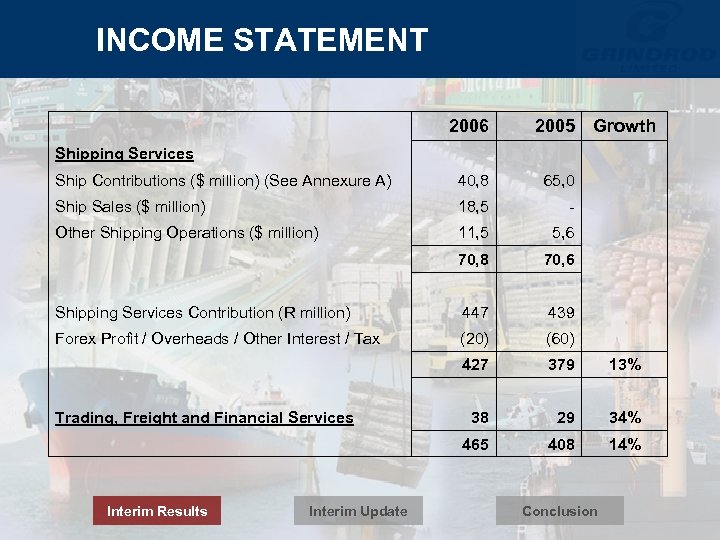

INCOME STATEMENT 2006 2005 Growth Ship Contributions ($ million) (See Annexure A) 40, 8 65, 0 Ship Sales ($ million) 18, 5 - Other Shipping Operations ($ million) 11, 5 5, 6 70, 8 70, 6 Shipping Services Contribution (R million) 447 439 Forex Profit / Overheads / Other Interest / Tax (20) (60) 427 379 13% 38 29 34% 465 408 14% Shipping Services Trading, Freight and Financial Services Interim Results Interim Update Conclusion

INCOME STATEMENT 2006 2005 Growth Ship Contributions ($ million) (See Annexure A) 40, 8 65, 0 Ship Sales ($ million) 18, 5 - Other Shipping Operations ($ million) 11, 5 5, 6 70, 8 70, 6 Shipping Services Contribution (R million) 447 439 Forex Profit / Overheads / Other Interest / Tax (20) (60) 427 379 13% 38 29 34% 465 408 14% Shipping Services Trading, Freight and Financial Services Interim Results Interim Update Conclusion

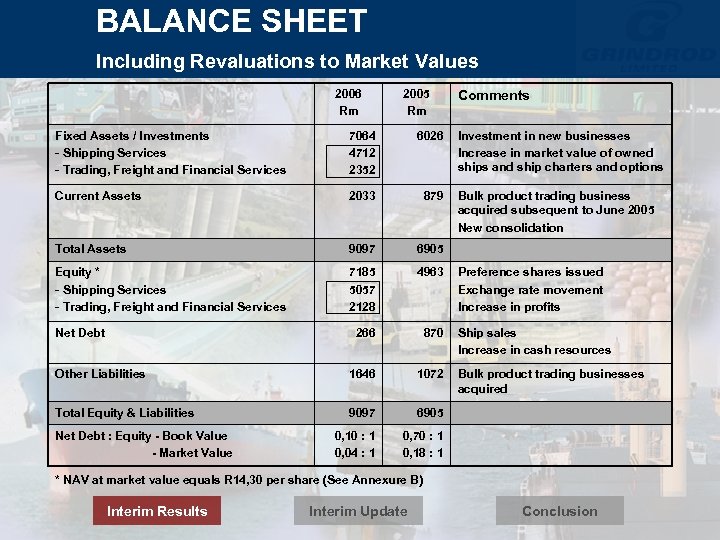

BALANCE SHEET Including Revaluations to Market Values 2006 Rm 2005 Rm Fixed Assets / Investments - Shipping Services - Trading, Freight and Financial Services 7064 4712 2352 6026 Current Assets 2033 879 Total Assets 9097 6905 Equity * - Shipping Services - Trading, Freight and Financial Services 7185 5057 2128 4963 266 870 Other Liabilities 1646 1072 Total Equity & Liabilities 9097 6905 0, 10 : 1 0, 04 : 1 Comments 0, 70 : 1 0, 18 : 1 Net Debt : Equity - Book Value - Market Value Investment in new businesses Increase in market value of owned ships and ship charters and options Bulk product trading business acquired subsequent to June 2005 New consolidation Preference shares issued Exchange rate movement Increase in profits Ship sales Increase in cash resources Bulk product trading businesses acquired * NAV at market value equals R 14, 30 per share (See Annexure B) Interim Results Interim Update Conclusion

BALANCE SHEET Including Revaluations to Market Values 2006 Rm 2005 Rm Fixed Assets / Investments - Shipping Services - Trading, Freight and Financial Services 7064 4712 2352 6026 Current Assets 2033 879 Total Assets 9097 6905 Equity * - Shipping Services - Trading, Freight and Financial Services 7185 5057 2128 4963 266 870 Other Liabilities 1646 1072 Total Equity & Liabilities 9097 6905 0, 10 : 1 0, 04 : 1 Comments 0, 70 : 1 0, 18 : 1 Net Debt : Equity - Book Value - Market Value Investment in new businesses Increase in market value of owned ships and ship charters and options Bulk product trading business acquired subsequent to June 2005 New consolidation Preference shares issued Exchange rate movement Increase in profits Ship sales Increase in cash resources Bulk product trading businesses acquired * NAV at market value equals R 14, 30 per share (See Annexure B) Interim Results Interim Update Conclusion

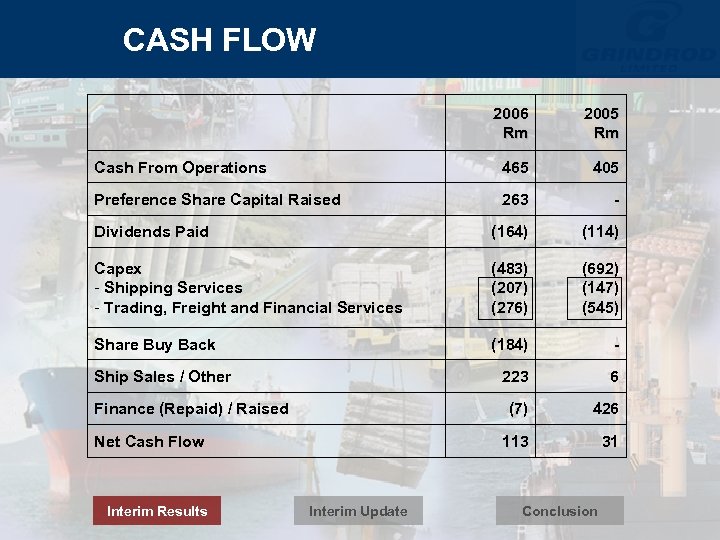

CASH FLOW 2006 Rm 2005 Rm Cash From Operations 465 405 Preference Share Capital Raised 263 - Dividends Paid (164) (114) Capex - Shipping Services - Trading, Freight and Financial Services (483) (207) (276) (692) (147) (545) Share Buy Back (184) - 223 6 (7) 426 113 31 Ship Sales / Other Finance (Repaid) / Raised Net Cash Flow Interim Results Interim Update Conclusion

CASH FLOW 2006 Rm 2005 Rm Cash From Operations 465 405 Preference Share Capital Raised 263 - Dividends Paid (164) (114) Capex - Shipping Services - Trading, Freight and Financial Services (483) (207) (276) (692) (147) (545) Share Buy Back (184) - 223 6 (7) 426 113 31 Ship Sales / Other Finance (Repaid) / Raised Net Cash Flow Interim Results Interim Update Conclusion

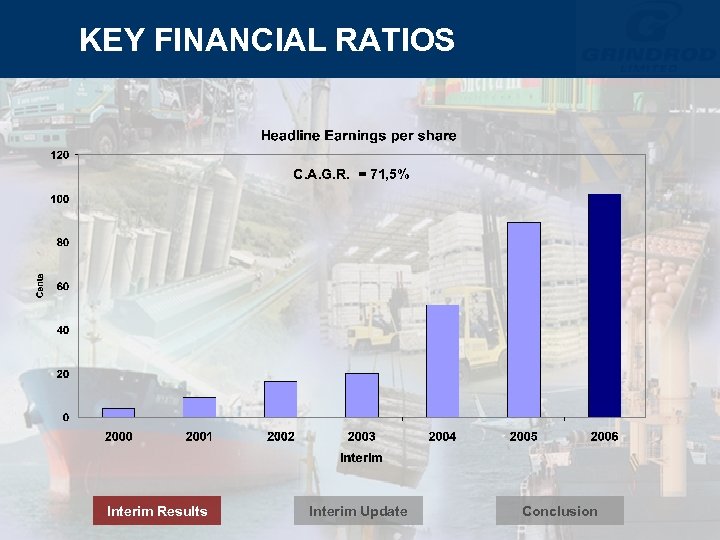

KEY FINANCIAL RATIOS C. A. G. R. = 71, 5% Interim Results Interim Update Conclusion

KEY FINANCIAL RATIOS C. A. G. R. = 71, 5% Interim Results Interim Update Conclusion

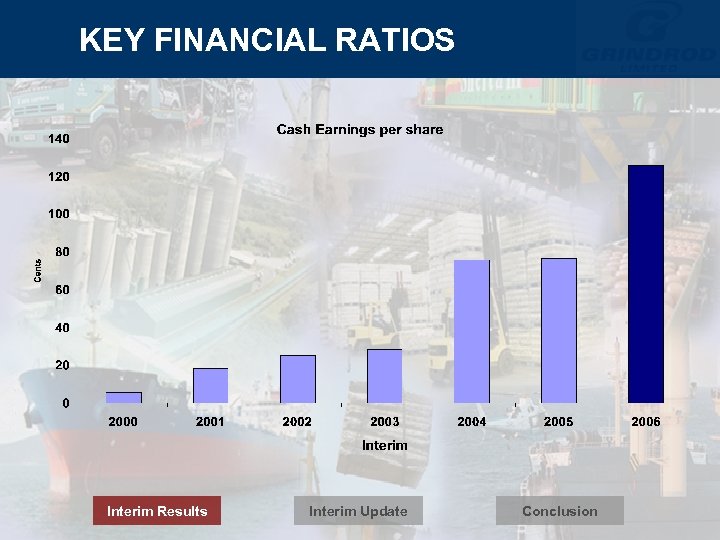

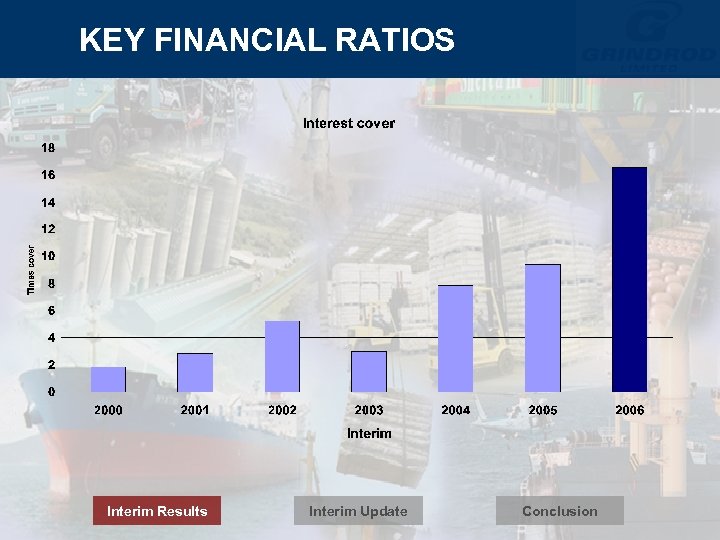

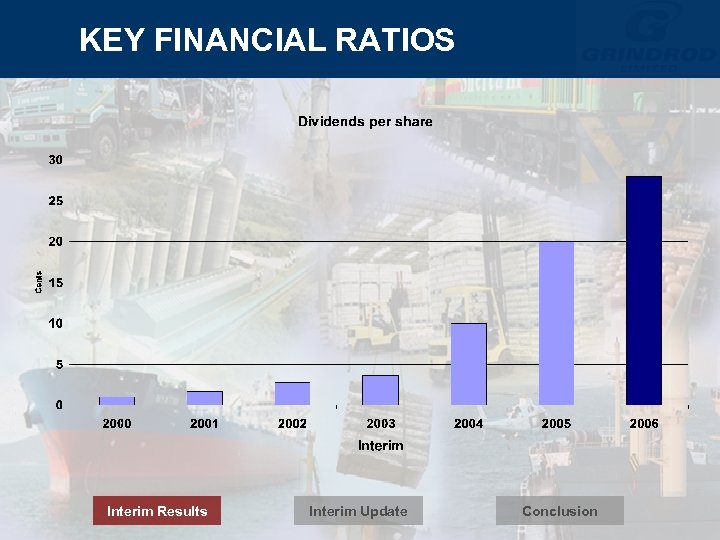

KEY FINANCIAL RATIOS Interim Results Interim Update Conclusion

KEY FINANCIAL RATIOS Interim Results Interim Update Conclusion

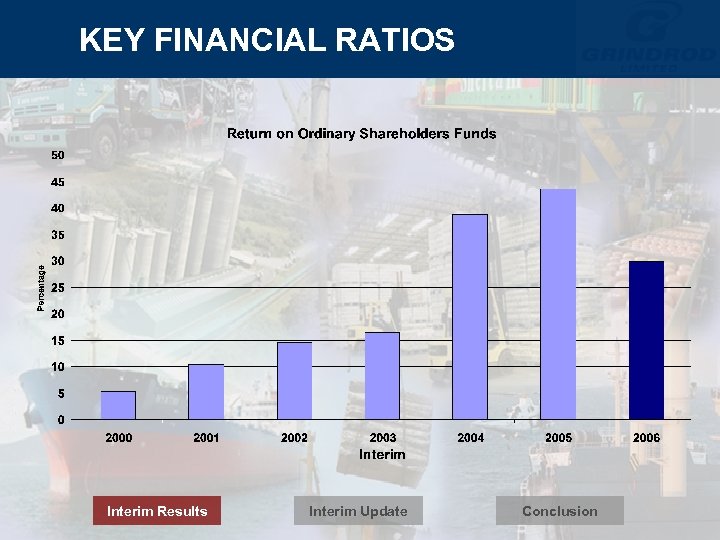

KEY FINANCIAL RATIOS Interim Results Interim Update Conclusion

KEY FINANCIAL RATIOS Interim Results Interim Update Conclusion

KEY FINANCIAL RATIOS Interim Results Interim Update Conclusion

KEY FINANCIAL RATIOS Interim Results Interim Update Conclusion

KEY FINANCIAL RATIOS Interim Results Interim Update Conclusion

KEY FINANCIAL RATIOS Interim Results Interim Update Conclusion

INTERIM UPDATE

INTERIM UPDATE

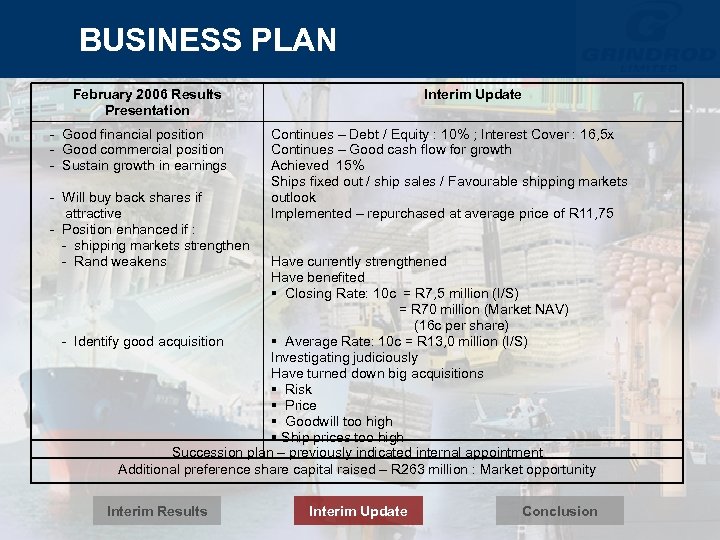

BUSINESS PLAN February 2006 Results Presentation - Good financial position - Good commercial position - Sustain growth in earnings - Will buy back shares if attractive - Position enhanced if : - shipping markets strengthen - Rand weakens Interim Update Continues – Debt / Equity : 10% ; Interest Cover : 16, 5 x Continues – Good cash flow for growth Achieved 15% Ships fixed out / ship sales / Favourable shipping markets outlook Implemented – repurchased at average price of R 11, 75 Have currently strengthened Have benefited § Closing Rate: 10 c = R 7, 5 million (I/S) = R 70 million (Market NAV) (16 c per share) - Identify good acquisition § Average Rate: 10 c = R 13, 0 million (I/S) Investigating judiciously Have turned down big acquisitions § Risk § Price § Goodwill too high § Ship prices too high Succession plan – previously indicated internal appointment Additional preference share capital raised – R 263 million : Market opportunity Interim Results Interim Update Conclusion

BUSINESS PLAN February 2006 Results Presentation - Good financial position - Good commercial position - Sustain growth in earnings - Will buy back shares if attractive - Position enhanced if : - shipping markets strengthen - Rand weakens Interim Update Continues – Debt / Equity : 10% ; Interest Cover : 16, 5 x Continues – Good cash flow for growth Achieved 15% Ships fixed out / ship sales / Favourable shipping markets outlook Implemented – repurchased at average price of R 11, 75 Have currently strengthened Have benefited § Closing Rate: 10 c = R 7, 5 million (I/S) = R 70 million (Market NAV) (16 c per share) - Identify good acquisition § Average Rate: 10 c = R 13, 0 million (I/S) Investigating judiciously Have turned down big acquisitions § Risk § Price § Goodwill too high § Ship prices too high Succession plan – previously indicated internal appointment Additional preference share capital raised – R 263 million : Market opportunity Interim Results Interim Update Conclusion

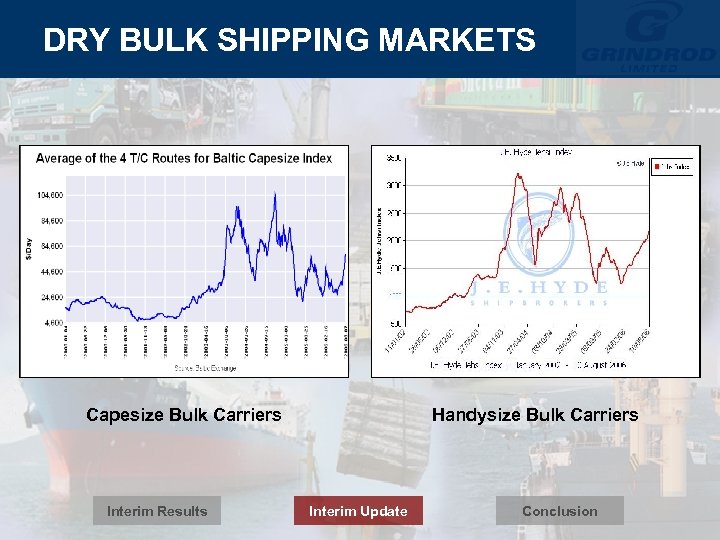

SHIPPING MARKETS & ACTIVITIES February 2006 Results Presentation Interim Update $15 000 per day $46 000 per day $25 000 per day $18 000 per day $60 000 per day $25 000 per day Shipping Markets • Current Market Rates - Handysize Bulk Carriers - Capesize Bulk Carriers - Product Tankers Markets expected to weaken during northern hemisphere summer but with volatility Favourable supply / demand fundamentals = favourable long-term outlook Interim Results Weakened as expected but recovered earlier and to higher levels Improved long-term outlook Interim Update Conclusion

SHIPPING MARKETS & ACTIVITIES February 2006 Results Presentation Interim Update $15 000 per day $46 000 per day $25 000 per day $18 000 per day $60 000 per day $25 000 per day Shipping Markets • Current Market Rates - Handysize Bulk Carriers - Capesize Bulk Carriers - Product Tankers Markets expected to weaken during northern hemisphere summer but with volatility Favourable supply / demand fundamentals = favourable long-term outlook Interim Results Weakened as expected but recovered earlier and to higher levels Improved long-term outlook Interim Update Conclusion

SHIPPING MARKETS • Averaged 15% lower than last year Interim but currently + 20% higher • Newbuilding demand very strong • Charter rates firm due to – Strong iron ore/steel demand – Cement exports out of China – Upcoming harvest season – Petroleum demand in USA • Long-term outlook favourable – Continued strong demand anticipated – Regulatory requirements – Newbuildings in line with demand – Old handysize fleet – significant scrapping Interim Results Interim Update Conclusion

SHIPPING MARKETS • Averaged 15% lower than last year Interim but currently + 20% higher • Newbuilding demand very strong • Charter rates firm due to – Strong iron ore/steel demand – Cement exports out of China – Upcoming harvest season – Petroleum demand in USA • Long-term outlook favourable – Continued strong demand anticipated – Regulatory requirements – Newbuildings in line with demand – Old handysize fleet – significant scrapping Interim Results Interim Update Conclusion

DRY BULK SHIPPING MARKETS Capesize Bulk Carriers Interim Results Handysize Bulk Carriers Interim Update Conclusion

DRY BULK SHIPPING MARKETS Capesize Bulk Carriers Interim Results Handysize Bulk Carriers Interim Update Conclusion

TANKER SHIPPING MARKETS Product Tanker Interim Results Chemical Tanker Interim Update Conclusion

TANKER SHIPPING MARKETS Product Tanker Interim Results Chemical Tanker Interim Update Conclusion

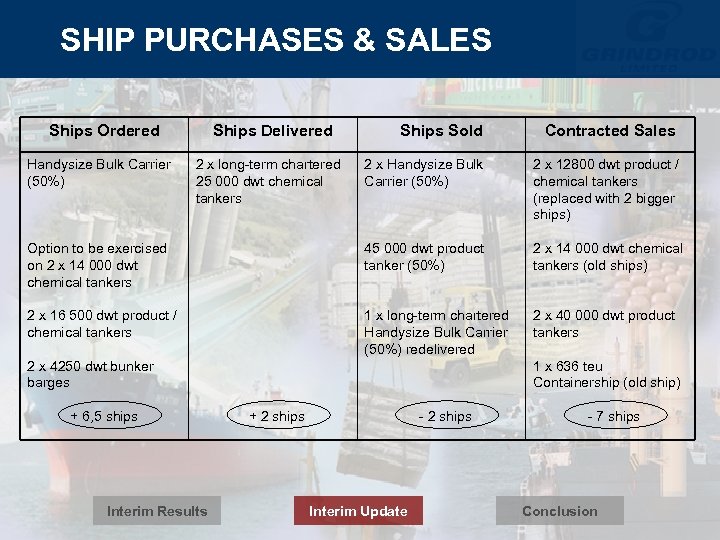

SHIP PURCHASES & SALES Ships Ordered Ships Sold Contracted Sales 2 x Handysize Bulk Carrier (50%) 2 x 12800 dwt product / chemical tankers (replaced with 2 bigger ships) Option to be exercised on 2 x 14 000 dwt chemical tankers 45 000 dwt product tanker (50%) 2 x 14 000 dwt chemical tankers (old ships) 2 x 16 500 dwt product / chemical tankers 1 x long-term chartered Handysize Bulk Carrier (50%) redelivered 2 x 40 000 dwt product tankers Handysize Bulk Carrier (50%) Ships Delivered 2 x long-term chartered 25 000 dwt chemical tankers 2 x 4250 dwt bunker barges + 6, 5 ships Interim Results 1 x 636 teu Containership (old ship) + 2 ships - 2 ships Interim Update - 7 ships Conclusion

SHIP PURCHASES & SALES Ships Ordered Ships Sold Contracted Sales 2 x Handysize Bulk Carrier (50%) 2 x 12800 dwt product / chemical tankers (replaced with 2 bigger ships) Option to be exercised on 2 x 14 000 dwt chemical tankers 45 000 dwt product tanker (50%) 2 x 14 000 dwt chemical tankers (old ships) 2 x 16 500 dwt product / chemical tankers 1 x long-term chartered Handysize Bulk Carrier (50%) redelivered 2 x 40 000 dwt product tankers Handysize Bulk Carrier (50%) Ships Delivered 2 x long-term chartered 25 000 dwt chemical tankers 2 x 4250 dwt bunker barges + 6, 5 ships Interim Results 1 x 636 teu Containership (old ship) + 2 ships - 2 ships Interim Update - 7 ships Conclusion

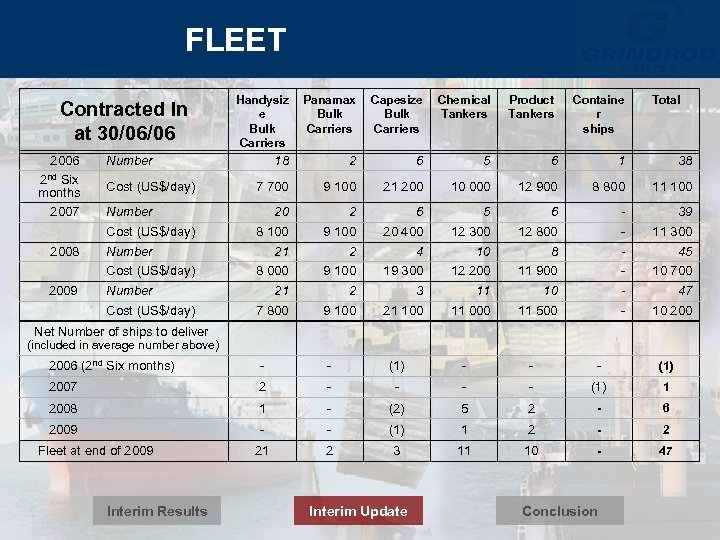

FLEET Contracted In at 30/06/06 2006 2 nd Six months 2007 Cost (US$/day) Capesize Bulk Carriers Chemical Tankers Product Tankers Containe r ships 18 2 6 5 6 1 38 7 700 9 100 21 200 10 000 12 900 8 800 11 100 20 2 6 5 6 - 39 8 100 9 100 20 400 12 300 12 800 - 11 300 21 2 4 10 8 - 45 8 000 9 100 19 300 12 200 11 900 - 10 700 21 2 3 11 10 - 47 7 800 9 100 21 100 11 000 11 500 - 10 200 Number Cost (US$/day) 2009 Panamax Bulk Carriers Number Cost (US$/day) 2008 Handysiz e Bulk Carriers Number Cost (US$/day) Total Net Number of ships to deliver (included in average number above) 2006 (2 nd Six months) - - (1) - - - (1) 2007 2 - - (1) 1 2008 1 - (2) 5 2 - 6 2009 - - (1) 1 2 - 2 21 2 3 11 10 - 47 Fleet at end of 2009 Interim Results Interim Update Conclusion

FLEET Contracted In at 30/06/06 2006 2 nd Six months 2007 Cost (US$/day) Capesize Bulk Carriers Chemical Tankers Product Tankers Containe r ships 18 2 6 5 6 1 38 7 700 9 100 21 200 10 000 12 900 8 800 11 100 20 2 6 5 6 - 39 8 100 9 100 20 400 12 300 12 800 - 11 300 21 2 4 10 8 - 45 8 000 9 100 19 300 12 200 11 900 - 10 700 21 2 3 11 10 - 47 7 800 9 100 21 100 11 000 11 500 - 10 200 Number Cost (US$/day) 2009 Panamax Bulk Carriers Number Cost (US$/day) 2008 Handysiz e Bulk Carriers Number Cost (US$/day) Total Net Number of ships to deliver (included in average number above) 2006 (2 nd Six months) - - (1) - - - (1) 2007 2 - - (1) 1 2008 1 - (2) 5 2 - 6 2009 - - (1) 1 2 - 2 21 2 3 11 10 - 47 Fleet at end of 2009 Interim Results Interim Update Conclusion

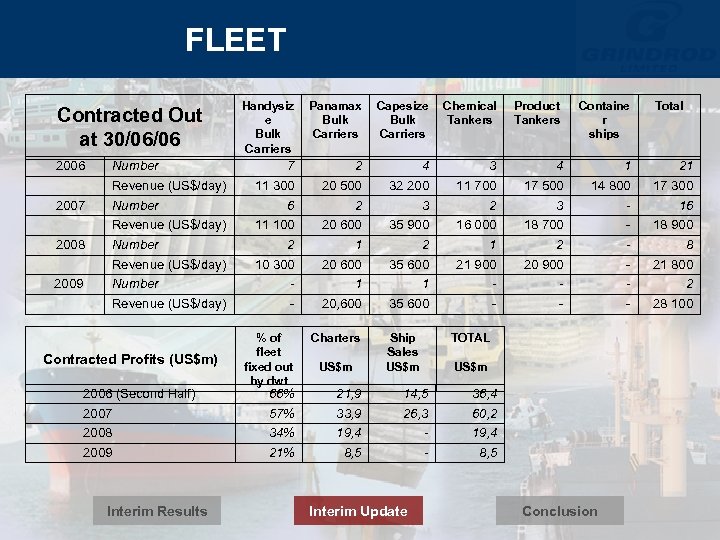

FLEET Handysiz e Bulk Carriers Panamax Bulk Carriers Capesize Bulk Carriers Chemical Tankers Product Tankers Containe r ships 7 2 4 3 4 1 21 11 300 20 500 32 200 11 700 17 500 14 800 17 300 6 2 3 - 16 11 100 20 600 35 900 16 000 18 700 - 18 900 2 1 2 - 8 10 300 20 600 35 600 21 900 20 900 - 21 800 Number - 1 1 - - - 2 Revenue (US$/day) - 20, 600 35 600 - - - 28 100 % of fleet fixed out by dwt Charters 66% 21, 9 14, 5 36, 4 2007 57% 33, 9 26, 3 60, 2 2008 34% 19, 4 - 19, 4 2009 21% 8, 5 - 8, 5 Contracted Out at 30/06/06 2006 Number Revenue (US$/day) 2007 Number Revenue (US$/day) 2008 Number Revenue (US$/day) 2009 Contracted Profits (US$m) 2006 (Second Half) Interim Results US$m Ship Sales US$m Interim Update TOTAL US$m Conclusion Total

FLEET Handysiz e Bulk Carriers Panamax Bulk Carriers Capesize Bulk Carriers Chemical Tankers Product Tankers Containe r ships 7 2 4 3 4 1 21 11 300 20 500 32 200 11 700 17 500 14 800 17 300 6 2 3 - 16 11 100 20 600 35 900 16 000 18 700 - 18 900 2 1 2 - 8 10 300 20 600 35 600 21 900 20 900 - 21 800 Number - 1 1 - - - 2 Revenue (US$/day) - 20, 600 35 600 - - - 28 100 % of fleet fixed out by dwt Charters 66% 21, 9 14, 5 36, 4 2007 57% 33, 9 26, 3 60, 2 2008 34% 19, 4 - 19, 4 2009 21% 8, 5 - 8, 5 Contracted Out at 30/06/06 2006 Number Revenue (US$/day) 2007 Number Revenue (US$/day) 2008 Number Revenue (US$/day) 2009 Contracted Profits (US$m) 2006 (Second Half) Interim Results US$m Ship Sales US$m Interim Update TOTAL US$m Conclusion Total

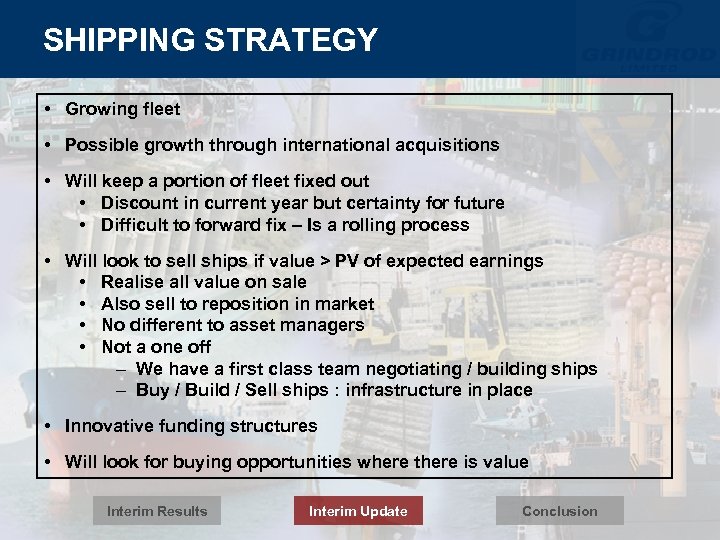

SHIPPING STRATEGY • Growing fleet • Possible growth through international acquisitions • Will keep a portion of fleet fixed out • Discount in current year but certainty for future • Difficult to forward fix – Is a rolling process • Will look to sell ships if value > PV of expected earnings • Realise all value on sale • Also sell to reposition in market • No different to asset managers • Not a one off – We have a first class team negotiating / building ships – Buy / Build / Sell ships : infrastructure in place • Innovative funding structures • Will look for buying opportunities where there is value Interim Results Interim Update Conclusion

SHIPPING STRATEGY • Growing fleet • Possible growth through international acquisitions • Will keep a portion of fleet fixed out • Discount in current year but certainty for future • Difficult to forward fix – Is a rolling process • Will look to sell ships if value > PV of expected earnings • Realise all value on sale • Also sell to reposition in market • No different to asset managers • Not a one off – We have a first class team negotiating / building ships – Buy / Build / Sell ships : infrastructure in place • Innovative funding structures • Will look for buying opportunities where there is value Interim Results Interim Update Conclusion

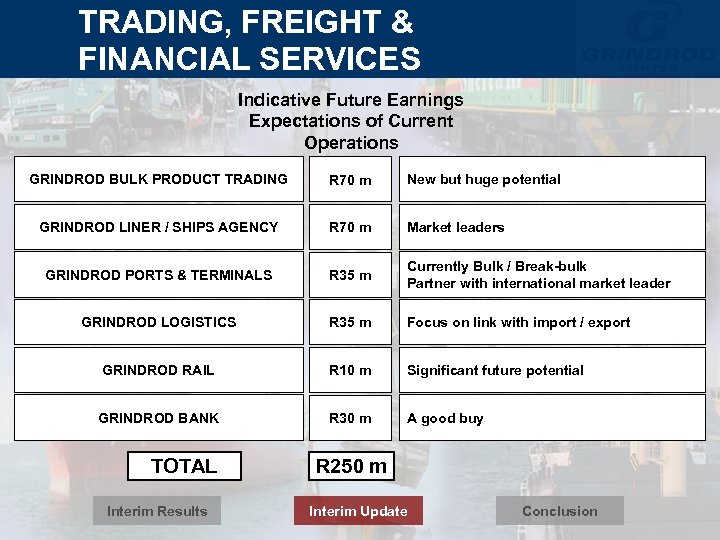

TRADING, FREIGHT & FINANCIAL SERVICES Indicative Future Earnings Expectations of Current Operations GRINDROD BULK PRODUCT TRADING R 70 m New but huge potential GRINDROD LINER / SHIPS AGENCY R 70 m Market leaders GRINDROD PORTS & TERMINALS R 35 m Currently Bulk / Break-bulk Partner with international market leader GRINDROD LOGISTICS R 35 m Focus on link with import / export GRINDROD RAIL R 10 m Significant future potential GRINDROD BANK R 30 m A good buy TOTAL Interim Results R 250 m Interim Update Conclusion

TRADING, FREIGHT & FINANCIAL SERVICES Indicative Future Earnings Expectations of Current Operations GRINDROD BULK PRODUCT TRADING R 70 m New but huge potential GRINDROD LINER / SHIPS AGENCY R 70 m Market leaders GRINDROD PORTS & TERMINALS R 35 m Currently Bulk / Break-bulk Partner with international market leader GRINDROD LOGISTICS R 35 m Focus on link with import / export GRINDROD RAIL R 10 m Significant future potential GRINDROD BANK R 30 m A good buy TOTAL Interim Results R 250 m Interim Update Conclusion

TRADING, FREIGHT & FINANCIAL SERVICES • Will consolidate and re-brand • Will not pay high PE / large goodwill for acquisitions • Prefer development of “Greenfield” operations • Partner with first-class operators • Huge growth opportunities from privatisation / PPP’s • Could buy out some current JV partners • Plan for one-third of profits Interim Results Interim Update Conclusion

TRADING, FREIGHT & FINANCIAL SERVICES • Will consolidate and re-brand • Will not pay high PE / large goodwill for acquisitions • Prefer development of “Greenfield” operations • Partner with first-class operators • Huge growth opportunities from privatisation / PPP’s • Could buy out some current JV partners • Plan for one-third of profits Interim Results Interim Update Conclusion

CONCLUSION

CONCLUSION

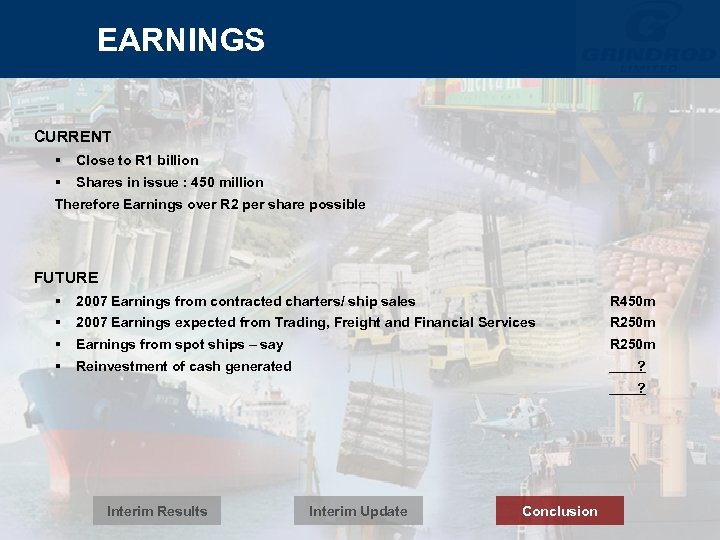

EARNINGS CURRENT § Close to R 1 billion § Shares in issue : 450 million Therefore Earnings over R 2 per share possible FUTURE § 2007 Earnings from contracted charters/ ship sales R 450 m § 2007 Earnings expected from Trading, Freight and Financial Services R 250 m § Earnings from spot ships – say R 250 m § Reinvestment of cash generated ? ? Interim Results Interim Update Conclusion

EARNINGS CURRENT § Close to R 1 billion § Shares in issue : 450 million Therefore Earnings over R 2 per share possible FUTURE § 2007 Earnings from contracted charters/ ship sales R 450 m § 2007 Earnings expected from Trading, Freight and Financial Services R 250 m § Earnings from spot ships – say R 250 m § Reinvestment of cash generated ? ? Interim Results Interim Update Conclusion

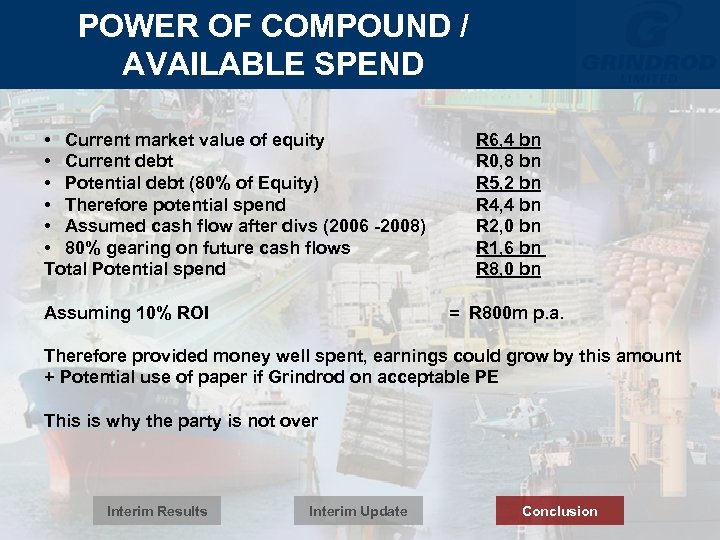

POWER OF COMPOUND / AVAILABLE SPEND • Current market value of equity • Current debt • Potential debt (80% of Equity) • Therefore potential spend • Assumed cash flow after divs (2006 -2008) • 80% gearing on future cash flows Total Potential spend Assuming 10% ROI R 6, 4 bn R 0, 8 bn R 5, 2 bn R 4, 4 bn R 2, 0 bn R 1, 6 bn R 8, 0 bn = R 800 m p. a. Therefore provided money well spent, earnings could grow by this amount + Potential use of paper if Grindrod on acceptable PE This is why the party is not over Interim Results Interim Update Conclusion

POWER OF COMPOUND / AVAILABLE SPEND • Current market value of equity • Current debt • Potential debt (80% of Equity) • Therefore potential spend • Assumed cash flow after divs (2006 -2008) • 80% gearing on future cash flows Total Potential spend Assuming 10% ROI R 6, 4 bn R 0, 8 bn R 5, 2 bn R 4, 4 bn R 2, 0 bn R 1, 6 bn R 8, 0 bn = R 800 m p. a. Therefore provided money well spent, earnings could grow by this amount + Potential use of paper if Grindrod on acceptable PE This is why the party is not over Interim Results Interim Update Conclusion

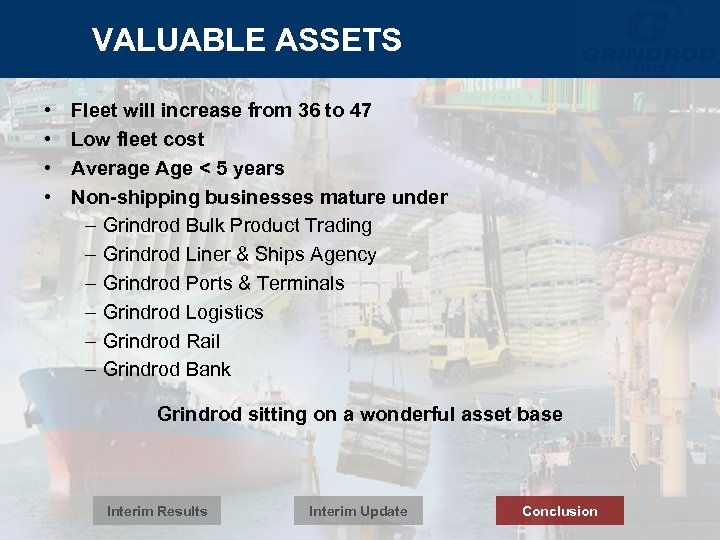

VALUABLE ASSETS • • Fleet will increase from 36 to 47 Low fleet cost Average Age < 5 years Non-shipping businesses mature under – Grindrod Bulk Product Trading – Grindrod Liner & Ships Agency – Grindrod Ports & Terminals – Grindrod Logistics – Grindrod Rail – Grindrod Bank Grindrod sitting on a wonderful asset base Interim Results Interim Update Conclusion

VALUABLE ASSETS • • Fleet will increase from 36 to 47 Low fleet cost Average Age < 5 years Non-shipping businesses mature under – Grindrod Bulk Product Trading – Grindrod Liner & Ships Agency – Grindrod Ports & Terminals – Grindrod Logistics – Grindrod Rail – Grindrod Bank Grindrod sitting on a wonderful asset base Interim Results Interim Update Conclusion

GOOD COMMERCIAL POSITION

GOOD COMMERCIAL POSITION

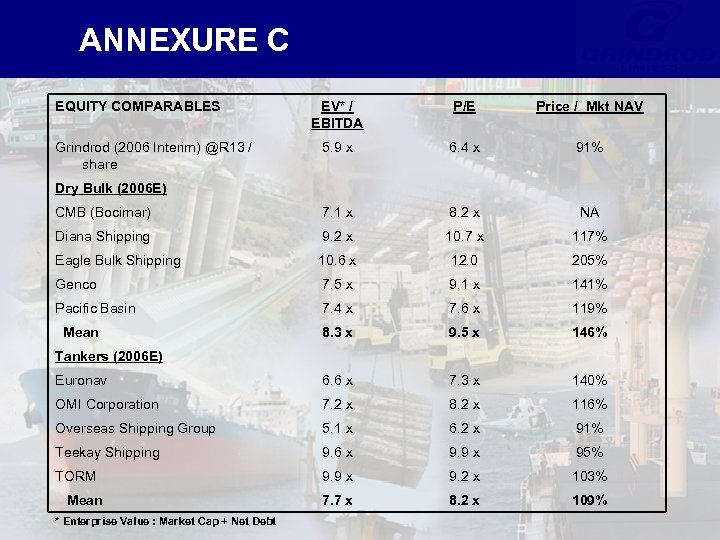

EQUITY COMPARABLES Grindrod PE 6, 4 Price / NAV (R 14, 30) 91% Comparable International Companies PE 8, 9 Price / NAV 128% Average PE of SA Competitors 11, 5 See Annexure C Interim Results Interim Update Conclusion

EQUITY COMPARABLES Grindrod PE 6, 4 Price / NAV (R 14, 30) 91% Comparable International Companies PE 8, 9 Price / NAV 128% Average PE of SA Competitors 11, 5 See Annexure C Interim Results Interim Update Conclusion

BUSINESS POSITION We are a company in the top 100 of the JSE Won SA’s top listed company : 2004 and 2005 We are a world leader in shipping Won Marine Money listed shipping company of the year : 2005 and 2006 With the Grindrod: § Earnings Base § Asset Base § Product / Customer Base § Market Cap vs NAV § Power of Compound Interim Results Interim Update Conclusion

BUSINESS POSITION We are a company in the top 100 of the JSE Won SA’s top listed company : 2004 and 2005 We are a world leader in shipping Won Marine Money listed shipping company of the year : 2005 and 2006 With the Grindrod: § Earnings Base § Asset Base § Product / Customer Base § Market Cap vs NAV § Power of Compound Interim Results Interim Update Conclusion

BUSINESS POSITION “I believe that Grindrod under the leadership of Alan Olivier and his management team has huge potential for substantial further sustainable growth into the future. ” Interim Results Interim Update Conclusion

BUSINESS POSITION “I believe that Grindrod under the leadership of Alan Olivier and his management team has huge potential for substantial further sustainable growth into the future. ” Interim Results Interim Update Conclusion

Interim Results and Dividend Announcement For the six months to June 2006

Interim Results and Dividend Announcement For the six months to June 2006

ANNEXURES

ANNEXURES

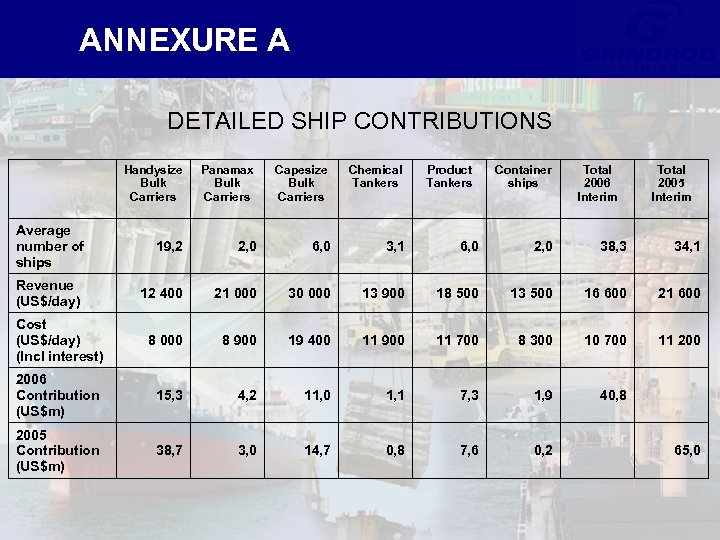

ANNEXURE A DETAILED SHIP CONTRIBUTIONS Handysize Bulk Carriers Panamax Bulk Carriers Capesize Bulk Carriers Chemical Tankers Product Tankers Container ships Total 2006 Interim Total 2005 Interim Average number of ships 19, 2 2, 0 6, 0 3, 1 6, 0 2, 0 38, 3 34, 1 Revenue (US$/day) 12 400 21 000 30 000 13 900 18 500 13 500 16 600 21 600 Cost (US$/day) (Incl interest) 8 000 8 900 19 400 11 900 11 700 8 300 10 700 11 2006 Contribution (US$m) 15, 3 4, 2 11, 0 1, 1 7, 3 1, 9 40, 8 2005 Contribution (US$m) 38, 7 3, 0 14, 7 0, 8 7, 6 0, 2 65, 0

ANNEXURE A DETAILED SHIP CONTRIBUTIONS Handysize Bulk Carriers Panamax Bulk Carriers Capesize Bulk Carriers Chemical Tankers Product Tankers Container ships Total 2006 Interim Total 2005 Interim Average number of ships 19, 2 2, 0 6, 0 3, 1 6, 0 2, 0 38, 3 34, 1 Revenue (US$/day) 12 400 21 000 30 000 13 900 18 500 13 500 16 600 21 600 Cost (US$/day) (Incl interest) 8 000 8 900 19 400 11 900 11 700 8 300 10 700 11 2006 Contribution (US$m) 15, 3 4, 2 11, 0 1, 1 7, 3 1, 9 40, 8 2005 Contribution (US$m) 38, 7 3, 0 14, 7 0, 8 7, 6 0, 2 65, 0

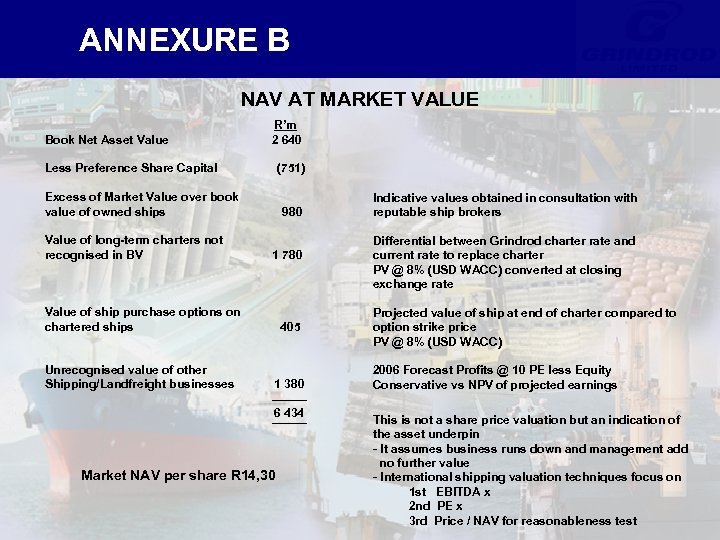

ANNEXURE B NAV AT MARKET VALUE Book Net Asset Value R’m 2 640 Less Preference Share Capital (751) Excess of Market Value over book value of owned ships Value of long-term charters not recognised in BV 980 1 780 Value of ship purchase options on chartered ships Unrecognised value of other Shipping/Landfreight businesses 405 1 380 6 434 Market NAV per share R 14, 30 Indicative values obtained in consultation with reputable ship brokers Differential between Grindrod charter rate and current rate to replace charter PV @ 8% (USD WACC) converted at closing exchange rate Projected value of ship at end of charter compared to option strike price PV @ 8% (USD WACC) 2006 Forecast Profits @ 10 PE less Equity Conservative vs NPV of projected earnings This is not a share price valuation but an indication of the asset underpin - It assumes business runs down and management add no further value - International shipping valuation techniques focus on 1 st EBITDA x 2 nd PE x 3 rd Price / NAV for reasonableness test

ANNEXURE B NAV AT MARKET VALUE Book Net Asset Value R’m 2 640 Less Preference Share Capital (751) Excess of Market Value over book value of owned ships Value of long-term charters not recognised in BV 980 1 780 Value of ship purchase options on chartered ships Unrecognised value of other Shipping/Landfreight businesses 405 1 380 6 434 Market NAV per share R 14, 30 Indicative values obtained in consultation with reputable ship brokers Differential between Grindrod charter rate and current rate to replace charter PV @ 8% (USD WACC) converted at closing exchange rate Projected value of ship at end of charter compared to option strike price PV @ 8% (USD WACC) 2006 Forecast Profits @ 10 PE less Equity Conservative vs NPV of projected earnings This is not a share price valuation but an indication of the asset underpin - It assumes business runs down and management add no further value - International shipping valuation techniques focus on 1 st EBITDA x 2 nd PE x 3 rd Price / NAV for reasonableness test

ANNEXURE C EQUITY COMPARABLES EV* / EBITDA P/E Price / Mkt NAV 5. 9 x 6. 4 x 91% CMB (Bocimar) 7. 1 x 8. 2 x NA Diana Shipping 9. 2 x 10. 7 x 117% Eagle Bulk Shipping 10. 6 x 12. 0 205% Genco 7. 5 x 9. 1 x 141% Pacific Basin 7. 4 x 7. 6 x 119% 8. 3 x 9. 5 x 146% Euronav 6. 6 x 7. 3 x 140% OMI Corporation 7. 2 x 8. 2 x 116% Overseas Shipping Group 5. 1 x 6. 2 x 91% Teekay Shipping 9. 6 x 9. 9 x 95% TORM 9. 9 x 9. 2 x 103% 7. 7 x 8. 2 x 109% Grindrod (2006 Interim) @R 13 / share Dry Bulk (2006 E) Mean Tankers (2006 E) Mean * Enterprise Value : Market Cap + Net Debt

ANNEXURE C EQUITY COMPARABLES EV* / EBITDA P/E Price / Mkt NAV 5. 9 x 6. 4 x 91% CMB (Bocimar) 7. 1 x 8. 2 x NA Diana Shipping 9. 2 x 10. 7 x 117% Eagle Bulk Shipping 10. 6 x 12. 0 205% Genco 7. 5 x 9. 1 x 141% Pacific Basin 7. 4 x 7. 6 x 119% 8. 3 x 9. 5 x 146% Euronav 6. 6 x 7. 3 x 140% OMI Corporation 7. 2 x 8. 2 x 116% Overseas Shipping Group 5. 1 x 6. 2 x 91% Teekay Shipping 9. 6 x 9. 9 x 95% TORM 9. 9 x 9. 2 x 103% 7. 7 x 8. 2 x 109% Grindrod (2006 Interim) @R 13 / share Dry Bulk (2006 E) Mean Tankers (2006 E) Mean * Enterprise Value : Market Cap + Net Debt