2e5ef3198e1d981b3a681d12834d56d2.ppt

- Количество слайдов: 67

• Interim Results 2004 1

• Interim Results 2004 1

Outline of presentation • Introduction • Financial results • Group operations Ongoing consistent improvement 2

Outline of presentation • Introduction • Financial results • Group operations Ongoing consistent improvement 2

In our 2003 Annual Report We said our business strategy was to: • Strengthen & rejuvenate retail brands • Introduce pharmacy into Clicks • Drive efficiency & productivity – shared services • Focus on improving stock turns • Boost profitability – improved turnover & margin • Create further value for shareholders Progress in most areas but still work to be done 3

In our 2003 Annual Report We said our business strategy was to: • Strengthen & rejuvenate retail brands • Introduce pharmacy into Clicks • Drive efficiency & productivity – shared services • Focus on improving stock turns • Boost profitability – improved turnover & margin • Create further value for shareholders Progress in most areas but still work to be done 3

In our 2003 Annual Report We also said we would: • Shift focus from strategy to delivery • Aim for ROE target of 4% to 5% above cost of capital in medium-term • Address the composition of the board & increase the number of independent non-executives • Adopt a board charter • Establish a nominations committee 4

In our 2003 Annual Report We also said we would: • Shift focus from strategy to delivery • Aim for ROE target of 4% to 5% above cost of capital in medium-term • Address the composition of the board & increase the number of independent non-executives • Adopt a board charter • Establish a nominations committee 4

Review of the period • Disposal of Australian operations • Turnaround in lifestyle category • Value proposition of Clicks paying off • Improved performance from Discom • Continued benefits of UPD acquisition • Turnover growth ahead of expense increase • Continued focus on stock turn improvements • Challenging pharmacy environment • Transfer of pharmacy licences albeit delayed • Single exit pricing legislation proposed 5

Review of the period • Disposal of Australian operations • Turnaround in lifestyle category • Value proposition of Clicks paying off • Improved performance from Discom • Continued benefits of UPD acquisition • Turnover growth ahead of expense increase • Continued focus on stock turn improvements • Challenging pharmacy environment • Transfer of pharmacy licences albeit delayed • Single exit pricing legislation proposed 5

• Financial Results • André Vermeulen Ongoing consistent improvement 6

• Financial Results • André Vermeulen Ongoing consistent improvement 6

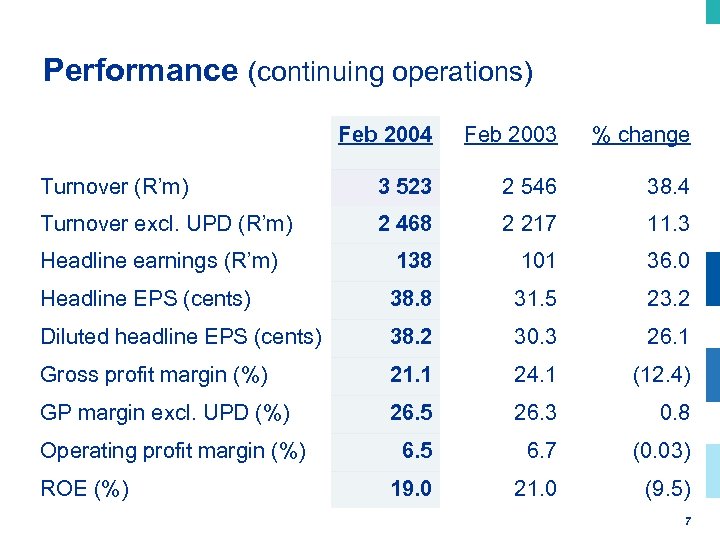

Performance (continuing operations) Feb 2004 Feb 2003 % change Turnover (R’m) 3 523 2 546 38. 4 Turnover excl. UPD (R’m) 2 468 2 217 11. 3 Headline earnings (R’m) 138 101 36. 0 Headline EPS (cents) 38. 8 31. 5 23. 2 Diluted headline EPS (cents) 38. 2 30. 3 26. 1 Gross profit margin (%) 21. 1 24. 1 (12. 4) GP margin excl. UPD (%) 26. 5 26. 3 0. 8 6. 5 6. 7 (0. 03) 19. 0 21. 0 (9. 5) Operating profit margin (%) ROE (%) 7

Performance (continuing operations) Feb 2004 Feb 2003 % change Turnover (R’m) 3 523 2 546 38. 4 Turnover excl. UPD (R’m) 2 468 2 217 11. 3 Headline earnings (R’m) 138 101 36. 0 Headline EPS (cents) 38. 8 31. 5 23. 2 Diluted headline EPS (cents) 38. 2 30. 3 26. 1 Gross profit margin (%) 21. 1 24. 1 (12. 4) GP margin excl. UPD (%) 26. 5 26. 3 0. 8 6. 5 6. 7 (0. 03) 19. 0 21. 0 (9. 5) Operating profit margin (%) ROE (%) 7

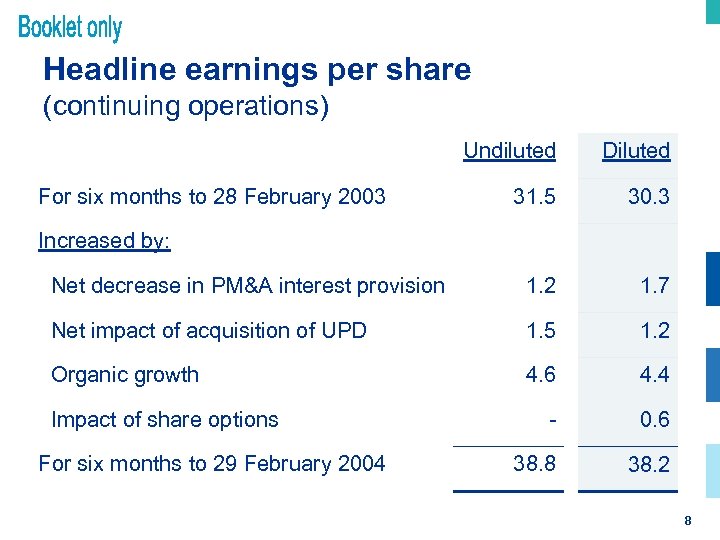

Headline earnings per share (continuing operations) Undiluted Diluted 31. 5 30. 3 Net decrease in PM&A interest provision 1. 2 1. 7 Net impact of acquisition of UPD 1. 5 1. 2 Organic growth 4. 6 4. 4 - 0. 6 38. 8 38. 2 For six months to 28 February 2003 Increased by: Impact of share options For six months to 29 February 2004 8

Headline earnings per share (continuing operations) Undiluted Diluted 31. 5 30. 3 Net decrease in PM&A interest provision 1. 2 1. 7 Net impact of acquisition of UPD 1. 5 1. 2 Organic growth 4. 6 4. 4 - 0. 6 38. 8 38. 2 For six months to 28 February 2003 Increased by: Impact of share options For six months to 29 February 2004 8

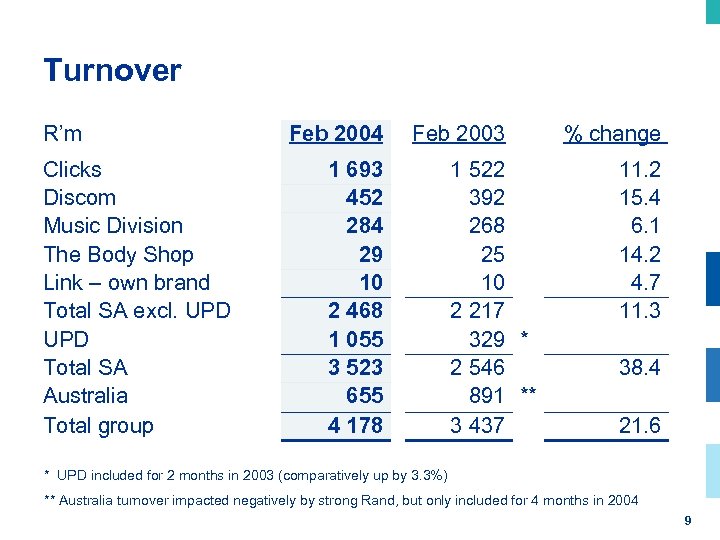

Turnover R’m Clicks Discom Music Division The Body Shop Link – own brand Total SA excl. UPD Total SA Australia Total group Feb 2004 Feb 2003 1 693 452 284 29 10 2 468 1 055 3 523 655 4 178 1 522 392 268 25 10 2 217 329 * 2 546 891 ** 3 437 % change 11. 2 15. 4 6. 1 14. 2 4. 7 11. 3 38. 4 21. 6 * UPD included for 2 months in 2003 (comparatively up by 3. 3%) ** Australia turnover impacted negatively by strong Rand, but only included for 4 months in 2004 9

Turnover R’m Clicks Discom Music Division The Body Shop Link – own brand Total SA excl. UPD Total SA Australia Total group Feb 2004 Feb 2003 1 693 452 284 29 10 2 468 1 055 3 523 655 4 178 1 522 392 268 25 10 2 217 329 * 2 546 891 ** 3 437 % change 11. 2 15. 4 6. 1 14. 2 4. 7 11. 3 38. 4 21. 6 * UPD included for 2 months in 2003 (comparatively up by 3. 3%) ** Australia turnover impacted negatively by strong Rand, but only included for 4 months in 2004 9

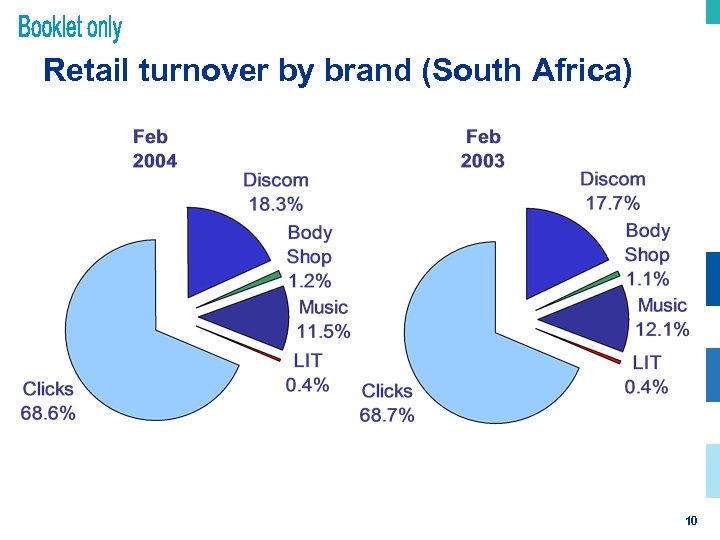

Retail turnover by brand (South Africa) 10

Retail turnover by brand (South Africa) 10

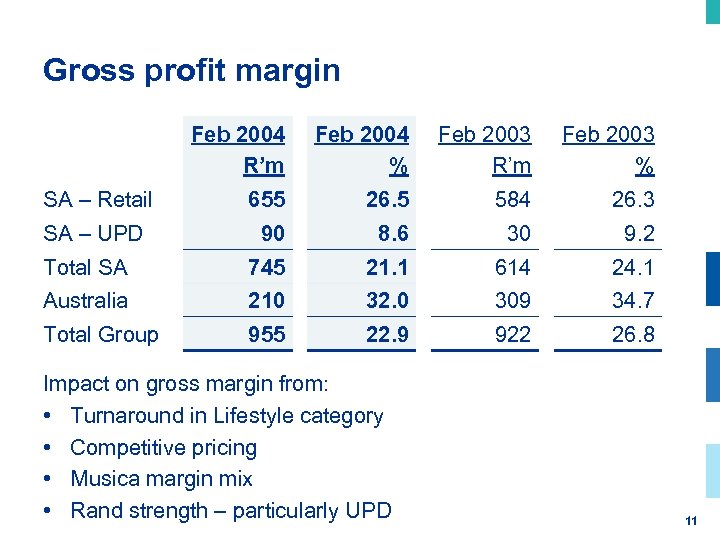

Gross profit margin Feb 2004 R’m Feb 2004 % Feb 2003 R’m Feb 2003 % SA – Retail 655 26. 5 584 26. 3 SA – UPD 90 8. 6 30 9. 2 Total SA 745 21. 1 614 24. 1 Australia 210 32. 0 309 34. 7 Total Group 955 22. 9 922 26. 8 Impact on gross margin from: • Turnaround in Lifestyle category • Competitive pricing • Musica margin mix • Rand strength – particularly UPD 11

Gross profit margin Feb 2004 R’m Feb 2004 % Feb 2003 R’m Feb 2003 % SA – Retail 655 26. 5 584 26. 3 SA – UPD 90 8. 6 30 9. 2 Total SA 745 21. 1 614 24. 1 Australia 210 32. 0 309 34. 7 Total Group 955 22. 9 922 26. 8 Impact on gross margin from: • Turnaround in Lifestyle category • Competitive pricing • Musica margin mix • Rand strength – particularly UPD 11

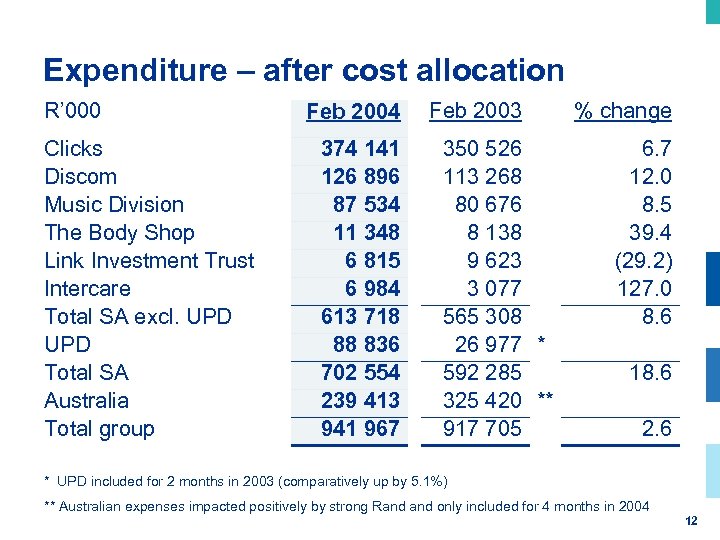

Expenditure – after cost allocation R’ 000 Clicks Discom Music Division The Body Shop Link Investment Trust Intercare Total SA excl. UPD Total SA Australia Total group Feb 2004 374 141 126 896 87 534 11 348 6 815 6 984 613 718 88 836 702 554 239 413 941 967 Feb 2003 350 526 113 268 80 676 8 138 9 623 3 077 565 308 26 977 * 592 285 325 420 ** 917 705 % change 6. 7 12. 0 8. 5 39. 4 (29. 2) 127. 0 8. 6 18. 6 2. 6 * UPD included for 2 months in 2003 (comparatively up by 5. 1%) ** Australian expenses impacted positively by strong Rand only included for 4 months in 2004 12

Expenditure – after cost allocation R’ 000 Clicks Discom Music Division The Body Shop Link Investment Trust Intercare Total SA excl. UPD Total SA Australia Total group Feb 2004 374 141 126 896 87 534 11 348 6 815 6 984 613 718 88 836 702 554 239 413 941 967 Feb 2003 350 526 113 268 80 676 8 138 9 623 3 077 565 308 26 977 * 592 285 325 420 ** 917 705 % change 6. 7 12. 0 8. 5 39. 4 (29. 2) 127. 0 8. 6 18. 6 2. 6 * UPD included for 2 months in 2003 (comparatively up by 5. 1%) ** Australian expenses impacted positively by strong Rand only included for 4 months in 2004 12

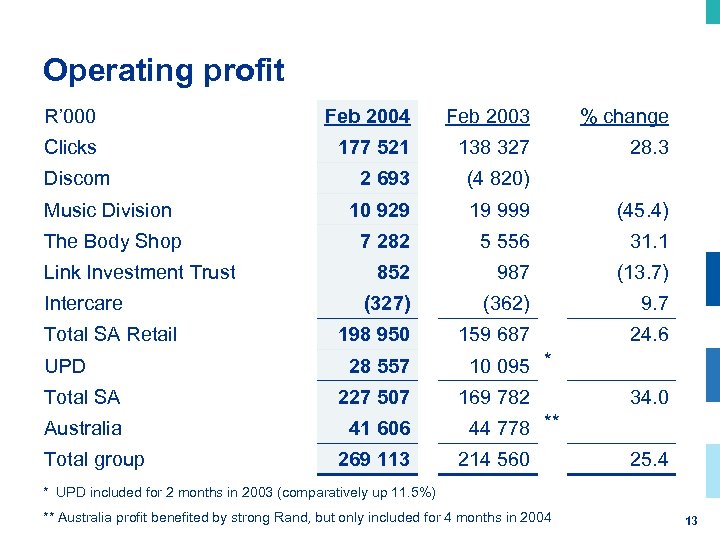

Operating profit R’ 000 Feb 2004 Feb 2003 % change Clicks 177 521 138 327 28. 3 2 693 (4 820) Music Division 10 929 19 999 (45. 4) The Body Shop 7 282 5 556 31. 1 852 987 (13. 7) (327) (362) 9. 7 198 950 159 687 24. 6 Discom Link Investment Trust Intercare Total SA Retail UPD 28 557 Total SA 227 507 Australia 41 606 Total group 269 113 10 095 * 169 782 34. 0 44 778 ** 214 560 25. 4 * UPD included for 2 months in 2003 (comparatively up 11. 5%) ** Australia profit benefited by strong Rand, but only included for 4 months in 2004 13

Operating profit R’ 000 Feb 2004 Feb 2003 % change Clicks 177 521 138 327 28. 3 2 693 (4 820) Music Division 10 929 19 999 (45. 4) The Body Shop 7 282 5 556 31. 1 852 987 (13. 7) (327) (362) 9. 7 198 950 159 687 24. 6 Discom Link Investment Trust Intercare Total SA Retail UPD 28 557 Total SA 227 507 Australia 41 606 Total group 269 113 10 095 * 169 782 34. 0 44 778 ** 214 560 25. 4 * UPD included for 2 months in 2003 (comparatively up 11. 5%) ** Australia profit benefited by strong Rand, but only included for 4 months in 2004 13

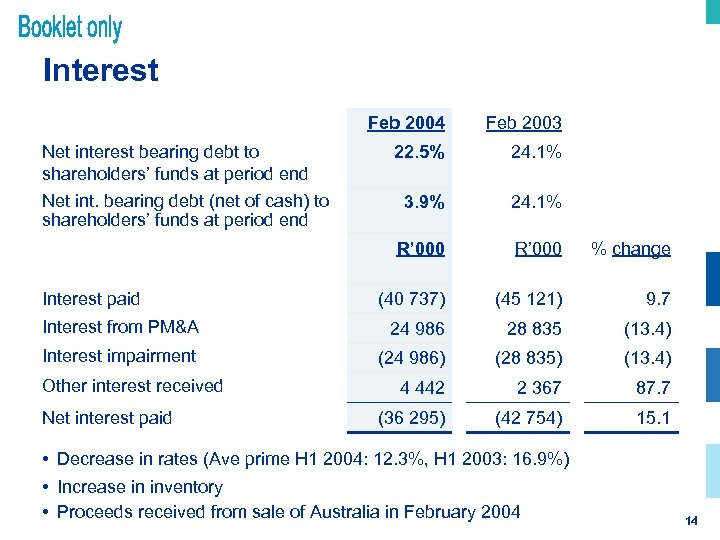

Interest Feb 2004 Feb 2003 22. 5% 24. 1% 3. 9% 24. 1% R’ 000 % change (40 737) (45 121) 9. 7 Interest from PM&A 24 986 28 835 (13. 4) Interest impairment (24 986) (28 835) (13. 4) 4 442 2 367 87. 7 (36 295) (42 754) 15. 1 Net interest bearing debt to shareholders’ funds at period end Net int. bearing debt (net of cash) to shareholders’ funds at period end Interest paid Other interest received Net interest paid • Decrease in rates (Ave prime H 1 2004: 12. 3%, H 1 2003: 16. 9%) • Increase in inventory • Proceeds received from sale of Australia in February 2004 14

Interest Feb 2004 Feb 2003 22. 5% 24. 1% 3. 9% 24. 1% R’ 000 % change (40 737) (45 121) 9. 7 Interest from PM&A 24 986 28 835 (13. 4) Interest impairment (24 986) (28 835) (13. 4) 4 442 2 367 87. 7 (36 295) (42 754) 15. 1 Net interest bearing debt to shareholders’ funds at period end Net int. bearing debt (net of cash) to shareholders’ funds at period end Interest paid Other interest received Net interest paid • Decrease in rates (Ave prime H 1 2004: 12. 3%, H 1 2003: 16. 9%) • Increase in inventory • Proceeds received from sale of Australia in February 2004 14

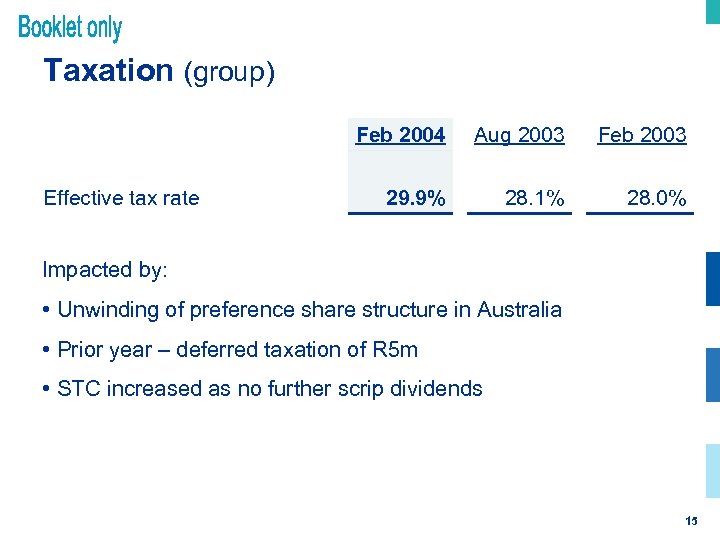

Taxation (group) Feb 2004 Effective tax rate Aug 2003 Feb 2003 29. 9% 28. 1% 28. 0% Impacted by: • Unwinding of preference share structure in Australia • Prior year – deferred taxation of R 5 m • STC increased as no further scrip dividends 15

Taxation (group) Feb 2004 Effective tax rate Aug 2003 Feb 2003 29. 9% 28. 1% 28. 0% Impacted by: • Unwinding of preference share structure in Australia • Prior year – deferred taxation of R 5 m • STC increased as no further scrip dividends 15

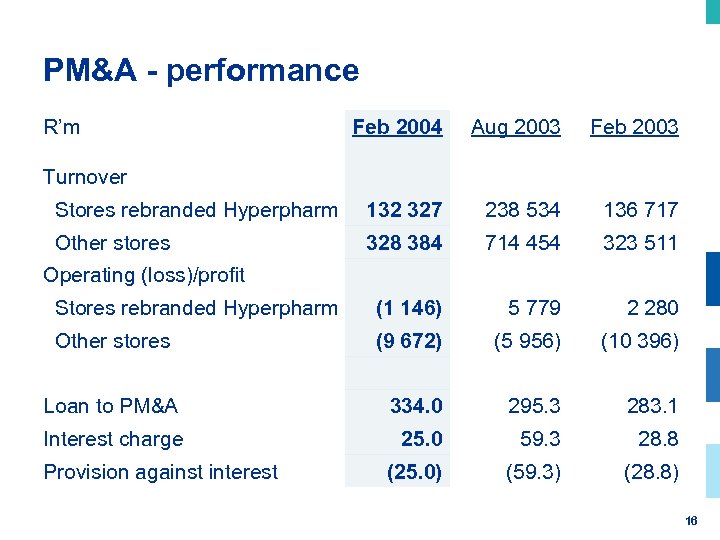

PM&A - performance R’m Feb 2004 Aug 2003 Feb 2003 Stores rebranded Hyperpharm 132 327 238 534 136 717 Other stores 328 384 714 454 323 511 Stores rebranded Hyperpharm (1 146) 5 779 2 280 Other stores (9 672) (5 956) (10 396) Loan to PM&A 334. 0 295. 3 283. 1 Interest charge 25. 0 59. 3 28. 8 (25. 0) (59. 3) (28. 8) Turnover Operating (loss)/profit Provision against interest 16

PM&A - performance R’m Feb 2004 Aug 2003 Feb 2003 Stores rebranded Hyperpharm 132 327 238 534 136 717 Other stores 328 384 714 454 323 511 Stores rebranded Hyperpharm (1 146) 5 779 2 280 Other stores (9 672) (5 956) (10 396) Loan to PM&A 334. 0 295. 3 283. 1 Interest charge 25. 0 59. 3 28. 8 (25. 0) (59. 3) (28. 8) Turnover Operating (loss)/profit Provision against interest 16

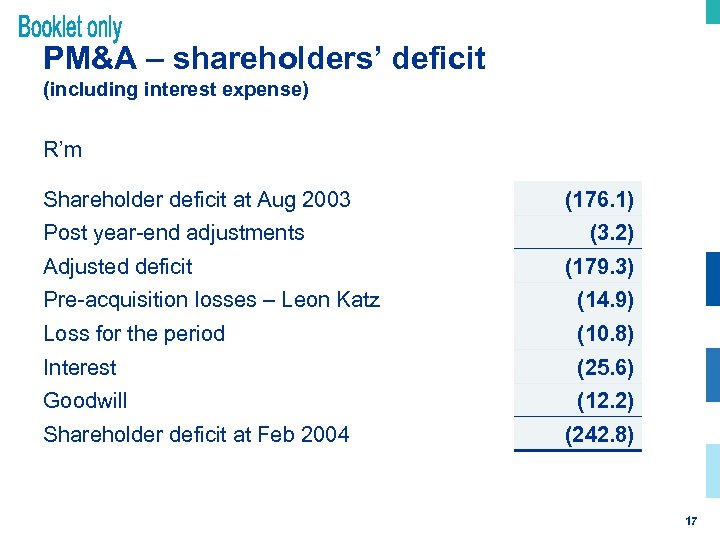

PM&A – shareholders’ deficit (including interest expense) R’m Shareholder deficit at Aug 2003 Post year-end adjustments Adjusted deficit (176. 1) (3. 2) (179. 3) Pre-acquisition losses – Leon Katz (14. 9) Loss for the period (10. 8) Interest (25. 6) Goodwill (12. 2) Shareholder deficit at Feb 2004 (242. 8) 17

PM&A – shareholders’ deficit (including interest expense) R’m Shareholder deficit at Aug 2003 Post year-end adjustments Adjusted deficit (176. 1) (3. 2) (179. 3) Pre-acquisition losses – Leon Katz (14. 9) Loss for the period (10. 8) Interest (25. 6) Goodwill (12. 2) Shareholder deficit at Feb 2004 (242. 8) 17

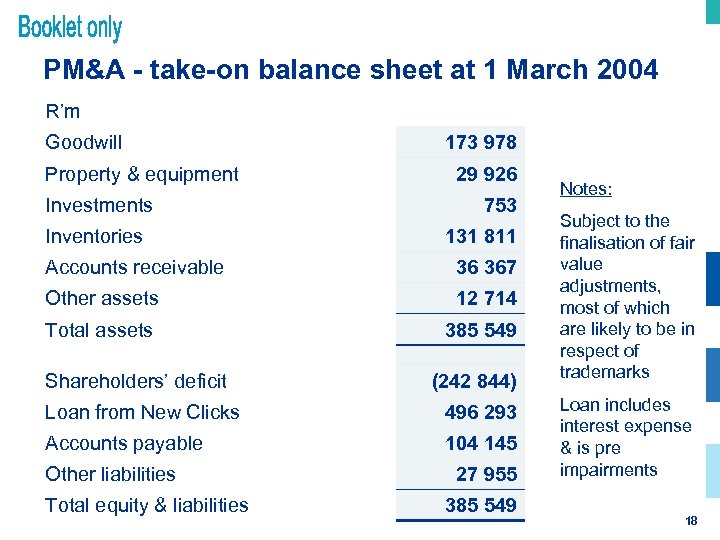

PM&A - take-on balance sheet at 1 March 2004 R’m Goodwill Property & equipment Investments Inventories 173 978 29 926 753 131 811 Accounts receivable 36 367 Other assets 12 714 Total assets 385 549 Shareholders’ deficit (242 844) Loan from New Clicks 496 293 Accounts payable 104 145 Other liabilities Total equity & liabilities 27 955 385 549 Notes: Subject to the finalisation of fair value adjustments, most of which are likely to be in respect of trademarks Loan includes interest expense & is pre impairments 18

PM&A - take-on balance sheet at 1 March 2004 R’m Goodwill Property & equipment Investments Inventories 173 978 29 926 753 131 811 Accounts receivable 36 367 Other assets 12 714 Total assets 385 549 Shareholders’ deficit (242 844) Loan from New Clicks 496 293 Accounts payable 104 145 Other liabilities Total equity & liabilities 27 955 385 549 Notes: Subject to the finalisation of fair value adjustments, most of which are likely to be in respect of trademarks Loan includes interest expense & is pre impairments 18

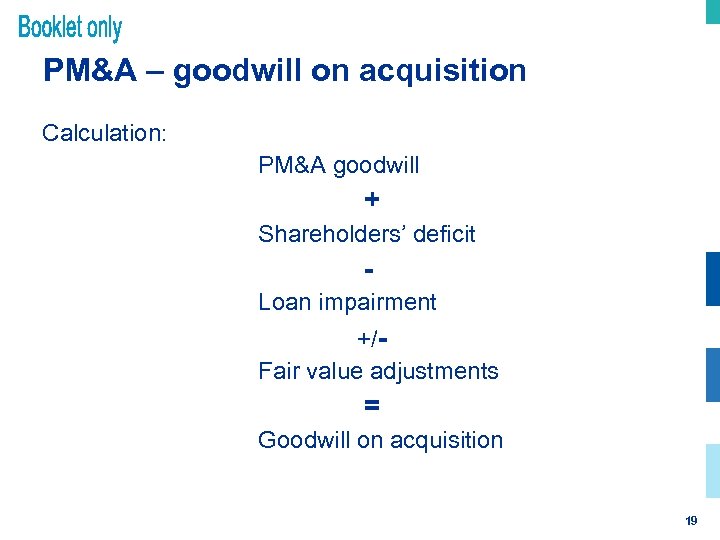

PM&A – goodwill on acquisition Calculation: PM&A goodwill + Shareholders’ deficit Loan impairment +/Fair value adjustments = Goodwill on acquisition 19

PM&A – goodwill on acquisition Calculation: PM&A goodwill + Shareholders’ deficit Loan impairment +/Fair value adjustments = Goodwill on acquisition 19

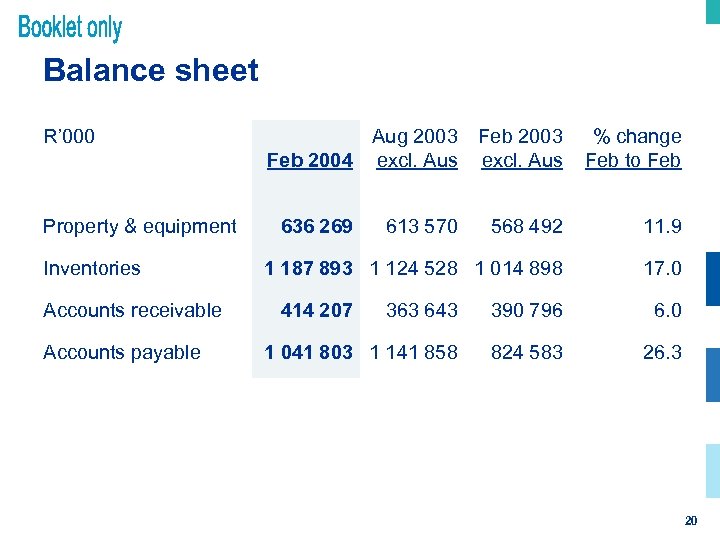

Balance sheet R’ 000 Property & equipment Inventories Accounts receivable Accounts payable Aug 2003 Feb 2004 excl. Aus Feb 2003 excl. Aus % change Feb to Feb 568 492 11. 9 1 187 893 1 124 528 1 014 898 17. 0 636 269 414 207 613 570 363 643 390 796 6. 0 1 041 803 1 141 858 824 583 26. 3 20

Balance sheet R’ 000 Property & equipment Inventories Accounts receivable Accounts payable Aug 2003 Feb 2004 excl. Aus Feb 2003 excl. Aus % change Feb to Feb 568 492 11. 9 1 187 893 1 124 528 1 014 898 17. 0 636 269 414 207 613 570 363 643 390 796 6. 0 1 041 803 1 141 858 824 583 26. 3 20

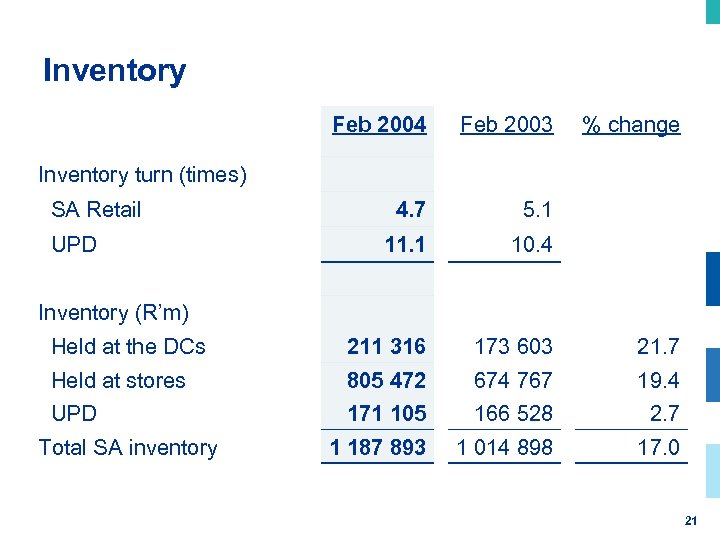

Inventory Feb 2004 Feb 2003 % change 4. 7 5. 1 11. 1 10. 4 Held at the DCs 211 316 173 603 21. 7 Held at stores 805 472 674 767 19. 4 UPD 171 105 166 528 2. 7 1 187 893 1 014 898 17. 0 Inventory turn (times) SA Retail UPD Inventory (R’m) Total SA inventory 21

Inventory Feb 2004 Feb 2003 % change 4. 7 5. 1 11. 1 10. 4 Held at the DCs 211 316 173 603 21. 7 Held at stores 805 472 674 767 19. 4 UPD 171 105 166 528 2. 7 1 187 893 1 014 898 17. 0 Inventory turn (times) SA Retail UPD Inventory (R’m) Total SA inventory 21

Inventory levels • Clicks & Discom - aggressive & successful promotions - better on-shelf position - more regular import programme • Body Shop growth - new stores - improved stock turns 22

Inventory levels • Clicks & Discom - aggressive & successful promotions - better on-shelf position - more regular import programme • Body Shop growth - new stores - improved stock turns 22

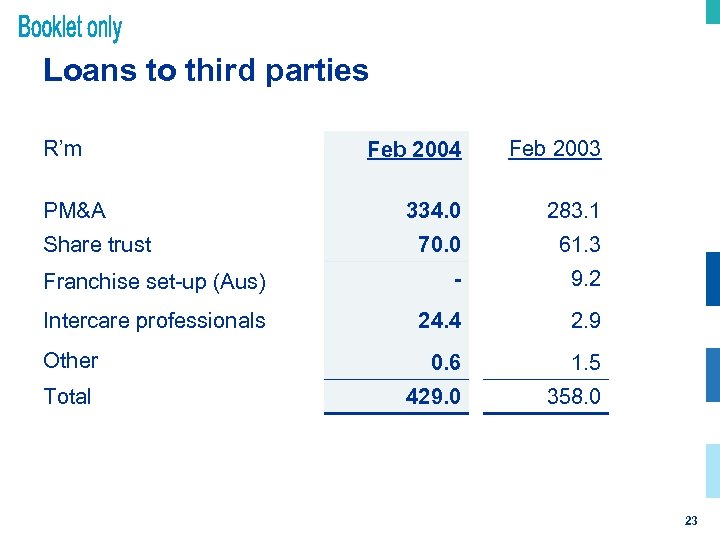

Loans to third parties R’m Feb 2004 Feb 2003 334. 0 283. 1 70. 0 61. 3 Franchise set-up (Aus) - 9. 2 Intercare professionals 24. 4 2. 9 Other 0. 6 1. 5 Total 429. 0 358. 0 PM&A Share trust 23

Loans to third parties R’m Feb 2004 Feb 2003 334. 0 283. 1 70. 0 61. 3 Franchise set-up (Aus) - 9. 2 Intercare professionals 24. 4 2. 9 Other 0. 6 1. 5 Total 429. 0 358. 0 PM&A Share trust 23

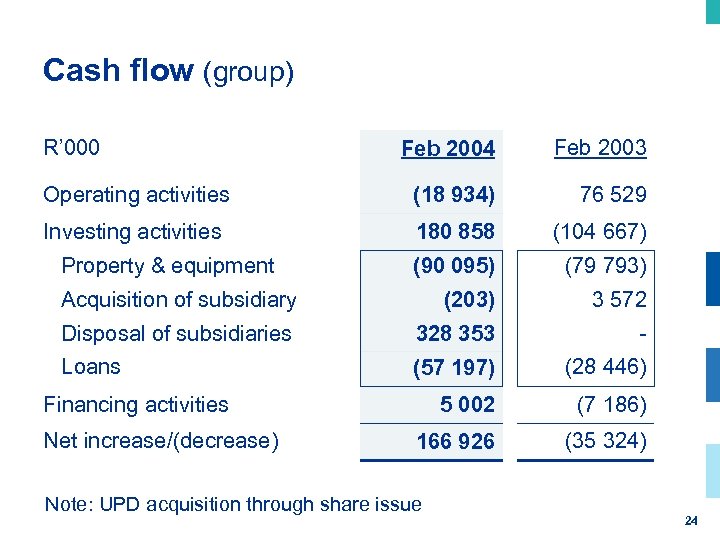

Cash flow (group) R’ 000 Feb 2004 Feb 2003 Operating activities (18 934) 76 529 Investing activities 180 858 (104 667) (90 095) (79 793) Acquisition of subsidiary (203) 3 572 Disposal of subsidiaries 328 353 - Loans (57 197) (28 446) 5 002 (7 186) 166 926 (35 324) Property & equipment Financing activities Net increase/(decrease) Note: UPD acquisition through share issue 24

Cash flow (group) R’ 000 Feb 2004 Feb 2003 Operating activities (18 934) 76 529 Investing activities 180 858 (104 667) (90 095) (79 793) Acquisition of subsidiary (203) 3 572 Disposal of subsidiaries 328 353 - Loans (57 197) (28 446) 5 002 (7 186) 166 926 (35 324) Property & equipment Financing activities Net increase/(decrease) Note: UPD acquisition through share issue 24

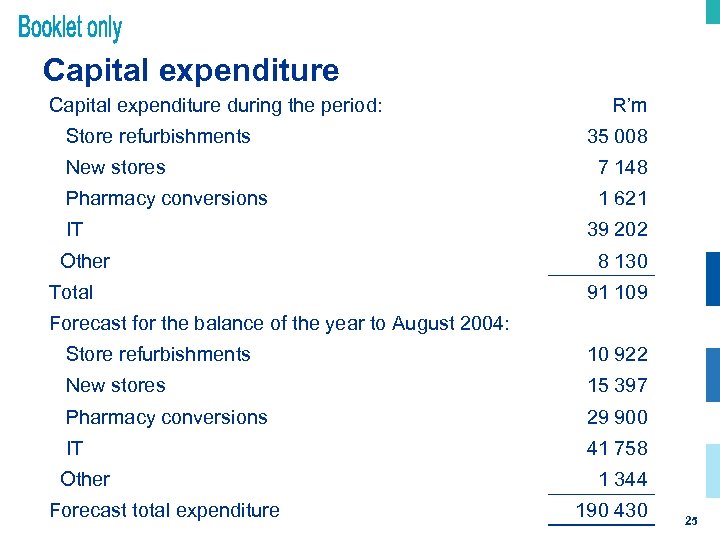

Capital expenditure during the period: Store refurbishments R’m 35 008 New stores 7 148 Pharmacy conversions 1 621 IT Other Total 39 202 8 130 91 109 Forecast for the balance of the year to August 2004: Store refurbishments 10 922 New stores 15 397 Pharmacy conversions 29 900 IT 41 758 Other Forecast total expenditure 1 344 190 430 25

Capital expenditure during the period: Store refurbishments R’m 35 008 New stores 7 148 Pharmacy conversions 1 621 IT Other Total 39 202 8 130 91 109 Forecast for the balance of the year to August 2004: Store refurbishments 10 922 New stores 15 397 Pharmacy conversions 29 900 IT 41 758 Other Forecast total expenditure 1 344 190 430 25

Sale of Australian operations • The key reason for selling Australia was to concentrate on the opportunity in SA • Multiple on sale 14. 2 • Profit on sale R 4. 5 m • Effective date 27 Dec 2003 • Cash repatriated Aus $87. 3 m • Cash repatriation date 17 February 2004 • Effective exchange rate Aus $4. 98 to R 1 26

Sale of Australian operations • The key reason for selling Australia was to concentrate on the opportunity in SA • Multiple on sale 14. 2 • Profit on sale R 4. 5 m • Effective date 27 Dec 2003 • Cash repatriated Aus $87. 3 m • Cash repatriation date 17 February 2004 • Effective exchange rate Aus $4. 98 to R 1 26

• Group Operations • Trevor Honneysett Ongoing consistent improvement 27

• Group Operations • Trevor Honneysett Ongoing consistent improvement 27

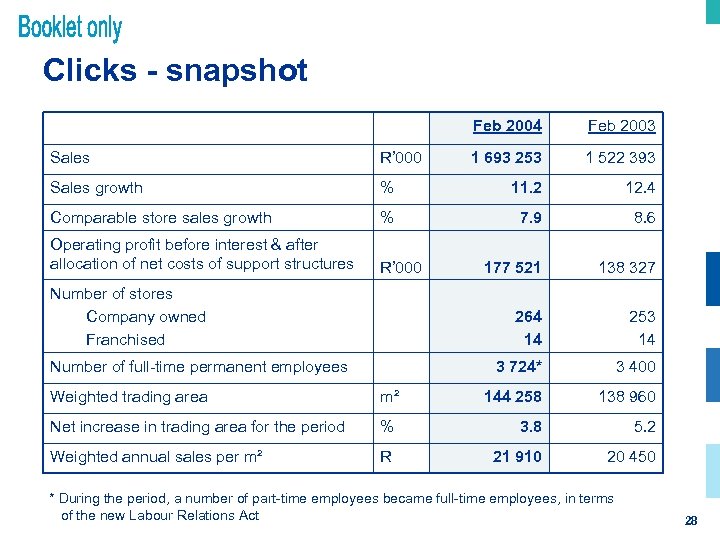

Clicks - snapshot Feb 2004 Feb 2003 1 693 253 1 522 393 Sales R’ 000 Sales growth % 11. 2 12. 4 Comparable store sales growth % 7. 9 8. 6 Operating profit before interest & after allocation of net costs of support structures R’ 000 177 521 138 327 264 14 253 14 3 724* 3 400 Number of stores Company owned Franchised Number of full-time permanent employees Weighted trading area m² 144 258 138 960 Net increase in trading area for the period % 3. 8 5. 2 Weighted annual sales per m² R 21 910 20 450 * During the period, a number of part-time employees became full-time employees, in terms of the new Labour Relations Act 28

Clicks - snapshot Feb 2004 Feb 2003 1 693 253 1 522 393 Sales R’ 000 Sales growth % 11. 2 12. 4 Comparable store sales growth % 7. 9 8. 6 Operating profit before interest & after allocation of net costs of support structures R’ 000 177 521 138 327 264 14 253 14 3 724* 3 400 Number of stores Company owned Franchised Number of full-time permanent employees Weighted trading area m² 144 258 138 960 Net increase in trading area for the period % 3. 8 5. 2 Weighted annual sales per m² R 21 910 20 450 * During the period, a number of part-time employees became full-time employees, in terms of the new Labour Relations Act 28

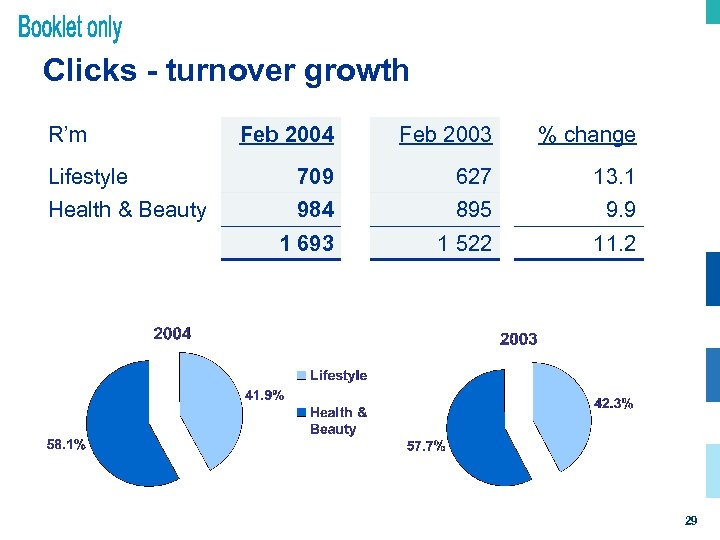

Clicks - turnover growth R’m Feb 2004 Feb 2003 % change Lifestyle 709 627 13. 1 Health & Beauty 984 895 9. 9 1 693 1 522 11. 2 29

Clicks - turnover growth R’m Feb 2004 Feb 2003 % change Lifestyle 709 627 13. 1 Health & Beauty 984 895 9. 9 1 693 1 522 11. 2 29

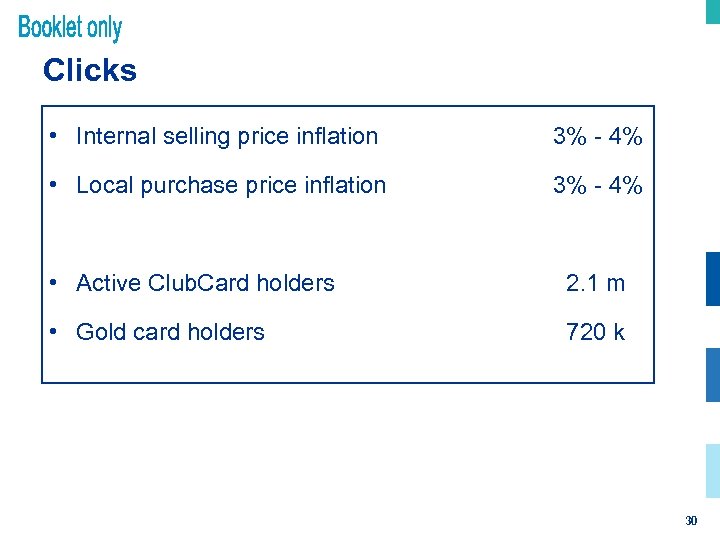

Clicks • Internal selling price inflation 3% - 4% • Local purchase price inflation 3% - 4% • Active Club. Card holders 2. 1 m • Gold card holders 720 k 30

Clicks • Internal selling price inflation 3% - 4% • Local purchase price inflation 3% - 4% • Active Club. Card holders 2. 1 m • Gold card holders 720 k 30

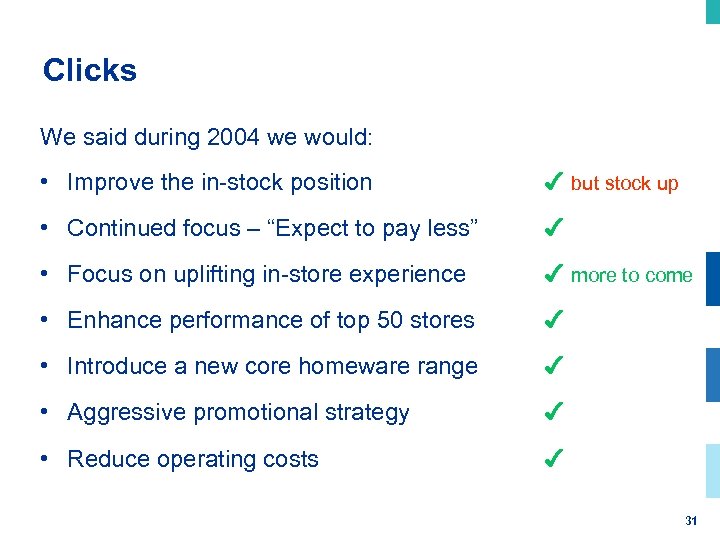

Clicks We said during 2004 we would: • Improve the in-stock position ✔ but stock up • Continued focus – “Expect to pay less” ✔ • Focus on uplifting in-store experience ✔ more to come • Enhance performance of top 50 stores ✔ • Introduce a new core homeware range ✔ • Aggressive promotional strategy ✔ • Reduce operating costs ✔ 31

Clicks We said during 2004 we would: • Improve the in-stock position ✔ but stock up • Continued focus – “Expect to pay less” ✔ • Focus on uplifting in-store experience ✔ more to come • Enhance performance of top 50 stores ✔ • Introduce a new core homeware range ✔ • Aggressive promotional strategy ✔ • Reduce operating costs ✔ 31

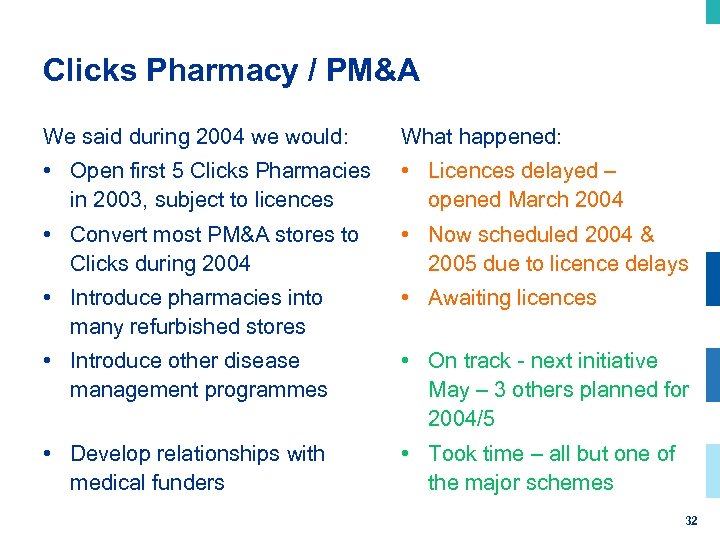

Clicks Pharmacy / PM&A We said during 2004 we would: What happened: • Open first 5 Clicks Pharmacies in 2003, subject to licences • Licences delayed – opened March 2004 • Convert most PM&A stores to Clicks during 2004 • Now scheduled 2004 & 2005 due to licence delays • Introduce pharmacies into many refurbished stores • Awaiting licences • Introduce other disease management programmes • On track - next initiative May – 3 others planned for 2004/5 • Develop relationships with medical funders • Took time – all but one of the major schemes 32

Clicks Pharmacy / PM&A We said during 2004 we would: What happened: • Open first 5 Clicks Pharmacies in 2003, subject to licences • Licences delayed – opened March 2004 • Convert most PM&A stores to Clicks during 2004 • Now scheduled 2004 & 2005 due to licence delays • Introduce pharmacies into many refurbished stores • Awaiting licences • Introduce other disease management programmes • On track - next initiative May – 3 others planned for 2004/5 • Develop relationships with medical funders • Took time – all but one of the major schemes 32

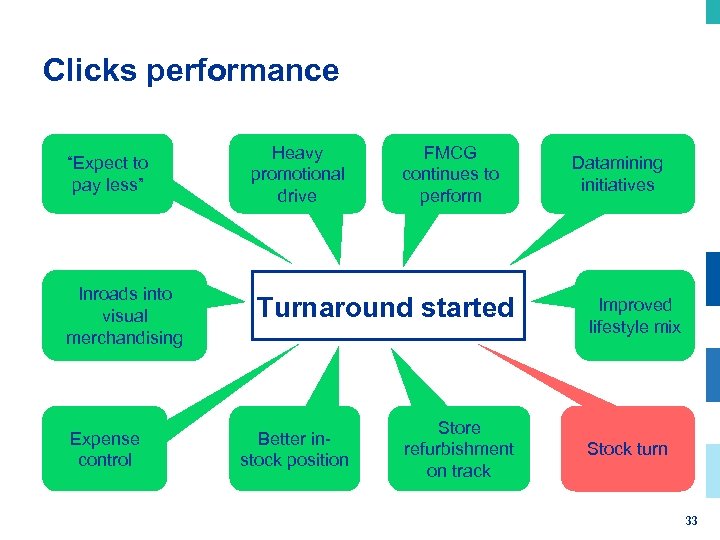

Clicks performance “Expect to pay less” Inroads into visual merchandising Expense control Heavy promotional drive FMCG continues to perform Turnaround started Better instock position Store refurbishment on track Datamining initiatives Improved lifestyle mix Stock turn 33

Clicks performance “Expect to pay less” Inroads into visual merchandising Expense control Heavy promotional drive FMCG continues to perform Turnaround started Better instock position Store refurbishment on track Datamining initiatives Improved lifestyle mix Stock turn 33

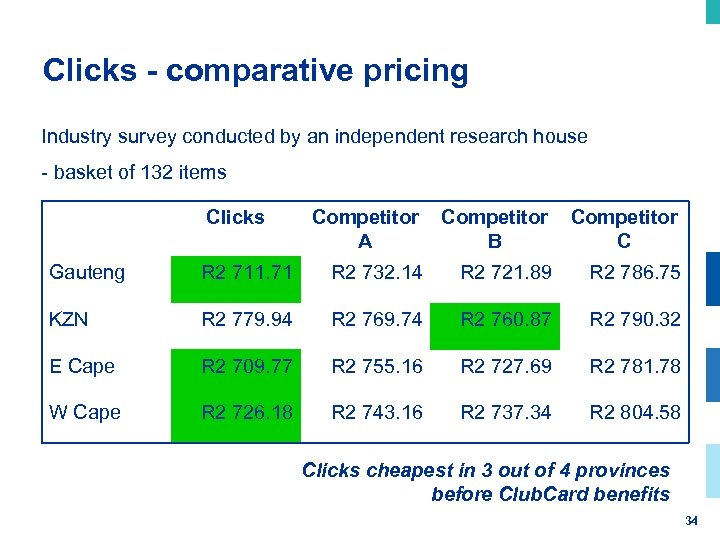

Clicks - comparative pricing Industry survey conducted by an independent research house - basket of 132 items Clicks Competitor A Competitor B Competitor C Gauteng R 2 711. 71 R 2 732. 14 R 2 721. 89 R 2 786. 75 KZN R 2 779. 94 R 2 769. 74 R 2 760. 87 R 2 790. 32 E Cape R 2 709. 77 R 2 755. 16 R 2 727. 69 R 2 781. 78 W Cape R 2 726. 18 R 2 743. 16 R 2 737. 34 R 2 804. 58 Clicks cheapest in 3 out of 4 provinces before Club. Card benefits 34

Clicks - comparative pricing Industry survey conducted by an independent research house - basket of 132 items Clicks Competitor A Competitor B Competitor C Gauteng R 2 711. 71 R 2 732. 14 R 2 721. 89 R 2 786. 75 KZN R 2 779. 94 R 2 769. 74 R 2 760. 87 R 2 790. 32 E Cape R 2 709. 77 R 2 755. 16 R 2 727. 69 R 2 781. 78 W Cape R 2 726. 18 R 2 743. 16 R 2 737. 34 R 2 804. 58 Clicks cheapest in 3 out of 4 provinces before Club. Card benefits 34

Clicks - key action plans • • • Further enhance homeware experience Value proposition maintained Continued focus on top 50 stores Store presentation – 77 of 270 stores in 2004 Continued aggressive promotional programme Maintain focus on costs New datamining initiatives in May Developing Clicks/Discovery Health alliance Profitable pharmacy integration 35

Clicks - key action plans • • • Further enhance homeware experience Value proposition maintained Continued focus on top 50 stores Store presentation – 77 of 270 stores in 2004 Continued aggressive promotional programme Maintain focus on costs New datamining initiatives in May Developing Clicks/Discovery Health alliance Profitable pharmacy integration 35

36

36

37

37

38

38

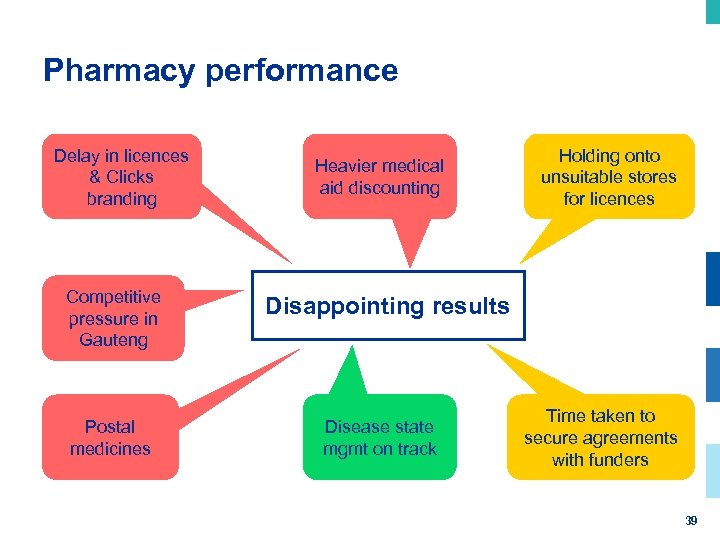

Pharmacy performance Delay in licences & Clicks branding Competitive pressure in Gauteng Postal medicines Heavier medical aid discounting Holding onto unsuitable stores for licences Disappointing results Disease state mgmt on track Time taken to secure agreements with funders 39

Pharmacy performance Delay in licences & Clicks branding Competitive pressure in Gauteng Postal medicines Heavier medical aid discounting Holding onto unsuitable stores for licences Disappointing results Disease state mgmt on track Time taken to secure agreements with funders 39

Pharmacy implementation 40

Pharmacy implementation 40

Pharmacy implementation 41

Pharmacy implementation 41

Pharmacy implementation 42

Pharmacy implementation 42

Pharmacy implementation 43

Pharmacy implementation 43

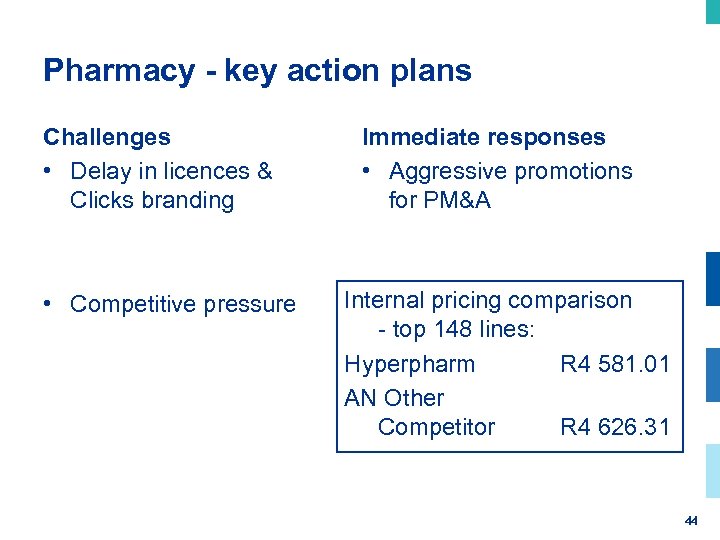

Pharmacy - key action plans Challenges • Delay in licences & Clicks branding • Competitive pressure Immediate responses • Aggressive promotions for PM&A Internal pricing comparison - top 148 lines: Hyperpharm R 4 581. 01 AN Other Competitor R 4 626. 31 44

Pharmacy - key action plans Challenges • Delay in licences & Clicks branding • Competitive pressure Immediate responses • Aggressive promotions for PM&A Internal pricing comparison - top 148 lines: Hyperpharm R 4 581. 01 AN Other Competitor R 4 626. 31 44

Pharmacy implementation continued 45

Pharmacy implementation continued 45

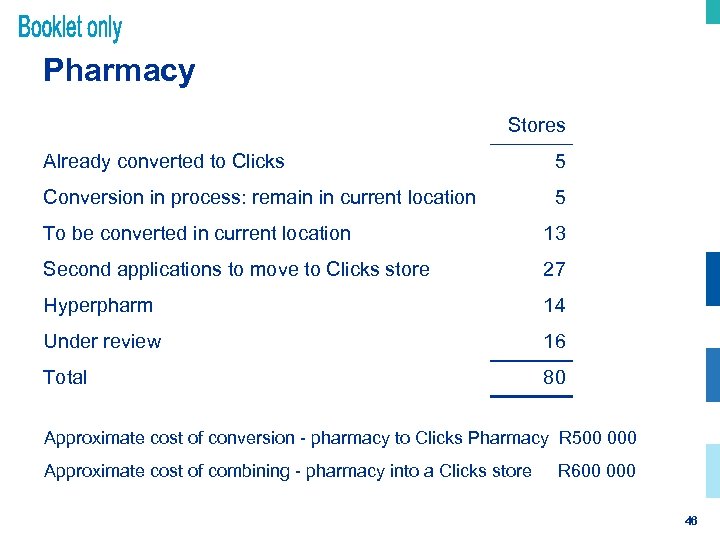

Pharmacy Stores Already converted to Clicks 5 Conversion in process: remain in current location 5 To be converted in current location 13 Second applications to move to Clicks store 27 Hyperpharm 14 Under review 16 Total 80 Approximate cost of conversion - pharmacy to Clicks Pharmacy R 500 000 Approximate cost of combining - pharmacy into a Clicks store R 600 000 46

Pharmacy Stores Already converted to Clicks 5 Conversion in process: remain in current location 5 To be converted in current location 13 Second applications to move to Clicks store 27 Hyperpharm 14 Under review 16 Total 80 Approximate cost of conversion - pharmacy to Clicks Pharmacy R 500 000 Approximate cost of combining - pharmacy into a Clicks store R 600 000 46

Pharmacy Environment remains uncertain • Single exit pricing legislation • Timing of licence approvals: • Balance of PM&A stores • Applications for all new Clicks stores • Second applications for transfers into Clicks stores • Success of Hyperpharm • Success of Clicks Pharmacy Positive to date, but still early days 47

Pharmacy Environment remains uncertain • Single exit pricing legislation • Timing of licence approvals: • Balance of PM&A stores • Applications for all new Clicks stores • Second applications for transfers into Clicks stores • Success of Hyperpharm • Success of Clicks Pharmacy Positive to date, but still early days 47

Pharmacy - key action plans • Integration into Clicks – 5 stores done, next 4 by June/July • Category management/buying further integrated with Clicks • More focused & aggressive promotions • Generic substitution going well & expanding • PM&A to move closer to branding used in Clicks Pharmacy • Hyperpharm introduced – monitored • IT platform integration on track – automated centralised pricing by August • Sustain relationship with government • Introduce Clicks Chronic Direct 48

Pharmacy - key action plans • Integration into Clicks – 5 stores done, next 4 by June/July • Category management/buying further integrated with Clicks • More focused & aggressive promotions • Generic substitution going well & expanding • PM&A to move closer to branding used in Clicks Pharmacy • Hyperpharm introduced – monitored • IT platform integration on track – automated centralised pricing by August • Sustain relationship with government • Introduce Clicks Chronic Direct 48

49

49

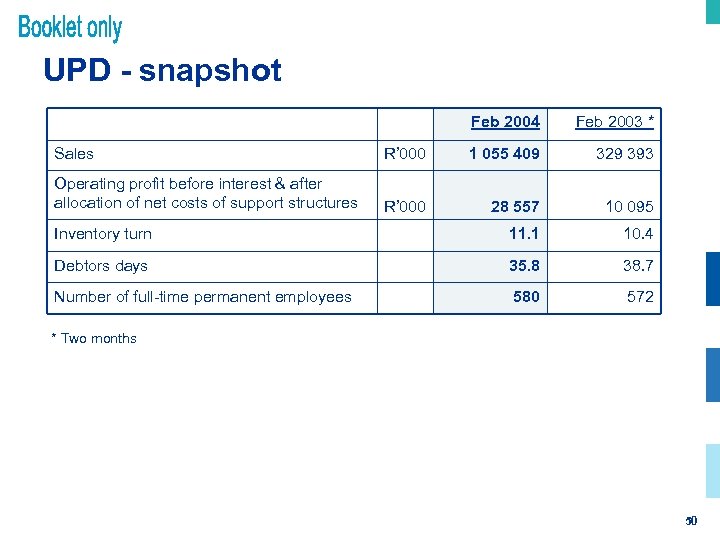

UPD - snapshot Feb 2004 Feb 2003 * Sales R’ 000 1 055 409 329 393 Operating profit before interest & after allocation of net costs of support structures R’ 000 28 557 10 095 Inventory turn 11. 1 10. 4 Debtors days 35. 8 38. 7 Number of full-time permanent employees 580 572 * Two months 50

UPD - snapshot Feb 2004 Feb 2003 * Sales R’ 000 1 055 409 329 393 Operating profit before interest & after allocation of net costs of support structures R’ 000 28 557 10 095 Inventory turn 11. 1 10. 4 Debtors days 35. 8 38. 7 Number of full-time permanent employees 580 572 * Two months 50

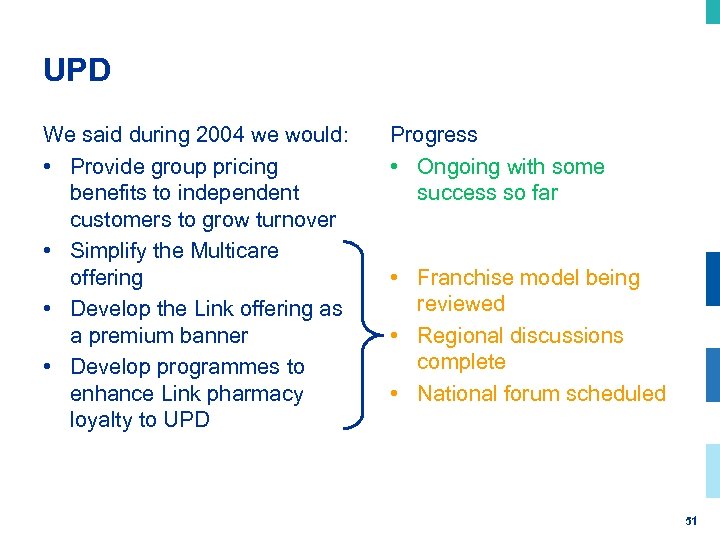

UPD We said during 2004 we would: • Provide group pricing benefits to independent customers to grow turnover • Simplify the Multicare offering • Develop the Link offering as a premium banner • Develop programmes to enhance Link pharmacy loyalty to UPD Progress • Ongoing with some success so far • Franchise model being reviewed • Regional discussions complete • National forum scheduled 51

UPD We said during 2004 we would: • Provide group pricing benefits to independent customers to grow turnover • Simplify the Multicare offering • Develop the Link offering as a premium banner • Develop programmes to enhance Link pharmacy loyalty to UPD Progress • Ongoing with some success so far • Franchise model being reviewed • Regional discussions complete • National forum scheduled 51

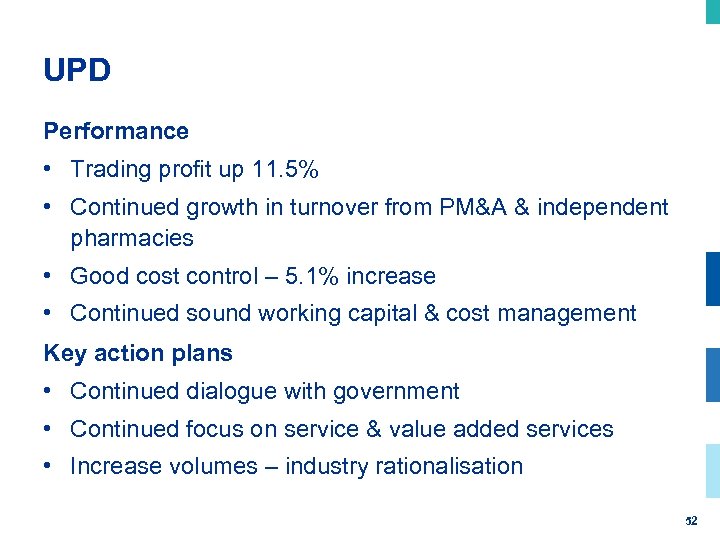

UPD Performance • Trading profit up 11. 5% • Continued growth in turnover from PM&A & independent pharmacies • Good cost control – 5. 1% increase • Continued sound working capital & cost management Key action plans • Continued dialogue with government • Continued focus on service & value added services • Increase volumes – industry rationalisation 52

UPD Performance • Trading profit up 11. 5% • Continued growth in turnover from PM&A & independent pharmacies • Good cost control – 5. 1% increase • Continued sound working capital & cost management Key action plans • Continued dialogue with government • Continued focus on service & value added services • Increase volumes – industry rationalisation 52

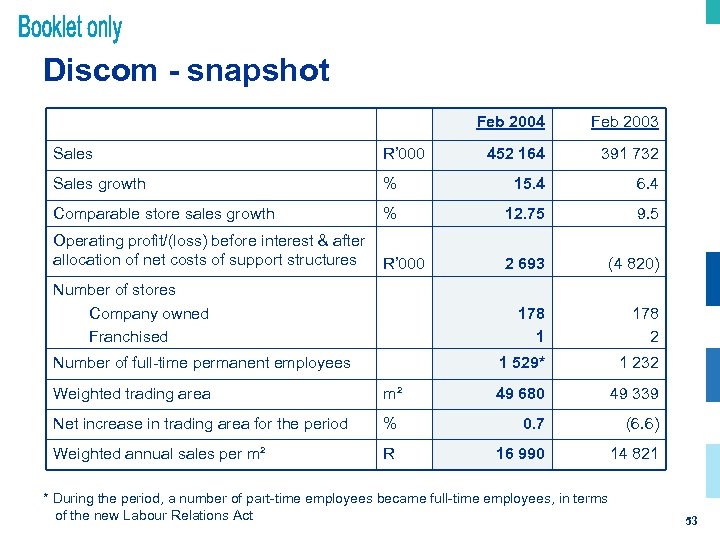

Discom - snapshot Feb 2004 Feb 2003 452 164 391 732 Sales R’ 000 Sales growth % 15. 4 6. 4 Comparable store sales growth % 12. 75 9. 5 Operating profit/(loss) before interest & after allocation of net costs of support structures R’ 000 2 693 (4 820) 178 1 178 2 1 529* 1 232 Number of stores Company owned Franchised Number of full-time permanent employees Weighted trading area m² 49 680 49 339 Net increase in trading area for the period % 0. 7 (6. 6) Weighted annual sales per m² R 16 990 14 821 * During the period, a number of part-time employees became full-time employees, in terms of the new Labour Relations Act 53

Discom - snapshot Feb 2004 Feb 2003 452 164 391 732 Sales R’ 000 Sales growth % 15. 4 6. 4 Comparable store sales growth % 12. 75 9. 5 Operating profit/(loss) before interest & after allocation of net costs of support structures R’ 000 2 693 (4 820) 178 1 178 2 1 529* 1 232 Number of stores Company owned Franchised Number of full-time permanent employees Weighted trading area m² 49 680 49 339 Net increase in trading area for the period % 0. 7 (6. 6) Weighted annual sales per m² R 16 990 14 821 * During the period, a number of part-time employees became full-time employees, in terms of the new Labour Relations Act 53

Discom We said during 2004 we would: • Return Discom to profitability in 2004 • Improve margin - stronger lifestyle & import programme • Close 12 stores, open 10 new stores & relocate 3 stores • Have strong sales & margin growth for ethnic beauty & hair care products • Implement POSware platform & merchandise planning Progress: • On track • Realising benefits • Closed 5, opened 5 & relocated 4 so far • Progressing well • Still on track for August 54

Discom We said during 2004 we would: • Return Discom to profitability in 2004 • Improve margin - stronger lifestyle & import programme • Close 12 stores, open 10 new stores & relocate 3 stores • Have strong sales & margin growth for ethnic beauty & hair care products • Implement POSware platform & merchandise planning Progress: • On track • Realising benefits • Closed 5, opened 5 & relocated 4 so far • Progressing well • Still on track for August 54

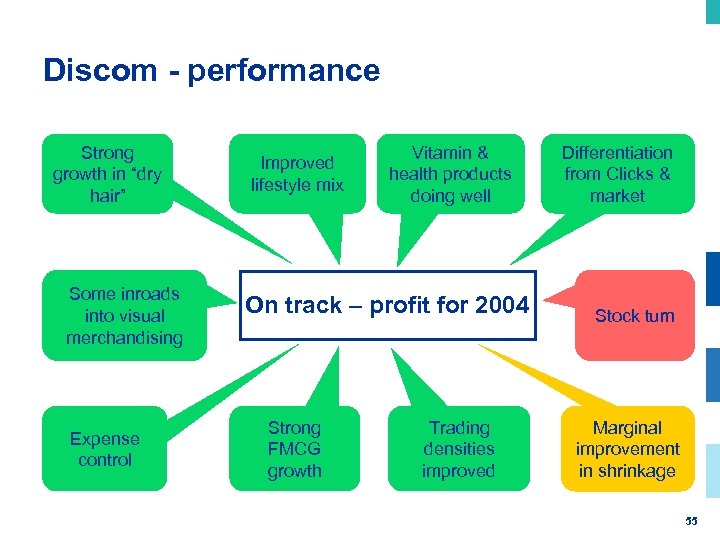

Discom - performance Strong growth in “dry hair” Some inroads into visual merchandising Expense control Improved lifestyle mix Vitamin & health products doing well On track – profit for 2004 Strong FMCG growth Trading densities improved Differentiation from Clicks & market Stock turn Marginal improvement in shrinkage 55

Discom - performance Strong growth in “dry hair” Some inroads into visual merchandising Expense control Improved lifestyle mix Vitamin & health products doing well On track – profit for 2004 Strong FMCG growth Trading densities improved Differentiation from Clicks & market Stock turn Marginal improvement in shrinkage 55

Discom - key action plans • Procure new store locations • Entrench dominant position in African beauty & hair care • Continued & sustainable improvement in margin • Continuing improvement in lifestyle offering • Implement POSware platform & merchandise planning • Exploit potential of inland consumer markets • Continual improvements in store design for new stores • Focused promotion activity 56

Discom - key action plans • Procure new store locations • Entrench dominant position in African beauty & hair care • Continued & sustainable improvement in margin • Continuing improvement in lifestyle offering • Implement POSware platform & merchandise planning • Exploit potential of inland consumer markets • Continual improvements in store design for new stores • Focused promotion activity 56

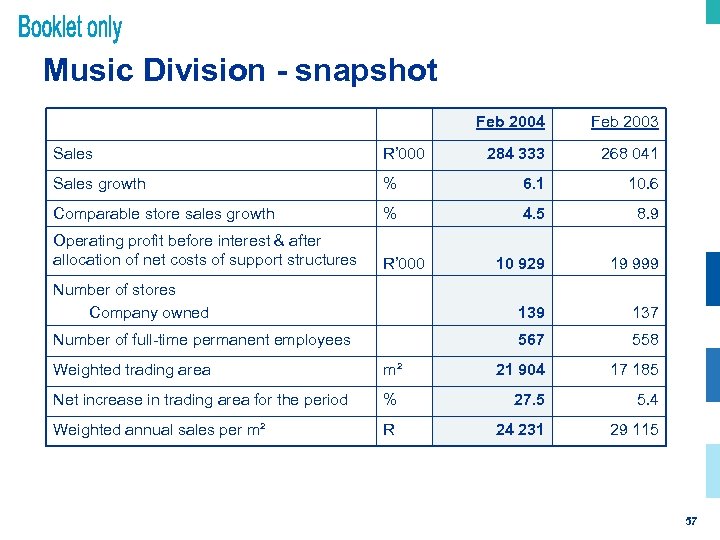

Music Division - snapshot Feb 2004 Feb 2003 284 333 268 041 Sales R’ 000 Sales growth % 6. 1 10. 6 Comparable store sales growth % 4. 5 8. 9 Operating profit before interest & after allocation of net costs of support structures R’ 000 10 929 19 999 Number of stores Company owned 139 137 Number of full-time permanent employees 567 558 Weighted trading area m² 21 904 17 185 Net increase in trading area for the period % 27. 5 5. 4 Weighted annual sales per m² R 24 231 29 115 57

Music Division - snapshot Feb 2004 Feb 2003 284 333 268 041 Sales R’ 000 Sales growth % 6. 1 10. 6 Comparable store sales growth % 4. 5 8. 9 Operating profit before interest & after allocation of net costs of support structures R’ 000 10 929 19 999 Number of stores Company owned 139 137 Number of full-time permanent employees 567 558 Weighted trading area m² 21 904 17 185 Net increase in trading area for the period % 27. 5 5. 4 Weighted annual sales per m² R 24 231 29 115 57

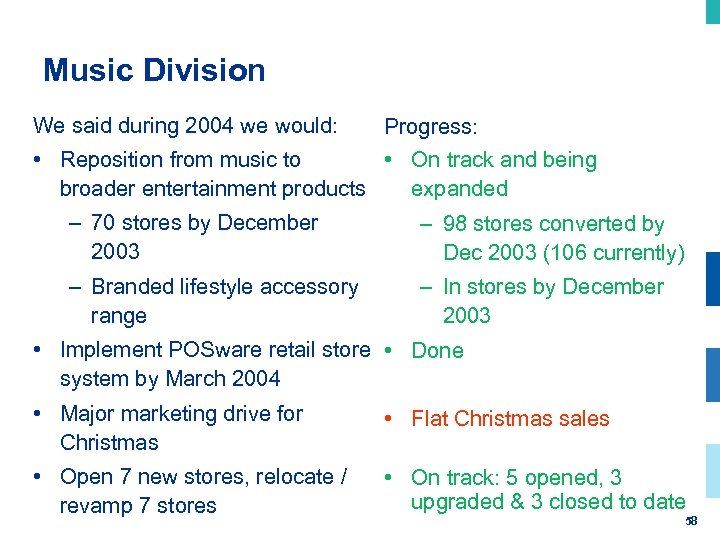

Music Division We said during 2004 we would: Progress: • Reposition from music to • On track and being broader entertainment products expanded – 70 stores by December 2003 – 98 stores converted by Dec 2003 (106 currently) – Branded lifestyle accessory range – In stores by December 2003 • Implement POSware retail store • Done system by March 2004 • Major marketing drive for Christmas • Flat Christmas sales • Open 7 new stores, relocate / revamp 7 stores • On track: 5 opened, 3 upgraded & 3 closed to date 58

Music Division We said during 2004 we would: Progress: • Reposition from music to • On track and being broader entertainment products expanded – 70 stores by December 2003 – 98 stores converted by Dec 2003 (106 currently) – Branded lifestyle accessory range – In stores by December 2003 • Implement POSware retail store • Done system by March 2004 • Major marketing drive for Christmas • Flat Christmas sales • Open 7 new stores, relocate / revamp 7 stores • On track: 5 opened, 3 upgraded & 3 closed to date 58

Music Division - performance • Musica – Declining trend in CD sales – Gaming, DVD’s & lifestyle products grew from 8. 3% to 16. 5% of sales • CD Wherehouse – Drop in CD sales – Strong growth in DVD sales – DVD biggest category in 2 of 4 CDW stores • Expense growth ahead of sales growth • We believe we are moving in the correct direction with entertainment 59

Music Division - performance • Musica – Declining trend in CD sales – Gaming, DVD’s & lifestyle products grew from 8. 3% to 16. 5% of sales • CD Wherehouse – Drop in CD sales – Strong growth in DVD sales – DVD biggest category in 2 of 4 CDW stores • Expense growth ahead of sales growth • We believe we are moving in the correct direction with entertainment 59

Music Division - key action plans • Continuing repositioning from music to broader entertainment products • Store plans: 4 new stores, 2 stores relocated & 2 revamped • Aggressive price promotions • Collaboration with Nu. Metro & Ster Kinekor to dominate DVD market 60

Music Division - key action plans • Continuing repositioning from music to broader entertainment products • Store plans: 4 new stores, 2 stores relocated & 2 revamped • Aggressive price promotions • Collaboration with Nu. Metro & Ster Kinekor to dominate DVD market 60

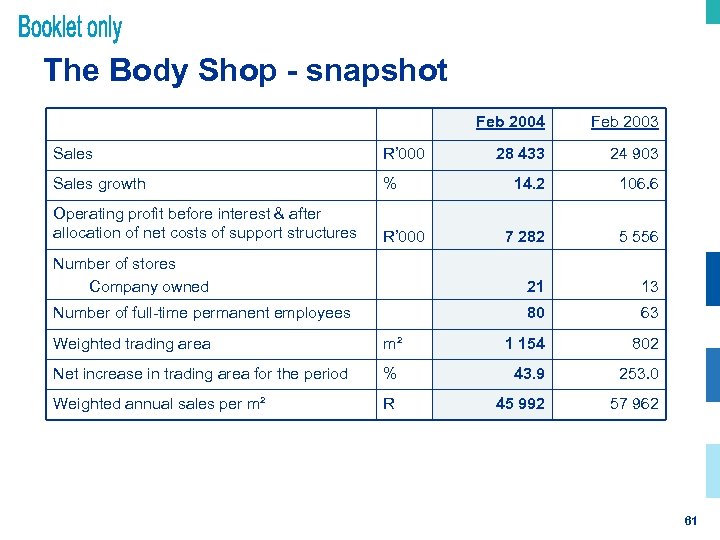

The Body Shop - snapshot Feb 2004 Feb 2003 28 433 24 903 14. 2 106. 6 7 282 5 556 Number of stores Company owned 21 13 Number of full-time permanent employees 80 63 Sales R’ 000 Sales growth % Operating profit before interest & after allocation of net costs of support structures R’ 000 Weighted trading area m² 1 154 802 Net increase in trading area for the period % 43. 9 253. 0 Weighted annual sales per m² R 45 992 57 962 61

The Body Shop - snapshot Feb 2004 Feb 2003 28 433 24 903 14. 2 106. 6 7 282 5 556 Number of stores Company owned 21 13 Number of full-time permanent employees 80 63 Sales R’ 000 Sales growth % Operating profit before interest & after allocation of net costs of support structures R’ 000 Weighted trading area m² 1 154 802 Net increase in trading area for the period % 43. 9 253. 0 Weighted annual sales per m² R 45 992 57 962 61

The Body Shop We said during 2004 we would: • Continue to show growth but at a slower rate • Heighten brand awareness through catalogue mailing & promotions • Focus on Christmas gifting • Introduce new range of sun care & hair care products • Open five new stores • Introduce four new concept stores in Clicks stores ✔ ✔ 3 opened, 2 to open in April ✔ 62

The Body Shop We said during 2004 we would: • Continue to show growth but at a slower rate • Heighten brand awareness through catalogue mailing & promotions • Focus on Christmas gifting • Introduce new range of sun care & hair care products • Open five new stores • Introduce four new concept stores in Clicks stores ✔ ✔ 3 opened, 2 to open in April ✔ 62

The Body Shop Performance • Good sales growth • Good cost control • Increased number of stores nationally to 21 • Stock turn improves to 6. 25 Key action plans • Promotions programme & radio advertising • Opening two new stores • Club. Card points - earned at Body Shop from May • Tight control on costs with further savings 63

The Body Shop Performance • Good sales growth • Good cost control • Increased number of stores nationally to 21 • Stock turn improves to 6. 25 Key action plans • Promotions programme & radio advertising • Opening two new stores • Club. Card points - earned at Body Shop from May • Tight control on costs with further savings 63

Shared Services We said we would: • Align shared services infrastructure with the needs of the brands • Improve the management of stock in stores • Implement a new financial system • Improve the speed & quality of information Progress: • On track • Disappointing progress • Phase 1 complete – balance on track • On track 64

Shared Services We said we would: • Align shared services infrastructure with the needs of the brands • Improve the management of stock in stores • Implement a new financial system • Improve the speed & quality of information Progress: • On track • Disappointing progress • Phase 1 complete – balance on track • On track 64

The next six months • Integration of pharmacies • Continued focus on lifestyle category • Clicks to be the pre-eminent health, home & beauty brand • UPD integral to healthcare plans • Increase volumes in UPD • Increasing profitability in Discom • Enhancing entertainment offering in music • Focus on stock distribution & management systems • Continued focus on expense control Ongoing consistent improvement 65

The next six months • Integration of pharmacies • Continued focus on lifestyle category • Clicks to be the pre-eminent health, home & beauty brand • UPD integral to healthcare plans • Increase volumes in UPD • Increasing profitability in Discom • Enhancing entertainment offering in music • Focus on stock distribution & management systems • Continued focus on expense control Ongoing consistent improvement 65

• Questions ? Ongoing consistent improvement 66

• Questions ? Ongoing consistent improvement 66

• Thank You Ongoing consistent improvement 67

• Thank You Ongoing consistent improvement 67